|

|

|

|

|

WHIRLPOOL CORPORATION Global Headquarters 2000 North M-63 Benton Harbor, Michigan 49022-2692 |

Dear Fellow Shareholder:

As we enter 2024, we would like to again thank you for your continued support as a Whirlpool shareholder. In 2023, we achieved significant milestones on our portfolio transformation journey, aimed at focusing our portfolio on higher-growth, higher-margin businesses. We completed the integration of InSinkErator into our global operations, announced our agreement to contribute our European major domestic appliance business to a newly formed company with Arçelik A.Ş. and undertook a resegmentation of our external operating segments beginning in 2024. In each of these efforts, the Board provided critical oversight and direction, leveraging their expertise in corporate strategy, business operations, risk management and finance, among other areas. We are proud to tell our corporate governance story in the following pages, which includes these highlights.

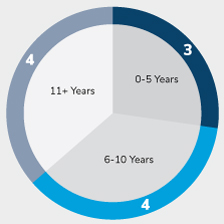

Board Refreshment and Diversity

In 2023, we continued our commitment to a Board composition that reflects an effective mix of business expertise, company knowledge, and diverse perspectives, with the right balance between board refreshment and continuity. In line with this commitment, eight of our directors are gender or racially/ethnically diverse, and four new directors have joined the Board in the past five years. This Board refreshment is balanced by our longer-tenured directors that have deep knowledge of our operations and the evolution of our strategy, and remaining directors that provide stability and continuity to the Board. We were pleased to announce the addition of Rudy Wilson last year and Rich Kramer last month to our Board. Rudy, who is President of Global Consumer Brands for SC Johnson, brings a wealth of marketing and operational expertise to the Board, providing critical insights around our strategic imperatives to inspire generations with our brands and grow our direct-to-consumer business. Rich, who is the former Chairman, Chief Executive Officer and President of The Goodyear Tire & Rubber Company, brings experience driving corporate strategy, as well as significant experience in accounting, finance and capital structure, and mergers and acquisitions, providing invaluable insights on our Board’s finance oversight responsibilities and the Company’s portfolio transformation process.

Strategic Focus on Emerging Trends

In 2023, as in prior years, the Board reviewed emerging trends impacting our industry and broader economy, and provided strategic insights aimed at best positioning the Company to benefit from such trends. This year, the Board participated in a deep-dive session on the potential transformative impact of generative AI, and better understanding the risks and opportunities for the company and impact on our consumers. The Board also reviewed significant cyber and data privacy trends, and provided oversight and insights into our cyber strategy for the future.

Sustainability and Corporate Responsibility

Our Board is responsible for overseeing the integration of environmental, social, and governance (ESG) principles throughout Whirlpool Corporation. The Board reviews and receives updates on our sustainability strategy and key long-term ESG initiatives every year. In 2023, the Board reviewed our ESG initiatives and progress against our global commitments centered around sustainable products and operations, supporting our people and doing the right thing. The Board also provided insights on the changing ESG regulatory environment, our goal to reach net zero emissions in our plants and operations by 2030, and our human capital management strategy centered on our three pillars of agile organization, great people, and winning culture.

Shareholder Engagement

Whirlpool values the feedback of our shareholders and seeks opportunities to engage on company performance, strategy, and governance, among other topics. We continue to engage with shareholders on important issues such as strategy and results, including our strategic portfolio transformation, ESG, executive compensation and Board diversity, and we share their feedback with our Board.

It is our pleasure to invite you to attend the 2024 Whirlpool Corporation annual meeting of stockholders to be held on Tuesday, April 16, 2024, at 8:00 a.m., Central Time, at 331 North LaSalle, Chicago, Illinois. At the meeting, shareholders will vote on the matters set forth in the formal notice of the meeting that follows on the next page. In addition, we will discuss our 2023 performance and our outlook for this year, and we will answer your questions. We have included with this booklet an annual report containing important financial and other information about Whirlpool. Your vote is important and much appreciated!

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MARC R. BITZER Chairman of the Board and Chief Executive Officer |

|

|

|

|

|

|

|

|

|

|

|

SAMUEL R. ALLEN Presiding Director |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 4, 2024

Sustainable Products & Operations

Sustainable Products & Operations  Supporting Our People

Supporting Our People  Doing the Right Thing

Doing the Right Thing