UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| Form |

| Amendment No. 1 |

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For the fiscal year ended | |

| OR | |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For the transition period from to . | |

Commission file number

(Exact name of registrant as specified in its charter)

____________________

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code:

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ | |

| Non-accelerated filer | ☐ | Smaller reporting company | |

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐

As of June 28, 2019, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $

shares of common stock issued and outstanding as of April 15, 2020.

DOCUMENTS INCORPORATED BY REFERENCE

This Amendment No. 1 on Form 10-K/A (this “Form 10-K/A”) amends our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, filed with the U.S. Securities and Exchange Commission (the “SEC”) on January 31, 2020 (the “2019 Form 10-K”). The sole purpose of this Form 10/K-A is to include the information required by Items 10 through 14 of Part III of Form 10-K. This information was previously omitted from the 2019 Form 10-K in reliance on General Instruction G(3) to Form 10-K, which permits the information in the above referenced items to be incorporated in the Form 10-K by reference from our definitive proxy statement if such statement is filed no later than 120 days after our fiscal year-end. We are filing this Form 10-K/A to include Part III information in our 2019 Form 10-K because we will not file a definitive proxy statement containing such information within 120 days after the end of the fiscal year covered by the 2019 Form 10-K.

This Form 10-K/A amends and restates in their entirety the cover page, Items 10 through 14 of Part III and the Exhibit Index (including the filing of new certifications as required by Section 302 of the Sarbanes-Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”), as exhibits in accordance with Rule 13a-14(a) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) of the 2019 Form 10-K. Except as otherwise expressly noted above, this Form 10-K/A does not amend any other information set forth in the 2019 Form 10-K. This Form 10 K/A continues to speak as of the date of the 2019 Form 10-K and, except where expressly noted, we have not updated disclosures contained herein or therein to reflect any events that occurred at a date subsequent to the date of the 2019 Form 10-K. Accordingly, this Form 10-K/A should be read in conjunction with the 2019 Form 10-K and our other filings with the SEC.

Because no financial statements have been included in this Form 10-K/A and this Form 10-K/A does not contain or amend any disclosure with respect to Item 307 or Item 308 of Regulation S-K, paragraphs 3, 4 and 5 of the certifications required by Section 302 of the Sarbanes-Oxley Act have been omitted.

Unless the context requires otherwise, all references to “we,” “our,” “us” or “eBay” mean eBay Inc., a Delaware corporation, and its consolidated subsidiaries.

2

eBay Inc.

Form 10-K

For the Fiscal Year Ended December 31, 2019

TABLE OF CONTENTS

3

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE.

Information Concerning Members of the Board

The following provides information regarding current members of the Company’s Board of Directors (the “Board”), which consists of fifteen members as of the date hereof. Each director is elected at our annual meeting of stockholders and holds office until the next annual meeting of stockholders and until his or her successor is elected and qualified, or until his or her earlier death, resignation, retirement, or removal.

|

Fred D. Anderson Jr.

Age: 75

Director Since: 2003

Committees:

●Audit Committee (Chair, Audit Committee Financial Expert) |

Other Public

Company Boards: ●Yelp Inc. (since 2011) |

|

Experience | ||

|

Mr. Anderson serves as a Managing Director of NextEquity Partners, a firm he co-founded in July 2015, backing innovative consumer and enterprise technology companies, and Elevation Partners, a firm he co-founded in July 2004, focusing on venture and private equity investments in technology and digital media companies. From 1996 until 2004, Mr. Anderson served as Executive Vice President and Chief Financial Officer of Apple Inc. From 1992 until 1996, Mr. Anderson served as Corporate Vice President and Chief Financial Officer of Automatic Data Processing, Inc. Prior to that, Mr. Anderson was the Chief Operating Officer and President of MAI Systems Corporation.

Mr. Anderson was formerly a Certified Public Accountant with Coopers & Lybrand and a captain in the U.S. Air Force.

Mr. Anderson currently serves on the board of directors of Yelp Inc. Mr. Anderson also serves on the Board of Trustees for Whittier College and on the Advisory Board for Stanford Athletics. Mr. Anderson received his B.A. from Whittier College and his M.B.A. from the University of California, Los Angeles. | ||

|

Director Qualifications

●Finance Expertise: Chief Financial Officer of Apple Inc. for eight years, and of Automatic Data Processing, Inc., one of the largest providers of business processing solutions, for four years.

●Technology Industry, Management, Strategy, Entrepreneurship and Leadership Experience: Former CFO of two large, innovative global technology companies, board member of public technology companies, former Chief Operating Officer and President of MAI Systems Corporation, and current Co-Founder and Managing Director of Elevation Partners and NextEquity Partners.

●Transactional and M&A Experience: Experience in all aspects of analyzing and executing sophisticated transactions with large and sophisticated technology companies and through his experience with Elevation Partners and NextEquity Partners. | ||

4

|

Anthony J. Bates

Age: 53

Director Since: 2015

Committees:

●Compensation Committee

●Risk Committee |

Other Public

Company Boards: ●VMware, Inc. (since 2016) |

|

Experience | ||

|

Mr. Bates is CEO of Genesys, which provides customer-experience and call-center technology. He was Vice Chairman of the board of Social Capital Hedosophia Holdings Corp. (“Social Capital,” a special purpose acquisition company) from 2017 to 2019. From May 2017 through June 2018, Mr. Bates held the position of Chief Executive Officer of Growth at Social Capital. He also has been a member of the board of directors of VMware, Inc. since 2016, where he is chair of the Mergers & Acquisitions committee. He was formerly a member of the board of directors of GoPro, Inc.

Mr. Bates was President of GoPro, a technology company that manufactures action cameras, from 2014 to 2016, and helped with the initial public offering of the company. Before joining GoPro, Mr. Bates was the executive vice president of Microsoft Corp.’s Business Development and Evangelism group, responsible for the company’s relationships with key original equipment manufacturers (OEMs), strategic innovation partners, independent software vendors and developers. Mr. Bates also led Microsoft’s corporate strategy team.

Mr. Bates was also the president of Microsoft’s Skype Division and the Chief Executive Officer of Skype, Inc. prior to its acquisition in October of 2011. Preceding Skype, Mr. Bates held senior positions with both Cisco Systems, Inc. and MCI Internet. Mr. Bates previously served as a member of the boards of YouTube, Inc. and LoveFilm. | ||

|

Director Qualifications

●Technology and Retail Industry Experience: Executive leadership in the technology industry, including the management of worldwide operations, sales, service and support areas. Technical skills, as evidenced by his 10 patents in network innovations and his 12 requests for comments published with the Internet Engineering Task Force. Retail industry experience from his prior employment at GoPro, a consumer products company, YouTube, and LoveFilm, a provider of DVD-by-mail and streaming video on demand.

●Management, Leadership and Strategy Experience: Current service on board of VMware, Inc.; formerly on board of Social Capital Hedosophia Holdings Corp.; and President and a board member of GoPro. Former Executive Vice President, Business Development and Evangelism at Microsoft Corporation, former Chief Executive Officer of Skype Inc. and former Senior Vice President of Cisco Systems, Inc. | ||

5

|

Adriane M. Brown

Age: 61

Director Since: 2017

Committees:

●Audit Committee

●Risk Committee |

Other Public

Company Boards: ●Allergan Plc (since 2017) |

|

Experience | ||

|

Ms. Brown became a Venture Partner at Flying Fish Fund, a venture capital firm, in November 2018. Prior to that, Ms. Brown served as President and Chief Operating Officer for Intellectual Ventures (“IV”), an invention and investment company that commercializes inventions, from January 2010 through July 2017, and served as a Senior Advisor until December 2018. Before joining IV, Ms. Brown served as President and Chief Executive Officer of Honeywell Transportation Systems. Over the course of 10 years at Honeywell, she held leadership positions serving the aerospace and automotive markets globally. Prior to Honeywell, Ms. Brown spent 19 years at Corning, Inc., ultimately serving as Vice President and General Manager, Environmental Products Division, having started her career there as a shift supervisor. Ms. Brown also served on the board of directors of Raytheon until 2020.

Ms. Brown also serves on the boards of directors of Allergan Plc, Washington Research Foundation, the Pacific Science Center and Jobs for America’s Graduates.

Ms. Brown holds a Doctorate of Humane Letters and a bachelor’s degree in environmental health from Old Dominion University, and is a winner of its Distinguished Alumni Award. She also holds a master’s degree in management from the Massachusetts Institute of Technology where she was a Sloan Fellow. | ||

|

Director Qualifications

●Leadership and Strategy Experience: Leadership of global technology and commercial businesses at Honeywell Transportation, Corning, Allergan and Raytheon. Experience driving business strategy, growth and development, innovation and R&D, manufacturing and sales, and customer service and expansion.

●Investment/Finance, Management and Technology Industry Experience: President and Chief Operating Officer for IV from January 2010 to July 2017. During her tenure at IV, the company delivered more than $3 billion in revenue, invented technology enabling 14 companies and joint ventures, acquired 50 customers and established Global Good and Research, a global health invention and innovation project. | ||

6

|

Jesse A. Cohn

Age: 39

Director Since: 2019

Committees:

●None |

Other Public

Company Boards: ●Citrix Systems, Inc. (since 2015) |

|

Experience | ||

|

Mr. Cohn is a Partner, member of the Management Committee, and the Head of U.S. Equity Activism at Elliott Management Corporation, an investment management firm he joined in 2004. Mr. Cohn’s primary responsibility is to manage U.S. equity activist efforts, and he spends considerable time focusing on Elliott’s technology investments.

Mr. Cohn serves on the board of directors of Citrix Systems, Inc. and Twitter, Inc., and is a member of the advisory board at the Harvard Law School Program on Corporate Governance. Mr. Cohn previously served on the board of directors of LogMeIn, Inc. from January 2017 to May 2018. Prior to joining Elliott, Mr. Cohn was an analyst in the mergers and acquisitions group at Morgan Stanley. He earned his B.S. in Economics from the University of Pennsylvania’s Wharton School of Business, from which he graduated summa cum laude. | ||

|

Director Qualifications

●Technology Industry and Strategy Experience: Sits on the boards of multiple technology companies.

●Leadership, Investment/Finance, Transactions/M&A: Head of U.S. Equity Activism at Elliott Management Corporation, and member of boards of multiple technology companies. | ||

7

|

Diana Farrell

Age: 55

Director Since: 2017

Committees:

●Risk Committee |

Other Public

Company Boards: ●None |

|

Experience | ||

|

Ms. Farrell is the founding President and Chief Executive Officer of the JPMorgan Chase Institute, a global think tank. Previously, Diana was a Senior Partner at McKinsey & Company where she was the Global Head of the McKinsey Center for Government and the McKinsey Global Institute.

Ms. Farrell served in the White House as Deputy Director of the National Economic Council and Deputy Assistant to the President on Economic Policy from 2009 to 2010. During her tenure, she led interagency processes and stakeholder management on a broad portfolio of economic and legislative initiatives. Ms. Farrell coordinated policy development and stakeholder engagement around the passage of major legislation. She also served as a member of the President’s Auto Recovery Task Force.

Ms. Farrell currently serves on the boards of directors of The Urban Institute and the National Bureau of Economic Research, and is a Trustee Emeritus of Wesleyan University. In addition, Ms. Farrell is a Trustee of the Trilateral Commission and served as a Co-Chair of the World Economic Forum’s Council on Economic Progress. Ms. Farrell is also a member of the Council on Foreign Relations, the Economic Club of New York, the Aspen Strategy Group, the Bretton Woods Committee and the National Academies of Science’s Committee on National Statistics.

Ms. Farrell holds a M.B.A. from Harvard Business School, and a B.A. from Wesleyan University, where she was awarded a Distinguished Alumna award. | ||

|

Director Qualifications

●Policy Experience: Previously global head of the McKinsey Global Institute and McKinsey Center for Government, a leading economic advisor to the President of the United States. Member of several economic and international policy groups and a trustee leading economic think tanks.

●Financial Expertise: Chief Executive Officer and founding President of the JPMorgan Chase Institute. Led research on global capital markets at McKinsey Global Institute, and interagency process on financial policy as Deputy Director of the National Economic Council.

●Leadership and Strategy Experience: Former Senior Partner at McKinsey & Company and Deputy Director of the National Economic Council. Service on non-profit boards and leadership of economic and policy organizations. | ||

8

|

Logan D. Green

Age: 36

Director Since: 2016

Committees:

●Corporate Governance and Nominating Committee

|

Other Public

Company Boards: ●Lyft, Inc. (since 2019) |

|

Experience | ||

|

Mr. Green has served as the

Chief Executive Officer and co-founder of Lyft, Inc., a rideshare company, since 2012. Lyft grew out of Zimride, a rideshare

company previously co-founded by Mr. Green in 2007. Zimride was acquired by Enterprise Rent-A-Car. Mr. Green received his

B.A. in Business Economics from the University of California, Santa Barbara. | ||

|

Director Qualifications

●Technology and E-Commerce Industry Experience; Leadership, Management, Strategy and Entrepreneurship Experience: CEO and co-founder of Lyft, a publicly traded, on-demand transportation company. | ||

9

|

Bonnie S. Hammer

Age: 69

Director Since: 2015

Committees:

●Compensation Committee |

Other Public

Company Boards: ●IAC/InteractiveCorp (since 2014) |

|

Experience | ||

|

Ms. Hammer is Chairman, NBCUniversal Content Studios, where she oversees Universal Television, Universal Content Productions and NBCUniversal International Studios. Previously, Ms. Hammer was Chairman, Direct-to-Consumer and Digital Enterprises, where she built the brand identity and greenlit the initial content slate for Peacock, NBCUniversal’s upcoming streaming service. Before that, she was Chairman, NBCUniversal Cable Entertainment and Cable Studios, where she oversaw cable brands USA Network, SYFY, Bravo, Oxygen, E! Entertainment and Universal Kids, as well as two Hollywood studios: Universal Cable Productions and Wilshire Studios, and the digital business, Bluprint. Additionally, Ms. Hammer has overseen the NBCUniversal Digital Enterprises Group and its investments in BuzzFeed, Vox and Snap.

Ms. Hammer joined NBCUniversal in 2004 as President of USA Network and SYFY, having served as President of SYFY from 2001 to 2004. She held other senior executive positions at SYFY and USA Network from 1989 to 2000. Before that, she was an original programming executive at Lifetime Television Network from 1987 to 1989. Ms. Hammer has served on the boards of ShopNBC, a 24-hour TV Shopping network, the International Radio and Television Society, and the Ad Council. Ms. Hammer also serves on the board of directors of IAC/InteractiveCorp and currently holds an advisory role with Boston University’s College of Communication. Additionally, Ms. Hammer serves on the board of governors for the Motion Picture & Television Fund.

Ms. Hammer holds a bachelor’s degree in communications and a master’s degree in media and new technology from Boston University. In 2017, Boston University awarded her an Honorary Doctorate of Humane Letters. | ||

|

Director Qualifications

●Product, Marketing and Media Experience: Industry leader in media for over 40 years, with expertise in network programming, production, marketing, and multiplatform branding.

●Leadership, Strategy and Management Experience: Chairman, NBCUniversal Content Studios and previous executive roles including oversight of NBCUniversal’s innovative streaming service, prominent cable brands and production studios. | ||

10

|

Jamie Iannone

Age: 47

Director Since: 2020

Committees:

●None |

Other Public

Company Boards: ●None |

|

Experience | ||

|

Mr. Iannone has been President and Chief Executive Officer of eBay since April 2020.

Earlier in 2020, Mr. Iannone served as Chief Operating Officer of Walmart eCommerce, where he also was responsible for Store No. 8, Walmart’s incubation hub. Since 2014, Mr. Iannone held leadership roles at Walmart Inc. including CEO of SamsClub.com and Executive Vice President of membership and technology, Sam's Club, a $57 billion business. In those roles, Mr. Iannone grew the SamsClub.com business and Sam’s Club's membership base.

Before Walmart Inc., Mr. Iannone was Executive Vice President of Digital Products at Barnes & Noble, Inc., where he was responsible for all NOOK devices, software, accessories and retail integration and experiences; books and digital content; and third-party partnerships.

Mr. Iannone held various roles at eBay from 2001 to 2009, including leading Product Marketing, Search, and Buyer Experience.

He previously worked at Epinions.com and Booz Allen Hamilton. Mr. Iannone also served on the Board of Directors of The Children’s Place.

He earned a Bachelor of Science in operations research, engineering and management systems from Princeton University and a Master of Business Administration from the Stanford Graduate School of Business. | ||

|

Director Qualifications

●Technology Industry, Management, Strategy, and Leadership Experience: Executive with three large, innovative global technology companies: eBay, Walmart, and Barnes and Noble. Board experience at The Children’s Place.

●E-Commerce and Retail Industry Experience: Leader with an array of online and offline retail businesses, including eBay, SamsClub.com, Sam's Club, Barnes and Noble, The Children’s Place, and Epinions.com.

●Product and Media Experience: Delivered innovative product experiences in executive roles at eBay, SamsClub.com and Sam's Club, and Barnes and Noble. Led media partnerships, books, digital content, and NOOK software at Barnes and Noble. | ||

11

|

Kathleen C. Mitic

Age: 50

Director Since: 2011

Committees:

●Compensation Committee

●Corporate Governance and Nominating Committee (Chair) |

Other Public

Company Boards: ●RH (f/k/a Restoration Hardware Holdings, Inc.) (since 2013) |

|

Experience | ||

|

Ms. Mitic is Co-CEO and Co-Founder of SomethingElse, a beverage company. From 2012 to 2017, Ms. Mitic was the Chief Executive Officer of Sitch, Inc., (formerly known as Three Koi Labs, Inc.), a mobile start-up company she founded. From 2010 to 2012, Ms. Mitic served as Director of Platform and Mobile Marketing for Facebook, Inc., a social networking service. From 2009 to 2010, Ms. Mitic served as Senior Vice President, Product Marketing of Palm, Inc., a smartphone manufacturer. She was Vice President and General Manager at Yahoo! Inc. from 2001 to 2005.

Ms. Mitic currently serves on the board of directors of RH (formerly known as Restoration Hardware Holdings, Inc.), where she serves as a member of the audit committee. She also serves on the board of directors of Headspace Inc.

Ms. Mitic received her B.A. from Stanford University and her M.B.A. from Harvard Business School. | ||

|

Director Qualifications

●Product, Marketing, and Media Experience: Expertise in global products, marketing and media through work leading Global Platform and Mobile Marketing at Facebook, Inc. and the Global Products Marketing group at Palm, Inc., and as Vice President and General Manager at Yahoo! Inc.

●Technology Industry, Entrepreneurship, and Leadership Experience: Consumer-facing executive positions in technology industry (listed above) for over twenty years. Entrepreneurial experience building and operating technology companies as founder and Chief Executive Officer of Sitch, Inc. and Vice President and General Manager of Yahoo! Inc. | ||

12

|

Matthew J. Murphy

Age: 47

Director Since: 2019

Committees:

●None |

Other Public

Company Boards: ●Marvell Technology Group Ltd. (since 2016) |

|

Experience | ||

|

Mr. Murphy is President and

Chief Executive Officer of Marvell Technology Group Ltd. (“Marvell”), a semiconductor company. He has led Marvell

since joining in July 2016 and also serves as a member of Marvell’s board of directors. In his role as CEO, Mr. Murphy

is responsible for leading new technology development, directing ongoing operations and driving Marvell’s growth

strategy.

Prior to joining Marvell, Mr. Murphy worked for Maxim Integrated Products, Inc., a company that designs, manufactures and sells analog and mixed-signal integrated circuits. He advanced there through a series of business leadership roles over two decades. Most recently, he served as Executive Vice President of Business Units and Sales & Marketing, overseeing all product development and go-to-market activities. Prior to that, he served as the Senior Vice President of the Communications and Automotive Solutions Group and Vice President of Worldwide Sales and Marketing.

Mr. Murphy is a recipient of a Silicon Valley Business Journal 2019 C-Suite award for CEO of a Large Public Company, and was a “40 Under 40” honoree in 2011. In 2018, Institutional Investor named him All-America Executive Team Best CEO in the semiconductor category. He also served as the Chairman of the Semiconductor Industry Association (SIA) in 2018.

Mr. Murphy earned a B.A. from Franklin & Marshall College, and is also a graduate of the Stanford Executive Program. He serves on the boards of directors of the SIA and Global Semiconductor Alliance. | ||

|

Director Qualifications

●Technology Industry and Product Experience; Leadership, Management, and Strategy Experience: Chief Executive Officer of Marvell, management and executive positions with Maxim Integrated Products, Inc., and board membership at Global Semiconductor Alliance and Semiconductor Industry Association. | ||

13

|

Pierre M. Omidyar

Age: 52

Director Since: 1996

Committees:

●None |

Other Public

Company Boards: ●None |

|

Experience | ||

|

Mr. Omidyar is a philanthropist, technologist, and innovator. Mr. Omidyar founded eBay in September 1995 and has served as a Board member of eBay since May 1996, and as Chairman of the Board from May 1996 to July 2015. He served as a director of PayPal Holdings, Inc. from July 2015 to May 2017.

Mr. Omidyar and his wife Pam are active philanthropists, engaged in the philanthropic organizations of The Omidyar Group, a few of which include: Democracy Fund, HopeLab, Humanity United, Omidyar Network, Ulupono Initiative, and the recently launched Luminate, Flourish, Spero, and Imaginable Futures. In addition, Mr. Omidyar is co-founder and publisher of Civil Beat, a nonprofit news service dedicated to serving Hawaii’s public interest through investigative journalism. He is also the founder of First Look Media, a media company devoted to supporting independent voices, from fearless investigative journalism and documentary filmmaking to smart, provocative entertainment. Mr. Omidyar serves on the boards of trustees of the Omidyar-Tufts Microfinance Fund, Punahou School, and Santa Fe Institute.

Mr. Omidyar received his B.S. from Tufts University. | ||

|

Director Qualifications

●Technology Industry and E-Commerce/Retail Experience: Technologist and innovator in e-commerce and retail.

●Leadership and Entrepreneurship: Founder of eBay, former director of PayPal Holdings, Inc., and founder of several innovative businesses, including Omidyar Network and First Look Media. | ||

14

|

Paul S. Pressler

Age: 63

Director Since: 2015

Committees:

●Compensation Committee (Chair)

●Corporate Governance and Nominating Committee |

Other Public

Company Boards: ●None |

|

Experience | ||

|

Mr. Pressler has been a senior

advisor of Clayton, Dubilier & Rice, LLC, a private equity investment firm, since 2020. He previously served as partner

at Clayton, Dubilier & Rice, LLC from 2009 to 2020. Before that, he served as Chairman of David’s Bridal, a retail

company specializing in formalwear. He also served as Chairman of AssuraMed from 2010 to 2013 and SiteOne Landscape Supply,

Inc. from to 2013 to 2017. Mr. Pressler served as President and Chief Executive Officer of The Gap, Inc. for five years, from

2002 to 2007. Before that, he spent 15 years in senior leadership roles with The Walt Disney Company, including Chairman of

the global theme park and resorts division, President of Disneyland, and President of The Disney Stores.

Mr. Pressler currently serves on the board of directors of The DryBar, Inc., Wilsonart, Inc. and MOD Super Fast Pizza, LLC.

Mr. Pressler received his B.S. from the State University of New York at Oneonta. | ||

|

Director Qualifications

●Investment/Finance Experience: Senior advisor and partner at private equity firm Clayton, Dubilier & Rice, LLC since 2009.

●Leadership, Management, Retail Industry and Strategy Experience: Former Chairman of David’s Bridal, Inc., Chairman of SiteOne Landscape Supply, Inc., Interim Chief Executive Officer of David’s Bridal, Inc., Chair of the board of AssuraMed Holding, Inc., President and Chief Executive Officer of The Gap, Inc., and 15 years in senior leadership at The Walt Disney Company, including President of The Disney Stores. | ||

15

|

Robert H. Swan

Age: 59

Director Since: 2015

Committees:

●Risk Committee (Chair) |

Other Public

Company Boards: ●Intel Corporation (since 2019) |

|

Experience | ||

|

Mr. Swan joined Intel Corporation (“Intel”), a multinational technology company, in 2016. He first served as Intel’s Executive Vice President and Chief Financial Officer, added interim CEO to his duties in June 2018 to January 2019 and has served as a director and CEO of Intel since January 2019. From 2015 to 2016, Mr. Swan served as an Operating Partner of General Atlantic, a leading global growth equity firm. From 2006 to 2015, Mr. Swan served as Senior Vice President, Finance, and Chief Financial Officer at eBay, where he oversaw all aspects of the Company’s finance function, including controllership, financial planning and analysis, tax, treasury, audit, mergers and acquisitions, and investor relations. Prior to eBay, Mr. Swan served as Chief Financial Officer at Electronic Data Systems Corp., TRW Inc., and Webvan Group, Inc. He also served as Chief Operating Officer and CEO of Webvan Group. He previously served on the board of directors of Applied Materials, Inc. from 2009 to 2016, and AppDynamics from 2016 to 2017.

Mr. Swan began his career at General Electric, where he spent 15 years in numerous senior finance roles, including divisional Chief Financial Officer for GE Transportation Systems, GE Healthcare Europe, and GE Lighting.

Mr. Swan received his B.S. from the University at Buffalo and his M.B.A. from the State University of New York at Binghamton. | ||

|

Director Qualifications

●Investment/Finance and Transactions/M&A Expertise: Former Chief Financial Officer of Intel, eBay and Electronic Data Systems.

●Leadership, Management, and Strategy Experience; Technology Industry and E-Commerce/Retail Experience: Chief Executive Officer of Intel and executive roles at eBay, Intel, and Electronic Data Systems. | ||

16

|

Thomas J. Tierney

Age: 66

Director Since: 2003

●Chairman of the Board

Committees:

●Compensation Committee

●Corporate Governance and Nominating Committee |

Other Public

Company Boards: ●None |

|

Experience | ||

|

Mr. Tierney is Chairman and co-founder of The Bridgespan Group, a non-profit organization that collaborates with mission-driven leaders and organizations to help accelerate social impact, and he has been its Chairman of the Board since late 1999. From 1980 to 2000, he held various positions at Bain & Company, including serving as its CEO from 1992 to 2000.

Mr. Tierney currently serves on charitable boards, including The Hoover Institution and The Woods Hole Oceanographic Institution. He recently completed his term as chairman of the global board of The Nature Conservancy.

Mr. Tierney received his B.A. from the University of California at Davis and his M.B.A. from Harvard Business School. | ||

|

Director Qualifications

●Policy and Leadership Experience: Social entrepreneur and non-profit leader. Frequent speaking engagements and publications on non-profit leadership and philanthropy. Chair of the Harvard Business School Initiative on Social Enterprise and member of Harvard Business School’s Dean’s advisory board.

●Management and Strategy Experience: Chairman of The Bridgespan Group and chief executive of Bain & Company. Over 35 years providing strategy and leadership consulting to CEOs across a range of industries.

●Management and Leadership Experience: Led Bain & Company through a highly successful turnaround. | ||

17

|

Perry M. Traquina

Age: 63

Director Since: 2015

Committees:

●Audit Committee

●Corporate Governance and Nominating Committee |

Other Public

Company Boards: ●Morgan Stanley (since 2015)

●The Allstate Corporation (since 2016) |

|

Experience | ||

|

Mr. Traquina is the former Chairman, Chief Executive Officer, and Managing Partner of Wellington Management Company LLP, a global investment management firm. Mr. Traquina held this position for a decade until his retirement from the firm in 2014. During his 34-year career at Wellington, he was an investor for 17 years and a member of the management team for the other half of his time at the firm.

Mr. Traquina received his B.A. from Brandeis University and his M.B.A. from Harvard University. | ||

|

Director Qualifications

●Investment/Finance Experience: More than 34 years of leadership at Wellington Management Company LLP.

●Leadership and Management Experience: Former Chairman, CEO, and Managing Partner of Wellington Management Company LLP, and current service on boards of directors of Morgan Stanley and The Allstate Corporation. | ||

Agreement with Elliott and Starboard

On February 28, 2019, we entered into separate agreements (collectively, the “Agreements”) with funds affiliated with Elliott Management Corporation (collectively, “Elliott”) and with Starboard Value LP and its affiliates (collectively, “Starboard”). The Agreements include provisions regarding various matters including, but not limited to, the appointment of directors, procedures for determining replacements for the newly appointed directors, voting commitments, “standstills” restricting certain conduct and activities during the periods specified in each Agreement, non-disparagement and other items that are addressed separately in each Agreement. A description of the Agreements and copies of the Agreements are included in a Form 8-K filed with the SEC on March 1, 2019.

Pursuant to the Agreements, Jesse Cohn was appointed to the Board on March 1, 2019, and Matthew Murphy was appointed to the Board on March 15, 2019.

Information Concerning Our Executive Officers

The following provides information regarding the Company’s current executive officers.

| Jamie Iannone |

| Age: 47 |

| Position: President and Chief Executive Officer |

| Biography |

|

Mr. Iannone’s biography is set forth under the heading

“Information Concerning Members of the Board” above. |

18

| Andy Cring |

| Age: 50 |

| Position: Interim Chief Financial Officer |

| Biography |

|

Mr. Cring has served eBay as Interim Chief Financial Officer since September 2019. Prior to that, he was eBay’s Vice President, Global

Financial Planning, beginning in 2013. Before joining eBay, Mr. Cring was Senior Vice President for Global Financial Planning and

Analysis at Yahoo! for three years and was in the Finance group at General Electric for 16 years.

|

| Marie Oh Huber |

| Age: 58 |

| Position: Senior Vice President, Legal Affairs, General Counsel and Secretary |

| Biography |

|

Ms. Huber serves eBay as Senior Vice President, Legal Affairs, General Counsel and Secretary. She assumed her current role in July 2015. Prior to joining eBay, Ms. Huber spent 15 years at Agilent Technologies, a technology and life sciences company, most recently as Senior Vice President, General Counsel and Secretary. |

| Wendy E. Jones |

| Age: 54 |

| Position: Senior Vice President, Global Customer Experience and Operations |

| Biography |

|

Ms. Jones serves eBay as Senior Vice President, Global Customer Experience & Operations. She joined eBay in 2003 as Vice President, Customer Service for North America and Australia. She has held various other leadership roles at eBay over the years. Prior to joining eBay, Ms. Jones worked at State Street Bank, Land Rover NA, and for iSKY, Inc., in various leadership roles. |

| Jae Hyun Lee |

| Age: 56 |

| Position: Senior Vice President, International |

| Biography |

|

Mr. Lee serves eBay as Senior Vice President, International, leading eBay’s core Marketplaces’ international business outside the UK, Germany, France, Italy and Spain. He has served in that capacity since January 2020. Prior to this position, he served as General Manager, eBay Markets, beginning February 2019; Senior Vice President, EMEA, beginning August 2017; and Senior Vice President, Asia Pacific, leading that region for 12 years. Prior to joining eBay, Mr. Lee was CEO of Korea Thrunet Co. Ltd, a NASDAQ-listed broadband Internet service company and spent almost eight years at Boston Consulting Group with various roles all over the world. |

| Pete Thompson |

| Age: 51 |

| Position: Senior Vice President, Chief Product Officer |

| Biography |

|

Mr. Thompson has served eBay as Senior Vice President and Chief Product Officer since August 2019. Before that, he was Vice President for Alexa Voice Services at Amazon from October 2017. Prior to that, Mr. Thompson was Executive Vice President and Chief Operating Officer at TiVo from September 2016 and Vice President – Product at Sonos, Inc. from September 2015. Prior to Sonos, he spent more than 9 years at Microsoft in various positions. |

| Kristin Yetto |

| Age: 53 |

| Position: Senior Vice President, Chief People Officer |

| Biography |

|

Ms. Yetto serves eBay as Senior Vice President, Chief People Officer. She has served in that capacity since July 2015. She has been with eBay since March 2003 and has held a number of executive roles, most recently as Senior Vice President of Human Resources for eBay Marketplaces from March 2010 until July 2015. Prior to joining eBay, Ms. Yetto served as an HR Business Partner at Palm. Before Palm, Ms. Yetto was a Director of Global Services for Seagate Technology. |

19

Family Relationships

There are no family relationships among any of our directors or executive officers.

Code of Ethics, Governance Guidelines and Committee Charters

We have adopted a Code of Business Conduct and Ethics that applies to all eBay employees and directors. The Code of Business Conduct and Ethics is posted on our website at https://investors.ebayinc.com/corporate-governance/governance-documents/. We will post any amendments to or waivers from the Code of Business Conduct and Ethics at that location.

We have also adopted Governance Guidelines for the Board of Directors and a written committee charter for each of our Audit Committee, Compensation Committee and Corporate Governance and Nominating Committee. Each of these documents is available on our website at https://investors.ebayinc.com/corporate-governance/governance-documents/.

Audit Committee

The Company has a separately-designated standing audit committee (the “Audit Committee”) established in accordance with Section 3(a)(58)(A) of the Exchange Act. Fred D. Anderson Jr., Adriane M. Brown and Perry M. Traquina are the members of the Audit Committee. Fred D. Anderson Jr. serves as the Chair of the Audit Committee. Each member of the Audit Committee is independent in accordance with the audit committee independence requirements of the listing rules of The Nasdaq Stock Market and the applicable rules and regulations of the SEC. Our Board has determined that Mr. Anderson is an “audit committee financial expert” as defined by the SEC.

ITEM 11. EXECUTIVE COMPENSATION.

Compensation Discussion and Analysis

This Compensation Discussion and Analysis describes the compensation of our “named executive officers” (“NEOs”) for 2019:

|

|

|

| Scott Schenkel | Andrew Cring | Jae Hyun Lee |

|

Interim Chief Executive |

Interim Chief Financial |

Senior Vice President, |

|

|

|

| Pete Thompson | Kristin Yetto | |

|

Senior Vice President, |

Senior Vice President, |

| (1) |

Mr. Schenkel served as Senior Vice President, Finance and Chief Financial Officer for a majority of the year. Effective as of September 24, 2019, in connection with Mr. Wenig’s departure as CEO, Mr. Schenkel served as the interim CEO until Mr. Iannone’s appointment on April 27, 2020 as CEO. Effective as of April 27, 2020, Mr. Schenkel assumed the role of Senior Advisor for a transition period commencing on April 27, 2020. His employment will terminate upon the conclusion of such transition period which is expected to end on June 19, 2020. Mr. Wenig is also a named executive officer due to his status as the CEO during a portion of 2019. |

| (2) |

Mr. Cring served as Vice President, Global Financial Planning and Analysis for the majority of the year. Effective as of September 24, 2019, in connection with Mr. Schenkel’s appointment to interim CEO, Mr. Cring has served as the interim CFO. In this position, Mr. Cring leads all aspects of eBay’s finance, analytics, and information technology functions – including controllership, financial planning and analysis, tax, treasury, audit, mergers and acquisitions, and investor relations. |

| (3) |

Mr. Lee served as Senior Vice President, General Manager, Markets until January 2020 when he was named Senior Vice President, International. In this role, Mr. Lee is responsible for leading eBay’s core Marketplaces’ international business outside the UK, Germany, France, Italy and Spain. He oversees a diverse portfolio of businesses: off-platform businesses in Korea, Japan and Turkey; our fourth largest on-platform business, in Australia; cross-border trade out of Greater China; and 180+ unsited markets in Asia, Latin America, Eastern Europe, the Middle East and Africa. |

| (4) |

Mr. Thompson was hired in 2019 as Senior Vice President, Chief Product Officer. In this position, Mr. Thompson leads eBay’s product experience, where he is focused on making the shopping journey simple, personalized and discovery-based, while providing the enhanced tools and insights that help eBay sellers succeed. |

| (5) |

Since 2015, Ms. Yetto serves as Senior Vice President, Chief People Officer. In this position, Ms. Yetto is responsible for all aspects of human resources across eBay, including business performance, talent development and acquisition, learning and development, compensation, benefits, HR shared services, and people tools and technologies. |

20

Our Compensation Program

The goals of our executive compensation program are to:

| ✓ | align compensation with our business objectives, performance and stockholder interests, |

| ✓ | motivate executive officers to enhance short-term results and long-term stockholder value, |

| ✓ | position us competitively among the companies against which we recruit and compete for talent, and |

| ✓ | enable us to attract, reward and retain executive officers and other key employees who contribute to our long-term success. |

We achieve these objectives primarily by employing the following elements of pay for our executive officers: (1) equity awards, both restricted stock unit (“RSU”) and performance-based restricted stock unit (“PBRSU”) grants under the eBay Inc. 2008 Equity Incentive Award Plan, (2) an annual bonus program (the “eBay Incentive Plan or eIP”); and (3) base salary.

21

Introduction

This Compensation Discussion and Analysis is presented as follows:

|

Elements of Our Executive Compensation Programs provides a description of our executive compensation practices, programs, and processes. |

|

2019 NEO Target Compensation discusses how we use the elements of compensation program to achieve our target pay mix. |

|

2019 Compensation Decisions explains executive compensation decisions made for our executive officers for 2019. |

|

Further Considerations for Setting Executive Compensation discusses the role of the Company’s compensation consultant, peer group considerations, and the impact of accounting and tax requirements on compensation. |

|

Severance and Change in Control Arrangements with Executive Officers and Clawbacks discusses the Company’s severance and change in control plans and other arrangements with executive officers. |

To achieve our executive compensation goals, we have three principal components of our executive compensation program: equity compensation (the “eBay Inc. 2008 Equity Incentive Award Plan”), an annual cash incentive (the “eBay Incentive Plan”), and base salary. We seek to ensure that total compensation for our executive officers is heavily weighted to variable, performance-based compensation by delivering a majority of compensation in the form of PBRSUs and annual cash incentives.

|

Elements of Our Executive Compensation Program |

The following chart provides a summary of the elements of our 2019 executive compensation program.

22

| Compensation Elements |

Performance Metrics |

Performance and Vesting Periods |

Rationale | ||||

|

Base Salary |

●Assessment and Target Positioning Strategy |

●N/A |

●Rewards executives’ current contributions to the Company

●Reflects the scope of executives’ roles and responsibilities | |||

|

Annual Cash Incentive Awards |

Threshold company performance measures: ●FX-neutral revenue (threshold)

●Non-GAAP net income (threshold)

If BOTH thresholds are met, then payout based on ●Total non-GAAP net income (75%)

●Individual performance (25%) |

●Annual |

●Aligns executive compensation with annual Company and individual performance

●Motivates executives to enhance annual results | |||

|

Equity Incentive Awards |

Time-based RSUs: N/A PBRSUs: ●FX-neutral revenue

●Non-GAAP operating margin dollars

●Return on invested capital (modifier)

●Payments (modifier) |

Time-based RSUs: ●Quarterly vesting over a four-year period subject to continued employment

PBRSUs: ●For CEO and CFO: 100% PBRSU awards granted will vest more than 14 months following the end of the applicable two-year performance.

●For other NEOs: One-half of the PBRSUs vest in March following the end of the applicable performance period, and the other half of the award vests in March of the following year, more than 14 months following the completion of the performance period.

Mr. Cring is not eligible for the PBRSU program due to his position as a VP. |

●Aligns executive incentives with the long-term interests of our stockholders

●Positions award guidelines at target level with the median of the market levels paid to peer group executives

●Recognizes individual executive’s recent performance and potential future contributions

●Retains executives for the long term

●Provides a total compensation opportunity with payouts varying based on our operating and stock price performance |

23

We chose a mix of equity and cash compensation vehicles to compensate executive officers based on sustainable long-term value drivers of Company performance over one- and multi-year periods (and, in the case of certain monthly performance bonuses to Messrs. Schenkel and Cring, during their interim service) and individual contributions to the Company.

Our executive officers were also eligible to receive a comprehensive set of benefits:

| ● | Health and welfare benefits plans; |

| ● | Employee stock purchase plan; |

| ● | Limited use of the corporate airplane (CEO and CFO only; with reimbursement required by the CFO and voluntarily provided by the CEO). Both Mr. Schenkel and Mr. Cring are authorized to use the corporate airplane in their interim CEO and CFO positions, respectively, subject to the same principles described in the preceding sentence. |

| ● | Broad-based 401(k) retirement savings plan and a VP and above deferred compensation plan (each plan is available to U.S.- based employees only); and |

| ● | Certain other limited perquisites. |

We provide certain executive officers with limited perquisites and other personal benefits not available to all employees that we believe are reasonable and consistent with our overall compensation program and philosophy. These benefits are provided to enable the Company to attract and retain these executive officers. We periodically review the levels of these benefits provided to our executive officers.

The Compensation Committee encouraged Mr. Wenig (and Mr. Schenkel in the interim CEO position) to use the corporate airplane for personal travel to reduce possible security concerns where relevant. Prior to his appointment to interim CEO and in his CFO role, Mr. Schenkel’s access to the corporate airplane was limited to 20 hours of personal use, subject to Mr. Schenkel fully reimbursing the Company for the incremental costs associated with such use. The Company does not grant bonuses to cover, reimburse, or otherwise “gross-up” any income tax owed for personal travel on the corporate airplane.

|

2019 NEO Target Compensation |

When making compensation decisions for our NEOs, the Compensation Committee evaluated each individual based on his or her leadership, competencies, innovation, and both past and expected future contributions toward the Company’s financial, strategic, and other priorities. The Company’s performance was reflected in our executive compensation program, holding leadership accountable for Company performance.

Incentive Compensation

Long-Term Equity Awards. The value of annual equity awards is determined within guidelines that the Compensation Committee approves on an annual basis for each position. These guidelines are based on our desired pay positioning relative to companies with which we compete for talent. The midpoint of the guidelines, or the median target award, reflects the 50th percentile of the competitive market.

In 2019, the Compensation Committee approved equity award guidelines by position based on the following:

| ● | equity compensation practices of technology companies in our peer group, as disclosed in their public filings (see page 35 for our 2019 peer group), and |

| ● | equity compensation practices for comparable technology companies that are included in proprietary third-party surveys. |

The Compensation Committee is also cognizant of dilution resulting from equity compensation, and so it carefully considers share usage each year and sets an upper limit on the number of shares that can be used for equity compensation, including awards to executive officers and the overall employee population.

24

Each executive officer’s individual contribution and impact, projected level of contribution and impact in the future, and competitive positioning are considered when determining individual awards. The retention value of current year awards and the total value of unvested equity from previous awards are also considered. The individual awards can be higher or lower than the median target award by an amount ranging from zero to three times the median target award.

Based on its assessment, the Compensation Committee approved individual compensation arrangements for each NEO based on the factors and guidelines described above and in this section.

Annual Cash Incentive. The Compensation Committee also assesses annual cash incentive award opportunities against data from public filings of our peer group companies and general industry data for comparable technology companies that are included in proprietary third-party surveys, and it approves target annual cash incentive opportunities for our NEOs at approximately the 50th percentile based on that data. We review market data annually, and periodically adjust incentive opportunities to the extent necessary where our practices are inconsistent with such market data.

Base Salary

Assessment and Target Positioning Strategy. We review market data annually and approve each executive officer’s base salary for the year. Increases, if any, generally become effective on or around April 1st of the year. We assess competitive market data on base salaries from public filings of our peer group companies and general industry data for comparable technology companies that are included in proprietary third-party surveys. When considering the competitive market data, we also recognize that the data is historical and does not necessarily reflect those companies’ current pay practices. We assess each executive officer’s base salary against the 50th percentile of the salaries paid to comparable executives at peer group companies and also consider individual performance, levels of responsibility, expertise, and prior experience in our evaluation of base salary adjustments.

Determining 2019 Target Annual Compensation for our CEO

Mr. Schenkel, Interim CEO

At Mr. Schenkel’s appointment as the interim CEO, the Compensation Committee focused on incentivizing Mr. Schenkel for leading the Company during this transition while remaining committed to the philosophy of tying compensation to Company performance.

In determining Mr. Schenkel’s compensation as the interim CEO, the Compensation Committee determined that a monthly performance bonus was appropriate in order to bring his cash compensation in line with that of the CEO position. Prior to his appointment, Mr. Schenkel’s salary was determined at a level appropriate for his role as the CFO in accordance with the methodology described below for NEOs other than the CEO. The Compensation Committee also determined that supplemental 2019-2020 PBRSU and RSU grants were necessary and appropriate to further compensate Mr. Schenkel for the additional responsibilities of the CEO position.

Mr. Wenig, Former CEO

Prior to Mr. Wenig’s departure, the Compensation Committee sought to link Mr. Wenig’s compensation with the sustainable long-term performance of the Company. The Compensation Committee considered many factors in setting the various components of Mr. Wenig’s compensation, including factors such as execution against long-term strategic plans and innovation and execution across eBay’s platforms. The Compensation Committee reviewed and approved the salary, target annual cash incentive award, and value of equity awards for Mr. Wenig considering available market data as well as Company and individual performance.

25

| Name | 2019

Base Salary |

Year- Over-Year Change for Base Salary ($) |

2019

Target Annual Cash Incentive Award |

Year-Over- Year Change for Target Annual Cash Incentive Award ($) |

2019

Target Value of Equity Awards ($) |

Year-Over- Year Change for Target Value of Equity Awards ($) | ||||||||||||

| Mr. Schenkel | $ | 750,000 | (1) | No Change | 100 | % | No Change | $ | 13,460,000 | (2) | 73 | % | ||||||

| Mr. Wenig | $ | 1,000,000 | No Change | 200 | % | No Change | $ | 10,850,000 | -30 | % | ||||||||

| (1) | The amount does not include monthly performance bonuses. |

| (2) | The amount includes a special grant of RSUs in the amount of $4,000,000 and a special grant of PBRSUs in the amount of $4,000,000 in recognition of the additional responsibilities of the Interim CEO position. |

Summary of Target Value of Equity Awards, Target Cash Incentive Award, and Salary for other NEOs

The Compensation Committee considered many factors in approving the various components of the other NEOs’ compensation, including those set forth below. In evaluating performance against these factors, the Compensation Committee assigned no specific weighting to any one of the factors, instead evaluating individual performance in a holistic manner.

| ● | Performance against target financial results for the NEO’s business unit or function |

| ● | Defining business unit or function strategy and executing against relevant goals |

| ● | Recognition of the interconnection between the eBay business units and functions and the degree to which the NEO supported and drove the success of other business units or functions and the overall business |

| ● | Driving innovation and execution for the business unit or function |

| ● | Organization development, including hiring, developing, and retaining the senior leadership team of the business unit or function |

| ● | Achievement of strategic or operational objectives, including control of costs in an environmentally and socially responsible manner |

The Compensation Committee reviewed and approved the target value of equity awards, target annual cash incentive award, and salary for our NEOs based on available market data as well as Company and individual performance.

The Compensation Committee approved a salary increase for Ms. Yetto in order to remain competitive with current market conditions. The Compensation Committee determined that the other NEOs’ target annual cash incentive awards remained competitive without an increase and that their overall cash compensation was consistent with creating an ownership culture by focusing the compensation mix on equity rather than cash. The Committee determined annual equity awards based on delivery against business metrics, financial targets and Company-level leadership.

The Compensation Committee limits the use of out-of-cycle compensation for executive officers to extraordinary circumstances only. In addition to the annual awards and the supplemental grant to Mr. Schenkel described above, two of our NEOs, Mr. Cring and Ms. Yetto, received additional equity grants. Mr. Cring received an RSU grant related to the additional responsibilities of his interim CFO role. Ms. Yetto received a 2019-2020 PBRSU grant and an RSU grant to recognize the critical nature of her role as Chief People Officer in the portfolio and operational review initiatives.

26

The following table shows the compensation arrangements for our other NEOs:

| Name | 2019 Base Salary | Year-

Over-Year Change for Base Salary ($) | 2019

Target Annual Cash Incentive Award | Year-Over- Year Change for Target Annual Cash Incentive Award ($) | 2019

Target Value of Equity Awards ($) | Year-Over- Year Change for Target Value of Equity Awards ($) | |||||||||||||

| Mr. Cring | $ | 440,000 | (1) | N/A | (2) | 55 | % | N/A(2) | $ | 4,400,000 | (3) | N/A | (2) | ||||||

| Mr. Lee | $ | 675,000 | (4) | No Change | 75 | % | No Change | $ | 4,250,000 | (5) | -15 | % | |||||||

| Mr. Thompson | $ | 625,000 | N/A | (6) | 65 | % | N/A(4) | $ | 8,000,000 | (5)(7) | N/A | (4) | |||||||

| Ms. Yetto | $ | 675,000 | N/A | (8) | 75 | % | N/A(7) | $ | 6,150,000 | (5)(9) | N/A | (7) | |||||||

| (1) | Does not include monthly performance bonuses. |

| (2) | Mr. Cring was not an NEO for fiscal year 2018. |

| (3) | Reflects 100% RSUs since Mr. Cring is not eligible for the PBRSU program due to his position as a VP. The amount also includes a special grant of RSUs in the amount of $3,000,000 in recognition of the additional responsibilities of the Interim CFO position. |

| (4) | Mr. Lee’s base salary is reported in U.S. dollars on an FX-neutral basis. |

| (5) | For the PBRSU portion of the award, if performance targets are met, 50% of the achieved portion of the award will vest on March 15, 2020 and the remaining 50% of the achieved portion of the award will vest on March 15, 2021. |

| (6) | Mr. Thompson was hired in July 2019 and therefore was not an NEO for fiscal year 2018. |

| (7) | Mr. Thompson received a new hire grant of $1,600,000 in RSUs and $2,400,000 in PBRSUs in accordance with the Company’s 2019 allocation of 60% PBRSUs and 40% RSUs. Mr. Thompson also received a supplemental grant of RSUs in the amount of $4,000,000. |

| (8) | Ms. Yetto was not an NEO for fiscal year 2018. |

| (9) | In addition to the annual focal equity award, on October 15, 2019, Ms. Yetto received a special grant of PBRSUs for the 2019-2020 performance period in the amount of $1,500,000 and a special grant of RSUs in the amount of $1,500,000. |

|

2019 Incentive Compensation Decisions |

Our executive compensation program is highly performance-based, with payouts under the program dependent on meeting financial and operational targets over designated performance periods. For 2019, we selected financial metrics and targets that the Compensation Committee believes incentivize our management team to achieve our strategic objectives and drive the Company’s financial performance and long-term stock performance, including FX-neutral revenue, non-GAAP operating margin dollars, return on invested capital, payment intermediation usage and non-GAAP net income. As mentioned above, we made one-time equity grants to Mr. Schenkel and Mr. Cring in recognition of the increased responsibilities inherent to their new roles. On October 15, 2019, Mr. Schenkel received grants of $4,000,000 in RSUs vesting over four years on a quarterly basis and a grant of $4,000,000 in PBRSUs for the 2019-2020 performance period. On October 15, 2019, Mr. Cring received a grant of $3,000,000 in RSUs vesting over four years on a quarterly basis. In addition, we made a one-time grant to recognize the critical nature of Ms. Yetto’s role as Chief People Officer in the portfolio and operational review initiatives. On October 15, 2019, Ms. Yetto received a grant of PBRSUs for the 2019-2020 performance period in the amount of $1,500,000 and a grant of RSUs in the amount of $1,500,000 vesting over four years on a quarterly basis.

27

2019 Long-Term Equity Incentive Awards

In general, the formula used to allocate the annual equity awards is as follows:

| In 2019, our NEOs received equity-related compensation as part of the Company’s standard annual equity award. |

PBRSU Program

The PBRSU Program is a key component of the annual equity compensation for each executive officer. At the beginning of each performance period, executive officers receive PBRSU grants that are subject to performance- and time-based vesting requirements.

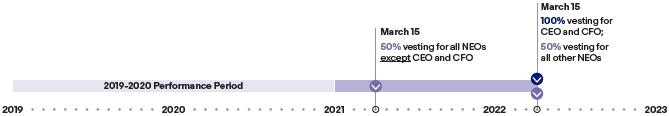

Performance Period and Vesting

Each PBRSU cycle has a two-year performance period. The performance goals for each cycle are approved by the Compensation Committee at the beginning of the performance period. Each executive officer is awarded a target number of shares subject to the PBRSU award at the beginning of the performance period.

If the Company’s actual performance exceeds or falls short of the target performance goals, the actual number of shares subject to the PBRSU award will be increased or decreased formulaically.

Under the PBRSU program, under which PBRSUs are awarded to executives at the level of Senior Vice President and above, 100% of any PBRSU awards granted to the CEO and CFO will vest, if at all, more than 14 months following the end of the applicable two-year performance period. This provision subjects 100% of the CEO and CFO PBRSU awards to at least three years of stock price volatility before the shares vest. For all SVPs other than the CEO and CFO, one-half of the PBRSUs vest in March following the end of the applicable performance period, and the other half of the award vests in March of the following year, more than 14 months following the completion of the performance period. The Compensation Committee believes that the post-performance-period vesting feature of the PBRSUs provides an important mechanism that helps to retain executive officers and align their interests with long-term stockholder value.

PBRSU Timeline

| * |

Mr. Cring is not eligible for the PBRSU program due to his position as a VP. |

28

Performance Measures and Rationale

As discussed above, the number of shares subject to a target PBRSU award are adjusted based on whether the Company’s actual performance exceeds or falls short of the target performance goals for the applicable performance period.

The following table outlines the performance measures for the 2018-2019 and 2019-2020 performance periods and the rationale for their selection.

| Performance Measures |

FX-neutral revenue(1) Non-GAAP operating margin dollars(2) Return on invested capital (modifier) Payments (modifier)(3) |

| Rationale |

The Compensation Committee believes these measures are key drivers of our long-term business success and stockholder value, and are directly affected by the decisions of the Company’s management. Both FX-neutral revenue and non-GAAP operating margin dollars measures are used to help ensure that leaders are accountable for driving profitable growth, and making appropriate tradeoffs between investments that increase operating expense and future growth in revenue. The return on invested capital modifier is used to hold leaders accountable for the efficient use of capital. Beginning with the 2018-2019 PBRSU cycle, we added a Payments component to the modifier element of the PBRSU Program design. This Payments modifier was used to incentivize the senior leadership team to work cross-functionally on a critical growth initiative and profit driver that impacts multiple areas of the business. Given the importance of the success of the Payments initiative to the Company’s success generally, as well as the priority placed on this initiative in the Company’s operational strategy for 2018 and 2019, our Compensation Committee determined that payout of PBRSUs for the 2018-2019 cycle should be subject to achievement in growing the use of our intermediation platform, as well as our existing Company financial performance metrics. The Payments modifier was also included for the 2019-2020 PBRSU cycle, but has been removed from the 2020-2021 PBRSU calculation as we believe, given the success and growth of the platform, that the other metrics will now accurately capture the performance of the Payments business. |

| Targets |

The two-year performance targets are generally set in a manner consistent with the current year budget and multi-year strategic plan. At the time the performance targets were set, the target goals were designed to be achievable with strong management performance, while the maximum goals were designed to be very difficult to achieve. |

| (1) | Calculated on a fixed foreign exchange basis. |

| (2) | Non-GAAP operating margin dollars excludes certain items, primarily stock-based compensation expense and related employer payroll taxes, amortization of acquired intangible assets, impairment of goodwill, separation expenses, and certain one-time gains, losses and/or expenses. |

| (3) | Applicable only to the 2018-2019 and 2019-2020 PBRSU cycles. Measures performance based on market launch thresholds and then percentage of intermediated GMV. |

29

Calculation Mechanics

2018-2019 and 2019-2020 PBRSU Cycles*. Shares that vest under the 2018-2019 and 2019-2020 PBRSU awards reflect the potential impact of the Payments modifier. The shares that vest will be 0% to 340% of the initial grant for the 2018-2019 performance period and 0% to 330% for the 2019-2020 performance period, based on eBay’s FX-neutral revenue, non-GAAP operating margin dollars, and return on invested capital and Payments modifiers, with the calculation as set forth below:

| FX-neutral revenue Payout % |

+ | Non-GAAP operating $ margin Payout % |

× | ROIC Modifier and Payments Modifier Payout % |

= | Total Payout % |

| Total Payout % |

× | Target Shares Awarded |

= | Total Shares Earned (subject to additional vesting periods) | ||

|

March 15, 2020 |

March 15, 2021 |

|||||

| * | Mr. Cring is not eligible for the PBRSU program due to his position as a VP. |

To receive any shares subject to a PBRSU award, at least one of the FX-neutral revenue or non-GAAP operating margin dollars minimum performance thresholds must be met. Each of the minimum performance thresholds are independent and, if any of the FX-neutral revenue or non-GAAP operating margin dollar performance thresholds are met, the award is adjusted with respect to that performance measure in accordance with the percentages outlined in the illustration below. If the minimum performance threshold for either FX-neutral revenue or non-GAAP operating margin dollars is not met, then no shares are awarded for that performance measure. The Compensation Committee may approve adjustments to the calculations of the performance measures due to material events not contemplated at the time the targets were set (such as major acquisitions or unusual or extraordinary corporate transactions, events, or developments) and the Compensation Committee may apply negative discretion to reduce the payout levels of the awards.

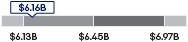

2018-2019 PBRSU Cycle Performance and Shares Earned

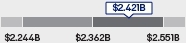

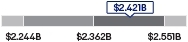

The following graphs show the goals and results achieved for the 2018-2019 performance period:

| Threshold | Target | Maximum | ||

|

Foreign-exchange neutral |

| |||

|

Non-GAAP operating |

| |||

|

Return on Invested |

| |||

|

Payments Modifier |

| |||

30

|

FX-neutral 65% |

+ |

Non-GAAP 55% |

× |

ROIC Modifier 144% |

= |

Total 86% |

For the 2018-2019 performance period, actual awards under the PBRSU Program could range from 0% to 340% of the target awards. Based on the Company’s financial performance during the 2018-2019 performance period, the actual PBRSU awards were 86% of target and our NEOs received the following awards:

Total Payout % |

× | Target Shares Awarded |

= | Total Shares Earned (subject to additional vesting periods) |

| Name | Percentage of Target |

Target Shares |

Shares Awarded for 2018-2019 Performance Cycle |

Vesting Schedule | ||||

| Mr. Schenkel | 86% | 108,124 | 92,987 | 100% on March 15, 2021 | ||||

| Mr. Cring* | N/A | N/A | N/A | N/A | ||||

| Mr. Lee | 86% | 69,310 | 59,607 | 50% on March 15, 2020; 50% on March 15, 2021 | ||||

| Mr. Thompson** | N/A | N/A | N/A | N/A | ||||

| Ms. Yetto | 86% | 62,379 | 53,646 | 50% on March 15, 2020; 50% on March 15, 2021 | ||||

| Mr. Wenig*** | N/A | 231,114 | N/A | N/A | ||||

| * | Mr. Cring is not eligible for our PBRSU program due to his position as VP. |

| ** | Mr. Thompson was hired in July 2019 and therefore, did not participate in the 2018-2019 PBRSU cycle. |

| *** | In accordance with the terms of the Mr. Wenig’s Letter Agreement dated September 29, 2014, his 2018-2019 PBRSU award was deemed earned prior to his separation date assuming achievement of target performance during the 2018-2019 performance period, and as such 231,114 shares were made payable to him in a cash lump sum, using certain value assumptions. |

Mr. Cring is not eligible for the PBRSU program due to his position as a VP.

Time-Based RSUs

Each executive officer receives a portion of his or her annual equity award as a grant of RSUs that vest on a quarterly basis over a four-year period subject to continued employment. For newly hired executive officers, 25% of the initial grant of RSUs vest on the first anniversary of the date of grant and the remainder vest on the quarterly schedule. This vesting schedule is aligned with market practice and helps enable the Company to remain competitive in attracting talent.

31

2019 Annual Cash Incentive Awards (the eBay Incentive Plan)

Plan Design

The eBay Incentive Plan (“eIP”) is a broad-based short-term cash incentive plan. The Compensation Committee has set an annual performance period under the plan.

In the first quarter of the year, the Compensation Committee approves Company performance measures based on business criteria and target levels of performance. After the end of each year, the Compensation Committee approves the actual performance against the Company financial performance measures to determine the payout percentage for that portion of the annual cash incentive plan.

Performance Measures and Rationale

The following table provides information on the Company performance measures set in 2019 and rationale for their selection:

|

Performance Measures(1) |

Rationale |

Target | ||

|

Company financial performance measure |

||||

|

FX-neutral revenue (threshold) |

The Compensation Committee believes that a minimum revenue threshold should be met before any cash incentive is paid. Once the minimum revenue threshold has been met, the Company financial performance component of the annual cash incentive payment is paid based on results in relation to the non-GAAP net income goal. |

Targets are set based primarily on the Company’s Board-approved budget for the year. | ||

|

Non-GAAP net income(2) |

Non-GAAP net income is the key measure of short- and intermediate-term results for the Company given that it can be directly affected by the decisions of the Company’s management and provides the most widely followed measure of financial performance. |

Targets are set based primarily on the Company’s Board-approved budget for the year. | ||

|

Individual measure |

||||

|

Individual performance |

The Compensation Committee believes that a portion of the compensation payable under this plan should be differentiated based on individual performance for which a review is conducted at the end of the year. |

●CEO’s assessment of the individual performance of the executive officers who are his direct reports.

●In making its determination of the individual performance of each executive officer, the Compensation Committee does not give any specific weighting to individual goals.

●A downward modifier to individual performance is applied if the Company fails to achieve target performance, regardless of individual goal achievement. | ||

| (1) |

Both minimum FX-neutral revenue and minimum non-GAAP net income performance thresholds must be met in order for there to be any incentive payout based on Company performance or individual performance, with the payout level for Company financial performance component based on the amount of non-GAAP net income. |

| (2) |

Non-GAAP net income excludes certain items, primarily stock-based compensation expense and related employer payroll taxes, amortization or impairment of acquired intangible assets, impairment of goodwill, amortization of the deferred tax asset associated with the realignment of the Company’s legal structure and related foreign exchange effects, significant gains or losses and transaction expenses from the acquisition or disposal of a business and certain gains or losses on investments. Non-GAAP net income is calculated quarterly, is publicly disclosed as part of our quarterly earnings releases, and is a basis of third-party analysts’ estimates of the Company’s results. |

32

Calculation Mechanics

The plan is designed to support a tight link between Company performance and any incentive payouts. The annual cash incentives payable for 2019 had both a FX-neutral revenue threshold and a non-GAAP net income minimum performance threshold. Unless both of these minimum performance thresholds are met, there is no incentive payout. If both minimum performance thresholds are met, the Company uses total non-GAAP net income to determine the payout percentage of the Company financial performance component of the annual cash incentive.

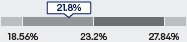

The following table shows the threshold, target, and maximum payout percentage for non-GAAP net income:

| Threshold | Target | Maximum | ||||

|

Non-GAAP net income |

| |||||

Additionally, if the minimum performance thresholds are met, 75% of executive officers’ payouts under the plan are based on the Company’s performance as described above. To facilitate differentiation based on individual performance, the remaining 25% of awards are generally based on individual performance. As discussed in more detail below, the Compensation Committee considers many factors in determining the CEO’s individual performance, but does not assign specific weighting to these factors. The CEO partners with the Compensation Committee to similarly assess the individual performance of the other executive officers. Consistent with our commitment to aligning executive compensation with Company performance, in circumstances (such as 2018) where the Company’s financial performance is above its minimum performance threshold and below the target performance threshold, a modifier is applied to the individual performance component to reduce it proportionately based on the Company financial performance component.

In 2019, the FX-neutral revenue threshold and a non-GAAP net income minimum performance threshold were met. The non-GAAP net income exceed target performance resulting in a payout of 122%.