April 3, 2024

Dear Stockholders:

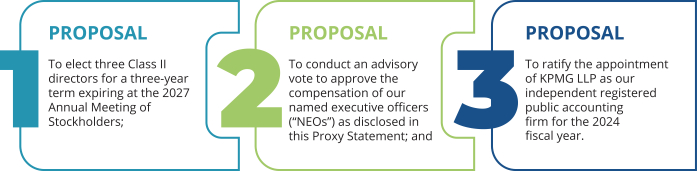

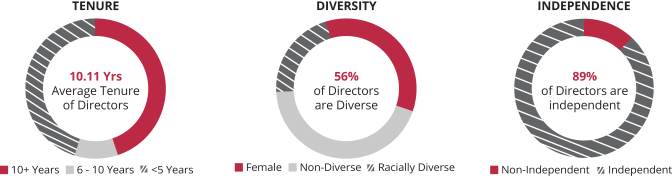

It is my pleasure to invite you to the 2024 Annual Meeting of Stockholders of Lennox International Inc. (NYSE: LII) (the “Annual Meeting”), which will be held virtually at 10:30 a.m., Central Daylight Time, on Thursday, May 16, 2024. Details regarding admission to the online meeting and the business to be conducted are provided in the accompanying Notice of 2024 Annual Meeting of Stockholders and Proxy Statement.

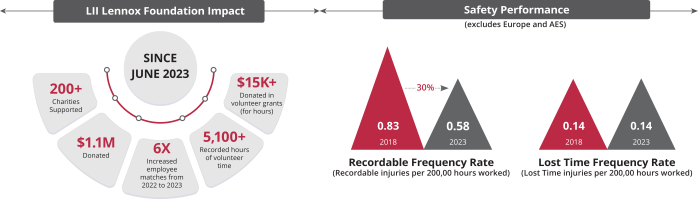

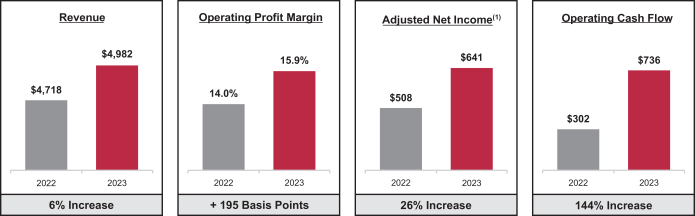

On behalf of the management team and our Board of Directors, I want to thank you for being a Lennox stockholder. Thanks to the efforts of our talented employees and the loyalty of our customers, relentless execution of our Lennox transformation strategy in 2023 yielded significant financial successes even as we navigated challenging residential end-markets. We successfully implemented the new minimum energy efficiency regulatory change, improved our factory production, built supply chain resiliency, and initiated our pricing excellence programs. In addition, we simplified our portfolio with the sale of our European businesses and improved our lifecycle value proposition by acquiring AES, a provider of installation services, adapter curbs, and reclaim services. As we step into 2024, we carry positive momentum and remain committed to overcoming end-market uncertainties through disciplined execution.

The accompanying Notice of 2024 Annual Meeting of Stockholders and Proxy Statement describe the items of business that will be discussed and voted upon during the Annual Meeting. Your vote is very important. Whether or not you plan to attend the Annual Meeting, we urge you to vote and submit your proxy by Internet, telephone, or mail, pursuant to the instructions on your Notice or Proxy Card. We encourage you to vote by Internet or telephone as those methods offer the most convenience. Please use the website or telephone number shown on your Notice or your Proxy Card to vote.

All of us at Lennox are tremendously proud of our 2023 accomplishments. Thank you for being a Lennox stockholder. We hope you can join us at the Annual Meeting.

| Sincerely, |

|

|

| Todd J. Teske |

| Chair of the Board |

Meeting Information

Meeting Information