UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number: | 811-08915 | |

| Exact name of registrant as specified in charter: | Prudential Investment Portfolios 16 | |

| Address of principal executive offices: | 655 Broad Street, 17th Floor | |

| Newark, New Jersey 07102 | ||

| Name and address of agent for service: | Deborah A. Docs | |

| 655 Broad Street, 17th Floor | ||

| Newark, New Jersey 07102 | ||

| Registrant’s telephone number, including area code: | 800-225-1852 | |

| Date of fiscal year end: | 10/31/2016 | |

| Date of reporting period: | 10/31/2016 | |

Item 1 – Reports to Stockholders

PRUDENTIAL INVESTMENTS, A PGIM BUSINESS | MUTUAL FUNDS

Prudential Income Builder Fund

| ANNUAL REPORT | OCTOBER 31, 2016 |

| To enroll in e-delivery, go to prudentialfunds.com/edelivery

|

|

| Objective: Income and long-term capital growth |

Highlights

PRUDENTIAL INCOME BUILDER FUND

| • | The Prudential Income Builder Fund’s allocation to interest-rate-sensitive assets boosted relative performance. |

| • | Income-oriented securities such as preferred stocks, global real estate investment trusts (REITs), convertible bonds, and dividend stocks generated particularly strong returns, contributing to performance. |

| • | Tactical allocations including an underweight in energy-sensitive segments earlier in the period and overweights in global REITs contributed to performance, whereas an underweight in convertible bonds detracted. |

| • | Strategically, exposure to MLPs (master limited partnerships) challenged portfolio performance as MLPs struggled mightily in the late months of 2015 and moving into 2016, and MLPs were the only asset class exposure to post negative returns on an absolute basis. |

| • | The biggest contributors in terms of subadvisor allocations came from Emerging Market Debt, Real Estate Income, and MLP, which significantly outperformed their benchmarks, while the Equity Income allocation trailed its benchmark by a large margin and was a headwind. |

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

Mutual funds are distributed by Prudential Investment Management Services LLC, a Prudential Financial company. Jennison Associates LLC and PGIM, Inc. (PGIM) are registered investment advisers and Prudential Financial companies. QMA is the primary business name of Quantitative Management Associates LLC, a wholly owned subsidiary of PGIM. PGIM Fixed Income and PGIM Real Estate are units of PGIM. © 2016 Prudential Financial, Inc. and its related entities. Jennison Associates, Jennison, the Prudential logo, and the Rock symbol are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

| 2 | Visit our website at prudentialfunds.com |

Letter from the President

Dear Shareholder:

We hope you find the annual report for the Prudential Income Builder Fund informative and useful. The report covers performance for the 12-month period that ended October 31, 2016.

During the reporting period, the US economy experienced modest growth. Labor markets were healthy, and consumer confidence rose. The housing market brightened somewhat, as momentum continued for the new home market. The Federal Reserve kept interest rates unchanged at its September meeting, but pointed to the strong possibility of a rate hike in December. Internationally, concerns over Brexit—the term used to represent Britain’s decision to leave the European Union—remained in the spotlight.

Equity markets in the US were firmly in positive territory at the end of the reporting period, as US stocks posted strong gains. European stocks struggled earlier, but found some traction in the third quarter. Asian markets also advanced, and emerging markets rose sharply.

US fixed income markets experienced overall gains. High yield bonds posted very strong results. Corporate bonds and Treasuries also performed well. Accommodative monetary policy by central banks helped lift global bond markets.

Given the uncertainty in today’s investment environment, we believe that active professional portfolio management offers a potential advantage. Active managers often have the knowledge and flexibility to find the best investment opportunities in the most challenging markets.

Even so, it’s best if investment decisions are based on your long-term goals rather than on short-term market and economic developments. We also encourage you to work with an experienced financial advisor who can help you set goals, determine your tolerance for risk, build a diversified plan that’s right for you, and make adjustments when necessary.

By having Prudential Investments help you address your goals, you gain the advantage of asset managers that also manage money for many major corporations and pension funds around the world. That means you benefit from the same expertise, innovation, and attention to risk demanded by today’s most sophisticated investors.

Thank you for choosing our family of funds.

Sincerely,

Stuart S. Parker, President

Prudential Income Builder Fund

December 15, 2016

| Prudential Income Builder Fund | 3 |

Your Fund’s Performance (unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at www.prudentialfunds.com or by calling (800) 225-1852.

| Cumulative Total Returns (Without Sales Charges) as of 10/31/16 | ||||||||||||

| One Year (%) | Five Years (%) | Ten Years (%) | ||||||||||

| Class A | 4.76 | 31.69 | 54.99 | |||||||||

| Class B | 3.97 | 26.81 | 43.75 | |||||||||

| Class C | 3.86 | 26.68 | 43.75 | |||||||||

| Class R | 4.40 | 29.88 | 51.15 | |||||||||

| Class Z | 4.98 | 33.24 | 58.96 | |||||||||

| S&P 500 Index | 4.49 | 88.79 | 91.14 | |||||||||

| Bloomberg Barclays US Aggregate Bond Index | 4.37 | 15.37 | 57.39 | |||||||||

| Lipper Flexible Portfolio Funds Average | 2.59 | 29.11 | 49.22 | |||||||||

| Average Annual Total Returns (With Sales Charges) as of 9/30/16 | ||||||||||||

| One Year (%) | Five Years (%) | Ten Years (%) | ||||||||||

| Class A | 5.99 | 5.95 | 4.31 | |||||||||

| Class B | 5.24 | 6.00 | 4.02 | |||||||||

| Class C | 9.13 | 6.13 | 4.01 | |||||||||

| Class R | 10.72 | 6.66 | 4.54 | |||||||||

| Class Z | 11.30 | 7.21 | 5.07 | |||||||||

| S&P 500 Index | 15.41 | 16.36 | 7.23 | |||||||||

| Bloomberg Barclays US Aggregate Bond Index | 5.19 | 3.08 | 4.79 | |||||||||

| Lipper Flexible Portfolio Funds Average | 7.97 | 6.68 | 4.42 | |||||||||

| Average Annual Total Returns (With Sales Charges) as of 10/31/16 | ||||||||||||

| One Year (%) | Five Years (%) | Ten Years (%) | ||||||||||

| Class A | 0.05 | 4.69 | 4.00 | |||||||||

| Class B | –1.01 | 4.71 | 3.70 | |||||||||

| Class C | 2.86 | 4.84 | 3.70 | |||||||||

| Class R | 4.40 | 5.37 | 4.22 | |||||||||

| Class Z | 4.98 | 5.91 | 4.74 | |||||||||

| 4 | Visit our website at prudentialfunds.com |

| Average Annual Total Returns (Without Sales Charges) as of 10/31/16 | ||||||

| One Year (%) | Five Years (%) | Ten Years (%) | ||||

| Class A | 4.76 | 5.66 | 4.48 | |||

| Class B | 3.97 | 4.87 | 3.70 | |||

| Class C | 3.86 | 4.84 | 3.70 | |||

| Class R | 4.40 | 5.37 | 4.22 | |||

| Class Z | 4.98 | 5.91 | 4.74 | |||

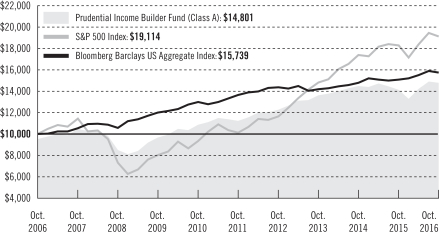

Growth of a $10,000 Investment

The graph compares a $10,000 investment in the Prudential Income Builder Fund (Class A shares) with a similar investment in the Standard & Poor’s 500 Composite Stock Price Index (S&P 500 Index) and the Bloomberg Barclays US Aggregate Index by portraying the initial account values at the beginning of the 10-year period for Class A shares (October 31, 2006) and the account values at the end of the current fiscal year (October 31, 2016) as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) the maximum applicable front-end sales charge was deducted from the initial $10,000 investment in Class A shares; (b) all recurring fees (including management fees) were deducted; and (c) all dividends and distributions were reinvested. The line graph provides information for Class A shares only. As indicated in the tables provided earlier, performance for Class B, Class C, Class R, and Class Z shares will vary due to the differing charges and expenses applicable to each share class (as indicated in the following paragraphs). Without waiver of fees and/or expense reimbursement, if any, the Fund’s returns would have been lower.

| Prudential Income Builder Fund | 5 |

Your Fund’s Performance (continued)

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

Source: Prudential Investments LLC and Lipper Inc.

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. The average annual total returns take into account applicable sales charges, which are described for each share class in the table below.

| Class A | Class B* | Class C | Class R | Class Z | ||||||

| Maximum initial sales charge | 4.50% of the public offering price | None | None | None | None | |||||

| Contingent deferred sales charge (CDSC) (as a percentage of the lower of original purchase price or net asset value at redemption) | 1% on sales of $1 million or more made within 12 months of purchase | 5% (Year 1) 4% (Year 2) 3% (Year 3) 2% (Year 4) 1% (Years 5/6) 0% (Year 7) | 1% on sales made within 12 months of purchase | None | None | |||||

| Annual distribution and service (12b-1) fees (shown as a percentage of average daily net assets) | .30% (.25% currently) |

1% | 1% | .75% (.50% currently) | None |

*Class B shares are closed to all purchase activity and no additional Class B shares may be purchased or acquired by except by exchange from Class B shares of another Fund or through dividend or capital gains reinvestment.

Benchmark Definitions

S&P 500 Index—The Standard & Poor’s 500 Composite Stock Price Index (S&P 500 Index) is an unmanaged index of over 500 stocks of large US public companies. It gives a broad look at how US investment-grade bonds have performed.

Bloomberg Barclays US Aggregate Bond Index—The Bloomberg Barclays US Aggregate Bond Index is an unmanaged index of investment-grade securities issued by the US Government and its agencies and by corporations with greater than one year remaining to maturity. It gives a broad look at how US investment-grade bonds have performed.

Lipper Flexible Portfolio Funds Average—The Lipper Flexible Portfolio Funds Average (Lipper Average) is based on the average return of all funds in the Lipper Flexible Portfolio Funds category for the periods noted.

| 6 | Visit our website at prudentialfunds.com |

The funds in the Lipper Average allocate their investments to both domestic and foreign securities across traditional asset classes with a focus on total return.

Investors cannot invest directly in an index or average. The returns for the Indexes would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes. Returns for the Lipper Average reflect the deduction of operating expenses, but not sales charges or taxes.

| Five Largest Holdings expressed as

a percentage of net assets as of 10/31/16 (%) |

||||

| PowerShares Preferred Portfolio ETF, ETFs |

5.8 | |||

| Prudential Total Return Bond Fund (Class Q Stock), Affiliated Mutual Funds |

5.7 | |||

| SPDR Bloomberg Barclays Convertible Securities ETF, ETFs |

3.9 | |||

| Prudential Short Duration High Yield Income Fund (Class Q Stock), Affiliated Mutual Funds |

3.0 | |||

| Cisco Systems, Inc., Communications Equipment |

0.8 | |||

Holdings reflect only long-term investments and are subject to change.

| Five Largest Industries expressed as

a percentage of net assets as of 10/31/16 (%) |

||||

| Oil, Gas & Consumable Fuels |

13.8 | |||

| Equity Real Estate Investment Trusts (REITs) |

13.2 | |||

| Foreign Government Bonds |

11.2 | |||

| ETFs |

9.7 | |||

| Affiliated Mutual Funds |

8.7 | |||

Industry weightings reflect only long-term investments and are subject to change.

| Prudential Income Builder Fund | 7 |

Strategy and Performance Overview

How did the Fund perform?

The Prudential Income Builder Fund’s Class A shares gained 4.76% for the 12-month reporting period ended October 31, 2016, outperforming the 4.37% return of the Bloomberg Barclays US Aggregate Bond Index, the 4.49% of the S&P 500 Index, and the 2.59% return of the Lipper Flexible Portfolio Funds Average.

What were market conditions?

| • | When the reporting period began, the equity markets were dominated by anxiety about a potential of a Federal Reserve (Fed) rate hike, the health of the Chinese economy, and China’s unexpected devaluation of its currency, the yuan. Fixed income markets, meanwhile, reflected investor uncertainty about weaker global economic growth, the Fed’s rate-hiking schedule and steep declines in energy and commodity prices. In mid-December, the Fed raised its federal funds rate target by 0.25% to between 0.25% and 0.50% and indicated that it would likely raise short-term interest rates four times during 2016. |

| • | Early in the first quarter of 2016, risk aversion increased amid deteriorating economic data in developed and emerging markets, a further drop in commodity prices, and heightened volatility in global financial markets. By March, investor sentiment had improved, commodity prices had regained some ground, and the number of negative economic surprises had diminished. Exiting their March policy meeting, the Fed revised its expected trajectory of rate hikes to reflect only two increase by the end of 2016. With a shallower path of rate hikes, there was a renewed interest for high yielding, interest-rate sensitive assets. |

| • | During the second quarter, fears about the global economy receded in the face of considerable stimulus by China’s policymakers, a strong rebound in commodity prices, and an improving growth outlook for developed economies. In late June, the UK’s surprise vote to leave the European Union, known as “Brexit,” briefly increased market volatility, although the macroeconomic fallout appeared manageable, if not limited. Ongoing stimulus by global central banks drove down interest rates around the world. |

| • | In the third quarter and through the end of the period, global central bank monetary policy remained accommodative, providing support to the world’s bond markets. Notably, the Fed had kept its short-term interest rate target unchanged since their first hike in December 2015. Credit spreads (differences in yields between corporate bonds and US Treasury securities of comparable maturity) continued to narrow during the quarter. US economic data released late October revealed strong-than-expected growth estimates for the third quarter. Despite this, equity markets closed lower and bond markets fluctuated throughout the month due in part to expectations of a Fed rate hike in December 2016 and uncertainty surrounding the US election. |

What worked?

| • | Strategic asset allocation has been a key driver of positive relative returns as the market rewarded interest-rate-sensitive assets given the dearth of yield and continued supportive global monetary policy, with income-oriented assets such as preferred stocks, global REITs, convertible bonds, and income-oriented equities posting strong returns. |

| 8 | Visit our website at prudentialfunds.com |

| • | Similarly, over the second half of the reporting period, the stabilization of energy prices was a tailwind for several income-oriented asset classes with high yield bonds and emerging market debt realizing double-digit returns over the 12-month period. |

| • | Tactical allocations also provided positive contributions, largely driven by an underweight in energy-sensitive segments of the Fund in late 2015 and early 2016, as oil prices were finding their bottom, along with tactical overweight allocations to global REITs. |

| • | The Fund’s subadviser allocations added value for the period as the managers, in aggregate, posted positive results relative to the benchmarks of portfolios they manage. |

| • | The Emerging Market Debt, Real Estate Income, and MLP sleeves were the largest contributors, beating their respective benchmarks by sizeable margins. |

What didn’t work?

| • | Strategically, exposure to MLPs (master limited partnerships) challenged portfolio performance as MLPs struggled mightily in the late months of 2015 and moving into 2016, and MLPs were the only asset class exposure to post negative returns on an absolute basis. |

| • | Tactically, an underweight in convertible bonds detracted from performance as convertible bonds experienced large gains, especially in the third quarter of 2016. |

| • | Specific to the underlying allocations, the Equity Income sleeve trailed its benchmark by a large margin, providing a headwind for performance. |

| • | Hybrid security ETFs also lagged their respective benchmarks, negatively contributing to Fund performance. |

Did the Fund use derivatives and how did they affect performance?

| • | In the high yield sleeve of the Fund, derivatives were used and were instrumental in attaining specific exposures targeted to gain from anticipated market developments. The high yield sleeve also used US Treasury futures to hedge interest rate risk relative to the Index. The derivatives helped to immunize any impact from interest-rate fluctuations. |

| • | In the emerging markets sleeve, currency positioning in the Fund was partially facilitated by the use of currency forward contracts. The Fund’s currency positioning detracted from relative performance. On various occasions throughout the reporting period, the Fund used the Emerging Markets CDX Index to obtain broad market exposure, which added to the Fund’s performance. The Markit CDX Emerging Markets Index is composed of fifteen (15) sovereign reference entities that trade in the credit default swap (CDS) market. A credit default swap is similar to buying or selling insurance contracts on a corporation’s debt. |

Current outlook

| • | The Fund seeks to provide income and long-term capital growth by investing in a dynamically managed diversified portfolio of income-oriented securities. The Fund adjusts its allocations as market conditions change in order to help provide a balance of yield, return, and risk. |

| Prudential Income Builder Fund | 9 |

Fees and Expenses (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested on May 1, 2016, at the beginning of the period, and held through the six-month period ended October 31, 2016. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of Prudential Investments Funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses

| 10 | Visit our website at prudentialfunds.com |

paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Prudential

Income Builder Fund |

Beginning

Account Value May 1, 2016 |

Ending

Account Value October 31, 2016 |

Annualized Expense Ratio Based on the Six-Month Period |

Expenses Paid During the Six-Month Period* |

||||||||||||||

| Class A | Actual | $ | 1,000.00 | $ | 1,041.00 | 0.95 | % | $ | 4.87 | |||||||||

| Hypothetical | $ | 1,000.00 | $ | 1,020.36 | 0.95 | % | $ | 4.82 | ||||||||||

| Class B | Actual | $ | 1,000.00 | $ | 1,036.80 | 1.70 | % | $ | 8.70 | |||||||||

| Hypothetical | $ | 1,000.00 | $ | 1,016.59 | 1.70 | % | $ | 8.62 | ||||||||||

| Class C | Actual | $ | 1,000.00 | $ | 1,035.70 | 1.70 | % | $ | 8.70 | |||||||||

| Hypothetical | $ | 1,000.00 | $ | 1,016.59 | 1.70 | % | $ | 8.62 | ||||||||||

| Class R | Actual | $ | 1,000.00 | $ | 1,038.70 | 1.20 | % | $ | 6.15 | |||||||||

| Hypothetical | $ | 1,000.00 | $ | 1,019.10 | 1.20 | % | $ | 6.09 | ||||||||||

| Class Z | Actual | $ | 1,000.00 | $ | 1,042.00 | 0.70 | % | $ | 3.59 | |||||||||

| Hypothetical | $ | 1,000.00 | $ | 1,021.62 | 0.70 | % | $ | 3.56 | ||||||||||

*Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended October 31, 2016, and divided by the 366 days in the Fund’s fiscal year ended October 31, 2016 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

| Prudential Income Builder Fund | 11 |

Fees and Expenses (continued)

The Fund’s annual expense ratios for the 12-month period ended October 31, 2016, are as follows:

| Class | Gross Operating Expenses (%) | Net Operating Expenses (%) | ||

| A | 1.42 | 0.95 | ||

| B | 2.12 | 1.70 | ||

| C | 2.12 | 1.70 | ||

| R | 1.87 | 1.20 | ||

| Z | 1.12 | 0.70 |

Net operating expenses shown above reflect fee waivers and/or expense reimbursements. These figures include a weighted average of the net operating expenses of the underlying Funds in which the Fund invests. Such expenses, annualized, amounted to 0.12% for each share class. Additional information on Fund expenses and any fee waivers and/or expense reimbursements can be found in the “Financial Highlights” tables in this report and in the Notes to the Financial Statements in this report.

| 12 | Visit our website at prudentialfunds.com |

Portfolio of Investments

as of October 31, 2016

| Description | Shares | Value (Note 1) | ||||||||||||||

| LONG-TERM INVESTMENTS 95.2% |

||||||||||||||||

| AFFILIATED MUTUAL FUNDS 8.7% |

||||||||||||||||

| Prudential Short Duration High Yield Income Fund (Class Q Stock) |

1,179,455 | $ | 10,744,837 | |||||||||||||

| Prudential Total Return Bond Fund (Class Q Stock) |

1,400,567 | 20,504,299 | ||||||||||||||

|

|

|

|||||||||||||||

| TOTAL AFFILIATED MUTUAL FUNDS |

31,249,136 | |||||||||||||||

|

|

|

|||||||||||||||

| COMMON STOCKS 38.1% |

||||||||||||||||

| Aerospace & Defense 0.4% |

||||||||||||||||

| Lockheed Martin Corp. |

2,972 | 732,242 | ||||||||||||||

| Safran SA (France) |

9,413 | 647,724 | ||||||||||||||

|

|

|

|||||||||||||||

| 1,379,966 | ||||||||||||||||

| Air Freight & Logistics 0.2% |

||||||||||||||||

| bpost SA (Belgium) |

27,576 | 733,649 | ||||||||||||||

| Banks 1.0% |

||||||||||||||||

| Bank of America Corp. |

58,397 | 963,551 | ||||||||||||||

| BB&T Corp. |

25,297 | 991,642 | ||||||||||||||

| JPMorgan Chase & Co. |

26,217 | 1,815,789 | ||||||||||||||

|

|

|

|||||||||||||||

| 3,770,982 | ||||||||||||||||

| Beverages 0.2% |

||||||||||||||||

| Molson Coors Brewing Co. (Class B Stock) |

6,638 | 689,091 | ||||||||||||||

| Biotechnology 0.1% |

||||||||||||||||

| AbbVie, Inc. |

7,631 | 425,657 | ||||||||||||||

| Capital Markets 0.2% |

||||||||||||||||

| Goldman Sachs Group, Inc. (The) |

4,548 | 810,635 | ||||||||||||||

| Chemicals 0.1% |

||||||||||||||||

| Air Products & Chemicals, Inc. |

1,666 | 222,278 | ||||||||||||||

| Communications Equipment 0.8% |

||||||||||||||||

| Cisco Systems, Inc. |

93,388 | 2,865,144 | ||||||||||||||

| Containers & Packaging 0.2% |

||||||||||||||||

| Bemis Co., Inc. |

15,455 | 752,968 | ||||||||||||||

| Diversified Telecommunication Services 0.5% |

||||||||||||||||

| AT&T, Inc. |

9,773 | 359,549 | ||||||||||||||

| Frontier Communications Corp. |

359,104 | 1,443,598 | ||||||||||||||

| HKBN Ltd. (Hong Kong), 144A(b) |

61,931 | 73,027 | ||||||||||||||

|

|

|

|||||||||||||||

| 1,876,174 | ||||||||||||||||

See Notes to Financial Statements.

| Prudential Income Builder Fund | 13 |

Portfolio of Investments (continued)

as of October 31, 2016

| Description | Shares | Value (Note 1) | ||||||||||||||

| COMMON STOCKS (Continued) |

||||||||||||||||

| Electric Utilities 1.0% |

||||||||||||||||

| Alupar Investimento SA (Brazil), UTS |

13,167 | $ | 75,900 | |||||||||||||

| Brookfield Infrastructure Partners LP, MLP (Canada)(c) |

42,925 | 1,452,153 | ||||||||||||||

| Exelon Corp. |

28,541 | 972,392 | ||||||||||||||

| PG&E Corp. |

16,262 | 1,010,195 | ||||||||||||||

|

|

|

|||||||||||||||

| 3,510,640 | ||||||||||||||||

| Energy Equipment & Services 0.4% |

||||||||||||||||

| Schlumberger Ltd. |

9,762 | 763,681 | ||||||||||||||

| USA Compression Partners LP, MLP |

41,663 | 794,930 | ||||||||||||||

|

|

|

|||||||||||||||

| 1,558,611 | ||||||||||||||||

| Equity Real Estate Investment Trusts (REITs) 10.5% |

||||||||||||||||

| Agellan Commercial Real Estate Investment Trust (Canada) |

45,960 | 365,610 | ||||||||||||||

| alstria office REIT-AG (Germany)(d) |

76 | 980 | ||||||||||||||

| Ascendas Real Estate Investment Trust (Singapore) |

293,000 | 499,315 | ||||||||||||||

| Cache Logistics Trust (Singapore) |

3,140,263 | 1,875,005 | ||||||||||||||

| Care Capital Properties, Inc. |

77,620 | 2,062,364 | ||||||||||||||

| Chesapeake Lodging Trust |

86,105 | 1,869,340 | ||||||||||||||

| Community Healthcare Trust, Inc. |

106,616 | 2,386,066 | ||||||||||||||

| Crown Castle International Corp. |

8,067 | 734,016 | ||||||||||||||

| CyrusOne, Inc. |

34,920 | 1,557,781 | ||||||||||||||

| DiamondRock Hospitality Co. |

65,000 | 594,750 | ||||||||||||||

| Digital Realty Trust, Inc.(c) |

6,391 | 597,111 | ||||||||||||||

| Empiric Student Property PLC (United Kingdom) |

503,281 | 682,580 | ||||||||||||||

| Eurocommercial Properties NV (Netherlands), CVA |

17,154 | 729,821 | ||||||||||||||

| First Potomac Realty Trust |

106,540 | 950,337 | ||||||||||||||

| Four Corners Property Trust, Inc. |

76,965 | 1,545,457 | ||||||||||||||

| Frasers Logistics & Industrial Trust (Singapore)(d) |

2,925,500 | 2,028,496 | ||||||||||||||

| Irish Residential Properties REIT PLC (Ireland) |

578,983 | 746,611 | ||||||||||||||

| Kenedix Retail REIT Corp. (Japan) |

176 | 424,818 | ||||||||||||||

| Keppel REIT (Singapore) |

1,926,800 | 1,511,244 | ||||||||||||||

| Lexington Realty Trust |

53,994 | 547,499 | ||||||||||||||

| Mapletree Commercial Trust (Singapore) |

1,333,821 | 1,466,105 | ||||||||||||||

| MedEquities Realty Trust, Inc. |

192,200 | 2,227,598 | ||||||||||||||

| MGM Growth Properties LLC (Class A Stock)(c) |

73,314 | 1,929,625 | ||||||||||||||

| New York REIT, Inc. |

78,033 | 735,071 | ||||||||||||||

| NorthStar Realty Finance Corp. |

95,220 | 1,382,594 | ||||||||||||||

| Omega Healthcare Investors, Inc. |

27,039 | 860,651 | ||||||||||||||

| Physicians Realty Trust |

38,957 | 770,180 | ||||||||||||||

| Prologis Property Mexico SA de CV (Mexico) |

449,608 | 756,443 | ||||||||||||||

| QTS Realty Trust, Inc. (Class A Stock) |

14,031 | 644,865 | ||||||||||||||

| Sabra Health Care REIT, Inc. |

39,914 | 929,996 | ||||||||||||||

See Notes to Financial Statements.

| 14 |

| Description | Shares | Value (Note 1) | ||||||||||||||

| COMMON STOCKS (Continued) |

||||||||||||||||

| Equity Real Estate Investment Trusts (REITs) (cont’d.) |

||||||||||||||||

| Senior Housing Properties Trust |

29,922 | $ | 636,441 | |||||||||||||

| Starhill Global REIT (Singapore) |

893,000 | 523,061 | ||||||||||||||

| Suntec Real Estate Investment Trust (Singapore) |

1,243,959 | 1,502,456 | ||||||||||||||

| Ventas, Inc. |

4,021 | 272,423 | ||||||||||||||

| Washington Prime Group, Inc. |

116,175 | 1,218,676 | ||||||||||||||

| Wereldhave NV (Netherlands) |

9,770 | 437,314 | ||||||||||||||

|

|

|

|||||||||||||||

| 38,002,700 | ||||||||||||||||

| Food Products 1.4% |

||||||||||||||||

| ConAgra Foods, Inc. |

24,340 | 1,172,701 | ||||||||||||||

| J.M. Smucker Co. (The) |

9,703 | 1,274,101 | ||||||||||||||

| Kraft Heinz Co. (The) |

30,396 | 2,703,724 | ||||||||||||||

|

|

|

|||||||||||||||

| 5,150,526 | ||||||||||||||||

| Gas Utilities 0.1% |

||||||||||||||||

| Infraestructura Energetica Nova SAB de CV (Mexico), 144A(b) |

64,477 | 284,844 | ||||||||||||||

| Hotels, Restaurants & Leisure 0.7% |

||||||||||||||||

| Dunkin’ Brands Group, Inc. |

14,444 | 698,512 | ||||||||||||||

| McDonald’s Corp. |

16,126 | 1,815,304 | ||||||||||||||

|

|

|

|||||||||||||||

| 2,513,816 | ||||||||||||||||

| Household Products 0.3% |

||||||||||||||||

| Procter & Gamble Co. (The) |

10,839 | 940,825 | ||||||||||||||

| Independent Power & Renewable Electricity Producers 0.2% |

||||||||||||||||

| Atlantica Yield PLC (Spain)(c) |

44,861 | 806,601 | ||||||||||||||

| Industrial Conglomerates 0.4% |

||||||||||||||||

| General Electric Co. |

51,561 | 1,500,425 | ||||||||||||||

| IT Services 0.7% |

||||||||||||||||

| Computer Sciences Corp. |

40,008 | 2,178,435 | ||||||||||||||

| Leidos Holdings, Inc. |

5,817 | 241,813 | ||||||||||||||

|

|

|

|||||||||||||||

| 2,420,248 | ||||||||||||||||

| Life Sciences Tools & Services 0.2% |

||||||||||||||||

| Thermo Fisher Scientific, Inc. |

5,733 | 842,923 | ||||||||||||||

| Media 0.3% |

||||||||||||||||

| Time Warner, Inc. |

12,933 | 1,150,908 | ||||||||||||||

See Notes to Financial Statements.

| Prudential Income Builder Fund | 15 |

Portfolio of Investments (continued)

as of October 31, 2016

| Description | Shares | Value (Note 1) | ||||||||||||||

| COMMON STOCKS (Continued) |

||||||||||||||||

| Mortgage Real Estate Investment Trusts (REITs) 0.6% |

||||||||||||||||

| MFA Financial, Inc. |

111,474 | $ | 814,875 | |||||||||||||

| Starwood Property Trust, Inc. |

52,290 | 1,162,930 | ||||||||||||||

|

|

|

|||||||||||||||

| 1,977,805 | ||||||||||||||||

| Multi-Utilities 0.1% |

||||||||||||||||

| Sempra Energy |

3,550 | 380,205 | ||||||||||||||

| Oil, Gas & Consumable Fuels 13.2% |

||||||||||||||||

| Antero Midstream Partners LP, MLP |

34,118 | 994,199 | ||||||||||||||

| Boardwalk Pipeline Partners LP, MLP |

85,188 | 1,466,086 | ||||||||||||||

| Buckeye Partners LP, MLP |

23,883 | 1,541,409 | ||||||||||||||

| Cheniere Energy Partners LP Holdings LLC |

70,588 | 1,407,525 | ||||||||||||||

| Cheniere Energy Partners LP, MLP |

63,188 | 1,674,482 | ||||||||||||||

| Enable Midstream Partners LP, MLP |

16,017 | 235,770 | ||||||||||||||

| Enbridge Energy Partners LP, MLP |

63,993 | 1,577,427 | ||||||||||||||

| Enbridge, Inc. (Canada) |

23,591 | 1,018,424 | ||||||||||||||

| Energy Transfer Equity LP, MLP |

46,084 | 688,034 | ||||||||||||||

| Energy Transfer Partners LP, MLP |

56,801 | 1,986,899 | ||||||||||||||

| EnLink Midstream Partners LP, MLP |

29,284 | 485,822 | ||||||||||||||

| Enterprise Products Partners LP, MLP |

67,840 | 1,712,282 | ||||||||||||||

| EQT GP Holdings LP, MLP |

15,433 | 360,515 | ||||||||||||||

| EQT Midstream Partners LP, MLP |

17,968 | 1,345,264 | ||||||||||||||

| Euronav NV (Belgium) |

17,658 | 138,615 | ||||||||||||||

| Kinder Morgan, Inc. |

80,312 | 1,640,774 | ||||||||||||||

| MPLX LP, MLP |

47,416 | 1,613,092 | ||||||||||||||

| Noble Midstream Partners LP, MLP(d) |

32,273 | 968,190 | ||||||||||||||

| NuStar Energy LP, MLP |

24,028 | 1,133,881 | ||||||||||||||

| Occidental Petroleum Corp. |

21,554 | 1,571,502 | ||||||||||||||

| ONEOK Partners LP, MLP |

42,557 | 1,691,215 | ||||||||||||||

| ONEOK, Inc. |

21,249 | 1,029,089 | ||||||||||||||

| Pembina Pipeline Corp. (Canada) |

26,866 | 826,398 | ||||||||||||||

| Phillips 66 Partners LP, MLP |

3,791 | 167,562 | ||||||||||||||

| Plains All American Pipeline LP, MLP |

63,133 | 1,916,718 | ||||||||||||||

| Plains GP Holdings LP, MLP (Class A Stock) |

51,643 | 648,636 | ||||||||||||||

| Rice Midstream Partners LP, MLP |

69,843 | 1,513,498 | ||||||||||||||

| Royal Dutch Shell PLC (Class A Stock) (Netherlands), ADR |

55,427 | 2,760,819 | ||||||||||||||

| SemGroup Corp. (Class A Stock) |

48,415 | 1,561,384 | ||||||||||||||

| Suncor Energy, Inc. (Canada) |

20,123 | 604,092 | ||||||||||||||

| Sunoco Logistics Partners LP, MLP |

58,679 | 1,504,530 | ||||||||||||||

| Tallgrass Energy GP LP, MLP |

20,695 | 486,953 | ||||||||||||||

| Tallgrass Energy Partners LP, MLP |

38,315 | 1,732,987 | ||||||||||||||

| Targa Resources Corp. |

56,104 | 2,462,966 | ||||||||||||||

See Notes to Financial Statements.

| 16 |

| Description | Shares | Value (Note 1) | ||||||||||||||

| COMMON STOCKS (Continued) |

||||||||||||||||

| Oil, Gas & Consumable Fuels (cont’d.) |

||||||||||||||||

| TC Pipelines LP, MLP |

8,806 | $ | 459,321 | |||||||||||||

| TransCanada Corp. (Canada) |

51,089 | 2,312,774 | ||||||||||||||

| Williams Cos., Inc. (The) |

42,896 | 1,252,563 | ||||||||||||||

| Williams Partners LP, MLP |

30,115 | 1,078,719 | ||||||||||||||

|

|

|

|||||||||||||||

| 47,570,416 | ||||||||||||||||

| Pharmaceuticals 0.8% |

||||||||||||||||

| Bristol-Myers Squibb Co. |

18,648 | 949,370 | ||||||||||||||

| Pfizer, Inc. |

60,302 | 1,912,176 | ||||||||||||||

|

|

|

|||||||||||||||

| 2,861,546 | ||||||||||||||||

| Real Estate Management & Development 0.2% |

||||||||||||||||

| TLG Immobilien AG (Germany) |

34,133 | 715,614 | ||||||||||||||

| Road & Rail 0.4% |

||||||||||||||||

| Ryder System, Inc. |

5,844 | 405,515 | ||||||||||||||

| Union Pacific Corp. |

12,157 | 1,072,004 | ||||||||||||||

|

|

|

|||||||||||||||

| 1,477,519 | ||||||||||||||||

| Semiconductors & Semiconductor Equipment 0.4% |

||||||||||||||||

| QUALCOMM, Inc. |

15,689 | 1,078,148 | ||||||||||||||

| Texas Instruments, Inc. |

5,138 | 364,027 | ||||||||||||||

|

|

|

|||||||||||||||

| 1,442,175 | ||||||||||||||||

| Software 0.7% |

||||||||||||||||

| Microsoft Corp. |

39,263 | 2,352,639 | ||||||||||||||

| Specialty Retail 0.5% |

||||||||||||||||

| Home Depot, Inc. (The) |

9,349 | 1,140,672 | ||||||||||||||

| Lowe’s Cos., Inc. |

11,494 | 766,075 | ||||||||||||||

|

|

|

|||||||||||||||

| 1,906,747 | ||||||||||||||||

| Textiles, Apparel & Luxury Goods 0.5% |

||||||||||||||||

| Coach, Inc. |

49,836 | 1,788,614 | ||||||||||||||

| Tobacco 0.6% |

||||||||||||||||

| Philip Morris International, Inc. |

21,514 | 2,074,810 | ||||||||||||||

| Transportation Infrastructure |

||||||||||||||||

| EcoRodovias Infraestrutura e Logistica SA (Brazil)(d) |

36,628 | 108,209 | ||||||||||||||

See Notes to Financial Statements.

| Prudential Income Builder Fund | 17 |

Portfolio of Investments (continued)

as of October 31, 2016

| Description | Shares | Value (Note 1) | ||||||||||||||

| COMMON STOCKS (Continued) |

||||||||||||||||

| Wireless Telecommunication Services 0.2% |

||||||||||||||||

| Vodafone Group PLC (United Kingdom), ADR(c) |

21,093 | $ | 587,229 | |||||||||||||

|

|

|

|||||||||||||||

| TOTAL COMMON STOCKS |

137,453,139 | |||||||||||||||

|

|

|

|||||||||||||||

| EXCHANGE TRADED FUNDS 9.7% |

||||||||||||||||

| PowerShares Preferred Portfolio ETF |

1,393,593 | 20,876,023 | ||||||||||||||

| SPDR Bloomberg Barclays Convertible Securities ETF(c) |

311,052 | 14,208,855 | ||||||||||||||

|

|

|

|||||||||||||||

| TOTAL EXCHANGE TRADED FUNDS |

35,084,878 | |||||||||||||||

|

|

|

|||||||||||||||

| PREFERRED STOCKS 4.6% |

||||||||||||||||

| Diversified Telecommunication Services 0.4% |

||||||||||||||||

| Frontier Communications Corp., CVT, Series A, 11.125% |

16,370 | 1,367,059 | ||||||||||||||

| Electric Utilities 0.2% |

||||||||||||||||

| NextEra Energy, Inc., CVT, 6.123% |

11,519 | 584,589 | ||||||||||||||

| Electronic Equipment, Instruments & Components 0.1% |

||||||||||||||||

| Belden, Inc., CVT, Series B, 6.750% |

5,555 | 537,224 | ||||||||||||||

| Equity Real Estate Investment Trusts (REITs) 2.7% |

||||||||||||||||

| American Homes 4 Rent, Series E, 6.350%(c) |

60,000 | 1,570,800 | ||||||||||||||

| American Tower Corp., CVT, Series B, 5.500% |

9,732 | 1,068,087 | ||||||||||||||

| Cedar Realty Trust, Inc., Series B, 7.250% |

29,700 | 763,290 | ||||||||||||||

| Gramercy Property Trust, Series A, 7.125%(c) |

44,039 | 1,191,035 | ||||||||||||||

| Pebblebrook Hotel Trust, Series D, 6.375%(c) |

17,322 | 453,663 | ||||||||||||||

| Pennsylvania Real Estate Investment Trust, Series A, 8.250% |

42,680 | 1,094,742 | ||||||||||||||

| Rexford Industrial Realty, Inc., Series A, 5.875%(d) |

23,600 | 593,540 | ||||||||||||||

| STAG Industrial, Inc., Series C, 6.875% |

21,420 | 567,630 | ||||||||||||||

| Sunstone Hotel Investors, Inc., Series E, 6.950%(c) |

43,100 | 1,189,129 | ||||||||||||||

| VERIEIT, Inc., Series F, 6.700% |

49,843 | 1,336,789 | ||||||||||||||

|

|

|

|||||||||||||||

| 9,828,705 | ||||||||||||||||

| Internet Software & Services 0.4% |

||||||||||||||||

| Alibaba Group Mandatory Exchangeable Trust, CVT, 144A, 5.75%(b) |

11,605 | 1,449,813 | ||||||||||||||

| Oil, Gas & Consumable Fuels 0.6% |

||||||||||||||||

| Anadarko Petroleum Corp., CVT, 7.500%(c) |

28,152 | 1,186,607 | ||||||||||||||

| Hess Corp., CVT, 8.000% |

13,438 | 794,857 | ||||||||||||||

|

|

|

|||||||||||||||

| 1,981,464 | ||||||||||||||||

See Notes to Financial Statements.

| 18 |

| Description | Shares | Value (Note 1) | ||||||||||||||

| PREFERRED STOCKS (Continued) |

||||||||||||||||

| Pharmaceuticals 0.2% |

||||||||||||||||

| Allergan PLC, CVT, Series A, 5.500% |

1,062 | $ | 816,678 | |||||||||||||

|

|

|

|||||||||||||||

| TOTAL PREFERRED STOCKS |

16,565,532 | |||||||||||||||

|

|

|

|||||||||||||||

| Interest Rate |

Maturity Date |

Principal Amount (000)# |

||||||||||||||

| CONVERTIBLE BONDS 0.4% |

||||||||||||||||

| Banks 0.2% |

| |||||||||||||||

| GS Pilgrims Pride Corp., Sr. Unsec’d. Notes, |

5.800 | % | 01/18/17 | 2,995 | 660,997 | |||||||||||

| Financial Services 0.2% |

| |||||||||||||||

| JPM Chase Bank NA, Sr. Unsec’d. Notes, 144A^(b) |

8.340 | 02/21/17 | 1,384 | 719,403 | ||||||||||||

|

|

|

|||||||||||||||

| TOTAL CONVERTIBLE BONDS |

1,380,400 | |||||||||||||||

|

|

|

|||||||||||||||

| CORPORATE BONDS 19.1% |

||||||||||||||||

| Advertising 0.1% |

||||||||||||||||

| Acosta, Inc., Sr. Unsec’d. Notes, 144A |

7.750 | 10/01/22 | 275 | 235,813 | ||||||||||||

| Aerospace & Defense 0.2% |

||||||||||||||||

| Alcoa, Inc., Sr. Unsec’d. Notes |

5.125 | 10/01/24 | 200 | 208,504 | ||||||||||||

| StandardAero Aviation Holdings, Inc., Gtd. |

10.000 | 07/15/23 | 150 | 159,000 | ||||||||||||

| TransDigm, Inc., |

||||||||||||||||

| Gtd. Notes |

6.000 | 07/15/22 | 75 | 78,188 | ||||||||||||

| Gtd. Notes |

6.500 | 07/15/24 | 125 | 131,562 | ||||||||||||

| Gtd. Notes, 144A |

6.375 | 06/15/26 | 75 | 76,695 | ||||||||||||

|

|

|

|||||||||||||||

| 653,949 | ||||||||||||||||

| Auto Manufacturer 0.1% |

||||||||||||||||

| Fiat Chrysler Automobiles NV (United Kingdom), Sr. Unsec’d. Notes |

5.250 | 04/15/23 | 200 | 204,000 | ||||||||||||

| Auto Parts & Equipment 0.5% |

||||||||||||||||

| Adient Global Holdings Ltd., Gtd. Notes, 144A |

4.875 | 08/15/26 | 200 | 196,720 | ||||||||||||

| American Axle & Manufacturing, Inc., Gtd. Notes |

7.750 | 11/15/19 | 150 | 169,500 | ||||||||||||

| Cooper-Standard Automotive, Inc., Sr. Unsec’d. Notes, 144A |

5.625 | 11/15/26 | 75 | 75,375 | ||||||||||||

| Dana Holding Corp., Sr. Unsec’d. Notes |

5.500 | 12/15/24 | 100 | 103,500 | ||||||||||||

| Lear Corp., Gtd. Notes |

5.250 | 01/15/25 | 200 | 214,500 | ||||||||||||

See Notes to Financial Statements.

| Prudential Income Builder Fund | 19 |

Portfolio of Investments (continued)

as of October 31, 2016

| Description | Interest Rate |

Maturity Date |

Principal Amount (000)# |

Value (Note 1) | ||||||||||||

| CORPORATE BONDS (Continued) |

||||||||||||||||

| Auto Parts & Equipment (cont’d.) |

||||||||||||||||

| Meritor, Inc., |

||||||||||||||||

| Gtd. Notes |

6.250 | 02/15/24 | 100 | $ | 98,625 | |||||||||||

| Gtd. Notes |

6.750 | 06/15/21 | 250 | 254,375 | ||||||||||||

| Nemak SAB de CV (Mexico), Sr. Unsec’d. Notes, 144A |

5.500 | % | 02/28/23 | 200 | 207,650 | |||||||||||

| Schaeffler Finance BV (Germany), Sr. Sec’d. Notes, 144A |

4.750 | 05/15/23 | 200 | 206,250 | ||||||||||||

| TI Group Automotive Systems LLC (United Kingdom), Sr. Unsec’d. Notes, 144A |

8.750 | 07/15/23 | 150 | 159,375 | ||||||||||||

| ZF North America Capital, Inc. (Germany), Gtd. Notes, 144A |

4.750 | 04/29/25 | 250 | 263,750 | ||||||||||||

|

|

|

|||||||||||||||

| 1,949,620 | ||||||||||||||||

| Banks 0.5% |

||||||||||||||||

| Bank of America Corp., |

||||||||||||||||

| Jr. Sub. Notes |

6.100 | (e) | 12/29/49 | 200 | 208,952 | |||||||||||

| Jr. Sub. Notes |

6.250 | (e) | 09/29/49 | 75 | 78,563 | |||||||||||

| Jr. Sub. Notes |

8.125 | (e) | 12/29/49 | 25 | 25,719 | |||||||||||

| Banque Centrale de Tunisie International Bond (Tunisia), Sr. Unsec’d. Notes, RegS |

5.750 | 01/30/25 | 200 | 192,866 | ||||||||||||

| BBVA Bancomer SA (Mexico), Sub. Notes, 144A |

6.750 | 09/30/22 | 200 | 224,910 | ||||||||||||

| Citigroup, Inc., |

||||||||||||||||

| Jr. Sub. Notes |

5.875 | (e) | 12/29/49 | 100 | 101,550 | |||||||||||

| Jr. Sub. Notes |

5.950 | (e) | 12/29/49 | 325 | 332,312 | |||||||||||

| Jr. Sub. Notes |

5.950 | (e) | 12/29/49 | 100 | 102,563 | |||||||||||

| ICICI Bank Ltd. (India), Jr. Sub. Notes, RegS |

6.375 | (e) | 04/30/22 | 100 | 101,361 | |||||||||||

| JPMorgan Chase & Co., |

||||||||||||||||

| Jr. Sub. Notes |

6.000 | (e) | 12/29/49 | 25 | 26,063 | |||||||||||

| Jr. Sub. Notes |

6.100 | (e) | 10/29/49 | 250 | 262,725 | |||||||||||

| Jr. Sub. Notes |

6.125 | (e) | 12/29/49 | 25 | 26,470 | |||||||||||

| Jr. Sub. Notes |

7.900 | (e) | 12/29/49 | 31 | 31,953 | |||||||||||

| Wells Fargo & Co., Jr. Sub. Notes |

5.900 | (e) | 12/29/49 | 225 | 235,406 | |||||||||||

|

|

|

|||||||||||||||

| 1,951,413 | ||||||||||||||||

| Beverages |

||||||||||||||||

| Cott Beverages, Inc. (Canada), Gtd. Notes |

6.750 | 01/01/20 | 100 | 103,875 | ||||||||||||

| Biotechnology 0.1% |

||||||||||||||||

| Concordia International Corp. (Canada), Sr. Sec’d. Notes, 144A |

9.000 | 04/01/22 | 200 | 195,000 | ||||||||||||

| Building Materials 0.6% |

||||||||||||||||

| BMC East LLC, Sr. Sec’d. Notes, 144A |

5.500 | 10/01/24 | 200 | 203,000 | ||||||||||||

See Notes to Financial Statements.

| 20 |

| Description | Interest Rate |

Maturity Date |

Principal Amount (000)# |

Value (Note 1) | ||||||||||||

| CORPORATE BONDS (Continued) |

||||||||||||||||

| Building Materials (cont’d.) |

||||||||||||||||

| Builders FirstSource, Inc., |

||||||||||||||||

| Gtd. Notes, 144A |

10.750 | 08/15/23 | 175 | $ | 201,250 | |||||||||||

| Sr. Sec’d. Notes, 144A |

5.625 | 09/01/24 | 75 | 75,750 | ||||||||||||

| Cemex Finance LLC (Mexico), Sr. Sec’d. Notes, 144A |

9.375 | % | 10/12/22 | 200 | 218,500 | |||||||||||

| Cemex SAB de CV (Mexico), Sr. Sec’d. Notes, 144A |

5.700 | 01/11/25 | 200 | 203,500 | ||||||||||||

| Griffon Corp., Gtd. Notes |

5.250 | 03/01/22 | 280 | 283,500 | ||||||||||||

| James Hardie International Finance Ltd. (Ireland), Gtd. Notes, 144A |

5.875 | 02/15/23 | 200 | 211,000 | ||||||||||||

| Standard Industries, Inc., |

||||||||||||||||

| Sr. Unsec’d. Notes, 144A (original cost $50,000; purchased 02/18/16)(b)(f) |

5.125 | 02/15/21 | 50 | 52,500 | ||||||||||||

| Sr. Unsec’d. Notes, 144A (original cost $101,750; purchased 03/25/15)(b)(f) |

5.375 | 11/15/24 | 100 | 103,375 | ||||||||||||

| Summit Materials LLC/Summit Materials Finance Corp., |

||||||||||||||||

| Gtd. Notes |

6.125 | 07/15/23 | 150 | 153,750 | ||||||||||||

| Gtd. Notes, 144A |

8.500 | 04/15/22 | 100 | 110,000 | ||||||||||||

| US Concrete, Inc., Gtd. Notes |

6.375 | 06/01/24 | 100 | 104,000 | ||||||||||||

| USG Corp., Gtd. Notes, 144A |

5.500 | 03/01/25 | 50 | 53,250 | ||||||||||||

| Votorantim Cimentos SA (Brazil), Sr. Unsec’d. Notes, RegS |

7.250 | 04/05/41 | 200 | 194,500 | ||||||||||||

|

|

|

|||||||||||||||

| 2,167,875 | ||||||||||||||||

| Chemicals 1.0% |

||||||||||||||||

| A Schulman, Inc., Gtd. Notes, 144A |

6.875 | 06/01/23 | 295 | 300,162 | ||||||||||||

| Ashland, Inc., Gtd. Notes |

6.875 | 05/15/43 | 100 | 109,500 | ||||||||||||

| Axalta Coating Systems LLC, Gtd. Notes, 144A |

4.875 | 08/15/24 | 150 | 152,250 | ||||||||||||

| Blue Cube Spinco, Inc., |

||||||||||||||||

| Gtd. Notes |

9.750 | 10/15/23 | 70 | 82,250 | ||||||||||||

| Gtd. Notes |

10.000 | 10/15/25 | 125 | 150,000 | ||||||||||||

| Chemours Co. (The), |

||||||||||||||||

| Gtd. Notes(c) |

6.625 | 05/15/23 | 250 | 242,500 | ||||||||||||

| Gtd. Notes |

7.000 | 05/15/25 | 110 | 106,975 | ||||||||||||

| CVR Partners LP/CVR Nitrogen Finance Corp., Sec’d. Notes, 144A |

9.250 | 06/15/23 | 225 | 220,635 | ||||||||||||

| Eco Services Operations LLC/Eco Finance Corp., Sr. Unsec’d. Notes, 144A (original cost $145,850; purchased 05/09/16 - 08/18/16)(b)(f) |

8.500 | 11/01/22 | 145 | 154,787 | ||||||||||||

| GCP Applied Technologies, Inc., Gtd. Notes, 144A |

9.500 | 02/01/23 | 75 | 84,938 | ||||||||||||

| Hexion, Inc., |

||||||||||||||||

| Sr. Sec’d. Notes |

6.625 | 04/15/20 | 200 | 175,000 | ||||||||||||

| Sr. Sec’d. Notes |

10.000 | 04/15/20 | 450 | 438,750 | ||||||||||||

See Notes to Financial Statements.

| Prudential Income Builder Fund | 21 |

Portfolio of Investments (continued)

as of October 31, 2016

| Description | Interest Rate |

Maturity Date |

Principal Amount (000)# |

Value (Note 1) | ||||||||||||

| CORPORATE BONDS (Continued) |

||||||||||||||||

| Chemicals (cont’d.) |

||||||||||||||||

| Hexion, Inc./Hexion Nova Scotia Finance ULC, Sec’d. Notes |

9.000 | 11/15/20 | 175 | $ | 126,000 | |||||||||||

| Mexichem SAB de CV (Mexico), Gtd. Notes, 144A |

6.750 | 09/19/42 | 200 | 212,000 | ||||||||||||

| Platform Specialty Products Corp., |

||||||||||||||||

| Sr. Unsec’d. Notes, 144A |

6.500 | % | 02/01/22 | 75 | 72,750 | |||||||||||

| Sr. Unsec’d. Notes, 144A |

10.375 | 05/01/21 | 175 | 189,000 | ||||||||||||

| PQ Corp., Sr. Sec’d. Notes, 144A (original cost $50,000; purchased 04/26/16)(b)(f) |

6.750 | 11/15/22 | 50 | 53,938 | ||||||||||||

| TPC Group, Inc., Sr. Sec’d. Notes, 144A (original cost $365,625; purchased 10/21/14 - 10/07/15)(b)(f) |

8.750 | 12/15/20 | 375 | 310,312 | ||||||||||||

| Tronox Finance LLC, Gtd. Notes |

6.375 | 08/15/20 | 100 | 89,750 | ||||||||||||

| Unifrax I LLC/Unifrax Holding Co., Gtd. Notes, 144A (original cost $353,750; purchased |

7.500 | 02/15/19 | 350 | 336,875 | ||||||||||||

|

|

|

|||||||||||||||

| 3,608,372 | ||||||||||||||||

| Coal 0.1% |

||||||||||||||||

| CONSOL Energy, Inc., Gtd. Notes |

5.875 | 04/15/22 | 350 | 323,531 | ||||||||||||

| Commercial Services 0.4% |

||||||||||||||||

| Ahern Rentals, Inc., Sec’d. Notes, 144A |

7.375 | 05/15/23 | 75 | 49,125 | ||||||||||||

| AMN Healthcare, Inc., Gtd. Notes, 144A |

5.125 | 10/01/24 | 25 | 25,375 | ||||||||||||

| Ashtead Capital, Inc. (United Kingdom), Sec’d. |

6.500 | 07/15/22 | 200 | 209,750 | ||||||||||||

| Laureate Education, Inc., Gtd. Notes, 144A |

10.000 | 09/01/19 | 475 | 439,375 | ||||||||||||

| LSC Communications, Inc., Sr. Sec’d. Notes, 144A |

8.750 | 10/15/23 | 95 | 93,575 | ||||||||||||

| NES Rentals Holdings, Inc., Sec’d. Notes, 144A (original cost $110,250; purchased |

7.875 | 05/01/18 | 125 | 122,500 | ||||||||||||

| R.R. Donnelley & Sons Co., Sr. Unsec’d. Notes |

6.500 | 11/15/23 | 100 | 97,250 | ||||||||||||

| United Rentals North America, Inc., |

||||||||||||||||

| Gtd. Notes |

5.500 | 07/15/25 | 75 | 75,938 | ||||||||||||

| Gtd. Notes |

5.500 | 05/15/27 | 150 | 149,250 | ||||||||||||

| Gtd. Notes |

5.875 | 09/15/26 | 50 | 50,930 | ||||||||||||

| Gtd. Notes |

7.625 | 04/15/22 | 75 | 79,753 | ||||||||||||

|

|

|

|||||||||||||||

| 1,392,821 | ||||||||||||||||

| Computers 0.3% |

||||||||||||||||

| Diamond 1 Finance Corp./Diamond 2 Finance Corp., |

||||||||||||||||

| Gtd. Notes, 144A |

5.875 | 06/15/21 | 100 | 105,396 | ||||||||||||

| Gtd. Notes, 144A |

7.125 | 06/15/24 | 100 | 109,546 | ||||||||||||

| Sr. Sec’d. Notes, 144A |

5.450 | 06/15/23 | 110 | 117,794 | ||||||||||||

| Western Digital Corp., Gtd. Notes, 144A |

10.500 | 04/01/24 | 685 | 791,175 | ||||||||||||

|

|

|

|||||||||||||||

| 1,123,911 | ||||||||||||||||

See Notes to Financial Statements.

| 22 |

| Description | Interest Rate |

Maturity Date |

Principal Amount (000)# |

Value (Note 1) | ||||||||||||

| CORPORATE BONDS (Continued) |

||||||||||||||||

| Distribution/Wholesale 0.2% |

||||||||||||||||

| American Tire Distributors, Inc., Sr. Sub. Notes, 144A |

10.250 | % | 03/01/22 | 100 | $ | 91,938 | ||||||||||

| Beacon Roofing Supply, Inc., Gtd. Notes |

6.375 | 10/01/23 | 125 | 133,750 | ||||||||||||

| Global Partners LP/GLP Finance Corp., Gtd. Notes |

7.000 | 06/15/23 | 125 | 119,375 | ||||||||||||

| H&E Equipment Services, Inc., Gtd. Notes(c) |

7.000 | 09/01/22 | 250 | 263,000 | ||||||||||||

|

|

|

|||||||||||||||

| 608,063 | ||||||||||||||||

| Diversified Financial Services 0.3% |

||||||||||||||||

| Ally Financial, Inc., |

||||||||||||||||

| Gtd. Notes |

8.000 | 03/15/20 | 100 | 113,250 | ||||||||||||

| Sr. Unsec’d. Notes |

4.250 | 04/15/21 | 25 | 25,250 | ||||||||||||

| CIT Group, Inc., Sr. Unsec’d. Notes |

5.000 | 08/15/22 | 150 | 159,937 | ||||||||||||

| Dana Financing Luxembourg Sarl, Gtd. Notes, 144A |

6.500 | 06/01/26 | 75 | 79,781 | ||||||||||||

| FBM Finance, Inc., Sr. Sec’d. Notes, 144A |

8.250 | 08/15/21 | 100 | 104,500 | ||||||||||||

| KCG Holdings, Inc., Sr. Sec’d. Notes, 144A |

6.875 | 03/15/20 | 125 | 122,187 | ||||||||||||

| Navient Corp., |

||||||||||||||||

| Sr. Unsec’d. Notes |

5.875 | 10/25/24 | 200 | 178,500 | ||||||||||||

| Sr. Unsec’d. Notes, MTN |

6.125 | 03/25/24 | 25 | 22,875 | ||||||||||||

| Sr. Unsec’d. Notes |

6.625 | 07/26/21 | 50 | 50,375 | ||||||||||||

| Sr. Unsec’d. Notes |

7.250 | 09/25/23 | 75 | 74,719 | ||||||||||||

| Sr. Unsec’d. Notes, MTN |

8.000 | 03/25/20 | 100 | 108,500 | ||||||||||||

| OneMain Financial Holdings LLC, Gtd. Notes, 144A (original cost $25,000; purchased 12/08/14)(b)(f) |

6.750 | 12/15/19 | 25 | 25,875 | ||||||||||||

| Springleaf Finance Corp., Gtd. Notes |

6.000 | 06/01/20 | 50 | 50,438 | ||||||||||||

|

|

|

|||||||||||||||

| 1,116,187 | ||||||||||||||||

| Electric 1.1% |

||||||||||||||||

| AES Corp., |

||||||||||||||||

| Sr. Unsec’d. Notes |

5.500 | 04/15/25 | 300 | 303,000 | ||||||||||||

| Sr. Unsec’d. Notes |

7.375 | 07/01/21 | 175 | 197,313 | ||||||||||||

| Calpine Corp., |

||||||||||||||||

| Sr. Sec’d. Notes, 144A |

7.875 | 01/15/23 | 350 | 367,062 | ||||||||||||

| Sr. Unsec’d. Notes |

5.375 | 01/15/23 | 250 | 247,500 | ||||||||||||

| Sr. Unsec’d. Notes |

5.500 | 02/01/24 | 150 | 146,250 | ||||||||||||

| DPL, Inc., |

||||||||||||||||

| Sr. Unsec’d. Notes |

6.750 | 10/01/19 | 250 | 259,375 | ||||||||||||

| Sr. Unsec’d. Notes |

7.250 | 10/15/21 | 25 | 26,094 | ||||||||||||

| Dynegy, Inc., |

||||||||||||||||

| Gtd. Notes |

6.750 | 11/01/19 | 325 | 328,929 | ||||||||||||

| Gtd. Notes(c) |

7.625 | 11/01/24 | 675 | 646,312 | ||||||||||||

| GenOn Energy, Inc., |

||||||||||||||||

| Sr. Unsec’d. Notes |

7.875 | 06/15/17 | 225 | 184,500 | ||||||||||||

| Sr. Unsec’d. Notes(c) |

9.875 | 10/15/20 | 275 | 205,563 | ||||||||||||

See Notes to Financial Statements.

| Prudential Income Builder Fund | 23 |

Portfolio of Investments (continued)

as of October 31, 2016

| Description | Interest Rate |

Maturity Date |

Principal Amount (000)# |

Value (Note 1) | ||||||||||||

| CORPORATE BONDS (Continued) |

||||||||||||||||

| Electric (cont’d.) |

||||||||||||||||

| Listrindo Capital BV (Indonesia), Gtd. Notes, 144A |

4.950 | % | 09/14/26 | 200 | $ | 202,006 | ||||||||||

| Mirant Mid-Atlantic, Pass-Through Trust, Pass-Through Certificates(b) |

9.125 | 06/30/17 | 153 | 124,874 | ||||||||||||

| NRG Energy, Inc., |

||||||||||||||||

| Gtd. Notes |

6.250 | 05/01/24 | 144 | 139,680 | ||||||||||||

| Gtd. Notes |

6.625 | 03/15/23 | 42 | 41,895 | ||||||||||||

| Gtd. Notes |

7.875 | 05/15/21 | 109 | 113,905 | ||||||||||||

| Gtd. Notes, 144A |

7.250 | 05/15/26 | 150 | 147,587 | ||||||||||||

| NRG REMA LLC, |

||||||||||||||||

| Pass-Through Certificates(b) |

9.237 | 07/02/17 | 8 | 6,470 | ||||||||||||

| Pass-Through Certificates(b) |

9.681 | 07/02/26 | 225 | 155,250 | ||||||||||||

|

|

|

|||||||||||||||

| 3,843,565 | ||||||||||||||||

| Engineering & Construction 0.1% |

||||||||||||||||

| AECOM, Gtd. Notes |

5.875 | 10/15/24 | 200 | 211,250 | ||||||||||||

| Delhi International Airport Pvt Ltd. (India), Sr. Sec’d. Notes, 144A |

6.125 | 10/31/26 | 200 | 205,152 | ||||||||||||

| Odebrecht Finance Ltd. (Brazil), Gtd. Notes, RegS (original cost $218,750; purchased 09/24/14)(b)(f) |

7.125 | 06/26/42 | 200 | 99,000 | ||||||||||||

|

|

|

|||||||||||||||

| 515,402 | ||||||||||||||||

| Entertainment 0.9% |

||||||||||||||||

| AMC Entertainment Holdings, Inc., Gtd. Notes, 144A |

5.875 | 11/15/26 | 50 | 50,188 | ||||||||||||

| AMC Entertainment, Inc., Gtd. Notes |

5.750 | 06/15/25 | 300 | 300,750 | ||||||||||||

| Carmike Cinemas, Inc., Sec’d. Notes, 144A |

6.000 | 06/15/23 | 125 | 133,437 | ||||||||||||

| CCM Merger, Inc., Gtd. Notes, 144A (original cost $397,478; purchased 09/26/14 - 11/17/15)(b)(f) |

9.125 | 05/01/19 | 375 | 391,875 | ||||||||||||

| Cinemark USA, Inc., Gtd. Notes |

4.875 | 06/01/23 | 350 | 350,437 | ||||||||||||

| Eldorado Resorts, Inc., Gtd. Notes |

7.000 | 08/01/23 | 200 | 212,500 | ||||||||||||

| GLP Capital LP/GLP Financing II, Inc., |

||||||||||||||||

| Gtd. Notes |

5.375 | 11/01/23 | 75 | 80,438 | ||||||||||||

| Gtd. Notes |

5.375 | 04/15/26 | 75 | 79,688 | ||||||||||||

| Isle of Capri Casinos, Inc., Gtd. Notes |

5.875 | 03/15/21 | 150 | 156,000 | ||||||||||||

| National CineMedia LLC, |

||||||||||||||||

| Sr. Sec’d. Notes |

6.000 | 04/15/22 | 100 | 104,000 | ||||||||||||

| Sr. Unsec’d. Notes, 144A |

5.750 | 08/15/26 | 100 | 103,000 | ||||||||||||

| Penn National Gaming, Inc., Sr. Unsec’d. Notes |

5.875 | 11/01/21 | 150 | 155,250 | ||||||||||||

| Pinnacle Entertainment, Inc., Sr. Unsec’d. |

5.625 | 05/01/24 | 350 | 352,625 | ||||||||||||

| Scientific Games International, Inc., |

||||||||||||||||

| Gtd. Notes |

6.625 | 05/15/21 | 675 | 555,187 | ||||||||||||

| Gtd. Notes |

10.000 | 12/01/22 | 250 | 231,250 | ||||||||||||

|

|

|

|||||||||||||||

| 3,256,625 | ||||||||||||||||

See Notes to Financial Statements.

| 24 |

| Description | Interest Rate |

Maturity Date |

Principal Amount (000)# |

Value (Note 1) | ||||||||||||

| CORPORATE BONDS (Continued) |

||||||||||||||||

| Environmental Control 0.1% |

||||||||||||||||

| Advanced Disposal Services, Inc., Sr. Unsec’d. |

5.625 | % | 11/15/24 | 100 | $ | 100,500 | ||||||||||

| Clean Harbors, Inc., Gtd. Notes |

5.125 | 06/01/21 | 150 | 153,563 | ||||||||||||

|

|

|

|||||||||||||||

| 254,063 | ||||||||||||||||

| Food 0.6% |

||||||||||||||||

| B&G Foods, Inc., Gtd. Notes |

4.625 | 06/01/21 | 100 | 102,750 | ||||||||||||

| Darling Ingredients, Inc., Gtd. Notes |

5.375 | 01/15/22 | 100 | 104,250 | ||||||||||||

| ESAL GmbH (Brazil), Gtd. Notes, 144A |

6.250 | 02/05/23 | 200 | 192,500 | ||||||||||||

| Hearthside Group Holdings LLC/Hearthside Finance Co., Gtd. Notes, 144A |

6.500 | 05/01/22 | 100 | 98,750 | ||||||||||||

| Ingles Markets, Inc., Sr. Unsec’d. Notes |

5.750 | 06/15/23 | 150 | 155,250 | ||||||||||||

| JBS USA LLC/JBS USA Finance, Inc. (Brazil), |

||||||||||||||||

| Gtd. Notes, 144A (original cost $173,875; purchased 05/20/16 - 10/27/16)(b)(f) |

5.750 | 06/15/25 | 175 | 171,500 | ||||||||||||

| Gtd. Notes, 144A (original cost $242,000; purchased 07/02/15 - 01/27/16)(b)(f) |

5.875 | 07/15/24 | 250 | 251,250 | ||||||||||||

| Gtd. Notes, 144A (original cost $351,875; purchased 01/05/16 - 07/05/16)(b)(f) |

7.250 | 06/01/21 | 350 | 358,750 | ||||||||||||

| Pilgrim’s Pride Corp., Gtd. Notes, 144A |

5.750 | 03/15/25 | 25 | 25,563 | ||||||||||||

| Pinnacle Foods Finance LLC/Pinnacle Foods Finance Corp., Gtd. Notes |

5.875 | 01/15/24 | 75 | 80,437 | ||||||||||||

| Post Holdings, Inc., |

||||||||||||||||

| Gtd. Notes, 144A |

6.750 | 12/01/21 | 100 | 107,000 | ||||||||||||

| Gtd. Notes, 144A |

8.000 | 07/15/25 | 125 | 142,500 | ||||||||||||

| Shearer’s Foods LLC/Chip Finance Corp., Sr. Sec’d. Notes, 144A |

9.000 | 11/01/19 | 150 | 156,750 | ||||||||||||

| Smithfield Foods, Inc., Sr. Unsec’d. Notes, 144A |

5.875 | 08/01/21 | 175 | 182,437 | ||||||||||||

| SUPERVALU, Inc., |

||||||||||||||||

| Sr. Unsec’d. Notes |

6.750 | 06/01/21 | 50 | 50,250 | ||||||||||||

| Sr. Unsec’d. Notes |

7.750 | 11/15/22 | 150 | 152,250 | ||||||||||||

|

|

|

|||||||||||||||

| 2,332,187 | ||||||||||||||||

| Gas 0.2% |

||||||||||||||||

| AmeriGas Partners LP/AmeriGas Finance Corp., |

||||||||||||||||

| Sr. Unsec’d. Notes |

5.625 | 05/20/24 | 75 | 78,563 | ||||||||||||

| Sr. Unsec’d. Notes |

5.875 | 08/20/26 | 225 | 236,250 | ||||||||||||

| Fermaca Enterprises S de RL de CV (Mexico), Sr. Sec’d. Notes, 144A (original cost $245,581; |

6.375 | 03/30/38 | 238 | 247,965 | ||||||||||||

| NGL Energy Partners LP/NGL Energy Finance Corp., Gtd. Notes, 144A |

7.500 | 11/01/23 | 100 | 100,250 | ||||||||||||

|

|

|

|||||||||||||||

| 663,028 | ||||||||||||||||

See Notes to Financial Statements.

| Prudential Income Builder Fund | 25 |

Portfolio of Investments (continued)

as of October 31, 2016

| Description | Interest Rate |

Maturity Date |

Principal Amount (000)# |

Value (Note 1) | ||||||||||||

| CORPORATE BONDS (Continued) |

||||||||||||||||

| Hand/Machine Tools |

||||||||||||||||

| Apex Tool Group LLC, Gtd. Notes, 144A (original cost $92,375; purchased 10/26/16)(b)(f) |

7.000 | % | 02/01/21 | 100 | $ | 91,250 | ||||||||||

| Healthcare-Products 0.2% |

||||||||||||||||

| Crimson Merger Sub., Inc., Sr. Unsec’d. Notes, 144A |

6.625 | 05/15/22 | 350 | 300,125 | ||||||||||||

| Greatbatch Ltd., Gtd. Notes, 144A |

9.125 | 11/01/23 | 175 | 168,000 | ||||||||||||

| Mallinckrodt International Finance SA, Gtd. Notes |

4.750 | 04/15/23 | 300 | 261,375 | ||||||||||||

|

|

|

|||||||||||||||

| 729,500 | ||||||||||||||||

| Healthcare-Services 1.2% |

||||||||||||||||

| Acadia Healthcare Co., Inc., Gtd. Notes |

5.625 | 02/15/23 | 268 | 268,335 | ||||||||||||

| Centene Corp., Sr. Unsec’d. Notes |

4.750 | 05/15/22 | 125 | 126,875 | ||||||||||||

| CHS/Community Health Systems, Inc., |

||||||||||||||||

| Gtd. Notes |

6.875 | 02/01/22 | 525 | 400,312 | ||||||||||||

| Gtd. Notes |

7.125 | 07/15/20 | 350 | 282,625 | ||||||||||||

| Gtd. Notes |

8.000 | 11/15/19 | 125 | 110,000 | ||||||||||||

| HCA, Inc., Gtd. Notes |

5.375 | 02/01/25 | 970 | 990,079 | ||||||||||||

| HealthSouth Corp., |

||||||||||||||||

| Gtd. Notes |

5.125 | 03/15/23 | 25 | 25,250 | ||||||||||||

| Gtd. Notes |

5.750 | 11/01/24 | 150 | 154,687 | ||||||||||||

| Gtd. Notes |

5.750 | 09/15/25 | 75 | 77,625 | ||||||||||||

| Kindred Healthcare, Inc., |

||||||||||||||||

| Gtd. Notes |

8.000 | 01/15/20 | 225 | 222,750 | ||||||||||||

| Gtd. Notes |

8.750 | 01/15/23 | 50 | 48,500 | ||||||||||||

| LifePoint Health, Inc., Gtd. Notes |

5.875 | 12/01/23 | 75 | 76,125 | ||||||||||||

| MPH Acquisition Holdings LLC, Sr. Unsec’d. Notes, 144A |

7.125 | 06/01/24 | 75 | 80,243 | ||||||||||||

| Select Medical Corp., Gtd. Notes |

6.375 | 06/01/21 | 325 | 320,937 | ||||||||||||

| Surgery Center Holdings, Inc., Gtd. Notes, 144A |

8.875 | 04/15/21 | 75 | 79,875 | ||||||||||||

| Tenet Healthcare Corp., |

||||||||||||||||

| Sr. Sec’d. Notes |

4.750 | 06/01/20 | 150 | 153,375 | ||||||||||||

| Sr. Unsec’d. Notes |

6.750 | 02/01/20 | 475 | 465,500 | ||||||||||||

| Sr. Unsec’d. Notes |

6.750 | 06/15/23 | 325 | 298,594 | ||||||||||||

| Sr. Unsec’d. Notes |

8.125 | 04/01/22 | 25 | 24,438 | ||||||||||||

|

|

|

|||||||||||||||

| 4,206,125 | ||||||||||||||||

| Home Builders 0.8% |

||||||||||||||||

| Beazer Homes USA, Inc., |

||||||||||||||||

| Gtd. Notes |

5.750 | 06/15/19 | 50 | 51,625 | ||||||||||||

| Gtd. Notes |

7.250 | 02/01/23 | 100 | 100,500 | ||||||||||||

| Gtd. Notes |

7.500 | 09/15/21 | 225 | 227,250 | ||||||||||||

See Notes to Financial Statements.

| 26 |

| Description | Interest Rate |

Maturity Date |

Principal Amount (000)# |

Value (Note 1) | ||||||||||||

| CORPORATE BONDS (Continued) |

||||||||||||||||

| Home Builders (cont’d.) |

||||||||||||||||

| Brookfield Residential Properties, Inc. (Canada), |

||||||||||||||||

| Gtd. Notes, 144A |

6.375 | % | 05/15/25 | 75 | $ | 74,813 | ||||||||||

| Gtd. Notes, 144A |

6.500 | 12/15/20 | 125 | 128,750 | ||||||||||||

| CalAtlantic Group, Inc., |

||||||||||||||||

| Gtd. Notes |

5.375 | 10/01/22 | 25 | 26,281 | ||||||||||||

| Gtd. Notes |

8.375 | 01/15/21 | 200 | 237,500 | ||||||||||||

| D.R. Horton, Inc., Gtd. Notes |

4.750 | 02/15/23 | 100 | 105,500 | ||||||||||||

| KB Home, |

||||||||||||||||

| Gtd. Notes |

7.250 | 06/15/18 | 150 | 159,000 | ||||||||||||

| Gtd. Notes |

7.625 | 05/15/23 | 50 | 53,250 | ||||||||||||

| Lennar Corp., |

||||||||||||||||

| Gtd. Notes |

4.750 | 05/30/25 | 185 | 187,682 | ||||||||||||

| Gtd. Notes |

4.875 | 12/15/23 | 65 | 66,300 | ||||||||||||

| M/I Homes, Inc., Gtd. Notes |

6.750 | 01/15/21 | 75 | 78,938 | ||||||||||||

| Meritage Homes Corp., Gtd. Notes |

6.000 | 06/01/25 | 50 | 52,750 | ||||||||||||

| PulteGroup, Inc., |

||||||||||||||||

| Gtd. Notes |

5.000 | 01/15/27 | 125 | 124,062 | ||||||||||||

| Gtd. Notes |

5.500 | 03/01/26 | 175 | 182,000 | ||||||||||||

| Shea Homes LP/Shea Homes Funding Corp., Gtd. Notes, 144A |

5.875 | 04/01/23 | 75 | 73,688 | ||||||||||||

| Gtd. Notes, 144A |

6.125 | 04/01/25 | 225 | 221,625 | ||||||||||||

| Taylor Morrison Communities, Inc./Monarch Communities, Inc., Gtd. Notes, 144A |

5.875 | 04/15/23 | 425 | 448,375 | ||||||||||||

| WCI Communities, Inc., Gtd. Notes |

6.875 | 08/15/21 | 75 | 79,125 | ||||||||||||

| William Lyon Homes, Inc., Gtd. Notes |

7.000 | 08/15/22 | 200 | 208,000 | ||||||||||||

|

|

|

|||||||||||||||

| 2,887,014 | ||||||||||||||||

| Household Products/Wares |

||||||||||||||||

| Spectrum Brands, Inc., Gtd. Notes |

5.750 | 07/15/25 | 75 | 81,188 | ||||||||||||

| Housewares |

||||||||||||||||

| Scotts Miracle-Gro Co. (The), Gtd. Notes, 144A |

6.000 | 10/15/23 | 50 | 53,000 | ||||||||||||

| Internet |

||||||||||||||||

| Zayo Group LLC/Zayo Capital, Inc., Gtd. Notes |

6.375 | 05/15/25 | 95 | 100,018 | ||||||||||||

| Iron/Steel 0.2% |

||||||||||||||||

| AK Steel Corp., Sr. Sec’d. Notes |

7.500 | 07/15/23 | 150 | 161,625 | ||||||||||||

| ArcelorMittal (Luxembourg), Sr. Unsec’d. Notes |

10.850 | 06/01/19 | 180 | 215,550 | ||||||||||||

See Notes to Financial Statements.

| Prudential Income Builder Fund | 27 |

Portfolio of Investments (continued)

as of October 31, 2016

| Description | Interest Rate |

Maturity Date |

Principal Amount (000)# |

Value (Note 1) | ||||||||||||

| CORPORATE BONDS (Continued) |

||||||||||||||||

| Iron/Steel (cont’d.) |

||||||||||||||||

| Signode Industrial Group Lux SA/Signode Industrial Group US, Inc., Gtd. Notes, 144A (original cost $120,156; purchased 12/22/14)(b)(f) |

6.375 | % | 05/01/22 | 125 | $ | 126,250 | ||||||||||

| Vale Overseas Ltd. (Brazil), Gtd. Notes |

6.250 | 08/10/26 | 80 | 85,800 | ||||||||||||

|

|

|

|||||||||||||||

| 589,225 | ||||||||||||||||

| Leisure Time 0.1% |

||||||||||||||||

| Viking Cruises Ltd., |

||||||||||||||||

| Sr. Unsec’d. Notes, 144A (original cost $108,875; purchased 05/05/16 - 04/06/16)(b)(f) |

6.250 | 05/15/25 | 125 | 114,375 | ||||||||||||

| Sr. Unsec’d. Notes, 144A (original cost $124,375; purchased 03/30/15 - 06/09/16)(b)(f) |

8.500 | 10/15/22 | 125 | 126,250 | ||||||||||||

|

|

|

|||||||||||||||

| 240,625 | ||||||||||||||||

| Lodging 0.4% |

||||||||||||||||

| Boyd Gaming Corp., |

||||||||||||||||

| Gtd. Notes |

6.875 | 05/15/23 | 325 | 347,750 | ||||||||||||

| Gtd. Notes, 144A |

6.375 | 04/01/26 | 50 | 53,500 | ||||||||||||

| Golden Nugget Escrow, Inc., Sr. Unsec’d. Notes, 144A (original cost $361,500; purchased |

8.500 | 12/01/21 | 350 | 367,500 | ||||||||||||

| Interval Acquisition Corp., Gtd. Notes |

5.625 | 04/15/23 | 75 | 77,437 | ||||||||||||

| MGM Resorts International, |

||||||||||||||||

| Gtd. Notes |

6.625 | 12/15/21 | 225 | 251,298 | ||||||||||||

| Gtd. Notes |

6.750 | 10/01/20 | 50 | 55,500 | ||||||||||||

| Sugarhouse HSP Gaming Prop Mezz LP/Sugarhouse HSP Gaming Finance Corp., Sr. Sec’d. Notes, 144A (original cost $284,000;

purchased |

6.375 | 06/01/21 | 300 | 301,386 | ||||||||||||

|

|

|

|||||||||||||||

| 1,454,371 | ||||||||||||||||

| Machinery-Construction & Mining |

||||||||||||||||

| Terex Corp., |

||||||||||||||||

| Gtd. Notes |

6.000 | 05/15/21 | 25 | 25,437 | ||||||||||||

| Gtd. Notes |

6.500 | 04/01/20 | 100 | 102,000 | ||||||||||||

| Vander Intermediate Holding II Corp., Sr. Unsec’d. Notes, PIK, 144A(b) |

9.750 | 02/01/19 | 26 | 13,814 | ||||||||||||

|

|

|

|||||||||||||||

| 141,251 | ||||||||||||||||

See Notes to Financial Statements.

| 28 |

| Description | Interest Rate |

Maturity Date |

Principal Amount (000)# |

Value (Note 1) | ||||||||||||

| CORPORATE BONDS (Continued) |

||||||||||||||||

| Machinery-Diversified 0.1% |

||||||||||||||||

| ATS Automation Tooling Systems, Inc. (Canada), |

6.500 | % | 06/15/23 | 275 | $ | 284,625 | ||||||||||

| Cleaver-Brooks, Inc., Sr. Sec’d. Notes, 144A (original cost $27,156; purchased 10/06/14)(b)(f) |

8.750 | 12/15/19 | 25 | 26,125 | ||||||||||||

| Cloud Crane LLC, Sec’d. Notes, 144A (original cost $152,094; purchased 07/15/16 - 09/23/16)(b)(f) |

10.125 | 08/01/24 | 150 | 156,375 | ||||||||||||

| Manitowoc Foodservice, Inc., Sr. Unsec’d. Notes |

9.500 | 02/15/24 | 50 | 57,437 | ||||||||||||

|

|

|

|||||||||||||||

| 524,562 | ||||||||||||||||

| Media 2.0% |

||||||||||||||||

| Altice US Finance I Corp., Sr. Sec’d. Notes, 144A |

5.375 | 07/15/23 | 200 | 204,610 | ||||||||||||

| CBS Radio, Inc., Gtd. Notes, 144A |

7.250 | 11/01/24 | 50 | 51,938 | ||||||||||||

| CCO Holdings LLC/CCO Holdings Capital Corp., |

||||||||||||||||

| Sr. Unsec’d. Notes |

5.750 | 01/15/24 | 200 | 211,500 | ||||||||||||

| Sr. Unsec’d. Notes, 144A |

5.375 | 05/01/25 | 50 | 51,375 | ||||||||||||

| Sr. Unsec’d. Notes, 144A |

5.500 | 05/01/26 | 100 | 102,438 | ||||||||||||

| Sr. Unsec’d. Notes, 144A |

5.875 | 05/01/27 | 425 | 445,187 | ||||||||||||

| Cequel Communications Holdings I LLC/Cequel Capital Corp., |

||||||||||||||||

| Sr. Sec’d. Notes, 144A |

7.750 | 07/15/25 | 1,000 | 1,070,000 | ||||||||||||

| Sr. Unsec’d. Notes, 144A |

5.125 | 12/15/21 | 305 | 296,612 | ||||||||||||