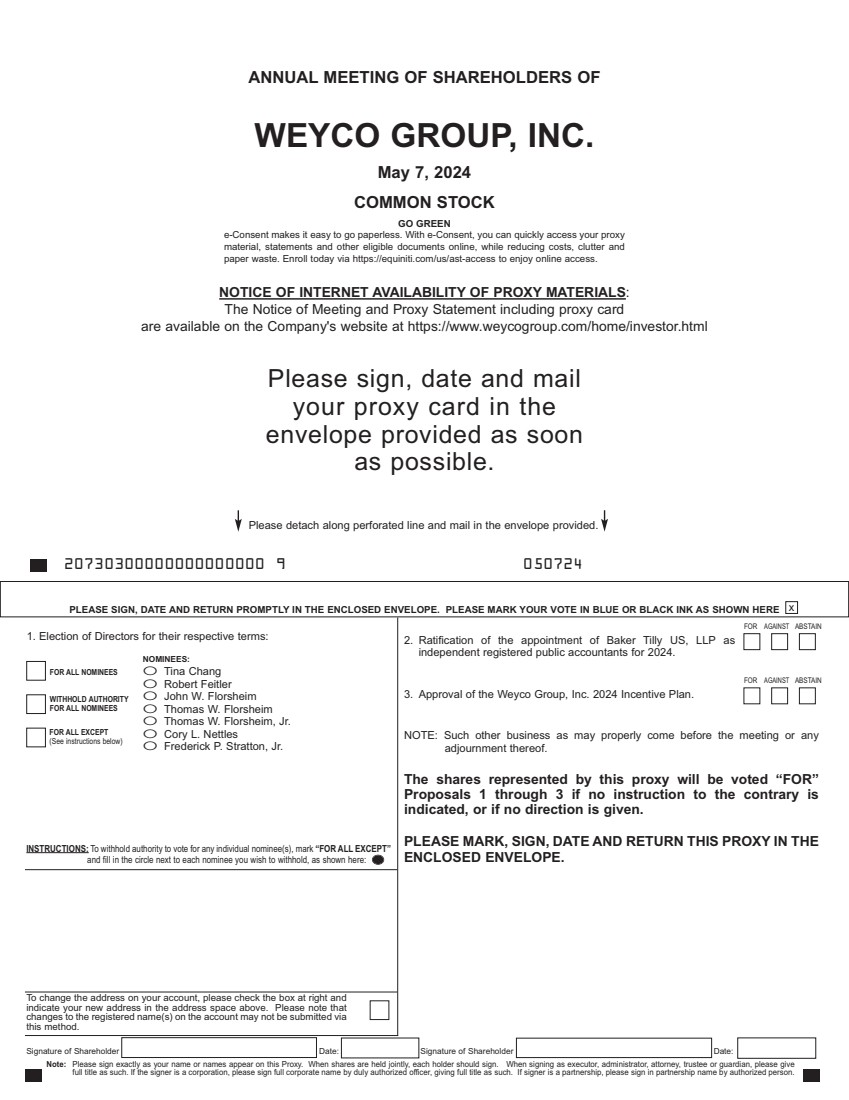

| Signature of Shareholder Date: Signature of Shareholder Date: Note: Please sign exactly as your name or names appear on this Proxy. When shares are held jointly, each holder should sign. When signing as executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized person. To change the address on your account, please check the box at right and indicate your new address in the address space above. Please note that changes to the registered name(s) on the account may not be submitted via this method. 1. Election of Directors for their respective terms: O Tina Chang O Robert Feitler O John W. Florsheim O Thomas W. Florsheim O Thomas W. Florsheim, Jr. O Cory L. Nettles O Frederick P. Stratton, Jr. 2. Ratification of the appointment of Baker Tilly US, LLP as independent registered public accountants for 2024. 3. Approval of the Weyco Group, Inc. 2024 Incentive Plan. NOTE: Such other business as may properly come before the meeting or any adjournment thereof. The shares represented by this proxy will be voted “FOR” Proposals 1 through 3 if no instruction to the contrary is indicated, or if no direction is given. PLEASE MARK, SIGN, DATE AND RETURN THIS PROXY IN THE ENCLOSED ENVELOPE. FOR ALL NOMINEES WITHHOLD AUTHORITY FOR ALL NOMINEES FOR ALL EXCEPT (See instructions below) INSTRUCTIONS: To withhold authority to vote for any individual nominee(s), mark “FOR ALL EXCEPT” and fill in the circle next to each nominee you wish to withhold, as shown here: NOMINEES: PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HERE x Please detach along perforated line and mail in the envelope provided. 20730300000000000000 9 050724 FOR AGAINST ABSTAIN ANNUAL MEETING OF SHAREHOLDERS OF WEYCO GROUP, INC. May 7, 2024 COMMON STOCK NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS: The Notice of Meeting and Proxy Statement including proxy card are available on the Company's website at https://www.weycogroup.com/home/investor.html Please sign, date and mail your proxy card in the envelope provided as soon as possible. GO GREEN e-Consent makes it easy to go paperless. With e-Consent, you can quickly access your proxy material, statements and other eligible documents online, while reducing costs, clutter and paper waste. Enroll today via https://equiniti.com/us/ast-access to enjoy online access. FOR AGAINST ABSTAIN |