UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2016

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____ to ____

Commission file number: 001-34502

| SKYPEOPLE FRUIT JUICE, INC. |

| (Exact name of registrant as specified in its charter) |

| Florida | 98-0222013 | |

| (State

or other jurisdiction of incorporation or organization) |

(I.R.S.

Employer Identification No.) |

16F, China Development Bank

Tower, No. 2, Gaoxin 1st Road,

Xi’an, PRC

710075

(Address of principal executive offices including zip code)

86-29-88377161

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☐ Yes ☒ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☐ | Smaller reporting company ☒ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No.

| Class | Outstanding at December 19, 2016 | |

| Common Stock, $0.001 par value per share | 4,061,090 |

TABLE OF CONTENTS

| PART I. | FINANCIAL INFORMATION | 1 |

| Item 1. | Financial Statements | 1 |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 13 |

| Item 3. | Quantitative and Qualitative Disclosures about Market Risk | 21 |

| Item 4. | Controls and Procedures | 21 |

| PART II. | OTHER INFORMATION | 22 |

| Item 1. | Legal Proceedings | 22 |

| Item 1A. | Risk Factors | 23 |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 23 |

| Item 3. | Defaults upon Senior Securities | 23 |

| Item 4. | Mine Safety Disclosure | 23 |

| Item 5. | Other Information | 23 |

| Item 6. | Exhibits | 23 |

| SIGNATURES | 24 | |

PART I. FINANCIAL INFORMATION

| Item 1. | Financial Statements |

SKYPEOPLE FRUIT JUICE, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

| March 31, | December 31, | |||||||

| 2016 | 2015 | |||||||

| (Unaudited) | (Audited) | |||||||

| CURRENT ASSETS | ||||||||

| Cash and cash equivalents | $ | 60,060,777 | $ | 50,006,914 | ||||

| Restricted cash | 6,190,800 | 3,079,956 | ||||||

| Accounts receivable, net of allowance of $2,407,160 as of March 31, 2016 and December 31, 2015, respectively | 49,556,277 | 50,062,300 | ||||||

| Other receivables | 519,665 | 265,079 | ||||||

| Inventories | 4,307,529 | 3,444,740 | ||||||

| Deferred tax assets | 2,337,860 | 2,326,194 | ||||||

| Advances to suppliers and other current assets | 670,275 | 3,809,970 | ||||||

| TOTAL CURRENT ASSETS | 123,643,183 | 112,995,153 | ||||||

| PROPERTY, PLANT AND EQUIPMENT, NET | 82,462,660 | 82,947,233 | ||||||

| LAND USE RIGHT, NET | 26,330,409 | 25,867,932 | ||||||

| LONG TERM ASSETS | 21,328,190 | 2,979,857 | ||||||

| DEPOSITS | 47,897,622 | 45,321,919 | ||||||

| Related party receivables | 293,236 | 290,976 | ||||||

| TOTAL ASSETS | $ | 301,955,300 | $ | 270,403,070 | ||||

| LIABILITIES | ||||||||

| CURRENT LIABILITIES | ||||||||

| Accounts payable | $ | 29,669,360 | $ | 18,332,502 | ||||

| Accrued expenses | 9,061,849 | 17,356,081 | ||||||

| Income tax payable | - | 1,153,194 | ||||||

| Advances from customers | 1,499,760 | 369,992 | ||||||

| Short-term bank loans | 32,427,986 | 33,506,838 | ||||||

| TOTAL CURRENT LIABILITIES | 72,658,955 | 70,718,607 | ||||||

| NON-CURRENT LIABILITIES | ||||||||

| Obligations under capital leases | 15,561,335 | 16,720,307 | ||||||

| TOTAL NON-CURRENT LIABILITIES | 15,561,335 | 16,720,307 | ||||||

| TOTAL LIABILITIES | 88,220,290 | 87,443,786 | ||||||

| EQUITY | ||||||||

| SkyPeople Fruit Juice, Inc, Stockholders' equity | ||||||||

| Series B Preferred stock, $0.001 par value; 10,000,000 shares authorized; None issued and outstanding as of March 31, 2016 and December 31, 2015, respectively | - | - | ||||||

| Common stock, $0.001 par value; 8,333,333 shares authorized; 4,061,090 and 27,161,499* shares issued and outstanding as of March 31, 2016 and December 31, 2015, respectively | 4,061 | 27,161 | ||||||

| Additional paid-in capital | 108,732,960 | 59,189,860 | ||||||

| Retained earnings | 104,716,402 | 105,782,482 | ||||||

| Accumulated other comprehensive income | (12,302,357 | ) | 13,069,031 | |||||

| Total SkyPeople Fruit Juice, Inc. stockholders' equity | 201,151,066 | 178,068,534 | ||||||

| Non-controlling interests | 12,583,944 | 4,895,622 | ||||||

| TOTAL EQUITY | 213,735,010 | 182,964,156 | ||||||

| TOTAL LIABILITIES AND EQUITY | $ | 301,955,300 | $ | 270,403,070 | ||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

(* The amount of shares is given prior to the Company’s 1-for-8 reverse stock split on March 10, 2016.)

| 1 |

SKYPEOPLE FRUIT JUICE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

(Unaudited)

| For the three month Ended March 31, | ||||||||

| 2016 | 2015 | |||||||

| Revenue | $ | 5,436,308 | $ | 16,571,039 | ||||

| Cost of goods sold | 5,393,484 | 9,411,678 | ||||||

| Gross profit | 42,824 | 7,159,361 | ||||||

| Operating Expenses | ||||||||

| General and administrative expenses | 679,944 | 2,984,482 | ||||||

| Selling expenses | 861,140 | 1,052,654 | ||||||

| Total operating expenses | 1,541,084 | 4,037,136 | ||||||

| Income (loss) from operations | (1,498,260 | ) | 3,122,225 | |||||

| Other income (expenses) | ||||||||

| Interest income | 131,024 | 33,553 | ||||||

| Subsidy income | 531,445 | 188,761 | ||||||

| Interest expenses | (208,665 | ) | (1,099,070 | ) | ||||

| Consulting fee related to capital lease | (9,159 | ) | - | |||||

| Total other income (expenses) | 444,645 | (876,756 | ) | |||||

| Income (loss) before income tax | (1,053,615 | ) | 2,245,469 | |||||

| Income tax provision | - | 562,569 | ||||||

| Net income (loss) | (1,053,615 | ) | 1,682,900 | |||||

| Less: Net income attributable to non-controlling interests | (12,465 | ) | (183,290 | ) | ||||

| NET INCOME (LOSS) ATTRIBUTABLE TO SKYPEOPLE FRUIT JUICE, INC. STOCKHOLDERS | $ | (1,066,080 | ) | $ | 1,499,610 | |||

| Other comprehensive income (loss) | ||||||||

| Foreign currency translation adjustment | $ | 20,698,646 | $ | (758,356 | ) | |||

| Total comprehensive income | 19,645,031 | 924,544 | ||||||

| Comprehensive expenses attributable to non-controlling interests | (4,997,409 | ) | (166,407 | ) | ||||

| COMPREHENSIVE INCOME ATTRIBUTABLE TO SKYPEOPLE FRUIT JUICE, INC. STOCKHOLDERS | $ | 14,647,622 | $ | 907,661 | ||||

| Earnings (loss) per share: | ||||||||

| Basic and diluted earnings (loss) per share | $ | (0.30 | ) | $ | 0.06 | |||

| Weighted average number of shares outstanding | ||||||||

| Basic and diluted | 3,548,183 | 26,661,499 | * | |||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

(* The amount of shares is given prior to the Company’s 1-for-8 reverse stock split on March 10, 2016.)

| 2 |

SKYPEOPLE FRUIT JUICE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| For the three months ended March 31, | ||||||||

| 2016 | 2015 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||

| Net income (loss) | $ | (1,053,615 | ) | $ | 1,682,900 | |||

| Adjustments to reconcile net income to net cash provided by operating activities | ||||||||

| Depreciation and amortization | 2,745,539 | 1,591,176 | ||||||

| Deferred income tax assets | (11,666 | ) | (710,208 | ) | ||||

| Provisions provided for bad debt expenses | - | 1,452,096 | ||||||

| Inventory markdown | - | 32,629 | ||||||

| Changes in operating assets and liabilities | ||||||||

| Accounts receivable | (1,852,548 | ) | 12,389,382 | |||||

| Other receivable | (2,572,743 | ) | 305,987 | |||||

| Advances to suppliers and other current assets | 3,135,265 | 225,142 | ||||||

| Inventories | (836,764 | ) | (1,364,810 | ) | ||||

| Accounts payable | 4,200,224 | (5,774,160 | ||||||

| Accrued expenses | (989,025 | ) | (940,810 | ) | ||||

| Income tax payable | (3,473,175 | ) | (710,828 | ) | ||||

| Advances from customers | 1,116,238 | (29,412 | ) | |||||

| Net cash provided by operating activities | 407,730 | 8,149,084 | ||||||

| CASH FLOWS FROM INVESTING ACTIVITIES | ||||||||

| Additions to property, plant and equipment | (2,527,423 | ) | (1,984,556 | ) | ||||

| Prepayment for other assets | (257,189 | ) | - | |||||

| Prepayments for deposit on equipment | - | (145,035 | ) | |||||

| Net cash used in investing activities | (2,784,612 | ) | (2,129,591 | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||||||

| Issue of common stock | 16,641,394 | - | ||||||

| Proceeds from short-term bank loans | - | 17,332,906 | ||||||

| Repayment of short-term bank loans | (1,233,968 | ) | (9,213,508 | ) | ||||

| Payment for capital lease | (11,391,267 | ) | (39,212 | ) | ||||

| Net cash provided by financing activities | 4,016,159 | 8,080,186 | ||||||

| Effect of change in exchange rate | 5,814,354 | (74,212 | ) | |||||

| NET INCREASE IN CASH AND CASH EQUIVALENTS | 10,053,863 | 14,025,467 | ||||||

| Cash and cash equivalents, beginning of period | 50,006,914 | 25,130,302 | ||||||

| Cash and cash equivalents, end of period | $ | 60,060,777 | $ | 39,155,769 | ||||

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION | ||||||||

| Cash paid for interest | $ | 208,665 | $ | 1,099,070 | ||||

| Cash paid for income taxes | $ | 1,259,559 | $ | 1,645,954 | ||||

| SUPPLEMENTARY DISCLOSURE OF SIGNIFICANT NON-CASH TRANSACTION | ||||||||

| Transferred from other assets to property, plant and equipment and construction in process | $ | 2,342,127 | $ | 6,894,428 | ||||

| Equipment acquired by capital lease | $ | - | $ | 1,682,900 | ||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| 3 |

SKYPEOPLE FRUIT JUICE, INC

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

| 1. | Basis of Presentation |

The unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States for interim financial information and the rules and regulations of the Securities and Exchange Commission. In the opinion of management, the unaudited financial statements have been prepared on the same basis as the annual financial statements and reflect all adjustments, which include only normal recurring adjustments, necessary to present fairly the financial position as of March 31, 2016 and the results of operations and cash flows for the periods ended March 31, 2016 and 2015. The financial data and other information disclosed in these notes to the interim financial statements related to these periods are unaudited. The results for the three months ended March 31, 2016 are not necessarily indicative of the results to be expected for any subsequent periods or for the entire year ending December 31, 2016. The balance sheet at December 31, 2015 has been derived from the audited financial statements at that date.

Certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States have been condensed or omitted pursuant to the Securities and Exchange Commission’s rules and regulations. These unaudited financial statements should be read in conjunction with our audited financial statements and notes thereto for the year ended December 31, 2015 as included in our Annual Report on Form 10-K.

| 2. | Business Description and Significant Accounting Policies |

The principal activities of SkyPeople Fruit Juice, Inc. (together with our direct or indirect subsidiaries, “we,” “us,” “our” or “the Company”) consist of production and sales of fruit juice concentrates, fruit juice beverages, and other fruit-related products in the People’s Republic of China (“PRC”, or “China”), and overseas markets. All activities of the Company are principally conducted by subsidiaries operating in the PRC.

| 4 |

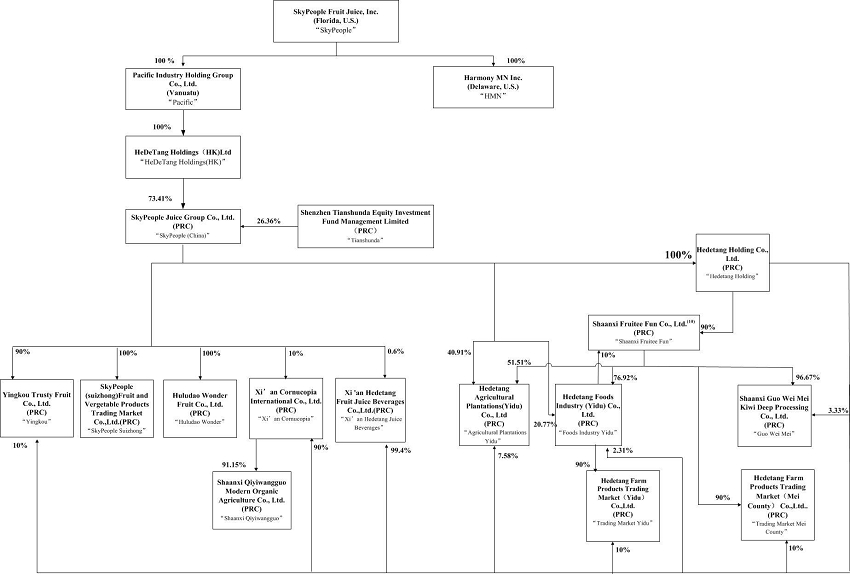

Organizational Structure

Current organizational structure is set forth in the diagram below:

| (1) | Xi’an Qinmei Food Co., Ltd., an entity not affiliated with the Company, owns the other 8.85% of the equity interest in Shaanxi Qiyiwangguo. |

| (2) | Formerly known as Shaanxi Tianren Organic Food Co. Ltd. |

| (3) | SkyPeople Juice Group Yidu Orange Products Co., Ltd. was established on March 13, 2012. Its scope of business includes deep processing and sales of oranges. |

| (4) | Hedetang Fruit Juice Beverages (Yidu) Co., Ltd. was established on March 13, 2012. Its scope of business includes the production and sales of fruit juice beverages. |

| (5) | SkyPeople (Suizhong) Fruit and Vegetable Products Co., Ltd. was established on April 26, 2012. Its scope of business includes the initial processing, quick-frozen and sales of agricultural products and related by-products. |

| (6) | SkyPeople Juice Group (Mei County) Kiwi Fruit and Farm Products Trading Market Co., Ltd. (“Kiwi Fruit & Farm Products”) was established on April 19, 2013. Its scope of business includes preliminary processing of agricultural and subsidiary products, establishment of trading market for agriculture products, and similar activities. |

| (7) | Shaanxi Guo Wei Mei Kiwi Deep Processing Co., Ltd. was established on April 19, 2013. Its scope of business includes producing kiwi fruit juice, kiwi puree and cider beverages, and similar products. |

| 5 |

| (8) | Xi’an Hedetang Fruit Juice Beverages Co., Ltd. (“Xi’an Hedetang”) was established on March 31, 2014. Its scope of business includes the production and sales of fruit juice beverages. |

| (9) | Xi’an Cornucopia International Co., Ltd. (“Cornucopia”) was established on July 2, 2014. Its scope of business includes retail and wholesale of pre-packaged food. |

| (10) | Shaanxi Fruitee Fun Co., Ltd. (“Fruitee Fun”) was established on July 3, 2014. Its scope of business includes retail and wholesale of pre-packaged food. |

| (11) | Hedetang Holding Co., Ltd. (“Hedetang Holding”) was established on July 21, 2014. Its scope of business includes corporate investment consulting, corporate management consulting, corporate imagine design and corporative marketing planning. |

| (12) | The Company acquired Huludao Wonder Co. Ltd. (“Huludao”) on June 10, 2008. Its scope of business mainly includes the manufacture and sale of concentrated fruit juice and fruit juice beverages. |

| (13) | The Company acquired Yingkou Trusty Fruits Co., Ltd. (“Yingkou”) on November 25, 2009. Its scope of business mainly includes the manufacture of concentrated fruit juice. |

Principles of Consolidation

Our consolidated financial statements include the accounts of the Company and its subsidiaries. All material intercompany accounts and transactions have been eliminated in consolidation.

The consolidated financial statements are prepared in accordance with U.S. GAAP. This basis differs from that used in the statutory accounts of SkyPeople (China), Shaanxi Qiyiwangguo, Huludao Wonder, Yingkou, Hedetang Juice Beverages, Orange Products, SkyPeople Suizhong, Kiwi Fruit & Farm Products, Guo Wei Mei, Xi’an Hedetang, Cornucopia, Fruitee Fun and Hedetang Holding, which were prepared in accordance with the accounting principles and relevant financial regulations applicable to enterprises in the PRC. All necessary adjustments have been made to present the financial statements in accordance with U.S. GAAP.

Uses of estimates in the preparation of financial statements

The Company’s condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America and this requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the condensed consolidated financial statements and reported amounts of revenue and expenses during the reporting period. The significant areas requiring the use of management estimates include, but not limited to, the allowance for doubtful accounts receivable, estimated useful life and residual value of property, plant and equipment, provision for staff benefit, recognition and measurement of deferred income taxes and valuation allowance for deferred tax assets. Although these estimates are based on management’s knowledge of current events and actions management may undertake in the future, actual results may ultimately differ from those estimates.

| 6 |

Shipping and Handling Costs

Shipping and handling amounts billed to customers in related sales transactions are included in sales revenues and shipping expenses incurred by the Company are reported as a component of selling expenses. The shipping and handling expenses of $92,408 and $956,653 for the three months ended March 31, 2016 and 2015, respectively, are reported in the Consolidated Statements of Comprehensive Income as a component of selling expenses.

Leases

Leases are reviewed and classified as capital or operating at their inception in accordance with ASC Topic 840, Accounting for Leases. For leases that contain rent escalations, the Company records monthly rent expense equal to the total amount of the payments due in the reporting period over the lease term. The difference between rent expense recorded and the amount paid is credited or charged to deferred rent account.

Earnings per share

The Company adopted ASC Topic 215, Statement of Shareholder Equity. Basic EPS are computed by dividing net income available to common shareholders (numerator) by the weighted average number of common shares outstanding (denominator) during the period. Diluted EPS give effect to all dilutive potential common shares outstanding during a period. In computing diluted EPS, the average price for the period is used in determining the number of shares assumed to be purchased from the exercise of stock options and warrants.

Recent Accounting Pronouncements

In January 2016, the FASB issued an amendment to its accounting guidance related to recognition and measurement of financial assets and financial liabilities. The amendment addresses certain aspects of recognition, measurement, presentation and disclosure of financial instruments. The amendment will be effective for us beginning in our first quarter of fiscal year 2019. We are evaluating the impact of adopting this amendment to our consolidated financial statements.

In February 2016, the FASB issued a new standard on accounting for leases. The new standard is intended to provide enhanced transparency and comparability by requiring lessees to record right-of-use assets and corresponding lease liabilities on the balance sheet. The new standard will continue to classify leases as either finance or operating, with classification affecting the pattern of expense recognition in the statement of earnings. The new standard is required to be adopted using a modified retrospective method to each prior reporting period presented with various optional practical expedients. The new standard will be effective for us beginning in our first quarter of fiscal year 2020 with early adoption permitted. We are evaluating the impact of adopting this amendment to our consolidated financial statements.

| 7 |

In March 2016, the FASB issued an amendment to its accounting guidance related to employee share-based payments. The amendment simplifies several aspects of the accounting for employee share-based payments including the accounting for income taxes, forfeitures, and statutory tax withholding requirements, as well as classification in the statement of cash flows. The amendment will be effective for us beginning in our first quarter of fiscal year 2018 with early adoption permitted. We are evaluating the impact of adopting this amendment to our consolidated financial statements.

There were no other recent accounting pronouncements or changes in accounting pronouncements during the three months ended March 31, 2016 compared to the recent accounting pronouncements described in our Annual Report on Form 10-K for the fiscal year ended December 31, 2015 that are of significance or potential significance to us.

| 3. | Inventories |

Inventories by major categories are summarized as follows:

| March 31, 2016 | December 31, 2015 | |||||||

| Raw materials and packaging | $ | 1,143,570 | $ | 944,812 | ||||

| Finished goods | 3,163,959 | 2,499,928 | ||||||

| Inventories | $ | 4,307,529 | $ | 3,444,740 | ||||

| 4. | Related Party Transaction |

Sales to related party

The company’s subsidiary sold fruit beverages to a related entity, Shaanxi Fullmart Convenient Chain Supermarket Co., Ltd. ("Fullmart"), for approximately $0 and $412,543 for the three months ended March 31, 2016 and 2015, respectively. The accounts receivable balances were approximately $366,081 and $441,253 as of March 31, 2016 and December 31, 2015, respectively. Fullmart is a company indirectly owned by a member of our Board of Directors (former Chairman and Chief Executive Officer), Mr. Yongke Xue.

Long-term loan – related party

There were no short-term loans to a related party as of March 31, 2016.

On February 18, 2013, SkyPeople (China) entered into a loan agreement with SkyPeople International Holdings Group Limited (the

"Lender"). The Lender indirectly holds 50.2% interest in the Company. Mr. Yongke Xue ("Y. K. Xue"), then the

Chairman and Chief Executive Officer (“CEO”) of the Company and currently a Member of the Company’s Board of

Directors (the "Board") and Mr. Hongke Xue, our Chairman and CEO, indirectly and beneficially own 80.0% and 9.4% of

the equity interest in the Lender, respectively. Pursuant to the Agreement, the Lender agreed to extend to the Company a one-year

unsecured term loan with a principal amount of $8.0 million at an interest rate of 6% per annum. During 2013, the Company received

$8.0 million from the Lender. In February 2014, both parties extended this loan for another two years under the original terms

of the agreement.

| 8 |

The Company recorded interest expense on this loan in the amount of $116,073 for the three months ended March 31, 2015.

On October 16, 2015, the Company entered into a Share Purchase Agreement with the Lender to sell 5,321,600 shares of the common stock of the Company at the price of $7,982,400, and which was paid by cancellation of the loan by the Lender. On March 10, 2016, the Lender canceled the loan and the shares were issued to the Lender.

| 5. | Concentrations |

| (1) | Concentration of customers |

Sales to our five largest customers accounted for approximately 53% and 32% of our net sales during the three months ended March 31, 2016 and 2015, respectively. There were two customers each representing over 10% of total sales for the three months ended March 31, 2015, and there was no customer representing over 10% of total sales for the three months ended March 31, 2016.

| (2) | Concentration of suppliers |

Two suppliers accounted for 97% and 13% of our purchases for the three months ended March 31, 2016 and March 31, 2015, respectively. Our top supplier accounted for 96% of our purchases for the three months ended March 31, 2016, and there was no other single supplier that accounted for over 10% of our purchases for the three months ended March 31, 2015.

| 6. | Share split |

On March 10, 2016, the Company filed with the Florida Secretary of State's office an amendment to its Articles of Incorporation. As a result of the Articles of Amendment, the Company authorized and approved an 1-for-8 reverse stock split of the Company’s authorized shares of common stock from 66,666,666 shares to 8,333,333 shares, accompanied by a corresponding decrease in the Company’s issued and outstanding shares of common stock (the "Reverse Stock Split"). The common stock remains a par value of $0.001. No changes were made to the number of authorized preferred shares of the Company, which remains as 10,000,000, none of which have been issued. The amendment to the Articles of Incorporation of the Company took effect on March 16, 2016.

| 7. | Transfer of shares |

On March 11, 2016, Skypeople Juice International Holding (HK) Limited (the “Skypeople HK”), a wholly owned subsidiary

of SkyPeople Fruit Juice, Inc. (the "Company") and a 99.78% owner of SkyPeople Juice Group Co., Ltd. (“Skypeople

China”) entered into a Share Transfer Agreement and a Capital Contribution (the “Agreements”) with Shenzhen

TianShunDa Equity Investment Fund Management Co., Ltd. (the “TSD”), a limited liability corporation registered in

China.

| 9 |

Skypeople HK incorporated Skypeople China in Shaanxi Province, China on March 13, 2012 and pursuant to the approval certificate and business license of Skypeople China, SkyPeople HK was required to contribute RMB 427,000,000 (approximately $65,698,308) and Hongke Xue, currently the Chairman of the Board of Directors of the Company and our Chief Executive Officer (“Xue”), was required to contribute RMB 1,000,000 (approximately $153,846) to Skypeople China, and Skypeople HK and Xue as a result would own 427,000,000 shares (99.78%) and 1,000,000 shares (0.22%) of Skypeople China, respectively. As of March 10, 2016, Skypeople HK had contributed RMB 314,190,900 (approximately $48,337,062) to Skypeople China but had not contributed the remaining RMB 112,809,100 (approximately $17,355,246) as the payment for 112,809,100 shares of Skypeople China.

Pursuant to the Agreements, TSD shall acquire 112,809,100 shares of Skypeople China from Skypeople HK and shall make a total capital contribution RMB 131,761,028.80 (approximately $20,270,928) to Skypeople China, which is calculated based upon 8 times of Skypeople China’s net profit per share for 2014 (about RMB 0.146 per share) multiplied by 112,809,100 shares. RMB 112,809,100 out of the RMB 131,761,028.80 (the "Capital Contributions") shall be used as payment for outstanding capital contribution due to Skypeople China by Skypeople HK and the remaining RMB 18,951,928.80 (approximately $2,915,681) shall be used as additional capital contribution to Skypeople China and shall be deposited into Skypeople China’s capital surplus account. On March 18, 2016, TSD paid the full Capital Contributions to Skypeople China s and the shares were transferred, resulting in TSD owning 112,809,100 shares, or 26.36%, of Skypeople China.

| 8. | Segment Reporting |

The Company operates in six segments: concentrated apple juice and apple aroma, concentrated kiwifruit juice and kiwifruit puree, concentrated pear juice, fruit juice beverages, fresh fruits and vegetables, and others. Our concentrated apple juice and apple aroma is primarily produced by the Company’s Huludao Wonder factory; concentrated pear juice is primarily produced by the Company’s Jiangyang factory. However, as the Company uses the same production line to manufacture concentrated apple juice and concentrated pear juice. In addition, both Shaanxi Province, where the factory of Jianyang factory is located, and Liaoning Province, where the factory of Huludao Wonder is located, are rich in fresh apple and pear supplies. Jinagyang factory also produces concentrated apple juice and Huludao Wonder factory also produces concentrated pear juice when necessary. Concentrated kiwifruit juice and kiwifruit puree is primarily produced by the Company’s Qiyiwangguo factory, and fruit juice beverages is primarily produced by the Company’s Qiyiwangguo factory. The Company’s other products include fructose, concentrated turnjujube juice, and other by products, such as kiwifruit seeds.

Concentrated fruit juice is used as a basic ingredient for manufacturing juice drinks and as an additive to fruit wine and fruit jam, cosmetics and medicines. The Company sells its concentrated fruit juice to domestic customers and exported directly or via distributors. The Company believes that its main export markets are the United States, the European Union, South Korea, Russia and the Middle East to North America, Europe, Russia, South Korea and the Middle East. The Company sells its Hedetang branded bottled fruit beverages domestically primarily to supermarkets in the PRC. The Company sells its fresh fruit and vegetables to supermarkets and whole sellers in the PRC.

| 10 |

Some of these product segments might never individually meet the quantitative thresholds for determining reportable segments and we determine the reportable segments based on the discrete financial information provided to the chief operating decision maker. The chief operating decision maker evaluates the results of each segment in assessing performance and allocating resources among the segments. Since there is an overlap of services provided and products manufactured between different subsidiaries of the Company, the Company does not allocate operating expenses and assets based on the product segments. Therefore, operating expenses and assets information by segment are not presented. Segment profit represents the gross profit of each reportable segment.

For the Three Months Ended March 31, 2016 (in thousands)

| Concentrated apple juice and apple aroma | Concentrated kiwifruit juice and kiwifruit puree | Concentrated pear juice | Fruit juice beverages | Fresh fruits and vegetables | Others | Total | ||||||||||||||||||||||

| Reportable segment revenue | $ | 10,473 | $ | 39 | $ | 310 | $ | 4 | $ | - | - | $ | 10,830 | |||||||||||||||

| Inter-segment loss | (5,214 | ) | (23 | ) | (153 | ) | (2 | ) | - | - | (5,394 | ) | ||||||||||||||||

| Revenue from external customers | 5,259 | 16 | 157 | 2 | 2 | - | 5,436 | |||||||||||||||||||||

| Segment gross profit (loss) | $ | 45 | $ | (8 | ) | $ | 4 | $ | 1 | $ | 1 | - | $ | 43 | ||||||||||||||

For the Three Months Ended March 31, 2015 (in thousands)

| Concentrated apple juice and apple aroma | Concentrated kiwifruit juice and kiwifruit puree | Concentrated pear juice | Fruit juice beverages | Fresh fruits and vegetables | Others | Total | ||||||||||||||||||||||

| Reportable segment revenue | $ | 25 | $ | 3,560 | $ | 4,764 | $ | 22,013 | $ | - | - | $ | 30,362 | |||||||||||||||

| Inter-segment revenue | - | (1,672 | ) | (101 | ) | (12,018 | ) | - | - | (13,791 | ) | |||||||||||||||||

| Revenue from external customers | 25 | 1,888 | 4,663 | 9,995 | - | - | 16,571 | |||||||||||||||||||||

| Segment gross profit | $ | 8 | $ | 686 | $ | 1,886 | $ | 4,579 | $ | - | - | $ | 7,159 | |||||||||||||||

| 11 |

The following table reconciles reportable segment profit to the Company’s condensed consolidated income before income tax provision for the three months ended March 31, 2016 and 2015:

| 2016 | 2015 | |||||||

| Segment profit | $ | 42,824 | $ | 7,159,361 | ||||

| Unallocated amounts: | ||||||||

| Operating expenses | (1,541,084 | ) | (4,037,136 | ) | ||||

| Other income (expenses) | 444,645 | (876,756 | ) | |||||

| Income (loss) before tax provision | $ | (1,053,615 | ) | $ | 2,245,469 | |||

| 9. | Subsequent Events |

On June 15, 2016, Hedetang Holdings Co., Ltd. (the “Hedetang”), a wholly owned subsidiary of SkyPeople Fruit Juice, Inc. (the "Company"), entered into a Share Transfer Agreement (the “Agreement”) with Shaanxi New Silk Road Kiwifruit Group Inc. ( the “NSR”), a limited liability corporation registered in China.

Pursuant to the Agreement, NSR will acquire 51% of the equity shares of Shaanxi Guoweiduomei Beverage Co, Limited, a wholly owned subsidiary of Hedetang (the "Shares"). The tentative total transfer price for the Shares is 300 million RMB (approximately $46 million) and is subject to and will be settled according to the final price in the valuation report to be issued by an appraisal firm jointly engaged by both parties. NSR shall pay the total transfer price to Hedetang within six months of the effective date of the Agreement. If NSR fails to pay the total transfer price within six months due to the delay of the approval process from the local authority, NSR can receive a payment extension for up to twelve months from the effective date of the Agreement upon the negotiation and agreement by the parties. Because NSR is a state-owned enterprise in China and its investment needs to be approved by a higher level administrative authority in China, NSR has the right to terminate the Agreement unilaterally if it fails to receive the approval from such administrative authority within twelve months from the date of this Agreement. As of the date of this report, the local authority has not approved this transaction, and we have not yet received payment from NSR. The Company is now negotiating with NSR the potential terms to terminate this Agreement.

| 12 |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

The following discussion should be read in conjunction with the Financial Statements and Notes thereto appearing elsewhere in this Form 10-Q.

DISCLAIMER REGARDING FORWARD-LOOKING STATEMENTS

The following discussion and analysis of the condensed consolidated financial condition and results of operations should be read in conjunction with the condensed consolidated financial statements and notes in Item I above and with the audited consolidated financial statements and notes, and with the information under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our most recent Annual Report on Form 10-K. This discussion and analysis contains forward-looking statements that involve risks, uncertainties and assumptions. Our actual results could differ materially from the results described in or implied by these forward-looking statements as a result of various factors, including those discussed in this report and under the heading “Risk Factors” in our most recent Annual Report on Form 10-K.

Overview of Our Business

We are engaged in the production and sales of fruit juice concentrates (including fruit purees, concentrated fruit purees and concentrated fruit juices), fruit beverages (including fruit juice beverages and fruit cider beverages), and other fruit related products (including organic and non-organic fresh fruits) in and out of the PRC. Our fruit juice concentrates, which include apple, pear and kiwifruit concentrates, are sold to domestic customers and exported directly or via distributors. We sell our Hedetang branded bottled fruit beverages domestically primarily to supermarkets in the PRC. For the three months ended March 31, 2016, sales of our fruit concentrates, fruit beverages, fresh fruits and other fruit related products represented 100%, 0% and 0% of our revenue, respectively, compared to 40%, 60% and 0% respectively, for the same period of 2015.

In addition to our domestic sales, we also export our products. We sell our products either through distributors with good credit or to end users directly. Our main export markets are Asia, North America, Europe, Russia and the Middle East. We sell our other fruit related products to domestic customers.

We currently market our Hedetang brand fruit beverages in only certain regions of the PRC. We plan to expand the market presence of Hedetang over a broader geographic area in the PRC. In particular, we plan to expand our glass bottle production line to produce higher margin portable fruit juice beverages targeting consumers in more populated Chinese cities. Currently we produce six flavors of fruit beverages in 280 ml glass bottles, 418 ml glass and 500 ml glass bottles and BIB packages, including apple juice, pear juice, kiwifruit juice, mulberry juice, peach juice and pomegranate juice. We currently sell our fruit beverages to over 100 distributors and more than 20,000 retail stores in approximately 20 provinces. Our products are sold through distributors in stores such as Hualian Supermarket in Beijing, RT-Mart in Shenyang, WOWO in Chengdu, Quanjia convenient store chain, Vanguard in Xi’an, Carrefour in Chongqing and Shenyang and Lianhua Supermarket in Shanghai.

| 13 |

We plan to continue to focus on creating new products with high margins to supplement our current product offering.

Our business is highly seasonal and can be greatly affected by weather because of the seasonal nature in the growing and harvesting of fruits and vegetables. Our core products are apple, pear and kiwifruit juice concentrates, which are produced from July or August to April of the following year. The squeezing season for (i) apples is from August to January or February; (ii) pears is from July or August until April of next year; and (iii) kiwifruit is from September through December. Typically, a substantial portion of our revenues is earned during our first and fourth quarters. To minimize the seasonality of our business, we make continued efforts in identifying new products with harvesting seasons complementary to our current product mix. Our goal is to lengthen our squeezing season, thus increasing our annual production of fruit juice concentrates and fruit beverages. In the first quarter of 2009, we introduced mulberry and kiwifruit cider beverages in the Chinese market. Unlike fruit juice concentrates, which can only be produced during the squeezing season, such fruit beverages are made out of fruit juice concentrates and can be produced and sold in all seasons. With continuous efforts in marketing of our beverages in domestic market, we believe that our seasonality will be reduced.

Fresh fruits are the primary raw materials needed for the production of our products. Our raw materials mainly consist of apples, pears and kiwifruits. Other raw materials used in our business include pectic enzyme, amylase, auxiliary power fuels and other power sources such as coal, electricity and water.

We purchase raw materials from local markets and fruit growers that deliver directly to our plants. We have implemented a fruit-purchasing program in areas surrounding our factories. In addition, we organize purchasing centers in rich fruit production areas, helping farmers deliver fruit to our purchasing agents easily and in a timely manner. We are then able to deliver the fruit directly to our factory for production. We have assisted local farmers in their development of kiwifruit fields to help ensure a high quality product throughout the production channel. Our raw material supply chain is highly fragmented and raw fruit prices are highly volatile in China. Fruit concentrate and fruit juice beverage companies generally do not enter into purchasing agreements with raw fruit suppliers. In addition to raw materials, we purchase various ingredients and packaging materials such as sweeteners, glass and plastic bottles, cans and packing barrels. We generally purchase our materials or supplies from multiple suppliers. We are not dependent on any one supplier or group of suppliers.

Shaanxi and Liaoning Provinces, where our manufacturing facilities are located, are large fruit producing provinces. We own and operate four manufacturing facilities in the PRC, all of which are strategically located near fruit growing centers so that we can better preserve the freshness of the fruits and lower our transportation costs. To take advantage of economies of scale and to enhance our production efficiency, generally, each of our manufacturing facilities has a focus on products made from one particular fruit according to the proximity of such manufacturing to the sources of supply for that fruit. Our kiwifruit processing facilities are located in Zhouzhi County of Shaanxi Province, which has the largest planting area of apples and kiwifruit in the PRC. Our pear processing facilities are located in Shaanxi Province, which is the main pear-producing province in the PRC. Our apple processing facilities are located in Liaoning Province, a region that abounds with high acidity apples. As we use the same production line for concentrated apple juice and concentrated pear juice and both Shaanxi Province and Liaoning Province are rich in fresh apple and pear production, our Liaoning facilities also produced concentrated apple juice and our Shaanxi Province facilities also produced concentrated apple juice based on customer need. We believe that these regions provide adequate supply of raw materials for our production needs in the foreseeable future.

| 14 |

On August 30, 2010, we closed the public offering of 5,181,285 shares of our Common Stock at a price of $5.00 per share for approximately $25.9 million. We received an aggregate of approximately $24 million as net proceeds after deducting underwriting discounts and commissions and offering expenses. As of December 31, 2015, we had spent approximately $18.6 million on various capital projects in Huludao Wonder and $5.4 million on projects in SkyPeople Suizhong, as described in project (1) below using the proceeds from our public offering. The following table presents the capital projects on which we currently plan to use the proceeds from this offering. We review these projects and capital expenditures on a quarterly basis based on the market conditions and associated costs of these projects.

Capital Investment Projects

Investment/Service Agreement with Yidu Municipal People’s Government

On October 29, 2012, SkyPeople (China) entered into an investment/service agreement (the “Investment Agreement”) with Yidu Municipal People’s Government in Hubei Province of China.

Under the Investment Agreement, the parties agreed to invest and establish an orange comprehensive deep processing zone in Yidu.

The Company is responsible for the establishment, construction and financing of the project with a total investment of RMB 300 million (approximately $48 million), in fixed assets and the purchase of land use rights, while the Yidu government agreed to provide a parcel of land for the project that is approximately 280 mu in size located at Gaobazhou Town of Yidu for a fee payable by the Company. The consideration for transferring the land use right for the project land shall be RMB 0.3 million per mu.

The main scope of the Yidu project includes the establishment of:

| 1. | one modern orange distribution and sales center (the “distribution center”); |

| 2. | one orange comprehensive utilization deep processing zone (the “deep processing zone”), including: |

| a) | one 45 ton/hour concentrated orange juice and byproduct deep processing production line; | |

| b) | one bottled juice drink production line with a capacity to produce 6,000 glass bottles per hour; | |

| c) | one storage freezer facility with a capacity to store 20,000 tons of concentrated orange juice; and | |

| d) | general purpose facilities within the zone, office space, general research and development facilities, service area, living quarters and other ancillary support areas |

| 3. | one research and development center for orange varietal improvement and engineering technology (the “R&D center”) and |

| 4. | one standardized orange plantation (the “orange plantation”). |

| 15 |

The total amount of RMB 300 million (approximately $48 million) will mainly be used to establish the distribution center and the deep processing zone on the project land of approximately 280 mu. The Company and Yidu Municipal People’s Government agreed to discuss the investment amount and location for establishing the R&D center and the orange plantation in the future.

On November 23, 2015, the Company started the construction of the Yidu project. The Company plan to finish the construction of the infrastructure of office building, R&D center, fruit juice production facility and cold storage, and other areas in the second quarter of 2017.

The distribution center is planned to be completed by the last quarter of 2017, and the orange plantation is planned to be operational in the second quarter of 2017.

Investment/Service Agreement with Mei County National Kiwi Fruit Wholesale Trading Center

On April 3, 2013, SkyPeople (China) entered into an Investment Agreement (the "Agreement") with the Managing Committee of Mei County National Kiwi Fruit Wholesale Trading Center (the "Committee"). The Committee has been authorized by the People’s Government of Mei County to be in charge of the construction and administration of the Mei County National Kiwi Fruit Wholesale Trading Center (the “Trading Center”).

Under the Agreement, the parties agreed to invest in and establish a kiwi fruit comprehensive deep processing zone and kiwi fruit and fruit-related materials trading zone in Yangjia Village, Changxing Town of Mei County with a total planned area of total planned area of 286 mu (approximately 47 acres) (the “Project”).

Pursuant to the Agreement, the Company will be responsible for the construction and financing of the Project with a total investment of RMB 445.6 million (approximately $71.9 million) in buildings and equipment. In addition, the Company agreed to pay for the land use rights for the Project land a fee of RMB 0.3 million per mu. The Committee is responsible for financing and constructing the basic infrastructure surrounding the Project, such as the main water supply, main water drainage, electricity, sewage, access roads to the Project, natural gas and communications networks.

Mei County National Kiwi Fruit Wholesale Trading Center built by the Company has started normal operations. There are 25 enterprises operating in the trading center, which includes 12 logistic companies, 4 on-line sales companies, 2 packing companies, and 3 agriculture companies, and other operations. In addition, all related government departments of National Kiwi Fruit Wholesale Trading Center have moved in. The trading center is expected to complete the promotion for the sale and lease of spaces of the trading center in the second quarter of 2017. The Company is expected to generate income from this trading center in various operations and maximize the Company’s profit in agriculture trading area.

On April 19, 2013, we established Shaanxi Guo Wei Mei Kiwi Deep Processing Co., Ltd. (“Guo Wei Mei”) as a part of National Kiwi Fruit Wholesale Trading Center to engage in the business of producing kiwi fruit juice, kiwi puree and cider beverages, and similar products. The total estimated investment was RMB 294 million (approximately $46 million). We are now building fruit juice production lines, a vegetable and fruit flash freeze facility, an R&D center and an office building. We plan to compete the construction in the second quarter of 2017.

| 16 |

Suizhong Project

On July 15, 2011, SkyPeople entered into a Letter of Intent with the People’s Government of Suizhong County, Liaoning Province, to establish a fruit and vegetable industry chain and further processing demonstration zone in Suizhong County, Liaoning Province (the “Suizhong project”).

The Suizhong project may include one or more of the following: the construction and operation of fruit juice production lines, vegetable and fruit flash freeze facility, refrigeration storage facility and warehouse, a world class food safety testing center, fruit and vegetable modern supply chain and e-commerce platform, fruit and vegetable finished products processing center and exhibition center.

The Company has made partial payment to acquire land use rights from the local government, purchase equipment and build facilities. The Company is currently in the process of building up facilities and purchasing equipment. As of date of this report, the Company has finished construction of an office building, dormitory, refrigeration storage facility and warehouse. Due to heavy competition in the concentrated fruit juice business in China, the construction work on this project is currently suspended.

Results of Operations

Comparison of Three Months ended March 31, 2016 and 2015:

Revenue

The following table presents our consolidated revenues for each of our main products for the three months ended March 31, 2016 and 2015, respectively (in thousands for the revenue):

| Three month ended March 31, | Change | |||||||||||||||

| 2016 | 2015 | Amount | % | |||||||||||||

| Concentrated apple juice and apple aroma | $ | 5,259 | $ | 25 | $ | 5,234 | 20,936 | %) | ||||||||

| Concentrated kiwifruit juice and kiwifruit puree | 16 | 1,888 | (1,872 | ) | 99 | % | ||||||||||

| Concentrated pear juice | 157 | 4,663 | (4,506 | ) | 97 | % | ||||||||||

| Fruit juice beverages | 2 | 9,995 | (9,993 | ) | 100 | % | ||||||||||

| Fresh fruits and vegetables | - | - | - | |||||||||||||

| Others | 2 | - | (100 | %) | ||||||||||||

| Total | $ | 5,436 | $ | 16,571 | $ | (11,135 | ) | (67 | %) | |||||||

The decrease in gross revenue for the three months ended March 31, 2016 was primarily due to decreased sales in most of our product lines that was partially offset by increased revenues from concentrated apple juice and apple aroma.

| 17 |

Sales from apple-related products increased for the three months ended March 31, 2016, as the Company sold approximately 4,796 tons of concentrated apple juice versus 211 tons of concentrated apple juice in the same period of 2015. Such an increase was partially offset by a decrease in unit price of concentrated apple juice. Most of our concentrated apple juice was sold directly or indirectly to the international market. In 2016, international demand of concentrated apple juice from China continued to drop. According to the data provided by the Chinese Customs, the amount of exported concentrated apple juice from China dropped by 11% in the first half year of 2016 as compared to the same period of last year. Over the past three years, the purchase price of fresh apple has increased, but the sales price of concentrated apple related products was low in 2016. Because of the negative trend of the international market and estimated lower margin, our YingKou factory did not operate its concentrated apple juice production facilities in 2016, which caused a lower inventory of concentrated apple juice.

During the first quarter of 2016, due to increased demand for concentrated apple juice from our customers, we purchased the concentrated apple juice from our suppliers and sold such concentrated apple juice to our customers to satisfy our customers’ need. We do not expect a continued increase in customers’ order for concentrated apple juice in near future.

Sales from concentrated kiwifruit juice and kiwifruit puree decreased during the first quarter of 2016 as compared to net sales of kiwi-related product line in the same quarter of 2015, primarily as a result of the decreased amount of products sold in the first quarter of 2016 as compare to same period of 2015. Our production of concentrated kiwifruit juice and kiwifruit puree in the first quarter of 2016 was low as the demand for our products decreased in the market and our factories were closed in observance of the Spring Festival holidays in China.

Sales of concentrated pear juice decreased in the first quarter of 2016 as we sold 199 and 1,519 tons of concentrated pear juice during first quarter of 2016 and 2015, respectively. The decrease in sales amount was mainly due to short of inventory of concentrated pear juice. Due to unexpected weather conditions in the 2015 pear harvest season, the amount of available raw material supplies was low in early 2016. As a result, the squeezing season started later than usual, and the production amount was lower.

Sales from our fruit juice beverages decreased for the first quarter of 2016, primarily due to due to a decrease in the in-store demand of our products as a result of heavy competition in China market, as consumers increased their fruit juice beverage purchases through on-line home delivery of groceries instead of through the traditional in-store supermarkets in which we sell our products.

Gross Margin

The following table presents the consolidated gross profit of each of our main products and the consolidated gross profit margin, which is gross profit as a percentage of the related revenues, for the three months ended March 31, 2016 and 2015, respectively (in thousands for the gross profit):

| Three months ended March 31, | ||||||||||||||||

| 2016 | 2015 | |||||||||||||||

| Gross profit | Gross margin | Gross profit | Gross margin | |||||||||||||

| Concentrated apple juice and apple aroma | $ | 45 | 1 | % | $ | 8 | 32 | % | ||||||||

| Concentrated kiwifruit juice and kiwifruit puree | (8 | ) | (48 | % | ) | 686 | 36 | % | ||||||||

| Concentrated pear juice | 4 | 2 | % | 1,886 | 40 | % | ||||||||||

| Fruit juice beverages | 1 | 26 | % | 4,579 | 46 | % | ||||||||||

| Fresh fruits and vegetables | - | - | - | - | % | |||||||||||

| Others | 1 | - | - | - | % | |||||||||||

| Total/Overall (for gross margin) | $ | 43 | 1 | % | $ | 7,159 | 43 | % | ||||||||

| 18 |

The consolidated gross profit for the three months ended March 31, 2016 was $0.43 million, a decrease of $7.1 million, from 7.2 million for the same period of 2015, primarily due to a decrease of profit margin of all of our products.

The gross profit margin of concentrated apple juice for the first quarter of 2016 and 2015 were 1% and 32%, respectively. We did not have any inventory of concentrated apple juice during the first quarter of 2016 and we had to purchase concentrated apple juice to satisfy our customers’ demand, which caused a lower margin.

The gross profit margin of the concentrated kiwifruit juice and kiwifruit puree decreased from 36% for the three months ended March 31, 2015 to negative 48% for the same period of 2016, primarily due to lower production during the first quarter of 2016, which resulted in a higher ratio of fixed expenses to the unit cost of our products. In addition, due to the higher cost of fresh kiwi purchased in the last squeezing season, we experienced a higher cost of concentrated kiwifruit juice and kiwifruit puree sold during the current period as compared to the same period of 2015. We also reduced the sales prices of our products as a result of lower market demand.

The gross profit margin of the concentrated pear juice decreased from 40% to 2% for first quarter of 2015 to 2016, respectively, primarily due to the higher costs of raw material.

The gross profit margin of our fruit juice beverages decreased from 46% for the three months ended March 31, 2015, to 26% for the same period of 2016. The decrease of gross margin of fruit juice beverages was primarily due to lower unit selling prices in the first quarter of 2016 as compared to same period of 2015 as a result of heavy market competition.

Operating Expenses

The following table presents our consolidated operating expenses and operating expenses as a percentage of revenue for the three months ended March 31, 2016 and 2015, respectively:

| First quarter of 2016 | First quarter of 2015 | |||||||||||||||

| Amount | % of revenue | Amount | % of revenue | |||||||||||||

| General and administrative | $ | 679,944 | 13 | % | $ | 2,984,482 | 18 | % | ||||||||

| Selling expenses | 861,140 | 16 | % | 1,052,654 | 6 | % | ||||||||||

| Total operating expenses | $ | 1,541,084 | 29 | % | $ | 4,037,136 | 24 | % | ||||||||

Operating expenses decreased for the three months ended March 31, 2016 compared to the corresponding period in 2015.

| 19 |

The decrease in general and administrative expenses for the three months ended March 31, 2016, as compared with same period of 2015, was mainly due to a decrease in the provision for doubtful accounts. We recorded provision of doubtful accounts of $1,452,096 in the first quarter of 2015. In April 2015, the Company recruited new employees to strengthen it sales team and replace certain sales employees. As a result, the collection of accounts receivable were slower than expected. The Company has provided an allowance covering 50% of the accounts receivable which were outstanding for 120 or more days, reflecting management’s best estimate of ultimate collectability of such accounts receivable. In addition, we reduced our headcount from 250 full-time employees as of December 31, 2015 to 180 employees as of March 31, 2016 as a result of less production and competitive market condition in China. Salary and related expenses were reduced in the first quarter of 2016.

Selling expenses decreased for the three months ended March 31, 2016 as compared to the same period in 2015, mainly due to a decrease in shipping and handling expenses as a result of a decrease in volume of sales.

Other Income (Expense), Net

Other income, net was $444,645 for three months ended March 31, 2016 and other expenses, net were $876,756 for three months ended March 31, 2015. Subsidy income increased from $188,761 for the three months ended March 31, 2015 to $ 531,445 in the same period of 2016. Subsidy income in the first quarter of 2016 was related to our Yidu project and subsidy income in the first quarter of 2015 represents the value-added tax rebates provided on our exports.

Interest expense decreased to $208,665, representing a decrease of $890,405 or 81%, during the current period as compared to interest expense of $1,099,070 for the same period of 2015, which was primarily due to lower bank loan amounts and interest rates on our bank loans in the first quarter of 2016 as compared to the same period of 2015. During the first quarter of 2016, China reduced the basic bank rate to stimulate the economy. Consulting fees related to a capital lease were $9,159 in the first quarter of 2016 and there was no such expense in the first quarter of 2015.

Income Tax

We did not have tax provision for the three months ended March 31, 2016 as the company suffered a loss in the first quarter of 2016. Our consolidated income tax rates were 26% for the three months ended March 31, 2015.

Noncontrolling Interests

As of March 31, 2016, SkyPeople (China) held a 91.15% interest in Shaanxi Qiyiwangguo and Pacific held a 99.78% interest in SkyPeople (China). TSD held a 26.36% interest in Skypeople China. Net income attributable to noncontrolling interests decreased mainly due to the decrease in the net income generated from Shaanxi Qiyiwangguo and SkyPeople (China).

Liquidity and Capital Resources

As of March 31, 2016, we had cash, cash equivalents and restricted cash of $66,251,577, an increase of $13,164,707, or 26%, from $53,086,870 as of December 31, 2015. We expect the projected cash flows from operations, anticipated cash receipts, cash on hand, and trade credit to provide sufficient capital to meet our projected operating cash requirements at least for the next 12 months, which does not take into account any potential expenditures related to the potential expansion of our current production capacity.

Our working capital has historically been generated from our operating cash flows, advances from our customers and loans from bank facilities. Our working capital was $50,984,228 as of March 31, 2016, an increase of $228,118, from working capital of $14,324,493 as of March 31, 2015. During the first quarter of 2016, net cash provided by our operating activities was $407,730 compared to $8,149,084 from operating activities of same period of 2015. The decrease was primarily due to a decrease in net income of $2.7 million during the first quarter of 2016 as compared to the same period of last year. In addition, there was cash outflow of $1,852,548 from a decrease in accounts receivable during the first quarter of 2016 as compared to $12,389,382 in net cash inflow during the first quarter of 2015. This increase in cash outflow was partially offset by an increase in cash inflow from changes of accounts payables during the first quarter of 2016 as compared to the same period of last year.

During the three months ended March 31, 2016, our investing activities used net cash of $2,784,612, including $2,527,423 of additions to property, plant and equipment as compare to $1,984,556 for the same period of 2015.

| 20 |

During the three months ended March 31, 2016, our financing activities generated net cash inflow of $4,016,159 as compared to net cash inflow of $8,080,186 in the same period of 2015.

During the first quarter of 2016, the Company repaid $1,233,968 on bank loans as compared to repayment of $9,213,508 for the same period of last year. In addition, the Company repaid capital lease of $11,391,267 as compared to $39,212 for the same period of last year.

On March 11, 2016, Skypeople HK, a wholly owned subsidiary of the Company and a 99.78% owner of Skypeople China entered into a Share Transfer Agreement and a Capital Contribution (the “Agreements”) with Shenzhen TianShunDa Equity Investment Fund Management Co., Ltd. (the “TSD”), a limited liability corporation registered in China. Pursuant to the Agreements, TSD paid $16,641,394 and acquired 112,809,100 shares of Skypeople China from Skypeople HK, resulting in TSD owning 112,809,100 shares, or 26.36%, of Skypeople China.

Off-balance sheet arrangements

As of March 31, 2016, we did not have any off-balance sheet arrangements.

| Item 3. | Quantitative and Qualitative Disclosures about Market Risk |

Not applicable.

| Item 4. | Controls and Procedures |

Disclosure Controls and Procedures

Our management, with the participation of our Chief Executive Officer and Interim Chief Financial Officer, our principal executive officer and principal financial officer, respectively, evaluated the effectiveness of our disclosure controls and procedures as defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act, as of the end of the period covered by this report. Disclosure controls and procedures include, without limitation, controls and procedures designed to provide reasonable assurance that information we are required to disclose in reports that we file or submit under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms, and that such information is accumulated and communicated to our management, including our Chief Executive Officer and Interim Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosure. Based on this evaluation, our Chief Executive Officer and Interim Chief Financial Officer concluded that, as of March 31, 2016, our disclosure controls and procedures were not effective as of such date as identified in our internal control over financial reporting below.

Notwithstanding this material weakness, our management has concluded that, based upon the interim remediation of internal control described below under “Changes in Internal Control over Financial Reporting”, our consolidated financial statements for the periods covered by and included in this report are prepared in accordance with U.S. GAAP and fairly present, in all material respects, our financial position, results of operations and cash flows for each of the periods presented herein.

Changes in Internal Control over Financial Reporting

Our management, including our Chief Executive Officer and Interim Chief Financial Officer, assessed the effectiveness of our internal control over financial reporting as of March 31, 2016, based upon the updated framework in the Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”) in 1992 and updated in May 2013. Based on this assessment, our management concluded that, as of March 31, 2016, there is a material weakness in our internal control over financial reporting. Specifically, we currently lack sufficient accounting personnel with the appropriate level of knowledge, experience and training in U.S. GAAP and SEC reporting requirements.

We have taken, and are taking, certain actions to remediate the material weakness related to our lack of U.S. GAAP experience. We have hired an assistant to the Interim Chief Financial Officer in September 2016 who has an accounting degree from the U.S. and is familiar with U.S. GAAP to help us in preparation of our financial statements to ensure that our financial statements are prepared in accordance with U.S. GAAP. We plan to hire additional credentialed professional staff and consulting professionals with greater knowledge and experience of U.S. GAAP and related regulatory requirements to oversee our financial reporting process in order to ensure our compliance with U.S. GAAP and other relevant securities laws. In addition to the above stated remediation plan we previously engaged an outside Sarbanes-Oxley Act consultant in March 2012 to assist us with improving the design and operations of our internal controls over financial reporting for our U.S. parent company and all subsidiaries.

We believe the measures described above will remediate the material weakness identified above. As we continue to evaluate and work to improve our internal control over financial reporting, we may determine that additional measures are necessary to address control any future deficiencies.

Other than as described above, there were no changes in our internal control over financial reporting during the quarter ended March 31, 2016, that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

| 21 |

PART II. OTHER INFORMATION

| Item 1. | Legal Proceedings |

In April 2015, China Cinda Asset Management Co., Ltd. Shaanxi Branch (“Cinda Shaanxi Branch”) filed two enforcement proceedings with Xi'an Intermediate People's Court against the Company for alleged defaults pursuant to guarantees by the Company to its suppliers for a total amount of RMB 39,596,250, or approximately $6.1 million.

In June 2014, two long term suppliers of pear, mulberry, kiwi fruits to the Company requested the Company to provide guarantees for their loans with Cinda Shaanxi Branch. Considering the long term business relationship and to ensure the timely supply of raw materials, the Company agreed to provide guarantees upon the value of the raw materials supplied to the Company. Because Cinda Shaanxi Branch is not a bank authorized to provide loans, it eventually provided financing to the two suppliers through purchase of accounts receivables of the two suppliers with the Company. In July, 2014, the parties entered into two agreements - Accounts Receivables Purchase and Debt Restructure Agreement and Guarantee Agreements for Accounts Receivables Purchase and Debt Restructure. Pursuant to the agreements, Cinda Shaanxi Branch agreed to provide a RMB 100 million credit line on a rolling basis to the two suppliers and the Company agreed to pay its accounts payables to the two suppliers directly to Cinda Shaanxi Branch and provided guarantees for the two suppliers. In April 2015, Cinda Shaanxi Branch stopped providing financing to the two suppliers and the two suppliers were unable to continue the supply of raw materials to the Company. Consequently, the Company stopped making any payment to Cinda Shaanxi Branch.

The Company has responded to the court and taken the position that the financings under the agreements are essentially the loans from Cinda Shaanxi Branch to the two suppliers, and because Cinda Shaanxi Branch does not have permits to make loans in China, the agreements are invalid, void and have no legal forces from the beginning. Therefore, the Company has no obligations to repayment the debts owed by the two suppliers to Cinda Shaanxi Branch. The proceeding is currently pending for the verdict of the judge.

From time to time we may be a party to various litigation proceedings arising in the ordinary course of our business, none of which, in the opinion of management, is likely to have a material adverse effect on our financial condition or results of operations.

| 22 |

| Item 1A. | Risk Factors |

Not applicable.

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds |

None.

| Item 3. | Defaults upon Senior Securities |

None.

| Item 4. | Mine Safety Disclosure |

Not applicable.

| Item 5. | Other Information |

None.

| Item 6. | Exhibits |

| Exhibit No. | Description | |

| 31.1 | Certification of Principal Executive Officer pursuant to Rule 13a-14(a) and Rule15d-14(a) of the Securities Exchange Act of 1934, as amended* | |

| 31.2 | Certification of Principal Financial Officer pursuant to Rule 13a-14(a) and Rule 15d-14(a) of the Securities Exchange Act of 1934, as amended* | |

| 32.1 | Certification of Principal Executive Officer, pursuant to 18 U.S.C. 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002* | |

| 32.2 | Certification of Principal Financial Officer, pursuant to 18 U.S.C. 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002* | |

| 101.INS | XBRL Instance Document*+ | |

| 101.SCH | XBRL Schema Document*+ | |

| 101.CAL | XBRL Calculation Linkbase Document*+ | |

| 101.DEF | XBRL Definition Linkbase Document*+ | |

| 101.LAB | XBRL Label Linkbase Document*+ | |

| 101.PRE | XBRL Presentation Linkbase Document*+ |

| * | filed herewith |

| + | As provided in Rule 406T of Regulation S-T, this information shall not be deemed “filed” for purposes of Section 11 and 12 of the Securities Act of 1933 and Section 18 of the Securities Exchange Act of 1934 or otherwise subject to liability under those sections, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, except as expressly set forth by specific reference in such filing. |

| 23 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| SKYPEOPLE FRUIT JUICE, INC. | ||

| By: | /s/ Hongke Xue | |

| Hongke Xue | ||

| Chief Executive Officer | ||

| (Principal Executive Officer) | ||

| December 20, 2016 | ||

| By: | /s/ Hanjun Zheng | |

| Hanjun Zheng | ||

| Interim Chief Financial Officer | ||

| (Principal Financial and Accounting Officer) | ||

| December 20, 2016 | ||

24