Document

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

Commission File Number 001-15149

LENNOX INTERNATIONAL INC.

(Exact name of Registrant as specified in its charter)

|

| |

Delaware | 42-0991521 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

2140 Lake Park Blvd. Richardson, Texas 75080

(Address of principal executive offices, including zip code)

(Registrant's telephone number, including area code): (972) 497-5000

Securities Registered Pursuant to Section 12(b) of the Act:

|

| |

Title of each class | Name of each exchange on which registered |

Common Stock, $.01 par value per share | New York Stock Exchange |

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by checkmark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [X] No [ ]

Indicate by checkmark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act.

Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the last 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T(§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer or a non-accelerated filer (see definition of “accelerated filer” and “large accelerated filer” in Rule 12b-2 of the Exchange Act).

|

| | | | |

Large Accelerated Filer | [X] | | Accelerated Filer | [ ] |

Non-Accelerated Filer | [ ] | | Smaller Reporting Company | [ ] |

| | | Emerging growth company | [ ] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).Yes [ ] No[X]

As of June 30, 2017, the aggregate market value of the common stock held by non-affiliates of the registrant was approximately $7.7 billion based on the closing price of the registrant's common stock on the New York Stock Exchange. As of February 9, 2018, there were 41,176,787 shares of the registrant's common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's 2018 Definitive Proxy Statement to be filed with the Securities and Exchange Commission in connection with the registrant's 2018 Annual Meeting of Stockholders to be held on May 16, 2018 are incorporated by reference into Part III of this report.

LENNOX INTERNATIONAL INC.

FORM 10-K

For the Fiscal Year Ended December 31, 2017

INDEX

|

| | |

| | Page |

| | |

PART I | | |

ITEM 1. | | |

ITEM 1A. | | |

ITEM 1B. | | |

ITEM 2. | | |

ITEM 3. | | |

ITEM 4. | | |

| | |

PART II | | |

ITEM 5. | | |

ITEM 6. | | |

ITEM 7. | | |

ITEM 7A. | | |

ITEM 8. | | |

ITEM 9. | | |

ITEM 9A. | | |

ITEM 9B. | | |

| | |

PART III | | |

ITEM 10. | | |

ITEM 11. | | |

ITEM 12. | | |

ITEM 13. | | |

ITEM 14. | | |

| | |

PART IV | | |

ITEM 15. | | |

| | |

| | |

| | |

| | |

PART I

Item 1. Business

References in this Annual Report on Form 10-K to “we,” “our,” “us,” “LII” or the “Company” refer to Lennox International Inc. and its subsidiaries, unless the context requires otherwise.

The Company

We are a leading global provider of climate control solutions. We design, manufacture and market a broad range of products for the heating, ventilation, air conditioning and refrigeration (“HVACR”) markets. We have leveraged our expertise to become an industry leader known for innovation, quality and reliability. Our products and services are sold through multiple distribution channels under various brand names. The Company was founded in 1895, in Marshalltown, Iowa, by Dave Lennox, the owner of a machine repair business for railroads. He designed and patented a riveted steel coal-fired furnace, which led to numerous advancements in heating, cooling and climate control solutions.

Shown in the table below are our three business segments, the key products, services and well-known product and brand names within each segment and net sales in 2017 by segment. Segment financial data for 2017, 2016 and 2015, including financial information about foreign and domestic operations, is included in Note 18 of the Notes to our Consolidated Financial Statements in “Item 8. Financial Statements and Supplementary Data” and is incorporated herein by reference.

|

| | | | | | | | |

Segment | | Products & Services | | Product and Brand Names | | 2017 Net Sales (in millions) |

Residential Heating & Cooling | | Furnaces, air conditioners, heat pumps, packaged heating and cooling systems, indoor air quality equipment, comfort control products, replacement parts and supplies | | Lennox, Dave Lennox Signature, Armstrong Air, Ducane, Aire-Flo, Air-Ease, Concord, Magic-Pak, ADP Advanced Distributor Products, iComfort and Lennox PartsPlus | | $ | 2,140.4 |

|

Commercial Heating & Cooling | | Unitary heating and air conditioning equipment, applied systems, controls, installation and service of commercial heating and cooling equipment, variable refrigerant flow commercial products | | Lennox, Allied Commercial, Magic-Pak, Raider, Landmark, Prodigy, Strategos, Energence, Lennox VRF and Lennox National Account Services | | 973.8 |

|

Refrigeration | | Condensing units, unit coolers, fluid coolers, air cooled condensers, air handlers, process chillers, controls, compressorized racks, supermarket display cases and systems | | Heatcraft Worldwide Refrigeration, Bohn, Larkin, Climate Control, Chandler Refrigeration, Kysor/Warren, Friga-Bohn, HK Refrigeration, Hyfra, Kirby and Interlink | | 725.4 |

|

| | | | Total | | $ | 3,839.6 |

|

Products and Services

Residential Heating & Cooling

Heating & Cooling Products. We manufacture and market a broad range of furnaces, air conditioners, heat pumps, packaged heating and cooling systems, equipment and accessories to improve indoor air quality, comfort control products, replacement parts and supplies and related products for both the residential replacement and new construction markets in North America. These products are available in a variety of designs and efficiency levels and at a range of price points, and are intended to provide a complete line of home comfort systems. We believe that by maintaining a broad product line marketed under multiple brand names, we can address different market segments and penetrate multiple distribution channels.

The “Lennox” and “Aire-Flo” brands are sold directly to a network of approximately 7,000 independent installing dealers, making us one of the largest wholesale distributors of residential heating and air conditioning products in North America. The Allied Air Enterprise brands (“Armstrong Air,” “Air-Ease,” “Concord,” “Ducane,” and “Magic-Pak”) include a full line of heating and air conditioning products and are sold through independent distributors in North America.

We are continuing to grow our network of 230 Lennox PartsPlus stores across the United States and Canada. These stores provide an easy access solution for contractors and independent dealers to obtain universal service and replacement parts, supplies, convenience items, tools, Lennox equipment and OEM parts.

Our Advanced Distributor Products (“ADP”) operation builds evaporator coils and air handlers under the “ADP Advanced Distributor Products” brand and also builds evaporator coils under the “Lennox” brand and Allied Air Enterprise brands. ADP sells its own ADP branded evaporator coils to over 400 HVAC wholesale distributors across North America.

Commercial Heating & Cooling

North America. In North America, we manufacture and sell unitary heating and cooling equipment used in light commercial applications, such as low-rise office buildings, restaurants, retail centers, churches and schools. Our product offerings for these applications include rooftop units ranging from 2 to 50 tons of cooling capacity and split system/air handler combinations, which range from 1.5 to 20 tons of cooling capacity. These products are distributed primarily through commercial contractors and directly to national account customers. In 2014, we launched Lennox-branded variable refrigerant flow ("VRF") commercial products through Lennox company-owned distribution. We believe the success of our products is attributable to their efficiency, design flexibility, total cost of ownership, low life-cycle cost, ease of service and advanced control technology.

National Account Services. National Account Service ("NAS") provides installation, service and preventive maintenance for commercial HVAC national account customers in the United States and Canada.

Europe. In Europe, we manufacture and sell unitary products, which range from 2 to 70 tons of cooling capacity, and applied systems with up to 200 tons of cooling capacity. Our European products consist of small package units, rooftop units, chillers, air handlers and fan coils that serve medium-rise commercial buildings, shopping malls, other retail and entertainment buildings, institutional applications and other field-engineered applications. We manufacture heating and cooling products in several locations in Europe and market these products through both direct and indirect distribution channels in Europe, Russia, Turkey and the Middle East.

Refrigeration

We manufacture and market equipment for the global commercial refrigeration markets under the Heatcraft Worldwide Refrigeration name. We sell these products to distributors, installing contractors, engineering design firms, original equipment manufacturers and end-users. Our global manufacturing, distribution, sales and marketing footprint serves customers in over 115 countries worldwide.

North America. Our commercial refrigeration products for the North American market include condensing units, unit coolers, fluid coolers, air-cooled condensers, air handlers, display cases and refrigeration rack systems. These products preserve food and other perishables in supermarkets, convenience stores, restaurants, warehouses and distribution centers. In addition, our products are used to cool a wide variety of industrial processes, including data centers, machine tooling, and other critical cooling applications. We routinely provide application engineering for consulting engineers, contractors, store planners, end customers and others to support the sale of commercial refrigeration products. In addition to providing complete refrigeration systems and display cases, we also provide turnkey installations for our supermarket customers in Mexico.

International. In international markets, we manufacture and market refrigeration products including condensing units, unit coolers, air-cooled condensers, fluid coolers, compressor racks and industrial process chillers. We have manufacturing locations in Germany, France, Brazil and China. In Australia and New Zealand, we are the leading wholesale distribution business serving the HVACR industry with more than 60 locations serving our customers, which also includes the sale of refrigerant. In addition, we own a 50% common stock interest in a joint venture in Mexico that produces unit coolers, air-cooled condensers, condensing units, compressors and compressorized racks of the same design and quality as those manufactured by our U.S. business. This joint venture product line is complemented with imports from the U.S., which are sold through the joint venture's distribution network.

Business Strategy

Our business strategy is to sustain and expand our premium market position as well as offer a full spectrum of products to meet our customers' needs. We plan to expand our market position through organic growth and acquisitions while maintaining our focus on cost reductions to drive margin expansion and support growth in target business segments. This strategy is supported by the following five strategic priorities:

Innovative Product and System Solutions. In all of our markets, we are building on our heritage of innovation by developing residential, commercial and refrigeration products that give families and business owners more precise control over more aspects of their indoor environments, while significantly lowering their energy costs.

Manufacturing and Sourcing Excellence. We maintain our commitment to manufacturing and sourcing excellence by driving low-cost assembly through rationalization of our facilities and product lines, maximizing factory efficiencies, and leveraging our purchasing power and sourcing initiatives to expand the use of lower-cost components that meet our high-quality requirements.

Distribution Excellence. By investing resources in expanding our distribution network, we are making products available to our customers in a timely, cost-efficient manner. Additionally, we provide enhanced dealer support through the use of technology, training, advertising and merchandising.

Geographic Expansion. We are growing our business by extending our successful business model and product knowledge to capitalize on additional domestic and international market opportunities.

Expense Reduction. Through our cost management initiatives, we are optimizing operating, manufacturing and administrative costs.

Marketing and Distribution

We utilize multiple channels of distribution and offer different brands at various price points in order to better penetrate the HVACR markets. Our products and services are sold through a combination of direct sales, distributors and company-owned parts and supplies stores. Dedicated sales forces and manufacturers' representatives are deployed across our business segments and brands in a manner designed to maximize our ability to service each distribution channel. To optimize enterprise-wide effectiveness, we have active cross-functional and cross-organizational teams coordinating approaches to pricing, product design, distribution and national account customers.

The North American residential heating and cooling market provides an example of the competitive strength of our marketing and distribution strategy. We use three distinct distribution approaches in this market: the company-owned distribution system, the independent distribution system and direct sales to end-users. We distribute our “Lennox” and “Aire-Flo” brands in a company-owned process directly to independent dealers that install these heating and cooling products. We distribute our “Armstrong Air,” “Ducane,” “Air-Ease,” “Concord,” “Magic-Pak” and “ADP Advanced Distributor Products” brands through the traditional independent distribution process pursuant to which we sell our products to distributors who, in turn, sell the products to installing contractors. We also sell our products directly to customers through our Lennox PartsPlus stores.

Manufacturing

We operate manufacturing facilities worldwide and utilize the best available manufacturing techniques based on the needs of our businesses, including the use of lean manufacturing and principles of Six Sigma, a disciplined, data-driven approach and methodology for improving quality. We use numerous metrics to track and manage annual efficiency improvements. Some facilities are impacted by seasonal production demand, and we manufacture both heating and cooling products in those facilities to balance production and maintain a relatively stable labor force. We may also hire temporary employees to meet changes in demand.

Strategic Sourcing

We rely on various suppliers to furnish the raw materials and components used in the manufacturing of our products. To maximize our buying effectiveness in the marketplace, we have a central strategic sourcing group that consolidates purchases of certain materials, components and indirect items across business segments. The goal of the strategic sourcing group is to develop global strategies for a given component group, concentrate purchases with three to five suppliers and develop long-term relationships with these vendors. By developing these strategies and relationships, we seek to leverage our material needs to reduce costs and improve financial and operating performance. Our strategic sourcing group also works with selected suppliers to reduce costs

and improve quality and delivery performance by employing lean manufacturing and Six Sigma.

Compressors, motors and controls constitute our most significant component purchases, while steel, copper and aluminum account for the bulk of our raw material purchases. We own equity interests in joint ventures that manufacture compressors. These joint ventures provide us with compressors for our residential and commercial heating and cooling and refrigeration businesses.

Research and Development and Technology

Research and development is a key pillar of our growth strategy. We operate a global engineering and technology organization that focuses on new technology invention, product development, product quality improvements and process enhancements, including our development of next-generation control systems as well as heating and cooling products that include some of the most efficient products in their respective categories. We leverage intellectual property and innovative designs across our businesses. We also leverage product development cycle time improvements and product data management systems to commercialize new products to market more rapidly. We use advanced, commercially available computer-aided design, computer-aided manufacturing, computational fluid dynamics and other sophisticated design tools to streamline the design and manufacturing processes. We use complex computer simulations and analyses in the conceptual design phase before functional prototypes are created. We also operate a full line of prototype machine equipment and advanced laboratories certified by applicable industry associations.

Seasonality

Our sales and related segment profit tend to be seasonally higher in the second and third quarters of the year because summer is the peak season for sales of air conditioning equipment and services in the U.S. and Canada. For the same reason, our working capital needs are generally greater in the first and second quarters, and we generally have higher operating cash inflows in the third and fourth quarters.

Our markets are driven by seasonal weather patterns. HVAC products and services are sold year round, but the volume and mix of product sales and service change significantly by season. The industry generally ships roughly twice as many units during June as it does in December. Overall, cooling equipment represents a substantial portion of the annual HVAC market. Between the heating season (roughly November through February) and cooling season (roughly May through August) are periods commonly referred to as "shoulder seasons" when the distribution channel transitions its buying patterns from one season to the next. These seasonal fluctuations in mix and volume drive our sales and related segment profit, resulting in somewhat higher sales in the second and third quarters due to the higher volume in the cooling season relative to the heating season.

Patents and Trademarks

We hold numerous patents that relate to the design and use of our products. We consider these patents important, but no single patent is material to the overall conduct of our business. We proactively obtain patents to further our strategic intellectual property objectives. We own or license several trademarks and service marks we consider important in the marketing of our products and services, and we protect our marks through national registrations and common law rights.

Competition

Substantially all markets in which we participate are competitive. The most significant competitive factors we face are product reliability, product performance, service and price, with the relative importance of these factors varying among our businesses. The following are some of the companies we view as significant competitors in each of our three business segments, with relevant brand names, when different from the company name, shown in parentheses. The marks below may be the registered or unregistered trademarks or trade names of their respective owners.

| |

• | Residential Heating & Cooling - United Technologies Corp. (Carrier, Bryant, Tempstar, Comfortmaker, Heil, Arcoaire, KeepRite, Day & Night); Ingersoll-Rand plc (Trane, American Standard); Paloma Industries, Inc. (Rheem, Ruud); Johnson Controls, Inc. (York); Daikin Industries, Ltd. (Goodman, Amana); and Melrose Industries PLC (Maytag, Westinghouse, Frigidaire, Tappan, Philco, Kelvinator, Gibson, Broan, NuTone). |

| |

• | Commercial Heating & Cooling - United Technologies Corp. (Carrier, ICP Commercial); Ingersoll-Rand plc (Trane); Paloma Industries, Inc. (Rheem, Ruud); Johnson Controls, Inc. (York); Daikin Industries, Ltd. (Goodman, McQuay); Melrose Industries PLC (Mammoth); and AAON, Inc. |

| |

• | Refrigeration - Hussmann Corporation; Paloma Industries, Inc. (Rheem Manufacturing Company (Heat Transfer Products |

Group)); Emerson Electric Co. (Copeland); United Technologies Corp. (Carrier); GEA Group (Kuba, Searle, Goedhart); Alfa Laval; Guntner GmbH; and Panasonic Corp. (Sanyo).

Employees

As of December 31, 2017, we employed approximately 11,450 employees. Approximately 5,200 of these employees were salaried and 6,250 were hourly. The number of hourly workers we employ may vary in order to match our labor needs during periods of fluctuating demand. Approximately 3,100 employees, including international locations, are represented by unions. We believe we have good relationships with our employees and with the unions representing our employees. We currently do not anticipate any material adverse consequences resulting from negotiations to renew any collective bargaining agreements.

Environmental Regulation

Our operations are subject to evolving and often increasingly stringent international, federal, state and local laws and regulations concerning the environment. Environmental laws that affect or could affect our domestic operations include, among others, the National Appliance Energy Conservation Act of 1987, as amended (“NAECA”), the Energy Policy Act, the Energy Policy and Conservation Act, the Clean Air Act, the Clean Water Act, the Resource Conservation and Recovery Act, the Comprehensive Environmental Response, Compensation and Liability Act, the National Environmental Policy Act, the Toxic Substances Control Act, any regulations promulgated under these acts and various other international, federal, state and local laws and regulations governing environmental matters. We believe we are in substantial compliance with such existing environmental laws and regulations.

Energy Efficiency. The U.S. Department of Energy has numerous active energy conservation rulemakings that impact residential and commercial heating, air conditioning and refrigeration equipment. We are actively involved in U.S. Department of Energy and Congressional activities related to energy efficiency. We are prepared to have compliant products in place in advance of the effectiveness of all such regulations being considered by the U.S. Department of Energy.

Refrigerants. The use of hydrochlorofluorocarbons ("HCFCs”) and hydroflurocarbons ("HFCs") as refrigerants for air conditioning and refrigeration equipment is common practice in the HVACR industry and is regulated. We believe we have complied with applicable rules and regulations in various countries governing the use of HCFCs and HFCs. The U.S. Congress and the Environmental Protection Agency are considering steps to phase down the future use of HFCs in HVACR products and an international accord was adopted in October 2016 which would significantly phase-down the use of HFCs when ratified. We are an active participant in the ongoing international and domestic dialogue on this subject and are well positioned to react in a timely manner to changes in the regulatory landscape. In addition, we are taking proactive steps to implement responsible use principles and guidelines with respect to limiting refrigerants from escaping into the atmosphere throughout the life span of our HVACR equipment.

Remediation Activity. In addition to affecting our ongoing operations, applicable environmental laws can impose obligations to remediate hazardous substances at our properties, at properties formerly owned or operated by us and at facilities to which we have sent or send waste for treatment or disposal. We are aware of contamination at some of our facilities; however, based on facts presently known, we do not believe that any future remediation costs at such facilities will be material to our results of operations. For more information, see Note 10 in the Notes to our Consolidated Financial Statements.

In the past, we have received notices that we are a potentially responsible party along with other potentially responsible parties in Superfund proceedings under the Comprehensive Environmental Response, Compensation and Liability Act for cleanup of hazardous substances at certain sites to which the potentially responsible parties are alleged to have sent waste. Based on the facts presently known, we do not believe environmental cleanup costs associated with any Superfund sites about which we have received notice that we are a potentially responsible party will be material.

European WEEE and RoHS Compliance. In the European marketplace, electrical and electronic equipment is required to comply with the Directive on Waste Electrical and Electronic Equipment (“WEEE”) and the Directive on Restriction of Use of Certain Hazardous Substances (“RoHS”). WEEE aims to prevent waste by encouraging reuse and recycling and RoHS restricts the use of six hazardous substances in electrical and electronic products. All HVACR products and certain components of such products “put on the market” in the EU (whether or not manufactured in the EU) are potentially subject to WEEE and RoHS. Because all HVACR manufacturers selling within or from the EU are subject to the standards promulgated under WEEE and RoHS, we believe that neither WEEE nor RoHS uniquely impacts us as compared to such other manufacturers. Similar directives are being introduced in other parts of the world, including the U.S. For example, California, China and Japan have all adopted standards possessing similar intent as RoHS. We are actively monitoring the development of such directives and believe we are well positioned to comply with such directives in the required time frames.

Available Information

Our web site address is www.lennoxinternational.com. We make available, free of charge through our web site, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to the Securities Exchange Act of 1934, as amended (the "Exchange Act"), as soon as reasonably possible after such material is electronically filed with, or furnished to, the Securities and Exchange Commission. The information on our web site is not a part of, or incorporated by reference into, this annual report on Form 10-K.

You can also read and copy any document that we file, including this Annual Report on Form 10-K, at the Securities and Exchange Commission's Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Call the Securities and Exchange Commission at 1-800-SEC-0330 for information on the operation of the Public Reference Room. In addition, the Securities and Exchange Commission maintains a website at www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers, including Lennox International, that file electronically with the Securities and Exchange Commission.

Executive Officers of the Company

Our executive officers, their present positions and their ages are as follows as of February 4, 2018:

|

| | |

Name | Age | Position |

Todd M. Bluedorn | 54 | Chairman of the Board and Chief Executive Officer

|

Joseph W. Reitmeier | 53 | Executive Vice President, Chief Financial Officer

|

Douglas L. Young | 55 | Executive Vice President, President and Chief Operating Officer, Residential Heating & Cooling

|

Terry L. Johnston | 60 | Executive Vice President, President and Chief Operating Officer, North America Commercial Heating & Cooling

|

Gary S Bedard | 53 | Executive Vice President, President and Chief Operating Officer, Worldwide Refrigeration

|

Prakash Bedapudi | 51 | Executive Vice President, Chief Technology Officer

|

Daniel M. Sessa | 53 | Executive Vice President, Chief Human Resources Officer

|

John D. Torres | 59 | Executive Vice President, Chief Legal Officer and Secretary

|

Chris A Kosel | 50 | Vice President, Chief Accounting Officer and Controller

|

Todd M. Bluedorn was appointed Chief Executive Officer and was elected to our Board of Directors in April 2007. Mr. Bluedorn was elected Chairman of the Board of Directors in May 2012. Prior to joining Lennox International, Mr. Bluedorn served in numerous senior management positions for United Technologies since 1995, including President, Americas - Otis Elevator Company; President, North America - Commercial Heating, Ventilation and Air Conditioning for Carrier Corporation; and President, Hamilton Sundstrand Industrial. He began his professional career with McKinsey & Company in 1992. A graduate of the United States Military Academy at West Point with a bachelor of science in electrical engineering, Mr. Bluedorn served in the United States Army as a combat engineer officer and United States Army Ranger from 1985 to 1990. He received his MBA from Harvard University School of Business in 1992. Mr. Bluedorn also serves on the Board of Directors of Eaton Corporation, a diversified industrial manufacturer, on the Board of Directors of Texas Instruments Incorporated, a global designer and manufacturer of semiconductors, and on the Board of Trustees of Washington University in St. Louis. Mr. Bluedorn possesses considerable industry knowledge and executive leadership experience. Mr. Bluedorn’s extensive knowledge of our Company and its business, combined with his drive for excellence and innovation, position him well to serve as CEO and a director of our Company.

Joseph W. Reitmeier was appointed Executive Vice President, Chief Financial Officer in July 2012. He had served as Vice President of Finance for the LII’s Commercial Heating & Cooling segment since 2007 and as Director of Internal Audit from 2005 to 2007. Before joining the company, he held financial leadership roles at Cummins Inc. and PolyOne Corporation. He is a

director of Watts Water Technologies, Inc., a global provider of plumbing, heating and water quality solutions for residential, industrial, municipal and commercial settings. Mr. Reitmeier holds a bachelor’s degree in accounting from the University of Akron and an MBA from Case Western Reserve University. He is also a Certified Public Accountant.

Douglas L. Young was appointed Executive Vice President, President and Chief Operating Officer of LII's Residential Heating & Cooling segment in October 2006. Mr. Young had previously served as Vice President and General Manager of North American Residential Products since 2003 and as Vice President and General Manager of Lennox North American Residential Sales, Marketing, and Distribution from 1999 to 2003. Prior to his career with LII, Mr. Young was employed in the Appliances division of GE, where he held various management positions before serving as General Manager of Marketing for GE Appliance division's retail group from 1997 to 1999 and as General Manager of Strategic Initiatives in 1999. He holds a BSBA from Creighton University and a master’s of science in management from Purdue University. Mr. Young serves on the Board of Directors of Beacon Roofing Supply, a general building material distributor and is on the Board of Directors of AHRI (the Air-Conditioning, Heating, and Refrigeration Institute), the trade association for the HVACR and water heating equipment industries.

Terry L. Johnston was appointed Executive Vice President, President and Chief Operating Officer of LII's North America Commercial Heating & Cooling business in January 2013. Since May 2007, he had served as Vice President and General Manager, North America Commercial. He had previously served as Vice President, Marketing and Product Management, LII Worldwide Heating & Cooling and as Vice President, Marketing and Product Management for Lennox Industries. Before joining LII in 2001, Mr. Johnston worked for 20 years at GE in a variety of product management and sales and marketing roles. He is on the Board of Directors of CSW Industrials, Inc., a diversified industrial growth company with businesses in industrial products, sealants and adhesives and specialty chemicals segments. He holds a bachelor of science in marketing from the University of Arkansas.

Gary S. Bedard was appointed Executive Vice President, President and Chief Operating Officer of LII's Worldwide Refrigeration business in October 2017. Since 2005, Mr. Bedard served as Vice President and General Manager, LII Residential Heating and Cooling. He has also held the positions of Vice President, Residential Product Management, LII Worldwide Heating and Cooling, Director of Brand and Product Management, and District Manager for Lennox Industries’ New York District. Prior to joining LII in 1998, Mr. Bedard spent eight years at York International in product management and sales leadership roles for commercial applied and unitary systems as well as residential systems. Mr. Bedard has a bachelor’s degree in engineering management from the United States Military Academy at West Point.

Prakash Bedapudi was appointed Executive Vice President, Chief Technology Officer in July 2008. He had previously served as Vice President, Global Engineering and Program Management for Trane Inc. Commercial Systems from 2006 through 2008, and as Vice President, Engineering and Technology for Trane's Residential Systems division from 2003 through 2006. Prior to his career at Trane, Mr. Bedapudi served in senior engineering leadership positions for GE Transportation Systems, a division of General Electric Company, and for Cummins Engine Company. He holds a bachelor of science in mechanical/automotive engineering from Karnataka University, India and a master's of science in mechanical/aeronautical engineering from the University of Cincinnati.

Daniel M. Sessa was appointed Executive Vice President, Chief Human Resources Officer in June 2007. He had previously served in numerous senior human resources and legal leadership positions for United Technologies Corporation since 1996, including Vice President, Human Resources for Otis Elevator Company - Americas from 2005 to 2007, Director, Employee Benefits and Human Resources Systems for United Technologies Corporation from 2004 to 2005, and Director, Human Resources for Pratt & Whitney from 2002 to 2004. He holds a bachelor of arts in law and society from the State University of New York at Binghamton and a juris doctor from the Hofstra University School of Law.

John D. Torres was appointed Executive Vice President , Chief Legal Officer and Secretary in December 2008. He had previously served as Senior Vice President, General Counsel and Secretary for Freescale Semiconductor, a semiconductor manufacturer that was originally part of Motorola. He joined Motorola's legal department as Senior Counsel in 1996 and was appointed Vice President, General Counsel of the company's semiconductor business in 2001. Prior to joining Motorola, Mr. Torres served 13 years in private practice in Phoenix, specializing in commercial law. He holds a bachelor of arts from Notre Dame and a juris doctor from the University of Chicago.

Chris A. Kosel was appointed Vice President, Chief Accounting Officer and Controller in May 2017. He had previously served as Vice President, Business Analysis and Planning for the Company since 2016. He also had served as Vice President, Finance and Controller / Director, Finance for the Company’s North America Commercial Business from 2015 - 2016 and Director, Financial Planning and Analysis for the Company’s Residential Business Unit from 2014 to 2015. Prior to 2014 he had served as Director, Finance for the Company’s Parts Plus Business and Director of the Company’s Financial Shared Services function. Prior to joining Lennox, he worked for Ernst & Young. He holds a bachelor's degree in accounting from Texas A&M University. He is also a Certified Public Accountant.

Item 1A. Risk Factors

Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act that are based on information currently available to management as well as management's assumptions and beliefs as of the date hereof. All statements, other than statements of historical fact, included in this Annual Report on Form 10-K constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by the words “may,” “will,” “should,” “plan,” “predict,” “anticipate,” “believe,” “intend,” “estimate” and “expect” and similar expressions. Statements that are not historical should also be considered forward-looking statements. Such statements reflect our current views with respect to future events. Readers are cautioned not to place undue reliance on these forward-looking statements. We believe these statements are based on reasonable assumptions; however, such statements are inherently subject to risks and uncertainties, including but not limited to the specific uncertainties discussed elsewhere in this Annual Report on Form 10-K and the risk factors set forth in Item 1A. Risk Factors in this Annual Report on Form 10-K. These risks and uncertainties may affect our performance and results of operations. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may differ materially from those in the forward-looking statements. We disclaim any intention or obligation to update or review any forward-looking statements or information, whether as a result of new information, future events or otherwise unless required by law.

Risk Factors

The following risk factors and other information included in this Annual Report on Form 10-K should be carefully considered. We believe these are the principal material risks currently facing our business; however, additional risks and uncertainties not presently known to us or that we presently deem less significant may also impair our business operations. If any of the following risks or those disclosed in our other SEC filings actually occurs, our business, financial condition or results of operations could be materially adversely affected.

We May Not be Able to Compete Favorably in the Competitive HVACR Business.

Substantially all of the markets in which we operate are competitive. The most significant competitive factors we face are product reliability, product performance, reputation of our company and brands, service and price, with the relative importance of these factors varying among our product lines. Other factors that affect competition in the HVACR market include the development and application of new technologies, an increasing emphasis on the development of more efficient HVACR products and new product introductions. We may not be able to adapt to market changes as quickly or effectively as our current and future competitors. Also, the establishment of manufacturing operations in low-cost countries could provide cost advantages to existing and emerging competitors. Some of our competitors may have greater financial resources than we have, allowing them to invest in more extensive research and development and/or marketing activity and making them better able to withstand adverse HVACR market conditions. Current and future competitive pressures may cause us to reduce our prices or lose market share, or could negatively affect our cash flow, all of which could have an adverse effect on our results of operations.

Our Financial Performance Is Affected by the Conditions of the U.S. Construction Industry.

Our business is affected by the performance of the U.S. construction industry. Our sales in the residential and commercial new construction markets correlate to the number of new homes and buildings that are built, which in turn is influenced by cyclical factors such as interest rates, inflation, availability of financing, consumer spending habits and confidence, employment rates and other macroeconomic factors over which we have no control. Although the industry has improved for the last several years, our sales may not continue to improve or such improvement may be limited or lower than expected.

Cooler than Normal Summers and Warmer than Normal Winters May Depress Our Sales.

Demand for our products and for our services is seasonal and strongly affected by the weather. Cooler than normal summers depress our sales of replacement air conditioning and refrigeration products and services. Similarly, warmer than normal winters have the same effect on our heating products and services.

Changes in Legislation or Government Regulations or Policies Can Have a Significant Impact on Our Results of Operations.

The sales, gross margins and profitability for each of our segments could be directly impacted by changes in legislation, trade agreements or government regulations, such as the changes to taxes, tariffs and trade agreements. Changes in environmental and energy efficiency standards and regulations, such as the recent amendments to the Montreal Protocol to phase down the use of hydrofluorocarbons, may particularly have a significant impact on the types of products that we are allowed to develop and sell, and the types of products that are developed and sold by our competitors. Our inability or delay in developing or marketing products that match customer demand and that meet applicable efficiency and environmental standards may negatively impact our results. The demand for our products and services could also be affected by the size and availability of tax incentives for purchasers of our products and services. Future legislation or regulations, including environmental matters, product certification, product liability, tariffs, duties, taxes, tax incentives and other matters, may impact the results of each of our operating segments and our consolidated results.

Global General Business, Economic and Market Conditions Could Adversely Affect Our Financial Performance and Limit our Access to the Capital Markets.

Future disruptions in U.S. or global financial and credit markets or increases in the costs of capital might have an adverse impact on our business. The tightening, unavailability or increased costs of credit adversely affects the ability of our customers to obtain financing for significant purchases and operations, which could result in a decrease in sales of our products and services and may impact the ability of our customers to make payments to us. Similarly, tightening of credit may adversely affect our supplier base and increase the potential for one or more of our suppliers to experience financial distress or bankruptcy. Our business may also be adversely affected by future decreases in the general level of economic activity and increases in borrowing costs, which may cause our customers to cancel, decrease or delay their purchases of our products and services.

If financial markets were to deteriorate, or costs of capital were to increase significantly due to a lowering of our credit ratings, prevailing industry conditions, the volatility of the capital markets or other factors, we may be unable to obtain new financing on acceptable terms, or at all. A deterioration in our financial performance could also limit our future ability to access amounts currently available under our domestic credit facility. In addition, availability under our asset securitization agreement may be adversely impacted by credit quality and performance of our customer accounts receivable. The availability under our asset securitization agreement is based on the amount of accounts receivable that meet the eligibility criteria of the asset securitization agreement. If receivable losses increase or credit quality deteriorates, the amount of eligible receivables could decline and, in turn, lower the availability under the asset securitization.

We cannot predict the likelihood, duration or severity of any future disruption in financial markets or any adverse economic conditions in the U.S. and other countries.

Our International Operations Subject Us to Risks Including Foreign Currency Fluctuations, Regulations and Other Risks.

We earn revenue, pay expenses, own assets and incur liabilities in countries using currencies other than the U.S. dollar. Our consolidated financial statements are presented in U.S. dollars and we translate revenue, income, expenses, assets and liabilities into U.S. dollars at exchange rates in effect during or at the end of each reporting period. Therefore, increases or decreases in the value of the U.S. dollar relative to other currencies may affect our net operating revenues, operating income and the value of balance sheet items denominated in foreign currencies. Because of the geographic diversity of our operations, weaknesses in some currencies might be offset by strengths in others over time. However, we cannot assure that fluctuations in foreign currency exchange rates, particularly the strengthening of the U.S. dollar against major currencies, would not materially affect our financial results.

In addition to the currency exchange risks inherent in operating in foreign countries, our international sales and operations, including purchases of raw materials from international suppliers, are subject to risks associated with local government laws, regulations and policies (including those related to tariffs and trade barriers, investments, taxation, exchange controls, employment regulations and changes in laws and regulations). Our international sales and operations are also sensitive to changes in foreign national priorities, including government budgets, as well as to geopolitical and economic instability. International transactions may involve increased financial and legal risks due to differing legal systems and customs in foreign countries, as well as compliance with anti-corruption laws such as the U.S. Foreign Corrupt Practices Act and the U.K. Bribery Act. The ability to manage these risks could be difficult and may limit our operations and make the manufacture and sale of our products internationally more difficult, which could negatively affect our business and results of operations.

Conflicts, wars, natural disasters or terrorist acts could also cause significant damage or disruption to our operations, employees, facilities, systems, suppliers, distributors, resellers or customers in the United States and internationally for extended periods of time and could also affect demand for our products.

Net sales outside of the United States comprised 18.5% of our net sales in 2017.

Our Ability to Meet Customer Demand may be Limited by Our Single-Location Production Facilities, Reliance on Certain Key Suppliers and Unanticipated Significant Shifts in Customer Demand.

We manufacture many of our products at single-location production facilities, and we rely on certain suppliers who also may concentrate production in single locations. Any significant interruptions in production at one or more of our facilities, or at a facility of one of our suppliers, could negatively impact our ability to deliver our products to our customers. Further, even with all of our facilities running at full production, we could potentially be unable to fully meet demand during an unanticipated period of exceptionally high demand. Our inability to meet our customers' demand for our products could have a material adverse impact on our business, financial condition and results of operations.

Price Volatility for Commodities and Components We Purchase or Significant Supply Interruptions Could Have an Adverse Effect on Our Cash Flow or Results of Operations.

We depend on raw materials, such as steel, copper and aluminum, and components purchased from third parties to manufacture our products. We generally concentrate purchases for a given raw material or component with a small number of suppliers. If a supplier is unable or unwilling to meet our supply requirements, including suffering any disruptions at its facilities or in its supply chain, we could experience supply interruptions or cost increases, either of which could have an adverse effect on our results of operations. Similarly, suppliers of components that we purchase for use in our products may be affected by rising material costs and pass these increased costs on to us. Although we regularly pre-purchase a portion of our raw materials at fixed prices each year to hedge against price increases, an increase in raw materials prices not covered by our fixed price arrangements could significantly increase our cost of goods sold and negatively impact our margins if we are unable to effectively pass such price increases on to our customers. Alternatively, if we increase our prices in response to increases in the prices or quantities of raw materials or components or if we encounter significant supply interruptions, our competitive position could be adversely affected, which may result in depressed sales and profitability.

In addition, we use derivatives to hedge price risk associated with forecasted purchases of certain raw materials. Our hedged prices could result in paying higher or lower prices for commodities as compared to the market prices for those commodities when purchased.

We May Incur Substantial Costs as a Result of Claims Which Could Have an Adverse Effect on Our Results of Operations.

The development, manufacture, sale and use of our products involve warranty, intellectual property infringement, product liability claim and other risks. In some cases, we may incur liability claims for the installation and service of our products. Our product liability insurance policies have limits that, if exceeded, may result in substantial costs that would have an adverse effect on our results of operations. In addition, warranty claims are not covered by our product liability insurance and certain product liability claims may also not be covered by our product liability insurance.

For some of our HVAC products, we provide warranty terms ranging from one to 20 years to customers for certain components such as compressors or heat exchangers. For certain limited products, we provided lifetime warranties for heat exchangers. Warranties of such extended lengths pose a risk to us as actual future costs may exceed our current estimates of those costs. Warranty expense is recorded on the date that revenue is recognized and requires significant assumptions about what costs will be incurred in the future. We may be required to record material adjustments to accruals and expense in the future if actual costs for these warranties are different from our assumptions.

If We Cannot Successfully Execute our Business Strategy, Our Results of Operations Could be Adversely Impacted

Our future success depends on our continued investment in research and new product development as well as our ability to commercialize new HVACR technological advances in domestic and global markets. If we are unable to continue to timely and successfully develop and market new products, achieve technological advances or extend our business model and technological advances into international markets, our business and results of operations could be adversely impacted.

We are engaged in various manufacturing rationalization actions designed to achieve our strategic priorities of manufacturing sourcing and distribution excellence and of lowering our cost structure. For example, we are continuing to reorganize our North

American distribution network in order to better serve our customers' needs by deploying parts and equipment inventory closer to them and are expanding our sourcing activities outside of the U.S. We also continue to rationalize and reorganize various support and administrative functions in order to reduce ongoing selling and administrative expenses. If we cannot successfully implement such distribution and restructuring strategies or other cost savings plans, we may not achieve our expected cost savings in the time anticipated, or at all. In such case, our results of operations and profitability may be negatively impacted, making us less competitive and potentially causing us to lose market share.

We May Not be Able to Successfully Integrate and Operate Businesses that We May Acquire nor Realize the Anticipated Benefits of Strategic Relationships We May Form.

From time to time, we may seek to complement or expand our businesses through strategic acquisitions, joint ventures and strategic relationships. The success of these transactions will depend, in part, on our ability to timely identify those relationships, negotiate and close the transactions and then integrate, manage and operate those businesses profitably. If we are unable to successfully do those things, we may not realize the anticipated benefits associated with such transactions, which could adversely affect our business and results of operations.

Because a Significant Percentage of Our Workforce is Unionized in Certain Manufacturing Facilities, We Face Risks of Work Stoppages and Other Labor Relations Problems.

As of February 6, 2018, approximately 27% of our workforce, including international locations, was unionized. The results of future negotiations with these unions and the effects of any production interruptions or labor stoppages could have an adverse effect on our results of operations.

We are Subject to Litigation and Tax, Environmental and Other Regulations that Could Have an Adverse Effect on Our Results of Operations.

We are involved in various claims and lawsuits incidental to our business, including those involving product liability, labor relations, alleged exposure to asbestos-containing materials and environmental matters, some of which claim significant damages. Estimates related to our claims and lawsuits, including estimates for asbestos-related claims and related insurance recoveries, involve numerous uncertainties. Given the inherent uncertainty of litigation and estimates, we cannot be certain that existing claims or litigation or any future adverse legal developments will not have a material adverse impact on our financial condition. In addition, we are subject to extensive and changing federal, state and local laws and regulations designed to protect the environment. These laws and regulations could impose liability for remediation costs and civil or criminal penalties in cases of non-compliance. Compliance with environmental laws increases our costs of doing business. Because these laws are subject to frequent change, we are unable to predict the future costs resulting from environmental compliance.

Any Future Determination that a Significant Impairment of the Value of Our Goodwill Intangible Asset Occurred Could Have a Material Adverse Effect on Our Results of Operations.

As of December 31, 2017, we had goodwill of $200.5 million on our Consolidated Balance Sheet. Any future determination that an impairment of the value of goodwill occurred would require a write-down of the impaired portion of goodwill to fair value and would reduce our assets and stockholders' equity and could have a material adverse effect on our results of operations.

Volatility in Capital Markets Could Necessitate Increased Cash Contributions by Us to Our Pension Plans to Maintain Required Levels of Funding.

Volatility in the capital markets may have a significant impact on the funding status of our defined benefit pension plans. If the performance of the capital markets depresses the value of our defined benefit pension plan assets or increases the liabilities, we would be required to make additional contributions to the pension plans. The amount of contributions we may be required to make to our pension plans in the future is uncertain and could be significant, which may have a material impact on our results of operations.

Security Breaches and Other Disruptions or Misuse of Information Systems We Rely Upon Could Affect Our Ability to Conduct Our Business Effectively.

Our information systems and those of our business partners are important to our business activities. We also outsource various information systems, including data management, to third party service providers. Despite our security measures as well as those of our business partners and third-party service providers, the information systems we rely upon may be vulnerable to interruption or damage from computer hackings, computer viruses, worms or other destructive or disruptive software, process breakdowns,

denial of service attacks, malicious social engineering or other malicious activities, or any combination thereof. These information systems have been, and will likely continue to be, subject to attack. While we have implemented controls and taken other preventative actions to strengthen these systems against future attacks, we can give no assurance that these controls and preventative actions will be effective. Any breach of data security could result in a disruption of our services or improper disclosure of personal data or confidential information, which could harm our reputation, require us to expend resources to remedy such a security breach or defend against further attacks or subject us to liability under laws that protect personal data, resulting in increased operating costs or loss of revenue.

Our Results of Operations May Suffer if We Cannot Continue to License or Enforce the Intellectual Property Rights on Which Our Businesses Depend or if Third Parties Assert That We Violate Their Intellectual Property Rights.

We rely upon patent, copyright, trademark and trade secret laws and agreements to establish and maintain intellectual property rights in the products we sell. Our intellectual property rights could be challenged, invalidated, infringed, circumvented, or be insufficient to permit us to take advantage of current market trends or to otherwise provide competitive advantages. Further, the laws of certain countries do not protect proprietary rights to the same extent as the laws of the United States.

Third parties may also claim that we are infringing upon their intellectual property rights. If we do not license infringed intellectual property or if we are required to substitute similar technology from another source, our operations could be adversely affected. Even if we believe that intellectual property claims are without merit, they can be time consuming, require significant resources and be costly to defend. Claims of intellectual property infringement also might require us to redesign affected products, pay costly damage awards, or face injunction prohibiting us from manufacturing, importing, marketing or selling certain of our products. Even if we have agreements to indemnify us, indemnifying parties may be unable or unwilling to do so.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

The following chart lists our principal domestic and international manufacturing, distribution and office facilities as of December 31, 2017 and indicates the business segment that uses such facilities, the approximate size of such facilities and whether such facilities are owned or leased. Also included in the chart are large warehouses that hold significant inventory balances.

|

| | | | |

Location | Segment | Type or Use of Facility | Approx. Sq. Ft. (In thousands) | Owned/Leased |

Marshalltown, IA | Residential Heating & Cooling | Manufacturing & Distribution | 1,300 | Owned & Leased |

Orangeburg, SC | Residential Heating & Cooling | Manufacturing & Distribution | 750 | Owned & Leased |

Saltillo, Mexico | Residential Heating & Cooling | Manufacturing & Distribution | 638 | Owned |

Grenada, MS | Residential Heating & Cooling | Manufacturing & Distribution | 395 | Leased |

Romeoville, IL | Residential Heating & Cooling | Distribution | 312 | Leased |

Columbus, OH | Residential Heating & Cooling | Distribution | 279 | Leased |

McDonough, GA | Residential Heating & Cooling | Distribution | 254 | Leased |

Concord, NC

| Residential Heating & Cooling | Distribution | 123 | Leased |

Harahan, LA | Residential Heating & Cooling | Distribution | 83 | Leased |

Denver, CO | Residential Heating & Cooling | Distribution | 50 | Leased |

Eastvale, CA | Residential & Commercial Heating & Cooling | Distribution | 377 | Leased |

Carrollton, TX | Residential & Commercial Heating & Cooling | Distribution | 252 | Leased |

Brampton, Canada | Residential & Commercial Heating & Cooling | Distribution | 251 | Leased |

Houston, TX | Residential & Commercial Heating & Cooling | Distribution | 241 | Leased |

Orlando, FL | Residential & Commercial Heating & Cooling | Distribution | 173 | Leased |

Middletown, PA | Residential & Commercial Heating & Cooling | Distribution | 166 | Leased |

Lenexa, KS | Residential & Commercial Heating & Cooling | Distribution | 147 | Leased |

East Fife, WA

| Residential & Commercial Heating & Cooling

| Distribution

| 112 | Leased |

Calgary, Canada | Residential & Commercial Heating & Cooling | Distribution | 110 | Leased |

Stuttgart, AR | Commercial Heating & Cooling | Manufacturing | 750 | Owned |

Longvic, France | Commercial Heating & Cooling | Manufacturing | 142 | Owned |

Longvic, France | Commercial Heating & Cooling | Distribution | 133 | Owned |

Burgos, Spain | Commercial Heating & Cooling & Refrigeration | Manufacturing | 140 | Owned |

Mions, France | Commercial Heating & Cooling & Refrigeration | Research & Development | 129 | Owned |

Genas, France | Commercial Heating & Cooling & Refrigeration | Manufacturing, Distribution & Offices | 111 | Owned |

Tifton, GA | Refrigeration | Manufacturing & Distribution | 570 | Owned & Leased |

Columbus, GA | Refrigeration | Manufacturing, Warehousing & Offices | 523 | Owned & Leased |

Milperra, Australia | Refrigeration | Distribution & Business Unit Headquarters | 416 | Owned |

Stone Mountain, GA | Refrigeration | Manufacturing & Business Unit Headquarters | 139 | Owned |

Midland, GA | Refrigeration | Warehousing & Offices | 138 | Leased |

Mt. Wellington, New Zealand | Refrigeration | Distribution & Offices | 110 | Owned |

San Jose dos Campos, Brazil | Refrigeration | Manufacturing, Warehousing & Offices | 98 | Owned |

Wuxi, China | Refrigeration | Manufacturing | 89 | Owned & Leased |

Krunkel, Germany | Refrigeration | Manufacturing, Distribution & Offices | 43 | Owned |

Richardson, TX | Corporate and other | Corporate Headquarters | 356 | Owned & Leased |

Carrollton, TX | Corporate and other | Research & Development | 294 | Owned |

In addition to the properties described above, we lease numerous facilities in the U.S. and worldwide for use as sales offices, service offices and district and regional warehouses. We routinely evaluate our facilities to ensure adequate capacity, effective cost structure, and consistency with our business strategy. We believe that our properties are in good condition, suitable and adequate for their present requirements and that our principal manufacturing plants are generally adequate to meet our production needs.

Item 3. Legal Proceedings

We are involved in a number of claims and lawsuits incident to the operation of our businesses. Insurance coverages are maintained and estimated costs are recorded for such claims and lawsuits. It is management's opinion that none of these claims or lawsuits will have a material adverse effect, individually or in the aggregate, on our financial position, results of operations or cash flows. For more information, see Note 10 in the Notes to the Consolidated Financial Statements.

Item 4. Mine Safety Disclosures

Not applicable.

PART II

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Price for Common Stock

Our common stock is listed for trading on the New York Stock Exchange under the symbol “LII.” The high and low sales prices for our common stock for each quarterly period during 2017 and 2016 were as follows:

|

| | | | | | | | | | | | | | | |

| Price Range per Common Share |

| 2017 | | 2016 |

| High | | Low | | High | | Low |

First Quarter | $ | 172.96 |

| | $ | 147.54 |

| | $ | 136.32 |

| | $ | 105.65 |

|

Second Quarter | 192.58 |

| | 161.11 |

| | 143.19 |

| | 131.90 |

|

Third Quarter | 187.49 |

| | 160.18 |

| | 164.02 |

| | 141.90 |

|

Fourth Quarter | 213.78 |

| | 177.68 |

| | 164.57 |

| | 140.97 |

|

Dividends

During 2017 and 2016, we declared quarterly cash dividends as set forth below:

|

| | | | | | | |

| Dividends per

Common Share |

| 2017 | | 2016 |

First Quarter | $ | 0.43 |

| | $ | 0.36 |

|

Second Quarter | 0.51 |

| | 0.43 |

|

Third Quarter | 0.51 |

| | 0.43 |

|

Fourth Quarter | 0.51 |

| | 0.43 |

|

Fiscal Year | $ | 1.96 |

| | $ | 1.65 |

|

The amount and timing of dividend payments are determined by our Board of Directors and subject to certain restrictions under our domestic revolving credit facility.

Holders of Common Stock

As of the close of business on February 9, 2018, approximately 650 holders of record held our common stock.

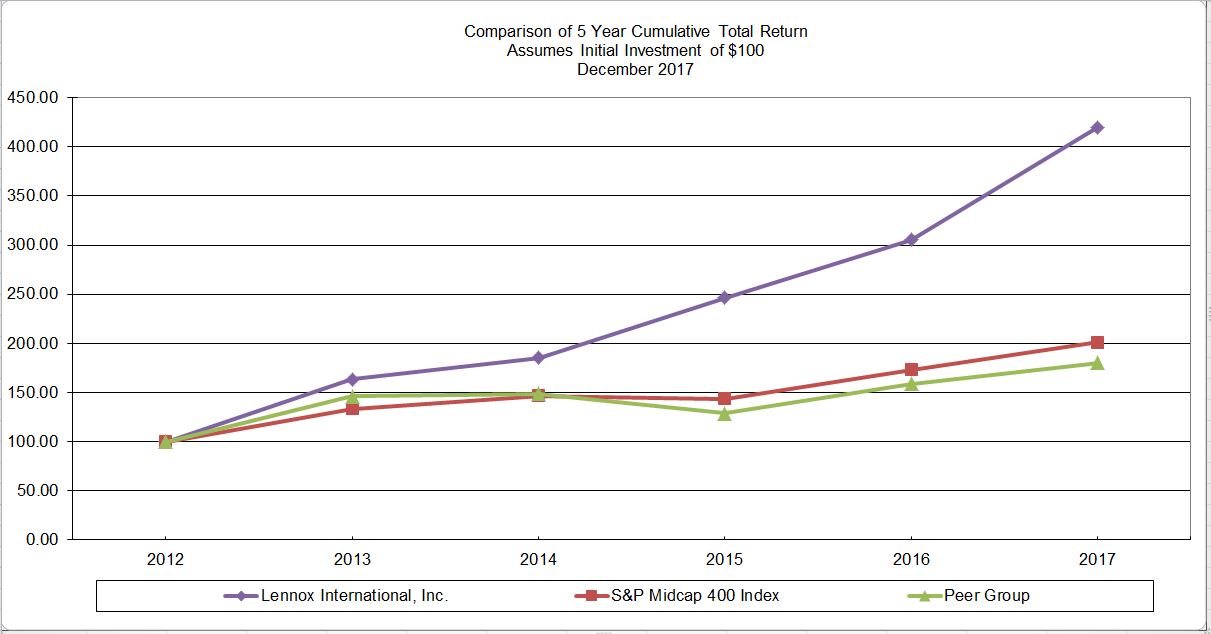

Comparison of Total Stockholder Return

The following graph compares the cumulative total returns of LII's common stock with the cumulative total returns of the Standards & Poor's Midcap 400 Index, a broad index of mid-size U.S. companies of which the Company is a part, and with a peer group of U.S. industrial manufacturing and service companies in the HVACR businesses. The graph assumes that $100 was invested on December 31, 2012, with dividends reinvested. Our peer group includes AAON, Inc., Ingersoll-Rand plc, Comfort Systems USA, Inc., United Technologies Corporation, Johnson Controls Inc., and Watsco, Inc. Peer group returns are weighted by market capitalization.

This performance graph and other information furnished under this Comparison of Total Stockholder Return section shall not be deemed to be “soliciting material” or to be “filed” with the Securities and Exchange Commission or subject to Regulation 14A or 14C, or to the liabilities of Section 18 of the Exchange Act.

Our Purchases of LII Equity Securities

Our Board of Directors has authorized a total of $2 billion towards the repurchase of shares of our common stock (collectively referred to as the "Share Repurchase Plans"), including a $550 million share repurchase authorization in 2016. The Share Repurchase Plans authorize open market repurchase transactions and do not have a stated expiration date. As of December 31, 2017, $396 million of shares may yet be repurchased under the Share Repurchase Plans.

In the fourth quarter of 2017, we purchased shares of our common stock as follows:

|

| | | | | | | | | | | | |

| Total Shares Purchased (1) | | Average Price Paid per Share (including fees) | | Shares Purchased As Part of Publicly Announced Plans | | Approximate Dollar Value of Shares that may yet be Purchased Under the Plans (in millions) (3) |

October 1 through October 31 (2) | 7,426 |

| | $ | 193.24 |

| | — |

| | 396.0 |

|

November 1 through November 30 | 73,837 |

| | 172.61 |

| | 68,381 |

| | 396.0 |

|

December 1 through December 31 | 36,626 |

| | 206.49 |

| | — |

| | 396.0 |

|

| 117,889 |

| | | | 68,381 |

| | |

(1) Includes the surrender to LII of 49,508 shares of common stock to satisfy employee tax-withholding obligations in connection with the exercise of vested stock appreciation rights and the vesting of restricted stock units.

(2) Includes final settlement of shares repurchased in Accelerated Share Repurchase Plan (ASR) executed in the third quarter of 2017.

(3) After a $75 million payment for Accelerated Share Repurchase Plan (ASR) executed in February 2017, $100 million payment for an ASR executed in April 2017 and $75 million payment for an ASR executed in July 2017. Final settlement of the February ASR occurred in the second quarter, final settlement for the April ASR occurred in the third quarter and the final settlement of the July ASR occurred in the fourth quarter. The February, April and July ASRs were effected pursuant to a previously announced repurchase plan.

Item 6. Selected Financial Data

The following table presents selected financial data for each of the five years ended December 31, 2017 to 2013 (in millions, except per share data):

|

| | | | | | | | | | | | | | | | | | | |

| For the Years Ended December 31, |

| 2017 | | 2016 | | 2015 | | 2014 | | 2013 |

Statements of Operations Data: | | | | | | | | | |

Net Sales | $ | 3,839.6 |

| | $ | 3,641.6 |

| | $ | 3,467.4 |

| | $ | 3,367.4 |

| | $ | 3,199.1 |

|

Operating Income | 494.5 |

| | 429.4 |

| | 305.4 |

| | 334.7 |

| | 289.0 |

|

Income From Continuing Operations | 307.1 |

| | 278.6 |

| | 187.2 |

| | 208.1 |

| | 179.9 |

|

Net Income | 305.7 |

| | 277.8 |

| | 186.6 |

| | 205.8 |

| | 171.8 |

|

Basic Earnings Per Share From Continuing Operations | 7.28 |

| | 6.41 |

| | 4.17 |

| | 4.35 |

| | 3.61 |

|

Diluted Earnings Per Share From Continuing Operations | 7.17 |

| | 6.34 |

| | 4.11 |

| | 4.28 |

| | 3.55 |

|

Cash Dividends Declared Per Share | 1.96 |

| | 1.65 |

| | 1.38 |

| | 1.14 |

| | 0.92 |

|

| | | | | | | | | |

Other Data: | | | | | | | | | |

Capital Expenditures | $ | 98.3 |

| | $ | 84.3 |

| | $ | 69.9 |

| | $ | 88.4 |

| | $ | 78.3 |

|

Research and Development Expenses | 73.6 |

| | 64.6 |

| | 62.3 |

| | 60.7 |

| | 53.7 |

|

| | | | | | | | | |

Balance Sheet Data at Period End: | | | | | | | | | |

Total Assets | $ | 1,891.5 |

| | $ | 1,760.3 |

| | $ | 1,677.4 |

| | $ | 1,764.3 |

| | $ | 1,626.7 |

|

Total Debt | 1,004.0 |

| | 868.2 |

| | 741.1 |

| | 925.6 |

| | 400.4 |

|

Stockholders' Equity | 50.1 |

| | 38.0 |

| | 101.6 |

| | 9.0 |

| | 485.7 |

|

Information in the table above is not necessarily indicative of results of future operations. To understand the factors that may affect comparability, the financial data should be read in conjunction with Item 7, "Management's Discussion and Analysis of

Financial Condition and Results of Operations," and the Consolidated Financial Statements and the related Notes to the Consolidated Financial Statements in Item 8, "Financial Statements and Supplementary Data," of this Form 10-K.

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with the other sections of this report, including the consolidated financial statements and related notes contained in Item 8 of this Annual Report on Form 10-K.

Business Overview

We operate in three reportable business segments of the heating, ventilation, air conditioning and refrigeration (“HVACR”) industry. Our reportable segments are Residential Heating & Cooling, Commercial Heating & Cooling, and Refrigeration. For more detailed information regarding our reportable segments, see Note 18 in the Notes to the Consolidated Financial Statements.

We sell our products and services through a combination of direct sales, distributors and company-owned stores. The demand for our products and services is seasonal and significantly impacted by the weather. Warmer than normal summer temperatures generate demand for replacement air conditioning and refrigeration products and services, and colder than normal winter temperatures have a similar effect on heating products and services. Conversely, cooler than normal summers and warmer than normal winters depress the demand for HVACR products and services. In addition to weather, demand for our products and services is influenced by national and regional economic and demographic factors, such as interest rates, the availability of financing, regional population and employment trends, new construction, general economic conditions and consumer spending habits and confidence. A substantial portion of the sales in each of our business segments is attributable to replacement business, with the balance comprised of new construction business.

The principal elements of cost of goods sold are components, raw materials, factory overhead, labor, estimated costs of warranty expense and freight and distribution costs. The principal raw materials used in our manufacturing processes are steel, copper and aluminum. In recent years, pricing volatility for these commodities and related components has impacted us and the HVACR industry in general. We seek to mitigate the impact of commodity price volatility through a combination of pricing actions, vendor contracts, improved production efficiency and cost reduction initiatives. We also partially mitigate volatility in the prices of these commodities by entering into futures contracts and fixed forward contracts.

Financial Highlights

| |

• | Net sales increased $198 million, or 5.4%, to $3,840 million in 2017 from $3,642 million in 2016. |

| |

• | Operating income in 2017 was $495 million compared to $429 million in 2016. The increase was primarily due to increased sales, sourcing and engineering-led cost reductions, and a reduction in pension settlement costs partially offset by an increase in commodities in 2017. |

| |

• | Net income in 2017 increased to $306 million from $278 million in 2016. |

| |

• | Diluted earnings per share from continuing operations were $7.17 per share in 2017 compared to $6.34 per share in 2016. |

| |

• | We generated $325 million of cash flow from operating activities in 2017 compared to $374 million in 2016. The decrease was primarily due to an increase in working capital, partially offset by a reduction in pension contributions and an increase in net income. |

| |

• | In 2017, we returned $80 million to shareholders through dividend payments and we used $250.0 million to purchase 1.5 million shares of stock under our share repurchase plans. |

Overview of Results

The Residential Heating & Cooling segment led our overall financial performance in 2017, with a 7.0% increase in net sales and a $25 million increase in segment profit compared to 2016. This segment's results benefited from market growth in the replacement and new construction markets and favorable foreign currency exchange rates. Our Commercial Heating & Cooling segment also performed well in 2017 with a 6.1% increase in net sales and a $8 million increase in segment profit compared to 2016. This segment's results benefited from market growth in North America. Sales in our Refrigeration segment were up slightly and segment profit increased $4 million compared to 2016. This segment's profit benefited from sourcing and engineering-led cost reductions partially offset by lower factory productivity.

On a consolidated basis, our gross profit margins decreased to 29.3% in 2017 due primarily to unfavorable commodities, factory inefficiencies, and continued investment in distribution expansion. These declines were partially offset by favorable price and mix and sourcing and engineering-led cost reductions across our business.

Results of Operations

The following table provides a summary of our financial results, including information presented as a percentage of net sales (dollars in millions):

|

| | | | | | | | | | | | | | | | | | | | |

| For the Years Ended December 31, |

| 2017 | | 2016 | | 2015 |

| Dollars | | Percent | | Dollars | | Percent | | Dollars | | Percent |