7 Things To Know About Today’s BTU 09.10.15 Glenn Kellow President and Chief Executive Officer Peabody Energy

Certain statements in this presentation are forward-looking as defined in the Private Securities Litigation Reform Act of 1995. The company uses words such as “anticipate,” “believe,” “expect,” “may,” “forecast,” “project,” “should,” “estimate,” “plan,” “outlook,” “target,” “likely,” “will,” “to be,” “provide,” or other similar words to identify forward-looking statements. These forward-looking statements are based on numerous assumptions that the company believes are reasonable, but they are open to a wide range of uncertainties and business risks that may cause actual results to differ materially from expectations as of Sept. 10, 2015. These factors are difficult to accurately predict and may be beyond the company’s control. The company does not undertake to update its forward- looking statements. Factors that could affect the company’s results include, but are not limited to: supply and demand for our coal products; price volatility and customer procurement practices, particularly in international seaborne products and in the company’s trading and brokerage businesses; impact of alternative energy sources, including natural gas and renewables; global steel demand and the downstream impact on metallurgical coal prices; impact of weather and natural disasters on demand and production; reductions and/or deferrals of purchases by major customers and ability to renew sales contracts; credit and performance risks associated with customers, suppliers, contract miners, co-shippers, and trading, banks and other financial counterparties; geologic, equipment, permitting, site access, operational risks and new technologies related to mining; transportation availability, performance and costs; availability, timing of delivery and costs of key supplies, capital equipment or commodities such as diesel fuel, steel, explosives and tires; impact of take-or-pay agreements for rail and port commitments for the delivery of coal; successful implementation of business strategies; negotiation of labor contracts, employee relations and workforce availability; changes in postretirement benefit and pension obligations and their related funding requirements; replacement and development of coal reserves; adequate liquidity, and the cost, availability, access to capital and financial markets; ability to appropriately secure our obligations for land reclamation, federal and state workers’ compensation, federal coal leases and other obligations related to the company’s operations, including its ability to remain eligible for self-bonding and/or successfully access the commercial surety market; effects of changes in interest rates and currency exchange rates (primarily the Australian dollar); effects of acquisitions or divestitures; economic strength and political stability of countries in which the company has operations or serves customers; legislation, regulations and court decisions or other government actions, including, but not limited to, new environmental and mine safety requirements; changes in income tax regulations, sales-related royalties, or other regulatory taxes and changes in derivative laws and regulations; litigation, including claims not yet asserted; terrorist attacks or security threats, including cybersecurity threats; impacts of pandemic illnesses; and other risks detailed in the company’s reports filed with the United States Securities and Exchange Commission (SEC). Adjusted EBITDA is defined as (loss) income from continuing operations before deducting net interest expense; income taxes; asset retirement obligation expenses; depreciation, depletion, and amortization; asset impairment and mine closure costs; charges for the settlement of claims and litigation related to previously divested operations; and changes in deferred tax asset valuation allowance and amortization of basis difference related to equity affiliates. Adjusted EBITDA, which is not calculated identically by all companies, is not a substitute for operating income, net income or cash flow as determined in accordance with United States GAAP. Management uses Adjusted EBITDA as the primary metric to measure segment operating performance and also believes it is useful to investors in comparing the company’s current results with those of prior and future periods and in evaluating the company’s operating performance without regard to its capital structure or the cost basis of its assets. 2 Statement on Forward-Looking Information

3 7 Things To Know About Today’s BTU New Management Team Unmatched Assets: Size, Scope and Market Access Operational Results Reveal Strong Underlying Business Key Value Drivers: PRB, ILB and Australia Safe, Responsible Mining Practices Long-Term Coal Demand Masked by Current Headwinds Financial Focus on Liquidity and Deleveraging 3 2 1 4 5 6 7 Peabody Energy Benefits From:

New Management Team

Areas of Management Emphasis - New CEO, CFO and CLO join a veteran team and highly productive workforce - Current leadership team combines 150+ years of related industry experience - Spans 6 continents - Nearly 60 years of BTU experience 5 Management Combines Traditional Strengths with New Perspectives Operational Excellence Lean Organization Portfolio Management Financial Strength

6 Management Team Committed to Moving with Speed, Focus and Purpose Glenn Kellow President & CEO Charles Meintjes Australia Kemal Williamson Americas Amy Schwetz CFO Verona Dorch CLO & Govt Affairs Andy Slentz HR & Admin Bryan Galli Marketing & Trading Chris Hagedorn Strategy & Development

Unmatched Assets: Size, Scope and Market Access Kayenta Mine

8 Source: Peabody Energy 2014 10-K filing. Peabody Holds Substantial Portfolio with Strong Option Value - 26 active operations in U.S. and Australia - 7.6 billion tons of coal reserves - 3 billion tons of unassigned reserves - 500,000 acres of surface property - Ownership interests in ports and generation - Assets offer geographic and product diversity Rawhide Mine

Operational Results Reveal Strong Underlying Business North Antelope Rochelle Mine

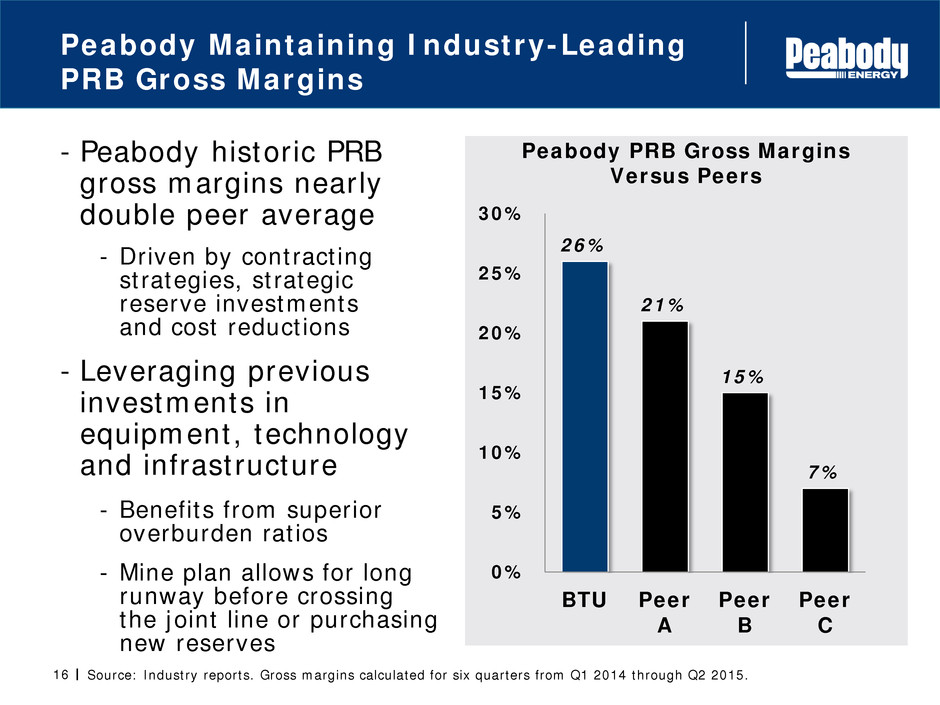

10 Source: Peabody Energy Q2 2015 Earnings Release. Revenue per ton, margin per ton and gross margin calculated for YTD 2015. Cost reductions exclude approximately $620 million of higher costs related to fuel and currency hedges. Strong Q2 Operating Margins Reflect Cost Reductions in All Regions - 4 out of 5 mining segments report strong margins even with lower volumes - Australian met coal margins reflect multi-year low in product price - Peabody operating costs significantly decline - $1.2 billion in cost reductions since beginning of 2012 *2015 YTD Revenue Per Ton Margin Per Ton Gross Margin Powder River Basin $13.58 $3.47 26% Midwestern U.S. $46.60 $13.14 28% Western U.S. $38.67 $11.29 29% Australian Thermal $42.37 $10.80 25% Australian Met $83.96 $1.72 2%

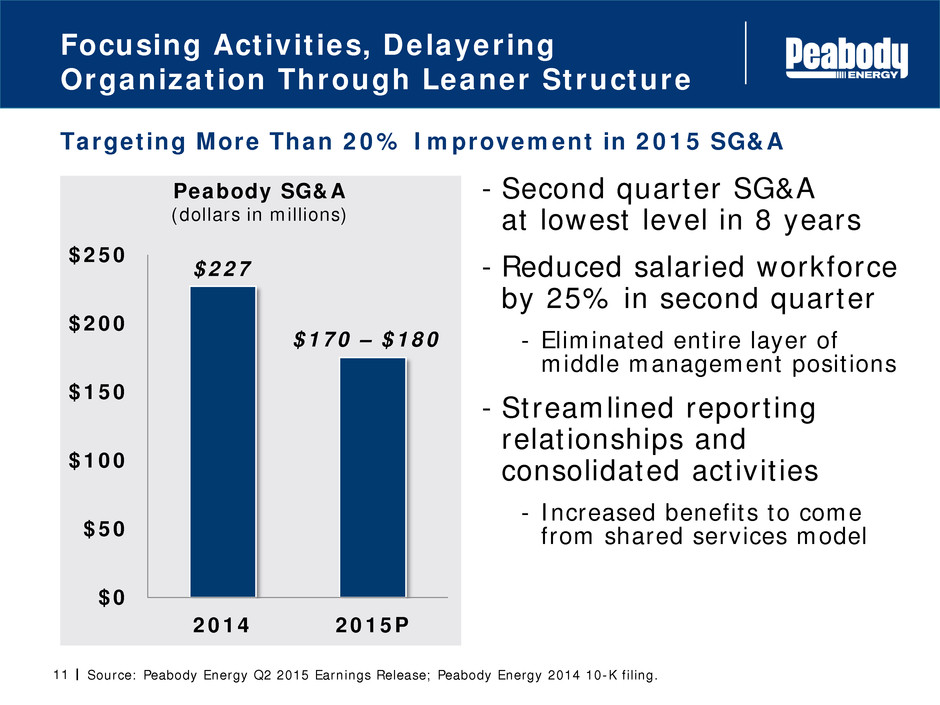

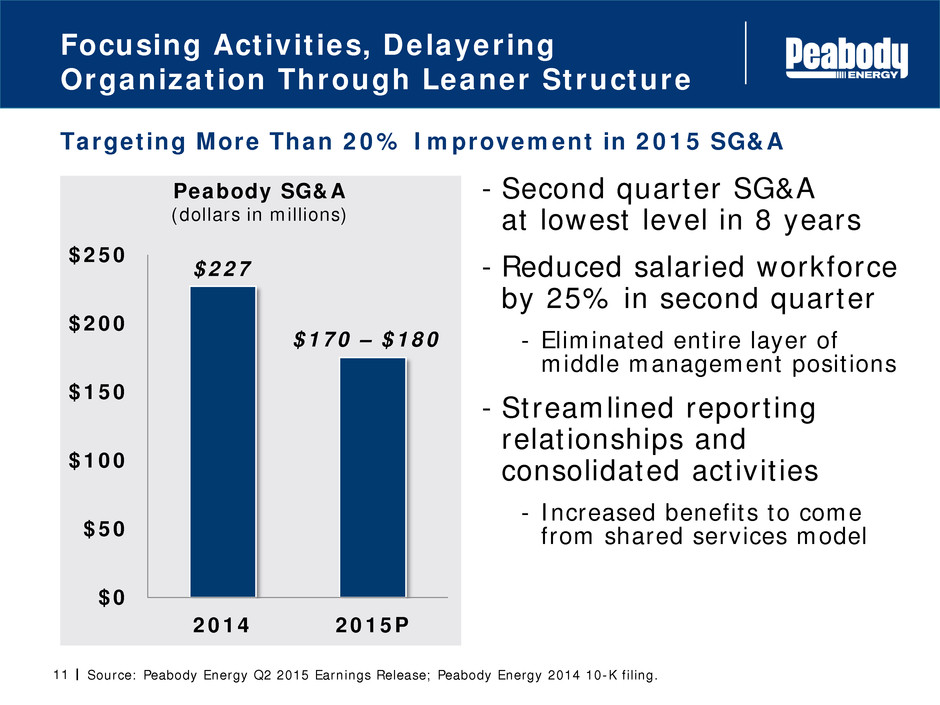

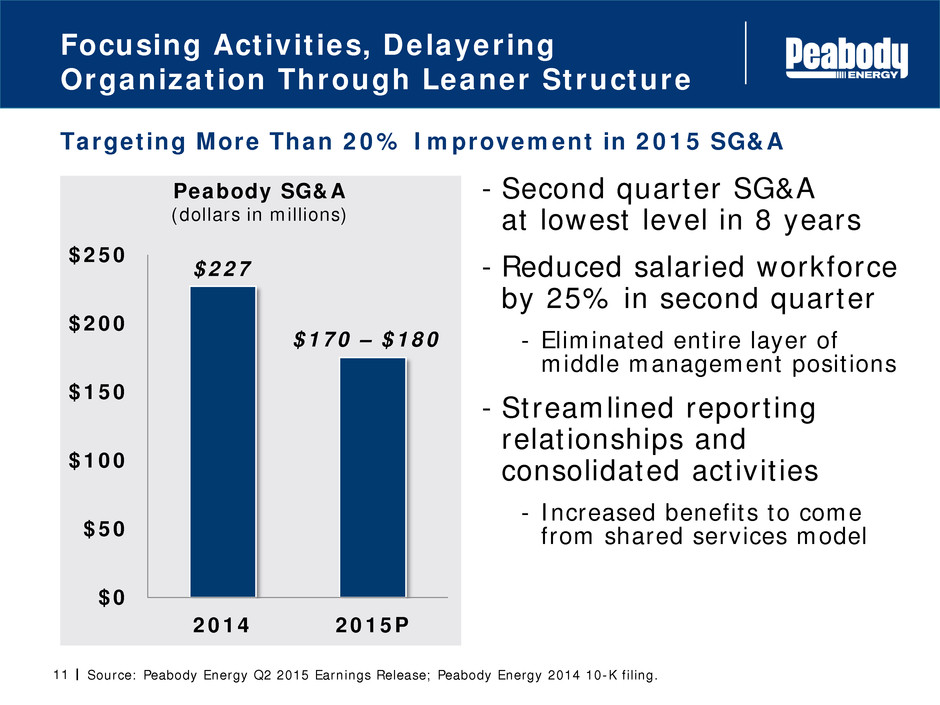

11 Targeting More Than 20% Improvement in 2015 SG&A Source: Peabody Energy Q2 2015 Earnings Release; Peabody Energy 2014 10-K filing. Peabody SG&A (dollars in millions) $227 $0 $50 $100 $150 $200 $250 2014 2015P Focusing Activities, Delayering Organization Through Leaner Structure - Second quarter SG&A at lowest level in 8 years - Reduced salaried workforce by 25% in second quarter - Eliminated entire layer of middle management positions - Streamlined reporting relationships and consolidated activities - Increased benefits to come from shared services model $170 – $180

12 Potential lower costs based on forward prices as of June 30, 2015. Quarterly Hedge Losses ($ in millions) Peabody Projects Over $300 Million Benefit as Legacy Hedges Roll Off $- $10 $20 $30 $40 $50 $60 $70 $80 Currency Fuel - Hedging losses in second quarter totaled $106 million, primarily related to Australian dollar - Peabody has reduced currency hedging program duration - No additional currency hedges layered on in over one year; No hedges in 2018 - $0.05 reduction in A$ would result in $27 million in Adj. EBITDA benefit in second half; $69 million benefit in 2016 2016P 2017P

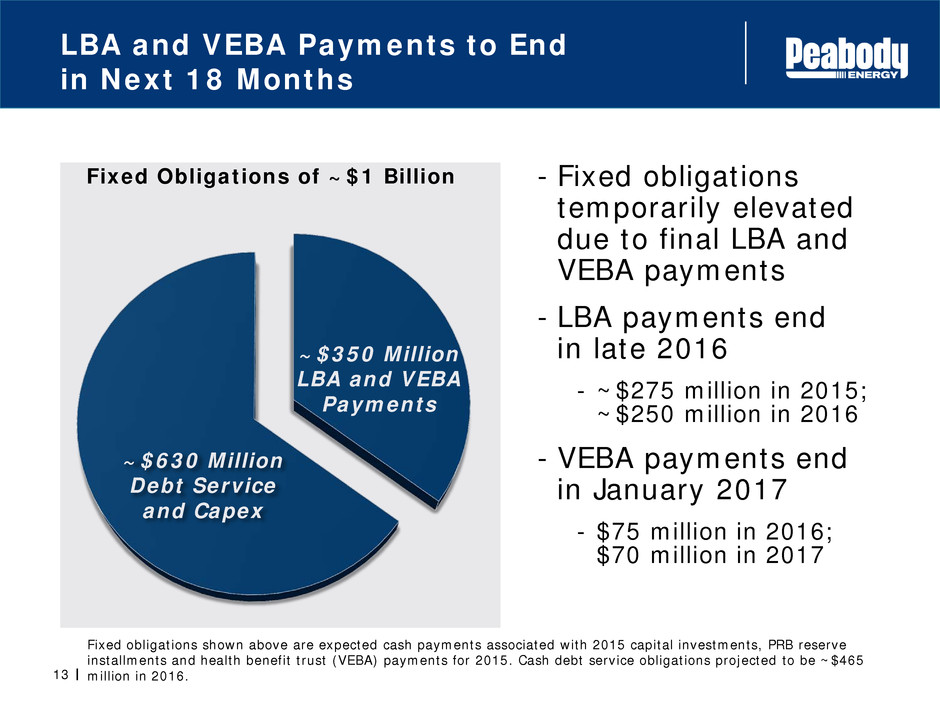

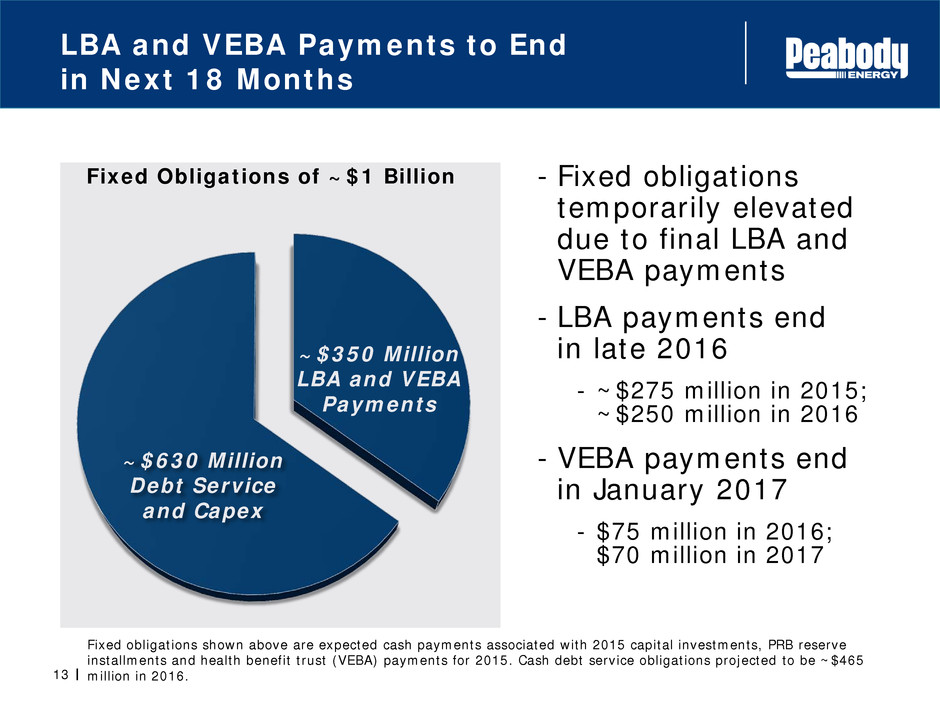

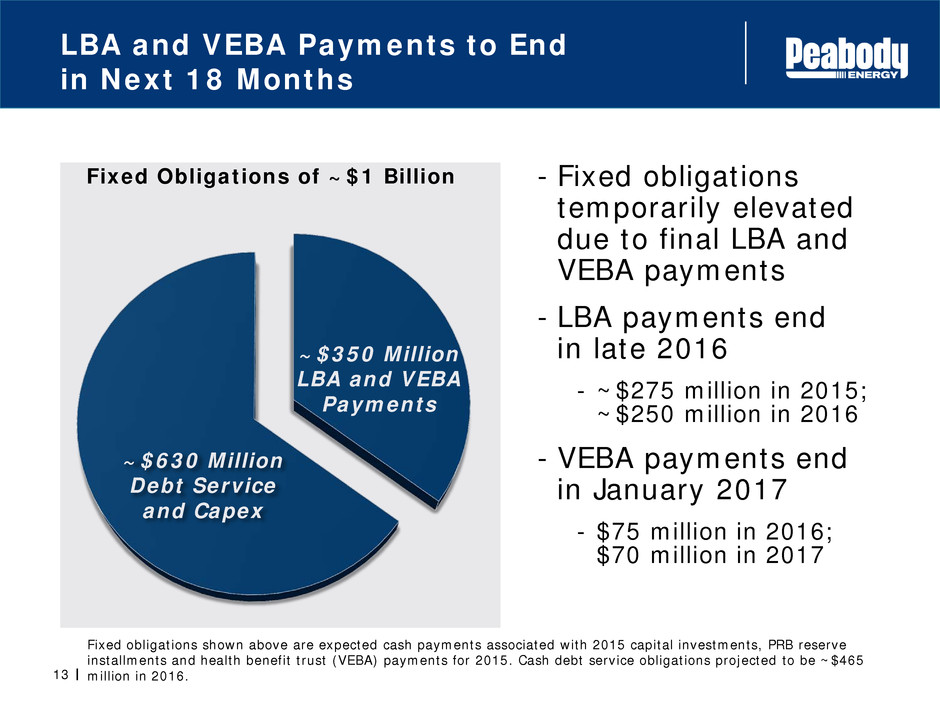

13 Fixed obligations shown above are expected cash payments associated with 2015 capital investments, PRB reserve installments and health benefit trust (VEBA) payments for 2015. Cash debt service obligations projected to be ~$465 million in 2016. Fixed Obligations of ~$1 Billion LBA and VEBA Payments to End in Next 18 Months ~$350 Million LBA and VEBA Payments ~$630 Million Debt Service and Capex - Fixed obligations temporarily elevated due to final LBA and VEBA payments - LBA payments end in late 2016 - ~$275 million in 2015; ~$250 million in 2016 - VEBA payments end in January 2017 - $75 million in 2016; $70 million in 2017

Key Value Drivers: PRB, ILB and Australia El Segundo Mine

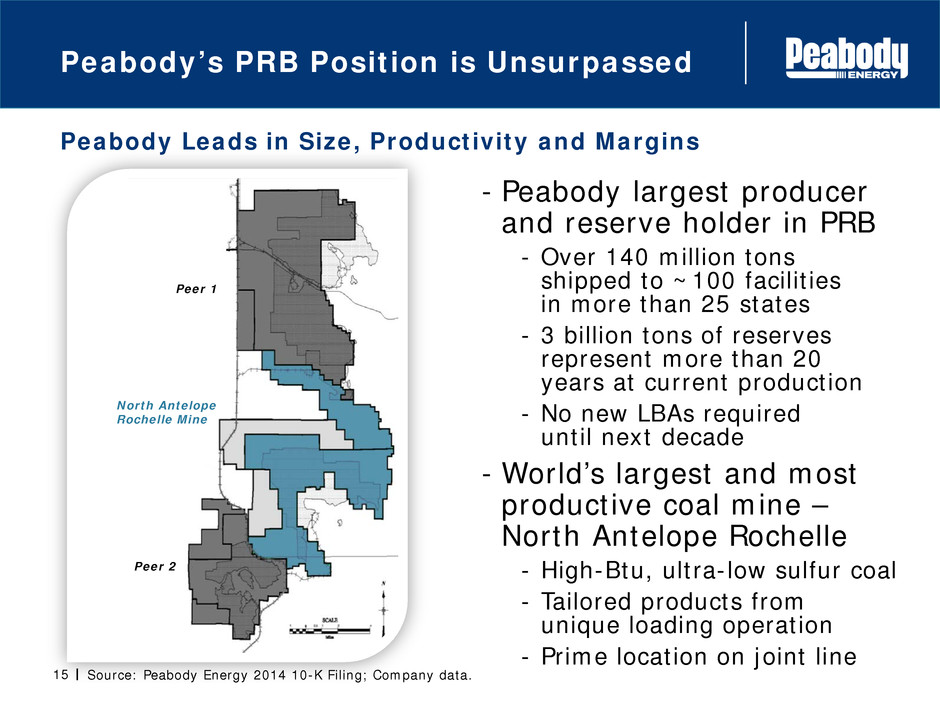

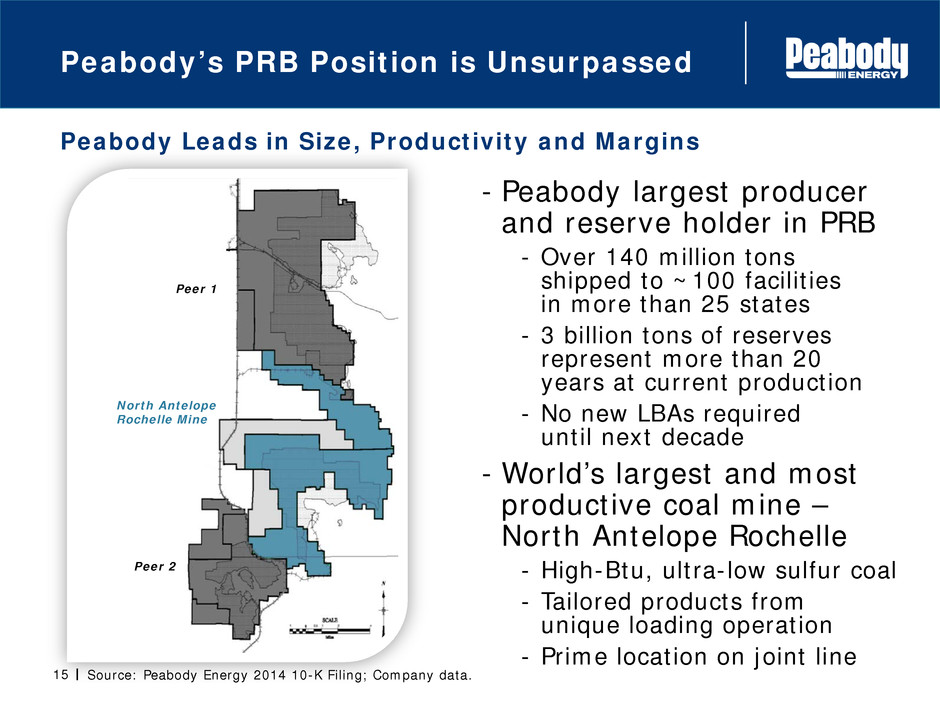

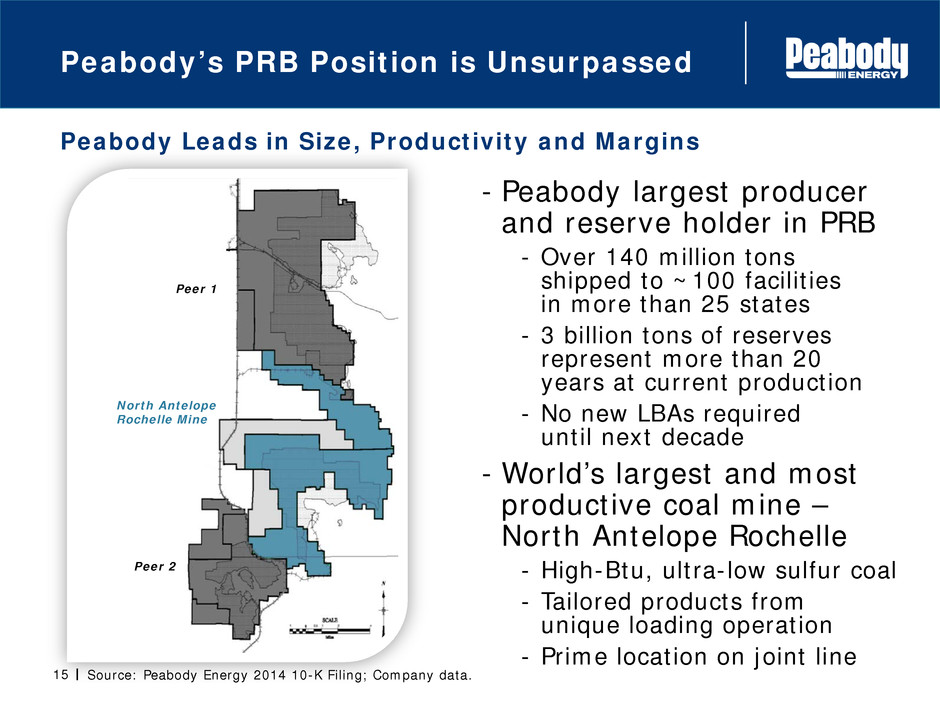

15 Peabody Leads in Size, Productivity and Margins Source: Peabody Energy 2014 10-K Filing; Company data. Peabody’s PRB Position is Unsurpassed - Peabody largest producer and reserve holder in PRB - Over 140 million tons shipped to ~100 facilities in more than 25 states - 3 billion tons of reserves represent more than 20 years at current production - No new LBAs required until next decade - World’s largest and most productive coal mine – North Antelope Rochelle - High-Btu, ultra-low sulfur coal - Tailored products from unique loading operation - Prime location on joint line North Antelope Rochelle Mine Peer 1 Peer 2

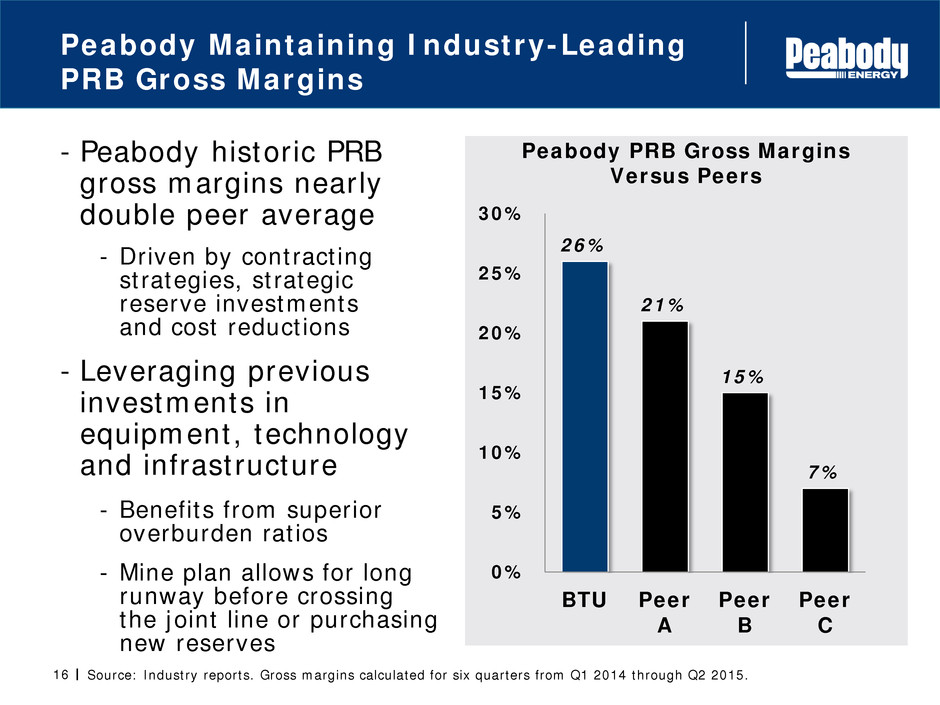

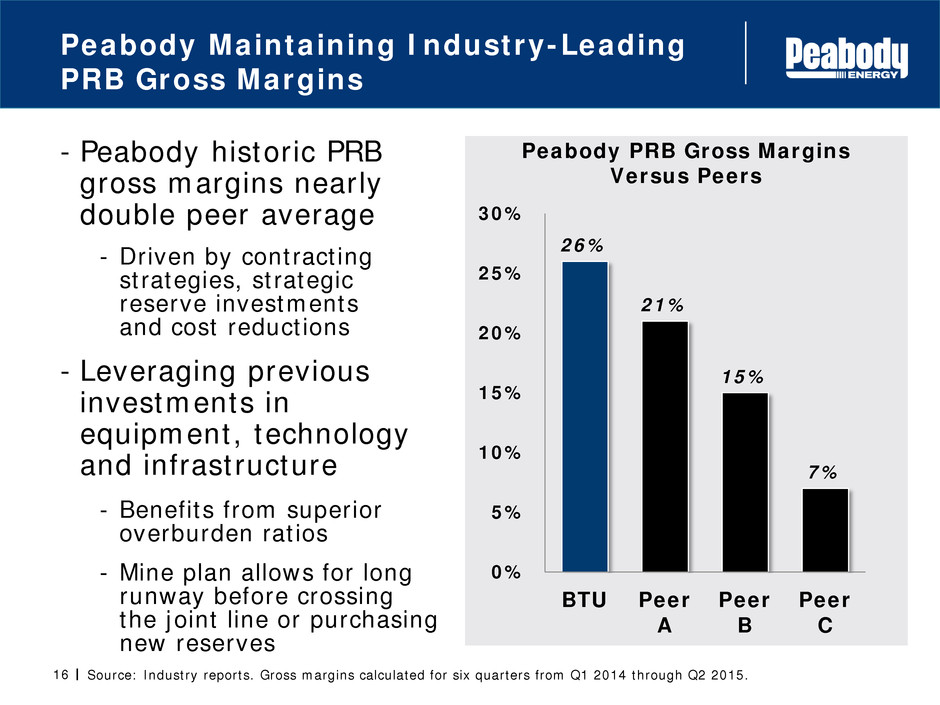

Peabody PRB Gross Margins Versus Peers 26% 21% 15% 7% 0% 5% 10% 15% 20% 25% 30% BTU Peer A Peer B Peer C 16 Source: Industry reports. Gross margins calculated for six quarters from Q1 2014 through Q2 2015. - Peabody historic PRB gross margins nearly double peer average - Driven by contracting strategies, strategic reserve investments and cost reductions - Leveraging previous investments in equipment, technology and infrastructure - Benefits from superior overburden ratios - Mine plan allows for long runway before crossing the joint line or purchasing new reserves Peabody Maintaining Industry-Leading PRB Gross Margins

17 Source: Peabody Energy 2014 10-K Filing. Illinois Basin Portfolio Well Positioned: Anchored by Key Mines - Operations strategically located to serve local customer base - 25 million tons shipped in 2014 - Major emphasis on Indiana sub-region - Bear Run Mine largest surface mine in Eastern U.S. - Produces 8+ million tons per year - New Gateway North Mine extends life of one of lowest cost operations in region Operations Well Capitalized From Previous Investments Bear Run Mine

18 Peabody Australian Platform Offers Long-Term Strategic Advantage - Competitive advantage with mines close to ports; Near high-growth regions - Platform benefits from quality, location, lower AUD and costs - Among leading producers of seaborne metallurgical coal - Peabody is largest seaborne low-vol PCI supplier - World-class thermal operations competitive among peers North Goonyella Mine

19 Source: Peabody Energy Q2 2015 Earnings Release. Australian Thermal Coal Platform: Low Costs Heighten Competitiveness - Australian thermal costs decline 25% to less than $30 per ton in second quarter - Upper 20% margins even in low price environment - Low costs and strong margins anchored by Wilpinjong Mine - Among premier thermal assets in Australia - Low overburden ratios Wilpinjong Mine

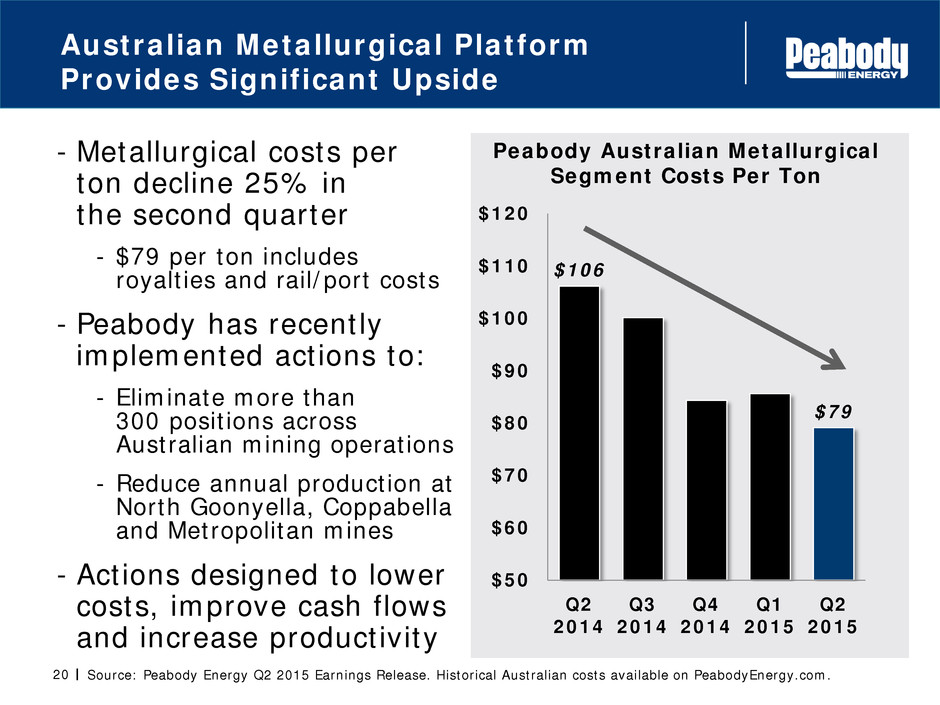

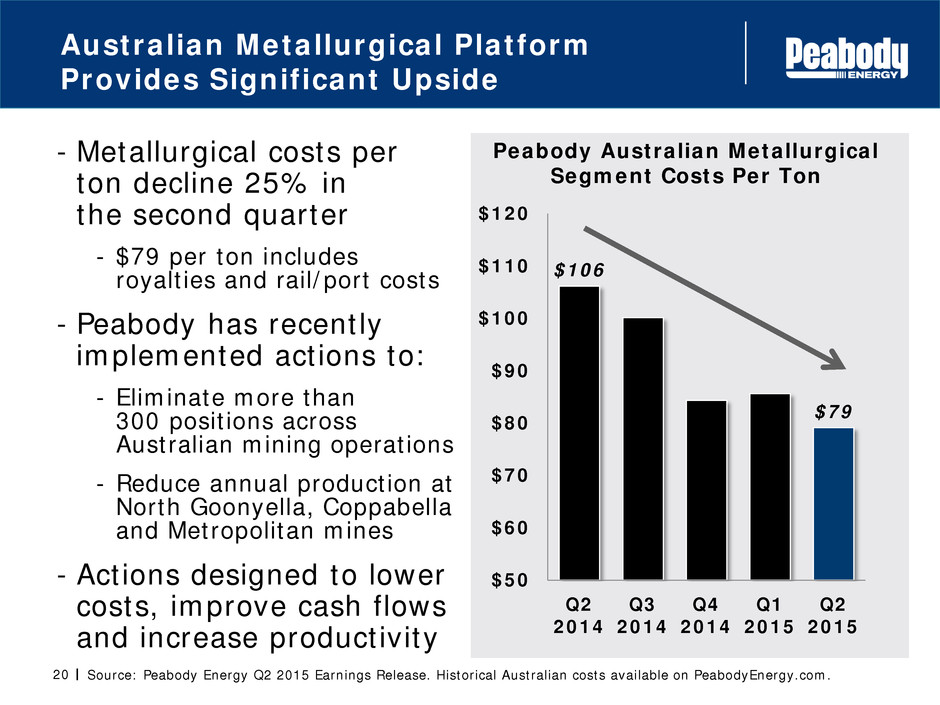

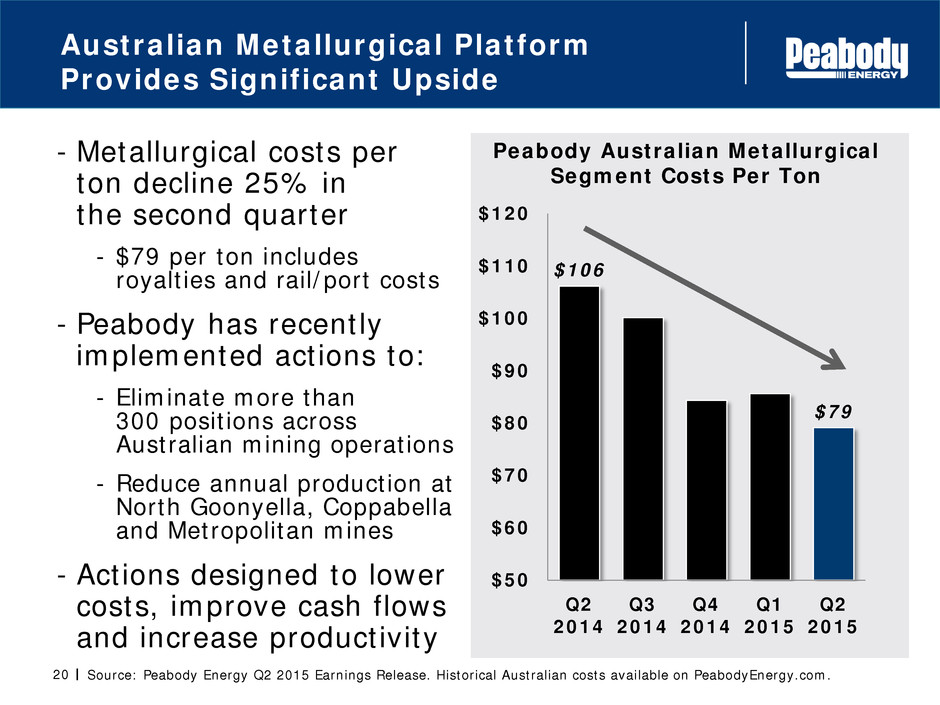

Peabody Australian Metallurgical Segment Costs Per Ton $106 $79 $50 $60 $70 $80 $90 $100 $110 $120 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 20 Source: Peabody Energy Q2 2015 Earnings Release. Historical Australian costs available on PeabodyEnergy.com. - Metallurgical costs per ton decline 25% in the second quarter - $79 per ton includes royalties and rail/port costs - Peabody has recently implemented actions to: - Eliminate more than 300 positions across Australian mining operations - Reduce annual production at North Goonyella, Coppabella and Metropolitan mines - Actions designed to lower costs, improve cash flows and increase productivity Australian Metallurgical Platform Provides Significant Upside

Safe, Responsible Mining Practices Caballo Mine

Multiple Honors: Safety, Environmental, Corporate Excellence 22 Peabody Strives for Best-In-Class Model Caballo Mine Excellence in Sustainable Mining Practices Increased Access to Low-Cost Electricity Continued Advancement of Clean Coal Technologies

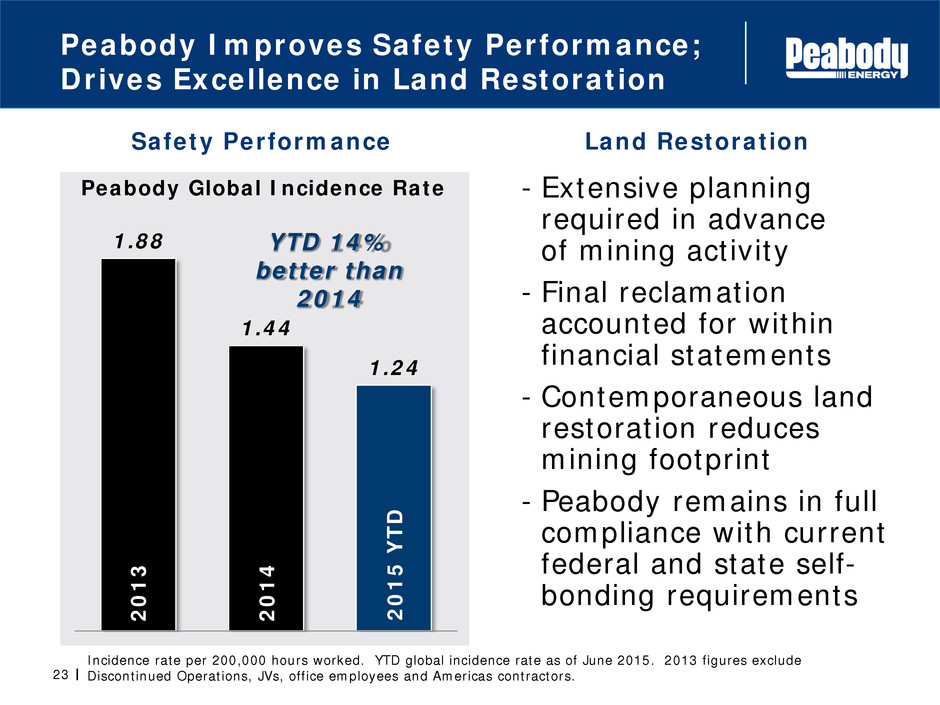

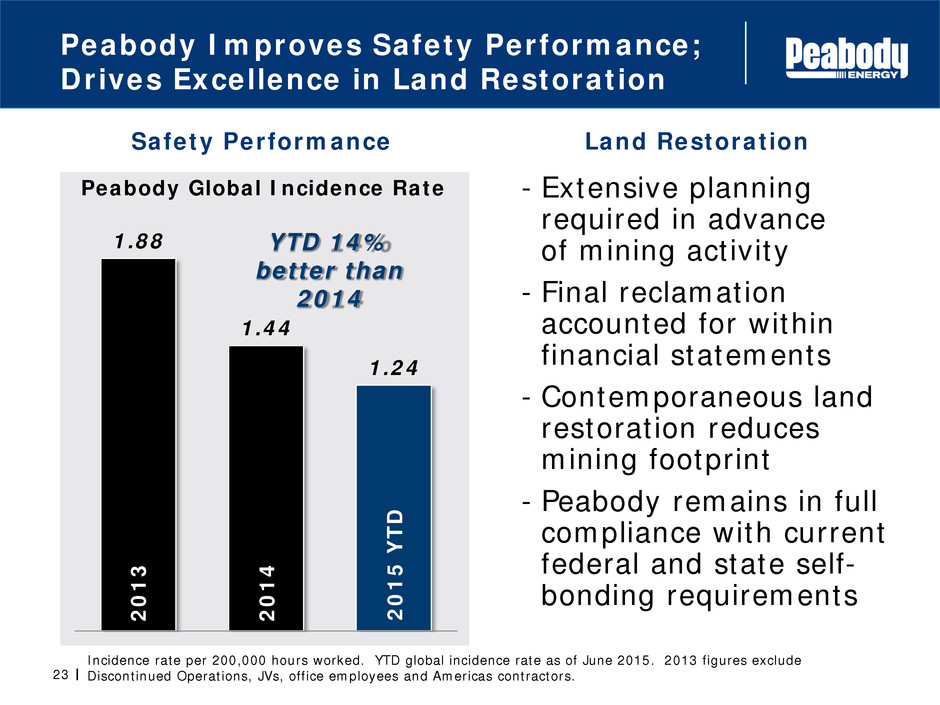

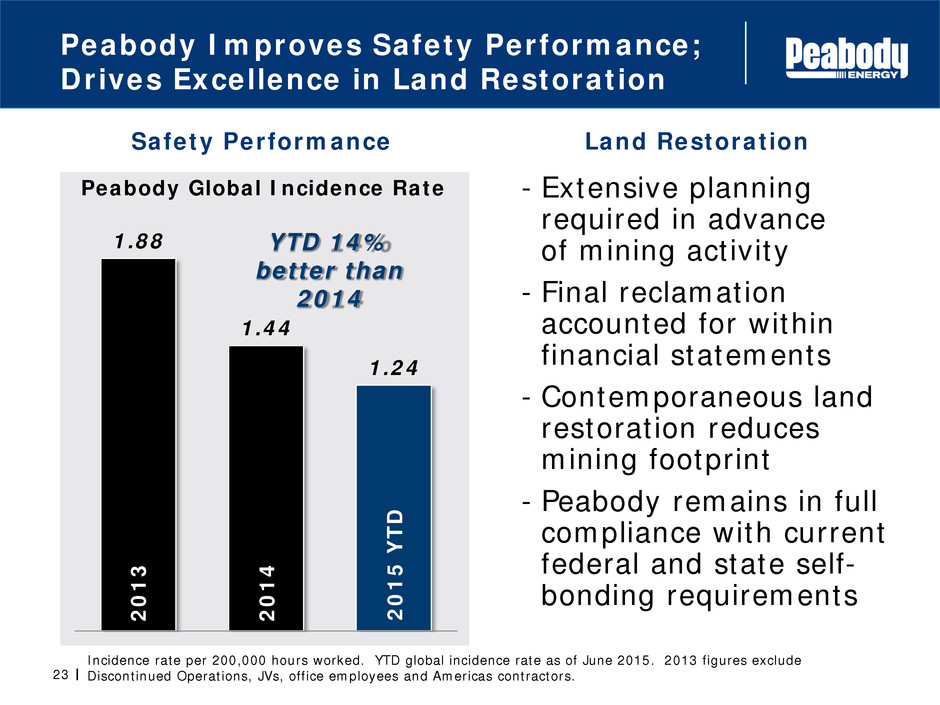

23 Safety Performance Incidence rate per 200,000 hours worked. YTD global incidence rate as of June 2015. 2013 figures exclude Discontinued Operations, JVs, office employees and Americas contractors. Peabody Global Incidence Rate 1.88 1.44 1.24 Peabody Improves Safety Performance; Drives Excellence in Land Restoration 2 0 1 3 2 0 1 4 2 0 1 5 Y T D - Extensive planning required in advance of mining activity - Final reclamation accounted for within financial statements - Contemporaneous land restoration reduces mining footprint - Peabody remains in full compliance with current federal and state self- bonding requirements YTD 14% better than 2014 Land Restoration

Long-Term Coal Demand Masked by Current Headwinds Jakarta

Current Headwinds… Catalysts for Improvement… 25 Source: Peabody Energy Global Analytics. Difficult Near-Term Global Coal Markets Expected to Improve Over Time - Seaborne coal prices fall on slower global GDP - Total seaborne coal demand declines as China reductions offset growth in rest of world - Reduced steel demand outpaces met coal cuts - China’s steel exports reduce need for met imports - Seaborne met supply expected to decline 15 million tons in 2015 - Urbanization and industrialization in Asia - India, SE Asia demand for steel and electricity projected to increase seaborne coal demand - Stabilization of China’s economy and property market as country works through oversupply - Lack of investment, acceleration of production cutbacks taking hold

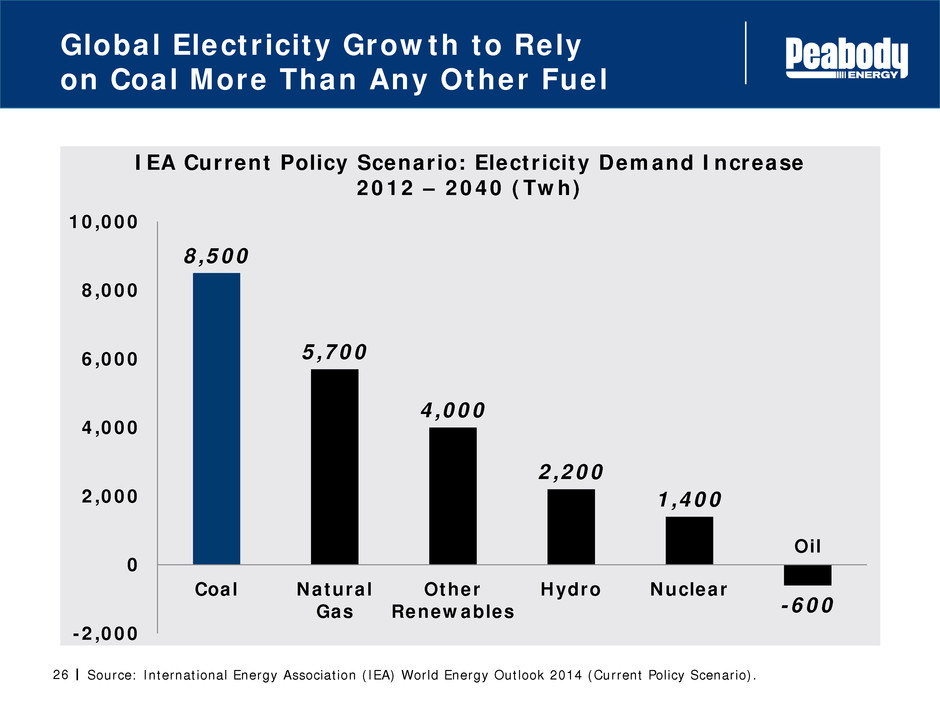

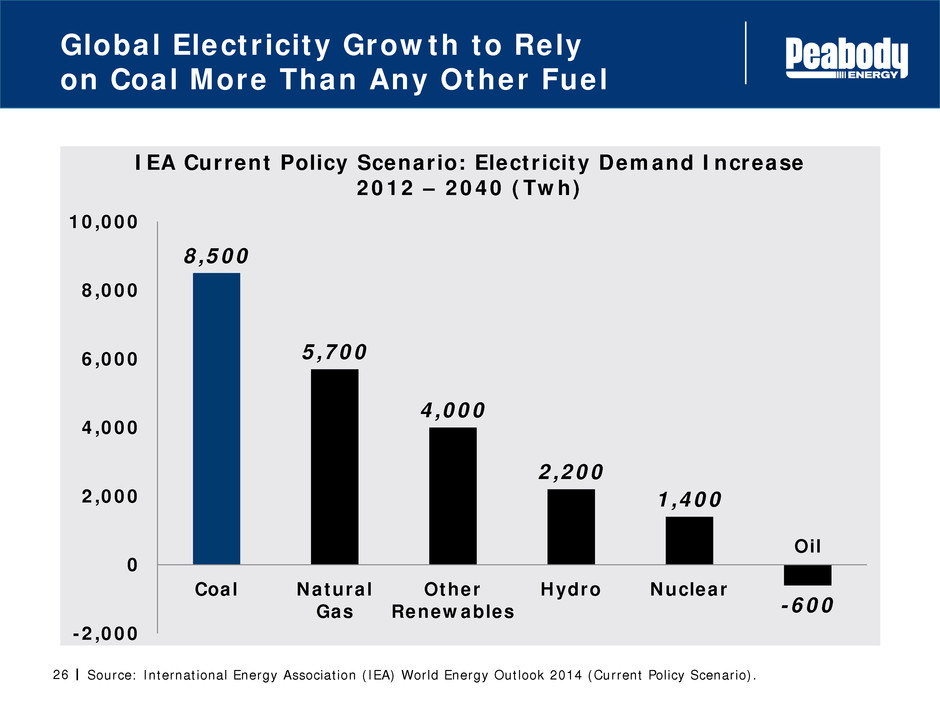

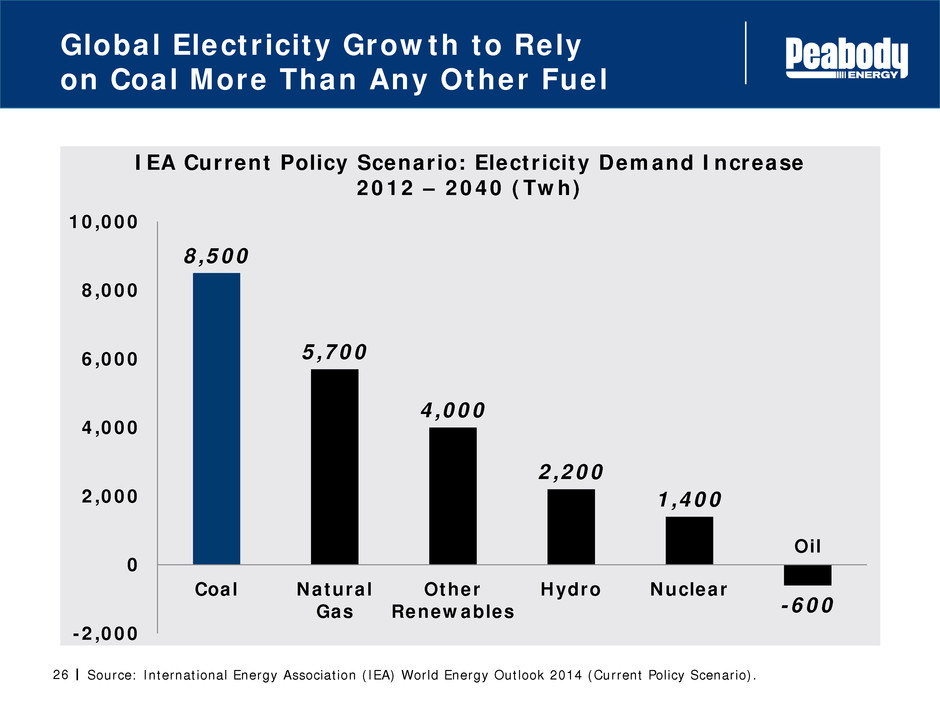

26 Source: International Energy Association (IEA) World Energy Outlook 2014 (Current Policy Scenario). IEA Current Policy Scenario: Electricity Demand Increase 2012 – 2040 (Twh) 8,500 5,700 4,000 2,200 1,400 -600 -2,000 0 2,000 4,000 6,000 8,000 10,000 Coal Natural Gas Other Renewables Hydro Nuclear Global Electricity Growth to Rely on Coal More Than Any Other Fuel Oil

Expected 2015 U.S. Electricity Generation 35% 31% 21% 13% 0% 5% 10% 15% 20% 25% 30% 35% 40% 27 Peabody Global Analytics. YTD coal use and shipments based on August 2015 estimates. - 2015 U.S. coal use likely to decline 90 – 100 million tons - Production curtailments accelerating; Shipments down 8% YTD - Down 3% in PRB, down 10% outside of PRB - SPRB most competitive against natural gas - $2.50 – $2.75/mmBtu U.S. Coal Demand Declining in 2015 Largely Due to Lower Natural Gas Prices C o a l N a tu ra l G a s N u cl e a r O th e r

28 PRB/ILB Expected to Overcome 2015 Declines by 2017 Source: Peabody Energy Global Analytics. U.S. Coal Demand (tons in millions) U.S. Projections Expected to Reflect a Tale of Two Regions 0 100 200 300 400 500 2014 2015P 2017P S R P B / IL B O th e r R e g io n s - Demand for PRB and ILB coal expected to increase 35 – 50 million tons from 2015 to 2017 - Regions retain fundamental delivered cost advantage over other U.S. basins - Increase based on higher capacity utilization of remaining plants - On average, other U.S. regions expected to remain largely stable from 2015 levels

- EPA overreach rejected by U.S. Supreme Court in MATS ruling - Congress, governors, legislatures, business and consumer groups advance opposition to carbon regulations - Peabody supports advanced coal technology as path to achieve environmental goals 29 MATS refers to U.S. EPA Mercury and Air Toxics Standards. EPA Carbon Regulations Face Significant Early Opposition by Multiple Groups Regulations Challenged on Legal, Policy and Practical Grounds

Financial Focus on Liquidity and Deleveraging Rawhide Mine

31 Peabody Focused on Maximizing Near-Term Liquidity and Deleveraging - Continue to focus on liquidity needs in light of ongoing business requirements and potential collateral obligations - No significant debt maturities until 2018 - Peabody targeting deleveraging through potential avenues including: - Proceeds from asset sales - Reduced cash outlays - Lower costs/capital - Improving coal markets - Debt buybacks/exchanges Source: Peabody Energy June 30, 2015 10-Q filing.

- Peabody’s asset base located in low-cost U.S. basins and higher-demand Australian region - Leading PRB operations with lowest cost and highest margins - Dramatic cost improvements across Australian operations - 4 of 5 segments with gross margins above 25% - BTU continues to pursue multiple avenues for success - Implementing multiple operational and SG&A improvements - Aggressively targeting additional asset sales - Focus on maximizing near-term liquidity and deleveraging - Major fixed charges and hedge losses roll off in coming years - Actions designed to preserve and enhance long-term value 32 Building a Stronger BTU: Targeting Multiple Improvements North Antelope Rochelle Mine

PeabodyEnergy.com AdvancedEnergyForLife.com

34 Appendix: 2015 Guidance Sales Volumes (in million tons) U.S. Australia Trading & Brokerage Total 180 – 190 34 – 36 11 – 19 225 – 245 U.S. Operations Revenue Per Ton Costs Per Ton $19.95 – $20.40 $14.65 – $15.00 Australia Operations Metallurgical Coal Sales Export Thermal Coal Sales Domestic Thermal Coal Sales Costs Per Ton 14 – 15 million tons 12 – 13 million tons 8 million tons $53 – $56 Selling & Administrative Expenses $170 – $180 million Depreciation, Depletion and Amortization $580 – $620 million Capital Expenditures $160 – $170 million Notes: Peabody classifies its Australian mines with the Australian Metallurgical or Thermal Mining segments based on the primary customer base and reserve type. A small portion of the coal mined by the Australian Metallurgical Mining segment is of a thermal grade and vice versa. Also, Peabody may market some of its metallurgical coal products as a thermal product from time to time depending on market conditions.

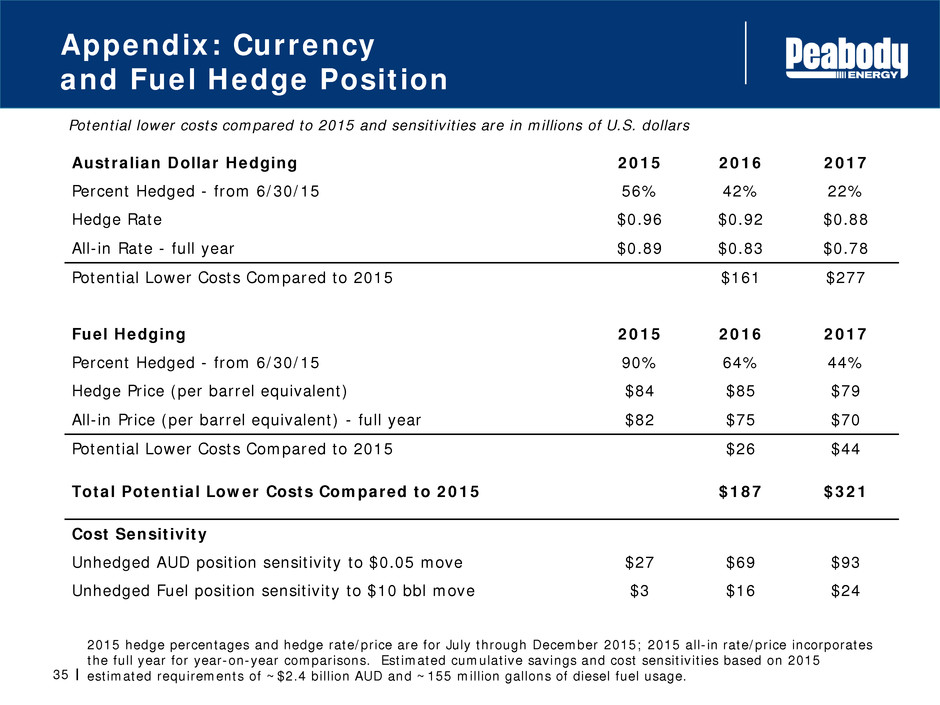

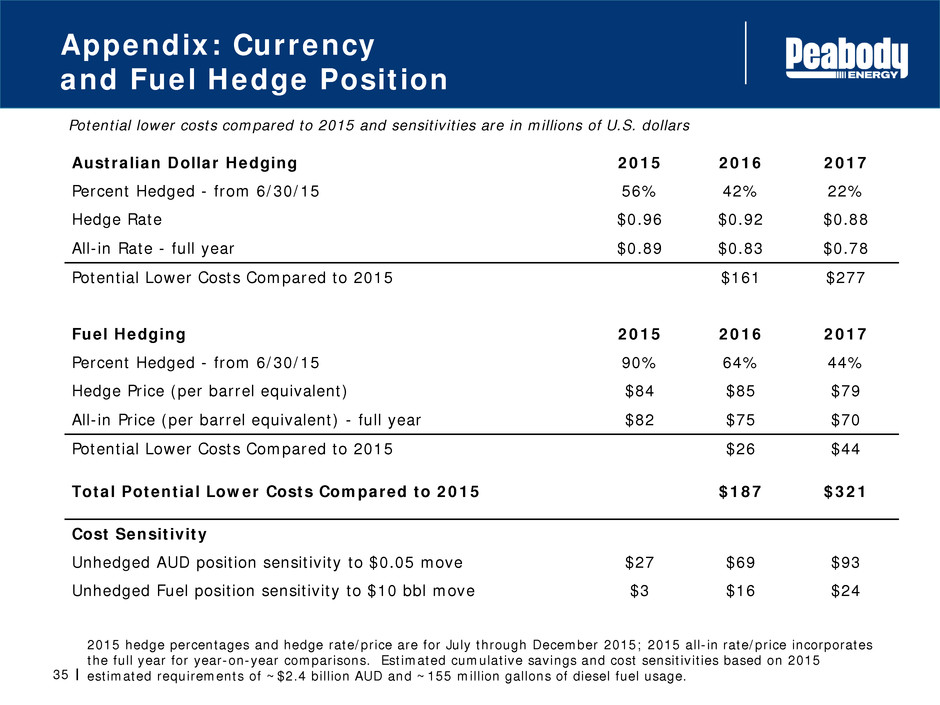

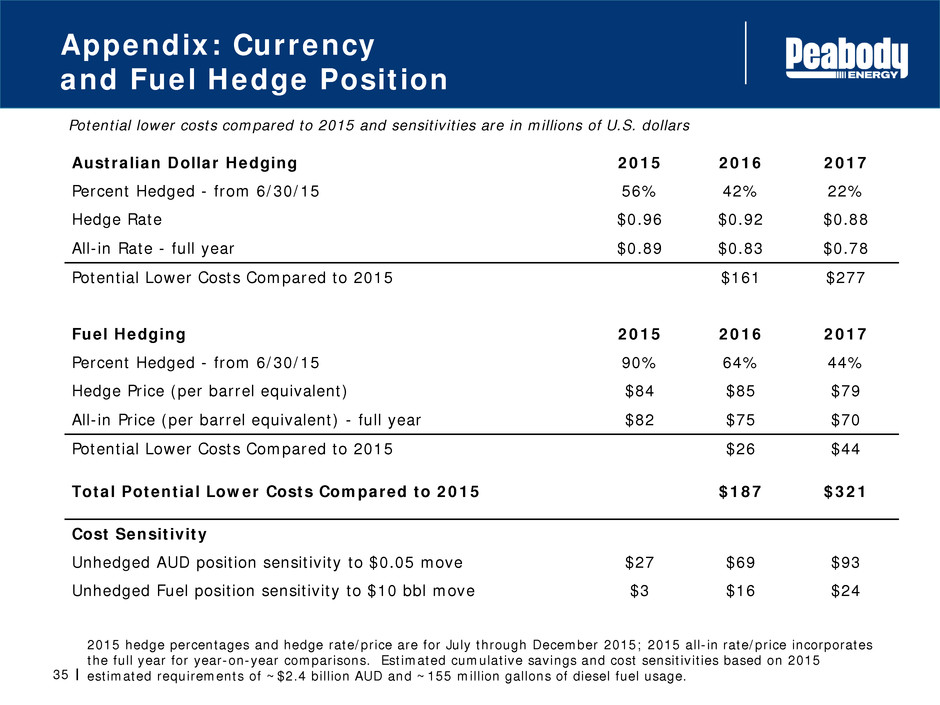

35 Appendix: Currency and Fuel Hedge Position To Be Updated Australian Dollar Hedging 2015 2016 2017 Percent Hedged - from 6/30/15 56% 42% 22% Hedge Rate $0.96 $0.92 $0.88 All-in Rate - full year $0.89 $0.83 $0.78 Potential Lower Costs Compared to 2015 $161 $277 Fuel Hedging 2015 2016 2017 Percent Hedged - from 6/30/15 90% 64% 44% Hedge Price (per barrel equivalent) $84 $85 $79 All-in Price (per barrel equivalent) - full year $82 $75 $70 Potential Lower Costs Compared to 2015 $26 $44 Total Potential Lower Costs Compared to 2015 $187 $321 Cost Sensitivity Unhedged AUD position sensitivity to $0.05 move $27 $69 $93 Unhedged Fuel position sensitivity to $10 bbl move $3 $16 $24 2015 hedge percentages and hedge rate/price are for July through December 2015; 2015 all-in rate/price incorporates the full year for year-on-year comparisons. Estimated cumulative savings and cost sensitivities based on 2015 estimated requirements of ~$2.4 billion AUD and ~155 million gallons of diesel fuel usage. Potential lower costs compared to 2015 and sensitivities are in millions of U.S. dollars