UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Amendment No. 1)

For the fiscal year ended

OR

For the Transition Period from _________ to _________

Commission File Number

(Exact name of registrant as specified in its charter)

| | | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification Number) | |

| | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s Telephone Number:

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| | |

Securities registered pursuant to Section 12(g) of the Act:

| None | ||

| (Title of class) |

Indicate by check mark if the registrant is

a well-known seasoned issuer, as defined in rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is

not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12

months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy statement or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes ☐ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| | ☒ | Smaller reporting company | |

| Emerging growth company | | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over

financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that

prepared or issued its audit report.

Indicate by check mark whether the registrant

is a shell company (as defined in rule 12b-2 of the Exchange Act). Yes ☐

No

The aggregate market value of voting and nonvoting

stock held by non-affiliates of the registrant, based upon the closing price of $3.15 per share for shares of the registrant’s

Common Stock on June 30, 2021, the last business day of the registrant’s most recently completed second fiscal quarter as reported

by the NASDAQ Capital Market, was approximately $

The number of shares of Common Stock outstanding as of April 12,

2022 was

EXPLANATORY NOTE

This Form 10-K/A should be read in conjunction with the Company’s periodic filings made with the SEC subsequent to the filing date of the Original Form 10-K, including any amendments to those filings, as well as any Current Reports, filed on Form 8-K subsequent to the date of the Original Form 10-K. In addition, in accordance with applicable rules and regulations promulgated by the SEC, the Company’s Chief Executive Officer and Chief Financial Officer are providing currently dated certifications in connection with this Form 10-K/A. The certifications are filed as Exhibits 31.1, 31.2, 32.1 and 32.2. Because this Form 10-K/A sets forth the Original Form 10-K in its entirety, it includes both items that have been changed as a result of the amended disclosures and items that are unchanged from the Original Form 10-K. Other than the revision of the disclosures as discussed in our response letters to SEC, this Form 10-K/A speaks as of the original filing date of the Original Form 10-K and has not been updated to reflect other events occurring subsequent to the original filing date. This includes forward-looking statements and all other sections of this Form 10-K/A that were not directly impacted by this amendment, which should be read in their historical context.

FUTURE FINTECH GROUP INC.

Annual Report on Form 10-K for Fiscal Year Ended December 31, 2021

i

NOTE CONCERNING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K for the fiscal year ended December 31, 2021 (“Annual Report”) of Future Fintech Group, Inc. (together with our direct or indirect subsidiaries, “we,” “us,” “our”, “the Company” or “Future FinTech”) includes forward-looking statements regarding, among other things, Future FinTech’s plans, strategies and prospects, both business and financial. Although Future FinTech believes that its plans, intentions and expectations reflected in or suggested by these forward-looking statements are reasonable, Future FinTech cannot assure you that we will achieve or realize these plans, intentions or expectations. Forward-looking statements are inherently subject to risks, uncertainties and assumptions including, without limitation, the factors described under “Risk Factors” from time to time in Future FinTech’s filings with the SEC. Many of the forward-looking statements contained in this presentation may be identified by the use of forward-looking words such as “believe”, “expect”, “anticipate”, “should”, “planned”, “will”, “may”, “intend”, “estimated”, “aim”, “on track”, “target”, “opportunity”, “tentative”, “positioning”, “designed”, “create”, “predict”, “project”, “seek”, “would”, “could”, “continue”, “ongoing”, “upside”, “increases” and “potential”, among others. Important factors that could cause actual results to differ materially from the forward-looking statements we make in this presentation are set forth in other reports or documents that we file from time to time with the SEC, and include, but are not limited to:

| ● | fluctuations in the supply of products from our suppliers; | |

| ● | the expected growth of the online retail and supply chain industries in China, asset management business in Hong Kong and global financial technology industry; | |

| ● | changes in general economic conditions and conditions adversely affecting the businesses in which Future FinTech is engaged; | |

| ● | changes in U.S., China and global financial and equity markets, including market disruptions and significant interest rate fluctuations, which may impede our access to, or increase the cost of, external financing for our operations and investments; | |

| ● | our success in implementing our business strategy or introducing new products and services; | |

| ● | our ability to attract and retain customers; | |

| ● | changes in tastes and preferences for, or the consumption of, our products and services; | |

| ● | impact of competitive activities on our business; | |

| ● | the result of future financing efforts; | |

| ● | risks associated with the adverse effects of COVID-19 pandemic globally; | |

| ● | risks associated with conducting business internationally and especially in the People’s Republic of China (“PRC”, or “China”), including currency fluctuations and devaluation, currency restrictions, local laws and restrictions and possible social, political and economic instability; and | |

| ● | change of laws and regulations of blockchain technology and its application to business; | |

| ● | other economic, financial and regulatory factors beyond the Company’s control. |

Any or all of our forward-looking statements in this report may turn out to be inaccurate. They can be affected by inaccurate assumptions we might make or by known or unknown risks or uncertainties. Consequently, no forward-looking statement can be guaranteed. Actual future results may vary materially as a result of various factors, including, without limitation, the risks outlined under “Item 1A. Risk Factors” in this Annual Report. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this filing will in fact occur. You should not place undue reliance on these forward-looking statements.

We undertake no obligation to update forward-looking statements to reflect subsequent events, changed circumstances or the occurrence of unanticipated events except as required by law.

ii

Future Fintech Group, Inc. is a holding company incorporated in Florida and it is not an operating company. As a holding company with no material operations of its own, the Company conducts its operations through its subsidiaries and contractual arrangements with a variable interest entity (VIE) – Cloud Chain E-Commerce (Tianjin) Co., Ltd. (“E-Commerce Tianjin”). We are the primary beneficiary of the VIE for accounting purposes. It is the holding company that the investors will hold an interest.

Unless otherwise stated, as used in this report “we,” “us,” “Company,” “our,” or “Future FinTech” refers to Future FinTech Group Inc., a Florida holding company, and “VIE” refers to the PRC variable interest entity (E-Commerce Tianjin).

Summary of Significant Risk Factors

The following is a summary of significant risk factors and uncertainties that may affect our business, which are discussed in more detail below in “Part I—Item 1A—Risk Factors” included in this Annual Report on Form 10-K:

Risks Related to Our Business

| ● | An occurrence of an uncontrollable event such as the COVID-19 pandemic may negatively affect our operations and financial results. (see page 28 of this report) |

| ● | The supply chain financing service industry is an emerging and rapidly evolving industry in China and we might not achieve the development as we expected. (see page 30 of this report) |

| ● | The supply chain financing service industry is increasingly competitive in China. If we fail to compete effectively, we may lose our customers and partners, which could materially and adversely affect our business, financial condition and results of operations. (see page 30 of this report) |

| ● | The asset management services that NTAM provides involve various risks, and failure to identify or fully appreciate such risks will negatively affect our reputation, client relationships, operations and prospects. (see page 30 of this report) |

| ● | Our operations of NTAM depend on key management and professional staff and our business may suffer if we are unable to recruit or retain them. (see page 31 of this report) |

| ● | The regulatory regime governing blockchain technologies, cryptocurrencies, digital assets, and offerings of digital assets is uncertain, and new regulations or policies may materially adversely affect the development of our blockchain related business. (see page 33 of this report) |

| ● | We are subject to cyber security risks and may incur increasing costs in an effort to minimize those risks and to respond to cyber incidents. (see page 34 of this report) |

| ● | Our business depends on our website, app, network infrastructure and transaction-processing systems. (see page 33 of this report) |

Risks Related to Doing Business in the PRC

| ● | Changes in China’s economic, political or social conditions or government policies could have a material adverse effect on our business and results of operations. (see page 36 of this report) |

| ● | Uncertainties and quick change in the interpretation and enforcement of Chinese laws and regulations with little advance notice could result in a material and negative impact our business operations, decrease the value of our shares of common stock and limit the legal protections available to us. (see page 37 of this report) |

iii

| ● | The Chinese government exerts substantial influence over the manner in which we must conduct our business as well as more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers, and may intervene or influence our operations at any time, which could result in a material change in our operations, and significantly limit or completely hinder our ability to offer or continue to offer securities to investors and, and cause the value of our shares of common stock to significantly decline or be worthless. (see page 38 of this report) |

| ● | There are uncertainties under the PRC Securities Law relating to the procedures and requisite timing for the U.S. securities regulatory agencies to conduct investigations and collect evidence within the territory of the PRC. (see page 39 of this report) |

| ● | We could be restricted from paying dividends to shareholders due to PRC laws and other contractual requirements. To the extent cash and/or assets in the business are in the PRC and/or Hong Kong or our PRC and/or Hong Kong entities, the VIE, and the WFOE, such funds and/or assets may not be available to fund operations or for other use outside of the PRC and/or Hong Kong due to interventions in or the imposition of restrictions and limitations on the ability of us or our subsidiaries by the PRC government to transfer cash and/or assets. (see page 40 of this report) |

| ● | The Holding Foreign Companies Accountable Act, or the HFCA Act, and the related regulations are evolving quickly. Further implementations and interpretations of or amendments to the HFCA Act or the related regulations, or a PCOAB’s determination of its lack of sufficient access to inspect our auditor, might pose regulatory risks to and impose restrictions on us because of our operations in mainland China. A potential consequence is that our shares of common stock may be delisted by the exchange. The delisting of our common stock, or the threat of our common stock being delisted, may materially and adversely affect the value of your investment. Additionally, the inability of the PCAOB to conduct full inspections of our auditor deprives our investors of the benefits of such inspections. (see page 42 of this report) |

Risks Relating to Our Corporate Structure

| ● | If the PRC government deems that the contractual arrangements in relation to the consolidated variable interest entity do not comply with PRC regulatory restrictions on foreign investment in the relevant industries, or if these regulations or the interpretation of existing regulations change in the future, we could be subject to severe penalties or be forced to relinquish our interests in those operations. (see page 43 of this report) |

| ● | The shareholders of the consolidated VIE may have potential conflicts of interest with us, which may materially and adversely affect our business and financial condition. (see page 44 of this report) |

| ● | Any failure by the consolidated VIE or their shareholders to perform their obligations under the contractual arrangements with them would have a material adverse effect on our business. (see page 44 of this report) |

| ● | The contractual arrangements with the consolidated affiliated entity may not be as effective in providing operational control as direct ownership. (see page 44 of this report) |

Risks Related to Our Common Stock

| ● | We are authorized to issue blank check preferred stock, which may be issued without shareholder approval and which may adversely affect the rights of holders of our Common Stock. (see page 45 of this report) |

| ● | In recent years, our Common Stock has been in danger of being delisted from the NASDAQ Stock Market (“NASDAQ”). (see page 46 of this report) |

Other risks and uncertainties, including those listed under “Part I—Item 1A—Risk Factors”.

These factors should not be construed as exhaustive, and should be read with the other cautionary statements, and other information in this Annual Report on Form 10-K, and our other filings with the SEC.

iv

PART I

ITEM 1 – BUSINESS

Overview

Future FinTech is a holding company incorporated under the laws of the State of Florida and it is not a Chinese operating company. As a holding company with no material operations of our own, we conduct a substantial majority of our operations through our subsidiaries and contractual arrangements with a variable interest entity (VIE) – Cloud Chain E-Commerce (Tianjin) Co., Ltd., formerly known as Chain Cloud Mall E-Commerce (Tianjin) Co., Ltd. (“E-Commerce Tianjin”), based in China and this structure involves unique risks to investors. The Company historically engaged in the production and sale of fruit juice concentrates (including fruit purees and fruit juices), fruit beverages (including fruit juice beverages and fruit cider beverages) in People’s Republic of China (“PRC” or “China”). Due to drastically increased production costs and tightened environmental laws in China, the Company had transformed its business from fruit juice manufacturing and distribution to a real-name blockchain based e-commerce platform, supply chain financing services and trading business and financial technology business. The main business of the Company includes an online shopping platform, Chain Cloud Mall (“CCM”), which is based on blockchain technology; supply chain financing services and trading, financial technology service business and the application and development of blockchain-based technology in financial technology services. The Company has also expanded into financial services and cryptocurrency market data and information service businesses.

There are legal and operational risks associated with being based in and having majority of our operations in Hong Kong and China. Recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. On July 6, 2021, the General Office of the Communist Party of China Central Committee and the General Office of the State Council jointly issued an announcement to crack down on illegal activities in the securities market and promote the high-quality development of the capital market, which, among other things, requires the relevant governmental authorities to strengthen cross-border oversight of law-enforcement and judicial cooperation, to enhance supervision over China-based companies listed overseas, and to establish and improve the system of extraterritorial application of the PRC securities laws. On December 28, 2021, Cybersecurity Review Measures published by Cyberspace Administration of China or the CAC, National Development and Reform Commission, Ministry of Industry and Information Technology, Ministry of Public Security, Ministry of State Security, Ministry of Finance, Ministry of Commerce, People’s Bank of China, State Administration of Radio and Television, China Securities Regulatory Commission, State Secrecy Administration and State Cryptography Administration, effective on February 15, 2022, which provides that, Critical Information Infrastructure Operators (“CIIOs”) that purchase internet products and services and Data Processing Operators (“DPOs”) engaging in data processing activities that affect or may affect national security shall be subject to the cybersecurity review by the Cybersecurity Review Office. On November 14, 2021, CAC published the Administration Measures for Cyber Data Security (Draft for Public Comments), or the “Cyber Data Security Measure (Draft)”, which requires cyberspace operators with personal information of more than 1 million users who want to list abroad to file a cybersecurity review with the Office of Cybersecurity Review. As of the date of this report, these new laws and guidelines have not impacted the Company’s ability to conduct its business, accept foreign investments, or list and trade on a U.S. or other foreign exchange; however, there are uncertainties in the interpretation and enforcement of these new laws and guidelines, which could materially and adversely impact our business and financial outlook and may impact our ability to accept foreign investments or continue to list on a U.S. or other foreign exchange. Any change in foreign investment regulations, and other policies in China or related enforcement actions by Chinese government could result in a material change in our operations and the value of our securities and could significantly limit or completely hinder our ability to offer our securities to investors or cause the value of our securities to significantly decline or be worthless. The Company’s auditor is headquartered in the U.S. and the Public Company Accounting Oversight Board (United States) (the “PCAOB”) currently has access to inspect the working papers of our auditor and our auditor is not subject to the determinations announced by the PCAOB on December 16, 2021. The Holding Foreign Companies Accountable Act, or the HFCA Act, was enacted on December 18, 2020. In accordance with the HFCA Act, trading in securities of any registrant on a national securities exchange or in the over-the-counter trading market in the United States may be prohibited if the PCAOB determines that it cannot inspect or fully investigate the registrant’s auditor for three consecutive years beginning in 2021, and, as a result, an exchange may determine to delist the securities of such registrant. On June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, which, if enacted, would amend the HFCA Act and require the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three, thus reducing the time period before our securities may be prohibited from trading or delisted if our auditor is unable to meet the PCAOB inspection requirement. The Holding Foreign Companies Accountable Act and related regulations currently does not affect the Company as the Company’s auditor is subject to PCAOB’s inspections and investigations. However, if it is later determined that the PCAOB is unable to inspect or investigate completely our auditor because of a position taken by an authority in a foreign jurisdiction or any other reasons, the lack of inspection could cause the trading in our securities to be prohibited under the Holding Foreign Companies Accountable Act, and as a result Nasdaq may delist our securities.

As a holding company, we may rely on dividends and other distributions on equity paid by our subsidiaries for our cash and financing requirements. If any of our subsidiaries or our WFOE incurs debt on its own behalf in the future, the instruments governing such debt may restrict their ability to pay dividends to us. However, neither any of our subsidiaries or the VIE has made any dividends, other distributions or cash transfers to our holding company or any U.S. investors as of the date of this report. In the future, cash proceeds raised from overseas financing activities may be transferred by us to our PRC subsidiaries via capital contribution or shareholder loans, as the case may be. As a holding company, we may rely principally on dividends and other distributions on equity paid by our subsidiaries for our cash and financing requirements we may have. As of the date of this report, we do not have cash management policies and procedures in place that dictate how funds are transferred through our organization. Rather, the funds can be transferred in accordance with the applicable PRC laws and regulations. See “Dividend Distribution and Cash Transfer Between the Holding Company, Subsidiary and VIE” and “Selected Condensed Consolidated Financial Schedule of the Company and Its Subsidiaries and VIE.

1

As of the date of this report, no dividends or distributions have been made between the holding company, its subsidiaries, and consolidated VIE, or to investors other than U.S. investors. The holding company, its subsidiaries, and the VIE do not have any plan to distribute dividend or settle amounts owed under the VIE Agreements in the foreseeable future. To the extent cash and/or assets in the business are in the PRC and/or Hong Kong or our PRC and/or Hong Kong entities, the VIE, and the WFOE (as defined below), such funds and/or assets may not be available to fund operations or for other use outside of the PRC and/or Hong Kong due to interventions in or the imposition of restrictions and limitations on the ability of us or our subsidiaries by the PRC government to transfer cash and/or assets. See “Dividend Distribution and Cash Transfer Between the Holding Company, Subsidiary and VIE.” and “Risk Factor - We could be restricted from paying dividends to shareholders due to PRC laws and other contractual requirements. To the extent cash and/or assets in the business are in the PRC and/or Hong Kong or our PRC and/or Hong Kong entities, the VIE, and the WFOE, such funds and/or assets may not be available to fund operations or for other use outside of the PRC and/or Hong Kong due to interventions in or the imposition of restrictions and limitations on the ability of us or our subsidiaries by the PRC government to transfer cash and/or assets.”

In the opinion of our PRC counsel Fengdong Law Firm, the VIE and certain subsidiaries of the Company are incorporated and operating in mainland China and they have received all required permissions from Chinese authorities to operate their current business in China, including Business licenses, Bank Account Open Permits and Value Added Telecom Business License. Our subsidiaries outside of mainland China also have obtained permissions or approvals to operate their business in the countries where they operate their business.

As of the date of this report, in the opinion of our PRC counsel Fengdong Law Firm, we, our subsidiaries and the VIE in China are not subject to permission requirements from the China Securities Regulatory Commission (“CSRC”), Cyberspace Administration of China (“CAC”) or any other entity that is required to approve of the VIE’s operations and have not received or were denied such permissions by any PRC authorities. Nevertheless, the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council jointly issued the “Opinions on Severely Cracking Down on Illegal Securities Activities According to Law,” or the Opinions, which were made available to the public on July 6, 2021. The Opinions emphasized the need to strengthen the administration over illegal securities activities, and the need to strengthen the supervision over overseas listings by Chinese companies. Given the current PRC regulatory environment, it is uncertain when and whether we, our subsidiaries or the VIE, might be required to obtain permission from the PRC government to offer our securities to foreign investors in the future, and even when such permission is obtained, whether it will be denied or rescinded. If we or any of our subsidiaries or the VIE do not receive or maintain such permissions or approvals, inadvertently conclude that such permissions or approvals are not required, or applicable laws, regulations, or interpretations change and we or our subsidiaries are required to obtain such permissions or approvals in the future, it could significantly limit or completely hinder our ability to offer or continue to offer our securities to investors and cause the value of our securities to significantly decline or become worthless. If applicable laws, regulations, or interpretations change and the VIE is required to obtain such permissions or approvals in the future, we may face substantial uncertainties as to whether we can obtain such permissions or approvals in a timely manner, or at all. Failure to take timely and appropriate measures to adapt to any of these or similar regulatory compliance challenges could materially and adversely affect our current corporate structure and business operations. In addition, these VIE agreements have not been truly tested in the courts in China and Chinese regulatory authorities could disallow the VIE structure, which would likely result in a material change in our operations and/or value of our securities, including that it could cause the value of our securities to significantly decline or become worthless. The VIE structure is used to provide investors with exposure to foreign investment in China-based companies where Chinese law prohibits or restricts direct foreign investment in certain types of operating companies, and that investors may never hold equity interests in the VIE. See “Risk Factor - If the PRC government deems that the contractual arrangements in relation to the consolidated variable interest entity do not comply with PRC regulatory restrictions on foreign investment in the relevant industries, or if these regulations or the interpretation of existing regulations change in the future, we could be subject to severe penalties or be forced to relinquish our interests in those operations.”

On May 11, 2021, the Company established Future Supply Chain (Chengdu) Co., Ltd. Its business is coal and aluminum ingots supply chain financing services and trading.

On May 12, 2021, the Company established Future Big Data (Chengdu) Co., Ltd. in Chengdu, China. Its business includes big data technology and industrial internet data services.

On June 8, 2021, the Company established Tianjin Future Private Equity Fund Management Partnership (Limited Partnership) in Tianjin, China. Its main business is external equity investment.

On June 24, 2021, the Company established FTFT Capital Investments L.L.C. in Dubai, United Arab Emirates. In December 2021, FTFT Capital Investments, LLC (“FTFT Dubai”), a subsidiary of the Company, officially launched FTFTX, a cryptocurrency market data platform that provides investors with real-time cryptocurrency market data and trading information from a large number of cryptocurrency exchanges. The market data is available for Bitcoin, ETH, EOS, Litecoin, TRON and other cryptocurrencies at https://www.ftftx.com and via the FTFTX App on iOS and Android devices. The FTFTX app is free to download on Google Play and the Apple Store.

2

June 14, 2021, the Company established Future FinTech Labs Inc. in New York to serve as its global R&D and technical support center.

On July 2, 2021, the Company established Future Fintech Digital Number One US, LP. which is an investment fund.

On July 6, 2021, the Company established Future Fintech Digital Capital Management, LLC., which provides investment advisory services and investment fund management.

On July 6, 2021, the Company established Future Fintech Digital Number One GP, LLC., which is an off-shore investment fund.

On August 2, 2021, the Company incorporated FTFT UK Limited in United Kingdom as serve as its operating base to develop fintech business in Europe.

On August 6, 2021, the Company completed acquisition of 90% of the issued and outstanding shares of Nice Talent Asset Management Limited (“NTAM”), a Hong Kong-based asset management company, from Joy Rich Enterprises Limited (“Joy Rich”). NTAM is licensed under the Securities and Futures Commission of Hong Kong (“SFC”) to carry out regulated activities in Type 4: Advising on Securities and Type 9: Asset Management.

On August 11, 2021, the Company established Future Private Equity Fund Management (Hainan) Co., Ltd. Its business is investment fund management.

On September 1, 2021, FTFT UK Limited, a company organized under the laws of United Kingdom and a wholly owned subsidiary of the Company (“FTFT UK”) entered into a Share Purchase Agreement with Rahim Shah, a resident of United Kingdom (“Seller”) to acquire 100% of the issued and outstanding shares (the “Sale Shares”) of Khyber Money Exchange Ltd., which is a money transfer company with a platform for transferring money through one of its agent locations or via its online portal, mobile platform or over the phone. Khyber Money Exchange Ltd. is regulated by the UK Financial Conduct Authority (FCA) and the parties are waiting for the approval by the FCA before formal closing of the transaction.

On August 11, 2021, the Company established Future Private Equity Fund Management (Hainan) Co., Ltd. Its business is investment fund management.

On November 22, 2021, the Company established FTFT Digital Number One, Ltd., an investment fund.

On November 22, 2021, the Company established Future Fintech Digital Number One Offshore, LLC., an investment fund.

On December 15, 2021, the Company established FTFT Super Computing Inc. Its business is bitcoin and other cryptocurrency mining and related services.

In March 2022, FTFT UK received has received approval to operate as an Electronic Money Directive (“EMD”) Agent and has been registered as such with the Financial Conduct Authority (FCA), a UK regulator. This status grants FTFT UK the ability to distribute or redeem e-money and provide certain financial services on behalf of an e-money institution (registration number 903050).

Currently, Chain Cloud Mall adopts an “Enterprise Communication as A Service” or eCAAS platform which is a part of 3.15 China Responsible Brand Program run by the Anti-Counterfeiting Committee of China Foundation of Consumer Protection (the “Anti-Counterfeiting Committee”). Anti-Counterfeiting Committee reviews and accepts the companies to join its 3.15 China Responsible Brand Program. After acceptance, these companies are authorized to use anti-counterfeiting labels on their products which have authenticated signatures of these companies and Anti-Counterfeiting Committee recorded on the blockchain quality and safety traceability system controlled by the Anti-Counterfeiting Committee. The companies will sell such products on our eCAAS platform. The companies can also use sales agents to sell their products on our eCAAS platform and parties can negotiate the commission percentages for the products sold. Any new sales agent must be recommended by existing agents and pay a one-time fee to the eCAAS platform to be admitted as the authorized agent to provide sales agent services on the platform.

The Company started its trial operation of NONOGIRL, a cross-border e-commerce platform, in March 2020 and formally launched it in July 2020. The cross-border e-commerce platform aimed to build a new s2b2c (supplier to business and consumer) outsourcing sales platform dominated by social media influencers. It was aimed at the growing female consumer market, with the ability to broadcast, short video, and all forms communication through the platform. It could also create a sales oriented sharing ecosystem with other major social media used by customers, etc. The Company’s promotion strategy previously mainly relied on the training of members and distributors through meetings and conferences. Due to the outbreak of COVID-19, the Chinese government put a restriction on large gatherings. These restrictions made the promotion strategy for our online e-commerce platforms difficult to implement and the Company has experienced difficulties to subscribe new members for its online e-commerce platforms. Due to the lack of new subscribers, in June 2021, the Company suspended its cross-border e-commerce platform (NONOGIRL). Also, since the second quarter of 2021, the Company has transformed its member-based business model of Chain Cloud Mall to a sale agent based “Enterprise Communication as A Service” or eCAAS platform and began to provide supply chain financing services and trading of coal for coal mines and power generation plants as well as aluminum ingots.

3

The Company currently has nine direct wholly-owned subsidiaries: DigiPay FinTech Limited (“DigiPay”), a company incorporated under the laws of the British Virgin Islands, Future FinTech (Hong Kong) Limited, a company incorporated under the laws of Hong Kong, GlobalKey Shared Mall Limited, a company incorporated under the laws of Cayman Islands (“GlobalKey Shared Mall”), Tianjin Future Private Equity Fund Management Partnership, a Limited Partnership under the laws of China, FTFT UK Limited, a company incorporated under the laws of United Kingdom, Future Fintech Digital Capital Management, LLC, a company incorporated under the laws of Connecticut, Future Fintech Digital Number One GP, LLC, a company incorporated under the laws of Connecticut, Future FinTech Labs Inc., a company incorporated under the laws of New York and FTFT SuperComputing Inc. a company incorporated under the laws of Ohio.

SkyPeople Foods Holdings Limited (“SkyPeople BVI”) was a wholly owned subsidiary of the Company and a company organized under the laws of the British Virgin Islands, which held 100% of the equity interest of HeDeTang Holdings (HK) Ltd. (“HeDeTang HK”), a company organized under the laws of the Hong Kong Special Administrative Region of the People’s Republic of China (“Hong Kong”), and HeDeTang HK held 73.42% of the equity interest of SkyPeople Juice Group Co., Ltd., (“SkyPeople (China)”), a company incorporated under the laws of the PRC. SkyPeople (China) had eleven subsidiaries in the PRC, which were mainly involved in the production and sales of fruit juice concentrates, fruit juice beverages and other fruit-related products in the PRC and overseas markets. On February 27, 2020, SkyPeople BVI (the “Seller”) completed the transfer of its ownership of HeDeTang HK to New Continent International Co., Ltd. (the “Buyer”), an unrelated third party and a company incorporated in the British Virgin Islands for a total price of RMB 0.6 million (approximately $85,714), pursuant to a Share Transfer Agreement entered into by the Seller and the Buyer on September 18, 2019 and approved at the special shareholders meeting of the Company on February 26, 2020 (the “Sale Transaction”). SkyPeople BVI had no operational assets or business after the transfer and the Company dissolved SkyPeople BVI on July 27, 2020.

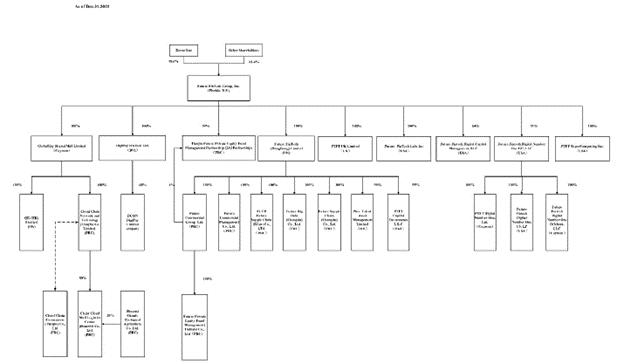

Our organizational structure as of December 31, 2021 is set forth in the diagram:

Contractual

Arrangements

Contractual

Arrangements

Equity

Interest

Equity

Interest

4

VIE Contractual Arrangements

On July 31, 2019, Cloud Chain Network and Technology (Tianjin) Co., Limited (“CCM Network” or “CCM Tianjin”, formerly known as Chain Cloud Mall Network and Technology (Tianjin) Co., Limited), Cloud Chain E-Commerce (Tianjin) Co., Ltd., formerly known as Chain Cloud Mall E-Commerce (Tianjin) Co., Ltd. (“E-Commerce Tianjin”), a limited liability company incorporated under the laws of China, and Mr. Zeyao Xue and Mr. Kai Xu, citizens of China and together 100% shareholders of E-Commerce Tianjin, entered into the following agreements, or collectively, the “Variable Interest Entity Agreements” or “VIE Agreements,” pursuant to which CCM Network has contractual rights to control and operate the business of E-commerce Tianjin (the “VIE”). Mr. Zeyao Xue is a major shareholder of the Company and the son of Mr. Yongke Xue, the President of the Company. Mr. Kai Xu was the Chief Operating Officer of the Company then and currently is the Deputy General Manager of FT Commercial Group Ltd., a wholly owned subsidiary of the Company and the vice president of blockchain division of the Company. The VIE is consolidated for accounting purposes but is not an entity in which we own equity.

Pursuant to Chinese law and regulations, a foreign owned enterprise cannot apply for and hold a license for operation of certain e-commerce businesses. CCM Network is an indirectly wholly foreign owned enterprise of the Company (“WFOE”). In order to comply with Chinese law and regulations, CCM Network agreed to provide E-Commerce Tianjin an Exclusive Operation and Use Rights Authorization to operate and use the Chain Cloud Mall System owned by CCM Network. Although the VIE Contractual Arrangements have been widely adopted by PRC companies seeking for listing aboard, such arrangements have not been truly tested in any of the PRC courts. There are very few precedents as to how contractual arrangements in the context of a consolidated variable interest entity should be interpreted or enforced under PRC laws. In addition, these VIE agreements have not been truly tested in the courts in China and Chinese regulatory authorities could disallow the VIE structure, which would likely result in a material change in our operations and/or value of our securities, including that it could cause the value of our securities to significantly decline or become worthless. The VIE structure is used to provide investors with exposure to foreign investment in China-based companies where Chinese law prohibits or restricts direct foreign investment in certain types of operating companies, and that investors may never hold equity interests in the VIE. If the consolidated VIE or its shareholders fail to perform their respective obligations under the contractual arrangements, we may have to incur substantial costs and expend additional resources to enforce such arrangements.

The following is a summary of the currently effective contractual arrangements relating to E-Commerce Tianjin.

Contractual Arrangements with The Consolidated Affiliated Entity and Its Respective Shareholders

The contractual arrangements with the VIE and its shareholders allow us to consolidate financial results of the VIE in our financial statements because we have satisfied conditions for consolidation of the VIE under U.S. GAAP, pursuant to which E-Commerce Tianjin is considered a VIE under the Statement of Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 810 “Consolidation”, because the equity investments in E-Commerce Tianjin no longer have the characteristics of a controlling financial interest, and the Company, through CCM Network, is the primary beneficiary of E-Commerce Tianjin for accounting purposes. A VIE is an entity that either has a total equity investment that is insufficient to finance its activities without additional subordinated financial support, or whose equity investors lack the characteristics of a controlling financial interest, such as through voting rights, right to receive the expected residual returns of the entity. The variable interest holder, if any, that has a controlling financial interest in a VIE is deemed to be the primary beneficiary of, and must consolidate, the VIE. CCM Network has a controlling financial interest in, receives the economic benefits from, is the primary beneficiary of and has the power to direct the activities of the VIE to the extent that it has satisfied the conditions for consolidation of the VIE under U.S. GAAP. Pursuant to the contractual arrangements with CCM Network, E-Commerce Tianjin shall pay service fees equal to all of its net profit after tax to CCM Network. Such contractual arrangements are designed so that the E-Commerce Tianjin would operate for the benefit of CCM Network and ultimately, the Company.

As a result of the contractual arrangements with the VIE, we are regarded as the primary beneficiary of the VIE for accounting purposes, and we treat the VIE and its subsidiaries as the consolidated affiliated entities under U.S. GAAP. We have consolidated the financial results of the VIE in our consolidated financial statements in accordance with U.S. GAAP.

Exclusive Technology Consulting and Service Agreement.

Pursuant to the Exclusive Technology Consulting and Service Agreement, CCM Network agreed to act as the exclusive consultant of E-Commerce Tianjin and provide technology consulting and services to E-Commerce Tianjin. In exchange, E-Commerce Tianjin agreed to pay CCM Network a technology consulting and service fee, the amount of which is to be equivalent to the amount of net profit before tax of E-Commerce Tianjin, payable on a quarterly basis after making up losses of previous years (if necessary) and deducting necessary costs and expenses related to the business operations of E-Commerce Tianjin. Without the prior written consent of CCM Network, E-Commerce Tianjin may not accept the same or similar technology consulting and services provided by any third party during the term of the agreement. All the benefits and interests generated from the agreement, including but not limited to intellectual property rights, know-how and trade secrets, will be CCM Network’s sole and exclusive property. This agreement has a term of 10 years and may be extended unilaterally by CCM Network with CCM Network’s written confirmation prior to the expiration date. E-Commerce Tianjin cannot terminate the agreement early unless CCM Network commits fraud, gross negligence or illegal acts, or becomes bankrupt or winds up.

5

Exclusive Purchase Option Agreement and Power of Attorney.

Pursuant to the Exclusive Purchase Option Agreement, Mr. Zeyao Xue and Mr. Kai Xu granted to CCM Network and any party designated by CCM Network the exclusive right to purchase, at any time during the term of this agreement, all or part of the equity interests in E-Commerce Tianjin, or the “Equity Interests,” at a purchase price equal to the registered capital paid by Mr. Zeyao Xue and Mr. Kai Xu for the Equity Interests, or, in the event that applicable law requires an appraisal of the Equity Interests, the lowest price permitted under applicable law. Pursuant to powers of attorney executed by Mr. Zeyao Xue and Mr. Kai Xu, they irrevocably authorized any person appointed by CCM Network to exercise all shareholder rights, including but not limited to voting on their behalf on all matters requiring approval of E-Commerce Tianjin’s shareholder, disposing of all or part of the shareholder’s equity interest in E-Commerce Tianjin, and electing, appointing or removing directors and executive officers. The person designated by CCM Network is entitled to dispose of dividends and profits on the equity interest without reliance on any oral or written instructions of Mr. Zeyao Xue and Mr. Kai Xu. The powers of attorney will remain in force for so long as Mr. Zeyao Xue and Mr. Kai Xu remain the shareholders of E-Commerce Tianjin. Mr. Zeyao Xue and Mr. Kai Xu have waived all the rights which have been authorized to CCM Network’s designated person under the powers of attorney.

Equity Pledge Agreement.

Pursuant to the Equity Pledge Agreements, Mr. Zeyao Xue and Mr. Kai Xu pledged all of the Equity Interests to CCM Network to secure the full and complete performance of the obligations and liabilities on the part of E-Commerce Tianjin and them under this and the above contractual arrangements. If E-Commerce Tianjin, Mr. Zeyao Xue, or Mr. Kai Xu breaches their contractual obligations under these agreements, then CCM Network, as pledgee, will have the right to dispose of the pledged equity interests. Mr. Zeyao Xue and Mr. Kai Xu agree that, during the term of the Equity Pledge Agreements, they will not dispose of the pledged equity interests or create or allow any encumbrance on the pledged equity interests, and they also agree that CCM Network’s rights relating to the equity pledge should not be interfered with or impaired by the legal actions of the shareholders of E-Commerce Tianjin, their successors or designees. During the term of the equity pledge, CCM Network has the right to receive all of the dividends and profits distributed on the pledged equity. The Equity Pledge Agreements will terminate on the second anniversary of the date when E-Commerce Tianjin, Mr. Zeyao Xue and Mr. Kai Xu have completed all their obligations under the contractual agreements described above.

Spousal Consent Letters. The spouse of Mr. Kai Xu (Mr. Zeyao Xue is not married), the shareholder of E-Commerce Tianjin has signed a spousal consent letter agreeing that the equity interests in E-Commerce Tianjin held by and registered under the name of such shareholder will be disposed pursuant to the contractual agreements with CCM Network. The spouse of such shareholder agreed not to assert any rights over the equity interest in E-Commerce Tianjin held by such shareholder.

We are a holding company incorporated in Florida. As a holding company with no material operations of our own, we conduct a substantial majority of our operations through our subsidiaries and contractual arrangements with the VIE (E-Commerce Tianjin) based in China. The VIE is consolidated for accounting purposes but is not an entity in which we own equity. The VIE structure is subject to various risks. For example, the contractual arrangements may not be as effective as direct ownership in providing us with control over E-Commerce Tianjin. We expect to rely on the performance by the VIE shareholders of their respective obligations under the contracts to exercise control over E-Commerce Tianjin. The VIE shareholders may not act in the best interests of our company or may not perform their obligations under these contracts. Such risks will exist throughout the period in which we operate related e-commerce platform business through the contractual arrangements. If any dispute relating to these contracts remains unresolved, we will have to enforce our rights under these contracts through the operations of PRC law and arbitration, litigation or other legal proceedings which could be a lengthy process and very costly.

Dividend Distribution and Cash Transfer Between the Holding Company, Subsidiary and VIE

Our PRC operating entities receive a substantial part of our revenue in the RMB. Under our current corporate structure, to fund any cash and financing requirements we may have, the Company may rely on dividend payments from its nine direct wholly-owned subsidiaries. CCM Network will receives payment from E-Commerce Tianjin when it starts to generate profits, pursuant to the VIE Agreements. Under existing PRC foreign exchange regulations, payments of current account items, such as profit distributions and trade and service-related foreign exchange transactions, can be made in foreign currencies without prior approval from State Administration of Foreign Exchange or the SAFE by complying with certain procedural requirements. Therefore, our Chinese subsidiaries are able to pay dividends in foreign currencies to us without prior approval from SAFE, subject to the condition that the remittance of such dividends outside of the PRC complies with certain procedures under PRC foreign exchange regulation, such as the overseas investment registrations by our shareholders or the ultimate shareholders of our corporate shareholders who are PRC residents. Approval from or registration with appropriate government authorities is, however, required where the RMB is to be converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of loans denominated in foreign currencies. The PRC government may also at its discretion restrict access in the future to foreign currencies for current account transactions. For the Company and our subsidiaries in Hong Kong, BVI, Japan, Cayman, UK, Dubai and U.S. (“Non-PRC Entities”), there is no restrictions on foreign exchange for such entities and they are able to transfer cash among these entities across borders. Also, there is no restrictions and limitations on the abilities of Non-PRC Entities to distribute earnings from their businesses, including from subsidiaries to the parent company or from the Company to the U.S. investors.

6

Current PRC regulations permit our PRC subsidiaries to pay dividends to the Company only out of their accumulated profits, if any, determined in accordance with Chinese accounting standards and regulations. In addition, each of our subsidiaries in China is required to set aside at least 10% of its after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches 50% of its registered capital. Each such entity in China is also required to further set aside a portion of its after-tax profits to fund the employee welfare fund, although the amount to be set aside, if any, is determined at the discretion of its board of directors. Although the statutory reserves can be used, among other ways, to increase the registered capital and eliminate future losses in excess of retained earnings of the respective companies, the reserve funds are not distributable as cash dividends except in the event of liquidation. Under the existing laws of Hong Kong, funds from capital accounts can be repatriated and remitted overseas without restrictions, and there is no foreign exchange control imposed.

To the extent cash and/or assets in the business are in the PRC and/or Hong Kong or our PRC and/or Hong Kong entities, the VIE, and the WFOE, such funds and/or assets may not be available to fund operations or for other use outside of the PRC and/or Hong Kong due to interventions in or the imposition of restrictions and limitations on the ability of us or our subsidiaries by the PRC government to transfer cash and/or assets. See “Risk Factor - We could be restricted from paying dividends to shareholders due to PRC laws and other contractual requirements.” and “Risk Factor - We could be restricted from paying dividends to shareholders due to PRC laws and other contractual requirements. To the extent cash and/or assets in the business are in the PRC and/or Hong Kong or our PRC and/or Hong Kong entities, the VIE, and the WFOE, such funds and/or assets may not be available to fund operations or for other use outside of the PRC and/or Hong Kong due to interventions in or the imposition of restrictions and limitations on the ability of us or our subsidiaries by the PRC government to transfer cash and/or assets.” We intend to keep any future earnings to re-invest in and finance the expansion of our business, and we do not anticipate that any cash dividends will be paid in the foreseeable future. We currently don’t have any cash management policies and procedures in place that dictate how funds are transferred through our organization. Rather, the funds can be transferred in accordance with the applicable PRC laws and regulations.

Cash dividends, if any, on our shares of common stock will be paid in U.S. dollars. If we are considered a PRC tax resident enterprise for tax purposes, any dividends we pay to our overseas shareholders may be regarded as China-sourced income and as a result may be subject to PRC withholding tax at a rate of up to 10.0%. Pursuant to the Arrangement between the Mainland of China and the Hong Kong Special Administrative Region for the Avoidance of Double Taxation and the Prevention of Fiscal Tax Evasion With Respect to Taxes On Income, or the Double Tax Avoidance Arrangement, the 10% withholding tax rate may be lowered to 5%, if the recipient of the relevant dividends qualifies certain necessary requirements, including without limitation that (a) the Hong Kong project must be the beneficial owner of the relevant dividends; and (b) the Hong Kong project must directly hold no less than 25% share ownership in the PRC project during the 12 consecutive months preceding its receipt of the dividends. The 5% withholding tax rate, however, does not automatically apply and in current practice, a Hong Kong project must obtain a tax resident certificate from the Hong Kong tax authority to apply for the 5% lower PRC withholding tax rate. As the Hong Kong tax authority will issue such a tax resident certificate on a case-by-case basis, we cannot assure you that we will be able to obtain the tax resident certificate from the relevant Hong Kong tax authority and enjoy the preferential withholding tax rate of 5% under the Double Taxation Arrangement with respect to any dividends paid by our PRC subsidiaries to its immediate holding company, Future FinTech (Hong Kong) Limited. As of the date of this report, we have not applied for the tax resident certificate from the relevant Hong Kong tax authority. Future FinTech (Hong Kong) Limited intends to apply for the tax resident certificate if and when its PRC subsidiaries plan to declare and pay dividends to Future FinTech (Hong Kong) Limited.

7

During the fiscal years ended December 31, 2021 and 2020, cash transfers between our Company, our subsidiaries, and the VIE were as follows:

Selected Condensed Consolidated Financial Schedule of the Company and Its Subsidiaries and VIE

The following tables present selected condensed consolidated financial data of the Company and its subsidiaries and VIE for the years ended December 31, 2021 and 2020, and balance sheet data as of December 31, 2021 and 2020, which have been derived from our audited consolidated financial statements for those periods. The Company records its investments in its subsidiaries under the equity method of accounting. Such investments are presented in the selected condensed consolidated balance sheets of the Company as “Investments in VIE” and the profit of the subsidiaries is presented as “Income for equity method investment” in the selected condensed consolidated statements of income and comprehensive income.

Future FinTech Group Inc.

As of December 31, 2021

| Future FinTech(1) | WOFE(2) | Parent(3) | Subsidiaries(4) | PRC(5) | Hong Kong subsidiaries(6) | VIE(7) | Eliminations | Consolidated Total(8) | ||||||||||||||||||||||||||||

| Cash | 50,262,855 | 3,208 | 36,013,785 | 1,735,353 | 11,385,955 | 1,127,762 | 10,662 | - | 50,273,517 | |||||||||||||||||||||||||||

| Intercompany receivables | 91,648 | 145,935,113 | - | 731,542 | 21,606,086 | 399,594 | (168,672,334 | ) | - | |||||||||||||||||||||||||||

| TOTAL CURRENT ASSETS | 72,282,967 | 174,690 | 181,977,108 | 3,627,337 | 40,615,756 | 31,110,930 | 438,088 | (185,048,164 | ) | 72,721,055 | ||||||||||||||||||||||||||

| Investment in subsidiaries | - | - | 373,366 | 153,259 | 1,568,455 | 42,943,083 | - | (45,038,163 | ) | - | ||||||||||||||||||||||||||

| TOTAL NON CURRENT ASSETS | 18,899,330 | 37,590 | 373,366 | 649,526 | 4,341,708 | 42,989,219 | 36,700 | (29,454,489 | ) | 18,936,030 | ||||||||||||||||||||||||||

| TOTAL ASSETS | 91,182,297 | 212,280 | 182,350,474 | 4,276,863 | 44,957,464 | 74,100,149 | 474,788 | (214,502,653 | ) | 91,657,085 | ||||||||||||||||||||||||||

| Intercompany payables | - | - | 20,090,419 | 79,878,750 | 87,889,375 | 601,915 | (188,460,459 | ) | - | |||||||||||||||||||||||||||

| TOTAL LIABILITIES | 9,938,826 | 1,972,157 | 313,363 | 20,297,678 | 82,134,085 | 96,232,710 | 864,101 | (189,039,010 | ) | 10,802,927 | ||||||||||||||||||||||||||

| TOTAL STOCKHOLDERS’ EQUITY | 81,243,471 | (1,759,877 | ) | 182,037,111 | (16,020,815 | ) | (37,176,621 | ) | (22,132,561 | ) | (389,313 | ) | (25,463,643 | ) | 80,854,158 | |||||||||||||||||||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | 91,182,297 | 212,280 | 182,350,474 | 4,276,863 | 44,957,464 | 74,100,149 | 474,788 | (214,502,653 | ) | 91,657,085 | ||||||||||||||||||||||||||

Future FinTech Group Inc.

For the year ended December 31, 2021

| Future FinTech(1) | WOFE(2) | Parent(3) | Subsidiaries(4) | PRC(5) | Hong Kong subsidiaries(6) | VIE(7) | Eliminations | Consolidated Total(8) | ||||||||||||||||||||||||||||

| Revenues | 25,044,142 | - | - | - | 34,034,661 | 5,315,708 | 6,659 | (14,306,227 | ) | 25,050,801 | ||||||||||||||||||||||||||

| Cost of goods/services | 23,242,882 | - | - | - | 33,524,791 | 4,024,318 | 6,054 | (14,306,227 | ) | 23,248,936 | ||||||||||||||||||||||||||

| Other material expenses | 14,879,235 | 66,955 | 11,401,929 | 2,564,823 | (566,789 | ) | 1,479,272 | 131,214 | - | 15,010,449 | ||||||||||||||||||||||||||

| Subtotals | (13,077,975 | ) | (66,955 | ) | (11,401,929 | ) | (2,564,823 | ) | 1,076,659 | (187,882 | ) | (130,609 | ) | - | (13,208,584 | ) | ||||||||||||||||||||

| Net Income (Loss) | (14,117,924 | ) | 341,357 | (11,413,830 | ) | (2,584,775 | ) | (523,733 | ) | (235,699 | ) | (88,001 | ) | 640,113 | (14,205,925 | ) | ||||||||||||||||||||

| Comprehensive Income ( Loss) | (14,349,765 | ) | 385,623 | (11,413,830 | ) | (2,584,775 | ) | (115,462 | ) | (235,699 | ) | (56,007 | ) | - | (14,405,773 | ) | ||||||||||||||||||||

8

Future FinTech Group Inc.

For the year ended December 31, 2021

| Future FinTech(1) | WOFE(2) | Parent(3) | Subsidiaries(4) | PRC(5) | Hong Kong subsidiaries(6) | VIE(7) | Eliminations | Consolidated Total(8) | ||||||||||||||||||||||||||||

| Net cash provided by (used in) operating activities | (17,378,033 | ) | (44,014 | ) | 29,838,415 | 2,981,154 | (56,152,939 | ) | 5,955,337 | 4,439 | - | (17,373,594 | ) | |||||||||||||||||||||||

| Net Cash Used in Investing Activities | (11,144,882 | ) | - | - | (586,913 | ) | (4,797,486 | ) | (5,760,483 | ) | (36,105 | ) | - | (11,180,987 | ) | |||||||||||||||||||||

| Net Cash Provided by Financing Activities | 69,274,810 | - | (1,163,146 | ) | - | 70,437,956 | - | - | - | 69,274,810 | ||||||||||||||||||||||||||

Future FinTech Group Inc.

As of December 31 2020

| Future FinTech(1) | WOFE(2) | Parent(3) | Subsidiaries(4) | PRC(5) | Hong Kong subsidiaries(6) | VIE(7) | Eliminations | Consolidated Total (8) | ||||||||||||||||||||||||||||

| Cash | 9,777,282 | 2,955 | 7,338,516 | 1,765 | 2,436,497 | 504 | 10,759 | - | 9,788,041 | |||||||||||||||||||||||||||

| Intercompany receivables | 173,924 | 101,097,836 | - | 5,097,188 | 22,010,542 | 273,538 | (128,479,105 | ) | - | |||||||||||||||||||||||||||

| TOTAL CURRENT ASSETS | 15,216,076 | 178,259 | 108,451,352 | 5,765 | 13,263,597 | 22,011,046 | 303,792 | (128,515,684 | ) | 15,519,869 | ||||||||||||||||||||||||||

| Investment in subsidiaries | - | - | - | 153,259 | 153,259 | - | - | (306,518 | ) | - | ||||||||||||||||||||||||||

| TOTAL NON CURRENT ASSETS | 410,548 | 50,260 | 153,259 | 860,470 | - | 1,296 | (603,181 | ) | 411,843 | |||||||||||||||||||||||||||

| TOTAL ASSETS | 15,626,624 | 228,519 | 108,451,352 | 159,024 | 14,124,066 | 22,011,046 | 305,088 | (129,118,865 | ) | 15,931,712 | ||||||||||||||||||||||||||

| Intercompany payables | 1,868,390 | - | 15,182,391 | 72,455,666 | 44,533,300 | 435,954 | (132,607,312 | ) | - | |||||||||||||||||||||||||||

| TOTAL LIABILITIES | 6,602,083 | 2,285,671 | 2,032,810 | 15,182,391 | 76,580,789 | 44,581,295 | 598,488 | (131,775,202 | ) | 7,200,571 | ||||||||||||||||||||||||||

| TOTAL STOCKHOLDERS’ EQUITY | 9,024,541 | (2,057,152 | ) | 106,418,542 | (15,023,367 | ) | (62,456,723 | ) | (22,570,248 | ) | (293,400 | ) | 2,656,337 | 8,731,141 | ||||||||||||||||||||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | 15,626,624 | 228,519 | 108,451,352 | 159,024 | 14,124,066 | 22,011,046 | 305,088 | (129,118,865 | ) | 15,931,712 | ||||||||||||||||||||||||||

9

Future FinTech Group Inc.

For the year ended December 31 2020

| Future FinTech(1) | WOFE(2) | Parent(3) | Subsidiaries(4) | PRC(5) | Hong Kong subsidiaries(6) | VIE(7) | Eliminations | Consolidated Total(8) | ||||||||||||||||||||||||||||

| Revenues | 189,131 | 187,199 | - | - | 189,964 | - | 181,526 | (833 | ) | 370,657 | ||||||||||||||||||||||||||

| Cost of goods/services | 265 | - | - | - | 1,098 | - | 35,021 | (833 | ) | 35,286 | ||||||||||||||||||||||||||

| Other material expenses | 15,040,378 | 1,911,205 | 8,843,304 | 160,148 | (16,478,272 | ) | 22,515,198 | 312,624 | - | 15,353,002 | ||||||||||||||||||||||||||

| Subtotals | (14,851,512 | ) | (1,724,006 | ) | (8,843,304 | ) | (160,148 | ) | 16,667,138 | (22,515,198 | ) | (166,119 | ) | - | (15,017,631 | ) | ||||||||||||||||||||

| Net Income (Loss) | 89,108,113 | (1,750,192 | ) | (11,750,075 | ) | 12,410,399 | 65,930,569 | 22,517,221 | (177,802 | ) | - | 88,930,311 | ||||||||||||||||||||||||

| Comprehensive Income ( Loss) | 75,440,746 | (4,963,670 | ) | (11,750,075 | ) | 12,410,399 | 52,263,201 | 22,517,221 | 102,143 | - | 75,542,889 | |||||||||||||||||||||||||

Future FinTech Group Inc.

For the year ended December 31 2020

| Future FinTech (1) | WOFE (2) | Parent(3) | Subsidiaries(4) | PRC(5) | Hong Kong subsidiaries(6) | VIE(7) | Eliminations | Consolidated Total(8) | ||||||||||||||||||||||||||||

| Net cash provided by (used in) operating activities | (10,274,604 | ) | (957,990 | ) | - | (9,495,682 | ) | 179,068 | 133,770 | - | (10,140,834 | ) | ||||||||||||||||||||||||

| Net Cash Used in Investing Activities | (46,195 | ) | - | - | (46,195 | ) | - | (1,814 | ) | - | (48,009 | ) | ||||||||||||||||||||||||

| Net Cash Provided by Financing Activities | 3,220,580 | 957,990 | - | 2,262,590 | - | 4,531 | - | 3,225,111 | ||||||||||||||||||||||||||||

| (1) | Future FinTech:all companies except for VIE. |

| (2) | WFOE: Cloud Chain Network and Technology (Tianjin) Co., Limited, the wholly foreign owned entity of the Company that is the primary beneficiary of the VIE. |

| (3) | Parent:the holding company, i.e. Future FinTech Group Inc. |

| (4) | Subsidiaries:all subsidiaries except for VIE, subsidiaries in PRC, Future FinTech (Hong Kong) Limited and Nice Talent Asset Management Limited in Hong Kong. |

| (5) | PRC:all subsidiaries in China except for VIE. |

| (6) | Hong Kong subsidiaries:Future FinTech (Hong Kong) Limited and Nice Talent Asset Management Limited. |

| (7) | VIE:E-Commerce Tianjin. |

| (8) | Consolidated Total:all companies included. |

10

Impact of COVID-19 on our Business

In December 2019, a novel strain of coronavirus was reported and has spread throughout China and other parts of the world. On March 11, 2020, the World Health Organization characterized the outbreak as a “pandemic”. In early 2020, Chinese government took emergency measures to combat the spread of the virus, including quarantines, travel restrictions, and the temporary closure of office buildings and facilities in China. In response to the evolving dynamics related to the COVID-19 outbreak, the Company is following the guidelines of local authorities as it prioritizes the health and safety of its employees, contractors, suppliers and business partners. Our offices in China were closed and the employees worked from home at the end of January until late March 2020 and was closed again in January 2022 due to the COVID-19 outbreak. The quarantines, travel restrictions, and the temporary closure of office buildings have materially negatively impacted our business. Our suppliers were negatively affected, and could continue to be negatively affected in their ability to supply and ship products to our customers in case of any resurgence of COVID-19. Our customers that have been negatively impacted by the outbreak of COVID-19 may reduce their budgets to purchase products and services from us, which may materially adversely impact our revenue. The business operations of the third parties’ stores on our e-commerce platform have been and continue to be negatively impacted by the outbreak, which in turn adversely affects the business of our platform as a whole as well as our financial condition and operating results. The outbreak has had and continues to have disruption to our supply chain, logistics providers, customers or our marketing activities with the new variants of COVID-19, which could materially adversely impact our business and results of operations. Although China has already begun to recover from the outbreak of COVID-19, there are still outbreak in various cities and provinces due to new variants, including the recent outbreak of Omicron variant in Xi’an city, Hong Kong and Shanghai city in 2022 which have resulted quarantines, travel restrictions, and temporary closure of office buildings and facilities in these cities. The Company’s promotion strategy of CCM Shopping Mall previously mainly relied on the training of members and distributors through meetings and conferences. Chinese government still puts a restriction on large gatherings. These restrictions made the promotion strategy for our online e-commerce platforms difficult to implement and the Company has experienced difficulties to subscribe new members for its online e-commerce platforms. Due to the lack of new subscribers, in June 2021, the Company suspended its cross-border e-commerce platform NONOGIRL. Also, since the second quarter of 2021, the Company has transformed its member-based Chain Cloud Mall to a sale agent based eCAAS platform and began to provide supply chain financing services.

The global economy has also been materially negatively affected by the COVID-19 and there is continued severe uncertainty about the duration and intensity of its impacts. The Chinese and global growth forecast is extremely uncertain, which would seriously affect our business.

While the potential economic impact brought by, and the duration of COVID-19 and its new variants may be difficult to assess or predict, a widespread pandemic could result in significant disruption of global financial markets, reducing our ability to access capital, which could negatively affect our liquidity. In addition, a recession or market correction resulting from the spread of COVID-19 and its new variants could materially negatively affect our business and the value of our common stock.

Further, as we do not have access to a revolving credit facility, there can be no assurance that we would be able to secure commercial debt financing in the future in the event that we require additional capital. We currently believe that our financial resources will be adequate to see us through the outbreak. However, in the event that we do need to raise capital in the future, outbreak-related instability in the securities markets could adversely affect our ability to raise additional capital.

Consequently, our results of operations have been materially and adversely affected by COVID-19 pandemic. Any potential further impact to our results will depend on, to a large extent, future developments and new information that may emerge regarding the duration and severity of the COVID-19, new variants of COVID-19, the efficacy and distribution of COVID-19 vaccines and the actions taken by government authorities and other entities to contain the COVID-19 or treat its impact, almost all of which are beyond our control.

Company Strategy and Principal Products and Services

Our core business historically has been in the production and sale of fruit juice concentrates (including fruit purees and fruit juices), fruit beverages (including fruit juice beverages and fruit cider beverages) in the PRC and internationally. Due to drastically increased production cost and tightened environmental laws in China, the Company has transformed its main business from fruit juice manufacturing and distribution to a real-name blockchain e-commerce platform that integrates blockchain and internet technology in fiscal year 2019. The e-commerce platform contributed 93.7% to the total revenue for fiscal year 2020. Due to the outbreak of COVID-19, the Chinese government put a restriction on large gatherings. These restrictions made the promotion strategy for our online e-commerce platforms difficult to implement and the Company has experienced difficulties to subscribe new members for its online e-commerce platforms. Due to the lack of new subscribers, since the second quarter of 2021, the Company has transformed its member-based business model of Chain Cloud Mall to a sale agent based eCAAS platform and began to provide supply chain financing services and trading of coal for coal mines and power generation plants as well as aluminum ingots. Also, the Company acquired 90% of the issued and outstanding shares of NTAM, a Hong Kong-based asset management company in August 2021. NTAM is licensed under the Securities and Futures Commission of Hong Kong (“SFC”) to carry out regulated activities in Type 4: Advising on Securities and Type 9: Asset Management. During the fiscal year of 2021, the supply chain financing and wealth management business of NTAM contributed 78.75% and 21.22% of our revenues, respectively.

11

On September 1, 2021, FTFT UK entered into a Share Purchase Agreement with Rahim Shah, a resident of United Kingdom (“Seller”) to acquire 100% of the issued and outstanding shares (the “Sale Shares”) of Khyber Money Exchange Ltd., which is a money transfer company with a platform for transferring money through one of its agent locations or via its online portal, mobile platform or over the phone. Khyber Money Exchange Ltd. is regulated by the UK Financial Conduct Authority (FCA) and the parties are waiting for the approval by the FCA before formal closing of the transaction.

In December 2021, FTFT Capital Investments, LLC officially launched FTFTX, a cryptocurrency market data platform that provides investors with real-time cryptocurrency market data and trading information from a large number of cryptocurrency exchanges. The market data is available for Bitcoin, ETH, EOS, Litecoin, TRON and other cryptocurrencies at https://www.ftftx.com and via the FTFTX App on iOS and Android devices. The FTFTX app is free to download on Google Play and the Apple Store.

In March 2022, FTFT UK FTFT UK received has received approval to operate as an Electronic Money Directive (“EMD”) Agent and has been registered as such with the Financial Conduct Authority (FCA), a UK regulator. This status grants FTFT UK the ability to distribute or redeem e-money and provide certain financial services on behalf of an e-money institution (registration number 903050).

The Company is in the process of transition and developing its financial technology related business, including asset management, supply chain financial services, digital banking and payment services, blockchain based e-commerce, and cryptocurrency market data services.

Chain Cloud Mall (CCM)

The trial operation of CCM started on December 26, 2018. On January 22, 2019, the Company formally launched Chain Cloud Mall, the real-name and membership-based blockchain shared shopping mall platform that integrates blockchain and internet technology. On June 1, 2019, CCM v2.0 was launched and on May 1, 2020, CCM v3.0 was launched. The blockchain technology enables CCM to record every event or transaction on a distributed ledger and makes the whole process traceable. It also enables the CCM to record and provide CCM points to its members upon a successful new member and/or product referral, which can be used as credit when making purchases on CCM. It incentivizes its members to promote the platform and share the products with their social contacts, which in turn increases the sales through CCM.

Due to the outbreak of COVID-19, the Chinese government put a restriction on large gatherings. These restrictions made the promotion strategy for our online e-commerce platforms difficult to implement and the Company has experienced difficulties to subscribe new members for its online e-commerce platforms. Due to the lack of new subscribers, since the second quarter of 2021, the Company has transformed its member-based business model of CCM to a sale agent based eCAAS platform.

Currently, Chain Cloud Mall adopts an “Enterprise Communication as A Service” or eCAAS platform which is a part of 3.15 China Responsible Brand Program run by the Anti-Counterfeiting Committee of China Foundation of Consumer Protection (the “Anti-Counterfeiting Committee”). Anti-Counterfeiting Committee reviews and accepts the companies to join its 3.15 China Responsible Brand Program. After acceptance, these companies are authorized to use anti-counterfeiting labels on their products which have authenticated signatures of these companies and Anti-Counterfeiting Committee recorded on the blockchain quality and safety traceability system controlled by the Anti-Counterfeiting Committee. The companies will sell such products on our eCAAS platform. The companies can also use sales agents to sell their products on our eCAAS platform and parties can negotiate the commission percentages for the products sold. Any new sales agent must be recommended by existing agents and pay a one-time fee to the eCAAS platform to be admitted as the authorized agent to provide sales agent services on the platform.

12

Coal and Aluminum Ingots Supply Chain Financing Service and Trading

Since the second quarter of 2021, we started coal supply chain financing service and trading business. Since the third quarter of 2021, we started aluminum ingots supply chain financing service and trading business.

Our supply chain finance business mainly serves the receivables and payables of industrial customers, obtains the creditor’s rights or commodity goods rights of large state-owned enterprises through trade execution, provides customers with working capital, accelerates capital turnover, and then expands the business scale and improves the industrial value.

Through our supply chain service ability and customer resources, we can tap into low-risk assets, flexibly carry out financial services around the actual financial needs of certain industries, and reduce the overall risk of the business by using the control of business flow, goods logistics and capital flow in the process of commodity circulation.

We focus on bulk coal and aluminum ingots an take large state-owned or listed companies as the core service targets; We use our own funds as the operation basis, actively uses a variety of channels and products for financing, such as banks, commercial factoring companies, accounts receivable, asset-backed securities, and other innovative financing methods to obtain sufficient funds.

We sign purchase and sale agreements with suppliers and buyers. The suppliers are responsible for the supply and transportation of coal to the end users’ designated freight yard or transfer the title of aluminum ingots to us in certain warehouses. We select the customers and suppliers that have good credit and reputation.

Asset Management Service.