Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-14649

Trex Company, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 54-1910453 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 160 Exeter Drive, Winchester, Virginia | 22603-8605 | |

| (Address of principal executive offices) | (Zip Code) | |

(540) 542-6300

Registrant’s telephone number, including area code:

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: |

Name of each exchange on which registered: | |

| Common Stock, par value $0.01 per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posed pursuant to Rule 405 of Regulation S-T during the preceding 12 months. Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting Company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting Company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☒ | Accelerated filer | ☐ | ||||

|

Non-accelerated filer ☐ |

(Do not check if a smaller reporting Company) |

Smaller reporting company |

☐ |

Indicate by check mark whether the registrant is a shell Company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the registrant’s common equity held by non-affiliates of the registrant at June 30, 2016, which was the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $1.3 billion based on the closing price of the common stock as reported on the New York Stock Exchange on such date and assuming, for purposes of this computation only, that the registrant’s directors, executive officers and beneficial owners of 10% or more of the registrant’s common stock are affiliates.

The number of shares of the registrant’s common stock outstanding on February 7, 2017 was 29,384,211.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the following documents are incorporated by reference in this Form 10-K as indicated herein:

| Document |

Part of 10-K into which incorporated | |

| Proxy Statement relating to Registrant’s 2017 Annual Meeting of Stockholders |

Part III |

Table of Contents

| Page | ||||||

| PART I | ||||||

| Item 1. |

1 | |||||

| Item 1A. |

7 | |||||

| Item 1B. |

11 | |||||

| Item 2. |

11 | |||||

| Item 3. |

12 | |||||

| Item 4. |

12 | |||||

| PART II | ||||||

| Item 5. |

13 | |||||

| Item 6. |

15 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

18 | ||||

| Item 7A. |

29 | |||||

| Item 8. |

30 | |||||

| Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

30 | ||||

| Item 9A. |

30 | |||||

| Item 9B. |

33 | |||||

| PART III | ||||||

| Item 10. |

33 | |||||

| Item 11. |

33 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

33 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

33 | ||||

| Item 14. |

33 | |||||

| PART IV | ||||||

| Item 15. |

34 | |||||

| F-1 | ||||||

i

Table of Contents

NOTE ON FORWARD-LOOKING STATEMENTS

This report, including the information it incorporates by reference, contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. We intend our forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in these sections. All statements regarding our expected financial position and operating results, our business strategy, our financing plans, forecasted demographic and economic trends relating to our industry and similar matters are forward-looking statements. These statements can sometimes be identified by our use of forward-looking words such as “believe,” “may,” “will,” “anticipate,” “estimate,” “expect,” “intend” or similar expressions. We cannot promise you that our expectations in such forward-looking statements will turn out to be correct. Our actual results could be materially different from our expectations because of various factors, including the factors discussed under “Item 1A. Risk Factors” in this report.

ii

Table of Contents

Some of the information contained in this report concerning the markets and industry in which we operate is derived from publicly available information and from industry sources. Although we believe that this publicly available information and the information provided by these industry sources are reliable, we have not independently verified the accuracy of any of this information.

| Item 1. | Business |

General

Trex Company, Inc. (Company, we, us or our), was incorporated as a Delaware corporation in 1998, and is the world’s largest manufacturer of wood-alternative decking and railing products, which are marketed under the brand name Trex® and manufactured in the United States. Our principal executive offices are located at 160 Exeter Drive, Winchester, Virginia 22603, and our telephone number at that address is (540) 542-6300. We operate in a single reportable segment.

Products

We offer a comprehensive set of aesthetically pleasing, high performance and low maintenance outdoor living products in the decking, railing, porch, fencing, steel deck framing and outdoor lighting categories. We believe that the range and variety of our product offerings allow consumers to design much of their outdoor living space using Trex® brand products. A majority of our products are made in a proprietary process that combines reclaimed wood fibers and scrap polyethylene. Our products come in a wide selection of popular sizes and lengths and are available with several finishes and in numerous colors.

| Decking | Our principal decking products are Trex Transcend®, Trex Enhance® and Trex Select®. Our decking products are comprised of a blend of 95 percent recycled wood and recycled plastic film and feature a protective polymer shell for enhanced protection against fading, staining, mold and scratching. We also offer Trex Hideaway®, a hidden fastening system for grooved boards. We have a product in development, which is a high performance decking product that will be focused on the top end of the market with outstanding aesthetics and performance capabilities.

| |

| Railing | Our railing products are Trex Transcend Railing, Trex Select Railing, and Trex Signature® aluminum railing. Trex Transcend Railing is available in the colors of Trex Transcend decking and finishes that make it appropriate for use with Trex decking products as well as other decking materials, which we believe enhances the sales prospects of our railing products. Trex Select Railing is offered in a white finish and is ideal for consumers who desire a simple clean finished look for their deck. Trex Signature® aluminum railing is available in three colors and designed for consumers who want a sleek, contemporary look.

| |

| Porch | Our Trex Transcend Porch Flooring and Railing System is an integrated system of porch components and accessories.

| |

| Fencing | Our Trex Seclusions® fencing product is offered through two specialty distributors. This product consists of structural posts, bottom rail, pickets, top rail and decorative post caps.

| |

| Steel Deck Framing |

Our triple-coated steel deck framing system called Trex Elevations® leverages the strength and dimensional stability of steel to create a flat surface for our decking. Trex Elevations provides consistency and reliability that wood does not and is fire resistant.

| |

| Outdoor Lighting |

Our outdoor lighting systems are Trex DeckLighting™ and Trex LandscapeLighting™. Trex DeckLighting is a line of energy-efficient LED dimmable deck lighting, which is designed for use on posts, floors and steps. The line includes a post cap light, deck rail light, riser light and a recessed deck light. The Trex LandscapeLighting line includes an energy-efficient well light, path light, multifunction light and spotlight.

|

1

Table of Contents

We are a licensor in a number of licensing agreements with third parties to manufacture and sell products under the Trex trademark. Our licensed products are:

| Trex Outdoor Furniture™ | A line of outdoor furniture products manufactured and sold by PolyWood, Inc.

| |

| Trex RainEscape® | An above joist deck drainage system manufactured and sold by DriDeck Enterprises, LLC.

| |

| Trex CustomCurve® | A system manufactured and sold by Curvelt, LLC that allows contractors to heat and bend Trex Products while on the job site.

| |

| Trex Pergola™ | Pergolas made from low maintenance cellular PVC product, manufactured by Home & Leisure, Inc. dba Structureworks Fabrication.

| |

| Diablo® Trex Blade | A specialty saw blade for wood-plastic composite decking manufactured and sold by Freud America, Inc.

| |

| Trex SpiralStairs™ and Structural Steel Posts | An ultimate staircase alternative and structural steel posts for use with all deck substructures manufactured and sold by M. Cohen and Sons, Inc. dba The Iron Shop.

| |

| Trex Outdoor Kitchens, Cabinetry and Storage™ | Outdoor kitchens, cabinetry and storage manufactured and sold by NatureKast Products, LLC.

|

Trex products offer a number of significant aesthetic advantages over wood while eliminating many of wood’s major functional disadvantages, which include warping, splitting and other damage from moisture. Our products require no staining, are resistant to moisture damage, provide a splinter-free surface and need no chemical treatment against rot or insect infestation. These qualities result in low maintenance products when compared to the on-going maintenance requirements for a wood deck and make Trex products less costly than wood over the life of the deck. Trex products are stain resistant and color fast. Special characteristics (including resistance to splitting, the ability to bend, and ease and consistency of machining and finishing) facilitate deck, railing, and fencing installation, reduce contractor call-backs and afford customers a wide range of design options. Trex decking products do not have the tensile strength of wood and, as a result, are not used as primary structural members in posts, beams or columns used in a deck’s substructure. However, Trex does offer the Trex Elevations steel deck framing system.

We have received product building code listings from the major U.S. building code listing agencies for decking and railing and from the major Canadian building code listing agency for decking. The listings facilitate the acquisition of building permits by deck builders and promote consumer and industry acceptance of our products as an alternative to wood decking.

During the second half of 2014, we entered the specialty materials market. Our specialty product is made from plastic and is a linear low-density polyethylene pellet for use in blown film, profile extrusion and molding and compounding applications. Our entry into this adjacent market leverages our core recycling and extrusion capabilities. Our initial manufacturing line commenced operations during the second quarter of 2014 and during 2015 we added three additional lines. The Company remains in the early stages of specialty market penetration and is working on developing products that it believes will drive that market.

2

Table of Contents

Customers and Distribution

We distribute our products as follows:

Wholesale Distributors/Retail Lumber Dealers. We generate most of our sales through our wholesale distribution network by selling Trex products to wholesale distributors, who in turn, sell our products to retail lumber outlets. These retail dealers market to both homeowners and contractors, but they emphasize sales to professional contractors, remodelers and homebuilders. Contractor-installed decks generally are larger installations with professional craftsmanship. Our retail dealers generally provide sales personnel trained in Trex products, contractor training, inventory commitment and point-of-sale display support.

We believe that attracting wholesale distributors, who are committed to our products and marketing approach and can effectively sell higher value products to contractor-oriented lumber yards and other retail outlets, is important to our future growth. Our distributors are able to provide value-added service in marketing our products because they sell premium wood decking products and other innovative building materials that typically require product training and personal selling efforts. We typically appoint two distributors on a non-exclusive basis to distribute Trex products within a specified area. The distributor purchases our products at prices in effect at the time we ship the product to the distributor. Sales to two of our distributors, Boise Cascade Company and U.S. Lumber Group, LLC, each exceeded 10% of gross sales in 2016.

Home Depot and Lowe’s. We sell our products through Home Depot and Lowe’s stores. Home Depot and Lowe’s purchase products directly from us for stocking on their shelves. They also purchase product through our wholesale distributors for special orders placed by consumers. Home Depot and Lowe’s serve both the contractor market and the “do-it-yourself” market. We believe that brand exposure through Home Depot and Lowe’s distribution promotes consumer acceptance of our products.

Manufacturing Process

Trex products manufactured at our Winchester, Virginia and Fernley, Nevada manufacturing facilities are primarily manufactured from reclaimed wood fiber and scrap polyethylene. Our primary manufacturing process involves mixing wood particles with plastic, heating and then extruding, or forcing, the highly viscous and abrasive material through a profile die. We use many proprietary and skill-based advantages in our manufacturing process.

Our manufacturing process requires significant capital investment, expertise and time to develop. We have continuously invested the capital necessary to expand our manufacturing throughput and improve our manufacturing processes. We have also broadened the range of raw materials that we can use to produce a consistent and high-quality finished product. In connection with national building code listings, we maintain a quality control testing program.

We utilize Six Sigma and Lean Manufacturing methodologies within our plant operations. We also use these methodologies throughout our Company in the planning and execution of projects that are important to our success.

Suppliers

The production of most of our products requires a supply of reclaimed wood fiber and scrap polyethylene. We fulfill requirements for raw materials under both purchase orders and supply contracts. In the year ended December 31, 2016, we purchased substantially all of our reclaimed wood fiber requirements under purchase orders, which do not involve long-term supply commitments. All of our polyethylene purchases are under short-term supply contracts that

3

Table of Contents

average approximately one to two years for which pricing is negotiated as needed, or under purchase orders that do not involve long-term supply commitments.

| • | Reclaimed Wood Fiber: Cabinet and flooring manufacturers are our preferred suppliers of reclaimed wood fiber because the reclaimed wood fiber produced by these operations contains little contamination and is low in moisture. These facilities generate reclaimed wood fiber as a byproduct of their manufacturing operations. If the reclaimed wood fiber meets our specifications, our reclaimed wood fiber supply agreements generally require us to purchase at least a specified minimum and at most a specified maximum amount of reclaimed wood fiber each year. Depending on our needs, the amount of reclaimed wood fiber that we actually purchase within the specified range under any supply agreement may vary significantly from year to year. |

| • | Scrap Polyethylene: The polyethylene we consumed in 2016 was primarily composed of scrap plastic film and plastic bags. We will continue to seek to meet our future needs for scrap polyethylene from the expansion of our existing supply sources and the development of new sources. We believe our use of multiple sources provides us with a cost advantage and facilitates an environmentally responsible approach to our procurement of polyethylene. Our ability to source and use a wide variety of polyethylene from third party distribution and manufacturing operations is important to our cost strategy. We maintain this ability through the continued expansion of our plastic reprocessing operations in combination with the advancement of our proprietary material preparation and extrusion processes. |

In addition, we outsource the production of certain products to third-party manufacturers.

Research and Development and Training

We maintain research and development operations in the Trex Technical Center in Winchester, Virginia. Our research and development efforts focus on innovation and developing new products, lowering the cost of manufacturing our existing products and redesigning existing product lines to increase efficiency and enhance performance. For the years ended December 31, 2016, 2015 and 2014, research and development costs were $3.7 million, $1.5 million and $2.3 million, respectively, and have been included in “Selling, general and administrative expenses” in the accompanying Consolidated Statements of Comprehensive Income.

During 2016, we launched Trex University, our state-of-the-art training facility located near our Winchester manufacturing plant. Trex University is designed to educate and train retailers, contractors and other partners on the benefits of Trex aesthetically pleasing, high performance and low maintenance outdoor living products.

Growth Strategies

Our long-term goal is to perpetuate our position as the leading producer of branded superior wood-alternative outdoor living products by increasing our market share and expanding into new product categories and geographic markets through the design, creation and marketing of high-performance outdoor living products that offer superior aesthetics and quality. Also, we will explore opportunities that leverage our manufacturing and extrusion expertise and are tied to our recycling heritage. To attain these goals, we intend to employ the following long-term strategies:

| • | Innovation: Bring to the market new products that address unmet consumer and trade professional needs. Provide a compelling value proposition through ease of installation, low maintenance, long-term durability and superior aesthetics. |

| • | Brand: Expand preference and commitment for the Trex brand with both the consumer and trade professional. Deliver on the brand’s promise of superior quality, functionality, pleasing aesthetics and overall performance in outdoor living products. Leverage online efforts to extend the Trex brand digital presence, both nationally and globally. |

4

Table of Contents

| • | Channels: Achieve comprehensive market segment and geographic coverage for Trex products by increasing the number of stocking dealers and retailers and expanding our international presence, thereby making our products available wherever our customers choose to purchase their decking, railing, porch, steel deck framing and outdoor lighting products. |

| • | Quality: Continuously advance the quality of all operational and business processes, with the goal of achieving superior product quality and service levels, thereby giving us a sustainable competitive advantage. |

| • | Cost: Through capital investments and process engineering, continuously seek to lower the cost to manufacture Trex products. Investments in plastic recycling capabilities will allow us to expand our ability to use a wider breadth of waste materials thereby lowering our raw material costs. We plan to continue to achieve significant improvements in manufacturing productivity by reducing waste and improving our production process, from raw materials preparation through extrusion into finishing and packaging. |

| • | Customer Service: Through our commitment to superior customer service, continually deliver consistently outstanding, personalized service to all of our customers and prospects in all target segments. |

Competition

Our primary competition consists of wood products, which constitutes a substantial majority of decking and railing sales, as measured by linear feet of lumber. Many of the conventional lumber suppliers with which we compete have established ties to the building and construction industry and have well-accepted products. A majority of the lumber used in wood decks is pressure-treated lumber. Southern yellow pine and fir have a porosity that readily allows the chemicals used in the pressure treating process to be absorbed. The same porosity makes southern yellow pine susceptible to absorbing moisture, which causes the lumber to warp, crack, splinter and expel fasteners. In addition to pine and fir, other segments of wood material for decking include redwood, cedar and tropical hardwoods, such as ipe, teak and mahogany. These products are often significantly more expensive than pressure-treated lumber, but do not eliminate many of the disadvantages of other wood products.

In addition to wood, we also compete with other manufacturers of wood-alternative products. Industry studies indicate that we have the leading market share of the wood-alternative segment of the decking and railing market. Our principal competitors include Advanced Environmental Recycling Technologies, Inc., CPG International LLC and Fiberon, LLC.

Our ability to compete depends, in part, on a number of factors outside our control, including the ability of our competitors to develop new wood-alternative decking and railing products that are competitive with our products. We believe that the principal competitive factors in the decking and railing market include product quality, price, aesthetics, maintenance cost, distribution and brand strength. We believe we compete favorably with respect to these factors. We believe that our products offer aesthetic and cost advantages over the life of a deck when compared to other types of decking and railing materials. Although a contractor-installed deck built with Trex products using a pressure-treated wood substructure generally costs more than a deck made entirely from pressure-treated wood, Trex products are low maintenance compared to the on-going maintenance required for a pressure-treated deck and are, therefore, less costly over the life of the deck. We believe that our manufacturing process and utilization of relatively low-cost raw material sources provide us with a competitive cost advantage relative to other manufacturers of wood-alternative decking and railing products. The scale of our operations also confers cost efficiencies in manufacturing, sales and marketing.

Seasonality

Our net sales, gross profit and income from operations have historically varied from quarter to quarter. Such variations are often attributable to seasonal trends in the demand for our products. We have historically

5

Table of Contents

experienced lower net sales during the fourth quarter due to the holiday season. Also, seasonal, erratic or prolonged adverse weather conditions in certain geographic regions reduce the level of home improvement and construction activity and can shift net sales to a later period.

Government Regulation

We are subject to federal, state and local environmental regulation. The emissions of particulates and other substances from our manufacturing facilities must meet federal and state air quality standards implemented through air permits issued to us by the Department of Environmental Quality of the Commonwealth of Virginia, and the Division of Environmental Protection of Nevada’s Department of Conservation and Natural Resources. Our facilities are regulated by federal and state laws governing the disposal of solid waste and by state and local permits and requirements with respect to wastewater and storm water discharge. Compliance with environmental laws and regulations has not had a material adverse effect on our business, operating results or financial condition.

Our operations also are subject to work place safety regulation by the U.S. Occupational Safety and Health Administration, the Commonwealth of Virginia and the State of Nevada. Our compliance efforts include safety awareness and training programs for our production and maintenance employees.

Intellectual Property

Our success depends, in part, upon our intellectual property rights relating to our products, production processes and other operations. We rely upon a combination of trade secret, nondisclosure and other contractual arrangements, and patent, copyright and trademark laws, to protect our proprietary rights. We have made substantial investments in manufacturing process improvements that have enabled us to increase manufacturing line production rates, facilitate our development of new products, and produce improvements in our existing products’ dimensional consistency, surface texture and color uniformity.

Intellectual property rights may be challenged by third parties and may not exclude competitors from using the same or similar technologies, brands or works. We seek to secure effective rights for our intellectual property, but cannot provide assurance that third parties will not successfully challenge, or avoid infringing, our intellectual property rights.

We consider our trademarks to be of material importance to our business plans. The U.S. Patent and Trademark Office has granted us federal registrations for many of our trademarks. Federal registration of trademarks is effective for as long as we continue to use the trademarks and renew their registrations. We do not generally register any of our copyrights with the U.S. Copyright Office, but rely on the protection afforded to such copyrights by the U.S. Copyright Act. This law provides protection to authors of original works, whether published or unpublished, and whether registered or unregistered.

We enter into confidentiality agreements with our employees and limit access to and distribution of our proprietary information. If it is necessary to disclose proprietary information to third parties for business reasons, we require that such third parties sign a confidentiality agreement prior to any disclosure.

Employees

At December 31, 2016, we had approximately 830 full-time employees, approximately 630 of whom were employed in our manufacturing operations. Our employees are not covered by collective bargaining agreements. We believe that our relationships with our employees are favorable.

6

Table of Contents

Web Sites and Additional Information

The U. S. Securities and Exchange Commission (SEC) maintains an Internet web site at www.sec.gov that contains reports, proxy statements, and other information regarding our Company. In addition, we maintain an Internet corporate web site at www.trex.com. We make available through our web site our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports, as soon as reasonably practicable after we electronically file with or furnish such material to the SEC. We do not charge any fees to view, print or access these reports on our web site. The contents of our web site are not a part of this report.

| Item 1A. | Risk Factors |

Our business is subject to a number of risks, including the following:

We may not be able to grow unless we increase market acceptance of our products, compete effectively and develop new products and applications.

Our primary competition consists of wood products, which constitute a substantial majority of decking, railing, porches, fencing, and deck framing sales. Since wood-alternative products were introduced to the market in the late 1980s, their market acceptance has increased. Our ability to grow will depend, in part, on our success in continuing to convert demand for wood products into demand for wood-alternative Trex products. To increase our market share, we must overcome:

| • | lack of awareness of the enhanced value of wood-alternative products in general and Trex brand products in particular; |

| • | resistance of many consumers and contractors to change from well-established wood products; |

| • | consumer lack of awareness that the greater initial expense of Trex products compared to wood is a one-time cost that is reduced over time as Trex products have lower maintenance costs and a longer life span than wood; |

| • | established relationships existing between suppliers of wood products and contractors and homebuilders; |

| • | actual and perceived quality issues with first generation wood-alternative products; and |

| • | competition from other wood-alternative manufacturers. |

Our failure to compete successfully in such markets could have a material adverse effect on our ability to replace wood or increase our market share amongst wood-alternatives. Many of the conventional lumber suppliers with which we compete have established ties to the building and construction industry and have well-accepted products. Our ability to compete depends, in part, upon a number of factors outside our control, including the ability of competitors to develop new alternatives that are more competitive with Trex products.

In addition, substantially all of our revenues are derived from sales of our proprietary wood/polyethylene composite material. Although we have developed, and continue to develop, new products made from other materials, if we should experience significant problems, real or perceived, with acceptance of the Trex wood/polyethylene composite material, our lack of product diversification could have a significant adverse impact on our net sales levels.

Our prospects for sales growth and profitability may be adversely affected if we fail to maintain product quality and product performance at an acceptable cost.

In order to expand our net sales and sustain profitable operations we must maintain the quality and performance of our products. If we are unable to produce high-quality products at standard manufacturing rates

7

Table of Contents

and yields, unit costs may be higher. A lack of product performance could impede acceptance of our products in the marketplace and negatively affect our profitability. We continue to receive and settle claims and maintain a warranty reserve related to material produced at our Nevada facility prior to 2007 that exhibits surface flaking. We have limited our financial exposure by settling a nationwide class action lawsuit that lessens our exposure to provide replacement product and partial labor reimbursement. However, because the establishment of reserves is an inherently uncertain process involving estimates of the number of future claims and the average cost of claims, our ultimate losses may differ from our warranty reserve. Increases to the warranty reserve and payments for related claims have had a material adverse effect on our profitability and cash flows. Future increases to the warranty reserve could have a material adverse effect on our profitability and cash flows.

A number of class action lawsuits alleging defects in our products have been brought against us, all of which have been settled. In the event future lawsuits relating to alleged product quality issues are brought against us, such lawsuits may be costly and could cause adverse publicity, which in turn could result in a loss of consumer confidence in our products and reduce our sales. Product quality claims could increase our expenses, have a material adverse effect on demand for our products and decrease net sales, net income and liquidity.

Our business is subject to risks in obtaining the raw materials we use at acceptable prices.

The manufacture of our products requires substantial amounts of wood fiber and scrap polyethylene. Our business strategy is to create a substantial cost advantage over our competitors by using reclaimed wood fibers and scrap polyethylene. Our business could suffer from the termination of significant sources of raw materials, the payment of higher prices for raw materials, the quality of available raw materials, or from the failure to obtain sufficient additional raw materials to meet planned increases in production.

Our ability to obtain adequate supplies of reclaimed wood fibers and scrap polyethylene depends on our success in developing new sources that meet our quality requirements, maintaining favorable relationships with suppliers and managing the collection of supplies from geographically dispersed locations.

Certain of our customers account for a significant portion of our sales, and the loss of one or more of these customers could have an adverse effect on our business.

A limited number of our customers account for a significant percentage of our sales. Specifically, sales through our 15 largest customers accounted for approximately 90% of gross sales during fiscal year 2016, 89% during fiscal year 2015 and 86% during fiscal year 2014.

We expect that a significant portion of our sales will continue to be sold through a small number of customers, and certain customers will continue to account for a significant portion of our sales. The loss of a significant customer could have a significant negative impact on our business, results of operations and financial condition.

We have limited ability to control or project inventory build-ups in our distribution channel that can negatively affect our sales in subsequent periods.

The seasonal nature of, and changing conditions in, our industry can result in substantial fluctuations in inventory levels of Trex products carried in our two-step distribution channel. We have limited ability to control or precisely project inventory build-ups, which can adversely affect our net sales levels in subsequent periods. We make the substantial majority of our sales to wholesale distributors, who, in turn, sell our products to local dealers. Because of the seasonal nature of the demand for our products, our distribution channel partners must forecast demand for our products, place orders for the products, and maintain Trex product inventories in advance of the prime deck-building season, which generally occurs in the latter part of the first calendar quarter through the third calendar quarter. Accordingly, our results for the second and third quarters are difficult to predict and past performance will not necessarily indicate future performance. Inventory levels respond to a

8

Table of Contents

number of changing conditions in our industry, including product price increases, increases in the number of competitive producers, the rapid pace of product introduction and innovation, changes in the levels of home-building and remodeling expenditures and the cost and availability of consumer credit.

The demand for our products is negatively affected by adverse weather conditions.

Our products are generally purchased shortly before installation and used in outdoor environments. As a result, there is a correlation between the amount of product we sell and weather conditions during the time they are to be installed. Adverse weather conditions may interfere with ordinary construction, delay projects or lead to cessation of construction involving our products. These interferences may shift sales to subsequent reporting periods or decrease overall sales, given the limited decking season in many locations. Prolonged adverse weather conditions could have a negative impact on our results of operations and liquidity.

We depend on third parties for transportation services and the lack of availability of transportation and/or increases in cost could materially adversely affect our business and operations.

Our business depends on the transportation of both finished goods to our distributors and the transportation of raw materials to us. We rely on third parties for transportation of these items. In particular, a significant portion of our finished goods are transported by flatbed trucks, which are occasionally in high demand (especially at the end of calendar quarters) and/or subject to price fluctuations based on market conditions and the price of fuel.

If the required supply of transportation services is unavailable when needed, we may be unable to sell our products at full value, or at all. Similarly, if any of these providers were unavailable to deliver raw materials to us in a timely manner, we may be unable to manufacture our products in response to customer demand. This could harm our reputation, negatively impact our customer relationships and have a material adverse effect on our financial condition and results of operations. In addition, a material increase in transportation rates or fuel surcharges could have a material adverse effect on our profitability.

The demand for our products is influenced by general economic conditions and could be adversely affected by economic downturns.

The demand for our products is influenced by the general health of the economy, the level of home improvement activity and, to a much lesser extent, new home construction. These factors are affected by home equity values, credit availability, consumer confidence and spending habits, employment, interest rates, inflation and general economic conditions. Devaluation in home equity values can adversely affect the availability of home equity withdrawals and result in decreased home improvement spending. We cannot predict general economic conditions or the home remodeling and new home construction environments. Any economic downturn could reduce consumer income or equity capital available for spending on discretionary items, which could adversely affect the demand for our products.

We have significant capital invested in property, plant and equipment that may become obsolete or impaired and result in a charge to our earnings.

We have made and may continue to make significant capital investments to improve or expand our manufacturing capabilities. These investments sometimes involve the implementation of new technology and replacement of existing equipment at our manufacturing facilities, which may result in charges to our earnings if the existing equipment is not fully depreciated. Significant replacement of equipment or changes in the expected cash flows related to our assets could result in reduced earnings or cash flows in future periods.

9

Table of Contents

Our ability to continue to obtain financing on favorable terms, and the level of any outstanding indebtedness, could adversely affect our financial health and ability to compete.

Our ability to continue to obtain financing on favorable terms may limit our discretion on some business matters, which could make it more difficult for us to expand, finance our operations and engage in other business activities that may be in our interest. In addition, the operating and financial restrictions imposed by our senior credit facility may limit our ability to:

| • | incur additional indebtedness and additional liens on our assets; |

| • | engage in mergers or acquisitions or dispose of assets; |

| • | enter into sale-leaseback transactions; |

| • | pay dividends or make other distributions; |

| • | voluntarily prepay other indebtedness; |

| • | enter into transactions with affiliated persons; |

| • | make investments; and |

| • | change the nature of our business. |

Any additional indebtedness we may incur in the future could subject us to similar or even more restrictive conditions.

At certain periods during the year, we borrow significant amounts on our senior credit facility for working capital purposes. In addition, we may borrow on the senior credit facility to pursue strategic opportunities or other general business matters. Accordingly, our future level of indebtedness could have important consequences. For example, it may:

| • | increase our vulnerability to general adverse economic and industry conditions, including interest rate fluctuations; |

| • | require us to dedicate a substantial portion of our cash flow from operations to payments on our indebtedness, thereby reducing the availability of our cash flow to fund working capital, capital expenditures and other general corporate purposes; |

| • | limit our ability to borrow additional funds to alleviate liquidity constraints, as a result of financial and other restrictive covenants in our indebtedness; |

| • | limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; |

| • | place us at a competitive disadvantage relative to companies that have less indebtedness; and |

| • | limit our ability to refinance our principal secured indebtedness. |

Our ability to make future principal and interest payments, borrow and repay amounts under our senior credit facility and continue to comply with our loan covenants will depend primarily on our ability to generate sufficient cash flow from operations. Our failure to comply with our loan covenants might cause our lenders to accelerate our repayment obligations under our senior credit facility, which may be declared payable immediately based on a default. To remain in compliance with our credit facility, we must maintain specified financial ratios based on our levels of debt, fixed charges, and earnings (excluding extraordinary gains and extraordinary non-cash losses) before interest, taxes, depreciation and amortization, all of which are subject to the risks of our business.

10

Table of Contents

Any expansion into new product markets may be costly and there is no guarantee that the new product market would be successful.

In addition to developing enhancements to and new products for the outdoor living market, we may also develop new products that allow us to expand into new product markets. Expansion into new markets and the development of new products may involve considerable costs and may not generate sufficient revenue to be profitable or cover the costs of development.

| Item 1B. | Unresolved Staff Comments |

None.

| Item 2. | Properties |

We lease our corporate headquarters in Winchester, Virginia, which consists of approximately 36,000 square feet of office space, under a lease that expires in March 2020. In addition, we lease 55,047 square feet of office and storage space in Dulles, Virginia, that we do not occupy. We have sublet all of the office space for the remainder of the term of the lease obligation, which expires in mid-2019. For a description of our financial reporting in connection with the Dulles lease agreement, see Note 13 to our Consolidated Financial Statements appearing elsewhere in this report.

We own approximately 92 acres of land in Winchester, Virginia and the buildings on this land. The site includes our research and development technical facility and manufacturing facility, which contains approximately 465,000 square feet of space, and outside open storage. We own approximately 37 acres of land in Fernley, Nevada and the buildings on this land. The site includes our manufacturing facility, which contains approximately 240,000 square feet of space, and outside open storage. These facilities provide adequate capacity for current and anticipated future consumer demand.

In September 2007, we suspended operations at our Olive Branch, Mississippi facility (Olive Branch facility) and consolidated all of our manufacturing operations into our Winchester and Fernley sites. In January 2016, we sold a portion of the Olive Branch facility that contained the buildings. As of the date of this report, we continue to own approximately 62 acres of undeveloped land at the Olive Branch facility.

We lease a total of approximately 1.4 million square feet of warehouse and facility space under leases with expiration dates ranging from 2017 to 2026. For information about these leases, see Note 10 to our Consolidated Financial Statements appearing elsewhere in this report.

The equipment and machinery we use in our operations consist principally of plastic and wood conveying and processing equipment. We own all of our manufacturing equipment. We lease some forklift equipment at our facilities under operating leases.

We regularly evaluate our various facilities and equipment and make capital investments where necessary. In 2016, we spent a total of $14.6 million on capital expenditures, primarily related to equipment purchases, the purchase of land adjacent to our Winchester, Virginia manufacturing facility, Trex University (our state-of-the-art training facility), general plant cost reduction initiatives, process and productivity improvements . We estimate that our capital expenditures in 2017 will be approximately $15 million to $20 million. We expect to use these expenditures principally to support cost reduction initiatives, new product launches in current and adjacent categories and general business support.

11

Table of Contents

| Item 3. | Legal Proceedings |

The Company has lawsuits, as well as other claims, pending against it which are ordinary routine litigation and claims incidental to the business. Management has evaluated the merits of these lawsuits and claims, and believes that their ultimate resolution will not have a material effect on the Company’s consolidated financial condition, results of operations, liquidity or competitive position.

| Item 4. | Mine Safety Disclosures. |

Not applicable.

12

Table of Contents

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Market for Common Stock

Our common stock has been listed on the New York Stock Exchange (NYSE) since April 8, 1999. Between April 8, 1999 and November 22, 2009, it was listed under the symbol “TWP”. Effective November 23, 2009, the symbol changed to “TREX”. The table below shows the reported high and low sale prices of our common stock for each quarter during 2016 and 2015 as reported by the NYSE.

| 2016 |

High | Low | ||||||

| First Quarter |

$ | 48.14 | $ | 31.11 | ||||

| Second Quarter |

50.62 | 39.74 | ||||||

| Third Quarter |

64.36 | 44.38 | ||||||

| Fourth Quarter |

72.21 | 50.81 | ||||||

| 2015 |

High | Low | ||||||

| First Quarter |

$ | 55.13 | $ | 38.05 | ||||

| Second Quarter |

57.72 | 46.72 | ||||||

| Third Quarter |

50.16 | 31.73 | ||||||

| Fourth Quarter |

44.17 | 33.72 | ||||||

Dividend Policy

We have never paid cash dividends on our common stock and our credit agreement places limitations on our ability to pay cash dividends. We intend to retain future earnings to finance the development and expansion of our business and, therefore, have no current intention to pay cash dividends. However, we reconsider our dividend policy on a regular basis and may determine to pay dividends in the future.

13

Table of Contents

Stockholder Return Performance Graph

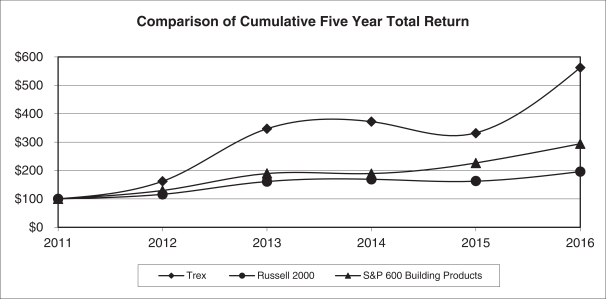

The following graph and table show the cumulative total stockholder return on the Company’s common stock for the last five fiscal years compared to the Russell 2000 Index and the Standard and Poor’s 600 Building Products Index (S&P 600 Building Products). The graph assumes $100 was invested on December 31, 2011 in (1) the Company’s common stock, (2) the Russell 2000 Index and (3) the S&P 600 Building Products, and assumes reinvestment of dividends and market capitalization weighting as of December 31, 2012, 2013, 2014, 2015 and 2016.

Comparison of Cumulative Total Return

Among Trex Company, Inc., Russell 2000 Index, and S&P 600 Building Products Index

| December 31, 2011 |

December 31, 2012 |

December 31, 2013 |

December 31, 2014 |

December 31, 2015 |

December 31, 2016 |

|||||||||||||||||||

| Trex Company, Inc. |

$ | 100.00 | $ | 162.53 | $ | 347.25 | $ | 371.88 | $ | 332.23 | $ | 562.45 | ||||||||||||

| Russell 2000 Index |

$ | 100.00 | $ | 116.35 | $ | 161.52 | $ | 169.42 | $ | 161.94 | $ | 196.45 | ||||||||||||

| S&P 600 Building Products |

$ | 100.00 | $ | 129.86 | $ | 189.32 | $ | 188.86 | $ | 226.58 | $ | 294.05 | ||||||||||||

Other Stockholder Matters

As of February 7, 2017, there were approximately 181 holders of record of our common stock.

In 2016, we submitted to the NYSE in a timely manner the annual certification that our Chief Executive Officer was not aware of any violation by us of the NYSE corporate governance listing standards.

14

Table of Contents

| Item 6. | Selected Financial Data |

The following table presents selected financial data as of December 31, 2016, 2015, 2014, 2013, and 2012 and for each year in the five-year period ended December 31, 2016.

The selected financial data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our Consolidated Financial Statements and related notes thereto appearing elsewhere in this report.

| Year Ended December 31, (1) | ||||||||||||||||||||

| 2016 (2) | 2015 (3) | 2014 | 2013 (4) | 2012 (5) | ||||||||||||||||

| (In thousands, except share and per share data) | ||||||||||||||||||||

| Statement of Comprehensive Income Data: |

||||||||||||||||||||

| Net sales |

$ | 479,616 | $ | 440,804 | $ | 391,660 | $ | 342,511 | $ | 307,354 | ||||||||||

| Cost of sales |

292,521 | 285,935 | 251,464 | 243,893 | 222,772 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

187,095 | 154,869 | 140,196 | 98,618 | 84,582 | |||||||||||||||

| Selling, general and administrative expenses |

83,140 | 77,463 | 72,370 | 73,967 | 71,907 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income from operations |

103,955 | 77,406 | 67,826 | 24,651 | 12,675 | |||||||||||||||

| Interest expense, net |

1,125 | 619 | 878 | 602 | 8,946 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income before income taxes |

102,830 | 76,787 | 66,948 | 24,049 | 3,729 | |||||||||||||||

| Provision (benefit) for income taxes |

34,983 | 28,689 | 25,427 | (10,549 | ) | 1,009 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income |

$ | 67,847 | $ | 48,098 | $ | 41,521 | $ | 34,598 | $ | 2,720 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Basic earnings per share |

$ | 2.31 | $ | 1.53 | $ | 1.28 | $ | 1.03 | $ | 0.08 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Basic weighted average shares outstanding |

29,394,559 | 31,350,542 | 32,319,649 | 33,589,682 | 32,247,184 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Diluted earnings per share |

$ | 2.29 | $ | 1.52 | $ | 1.27 | $ | 1.01 | $ | 0.08 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Diluted weighted average shares outstanding |

29,612,669 | 31,682,509 | 32,751,074 | 34,273,502 | 34,129,712 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Cash Flow Data: |

||||||||||||||||||||

| Cash provided by operating activities |

$ | 85,293 | $ | 62,634 | $ | 58,642 | $ | 45,208 | $ | 60,443 | ||||||||||

| Cash used in investing activities |

(10,202 | ) | (23,329 | ) | (12,873 | ) | (12,697 | ) | (7,484 | ) | ||||||||||

| Cash used in financing activities |

(62,422 | ) | (42,854 | ) | (39,997 | ) | (30,898 | ) | (55,326 | ) | ||||||||||

| Other Data (unaudited): |

||||||||||||||||||||

| EBITDA (6) |

$ | 118,136 | $ | 91,701 | $ | 82,653 | $ | 40,597 | $ | 29,149 | ||||||||||

| Balance Sheet Data: |

||||||||||||||||||||

| Cash and cash equivalents and restricted cash |

$ | 18,664 | $ | 5,995 | $ | 9,544 | $ | 3,772 | $ | 2,159 | ||||||||||

| Working capital |

54,264 | 38,581 | 35,787 | 28,994 | 10,158 | |||||||||||||||

| Total assets |

221,430 | 211,998 | 195,824 | 188,157 | 168,615 | |||||||||||||||

| Total debt |

— | 7,000 | — | — | 5,000 | |||||||||||||||

| Total stockholder’s equity |

$ | 134,161 | $ | 116,463 | $ | 113,385 | $ | 106,616 | $ | 93,986 | ||||||||||

| 1) | All common stock share and per share data in the above table are presented on a post-split basis to reflect the two-for-one stock split of our common stock, in the form of a stock dividend distributed on May 7, 2014 to stockholders of record at the close of business on April 7, 2014. |

15

Table of Contents

| 2) | Year ended December 31, 2016 was materially affected by a pre-tax increase of $9.8 million to the warranty reserve related to surface flaking. Also, during 2016, the Company adopted Financial Accounting Standards Board Accounting Standards Update (ASU) No. 2015-17, “Income Taxes (Topic 740): Balance Sheet Classification of Deferred Taxes,” and ASU No. 2016-09, “Compensation – Stock Compensation (Topic 718): Improvements to Employee Share-Based Payment Accounting.” |

| Because the Company applied ASU No. 2015-17 prospectively in the quarterly period ended December 31, 2016, prior periods have not been adjusted. As a result, in 2016 deferred tax assets are now reported net of deferred tax liabilities, included as either a non-current asset or liability, and are no longer a component of working capital. Deferred tax assets or liabilities of prior fiscal years that were previously included in current assets or current liabilities continue to be reported as a component of working capital. |

| Adoption of ASU No. 2016-09 did not have a material impact on the Company’s results of operations and financial condition or cash flows for prior periods. Note 2 to our Consolidated Financial Statements appearing elsewhere in this report discusses the method used to apply each provision of ASU No. 2016-09. |

| 3) | Year ended December 31, 2015 was materially affected by a pre-tax increase of $7.8 million to the warranty reserve, the majority of which related to surface flaking. |

| 4) | Year ended December 31, 2013 was materially affected by a pre-tax increase of $20.0 million to the warranty reserve and a $19.9 million income tax benefit resulting from a significant reversal of our valuation allowance, $10.9 million of which was a direct result of the Company’s decision to exit a full valuation allowance. |

| 5) | Year ended December 31, 2012 was materially affected by a pre-tax increase of $21.5 million to the warranty reserve. |

| 6) | EBITDA represents net income before interest, income taxes, depreciation and amortization. EBITDA is not a measurement of financial performance under accounting principles generally accepted in the United States (GAAP). The Company has included data with respect to EBITDA because management evaluates and projects the performance of the Company’s business using several measures, including EBITDA. Management considers EBITDA to be an important supplemental indicator of the Company’s operating performance, particularly as compared to the operating performance of the Company’s competitors, because this measure eliminates many differences among companies in capitalization and tax structures, capital investment cycles and ages of related assets, as well as some recurring non-cash and non-operating charges to net income or loss. For these reasons, management believes that EBITDA provides important supplemental information to investors regarding the operating performance of the Company and facilitates comparisons by investors between the operating performance of the Company and the operating performance of its competitors. Management believes that consideration of EBITDA should be supplemental, because EBITDA has limitations as an analytical financial measure. These limitations include the following: |

| • | EBITDA does not reflect the Company’s cash expenditures, or future requirements for capital expenditures, or contractual commitments; |

| • | EBITDA does not reflect the interest expense, or the cash requirements necessary to service interest or principal payments, on the Company’s indebtedness; |

| • | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and EBITDA does not reflect any cash requirements for such replacements; |

| • | EBITDA does not reflect the effect of earnings or charges resulting from matters the Company considers not to be indicative of its ongoing operations; and |

| • | not all entities in the Company’s industry may calculate EBITDA in the same manner in which the Company calculates EBITDA, which limits its usefulness as a comparative measure. |

16

Table of Contents

The Company compensates for these limitations by relying primarily on its GAAP results to evaluate its operating performance and by considering independently the economic effects of the foregoing items that are not reflected in EBITDA. As a result of these limitations, EBITDA should not be considered as an alternative to net income, as calculated in accordance with GAAP, as a measure of operating performance, nor should it be considered as an alternative to cash flows as a measure of liquidity. The following table sets forth, for the years indicated, a reconciliation of EBITDA to net income:

| Year Ended December 31, | ||||||||||||||||||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||

| (In thousands) | ||||||||||||||||||||

| Net income |

$ | 67,847 | $ | 48,098 | $ | 41,521 | $ | 34,598 | $ | 2,720 | ||||||||||

| Plus interest expense, net |

1,125 | 619 | 878 | 602 | 8,946 | |||||||||||||||

| Plus income tax provision (benefit) |

34,983 | 28,689 | 25,427 | (10,549 | ) | 1,009 | ||||||||||||||

| Plus depreciation and amortization |

14,181 | 14,295 | 14,827 | 15,946 | 16,474 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| EBITDA |

$ | 118,136 | $ | 91,701 | $ | 82,653 | $ | 40,597 | $ | 29,149 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

17

Table of Contents

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

This management’s discussion and analysis contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements regarding our expected financial position and operating results, our business strategy, our financing plans, forecasted demographic and economic trends relating to our industry and similar matters are forward-looking statements. These statements can sometimes be identified by our use of forward-looking words such as “may,” “will,” “anticipate,” “estimate,” “expect,” “intend” or similar expressions. We cannot promise you that our expectations in such forward-looking statements will turn out to be correct. Our actual results could be materially different from our expectations because of various factors, including the factors discussed under “Item 1A. Risk Factors.” These statements are also subject to risks and uncertainties that could cause the Company’s actual operating results to differ materially. Such risks and uncertainties include, but are not limited to, the extent of market acceptance of the Company’s current and newly developed products; the costs associated with the development and launch of new products and the market acceptance of such new products; the sensitivity of the Company’s business to general economic conditions; the impact of seasonal and weather-related demand fluctuations on inventory levels in the distribution channel and sales of the Company’s products; the availability and cost of third-party transportation services for our products and raw materials; the Company’s ability to obtain raw materials at acceptable prices; the Company’s ability to maintain product quality and product performance at an acceptable cost; the level of expenses associated with product replacement and consumer relations expenses related to product quality; and the highly competitive markets in which the Company operates.

OVERVIEW

General. Trex Company, Inc. is the world’s largest manufacturer of wood-alternative decking and railing products marketed under the brand name Trex® and manufactured in the United States. We offer a comprehensive set of aesthetically pleasing, high performance, low maintenance products in the decking, railing, porch, fencing, steel deck framing and outdoor lighting categories. We believe that the range and variety of our products allow consumers to design much of their outdoor living space using Trex brand products.

We offer the following products:

| Decking | Trex Transcend® Trex Enhance® Trex Select®

| |

| Railing | Trex Transcend Railing Trex Signature™ aluminum railing Trex Select Railing

| |

| Porch | Trex Transcend Porch Flooring and Railing System

| |

| Fencing | Trex Seclusions®

| |

| Steel Deck Framing System | Trex Elevations®

| |

| Outdoor Lighting Systems | Trex DeckLighting™ Trex LandscapeLighting™

| |

| Hidden Fastening System for Specially Grooved Boards

|

Trex Hideaway® |

18

Table of Contents

Highlights related to the twelve months ended December 31, 2016 include:

| • | Increase in net sales of 8.8%, or $38.8 million, in the twelve months ended 2016 compared to the twelve months ended 2015. Net sales in 2016 were the highest of any year in our history. |

| • | Increase in gross profit of 20.8%, or $32.2 million. Gross profit in 2016 was the highest of any year in our history. |

| • | Net income of $67.8 million also reflects the highest of any year in our history. |

| • | $85.3 million of positive cash flows from operating activities in the twelve months ended 2016 compared to $62.6 million in the twelve months ended 2015. |

Net Sales. Net sales consist of sales and freight, net of returns and discounts. The level of net sales is principally affected by sales volume and the prices paid for Trex products. Our branding and product differentiation strategy enables us to command premium prices over wood products. Our operating results have historically varied from quarter to quarter, often due to seasonal trends in the demand for outdoor living products. We have historically experienced lower net sales during the fourth quarter due to the holiday season. Also, seasonal, erratic or prolonged adverse weather conditions in certain geographic regions reduce the level of home improvement and construction activity and can shift net sales to a later period.

As part of our normal business practice and consistent with industry practices, we have historically provided our distributors and dealers incentives to build inventory levels before the start of the prime deck-building season to ensure adequate availability of product to meet anticipated seasonal consumer demand and to enable production planning. These incentives include prompt payment discounts and favorable payment terms. In addition, we offer price discounts or volume rebates on specified products and other incentives based on increases in purchases as part of specific promotional programs. The timing of sales incentive programs can significantly impact sales, receivables and inventory levels during the offering period. However, the timing and terms of the majority of our programs are generally consistent from year to year.

Gross Profit. Gross profit represents the difference between net sales and cost of sales. Cost of sales consists of raw materials costs, direct labor costs, manufacturing costs, warranty costs, and freight. Raw materials costs generally include the costs to purchase and transport reclaimed wood fiber, scrap polyethylene and pigmentation for coloring Trex products. Direct labor costs include wages and benefits of personnel engaged in the manufacturing process. Manufacturing costs consist of costs of depreciation, utilities, maintenance supplies and repairs, indirect labor, including wages and benefits, and warehouse and equipment rental activities.

Selling, General and Administrative Expenses. The largest component of selling, general and administrative expenses is personnel related costs, which include salaries, commissions, incentive compensation, and benefits of personnel engaged in sales and marketing, accounting, information technology, corporate operations, research and development, and other business functions. Another component of selling, general and administrative expenses is branding and other sales and marketing costs, which are used to build brand awareness of Trex. These costs consist primarily of advertising, merchandising, and other promotional costs. Other general and administrative expenses include professional fees, office occupancy costs attributable to the business functions previously referenced, and consumer relations expenses. As a percentage of net sales, selling, general and administrative expenses have varied from quarter to quarter due, in part, to the seasonality of our business.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

Our significant accounting policies are described in Note 2 to our Consolidated Financial Statements appearing elsewhere in this report. Our critical accounting estimates include the areas where we have made what we consider to be particularly difficult, subjective or complex judgments in making estimates, and where these estimates can significantly affect our financial results under different assumptions and conditions. We prepare our financial statements in conformity with accounting principles generally accepted in the United States. As a result, we are required to make estimates, judgments and assumptions that we believe are reasonable based upon

19

Table of Contents

the information available. These estimates, judgments and assumptions affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the periods presented. Actual results could be different from these estimates.

Product Warranty. We warrant that our products will be free from material defects in workmanship and materials. Generally this warranty period is 25 years for residential use and 10 years for commercial use, excluding Trex Signature™ Railing, which has a warranty period of 25 years for both residential and commercial use. We further warrant that Trex Transcend, Trex Enhance, Trex Select and Universal Fascia products will not fade in color more than a certain amount and will be resistant to permanent staining from food substances or mold, provided the stain is cleaned within seven days of appearance. This warranty extends for a period of 25 years for residential use and 10 years for commercial use. If there is a breach of such warranties, we have an obligation either to replace the defective product or refund the purchase price.

We continue to receive and settle claims for products manufactured at our Nevada facility prior to 2007 that exhibit surface flaking and maintain a warranty reserve to provide for the settlement of these claims. Estimating the warranty reserve for surface flaking claims requires management to estimate (1) the number of claims to be settled with payment and (2) the average cost to settle each claim.

To estimate the number of claims to be settled with payment, we utilize actuarial techniques to quantify both the expected number of claims to be received and the percentage of those claims that will ultimately require payment (collectively, elements). Estimates for these elements are quantified using a range of assumptions derived from claim count history and the identification of factors influencing the claim counts. The number of claims received has declined each year since peaking in 2009, although the rate of decline has decelerated in recent years. Additionally, events such as the 2009 settlement of a class action lawsuit covering the surface flaking defect and communications by us in 2013 informing homeowners of potential hazards associated with products exhibiting surface flaking that are not timely replaced, have obscured observable trends in historical claims activity. The cost per claim varies due to a number of factors, including the size of affected decks, the availability and type of replacement material used, the cost of production of replacement material and the method of claim settlement.

We monitor surface flaking claims activity each quarter for indications that our estimates require revision. Typically, a majority of surface flaking claims received in a year are received during the summer outdoor season, which spans the second and third quarters. It has been our practice to utilize the actuarial techniques discussed above during the third quarter, after a significant portion of all claims has been received for the fiscal year and variances to annual claims expectations are more meaningful. The number of claims received in the year ended December 31, 2016 was lower than claims received in the year ended December 31, 2015, continuing the historical year-over-year decline in incoming claims, but was higher than our expectations. Also, the average settlement cost per claim experienced in the year ended December 31, 2016 was higher than the average settlement cost per claim experienced during the year ended December 31, 2015 and higher than our expectation for 2016. As a result and after actuarial review, we revised our estimate and recorded an increase to the warranty reserve of $9.8 million during the third quarter of 2016. Based on the facts and circumstances at December 31, 2016, we believe our reserve is sufficient to cover future surface flaking obligations. We note that our annual cash outflows for surface flaking claims declined by $1.5 million, or 21%, in 2016 compared to 2015, and declined by $1.7 million, or 19%, in 2015 compared to 2014.

Our analysis is based on currently known facts and a number of assumptions, as discussed above, and current expectations. Projecting future events such as the number of claims to be received, the number of claims that will require payment and the average cost of claims could cause the actual warranty liabilities to be higher or lower than those projected, which could materially affect our financial condition, results of operations or cash flows. We estimate that the annual number of claims received will continue to decline over time and that the average cost per claim will increase slightly, primarily due to inflation. If the level of claims received or average cost per claim differs materially from expectations, it could result in additional increases or decreases to the warranty reserve and a decrease or increase in earnings and cash flows in future periods. We estimate that a 10%

20

Table of Contents

change in the expected number of remaining claims to be settled with payment or the expected cost to settle claims may result in approximately a $3.4 million change in the surface flaking warranty reserve.

The following table details surface flaking claims activity related to our warranty:

| Year Ended December 31, | ||||||||||||

| 2016 | 2015 | 2014 | ||||||||||

| Claims unresolved beginning of period |

2,500 | 2,872 | 4,249 | |||||||||

| Claims received (1) |

2,615 | 2,968 | 3,212 | |||||||||

| Claims resolved (2) |

(2,360 | ) | (3,340 | ) | (4,589 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Claims unresolved end of period |

2,755 | 2,500 | 2,872 | |||||||||

|

|

|

|

|

|

|

|||||||

| Average cost per claim (3) |

$ | 2,639 | $ | 2,521 | $ | 2,287 | ||||||

| (1) | Claims received include new claims received or identified during the period. |

| (2) | Claims resolved include all claims settled with or without payment and closed during the period. |

| (3) | Average cost per claim represents the average settlement cost of claims closed with payment during the period. |

For additional information about product warranties, see Notes 2 and 13 to the Consolidated Financial Statements appearing elsewhere in this report.

Inventories. We account for inventories at the lower of cost (last-in, first-out, or LIFO) or market value. We believe that our current inventory of finished goods will be saleable in the ordinary course of business and, accordingly, have not established significant reserves for estimated slow moving products or obsolescence. At December 31, 2016, the excess of the replacement cost of inventory over the LIFO value of inventory was approximately $21.4 million.

Income Taxes. We recognize deferred tax assets and liabilities based on the difference between the financial statement basis and tax basis of assets and liabilities using enacted tax rates in effect during the year in which it is expected that the differences reverse. We assess the likelihood that our deferred tax assets will be realized. Deferred tax assets are reduced by a valuation allowance when, after considering all available positive and negative evidence, it is determined that it is more likely than not that some portion, or all, of the deferred tax asset will not be realized. As of December 31, 2016, we have a valuation allowance of $4.1 million against the deferred tax assets related to state tax credits we estimate will expire before they are realized. We will analyze our position in subsequent reporting periods, considering all available positive and negative evidence, in determining the expected realization of our deferred tax assets.

Stock-Based Compensation. The fair value of each stock-based award to officers, directors and certain key employees is established on the date of the grant. We calculate the grant date fair value of stock options and stock appreciation rights using the Black-Scholes valuation model. Determining the fair value of these awards is judgmental in nature and involves the use of significant estimates and assumptions, including the term of the share-based awards, risk-free interest rates over the vesting period, expected dividend rates, and the price volatility of our shares. The Company uses the historical volatility over the average expected term of the options granted as the expected volatility. The Company recognizes forfeitures as they occur. We base our fair value estimates on assumptions we believe to be reasonable but that are inherently uncertain. Actual future results may differ from those estimates.

We grant performance-based restricted stock units, the vesting of which is subject to holder’s continuing employment and our achievement of certain performance measures. At each reporting period, we assess actual performance versus the predetermined performance measures, and adjust the stock-based compensation expense to reflect the relative performance achievement. Actual distributed shares are calculated upon conclusion of the service and performance periods.

21

Table of Contents

RESULTS OF OPERATIONS