UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

Investment Company Act file number |

811-08921 | ||||||||

|

| |||||||||

|

CREDIT SUISSE LARGE CAP BLEND FUND, INC. | |||||||||

|

(Exact name of registrant as specified in charter) | |||||||||

|

| |||||||||

|

Eleven Madison Avenue, New York, New York |

|

10010 | |||||||

|

(Address of principal executive offices) |

|

(Zip code) | |||||||

|

| |||||||||

|

John G. Popp Credit Suisse Large Cap Blend Fund, Inc. Eleven Madison Avenue New York, New York 10010 | |||||||||

|

(Name and address of agent for service) | |||||||||

|

| |||||||||

|

Registrant’s telephone number, including area code: |

(212) 325-2000 |

| |||||||

|

| |||||||||

|

Date of fiscal year end: |

December 31 |

| |||||||

|

| |||||||||

|

Date of reporting period: |

January 1, 2011 to June 30, 2011 |

| |||||||

Item 1. Reports to Stockholders.

CREDIT SUISSE FUNDS

Semiannual Report

June 30, 2011

(unaudited)

n CREDIT SUISSE

LARGE CAP BLEND FUND, INC.

The Fund's investment objectives, risks, charges and expenses (which should be considered carefully before investing), and more complete information about the Fund, are provided in the Prospectus, which should be read carefully before investing. You may obtain additional copies by calling 877-870-2874 or by writing to Credit Suisse Funds, P.O. Box 55030, Boston, MA 02205-5030.

Credit Suisse Asset Management Securities, Inc., Distributor, is located at Eleven Madison Avenue, New York, NY 10010. Credit Suisse Funds are advised by Credit Suisse Asset Management, LLC.

Investors in the Credit Suisse Funds should be aware that they may be eligible to purchase Common Class shares (where offered) directly or through certain intermediaries. Such shares are not subject to a sales charge but may be subject to an ongoing service and distribution fee of up to 0.25% of average daily net assets. Investors in the Credit Suisse Funds should also be aware that they may be eligible for a reduction or waiver of the sales charge with respect to Class A, B or C shares (where offered). For more information, please review the relevant prospectuses or consult your financial representative.

The views of the Fund's management are as of the date of the letter and the Fund holdings described in this document are as of June 30, 2011; these views and Fund holdings may have changed subsequent to these dates. Nothing in this document is a recommendation to purchase or sell securities.

Fund shares are not deposits or other obligations of Credit Suisse Asset Management, LLC ("Credit Suisse") or any affiliate, are not FDIC-insured and are not guaranteed by Credit Suisse or any affiliate. Fund investments are subject to investment risks, including loss of your investment.

Credit Suisse Large Cap Blend Fund, Inc.

Semiannual Investment Adviser's Report

June 30, 2011 (unaudited)

July 20, 2011

Dear Shareholder:

Performance Summary

01/01/11 – 6/30/11

| Fund & Benchmark | Performance | ||||||

| Common1 | 8.38 | % | |||||

| Class A1,2 | 8.24 | % | |||||

| Class B1,2 | 7.85 | % | |||||

| Class C1,2 | 7.88 | % | |||||

| S&P 500 Index3 | 6.02 | % | |||||

Performance for the Fund's Class A, Class B and Class C Shares is shown without including the effect of the maximum sales charge of 5.75%, 4.00% and 1.00%, respectively.2

Market Review: Positive performance despite global events

The six-month period ended June 30, 2011, was a positive one for equities as central banking stimulus policies in the United States and Europe combined with encouraging economic data and growth to ease investor concerns of a double-dip recession. Stock prices also received a boost as a result of these developments. Additionally, the global markets received injections of liquidity from the Federal Reserve's anti-deflationary policy of implementing multiple quantitative easing measures and the cooperative action of G7 nations to stabilize the yen.

The S&P 500 Index — led by the healthcare sector — finished the period up 6.02%, while the Dow Jones Industrial Average gained 7.30%. In international markets, the MSCI World Index Net Dividends registered a 5.28% gain, while the Nikkei Index Total Return finished 3.02% lower.

At the end of June, the target U.S. Federal Funds rate was being maintained at 0.00%-0.25%, and the discount rate was 0.75%. The Conference Board Consumer Confidence Index experienced a slight decline and now stands at 58.50 (1985 = 100), down from a revised 63.40 in December.

Strategic Review and Outlook: Fundamentals increase in importance

For the six-month period ended June 30, 2011, the Fund outperformed the benchmark. Stock selection and sector weighting in consumer staples, financials and healthcare contributed positively to performance. Conversely, information technology and utilities detracted from performance due to a combination of stock selection and sector weighting.

1

Credit Suisse Large Cap Blend Fund, Inc.

Semiannual Investment Adviser's Report (continued)

June 30, 2011 (unaudited)

In our opinion, company specific fundamentals are becoming increasingly important as the business cycle continues to strengthen. Additionally, although many macroeconomic risks have diminished over the past two years, there are still significant events on the horizon that could impact investors — including sovereign credit risk and the rebuilding of Japan's infrastructure.

Credit Suisse Quantitative Equities Group

Mika Toikka

Timothy Schwider

The value of investments generally will fluctuate in response to market movements.

In addition to historical information, this report contains forward-looking statements, which may concern, among other things, domestic and foreign market, industry and economic trends and developments and government regulation and their potential impact on the Fund's investments. These statements are subject to risks and uncertainties and actual trends, developments and regulations in the future, and their impact on the Fund could be materially different from those projected, anticipated or implied. The Fund has no obligation to update or revise forward-looking statements.

On June 30, 2011, the Fund's Board of Directors approved the reorganization of the Fund into a fund advised by Aberdeen Asset Management Inc. (the "Reorganization"). Pursuant to the proposed Reorganization, all of the assets and liabilities of the Fund would be transferred to Aberdeen U.S. Equity I Fund, a series of Aberdeen Funds (the "Acquiring Fund"), in exchange for shares of the Acquiring Fund. The Reorganization is subject to the completion of certain conditions including the approval of the Fund's shareholders. Proxy materials describing the Reorganization will be mailed to shareholders in anticipation of a special meeting of shareholders to be held at a later date. If the Reorganization is completed, each shareholder of the Fund would become a shareholder of the Acquiring Fund and would receive on a tax-free basis shares of the Acquiring Fund with the same aggregate net asset value as their shares of the Fund.

2

Credit Suisse Large Cap Blend Fund, Inc.

Semiannual Investment Adviser's Report (continued)

June 30, 2011 (unaudited)

Average Annual Returns as of June 30, 20111

| 1 Year | 5 Years | 10 Years |

Since Inception |

Inception Date |

|||||||||||||||||||

| Common Class | 30.17 | % | 3.23 | % | 0.81 | % | 3.28 | % | 10/30/98 | ||||||||||||||

|

Class A Without Sales Charge |

29.93 | % | 3.19 | % | — | 1.15 | % | 07/31/01 | |||||||||||||||

|

Class A With Maximum Sales Charge |

22.51 | % | 1.97 | % | — | 0.55 | % | 07/31/01 | |||||||||||||||

| Class B Without CDSC | 29.05 | % | 2.43 | % | — | 0.39 | % | 07/31/01 | |||||||||||||||

| Class B With CDSC | 25.05 | % | 2.43 | % | — | 0.39 | % | 07/31/01 | |||||||||||||||

| Class C Without CDSC | 29.15 | % | 2.45 | % | — | 0.37 | % | 07/31/01 | |||||||||||||||

| Class C With CDSC | 28.15 | % | 2.45 | % | — | 0.37 | % | 07/31/01 | |||||||||||||||

Returns represent past performance and include change in share price and reinvestment of dividends and capital gains. Past performance cannot guarantee future results. The current performance of the Fund may be lower or higher than the figures shown. Returns and share price will fluctuate, and redemption value may be more or less than original cost. The performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance information current to the most recent month-end is available at www.credit-suisse.com/us.

The annualized gross expense ratios are 0.94% for Common Class shares, 1.19% for Class A shares, 1.93% for Class B shares and 1.94% for Class C shares. The annualized net expense ratios after fee waivers and/or expense reimbursements are 0.94% for Common Class shares, 1.18% for Class A shares, 1.93% for Class B shares and 1.94% for Class C shares.

1 Fee waivers and/or expense reimbursements may reduce expenses for the Fund, without which performance would be lower. Waivers and/or reimbursements may be discontinued at any time.

2 Total return for the Fund's Class A shares for the reporting period, based on offering price (including maximum sales charge of 5.75%), was 2.05%. Total return for the Fund's Class B shares for the reporting period, based on redemption value (including maximum contingent deferred sales charge of 4.00%), was 3.85%. Total return for the Fund's Class C shares for the reporting period, based on redemption value (including maximum contingent deferred sales charge of 1.00%), was 6.88%.

3 The Standard & Poor's 500 Index is an unmanaged index (with no defined investment objective) of common stocks, includes reinvestment of dividends, and is a registered trademark of The McGraw-Hill Companies, Inc. Investors cannot invest directly in an index.

3

Credit Suisse Large Cap Blend Fund, Inc.

Semiannual Investment Adviser's Report (continued)

June 30, 2011 (unaudited)

Information About Your Fund's Expenses

As an investor of the Fund, you incur two types of costs: ongoing expenses and transaction costs. Ongoing expenses include management fees, distribution and service (12b-1) fees and other Fund expenses. Examples of transaction costs include sales charges (loads), redemption fees and account maintenance fees, which are not shown in this section and which would result in higher total expenses. The following table is intended to help you understand your ongoing expenses of investing in the Fund and to help you compare these expenses with the ongoing expenses of investing in other mutual funds. The table is based on an investment of $1,000 made at the beginning of the six month period ended June 30, 2011.

The table illustrates your Fund's expenses in two ways:

• Actual Fund Return. This helps you estimate the actual dollar amount of ongoing expenses paid on a $1,000 investment in the Fund using the Fund's actual return during the period. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the "Expenses Paid per $1,000" line under the share class you hold.

• Hypothetical 5% Fund Return. This helps you to compare your Fund's ongoing expenses with those of other mutual funds using the Fund's actual expense ratio and a hypothetical rate of return of 5% per year before expenses. Examples using a 5% hypothetical fund return may be found in the shareholder reports of other mutual funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Please note that the expenses shown in these tables are meant to highlight your ongoing expenses only and do not reflect any transaction costs, such as sales charges (loads) or redemption fees. If these transaction costs had been included, your costs would have been higher. The "Expenses Paid per $1,000" line of the tables is useful in comparing ongoing expenses only and will not help you determine the relative total expenses of owning different funds.

4

Credit Suisse Large Cap Blend Fund, Inc.

Semiannual Investment Adviser's Report (continued)

June 30, 2011 (unaudited)

Expenses and Value for a $1,000 Investment

for the six month period ended June 30, 2011

| Actual Fund Return |

Common Class |

Class A | Class B | Class C | |||||||||||||||

| Beginning Account Value 1/1/11 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | |||||||||||

| Ending Account Value 6/30/11 | $ | 1,083.80 | $ | 1,082.40 | $ | 1,078.50 | $ | 1,078.80 | |||||||||||

| Expenses Paid per $1,000* | $ | 4.86 | $ | 6.09 | $ | 9.95 | $ | 10.00 | |||||||||||

| Hypothetical 5% Fund Return | |||||||||||||||||||

| Beginning Account Value 1/1/11 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | |||||||||||

| Ending Account Value 6/30/11 | $ | 1,020.13 | $ | 1,018.94 | $ | 1,015.22 | $ | 1,015.17 | |||||||||||

| Expenses Paid per $1,000* | $ | 4.71 | $ | 5.91 | $ | 9.64 | $ | 9.69 | |||||||||||

|

Common Class |

Class A | Class B | Class C | ||||||||||||||||

| Annualized Expense Ratios* | 0.94 | % | 1.18 | % | 1.93 | % | 1.94 | % | |||||||||||

* Expenses are equal to the Fund's annualized expense ratio for each share class, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year period, then divided by 365.

The "Expenses Paid per $1,000" and the "Annualized Expense Ratios" in the tables are based on actual expenses paid by the Fund during the period, net of fee waivers and/or expense reimbursements. If those fee waivers and/or expense reimbursements had not been in effect, the Fund's actual expenses would have been higher.

For more information, please refer to the Fund's prospectus.

5

Credit Suisse Large Cap Blend Fund, Inc.

Semiannual Investment Adviser's Report (continued)

June 30, 2011 (unaudited)

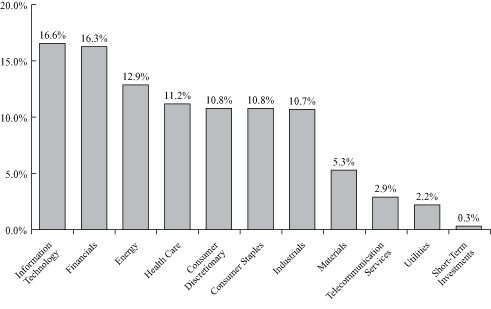

SECTOR BREAKDOWN*

* Expressed as a percentage of total investments (excluding securities lending collateral if applicable) and may vary over time.

6

Credit Suisse Large Cap Blend Fund, Inc.

Schedule of Investments

June 30, 2011 (unaudited)

|

Number of Shares |

Value | ||||||||||

| COMMON STOCKS (99.5%) | |||||||||||

| Aerospace & Defense (2.5%) | |||||||||||

| Goodrich Corp. | 800 | $ | 76,400 | ||||||||

| Honeywell International, Inc. | 5,800 | 345,622 | |||||||||

| Huntington Ingalls Industries, Inc.* | 366 | 12,627 | |||||||||

| ITT Corp. | 1,300 | 76,609 | |||||||||

| L-3 Communications Holdings, Inc. | 13,800 | 1,206,810 | |||||||||

| Lockheed Martin Corp. | 8,100 | 655,857 | |||||||||

| Northrop Grumman Corp. | 6,800 | 471,580 | |||||||||

| Precision Castparts Corp. | 1,100 | 181,115 | |||||||||

| Raytheon Co. | 2,500 | 124,625 | |||||||||

| Rockwell Collins, Inc. | 1,100 | 67,859 | |||||||||

| The Boeing Co. | 57,500 | 4,250,975 | |||||||||

| United Technologies Corp. | 10,400 | 920,504 | |||||||||

| 8,390,583 | |||||||||||

| Air Freight & Logistics (0.6%) | |||||||||||

| CH Robinson Worldwide, Inc. | 1,200 | 94,608 | |||||||||

| Expeditors International of Washington, Inc. | 1,500 | 76,785 | |||||||||

| FedEx Corp. | 2,300 | 218,155 | |||||||||

| United Parcel Service, Inc. Class B | 23,300 | 1,699,269 | |||||||||

| 2,088,817 | |||||||||||

| Airlines (0.1%) | |||||||||||

| Delta Air Lines, Inc.* | 10,400 | 95,368 | |||||||||

| Southwest Airlines Co. | 10,112 | 115,479 | |||||||||

| 210,847 | |||||||||||

| Auto Components (0.2%) | |||||||||||

| Johnson Controls, Inc. | 14,900 | 620,734 | |||||||||

| The Goodyear Tire & Rubber Co.* | 1,600 | 26,832 | |||||||||

| 647,566 | |||||||||||

| Automobiles (0.6%) | |||||||||||

| Ford Motor Co.* | 143,000 | 1,971,970 | |||||||||

| Harley-Davidson, Inc. | 1,800 | 73,746 | |||||||||

| 2,045,716 | |||||||||||

| Beverages (3.2%) | |||||||||||

| Brown-Forman Corp. Class B | 2,900 | 216,601 | |||||||||

| Coca-Cola Enterprises, Inc. | 2,300 | 67,114 | |||||||||

| Constellation Brands, Inc. Class A* | 1,200 | 24,984 | |||||||||

| Dr. Pepper Snapple Group, Inc. | 20,200 | 846,986 | |||||||||

| Molson Coors Brewing Co. Class B | 1,000 | 44,740 | |||||||||

| PepsiCo, Inc. | 10,888 | 766,842 | |||||||||

| The Coca-Cola Co. | 126,100 | 8,485,269 | |||||||||

| 10,452,536 | |||||||||||

See Accompanying Notes to Financial Statements.

7

Credit Suisse Large Cap Blend Fund, Inc.

Schedule of Investments (continued)

June 30, 2011 (unaudited)

|

Number of Shares |

Value | ||||||||||

| COMMON STOCKS | |||||||||||

| Biotechnology (1.0%) | |||||||||||

| Amgen, Inc.* | 23,208 | $ | 1,354,187 | ||||||||

| Biogen Idec, Inc.* | 7,700 | 823,284 | |||||||||

| Celgene Corp.* | 3,250 | 196,040 | |||||||||

| Cephalon, Inc.*§ | 4,239 | 338,696 | |||||||||

| Gilead Sciences, Inc.* | 13,800 | 571,458 | |||||||||

| 3,283,665 | |||||||||||

| Building Products (0.0%) | |||||||||||

| Masco Corp.§ | 2,500 | 30,075 | |||||||||

| Capital Markets (1.9%) | |||||||||||

| Ameriprise Financial, Inc. | 15,000 | 865,200 | |||||||||

| BlackRock, Inc. | 700 | 134,267 | |||||||||

| E*Trade Financial Corp.* | 1,300 | 17,940 | |||||||||

| Federated Investors, Inc. Class B§ | 2,800 | 66,752 | |||||||||

| Franklin Resources, Inc. | 4,100 | 538,289 | |||||||||

| Invesco, Ltd. | 3,100 | 72,540 | |||||||||

| Janus Capital Group, Inc. | 1,200 | 11,328 | |||||||||

| Legg Mason, Inc. | 1,300 | 42,588 | |||||||||

| Morgan Stanley | 39,200 | 901,992 | |||||||||

| Northern Trust Corp. | 3,600 | 165,456 | |||||||||

| Raymond James Financial, Inc. | 6,400 | 205,760 | |||||||||

| State Street Corp. | 14,200 | 640,278 | |||||||||

| T. Rowe Price Group, Inc. | 2,000 | 120,680 | |||||||||

| The Bank of New York Mellon Corp. | 34,500 | 883,890 | |||||||||

| The Charles Schwab Corp. | 6,700 | 110,215 | |||||||||

| The Goldman Sachs Group, Inc. | 11,750 | 1,563,807 | |||||||||

| 6,340,982 | |||||||||||

| Chemicals (4.1%) | |||||||||||

| Air Products & Chemicals, Inc. | 1,500 | 143,370 | |||||||||

| Airgas, Inc. | 500 | 35,020 | |||||||||

| CF Industries Holdings, Inc. | 500 | 70,835 | |||||||||

| E.I. Du Pont de Nemours & Co. | 120,400 | 6,507,620 | |||||||||

| Eastman Chemical Co. | 550 | 56,139 | |||||||||

| Ecolab, Inc. | 1,700 | 95,846 | |||||||||

| FMC Corp. | 400 | 34,408 | |||||||||

| International Flavors & Fragrances, Inc. | 856 | 54,989 | |||||||||

| Lubrizol Corp. | 30,753 | 4,129,205 | |||||||||

| Monsanto Co. | 11,700 | 848,718 | |||||||||

| PPG Industries, Inc. | 8,600 | 780,794 | |||||||||

| Praxair, Inc. | 2,200 | 238,458 | |||||||||

| Sigma-Aldrich Corp. | 900 | 66,042 | |||||||||

| The Dow Chemical Co. | 8,200 | 295,200 | |||||||||

| The Sherwin-Williams Co. | 600 | 50,322 | |||||||||

| 13,406,966 | |||||||||||

See Accompanying Notes to Financial Statements.

8

Credit Suisse Large Cap Blend Fund, Inc.

Schedule of Investments (continued)

June 30, 2011 (unaudited)

|

Number of Shares |

Value | ||||||||||

| COMMON STOCKS | |||||||||||

| Commercial Banks (2.6%) | |||||||||||

| BB&T Corp. | 7,200 | $ | 193,248 | ||||||||

| Comerica, Inc. | 1,400 | 48,398 | |||||||||

| Commerce Bancshares, Inc. | 2,219 | 95,417 | |||||||||

| Fifth Third Bancorp | 20,300 | 258,825 | |||||||||

| First Horizon National Corp. | 1,800 | 17,172 | |||||||||

| Huntington Bancshares, Inc. | 9,500 | 62,320 | |||||||||

| KeyCorp | 27,100 | 225,743 | |||||||||

| M&T Bank Corp. | 9,800 | 861,910 | |||||||||

| PNC Financial Services Group, Inc. | 25,700 | 1,531,977 | |||||||||

| Regions Financial Corp. | 21,300 | 132,060 | |||||||||

| SunTrust Banks, Inc. | 3,900 | 100,620 | |||||||||

| Synovus Financial Corp.§ | 47,600 | 99,008 | |||||||||

| U.S. Bancorp | 49,400 | 1,260,194 | |||||||||

| Wells Fargo & Co. | 127,200 | 3,569,232 | |||||||||

| Zions Bancorporation | 1,200 | 28,812 | |||||||||

| 8,484,936 | |||||||||||

| Commercial Services & Supplies (0.1%) | |||||||||||

| Avery Dennison Corp. | 700 | 27,041 | |||||||||

| Cintas Corp.§ | 800 | 26,424 | |||||||||

| Iron Mountain, Inc. | 1,300 | 44,317 | |||||||||

| Pitney Bowes, Inc. | 1,400 | 32,186 | |||||||||

| R. R. Donnelley & Sons Co.§ | 1,400 | 27,454 | |||||||||

| Republic Services, Inc. | 1,900 | 58,615 | |||||||||

| Stericycle, Inc.* | 600 | 53,472 | |||||||||

| Waste Management, Inc.§ | 3,400 | 126,718 | |||||||||

| 396,227 | |||||||||||

| Communications Equipment (1.6%) | |||||||||||

| ADTRAN, Inc. | 12,000 | 464,520 | |||||||||

| Cisco Systems, Inc. | 138,700 | 2,165,107 | |||||||||

| F5 Networks, Inc.* | 500 | 55,125 | |||||||||

| Harris Corp. | 1,100 | 49,566 | |||||||||

| JDS Uniphase Corp.* | 1,800 | 29,988 | |||||||||

| Juniper Networks, Inc.* | 3,800 | 119,700 | |||||||||

| Motorola Mobility Holdings, Inc.* | 2,337 | 51,507 | |||||||||

| Motorola Solutions, Inc.* | 2,371 | 109,161 | |||||||||

| QUALCOMM, Inc. | 41,500 | 2,356,785 | |||||||||

| Unity Wireless Corp.* | 712,201 | 499 | |||||||||

| 5,401,958 | |||||||||||

| Computers & Peripherals (3.6%) | |||||||||||

| Apple, Inc.* | 31,000 | 10,405,770 | |||||||||

| Dell, Inc.* | 12,000 | 200,040 | |||||||||

| EMC Corp.* | 20,400 | 562,020 | |||||||||

| Hewlett-Packard Co. | 15,100 | 549,640 | |||||||||

| Lexmark International, Inc. Class A* | 500 | 14,630 | |||||||||

| NetApp, Inc.* | 2,600 | 137,228 | |||||||||

| SanDisk Corp.* | 1,800 | 74,700 | |||||||||

See Accompanying Notes to Financial Statements.

9

Credit Suisse Large Cap Blend Fund, Inc.

Schedule of Investments (continued)

June 30, 2011 (unaudited)

|

Number of Shares |

Value | ||||||||||

| COMMON STOCKS | |||||||||||

| Computers & Peripherals | |||||||||||

| Western Digital Corp.* | 1,699 | $ | 61,810 | ||||||||

| 12,005,838 | |||||||||||

| Construction & Engineering (0.0%) | |||||||||||

| Fluor Corp. | 1,269 | 82,054 | |||||||||

| Jacobs Engineering Group, Inc.* | 800 | 34,600 | |||||||||

| Quanta Services, Inc.* | 1,500 | 30,300 | |||||||||

| 146,954 | |||||||||||

| Construction Materials (0.0%) | |||||||||||

| Vulcan Materials Co.§ | 1,100 | 42,383 | |||||||||

| Consumer Finance (1.0%) | |||||||||||

| American Express Co. | 22,500 | 1,163,250 | |||||||||

| Capital One Financial Corp. | 35,327 | 1,825,346 | |||||||||

| Discover Financial Services | 4,000 | 107,000 | |||||||||

| SLM Corp. | 3,400 | 57,154 | |||||||||

| 3,152,750 | |||||||||||

| Containers & Packaging (0.6%) | |||||||||||

| Ball Corp. | 1,200 | 46,152 | |||||||||

| Bemis Co., Inc. | 700 | 23,646 | |||||||||

| Owens-Illinois, Inc.* | 1,100 | 28,391 | |||||||||

| Sealed Air Corp. | 79,700 | 1,896,063 | |||||||||

| 1,994,252 | |||||||||||

| Distributors (0.0%) | |||||||||||

| Genuine Parts Co. | 1,300 | 70,720 | |||||||||

| Diversified Consumer Services (0.0%) | |||||||||||

| H&R Block, Inc. | 2,200 | 35,288 | |||||||||

| Diversified Financial Services (4.1%) | |||||||||||

| Bank of America Corp. | 252,894 | 2,771,718 | |||||||||

| Citigroup, Inc. | 82,660 | 3,441,963 | |||||||||

| CME Group, Inc. | 1,100 | 320,749 | |||||||||

| IntercontinentalExchange, Inc.* | 500 | 62,355 | |||||||||

| JPMorgan Chase & Co. | 109,600 | 4,487,024 | |||||||||

| Leucadia National Corp. | 1,300 | 44,330 | |||||||||

| Moody's Corp.§ | 24,400 | 935,740 | |||||||||

| NYSE Euronext | 2,100 | 71,967 | |||||||||

| The NASDAQ OMX Group, Inc.* | 57,900 | 1,464,870 | |||||||||

| 13,600,716 | |||||||||||

| Diversified Telecommunication Services (2.7%) | |||||||||||

| AT&T, Inc. | 127,600 | 4,007,916 | |||||||||

| CenturyTel, Inc. | 4,219 | 170,574 | |||||||||

| Frontier Communications Corp.§ | 7,892 | 63,689 | |||||||||

| Verizon Communications, Inc. | 126,000 | 4,690,980 | |||||||||

| Windstream Corp. | 3,300 | 42,768 | |||||||||

| 8,975,927 | |||||||||||

See Accompanying Notes to Financial Statements.

10

Credit Suisse Large Cap Blend Fund, Inc.

Schedule of Investments (continued)

June 30, 2011 (unaudited)

|

Number of Shares |

Value | ||||||||||

| COMMON STOCKS | |||||||||||

| Electric Utilities (1.1%) | |||||||||||

| American Electric Power Co., Inc. | 13,300 | $ | 501,144 | ||||||||

| Duke Energy Corp. | 10,500 | 197,715 | |||||||||

| Edison International | 2,500 | 96,875 | |||||||||

| Entergy Corp. | 1,400 | 95,592 | |||||||||

| Exelon Corp. | 17,300 | 741,132 | |||||||||

| FirstEnergy Corp. | 12,100 | 534,215 | |||||||||

| NextEra Energy, Inc. | 3,200 | 183,872 | |||||||||

| Pepco Holdings, Inc.§ | 1,500 | 29,445 | |||||||||

| Pinnacle West Capital Corp. | 700 | 31,206 | |||||||||

| PPL Corp. | 4,000 | 111,320 | |||||||||

| Progress Energy, Inc. | 1,900 | 91,219 | |||||||||

| Southern Co. | 23,900 | 965,082 | |||||||||

| 3,578,817 | |||||||||||

| Electrical Equipment (0.8%) | |||||||||||

| Emerson Electric Co. | 21,000 | 1,181,250 | |||||||||

| Rockwell Automation, Inc. | 15,800 | 1,370,808 | |||||||||

| Roper Industries, Inc.§ | 700 | 58,310 | |||||||||

| 2,610,368 | |||||||||||

| Electronic Equipment, Instruments & Components (0.1%) | |||||||||||

| Amphenol Corp. Class A | 1,300 | 70,187 | |||||||||

| Corning, Inc. | 11,200 | 203,280 | |||||||||

| FLIR Systems, Inc. | 1,000 | 33,710 | |||||||||

| Jabil Circuit, Inc. | 1,400 | 28,280 | |||||||||

| Molex, Inc.§ | 900 | 23,193 | |||||||||

| 358,650 | |||||||||||

| Energy Equipment & Services (2.2%) | |||||||||||

| Baker Hughes, Inc. | 19,080 | 1,384,445 | |||||||||

| Cameron International Corp.* | 1,700 | 85,493 | |||||||||

| Diamond Offshore Drilling, Inc. | 600 | 42,246 | |||||||||

| FMC Technologies, Inc.* | 1,600 | 71,664 | |||||||||

| Halliburton Co. | 6,100 | 311,100 | |||||||||

| Helmerich & Payne, Inc. | 800 | 52,896 | |||||||||

| Nabors Industries, Ltd.* | 2,100 | 51,744 | |||||||||

| National-Oilwell Varco, Inc. | 2,800 | 218,988 | |||||||||

| Noble Corp. | 7,200 | 283,752 | |||||||||

| Rowan Cos., Inc.* | 900 | 34,929 | |||||||||

| Schlumberger, Ltd. | 52,653 | 4,549,219 | |||||||||

| 7,086,476 | |||||||||||

| Food & Staples Retailing (2.5%) | |||||||||||

| Costco Wholesale Corp. | 12,200 | 991,128 | |||||||||

| CVS Caremark Corp. | 11,400 | 428,412 | |||||||||

| Safeway, Inc. | 2,621 | 61,253 | |||||||||

| SUPERVALU, Inc.§ | 5,900 | 55,519 | |||||||||

| Sysco Corp. | 4,100 | 127,838 | |||||||||

| The Kroger Co. | 18,600 | 461,280 | |||||||||

See Accompanying Notes to Financial Statements.

11

Credit Suisse Large Cap Blend Fund, Inc.

Schedule of Investments (continued)

June 30, 2011 (unaudited)

|

Number of Shares |

Value | ||||||||||

| COMMON STOCKS | |||||||||||

| Food & Staples Retailing | |||||||||||

| Wal-Mart Stores, Inc. | 48,600 | $ | 2,582,604 | ||||||||

| Walgreen Co. | 77,800 | 3,303,388 | |||||||||

| Whole Foods Market, Inc. | 1,000 | 63,450 | |||||||||

| 8,074,872 | |||||||||||

| Food Products (1.5%) | |||||||||||

| Archer-Daniels-Midland Co. | 6,960 | 209,844 | |||||||||

| Campbell Soup Co. | 1,300 | 44,915 | |||||||||

| ConAgra Foods, Inc. | 2,900 | 74,849 | |||||||||

| General Mills, Inc. | 4,500 | 167,490 | |||||||||

| H.J. Heinz Co. | 55,870 | 2,976,754 | |||||||||

| Hormel Foods Corp. | 800 | 23,848 | |||||||||

| Kellogg Co. | 1,800 | 99,576 | |||||||||

| Kraft Foods, Inc. Class A | 18,900 | 665,847 | |||||||||

| McCormick & Co., Inc. | 900 | 44,613 | |||||||||

| Mead Johnson Nutrition Co. | 1,503 | 101,528 | |||||||||

| Sara Lee Corp. | 4,400 | 83,556 | |||||||||

| The Hershey Co. | 1,310 | 74,473 | |||||||||

| The J.M. Smucker Co. | 900 | 68,796 | |||||||||

| Tyson Foods, Inc. Class A | 20,100 | 390,342 | |||||||||

| 5,026,431 | |||||||||||

| Gas Utilities (0.1%) | |||||||||||

| Atmos Energy Corp. | 5,000 | 166,250 | |||||||||

| Nicor, Inc. | 300 | 16,422 | |||||||||

| ONEOK, Inc. | 1,000 | 74,010 | |||||||||

| 256,682 | |||||||||||

| Health Care Equipment & Supplies (1.3%) | |||||||||||

| Baxter International, Inc. | 16,400 | 978,916 | |||||||||

| Becton, Dickinson and Co. | 1,600 | 137,872 | |||||||||

| Boston Scientific Corp.* | 19,835 | 137,060 | |||||||||

| CareFusion Corp.* | 1,500 | 40,755 | |||||||||

| Covidien PLC | 3,500 | 186,305 | |||||||||

| CR Bard, Inc. | 14,300 | 1,570,998 | |||||||||

| DENTSPLY International, Inc. | 900 | 34,272 | |||||||||

| Intuitive Surgical, Inc.* | 200 | 74,422 | |||||||||

| Medtronic, Inc. | 7,565 | 291,479 | |||||||||

| St. Jude Medical, Inc. | 2,500 | 119,200 | |||||||||

| Stryker Corp. | 2,400 | 140,856 | |||||||||

| The Cooper Cos., Inc. | 5,500 | 435,820 | |||||||||

| Varian Medical Systems, Inc.* | 900 | 63,018 | |||||||||

| Zimmer Holdings, Inc.* | 1,400 | 88,480 | |||||||||

| 4,299,453 | |||||||||||

| Health Care Providers & Services (2.1%) | |||||||||||

| Aetna, Inc. | 2,800 | 123,452 | |||||||||

| AmerisourceBergen Corp. | 2,100 | 86,940 | |||||||||

| Cardinal Health, Inc. | 2,700 | 122,634 | |||||||||

See Accompanying Notes to Financial Statements.

12

Credit Suisse Large Cap Blend Fund, Inc.

Schedule of Investments (continued)

June 30, 2011 (unaudited)

|

Number of Shares |

Value | ||||||||||

| COMMON STOCKS | |||||||||||

| Health Care Providers & Services | |||||||||||

| CIGNA Corp. | 2,200 | $ | 113,146 | ||||||||

| Coventry Health Care, Inc.* | 1,000 | 36,470 | |||||||||

| DaVita, Inc.* | 700 | 60,627 | |||||||||

| Express Scripts, Inc.* | 17,500 | 944,650 | |||||||||

| Humana, Inc. | 9,900 | 797,346 | |||||||||

| Laboratory Corp. of America Holdings* | 800 | 77,432 | |||||||||

| McKesson Corp. | 1,800 | 150,570 | |||||||||

| Medco Health Solutions, Inc.* | 25,600 | 1,446,912 | |||||||||

| Patterson Cos., Inc. | 600 | 19,734 | |||||||||

| Quest Diagnostics, Inc. | 1,100 | 65,010 | |||||||||

| Tenet Healthcare Corp.* | 3,300 | 20,592 | |||||||||

| UnitedHealth Group, Inc. | 39,900 | 2,058,042 | |||||||||

| WellPoint, Inc. | 10,728 | 845,045 | |||||||||

| 6,968,602 | |||||||||||

| Health Care Technology (0.0%) | |||||||||||

| Cerner Corp.*§ | 1,000 | 61,110 | |||||||||

| Hotels, Restaurants & Leisure (1.5%) | |||||||||||

| Carnival Corp. | 3,100 | 116,653 | |||||||||

| Darden Restaurants, Inc. | 921 | 45,829 | |||||||||

| International Game Technology | 2,100 | 36,918 | |||||||||

| Marriott International, Inc. Class A | 2,100 | 74,529 | |||||||||

| McDonald's Corp. | 42,750 | 3,604,680 | |||||||||

| Starbucks Corp. | 21,200 | 837,188 | |||||||||

| Starwood Hotels & Resorts Worldwide, Inc. | 1,400 | 78,456 | |||||||||

| Wyndham Worldwide Corp. | 1,100 | 37,015 | |||||||||

| Wynn Resorts, Ltd. | 500 | 71,770 | |||||||||

| Yum! Brands, Inc.* | 3,300 | 182,292 | |||||||||

| 5,085,330 | |||||||||||

| Household Durables (0.7%) | |||||||||||

| D.R. Horton, Inc. | 2,000 | 23,040 | |||||||||

| Fortune Brands, Inc. | 900 | 57,393 | |||||||||

| Harman International Industries, Inc. | 18,200 | 829,374 | |||||||||

| Leggett & Platt, Inc. | 1,000 | 24,380 | |||||||||

| Lennar Corp. Class A | 1,100 | 19,965 | |||||||||

| Newell Rubbermaid, Inc. | 2,000 | 31,560 | |||||||||

| Pulte Group, Inc.*§ | 2,400 | 18,384 | |||||||||

| Whirlpool Corp. | 14,200 | 1,154,744 | |||||||||

| 2,158,840 | |||||||||||

| Household Products (0.8%) | |||||||||||

| Clorox Co. | 2,266 | 152,819 | |||||||||

| Colgate-Palmolive Co. | 3,600 | 314,676 | |||||||||

| Kimberly-Clark Corp. | 14,900 | 991,744 | |||||||||

| The Procter & Gamble Co. | 19,900 | 1,265,043 | |||||||||

| 2,724,282 | |||||||||||

See Accompanying Notes to Financial Statements.

13

Credit Suisse Large Cap Blend Fund, Inc.

Schedule of Investments (continued)

June 30, 2011 (unaudited)

|

Number of Shares |

Value | ||||||||||

| COMMON STOCKS | |||||||||||

| Independent Power Producers & Energy Traders (0.0%) | |||||||||||

| Constellation Energy Group, Inc. | 1,500 | $ | 56,940 | ||||||||

| NRG Energy, Inc.* | 1,700 | 41,786 | |||||||||

| The AES Corp.* | 4,100 | 52,234 | |||||||||

| 150,960 | |||||||||||

| Industrial Conglomerates (2.3%) | |||||||||||

| 3M Co. | 19,900 | 1,887,515 | |||||||||

| General Electric Co. | 284,000 | 5,356,240 | |||||||||

| Tyco International, Ltd. | 3,327 | 164,454 | |||||||||

| 7,408,209 | |||||||||||

| Insurance (5.2%) | |||||||||||

| ACE, Ltd. | 9,400 | 618,708 | |||||||||

| Aflac, Inc. | 14,700 | 686,196 | |||||||||

| American International Group, Inc.* | 4,100 | 120,212 | |||||||||

| AON Corp. | 22,700 | 1,164,510 | |||||||||

| Berkshire Hathaway, Inc. Class B* | 43,698 | 3,381,788 | |||||||||

| Chubb Corp. | 35,700 | 2,235,177 | |||||||||

| Cincinnati Financial Corp.§ | 1,100 | 32,098 | |||||||||

| First American Financial Corp.§ | 7,100 | 111,115 | |||||||||

| Hartford Financial Services Group, Inc. | 3,500 | 92,295 | |||||||||

| Lincoln National Corp. | 2,200 | 62,678 | |||||||||

| Loews Corp. | 2,426 | 102,111 | |||||||||

| Marsh & McLennan Cos., Inc. | 72,000 | 2,245,680 | |||||||||

| MetLife, Inc. | 30,200 | 1,324,874 | |||||||||

| Principal Financial Group, Inc. | 2,600 | 79,092 | |||||||||

| Prudential Financial, Inc. | 13,500 | 858,465 | |||||||||

| The Allstate Corp. | 9,400 | 286,982 | |||||||||

| The Progressive Corp. | 5,400 | 115,452 | |||||||||

| The Travelers Cos., Inc. | 40,300 | 2,352,714 | |||||||||

| Torchmark Corp. | 13,100 | 840,234 | |||||||||

| Unum Group | 3,400 | 86,632 | |||||||||

| XL Group PLC | 11,300 | 248,374 | |||||||||

| 17,045,387 | |||||||||||

| Internet & Catalog Retail (1.6%) | |||||||||||

| Amazon.com, Inc.* | 16,200 | 3,312,738 | |||||||||

| Expedia, Inc.§ | 54,000 | 1,565,460 | |||||||||

| NetFlix, Inc.* | 1,200 | 315,228 | |||||||||

| priceline.com, Inc.* | 300 | 153,579 | |||||||||

| 5,347,005 | |||||||||||

| Internet Software & Services (3.1%) | |||||||||||

| Akamai Technologies, Inc.* | 1,300 | 40,911 | |||||||||

| eBay, Inc.* | 68,200 | 2,200,814 | |||||||||

| Google, Inc. Class A* | 12,500 | 6,329,750 | |||||||||

| Monster Worldwide, Inc.*§ | 900 | 13,194 | |||||||||

| VeriSign, Inc. | 40,800 | 1,365,168 | |||||||||

See Accompanying Notes to Financial Statements.

14

Credit Suisse Large Cap Blend Fund, Inc.

Schedule of Investments (continued)

June 30, 2011 (unaudited)

|

Number of Shares |

Value | ||||||||||

| COMMON STOCKS | |||||||||||

| Internet Software & Services | |||||||||||

| Yahoo!, Inc.* | 22,400 | $ | 336,896 | ||||||||

| 10,286,733 | |||||||||||

| IT Services (2.5%) | |||||||||||

| Automatic Data Processing, Inc. | 14,000 | 737,520 | |||||||||

| Cognizant Technology Solutions Corp. Class A* | 2,300 | 168,682 | |||||||||

| Computer Sciences Corp. | 1,100 | 41,756 | |||||||||

| Fidelity National Information Services, Inc. | 1,700 | 52,343 | |||||||||

| Fiserv, Inc.* | 1,000 | 62,630 | |||||||||

| International Business Machines Corp. | 28,450 | 4,880,597 | |||||||||

| Mastercard, Inc. Class A | 2,600 | 783,484 | |||||||||

| Paychex, Inc. | 2,400 | 73,728 | |||||||||

| SAIC, Inc.* | 2,000 | 33,640 | |||||||||

| Teradata Corp.* | 1,100 | 66,220 | |||||||||

| The Western Union Co. | 5,000 | 100,150 | |||||||||

| Total System Services, Inc. | 1,100 | 20,438 | |||||||||

| Visa, Inc. Class A | 15,300 | 1,289,178 | |||||||||

| 8,310,366 | |||||||||||

| Leisure Equipment & Products (0.0%) | |||||||||||

| Hasbro, Inc. | 900 | 39,537 | |||||||||

| Mattel, Inc. | 2,100 | 57,729 | |||||||||

| 97,266 | |||||||||||

| Life Sciences Tools & Services (1.4%) | |||||||||||

| Agilent Technologies, Inc.* | 77,000 | 3,935,470 | |||||||||

| Life Technologies Corp.* | 6,275 | 326,739 | |||||||||

| PerkinElmer, Inc. | 800 | 21,528 | |||||||||

| Thermo Fisher Scientific, Inc.* | 3,100 | 199,609 | |||||||||

| Waters Corp.* | 600 | 57,444 | |||||||||

| 4,540,790 | |||||||||||

| Machinery (3.6%) | |||||||||||

| AGCO Corp.* | 20,900 | 1,031,624 | |||||||||

| Caterpillar, Inc. | 31,800 | 3,385,428 | |||||||||

| Cummins, Inc. | 1,400 | 144,886 | |||||||||

| Danaher Corp. | 4,000 | 211,960 | |||||||||

| Deere & Co. | 14,200 | 1,170,790 | |||||||||

| Dover Corp. | 56,000 | 3,796,800 | |||||||||

| Eaton Corp. | 2,400 | 123,480 | |||||||||

| Flowserve Corp. | 400 | 43,956 | |||||||||

| Illinois Tool Works, Inc. | 3,600 | 203,364 | |||||||||

| Ingersoll-Rand PLC | 2,300 | 104,443 | |||||||||

| Joy Global, Inc. | 10,300 | 980,972 | |||||||||

| PACCAR, Inc. | 2,600 | 132,834 | |||||||||

| Pall Corp. | 700 | 39,361 | |||||||||

| Parker Hannifin Corp. | 4,500 | 403,830 | |||||||||

| Snap-on, Inc. | 400 | 24,992 | |||||||||

See Accompanying Notes to Financial Statements.

15

Credit Suisse Large Cap Blend Fund, Inc.

Schedule of Investments (continued)

June 30, 2011 (unaudited)

|

Number of Shares |

Value | ||||||||||

| COMMON STOCKS | |||||||||||

| Machinery | |||||||||||

| Stanley Black & Decker, Inc. | 1,210 | $ | 87,180 | ||||||||

| 11,885,900 | |||||||||||

| Media (3.3%) | |||||||||||

| Cablevision Systems Corp. Group A | 1,600 | 57,936 | |||||||||

| CBS Corp. Class B | 5,400 | 153,846 | |||||||||

| Comcast Corp. Class A | 52,600 | 1,332,884 | |||||||||

| DIRECTV Class A* | 25,200 | 1,280,664 | |||||||||

| Discovery Communications, Inc. Class A* | 2,100 | 86,016 | |||||||||

| Gannett Co., Inc. | 1,700 | 24,344 | |||||||||

| News Corp. Class A | 65,400 | 1,157,580 | |||||||||

| Omnicom Group, Inc. | 37,900 | 1,825,264 | |||||||||

| Scripps Networks Interactive, Inc. Class A | 600 | 29,328 | |||||||||

| The Interpublic Group of Cos., Inc. | 5,600 | 70,000 | |||||||||

| The McGraw-Hill Cos., Inc. | 2,173 | 91,070 | |||||||||

| The Walt Disney Co. | 43,049 | 1,680,633 | |||||||||

| The Washington Post Co. Class B§ | 203 | 85,047 | |||||||||

| Time Warner Cable, Inc. | 22,300 | 1,740,292 | |||||||||

| Time Warner, Inc. | 30,400 | 1,105,648 | |||||||||

| Viacom, Inc. Class B | 4,400 | 224,400 | |||||||||

| 10,944,952 | |||||||||||

| Metals & Mining (0.6%) | |||||||||||

| AK Steel Holding Corp. | 3,100 | 48,856 | |||||||||

| Alcoa, Inc. | 7,700 | 122,122 | |||||||||

| Allegheny Technologies, Inc. | 600 | 38,082 | |||||||||

| Cliffs Natural Resources, Inc. | 900 | 83,205 | |||||||||

| Freeport-McMoRan Copper & Gold, Inc. | 22,900 | 1,211,410 | |||||||||

| Newmont Mining Corp. | 3,600 | 194,292 | |||||||||

| Nucor Corp. | 2,200 | 90,684 | |||||||||

| United States Steel Corp.§ | 1,200 | 55,248 | |||||||||

| 1,843,899 | |||||||||||

| Multi-Utilities (1.0%) | |||||||||||

| Ameren Corp. | 1,700 | 49,028 | |||||||||

| CenterPoint Energy, Inc. | 3,000 | 58,050 | |||||||||

| CMS Energy Corp. | 1,600 | 31,504 | |||||||||

| Consolidated Edison, Inc. | 16,500 | 878,460 | |||||||||

| Dominion Resources, Inc. | 4,400 | 212,388 | |||||||||

| DTE Energy Co. | 1,300 | 65,026 | |||||||||

| Integrys Energy Group, Inc. | 500 | 25,920 | |||||||||

| NiSource, Inc. | 1,900 | 38,475 | |||||||||

| NSTAR | 3,758 | 172,793 | |||||||||

| PG&E Corp. | 20,500 | 861,615 | |||||||||

| Public Service Enterprise Group, Inc. | 13,784 | 449,910 | |||||||||

| SCANA Corp. | 700 | 27,559 | |||||||||

| Sempra Energy | 1,821 | 96,294 | |||||||||

| TECO Energy, Inc. | 6,000 | 113,340 | |||||||||

| Wisconsin Energy Corp. | 1,800 | 56,430 | |||||||||

See Accompanying Notes to Financial Statements.

16

Credit Suisse Large Cap Blend Fund, Inc.

Schedule of Investments (continued)

June 30, 2011 (unaudited)

|

Number of Shares |

Value | ||||||||||

| COMMON STOCKS | |||||||||||

| Multi-Utilities | |||||||||||

| Xcel Energy, Inc. | 3,400 | $ | 82,620 | ||||||||

| 3,219,412 | |||||||||||

| Multiline Retail (0.5%) | |||||||||||

| Big Lots, Inc.* | 500 | 16,575 | |||||||||

| Dollar Tree, Inc.* | 1,900 | 126,578 | |||||||||

| Family Dollar Stores, Inc. | 1,100 | 57,816 | |||||||||

| J.C. Penney Co., Inc. | 1,700 | 58,718 | |||||||||

| Kohl's Corp. | 7,900 | 395,079 | |||||||||

| Macy's, Inc. | 2,800 | 81,872 | |||||||||

| Nordstrom, Inc. | 1,100 | 51,634 | |||||||||

| Sears Holdings Corp.*§ | 1,200 | 85,728 | |||||||||

| Target Corp. | 12,944 | 607,203 | |||||||||

| 1,481,203 | |||||||||||

| Office Electronics (0.0%) | |||||||||||

| Xerox Corp. | 11,061 | 115,145 | |||||||||

| Oil, Gas & Consumable Fuels (10.7%) | |||||||||||

| Alpha Natural Resources, Inc.* | 820 | 37,261 | |||||||||

| Anadarko Petroleum Corp. | 13,400 | 1,028,584 | |||||||||

| Apache Corp. | 2,700 | 333,153 | |||||||||

| Arch Coal, Inc. | 20,300 | 541,198 | |||||||||

| Cabot Oil & Gas Corp. | 700 | 46,417 | |||||||||

| Chesapeake Energy Corp. | 12,000 | 356,280 | |||||||||

| Chevron Corp. | 77,300 | 7,949,532 | |||||||||

| ConocoPhillips | 52,400 | 3,939,956 | |||||||||

| Consol Energy, Inc. | 1,300 | 63,024 | |||||||||

| Denbury Resources, Inc.* | 3,147 | 62,940 | |||||||||

| Devon Energy Corp. | 15,700 | 1,237,317 | |||||||||

| El Paso Corp. | 4,800 | 96,960 | |||||||||

| EOG Resources, Inc. | 1,700 | 177,735 | |||||||||

| EQT Corp. | 1,100 | 57,772 | |||||||||

| Exxon Mobil Corp. | 132,527 | 10,785,047 | |||||||||

| Hess Corp. | 25,300 | 1,891,428 | |||||||||

| Marathon Oil Corp. | 19,800 | 1,043,064 | |||||||||

| Murphy Oil Corp. | 29,600 | 1,943,536 | |||||||||

| Newfield Exploration Co.* | 900 | 61,218 | |||||||||

| Noble Energy, Inc. | 1,200 | 107,556 | |||||||||

| Occidental Petroleum Corp. | 12,400 | 1,290,096 | |||||||||

| Peabody Energy Corp. | 2,100 | 123,711 | |||||||||

| Pioneer Natural Resources Co. | 900 | 80,613 | |||||||||

| QEP Resources, Inc. | 1,400 | 58,562 | |||||||||

| Range Resources Corp. | 1,200 | 66,600 | |||||||||

| Southwestern Energy Co.* | 2,600 | 111,488 | |||||||||

| Spectra Energy Corp. | 4,700 | 128,827 | |||||||||

| Sunoco, Inc. | 800 | 33,368 | |||||||||

| The Williams Cos., Inc. | 3,800 | 114,950 | |||||||||

| Valero Energy Corp. | 55,937 | 1,430,309 | |||||||||

| 35,198,502 | |||||||||||

See Accompanying Notes to Financial Statements.

17

Credit Suisse Large Cap Blend Fund, Inc.

Schedule of Investments (continued)

June 30, 2011 (unaudited)

|

Number of Shares |

Value | ||||||||||

| COMMON STOCKS | |||||||||||

| Paper & Forest Products (0.0%) | |||||||||||

| International Paper Co. | 3,200 | $ | 95,424 | ||||||||

| MeadWestvaco Corp. | 1,100 | 36,641 | |||||||||

| 132,065 | |||||||||||

| Personal Products (0.5%) | |||||||||||

| Avon Products, Inc. | 3,100 | 86,800 | |||||||||

| The Estee Lauder Cos., Inc. Class A | 15,400 | 1,619,926 | |||||||||

| 1,706,726 | |||||||||||

| Pharmaceuticals (5.4%) | |||||||||||

| Abbott Laboratories | 35,700 | 1,878,534 | |||||||||

| Allergan, Inc. | 8,400 | 699,300 | |||||||||

| Bristol-Myers Squibb Co. | 41,436 | 1,199,987 | |||||||||

| Eli Lilly & Co. | 17,000 | 638,010 | |||||||||

| Endo Pharmaceuticals Holdings, Inc.* | 23,035 | 925,316 | |||||||||

| Forest Laboratories, Inc.* | 23,100 | 908,754 | |||||||||

| Hospira, Inc.* | 1,278 | 72,411 | |||||||||

| Johnson & Johnson | 58,650 | 3,901,398 | |||||||||

| Merck & Co., Inc. | 73,447 | 2,591,945 | |||||||||

| Mylan, Inc.* | 3,100 | 76,477 | |||||||||

| Pfizer, Inc. | 224,807 | 4,631,024 | |||||||||

| Teva Pharmaceutical Industries, Ltd. ADR | 3,022 | 145,721 | |||||||||

| Watson Pharmaceuticals, Inc.* | 1,000 | 68,730 | |||||||||

| 17,737,607 | |||||||||||

| Professional Services (0.0%) | |||||||||||

| Dun & Bradstreet Corp. | 300 | 22,662 | |||||||||

| Equifax, Inc. | 800 | 27,776 | |||||||||

| Robert Half International, Inc. | 1,000 | 27,030 | |||||||||

| 77,468 | |||||||||||

| Real Estate Investment Trusts (1.4%) | |||||||||||

| Apartment Investment & Management Co. Class A | 800 | 20,424 | |||||||||

| AvalonBay Communities, Inc. | 531 | 68,180 | |||||||||

| Boston Properties, Inc. | 1,100 | 116,776 | |||||||||

| Cousins Properties, Inc. | 16 | 137 | |||||||||

| Equity Residential | 2,100 | 126,000 | |||||||||

| HCP, Inc. | 2,800 | 102,732 | |||||||||

| Health Care REIT, Inc. | 1,300 | 68,159 | |||||||||

| Host Hotels & Resorts, Inc. | 4,514 | 76,512 | |||||||||

| Kimco Realty Corp. | 3,300 | 61,512 | |||||||||

| Plum Creek Timber Co., Inc. | 1,000 | 40,540 | |||||||||

| ProLogis, Inc. | 1,830 | 65,587 | |||||||||

| Public Storage | 4,100 | 467,441 | |||||||||

| Simon Property Group, Inc. | 24,257 | 2,819,391 | |||||||||

| Ventas, Inc. | 1,200 | 63,252 | |||||||||

| Vornado Realty Trust | 3,232 | 301,158 | |||||||||

| Weyerhaeuser Co. | 3,943 | 86,194 | |||||||||

| 4,483,995 | |||||||||||

See Accompanying Notes to Financial Statements.

18

Credit Suisse Large Cap Blend Fund, Inc.

Schedule of Investments (continued)

June 30, 2011 (unaudited)

|

Number of Shares |

Value | ||||||||||

| COMMON STOCKS | |||||||||||

| Real Estate Management & Development (0.1%) | |||||||||||

| CB Richard Ellis Group, Inc. Class A* | 16,800 | $ | 421,848 | ||||||||

| Road & Rail (0.6%) | |||||||||||

| CSX Corp. | 8,100 | 212,382 | |||||||||

| Norfolk Southern Corp. | 4,000 | 299,720 | |||||||||

| Union Pacific Corp. | 13,200 | 1,378,080 | |||||||||

| 1,890,182 | |||||||||||

| Semiconductors & Semiconductor Equipment (2.6%) | |||||||||||

| Advanced Micro Devices, Inc.*§ | 4,000 | 27,960 | |||||||||

| Altera Corp. | 10,900 | 505,215 | |||||||||

| Analog Devices, Inc. | 17,200 | 673,208 | |||||||||

| Applied Materials, Inc. | 10,400 | 135,304 | |||||||||

| Broadcom Corp. Class A* | 3,400 | 114,376 | |||||||||

| First Solar, Inc.*§ | 1,500 | 198,405 | |||||||||

| Intel Corp. | 146,500 | 3,246,440 | |||||||||

| KLA-Tencor Corp. | 1,100 | 44,528 | |||||||||

| Linear Technology Corp. | 1,500 | 49,530 | |||||||||

| LSI Corp.* | 4,300 | 30,616 | |||||||||

| MEMC Electronic Materials, Inc.* | 1,600 | 13,648 | |||||||||

| Microchip Technology, Inc. | 1,400 | 53,074 | |||||||||

| Micron Technology, Inc.* | 6,700 | 50,116 | |||||||||

| National Semiconductor Corp. | 1,700 | 41,837 | |||||||||

| Novellus Systems, Inc.* | 600 | 21,684 | |||||||||

| NVIDIA Corp.* | 4,700 | 74,894 | |||||||||

| Teradyne, Inc.* | 1,200 | 17,760 | |||||||||

| Texas Instruments, Inc. | 96,600 | 3,171,378 | |||||||||

| Xilinx, Inc. | 1,800 | 65,646 | |||||||||

| 8,535,619 | |||||||||||

| Software (2.9%) | |||||||||||

| Adobe Systems, Inc.* | 10,100 | 317,645 | |||||||||

| Autodesk, Inc.* | 1,500 | 57,900 | |||||||||

| BMC Software, Inc.* | 1,300 | 71,110 | |||||||||

| CA, Inc. | 2,600 | 59,384 | |||||||||

| Citrix Systems, Inc.* | 1,400 | 112,000 | |||||||||

| Compuware Corp.* | 1,500 | 14,640 | |||||||||

| Electronic Arts, Inc.* | 2,300 | 54,280 | |||||||||

| Intuit, Inc.* | 21,100 | 1,094,246 | |||||||||

| Microsoft Corp. | 153,650 | 3,994,900 | |||||||||

| Oracle Corp. | 108,020 | 3,554,938 | |||||||||

| Red Hat, Inc.* | 1,900 | 87,210 | |||||||||

| Salesforce.com, Inc.* | 800 | 119,184 | |||||||||

| Symantec Corp.* | 5,800 | 114,376 | |||||||||

| 9,651,813 | |||||||||||

| Specialty Retail (1.9%) | |||||||||||

| Abercrombie & Fitch Co. Class A | 600 | 40,152 | |||||||||

| AutoNation, Inc.*§ | 1,700 | 62,237 | |||||||||

See Accompanying Notes to Financial Statements.

19

Credit Suisse Large Cap Blend Fund, Inc.

Schedule of Investments (continued)

June 30, 2011 (unaudited)

|

Number of Shares |

Value | ||||||||||

| COMMON STOCKS | |||||||||||

| Specialty Retail | |||||||||||

| AutoZone, Inc.* | 7,100 | $ | 2,093,435 | ||||||||

| Bed Bath & Beyond, Inc.* | 2,000 | 116,740 | |||||||||

| Best Buy Co., Inc.§ | 9,600 | 301,536 | |||||||||

| CarMax, Inc.*§ | 1,500 | 49,605 | |||||||||

| GameStop Corp. Class A* | 1,000 | 26,670 | |||||||||

| Home Depot, Inc. | 25,900 | 938,098 | |||||||||

| Lowe's Cos., Inc. | 9,500 | 221,445 | |||||||||

| Ltd Brands, Inc. | 14,000 | 538,300 | |||||||||

| O'Reilly Automotive, Inc.* | 900 | 58,959 | |||||||||

| PetSmart, Inc. | 3,200 | 145,184 | |||||||||

| Ross Stores, Inc. | 800 | 64,096 | |||||||||

| Staples, Inc. | 20,600 | 325,480 | |||||||||

| The Gap, Inc. | 3,700 | 66,970 | |||||||||

| Tiffany & Co. | 800 | 62,816 | |||||||||

| TJX Cos., Inc. | 2,800 | 147,084 | |||||||||

| Urban Outfitters, Inc.* | 900 | 25,335 | |||||||||

| Williams-Sonoma, Inc. | 22,200 | 810,078 | |||||||||

| 6,094,220 | |||||||||||

| Textiles, Apparel & Luxury Goods (0.5%) | |||||||||||

| Coach, Inc. | 2,200 | 140,646 | |||||||||

| NIKE, Inc. Class B | 10,652 | 958,467 | |||||||||

| Polo Ralph Lauren Corp.§ | 500 | 66,305 | |||||||||

| VF Corp. | 2,900 | 314,824 | |||||||||

| 1,480,242 | |||||||||||

| Thrifts & Mortgage Finance (0.1%) | |||||||||||

| Hudson City Bancorp, Inc. | 14,400 | 117,936 | |||||||||

| People's United Financial, Inc. | 2,500 | 33,600 | |||||||||

| 151,536 | |||||||||||

| Tobacco (2.3%) | |||||||||||

| Altria Group, Inc. | 35,100 | 926,991 | |||||||||

| Lorillard, Inc. | 26,600 | 2,895,942 | |||||||||

| Philip Morris International, Inc. | 56,050 | 3,742,458 | |||||||||

| Reynolds American, Inc. | 2,600 | 96,330 | |||||||||

| 7,661,721 | |||||||||||

| Trading Companies & Distributors (0.0%) | |||||||||||

| Fastenal Co. | 2,200 | 79,178 | |||||||||

| WW Grainger, Inc. | 400 | 61,460 | |||||||||

| 140,638 | |||||||||||

| Wireless Telecommunication Services (0.2%) | |||||||||||

| American Tower Corp. Class A* | 2,700 | 141,291 | |||||||||

| MetroPCS Communications, Inc.* | 1,800 | 30,978 | |||||||||

| Sprint Nextel Corp.* | 90,600 | 488,334 | |||||||||

| 660,603 | |||||||||||

| TOTAL COMMON STOCKS (Cost $301,390,229) | 328,197,627 | ||||||||||

See Accompanying Notes to Financial Statements.

20

Credit Suisse Large Cap Blend Fund, Inc.

Schedule of Investments (continued)

June 30, 2011 (unaudited)

|

Number of Shares |

Value | ||||||||||

| SHORT-TERM INVESTMENTS (1.3%) | |||||||||||

| State Street Navigator Prime Portfolio, 0.2299%§§ | 3,157,851 | $ | 3,157,851 | ||||||||

|

Par (000) |

|||||||||||

| State Street Bank and Trust Co. Euro Time Deposit, 0.010%, 07/01/11 | $ | 1,032 | 1,032,000 | ||||||||

| TOTAL SHORT-TERM INVESTMENTS (Cost $4,189,851) | 4,189,851 | ||||||||||

| TOTAL INVESTMENTS AT VALUE (100.8%) (Cost $305,580,080) | 332,387,478 | ||||||||||

| LIABILITIES IN EXCESS OF OTHER ASSETS (-0.8%) | (2,593,221 | ) | |||||||||

| NET ASSETS (100.0%) | $ | 329,794,257 | |||||||||

INVESTMENT ABBREVIATION

ADR = American Depositary Receipt

* Non-income producing security.

§ Security or portion thereof is out on loan.

§§ Represents security purchased with cash collateral received for securities on loan. The rate shown is the annualized seven-day yield at June 30, 2011.

See Accompanying Notes to Financial Statements.

21

Credit Suisse Large Cap Blend Fund, Inc.

Statement of Assets and Liabilities

June 30, 2011 (unaudited)

| Assets | |||||||

|

Investments at value, including collateral for securities on loan of $3,157,851 (Cost $305,580,080) (Note 2) |

$ | 332,387,4781 | |||||

| Cash | 134 | ||||||

| Receivable for investments sold | 6,842,077 | ||||||

| Dividend and interest receivable | 427,328 | ||||||

| Receivable for fund shares sold | 67,966 | ||||||

| Prepaid expenses and other assets | 74,615 | ||||||

| Total Assets | 339,799,598 | ||||||

| Liabilities | |||||||

| Advisory fee payable (Note 3) | 136,735 | ||||||

| Administrative services fee payable (Note 3) | 69,052 | ||||||

| Shareholder servicing/Distribution fee payable (Note 3) | 40,956 | ||||||

| Payable for investments purchased | 6,088,159 | ||||||

| Payable upon return of securities loaned (Note 2) | 3,157,851 | ||||||

| Payable for fund shares redeemed | 196,986 | ||||||

| Directors' fee payable | 2,981 | ||||||

| Other accrued expenses payable | 312,621 | ||||||

| Total Liabilities | 10,005,341 | ||||||

| Net Assets | |||||||

| Capital stock, $.001 par value (Note 6) | 28,910 | ||||||

| Paid-in capital (Note 6) | 346,604,780 | ||||||

| Undistributed net investment income | 1,556,696 | ||||||

| Accumulated net realized loss on investments and foreign currency transactions | (45,203,527 | ) | |||||

| Net unrealized appreciation from investments | 26,807,398 | ||||||

| Net Assets | $ | 329,794,257 | |||||

| Common Shares | |||||||

| Net assets | $ | 135,332,506 | |||||

| Shares outstanding | 11,887,731 | ||||||

| Net asset value, offering price and redemption price per share | $ | 11.38 | |||||

| A Shares | |||||||

| Net assets | $ | 191,916,999 | |||||

| Shares outstanding | 16,786,972 | ||||||

| Net asset value and redemption price per share | $ | 11.43 | |||||

| Maximum offering price per share (net asset value/(1-5.75%)) | $ | 12.13 | |||||

| B Shares | |||||||

| Net assets | $ | 1,539,450 | |||||

| Shares outstanding | 141,893 | ||||||

| Net asset value and offering price per share | $ | 10.85 | |||||

| C Shares | |||||||

| Net assets | $ | 1,005,302 | |||||

| Shares outstanding | 92,938 | ||||||

| Net asset value and offering price per share | $ | 10.82 | |||||

1 Including $3,112,736 of securities on loan.

See Accompanying Notes to Financial Statements.

22

Credit Suisse Large Cap Blend Fund, Inc.

Statement of Operations

For the Six Months Ended June 30, 2011 (unaudited)

| Investment Income (Note 2) | |||||||

| Dividends | $ | 3,314,710 | |||||

| Interest | 47 | ||||||

| Securities lending | 17,374 | ||||||

| Foreign taxes withheld | (151 | ) | |||||

| Total investment income | 3,331,980 | ||||||

| Expenses | |||||||

| Investment advisory fees (Note 3) | 828,113 | ||||||

| Administrative services fees (Note 3) | 238,277 | ||||||

| Shareholder servicing/Distribution fees (Note 3) | |||||||

| Class A | 240,687 | ||||||

| Class B | 8,852 | ||||||

| Class C | 6,820 | ||||||

| Transfer agent fees (Note 3) | 284,376 | ||||||

| Registration fees | 68,614 | ||||||

| Printing fees (Note 3) | 55,668 | ||||||

| Directors' fees | 20,199 | ||||||

| Legal fees | 18,120 | ||||||

| Audit and tax fees | 17,725 | ||||||

| Custodian fees | 13,463 | ||||||

| Insurance expense | 1,198 | ||||||

| Commitment fees (Note 4) | 895 | ||||||

| Miscellaneous expense | 3,899 | ||||||

| Total expenses | 1,806,906 | ||||||

| Less: fees waived (Note 3) | (3,472 | ) | |||||

| Net expenses | 1,803,434 | ||||||

| Net investment income | 1,528,546 | ||||||

| Net Realized and Unrealized Gain (Loss) from Investments | |||||||

| Net realized gain from investments | 25,471,869 | ||||||

| Net change in unrealized appreciation (depreciation) from investments | (436,469 | ) | |||||

| Net realized and unrealized gain from investments | 25,035,400 | ||||||

| Net increase in net assets resulting from operations | $ | 26,563,946 | |||||

See Accompanying Notes to Financial Statements.

23

Credit Suisse Large Cap Blend Fund, Inc.

Statements of Changes in Net Assets

|

For the Six Months Ended June 30, 2011 (unaudited) |

For the Year Ended December 31, 2010 |

||||||||||

| From Operations | |||||||||||

| Net investment income | $ | 1,528,546 | $ | 871,932 | |||||||

| Net realized gain from investments and foreign currency transactions | 25,471,869 | 21,774,334 | |||||||||

|

Net change in unrealized appreciation (depreciation) from investments and foreign currency translations |

(436,469 | ) | (824,389 | ) | |||||||

| Net increase in net assets resulting from operations | 26,563,946 | 21,821,877 | |||||||||

| From Dividends and Distributions | |||||||||||

| Dividends from net investment income | |||||||||||

| Common Class shares | — | (397,074 | ) | ||||||||

| Class A shares | — | (461,909 | ) | ||||||||

| Class B shares | — | (34 | ) | ||||||||

| Class C shares | — | (27 | ) | ||||||||

| Dividends from net realized gains | |||||||||||

| Common Class shares | — | (1,407,901 | ) | ||||||||

| Class A shares | — | (1,939,811 | ) | ||||||||

| Class B shares | — | (23,425 | ) | ||||||||

| Class C shares | — | (15,339 | ) | ||||||||

| Net decrease in net assets resulting from dividends and distributions | — | (4,245,520 | ) | ||||||||

| From Capital Share Transactions (Note 6) | |||||||||||

| Proceeds from sale of shares | 4,337,171 | 3,968,136 | |||||||||

| Exchange value of shares due to merger | — | 294,879,973 | |||||||||

| Reinvestment of dividends and distributions | 20 | 3,983,310 | |||||||||

| Net asset value of shares redeemed | (27,553,291 | ) | (29,693,513 | ) | |||||||

| Net increase (decrease) in net assets from capital share transactions | (23,216,100 | ) | 273,137,906 | ||||||||

| Net increase in net assets | 3,347,846 | 290,714,263 | |||||||||

| Net Assets | |||||||||||

| Beginning of period | 326,446,411 | 35,732,148 | |||||||||

| End of period | $ | 329,794,257 | $ | 326,446,411 | |||||||

| Undistributed net investment income | $ | 1,556,696 | $ | 28,150 | |||||||

See Accompanying Notes to Financial Statements.

24

Credit Suisse Large Cap Blend Fund, Inc.

Financial Highlights

(For a Common Class Share of the Fund Outstanding Throughout Each Period)

|

For the Six Months Ended June 30, 2011 |

For the Year Ended December 31, | ||||||||||||||||||||||||||

| (unaudited) | 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||||||||||||

| Per share data | |||||||||||||||||||||||||||

| Net asset value, beginning of period | $ | 10.50 | $ | 9.63 | $ | 7.71 | $ | 11.95 | $ | 12.71 | $ | 12.23 | |||||||||||||||

| INVESTMENT OPERATIONS | |||||||||||||||||||||||||||

| Net investment income1 | 0.06 | 0.13 | 0.08 | 0.11 | 0.08 | 0.05 | |||||||||||||||||||||

|

Net gain (loss) on investments and foreign currency related items (both realized and unrealized) |

0.82 | 0.88 | 1.93 | (4.23 | ) | 0.68 | 1.22 | ||||||||||||||||||||

| Total from investment operations | 0.88 | 1.01 | 2.01 | (4.12 | ) | 0.76 | 1.27 | ||||||||||||||||||||

| LESS DIVIDENDS AND DISTRIBUTIONS | |||||||||||||||||||||||||||

| Dividends from net investment income | — | (0.03 | ) | (0.09 | ) | (0.12 | ) | (0.06 | ) | (0.07 | ) | ||||||||||||||||

| Distributions from net realized gains | — | (0.11 | ) | — | (0.00 | )2 | (1.46 | ) | (0.72 | ) | |||||||||||||||||

| Total dividends and distributions | — | (0.14 | ) | (0.09 | ) | (0.12 | ) | (1.52 | ) | (0.79 | ) | ||||||||||||||||

| Net asset value, end of period | $ | 11.38 | $ | 10.50 | $ | 9.63 | $ | 7.71 | $ | 11.95 | $ | 12.71 | |||||||||||||||

| Total return3 | 8.38 | % | 10.50 | % | 26.03 | % | (34.46 | )% | 6.15 | % | 10.44 | % | |||||||||||||||

| RATIOS AND SUPPLEMENTAL DATA | |||||||||||||||||||||||||||

| Net assets, end of period (000s omitted) | $ | 135,333 | $ | 133,419 | $ | 1,293 | $ | 1,237 | $ | 1,883 | $ | 2,202 | |||||||||||||||

| Ratio of expenses to average net assets | 0.94 | %4 | 0.95 | % | 1.30 | % | 1.30 | % | 1.28 | % | 1.30 | % | |||||||||||||||

|

Ratio of net investment income to average net assets |

1.08 | %4 | 1.28 | % | 0.99 | % | 1.10 | % | 0.58 | % | 0.40 | % | |||||||||||||||

|

Decrease reflected in above operating expense ratios due to waivers/reimbursements |

— | % | — | % | 0.78 | % | 0.41 | % | 0.07 | % | 0.26 | % | |||||||||||||||

| Portfolio turnover rate | 86 | % | 360 | % | 362 | % | 222 | % | 114 | % | 106 | % | |||||||||||||||

1 Per share information is calculated using the average shares outstanding method.

2 This amount represents less than $(0.01) per share.

3 Total returns are historical and assume changes in share price and reinvestment of all dividends and distributions. Had certain expenses not been reduced during the periods shown, total returns would have been lower. Total returns for periods less than one year are not annualized.

4 Annualized.

See Accompanying Notes to Financial Statements.

25

Credit Suisse Large Cap Blend Fund, Inc.

Financial Highlights

(For a Class A Share of the Fund Outstanding Throughout Each Period)

|

For the Six Months Ended June 30, 2011 |

For the Year Ended December 31, | ||||||||||||||||||||||||||

| (unaudited) | 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||||||||||||

| Per share data | |||||||||||||||||||||||||||

| Net asset value, beginning of period | $ | 10.56 | $ | 9.68 | $ | 7.75 | $ | 12.01 | $ | 12.78 | $ | 12.26 | |||||||||||||||

| INVESTMENT OPERATIONS | |||||||||||||||||||||||||||

| Net investment income1 | 0.05 | 0.07 | 0.08 | 0.11 | 0.08 | 0.05 | |||||||||||||||||||||

|

Net gain (loss) on investments and foreign currency related items (both realized and unrealized) |

0.82 | 0.95 | 1.94 | (4.25 | ) | 0.67 | 1.23 | ||||||||||||||||||||

| Total from investment operations | 0.87 | 1.02 | 2.02 | (4.14 | ) | 0.75 | 1.28 | ||||||||||||||||||||

| LESS DIVIDENDS AND DISTRIBUTIONS | |||||||||||||||||||||||||||

| Dividends from net investment income | — | (0.03 | ) | (0.09 | ) | (0.12 | ) | (0.06 | ) | (0.04 | ) | ||||||||||||||||

| Distributions from net realized gains | — | (0.11 | ) | — | (0.00 | )2 | (1.46 | ) | (0.72 | ) | |||||||||||||||||

| Total dividends and distributions | — | (0.14 | ) | (0.09 | ) | (0.12 | ) | (1.52 | ) | (0.76 | ) | ||||||||||||||||

| Net asset value, end of period | $ | 11.43 | $ | 10.56 | $ | 9.68 | $ | 7.75 | $ | 12.01 | $ | 12.78 | |||||||||||||||

| Total return3 | 8.24 | % | 10.50 | % | 26.02 | % | (34.45 | )% | 6.03 | % | 10.48 | % | |||||||||||||||

| RATIOS AND SUPPLEMENTAL DATA | |||||||||||||||||||||||||||

| Net assets, end of period (000s omitted) | $ | 191,917 | $ | 189,455 | $ | 33,671 | $ | 28,642 | $ | 47,691 | $ | 51,493 | |||||||||||||||

| Ratio of expenses to average net assets | 1.18 | %4 | 1.30 | % | 1.30 | % | 1.30 | % | 1.28 | % | 1.30 | % | |||||||||||||||

|

Ratio of net investment income to average net assets |

0.83 | %4 | 0.70 | % | 0.99 | % | 1.09 | % | 0.58 | % | 0.40 | % | |||||||||||||||

|

Decrease reflected in above operating expense ratios due to waivers/reimbursements |

0.01 | %4 | 0.10 | % | 0.77 | % | 0.40 | % | 0.07 | % | 0.26 | % | |||||||||||||||

| Portfolio turnover rate | 86 | % | 360 | % | 362 | % | 222 | % | 114 | % | 106 | % | |||||||||||||||

1 Per share information is calculated using the average shares outstanding method.

2 This amount represents less than $(0.01) per share.

3 Total returns are historical and assume changes in share price, reinvestment of all dividends and distributions and no sales charge. Had certain expenses not been reduced during the periods shown, total returns would have been lower. Total returns for periods less than one year are not annualized.

4 Annualized.

See Accompanying Notes to Financial Statements.

26

Credit Suisse Large Cap Blend Fund, Inc.

Financial Highlights

(For a Class B Share of the Fund Outstanding Throughout Each Period)

|

For the Six Months Ended June 30, 2011 |

For the Year Ended December 31, | ||||||||||||||||||||||||||

| (unaudited) | 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||||||||||||

| Per share data | |||||||||||||||||||||||||||

| Net asset value, beginning of period | $ | 10.06 | $ | 9.27 | $ | 7.43 | $ | 11.49 | $ | 12.35 | $ | 11.92 | |||||||||||||||

| INVESTMENT OPERATIONS | |||||||||||||||||||||||||||

| Net investment income (loss)1 | 0.002 | (0.00 | )3 | 0.02 | 0.03 | (0.02 | ) | (0.04 | ) | ||||||||||||||||||

|

Net gain (loss) on investments and foreign currency related items (both realized and unrealized) |

0.79 | 0.90 | 1.85 | (4.05 | ) | 0.65 | 1.19 | ||||||||||||||||||||

| Total from investment operations | 0.79 | 0.90 | 1.87 | (4.02 | ) | 0.63 | 1.15 | ||||||||||||||||||||

| LESS DIVIDENDS AND DISTRIBUTIONS | |||||||||||||||||||||||||||

| Dividends from net investment income | — | (0.00 | )3 | (0.03 | ) | (0.04 | ) | (0.03 | ) | — | |||||||||||||||||

| Distributions from net realized gains | — | (0.11 | ) | — | (0.00 | )3 | (1.46 | ) | (0.72 | ) | |||||||||||||||||

| Total dividends and distributions | — | (0.11 | ) | (0.03 | ) | (0.04 | ) | (1.49 | ) | (0.72 | ) | ||||||||||||||||

| Net asset value, end of period | $ | 10.85 | $ | 10.06 | $ | 9.27 | $ | 7.43 | $ | 11.49 | $ | 12.35 | |||||||||||||||

| Total return4 | 7.85 | % | 9.71 | % | 25.11 | % | (34.97 | )% | 5.24 | % | 9.67 | % | |||||||||||||||

| RATIOS AND SUPPLEMENTAL DATA | |||||||||||||||||||||||||||

| Net assets, end of period (000s omitted) | $ | 1,539 | $ | 2,188 | $ | 500 | $ | 1,201 | $ | 3,087 | $ | 5,010 | |||||||||||||||

| Ratio of expenses to average net assets | 1.93 | %5 | 2.04 | % | 2.05 | % | 2.05 | % | 2.03 | % | 2.05 | % | |||||||||||||||

|

Ratio of net investment income (loss) to average net assets |

0.04 | %5 | (0.03 | )% | 0.28 | % | 0.25 | % | (0.19 | )% | (0.35 | )% | |||||||||||||||

|

Decrease reflected in above operating expense ratios due to waivers/reimbursements |

— | % | 0.10 | % | 0.85 | % | 0.35 | % | 0.06 | % | 0.26 | % | |||||||||||||||

| Portfolio turnover rate | 86 | % | 360 | % | 362 | % | 222 | % | 114 | % | 106 | % | |||||||||||||||

1 Per share information is calculated using the average shares outstanding method.

2 This amount represents less than $0.01 per share.

3 This amount represents less than $(0.01) per share.

4 Total returns are historical and assume changes in share price, reinvestment of all dividends and distributions and no sales charge. Had certain expenses not been reduced during the periods shown, total returns would have been lower. Total returns for periods less than one year are not annualized.

5 Annualized.

See Accompanying Notes to Financial Statements.

27

Credit Suisse Large Cap Blend Fund, Inc.

Financial Highlights

(For a Class C Share of the Fund Outstanding Throughout Each Period)

|

For the Six Months Ended June 30, 2011 |

For the Year Ended December 31, | ||||||||||||||||||||||||||

| (unaudited) | 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||||||||||||

| Per share data | |||||||||||||||||||||||||||

| Net asset value, beginning of period | $ | 10.03 | $ | 9.24 | $ | 7.41 | $ | 11.45 | $ | 12.31 | $ | 11.89 | |||||||||||||||

| INVESTMENT OPERATIONS | |||||||||||||||||||||||||||

| Net investment income (loss)1 | 0.002 | (0.00 | )3 | 0.02 | 0.03 | (0.02 | ) | (0.04 | ) | ||||||||||||||||||

|

Net gain (loss) on investments and foreign currency related items (both realized and unrealized) |

0.79 | 0.90 | 1.84 | (4.03 | ) | 0.65 | 1.18 | ||||||||||||||||||||

| Total from investment operations | 0.79 | 0.90 | 1.86 | (4.00 | ) | 0.63 | 1.14 | ||||||||||||||||||||

| LESS DIVIDENDS AND DISTRIBUTIONS | |||||||||||||||||||||||||||

| Dividends from net investment income | — | (0.00 | )3 | (0.03 | ) | (0.04 | ) | (0.03 | ) | — | |||||||||||||||||

| Distributions from net realized gains | — | (0.11 | ) | — | (0.00 | )3 | (1.46 | ) | (0.72 | ) | |||||||||||||||||

| Total dividends and distributions | — | (0.11 | ) | (0.03 | ) | (0.04 | ) | (1.49 | ) | (0.72 | ) | ||||||||||||||||

| Net asset value, end of period | $ | 10.82 | $ | 10.03 | $ | 9.24 | $ | 7.41 | $ | 11.45 | $ | 12.31 | |||||||||||||||

| Total return4 | 7.88 | % | 9.75 | % | 25.04 | % | (34.91 | )% | 5.26 | % | 9.61 | % | |||||||||||||||

| RATIOS AND SUPPLEMENTAL DATA | |||||||||||||||||||||||||||

| Net assets, end of period (000s omitted) | $ | 1,005 | $ | 1,384 | $ | 268 | $ | 281 | $ | 616 | $ | 851 | |||||||||||||||

| Ratio of expenses to average net assets | 1.94 | %5 | 2.03 | % | 2.05 | % | 2.05 | % | 2.03 | % | 2.05 | % | |||||||||||||||

|

Ratio of net investment income (loss) to average net assets |

0.09 | %5 | (0.04 | )% | 0.25 | % | 0.31 | % | (0.18 | )% | (0.35 | )% | |||||||||||||||

|

Decrease reflected in above operating expense ratios due to waivers/reimbursements |

— | % | 0.15 | % | 0.79 | % | 0.38 | % | 0.06 | % | 0.26 | % | |||||||||||||||

| Portfolio turnover rate | 86 | % | 360 | % | 362 | % | 222 | % | 114 | % | 106 | % | |||||||||||||||

1 Per share information is calculated using the average shares outstanding method.

2 This amount represents less than $0.01 per share.

3 This amount represents less than $(0.01) per share.

4 Total returns are historical and assume changes in share price, reinvestment of all dividends and distributions and no sales charge. Had certain expenses not been reduced during the periods shown, total returns would have been lower. Total returns for periods less than one year are not annualized.

5 Annualized.

See Accompanying Notes to Financial Statements.

28

Credit Suisse Large Cap Blend Fund, Inc.

Notes to Financial Statements

June 30, 2011 (unaudited)

Note 1. Organization

Credit Suisse Large Cap Blend Fund, Inc. (the "Fund"), is registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as a diversified, open-end management investment company that seeks long-term appreciation of capital. The Fund was incorporated under the laws of the State of Maryland on July 31, 1998.

The Fund offers four classes of shares: Common Class shares, Class A shares, Class B shares and Class C shares. The Fund's Common Class shares are closed to new investors, with certain exceptions as set forth in the prospectus. Each class of shares represents an equal pro rata interest in the Fund, except that they bear different expenses, which reflect the differences in the range of services provided to them. Class A shares are sold subject to a front-end sales charge of 5.75%. Class B shares are sold subject to a contingent deferred sales charge which declines from 4.00% to zero depending on the period of time the shares are held. Class B shares automatically convert to Class A shares after 8 years. Class C shares are sold subject to a contingent deferred sales charge of 1.00% if the shares are redeemed within the first year of purchase.

Note 2. Significant Accounting Policies

A) SECURITY VALUATION — The net asset value of the Fund is determined daily as of the close of regular trading on the New York Stock Exchange, Inc. (the "Exchange") on each day the Exchange is open for business. Equity investments are valued at market value, which is generally determined using the closing price on the exchange or market on which the security is primarily traded at the time of valuation (the "Valuation Time"). If no sales are reported, equity investments are generally valued at the most recent bid quotation as of the Valuation Time or at the lowest asked quotation in the case of a short sale of securities. Equity investments are generally categorized as Level 1. Debt securities with a remaining maturity greater than 60 days are valued in accordance with the price supplied by a pricing service, which may use a matrix, formula or other objective method that takes into consideration market indices, yield curves and other specific adjustments. Debt obligations that will mature in 60 days or less are valued on the basis of amortized cost, which approximates market value, unless it is determined that using this method would not represent fair value. Debt securities are generally categorized as Level 2. Investments in open-end investment companies are valued at their net asset value each business day and are generally categorized as Level 1. Securities and other assets for which market quotations are not readily available, or whose values have been materially affected by events occurring

29

Credit Suisse Large Cap Blend Fund, Inc.

Notes to Financial Statements (continued)

June 30, 2011 (unaudited)

Note 2. Significant Accounting Policies

before the Fund's Valuation Time but after the close of the securities' primary markets, are valued at fair value as determined in good faith by, or under the direction of, the Board of Directors under procedures established by the Board of Directors and are generally categorized as Level 3. The Fund may utilize a service provided by an independent third party which has been approved by the Board of Directors to fair value certain securities. When fair value pricing is employed, the prices of securities used by a fund to calculate its net asset value may differ from quoted or published prices for the same securities.