Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For the fiscal year ended December 31, 2013 | ||

| OR | ||

| ¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

Commission File No. 0-25837

HEIDRICK & STRUGGLES INTERNATIONAL, INC.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 36-2681268 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

233 South Wacker Drive, Suite 4200, Chicago, Illinois 60606-6303

(Address of principal executive offices) (Zip Code)

(312) 496-1200

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title Of Each Class |

Name Of Each Exchange On Which Registered | |

| Common Stock, $.01 par value | The Nasdaq Stock Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 of Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K Yes x No ¨.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer ¨ Accelerated Filer x Non-Accelerated Filer ¨ Smaller Reporting Company ¨

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the registrant’s Common Stock held by non-affiliates of the registrant on June 28, 2013 was approximately $297,992,768 based upon the closing market price of $16.72 on that date of a share of Common Stock as reported on the Nasdaq Global Stock Market. As of March 7, 2014, there were 18,134,129 shares of the Company’s Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for its Annual Meeting of Stockholders to be held on May 22, 2014, are incorporated by reference into Part III of this Form 10-K.

Table of Contents

HEIDRICK & STRUGGLES INTERNATIONAL, INC. AND SUBSIDIARIES

Table of Contents

Overview

Heidrick & Struggles International, Inc. (“Heidrick & Struggles”) is a leadership advisory firm providing executive search, culture shaping and leadership consulting services to businesses and business leaders worldwide. When we use the terms “Heidrick & Struggles,” “the company,” “we,” “us” and “our,” in this Form 10-K, we mean Heidrick & Struggles International, Inc. a Delaware corporation, and its consolidated subsidiaries. We provide our services to a broad range of clients through the expertise of approximately 300 consultants located in major cities around the world. Heidrick & Struggles and its predecessors have been a leadership advisor for 60 years. Heidrick & Struggles was formed as a Delaware corporation in 1999 when two of our predecessors merged to form Heidrick & Struggles.

Our service offerings include the following:

Executive Search. We partner with respected organizations globally to build and sustain the best leadership teams in the world, with a specialized focus on the placement of top-level senior executives. We believe focusing on top-level senior executives provides the opportunity for several advantages including access to and influence with key decision makers, increased potential for recurring search and consulting engagements, higher fees per search, enhanced brand visibility, and a leveraged global footprint. Working at the top of client organizations also facilitates the attraction and retention of high-caliber consultants who desire to serve top industry executives and their management needs. Our executive search services generate revenues through the fees generated for each search engagement, which generally are based on the annual cash compensation for the placed executive. We provide our executive search services on a retained basis, recruiting senior executives whose first year base salary and bonus averaged approximately $340,200 in 2013 on a worldwide basis.

The executive search industry is highly fragmented, consisting of several thousand executive search firms worldwide. Executive search firms are generally separated into two broad categories: retained search and contingency search. Retained executive search firms fulfill their clients’ senior leadership needs by identifying potentially qualified candidates and assisting clients in evaluating and assessing these candidates. Retained executive search firms generally are compensated for their services regardless of whether the client employs a candidate identified by the search firm and are generally retained on an exclusive basis. Retained executive search firms normally charge a fee for their services equal to approximately one-third of the first year’s total compensation for the position being filled. In contrast, contingency search firms are compensated only upon successfully placing a recommended candidate.

We are a retained executive search firm. Our search process typically consists of the following steps:

| • | Analyzing the client’s business needs in order to understand its organizational structure, relationships, and culture; advising the client as to the required set of skills and experience for the position; and identifying with the client the other characteristics desired of the successful candidate. |

| • | Selecting, contacting, interviewing and evaluating candidates on the basis of experience and potential cultural fit with the client organization |

| • | Presenting confidential written reports on the candidates who potentially fit the position specification |

| • | Scheduling a mutually convenient meeting between the client and each candidate |

| • | Completing references on the final candidate selected by the client |

| • | Assisting the client in structuring compensation packages and supporting the successful candidate’s integration into the client team |

1

Table of Contents

Culture Shaping. On December 31, 2012 we acquired Senn-Delaney Leadership Consulting Group, LLC, a global leader of corporate culture shaping. Chief executives seek our guidance to create thriving organizational cultures in a variety of business situations, including:

| • | Aligning executive teams when there are new leaders and/or new roles |

| • | Integrating cultures following mergers and acquisitions |

| • | Shaping the culture to support new strategies and structures |

| • | Helping minimize cultural barriers to change when implementing major organizational systems or processes |

| • | Creating greater organizational agility to meet the challenges of a changing marketplace. |

Senn Delaney uses its proprietary technology to administer, analyze and interpret organizational cultures and drivers, as well as methods to develop clarity around leadership teams and desired organizational outcomes. Culture shaping is currently less than 10% of our net revenue. Our culture shaping services generate revenue through a combination of professional service and license fees related to the engagement.

Leadership Consulting. Our leadership consulting services include succession planning, executive assessment and top team and board effectiveness. Leadership Consulting is currently less than 10% of our net revenue. Our leadership consulting services generate revenue primarily through the professional fees generated for each engagement which are generally based on the size of the project and scope of services.

Client base. For many of our clients, our global access to and knowledge of regional and functional markets and candidate talent is an important differentiator of our business. Our clients generally fall into one of the following categories:

| • | Fortune 1000 companies |

| • | Major U.S. and non-U.S. companies |

| • | Middle market and emerging growth companies |

| • | Governmental, higher education and not-for-profit organizations |

| • | Other leading private and public entities |

Available Information

We maintain an Internet website at http://www.heidrick.com. We make available free of charge through the investor relations section of our web site, annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the U.S. Securities Exchange Act of 1934 (Exchange Act), as well as proxy statements, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Also posted on our web site, and available in print upon request of any shareholder to Investor Relations, are our certificate of incorporation and by-laws, charters for our Audit and Finance Committee, Human Resources and Compensation Committee, and Nominating and Board Corporate Governance Committee, our Policy Regarding Director Independence Determinations, our Policy on Reporting of Concerns Regarding Accounting and Other Matters, our Corporate Governance Guidelines and our Code of Business Conduct and Ethics governing our directors, officers and employees. Within the time period required by the SEC, we will post on our web site any amendment to the Code of Business Conduct and Ethics and any waiver applicable to any executive officer, director or senior financial officer.

In addition, our web site includes information concerning purchases and sales of our equity securities by our executive officers and directors, as well as disclosure relating to certain non-GAAP financial measures (as defined in the SEC’s Regulation G) that we may make public orally, telephonically, by webcast, by broadcast or by similar means from time to time.

2

Table of Contents

Investor Relations can be contacted at Heidrick & Struggles International, Inc., 233 South Wacker Drive, Suite 4200, Chicago, Illinois, 60606, Attn: Investor Relations Officer, telephone: 312-496-1200, e-mail: InvestorRelations@heidrick.com.

Organization

Our organizational structure, which is arranged by geography, service offering and industry/functional practices, is designed to enable us to better understand our clients’ cultures, operations, business strategies, industries and regional markets for leadership talent.

Geographic Structure. We provide senior-level executive search, culture shaping and leadership consulting services to our clients worldwide through a network of approximately 50 offices in 30 countries. Major locations are staffed with consultants, research associates, administrative assistants and other support staff. Administrative functions are centralized where possible, although certain support and research functions are situated regionally because of variations in local requirements. We face risks associated with political instability, legal requirements and currency fluctuations in our international operations. Examples of such risks include difficulties in managing global operations, social and political instability, regulations, and potential adverse tax consequences. For a more complete description of the risks associated with our business please see the Section in this Form 10-K entitled “Risk Factors”.

Our worldwide network includes affiliate relationships in Finland, South Africa, Turkey and Portugal. We have no financial investment in these affiliates but receive licensing fees from them for the use of our name and our databases. Licensing fees are less than 1% of our net revenue.

Information by Geography. We operate our executive search and leadership consulting services in three geographic regions: the Americas (which includes the countries in North and South America); Europe (which includes the continents of Europe and Africa); and Asia Pacific (which includes Asia and the region generally known as the Middle East). During 2013 our culture shaping segment operated in the Americas and Europe.

Americas. As of December 31, 2013, we had 126 consultants in our Americas segment. The largest offices in this segment, as defined by net revenue, are located in New York, Chicago and San Francisco.

Europe. As of December 31, 2013, we had 83 consultants in our European segment. The largest countries in this segment, as defined by net revenue, are located in the United Kingdom, Germany and France.

Asia Pacific. As of December 31, 2013, we had 84 consultants in our Asia Pacific segment. The largest countries in this segment, as defined by net revenue, are located in Australia, China (including Hong Kong), and Singapore.

Culture Shaping. As of December 31, 2013, we had 24 consultants (including outside contractors) in our Culture Shaping segment. The culture shaping consultants are primarily based in Huntington Beach, CA and approximately 85% of the net revenue is generated in the United States.

The relative percentages of net revenue attributable to each segment were as follows:

| Year Ended December 31, | ||||||||||||

| 2013 | 2012 | 2011 | ||||||||||

| Executive Search and Leadership Consulting |

||||||||||||

| Americas |

56 | % | 58 | % | 54 | % | ||||||

| Europe |

19 | % | 22 | % | 25 | % | ||||||

| Asia Pacific |

20 | % | 20 | % | 21 | % | ||||||

| Culture Shaping |

5 | % | — | — | ||||||||

3

Table of Contents

For financial information relating to each segment, see Note 20, Segment Information, in the Notes to Consolidated Financial Statements.

Global Industry Practices. Our executive search business, excluding leadership consulting, operates in six broad industry groups listed below. These industry categories and their relative sizes, as measured by net revenue for 2013 and 2012, are as follows:

| Percentage of Net Revenue | ||||||||

| Global Industry Practices |

2013 | 2012 | ||||||

| Industrial |

25 | % | 26 | % | ||||

| Financial Services |

25 | 25 | ||||||

| Global Technology & Services |

20 | 19 | ||||||

| Consumer Markets |

17 | 17 | ||||||

| Healthcare & Life Sciences |

9 | 9 | ||||||

| Education, Non-Profit & Social Enterprise |

4 | 4 | ||||||

|

|

|

|

|

|||||

| 100 | % | 100 | % | |||||

|

|

|

|

|

|||||

Within each broad industry group are a number of industry sub-sectors. Consultants often specialize in one or more sub sectors to provide clients with market intelligence and candidate knowledge specific to their industry. For example, within the Financial Services sector our business is diversified among a number of industry sub sectors including Asset & Wealth Management, Consumer & Commercial Finance, Financial Services Practices & Infrastructure, Investment Banking, Global Markets, Hedge Fund, Insurance, Private Equity Investment Professionals, and Real Estate.

We service our clients with global industry interests and needs through unified global executive search teams who specialize in industry practices. This go-to-market strategy allows us to leverage our global diversity and market intelligence and is designed to provide better client service. Each client is served by one global account team, which we believe is a key differentiator from our competition.

Global Functional Practices. Our executive search consultants also specialize in searches for specific “C-level” functional positions, which are roles that generally report directly to the chief executive officer.

Our Global Functional Practices include Chief Executive Officer and Board of Directors; Human Resources Officers; Financial Officers; Information &Technology Officers; Interim Executives; Legal, Risk, Compliance & Government Affairs; Marketing, Sales & Strategy Officers; Research & Development; and Supply Chain & Transportation.

Our team of executive search consultants may service clients from any one of our offices around the world. For example, an executive search for a chief financial officer of an industrial company located in the United Kingdom may involve a consultant in the United Kingdom with an existing relationship with the client, another executive search consultant in the United States with expertise in our Industrial practice and a third executive search consultant with expertise in recruiting chief financial officers. This same industrial client may also engage us to perform skill-based assessments for each of its senior managers, which could require the expertise of one of our leadership advisory consultants trained in this service.

Seasonality

There is no discernible seasonality in our business, although as a percentage of total annual net revenue, the first quarter is typically the lowest. Revenue and operating income have historically varied by quarter and are hard to predict from quarter to quarter. In addition, the volatility in the global economy and business cycles can impact our quarterly revenue and operating income.

4

Table of Contents

Clients and Marketing

Our consultants market the firm’s executive search, culture shaping and leadership consulting services through two principal means: targeted client calling and industry networking with clients and referral sources. These efforts are supported by proprietary databases, which provide our consultants with information as to contacts made by their colleagues with particular referral sources, candidates and clients. In addition, we benefit from a significant number of referrals generated by our reputation for high quality service and successfully completed assignments, as well as repeat business resulting from our ongoing client relationships.

In support of client calling and networking, the practice teams as well as individual consultants also author and publish articles and white papers on a variety of leadership and talent topics and trends around the world. Our consultants often present research findings and talent insights at notable conferences and events as well. Our insights are sometimes acknowledged by major media outlets and trade journalists. These efforts aid in the marketing of our services as well.

Either by agreement with the clients or to maintain strong client relationships, we may refrain from recruiting employees of a client, or possibly other entities affiliated with that client, for a specified period of time but typically not more than one year from the commencement of a search. We seek to mitigate any adverse effects of these off-limits arrangements by strengthening our long-term relationships, allowing us to communicate our belief to prospective clients that we can conduct searches without these off-limits arrangements impeding the quality of our work.

No single client accounted for more than 2% of our net revenue in 2013, 2012 or 2011. As a percentage of total revenue, our top ten clients in aggregate accounted for approximately 7% of total net revenue in 2013 and approximately 8% in 2012 and 2011.

Information Management Systems

We rely on technology to support our consultants and staff in the search process. Our technology infrastructure consists of internally developed databases containing candidate profiles and client records, coupled with online services and industry reference sources. We use technology to manage and share information on current and potential clients and candidates, to communicate to both internal and external constituencies and to support administrative functions.

Our culture shaping business’ proprietary Web-based system, SD Connect™ is integral to the culture-shaping process. This technology platform enables our consultants to administer, analyze and interpret online Corporate Culture Profiles™ (CCP) surveys to develop clarity around team and organizational need and desired outcomes. In addition, we gather data using our online Customer Intake Survey™ (CIS) to determine which culture-shaping concepts are being utilized by individuals and the team as a whole.

Professional Staff and Employees

Our professionals are generally categorized either as consultants or associates. Associates assist consultants by providing research support, coordinating candidate contact and performing other engagement-related functions. As of December 31, 2013, we had full-time equivalent head count (including contractors) of 1,499, consisting of 317 consultants, 423 associates and 759 other search, support and Global Operations Support staff.

We promote our associates to consultant during the annual consultant promotion process and we recruit our consultants from other executive search or human capital firms, or in the case of executive search, consultants new to search who have worked in industries or functions represented by our practices. In the latter case, these are often seasoned executives with extensive contacts and outstanding reputations who are entering the search profession as a second career and whom we train in our techniques and methodologies. Our culture shaping

5

Table of Contents

consultants are recruited for their consulting and leadership advisory experience and often are former clients who are familiar with our culture shaping methodology. In each of the past five years, no single consultant accounted for a material portion of our net revenue. We are not a party to any U.S. based collective bargaining agreement, and we consider relations with our employees to be good.

Competition

The executive search industry is highly competitive. While we face competition to some degree from all firms in the industry, we believe our most direct competition comes from four established global retained executive search firms that conduct searches primarily for the most senior-level positions within an organization. In particular, our competitors include Egon Zehnder International, Korn Ferry International, Russell Reynolds Associates, Inc. and Spencer Stuart & Associates. To a lesser extent, we also face competition from Internet-based firms and smaller firms that specialize in certain regional markets or industry segments. Each firm with which we compete is also a competitor in the marketplace for effective consultants.

Overall, the search industry has relatively few barriers to entry; however, there are higher barriers to entry to compete at the level of a global retained executive search firms that can provide leadership consulting services at the senior level. At this level, clients rely more heavily on a search firm’s reputation, global access and the experience level of its consultants. We believe that the segment of executive search in which we compete is more quality-sensitive than price-sensitive. As a result, we compete on the level of service we offer, reflected by our client services specialties and, ultimately, by the quality of our search results. We believe that our emphasis on senior-level executive search, the depth of experience of our search consultants and our global presence enable us to compete favorably with other executive search firms.

Competition in the leadership consulting services and culture shaping markets in which we operate is highly fragmented, with no universally recognized market leaders.

6

Table of Contents

Below is the name, age, present title, principal occupation and certain biographical information for each of our executive officers as of the date of this report. All of our executive officers have been appointed by and serve at the pleasure of our board of directors. There are no family relationships between any executive officer or director.

Tracy R. Wolstencroft (55) Mr. Wolstencroft has been our President and Chief Executive Officer since February 3, 2014, and a director since February 6, 2014. From 1994 until his retirement in 2010, Mr. Wolstencroft served as a partner for Goldman Sachs & Co. (“Goldman”), concluding a twenty-five year career with the firm. During his service to Goldman, Mr. Wolstencroft served on the Firmwide Partnership Committee, the Investment Banking Operating Committee, and the Asia Management Committee. During his career, he led a wide range of businesses in the United States and abroad, including Investment Banking Services, Environmental Markets, Latin America, Public Sector and Infrastructure Banking, and Fixed Income Capital Markets. While living in Asia from 1998 to 2002, Mr. Wolstencroft was President of GS Singapore, co-head of investment banking in Japan, head of Asia financial institutions, and a leader of the firm’s strategy in China. Mr. Wolstencroft also served as an Advisory Director for Goldman and as Chairman of the firm’s Clean Technology and Renewables business. He currently serves as a member of the Board of the Brookings Institution, the National Geographic Society and the International Rescue Committee.

Richard W. Pehlke (60) Mr. Pehlke has been our Executive Vice President and Chief Financial Officer since August 2011 after serving as interim Chief Financial Officer since May 2011. Previously, Mr. Pehlke was Executive Vice President and Chief Financial Officer at Grubb & Ellis Company, a commercial real estate firm, from 2007 to 2010. During his extensive career, he also has held senior financial positions in the business services, telecommunications, financial services, food and consumer products and executive search and staffing industries. Mr. Pehlke currently serves on the board of directors of Ideal Industries and Valparaiso University.

Stephen W. Beard (42) Mr. Beard has been our Executive Vice President, Chief Administrative Officer, General Counsel and Secretary since January 1, 2013. During his 10-year service to the company he has served in several senior leadership capacities, including serving as our Executive Vice President, General Counsel and Secretary (November 2010 to January 2013), Vice President, Deputy General Counsel and Chief Compliance Officer (2008 through November 2010) and Assistant General Counsel (2003 through 2008). Previously, Mr. Beard worked with Schiff Hardin, LLP, in Chicago where he was a member of the firm’s corporate and securities practice group, representing public and private companies in mergers and acquisitions, corporate finance, securities and corporate governance matters.

| ITEM 1A. | RISK FACTORS |

In addition to other information in this Form 10-K, the following risk factors should be carefully considered in evaluating our business because such factors may have a material impact on our business, operating results, cash flows and financial condition. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations.

We depend on attracting, integrating, managing, and retaining qualified consultants and senior leaders.

Our success depends upon our ability to attract, integrate, manage and retain consultants who possess the skills and experience necessary to fulfill our clients’ needs. Our ability to hire and retain qualified consultants could be impaired by any diminution of our reputation, decrease in compensation levels relative to our competitors or modifications to our total compensation philosophy or competitor hiring programs. If we cannot attract, hire and retain qualified consultants, our business, financial condition and results of operations may suffer. Our future success also depends upon our ability to complete the integration of newly-hired consultants successfully into our operations and to manage the performance of our consultants. Failure to successfully

7

Table of Contents

integrate newly-hired consultants or to manage the performance of our consultants could affect our profitability by causing operating inefficiencies that could increase operating expenses and reduce operating income. There is also a risk that unanticipated turnover in senior leadership coupled with an inadequate succession plan stalls company activity, interrupts strategic vision or lowers productive output which may adversely impact our financial condition and results of operations.

We may not be able to prevent our consultants from taking our clients with them to another firm.

Our success depends upon our ability to develop and maintain strong, long-term relationships with our clients. Although we work on building these relationships between our firm and our clients, in many cases, one or two consultants have primary responsibility for a client relationship. When a consultant leaves one executive search firm and joins another, clients who have established relationships with the departing consultant may move their business to the consultant’s new employer. We may also lose clients if the departing consultant has widespread name recognition or a reputation as a specialist in executing searches in a specific industry or management function. If we fail to limit departing consultants from moving business to another employer, our business, financial condition and results of operations may be adversely affected.

Our success depends on our ability to maintain our professional reputation and brand name.

We depend on our overall professional reputation and brand name recognition to secure new engagements and hire qualified consultants. Our success also depends on the individual reputations of our consultants. We obtain many of our new engagements from existing clients or from referrals by those clients. A client who is dissatisfied with our work can adversely affect our ability to secure new engagements. If any factor hurts our reputation, including poor performance, we may experience difficulties in competing successfully for both new engagements and qualified consultants. Failure to maintain our professional reputation and brand name could seriously harm our business, financial condition and results of operations.

Our net revenue may be affected by adverse economic conditions.

Demand for our services is affected by global economic conditions and the general level of economic activity in the geographic regions in which we operate. During periods of slowed economic activity many companies hire fewer permanent employees, and our financial condition and results of operations can be adversely affected. If unfavorable changes in economic conditions occur, our business, financial condition and results of operations could suffer.

Because our clients may restrict us from recruiting their employees, we may be unable to fill or obtain new executive search assignments.

Clients frequently require us to refrain from recruiting certain of their employees when conducting executive searches on behalf of other clients. These restrictions generally remain in effect for no more than one year following the commencement of an engagement. However, the specific duration and scope of the off-limits arrangements depend on the length of the client relationship, the frequency with which the client engages us to perform searches, the number of assignments we have performed for the client and the potential for future business with the client.

Client restrictions on recruiting their employees could hinder us from fulfilling executive searches. Additionally, if a prospective client believes that we are overly restricted by these off-limits arrangements from recruiting the employees of our existing clients, these prospective clients may not engage us to perform their executive searches. As a result, our business, financial condition and results of operations may suffer.

We face aggressive competition.

The global executive search industry is highly competitive and fragmented. We compete with other large global executive search firms, smaller specialty firms, and more recently with Internet-based firms. Specialty firms can focus on regional or functional markets or on particular industries. Some of our competitors may

8

Table of Contents

possess greater resources, greater name recognition and longer operating histories than we do in particular markets or practice areas, or be willing to reduce their fees in order to attract clients and increase market share. There are limited barriers to entry into the search industry and new search firms continue to enter the market. Many executive search firms that have a smaller client base may be subject to fewer off-limits arrangements. In addition, our clients or prospective clients may decide to perform executive searches using in-house personnel. Also, as internet-based firms continue to evolve, they may develop offerings similar to or more expansive than ours, thereby increasing competition for our services or more broadly causing market disruption in the executive search industry. We may not be able to continue to compete effectively with existing or potential competitors and we may not be able to implement our leadership strategy effectively. Our inability to meet these competitive challenges could have an adverse impact on our business, financial condition and results of operations.

We rely heavily on information management systems.

Our success depends upon our ability to store, retrieve, process and manage substantial amounts of information. To achieve our goals, we must continue to improve and upgrade our information management systems. We may be unable to license, design and implement, in a cost-effective and timely manner, improved information systems that allow us to compete effectively. In addition, business process reengineering efforts may result in a change in software platforms and programs. Such efforts may result in an acceleration of depreciation expense over the shortened expected remaining life of the software and present transitional problems. Problems or issues with our proprietary search system or other factors may result in interruptions or loss in our information processing capabilities which may cause our business, financial condition and results of operations to suffer.

We may experience security breaches that could lead to the inability to protect confidential information

Despite the implementation of security measures, our operating systems are vulnerable to electronic breaches of security. Such breaches could lead to disruptions of our operations and potential unauthorized disclosure of confidential information, which could result in legal claims or proceedings. While we have taken steps to prevent and mitigate the damage of a security breach by continuously improving our design and coordination of security controls across our business, those steps may not be effective and there can be no assurance that any such steps can be effective against certain risks. The unauthorized disclosure of confidential information could negatively impact our reputation, business and results of operations.

We face the risk of liability in the services we perform.

We are exposed to potential claims with respect to the executive search process. A client could assert a claim for violations of off-limits arrangements, breaches of confidentiality agreements or professional malpractice. The growth and development of our culture shaping and other leadership advisory services brings with it the potential for new types of claims. In addition, candidates and client employees could assert claims against us. Possible claims include failure to maintain the confidentiality of the candidate’s employment search or for discrimination or other violations of the employment laws or malpractice. In various countries, we are subject to data protection laws impacting the processing of candidate information. We maintain professional liability insurance in amounts and coverage that we believe are adequate; however, we cannot guarantee that our insurance will cover all claims or that coverage will always be available. Significant uninsured liabilities could have a negative impact on our business, financial condition and results of operations.

Our multinational operations may be adversely affected by social, political, regulatory, legal and economic risks.

We generate substantial revenue outside the United States. We offer our services through a network of offices in 30 countries around the world. Our ability to effectively serve our clients is dependent upon our ability to successfully leverage our operating model across all of these and any future locations, maintain effective management controls over all of our locations to ensure, among other things, compliance with applicable laws, rules and regulations, and instill our core values in all of our personnel at each of these and any future locations. We are exposed to the risk of changes in social, political, legal and economic conditions inherent in international

9

Table of Contents

operations, which could have a significant impact on our business, financial condition and results of operations. Beginning in 2011, several countries within the European Union experienced sovereign debt and credit issues. This has caused more volatility in the economic environment throughout the European Union. In addition, we conduct business in countries where the legal systems, local laws and trade practices are unsettled and evolving. Commercial laws in these countries are sometimes vague, arbitrary and inconsistently applied. Under these circumstances, it is difficult for us to determine at all times the exact requirements of such local laws. If we fail to comply with local laws, our business, financial condition and results of operations could suffer. In addition, the global nature of our operations poses challenges to our management, and financial and accounting systems. Failure to meet these challenges could seriously harm our business, financial condition and results of operations.

A significant currency fluctuation between the U.S. dollar and other currencies could adversely impact our operating income.

With our operations in the Americas, Europe and Asia Pacific, we conduct business using various currencies. In 2013, approximately 44% of our net revenue was generated outside the United States. As we typically transact business in the local currency of our subsidiaries, our profitability may be impacted by the translation of foreign currency financial statements into U.S. dollars. Significant long-term fluctuations in relative currency values, in particular an increase in the value of the U.S. dollar against foreign currencies, could have an adverse effect on our profitability and financial condition.

We may not be able to align our cost structure with net revenue.

We must ensure that our costs and workforce continue to be in proportion to demand for our services. Failure to align our cost structure and headcount with net revenue could adversely affect our business, financial condition, and results of operations.

Unfavorable tax law changes and tax authority rulings may adversely affect results.

We are subject to income taxes in the United States and in various foreign jurisdictions. Domestic and international tax liabilities are subject to the allocation of income among various tax jurisdictions. Our effective tax rate could be adversely affected by changes in the mix of earnings among countries with differing statutory tax rates, or changes in the valuation allowance of deferred tax assets or tax laws. The amount of income taxes and other taxes are subject to ongoing audits by U.S. federal, state and local tax authorities and by non-U.S. authorities. If these audits result in assessments different from amounts recorded, future financial results may include unfavorable tax adjustments.

We may not be able to generate sufficient profits to realize the benefit of our net deferred tax assets.

We establish valuation allowances against deferred tax assets when there is insufficient evidence that we will be able to realize the benefit of these deferred tax assets. We reassess our ability to realize deferred tax assets as facts and circumstances dictate. If after future assessments of our ability to realize the deferred tax assets, we determine that a lesser or greater allowance is required, we record a reduction or increase to the income tax expense and the valuation allowance in the period of such determination. The uncertainty surrounding the future realization of our net deferred tax assets could adversely impact our results of operations.

We may experience impairment of our goodwill and other intangible assets.

In accordance with generally accepted accounting principles, we perform assessments of the carrying value of our goodwill at least annually and we review our goodwill and other intangible assets for impairment whenever events occur or circumstances indicate that a carrying amount of these assets may not be recoverable. These events and circumstances include a significant change in business climate, attrition of key personnel, changes in financial condition or results of operations, a prolonged decline in our stock price and market capitalization, competition, and other factors. In performing these assessments, we must make assumptions regarding the estimated fair value of our goodwill and other intangible assets. These assumptions include

10

Table of Contents

estimates of future market growth and trends, forecasted revenue and costs, capital investments, discount rates, and other variables. If the fair market value of one of our reporting units or other long term assets is less than the carrying amount of the related assets, we could be required to record an impairment charge. In the third quarter of 2011, we recorded a non-cash impairment charge in the amount of $26.4 million (See Note 18, Restructuring and Impairment Charges). Due to continual changes in market and general business conditions, we cannot predict whether, and to what extent, our goodwill and long-lived intangible assets may be further impaired in future periods. Any resulting impairment loss could have an adverse impact on our business, financial condition and results of operations.

We have anti-takeover provisions that make an acquisition of us difficult and expensive.

Anti-takeover provisions in our Certificate of Incorporation, our Bylaws and the Delaware laws make it difficult and expensive for someone to acquire us in a transaction which is not approved by our Board of Directors. Some of the provisions in our Certificate of Incorporation and Bylaws include:

| • | a classified board of directors |

| • | limitations on the removal of directors |

| • | limitations on stockholder actions |

| • | the ability to issue one or more series of preferred stock by action of our Board of Directors |

These provisions could discourage an acquisition attempt or other transaction in which stockholders could receive a premium over the current market price for the common stock.

Our ability to access additional credit could be limited.

Banks can be expected to strictly enforce the terms of our credit agreement. Although we are currently in compliance with the financial covenants of our revolving credit facility, a deterioration of economic conditions may negatively impact our business resulting in our failure to comply with these covenants, which could limit our ability to borrow funds under our credit facility or from other borrowing facilities in the future. In such circumstances, we may not be able to secure alternative financing or may only be able to do so at significantly higher costs.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

Our corporate headquarters is located in Chicago, Illinois. We have leased office space in 50 cities in 26 countries around the world. All of our offices are leased. We do not own any real estate. The aggregate square footage of office space under lease was 496,139 as of December 31, 2013. Our office leases call for future minimum lease payments of approximately $167.7 million and have terms that expire between 2014 and 2024, exclusive of renewal options that we can exercise. Approximately 14,200 square feet of office space has been sublet to third parties.

Our office space and future minimum lease payments by geography as of December 31, 2013 are as follows:

| Square Footage |

Office Leases (in millions) |

|||||||

| Americas |

259,730 | $ | 94.3 | |||||

| Europe |

115,805 | 53.9 | ||||||

| Asia Pacific |

120,604 | 19.5 | ||||||

|

|

|

|

|

|||||

| Total |

496,139 | $ | 167.7 | |||||

|

|

|

|

|

|||||

11

Table of Contents

We have contingent liabilities from various pending claims and litigation matters arising in the ordinary course of our business, some of which involve claims for damages that may be substantial in amount. Some of these matters are covered by insurance. Based upon information currently available, we believe the ultimate resolution of such claims and litigation, including the “UK Employee Benefit Trust” matter discussed below, will not have a material adverse effect on our financial condition, results of operations or liquidity.

UK Employee Benefits Trust

On January 27, 2010, HM Revenue & Customs (“HMRC”) in the United Kingdom notified us that it was challenging the tax treatment of certain of our contributions in the United Kingdom to an Employee Benefits Trust between 2002 and 2008. HMRC alleges that these contributions should have been subject to Pay As You Earn tax and Class 1 National Insurance Contributions in the United Kingdom; and HMRC is proposing an adjustment to our payroll tax liability for the affected years. The aggregate amount of HMRC’s proposed adjustment is approximately £3.9 million (equivalent to $6.5 million at December 31, 2013). We have appealed the proposed adjustment. At this time, we believe that the likelihood of an unfavorable outcome with respect to the proposed adjustment is not probable and the potential amount of any loss cannot be reasonably estimated. We also believe that the amount of a final adjustment, if any, would not be material to our financial condition.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

12

Table of Contents

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market for Registrant’s Common Equity

Our common stock is listed on the Nasdaq Global Stock Market under the symbol “HSII.” The following table sets forth the high and low stock price per share of the common stock for the periods indicated, as reported on the Nasdaq Global Stock Market.

| Year Ended December 31, 2013 |

High | Low | ||||||

| First Quarter |

$ | 17.42 | $ | 12.51 | ||||

| Second Quarter |

17.89 | 12.20 | ||||||

| Third Quarter |

19.37 | 14.51 | ||||||

| Fourth Quarter |

20.62 | 16.89 | ||||||

| Year Ended December 31, 2012 |

||||||||

| First Quarter |

$ | 23.95 | $ | 19.78 | ||||

| Second Quarter |

22.41 | 15.60 | ||||||

| Third Quarter |

18.41 | 11.95 | ||||||

| Fourth Quarter |

15.72 | 11.12 | ||||||

13

Table of Contents

Performance Graph

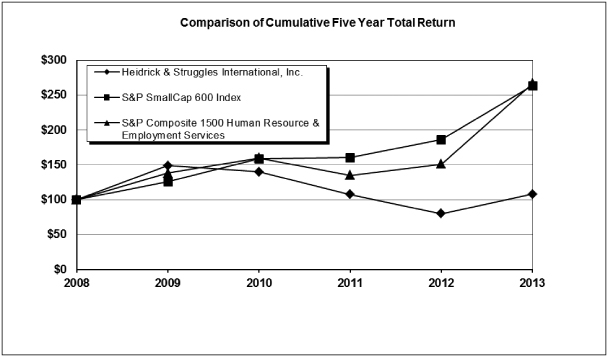

We have presented below a graph which compares the cumulative total stockholder return on our common shares with the cumulative total stockholder return of the Standard & Poor’s SmallCap 600 Index and the Standard & Poor’s Composite 1500 Human Resource and Employment Services Index. The S&P Composite 1500 Human Resource & Employment Services Index includes 11 companies in related businesses, including Heidrick & Struggles. Cumulative total return for each of the periods shown in the performance graph is measured assuming an initial investment of $100 on December 31, 2008.

The stock price performance depicted in this graph is not necessarily indicative of future price performance. This graph will not be deemed to be filed as part of this Form 10-K and will not be deemed to be incorporated by reference by any general statement incorporating this Form 10-K into any filing by us under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent we specifically incorporate this information by reference.

* Assuming $100 invested on 12/31/08 in HSII or index, including reinvestment of dividends.

Prepared by: Zacks Investment Research, Inc.

Copyright: Standard and Poor’s, Inc.

14

Table of Contents

Dividends

Since September 2007, we have paid a quarterly cash dividend of $0.13 per share as approved by our Board of Directors. In 2013, the total cash dividend paid was $0.39 per share.

The following table outlines the record date, payment date and amount of quarterly cash dividends paid during 2012 and 2013:

|

Quarter |

Record Date |

Payment Date |

Dividends (in millions) | |||

| Q4 2011 |

February 3, 2012 | February 17, 2012 | $2.3 | |||

| Q1 2012 |

May 4, 2012 | May 18, 2012 | 2.3 | |||

| Q2 2012 |

August 3, 2012 | August 17, 2012 | 2.3 | |||

| Q3 2012 |

November 2, 2012 | November 16, 2012 | 2.3 | |||

| Q4 2012 |

December 27, 2012 | December 31, 2012 | 2.3 | |||

| Q1 2013 |

May 3, 2013 | May 17, 2013 | 2.3 | |||

| Q2 2013 |

August 2, 2013 | August 16, 2013 | 2.4 | |||

| Q3 2013 |

November 1, 2013 | November 15, 2013 | 2.4 |

In December 2013, our Board of Directors declared a quarterly dividend of $0.13 per share on our common stock which was paid on February 21, 2014 to shareholders of record as of February 7, 2014. Cash dividends payable of $2.3 million related to the fourth quarter 2013 cash dividend, which was paid in the first quarter of 2014 is accrued in the Consolidated Balance Sheets as of December 31, 2013. Cash dividends payable of $2.3 million related to the fourth quarter 2012 cash dividend, was paid in the fourth quarter of 2012.

In connection with the quarterly cash dividend, we also pay a dividend equivalent on outstanding restricted stock units. The amounts related to the dividend equivalent payments for restricted stock units are accrued over the vesting period and paid upon vesting. In 2013 and 2012, we paid $0.2 million and $0.3 million, respectively, in dividend equivalent payments.

Issuer Purchases of Equity Securities

On February 11, 2008, we announced that our Board of Directors authorized management to repurchase shares of our common stock with an aggregate purchase price up to $50 million. We intend from time to time and as business conditions warrant, to purchase shares of our common stock on the open market or in negotiated or block trades. No time limit has been set for completion of this program. We did not repurchase any shares of our common stock in 2013. As of December 31, 2013 and December 31, 2012, we have purchased 1,038,670 shares of our common stock for a total of $28.3 million and $21.7 million remains available for future purchases under the authorization. For further information of our share repurchase activity, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources.”

15

Table of Contents

ITEM 6. SELECTED FINANCIAL DATA

The selected financial data presented below have been derived from our audited consolidated financial statements. The data as of December 31, 2013 and 2012 and for the years ended December 31, 2013, 2012 and 2011 are derived from the audited current and historical consolidated financial statements, which are included elsewhere in this Form 10-K. The data as of December 31, 2011, 2010 and 2009 and for the years ended December 31, 2010 and 2009 are derived from audited historical consolidated financial statements, which are not included in this report. The data set forth is qualified in its entirety by, and should be read in conjunction with, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” the audited consolidated financial statements, the notes thereto, and the other financial data and statistical information included in this Form 10-K.

| Year Ended December 31, | ||||||||||||||||||||

| 2013 | 2012 | 2011 | 2010 | 2009 | ||||||||||||||||

| (in thousands, except per share and other operating data) | ||||||||||||||||||||

| Statements of Operations Data: |

||||||||||||||||||||

| Revenue: |

||||||||||||||||||||

| Revenue before reimbursements (net revenue) |

$ | 461,995 | $ | 443,777 | $ | 527,793 | $ | 493,091 | $ | 395,651 | ||||||||||

| Reimbursements |

18,998 | 21,304 | 26,187 | 20,145 | 19,067 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total revenue |

480,993 | 465,081 | 553,980 | 513,236 | 414,718 | |||||||||||||||

| Operating expenses: |

||||||||||||||||||||

| Salaries and employee benefits |

319,499 | 309,502 | 372,406 | 340,178 | 281,545 | |||||||||||||||

| General and administrative expenses |

126,931 | 113,826 | 123,592 | 130,622 | 115,758 | |||||||||||||||

| Other charges |

— | — | — | 4,218 | (5) | — | ||||||||||||||

| Reimbursed expenses |

18,998 | 21,304 | 26,187 | 20,145 | 19,067 | |||||||||||||||

| Restructuring charges |

— | 810 | (1) | 16,344 | (2) | 1,621 | (6) | 22,640 | (8) | |||||||||||

| Impairment charges |

— | — | 26,366 | (3) | — | 4,080 | (9) | |||||||||||||

| Other operating income |

— | — | — | (1,072 | )(7) | (1,661 | )(10) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expenses |

465,428 | 445,442 | 564,895 | 495,712 | 441,429 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating income (loss) |

15,565 | 19,639 | (10,915 | ) | 17,524 | (26,711 | ) | |||||||||||||

| Non-operating income (expense): |

||||||||||||||||||||

| Interest, net |

(175 | ) | 1,118 | 1,402 | 813 | 1,201 | ||||||||||||||

| Other, net |

(2,002 | ) | (495 | ) | (5,262 | )(4) | (1,389 | ) | (4,189 | )(11) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net non-operating income (expense) |

(2,177 | ) | 623 | (3,860 | ) | (576 | ) | (2,988 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) before income taxes |

13,388 | 20,262 | (14,775 | ) | 16,948 | (29,699 | ) | |||||||||||||

| Provision for (benefit from) income taxes |

7,041 | 14,022 | 18,947 | 9,455 | (8,791 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) |

$ | 6,347 | $ | 6,240 | $ | (33,722 | ) | $ | 7,493 | $ | (20,908 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Basic weighted average common shares outstanding |

18,077 | 17,971 | 17,780 | 17,437 | 16,901 | |||||||||||||||

| Diluted weighted average common shares outstanding |

18,232 | 18,120 | 17,780 | 17,869 | 16,901 | |||||||||||||||

| Basic earnings (loss) per common share |

$ | 0.35 | $ | 0.35 | $ | (1.90 | ) | $ | 0.43 | $ | (1.24 | ) | ||||||||

| Diluted earnings (loss) per common share |

$ | 0.35 | $ | 0.34 | $ | (1.90 | ) | $ | 0.42 | $ | (1.24 | ) | ||||||||

| Cash dividends paid per share |

$ | 0.39 | $ | 0.65 | $ | 0.52 | $ | 0.52 | $ | 0.52 | ||||||||||

| Balance Sheet Data (at end of period): |

||||||||||||||||||||

| Working capital |

$ | 114,987 | $ | 73,886 | $ | 125,235 | $ | 140,010 | $ | 127,661 | ||||||||||

| Total assets |

553,224 | 494,992 | 515,565 | 545,027 | 474,847 | |||||||||||||||

| Long-term debt, less current maturities |

29,500 | — | — | — | — | |||||||||||||||

| Stockholders’ equity |

247,873 | 248,347 | 251,295 | 294,542 | 290,852 | |||||||||||||||

| Other Operating Data: |

||||||||||||||||||||

| Average number of consultants during the period |

341 | 342 | 376 | 353 | 385 | |||||||||||||||

16

Table of Contents

Notes to Selected Financial Data:

| (1) | In 2012, we recorded restructuring charges of $0.8 million in Europe related to adjustments associated with our 2011 restructuring plan. These charges consist of $1.1 million of employee-related costs associated with severance arrangements, partially offset by $0.3 million of adjustments to premise-related costs. See Note 18, Restructuring and Impairment Charges, in the Notes to Consolidated Financial Statements. |

| (2) | In 2011, we recorded restructuring charges of $16.3 million in connection with initiatives to reduce overall costs and improve operational efficiencies. These charges consist of employee-related costs, including severance associated with reductions in our workforce of 139 employees globally, and expenses associated with consolidating and closing 11 of our smaller office locations, predominately in Europe. By segment, the restructuring charges recorded in 2011 were $8.3 million in Europe, $5.1 million in the Americas, $0.7 million in Asia Pacific and $2.2 million in Global Operations Support. See Note 18, Restructuring and Impairment Charges, in the Notes to Consolidated Financial Statements. |

| (3) | In 2011, as a result of our restructuring initiatives, primarily in Europe, and the volatility associated with the economic outlook for Europe, including political and economic uncertainty in the region, we performed a goodwill and intangible asset impairment evaluation. Based on the evaluation, we recorded a goodwill and intangible asset impairment charge in Europe of $26.0 million, resulting in a write-off of all the goodwill in Europe, and an intangible asset impairment of $0.4 million in the Americas. See Note 10, Goodwill and Other Intangible Assets, and Note 18, Restructuring and Impairment Charges, in the Notes to Consolidated Financial Statements. |

| (4) | In 2011, we wrote-off our $1.8 million investment in JobKoo and our $1.0 million loan to JobKoo made in the first quarter of 2011. JobKoo was a joint venture in which we held an equity method investment. |

| (5) | In 2010, we recorded other charges of $4.2 million, which consist of $3.2 million of accelerated occupancy costs and depreciation, dilapidation costs, and professional fees related to the settlement of our lease obligations for our former London office which we vacated and $1.0 million due to an unfavorable judgment in a lawsuit filed by a former European employee who separated from us in 2006. |

| (6) | In 2010, we recorded restructuring charges of $1.6 million. These charges consist of $0.6 million of severance associated with reductions in our workforce of 19 employees globally and $1.0 million related to the default of two of our subtenants in previously restructured offices. By segment, the restructuring charges recorded in 2010 were $1.0 million in the Americas, $0.3 million in Europe, and $0.3 million in Global Operations Support. |

| (7) | In 2010, as a result of continued lower than expected 2010 revenue production from consultants acquired in the Ray and Berndston Sp. z o. o acquisition, we performed a fair value assessment of the potential future earnout payments under the purchase agreement. This assessment indicated that there would not be any future earnout payments and resulted in a $1.1 million adjustment. Under the acquisition method of accounting for business combinations, we recognized the fair value adjustment as other operating income in the Consolidated Statement of Comprehensive Income (Loss). |

| (8) | In 2009, we recorded net restructuring charges of $22.6 million. These charges relate to $22.9 million of employee-related costs, including severance associated with reductions in our workforce of 363 employees globally, including 75 executive search consultants. By segment, the restructuring charges recorded in 2009 were $9.5 million in the Americas, $9.5 million in Europe, $2.4 million in Asia Pacific and $1.5 million in Global Operations Support. Additionally, during 2009 we recorded a reduction of $0.3 million in Europe related to a previously restructured office. |

| (9) | In 2009, as a result of our workforce reductions in January and May 2009 and continued business and economic uncertainty, we performed an evaluation of the remaining client relationship intangible asset associated with our 2006 acquisition of Highland Partners. Based on this analysis, we recorded an impairment charge related to the Americas region of $3.8 million. Additionally, the deterioration in business |

17

Table of Contents

| performance from the consultants acquired in the Ray and Berndston Sp. z o. o acquisition triggered a review of the client relationship intangible assets associated with this acquisition, resulting in an impairment charge in the European region of $0.2 million. |

| (10) | In 2009, as a result of significantly lower than expected 2009 revenue production from consultants acquired in the Ray and Berndtson Sp. z o. o acquisition and uncertainty regarding their future performance, we performed a fair value assessment of the potential future earnout payments under the purchase agreement. This assessment resulted in a $1.7 million reduction to the original earnout accrual. Under the acquisition method of accounting for business combinations, we recognized the fair value adjustment as other operating income in the Consolidated Statement of Comprehensive Income (Loss). |

| (11) | In 2009, we wrote-off our investment in VisualCV, Inc. of $3.0 million. |

18

Table of Contents

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Management’s Discussion and Analysis of Financial Condition and Results of Operations as well as other sections of this annual report on Form 10-K contain forward-looking statements. The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements. Forward-looking statements are not historical facts, but instead represent only our beliefs, assumptions, expectations, estimates, forecasts and projections regarding future events, many of which, by their nature, are inherently uncertain and outside our control. These statements include statements other than historical information or statements of current condition and may relate to our future plans and objectives and results. By identifying these statements for you in this manner, we are alerting you to the possibility that our actual results and financial condition may differ, possibly materially, from the anticipated results and financial condition indicated in these forward-looking statements. Important factors that could cause our actual results and financial condition to differ from those indicated in the forward-looking statements include, among others, those discussed under the Section heading “Risk Factors” in Part I, Item 1A of this Form 10-K.

Factors that may affect the outcome of the forward-looking statements include, among other things, leadership changes, our ability to attract, integrate, manage and retain qualified consultants and senior leaders; our ability to develop and maintain strong, long-term relationships with our clients; fluctuations in the global economy and our ability to execute successfully our leadership advisory strategy through business cycles; the timing, speed or robustness of any future economic recovery; social or political instability in markets where we operate, the impact of foreign currency exchange rate fluctuations; unfavorable tax law changes and tax authority rulings; price competition; the ability to forecast, on a quarterly basis, variable compensation accruals that ultimately are determined based on the achievement of annual results; our ability to realize our tax losses; the timing of the establishment or reversal of valuation allowance on deferred tax assets; the mix of profit and loss by country; our reliance on information management systems; any further impairment of our goodwill and other intangible assets; and the ability to align our cost structure and headcount with net revenue. We undertake no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Executive Overview

Our Business

We are a leadership advisory firm providing executive search, culture shaping and leadership consulting services. We help our clients build leadership teams by facilitating the recruitment, management and deployment of senior executives. We believe focusing on top-level services offers us several advantages that include access to and influence with key decision makers, increased potential for recurring search consulting engagements, higher fees per search, enhanced brand visibility, and a leveraged global footprint, which create added barriers to entry for potential competitors. Working at the top of client organizations also allows us to attract and retain high-caliber consultants.

In addition to executive search, we provide a range of other services to clients. Our other services include culture shaping provided by Senn Delaney, a business that we acquired on December 31, 2012, and leadership consulting services which includes executive assessment, leadership development, board and top team effectiveness, and succession planning.

We provide our services to a broad range of clients through the expertise of approximately 300 consultants located in major cities around the world. Our executive search services are provided on a retained basis. Revenue before reimbursements of out-of-pocket expenses (“net revenue”) consists of retainers and indirect expenses billed to clients. Typically, we are paid a retainer for our executive search services equal to approximately one-third of the estimated first year compensation for the position to be filled. In addition, if the actual compensation of a placed candidate exceeds the estimated compensation, we often are authorized to bill the

19

Table of Contents

client for one-third of the excess. Indirect expenses are calculated as a percentage of the retainer with certain dollar limits per search. Net revenue associated with culture shaping consulting is recognized proportionally as services are performed. Net revenue associated with licenses to use Senn Delaney proprietary materials is typically recognized over the term of the license. Net revenue from leadership consulting is recognized in accordance with the completion of the engagement deliverables.

Key Performance Indicators

We manage and assess Heidrick & Struggles’ performance through various means, with the primary financial and operational measures including net revenue, operating income, operating margin, Adjusted EBITDA, Adjusted EBITDA margin, consultant headcount, confirmation trends, consultant productivity, and average revenue per search or project.

Revenue is driven by market conditions and a combination of the number of executive search engagements and leadership consulting and culture shaping projects and the average revenue per search or project. With the exception of compensation expense, incremental increases in revenue do not necessarily result in proportionate increases in costs, particularly operating and administrative expenses, thus potentially improving operating margins.

The number of consultants, confirmation trends, number of searches or projects completed, productivity levels and the average revenue per search or project will vary from quarter to quarter, affecting net revenue and operating margin.

Our Compensation Model

At the consultant level there are fixed and variable components of compensation. Individuals are largely rewarded for their performance based on a system that directly ties a significant portion of their compensation to the amount of net revenue for which they are responsible. A portion of the reward may be based upon individual performance against a series of non-financial measures. Credit towards the variable portion of a consultant’s compensation is earned by generating net revenue for winning and executing work. Each quarter, we review and update the expected annual performance of all consultants and accrue variable compensation accordingly. The amount of variable compensation that is accrued for each consultant is based on a tiered payout model and adjusted for overall Company performance. The more net revenue that is generated by the consultant, the higher the percentage credited towards the consultant’s variable compensation and thus accrued by our Company as expense. The mix of individual consultants who generate the revenue can significantly affect the total amount of compensation expense recorded, which directly impacts operating margins. As a result, the variable portion of the compensation expense may fluctuate significantly from quarter to quarter. The total variable compensation is discretionary and is based on Company-wide financial targets approved by the Human Resources and Compensation Committee of the Board of Directors.

A portion of our consultants’ and management cash bonuses are deferred and paid over a three-year vesting period. The compensation expense related to the amounts being deferred is recognized on a graded vesting attribution method over the requisite service period. This service period begins on January 1 of the respective fiscal year and continues through the deferral date, which coincides with our bonus payments in the first quarter of the following year, and for an additional three year vesting period. The deferrals are recorded in accrued salaries and employee benefits and other non-current liabilities in the Consolidated Balance Sheets.

2013 Overview

Consolidated net revenue of $462.0 million increased 4.1% or $18.2 million in 2013, compared to 2012. Culture Shaping and executive search in the Americas contributed $24.8 million and $2.3 million, respectively to the increase in net revenue. Net revenue decreased $8.9 million in Executive Search and Leadership Consulting - Europe and remained consistent year over year in Executive Search and Leadership Consulting - Asia Pacific.

20

Table of Contents

Consultant productivity measured by net executive search and leadership consulting revenue per consultant was $1.4 million for the year ended December 31, 2013, compared to $1.3 million for the year ended December 31, 2012. Average revenue per executive search was $113,400 for the year ended December 31, 2013 compared to $113,700 for the year ended December 31, 2012.

Operating income as a percentage of net revenue was 3.4% in 2013 compared to 4.4% in 2012. The operating income was driven by an increase in net revenue of $18.2 million and a decrease in restructuring charges of $0.8 million, offset by increases in general and administrative expenses of $13.1 million, including $5.4 million of intangible asset amortization and $2.1 million of accretion expense associated with the acquisition of Senn Delaney, and salaries and employee benefits expense of $10.0 million Salaries and employee benefits expense as a percentage of net revenue was 69.7% in 2012 and 69.2% in 2013. General and administrative expense as a percentage of net revenue was 25.6% in 2012 and 27.5% in 2013.

We ended the year with a combined cash and cash equivalents balance of $181.6 million, an increase of $64.0 million compared to $117.6 million at December 31, 2012. The increase is primarily due to a borrowing of $40 million in January of 2013 to compensate for the cash payments in the fourth quarter of 2012 of $60 million related to the acquisition of Senn Delaney. We pay the majority of bonuses in the first quarter following the year in which they were earned. Employee bonuses are accrued throughout the year and are based on the Company’s performance and the performance of the individual employee. We expect to pay approximately $85 million in bonuses related to 2013 performance in March and April 2014. In February 2014, we paid approximately $10 million in cash bonuses deferred in prior years.

2014 Outlook

We are currently forecasting 2014 first quarter net revenue of between $110 million and $120 million. Our 2014 first quarter guidance is based upon, among other things, management’s assumptions for the anticipated volume of new executive search confirmations and leadership consulting and culture shaping projects, the current backlog, consultant productivity, consultant retention, the seasonality of our business and no change in future currency rates.

Our 2014 first quarter guidance is subject to a number of risks and uncertainties, including those disclosed under Risk Factors and Management’s Discussion and Analysis of Financial Condition and Results of Operations included in this Form 10-K (See Item 1A. Risk Factors). As such, actual results could vary from these projections.

21

Table of Contents

Results of Operations

The following table summarizes, for the periods indicated, the results of operations (in thousands):

| Year Ended December 31, | ||||||||||||

| 2013 | 2012 | 2011 | ||||||||||

| Revenue: |

||||||||||||

| Revenue before reimbursements (net revenue) |

$ | 461,995 | $ | 443,777 | $ | 527,793 | ||||||

| Reimbursements |

18,998 | 21,304 | 26,187 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total revenue |

480,993 | 465,081 | 553,980 | |||||||||

| Operating expenses: |

||||||||||||

| Salaries and employee benefits |

319,499 | 309,502 | 372,406 | |||||||||

| General and administrative expenses |

126,931 | 113,826 | 123,592 | |||||||||

| Reimbursed expenses |

18,998 | 21,304 | 26,187 | |||||||||

| Restructuring charges |

— | 810 | 16,344 | |||||||||

| Impairment charges |

— | — | 26,366 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total operating expenses |

465,428 | 445,442 | 564,895 | |||||||||

|

|

|

|

|

|

|

|||||||

| Operating income (loss) |

15,565 | 19,639 | (10,915 | ) | ||||||||

| Non-operating income (expense): |

||||||||||||

| Interest, net |

(175 | ) | 1,118 | 1,402 | ||||||||

| Other, net |

(2,002 | ) | (495 | ) | (5,262 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net non-operating income (expense) |

(2,177 | ) | 623 | (3,860 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Income (loss) before income taxes |

13,388 | 20,262 | (14,775 | ) | ||||||||

| Provision for income taxes |

7,041 | 14,022 | 18,947 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net income (loss) |

$ | 6,347 | $ | 6,240 | $ | (33,722 | ) | |||||

|

|

|

|

|

|

|

|||||||

| Basic weighted average common shares outstanding |

18,077 | 17,971 | 17,780 | |||||||||

| Diluted weighted average common shares outstanding |

18,232 | 18,120 | 17,780 | |||||||||

| Basic earnings (loss) per common share |

$ | 0.35 | $ | 0.35 | $ | (1.90 | ) | |||||

| Diluted earnings (loss) per common share |

$ | 0.35 | $ | 0.34 | $ | (1.90 | ) | |||||

| Cash dividends paid per share |

$ | 0.39 | $ | 0.65 | $ | 0.52 | ||||||

22

Table of Contents

The following table summarizes, for the periods indicated, our results of operations as a percentage of revenue before reimbursements (net revenue):

| Year Ended December 31, | ||||||||||||

| 2013 | 2012 | 2011 | ||||||||||

| Revenue: |

||||||||||||

| Revenue before reimbursements (net revenue) |

100.0 | % | 100.0 | % | 100.0 | % | ||||||

| Reimbursements |

4.1 | 4.8 | 5.0 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total revenue |

104.1 | 104.8 | 105.0 | |||||||||

| Operating expenses: |

||||||||||||

| Salaries and employee benefits |

69.2 | 69.7 | 70.6 | |||||||||

| General and administrative expenses |

27.5 | 25.6 | 23.4 | |||||||||

| Reimbursements |

4.1 | 4.8 | 5.0 | |||||||||

| Restructuring charges |

— | 0.2 | 3.1 | |||||||||

| Impairment charges |

— | — | 5.0 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total operating expenses |

100.7 | 100.4 | 107.0 | |||||||||

|

|

|

|

|

|

|

|||||||

| Operating income (loss) |