| Label |

Element |

Value |

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Registrant Name |

dei_EntityRegistrantName |

PRUDENTIAL INVESTMENT PORTFOLIOS 16

|

|

| Prospectus Date |

rr_ProspectusDate |

Feb. 26, 2018

|

|

| PRUDENTIAL INCOME BUILDER FUND |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Risk/Return [Heading] |

rr_RiskReturnHeading |

FUND SUMMARY

IMPORTANT NOTE: Effective June 11, 2018, the Fund’s new name will be PGIM Income Builder Fund. Fund symbols will not change.

|

|

| Objective [Heading] |

rr_ObjectiveHeading |

INVESTMENT OBJECTIVE

|

|

| Objective, Primary [Text Block] |

rr_ObjectivePrimaryTextBlock |

The investment objective of the Fund is to seek income and long-term capital growth.

|

|

| Expense [Heading] |

rr_ExpenseHeading |

FUND FEES AND EXPENSES

|

|

| Expense Narrative [Text Block] |

rr_ExpenseNarrativeTextBlock |

The tables below describe the sales charges, fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and an eligible group of related investors purchase, or agree to purchase in the future, $25,000 or more in shares of the Fund or other funds in the Prudential mutual funds. More information about these discounts as well as other waivers or discounts is available from your financial professional and is explained in Reducing or Waiving Class A's and Class C’s Sales Charges on page 44 of the Fund's Prospectus, Appendix A: Waivers and Discounts Available From Certain Financial Intermediaries on page 69 of the Fund's Prospectus and in Rights of Accumulation on page 68 of the Fund's Statement of Additional Information (SAI).

|

|

| Shareholder Fees Caption [Text] |

rr_ShareholderFeesCaption |

Shareholder Fees (fees paid directly from your investment)

|

|

| Operating Expenses Caption [Text] |

rr_OperatingExpensesCaption |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

|

|

| Fee Waiver or Reimbursement over Assets, Date of Termination |

rr_FeeWaiverOrReimbursementOverAssetsDateOfTermination |

February 29, 2020

February 28, 2019

|

|

| Portfolio Turnover [Heading] |

rr_PortfolioTurnoverHeading |

Portfolio Turnover.

|

|

| Portfolio Turnover [Text Block] |

rr_PortfolioTurnoverTextBlock |

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. During the Fund's most recent fiscal year, the Fund's portfolio turnover rate was 102% of the average value of its portfolio.

|

|

| Portfolio Turnover, Rate |

rr_PortfolioTurnoverRate |

102.00%

|

|

| Expense Breakpoint Discounts [Text] |

rr_ExpenseBreakpointDiscounts |

You may qualify for sales charge discounts if you and an eligible group of related investors purchase, or agree to purchase in the future, $25,000 or more in shares of the Fund or other funds in the Prudential mutual funds.

|

|

| Expense Breakpoint, Minimum Investment Required [Amount] |

rr_ExpenseBreakpointMinimumInvestmentRequiredAmount |

$ 25,000

|

|

| Other Expenses, New Fund, Based on Estimates [Text] |

rr_OtherExpensesNewFundBasedOnEstimates |

Other expenses are based on estimates.

|

|

| Expense Example [Heading] |

rr_ExpenseExampleHeading |

Example.

|

|

| Expense Example Narrative [Text Block] |

rr_ExpenseExampleNarrativeTextBlock |

The following hypothetical example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. It assumes that you invest $10,000 in the Fund for the time periods indicated and then, except as indicated, redeem all your shares at the end of those periods. It assumes a 5% return on your investment each year, that the Fund's operating expenses remain the same (except that fee waivers or reimbursements, if any, are only reflected in the 1-Year figures) and that all dividends and distributions are reinvested. Your actual costs may be higher or lower.

|

|

| Expense Example by, Year, Caption [Text] |

rr_ExpenseExampleByYearCaption |

If Shares Are Redeemed

|

|

| Expense Example, No Redemption, By Year, Caption [Text] |

rr_ExpenseExampleNoRedemptionByYearCaption |

If Shares Are Not Redeemed

|

|

| Strategy [Heading] |

rr_StrategyHeading |

INVESTMENTS, RISKS AND PERFORMANCE

Principal Investment Strategies.

|

|

| Strategy Narrative [Text Block] |

rr_StrategyNarrativeTextBlock |

In order to achieve its investment objective, the Fund seeks investments that are expected to both generate income and appreciate in value. The Fund seeks to achieve its investment objectives by investing in a diversified portfolio consisting of a wide variety of income-oriented investments and strategies within the equity and fixed income market segments. The Fund may invest approximately 20% to 80% of its total assets in equity and equity-related securities. The Fund also may invest approximately 20% to 80% of its total assets in fixed income investments. The Fund gains exposure to the equities and fixed income market segments by investing in varying combinations of other Prudential mutual funds (the Underlying Prudential Funds), exchange-traded funds (ETFs, and together with the Underlying Prudential Funds, the Underlying Funds) and direct investments by the Fund's subadvisers. Investments in Underlying Funds will be included in the applicable market segment based on the primary investment focus of the Underlying Funds.

Quantitative Management Associates LLC (QMA), one of the Fund’s subadvisers, will tactically allocate the Fund's assets among the different sub-classes within equities and equity-related securities and fixed income investments. Asset allocation decisions will be determined using a combination of quantitative tools and the judgment of QMA's investment professionals. To the extent consistent with the Fund’s investment objective, QMA’s asset allocation also may tactically invest up to 10% of the Fund’s total assets in a variety of ETFs, futures and swaps in new or current sub-classes within equities and fixed income investments (the “10% allocation”).

Equity and Equity-Related Securities. The Fund's equity and equity-related securities include common stock, securities convertible or exchangeable for common stock or the cash value of such common stock, structured notes, preferred securities, warrants and rights, Underlying Prudential Funds, ETFs, investments in various types of business ventures including partnerships and joint ventures and business development companies, real estate securities, securities of real estate investment trusts (REITs) and income and royalty trusts, American Depositary Receipts and other similar securities issued by US or foreign companies of any market capitalization. The Fund may invest in securities issued in an initial public offering (IPO). The Fund may invest up to 25% of total assets in publicly-traded master limited partnerships (MLPs).

Fixed Income Investments. PGIM Fixed Income serves as the subadviser for the Fund’s fixed income investments. The Fund's fixed income investments include Underlying Funds and all types of bonds of varying maturities and credit quality (including “junk” bonds), such as US Government securities, debentures, notes, commercial paper, mortgage-related and asset-backed securities, convertibles, loan assignments and participations, corporate debt securities, money market instruments, foreign securities (including emerging market securities) and other similar investments. Such investments may be denominated in US or foreign currencies (including currencies of emerging markets) and may consist of fixed income instruments of companies or governments of US or foreign issuers, including emerging markets.

The Fund's investments in high yield fixed income investments (commonly referred to as “junk” bonds) generally are rated either Ba1 or lower by Moody’s Investors Service (Moody’s), BB+ or lower by S&P Global Ratings (Standard & Poor’s), or comparably rated by another nationally recognized statistical rating organization (NRSRO), or, if unrated, are considered by PGIM Fixed Income to be of comparable quality.

In managing the Fund’s assets, PGIM Fixed Income uses a combination of top-down economic analysis and bottom-up research in conjunction with proprietary quantitative models and risk management systems. In the top-down economic analysis, PGIM Fixed Income develops views on economic, policy and market trends. In its bottom-up research, PGIM Fixed Income develops an internal rating and outlook on issuers. The rating and outlook is determined based on a complete review of the financial health and trends of the issuer. PGIM Fixed Income may also consider investment factors such as expected total return, yield, spread and potential for price appreciation as well as credit quality, maturity and risk. The Fund may invest in a security based upon the expected total return rather than the yield of such security.

|

|

| Risk [Heading] |

rr_RiskHeading |

Principal Risks.

|

|

| Risk Narrative [Text Block] |

rr_RiskNarrativeTextBlock |

All investments have risks to some degree. An investment in the Fund is not guaranteed to achieve its investment objective; is not a deposit with a bank; is not insured, endorsed or guaranteed by the Federal Deposit Insurance Corporation or any other government agency; and is subject to investment risks, including possible loss of your original investment.

Set forth below is a description of the principal risks associated with an investment in the Fund either through direct investments or indirectly through the Fund’s investments in the Underlying Funds.

Asset Allocation Risk. Asset allocation risk is the risk that the Fund’s assets may be allocated to an asset class that underperforms other asset classes. For example, fixed income securities may underperform equities.

Fund of Funds Risk. The value of an investment in the Fund will be related, to a degree, to the investment performance of the Underlying Funds in which it invests. Therefore, the principal risks of investing in the Fund are closely related to the principal risks associated with these Underlying Funds and their investments. Because the Fund’s allocation among different Underlying Funds and direct investments in securities and derivatives will vary, an investment in the Fund may be subject to any and all of these risks at different times and to different degrees. Investing in an Underlying Fund will also expose the Fund to a pro rata portion of the Underlying Fund’s fees and expenses. In addition, one Underlying Fund may buy the same securities that another Underlying Fund sells. Therefore, the Fund would indirectly bear the costs of these trades without accomplishing the investment purpose.

Affiliated Funds Risk. The Fund’s manager serves as the manager of the Underlying Prudential Funds. It is possible that a conflict of interest among the Fund and the Underlying Prudential Funds could impact the manager and subadvisers. Because the amount of the investment management fees to be retained by the manager and the subadvisers may differ depending upon the Underlying Prudential Funds in which the Fund invests, there is a conflict of interest for the manager and the subadvisers in selecting the Underlying Prudential Funds. In addition, the manager and the subadvisers may have an incentive to take into account the effect on an Underlying Prudential Fund in which the Fund may invest in determining whether, and under what circumstances, to purchase or sell shares in that Underlying Prudential Fund. Although the manager and the subadvisers take steps to address the conflicts of interest, it is possible that the conflicts could impact the Fund. In addition, the subadvisers may invest in Underlying Prudential Funds that have a limited or no performance history.

Asset Class Variation Risk. The Underlying Funds invest principally in the securities constituting their asset class (i.e., domestic or international real estate, utilities, infrastructure, natural resources, MLPs and various types of fixed-income investments). However, under normal market conditions, an Underlying Fund may vary the percentage of its assets in these securities (subject to any applicable regulatory requirements). Depending upon the percentage of securities in a particular asset class held by the Underlying Funds at any given time and the percentage of the Fund’s assets invested in the Underlying Funds, the Fund’s actual exposure to the securities in a particular asset class may vary substantially from its allocation to that asset class.

Multi-Manager Risk. While the manager monitors the investments of each subadviser and monitors the overall management of the Fund, each subadviser makes investment decisions for the asset classes it manages independently from one another. It is possible that the investment styles used by a subadviser in an asset class will not always be complementary to those used by others, which could adversely affect the performance of the Fund.

Master Limited Partnerships Risk. The risks of investing in an MLP are generally those involved in investing in a partnership as opposed to a corporation. For example, state law governing partnerships is often less restrictive than state law governing corporations. MLPs may have limited financial resources, their securities may trade infrequently and in limited volume and they may be relatively illiquid, and they may be subject to more abrupt or erratic price movements than securities of larger or more broadly-based companies. The Fund’s investments in MLPs also subject the Fund to risks associated with the specific industry or industries in which the MLPs invest, risks related to limited control and limited rights to vote on matters affecting the MLP, risks related to potential conflicts of interest between the MLP and the MLP’s general partner, cash flow risks, dilution risks and risks related to the general partner’s right to require unit-holders to sell their common units at an undesirable time or price. MLPs are generally considered interest-rate sensitive investments. During periods of interest rate volatility, these investments may not provide attractive returns. Since MLPs generally conduct business in multiple states, the Fund may be subject to income or franchise tax in each of the states in which the partnership does business. The additional cost of preparing and filing the tax returns and paying the related taxes may adversely impact the Fund’s return on its investment in MLPs.

Initial Public Offerings Risk. The volume of IPOs and the levels at which the newly issued stocks trade in the secondary market are affected by the performance of the stock market overall. If IPOs are brought to the market, availability may be limited and if the Fund desires to acquire shares in such an offering, it may not be able to buy any shares at the offering price, or if it is able to buy shares, it may not be able to buy as many shares at the offering price as it would like. The prices of securities involved in IPOs are often subject to greater and more unpredictable price changes than more established stocks. Such unpredictability can have a dramatic impact on the Fund's performance (higher or lower) and any assumptions by investors based on the affected performance may be unwarranted. In addition, as Fund assets grow, the impact of IPO investments on performance will decline, which could reduce total returns.

Portfolio Turnover Risk. The length of time the Fund has held a particular security is not generally a consideration in investment decisions. Under certain market conditions, the Fund’s turnover rate may be higher than that of other mutual funds. Portfolio turnover generally involves some expense to the Fund, including brokerage commissions or dealer mark-ups and other transaction costs on the sale of securities and reinvestment in other securities. These transactions may result in realization of taxable capital gains. The trading costs and tax effects associated with portfolio turnover may adversely affect the Fund’s investment performance.

Management Risk. Actively managed mutual funds are subject to management risk. The subadvisers will apply investment techniques and risk analyses in making investment decisions for the Fund, but there can be no guarantee that these techniques will produce the desired results. Additionally, the securities or Underlying Prudential Funds selected by the manager and/or subadvisers may underperform the markets in general, the Fund’s benchmarks and other mutual funds with similar investment objectives.

Bond Obligations Risk. As with credit risk, market risk and interest rate risk, the Fund's holdings, share price, yield and total return may fluctuate in response to bond market movements. The value of bonds may decline for issuer-related reasons, including management performance, financial leverage and reduced demand for the issuer’s goods and services. Certain types of fixed-income obligations also may be subject to “call and redemption risk,” which is the risk that the issuer may call a bond held by the Fund for redemption before it matures and the Fund may not be able to reinvest at the same level and therefore would earn less income.

Junk Bonds Risk. High-yield, high-risk bonds have predominantly speculative characteristics, including particularly high credit risk. Junk bonds tend to be less liquid than higher-rated securities. The liquidity of particular issuers or industries within a particular investment category may shrink or disappear suddenly and without warning. The non-investment grade bond market can experience sudden and sharp price swings and become illiquid due to a variety of factors, including changes in economic forecasts, stock market activity, large sustained sales by major investors, a high profile default or a change in the market's psychology.

Credit Risk. This is the risk that the issuer, the guarantor or the insurer of a fixed-income security, or the counterparty to a contract may be unable or unwilling to make timely principal and interest payments or to otherwise honor its obligations. Additionally, the securities could lose value due to a loss of confidence in the ability of the issuer, guarantor, insurer or counterparty to pay back debt. The longer the maturity and the lower the credit quality of a bond, the more sensitive it is to credit risk.

Interest Rate Risk. This is the risk that the securities in which the Fund invests could lose value because of interest rate changes. For example, bonds tend to decrease in value if interest rates rise. Debt obligations with longer maturities generally are more sensitive to interest rate changes. In addition, short-term and long-term interest rates do not necessarily move in the same direction or by the same amount. An instrument's reaction to interest rate changes depends on the timing of its interest and principal payments and the current interest rate for each of those time periods. Instruments with floating interest rates can be less sensitive to interest rate changes. The Fund may face a heightened level of interest rate risk since the US Federal Reserve Board has ended its quantitative easing program and may continue to raise rates. The Fund may lose money if short-term or long-term interest rates rise sharply or in a manner not anticipated by the subadvisers. Certain types of debt obligations are also subject to prepayment and extension risk. When interest rates fall, the issuers of debt obligations may prepay principal more quickly than expected, and the Fund may be required to reinvest the proceeds at a lower interest rate. This is referred to as “prepayment risk.” When interest rates rise, debt obligations may be repaid more slowly than expected, and the value of the Fund's holdings may fall sharply. This is referred to as “extension risk.”

Foreign Securities Risk. Investing in securities of non-US issuers generally involves more risk than investing in securities of US issuers. Foreign political, economic and legal systems, especially those in developing and emerging countries, may be less stable and more volatile than in the US. Foreign legal systems generally have fewer regulatory requirements than the US legal system. Additionally, the changing value of foreign currencies could also affect the value of the assets the Fund holds and the Fund's performance. Certain foreign countries may impose restrictions on the ability of issuers of foreign securities to make payment of principal and interest or dividends to investors located outside the country, due to blockage of foreign currency exchanges or otherwise. Investments in foreign securities may be subject to non-US withholding and other taxes. Investments in emerging markets countries are subject to greater volatility and price declines. Low trading volumes may result in a lack of liquidity and in price volatility. In addition, such countries may have policies that restrict investment by foreign investors, or that prevent foreign investors from withdrawing their money at will.

Liquidity Risk. This is the risk that the Fund may invest to a greater degree in instruments that trade in lower volumes and may make investments that may be less liquid than other investments. It also includes the risk that the Fund may make investments that may become less liquid in response to market developments or adverse investor perceptions. When there is no willing buyer and investments cannot be readily sold at the desired time or price, the Fund may have to accept a lower price or may not be able to sell the instrument at all. An inability to sell a portfolio position can adversely affect the Fund’s value or prevent the Fund from being able to take advantage of other investment opportunities. Liquidity risk may also refer to the risk that the Fund will not be able to pay redemption proceeds within the allowable time period because of unusual market conditions, an unusually high volume of redemption requests, or other reasons. To meet redemption requests, the Fund may be forced to sell liquid securities at an unfavorable time and conditions.

Emerging Markets Risk. The risks of foreign investments are greater for investments in or exposed to emerging markets. Emerging market countries typically have economic and political systems that are less fully developed, and can be expected to be less stable, than those of more developed countries. For example, the economies of such countries can be subject to rapid and unpredictable rates of inflation or deflation. Low trading volumes may result in a lack of liquidity and price volatility. Emerging market countries may have policies that restrict investment by non-US investors, or that prevent non-US investors from withdrawing their money at will. Countries with emerging markets can be found in regions such as Asia, Latin America, Eastern Europe and Africa.

Equity Securities Risk. The price of a particular stock the Fund owns could go down and you could lose money. In addition to an individual stock losing value, the value of the equity markets or a sector of them in which the Fund invests could go down. Different sectors of a market can react differently to adverse issuer, market, regulatory, political and economic developments.

Market Capitalization Risk. The Fund may invest in companies of any market capitalization. Generally, the stock prices of small- and medium-sized companies are less stable than the prices of large company stocks and may present greater risks. Large capitalization companies as a group could fall out of favor with the market, causing the Fund to underperform compared to investments that focus on smaller capitalized companies.

Risks of Investing in Infrastructure Companies. Securities of infrastructure companies are more susceptible to adverse economic, social, political and regulatory occurrences affecting their industries. Infrastructure companies may be subject to a variety of factors that may adversely affect their business or operations, including high interest costs in connection with capital construction programs, high leverage, costs associated with environmental and other regulations, the effects of economic slowdown, surplus capacity, insufficient supply of necessary resources, increased competition from other providers of similar services, uncertainties concerning the availability of fuel at reasonable prices, the effects of energy conservation policies and other factors. Certain infrastructure companies may operate in limited areas or have few sources of revenue.

Infrastructure companies may also be affected by or subject to:- regulation by various government authorities;

- government regulation of rates charged to customers;

- service interruption due to environmental, operational or other mishaps as well as political and social unrest;

- the imposition of special tariffs and changes in tax laws, regulatory policies and accounting standards; and

- general changes in market sentiment towards the assets of infrastructure companies.

Real Estate Risk. The value of real estate securities in general, and REITs in particular, is subject to the same risks as direct investments in real estate and mortgages, and their value will depend on the value of the underlying properties or the underlying loans or interests. The underlying loans may be subject to the risks of default or of prepayments that occur earlier or later than expected, and such loans may also include so-called “subprime” mortgages. The value of these securities will rise and fall in response to many factors, including economic conditions, the demand for rental property, interest rates and, with respect to REITs, the management skill and creditworthiness of the issuer. In particular, the value of these securities may decline when interest rates rise and will also be affected by the real estate market and by the management of the underlying properties. REITs may be more volatile and/or more illiquid than other types of equity securities. The Fund will indirectly bear a portion of the expenses, which may include management fees, paid by each REIT in which it invests, in addition to the expenses of the Fund.

Because the Fund invests in real estate securities, including REITs, the Fund is subject to the risks of investing in the real estate industry, such as changes in general and local economic conditions, the supply and demand for real estate and changes in zoning and tax laws. Real estate companies, including REITs, utilize leverage (and some may be highly leveraged), which increases investment risk. Because the Fund invests in stocks, there is the risk that the price of a particular stock could go down or pay lower-than-expected or no dividends. In addition to an individual stock losing value, the value of the equity markets or of companies comprising the real estate industry could go down.

Real Estate Investment Trust (REIT) Risk. Investing in REITs involves certain unique risks in addition to those risks associated with investing in the real estate industry in general. Equity REITs may be affected by changes in the value of the underlying property owned by the REITs, while mortgage REITs may be affected by the quality of any credit extended. REITs are dependent upon management skills, may not be diversified geographically or by property/mortgage asset type, and are subject to heavy cash flow dependency, default by borrowers and self-liquidation. REITs (especially mortgage REITs) are subject to interest rate risks. Small capitalization REITs may have limited financial resources, may trade less frequently and in limited volume and may be subject to more abrupt or erratic price movements than larger company securities. REITs may incur significant amounts of leverage. The Fund’s investments in REITs may subject the Fund to duplicate management and/or advisory fees.

REITs must also meet certain requirements under the Internal Revenue Code of 1986, as amended (the “Code”) to avoid entity level tax and be eligible to pass-through certain tax attributes of their income to shareholders. REITs are consequently subject to the risk of failing to meet these requirements for favorable tax treatment and of failing to maintain their exemptions from registration under the Investment Company Act of 1940 (the 1940 Act). REITs are subject to the risks of changes in the Code affecting their tax status.

Tax reform legislation commonly referred to as the Tax Cuts and Jobs Act (the “Tax Act”) permits a direct REIT shareholder to claim a 20% “qualified business income” deduction for ordinary REIT dividends, but does not permit a regulated investment company (such as the Fund) paying dividends attributable to such income to pass through this special treatment to its shareholders. Unless future legislation provides for a pass-through, investors in such a regulated investment company will treat such distributions as ordinary dividend income, as under prior law, whereas a direct REIT investor would benefit from the special treatment.

Economic and Market Events Risk. Events in the US and global financial markets, including actions taken by the US Federal Reserve or foreign central banks to stimulate or stabilize economic growth, may at times result in unusually high market volatility, which could negatively impact performance. Reduced liquidity in credit and fixed income markets could adversely affect issuers worldwide.

Risk of Increase in Expenses. Your actual cost of investing in the Fund may be higher than the expenses shown in the expense table for a variety of reasons. For example, expense ratios may be higher than those shown if average net assets decrease. Net assets are more likely to decrease and Fund expense ratios are more likely to increase when markets are volatile. Active and frequent trading of Fund securities can increase expenses.

|

|

| Risk Lose Money [Text] |

rr_RiskLoseMoney |

and is subject to investment risks, including possible loss of your original investment.

|

|

| Risk Not Insured Depository Institution [Text] |

rr_RiskNotInsuredDepositoryInstitution |

An investment in the Fund is not guaranteed to achieve its investment objective; is not a deposit with a bank; is not insured, endorsed or guaranteed by the Federal Deposit Insurance Corporation or any other government agency;

|

|

| Bar Chart and Performance Table [Heading] |

rr_BarChartAndPerformanceTableHeading |

Performance.

|

|

| Performance Narrative [Text Block] |

rr_PerformanceNarrativeTextBlock |

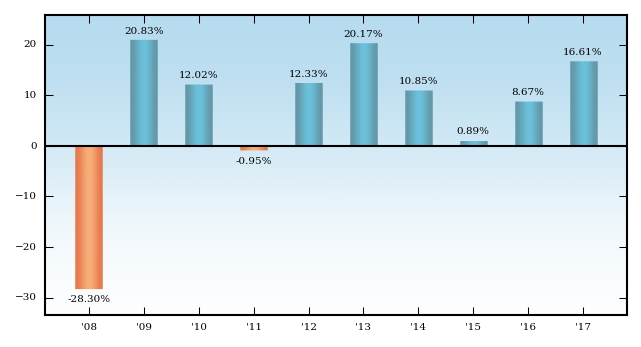

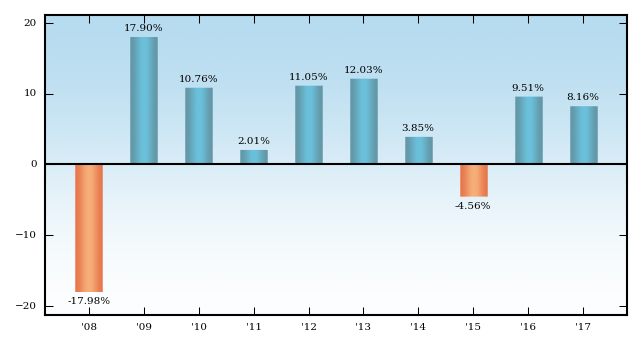

The following bar chart shows the Fund's performance for Class Z shares for each full calendar year of operations or for the last 10 calendar years, whichever is shorter. The following table shows the average annual returns of each of the Fund’s share classes and also compares the Fund’s performance with the average annual total returns of an index or other benchmark and a group of similar mutual funds. The bar chart and table demonstrate the risk of investing in the Fund by showing how returns can change from year to year.

Past performance (before and after taxes) does not mean that the Fund will achieve similar results in the future. Updated Fund performance information is available online at www.pgiminvestments.com.

Effective September 23, 2014, the Fund’s investment objective, strategies and policies were changed and QMA, Jennison Associates LLC, PGIM Fixed Income and PGIM Real Estate became the subadvisers to the Fund. The Fund’s performance prior to September 23, 2014 is not attributable to the Fund's current subadvisers or to its current investment strategies.

|

|

| Performance Information Illustrates Variability of Returns [Text] |

rr_PerformanceInformationIllustratesVariabilityOfReturns |

The following table shows the average annual returns of each of the Fund’s share classes and also compares the Fund’s performance with the average annual total returns of an index or other benchmark and a group of similar mutual funds. The bar chart and table demonstrate the risk of investing in the Fund by showing how returns can change from year to year.

|

|

| Performance Availability Website Address [Text] |

rr_PerformanceAvailabilityWebSiteAddress |

www.pgiminvestments.com

|

|

| Performance Past Does Not Indicate Future [Text] |

rr_PerformancePastDoesNotIndicateFuture |

Past performance (before and after taxes) does not mean that the Fund will achieve similar results in the future.

|

|

| Bar Chart [Heading] |

rr_BarChartHeading |

Annual Total Returns (Class Z Shares)1

|

|

| Bar Chart Closing [Text Block] |

rr_BarChartClosingTextBlock |

| Best Quarter: | Worst Quarter: | | 9.80% | 2nd Quarter 2009 | -7.83% | 4th Quarter 2008 |

|

|

| Bar Chart, Reason Selected Class Different from Immediately Preceding Period [Text] |

rr_BarChartReasonSelectedClassDifferentFromImmediatelyPrecedingPeriod |

Prior to this year, the annual returns bar chart displayed returns for the Fund’s Class A shares. The Fund now shows annual returns for Class Z shares in light of the relative growth of assets in this share class.

|

|

| Performance Table Heading |

rr_PerformanceTableHeading |

Average Annual Total Returns % (including sales charges) (as of 12-31-17)

|

|

| Performance Table Uses Highest Federal Rate |

rr_PerformanceTableUsesHighestFederalRate |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes.

|

|

| Performance Table Not Relevant to Tax Deferred |

rr_PerformanceTableNotRelevantToTaxDeferred |

Actual after-tax returns depend on an investor's tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

|

|

| Performance Table One Class of after Tax Shown [Text] |

rr_PerformanceTableOneClassOfAfterTaxShown |

After-tax returns are shown only for Class Z shares. After-tax returns for other classes will vary due to differing sales charges and expenses.

|

|

| Performance Table Narrative |

rr_PerformanceTableNarrativeTextBlock |

° After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns are shown only for Class Z shares. After-tax returns for other classes will vary due to differing sales charges and expenses.

|

|

| PRUDENTIAL INCOME BUILDER FUND | Class R |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of the lower of original purchase price or net asset value at redemption) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Maximum sales charge (load) imposed on reinvested dividends and other distributions |

rr_MaximumSalesChargeOnReinvestedDividendsAndDistributionsOverOther |

none

|

|

| Redemption fee |

rr_RedemptionFeeOverRedemption |

none

|

|

| Exchange fee |

rr_ExchangeFeeOverRedemption |

none

|

|

| Maximum account fee (accounts under $10,000) |

rr_MaximumAccountFee |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.70%

|

|

| Distribution and service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

0.75%

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

2.79%

|

[1] |

| Acquired Fund fees and expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.10%

|

|

| Total annual Fund operating expenses |

rr_ExpensesOverAssets |

4.34%

|

|

| Fee waiver and/or expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

(3.14%)

|

|

| Total annual Fund operating expenses after fee waiver and/or expense reimbursement |

rr_NetExpensesOverAssets |

1.20%

|

[2],[3] |

| 1 Year |

rr_ExpenseExampleYear01 |

$ 122

|

|

| 3 Years |

rr_ExpenseExampleYear03 |

1,029

|

|

| 5 Years |

rr_ExpenseExampleYear05 |

1,948

|

|

| 10 Years |

rr_ExpenseExampleYear10 |

4,299

|

|

| 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

122

|

|

| 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

1,029

|

|

| 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

1,948

|

|

| 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 4,299

|

|

| One Year |

rr_AverageAnnualReturnYear01 |

7.58%

|

|

| Five Years |

rr_AverageAnnualReturnYear05 |

5.11%

|

|

| Ten Years |

rr_AverageAnnualReturnYear10 |

4.26%

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

|

|

| PRUDENTIAL INCOME BUILDER FUND | Class A |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

4.50%

|

|

| Maximum deferred sales charge (load) (as a percentage of the lower of original purchase price or net asset value at redemption) |

rr_MaximumDeferredSalesChargeOverOther |

1.00%

|

|

| Maximum sales charge (load) imposed on reinvested dividends and other distributions |

rr_MaximumSalesChargeOnReinvestedDividendsAndDistributionsOverOther |

none

|

|

| Redemption fee |

rr_RedemptionFeeOverRedemption |

none

|

|

| Exchange fee |

rr_ExchangeFeeOverRedemption |

none

|

|

| Maximum account fee (accounts under $10,000) |

rr_MaximumAccountFee |

$ 15

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.70%

|

|

| Distribution and service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

0.30%

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.25%

|

[1] |

| Acquired Fund fees and expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.10%

|

|

| Total annual Fund operating expenses |

rr_ExpensesOverAssets |

1.35%

|

|

| Fee waiver and/or expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

(0.40%)

|

|

| Total annual Fund operating expenses after fee waiver and/or expense reimbursement |

rr_NetExpensesOverAssets |

0.95%

|

[2],[3] |

| 1 Year |

rr_ExpenseExampleYear01 |

$ 543

|

|

| 3 Years |

rr_ExpenseExampleYear03 |

821

|

|

| 5 Years |

rr_ExpenseExampleYear05 |

1,120

|

|

| 10 Years |

rr_ExpenseExampleYear10 |

1,968

|

|

| 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

543

|

|

| 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

821

|

|

| 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

1,120

|

|

| 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 1,968

|

|

| One Year |

rr_AverageAnnualReturnYear01 |

2.99%

|

|

| Five Years |

rr_AverageAnnualReturnYear05 |

4.40%

|

|

| Ten Years |

rr_AverageAnnualReturnYear10 |

4.03%

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

|

|

| PRUDENTIAL INCOME BUILDER FUND | Class B |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of the lower of original purchase price or net asset value at redemption) |

rr_MaximumDeferredSalesChargeOverOther |

5.00%

|

|

| Maximum sales charge (load) imposed on reinvested dividends and other distributions |

rr_MaximumSalesChargeOnReinvestedDividendsAndDistributionsOverOther |

none

|

|

| Redemption fee |

rr_RedemptionFeeOverRedemption |

none

|

|

| Exchange fee |

rr_ExchangeFeeOverRedemption |

none

|

|

| Maximum account fee (accounts under $10,000) |

rr_MaximumAccountFee |

$ 15

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.70%

|

|

| Distribution and service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

1.00%

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

1.16%

|

[1] |

| Acquired Fund fees and expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.10%

|

|

| Total annual Fund operating expenses |

rr_ExpensesOverAssets |

2.96%

|

|

| Fee waiver and/or expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

(1.26%)

|

|

| Total annual Fund operating expenses after fee waiver and/or expense reimbursement |

rr_NetExpensesOverAssets |

1.70%

|

[2],[3] |

| 1 Year |

rr_ExpenseExampleYear01 |

$ 673

|

|

| 3 Years |

rr_ExpenseExampleYear03 |

1,097

|

|

| 5 Years |

rr_ExpenseExampleYear05 |

1,547

|

|

| 10 Years |

rr_ExpenseExampleYear10 |

2,622

|

|

| 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

173

|

|

| 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

797

|

|

| 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

1,447

|

|

| 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 2,622

|

|

| One Year |

rr_AverageAnnualReturnYear01 |

2.08%

|

|

| Five Years |

rr_AverageAnnualReturnYear05 |

4.45%

|

|

| Ten Years |

rr_AverageAnnualReturnYear10 |

3.74%

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

|

|

| PRUDENTIAL INCOME BUILDER FUND | Class C |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of the lower of original purchase price or net asset value at redemption) |

rr_MaximumDeferredSalesChargeOverOther |

1.00%

|

|

| Maximum sales charge (load) imposed on reinvested dividends and other distributions |

rr_MaximumSalesChargeOnReinvestedDividendsAndDistributionsOverOther |

none

|

|

| Redemption fee |

rr_RedemptionFeeOverRedemption |

none

|

|

| Exchange fee |

rr_ExchangeFeeOverRedemption |

none

|

|

| Maximum account fee (accounts under $10,000) |

rr_MaximumAccountFee |

$ 15

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.70%

|

|

| Distribution and service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

1.00%

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.24%

|

[1] |

| Acquired Fund fees and expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.10%

|

|

| Total annual Fund operating expenses |

rr_ExpensesOverAssets |

2.04%

|

|

| Fee waiver and/or expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

(0.34%)

|

|

| Total annual Fund operating expenses after fee waiver and/or expense reimbursement |

rr_NetExpensesOverAssets |

1.70%

|

[2],[3] |

| 1 Year |

rr_ExpenseExampleYear01 |

$ 273

|

|

| 3 Years |

rr_ExpenseExampleYear03 |

607

|

|

| 5 Years |

rr_ExpenseExampleYear05 |

1,067

|

|

| 10 Years |

rr_ExpenseExampleYear10 |

2,342

|

|

| 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

173

|

|

| 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

607

|

|

| 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

1,067

|

|

| 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 2,342

|

|

| One Year |

rr_AverageAnnualReturnYear01 |

6.08%

|

|

| Five Years |

rr_AverageAnnualReturnYear05 |

4.60%

|

|

| Ten Years |

rr_AverageAnnualReturnYear10 |

3.74%

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

|

|

| PRUDENTIAL INCOME BUILDER FUND | Class Z |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of the lower of original purchase price or net asset value at redemption) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Maximum sales charge (load) imposed on reinvested dividends and other distributions |

rr_MaximumSalesChargeOnReinvestedDividendsAndDistributionsOverOther |

none

|

|

| Redemption fee |

rr_RedemptionFeeOverRedemption |

none

|

|

| Exchange fee |

rr_ExchangeFeeOverRedemption |

none

|

|

| Maximum account fee (accounts under $10,000) |

rr_MaximumAccountFee |

none

|

[4] |

| Management fees |

rr_ManagementFeesOverAssets |

0.70%

|

|

| Distribution and service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.26%

|

[1] |

| Acquired Fund fees and expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.10%

|

|

| Total annual Fund operating expenses |

rr_ExpensesOverAssets |

1.06%

|

|

| Fee waiver and/or expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

(0.36%)

|

|

| Total annual Fund operating expenses after fee waiver and/or expense reimbursement |

rr_NetExpensesOverAssets |

0.70%

|

[2],[3] |

| 1 Year |

rr_ExpenseExampleYear01 |

$ 72

|

|

| 3 Years |

rr_ExpenseExampleYear03 |

301

|

|

| 5 Years |

rr_ExpenseExampleYear05 |

550

|

|

| 10 Years |

rr_ExpenseExampleYear10 |

1,262

|

|

| 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

72

|

|

| 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

301

|

|

| 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

550

|

|

| 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 1,262

|

|

| 2008 |

rr_AnnualReturn2008 |

(17.98%)

|

[5] |

| 2009 |

rr_AnnualReturn2009 |

17.90%

|

[5] |

| 2010 |

rr_AnnualReturn2010 |

10.76%

|

[5] |

| 2011 |

rr_AnnualReturn2011 |

2.01%

|

[5] |

| 2012 |

rr_AnnualReturn2012 |

11.05%

|

[5] |

| 2013 |

rr_AnnualReturn2013 |

12.03%

|

[5] |

| 2014 |

rr_AnnualReturn2014 |

3.85%

|

[5] |

| 2015 |

rr_AnnualReturn2015 |

(4.56%)

|

[5] |

| 2016 |

rr_AnnualReturn2016 |

9.51%

|

[5] |

| 2017 |

rr_AnnualReturn2017 |

8.16%

|

[5] |

| Highest Quarterly Return, Label |

rr_HighestQuarterlyReturnLabel |

Best Quarter:

|

|

| Highest Quarterly Return, Date |

rr_BarChartHighestQuarterlyReturnDate |

Jun. 30, 2009

|

|

| Highest Quarterly Return |

rr_BarChartHighestQuarterlyReturn |

9.80%

|

|

| Lowest Quarterly Return, Label |

rr_LowestQuarterlyReturnLabel |

Worst Quarter:

|

|

| Lowest Quarterly Return, Date |

rr_BarChartLowestQuarterlyReturnDate |

Dec. 31, 2008

|

|

| Lowest Quarterly Return |

rr_BarChartLowestQuarterlyReturn |

(7.83%)

|

|

| One Year |

rr_AverageAnnualReturnYear01 |

8.16%

|

|

| Five Years |

rr_AverageAnnualReturnYear05 |

5.63%

|

|

| Ten Years |

rr_AverageAnnualReturnYear10 |

4.78%

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

|

|

| PRUDENTIAL INCOME BUILDER FUND | Class Q |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as a percentage of the lower of original purchase price or net asset value at redemption) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Maximum sales charge (load) imposed on reinvested dividends and other distributions |

rr_MaximumSalesChargeOnReinvestedDividendsAndDistributionsOverOther |

none

|

|

| Redemption fee |

rr_RedemptionFeeOverRedemption |

none

|

|

| Exchange fee |

rr_ExchangeFeeOverRedemption |

none

|

|

| Maximum account fee (accounts under $10,000) |

rr_MaximumAccountFee |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.70%

|

|

| Distribution and service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

1.18%

|

[1] |

| Acquired Fund fees and expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.10%

|

|

| Total annual Fund operating expenses |

rr_ExpensesOverAssets |

1.98%

|

|

| Fee waiver and/or expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

(1.28%)

|

|

| Total annual Fund operating expenses after fee waiver and/or expense reimbursement |

rr_NetExpensesOverAssets |

0.70%

|

[2],[3] |

| 1 Year |

rr_ExpenseExampleYear01 |

$ 72

|

|

| 3 Years |

rr_ExpenseExampleYear03 |

497

|

|

| 5 Years |

rr_ExpenseExampleYear05 |

949

|

|

| 10 Years |

rr_ExpenseExampleYear10 |

2,203

|

|

| 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

72

|

|

| 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

497

|

|

| 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

949

|

|

| 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 2,203

|

|

| One Year |

rr_AverageAnnualReturnYear01 |

8.21%

|

|

| Five Years |

rr_AverageAnnualReturnYear05 |

|

|

| Ten Years |

rr_AverageAnnualReturnYear10 |

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

8.17%

|

|

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Dec. 30, 2016

|

|

| PRUDENTIAL INCOME BUILDER FUND | Return After Taxes on Distributions | Class Z |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| One Year |

rr_AverageAnnualReturnYear01 |

6.49%

|

|

| Five Years |

rr_AverageAnnualReturnYear05 |

3.32%

|

|

| Ten Years |

rr_AverageAnnualReturnYear10 |

3.19%

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

|

|

| PRUDENTIAL INCOME BUILDER FUND | Return After Taxes on Distributions and Sale of Fund Shares | Class Z |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| One Year |

rr_AverageAnnualReturnYear01 |

4.81%

|

|

| Five Years |

rr_AverageAnnualReturnYear05 |

3.75%

|

|

| Ten Years |

rr_AverageAnnualReturnYear10 |

3.30%

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

|

|

| PRUDENTIAL INCOME BUILDER FUND | S&P 500 Index (reflects no deduction for fees, expenses or taxes) |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| One Year |

rr_AverageAnnualReturnYear01 |

21.82%

|

|

| Five Years |

rr_AverageAnnualReturnYear05 |

15.78%

|

|

| Ten Years |

rr_AverageAnnualReturnYear10 |

8.49%

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

|

|

| PRUDENTIAL INCOME BUILDER FUND | Bloomberg Barclays US Aggregate Bond Index (reflects no deduction for fees, expenses or taxes) |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| One Year |

rr_AverageAnnualReturnYear01 |

3.54%

|

|

| Five Years |

rr_AverageAnnualReturnYear05 |

2.10%

|

|

| Ten Years |

rr_AverageAnnualReturnYear10 |

4.01%

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

|

|

| PRUDENTIAL INCOME BUILDER FUND | Lipper Flexible Portfolio Funds Average (reflects no deduction for sales charges or taxes) |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| One Year |

rr_AverageAnnualReturnYear01 |

12.70%

|

|

| Five Years |

rr_AverageAnnualReturnYear05 |

6.14%

|

|

| Ten Years |

rr_AverageAnnualReturnYear10 |

4.43%

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

|

|

|

|