Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08879

SUN CAPITAL ADVISERS TRUST

(Exact name of registrant as specified in charter)

One Sun Life Executive Park, Wellesley Hills, Massachusetts 02481

(Address of principal executive offices) (Zip code)

John T. Donnelly

Sun Capital Advisers Trust

One Sun Life Executive Park

Wellesley Hills, Massachusetts 02481

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 432-1102 x 3330

Date of fiscal year end: December 31

Date of reporting period: December 31, 2010

Table of Contents

| Item 1. | Reports to Stockholders. |

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended:

Table of Contents

SUN CAPITAL ADVISERS TRUST®

Annual Report December 31, 2010

SCSM AllianceBernstein International Value Fund

SCSM BlackRock International Index Fund

SCSM BlackRock Large Cap Index Fund

SCSM BlackRock Small Cap Index Fund

SCSM Goldman Sachs Mid Cap Value Fund

SCSM Columbia Small Cap Value Fund

SCSM Davis Venture Value Fund

SCSM Invesco Small Cap Growth Fund

SCSM Lord Abbett Growth & Income Fund

SCSM WMC Blue Chip Mid Cap Fund

SCSM WMC Large Cap Growth Fund

Sun Capital Global Real Estate Fund

SCSM Ibbotson Tactical Opportunities Fund

Sun Capital Investment Grade Bond Fund®

Sun Capital Money Market Fund®

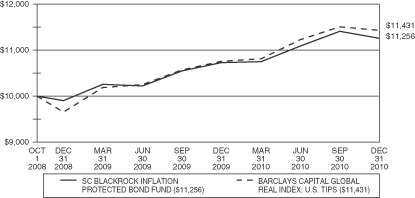

SCSM BlackRock Inflation Protected Bond Fund

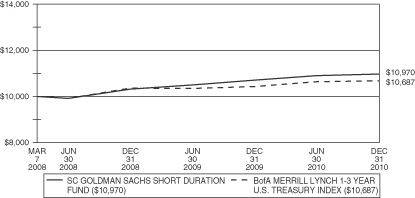

SCSM Goldman Sachs Short Duration Fund

SCSM PIMCO High Yield Fund

SCSM PIMCO Total Return Fund

SCSM Ibbotson Balanced Fund

SCSM Ibbotson Conservative Fund

SCSM Ibbotson Growth Fund

|

Sun Capital Advisers Trust is registered under the Investment Company Act of 1940 as an open-end management investment company. Its investment adviser is Sun Capital Advisers LLC®, a member of the Sun Life Financial group of companies. |

Table of Contents

| Important Information about this Report |

||||

| Management’s Discussion & Analysis |

||||

| 1 | ||||

| 6 | ||||

| 9 | ||||

| 13 | ||||

| 17 | ||||

| 21 | ||||

| 26 | ||||

| 30 | ||||

| 35 | ||||

| 40 | ||||

| 45 | ||||

| 49 | ||||

| 53 | ||||

| 56 | ||||

| 60 | ||||

| 64 | ||||

| 68 | ||||

| 72 | ||||

| 77 | ||||

| 82 | ||||

| 82 | ||||

| 82 | ||||

| 93 | ||||

| Portfolios of Investments |

||||

| 96 | ||||

| 103 | ||||

| 120 | ||||

| 130 | ||||

| 157 | ||||

| 163 | ||||

| 169 | ||||

| 174 | ||||

| 178 | ||||

| 181 | ||||

| 185 | ||||

| 188 | ||||

| 191 | ||||

| 192 | ||||

| 200 | ||||

| 203 | ||||

| 207 | ||||

| 215 | ||||

| 232 | ||||

| 255 | ||||

| 257 | ||||

| 258 | ||||

| Financial Statements |

||||

| 260 | ||||

| 265 | ||||

| 270 | ||||

| 278 | ||||

| 293 | ||||

| 328 | ||||

| 329 | ||||

| 329 | ||||

| 329 | ||||

| 329 | ||||

| 330 | ||||

| 337 |

Table of Contents

Important Information about this Report:

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Funds. This report is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective prospectus. Investors should consider the investment objectives, risks, charges and expenses of a Fund before investing. This and other information is contained in a Fund’s prospectus. Please read the prospectus carefully before you invest.

The views and opinions expressed in each Fund’s “Management’s Discussion and Analysis” are those of the portfolio manager(s) of the Fund. The views and opinions expressed, and the portfolio holdings described, are as of December 31, 2010, and are subject to change at any time without notice due to market or other conditions. These should not be construed as investment advice or as a recommendation to buy or sell any security. Any forecasts or other forward looking views may not come to pass. Past performance is no guarantee of future results. Performance may have changed materially since December 31, 2010.

An investment in a Fund is not a bank deposit and is not insured by the Federal Deposit Insurance Corporation. It is possible to lose money on an investment in any of the Funds.

Country codes included within each Fund’s Portfolio of Investments are unaudited.

Table of Contents

SC ALLIANCEBERNSTEIN INTERNATIONAL VALUE FUND

(subadvised by AllianceBernstein L.P.)

MANAGEMENT’S DISCUSSION & ANALYSIS:

How did the Fund perform during the year ended December 31, 2010?

For the year ended December 31, 2010, the Initial and Service Class shares of SC AllianceBernstein International Value Fund (the “Fund”) returned 4.62% and 4.52%, respectively, underperforming the benchmark, the MSCI- EAFE Index (the “Index”), which returned 7.75% for the same period.

What economic and market factors most influenced the global equity markets as a whole during the year ended December 31, 2010?

Equities rose during 2010, but markets were erratic. Concerns about sovereign debt troubles in Europe, Chinese growth and the fears of a second economic slowdown or a “double dip” recession in the U.S. interrupted the global market recovery in the second quarter. Markets did recover in the last four months of the year, led by stocks in the U.S. and emerging markets.

Tough market conditions have created an unprecedented value opportunity in stocks across all market sectors. During 2010, macroeconomic uncertainties prompted a flight to safe assets such as government debt. Strong corporate fundamentals were not rewarded as equity correlation was high, meaning stocks tended to trade in the same direction despite a wide divergence in underlying company performance. High risk aversion led investors to shun the value stocks that the Fund invests in.

How did the country allocations affect relative Fund performance during the year ended December 31, 2010?

The Fund’s country allocations are primarily a result of the bottom-up stock selection process. Overall security selection within countries had a negative impact on the Fund’s performance, detracting the most in Germany, Hong Kong and France. Country selection was a positive contributor to performance due to the Fund’s overweight positions in the United Kingdom (U.K.) and Canada, but a detractor due to underweight positions in Sweden and Hong Kong as compared to the Index. Finally, currency selection in the Fund contributed to performance due to the Fund’s overweight position in the U.S. dollar and the Canadian dollar, but detracted due to underweight positions in the Australian dollar and Japanese yen.

Which stocks contributed most to the Fund’s returns during the year ended December 31, 2010?

Holdings in several sectors benefited from signs of improving demand that is likely to continue as the global economic recovery progresses. German automaker Bayerische Motoren Werke (BMW) outperformed as demand recovered and as the company introduced new models, helping it gain market share and outperform its peers. Industrial commodity stocks, such as U.K. companies Xstrata PLC and Rio Tinto PLC, and Canadian company Lundin Mining Corp. benefited from a strong price surge in the commodity sector, driven by the U.S. Federal Reserve’s new quantitative easing initiative (U.S. Treasury Bond purchases) and resulting U.S. dollar weakness.

Which stocks detracted from the Fund’s performance results during the year ended December 31, 2010?

Several European holdings suffered from sovereign debt concerns, including UniCredit SpA, the Italian banking group. As the crisis evolved, the Fund trimmed its position in UniCredit SpA.

Japanese company Sharp Corp. weighed on the Fund’s returns in the year. Sharp Corp., which competes with Korean companies, was adversely affected by the appreciation of the Japanese yen versus the Korean won and weaker Liquid Crystal Display (LCD) pricing. Also detracting from performance was the Fund’s position in Portuguese retailer Espirit Holdings Ltd. and French utility Electricié de France.

1

Table of Contents

SC ALLIANCEBERNSTEIN INTERNATIONAL VALUE FUND (Continued)

Did the fund experience major changes to its top ten holdings during the year ended December 31, 2010?

There were five positions on the top ten holdings list as of December 31, 2009 that still remained among the Fund’s top ten holdings as of December 31, 2010. The five new additions to the top ten holdings list were AstraZeneca PLC, Nestle SA, Toyota Motor Corp., BHP Billiton PLC and E.ON AG. These securities, except for Toyota Motor Corp., which was a new purchase in 2010, were held by the Fund as of December 31, 2009 but were not in the top ten holdings. However, during 2010, their position size expanded due to market fluctuation and/or additions to the position size such that they were in the top ten holdings as of December 31, 2010. The five top ten holdings as of December 31, 2009 that were no longer on the Fund’s top ten holdings list as of December 31, 2010 remain as holdings by the Fund in reduced positions with the exception of Banco Santander SA which was sold from the Fund after being affected by investor anxiety over the European sovereign debt crisis.

How was the Fund positioned relative to its benchmark index at December 31, 2010?

The Fund is constructed using a bottom-up stock selection process. Relative sector weights are therefore a function of that approach rather than a result of top-down insights. Many of the companies that the Fund holds have massive amounts of cash on their balance sheets and strong cash flow, giving them ability to pay dividends to shareholders in the years ahead. The Fund’s sector weights illustrate where we have found value opportunities created from this environment.

The Fund remains tilted to benefit from the continued economic recovery through its holdings in the Consumer Discretionary, Materials and Energy sectors specifically. There are also attractive opportunities within the Telecommunications sector, where holdings such as U.K. company Vodafone Group PLC have significant cash on the balance sheet, pay sizable dividends, yet trade at very attractive valuations.

The Fund’s underweight positions to the Consumer Staples and Financials sectors are a result of more limited value opportunities and our assessment of risk. The Fund remains underweight in the Consumer Staples sector where valuations are more demanding. The continued risk around sovereign debt issues in Europe has led to underweight positions in the Financial sector, although the Fund continues to own many companies in Europe, Asia and Australia that offer attractive risk/reward profiles.

2

Table of Contents

SC ALLIANCEBERNSTEIN INTERNATIONAL VALUE FUND (Continued)

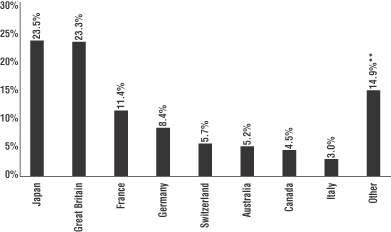

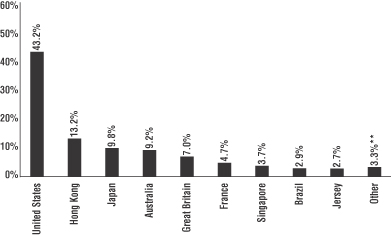

COUNTRY ALLOCATIONS AT DECEMBER 31, 2010*

Percentage of Net Assets

| * | The percentages shown for each country reflect the value of investments in that country as a percentage of net assets. Figures in the above graph may not total to 100% due to the exclusion of the Fund’s other assets and liabilities. |

| ** | Includes 21 countries with an allocation of less than 2% individually. |

TOP TEN EQUITY HOLDINGS AT DECEMBER 31, 2010

| % of Net Assets | Industry | |||||

| Royal Dutch Shell PLC, A Shares |

2.2 | % | Oil, Gas & Consumable Fuels | |||

| Rio Tinto PLC |

1.8 | Metals & Mining | ||||

| AstraZeneca PLC |

1.8 | Pharmaceuticals | ||||

| Vodafone Group PLC |

1.7 | Wireless Telecommunication Services | ||||

| BP PLC |

1.7 | Oil, Gas & Consumable Fuels | ||||

| Novartis AG |

1.5 | Pharmaceuticals | ||||

| Nestle SA |

1.5 | Food Products | ||||

| Toyota Motor Corp. |

1.5 | Automobiles | ||||

| BHP Billiton PLC |

1.2 | Metals & Mining | ||||

| E.ON AG |

1.2 | Electric Utilities | ||||

3

Table of Contents

SC ALLIANCEBERNSTEIN INTERNATIONAL VALUE FUND (Continued)

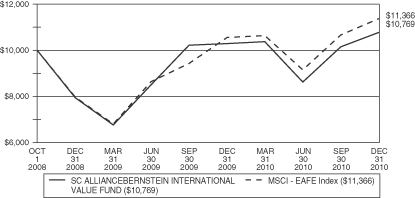

Comparison of Change in Value of a $10,000 Investment in the SC AllianceBernstein International Value Fund – Initial Class and the MSCI-EAFE Index

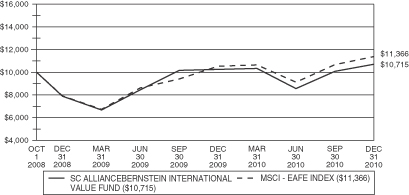

Comparison of Change in Value of a $10,000 Investment in the SC AllianceBernstein International Value Fund – Service Class and the MSCI-EAFE Index

4

Table of Contents

SC ALLIANCEBERNSTEIN INTERNATIONAL VALUE FUND (Continued)

Average Annual Total Returns for Periods Ended December 31, 2010**

| One Year | Life of Fund*** |

|||||||

| SC AllianceBernstein International Value Fund-Initial Class Shares |

4.62 | % | 3.34 | % | ||||

| SC AllianceBernstein International Value Fund-Service Class Shares |

4.52 | % | 3.12 | % | ||||

| MSCI-EAFE Index* |

7.75 | % | 5.85 | % | ||||

*The performance data of the index has been prepared from sources and data that the investment adviser believes to be reliable, but no representation is made as to their accuracy. The index is unmanaged and cannot be invested in directly. The MSCI-EAFE Index (Europe, Australasia, Far East) tracks performance of large cap international equity securities and is widely regarded as the standard for measuring large cap international stock market performance.

**Performance data is historical and includes changes in share price and reinvestment of income dividends and capital gains distributions. Past performance does not indicate future results. All Fund returns are net of fees and expenses, but do not include any insurance charges imposed in connection with your variable insurance contract. If this performance information included the effect of the insurance charges and the fees and expenses assumed by the investment adviser, performance numbers would be lower. The value of an investment in the SC AllianceBernstein International Value Fund and the return on the investment will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost.

***For the period from October 1, 2008 (commencement of operations) to December 31, 2010.

5

Table of Contents

SC BLACKROCK INTERNATIONAL INDEX FUND

(subadvised by BlackRock Investment Management, LLC)

MANAGEMENT’S DISCUSSION & ANALYSIS:

How did the Fund perform during the period ended December 31, 2010?

For the period from November 15, 2010 (commencement of operations) to December 31, 2010, the Initial and Service Class shares of SC BlackRock International Index Fund (the “Fund”) returned 3.80% and 3.70%, respectively, outperforming the benchmark, the MSCI-EAFE Index (the “Index”), which returned 1.87% for the same period.

What economic and market factors most influenced the global equity markets as a whole during the quarter ended December 31, 2010?

International equity markets continued their climb over the fourth quarter, although the pace of the rally slowed relative to the previous quarter. The Index advanced 6.6% for the quarter, finishing the year with a 7.8% gain. Most countries in the Index posted gains for the quarter with the strongest returns seen in Japan, Norway, Austria and New Zealand, while Greece and Spain declined.

Emerging markets continued to outpace the developed world in terms of economic growth, and continued to post respectable gains despite the surfacing of concerns around the implementation of widespread tightening of monetary policy. While the MSCI Emerging Markets Index marginally outperformed the MSCI-EAFE Index for the quarter with its 7.4% return, it significantly outpaced the Index for the year, with a gain of 19.2%.

In Europe, concerns over the regional debt crisis resurfaced and dominated equity markets. Ireland’s acceptance of a bailout package elevated concerns over further contagion of the crisis to peripheral European nations, with particular focus on Spain and Portugal. Nevertheless, macroeconomic data from core European countries remained solid over the quarter, highlighted by strong industrial production. Germany was the main growth engine in the Eurozone, as German macro data consistently beat expectations.

Despite a weak start to the quarter, Japanese equities posted powerful gains, driven by exchange rate movements, generally improving macroeconomic data, and gross domestic product (“GDP”) growth that exceeded expectations. Elsewhere in Asia, geopolitical tensions in Korea and increasing concerns about overheating in China resulted in mixed performance across the region.

While all of the sectors in the Index advanced over the quarter, cyclical sectors outpaced defensive sectors as investors experienced a renewed confidence and gravitated toward higher risk assets. The Materials sector charged ahead of the Index, followed by the Information Technology, Industrials, and Energy sectors. The Financials sector had the weakest positive return.

How did the country allocations affect Fund performance during the period ended December 31, 2010?

The top contributors to the Fund’s performance were Japan, Australia, United Kingdom and Switzerland while the top detractors were Spain and Italy.

Which sectors contributed most to the Fund’s performance results during the period ended December 31, 2010?

The Fund’s investment in a money market fund during the short period at the Fund’s inception positively contributed to the relative Fund’s performance against the Index that declined during that period. The top contributors to the Fund’s performance were the Materials, Industrials and Consumer Discretionary sectors.

Which sectors detracted most from the Fund’s performance results during the period ended December 31, 2010?

The Telecommunication Services sector was the primary detractor from the Fund’s performance.

6

Table of Contents

SC BLACKROCK INTERNATIONAL INDEX FUND (Continued)

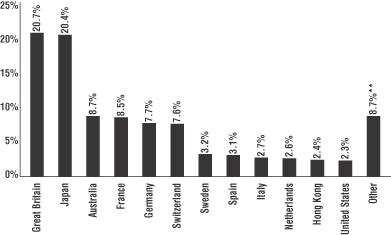

COUNTRY ALLOCATIONS AT DECEMBER 31, 2010*

Percentage of Net Assets

| * | The percentages shown for each country reflect the value of investments in that country as a percentage of net assets. Figures in the above graph may not total to 100% due to the exclusion of the Fund’s other assets and liabilities. |

| ** | Includes 19 countries with an allocation of less than 2% individually. |

TOP TEN EQUITY HOLDINGS AT DECEMBER 31, 2010

| % of Net Assets | Industry | |||||

| Nestle SA |

1.8 | % | Food Products | |||

| HSBC Holdings PLC |

1.6 | Commercial Banks | ||||

| BHP Billiton Ltd. |

1.3 | Metals & Mining | ||||

| BP PLC |

1.2 | Oil, Gas & Consumable Fuels | ||||

| Vodafone Group PLC |

1.2 | Wireless Telecommunication Services | ||||

| Novartis AG |

1.1 | Pharmaceuticals | ||||

| Royal Dutch Shell PLC, Class A |

1.0 | Oil, Gas & Consumable Fuels | ||||

| Total SA |

1.0 | Oil, Gas & Consumable Fuels | ||||

| Toyota Motor Corp. |

0.9 | Automobiles | ||||

| Roche Holding AG |

0.9 | Pharmaceuticals | ||||

7

Table of Contents

SC BLACKROCK INTERNATIONAL INDEX FUND (Continued)

As of the year ended 12/31/10, the Fund did not have six months of performance and therefore line graphs are not presented.

Total Returns for Period Ended December 31, 2010**

| Life of Fund***± |

||||

| SC BlackRock International Index Fund-Initial Class Shares |

3.80 | % | ||

| SC BlackRock International Index Fund-Service Class Shares |

3.70 | % | ||

| MSCI-EAFE Index* |

1.87 | % | ||

*The performance data of the index has been prepared from sources and data that the investment adviser believes to be reliable, but no representation is made as to their accuracy. The index is unmanaged and cannot be invested in directly. The MSCI-EAFE Index (Europe, Australasia, Far East) tracks performance of large cap international equity securities and is widely regarded as the standard for measuring large cap international stock market performance.

**Performance data is historical and includes changes in share price and reinvestment of income dividends and capital gains distributions. Past performance does not indicate future results. All Fund returns are net of fees and expenses, but do not include any insurance charges imposed in connection with your variable insurance contract. If this performance information included the effect of the insurance charges and the fees and expenses assumed by the investment adviser, performance numbers would be lower. The value of an investment in the SC BlackRock International Index Fund and the return on the investment will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost.

***For the period from November 15, 2010 (commencement of operations) to December 31, 2010.

± Returns for period of less than one year are not annualized.

8

Table of Contents

SC BLACKROCK LARGE CAP INDEX FUND

(subadvised by BlackRock Investment Management, LLC)

MANAGEMENT’S DISCUSSION & ANALYSIS:

How did the Fund perform during the year and period ended December 31, 2010?

Effective November 15, 2010, BlackRock Investment Management, LLC replaced OppenheimerFunds, Inc. as subadviser to the SC Oppenheimer Large Cap Core Fund, and the name of the fund was changed to SC BlackRock Large Cap Index Fund (the “Fund”). In connection with this change, the Fund changed its investment goal and investment strategy from an active to a passive management approach, and will attempt to invest in a portfolio of assets whose performance is expected to match approximately the performance of the Standard & Poor’s (“S&P”) 500 Index (the “Index”).

For the year ended December 31, 2010, the Fund’s Initial and Service Class shares returned 16.76% and 16.45%, respectively, outperforming the benchmark Index, which returned 15.06% for the same period. For the period from November 15, 2010 to December 31, 2010, the Fund’s Initial and Service Class shares returned 5.16% and 5.15%, respectively, underperforming the Index which returned 5.28% for the same period.

What economic and market factors most influenced the equity markets as a whole during the quarter ended December 31, 2010?

Domestic equity markets continued their rally through the fourth quarter as the economic recovery gained traction and accelerated toward year end. During the quarter, the Federal Reserve Board (Fed) launched a second round of quantitative easing (“QE2”) measures consisting of U.S. Treasury Bond purchases, the Republicans won control of the House of Representatives in the November election, and the Bush-era tax cuts were extended and supplemented with some fiscal enhancements. As a result of these market-friendly actions, together with stronger economic data and continued positive surprises on the corporate earnings front, U.S. equity markets posted strong gains for the quarter despite a correction during the month of November due to concerns about the European sovereign debt crisis and heightened geopolitical tensions in Korea.

Although, the corporate sector was an important area of strength for the U.S. economy and consumer spending showed improvement, weakness in the housing and labor markets continued to burden the economy. The housing sector remained plagued with declining home prices and depressed levels of sales, starts, and overall construction activity.

Deflationary risk continued to threaten the momentum of economic growth in the United States, tempering gains in the equity markets as inflation remained muted. The seasonally adjusted Consumer Price Index was up only 0.1% in November, leaving the year-over-year rate at 1.1%. The high degree of excess capacity in labor and manufacturing leaves little potential for widespread inflation taking hold. As noted above, the Fed demonstrated its efforts to combat deflation and unemployment by maintaining an investor-favorable easy monetary policy for eight consecutive quarters. Although QE2 measures have thus far failed to make an impact on the unemployment situation, they have successfully boosted confidence and stimulated equity markets.

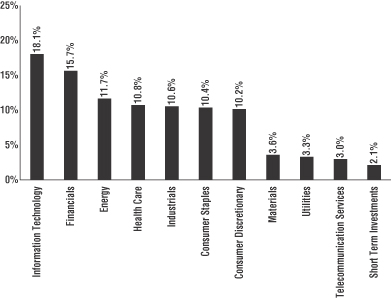

Which sectors contributed most to the Fund’s performance results during the period ended December 31, 2010?

The Financials sector was the strongest contributor during the period, followed by the Energy and Industrials sectors. The Utilities sector was the weakest positive contributor to the Fund’s performance during the period.

9

Table of Contents

SC BLACKROCK LARGE CAP INDEX FUND (Continued)

Which sectors detracted most from the Fund’s performance results during the period ended December 31, 2010?

There were no detractors during the period ended December 31, 2010.

SECTOR ALLOCATIONS AT DECEMBER 31, 2010*

Percentage of Net Assets

| * | The above graph categorizes investments using Global Industry Classification Standards (“GICS”). The percentages shown for each sector reflect the value of investments in that sector as a percentage of net assets. Figures in the above graph may not total to 100% due to the exclusion of the Fund’s other assets and liabilities. |

TOP TEN EQUITY HOLDINGS AT DECEMBER 31, 2010

| % of Net Assets | Industry | |||||

| Exxon Mobil Corp. |

3.1 | % | Oil, Gas & Consumable Fuels | |||

| Apple, Inc. |

2.5 | Computers & Peripherals | ||||

| Microsoft Corp. |

1.8 | Software | ||||

| General Electric Co. |

1.7 | Industrial Conglomerates | ||||

| Chevron Corp. |

1.6 | Oil, Gas & Consumable Fuels | ||||

| International Business Machines Corp. |

1.6 | IT Services | ||||

| The Procter & Gamble Co. |

1.5 | Household Products | ||||

| AT&T, Inc. |

1.5 | Diversified Telecommunication Services | ||||

| Johnson & Johnson |

1.4 | Pharmaceuticals | ||||

| JP Morgan Chase & Co. |

1.4 | Diversified Financial Services | ||||

10

Table of Contents

SC BLACKROCK LARGE CAP INDEX FUND (Continued)

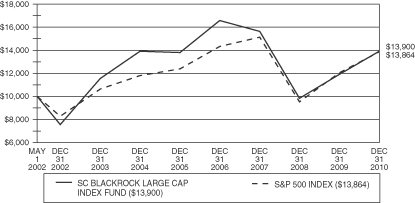

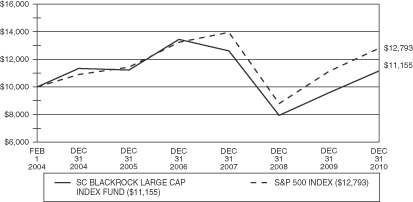

Comparison of Change in Value of a $10,000 Investment in the SC BlackRock Large Cap Index Fund – Initial Class and the S&P 500 Index

Comparison of Change in Value of a $10,000 Investment in the SC BlackRock Large Cap Index Fund – Service Class and the S&P 500 Index

11

Table of Contents

SC BLACKROCK LARGE CAP INDEX FUND (Continued)

Average Annual Total Returns for Periods Ended December 31, 2010**

| Initial Class Shares |

One Year | Three Years | Five Years | Life of Fund*** |

||||||||||||

| SC BlackRock Large Cap Index Fund |

16.76 | % | (3.81 | )% | 0.13 | % | 3.87 | % | ||||||||

| S&P 500 Index* |

15.06 | % | (2.86 | )% | 2.29 | % | 3.84 | % | ||||||||

| Service Class Shares |

||||||||||||||||

| SC BlackRock Large Cap Index Fund |

16.45 | % | (4.01 | )% | (0.10 | )% | 1.59 | % | ||||||||

| S&P 500 Index* |

15.06 | % | (2.86 | )% | 2.29 | % | 3.63 | % | ||||||||

*The performance data of the index has been prepared from sources and data that the investment adviser believes to be reliable, but no representation is made as to their accuracy. The index is unmanaged and cannot be invested in directly. The S&P 500 Index is a market-value weighted index of 500 blue chip stocks and is considered to be a benchmark of the overall stock market.

**Performance data is historical and includes changes in share price and reinvestment of income dividends and capital gains distributions. Past performance does not indicate future results. All Fund returns are net of fees and expenses, but do not include any insurance charges imposed in connection with your variable insurance contract. If this performance information included the effect of the insurance charges and the fees and expenses assumed by the investment adviser, performance numbers would be lower. The value of an investment in the SC BlackRock Large Cap Index Fund and the return on the investment will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost.

***Initial Class Shares for the period from May 1, 2002 (commencement of operations) to December 31, 2010. Service Class Shares for the period from February 1, 2004 (commencement of operations) to December 31, 2010.

12

Table of Contents

SC BLACKROCK SMALL CAP INDEX FUND

(subadvised by BlackRock Investment Management, LLC)

MANAGEMENT’S DISCUSSION & ANALYSIS:

How did the Fund perform during the year and period ended December 31, 2010?

Effective November 15, 2010, BlackRock Investment Management, LLC replaced OppenheimerFunds, Inc. as subadviser to the SC Oppenheimer Main Street Small Cap Core Fund, and the name of the fund was changed to SC BlackRock Small Cap Index Fund (the “Fund”). In connection with this change, the Fund changed its investment goal and investment strategy from an active to a passive management approach, and will attempt to invest in a portfolio of assets whose performance is expected to match approximately the performance of the Russell 2000 Index (the “Index”).

For the year ended December 31, 2010, the Fund’s Initial and Service Class shares returned 24.46% and 24.07%, respectively, underperforming the benchmark Index, which returned 26.86% for the same period. For the period from November 15, 2010 to December 31, 2010, the Fund’s Initial and Service Class shares returned 9.06% and 9.01%, respectively, with the Initial Class outperforming and the Service Class underperforming the benchmark which returned 9.05% for the same period.

What economic and market factors most influenced the equity markets as a whole during the quarter ended December 31, 2010?

Domestic equity markets continued their rally through the fourth quarter as the economic recovery gained traction and accelerated toward year end. During the quarter, the Federal Reserve Board (Fed) launched a second round of quantitative easing (“QE2”) measures consisting of U.S. Treasury Bond purchases, the Republicans won control of the House of Representatives in the November election, and the Bush-era tax cuts were extended and supplemented with some fiscal enhancements. As a result of these market-friendly actions, together with stronger economic data and continued positive surprises on the corporate earnings front, U.S. equity markets posted strong gains for the quarter despite a correction during the month of November due to concerns about the European sovereign debt crisis and heightened geopolitical tensions in Korea.

Although, the corporate sector was an important area of strength for the U.S. economy and consumer spending showed improvement, weakness in the housing and labor markets continued to burden the economy. The housing sector remained plagued with declining home prices and depressed levels of sales, starts, and overall construction activity.

Deflationary risk continued to threaten the momentum of economic growth in the United States, tempering gains in the equity markets as inflation remained muted. The seasonally adjusted Consumer Price Index (“CPI”) was up only 0.1% in November, leaving the year-over-year rate at 1.1%. The high degree of excess capacity in labor and manufacturing leaves little potential for widespread inflation taking hold. As noted above, The Fed demonstrated its efforts to combat deflation and unemployment by maintaining an investor favorable easy monetary policy for eight consecutive quarters. Although QE2 measures have thus far failed to make an impact on the unemployment situation, they have successfully boosted confidence and stimulated equity markets.

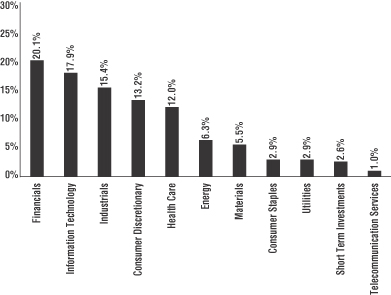

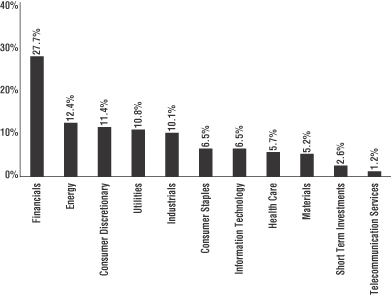

Which sectors contributed most to the Fund’s performance results during the period ended December 31, 2010?

The Information Technology sector was the strongest contributor to the Fund’s performance during the period, followed by the Industrials and Financials sectors. The Telecommunication Services sector was the weakest positive contributor for the Fund’s performance during the period.

13

Table of Contents

SC BLACKROCK SMALL CAP INDEX FUND (Continued)

Which sectors detracted most from the Fund’s performance results during the period ended December 31, 2010?

There were no detractors during the period ended December 31, 2010.

SECTOR ALLOCATIONS AT DECEMBER 31, 2010*

Percentage of Net Assets

| * | The above graph categorizes investments using GICS. The percentages shown for each sector reflect the value of investments in that sector as a percentage of net assets. Figures in the above graph may not total to 100% due to the exclusion of the Fund’s other assets and liabilities. |

TOP TEN EQUITY HOLDINGS AT DECEMBER 31, 2010

| % of Net Assets | Industry | |||||

| Riverbed Technology, Inc. |

0.4 | % | Communications Equipment | |||

| VeriFone Holdings, Inc. |

0.3 | IT Services | ||||

| TIBCO Software, Inc. |

0.3 | Software | ||||

| Brigham Exploration Co. |

0.3 | Oil, Gas & Consumable Fuels | ||||

| Deckers Outdoor Corp. |

0.3 | Textiles, Apparel & Luxury Goods | ||||

| Nordson Corp. |

0.2 | Machinery | ||||

| Rackspace Hosting, Inc. |

0.2 | Internet Software & Services | ||||

| Sotheby’s |

0.2 | Diversified Consumer Services | ||||

| Baldor Electric Co. |

0.2 | Electrical Equipment | ||||

| Hecla Mining Co. |

0.2 | Metals & Mining | ||||

14

Table of Contents

SC BLACKROCK SMALL CAP INDEX FUND (Continued)

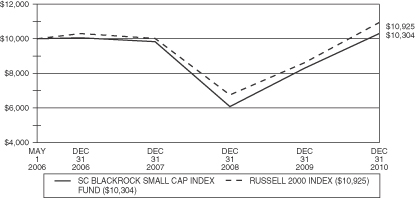

Comparison of Change in Value of a $10,000 Investment in the SC BlackRock Small Cap Index Fund – Initial Class and the Russell 2000 Index

Comparison of Change in Value of a $10,000 Investment in the SC BlackRock Small Cap Index Fund – Service Class and the Russell 2000 Index

15

Table of Contents

SC BLACKROCK SMALL CAP INDEX FUND (Continued)

Average Annual Total Returns for Periods Ended December 31, 2010**

| Initial Class Shares |

One Year | Three Years | Five Years | Ten Years | Life of Fund*** |

|||||||||||||||

| SC BlackRock Small Cap Index Fund |

24.46 | % | 1.82 | % | 3.40 | % | 5.98 | % | 7.73 | % | ||||||||||

| Russell 2000 Index* |

26.86 | % | 2.22 | % | 4.47 | % | 6.33 | % | 4.95 | % | ||||||||||

| Service Class Shares |

||||||||||||||||||||

| SC BlackRock Small Cap Index Fund |

24.07 | % | 1.56 | % | — | — | 0.64 | % | ||||||||||||

| Russell 2000 Index* |

26.86 | % | 2.22 | % | — | — | 1.91 | % | ||||||||||||

*The performance data of the index has been prepared from sources and data that the investment adviser believes to be reliable, but no representation is made as to their accuracy. The index is unmanaged and cannot be invested in directly. The Russell 2000 Index is comprised of the 2,000 companies with the smallest market capitalizations from the Russell 3000 Index.

**Performance data is historical and includes changes in share price and reinvestment of income dividends and capital gains distributions. Past performance does not indicate future results. All Fund returns are net of fees and expenses, but do not include any insurance charges imposed in connection with your variable insurance contract. If this performance information included the effect of the insurance charges and the fees and expenses assumed by the investment adviser, performance numbers would be lower. The value of an investment in the SC BlackRock Small Cap Index Fund and the return on the investment will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost.

***Initial Class Shares for the period from July 17, 2000 (commencement of operations) to December 31, 2010. Service Class Shares for the period from May 1, 2006 (commencement of operations) to December 31, 2010.

16

Table of Contents

SC GOLDMAN SACHS MID CAP VALUE FUND

(Subadvised by Goldman Sachs Asset Management, L.P.)

MANAGEMENT’S DISCUSSION & ANALYSIS:

How did the Fund perform during the year ended December 31, 2010?

For the year ended December 31, 2010, the Initial and Service Class shares of SC Goldman Sachs Mid Cap Value Fund (the “Fund”) returned 22.13% and 21.62%, respectively, underperforming the benchmark, the Russell Mid Cap Value Index (the “Index”), which returned 24.75% for the same period.

What economic and market factors most influenced the equity markets as a whole during the year ended December 31, 2010?

Some of the most notable events during 2010 that influenced the equity markets included the following: The Flash Crash in May; the sovereign debt crisis in Europe; the Federal Reserve Board’s (Fed) quantitative easing program consisting of U.S. Treasury Bond purchases in the second half of the year; and the mid-term election.

The Flash Crash was characterized by extreme intraday swings in the prices of numerous stocks trading in the U.S., swings that appeared to be driven by the mechanics of trading rather than fundamentals. The Flash Crash heightened investors’ concerns about the structure of the equity markets and the role and impact of electronic trading. In the immediate aftermath of the Flash Crash, market volatility, as measured by the Chicago Board Options Exchange Volatility Index (VIX), increased sharply. In addition, the U.S. Securities and Exchange Commission (SEC) and stock exchanges imposed new regulations on trading.

The sovereign debt crisis in Europe began when Greece experienced difficulty rolling over a portion of its substantial debt. The European Union and International Monetary Fund (IMF) provided assistance for Greece and later on, Ireland. The European debt crisis caused a drop in sovereign bond prices (and an increase in yields), along with a drop in the euro. The crisis also led market participants to revise their forecasts of economic growth globally, as well as the likelihood of an additional economic slowdown or a “double-dip” recession in Europe and other developed markets (including the U.S.).

The Fed’s quantitative easing program, informally referred to as QE2, was largely motivated by serious doubts about the strength of the economic recovery in the U.S. The Fed’s stimulus was designed to boost economic growth and lower the chances the economic recovery would stall. QE2 helped trigger a rally in the equity markets and a steady decline in volatility as measured by VIX.

The mid-term election effected a major realignment in Washington as the Republicans took control of the House of Representatives and picked up several seats in the Senate. The Republican gains shifted the political discussion from government stimulus to spending reductions and more business friendly policies. An immediate consequence of the election was the extension of the “Bush tax cuts”, which heightened investors’ concerns about U.S. debt levels and the longer term impact of high debt levels on economic growth.

Were there any significant sector under/over weights that materially affected Fund performance relative to the benchmark during the year ended December 31, 2010?

Among sectors, stock selection was negative overall during the year. An overweight position in the Consumer Discretionary sector and an underweight position in Utilities sector, were the Fund’s least successful weightings relative to the Index. In contrast, an underweight position in the Energy sector, and an overweight position in the Industrials sector were the most successful allocations relative to the Index.

Which stocks contributed most to the Fund’s returns during the year ended December 31, 2010?

In terms of individual stocks, overweight positions in energy companies Valero Energy Corp. and Cimarex Energy Co. and machinery company The Timken Co. were the largest positive contributors to the Fund’s performance.

17

Table of Contents

SC GOLDMAN SACHS MID CAP VALUE FUND (Continued)

Which stocks detracted from the Fund’s performance results during the year ended December 31, 2010?

Overweight positions in tobacco company Lorillard, Inc., media company DISH Network Corp. and technology company Seagate Technology were among the least successful selections for the year.

Did the Fund experience major changes to its top ten holdings during the year ended December 31, 2010?

The composition of the Fund’s top ten holdings has changed since December 31, 2009. All of the securities on the top ten holdings list from December 31, 2009 are still held by the Fund with the exception of Seagate Technology. The five new positions within the top ten holdings list at December 31, 2010 are Valero Energy Corp., DISH Network Corp., Class A, Rayonier, Inc., Tesoro Corp. and Suntrust Banks, Inc. The Fund seeks to outperform the Index by overweighting stocks that are expected to outperform the Index, and underweighting those stocks that may lag the Index. The Fund attempts to take active positions such as holding securities with better momentum and valuation characteristics than the Index and, at the same time, the Fund seeks to avoid taking risks in sectors where the risk is not compensated for. Thus, over a given period, top ten holdings will be driven by the Fund’s stock selection signals and proprietary risk model.

How was the Fund positioned relative to its benchmark index at December 31, 2010?

As of December 31, 2010, the Fund was overweight in the Energy, Consumer Discretionary, Healthcare, Information Technology and Materials sectors relative to the Index. In contrast, the Fund was underweight in the Telecommunication Services, Financials, Utilities, Industrials and Consumer Staples sectors.

SECTOR ALLOCATIONS AT DECEMBER 31, 2010*

Percentage of Net Assets

| * | The above graph categorizes investments using GICS. The percentages shown for each sector reflect the value of investments in that sector as a percentage of net assets. Figures in the above graph may not total to 100% due to the exclusion of the Fund’s other assets and liabilities. |

18

Table of Contents

SC GOLDMAN SACHS MID CAP VALUE FUND (Continued)

TOP TEN EQUITY HOLDINGS AT DECEMBER 31, 2010

| % of Net Assets | Industry | |||||

| Valero Energy Corp. |

3.9 | % | Oil, Gas & Consumable Fuels | |||

| Lorillard, Inc. |

3.1 | Tobacco | ||||

| AvalonBay Communities, Inc. |

1.8 | Real Estate Investment Trusts | ||||

| Rayonier, Inc. |

1.8 | Real Estate Investment Trusts | ||||

| DISH Network Corp., Class A |

1.5 | Media | ||||

| Tesoro Corp. |

1.5 | Oil, Gas & Consumable Fuels | ||||

| Cimarex Energy Co. |

1.5 | Oil, Gas & Consumable Fuels | ||||

| Integrys Energy Group, Inc. |

1.4 | Multi-Utilities | ||||

| Unum Group |

1.4 | Insurance | ||||

| Suntrust Banks, Inc. |

1.4 | Commercial Banks | ||||

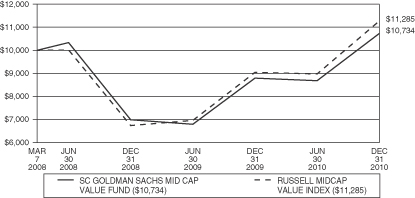

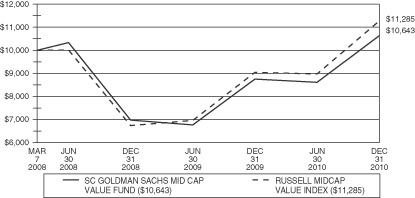

Comparison of Change in Value of a $10,000 Investment in the SC Goldman Sachs Mid Cap Value Fund – Initial Class and the Russell Midcap Value Index

Comparison of Change in Value of a $10,000 Investment in the SC Goldman Sachs Mid Cap Value Fund – Service Class and the Russell Midcap Value Index

19

Table of Contents

SC GOLDMAN SACHS MID CAP VALUE FUND (Continued)

Average Annual Total Returns for Periods Ended December 31, 2010**

| One Year | Life of Fund*** |

|||||||

| SC Goldman Sachs Mid Cap Value Fund-Initial Class Shares |

22.13 | % | 2.54 | % | ||||

| SC Goldman Sachs Mid Cap Value Fund-Service Class Shares |

21.62 | % | 2.23 | % | ||||

| Russell Midcap Value Index* |

24.75 | % | 4.38 | % | ||||

*The performance data of the index has been prepared from sources and data that the investment adviser believes to be reliable, but no representation is made as to their accuracy. The index is unmanaged and cannot be invested in directly. The Russell Midcap Value Index measures the performance of the mid-cap value segment of the U.S. equity universe. It includes those Russell Midcap Value Index companies with lower price-to-book ratios and lower forecasted growth values.

**Performance data is historical and includes changes in share price and reinvestment of income dividends and capital gains distributions. Past performance does not indicate future results. All Fund returns are net of fees and expenses, but do not include any insurance charges imposed in connection with your variable insurance contract. If this performance information included the effect of the insurance charges, performance numbers would be lower. The value of an investment in the SC Goldman Sachs Mid Cap Value Fund and the return on the investment will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost.

***For the period from March 7, 2008 (commencement of operations) to December 31, 2010.

20

Table of Contents

SC COLUMBIA SMALL CAP VALUE FUND

(subadvised by Columbia Management Investment Advisers, LLC)

MANAGEMENT’S DISCUSSION & ANALYSIS:

How did the Fund perform during the year and eight month period ended December 31, 2010?

Effective May 1, 2010, Columbia Management Investment Advisers, LLC replaced Dreman Value Management LLC as subadviser to the SC Dreman Small Cap Value Fund and the name of the fund was changed to SC Columbia Small Cap Value Fund (the “Fund”).

For the year ended December 31, 2010, the Fund’s Initial and Service Class shares returned 21.62% and 21.33%, respectively, underperforming the benchmark, the Russell 2000 Value Index (the “Index”), which returned 24.50% for the same period. For the period from May 1, 2010 to December 31, 2010, the Fund’s Initial and Service Class shares returned 9.46% and 9.29%, respectively, outperforming the Index which returned 5.77% for the same period.

What economic and market factors most influenced the equity markets as a whole during the period ended December 31, 2010?

May 2010 began a brief period of considerable uncertainty. Europe went through a crisis period and stocks retreated globally as contagion fears, or the fear that the sovereign debt crisis would lead to a slowdown of global economic growth, were foremost on investors’ minds. In the U.S., economic data signaled a retrenchment from the pace of growth observed towards the end of 2009 as markets began to worry that there might be a second economic slowdown, or a “double-dip” in economic growth. For most of the second and third quarters, markets either believed that global growth prospects were good and European risks were contained or they believed that growth prospects were deteriorating and risk was increasing. This “risk on-risk off” trading characterized much of 2010. The Federal Reserve (Fed) Chairman Ben Bernanke, in an August speech, announced that the Fed was considering round two of quantitative easing through purchases of U.S. Treasury Bonds. Markets responded positively to this announcement. Yields on U.S. Treasuries remained at historically low levels with continued buying by the Federal Reserve Bank and the 10 year yields fell from 3.8% at the beginning of the year to 3.3% by year end. Fiscal policy also received a boost for 2011, as tax cuts of previous years were extended for another two years. Meanwhile, companies continued to report strong earnings and economic data towards the end of the year which came in slightly better than expected.

The year ended on a stronger note with most economic data pointing to modest but sustainable growth, countering the expectations seen during the summer of growing probabilities of a double dip recession. Personal income measures have strengthened, as the labor market improved and government incentives are still active. This has resulted in better support for consumer spending which accounts for the majority of U.S. Gross Domestic Product (GDP), although consumers continue to delever both through defaults and write-offs. Retail sales have been surprisingly brisk, even on discretionary items and auto sales have increased. It is still expected that consumer deleveraging will be a continuing theme, presenting some resistance to growth. Leading indicators have stabilized and are still pointing to slow but stable growth in the period ahead. Labor market measures have indeed stabilized and are slowly improving, mainly because job cuts are behind us and hiring decisions have edged higher. However, the improvement is still not enough to move the unemployment rate significantly lower. Manufacturing and industrial production seem to have settled down a bit from the brisk pace seen earlier in the year but growth remains at very healthy levels.

Inflation measures have not stabilized as of yet with pervasive weakness still in the pipeline. However, this will keep the Fed in play and policy rates low. Quantitative easing has not had the desired effect on interest rates, with long term rates moving 50 basis points higher in December as the purchases of U.S. Treasury Bonds was re-started. This rise has the potential to short-circuit the recovery if allowed to continue and is counter to the Fed’s objectives.

21

Table of Contents

SC COLUMBIA SMALL CAP VALUE FUND (Continued)

Were there any significant sector under/over weights that materially affected Fund performance relative to the benchmark during the period ended December 31, 2010?

During the period from May 1, 2010 to December 31, 2010, the Fund’s strategic underweight positions in the Consumer Discretionary, Financial, and Utility sectors added to relative performance. Within the Consumer Discretionary sector, the avoidance of media stocks added significant positive returns as the media industry posted negative absolute returns overall. Utility stocks trailed in the 4th quarter as the market appreciated from previous lows, adding to relative performance. The Fund’s underweight position in Banks contributed to performance as continued credit pressure and revenue compression lead banks to underperform the Index. The Fund’s strategic overweight in the Industrial, Material and Technology sectors also contributed to relative performance as they all benefit from continued global growth trends. The Fund maintains its current exposure relative to the Index within these sectors. Sector selection contributed more than 35% of the alpha (excess return over the Index) generated during the period. There were no sectors that detracted from relative performance during the period.

Which stocks contributed most to the Fund’s returns during the period ended December 31, 2010?

During the period from May 1, 2010 to December 31, 2010, one of the main contributors to the Fund’s performance was Teletech Holdings, Inc. which is a well-managed, financially-strong provider of business process outsourcing services. The company is gaining share through addition of new capabilities and new customers. While the company remained solidly profitable, results were affected by the recession and the stock declined significantly. The Fund purchased the stock at a very attractive valuation as their business was bottoming. As the company`s outlook stabilized and improved, the stock has rebounded significantly yet remains reasonably valued.

Other strong contributors to the Fund’s performance include OM Group, Inc., a company that was a detractor during the period from May 1, 2010 to June 30, 2010 as the global economic slowdown took its toll on all mineral companies. The Fund accumulated additional shares during this period of weakness, and was rewarded with a significant positive return in the second half of 2010 as double dip fears subsided. Four other companies, Ladish Co., Inc., ADC Telecommunications, Inc., CNA Surety Corp. and Syniverse Holdings, Inc., all posted strong contributions to total returns as they were targeted for acquisition by different suitors. Given the strong movement by Ladish Co., Inc., ADC Telecommunications, Inc., and Syniverse Holdings, Inc., the Fund exited these positions by the end of the period, yet captured significant returns for the shareholders.

Which stocks detracted from the Fund’s performance results during the period ended December 31, 2010?

Bank Mutual Corp. and Home Federal Bancorp, Inc. both companies which are thrifts (financial institutions focused on taking in deposits and home mortgage originations) detracted from the Fund’s overall performance. Credit problems stemming from the U.S. economy have affected most every bank and thrift, these companies included. The low level of absolute interest rates also negatively affected their fundamental performance as excess liquidity could not be reinvested at satisfactory levels to sustain earnings. Overall both companies have been improving their mix of deposits and Home Federal Bancorp, Inc. has been able to acquire two failed banks from the Federal Deposit Insurance Corporation seizures. These actions actually improve the overall intrinsic value of the companies and we maintain our conviction in the future for these companies.

Did the Fund experience major changes to its top ten holdings during the period ended December 31, 2010?

All of the Fund’s top ten holdings changed as a result of the subadviser change that occurred on May 1, 2010.

22

Table of Contents

SC COLUMBIA SMALL CAP VALUE FUND (Continued)

How was the Fund positioned relative to its benchmark index at December 31, 2010?

At the end of the period, the Fund maintained an overweight position in Technology, Industrials and the Commodity sectors (both Energy and Materials). Headwinds due to low interest rates in the Financials and Utilities sectors as well as an over-levered consumer, both in Consumer Discretionary and Consumer Staples, have driven the Fund to maintain underweight positions in these sectors. The Fund continues to have a positive exposure to the Health Care sector, as we have conviction and continue to find selected health care stocks attractive, both on a valuation and a fundamental basis.

SECTOR ALLOCATIONS AT DECEMBER 31, 2010*

Percentage of Net Assets

| * | The above graph categorizes investments using GICS. The percentages shown for each sector reflect the value of investments in that sector as a percentage of net assets. Figures in the above graph may not total to 100% due to the exclusion of the Fund’s other assets and liabilities. |

23

Table of Contents

SC COLUMBIA SMALL CAP VALUE FUND (Continued)

TOP TEN EQUITY HOLDINGS AT DECEMBER 31, 2010

| % of Net Assets | Industry | |||||

| OM Group, Inc. |

1.1 | % | Chemicals | |||

| Global Indemnity PLC |

1.0 | Insurance | ||||

| Greif, Inc., Class B |

0.9 | Containers & Packaging | ||||

| Rental-A-Center, Inc. |

0.8 | Specialty Retail | ||||

| Healthspring, Inc. |

0.7 | Health Care Providers & Services | ||||

| Thompson Creek Metals Co., Inc. |

0.7 | Metals & Mining | ||||

| Fresh Del Monte Produce, Inc. |

0.7 | Food Products | ||||

| Knight Capital Group, Inc. |

0.7 | Capital Markets | ||||

| First Citizens BancShares, Inc. |

0.7 | Commercial Banks | ||||

| DiamondRock Hospitality Co. |

0.7 | Real Estate Investment Trusts | ||||

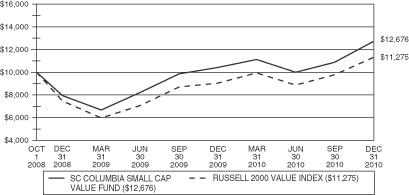

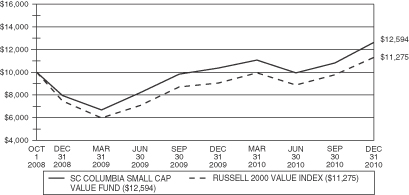

Comparison of Change in Value of a $10,000 Investment in the SC Columbia Small Cap Value Fund – Initial Class and the Russell 2000 Value Index

Comparison of Change in Value of a $10,000 Investment in the SC Columbia Small Cap Value Fund – Service Class and the Russell 2000 Value Index

24

Table of Contents

SC COLUMBIA SMALL CAP VALUE FUND (Continued)

Average Annual Total Returns for Periods Ended December 31, 2010**

| One Year | Life of Fund*** |

|||||||

| SC Columbia Small Cap Value Fund-Initial Class Shares |

21.62 | % | 11.10 | % | ||||

| SC Columbia Small Cap Value Fund-Service Class Shares |

21.33 | % | 10.78 | % | ||||

| Russell 2000 Value Index* |

24.50 | % | 5.48 | % | ||||

*The performance data of the index has been prepared from sources and data that the investment adviser believes to be reliable, but no representation is made as to their accuracy. The index is unmanaged and cannot be invested in directly. The Russell 2000 Value Index tracks the performance of the small value segment of the U.S. equity universe. It includes those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values.

**Performance data is historical and includes changes in share price and reinvestment of income dividends and capital gains distributions. Past performance does not indicate future results. All Fund returns are net of fees and expenses, but do not include any insurance charges imposed in connection with your variable insurance contract. If this performance information included the effect of the insurance charges and the fees and expenses assumed by the investment adviser, performance numbers would be lower. The value of an investment in the SC Columbia Small Cap Value Fund and the return on the investment will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost.

***For the period from October 1, 2008 (commencement of operations) to December 31, 2010.

25

Table of Contents

(subadvised by Davis Selected Advisers, L.P.)

MANAGEMENT’S DISCUSSION & ANALYSIS:

How did the Fund perform during the year ended December 31, 2010?

For the year ended December 31, 2010, the Initial and Service Class shares of SC Davis Venture Value Fund (the “Fund”) returned 12.92% and 12.68%, respectively, underperforming the benchmark, the S&P 500 Index (the “Index”), which returned 15.06% for the same period.

What economic and market factors most influenced the equity markets as a whole during the period ended December 31, 2010?

During 2010, the employment trend has been mildly positive but still below what is required to keep pace with the growing population and also absorb the current unemployed workers.

All sectors within the Index registered increases over the year. Consumer Discretionary, Industrials, and Materials were the sectors within the Index that increased the most. Health Care and Utilities were the sectors within the Index that increased the least.

Were there any significant sector under/over weights that materially affected Fund performance relative to the benchmark during the period ended December 31, 2010?

The Fund benefited when compared to the Index from its underweight position in the weakly performing Information Technology sector. Conversely, the Fund’s relative performance was hurt by its underweight positions in the Industrials and Consumer Discretionary sectors, the two best performing sectors of the Index for the year.

Which stocks contributed most to the Fund’s returns during the year ended December 31, 2010?

The Fund benefited the most from its allocation to a Consumer Staples company Costco Wholesale Corp., Financial companies Berkshire Hathaway, Inc. and Wells Fargo & Co., and Energy companies Occidental Petroleum Corp. and Canadian Natural Resources, Ltd.

Which stocks detracted from the Fund’s performance results during the year ended December 31, 2010?

The companies which detracted the most from the Fund’s performance were two information technology companies Hewlett-Packard Co. and Microsoft Corp., and three energy companies, EOG Resources, Inc., Transocean, Ltd. and China Coal Energy Co., Ltd.

Did the Fund experience major changes to its top ten holdings during the period ended December 31, 2010?

There were no material changes to the December 31, 2010 top ten holdings list relative to the December 31, 2009 top ten holdings list. This is consistent with the Fund’s low-turnover strategy. The Fund continues to own companies that dropped out of the top ten holdings but in reduced positions. The new additions to the Fund’s top ten holdings were among the Fund’s top twenty holdings at the end of 2009.

How was the Fund positioned relative to its benchmark index at December 31, 2010?

The Fund’s portfolio is positioned using a bottom-up stock selection process rather than a top down sector biased process. As a result, all weighting differentials relative to the Index reflect stock selection rather than sector bets.

26

Table of Contents

SC DAVIS VENTURE VALUE FUND (Continued)

The portfolio manager’s investment strategy is to perform extensive research to buy durable companies at a discount to their intrinsic values and to hold them for the long term.

As of December 31, 2010, the Fund continued to remain overweight as compared to the Index in the Financials, Consumer Staples and Energy sectors and underweight in the Industrials, Consumer Discretionary, Information Technology, and Utilities sectors.

SECTOR ALLOCATIONS AT DECEMBER 31, 2010*

Percentage of Net Assets

| * | The above graph categorizes investments using GICS. The percentages shown for each sector reflect the value of investments in that sector as a percentage of net assets. Figures in the above graph may not total to 100% due to the exclusion of the Fund’s other assets and liabilities. |

TOP TEN EQUITY HOLDINGS AT DECEMBER 31, 2010

| % of Net Assets | Industry | |||||

| Costco Wholesale Corp. |

5.0 | % | Food & Staples Retailing | |||

| Wells Fargo & Co. |

4.6 | Commercial Banks | ||||

| American Express Co. |

4.4 | Consumer Finance | ||||

| CVS Caremark Corp. |

3.8 | Food & Staples Retailing | ||||

| EOG Resources, Inc. |

3.4 | Oil, Gas & Consumable Fuels | ||||

| Occidental Petroleum Corp. |

3.3 | Oil, Gas & Consumable Fuels | ||||

| Merck & Co., Inc. |

3.1 | Pharmaceuticals | ||||

| Loews Corp. |

3.0 | Insurance | ||||

| Canadian Natural Resources, Ltd. |

2.9 | Oil, Gas & Consumable Fuels | ||||

| Devon Energy Corp. |

2.9 | Oil, Gas & Consumable Fuels | ||||

27

Table of Contents

SC DAVIS VENTURE VALUE FUND (Continued)

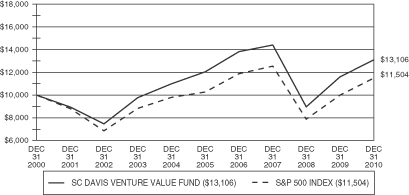

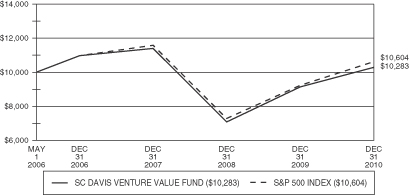

Comparison of Change in Value of a $10,000 Investment in the SC Davis Venture Value Fund – Initial Class and the S&P 500 Index

Comparison of Change in Value of a $10,000 Investment in the SC Davis Venture Value Fund – Service Class and the S&P 500 Index

28

Table of Contents

SC DAVIS VENTURE VALUE FUND (Continued)

Average Annual Total Returns for Periods Ended December 31, 2010**

| Initial Class Shares |

One Year | Three Years | Five Years | Ten Years | Life of Fund*** |

|||||||||||||||

| SC Davis Venture Value Fund |

12.92 | % | (3.14 | )% | 1.68 | % | 2.74 | % | 2.48 | % | ||||||||||

| S&P 500 Index* |

15.06 | % | (2.86 | )% | 2.29 | % | 1.41 | % | 0.11 | % | ||||||||||

| Service Class Shares |

||||||||||||||||||||

| SC Davis Venture Value Fund |

12.68 | % | (3.36 | )% | — | — | 0.60 | % | ||||||||||||

| S&P 500 Index* |

15.06 | % | (2.86 | )% | — | — | 1.27 | % | ||||||||||||

*The performance data of the index has been prepared from sources and data that the investment adviser believes to be reliable, but no representation is made as to their accuracy. The index is unmanaged and cannot be invested in directly. The S&P 500 Index is a market-value weighted index of 500 blue chip stocks and is considered to be a benchmark of the overall stock market.

**Performance data is historical and includes changes in share price and reinvestment of income dividends and capital gains distributions. Past performance does not indicate future results. All Fund returns are net of fees and expenses, but do not include any insurance charges imposed in connection with your variable insurance contract. If this performance information included the effect of the insurance charges and the fees and expenses assumed by the investment adviser, performance numbers would be lower. The value of an investment in the SC Davis Venture Value Fund and the return on the investment will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost.

*** Initial Class Shares for the period from July 17, 2000 (commencement of operations) to December 31, 2010. Service Class Shares for the period from May 1, 2006 (commencement of operations) to December 31, 2010.

29

Table of Contents

SC INVESCO SMALL CAP GROWTH FUND

(subadvised by Invesco Advisers, Inc.)

MANAGEMENT’S DISCUSSION & ANALYSIS:

How did the Fund perform during the year ended December 31, 2010?

For the year ended December 31, 2010, the Initial and Service Class shares of SC Invesco Small Cap Growth Fund (the “Fund”) returned 26.08% and 25.86%, respectively, underperforming its benchmark, the Russell 2000 Growth Index (the “Index”), which returned 29.09% for the same period.

What economic and market factors most influenced the equity markets as a whole during the year ended December 31, 2010?

The U.S. economy exhibited signs of improvement during the year, potentially indicating that the economy has transitioned from a contraction phase into an expansionary phase. Nevertheless, the pace of economic recovery remained modest and the transition from government stimulus-induced growth to the private sector driven economic recovery was uncertain.

The U.S. Federal Reserve’s federal funds target rate remained low, ranging from 0.00% to 0.25%. Real Gross Domestic Product (GDP) registered positive growth during the reporting period with quarterly increases of 3.7%, 1.7% and 2.6% for the first, second and third quarters of 2010, respectively. Inflation, measured by the seasonally-adjusted Consumer Price Index, remained relatively unchanged. While labor markets improved as layoffs moderated, new hiring remained fairly weak. Unemployment, after climbing steadily throughout 2009, declined slightly during 2010 to a rate of 9.4% at the end of 2010.

Were there any significant sector under/over weights that materially affected Fund performance relative to the benchmark during the year ended December 31, 2010?

There were no significant sector under/over weights that materially affected Fund performance relative to the Index during the year ended December 31, 2010. Security selection was the primary driver of performance during the year. The most notable changes to the Fund’s positioning consisted of reductions in the Health Care and Financials sectors where a number of holdings were sold. Proceeds from the sale of these holdings were used to purchase positions in more economically sensitive sectors such as the Consumer Discretionary, Materials and Energy sectors. Additionally, within the Information Technology sector, the Fund added exposure to more economically sensitive holdings in the Semiconductor and Hardware industry groups, and sold several Software holdings late in the year.

Which stocks contributed most to the Fund’s returns during the year ended December 31, 2010?

The Fund’s top five contributors to absolute performance were F5 Networks, Inc., Informatica Corp., TRW Automotive Holdings Corp., Netflix, Inc., and TransDigm Group, Inc.

Two of the leading contributors to the Fund’s performance during the year were information technology holdings: Network Services provider F5 Networks, Inc. and Enterprise Data Integration Software maker Informatica Corp. Both companies continued to benefit from strong demand for their technology products during the year, which resulted in revenue and earnings growth. The Fund also benefited from strong performance from Consumer Discretionary holdings, including automotive component supplier TRW Automotive Holdings Corp. and movie and television subscription service provider Netflix, Inc. Both companies benefited from the improving consumer spending environment, which resulted in strong growth in revenues and earnings during the year. While the Fund continues to own TRW Automotive Holdings, it sold Netflix, Inc. due to concerns about high valuation levels. Lastly, TransDigm Group, Inc. was a key contributor to performance during the year. This company benefited from solid demand for the aircraft components it manufactures for commercial and military customers.

30

Table of Contents

SC INVESCO SMALL CAP GROWTH FUND (Continued)

Which stocks detracted from the Fund’s performance results during the year ended December 31, 2010?

The Fund’s top five detractors from absolute performance were Arena Resources, Inc., Rehabcare Group, Inc., EnergySolutions Inc., AMAG Pharmaceuticals, Inc. and DreamWorks Animation SKG, Inc.

The leading detractor to the Fund’s performance during the year was Exploration and Production firm Arena Resources, Inc. which had had weak performance given the company’s higher exposure to natural gas. The Fund sold the position in Arena Resources, Inc. due to deteriorating fundamentals. Another key detractor from the Fund’s performance was Environmental Services provider EnergySolutions, Inc., which had weak performance as investors reacted negatively to the resignation of the company’s CEO. The Fund subsequently sold its position in this company. Several holdings in the Health Care sector also detracted from the Fund’s performance, including rehabilitation services provider Rehabcare Group, Inc. and biopharmaceutical holding AMAG Pharmaceuticals, Inc. The Fund sold both positions due to deteriorating fundamentals. Lastly, entertainment firm DreamWorks Animation SKG, Inc. detracted from the Fund’s performance as the latest movie release, Megamind, underperformed relative to investor expectations. The Fund continues to own DreamWorks because we believe the company will continue to produce blockbuster movies and should also benefit from other new lines of business.

Did the Fund experience major changes to its top ten holdings during the year ended December 31, 2010?

There were four holdings on the top ten holdings list as of December 31, 2009 that remained among the Fund’s top ten holdings as of December 31, 2010: Informatica Corp., TransDigm Group, Inc., SBA Communications Corp. and Polycom, Inc.

Several holdings that were top ten holdings as of December 31, 2009 remain as holdings by the Fund at December 31, 2010, but fell out of the top ten holdings due to market fluctuation and/or a reduction in position size. The securities still held by the Fund but in reduced positions were Quality Systems, Inc., Knight Transportation, Inc., Costar Group, Inc. and Greif, Inc., Class A. Dril Quip, Inc., and Sybase Inc. were two holdings that were top ten holdings as of December 31, 2009 which were sold during 2010.

Several top ten holdings as of December 31, 2010 were held by the Fund as of December 31, 2009 but were not in the top ten holdings. However, during the course of 2010, their position size expanded due to market fluctuation and/or additions to the position size such that they are in the top ten holdings as of December 31, 2010. Ciena Corp. was the one position in the top ten holdings as of December 31, 2010 that was added during the year.

How was the Fund positioned relative to its benchmark index at December 31, 2010?

Sector weights are always a result of the Fund’s bottom up stock selection process. As of December 31, 2010, the Fund had higher exposure to more economically sensitive holdings. The largest overweight industry groups were Energy, Semiconductors/ Semiconductor Equipment, Banks, and Consumer Services. The Fund had lower exposure to more defensive holdings in the Health Care and Consumer Staples sector. Within Health Care, the Fund was underweight the Pharmaceuticals/ Biotechnology/ Life Sciences and the Health Care Equipment & Services industry groups. Within Consumer Staples, the Fund was underweight Food & Staples Retailing and the Food/ Beverage/ Tobacco industry groups. Other underweight positions included Consumer Durables & Apparel, Real Estate, and Commercial & Professional Services.

31

Table of Contents

SC INVESCO SMALL CAP GROWTH FUND (Continued)

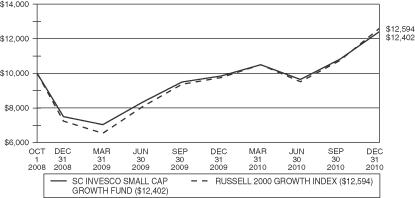

SECTOR ALLOCATIONS AT DECEMBER 31, 2010*

Percentage of Net Assets

| * | The above graph categorizes investments using GICS. The percentages shown for each sector reflect the value of investments in that sector as a percentage of net assets. Figures in the above graph may not total to 100% due to the exclusion of the Fund’s other assets and liabilities. |

TOP TEN EQUITY HOLDINGS AT DECEMBER 31, 2010

| % of Net Assets | Industry | |||||

| TransDigm Group, Inc. |

1.7 | % | Aerospace & Defense | |||

| TRW Automotive Holdings Corp. |

1.5 | Auto Components | ||||

| Informatica Corp. |

1.5 | Software | ||||

| Polycom, Inc. |

1.4 | Communications Equipment | ||||

| Ciena Corp. |

1.2 | Communications Equipment | ||||

| SBA Communications Corp. |

1.1 | Wireless Telecommunication Services | ||||

| Regal-Beloit Corp. |

1.1 | Electrical Equipment | ||||

| Affiliated Managers Group, Inc. |

1.0 | Capital Markets | ||||

| Williams-Sonoma, Inc. |

1.0 | Specialty Retail | ||||

| P.F. Chang’s China Bistro, Inc. |

1.0 | Hotels, Restaurants & Leisure | ||||

32

Table of Contents

SC INVESCO SMALL CAP GROWTH FUND (Continued)

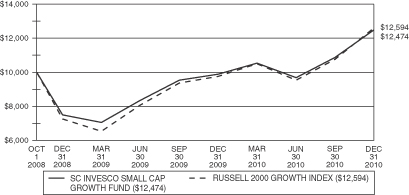

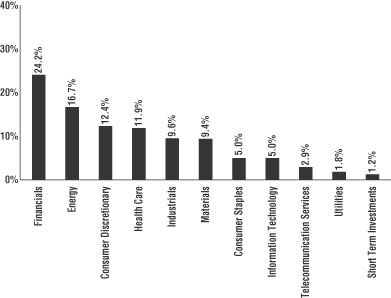

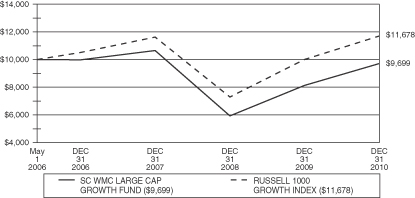

Comparison of Change in Value of a $10,000 Investment in the SC Invesco Small Cap Growth Fund – Initial Class and the Russell 2000 Growth Index

Comparison of Change in Value of a $10,000 Investment in the SC Invesco Small Cap Growth Fund – Service Class and the Russell 2000 Growth Index

33

Table of Contents

SC INVESCO SMALL CAP GROWTH FUND (Continued)

Average Annual Total Returns for Periods Ended December 31, 2010**

| One Year | Life of Fund*** |

|||||||

| SC Invesco Small Cap Growth Fund-Initial Class Shares |

26.08 | % | 10.32 | % | ||||

| SC Invesco Small Cap Growth Fund-Service Class Shares |

25.86 | % | 10.03 | % | ||||

| Russell 2000 Growth Index* |

29.09 | % | 10.80 | % | ||||

*The performance data of the index has been prepared from sources and data that the investment adviser believes to be reliable, but no representation is made as to their accuracy. The index is unmanaged and cannot be invested in directly. The Russell 2000 Growth Index measures the performance of those Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values.

**Performance data is historical and includes changes in share price and reinvestment of income dividends and capital gains distributions. Past performance does not indicate future results. All Fund returns are net of fees and expenses, but do not include any insurance charges imposed in connection with your variable insurance contract. If this performance information included the effect of the insurance charges and the fees and expenses assumed by the investment adviser, performance numbers would be lower. The value of an investment in the SC Invesco Small Cap Growth Fund and the return on the investment will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost.

***For the period from October 1, 2008 (commencement of operations) to December 31, 2010.

34

Table of Contents

SC LORD ABBETT GROWTH & INCOME FUND

(subadvised by Lord, Abbett & Co. LLC)

MANAGEMENT’S DISCUSSION & ANALYSIS:

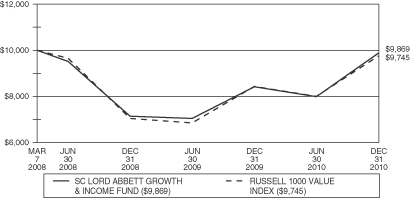

How did the Fund perform during the year ended December 31, 2010?

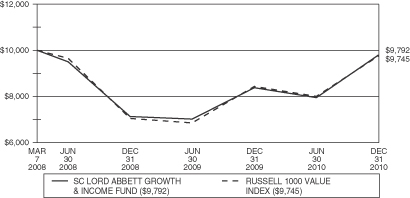

For the year ended December 31, 2010, the Initial and Service Class shares of SC Lord Abbett Growth & Income Fund (the “Fund”) returned 17.19% and 16.94%, respectively, outperforming the benchmark, the Russell 1000 Value Index (the “Index”), which returned 15.51% for the same period.

What economic and market factors most influenced the equity markets as a whole during the year ended December 31, 2010?

Equity markets fluctuated throughout much of the year, before trending upwards in the final months as the economic recovery strengthened and the sovereign debt crisis in Europe was addressed. Government support also contributed to the positive performance.

Uncertainty about the economic recovery persisted for much of the year. The housing market showed further weakness, despite low mortgage rates and a government tax incentive program. This contributed to fears that the economy would experience an additional economic slowdown and slip back into recession. Unemployment also remained high throughout the year. Nevertheless, the U.S. economy continued to expand. Real Gross Domestic Product rose 3.7% in the first quarter, 1.7% in the second, and 2.6% in the third. The manufacturing sector continued to advance, as indicated by the index published by the Institute for Supply Management. The consumer segment of the economy strengthened, with retail sales improving even as consumers continued to save at a higher than normal rate. Government actions in the form of both monetary and fiscal policy contributed heavily to the market’s performance toward the end of the year. A decision by the Federal Reserve to initiate a second round of quantitative easing (U.S. Treasury Bond purchases) helped to boost markets, and an extension of tax cuts implemented in 2003, combined with a temporary reduction in payroll taxes supported returns in December. Exposure to rapidly growing emerging markets also assisted U.S. stocks.

Gains in the stock market occurred across all major sectors of the Index, but Consumer Discretionary, Industrials, Energy, Materials, and Telecommunications outperformed the broader market. Consumer Staples, Financials, Technology, Health Care, and Utilities lagged behind. Growth stocks outperformed value stocks during the year, and small caps outperformed large caps.

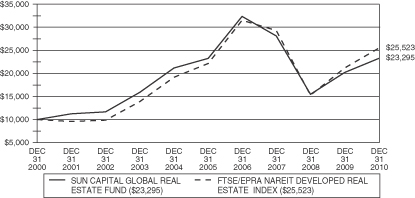

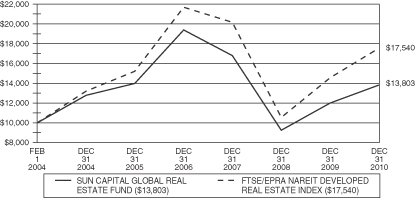

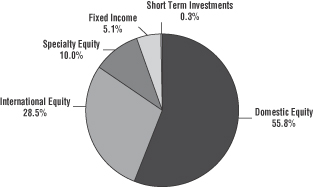

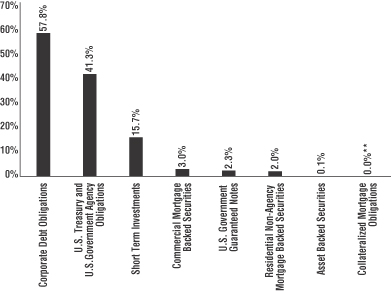

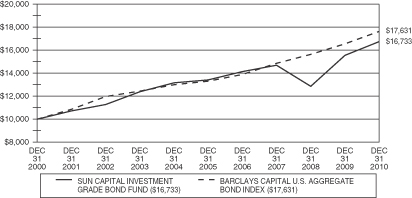

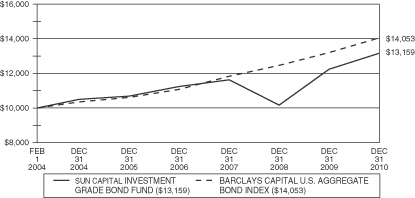

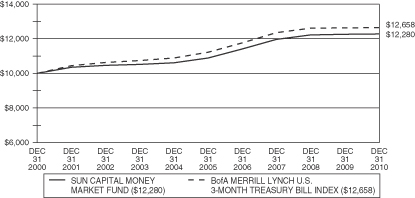

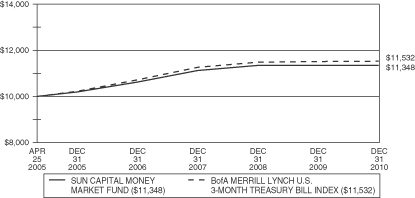

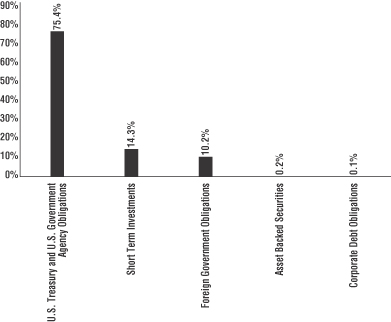

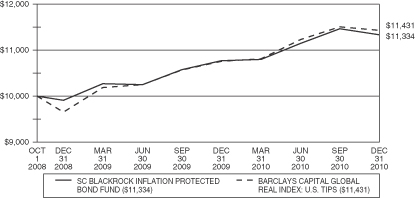

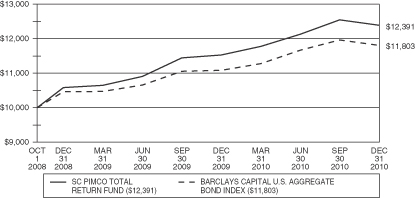

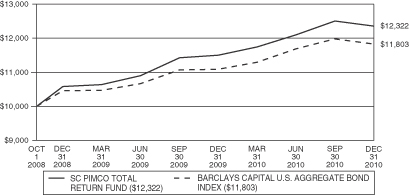

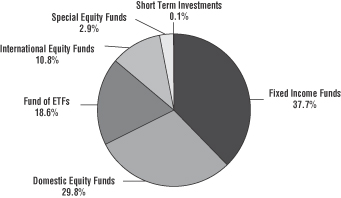

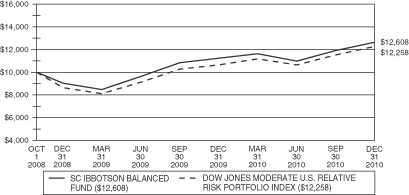

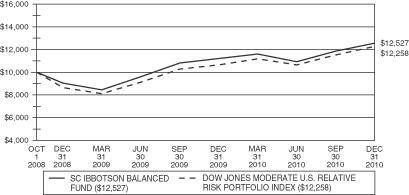

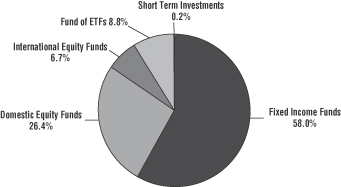

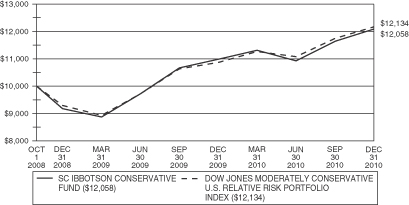

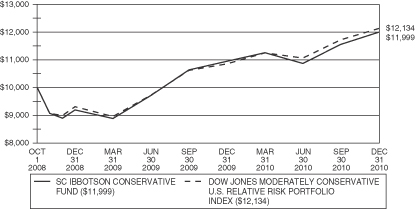

Were there any significant sector under/over weights that materially affected Fund performance relative to the benchmark during the year ended December 31, 2010?