UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number: | 811-08915 | |

| Exact name of registrant as specified in charter: | Prudential Investment Portfolios 16 | |

| Address of principal executive offices: | 655 Broad Street, 6th Floor | |

| Newark, New Jersey 07102 | ||

| Name and address of agent for service: | Andrew R. French | |

| 655 Broad Street, 6th Floor | ||

| Newark, New Jersey 07102 | ||

| Registrant’s telephone number, including area code: | 800-225-1852 | |

| Date of fiscal year end: | 10/31/2022 | |

| Date of reporting period: | 10/31/2022 | |

Item 1 – Reports to Stockholders

PGIM INCOME BUILDER FUND

ANNUAL REPORT

OCTOBER 31, 2022

To enroll in e-delivery, go to pgim.com/investments/resource/edelivery

| 3 | ||||

| 4 | ||||

| 5 | ||||

| 8 | ||||

| 10 | ||||

| 13 | ||||

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

Mutual funds are distributed by Prudential Investment Management Services LLC, a Prudential Financial company, member SIPC. Jennison Associates LLC and PGIM, Inc. (PGIM) are registered investment advisers and Prudential Financial companies. PGIM Quantitative Solutions, a wholly owned subsidiary of PGIM. © 2022 Prudential Financial, Inc. and its related entities. Jennison Associates, Jennison, PGIM, and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

| 2 | Visit our website at pgim.com/investments |

|

Dear Shareholder: | |

|

We hope you find the annual report for the PGIM Income Builder Fund informative and useful. The report covers performance for the 12-month period that ended October 31, 2022.

The attention of the global economy and financial markets pivoted during the period from the COVID-19 pandemic to the challenge of rapidly rising inflation. While job growth remained strong, prices for a wide range of goods and services rose in response to economic re-openings, supply-chain disruptions, governmental stimulus, and Russia’s invasion of Ukraine. | ||

| With inflation surging to a 40-year high, the Federal Reserve and other central banks aggressively hiked interest rates, prompting recession concerns. | ||

After rising to record levels at the end of 2021, stocks have fallen sharply in 2022 as investors worried about higher prices, slowing economic growth, geopolitical uncertainty, and new COVID-19 outbreaks. Equities rallied for a time during the summer but began falling again in late August on fears that the Fed would keep raising rates to tame inflation. For the entire 12-month period, equities suffered a broad-based global decline, although large-cap US stocks outperformed their small-cap counterparts. International developed and emerging markets trailed the US market during this time.

Rising rates and economic uncertainty drove fixed income prices broadly lower as well. US and global investment-grade bonds, along with US high yield corporate bonds and emerging market debt, all posted negative returns during the period.

Regarding your investments with PGIM, we believe it is important to maintain a diversified portfolio of funds consistent with your tolerance for risk, time horizon, and financial goals. Your financial advisor can help you create a diversified investment plan that may include funds covering all the basic asset classes and that reflects your personal investor profile and risk tolerance. However, diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets.

At PGIM Investments, we provide access to active investment strategies across the global markets in the pursuit of consistent outperformance for investors. PGIM is the world’s 11th-largest investment manager with more than $1.5 trillion in assets under management. Our scale and investment expertise allow us to deliver a diversified suite of actively managed solutions across a broad spectrum of asset classes and investment styles.

Thank you for choosing our family of funds.

Sincerely,

Stuart S. Parker, President

PGIM Income Builder Fund

December 15, 2022

PGIM Income Builder Fund 3

Your Fund’s Performance (unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at pgim.com/investments or by calling (800) 225-1852.

| Average Annual Total Returns as of 10/31/22 | ||||||||||||||||

| One Year (%) | Five Years (%) | Ten Years (%) | Since Inception (%) | |||||||||||||

| Class A |

||||||||||||||||

| (with sales charges) |

-17.87 | 1.06 | 3.17 | — | ||||||||||||

| (without sales charges) |

-14.00 | 2.00 | 3.65 | — | ||||||||||||

| Class C |

||||||||||||||||

| (with sales charges) |

-15.42 | 1.25 | 2.87 | — | ||||||||||||

| (without sales charges) |

-14.60 | 1.25 | 2.87 | — | ||||||||||||

| Class R |

||||||||||||||||

| (without sales charges) |

-14.15 | 1.77 | 3.39 | — | ||||||||||||

| Class Z |

||||||||||||||||

| (without sales charges) |

-13.85 | 2.26 | 3.90 | — | ||||||||||||

| Class R6 |

||||||||||||||||

| (without sales charges) |

-13.76 | 2.26 | N/A | 3.05 (12/30/2016) | ||||||||||||

| S&P 500 Index |

||||||||||||||||

| -14.60 | 10.44 | 12.78 | — | |||||||||||||

| Bloomberg US Aggregate Bond Index |

||||||||||||||||

| -15.68 | -0.54 | 0.74 | — | |||||||||||||

| Average Annual Total Returns as of 10/31/22 Since Inception (%) |

||||

| Class R6 (12/30/2016) |

||||

| S&P 500 Index |

11.84 | |||

| Bloomberg US Aggregate Bond Index |

0.07 | |||

Since Inception returns are provided for any share class with less than 10 fiscal years of returns. Since Inception returns for the Indexes are measured from the closest month-end to the class’s inception date.

| 4 | Visit our website at pgim.com/investments |

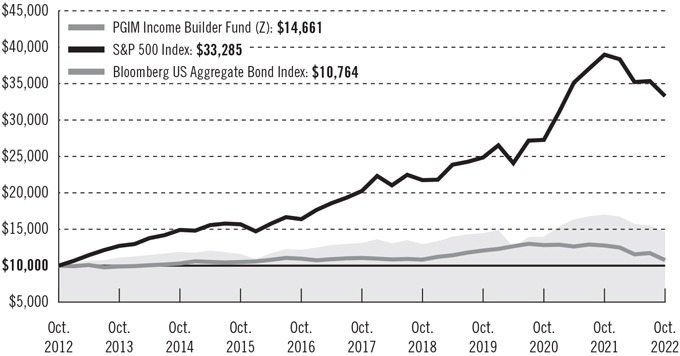

Growth of a $10,000 Investment (unaudited)

The graph compares a $10,000 investment in the Fund’s Class Z shares with a similar investment in the S&P 500 Index and the Bloomberg US Aggregate Bond Index by portraying the initial account values at the beginning of the 10-year period for Class Z shares (October 31, 2012) and the account values at the end of the current fiscal year (October 31, 2022), as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted and (b) all dividends and distributions were reinvested. The line graph provides information for Class Z shares only. As indicated in the tables provided earlier, performance for other share classes will vary due to the differing fees and expenses applicable to each share class (as indicated in the following paragraphs). Without waiver of fees and/or expense reimbursements, if any, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graphs include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

PGIM Income Builder Fund 5

Your Fund’s Performance (continued)

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. The average annual total returns take into account applicable sales charges, which are described for each share class in the table below.

| Class A | Class C | Class R | Class Z | Class R6 | ||||||

| Maximum initial sales charge | 4.50% of the public offering price |

None | None | None | None | |||||

| Contingent deferred sales charge (CDSC) (as a percentage of the lower of the original purchase price or the net asset value at redemption) | 1.00% on sales of $1 million or more made within 12 months of purchase |

1.00% on sales made within 12 months of purchase | None | None | None | |||||

| Annual distribution and service (12b-1) fees (shown as a percentage of average daily net assets)

|

0.30% (0.25% currently) |

1.00% | 0.75% (0.50% currently) |

None | None | |||||

Benchmark Definitions

S&P 500 Index*—The S&P 500 Index is an unmanaged index of over 500 stocks of large US public companies. It gives a broad look at how stock prices in the United States have performed.

*The S&P 500 Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by PGIM, Inc. and/or its affiliates. Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of S&P Global and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC.

Bloomberg US Aggregate Bond Index—The Bloomberg US Aggregate Bond Index is unmanaged and represents securities that are taxable and US dollar denominated. It covers the US investment-grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

| 6 | Visit our website at pgim.com/investments |

Investors cannot invest directly in an index. The returns for the Indexes would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes that may be paid by an investor.

Presentation of Fund Holdings as of 10/31/22

| Ten Largest Holdings | Line of Business | % of Net Assets | ||

| PGIM Emerging Markets Debt Hard Currency (Class R6) | Emerging Market Debt (Hard Currency) | 15.8% | ||

| PGIM Jennison MLP Fund (Class R6) | Master Limited Partnerships (MLPs) | 12.2% | ||

| PGIM Active High Yield Bond ETF | Exchange-Traded Funds | 12.0% | ||

| PGIM Quant Solutions International Equity Fund (Class R6) | International Equity | 8.2% | ||

| PGIM Core Conservative Bond Fund (Class R6) | Core Bond | 8.1% | ||

| PGIM Active Aggregate Bond ETF | Exchange-Traded Funds | 7.6% | ||

| PGIM Real Estate Income Fund (Class R6) | Real Estate | 6.6% | ||

| PGIM Quant Solutions Strategic Alpha International Equity ETF | Exchange-Traded Funds | 3.5% | ||

| Invesco Preferred ETF | Exchange-Traded Funds | 2.8% | ||

| Energy Select Sector SPDR Fund | Exchange-Traded Funds | 2.0% | ||

Holdings reflect only investments and are subject to change.

PGIM Income Builder Fund 7

Strategy and Performance Overview*

(unaudited)

How did the Fund perform?

The PGIM Income Builder Fund’s Class Z shares returned –13.85% in the 12-month reporting period that ended October 31, 2022, outperforming the –15.68% return of the Bloomberg US Aggregate Bond Index (the Index) and the –14.60% return of the S&P 500 Index.

What were the market conditions?

| ● | Following the sharp declines in stocks in the first half of 2022, global equity markets rebounded early in the third quarter but generally gave back most of their gains by the end of the reporting period. |

| ● | As of the end of the period, inflation had not declined as expected, and central banks had become increasingly hawkish. |

| ● | The US economy suffered two consecutive quarters of negative GDP growth in the first half of 2022, but this has not yet been designated by the National Bureau of Economic Research as an “official” US recession, probably because most other economic indicators remained strong. |

| ● | Much of the economic weakness seen during the period was driven by global central banks’ laser-beam focus on trying to stem increasing inflation by aggressively hiking interest rates, even at the risk of creating substantial economic pain. |

| ● | The US Federal Reserve (Fed) signaled that it intends to do whatever it takes to bring inflation down. |

| ● | The US dollar powered ahead despite significant overvaluation, driven by the Fed’s aggressive hiking posture and the risk-off sentiment in markets. |

What worked?

| ● | One of the Fund’s most successful positions was its strategic exposure to master limited partnerships (MLPs). This energy midstream asset class benefited from persistently high oil and gas prices and a chronic underinvestment in the sector’s infrastructure over the previous five years. |

| ● | In addition, a tactical use of higher-than-usual cash positions in the Fund contributed positively to relative performance. The rise in inflation expectations and interest rates hurt both fixed income and equities, leaving cash as the one of the year’s best performing assets. |

| ● | Among the Fund’s managers, the core domestic equity manager performed well due to a focus on dividend stocks, while the emerging market debt manager performed well as a result of an emphasis on higher-quality regions. |

What didn’t work?

| ● | The Fund’s strategic allocations to international equities—intended to diversify equity exposure and allocate to higher-yielding positions—detracted from performance. Both developed and emerging markets struggled to keep pace with the US market due to relatively slow, international economic growth and headwinds from a stronger dollar. |

| 8 | Visit our website at pgim.com/investments |

| ● | The Fund’s tilt in favor of emerging market debt in lieu of US high yield debt also detracted from returns. Forward-looking expectations for the asset class appeared more favorable on a relative basis, but a stronger dollar and slowing economic growth in emerging markets weighed on the asset class as a whole. |

| ● | Among the Fund’s managers, the largest detractor came from MLPs. This manager invests in higher-quality assets in the space, and thus has a lower beta relative to the asset class as a whole. (Beta is a measure of the volatility or risk of a security or portfolio compared to the market or index.) During a period such as this, when MLPs perform particularly well, it is not surprising to find the manager’s strong performance lagging the relevant index. |

Did the Fund use derivatives?

The Fund did not use any derivative instruments at the aggregate level during the reporting period, although the subadvisers of the underlying funds may use them, as is permitted in managing their respective strategies. The Fund’s use of derivatives by the underlying fund subadvisers did not have a material effect on performance.

Current outlook

| ● | Aggressive monetary policy tightening, sky-high energy prices in Europe, high inflation, and heightened geopolitical risk have all raised the specter of a global recession. |

| ● | Measured inflation remains high in most major developed economies and did not decline as expected late in the reporting period, even as weaker commodity prices relieved some pressure. |

| ● | While equities have already experienced the type of declines one might expect from a mild recession, still-larger declines are a real possibility given the odds of monetary policy over-tightening (and thus more significant economic contraction) in the current inflationary environment. |

| ● | Commodities are still attractive as an inexpensive inflation hedge. Although secular forces support rising commodity prices, they are at risk in the event of a global recession. |

| ● | Given this environment, PGIM Quantitative Solutions is maintaining cautious tactical positioning on asset allocation relative to policy benchmarks: The Fund holds overweight exposure to cash and commodities, underweight exposure to real estate and fixed income securities, and modestly underweight exposure to global equities. |

*This strategy and performance overview, which discusses what strategies or holdings (including derivatives, if applicable) affected the Fund’s performance, is compiled based on how the Fund performed relative to the Fund’s benchmark index and is viewed for performance attribution purposes at the aggregate Fund level, which in most instances will not directly correlate to the amounts disclosed in the Statement of Operations which conform to US generally accepted accounting principles.

| PGIM Income Builder Fund |

9 |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 held through the six-month period ended October 31, 2022. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of PGIM funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information

| 10 | Visit our website at pgim.com/investments |

provided in the expense table. Additional fees have the effect of reducing investment returns.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| PGIM Income Builder Fund

|

Beginning Account Value May 1, 2022

|

Ending Account Value October 31, 2022

|

Annualized Expense Ratio Based on the Six-Month Period

|

Expenses Paid During the Six-Month Period*

| ||||||||||

| Class A | Actual | $1,000.00 | $ 932.10 | 0.95% | $4.63 | |||||||||

| Hypothetical

|

|

$1,000.00

|

|

|

$1,020.42

|

|

0.95%

|

$4.84

| ||||||

| Class C | Actual | $1,000.00 | $ 929.10 | 1.70% | $8.27 | |||||||||

| Hypothetical

|

|

$1,000.00

|

|

|

$1,016.64

|

|

1.70%

|

$8.64

| ||||||

| Class R | Actual | $1,000.00 | $ 931.90 | 1.20% | $5.84 | |||||||||

| Hypothetical

|

|

$1,000.00

|

|

|

$1,019.16

|

|

1.20%

|

$6.11

| ||||||

| Class Z | Actual | $1,000.00 | $ 932.80 | 0.70% | $3.41 | |||||||||

| Hypothetical

|

|

$1,000.00

|

|

|

$1,021.68

|

|

0.70%

|

$3.57

| ||||||

| Class R6 | Actual | $1,000.00 | $ 933.80 | 0.70% | $3.41 | |||||||||

| Hypothetical

|

|

$1,000.00

|

|

|

$1,021.68

|

|

0.70%

|

$3.57

| ||||||

*Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended October 31, 2022, and divided by the 365 days in the Fund’s fiscal year ended October 31, 2022 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

| PGIM Income Builder Fund |

11 |

as of October 31, 2022

| Description

|

Shares

|

Value

|

||||||

| LONG-TERM INVESTMENTS 95.9% |

||||||||

| AFFILIATED MUTUAL FUNDS 51.8% |

||||||||

| PGIM Core Conservative Bond Fund (Class R6) |

2,455,079 | $ | 20,401,705 | |||||

| PGIM Emerging Markets Debt Hard Currency (Class R6) |

6,276,046 | 40,166,697 | ||||||

| PGIM Jennison MLP Fund (Class R6) |

4,289,844 | 31,015,576 | ||||||

| PGIM Quant Solutions Emerging Markets Equity Fund (Class R6) |

253,466 | 2,367,375 | ||||||

| PGIM Quant Solutions International Equity Fund (Class R6) |

3,542,270 | 20,686,856 | ||||||

| PGIM Real Estate Income Fund (Class R6) |

2,693,312 | 16,671,600 | ||||||

|

|

|

|||||||

| TOTAL AFFILIATED MUTUAL FUNDS |

||||||||

| (cost $148,803,980)(wd) |

131,309,809 | |||||||

|

|

|

|||||||

| COMMON STOCKS 12.9% |

||||||||

| Aerospace & Defense 0.5% |

||||||||

| Raytheon Technologies Corp. |

13,050 | 1,237,401 | ||||||

| Banks 0.4% | ||||||||

| JPMorgan Chase & Co. |

4,496 | 565,956 | ||||||

| Truist Financial Corp. |

8,625 | 386,314 | ||||||

|

|

|

|||||||

| 952,270 | ||||||||

| Beverages 0.4% | ||||||||

| Coca-Cola Co. (The) |

7,246 | 433,673 | ||||||

| PepsiCo, Inc. |

3,388 | 615,193 | ||||||

|

|

|

|||||||

| 1,048,866 | ||||||||

| Biotechnology 1.0% | ||||||||

| AbbVie, Inc. |

10,439 | 1,528,270 | ||||||

| Amgen, Inc. |

3,509 | 948,658 | ||||||

|

|

|

|||||||

| 2,476,928 | ||||||||

| Chemicals 0.2% | ||||||||

| Dow, Inc. |

3,995 | 186,726 | ||||||

| DuPont de Nemours, Inc. |

7,231 | 413,613 | ||||||

|

|

|

|||||||

| 600,339 | ||||||||

| Commercial Services & Supplies 0.1% | ||||||||

| Waste Management, Inc. |

2,296 | 363,618 | ||||||

| Consumer Finance 0.2% | ||||||||

| American Express Co. |

2,760 | 409,722 | ||||||

See Notes to Financial Statements.

| PGIM Income Builder Fund | 13 |

Schedule of Investments (continued)

as of October 31, 2022

| Description

|

Shares

|

Value

|

||||||

| COMMON STOCKS (Continued) | ||||||||

| Diversified Telecommunication Services 0.5% | ||||||||

| AT&T, Inc. | 30,778 | $ | 561,083 | |||||

| BCE, Inc. (Canada) | 18,012 | 812,341 | ||||||

|

|

|

|||||||

| 1,373,424 | ||||||||

| Electric Utilities 0.8% | ||||||||

| Entergy Corp. | 5,150 | 551,771 | ||||||

| FirstEnergy Corp. | 13,686 | 516,099 | ||||||

| NextEra Energy, Inc. | 6,042 | 468,255 | ||||||

| PNM Resources, Inc. | 12,271 | 570,233 | ||||||

|

|

|

|||||||

| 2,106,358 | ||||||||

| Entertainment 0.3% | ||||||||

| Electronic Arts, Inc. | 5,777 | 727,671 | ||||||

| Equity Real Estate Investment Trusts (REITs) 0.6% | ||||||||

| American Tower Corp. | 880 | 182,327 | ||||||

| Prologis, Inc. | 8,929 | 988,887 | ||||||

| Welltower, Inc. | 6,125 | 373,870 | ||||||

|

|

|

|||||||

| 1,545,084 | ||||||||

| Food & Staples Retailing 0.5% | ||||||||

| Walmart, Inc. | 9,233 | 1,314,133 | ||||||

| Food Products 1.3% | ||||||||

| General Mills, Inc. | 15,573 | 1,270,445 | ||||||

| J.M. Smucker Co. (The) | 7,593 | 1,143,962 | ||||||

| Kraft Heinz Co. (The) | 19,724 | 758,782 | ||||||

|

|

|

|||||||

| 3,173,189 | ||||||||

| Hotels, Restaurants & Leisure 0.3% | ||||||||

| McDonald’s Corp. | 3,057 | 833,522 | ||||||

| Household Products 0.2% | ||||||||

| Procter & Gamble Co. (The) | 2,742 | 369,265 | ||||||

| Independent Power & Renewable Electricity Producers 0.1% | ||||||||

| RWE AG (Germany) | 4,833 | 186,047 | ||||||

| Insurance 0.3% | ||||||||

| MetLife, Inc. | 9,319 | 682,244 | ||||||

See Notes to Financial Statements.

| 14 |

| Description

|

Shares

|

Value

|

||||||

| COMMON STOCKS (Continued) | ||||||||

| IT Services 0.3% | ||||||||

| International Business Machines Corp. | 5,486 | $ | 758,659 | |||||

| Life Sciences Tools & Services 0.3% | ||||||||

| Danaher Corp. | 3,015 | 758,785 | ||||||

| Machinery 0.3% | ||||||||

| Deere & Co. | 2,170 | 858,929 | ||||||

| Mortgage Real Estate Investment Trusts (REITs) 0.3% | ||||||||

| Starwood Property Trust, Inc. | 39,522 | 816,525 | ||||||

| Multi-Utilities 0.2% | ||||||||

| Ameren Corp. | 6,503 | 530,125 | ||||||

| Oil, Gas & Consumable Fuels 1.5% | ||||||||

| Arch Resources, Inc. | 4,854 | 739,216 | ||||||

| BP PLC (United Kingdom), ADR | 4,320 | 143,769 | ||||||

| Exxon Mobil Corp. | 13,511 | 1,497,154 | ||||||

| Williams Cos., Inc. (The)(a) | 42,314 | 1,384,937 | ||||||

|

|

|

|||||||

| 3,765,076 | ||||||||

| Pharmaceuticals 1.2% | ||||||||

| AstraZeneca PLC (United Kingdom), ADR | 22,263 | 1,309,287 | ||||||

| Bristol-Myers Squibb Co. | 14,634 | 1,133,696 | ||||||

| Eli Lilly & Co. | 1,752 | 634,382 | ||||||

|

|

|

|||||||

| 3,077,365 | ||||||||

| Road & Rail 0.3% | ||||||||

| Canadian National Railway Co. (Canada) | 3,567 | 422,475 | ||||||

| Union Pacific Corp. | 1,821 | 358,992 | ||||||

|

|

|

|||||||

| 781,467 | ||||||||

| Software 0.1% | ||||||||

| Microsoft Corp. | 1,038 | 240,951 | ||||||

| Specialty Retail 0.2% | ||||||||

| O’Reilly Automotive, Inc.* | 635 | 531,603 | ||||||

See Notes to Financial Statements.

| PGIM Income Builder Fund | 15 |

Schedule of Investments (continued)

as of October 31, 2022

| Description

|

Shares

|

Value

|

||||||

| COMMON STOCKS (Continued) | ||||||||

| Technology Hardware, Storage & Peripherals 0.5% | ||||||||

| Apple, Inc. | 7,429 | $ | 1,139,163 | |||||

| Western Digital Corp.* | 3,419 | 117,511 | ||||||

|

|

|

|||||||

| 1,256,674 | ||||||||

|

|

|

|||||||

| TOTAL COMMON STOCKS | ||||||||

| (cost $26,523,235) |

32,776,240 | |||||||

|

|

|

|||||||

| EXCHANGE-TRADED FUNDS 30.3% | ||||||||

| Energy Select Sector SPDR Fund |

55,100 | 4,959,000 | ||||||

| Invesco Preferred ETF(a) |

641,588 | 7,198,617 | ||||||

| iShares 0-5 Year High Yield Corporate Bond ETF(a) |

42,000 | 1,715,700 | ||||||

| iShares iBoxx High Yield Corporate Bond ETF(a) |

42,000 | 3,084,060 | ||||||

| iShares Latin America 40 ETF(a) |

50,200 | 1,300,180 | ||||||

| PGIM Active Aggregate Bond ETF(g) |

475,000 | 19,193,848 | ||||||

| PGIM Active High Yield Bond ETF(g) |

906,600 | 30,460,853 | ||||||

| PGIM Quant Solutions Strategic Alpha International Equity ETF(g) |

200,000 | 8,738,360 | ||||||

|

|

|

|||||||

| TOTAL EXCHANGE-TRADED FUNDS | ||||||||

| (cost $86,989,778) |

76,650,618 | |||||||

|

|

|

|||||||

| PREFERRED STOCKS 0.9% | ||||||||

| Auto Components 0.2% | ||||||||

| Aptiv PLC, Series A, CVT, 5.500%, Maturing 06/15/23 |

4,719 | 504,367 | ||||||

| Electric Utilities 0.3% | ||||||||

| NextEra Energy, Inc., CVT, 6.926%, Maturing 09/01/25 |

16,000 | 744,000 | ||||||

| Health Care Equipment & Supplies 0.4% | ||||||||

| Boston Scientific Corp., Series A, CVT, 5.500%, Maturing 06/01/23 |

9,616 | 1,058,145 | ||||||

|

|

|

|||||||

| TOTAL PREFERRED STOCKS |

2,306,512 | |||||||

|

|

|

|||||||

| TOTAL LONG-TERM INVESTMENTS |

243,043,179 | |||||||

|

|

|

|||||||

| SHORT-TERM INVESTMENTS 10.0% | ||||||||

| AFFILIATED MUTUAL FUNDS | ||||||||

| PGIM Core Ultra Short Bond Fund |

10,892,255 | 10,892,255 | ||||||

See Notes to Financial Statements.

| 16 |

| Description

|

Shares

|

Value

|

||||||

| AFFILIATED MUTUAL FUNDS (Continued) | ||||||||

| PGIM Institutional Money Market Fund |

||||||||

| (cost $14,502,747; includes $14,470,300 of cash collateral for securities on loan)(b) |

14,516,879 | $ | 14,503,813 | |||||

|

|

|

|||||||

| TOTAL SHORT-TERM INVESTMENTS |

25,396,068 | |||||||

|

|

|

|||||||

| TOTAL INVESTMENTS 105.9% |

268,439,247 | |||||||

| Liabilities in excess of other assets (5.9)% |

(14,977,272 | ) | ||||||

|

|

|

|||||||

| NET ASSETS 100.0% |

$ | 253,461,975 | ||||||

|

|

|

|||||||

Below is a list of the abbreviation(s) used in the annual report:

ADR—American Depositary Receipt

CVT—Convertible Security

ETF—Exchange-Traded Fund

iBoxx—Bond Market Indices

LIBOR—London Interbank Offered Rate

MLP—Master Limited Partnership

REITs—Real Estate Investment Trust

SOFR—Secured Overnight Financing Rate

SPDR—Standard & Poor’s Depositary Receipts

| * | Non-income producing security. |

| (a) | All or a portion of security is on loan. The aggregate market value of such securities, including those sold and pending settlement, is $14,076,536; cash collateral of $14,470,300 (included in liabilities) was received with which the Fund purchased highly liquid short-term investments. In the event of significant appreciation in value of securities on loan on the last business day of the reporting period, the Fund may reflect a collateral value that is less than the market value of the loaned securities and such shortfall is remedied the following business day. |

| (b) | Represents security, or portion thereof, purchased with cash collateral received for securities on loan and includes dividend reinvestment. |

| (g) | An affiliated security. |

| (wd) | PGIM Investments LLC, the manager of the Fund, also serves as the manager of the underlying funds in which the Fund invests. |

Fair Value Measurements:

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

Level 1—unadjusted quoted prices generally in active markets for identical securities.

Level 2—quoted prices for similar securities, interest rates and yield curves, prepayment speeds, foreign currency exchange rates and other observable inputs.

Level 3—unobservable inputs for securities valued in accordance with Board approved fair valuation procedures.

See Notes to Financial Statements.

| PGIM Income Builder Fund | 17 |

Schedule of Investments (continued)

as of October 31, 2022

The following is a summary of the inputs used as of October 31, 2022 in valuing such portfolio securities:

| Level 1 | Level 2 | Level 3 | ||||||||||

| Investments in Securities | ||||||||||||

| Assets | ||||||||||||

| Long-Term Investments | ||||||||||||

| Affiliated Mutual Funds |

$ | 131,309,809 | $ | — | $— | |||||||

| Common Stocks | ||||||||||||

| Aerospace & Defense |

1,237,401 | — | — | |||||||||

| Banks |

952,270 | — | — | |||||||||

| Beverages |

1,048,866 | — | — | |||||||||

| Biotechnology |

2,476,928 | — | — | |||||||||

| Chemicals |

600,339 | — | — | |||||||||

| Commercial Services & Supplies |

363,618 | — | — | |||||||||

| Consumer Finance |

409,722 | — | — | |||||||||

| Diversified Telecommunication Services |

1,373,424 | — | — | |||||||||

| Electric Utilities |

2,106,358 | — | — | |||||||||

| Entertainment |

727,671 | — | — | |||||||||

| Equity Real Estate Investment Trusts (REITs) |

1,545,084 | — | — | |||||||||

| Food & Staples Retailing |

1,314,133 | — | — | |||||||||

| Food Products |

3,173,189 | — | — | |||||||||

| Hotels, Restaurants & Leisure |

833,522 | — | — | |||||||||

| Household Products. |

369,265 | — | — | |||||||||

| Independent Power & Renewable Electricity Producers |

— | 186,047 | — | |||||||||

| Insurance |

682,244 | — | — | |||||||||

| IT Services |

758,659 | — | — | |||||||||

| Life Sciences Tools & Services |

758,785 | — | — | |||||||||

| Machinery |

858,929 | — | — | |||||||||

| Mortgage Real Estate Investment Trusts (REITs) |

816,525 | — | — | |||||||||

| Multi-Utilities |

530,125 | — | — | |||||||||

| Oil, Gas & Consumable Fuels |

3,765,076 | — | — | |||||||||

| Pharmaceuticals |

3,077,365 | — | — | |||||||||

| Road & Rail |

781,467 | — | — | |||||||||

| Software |

240,951 | — | — | |||||||||

| Specialty Retail |

531,603 | — | — | |||||||||

| Technology Hardware, Storage & Peripherals |

1,256,674 | — | — | |||||||||

| Exchange-Traded Funds |

76,650,618 | — | — | |||||||||

| Preferred Stocks | ||||||||||||

| Auto Components. |

504,367 | — | — | |||||||||

| Electric Utilities |

744,000 | — | — | |||||||||

| Health Care Equipment & Supplies |

1,058,145 | — | — | |||||||||

| Short-Term Investments | ||||||||||||

| Affiliated Mutual Funds |

25,396,068 | — | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 268,253,200 | $ | 186,047 | $— | |||||||

|

|

|

|

|

|

|

|||||||

See Notes to Financial Statements.

| 18 |

Industry Classification:

The industry classification of investments and liabilities in excess of other assets shown as a percentage of net assets as of October 31, 2022 were as follows:

| Affiliated Mutual Funds (5.7% represents investments purchased with collateral from securities on loan) |

61.8 | % | ||

| Exchange-Traded Funds |

30.3 | |||

| Oil, Gas & Consumable Fuels |

1.5 | |||

| Food Products |

1.3 | |||

| Pharmaceuticals |

1.2 | |||

| Electric Utilities |

1.1 | |||

| Biotechnology |

1.0 | |||

| Equity Real Estate Investment Trusts (REITs) |

0.6 | |||

| Diversified Telecommunication Services |

0.5 | |||

| Food & Staples Retailing |

0.5 | |||

| Technology Hardware, Storage & Peripherals |

0.5 | |||

| Aerospace & Defense |

0.5 | |||

| Health Care Equipment & Supplies |

0.4 | |||

| Beverages |

0.4 | |||

| Banks |

0.4 | |||

| Machinery |

0.3 | |||

| Hotels, Restaurants & Leisure |

0.3 | |||

| Mortgage Real Estate Investment Trusts (REITs) |

0.3 |

| Road & Rail |

0.3 | % | ||

| Life Sciences Tools & Services |

0.3 | |||

| IT Services |

0.3 | |||

| Entertainment |

0.3 | |||

| Insurance |

0.3 | |||

| Chemicals |

0.2 | |||

| Specialty Retail |

0.2 | |||

| Multi-Utilities |

0.2 | |||

| Auto Components |

0.2 | |||

| Consumer Finance |

0.2 | |||

| Household Products |

0.2 | |||

| Commercial Services & Supplies |

0.1 | |||

| Software |

0.1 | |||

| Independent Power & Renewable Electricity Producers |

0.1 | |||

|

|

|

|||

| 105.9 | ||||

| Liabilities in excess of other assets |

(5.9 | ) | ||

|

|

|

|||

|

|

100.0 |

% | ||

|

|

|

Financial Instruments/Transactions—Summary of Offsetting and Netting Arrangements:

The Fund entered into financial instruments/transactions during the reporting period that are either offset in accordance with current requirements or are subject to enforceable master netting arrangements or similar agreements that permit offsetting. The information about offsetting and related netting arrangements for financial instruments/transactions where the legal right to set-off exists is presented in the summary below.

Offsetting of financial instrument/transaction assets and liabilities:

| Description | Gross Market Value of Recognized Assets/(Liabilities) |

Collateral Pledged/(Received)(1) |

Net Amount | |||

| Securities on Loan |

$14,076,536 | $(14,076,536) | $— | |||

| (1) | Collateral amount disclosed by the Fund is limited to the market value of financial instruments/transactions. |

See Notes to Financial Statements.

| PGIM Income Builder Fund | 19 |

Statement of Assets and Liabilities

as of October 31, 2022

| Assets |

||||

| Investments at value, including securities on loan of $14,076,536: |

||||

| Unaffiliated investments (cost $46,661,560) |

$ | 53,340,309 | ||

| Affiliated investments (cost $243,263,935) |

215,098,938 | |||

| Cash |

27 | |||

| Receivable for Fund shares sold |

287,137 | |||

| Dividends receivable |

52,554 | |||

| Tax reclaim receivable |

29,282 | |||

| Due from Manager |

17,623 | |||

| Prepaid expenses |

1,263 | |||

|

|

|

|||

| Total Assets |

268,827,133 | |||

|

|

|

|||

| Liabilities | ||||

| Payable to broker for collateral for securities on loan |

14,470,300 | |||

| Payable for Fund shares purchased |

538,643 | |||

| Accrued expenses and other liabilities |

171,444 | |||

| Distribution fee payable |

65,752 | |||

| Payable for investments purchased |

52,443 | |||

| Dividends payable |

49,826 | |||

| Affiliated transfer agent fee payable |

15,453 | |||

| Trustees’ fees payable |

1,297 | |||

|

|

|

|||

| Total Liabilities |

15,365,158 | |||

|

|

|

|||

| Net Assets |

$ | 253,461,975 | ||

|

|

|

|||

| Net assets were comprised of: |

||||

| Shares of beneficial interest, at par |

$ | 29,591 | ||

| Paid-in capital in excess of par |

296,444,792 | |||

| Total distributable earnings (loss) |

(43,012,408 | ) | ||

|

|

|

|||

| Net assets, October 31, 2022 |

$ | 253,461,975 | ||

|

|

|

|||

See Notes to Financial Statements.

| 20 |

| Class A | ||||

| Net asset value and redemption price per share, |

$ | 8.58 | ||

| Maximum sales charge (4.50% of offering price) |

0.40 | |||

|

|

|

|||

| Maximum offering price to public |

$ | 8.98 | ||

|

|

|

|||

| Class C | ||||

| Net asset value, offering price and redemption price per share, |

$ | 8.38 | ||

|

|

|

|||

| Class R | ||||

| Net asset value, offering price and redemption price per share, |

$ | 8.57 | ||

|

|

|

|||

| Class Z | ||||

| Net asset value, offering price and redemption price per share, |

$ | 8.65 | ||

|

|

|

|||

| Class R6 | ||||

| Net asset value, offering price and redemption price per share, |

$ | 8.65 | ||

|

|

|

|||

See Notes to Financial Statements.

| PGIM Income Builder Fund | 21 |

Statement of Operations

Year Ended October 31, 2022

| Net Investment Income (Loss) |

||||

| Income |

||||

| Affiliated dividend income |

$ | 10,507,159 | ||

| Unaffiliated dividend income (net of $22,909 foreign withholding tax) |

2,245,219 | |||

| Income from securities lending, net (including affiliated income of $21,309) |

24,074 | |||

|

|

|

|||

| Total income |

12,776,452 | |||

|

|

|

|||

| Expenses |

||||

| Management fee |

2,083,689 | |||

| Distribution fee(a) |

1,014,908 | |||

| Transfer agent’s fees and expenses (including affiliated expense of $85,035)(a) |

311,389 | |||

| Custodian and accounting fees |

106,782 | |||

| Shareholders’ reports |

101,991 | |||

| Registration fees(a) |

75,818 | |||

| Audit fee |

53,000 | |||

| Legal fees and expenses |

22,517 | |||

| Trustees’ fees |

13,387 | |||

| Miscellaneous |

21,751 | |||

|

|

|

|||

| Total expenses |

3,805,232 | |||

| Less: Fee waiver and/or expense reimbursement(a) |

(2,260,812 | ) | ||

| Distribution fee waiver(a) |

(68,776 | ) | ||

|

|

|

|||

| Net expenses |

1,475,644 | |||

|

|

|

|||

| Net investment income (loss) |

11,300,808 | |||

|

|

|

|||

| Realized And Unrealized Gain (Loss) On Investment And Foreign Currency Transactions |

||||

| Net realized gain (loss) on: |

||||

| Investment transactions (including affiliated of $(8,280,194)) |

4,035,103 | |||

| Affiliated net capital gain distributions received |

7,918,529 | |||

| Foreign currency transactions |

(6,329 | ) | ||

|

|

|

|||

| 11,947,303 | ||||

|

|

|

|||

| Net change in unrealized appreciation (depreciation) on: |

||||

| Investments (including affiliated of $(48,897,808)) |

(68,147,422 | ) | ||

| Foreign currencies |

(1,592 | ) | ||

|

|

|

|||

| (68,149,014) | ||||

|

|

|

|||

| Net gain (loss) on investment and foreign currency transactions |

(56,201,711 | ) | ||

|

|

|

|||

| Net Increase (Decrease) In Net Assets Resulting From Operations |

$ | (44,900,903 | ) | |

|

|

|

|||

| (a) | Class specific expenses and waivers were as follows: |

| Class A | Class C | Class R | Class Z | Class R6 | ||||||||||||||||

| Distribution fee |

395,496 | 610,832 | 8,580 | — | — | |||||||||||||||

| Transfer agent’s fees and expenses |

157,954 | 56,146 | 1,730 | 95,402 | 157 | |||||||||||||||

| Registration fees |

18,910 | 14,463 | 11,169 | 16,807 | 14,469 | |||||||||||||||

| Fee waiver and/or expense reimbursement |

(1,007,385 | ) | (454,641 | ) | (20,074 | ) | (728,474 | ) | (50,238 | ) | ||||||||||

| Distribution fee waiver |

(65,916 | ) | — | (2,860 | ) | — | — | |||||||||||||

See Notes to Financial Statements.

| 22 |

Statements of Changes in Net Assets

| Year Ended October 31,

|

||||||||

| 2022 | 2021 | |||||||

| Increase (Decrease) in Net Assets |

||||||||

| Operations |

||||||||

| Net investment income (loss) |

$ | 11,300,808 | $ | 10,060,135 | ||||

| Net realized gain (loss) on investment and foreign currency transactions |

4,028,774 | 17,550,300 | ||||||

| Affiliated net capital gain distributions received |

7,918,529 | 271,167 | ||||||

| Net change in unrealized appreciation (depreciation) on investments and foreign currencies |

(68,149,014 | ) | 36,505,586 | |||||

|

|

|

|

|

|||||

| Net increase (decrease) in net assets resulting from operations |

(44,900,903 | ) | 64,387,188 | |||||

|

|

|

|

|

|||||

| Dividends and Distributions |

||||||||

| Distributions from distributable earnings |

||||||||

| Class A |

(7,395,596 | ) | (4,491,766 | ) | ||||

| Class C |

(3,102,363 | ) | (1,925,221 | ) | ||||

| Class R |

(65,167 | ) | (43,214 | ) | ||||

| Class Z |

(5,774,126 | ) | (3,694,362 | ) | ||||

| Class R6 |

(320,814 | ) | (174,374 | ) | ||||

|

|

|

|

|

|||||

| (16,658,066 | ) | (10,328,937 | ) | |||||

|

|

|

|

|

|||||

| Tax return of capital distributions |

||||||||

| Class A |

(72,944 | ) | (466,893 | ) | ||||

| Class C |

(30,599 | ) | (200,116 | ) | ||||

| Class R |

(643 | ) | (4,492 | ) | ||||

| Class Z |

(56,951 | ) | (384,007 | ) | ||||

| Class R6 |

(3,164 | ) | (18,125 | ) | ||||

|

|

|

|

|

|||||

| (164,301 | ) | (1,073,633 | ) | |||||

|

|

|

|

|

|||||

| Fund share transactions (Net of share conversions) |

||||||||

| Net proceeds from shares sold |

26,736,622 | 30,799,737 | ||||||

| Net asset value of shares issued in reinvestment of dividends and distributions |

15,704,435 | 10,576,547 | ||||||

| Cost of shares purchased |

(67,614,103 | ) | (68,075,045 | ) | ||||

|

|

|

|

|

|||||

| Net increase (decrease) in net assets from Fund share transactions |

(25,173,046 | ) | (26,698,761 | ) | ||||

|

|

|

|

|

|||||

| Total increase (decrease) |

(86,896,316 | ) | 26,285,857 | |||||

| Net Assets: |

||||||||

| Beginning of year |

340,358,291 | 314,072,434 | ||||||

|

|

|

|

|

|||||

| End of year |

$ | 253,461,975 | $ | 340,358,291 | ||||

|

|

|

|

|

|||||

See Notes to Financial Statements.

| PGIM Income Builder Fund | 23 |

Financial Highlights

| Class A Shares | ||||||||||||||||||||

| Year Ended October 31, | ||||||||||||||||||||

| 2022 | 2021 | 2020 | 2019 | 2018 | ||||||||||||||||

| Per Share Operating Performance(a): | ||||||||||||||||||||

| Net Asset Value, Beginning of Year | $10.54 | $8.99 | $9.69 | $9.12 | $9.62 | |||||||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||

| Net investment income (loss) | 0.37 | 0.31 | 0.33 | 0.36 | 0.35 | |||||||||||||||

| Net realized and unrealized gain (loss) on investment and foreign currency transactions | (1.79 | ) | 1.59 | (0.67 | ) | 0.62 | (0.46 | ) | ||||||||||||

| Total from investment operations | (1.42 | ) | 1.90 | (0.34 | ) | 0.98 | (0.11 | ) | ||||||||||||

| Less Dividends and Distributions: | ||||||||||||||||||||

| Dividends from net investment income | (0.53 | ) | (0.32 | ) | (0.36 | ) | (0.40 | ) | (0.33 | ) | ||||||||||

| Tax return of capital distributions | (0.01 | ) | (0.03 | ) | - | (0.01 | ) | (0.06 | ) | |||||||||||

| Total dividends and distributions | (0.54 | ) | (0.35 | ) | (0.36 | ) | (0.41 | ) | (0.39 | ) | ||||||||||

| Net asset value, end of year | $8.58 | $10.54 | $8.99 | $9.69 | $9.12 | |||||||||||||||

| Total Return(b): | (14.00 | )% | 21.34 | % | (3.44 | )% | 11.01 | % | (1.22 | )% | ||||||||||

| Ratios/Supplemental Data: | ||||||||||||||||||||

| Net assets, end of year (000) | $117,163 | $146,331 | $130,648 | $156,683 | $153,762 | |||||||||||||||

| Average net assets (000) | $131,832 | $144,478 | $141,977 | $153,066 | $169,651 | |||||||||||||||

| Ratios to average net assets(c): | ||||||||||||||||||||

| Expenses after waivers and/or expense reimbursement | 0.43 | % | 0.43 | % | 0.80 | % | 0.85 | % | 0.85 | % | ||||||||||

| Expenses before waivers and/or expense reimbursement | 1.24 | % | 1.22 | % | 1.28 | % | 1.28 | % | 1.25 | % | ||||||||||

| Net investment income (loss) | 3.85 | % | 3.04 | % | 3.61 | % | 3.82 | % | 3.63 | % | ||||||||||

| Portfolio turnover rate(d) | 59 | % | 53 | % | 84 | % | 110 | % | 114 | % | ||||||||||

| (a) | Calculated based on average shares outstanding during the year. |

| (b) | Total return does not consider the effects of sales loads. Total return is calculated assuming a purchase of a share on the first day and a sale on the last day of each year reported and includes reinvestment of dividends and distributions, if any. Total returns may reflect adjustments to conform to GAAP. |

| (c) | Does not include expenses of the underlying funds in which the Fund invests. |

| (d) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short-term investments, certain derivatives and in-kind transactions (if any). If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

See Notes to Financial Statements.

| 24 |

| Class C Shares | ||||||||||||||||||||

| Year Ended October 31, | ||||||||||||||||||||

| 2022 | 2021 | 2020 | 2019 | 2018 | ||||||||||||||||

| Per Share Operating Performance(a): | ||||||||||||||||||||

| Net Asset Value, Beginning of Year | $10.30 | $8.79 | $9.49 | $8.94 | $9.44 | |||||||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||

| Net investment income (loss) | 0.29 | 0.23 | 0.26 | 0.28 | 0.27 | |||||||||||||||

| Net realized and unrealized gain (loss) on investment and foreign currency transactions | (1.74 | ) | 1.55 | (0.66 | ) | 0.61 | (0.45 | ) | ||||||||||||

| Total from investment operations | (1.45 | ) | 1.78 | (0.40 | ) | 0.89 | (0.18 | ) | ||||||||||||

| Less Dividends and Distributions: | ||||||||||||||||||||

| Dividends from net investment income | (0.46 | ) | (0.24 | ) | (0.30 | ) | (0.33 | ) | (0.27 | ) | ||||||||||

| Tax return of capital distributions | (0.01 | ) | (0.03 | ) | - | (0.01 | ) | (0.05 | ) | |||||||||||

| Total dividends and distributions | (0.47 | ) | (0.27 | ) | (0.30 | ) | (0.34 | ) | (0.32 | ) | ||||||||||

| Net asset value, end of year | $8.38 | $10.30 | $8.79 | $9.49 | $8.94 | |||||||||||||||

| Total Return(b): | (14.60 | )% | 20.47 | % | (4.22 | )% | 10.32 | % | (1.98 | )% | ||||||||||

| Ratios/Supplemental Data: | ||||||||||||||||||||

| Net assets, end of year (000) | $48,573 | $72,376 | $75,284 | $100,653 | $109,767 | |||||||||||||||

| Average net assets (000) | $61,083 | $76,740 | $87,849 | $103,441 | $123,584 | |||||||||||||||

| Ratios to average net assets(c): | ||||||||||||||||||||

| Expenses after waivers and/or expense reimbursement | 1.18 | % | 1.18 | % | 1.55 | % | 1.60 | % | 1.60 | % | ||||||||||

| Expenses before waivers and/or expense reimbursement | 1.92 | % | 1.89 | % | 1.96 | % | 1.96 | % | 1.94 | % | ||||||||||

| Net investment income (loss) | 3.13 | % | 2.32 | % | 2.88 | % | 3.09 | % | 2.88 | % | ||||||||||

| Portfolio turnover rate(d) | 59 | % | 53 | % | 84 | % | 110 | % | 114 | % | ||||||||||

| (a) | Calculated based on average shares outstanding during the year. |

| (b) | Total return does not consider the effects of sales loads. Total return is calculated assuming a purchase of a share on the first day and a sale on the last day of each year reported and includes reinvestment of dividends and distributions, if any. Total returns may reflect adjustments to conform to GAAP. |

| (c) | Does not include expenses of the underlying funds in which the Fund invests. |

| (d) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short-term investments, certain derivatives and in-kind transactions (if any). If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

See Notes to Financial Statements.

| PGIM Income Builder Fund | 25 |

Financial Highlights (continued)

| Class R Shares | ||||||||||||||||||||

| Year Ended October 31, | ||||||||||||||||||||

| 2022 | 2021 | 2020 | 2019 | 2018 | ||||||||||||||||

| Per Share Operating Performance(a): | ||||||||||||||||||||

| Net Asset Value, Beginning of Year | $10.52 | $8.97 | $9.68 | $9.10 | $9.61 | |||||||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||

| Net investment income (loss) | 0.36 | 0.28 | 0.31 | 0.34 | 0.31 | |||||||||||||||

| Net realized and unrealized gain (loss) on investment and foreign currency transactions | (1.80 | ) | 1.59 | (0.68 | ) | 0.63 | (0.45 | ) | ||||||||||||

| Total from investment operations | (1.44 | ) | 1.87 | (0.37 | ) | 0.97 | (0.14 | ) | ||||||||||||

| Less Dividends and Distributions: | ||||||||||||||||||||

| Dividends from net investment income | (0.50 | ) | (0.29 | ) | (0.34 | ) | (0.38 | ) | (0.31 | ) | ||||||||||

| Tax return of capital distributions | (0.01 | ) | (0.03 | ) | - | (0.01 | ) | (0.06 | ) | |||||||||||

| Total dividends and distributions | (0.51 | ) | (0.32 | ) | (0.34 | ) | (0.39 | ) | (0.37 | ) | ||||||||||

| Net asset value, end of year | $8.57 | $10.52 | $8.97 | $9.68 | $9.10 | |||||||||||||||

| Total Return(b): | (14.15 | )% | 21.09% | (3.79 | )% | 10.88 | % | (1.58 | )% | |||||||||||

| Ratios/Supplemental Data: | ||||||||||||||||||||

| Net assets, end of year (000) | $923 | $1,465 | $1,369 | $1,762 | $1,768 | |||||||||||||||

| Average net assets (000) | $1,144 | $1,505 | $1,532 | $1,787 | $1,196 | |||||||||||||||

| Ratios to average net assets(c): | ||||||||||||||||||||

| Expenses after waivers and/or expense reimbursement | 0.68% | 0.68% | 1.05% | 1.10% | 1.10% | |||||||||||||||

| Expenses before waivers and/or expense reimbursement | 2.68% | 2.33% | 2.81% | 2.48% | 3.02% | |||||||||||||||

| Net investment income (loss) | 3.75% | 2.80% | 3.37% | 3.57% | 3.25% | |||||||||||||||

| Portfolio turnover rate(d) | 59% | 53% | 84% | 110% | 114% | |||||||||||||||

| (a) | Calculated based on average shares outstanding during the year. |

| (b) | Total return is calculated assuming a purchase of a share on the first day and a sale on the last day of each year reported and includes reinvestment of dividends and distributions, if any. Total returns may reflect adjustments to conform to GAAP. |

| (c) | Does not include expenses of the underlying funds in which the Fund invests. |

| (d) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short-term investments, certain derivatives and in-kind transactions (if any). If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

See Notes to Financial Statements.

| 26 |

| Class Z Shares | ||||||||||||||||||||

| Year Ended October 31, | ||||||||||||||||||||

| 2022 | 2021 | 2020 | 2019 | 2018 | ||||||||||||||||

| Per Share Operating Performance(a): | ||||||||||||||||||||

| Net Asset Value, Beginning of Year | $10.63 | $9.06 | $9.76 | $9.18 | $9.69 | |||||||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||

| Net investment income (loss) | 0.40 | 0.34 | 0.36 | 0.39 | 0.37 | |||||||||||||||

| Net realized and unrealized gain (loss) on investment and foreign currency transactions | (1.82 | ) | 1.61 | (0.68 | ) | 0.63 | (0.46 | ) | ||||||||||||

| Total from investment operations | (1.42 | ) | 1.95 | (0.32 | ) | 1.02 | (0.09 | ) | ||||||||||||

| Less Dividends and Distributions: | ||||||||||||||||||||

| Dividends from net investment income | (0.55 | ) | (0.35 | ) | (0.38 | ) | (0.42 | ) | (0.36 | ) | ||||||||||

| Tax return of capital distributions | (0.01 | ) | (0.03 | ) | - | (0.02 | ) | (0.06 | ) | |||||||||||

| Total dividends and distributions | (0.56 | ) | (0.38 | ) | (0.38 | ) | (0.44 | ) | (0.42 | ) | ||||||||||

| Net asset value, end of year | $8.65 | $10.63 | $9.06 | $9.76 | $9.18 | |||||||||||||||

| Total Return(b): | (13.85 | )% | 21.71 | % | (3.28 | )% | 11.44 | % | (1.08 | )% | ||||||||||

| Ratios/Supplemental Data: | ||||||||||||||||||||

| Net assets, end of year (000) | $81,362 | $114,491 | $102,220 | $147,834 | $133,029 | |||||||||||||||

| Average net assets (000) | $97,972 | $111,577 | $126,142 | $135,434 | $141,463 | |||||||||||||||

| Ratios to average net assets(c): | ||||||||||||||||||||

| Expenses after waivers and/or expense reimbursement | 0.18 | % | 0.18 | % | 0.55 | % | 0.60 | % | 0.60 | % | ||||||||||

| Expenses before waivers and/or expense reimbursement | 0.92 | % | 0.91 | % | 0.97 | % | 0.97 | % | 0.96 | % | ||||||||||

| Net investment income (loss) | 4.13 | % | 3.29 | % | 3.90 | % | 4.06 | % | 3.87 | % | ||||||||||

| Portfolio turnover rate(d) | 59 | % | 53 | % | 84 | % | 110 | % | 114 | % | ||||||||||

| (a) | Calculated based on average shares outstanding during the year. |

| (b) | Total return is calculated assuming a purchase of a share on the first day and a sale on the last day of each year reported and includes reinvestment of dividends and distributions, if any. Total returns may reflect adjustments to conform to GAAP. |

| (c) | Does not include expenses of the underlying funds in which the Fund invests. |

| (d) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short-term investments, certain derivatives and in-kind transactions (if any). If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

See Notes to Financial Statements.

| PGIM Income Builder Fund | 27 |

Financial Highlights (continued)

| Class R6 Shares | ||||||||||||||||||||

| Year Ended October 31, | ||||||||||||||||||||

| 2022 | 2021 | 2020 | 2019 | 2018 | ||||||||||||||||

| Per Share Operating Performance(a): | ||||||||||||||||||||

| Net Asset Value, Beginning of Year | $10.62 | $9.05 | $9.76 | $9.18 | $9.69 | |||||||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||

| Net investment income (loss) | 0.39 | 0.34 | 0.35 | 0.38 | 0.37 | |||||||||||||||

| Net realized and unrealized gain (loss) on investment and foreign currency transactions | (1.80 | ) | 1.61 | (0.68 | ) | 0.64 | (0.46 | ) | ||||||||||||

| Total from investment operations | (1.41 | ) | 1.95 | (0.33 | ) | 1.02 | (0.09 | ) | ||||||||||||

| Less Dividends and Distributions: | ||||||||||||||||||||

| Dividends from net investment income | (0.55 | ) | (0.35 | ) | (0.38 | ) | (0.42 | ) | (0.36 | ) | ||||||||||

| Tax return of capital distributions | (0.01 | ) | (0.03 | ) | - | (0.02 | ) | (0.06 | ) | |||||||||||

| Total dividends and distributions | (0.56 | ) | (0.38 | ) | (0.38 | ) | (0.44 | ) | (0.42 | ) | ||||||||||

| Net asset value, end of year | $8.65 | $10.62 | $9.05 | $9.76 | $9.18 | |||||||||||||||

| Total Return(b): | (13.76 | )% | 21.73% | (3.28 | )% | 11.33 | % | (1.07 | )% | |||||||||||

| Ratios/Supplemental Data: | ||||||||||||||||||||

| Net assets, end of year (000) | $5,441 | $5,695 | $4,552 | $4,840 | $3,343 | |||||||||||||||

| Average net assets (000) | $5,639 | $5,261 | $4,769 | $4,163 | $3,088 | |||||||||||||||

| Ratios to average net assets(c): | ||||||||||||||||||||

| Expenses after waivers and/or expense reimbursement | 0.18% | 0.18% | 0.54% | 0.60% | 0.60% | |||||||||||||||

| Expenses before waivers and/or expense reimbursement | 1.07% | 0.99% | 1.21% | 1.05% | 1.32% | |||||||||||||||

| Net investment income (loss) | 4.05% | 3.28% | 3.85% | 4.04% | 3.85% | |||||||||||||||

| Portfolio turnover rate(d) | 59% | 53% | 84% | 110% | 114% | |||||||||||||||

| (a) | Calculated based on average shares outstanding during the year. |

| (b) | Total return is calculated assuming a purchase of a share on the first day and a sale on the last day of each year reported and includes reinvestment of dividends and distributions, if any. Total returns may reflect adjustments to conform to GAAP. |

| (c) | Does not include expenses of the underlying funds in which the Fund invests. |

| (d) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short-term investments, certain derivatives and in-kind transactions (if any). If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

See Notes to Financial Statements.

| 28 |

Notes to Financial Statements

| 1. | Organization |

Prudential Investment Portfolios 16 (the “Registered Investment Company” or “RIC”) is registered under the Investment Company Act of 1940, as amended (“1940 Act”), as an open-end management investment company. The RIC is organized as a Delaware Statutory Trust and PGIM Income Builder Fund (the “Fund”) is the sole series of the RIC. The Fund is classified as a diversified fund for purposes of the 1940 Act.

The investment objective of the Fund is to seek income and long-term capital growth.

The Fund gains exposure to the equities and fixed income market segments by investing in varying combinations of other PGIM mutual funds (the “Underlying PGIM Mutual Funds”), PGIM exchange-traded funds (“Underlying PGIM ETFs,” and together with the Underlying PGIM Mutual Funds, the “Underlying PGIM Funds”), unaffiliated exchange-traded funds (“ETFs”) (collectively “Underlying Funds”), and direct investments by the Fund’s subadvisers.

| 2. | Accounting Policies |

The Fund follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification (“ASC”) Topic 946 Financial Services — Investment Companies. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The policies conform to U.S. generally accepted accounting principles (“GAAP”). The Fund consistently follows such policies in the preparation of its financial statements.

Securities Valuation: The Fund holds securities and other assets and liabilities that are fair valued as of the close of each day (generally, 4:00 PM Eastern time) the New York Stock Exchange (“NYSE”) is open for trading. As described in further detail below, the Fund’s investments are valued daily based on a number of factors, including the type of investment and whether market quotations are readily available. The RIC’s Board of Trustees (the “Board”) has approved the Fund’s valuation policies and procedures for security valuation and designated to PGIM Investments LLC (“PGIM Investments” or the “Manager”) as the Valuation Designee pursuant to SEC Rule 2a-5(b) to perform the fair value determination relating to all Fund investments. Pursuant to the Board’s oversight, the Valuation Designee has established a Valuation Committee to perform the duties and responsibilities as valuation designee under SEC Rule 2a-5. The valuation procedures permit the Fund to utilize independent pricing vendor services, quotations from market makers, and alternative valuation methods when market quotations are either not readily available or not deemed representative of fair value. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the

| PGIM Income Builder Fund |

29 |

Notes to Financial Statements (continued)

measurement date. A record of the Valuation Committee’s actions is provided to the Board at the first quarterly meeting following the quarter in which such actions take place.

For the fiscal reporting year-end, securities and other assets and liabilities were fair valued at the close of the last U.S. business day. Trading in certain foreign securities may occur when the NYSE is closed (including weekends and holidays). Because such foreign securities trade in markets that are open on weekends and U.S. holidays, the values of some of the Fund’s foreign investments may change on days when investors cannot purchase or redeem Fund shares.

Various inputs determine how the Fund’s investments are valued, all of which are categorized according to the three broad levels (Level 1, 2, or 3) detailed in the Schedule of Investments and referred to herein as the “fair value hierarchy” in accordance with FASB ASC Topic 820 - Fair Value Measurement.

Common or preferred stocks, exchange-traded funds and derivative instruments, if applicable, that are traded on a national securities exchange are valued at the last sale price as of the close of trading on the applicable exchange where the security principally trades. Securities traded via NASDAQ are valued at the NASDAQ official closing price. To the extent these securities are valued at the last sale price or NASDAQ official closing price, they are classified as Level 1 in the fair value hierarchy. In the event that no sale or official closing price on valuation date exists, these securities are generally valued at the mean between the last reported bid and ask prices, or at the last bid price in the absence of an ask price. These securities are classified as Level 2 in the fair value hierarchy.

Foreign equities traded on foreign securities exchanges are generally valued using pricing vendor services that provide model prices derived using adjustment factors based on information such as local closing price, relevant general and sector indices, currency fluctuations, depositary receipts, and futures, as applicable. Securities valued using such model prices are classified as Level 2 in the fair value hierarchy. The models generate an evaluated adjustment factor for each security, which is applied to the local closing price to adjust it for post closing market movements up to the time the Fund is valued. Utilizing that evaluated adjustment factor, the vendor provides an evaluated price for each security. If the vendor does not provide an evaluated price, securities are valued in accordance with exchange-traded common and preferred stock valuation policies discussed above.

Investments in open-end funds (other than exchange-traded funds) are valued at their net asset values as of the close of the NYSE on the date of valuation. These securities are classified as Level 1 in the fair value hierarchy since they may be purchased or sold at their net asset values on the date of valuation.

| 30 |

Fixed income securities traded in the OTC market are generally classified as Level 2 in the fair value hierarchy. Such fixed income securities are typically valued using the market approach which generally involves obtaining data from an approved independent third-party vendor source. The Fund utilizes the market approach as the primary method to value securities when market prices of identical or comparable instruments are available. The third-party vendors’ valuation techniques used to derive the evaluated bid price are based on evaluating observable inputs, including but not limited to, yield curves, yield spreads, credit ratings, deal terms, tranche level attributes, default rates, cash flows, prepayment speeds, broker/dealer quotations and reported trades. Certain Level 3 securities are also valued using the market approach when obtaining a single broker quote or when utilizing transaction prices for identical securities that have been used in excess of five business days. During the reporting period, there were no changes to report with respect to the valuation approach and/or valuation techniques discussed above.

Securities and other assets that cannot be priced according to the methods described above are valued based on policies and procedures approved by the Board. In the event that unobservable inputs are used when determining such valuations, the securities will be classified as Level 3 in the fair value hierarchy. Altering one or more unobservable inputs may result in a significant change to a Level 3 security’s fair value measurement.

When determining the fair value of securities, some of the factors influencing the valuation include: the nature of any restrictions on disposition of the securities; assessment of the general liquidity of the securities; the issuer’s financial condition and the markets in which it does business; the cost of the investment; the size of the holding and the capitalization of the issuer; the prices of any recent transactions or bids/offers for such securities or any comparable securities; any available analyst media or other reports or information deemed reliable by the Valuation Designee regarding the issuer or the markets or industry in which it operates. Using fair value to price securities may result in a value that is different from a security’s most recent closing price and from the price used by other unaffiliated mutual funds to calculate their net asset values.

Foreign Currency Translation: The books and records of the Fund are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars on the following basis:

(i) market value of investment securities, other assets and liabilities — at the exchange rate as of the valuation date;

(ii) purchases and sales of investment securities, income and expenses — at the rates of exchange prevailing on the respective dates of such transactions.

Although the net assets of the Fund are presented at the foreign exchange rates and market values at the close of the period, the Fund does not generally isolate that portion of the results of operations arising as a result of changes in the foreign exchange rates from the fluctuations arising from changes in the market prices of long-term portfolio securities held at the end of the period. Similarly, the Fund does not isolate the effect of changes in foreign

| PGIM Income Builder Fund |

31 |

Notes to Financial Statements (continued)

exchange rates from the fluctuations arising from changes in the market prices of long-term portfolio securities sold during the period. Accordingly, holding period unrealized and realized foreign currency gains (losses) are included in the reported net change in unrealized appreciation (depreciation) on investments and net realized gains (losses) on investment transactions on the Statements of Operations. Notwithstanding the above, the Fund does isolate the effect of fluctuations in foreign currency exchange rates when determining the gain (loss) upon the sale or maturity of foreign currency denominated debt obligations; such amounts are included in net realized gains (losses) on foreign currency transactions.

Additionally, net realized gains (losses) on foreign currency transactions represent net foreign exchange gains (losses) from the disposition of holdings of foreign currencies, currency gains (losses) realized between the trade and settlement dates on investment transactions, and the difference between the amounts of interest, dividends and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent amounts actually received or paid. Net unrealized currency gains (losses) arise from valuing foreign currency denominated assets and liabilities (other than investments) at period end exchange rates.

Master Netting Arrangements: The RIC, on behalf of the Fund, is subject to various Master Agreements, or netting arrangements, with select counterparties. These are agreements which a subadviser may have negotiated and entered into on behalf of all or a portion of the Fund. A master netting arrangement between the Fund and the counterparty permits the Fund to offset amounts payable by the Fund to the same counterparty against amounts to be received; and by the receipt of collateral from the counterparty by the Fund to cover the Fund’s exposure to the counterparty. However, there is no assurance that such mitigating factors are easily enforceable. In addition to master netting arrangements, the right to set-off exists when all the conditions are met such that each of the parties owes the other determinable amounts, the reporting party has the right to set-off the amount owed with the amount owed by the other party, the reporting party intends to set-off and the right of set-off is enforceable by law.

Securities Lending: The Fund lends its portfolio securities to banks and broker-dealers. The loans are secured by collateral at least equal to the market value of the securities loaned. Collateral pledged by each borrower is invested in an affiliated money market fund and is marked to market daily, based on the previous day’s market value, such that the value of the collateral exceeds the value of the loaned securities. In the event of significant appreciation in value of securities on loan on the last business day of the reporting period, the financial statements may reflect a collateral value that is less than the market value of the loaned securities. Such shortfall is remedied as described above. Loans are subject to termination at the option of the borrower or the Fund. Upon termination of the loan, the borrower will

| 32 |

return to the Fund securities identical to the loaned securities. The remaining open loans of the securities lending transactions are considered overnight and continuous. Should the borrower of the securities fail financially, the Fund has the right to repurchase the securities in the open market using the collateral.

The Fund recognizes income, net of any rebate and securities lending agent fees, for lending its securities in the form of fees or interest on the investment of any cash received as collateral. The borrower receives all interest and dividends from the securities loaned and such payments are passed back to the lender in amounts equivalent thereto, which are reflected in interest income or unaffiliated dividend income based on the nature of the payment on the Statement of Operations. The Fund also continues to recognize any unrealized gain (loss) in the market price of the securities loaned and on the change in the value of the collateral invested that may occur during the term of the loan. In addition, realized gain (loss) is recognized on changes in the value of the collateral invested upon liquidation of the collateral. Net earnings from securities lending are disclosed in the Statement of Operations.