Target Growth Allocation Fund

Target Growth Allocation Fund

| Class A: PHGAX | Class R: PGARX |

| Class B: PIHGX | Class X: N/A |

| Class C: PHGCX | Class Z: PDHZX |

| Class M: N/A |

| Summary Prospectus | September 30, 2011 |

Before you invest, you may want to review the Fund’s Prospectus, which contains more information about the Fund and its risks. You can find the Fund’s Prospectus, Statement of Additional Information (SAI), Annual Report and other information about the Fund online at www.prudentialfunds.com/docs. You can also get this information at no cost by calling 1-800-225-1852 or by sending an e-mail to: PrudentialTargetGrowthAllocationFund@prudentialfundsemail.com

The Fund’s Prospectus and SAI, both dated September 30, 2011, and the Fund’s most recent shareholder report, dated July 31, 2011, are all incorporated by reference into this Summary Prospectus.

MFSP504A2

INVESTMENT OBJECTIVE

The investment objective of the Fund is to seek to provide long-term capital appreciation.

FUND FEES AND EXPENSES

The tables below describe the sales charges, fees and expenses that you may pay if you buy and hold shares of the Fund.

You may qualify for sales charge discounts if you and an eligible group of investors purchase, or agree to purchase in the future, $25,000 or more in shares of the Fund or other funds in the Prudential Investments family of funds. More information about these discounts is available from your financial professional and is explained in Reducing or Waiving Class A’s Initial Sales Charge on page 52 of the Fund’s Prospectus and in the Fund’s Statement of Additional Information (SAI), in Rights of Accumulation on page 68.

| Shareholder Fees (fees paid directly from your investment) | |||||||

| Class A | Class B | Class C | Class M | Class R | Class X | Class Z | |

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | 5.50% | None | None | None | None | None | None |

| Maximum deferred sales charge (load) | 1% | 5% | 1% | 6% | None | 6% | None |

| Maximum sales charge (load) imposed on reinvested dividends and other distributions | None | None | None | None | None | None | None |

| Redemption fee | None | None | None | None | None | None | None |

| Exchange fee | None | None | None | None | None | None | None |

| Maximum account fee (accounts under $2,500) | $15 | $15 | $15 | $15 | None | $15 | None |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||||

| Class A | Class B | Class C | Class M | Class R | Class X | Class Z | |

| Management fees | ..75% | ..75% | ..75% | ..75% | ..75% | ..75% | ..75% |

| + Distribution and service (12b-1) fees | ..30 | 1.00 | 1.00 | 1.00 | ..75 | 1.00 | None |

| + Other expenses | ..51 | ..51 | ..51 | ..51 | ..51 | ..51 | ..51 |

| = Total annual Fund operating expenses | 1.56 | 2.26 | 2.26 | 2.26 | 2.01 | 2.26 | 1.26 |

| – Fee waiver or expense reimbursement | (.05) | None | None | None | (.25) | None | None |

| = Net annual Fund operating expenses | 1.51 | 2.26 | 2.26 | 2.26 | 1.76 | 2.26 | 1.26 |

Example. The following hypothetical example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. It assumes that you invest $10,000 in the Fund for the time periods indicated and then, except as indicated, redeem all your shares at the end of those periods. It assumes a 5% return on your investment each year, that the Fund’s operating expenses remain the same and that all dividends and distributions are reinvested. Your actual costs may be higher or lower.

| If Shares Are Redeemed | If Shares Are Not Redeemed | ||||||

| Share Class | 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years |

| Class A | $ 695 | $ 1,011 | $ 1,349 | $2,300 | $695 | $1,011 | $1,349 | $2,300 |

| Class B | $729 | $1,006 | $1,310 | $2,337 | $229 | $706 | $1,210 | $2,337 |

| Class C | $329 | $706 | $1,210 | $2,595 | $229 | $706 | $1,210 | $2,595 |

| Class M | $829 | $1,106 | $1,410 | $2,419 | $229 | $706 | $1,210 | $2,419 |

| Class R | $179 | $606 | $1,060 | $2,318 | $179 | $606 | $1,060 | $2,318 |

| Class X | $829 | $1,106 | $1,510 | $2,595 | $229 | $706 | $1,210 | $2,595 |

| Class Z | $128 | $400 | $692 | $1,523 | $128 | $400 | $692 | $1,523 |

° The distributor of the Fund has contractually agreed through November 30, 2012 to reduce its distribution and service (12b-1) fees for Class A shares to an annual rate of .25% of the average daily net assets of Class A shares and its distribution and service (12b-1) fees for Class R shares to an annual rate of .50% of the average daily net assets of Class R shares. These waivers may not be terminated prior to November 30, 2012. The decision on whether to renew, modify or terminate the waivers is subject to review by the distributor and the Fund’s Board of Trustees.

Portfolio Turnover. The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the Fund’s most recent fiscal year, the Fund’s portfolio turnover rate was 73% of the average value of its portfolio.

INVESTMENTS, RISKS AND PERFORMANCE

Principal Investment Strategies. The Fund is one of three funds which, together, comprise the Target Asset Allocation Funds. The Funds are designed for investors who want investment professionals to make their asset allocation decisions in light of their personal investment goals and risk tolerance. Each Fund pursues its investment objective by investing in a mix of equity and fixed-income securities appropriate for a particular type of investor. Each Fund may serve as the cornerstone of a larger investment portfolio.

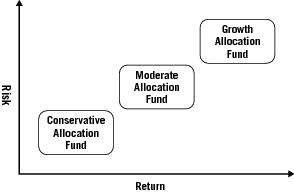

The risk/return balance of each Fund depends upon the proportion of assets it allocates to different types of investments. Higher risk does not always result in higher returns. The Manager (Prudential Investments LLC) has developed an asset allocation strategy for each Fund designed to provide a mix of investment types and styles that is appropriate for investors with conservative, moderate and aggressive investment orientations.

Each Fund has a distinct investment objective and is situated differently along the risk/return spectrum, as illustrated in the following table:

The Target Growth Allocation Fund may be appropriate for investors seeking long-term capital growth. In addition, investors who already have a diversified portfolio may find this allocation suitable as an additional growth component (e.g., investors in their 20s, 30s or 40s who are saving for retirement and who plan to retire in their early to mid 60s).

Principal Risks of Investing in the Fund. All investments have risks to some degree. Please remember that an investment in the Fund is not guaranteed to achieve its investment objective; is not a deposit with a bank; is not insured, endorsed or guaranteed by the Federal Deposit Insurance Corporation or any other government agency; and is subject to investment risks, including possible loss of your original investment.

Recent Market Events. The equity and debt capital markets in the United States and internationally have experienced unprecedented volatility. This financial crisis has caused a significant decline in the value and liquidity of many securities. This environment could make identifying investment risks and opportunities especially difficult for the subadvisers. These market conditions may continue or get worse. In response to the crisis, the U.S. and other governments and the Federal Reserve and certain foreign central banks have taken steps to support financial markets. The withdrawal of this support could negatively affect the value and liquidity of certain securities. In addition, legislation recently enacted in the United States calls for changes in many aspects of financial regulation. The impact of the legislation on the markets, and the practical implications for market participants, may not be known for some time.

Risk of Increase in Expenses. Your actual cost of investing in the Fund may be higher than the expenses shown in the expense table for a variety of reasons. For example, expense ratios may be higher than those shown if average net assets decrease. Net assets are more likely to decrease and Fund expense ratios are more likely to increase when markets are volatile.

Market Risk for Common Stocks. Since the Fund invests in common stocks, there is the risk that the price of a particular stock owned by the Fund could go down. Generally, the stock price of large companies is more stable than the stock price of smaller companies, but this is not always the case. In addition to an individual stock losing value, the value of a market sector or of the equity market as a whole could go down. In addition, different parts of a market can react differently to adverse issuer, market, regulatory, political and economic developments.

Small- and Medium-Size Company Risk. The Fund invests in stocks of small-size (“small-cap”) companies. In addition, each of the subadvisers that invests in stocks may from time to time invest in stocks of medium-size (“mid-cap”) companies. Mid-cap companies are similar to those found in the Russell MidCap Index, a market capitalization weighted index of common stocks designed to track the performance of mid-cap companies. Small- and mid-cap companies usually offer a smaller range of products and services than larger companies. They may also have limited financial resources and may lack management depth. As a result, the prices of stocks issued by small- and mid-cap companies tend to fluctuate more than the stocks of larger, more established companies.

Style Risk. Since some of the Fund segments focus on either a growth or value style, there is the risk that a particular style may be out of favor for a period of time.

Political Developments. Political developments may adversely affect the value of the Fund’s foreign securities.

Foreign Market Risk. Investing in foreign securities involves more risk than investing in securities of U.S. issuers. Foreign markets—especially emerging markets—tend to be more volatile than U.S. markets and are generally not subject to regulatory requirements comparable to those in the U.S.

Currency Risk. Changes in currency exchange rates may affect the value of foreign securities held by the Fund and the amount of income available for distribution. If a foreign currency grows weaker relative to the U.S. dollar, the value of securities denominated in that foreign currency generally decreases in terms of U.S. dollars. If the Fund does not correctly anticipate changes in exchange rates, certain hedging activities may also cause the Fund to lose money and reduce the amount of income available for distribution.

Derivatives Risk. The Fund may use derivatives including swaps, options and futures as a principal investment strategy to improve its returns or to protect its assets. When used for hedging purposes, derivatives may not fully offset or match the Fund’s underlying positions and this could result in losses to the Fund that would not otherwise have occurred.

Leverage Risk. The Fund may borrow from banks or through reverse repurchase agreements and dollar rolls to take advantage of investment opportunities. This is known as using “leverage.” If the Fund borrows money to purchase securities and those securities decline in value, then the value of the Fund’s shares will decline faster than if the Fund were not leveraged.

Management Risk. Actively managed mutual funds are subject to management risk. The subadvisers will apply investment techniques and risk analyses in making investment decisions for the Fund, but there can be no guarantee that these techniques will produce the desired results. Additionally, the securities selected by the subadvisers may underperform the markets in general, the Fund’s benchmark and other mutual funds with similar investment objectives.

Liquidity Risk. The risk that the Fund may invest to a greater degree in securities that trade in lower volumes and may make investments that may be less liquid than other investments. Also, the risk that the Fund may make investments that may become less liquid in response to market developments or adverse investor perceptions. When there is no willing buyer and investments cannot be readily sold at the desired time or price, the Fund may have to accept a lower price or may not be able to sell the security at all. An inability to sell a portfolio position can adversely affect the Fund’s value or prevent the Fund from being able to take advantage of other investment opportunities.

For more information on the risks of investing in this Fund, please see How the Fund Invests—Investment Risks in the Prospectus and Investment Risks and Considerations in the SAI.

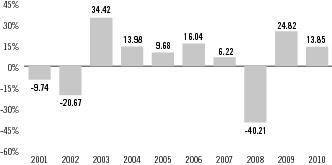

The Fund’s Past Performance. The following bar chart shows the Fund’s performance for the indicated share class for each full calendar year of operations or for the last 10 calendar years, whichever is shorter. The bar chart and Average Annual Total Returns table demonstrate the risk of investing in the Fund by showing how returns can change from year to year and by showing how the Fund’s average annual total returns for the share class compare with a broad-based securities market index and a group of similar mutual funds.

Past performance (before and after taxes) does not mean that the Fund will achieve similar results in the future. Updated Fund performance information is available online at www.prudentialfunds.com.

| Annual Total Returns % (Class A Shares)1 |

|

1 These annual total returns do not include sales charges. The return for Class A shares from 1/1/11—6/30/11 was 4.92%.

| Best Quarter: | Worst Quarter: | ||

| 17.94% | 2nd Quarter 2003 | -22.16% | 4th Quarter 2008 |

| Average Annual Total Returns % (as of 12-31-10) | ||||

| Return Before Taxes | One Year | Five Year | Ten Years | Since Inception |

| Class B shares | 7.92 | 0.02 | 1.57 | — |

| Class C shares | 12.03 | 0.21 | 1.58 | — |

| Class M shares | 7.01 | -0.13 | N/A | 2.93 (10/4/2004) |

| Class R shares | 13.63 | 0.70 | N/A | 3.55 (10/4/2004) |

| Class X shares | 7.88 | -0.04 | N/A | 3.02 (10/4/2004) |

| Class Z shares | 14.12 | 1.19 | 2.60 | — |

| Class A Shares % | ||||

| Return Before Taxes | 7.59 | -0.21 | 1.76 | — |

| Class A Shares % | ||||

| Return After Taxes on Distributions | 7.59 | -0.76 | 1.35 | — |

| Return After Taxes on Distribution and Sale of Fund Shares | 4.93 | -0.18 | 1.50 | — |

° After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax deferred arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns are shown only for Class A shares. After-tax returns for other classes will vary due to differing sales charges and expenses.

| Index % (reflects no deduction for fees, expenses or taxes) | ||||

| S&P 500 Index | 15.08 | 2.29 | 1.42 | — |

| Customized Blend Index | 15.13 | 2.75 | 2.48 | — |

| Lipper Average | 12.94 | 1.93 | 1.34 | — |

MANAGEMENT OF THE FUND

| Investment Manager | Subadviser | Portfolio Managers | Title | Service Date |

| Prudential Investments LLC | Eagle Asset Management | Bert L. Boksen, CFA | Senior Vice President & Managing Director | July 2008 |

| Eric Mintz, CFA | Co-Portfolio Manager | July 2008 |

| EARNEST Partners | Paul E. Viera, Jr. | Chief Executive Officer & Partner | December 2001 |

| Eaton Vance Management | Michael R. Mach, CFA | Vice President | December 2008 |

| Matthew F. Beaudry | Vice President | February 2010 |

| John D. Crowley | Vice President | February 2010 |

| Stephen J. Kaszynski | Vice President | February 2010 |

| Hotchkis and Wiley Capital Management, LLC | Sheldon Lieberman | Principal & Portfolio Manager | April 2005 |

| George Davis | Principal & CEO | April 2005 |

| Scott McBride | Portfolio Manager | February 2009 |

| Patricia McKenna | Principal & Portfolio Manager | April 2005 |

| Judd Peters | Portfolio Manager | February 2009 |

| LSV Asset Management | Josef Lakonishok | CEO, CIO, Partner & Portfolio Manager | April 2005 |

| Menno Vermuelen, CFA | Partner, Portfolio Manager & Senior Quantitative Analyst | April 2005 |

| Puneet Mansharamani, CFA | Partner, Portfolio Manager & Senior Quantitative Analyst | January 2006 |

| Marsico Capital Management, LLC | Thomas F. Marsico | Portfolio Manager, CIO, & CEO | June 2005 |

| A. Douglas Rao | Senior Analyst & Portfolio Manager | February 2010 |

| Coralie Witter, CFA | Senior Analyst & Portfolio Manager | February 2011 |

| Massachusetts Financial Services Company | Eric B. Fischman | Investment Officer | January 2011 |

| NFJ Investment Group LLC | Ben Fischer, CFA | Managing Director, Portfolio Manager | December 2005 |

| Tom Oliver, CPA, CFA | Managing Director, Portfolio Manager | September 2008 |

| Paul Magnuson | Managing Director, Portfolio Manager | December 2005 |

| R. Burns McKinney, CFA | Managing Director, Portfolio Manager | September 2010 |

| Jeff Reed, CFA | Vice President,Portfolio Manager | February 2011 |

| Thornburg Investment Management, Inc. | William V. Fries, CFA | Managing Director | April 2005 |

| Investment Manager | Subadviser | Portfolio Managers | Title | Service Date |

| Wendy Trevisani | Managing Director | April 2005 |

| Lei Wang, CFA | Managing Director | February 2006 |

| Vaughan Nelson Investment Management, L.P. | Chris D. Wallis, CFA | Senior Portfolio Manager | July 2005 |

| Scott Weber | Portfolio Manager | July 2005 |

BUYING AND SELLING FUND SHARES

| Minimum Initial Investment | Minimum Subsequent Investment |

| Fund shares (most cases) | $2,500 | $100 |

| Retirement accounts and custodial accounts for minors | $1,000 | $100 |

| Automatic Investment Plan (AIP) | $50 | $50 |

You can purchase or redeem shares through the Fund’s transfer agent or through servicing agents, including brokers, dealers and other financial intermediaries appointed by the distributor to receive purchase and redemption orders. Current shareholders may also purchase or redeem shares through the Fund’s website or by calling (800) 225-1852. Redemption proceeds may be sent by mail, by Federal funds wire or deposited directly into your bank account if you have established the link.

TAX INFORMATION

Dividends, Capital Gains and Taxes. The Fund’s dividends and distributions are taxable and will be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account. Such tax-deferred arrangements may be taxed later upon withdrawal of monies from those arrangements.

FINANCIAL INTERMEDIARY COMPENSATION

Potential Conflicts of Interest. If you purchase Fund shares through a financial services firm, the Fund, the Manager, or their related companies may pay the financial services firm for the sale of Fund shares and/or for services to shareholders. These payments may create a conflict of interest by influencing the financial services firm or the firm’s representatives to recommend the Fund over another investment. Ask your financial services firm or representative for more information or visit your financial services firm’s website.

|

| By Mail: | Prudential Mutual Fund Services LLC, PO Box 9658, Providence, RI 02940 |

| By Telephone: | 800-225-1852 or 973-367-3529 (outside the US) |

| On the Internet: | www.prudentialfunds.com |

MFSP504A2