| Label |

Element |

Value |

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Registrant Name |

dei_EntityRegistrantName |

PRUDENTIAL INVESTMENT PORTFOLIOS 16

|

|

| Prospectus Date |

rr_ProspectusDate |

Jan. 29, 2016

|

|

| PRUDENTIAL QMA DEFENSIVE EQUITY FUND |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Risk/Return [Heading] |

rr_RiskReturnHeading |

FUND SUMMARY

|

|

| Objective [Heading] |

rr_ObjectiveHeading |

INVESTMENT OBJECTIVE

|

|

| Objective, Primary [Text Block] |

rr_ObjectivePrimaryTextBlock |

The investment objective of the Fund is to seek long-term capital appreciation.

|

|

| Expense [Heading] |

rr_ExpenseHeading |

FUND FEES AND EXPENSES

|

|

| Expense Narrative [Text Block] |

rr_ExpenseNarrativeTextBlock |

The tables below describe the sales charges, fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and an eligible group of related investors purchase, or agree to purchase in the future, $25,000 or more in shares of the Fund or other funds in the Prudential Investments family of funds. More information about these discounts is available from your financial professional and is explained in Reducing or Waiving Class A's and Class C’s Sales Charges on page 22 of the Fund's Prospectus and in Rights of Accumulation on page 57 of the Fund's Statement of Additional Information (SAI).

|

|

| Shareholder Fees Caption [Text] |

rr_ShareholderFeesCaption |

Shareholder Fees (fees paid directly from your investment)

|

|

| Operating Expenses Caption [Text] |

rr_OperatingExpensesCaption |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

|

|

| Fee Waiver or Reimbursement over Assets, Date of Termination |

rr_FeeWaiverOrReimbursementOverAssetsDateOfTermination |

February 28, 2017

|

|

| Portfolio Turnover [Heading] |

rr_PortfolioTurnoverHeading |

Portfolio Turnover.

|

|

| Portfolio Turnover [Text Block] |

rr_PortfolioTurnoverTextBlock |

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. During the Fund's most recent fiscal year, the Fund's portfolio turnover rate was 74% of the average value of its portfolio.

|

|

| Portfolio Turnover, Rate |

rr_PortfolioTurnoverRate |

74.00%

|

|

| Expense Breakpoint Discounts [Text] |

rr_ExpenseBreakpointDiscounts |

You may qualify for sales charge discounts if you and an eligible group of related investors purchase, or agree to purchase in the future, $25,000 or more in shares of the Fund or other funds in the Prudential Investments family of funds.

|

|

| Expense Breakpoint, Minimum Investment Required [Amount] |

rr_ExpenseBreakpointMinimumInvestmentRequiredAmount |

$ 25,000

|

|

| Expense Example [Heading] |

rr_ExpenseExampleHeading |

Example.

|

|

| Expense Example Narrative [Text Block] |

rr_ExpenseExampleNarrativeTextBlock |

The following hypothetical example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. It assumes that you invest $10,000 in the Fund for the time periods indicated and then, except as indicated, redeem all your shares at the end of those periods. It assumes a 5% return on your investment each year, that the Fund's operating expenses remain the same (except that fee waivers or reimbursements, if any, are only reflected in the 1-Year figures) and that all dividends and distributions are reinvested. Your actual costs may be higher or lower.

|

|

| Expense Example by, Year, Caption [Text] |

rr_ExpenseExampleByYearCaption |

If Shares Are Redeemed

|

|

| Expense Example, No Redemption, By Year, Caption [Text] |

rr_ExpenseExampleNoRedemptionByYearCaption |

If Shares Are Not Redeemed

|

|

| Strategy [Heading] |

rr_StrategyHeading |

INVESTMENTS, RISKS AND PERFORMANCE

Principal Investment Strategies.

|

|

| Strategy Narrative [Text Block] |

rr_StrategyNarrativeTextBlock |

The Fund seeks to achieve its investment objective by investing in a well diversified portfolio of equity and equity-related securities. Under normal market conditions, the Fund will invest at least 80% of its investable assets (net assets plus borrowings for investment purposes, if any) in equity and equity-related securities. For purposes of this 80% policy, equity and equity-related securities include (i) common and preferred stock (and securities convertible into, or that the subadviser expects to be exchanged for, common or preferred stock), (ii) exchange-traded funds (ETFs), and (iii) synthetic instruments and derivatives that have economic characteristics that are similar to equity securities, including certain options, futures, swaps, and exchange-traded notes (ETNs) whose interest or principal payments are linked to one or more equity securities or equity indices. The subadviser will evaluate investments across equity market sectors, based on a variety of factors, including but not limited to momentum, valuation, volatility and correlation, and will allocate and periodically rebalance the Fund’s portfolio across the different sectors based on changes in these factors. The subadviser may also use risk mitigation techniques to reduce downside risk. Investment decisions will be determined using a combination of quantitative tools and the judgment of the subadviser's investment professionals.

The Fund may invest in securities of any market capitalization. The Fund may invest up to 20% of its investable assets in debt securities of varying credit quality. The Fund may invest up to 20% of total assets in securities of foreign issuers. The Fund may invest up to 25% of its net assets in derivatives. Although the Fund is not limited in the types of derivatives it can use, the Fund currently expects that its principal investments in derivative instruments will include investments in futures contracts, but the Fund may also invest in options and swaps.

|

|

| Risk [Heading] |

rr_RiskHeading |

Principal Risks.

|

|

| Risk Narrative [Text Block] |

rr_RiskNarrativeTextBlock |

All investments have risks to some degree. An investment in the Fund is not guaranteed to achieve its investment objective; is not a deposit with a bank; is not insured, endorsed or guaranteed by the Federal Deposit Insurance Corporation or any other government agency; and is subject to investment risks, including possible loss of your original investment.

Equity and Equity-Related Securities Risks. The value of a particular security could go down and you could lose money. In addition to an individual security losing value, the value of the equity markets or a sector in which the Fund invests could go down. The Fund's holdings can vary significantly from broad market indexes and the performance of the Fund can deviate from the performance of these indexes. Different parts of a market can react differently to adverse issuer, market, regulatory, political and economic developments.

Large Capitalization Company Risk. Companies with large market capitalizations go in and out of favor based on market and economic conditions. Larger companies tend to be less volatile than companies with smaller market capitalizations. In exchange for this potentially lower risk, the Fund's value may not rise or fall as much as the value of funds that emphasize companies with smaller market capitalizations.

Sector Focused Investing Risk. This is the risk that events negatively affecting an industry or market sector in which the Fund focuses its investments will cause the value of the Fund’s shares to decrease, perhaps significantly.

Derivatives Risk. Derivatives involve special risks and costs and may result in losses to the Fund. The successful use of derivatives requires sophisticated management, and, to the extent that derivatives are used, the Fund will depend on the subadviser’s ability to analyze and manage derivatives transactions. The prices of derivatives may move in unexpected ways, especially in abnormal market conditions. Some derivatives are “leveraged” and therefore may magnify or otherwise increase investment losses to the Fund. The Fund’s use of derivatives may also increase the amount of taxes payable by shareholders. Other risks arise from the potential inability to terminate or sell derivatives positions. A liquid secondary market may not always exist for the Fund’s derivatives positions. In fact, many over-the-counter derivative instruments will not have liquidity beyond the counterparty to the instrument. Over-the-counter derivative instruments also involve the risk that the other party will not meet its obligations to the Fund.

The US government and foreign governments are in the process of adopting and implementing regulations governing derivatives markets, including mandatory clearing of certain derivatives, margin and reporting requirements. The ultimate impact of the regulations remains unclear. Additional regulation of derivatives may make derivatives more costly, limit their availability or utility, or otherwise adversely affect their performance or disrupt markets.

Management Risk. Actively managed mutual funds are subject to management risk. The subadviser will apply investment techniques and risk analyses in making investment decisions for the Fund, but there can be no guarantee that these techniques will produce the desired results. Additionally, the securities selected by the subadviser may underperform the markets in general, the Fund’s benchmark and other mutual funds with similar investment objectives.

Market Risk. Securities markets may be volatile and the market prices of the Fund’s securities may decline. Securities fluctuate in price based on changes in an issuer’s financial condition and overall market and economic conditions. If the market prices of the securities owned by the Fund fall, the value of your investment in the Fund will decline.

Market Events Risk. Events in the financial markets have resulted in, and may continue to result in, an unusually high degree of volatility, both in non-US and US markets. This market volatility, in addition to reduced liquidity in credit and fixed-income markets, may adversely affect issuers worldwide. Furthermore, the impact of policy and legislative changes in the US and other countries may not be fully known for some time. This environment could make identifying investment risks and opportunities especially difficult for the subadviser.

Risk of Increase in Expenses. Your actual cost of investing in the Fund may be higher than the expenses shown in the expense table for a variety of reasons. For example, expense ratios may be higher than those shown if average net assets decrease. Net assets are more likely to decrease and Fund expense ratios are more likely to increase when markets are volatile. Active and frequent trading of Fund securities can increase expenses.

More information about the risks of investing in the Fund appears in the section of the Prospectus entitled “More Information About the Fund’s Principal and Non-Principal Investment Strategies, Investments and Risks.”

|

|

| Risk Lose Money [Text] |

rr_RiskLoseMoney |

and is subject to investment risks, including possible loss of your original investment.

|

|

| Risk Not Insured Depository Institution [Text] |

rr_RiskNotInsuredDepositoryInstitution |

An investment in the Fund is not guaranteed to achieve its investment objective; is not a deposit with a bank; is not insured, endorsed or guaranteed by the Federal Deposit Insurance Corporation or any other government agency;

|

|

| Bar Chart and Performance Table [Heading] |

rr_BarChartAndPerformanceTableHeading |

Performance.

|

|

| Performance Narrative [Text Block] |

rr_PerformanceNarrativeTextBlock |

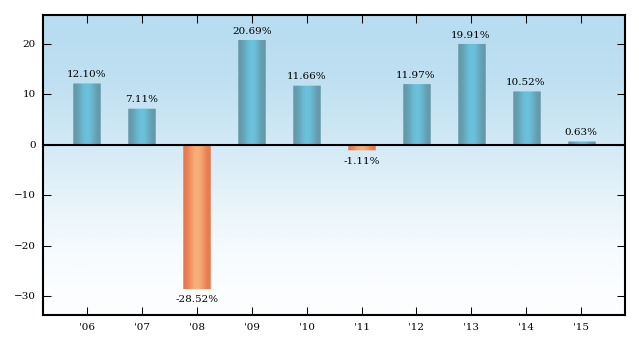

The following bar chart shows the Fund's performance for Class A shares for each full calendar year of operations or for the last 10 calendar years, whichever is shorter. The following table shows the average annual returns of each of the Fund’s share classes and also compares the Fund’s performance with the average annual total returns of an index or other benchmark and a group of similar mutual funds. The bar chart and table demonstrate the risk of investing in the Fund by showing how returns can change from year to year.

Past performance (before and after taxes) does not mean that the Fund will achieve similar results in the future. Updated Fund performance information is available online at www.prudentialfunds.com.

|

|

| Performance Information Illustrates Variability of Returns [Text] |

rr_PerformanceInformationIllustratesVariabilityOfReturns |

The following table shows the average annual returns of each of the Fund’s share classes and also compares the Fund’s performance with the average annual total returns of an index or other benchmark and a group of similar mutual funds. The bar chart and table demonstrate the risk of investing in the Fund by showing how returns can change from year to year.

|

|

| Performance Availability Website Address [Text] |

rr_PerformanceAvailabilityWebSiteAddress |

www.prudentialfunds.com

|

|

| Performance Past Does Not Indicate Future [Text] |

rr_PerformancePastDoesNotIndicateFuture |

Past performance (before and after taxes) does not mean that the Fund will achieve similar results in the future.

|

|

| Bar Chart [Heading] |

rr_BarChartHeading |

Annual Total Returns (Class A Shares)1*

|

|

| Bar Chart Does Not Reflect Sales Loads [Text] |

rr_BarChartDoesNotReflectSalesLoads |

These annual total returns do not include sales charges. If the sales charges were included, the annual total returns would be lower than those shown.

|

|

| Bar Chart Closing [Text Block] |

rr_BarChartClosingTextBlock |

| Best Quarter: | Worst Quarter: | | 12.60% | 2nd Quarter 2009 | -13.86% | 4th Quarter 2008 |

|

|

| Performance Table Heading |

rr_PerformanceTableHeading |

Average Annual Total Returns % (including sales charges) (as of 12-31-15)*

|

|

| Performance Table Uses Highest Federal Rate |

rr_PerformanceTableUsesHighestFederalRate |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes.

|

|

| Performance Table Not Relevant to Tax Deferred |

rr_PerformanceTableNotRelevantToTaxDeferred |

After-tax returns shown are not relevant to investors who hold their Fund shares through tax deferred arrangements, such as 401(k) plans or individual retirement accounts.

|

|

| Performance Table One Class of after Tax Shown [Text] |

rr_PerformanceTableOneClassOfAfterTaxShown |

After-tax returns are shown only for Class A shares. After-tax returns for other classes will vary due to differing sales charges and expenses.

|

|

| Performance Table Narrative |

rr_PerformanceTableNarrativeTextBlock |

° After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax deferred arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns are shown only for Class A shares. After-tax returns for other classes will vary due to differing sales charges and expenses.

|

|

| PRUDENTIAL QMA DEFENSIVE EQUITY FUND | Class A |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

5.50%

|

|

| Maximum deferred sales charge (load) (as percentage of the lower of original purchase price or net asset value at redemption) |

rr_MaximumDeferredSalesChargeOverOther |

1.00%

|

|

| Maximum sales charge (load) imposed on reinvested dividends and other distributions |

rr_MaximumSalesChargeOnReinvestedDividendsAndDistributionsOverOther |

none

|

|

| Redemption fee |

rr_RedemptionFeeOverRedemption |

none

|

|

| Exchange fee |

rr_ExchangeFeeOverRedemption |

none

|

|

| Maximum account fee (accounts under $10,000) |

rr_MaximumAccountFee |

$ 15

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.75%

|

|

| + Distribution and service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

0.30%

|

|

| + Other expenses |

rr_OtherExpensesOverAssets |

0.27%

|

|

| = Total annual Fund operating expenses |

rr_ExpensesOverAssets |

1.32%

|

|

| – Fee waiver and/or expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

(0.05%)

|

|

| = Total annual Fund operating expenses after fee waiver and/or expense reimbursement |

rr_NetExpensesOverAssets |

1.27%

|

[1] |

| 1 Year |

rr_ExpenseExampleYear01 |

$ 672

|

|

| 3 Years |

rr_ExpenseExampleYear03 |

941

|

|

| 5 Years |

rr_ExpenseExampleYear05 |

1,229

|

|

| 10 Years |

rr_ExpenseExampleYear10 |

2,049

|

|

| 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

672

|

|

| 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

941

|

|

| 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

1,229

|

|

| 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 2,049

|

|

| 2006 |

rr_AnnualReturn2006 |

12.10%

|

[2],[3] |

| 2007 |

rr_AnnualReturn2007 |

7.11%

|

[2],[3] |

| 2008 |

rr_AnnualReturn2008 |

(28.52%)

|

[2],[3] |

| 2009 |

rr_AnnualReturn2009 |

20.69%

|

[2],[3] |

| 2010 |

rr_AnnualReturn2010 |

11.66%

|

[2],[3] |

| 2011 |

rr_AnnualReturn2011 |

(1.11%)

|

[2],[3] |

| 2012 |

rr_AnnualReturn2012 |

11.97%

|

[2],[3] |

| 2013 |

rr_AnnualReturn2013 |

19.91%

|

[2],[3] |

| 2014 |

rr_AnnualReturn2014 |

10.52%

|

[2],[3] |

| 2015 |

rr_AnnualReturn2015 |

0.63%

|

[2],[3] |

| Highest Quarterly Return, Label |

rr_HighestQuarterlyReturnLabel |

Best Quarter:

|

|

| Highest Quarterly Return, Date |

rr_BarChartHighestQuarterlyReturnDate |

Jun. 30, 2009

|

|

| Highest Quarterly Return |

rr_BarChartHighestQuarterlyReturn |

12.60%

|

|

| Lowest Quarterly Return, Label |

rr_LowestQuarterlyReturnLabel |

Worst Quarter:

|

|

| Lowest Quarterly Return, Date |

rr_BarChartLowestQuarterlyReturnDate |

Dec. 31, 2008

|

|

| Lowest Quarterly Return |

rr_BarChartLowestQuarterlyReturn |

(13.86%)

|

|

| One Year |

rr_AverageAnnualReturnYear01 |

(4.90%)

|

[2] |

| Five Year |

rr_AverageAnnualReturnYear05 |

6.89%

|

[2] |

| Ten Years |

rr_AverageAnnualReturnYear10 |

4.90%

|

[2] |

| PRUDENTIAL QMA DEFENSIVE EQUITY FUND | Class B |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as percentage of the lower of original purchase price or net asset value at redemption) |

rr_MaximumDeferredSalesChargeOverOther |

5.00%

|

|

| Maximum sales charge (load) imposed on reinvested dividends and other distributions |

rr_MaximumSalesChargeOnReinvestedDividendsAndDistributionsOverOther |

none

|

|

| Redemption fee |

rr_RedemptionFeeOverRedemption |

none

|

|

| Exchange fee |

rr_ExchangeFeeOverRedemption |

none

|

|

| Maximum account fee (accounts under $10,000) |

rr_MaximumAccountFee |

$ 15

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.75%

|

|

| + Distribution and service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

1.00%

|

|

| + Other expenses |

rr_OtherExpensesOverAssets |

0.27%

|

|

| = Total annual Fund operating expenses |

rr_ExpensesOverAssets |

2.02%

|

|

| – Fee waiver and/or expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

none

|

|

| = Total annual Fund operating expenses after fee waiver and/or expense reimbursement |

rr_NetExpensesOverAssets |

2.02%

|

[1] |

| 1 Year |

rr_ExpenseExampleYear01 |

$ 705

|

|

| 3 Years |

rr_ExpenseExampleYear03 |

934

|

|

| 5 Years |

rr_ExpenseExampleYear05 |

1,188

|

|

| 10 Years |

rr_ExpenseExampleYear10 |

2,084

|

|

| 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

205

|

|

| 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

634

|

|

| 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

1,088

|

|

| 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 2,084

|

|

| One Year |

rr_AverageAnnualReturnYear01 |

(5.01%)

|

[2] |

| Five Year |

rr_AverageAnnualReturnYear05 |

7.14%

|

[2] |

| Ten Years |

rr_AverageAnnualReturnYear10 |

4.71%

|

[2] |

| PRUDENTIAL QMA DEFENSIVE EQUITY FUND | Class C |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as percentage of the lower of original purchase price or net asset value at redemption) |

rr_MaximumDeferredSalesChargeOverOther |

1.00%

|

|

| Maximum sales charge (load) imposed on reinvested dividends and other distributions |

rr_MaximumSalesChargeOnReinvestedDividendsAndDistributionsOverOther |

none

|

|

| Redemption fee |

rr_RedemptionFeeOverRedemption |

none

|

|

| Exchange fee |

rr_ExchangeFeeOverRedemption |

none

|

|

| Maximum account fee (accounts under $10,000) |

rr_MaximumAccountFee |

$ 15

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.75%

|

|

| + Distribution and service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

1.00%

|

|

| + Other expenses |

rr_OtherExpensesOverAssets |

0.27%

|

|

| = Total annual Fund operating expenses |

rr_ExpensesOverAssets |

2.02%

|

|

| – Fee waiver and/or expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

none

|

|

| = Total annual Fund operating expenses after fee waiver and/or expense reimbursement |

rr_NetExpensesOverAssets |

2.02%

|

[1] |

| 1 Year |

rr_ExpenseExampleYear01 |

$ 305

|

|

| 3 Years |

rr_ExpenseExampleYear03 |

634

|

|

| 5 Years |

rr_ExpenseExampleYear05 |

1,088

|

|

| 10 Years |

rr_ExpenseExampleYear10 |

2,348

|

|

| 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

205

|

|

| 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

634

|

|

| 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

1,088

|

|

| 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 2,348

|

|

| One Year |

rr_AverageAnnualReturnYear01 |

(1.03%)

|

[2] |

| Five Year |

rr_AverageAnnualReturnYear05 |

7.31%

|

[2] |

| Ten Years |

rr_AverageAnnualReturnYear10 |

4.71%

|

[2] |

| PRUDENTIAL QMA DEFENSIVE EQUITY FUND | Class R |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as percentage of the lower of original purchase price or net asset value at redemption) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Maximum sales charge (load) imposed on reinvested dividends and other distributions |

rr_MaximumSalesChargeOnReinvestedDividendsAndDistributionsOverOther |

none

|

|

| Redemption fee |

rr_RedemptionFeeOverRedemption |

none

|

|

| Exchange fee |

rr_ExchangeFeeOverRedemption |

none

|

|

| Maximum account fee (accounts under $10,000) |

rr_MaximumAccountFee |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.75%

|

|

| + Distribution and service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

0.75%

|

|

| + Other expenses |

rr_OtherExpensesOverAssets |

0.27%

|

|

| = Total annual Fund operating expenses |

rr_ExpensesOverAssets |

1.77%

|

|

| – Fee waiver and/or expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

(0.25%)

|

|

| = Total annual Fund operating expenses after fee waiver and/or expense reimbursement |

rr_NetExpensesOverAssets |

1.52%

|

[1] |

| 1 Year |

rr_ExpenseExampleYear01 |

$ 155

|

|

| 3 Years |

rr_ExpenseExampleYear03 |

533

|

|

| 5 Years |

rr_ExpenseExampleYear05 |

936

|

|

| 10 Years |

rr_ExpenseExampleYear10 |

2,063

|

|

| 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

155

|

|

| 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

533

|

|

| 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

936

|

|

| 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 2,063

|

|

| One Year |

rr_AverageAnnualReturnYear01 |

0.38%

|

[2] |

| Five Year |

rr_AverageAnnualReturnYear05 |

7.84%

|

[2] |

| Ten Years |

rr_AverageAnnualReturnYear10 |

5.23%

|

[2] |

| PRUDENTIAL QMA DEFENSIVE EQUITY FUND | Class Z |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) (as percentage of the lower of original purchase price or net asset value at redemption) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Maximum sales charge (load) imposed on reinvested dividends and other distributions |

rr_MaximumSalesChargeOnReinvestedDividendsAndDistributionsOverOther |

none

|

|

| Redemption fee |

rr_RedemptionFeeOverRedemption |

none

|

|

| Exchange fee |

rr_ExchangeFeeOverRedemption |

none

|

|

| Maximum account fee (accounts under $10,000) |

rr_MaximumAccountFee |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.75%

|

|

| + Distribution and service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| + Other expenses |

rr_OtherExpensesOverAssets |

0.27%

|

|

| = Total annual Fund operating expenses |

rr_ExpensesOverAssets |

1.02%

|

|

| – Fee waiver and/or expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

none

|

|

| = Total annual Fund operating expenses after fee waiver and/or expense reimbursement |

rr_NetExpensesOverAssets |

1.02%

|

[1] |

| 1 Year |

rr_ExpenseExampleYear01 |

$ 104

|

|

| 3 Years |

rr_ExpenseExampleYear03 |

325

|

|

| 5 Years |

rr_ExpenseExampleYear05 |

563

|

|

| 10 Years |

rr_ExpenseExampleYear10 |

1,248

|

|

| 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

104

|

|

| 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

325

|

|

| 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

563

|

|

| 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 1,248

|

|

| One Year |

rr_AverageAnnualReturnYear01 |

0.89%

|

[2] |

| Five Year |

rr_AverageAnnualReturnYear05 |

8.38%

|

[2] |

| Ten Years |

rr_AverageAnnualReturnYear10 |

5.76%

|

[2] |

| PRUDENTIAL QMA DEFENSIVE EQUITY FUND | Return After Taxes on Distributions | Class A |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| One Year |

rr_AverageAnnualReturnYear01 |

(5.58%)

|

[2] |

| Five Year |

rr_AverageAnnualReturnYear05 |

6.02%

|

[2] |

| Ten Years |

rr_AverageAnnualReturnYear10 |

4.02%

|

[2] |

| PRUDENTIAL QMA DEFENSIVE EQUITY FUND | Return After Taxes on Distributions and Sale of Fund Shares | Class A |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| One Year |

rr_AverageAnnualReturnYear01 |

(2.24%)

|

[2] |

| Five Year |

rr_AverageAnnualReturnYear05 |

5.39%

|

[2] |

| Ten Years |

rr_AverageAnnualReturnYear10 |

3.84%

|

[2] |

| PRUDENTIAL QMA DEFENSIVE EQUITY FUND | S&P 500 Index (reflects no deduction for fees, expenses or taxes) |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| One Year |

rr_AverageAnnualReturnYear01 |

1.39%

|

[2] |

| Five Year |

rr_AverageAnnualReturnYear05 |

12.55%

|

[2] |

| Ten Years |

rr_AverageAnnualReturnYear10 |

7.30%

|

[2] |

| PRUDENTIAL QMA DEFENSIVE EQUITY FUND | Russell 1000 Defensive Index (reflects no deduction for fees, expenses or taxes) |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| One Year |

rr_AverageAnnualReturnYear01 |

2.54%

|

[2] |

| Five Year |

rr_AverageAnnualReturnYear05 |

13.42%

|

[2] |

| Ten Years |

rr_AverageAnnualReturnYear10 |

7.69%

|

[2] |

| PRUDENTIAL QMA DEFENSIVE EQUITY FUND | Lipper Large-Cap Core Funds Average (reflects no deduction for sales charges or taxes) |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| One Year |

rr_AverageAnnualReturnYear01 |

(0.55%)

|

[2] |

| Five Year |

rr_AverageAnnualReturnYear05 |

10.92%

|

[2] |

| Ten Years |

rr_AverageAnnualReturnYear10 |

6.41%

|

[2] |

|

|