Acquisition of GVT

On September 18, 2014, we signed a share purchase agreement with Vivendi and some of its subsidiaries, or collectively, Vivendi, and with GVTPar, Telefónica, S.A. and GVT Operacional, under which we agreed to buy all shares of GVTPar, the controlling shareholder of GVT. This acquisition was approved by our board of directors on September 18, 2014.

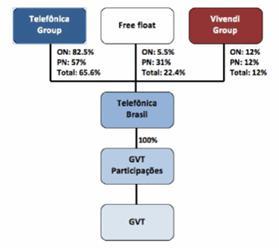

As consideration for the acquisition, we agreed to pay a portion of the price in cash and a portion in cash, in the form of our common and preferred shares, as follows: (1) €4,663,000,000 to be paid in cash on the closing date, as adjusted under the terms of the share purchase agreement, and (2) our common and preferred shares in the amount of 12% of our total capital after the capital increase contemplated in the share purchase agreement and the merger of GVTPar shares in us. The full consideration was paid upon completion of (A) a capital increase, the proceeds of which were used to pay the cash consideration described in (1) above, and (B) the merger of GVTPar shares in us.

On December 22, 2014, ANATEL approved the transaction and imposed certain obligations, which we believe did not compromise the terms of the acquisition of GVT or its value. On March 25, 2015, CADE’s administrative court approved the transaction on the basis of certain confidential commitments offered by us and Vivendi S.A. Commitments include the execution of two merger control agreements: the first between CADE and the second between CADE and Vivendi S.A.

On March 25, 2015, our board of directors approved the public offering of shares, including shares in the form of ADSs, in accordance with a capital increase of R$15,812,000,038.03, by issuing 121,711,240 common shares, at the price of R$38.47 and 236,803,588 preferred shares, at the price of R$47.00, as well as 6,282,660 preferred shares according to the exercise of the excessive allotment option. On May 28, 2015, our shareholders approved the ratification of the Share Purchase Agreement and Other Agreements, signed by the Company, as Buyer, and Vivendi S.A. and its subsidiaries, Société d'Investissements et de Gestion 108 SAS and Société d'Investissements et de Gestion 72 S.A., as Sellers, for which all shares issued by GVTPar, shareholder of Global Village Telecom S.A., were acquired by us.

Therefore, as provided for in the share purchase agreement, we paid a portion of GVT’s spot acquisition price with cash, receiving shares of GVTPar and GVT Operator, and another portion in shares, to FrHolding108 as a result of the merger of GVTPar’s shares in us, representing 12% of our share capital after the merger.

After the merger and as a result of the acquisition, our corporate structure was as follows:

On June 24, 2015, the transaction for the exchange of shares between Telefónica and Société d'Investissements et de Gestion 108 SAS, a company controlled by Vivendi S.A. was completed, through which FrHolding108 transferred to Telefónica 76,656,559 shares representing 4.5% of our share capital, including 68,597,306 common shares representing 12% of this class of shares and 8,059,253 preferred shares representing 0.72% of this class of shares, in exchange for 1,110,000,000 shares representing 8.2% of the common shares of Telecom Italia, S.p.A., previously held by Telco TE, S.p.A., a subsidiary of Telefónica.

24