Exhibit (p)(ii)

Code of Ethics

Effective March 31, 2022

| Information Classification: General | 1 |

Table of Contents

| Overview |

3 | |||

| Covered Person Classifications |

4 | |||

| Code of Ethics Rule Summary |

5 | |||

| Statement of General Fiduciary Principles |

6 | |||

| Related Policies and Procedures |

6 | |||

| General Requirements |

7 | |||

| Personal Trading Requirements – Accounts and Holdings |

8 | |||

| Reportable Accounts Guide |

10 | |||

| Personal Trading Requirements – Transactions |

12 | |||

| Exempted Transactions |

15 | |||

| Pre-Clearance |

16 | |||

| Personal Trading Requirements – Pre-Clearance |

16 | |||

| Administration and Enforcement of the Code of Ethics |

20 | |||

| Appendices | ||||

| Appendix A – Terms and Definitions |

21 | |||

| Appendix B – Beneficial Ownership of Accounts and Securities |

23 | |||

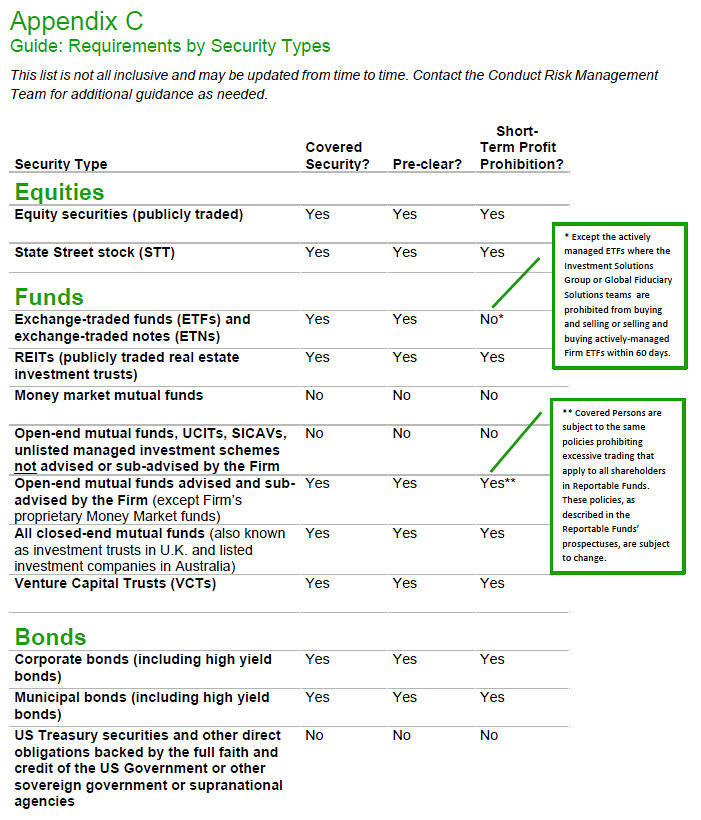

| Appendix C – Guide: Requirements by Security Types |

25 | |||

| Appendix D – Country Specific Requirements |

27 | |||

| Appendix E – Contacts |

32 | |||

| Appendix F – Code of Ethics Reporting Requirements |

33 | |||

| Appendix G – Code of Ethics FAQs |

34 | |||

| Information Classification: General | 2 |

The Purpose of this Code of Ethics

State Street Global Advisors+ (the “Firm”) will not tolerate misuse of information made available to us for the purpose of making investment decisions or providing advice to our clients. To do so would be a breach of trust that our clients place in us and may also breach securities laws.

What is the Code of Ethics?

The State Street Global Advisors Code of Ethics (the “Code”) is designed to promote compliance with regulations that apply to our business and to ensure Firm personnel meet expected standards of conduct. The Code is supplemental to the State Street Standard of Conduct, and Firm personnel are required to comply with both.

In certain countries outside the US, local laws, regulations or customs may impose additional requirements. Personnel located in countries outside the US must also refer to Appendix D for information on those additional requirements.

The Conduct Risk Management Team administers this Code in coordination with State Street Global Advisors’ Chief Compliance Officer (“CCO”).

|

Questions about the Code?

|

| Contact the Conduct Risk |

| Management Team: |

| ethics@statestreet.com

|

|

Definitions for some of the terms used in this Code of Ethics are provided in Appendix A. |

Who is subject to the Code of Ethics?

The Code of Ethics applies to you if:

| · | You are a full-time or part-time employee at State Street Global Advisors; |

| · | You are a contingent worker at State Street Global Advisors and have been notified that you are subject to the Code of Ethics; |

| · | You are an officer of the registered investment companies managed* by SSGA Funds Management, Inc. (“SSGA FM”) who is not employed by the Firm, but is employed by another business unit with access to Firm data such as non-public information regarding any client’s purchase or sale of securities, non-public information regarding any client’s portfolio holdings, or non-public securities recommendations made to clients; or |

| · | The Conduct Risk Management Team has designated you as a person subject to the Code of Ethics. |

For the purposes of the remainder of this document, those personnel who are subject the Code of Ethics will be called “Covered Persons”.

Your family members may also be subject to the Code of Ethics.

If you are a Covered Person, the requirements of this Code also apply to people related to you, such as spouses, domestic partners, minor children, financial dependents, including adult children and other relatives living in your household if they are financially dependent on you, as well as other persons designated as Covered Persons by the CCO or the Conduct Risk Management Team, or their designee(s).

+ For purposes of this Code of Ethics, “State Street Global Advisors” refers to all State Street Global Advisors legal entities globally.

*This excludes registered investment companies for which SSGA FM serves as sub-adviser.

| 3 |

Covered Person Classifications

As a Covered Person, you are either an Access Person, Investment Person, or Non-Access Person. Your classification is determined by your access to information. The Conduct Risk Management Team will notify you of your classification. Your classification may change as your responsibilities and access to information change. It is your responsibility to notify the Conduct Risk Management Team if your role or level of access to information changes.

Access Person Access Persons are those Covered Persons who:

| · | as part of their regular functions or duties have access to non-public information about a client’s holdings, or a client’s previous securities transactions; have access to non-public information about Firm portfolio holdings; or manage or are managed by employees who execute these functions; |

| · | are officers of the funds; or |

| · | have been designated as Access Persons by the Firm’s CCO or the Conduct Risk Management Team. |

Investment Person Investment Persons are Covered Persons who are involved in or have access to the investment decision-making process, or who have access to information regarding pending securities transactions, or decisions to buy or sell securities on behalf of clients. Investment Persons include those Covered Persons who:

| · | as part of their regular functions or duties, make investment recommendations or decisions on behalf of client portfolios; participate in making investment recommendations or decisions on behalf of client portfolios; are responsible for day-to-day management of a client or proprietary fund portfolio; have knowledge of or access to investment decisions under consideration for a client or proprietary fund portfolio; execute trades on behalf of |

client or proprietary fund portfolios; have access to information regarding pending trades; analyze and research securities on behalf of client or proprietary fund portfolios; have access to information regarding pending trade orders for any client or proprietary fund portfolio; have access to or knowledge of changes in investment recommendations; have access to mathematical models used by the Firm as basis for investment strategy for client or proprietary fund portfolios; or manage or are managed by employees who execute those functions; or

| · | other persons designated as Investment Persons by the Firm’s CCO or the Conduct Risk Management Team. |

Non-Access Persons are Covered Persons who are not categorized as Access Persons or Investment Persons.

| Examples of Investment Persons include, but are not limited to, portfolio managers, research analysts, IT and Operations professionals with certain systems access, and Investment Risk personnel. |

|

Unsure what classification applies to you?

|

| The Conduct Risk Management Team will notify you of your classification, which is based on your responsibilities and level of access to information at the Firm. |

| Dual employees may also be subject to the State Street Securities Trading policy and/or the Global Personal Investment Policy. |

| Contact the Conduct Risk Management Team at ethics@StateStreet.com if you have questions.

|

| Information Classification: General | 4 |

Code of Ethics Rule Summary

Refer to the list below to understand which rules apply to you based on your Covered Person Classification. Read the full text of the Code of Ethics to fully understand the requirements and prohibitions, as well as any exceptions to these rules.

| All Covered Persons |

Required

| • | Ensure compliance with the Code on the part of your spouse, domestic partner or other Covered Persons [p. 3] |

| • | Comply with applicable securities laws [p. 7] |

| • | Acknowledge the Code of Ethics when you become a Covered Person and annually thereafter [p. 7] |

| • | Report accounts and holdings when you become a Covered Person and annually thereafter [p. 8] |

| • | Report or confirm transactions quarterly [p. 12] |

| • | Maintain accounts at Approved Brokers if required in your region [p. 9] |

| • | Provide duplicate statements and confirmations to the Conduct Risk Management Team [p. 8] |

| • | Report any actual, attempted, or suspected violation of this policy as soon as you are aware of it [p. 7] |

| • | Obtain pre-approval from the Conduct Risk Management Team before participating in investment clubs [p. 13] |

| • | Contact the Conduct Risk Management Team for any exemption to this Code of Ethics [p. 20] |

| • | Understand if and how the State Street Securities Trading Policy applies to you [p. 15] |

Prohibited

| • | Do not misuse client or proprietary fund information, or State Street proprietary information for personal gain [p. 14] |

| • | Do not trade excessively [p. 13] |

| • | Do not sell securities short [p. 13] |

| • | Do not trade options or futures on Covered Securities or engage in spread-betting [p. 13] |

| Do not participate in Initial Public Offerings [p. 13] |

| Access Persons |

Required

| • | Follow all above rules for Covered Persons |

| • | Pre-Clear trades in Covered Securities [p. 16] |

Prohibited

| • | Do not sell or dispose of positions in Covered Securities for a profit that have been held for less than 60 days [p. 14] |

| Investment Persons |

Required

| • | Follow all the above rules for Covered Persons and for Access Persons |

Prohibited

| • | Do not personally trade Covered Securities when there is an open order on any trading desk for a client portfolio or fund for the same or similar security (Open Order Rule) [p. 17] |

| • | Do not personally trade Covered Securities within seven days (before or after) of a trade in the same or equivalent security in a client portfolio with which you are associated (Blackout Period) [p. 17] |

| • | Research Analysts: Do not personally trade Covered Securities in proximity to a recommendation you have made or to which you have access (Research Analyst Waiting Period) [p. 18]. This Rule applies regardless of the direction of trade, nature of recommendation, or amount traded. |

| Information Classification: General | 5 |

Statement of General Fiduciary Principles

State Street Global Advisors, its subsidiaries and affiliates, and the officers of the Funds owe a fiduciary duty to their advisory clients (including the Funds) and are subject to certain laws and regulations governing personal securities trading. As a Covered Person, you have an obligation to adhere to the following principles:

| • | At all times, avoid placing your personal interest ahead of the interests of the clients or Funds of the Firm; |

| • | Avoid actual and potential conflicts of interests between personal activities and the activities of the Firm’s clients or Funds; |

| • | Do not misappropriate investment opportunities from clients or Funds; |

| • | Do not employ or engage in any device, scheme, artifice, act, course of business, or manipulative practice to defraud clients or Funds; and |

| • | Do not make untrue or misleading statements that defraud clients or Funds. |

As such, your personal financial transactions and related activities, along with those of your family members and other Covered Persons, must be conducted consistently with this Code, including the principles herein, to avoid any actual or potential conflicts of interest with the Firm’s clients or funds, or abuse of your position of trust and responsibility.

When making personal investment decisions, you must ensure that you do not violate the letter or the spirit of this Code. We have developed this Code to promote the highest standards of behavior and ensure compliance with applicable laws. The Code sets forth procedures and limitations that govern the personal securities transactions of every Covered Person.

|

Related Policies and Procedures |

| All employees of the Firm are required to comply with the following key policies and procedures, which set forth ethical standards required of all Firm personnel. This is not an exhaustive list of State Street or State Street Global Advisors Policies or Procedures to which employees are subject. |

| State Street Corporate Policies and Procedures |

|

· Standard of Conduct |

|

· Gifts and Entertainment Policy |

|

· Political Contributions and Activities Policy |

|

· Outside Activities Policy |

|

· Conflicts of Interest Policy |

|

· Anti-Corruption and Bribery Policy |

|

· Conduct Standards Policy |

|

· Inside Information Standard |

| State Street Global Advisors Policies and Procedures |

|

· Inside Information/Information Barriers Policy and Procedure |

|

· Global Conflicts of Interest Procedure |

|

· Anti-Corruption and Bribery Procedure |

| Note: Policies and related procedures or guidance may be revised from time to time. Employees will find the most up-to-date policies on the intranet. |

It is not possible for this Code to address every situation involving the personal trading of Covered Persons. The Conduct Risk Management Team is charged with oversight and interpretation of the Code in a manner considered fair and equitable, in all cases placing the Firm’s clients’ interests first.

|

It is not enough to only comply with the technical aspects of the Code – it is every Covered Person’s responsibility to ensure their pesona investments do not, in any way, compromise the Firm’s fiduciary duty to any client. |

| If you are unsure whether a personal investment matter meets the required ethical standard, contact the Conduct Risk Management Team. |

| Information Classification: General | 6 |

Code Requirements of the Code

General Requirements

Applicable to All Covered Persons

| 001. | Comply with Applicable Securities Laws |

As a Covered Person, you must comply with securities laws and firm-wide policies and procedures, including this Code of Ethics. Securities laws include the Securities Act of 1933, the Securities Exchange Act of 1934, the Investment Company Act of 1940, the Investment Advisers Act of 1940, the Sarbanes-Oxley Act of 2002, Title V of the Gramm-Leach-Bliley Act, any rules adopted by the SEC under these statutes, the Bank Secrecy Act and rules adopted there under by the SEC or the Department of the Treasury. Covered Persons outside the US may be subject to additional country-specific requirements and securities laws, which are included in Appendix D.

| 002. | Report Violations |

Covered Persons are required to promptly report any violation of the Code, whether their own or another individual’s, to the Conduct Risk Management Team. Alternatively, you may contact the Senior Compliance Officer in your region, the CCO, or, to report anonymously, The Speakup Line (see Appendix E for contact information).

Nothing in the Code is intended to or should be understood to prohibit or otherwise discourage certain disclosures of confidential information protected by “whistleblower” laws to appropriate government authorities. State Street will not tolerate any discipline or other retaliation against employees who properly make such legally-protected disclosures.

This language does not apply to Covered Persons in France and Italy. Please see Appendix D.

|

Keep in mind |

|

Our policies and procedures and the Code of Ethics may be more restrictive than applicable securities laws.

|

| 003. | Certify Receipt and Compliance with the Code |

Initial Certification (New Covered Person)

Within 10 calendar days of becoming subject to the Code, each new Covered Person must certify in writing that they (i) have read, understand, and will comply with the Code, (ii) will promptly report violations or possible violations, and (iii) recognize that an employee conduct issue related to the Code may be grounds for action under the State Street Conduct Standards Policy.

Annual Certification (All Covered Persons)

Each Covered Person is required to certify annually in writing that they (i) have read and understand the Code, (ii) have complied with the Code during the course of their association with the Advisor; (iii) will continue to comply with the Code in the future; (iv) will promptly report violations or possible violations, (iv) recognize that an employee conduct issue with the Code may be grounds for action under the State Street Conduct Standards Policy.

|

Certification Required

Covered persons are required to certify to the Code of Ethics within 10 days of becoming subject to the Code of Ethics and on an annual basis.

|

| Information Classification: General | 7 |

Personal Trading Requirements – Accounts and Holdings

Applicable to All Covered Persons

You must disclose all Reportable Accounts (as defined on page 10) when you become a Covered Person and continue to make accurate and timely account and holding reports. If you are an employee in the US, you must maintain your account(s) with an Approved Broker. Employees in other regions are encouraged to maintain accounts with “Preferred Brokers” where available. All Covered Persons must ensure the Conduct Risk Management Team receives timely and accurate reporting from your broker.

| 004. | File Initial and Annual Holding Reports |

Covered Persons must file initial and annual holdings reports (“Holdings Reports”) in StarCompliance as follows:

| a. | Content of Holdings Reports |

| i. | The name of any broker, dealer or bank with whom the Covered Person maintained a Reportable Account. Please note that all Reportable Accounts (see page 10) must be reported in StarCompliance. |

| ii. | The title, number of shares and principal amount of each Covered Security. |

| b. | Timing of Holdings Reports |

| i. | Initial Report – No later than 10 calendar days after becoming a Covered Person. The information must be current as of a date no more than 45 days prior to the date the Covered Person became an Access Person, Investment Person, or Non-Access Person. |

| ii. | Annual Report – Annually, within 30 calendar days following calendar year end, and the information must be current as of a date no more than 45 calendar days prior to the date the report is submitted. |

| c. | Exceptions from Holdings Report Requirements |

| i. | Holdings in securities which are not Covered Securities are not required to be included in Holdings Reports (please see Appendix C). |

Any Reportable Accounts opened during the Covered Person’s employment or engagement with the Firm must also be immediately disclosed in StarCompliance regardless of whether there is any activity in the account. Any Reportable Accounts and holdings that become newly associated with a Covered Person through marriage, gift, inheritance, or any other life event, must be disclosed within 30 days of the event.

| 005. | Provide Duplicate Statements and Confirms |

Each Covered Person is responsible for ensuring the Conduct Risk Management Team receives timely reporting for their Reportable Accounts holdings, (as well as timely reporting for transactions of Covered Securities within the Reportable Account). This applies to any Reportable Accounts (including Fully Managed Accounts) active during the Covered Person’s employment or engagement with the Firm. Covered Persons must ensure that on a regular basis the Conduct Risk Management Team or their designee(s) receives account statements (e.g. monthly, quarterly statements) listing all transactions for the reporting period. (See Section 007 – Filing Quarterly Transaction Reports.)

The Covered Person can accomplish this one of two ways:

| a. | Maintain Reportable Accounts at Approved Brokers (or Preferred Brokers for employees based in non-US jurisdictions, where available). Approved Brokers and Preferred Brokers send electronic feeds to the Conduct Risk Management Team; Covered Persons are not required to provide paper-based reporting for accounts with Approved Brokers or Preferred Brokers. However, it |

| Information Classification: General | 8 |

| is the responsibility of the Covered Person to verify the accuracy of these feeds through Quarterly Transaction Reports and Annual Holdings Reports. Employees in the US, with limited exceptions, are required to maintain their accounts at Approved Brokers. (See Section 006- Maintain Accounts with Approved Brokers.) |

| b. | For accounts not on an electronic feed, the Covered Person must supply the Conduct Risk Management Team with required duplicate documents. Please see Appendix D for regional requirements. |

| 006. | Maintain Accounts with Approved Brokers (US Employees) or Preferred Brokers (Non-US employees) |

Unless an exemption applies, Covered Persons must maintain accounts with Approved Brokers or Preferred Brokers if required in their region. Please refer to the Personal Securities Trading FAQs on the Conduct Risk Management sharepoint site for regional requirements and for a list of Approved Brokers. The Approved Brokers provide both the holdings and transaction activity in each account through an electronic feed into StarCompliance.

The categorical exemptions to the Approved Broker and Preferred Broker requirement are:

| a. | Accounts approved by the Conduct Risk Management Team as Fully Managed Accounts (also known as Discretionary Accounts. See Appendix A.) |

| b. | Accounts that are part of a former employer’s retirement plan (such as a 401(k)); or accounts that are part of a spouse’s or other Covered family member’s retirement plan at their employer. |

| c. | Employees who are not US citizens and are working in the US on an ex-pat assignment or whose status is non-permanent resident. |

| d. | Securities held in physical form. |

| e. | Securities restricted from transfer. |

| f. | Accounts held by employees, or any Covered Persons, in countries outside the |

| region where they are currently assigned, which are not eligible for transfer to an Approved or Preferred Broker in that region. |

To apply for an exception to maintain an account outside of an Approved Broker, contact the Conduct Risk Management Team at ethics@statestreet.com.

Please see Appendix D for additional regional requirements.

| Information Classification: General | 9 |

Reportable Accounts Guide

To determine whether an account is a Reportable Account, determine who owns or benefits from the account and what types of investments the account can hold. If you have a beneficial interest in an account and the account can hold Covered Securities, it is likely a Reportable Account.

What is a Beneficially Owned Account?

A Beneficially Owned Account is:

| · | An account where the Covered Person enjoys the benefits of ownership (even if title is held in another name); and/or |

| · | An account where the Covered Person, either directly or indirectly, has investment control or the power to vote or influence the transaction decisions of the account. |

Generally, an individual is considered to be a beneficial owner of accounts or securities when the individual has or shares direct or indirect pecuniary interest in the accounts or securities. Pecuniary interest means that an individual has the ability to profit, directly or indirectly, or share in any profit from a transaction. Indirect pecuniary interest extends to, but is not limited to:

| · | Accounts and securities held by immediate family members sharing the same household; |

| · | Securities held in trust (certain restrictions may apply, see Appendix B for more details); and |

| · | A right to acquire Covered Securities through the exercise or conversion of any derivative security, whether or not presently exercisable |

|

No Reporting Required |

| · Checking and savings accounts holding only cash

· Government-subsidized pension saving products

· Pension Accounts established under the Hong Kong regulation or Singapore Regulation with no capacity to invest in Covered Securities

· Savings Plans within the course of company pension schemes which only allow unaffiliated open-end mutual funds

· Educational Savings Plans which only allow unaffiliated open-end mutual funds

· Other Registered Commingled Funds (such as IRC 529 Plans in the US)

When in doubt, contact the Conduct Risk Management Team ethics@statestreet.com

|

What are Covered Securities?

For a complete list of Covered Securities, see Appendix C. Some of the most common types are listed below.

| · | Stocks, including State Street Corp. (“STT”) |

| · | Exchange-traded funds (“ETFs”) |

| · | Exchange-traded notes (“ETNs”) |

| · | Open-ended mutual funds advised by the Firm |

| · | Municipal and Corporate bonds |

| Information Classification: General | 10 |

| Do I Have to Report this Account?

Common Reportable Account Types

The list of account types below is not all-inclusive. Consult the Conduct Risk Management Team if you have questions about whether an account is a Reportable Account.

· Brokerage Account All brokerage accounts are reportable, including but not limited to retirement accounts, non-retirement accounts, IRAs, RRSPs, UTMA and UGMA accounts. For further definition see Appendix A. · Employee Incentive Awards Deposit Account Provided by the Firm Accounts that are provided to employees into which their Employee Incentive Awards are deposited are reportable. · Employee Stock Ownership and Purchase Plans (“ESOPs”/ “ESPPs”) · Employer-sponsored Retirement Plans that invest/hold Covered Securities |

Practical Examples of Beneficial Ownership

See Appendix B for a more detailed discussion of Beneficial Ownership. For the purposes of this sidebar, “you” includes you, your spouse or domestic partner, or anyone else in your household who would be covered by the Code of Ethics, as discussed on page 3.

UGMA/UTMA Accounts If you are the custodian of an UGMA/UTMA account for a minor, and one or both of you is a parent of the minor, you are a beneficial owner. If you are the beneficiary of an UGMA/UTMA and are of majority age, you are a beneficial owner.

Education Accounts If you are the custodian of an Education Savings Account (ESA), or Coverdell IRA, you are a beneficial owner.

Trusts If you are a trustee or the settlor of the trust who can independently revoke the trust and participate in making investment decisions for the trust, you are a beneficial owner. If you are a beneficiary of the trust but have no investment control, the account is beneficially owned as of the date the trust is distributed, not before.

Investment Powers over an Account If you have any form of investment control, such as trading authorization or power of attorney, the account is beneficially owned as of the date you are able to direct or participate in the trading decisions.

|

Employer-sponsored retirement plans and accounts globally in which the employee/participant invests in or transacts in Covered Securities are reportable. Please see Appendix G “Code of Ethics FAQs” for further clarification on Reportable Retirement Plans.

| Information Classification: General | 11 |

Personal Trading Requirements – Transactions

Applicable to All Covered Persons

The Code of Ethics requires quarterly reporting of all Covered Transactions and imposes restrictions on certain types of transactions.

| 007. | Filing Quarterly Transaction Reports |

Each Covered Person is required to submit a quarterly transaction report for and certify to transactions during the calendar quarter in all Covered Securities. Each Covered Person shall also certify that the Reportable Accounts listed in the transaction report are the only Reportable Accounts in which Covered Securities were traded during the quarter for their direct or indirect benefit. For the purposes of this report, transactions in Covered Securities that are effected in Automatic Investment Plans or accounts approved by the Conduct Risk Management Team as Fully Managed Accounts need not be reported.

Covered Persons must file quarterly transaction reports (“Transaction Reports”) in StarCompliance

| a. | Quarterly Transactions Report For Transactions in Covered Securities are reported on a standardized form in StarCompliance that identifies the date, security, price, volume, amount, and effecting broker of each Covered Security transaction. |

| b. | Quarterly Transactions Report For Newly Established Reportable Accounts reported in StarCompliance Holding ANY Securities (provided there were transactions during the quarter) include the broker dealer or bank with whom the reportable account is held, the date the account was opened, and the date the report was submitted to Ethics. |

| c. | Timing of Transactions Report: No later than 30 calendar days after the end of the calendar quarter. |

| d. | Exception from Transactions Report Requirements |

| i. | Transactions effected pursuant to an Automatic Investment Plan as well as transactions in securities that are not Covered Securities, |

| ii. | Transactions effected in accounts that are not Reportable Accounts are not required to be included in the Quarterly Transaction Report (please see Appendix C), and |

| iii. | Transactions effected in a previously-approved Fully Managed Account. |

| e. | Confirmation of Trades |

| i. | Employees must confirm their transactions in StarCompliance after execution and before or simultaneously with their quarterly transaction certification. |

| ii. | If an electronic feed has been set up for broker account (e.g. Fidelity account), the trading data will flow automatically to StarCompliance overnight, however, it is still the employee’s responsibility to maintain accurate data in StarCompliance and it is best practice to check whether electronic feeds were accurate by checking records in StarCompliance prior to completing a quarterly certification. |

| f. | State Street Employee Incentive Stock Awards |

| i. | STT employee incentive stock awards must be treated as Covered Securities. Employees receiving awards during a quarter should ensure any awards vested during the quarter are appropriately reflected in their holdings, and |

| ii. | All employees must preclear any transactions in STT (note, STT employee incentive awards are not subject to the 60 day profit prohibition when they become vested). |

| Information Classification: General | 12 |

| 008. | Excessive Trading |

Excessive trading may interfere with job performance or compromise the duty that the Firm owes to clients and consequently is not permitted. Levels of personal trading will be monitored by the Conduct Risk Management Team and high levels of personal trading will be reported to senior management A pattern of excessive trading may lead to action under the State Street Conduct Standards Policy.

| 009. | Futures, Options, Contracts for Difference, and Spread Betting |

Covered Persons are prohibited from buying or selling options and futures on Covered Securities (other than employee stock options). Covered Persons are also prohibited from engaging in Contracts for Difference (“CFDs”) and spread betting related to Covered Securities.

| 010. | Shorting of Securities |

Covered Persons are prohibited from selling securities short.

| 011. | Initial Public Offerings |

Covered Persons are prohibited from acquiring securities through an allocation by an underwriter of an initial public offering (“IPO”). An exception may be considered for situations where the spouse/domestic partner/partner of a Covered Person (“PACs”) is eligible to acquire shares in an IPO of his/her employer with prior written disclosure to and written approval from the Conduct Risk Management Team.

| 012. | Private Transactions |

Covered Persons must obtain prior written approval from the Conduct Risk Management Team before participating in a Private Placement or any other private securities transaction. To request prior approval, Covered Persons must provide the Conduct Risk Management Team with a completed Private Placement Request form, which is available on StarCompliance.

If the request is approved, the Covered Person must confirm the transaction in StarCompliance, verify the details on the next

Quarterly Transaction Report, and report the holding on the Annual Holdings Report. If the transaction has already been loaded to the Covered Person’s Transaction report, the Covered Person must confirm the transaction in the Quarterly Transaction Report.

Covered Persons may not invest in Private Transactions if the opportunity to invest could be considered a favor or gift designed to influence the Covered Person’s judgment in the performance of his/her job duties, or as compensation for services rendered to the issuer, or if there are any other potential conflicts of interest with State Street business. In determining whether to grant approval for any investment for a Private Transaction, the Conduct Risk Management Team will consider, among other things, whether it would be possible (and appropriate) to reserve that investment opportunity for one or more of the Firm’s clients, as well as whether the opportunity to invest has been offered to the Covered Person as a gift, or as compensation for services rendered.

See Appendix A for definition and Appendix D for further regional definitions in France and Italy.

| 013. | Investment Clubs and Investment Contests |

Covered Persons must obtain prior written approval from the Conduct Risk Management Team before participating in an Investment Club. If approved, the brokerage account(s) of the Investment Club are subject to the Approved Broker, pre-clearance and reporting requirements of the Code. Sharing research or other proprietary information obtained through employment with State Street with Investment Club participants is prohibited.

Covered Persons are prohibited from direct or indirect participation in an investment contest. These prohibitions extend to the direct or indirect acceptance of payment or offers of payments of compensation, gifts, prizes, or winnings as a result of participation in such activities.

| Information Classification: General | 13 |

| 014. | Use of the Firm’s Proprietary Information |

The Firm’s investment recommendations and other Proprietary Information are for the exclusive use of the Firm and may not be used to inform employees’ personal investment decisions. Examples of Proprietary Information include but are not limited to:

| – | Information about Firm or issuer business strategies, technologies, or ideas; |

| – | client or proprietary transactions; |

| – | changes to recommended portfolio weightings, portfolio composition, or target prices for any security; |

| – | voluntary actions to be taken on any corporate actions; |

| – | research produced by employees of the Firm that could influence client investment decisions, such as employees’ recommendations in Tamale and ArtPro; or |

| – | any other information that may reasonably be expected could influence an investor’s decision-making that has not been made public without violation of law or our policies. |

The definition of Proprietary Information does not include information that has been made public or comes from a service that broadly disseminates published information, such as Bloomberg. You should always assume that information is confidential, and treat it as such, unless it is clearly indicated otherwise. It is our responsibility to protect Proprietary Information and Confidential Information against unintentional, malicious, or unauthorized disclosure or misuse. Any pattern of personal trading suggesting misuse of proprietary information may be investigated. Any misuse or distribution of information that is proprietary, confidential, or non-public is prohibited.

Applicable to Access Persons and Investment Persons

| 015. | Short-Term Trading |

All Access Persons and Investment Persons are prohibited from profiting from the purchase and sale (or sale and purchase) of the same or equivalent Covered Security within sixty (60) calendar days. Transactions that result in a profit will be considered an employee conduct issue and may result in action under the State Street Conduct Standards Policy. Any profit amount shall be calculated by the Conduct Risk Management Team or their designee(s), the calculation of which shall be binding. The following will not be matched with other purchases and sales for purposes of this provision:

| a. | Transactions in securities that are not Covered Securities such as money market funds (see Appendix C); |

| b. | Transactions in ETFs, except certain actively-managed SSGA ETFs (see Appendix C); |

| c. | Securities received as a gift or inheritance that cannot be matched to another transaction effected by a Covered Person within 60 days; |

| d. | Involuntary actions such as vested employer stock awards, dividend reinvestments, or other corporate actions; |

| e. | Cashless exercise of a Covered Person’s employer stock options |

| f. | Transactions executed in Fully Managed Accounts that have been approved by the Conduct Risk Management Team; or |

| g. | Transactions effected through an Automatic Investment Plan, the details of which the Conduct Risk Management Team has been notified of in advance. |

| Information Classification: General | 14 |

Exempted Transactions

Pre-clearance is not required for certain common transactions.

Automatic Investment Plans

Prior Notification to Conduct Risk Management Team Required

Purchases or sales that are part of an Automatic Investment Plan where the investment decisions are non-discretionary after the initial selections by the account owner (although the initial selection requires pre-clearance). These include dividend reinvestment plans, payroll and employer contributions to retirement plans, transactions in Employee Stock Ownership Programs (“ESOPs”) and similar services. Initiation of an Automatic Investment Plan must be disclosed to the Conduct Risk Management Team in advance.

Certain Exempt Covered Securities

Transaction(s) in Covered Securities for which the Conduct Risk Management Team has determined pre-clearance is not required (see Appendix C).

Discretionary Accounts (Fully Managed Accounts)

Prior Approval from Ethics Office Required

Subject to prior approval of the account from the Conduct Risk Management Team, transactions made in a Discretionary Account. An account will not be deemed a Discretionary Account until the Conduct Risk Management Team has approved the account as such.

Certain Educational Savings Plans

Transactions in educational savings plans that only allow unaffiliated open-end mutual funds, unit-investment trusts, or other registered commingled products (such as IRC 529 Plans in the US).

Involuntary Transactions

Involuntary purchases or sales such as mandatory tenders, dividend reinvestments, broker disposition of fractional shares, debt maturities. Voluntary tenders, transactions executed as a result of a margin call, and other non-mandatory corporate actions are to be pre-cleared, unless the timing of the action is outside the control of the Covered Person, or the Conduct Risk Management Team has determined pre-clearance is not required for a particular voluntary transaction.

Gifts or Inheritance

Covered Securities received via a gift or inheritance, although such Covered Securities must be reported in StarCompliance. Note that pre-clearance is required prior to giving or donating Covered Securities.

| 016. | State Street Securities |

Each Covered Person must ensure that they have reported any Reportable Account holding State Street securities, and that they have reported in StarCompliance any vested State Street shares acquired through an employee incentive award. During certain trading windows, employees may be permitted to exercise Employee Incentive Awards without being subject to the blackout and open order rules. However, these transactions remain subject to the pre-clearance and reporting requirements of the Code at all times. Employees will be notified when a trading window commences and terminates. During this period, all employees remain subject to the State Street Global Advisors Inside Information/Information Barrier Policy and Procedure, as well as the Personal Trading in Securities section of the State Street Standard of Conduct.

Additionally, certain employees of the Firm are subject to the State Street Securities Trading Policy (“SSTP”) and will be notified of this by the Conduct Risk Management Team. Employees subject to SSTP must also comply with all notifications under that Policy.

| Information Classification: General | 15 |

Pre-Clearance

The Pre-Clearance requirement mitigates the risk of creating actual or perceived conflicts of interest with the trading activities made on behalf of Firm clients. With limited exceptions, pre-clearance approval is required before you make any personal trades of Covered Securities.

It applies to all your Reportable Accounts, including those belonging to, or in which, your spouse or other Covered family member has an economic interest or control. (See Appendix B)

It applies to transactions in most types of securities, including transactions in State Street Corp. stock (STT). (See Appendix C)

Personal Trading Requirements – Pre-Clearance

Applicable to Access Persons and Investment Persons

You are required to receive pre-clearance approval before trading in any Covered Security, with limited exceptions. This applies to transactions made by your spouse, other Covered family member and/or in any other accounts in which you or they have beneficial ownership or control.

| 017. | Pre-Clearance |

Access Persons and Investment Persons must request and receive pre-clearance approval prior to effecting a personal transaction in all Covered Securities (see Appendix C).

| a. | All pre-clearance requests must be made by submitting a Trade Request for the amount of shares to be transacted in StarCompliance. |

| b. | Pre-clearance is required for donations and/or gifts of securities made. |

Trade requests may be approved or denied at the discretion of the Conduct Risk Management Team, In general, a transaction will be denied if the Covered Security is on any relevant Restricted List or if the Conduct Risk Management Team has reason to believe that the Covered Person has access to relevant information concerning the security or the issuer that is intended for the sole purpose of the Firm or its clients. If the Covered Person has access to such information, it is the Covered Person’s responsibility not to seek pre-clearance nor to trade in the security even if pre-clearance approval has been granted. For Investment Persons, a transaction may also be denied if the Covered Security is actively being purchased or sold for a client account or account of a Fund, or the Covered Security has been traded within seven days in a portfolio for which they have management discretion.

| Information Classification: General | 16 |

| 018. | Restricted List |

To manage potential conflicts of interest, lists of issuers whose securities (including options and futures) may not be traded are integrated into the pre-clearance approval process. A security that you already own could be placed on a Restricted List at any time. If this happens, you may be unable to sell the security until it is removed from any Restricted List. Employees are not entitled to review any Restricted List.

The contents of any Restricted Lists shall be considered material non-public information and is subject to the considerations of the Inside Information/Information Barrier Policy and Procedure.

| 019. | Pre-Clearance Approval |

Pre-clearance approval granted by the Conduct Risk Management Team is valid only for the same business day the approval is granted and is ineffective on all dates where the relevant Exchange is not open for business. Make note of any expiration time and date displayed on any approved Trade Request. Because approvals are strictly time-limited, place day orders only. “Good-till-cancelled” orders are not permitted, including stop-loss, limit, and stop-limit orders other than day orders. This is a result of the pre-clearance function relying upon point-in-time data in order to have any effect.

Applicable to Investment Persons

| 020. | Open Order Rule |

Subject to the de minimis transaction threshold (Section 023-De Minimis Transactions), Investment Persons may not trade in a Covered Security, with the exception of ETFs, on any day that the Firm, globally, has a pending buy or sell order in the same Covered Security on any of the trading desk(s) for any client or proprietary fund portfolio until the order is executed or withdrawn (note: Executed trades are considered with regards to the Blackout Period, as outlined below).

|

By seeking pre-clearance, you are attesting that you understand that the proposed trade: • Is not influenced by any non-public information that is proprietary or confidential to State Street or to our clients • Does not create any conflict with State Street’s responsibilities to its clients • Is lawful

If you are not certain whether it is appropriate to trade, then do not trade. Contact the Conduct Risk Management Team at Ethics@StateStreet.com for guidance prior to placing any order to trade.

|

| 021. | Blackout Period for Investment Persons |

Subject to the de minimis transaction threshold described below, Investment Persons may not buy or sell a Covered Security for seven calendar days before or after a transaction in the same or equivalent security for a client or proprietary fund portfolio with which they are associated. An employee is considered “associated” with a client or proprietary fund portfolio if they have ability to exercise, or direct, trades for the portfolio.

All Covered Persons are required to avoid placing their personal interest ahead of the interests of the clients of the Firm. Investment Persons associated with portfolios with fundamental strategies must be particularly careful not to engage in personal trading that calls into question whether they have placed their interests ahead of the interest of their clients. Trading in securities personally in advance of similar trades made by the respective Portfolio may lead to questions about the Covered Person’s priorities. In such cases, it will be incumbent upon the Covered Person to demonstrate that the clients’ priorities were not subordinated to their own priorities. Similarly, failing to trade in a security for a Portfolio because of a personal trade that has recently been made is also a subordination of client interest. Covered Persons with responsibility for portfolios with fundamental strategies finding themselves needing to violate the Blackout Period in order to avoid placing their personal interest

| Information Classification: General | 17 |

ahead of the clients’ interest must inform the Conduct Risk Management Team. Such violations are subject to action under the State Street Conduct Standards Policy.

| 022. | Waiting Period for Research Analysts |

Research Analysts with access to tools containing proprietary buy or sell recommendations, who receive internal communications regarding buy or sell recommendations, or participate in investment meetings where buy or sell recommendations are discussed, must refrain from trading in securities that are the subject of such recommendations for their personal account if it could reasonably be presumed that such information was relevant to an investment decision. Examples of recommendations that could reasonably be presumed to be relevant to investment decisions on behalf of client portfolios include but are not limited to buy or sell recommendations, internal analyst upgrades or downgrades related to an issuer, changes to recommended portfolio weightings, portfolio composition, or target prices for any security, or recommendations regarding voluntary corporate actions. Examples of information that are not presumed to be relevant to investment decisions include market analyses, economic updates, or financial updates regarding an issuer that do not also include a buy/sell recommendation or ratings analysis. Research Analysts who trade Covered Securities for their personal account in close

proximity to proprietary investment recommendations regarding the same issuer should expect heightened monitoring of such trades. If there is a reason to question whether such trades were made on the basis of confidential or proprietary non-public information, it will be incumbent upon the Covered Person to demonstrate otherwise.

Please see Appendix D for additional regional requirements.

| 023. | De Minimis Transactions |

De Minimis transactions are subject to the pre-clearance and reporting requirements of the Code; and must follow all holding period and Restricted List requirements of this Code. However, there is a limited exclusion applied for De Minimis transactions in that they are not subject to the Open Order Rule or the Blackout Rule as described above. This exclusion exists because of the breadth and frequency with which securities are being traded across all of the portfolios of the Firm, which would effectively prohibit almost all equity trading by Investment Persons.

A “De Minimis transaction” is a personal trade that meets one of the following conditions: A single transaction in a security with a value equal to or less than US $5,000 (or the local country equivalent) or multiple transactions in a security within a five business day window that have an aggregate value equal to or less than US $5,000.

De Minimis Transaction Examples: (All values are in US Dollars)

| Status

|

Transaction(s)

|

Notes

| ||

| De minimis

|

Day One: Buy $5,000 of ABC, Inc.

|

No subsequent transactions in the following five business days

| ||

|

De minimis |

Day One: Sell $1,000 of XYZ Corp. Day Two: Sell $3,000 of XYZ Corp. Day Four: Sell $800 of XYZ Corp.

|

Within five business days, less than $5,000 worth of XYZ Corp. is sold; all transactions in the aggregate is under the de minimis threshold

| ||

|

NOT de minimis |

Day One: Buy $4,500 of PQR, Inc. Day Three: Buy $1,000 of PQR, Inc.

|

Day Three transaction is not considered de minimis, as it brings the total for the five business day window over $5,000

| ||

|

NOT de minimis |

Day One: Sell $1,000 of Acme Corp. Day Two: Sell $3,000 of Acme Corp. Day Three: Sell $1,500 of Acme Corp. |

Day Three transaction is not considered de minimis, as it brings the total for the five business day window over $5,000 |

StarCompliance will calculate whether a transaction meets the De Minimis thresholds and will take this into account when determining whether to approve or deny a personal trade.

| Information Classification: General | 18 |

| 024. | Additional Requirements for Fundamental Equity Investment Persons |

Investment Persons on Fundamental Equity Teams are required to obtain the respective Asset Class CIO’s approval before transacting in single name equities and securities that can convert to single name equities for their personal accounts, including but not limited to transactions in stock, preferred stock, warrants, and any security convertible to an equity. This additional preapproval requirement includes the purchase of new positions and purchase of additional shares of existing positions, with the exception of dividend reinvestments and other involuntary corporate actions. With prior approval from the Conduct Risk Management Team, exceptions from the additional preapproval requirement may be allowed for Fully Managed Accounts. Prior approval can also be requested to transact in securities directly through an employer stock plan or employer stock options, or in circumstances of hardship.

Pre-approvals provided by Asset-Class CIOs will be effected after a trade pre-clearance request has been approved in StarCompliance. Upon receipt of the StarCompliance approval email, the employee shall forward the approval to the appropriate CIO and cc GA_Compliance_CIO_CodeReview. The employee shall provide the Asset Class CIO with any relevant information regarding the trade request. The CIO will review the request and “reply all” when approving or denying the request. Employees may not trade if the request has been denied by Conduct Risk Management Team via StarCompliance or by the CIO. Pre-approvals provided by Asset-Class CIOs expire at the same time and date noted on the StarCompliance pre-approval.

| Information Classification: General | 19 |

Administration and Enforcement of the Code

The Code of Ethics is administered by the Conduct Risk Management Team and reviewed and approved by State Street Global Advisors’ Global Operations and Compliance Committee. Violations of the Code are subject to consideration under the conduct standards framework and the State Street Conduct Standards Policy.

025. Distribution of the Code

Each new Covered Person will be given a copy of the Code. Each new employee’s offer letter will include a statement advising the individual that he/she will be subject to the Code if he/she accepts the offer or employment. If, outside the US due to local employment practices it is necessary to modify this approach, then the offer letters will be revised in accordance with local law.

| 026. | Applicability of the Code of Ethics’ Provisions |

The Conduct Risk Management Team has the discretion to determine that the provisions of the Code do not apply to a specific transaction or activity and may exempt any transaction from one or more trading prohibitions. The Conduct Risk Management Team will review applicable facts and circumstances of such situations, such as specific legal requirements, contractual obligations or financial hardship. Any Covered Person who would like such consideration must submit a request in writing to the Conduct Risk Management Team. Further, all granted exemptions must be in writing.

| 027. | Review of Reports |

The Conduct Risk Management Team shall review and monitor reports filed by Covered Persons. Covered Persons and their supervisors may or may not be notified of the Conduct Risk Management Team’s review.

1 In the US, recordkeeping requirements for code of ethics are set forth in Rule 17j-1 of the Investment Company Act of 1940 and Rule 204-2 of the Investment Advisers Act of 1940.

| 028. | Violations and Sanctions |

Any potential employee conduct issues related to the provisions of the Code may be investigated. If a determination is made that an employee conduct issue occurred, the issue will be addressed under the State Street Conduct Standards Policy. Where consistent with applicable law, and among other appropriate sanctions that should be considered, sanctions may include a requirement to disgorge an amount equivalent to profits earned or losses avoided as a result of personal trading made in egregious violation of the Code. Material violations will be reported promptly to the respective Firm Committees, boards of trustees/managers of the Reportable Funds or relevant committees of the boards and, when relevant, impacted clients. Please see Appendix D for additional regional requirements.

| 029. | Amendments and Committee Procedures |

The Global Operations and Compliance Committee (“the Committee”) will review and approve the Code, including appendices and exhibits, and any amendments thereto. The Committee may, from time to time, amend the Code and any appendices and exhibits to the Code to reflect updated business practice or changes in applicable law and regulation. In addition, the Committee, or its designee, shall submit any material amendments to this Code to the respective boards of trustees/managers of the Reportable Funds, or their designee(s), for ratification no later than six months after adoption of the material change.

| 030. | Recordkeeping |

The Conduct Risk Management Team shall maintain records in accordance with the requirements set forth in applicable securities laws.1

| Information Classification: General | 20 |

Appendix A

Terms and Definitions

These definitions are designed to help you, as a Covered Person, understand and apply the Code. These definitions are integral and a proper comprehension of them is necessary to comply with the Code.

Please contact the Conduct Risk Management Team (ethics@statestreet.com) if you have any questions.

Covered Person employees of the Firm, including full-time and part-time, exempt and non-exempt employees (where applicable); officers of the Funds who are not employed by the Firm; and other such persons as designated by the Conduct Risk Management Team. Covered Person also includes certain designated contingent workers engaged at the Firm, including but not limited to consultants, contractors, and temporary help, as well as an employee of another business unit with access to Firm data such as non-public information regarding any client’s purchase or sale of securities, non-public information regarding any client’s portfolio holdings, or non-public securities recommendations made to clients (SSGS APAC, corporate functions, etc.).

Covered Persons are subject to the provisions of this Code. The personal trading requirements of the Code also apply to related persons of Covered Persons, such as spouses, domestic partners, minor children, adult children and other relatives living in the Covered Person’s household, as well as other persons designated as a Covered Person by the CCO or the Conduct Risk Management Team, or their designee(s).

Automatic Investment Plan means a program in which regular periodic purchases (or withdrawals) are made automatically in (or from) investment accounts in accordance with a predetermined schedule and allocation. This includes a dividend reinvestment plan and some payroll or employer contributions to retirement plans.

Brokerage Account means an account with a financial institution in which the account owner can hold or trade a wide variety of securities and

exercises brokerage capabilities. Covered Persons should contact their financial institution(s) to verify whether or not their account(s) can hold Covered Securities.

Covered Securities are those securities subject to certain provisions of the Code. See Appendix C - Guide: Requirements by Security Types.

Contract for Difference (“CFD”) a financial derivative, a contract between two parties typically described as “buyer” and “seller”, stipulating that the seller will pay to the buyer the difference between the current value of an asset and its value at contract time. If the difference is negative, then the buyer pays instead to the seller. CFD allows investors to take advantage of prices moving up (long positions) or prices moving down (short positions) on underlying financial instruments and are often used to speculate on those markets.

Employees Incentive Awards means Firm Performance Equity Plan (“PEP”) Awards in State Street Corporation (“STT”) stock, Deferred Stock Awards (“DSAs”), Restricted Stock Awards (“RSAs”), STT stock options which are granted to employees, and any other awards that are convertible into or otherwise based on STT common stock.

Fully Managed Account (also known as Discretionary Account) means an account Beneficially Owned by you or your Related Persons in which you or your Related Persons have ceded all direct control, influence, and approval, and have contractually assigned responsibility for the timing and nature of all trades and all day-to-day investment management decisions to an independent party. For the purpose of this Policy, the Conduct Risk Management Team is required to approve in advance account arrangements qualifying as Fully Managed Accounts.

Private Transaction means a securities offering that is executed outside of a recognized securities exchange. Examples of private transactions include private placements, co-operative investments in real estate, commingled investment vehicles such as hedge funds, investments in family owned or privately held businesses, private company shares, and Initial Coin or Token Offerings promoted by a Decentralized

| Information Classification: General | 21 |

Autonomous Organization (“DAO”)2 where there is investment in a venture or project for expectation of profit. Time-shares and cooperative investments in real estate used as a primary or secondary residence are not considered to be private placements. Please see Appendix D for regional definitions of Private Placement in France and Italy.

Reportable Fund means any commingled investment vehicle (except money market funds), or Exchange Traded Note (“ETN”) for which the Firm act as investment advisor, sub-advisor, principal underwriter, or marketing agent.

Selling Short is the practice of selling a stock that is not currently owned, while simultaneously borrowing the shares from a lending party and delivering the borrowed shares to the buyer.

State Street Global Advisors Compliance Department means all global Firm compliance staff, including those in local offices, in charge of ensuring compliance with the laws and regulations in force worldwide and who report up to the Chief Compliance Officer of the Firm.

Spread Betting is any of various types of wagering, such as on sports, financial instruments or house prices for example, on the outcome of an event where the pay-off is based on the accuracy of the wager, rather than a simple “win or lose” outcome. As an example, spread betting on a stock allows the investor to speculate on the price movement of the stock.

2 A “virtual” organization embodied in computer code and executed on a distributed ledger of blockchain.

| Information Classification: General | 22 |

Appendix B

Beneficial Ownership of Accounts and Securities

A Beneficially Owned Account is:

| · | An account where the Covered Person enjoys the benefits of ownership (even if title is held in another name); and/or |

| · | An account where the Covered Person either directly or indirectly, has investment control or the power to vote or influence the transaction decisions of the account. |

The Code’s provisions apply to accounts beneficially owned by the Covered Person, as well as accounts under direct or indirect influence or control of the Covered Person.

Generally, an individual is considered to be a beneficial owner of accounts or securities when the individual has or shares direct or indirect pecuniary interest in the accounts or securities. Pecuniary interest means that an individual has the ability to profit, directly or indirectly, or share in any profit from a transaction. Indirect pecuniary interest extends to, but is not limited to:

| · | Accounts and securities held by immediate family members sharing the same household; |

| · | Securities held in trust (certain restrictions may apply); and |

| · | A right to acquire Covered Securities through the exercise or conversion of any derivative security, whether or not presently exercisable. |

Practical Application

If an adult child is living with his or her parents: If the child is living in the parents’ house, but does not financially support the parent, the parents’ accounts and securities are not beneficially owned by the child. If the child works for the Firm and does not financially support the parents, accounts and securities owned by the parents are not subject to the Code, with the exception of UGMA/UTMA, or similar types of accounts, which are legally owned by the child. If one or both parents work for the Firm, and the child is supported by the parent(s), the child’s accounts and securities are subject to the Code because the parent(s) is a beneficial owner of the child’s accounts and securities.

Co-habitation (domestic partnership or PACS): Domestic partnerships or PACS are generally considered to be permanent, committed arrangements. Accounts where the Covered Person is a joint owner are subject to the Code. If the Covered Person contributes to the maintenance of the household and the financial support of the partner, the partner’s accounts and securities are beneficially owned by the Covered Person and are therefore subject to the Code.

Co-habitation (roommate): Generally, roommates are presumed to be temporary and have no beneficial interest in one another’s accounts and securities.

UGMA/UTMA and similar types of accounts: If the Covered Person or the Covered Person’s spouse or other Covered family member is the custodian for a minor child, the account is beneficially owned by the Covered Person. If someone other than the Covered Person, or the Covered Person’s spouse or other Covered family member, is the custodian for the Covered Person’s minor child, the account is not beneficially owned by the Covered Person. If a Covered Person is the minor/beneficiary of the account, the account is a Reportable Account.

Transfer on Death accounts (“TOD accounts”): TOD accounts where the Covered Person receives the interest of the account upon death of the account owner are not beneficially owned by the Covered Person until the account transfer occurs (this particular account registration is not common).

| Information Classification: General | 23 |

Trusts

| · | If the Covered Person is the trustee for an account where the beneficiaries are not immediate family members, the position should be reviewed in light of outside business activity reporting requirements and generally will be subject to a case-by-case review for Code applicability. |

| · | If the Covered Person is a beneficiary and does not share investment control with a trustee, the Covered Person is not a beneficial owner until the Trust assets are distributed. |

| · | If a Covered Person is a beneficiary and can make investment decisions without consultation with a trustee, the trust is beneficially owned by the Covered Person. |

| · | If the Covered Person is a trustee and a beneficiary, the trust is beneficially owned by the Covered Person. |

| · | If the Covered Person is a trustee, and a family member is beneficiary, then the account is beneficially owned by the Covered Person. |

| · | If the Covered Person is a settler of a revocable trust, the trust is beneficially owned by the Covered Person. |

| · | If the Covered Person’s spouse/domestic partner is trustee and beneficiary, a case-by-case review will be performed to determine applicability of the Code. |

College age children: If a Covered Person has a child in college and still claims the child as a dependent for tax purposes, the Covered Person is a beneficial owner of the child’s accounts and securities.

Powers of Attorney: If a Covered Person has been granted durable or conditional power of attorney over an account, the Covered Person is not the beneficial owner of the account until such time as the power of attorney is exercised. If a Covered Person has been granted full power of attorney over an account, the account is a Reportable Account. Beneficial ownership runs until revocation/termination of the power of attorney.

| Information Classification: General | 24 |

| Information Classification: General | 25 |

| Information Classification: General | 26 |

Appendix D

Country Specific Requirements

All Countries

Personal Data

Refer to the Global Privacy and Personal Data Protection Standard (Standard) for the minimum requirements on how to handle and protect personal data in all jurisdictions in which State Street operates. Also reference the regional addenda to the Standard for any laws of a specific country that may require additional privacy or data protection measures.

Australia

Additional Blackout Period

From time to time the Responsible Entity (“RE”) of the Australian domiciled Exchange Traded Funds (ETFs) may determine certain Covered Persons could be in possession of material, non-public information relating to one or more ETFs for which State Street Global Advisors, Australia, Limited is the investment advisor, and request a blackout period covering the securities be implemented, whether due to consideration of Australian Securities Exchange listing rules, the insider trading provisions of the Corporations Act 2001 or similar. Typically this may occur during the two weeks prior to the public announcement of income distributions for an ETF.

Upon receipt of a request from the RE, the Conduct Risk Management Team, or their designee, will review the request and may initiate a blackout period over the relevant ETFs on such terms as are deemed appropriate. Covered Persons to whom a blackout period applies will be advised of the commencement, duration and other specifics of any such blackout period. Any trading in contravention of the blackout period will be treated as an employee conduct issue.

France

At the date of this Code, Covered Persons of State Street Global Advisors France are required in France to comply, in addition to the Code, with the following provisions:

Laws and Regulations

| · | The Monetary and Financial Code, and in the particular the rules of good conduct provided in Articles L.533-10 of the Monetary and Financial Code; |

| · | The General Regulation of the Financial Markets Authority, and in particular the organizational and good conduct rules provided in Book III of this Regulation; |

| · | Instructions, recommendations and decisions issued as the case may be by the French Markets Authority. |

Policies and Procedures Issued Locally by State Street Global Advisors France

| · | Provisions of the Internal Regulation, as updated on July 1, 2011 |

Further, as indicated in the Code, certain sections of the Code are not applicable in France, or are applicable in a modified version set forth below. References are to section headings used in the Code.

Private Placement

In France, a Private Placement means a securities offering that is exempt from registration or which is not subject to the obligation to publish a prospectus under certain relevant provisions of French law and regulation and/or similar laws of jurisdictions outside of France (if you are unsure whether the securities are issued in a private placement, you must consult with the Conduct Risk Management Team). In France, the rules relating to Private Placements are set forth in Articles L.411-2 and D.411-1 et seq. of the Monetary and Financial Code.

| Information Classification: General | 27 |

Discretionary Account

In France, the requirements of the Code shall not apply to personal transactions entered into under a Discretionary Account management service where there is no prior communication in connection with the transaction between the portfolio manager and the Covered Person.

Reporting Violations

If a Covered Person in France has reason to believe that a violation of law or regulations relating to internal control procedures in the financial, accounting, banking or anti-corruption areas or that a violation of an interest vital to State Street Global Advisors France or of the physical or moral integrity of its Covered Persons has been committed, he/she is encouraged to notify the Conduct Risk Management Team so that State Street Global Advisors France may carefully examine the facts and take corrective measures.

Covered Persons may identify themselves in order to allow State Street Global Advisors France to obtain a complete report on the relevant facts as rapidly as possible. Nonetheless, if circumstances require, Covered Persons may communicate the facts anonymously.

The information furnished to the company by a Covered Person believing in good faith that his/her action is necessary to protect State Street Global Advisors France from illegal or inappropriate behavior will be treated in a strictly confidential and secure manner to the extent allowed by law. Any person reporting violations, as identified within the framework of the procedure, will have a right to access, obtain further information, and if applicable, object to and correct the data regarding him/her.

State Street Global Advisors France will not take any sanctions or retaliatory measures against a Covered Person for reporting suspected violations in good faith. Failure to report will not give rise to any consequences for Covered Persons. However, an abusive use of the reporting procedure may in certain cases expose a Covered Person to sanctions.

Violations and Sanctions

Any potential employee conduct issues related to the provisions of the Code or related policies by Covered Persons in France will be investigated by the Conduct Risk Management Team. Covered Persons are invited to review the list of misconduct which may, among other violations, give rise to the disciplinary sanctions contemplated by State Street Global Advisors France’s Internal Regulation. If a determination is made that an employee conduct issue has occurred, the issue will be addressed under the State Street Conduct Standards Policy and enforcement actions, modified where necessary per Internal Regulation, may be imposed by the employer, State Street Global Advisors France. Material violations will be reported promptly to the respective Firm Committees, boards of trustees/managers of the Reportable Funds or relevant committees of the boards and related clients.

In France, all sanctions will be notified in writing to the employee concerned, indicating the grounds for the sanction.

Prior to any sanction affecting the duties, career, remuneration or presence of the employee, the following procedure will be implemented:

| · | The employee will be convened to a prior meeting within the two-month period described in Article L.1332-4 of the Labor Code, by registered letter or by hand delivery against receipt. |

| · | This letter will state the purpose for the convocation and will indicate the date, place and time of the meeting, as well as the possibility for the employee to be assisted by a person of his/her choice from a list which can be consulted at the town hall of State Street Global Advisors, Defense Plaza, 23-25 rue Delariviere-Lefoullon, 92064 Paris La Defense Cedex and/or the town hall of the employee’s domicile (if the employee’s domicile is located in the same department as the |

| Information Classification: General | 28 |

| offices of State Street Global Advisors France), or at the Labor Inspectorate located at State Street Global Advisors, Defense Plaza, 23-25 rue Delariviere-Lefoullon, 92064 Paris La Defense Cedex. |

| · | A preliminary meeting will be held during which the facts relating to the employee’s alleged misconduct will be presented to the employee and to the person assisting the employee and at which the employee’s explanations will be obtained. |

| · | As the case may be depending on the explanations given, a sanction letter will be sent by registered post, return receipt requested, at the earliest one full day and at the latest one month after the meeting. This letter should set forth the grounds for the sanction. |

When the behavior of an employee renders such actions indispensable, conservatory measures may be taken prior to implementing the procedure described above. No sanction may be taken until the procedure has been completed.

Publicity and Entry into Force

This Code, which has been filed in France with the secretariat of the clerk of the Labor Court of State Street Global Advisors, Defense Plaza, 23-25 rue Delariviere-Lefoullon, 92064 Paris La Defense Cedex and posted in compliance with the provisions of Articles R.1321-1 and R.1321-2 of the Labor Code, entered into force on December 1, 2009.

It will be provided to all Covered Persons and other relevant persons at the time of hire or arrival on the premises of State Street Global Advisors France.

Material modifications and additions to these internal rules shall be subject to the same consultation, communication and publicity procedures.

The Code has been previously submitted to the Labor Inspectorate, and is displayed on State Street Global Advisors France’s premises.

Germany

The German rules on personal account dealing are contained in the Securities Trading Act and specified in more detail by the BaFin circular 4/2010 (WA) MaComp “Minimum Requirements for the Compliance Function and Additional Requirements Governing Rules of Conduct, Organisation and Transparency pursuant to Sections 31 et seq. of the Securities Trading Act (Wertpapierhandelsgesetz - WpHG) for Investment Services Enterprises.”

Italy

At the date of this Code, the Firm’s Covered Persons are required in Italy to comply, in addition to the Code, with the following provisions:

Laws and regulations

| · | Legislative Decree No. 58 of 24 February 1998, as amended (the “Italian Financial Act”), containing, inter alia, general provisions concerning investment services; |

| · | Legislative Decree No. 231 of 21 November 2007, as amended (the “Anti-money Laundering Act”), containing, inter alia, the duty to identify each client and subsequently record his data, as well as to keep a unified electronic archive and to notify any suspect transactions; |

| · | Regulation No.16190 of 29 October 2007, adopted by CONSOB (the “Intermediaries Regulation”), with reference to the investment services and the financial activities carried out in Italy; |