THE SELECT SECTOR SPDR TRUST

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED

SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08837

THE SELECT SECTOR SPDR® TRUST

(Exact name of registrant as specified in charter)

One Iron

Street, Boston, Massachusetts 02210

(Address of principal executive offices) (zip code)

Sean O’Malley, Esq.

Senior Vice President and Deputy General Counsel

c/o SSGA Funds Management, Inc.

One Iron Street

Boston,

Massachusetts 02210

(Name and address of agent for service)

Copy to:

W. John

McGuire, Esq.

Morgan, Lewis, & Bockius, LLP

1111 Pennsylvania Avenue, NW

Washington, D.C. 20004

Registrant’s telephone number, including area code: (617) 664-1465

Date of fiscal year end: September 30

Date of reporting period: September 30, 2019

Item 1. Report to Shareholders.

The Select Sector SPDR

Trust

Beginning on January 1,

2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper

copies of a Fund’s annual and semi- annual shareholder reports will no

longer be sent by mail, unless you specifically request paper copies of the reports from the Fund (or from your financial intermediary, such as a broker-dealer or bank). Instead, the reports will be made available on a Fund’s website

(www.sectorspdrs.com ), and you will be notified by mail each time a report is posted, and provided with a website link to access the report. If you already elected to receive reports electronically, you will not be affected by this change and you

need not take any action. You may elect to receive shareholder reports and other communications by contacting your financial intermediary.

You may elect to receive all future reports in paper free of

charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds

held in your account.

Annual Report

September 30, 2019

Select Sector SPDR Funds

The Select Sector SPDR Trust consists of eleven separate investment

portfolios (each a “Select Sector SPDR Fund” or a “Fund” and collectively the “Select Sector SPDR Funds” or the “Funds”).

Select Sector SPDR Funds are “index funds” that

unbundle the benchmark S&P 500®† and give

you ownership in particular sectors or groups of industries that are represented by a specified Select Sector Index. Through a single share, investors can buy or sell any of eleven major industry sectors that make up the S&P 500®, in the same way as they would buy or sell a share of stock. Select Sector SPDR Fund shares are different from the shares of conventional mutual

funds. Select Sector SPDR Funds trade on NYSE Arca, Inc.

Eleven Select Sector SPDR Funds

Shares are available for exchange trading in the following Funds of The

Select Sector SPDR Trust:

| The

Communication Services Select Sector SPDR Fund |

XLC

|

| The

Consumer Discretionary Select Sector SPDR Fund |

XLY

|

| The

Consumer Staples Select Sector SPDR Fund |

XLP

|

| The

Energy Select Sector SPDR Fund |

XLE

|

| The

Financial Select Sector SPDR Fund |

XLF

|

| The

Health Care Select Sector SPDR Fund |

XLV

|

| The

Industrial Select Sector SPDR Fund |

XLI

|

| The

Materials Select Sector SPDR Fund |

XLB

|

| The

Real Estate Select Sector SPDR Fund |

XLRE

|

| The

Technology Select Sector SPDR Fund |

XLK

|

| The

Utilities Select Sector SPDR Fund |

XLU

|

Each of these Funds is designed

to, before expenses, correspond generally to the price and yield performance of a Select Sector Index. Each Fund’s portfolio is comprised principally of shares of constituent companies in the S&P 500®. Each stock in the S&P 500® is allocated to

one Select Sector Index. The combined companies of the eleven Select Sector Indexes represent all of the companies in the S&P 500®. Each Select

Sector SPDR Fund can be expected to move up or down in value with its underlying Select Sector Index. Investors cannot invest directly in an index. Funds focused on a single sector generally experience greater price fluctuations than the overall

stock market.

Objective

Select Sector SPDR Funds are designed to provide investors with an

affordable way to invest in a portfolio of equity securities in a sector or group of industries in a single trade. Select Sector SPDR Funds allow you to tailor asset allocations to fit your particular investment needs or goals. One Fund may

complement another; individual Select Sector SPDR Funds can be used to increase exposure to certain industries that may be outperforming the market or to hedge other holdings in your portfolio. Although an individual Select Sector SPDR Fund may bear

a higher level of risk than a broad-market fund, because of less diversification, sector investments may also offer opportunities for returns greater than an investment in the entire constituents of the S&P 500®.

The information

contained in this report is intended for the general information of shareholders of the Trust. This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current Trust prospectus which contains

important information concerning the Trust. You may obtain a current prospectus from the Distributor, ALPS Portfolio Solutions Distributor, Inc., by calling 1-866-SECTOR-ETF (1-866-732-8673). Please read the prospectus carefully before you

invest.

† S&P 500: the Standard & Poor’s composite index of 500 stocks, a widely recognized,

unmanaged, index of common stock prices.

[This Page Intentionally Left Blank]

Notes to Performance Summaries (Unaudited)

The performance chart of a Fund’s total return at net

asset value (“NAV”), the total return based on market price and its benchmark index is provided for comparative purposes only and represents the periods noted. A Fund’s per share NAV is the value of one share of a Fund and is

calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of a Fund and the market return is based on the market price per share of a Fund. The market price used

to calculate the market return is determined by using the midpoint between the highest bid and the lowest offer on the exchange on which the shares of a Fund are listed for trading, as of the time that a Fund’s NAV is calculated. NAV and

market returns assume that dividends and capital gain distributions have been reinvested in a Fund at NAV. Market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were

included market returns would be lower.

An index is a

statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities and therefore does not reflect deductions for fees or expenses. In comparison, a Fund’s performance is negatively impacted

by these deductions. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income.

The Communication Services Select Sector Index is intended

to give investors an efficient, modified market capitalization-based way to track the movements of certain public companies that are components of the S&P 500 and are involved in the development and production of communication services

products.

The Consumer Discretionary Select Sector

Index is intended to give investors an efficient, modified market capitalization-based way to track the movements of certain public companies that are components of the S&P 500 and are involved in the development and production of consumer

discretionary products.

The Consumer Staples Select

Sector Index is intended to give investors an efficient, modified market capitalization-based way to track the movements of certain public companies that are components of the S&P 500 and are involved in the development and production of

consumer products.

The Energy Select Sector Index is

intended to give investors an efficient, modified market capitalization-based way to track the movements of certain public companies that are components of the S&P 500 and are involved in the development and production of energy products.

The Financial Select Sector Index is intended to give

investors an efficient, modified market capitalization-based way to track the movements of certain public companies that are components of the S&P 500 and are involved in the development and production of financial products.

The Health Care Select Sector Index is intended to give

investors an efficient, modified market capitalization-based way to track the movements of certain public companies that are components of the S&P 500 and are health care related firms.

The Industrial Select Sector Index is intended to give

investors an efficient, modified market capitalization-based way to track the movements of certain public companies that are components of the S&P 500 and are industrials.

The Materials Select Sector Index is intended to give

investors an efficient, modified market capitalization-based way to track the movements of certain public companies that are components of the S&P 500 and are in basic industries.

The Real Estate Select Sector Index is intended to give

investors an efficient, modified market capitalization-based way to track the movements of certain public companies that are components of the S&P 500 and are involved in the investment in and/or management and development of real estate.

The Technology Select Sector Index is intended to give

investors an efficient, modified market capitalization-based way to track the movements of certain public companies that are components of the S&P 500 and are involved in the development and production of technology products.

The Utilities Select Sector Index is intended to give

investors an efficient, modified market capitalization-based way to track the movements of certain public companies that are components of the S&P 500 and are in the utilities industry.

The S&P 500 Index includes five hundred (500) selected

companies, all of which are listed on national stock exchanges and spans over 25 separate industry groups.

See accompanying notes to financial statements.

1

THE COMMUNICATION SERVICES SELECT SECTOR SPDR FUND

Management's Discussion of Fund Performance (Unaudited)

The Communication Services Select Sector SPDR Fund (the

“Fund”) seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Communication Services Select Sector Index. The

Fund’s benchmark is the Communication Services Select Sector Index (the “Index”).

For the 12-month period ended September 30, 2019 (the

“Reporting Period”), the total return for the Fund was 2.07%, and the Index was 2.17%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the

Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Cash, security misweights, transaction costs and compounding (the

exponential growth of outperformance or underperformance) also contributed to the difference between the Fund’s performance and that of the Index.

Despite a difficult start to the period, the Fund was able

to make a strong turnaround in 2019 and end the period in positive territory. Wireless technology demand continued to rise as communication and media devices increasingly move to the wireless arena, providing the potential for revenues to rise.

Despite faster growth, pursuing new technologies and providing attractive content costs money. An additional challenge for some companies is the increased attention from lawmakers, who have expressed concerns about their size and how well

they’re protecting consumers’ privacy. Both Facebook and Twitter are perfect examples of this. As these companies have continued to grow and profit, they are continuously fighting against privacy law violations. In Europe, antitrust

issues have resulted in pushback against the big U.S. companies in the form of fines, taxes and regulation. The rise in local regulation adds complexity and cost to providing users with fast and universal access to data that is increasingly

segregated behind layers of different regulations. As a result, although the Fund finished the period in positive territory, it was somewhat stifled by pressure on some of the largest and fastest growing companies.

On an individual security level, the top positive

contributors to the Fund’s performance during the Reporting Period were Facebook, Inc. Class A, Twitter, Inc., and Comcast Corporation Class A. The top negative contributors to the Fund’s performance during the Reporting Period were

Electronic Arts Inc., CenturyLink, Inc., and Activision Blizzard, Inc..

The views expressed above reflect those of the Fund’s

portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any

responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

2

The Communication Services Select Sector SPDR Fund

Performance Summary (Unaudited)

Performance as of September 30, 2019

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Cumulative

Total Return |

|

Average

Annual Total Return |

|

|

| |

|

|

|

Net

Asset

Value |

Market

Value |

Communication

Services Select Sector Index |

S&P

500 Index |

|

Net

Asset

Value |

Market

Value |

Communication

Services Select Sector Index |

S&P

500 Index |

|

| |

|

ONE

YEAR |

|

2.07%

|

2.03%

|

2.17%

|

4.25%

|

|

2.07%

|

2.03%

|

2.17%

|

4.25%

|

|

| |

|

SINCE

INCEPTION(1) |

|

0.25%

|

0.24%

|

0.38%

|

10.09%

|

|

0.20%

|

0.18%

|

0.30%

|

7.78%

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1)

|

For

the period June 18, 2018 to September 30, 2019. |

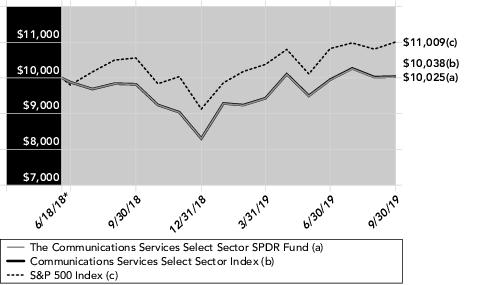

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line

graph is based on cumulative total return.

* Inception date.

The total expense ratio for The Communication Services Select

Sector SPDR Fund as stated in the Fees and Expenses table of the most recent prospectus is 0.13%.

Performance quoted represents past performance, which is no

guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.spdrs.com for most recent month-end

performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. See "Notes to Performance Summaries" on page 1 for more information.

See accompanying notes to financial

statements.

3

The Communication Services Select Sector SPDR

Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of September 30,

2019

|

|

|

|

|

| |

Description

|

Market

Value |

%

of Net Assets |

|

| |

Facebook,

Inc. Class A |

1,088,050,458

|

18.0%

|

|

| |

Alphabet,

Inc. Class C |

708,409,660

|

11.7

|

|

| |

Alphabet,

Inc. Class A |

703,495,090

|

11.7

|

|

| |

Verizon

Communications, Inc. |

282,603,166

|

4.7

|

|

| |

AT&T,

Inc. |

280,211,860

|

4.6

|

|

| |

TOTAL

|

3,062,770,234

|

50.7%

|

|

(The five largest holdings are subject to

change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

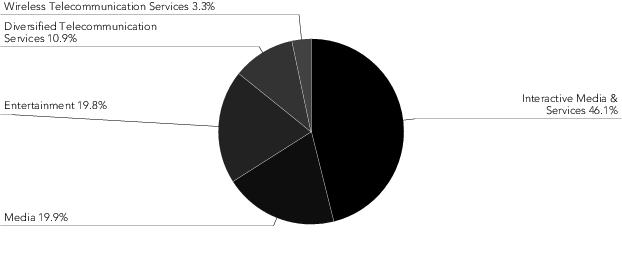

Industry Breakdown as of September 30,

2019*

* The

Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

4

THE CONSUMER DISCRETIONARY SELECT SECTOR SPDR

FUND

Management's Discussion of Fund Performance

(Unaudited)

The Consumer Discretionary Select Sector

SPDR Fund (the “Fund”) seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Consumer Discretionary Select Sector

Index. The Fund’s benchmark is the Consumer Discretionary Select Sector Index (the “Index”).

For the 12-month period ended September 30, 2019 (the

“Reporting Period”), the total return for the Fund was 4.45%, and the Index was 4.58%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the

Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Cash, security misweights, transaction costs and compounding (the

exponential growth of outperformance or underperformance) also contributed to the difference between the Fund’s performance and that of the Index.

Despite a difficult start to the period, the fund was able

to make a strong turnaround in 2019 and end the period in positive territory. Under the new GICS structure implemented in September 2018, select companies from the Consumer Discretionary were renamed Communication Services. As a result, the Consumer

Discretionary index no longer included media and entertainment companies, but continued to offer exposure to retailers, including Amazon and Home Depot. Despite the decline in Amazon performance for the period, this sector remained an attractive

option for growth investors with its continued exposure to stocks with relatively high expected earnings and sales growth. Thanks to falling mortgage rates, low unemployment and rising wages, homebuilding saw a lot of growth which benefited

home-improvement retailers like Home Depot. Positive performance was also driven by strong returns from Starbucks whose stock has taken off over the past year as comparable sales growth has consistently topped expectations. Many restaurants,

including fast food retailers, have also seen an uptick in sales as they partner up with delivery companies like Uber Eats and Door Dash to cater to customers whom enjoy the convenience of staying home and eating in.

On an individual security level, the top positive

contributors to the Fund’s performance during the Reporting Period were Starbucks Corporation, McDonald's Corporation, and Home Depot, Inc.. The top negative contributors to the Fund’s performance during the Reporting Period were

Tapestry, Inc., Carnival Corporation, and Amazon.com, Inc..

The views expressed above reflect those of the Fund’s

portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any

responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

5

The Consumer Discretionary Select Sector SPDR Fund

Performance Summary (Unaudited)

Performance as of September 30, 2019

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Cumulative

Total Return |

|

Average

Annual Total Return |

|

|

| |

|

|

|

Net

Asset

Value |

Market

Value |

Consumer

Discretionary Select Sector Index |

S&P

500 Index |

|

Net

Asset

Value |

Market

Value |

Consumer

Discretionary Select Sector Index |

S&P

500 Index |

|

| |

|

ONE

YEAR |

|

4.45%

|

4.43%

|

4.58%

|

4.25%

|

|

4.45%

|

4.43%

|

4.58%

|

4.25%

|

|

| |

|

FIVE

YEARS |

|

94.43%

|

94.38%

|

95.96%

|

67.27%

|

|

14.22%

|

14.22%

|

14.40%

|

10.84%

|

|

| |

|

TEN

YEARS |

|

408.41%

|

408.53%

|

418.44%

|

246.74%

|

|

17.66%

|

17.66%

|

17.89%

|

13.24%

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

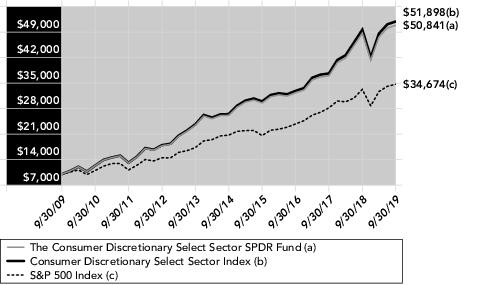

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line

graph is based on cumulative total return.

The total

expense ratio for The Consumer Discretionary Select Sector SPDR Fund as stated in the Fees and Expenses table of the most recent prospectus is 0.13%.

Performance quoted represents past performance, which is no

guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.spdrs.com for most recent month-end

performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. See "Notes to Performance Summaries" on page 1 for more information.

See accompanying notes to financial

statements.

6

The Consumer Discretionary Select Sector SPDR

Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of September 30,

2019

|

|

|

|

|

| |

Description

|

Market

Value |

%

of Net Assets |

|

| |

Amazon.com,

Inc. |

3,064,065,156

|

22.0%

|

|

| |

Home

Depot, Inc. |

1,552,552,085

|

11.1

|

|

| |

McDonald's

Corp. |

996,195,999

|

7.2

|

|

| |

NIKE,

Inc. Class B |

718,180,881

|

5.2

|

|

| |

Starbucks

Corp. |

646,492,645

|

4.6

|

|

| |

TOTAL

|

6,977,486,766

|

50.1%

|

|

(The five largest holdings are subject to

change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

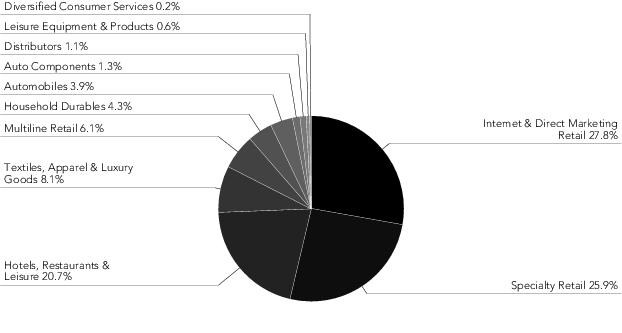

Industry Breakdown as of September 30,

2019*

* The

Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

7

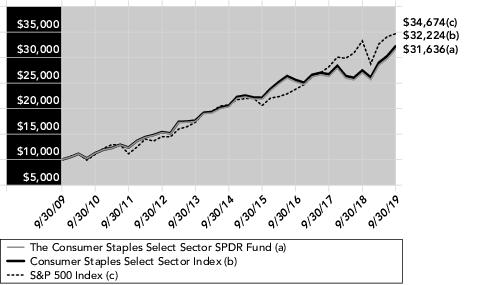

The Consumer Staples Select Sector SPDR Fund

Management's Discussion of Fund Performance (Unaudited)

The Consumer Staples Select Sector SPDR Fund (the

“Fund”) seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Consumer Staples Select Sector Index. The Fund’s

benchmark is the Consumer Staples Select Sector Index (the “Index”).

For the 12-month period ended September 30, 2019 (the

“Reporting Period”), the total return for the Fund was 17.14%, and the Index was 17.31%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing

the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Fees and expenses along with cash drag contributed to the

difference between the Fund’s performance and that of the Index.

Some hawkish comments from the Fed during the last quarter

of 2018, coupled with the arrest of a Chinese company’s Chief Financial Officer which stopped the progress being made on the trade talk front with China, were enough to put a quick halt to the ten year bull market run. After its best quarter

in five years, the U.S. equity market responded with its worst quarterly performance since 2011. As a result, Consumer Staples stocks benefited from their defensive nature, if you can call it that, sliding just

–4.96% (vs. S&P 500 Index return of –13.52%). While tobacco stocks caused a drag,

this was somewhat offset by strong performances in the household products and beverages groups. The first quarter of 2019 started out with a downgrade of growth expectations, but this led to a sharp shift in tone from the Central Banks from hawkish

to dovish which helped to buoy the markets. Earning reports, although not quite as strong as the previous three month period, were stronger than expected. Remarkably, the S&P 500 Index erased all of those losses in the first quarter of 2019 as

it rebounded by +13.64%. Despite this sharp rally led by the more traditionally known cyclical sectors, consumer staples held their own to climb a more than respectable +11.10%. Tobacco stocks rebounded strongly along with a continued rise from

household products and the packaged foods industry as accelerated sales growth and cheap valuations were the catalysts.

While the Fed began to put a halt to the markets

expectations of a rate cut, a renewed escalation in trade talks and tariff wars between the US and China in May of 2019 caused the Fed to change its tune once again giving the markets hope for future accommodations. The Fund continued its momentum

with this backdrop performing in line with the overall market with a gain of +4.40% for the three months ended June 30, 2019. Things only got better for the Fund in the last quarter of the fiscal year as a sharp decline in interest rates led to a

flight to defensive stocks. This flight to safety resulted in the sector gaining +6.36% to end on a high note.

On an individual security level, the top positive

contributors to the Fund’s performance during the Reporting Period were Procter & Gamble Company, PepsiCo, Inc., and Walmart Inc. The top negative contributors to the Fund’s performance during the Reporting Period were Walgreens

Boots Alliance Inc., Kraft Heinz Company, and Altria Group Inc.

The views expressed above reflect those of the Fund’s

portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any

responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

8

The Consumer Staples Select Sector SPDR Fund

Performance Summary (Unaudited)

Performance as of September 30, 2019

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Cumulative

Total Return |

|

Average

Annual Total Return |

|

|

| |

|

|

|

Net

Asset

Value |

Market

Value |

Consumer

Staples Select Sector Index |

S&P

500 Index |

|

Net

Asset

Value |

Market

Value |

Consumer

Staples Select Sector Index |

S&P

500 Index |

|

| |

|

ONE

YEAR |

|

17.14%

|

17.13%

|

17.31%

|

4.25%

|

|

17.14%

|

17.13%

|

17.31%

|

4.25%

|

|

| |

|

FIVE

YEARS |

|

55.59%

|

55.55%

|

56.69%

|

67.27%

|

|

9.24%

|

9.24%

|

9.40%

|

10.84%

|

|

| |

|

TEN

YEARS |

|

216.36%

|

216.56%

|

222.29%

|

246.74%

|

|

12.21%

|

12.21%

|

12.42%

|

13.24%

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line

graph is based on cumulative total return.

The total

expense ratio for The Consumer Staples Select Sector SPDR Fund as stated in the Fees and Expenses table of the most recent prospectus is 0.13%.

Performance quoted represents past performance, which is no

guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.spdrs.com for most recent month-end

performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. See "Notes to Performance Summaries" on page 1 for more information.

See accompanying notes to financial

statements.

9

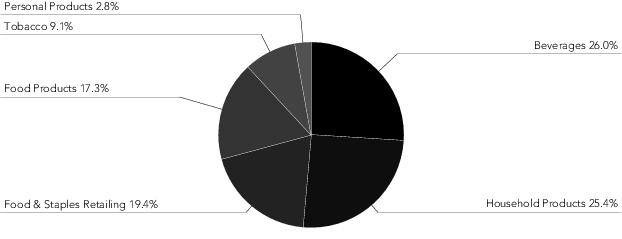

The Consumer Staples Select Sector SPDR Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of September 30,

2019

|

|

|

|

|

| |

Description

|

Market

Value |

%

of Net Assets |

|

| |

Procter

& Gamble Co. |

2,315,789,801

|

16.5%

|

|

| |

Coca-Cola

Co. |

1,558,533,743

|

11.1

|

|

| |

PepsiCo,

Inc. |

1,426,344,117

|

10.2

|

|

| |

Walmart,

Inc. |

1,255,884,103

|

9.0

|

|

| |

Mondelez

International, Inc. Class A |

653,481,828

|

4.7

|

|

| |

TOTAL

|

7,210,033,592

|

51.5%

|

|

(The five largest holdings are subject to

change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Industry Breakdown as of September 30,

2019*

* The

Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

10

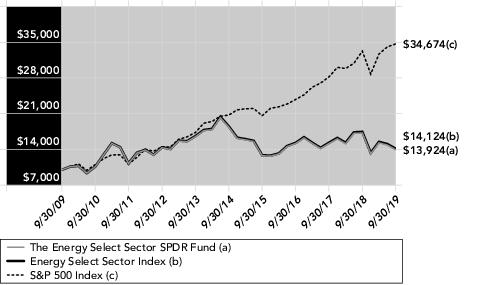

The Energy Select Sector SPDR Fund

Management's Discussion of Fund Performance (Unaudited)

The Energy Select Sector SPDR Fund (the “Fund”)

seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Energy Select Sector Index. The Fund’s benchmark is the Energy Select

Sector Index (the “Index”).

For the

12-month period ended September 30, 2019 (the “Reporting Period”), the total return for the Fund was –19.08%, and the Index was –19.01%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund,

including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Fees, the cumulative effect of security misweights, and Index

changes/corporate actions, contributed to the difference between the Fund’s performance and that of the Index.

It was a rough and volatile fiscal year for energy stocks

starting with a substantial decline of –23.62% in the first three months of the period, as the sector fell into bear market territory. This freefall was driven by

signs of an abundant supply of oil coupled with forecasts of weakening demand. Economic growth concerns and sharply declining oil prices, which dropped nearly 40% from the beginning of period highs, were sparked in part by the temporary waivers

granted to eight countries importing oil from Iran. This contributed to an increased supply to the market. However, the sector rebounded strongly at the start of 2019, recouping a good portion of what had been lost, as the fund realized a 16.21%

rise for the first three months of the calendar year. As January kicked in with a downgrade of global growth expectations from the International Monetary Fund, it did not look like things would get much better. But what it did lead to was a sudden

reversal by the central banks whose hawkish tones shifted quickly to more dovish ones. In fact, the prospect of further rate hikes in 2019 was all but taken off the table by quarter’s end. In addition, earnings reports, although not quite as

strong as the previous three month period, were stronger than expected. Oil prices also saw a significant bounce back as the calendar turned to 2019.

Continued tensions in trade talks and increasing tariffs

being applied by the US and China rattled markets in May of 2019 and the Fed Chair, Jerome Powell, had put a halt to the market expectations for potential rate cuts heading into the month. Once again, oil prices fell into bear market territory as a

result and the Fund declined –11.09% for the month alone. But as markets declined sharply during May, the sentiments from the Fed changed once again to give the

markets renewed hope of some accommodations in the near future. The Fund quickly recovered in June with strong performance of over 9.24% as oil prices swung back sharply, finishing just below the highs at the start of the quarter. The Fund finished

the fiscal year just as it began, on a down note, as escalating tariff wars were accompanied by a drone strike on Saudi Arabia oil facilities caused the largest single day rise in oil prices since 2008. These prices quickly retreated below levels

prior to the attack as Saudi Aramco reassured that the facilities would be fully restored in short order.

On an individual security level, the top positive

contributors to the Fund’s performance during the Reporting Period were Kinder Morgan Inc Class P, Chevron Corporation, and ONEOK, Inc.. The top negative contributors to the Fund’s performance during the Reporting Period were Occidental

Petroleum Corporation, EOG Resources, Inc., and Exxon Mobil Corporation.

The views expressed above reflect those of the Fund’s

portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any

responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

11

The Energy Select Sector SPDR Fund

Performance Summary (Unaudited)

Performance as of September 30, 2019

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Cumulative

Total Return |

|

Average

Annual Total Return |

|

|

| |

|

|

|

Net

Asset

Value |

Market

Value |

Energy

Select Sector Index |

S&P

500 Index |

|

Net

Asset

Value |

Market

Value |

Energy

Select Sector Index |

S&P

500 Index |

|

| |

|

ONE

YEAR |

|

–

19.08% |

–

19.09% |

–

19.01% |

4.25%

|

|

–

19.08% |

–

19.09% |

–

19.01% |

4.25%

|

|

| |

|

FIVE

YEARS |

|

–

24.16% |

–

24.18% |

–

23.79% |

67.27%

|

|

–

5.38% |

–

5.39% |

–

5.29% |

10.84%

|

|

| |

|

TEN

YEARS |

|

39.24%

|

39.40%

|

41.27%

|

246.74%

|

|

3.37%

|

3.38%

|

3.52%

|

13.24%

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line

graph is based on cumulative total return.

The total

expense ratio for The Energy Select Sector SPDR Fund as stated in the Fees and Expenses table of the most recent prospectus is 0.13%.

Performance quoted represents past performance, which is no

guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.spdrs.com for most recent month-end

performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. See "Notes to Performance Summaries" on page 1 for more information.

See accompanying notes to financial

statements.

12

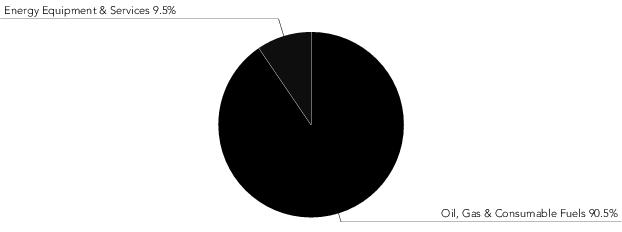

The Energy Select Sector SPDR Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of September 30,

2019

|

|

|

|

|

| |

Description

|

Market

Value |

%

of Net Assets |

|

| |

Exxon

Mobil Corp. |

2,279,412,814

|

22.8%

|

|

| |

Chevron

Corp. |

2,117,867,834

|

21.1

|

|

| |

ConocoPhillips

|

455,915,157

|

4.6

|

|

| |

Phillips

66 |

447,718,605

|

4.5

|

|

| |

Schlumberger,

Ltd. |

419,958,492

|

4.2

|

|

| |

TOTAL

|

5,720,872,902

|

57.2%

|

|

(The five largest holdings are subject to

change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Industry Breakdown as of September 30,

2019*

* The

Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

13

The Financial Select Sector SPDR Fund

Management's Discussion of Fund Performance (Unaudited)

The Financial Select Sector SPDR Fund (the

“Fund”) seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Financial Select Sector Index. The Fund’s benchmark

is the Financial Select Sector Index (the “Index”).

For the 12-month period ended September 30, 2019 (the

“Reporting Period”), the total return for the Fund was 3.81%, and the Index was 3.92%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the

Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Expenses and cash contributed to the difference between the

Fund’s performance and that of the Index.

The

Financial Select Sector SPDR Fund had an inauspicious start to the Reporting Period, down over 13% mainly as a result of a flattening yield curve, but also due in part from a Democrat controlled House. Financial stocks showed some momentum at the

beginning of 2019, but valuations still remained low and the sector was held back by the Fed’s gloomy views on the economic outlook. Heading into the 3rd quarter of the Reporting Period, the financial sector benefited from an environment where

interest rates crept steadily higher and the yield curve also reversed course from its prior flattening trend. And while financials struggled at times as interest rates fell amidst expectations for additional central bank easing, a robust report on

the health of the US banking sector from the Federal Reserve’s latest Comprehensive Capital Analysis and Review (CCAR) helped financials finish the quarter on a strong note. The financial sector held up fairly well during the final quarter of

the Reporting Period given the sharp drop in interest rates and yield curve inversions that occurred during the period.

On an individual security level, the top positive

contributors to the Fund’s performance during the Reporting Period were JPMorgan Chase & Co., CME Group Inc. Class A, and Chubb Limited. The top negative contributors to the Fund’s performance during the Reporting Period were Charles

Schwab Corporation, State Street Corporation, and Berkshire Hathaway Inc. Class B.

The views expressed above reflect those of the Fund’s

portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any

responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

14

The Financial Select Sector SPDR Fund

Performance Summary (Unaudited)

Performance as of September 30, 2019

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Cumulative

Total Return |

|

Average

Annual Total Return |

|

|

| |

|

|

|

Net

Asset

Value |

Market

Value |

Financial

Select Sector Index |

S&P

500 Index |

|

Net

Asset

Value |

Market

Value |

Financial

Select Sector Index |

S&P

500 Index |

|

| |

|

ONE

YEAR |

|

3.81%

|

3.81%

|

3.92%

|

4.25%

|

|

3.81%

|

3.81%

|

3.92%

|

4.25%

|

|

| |

|

FIVE

YEARS |

|

63.95%

|

63.98%

|

64.82%

|

67.27%

|

|

10.39%

|

10.40%

|

10.51%

|

10.84%

|

|

| |

|

TEN

YEARS |

|

174.39%

|

174.96%

|

178.29%

|

246.74%

|

|

10.62%

|

10.64%

|

10.78%

|

13.24%

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

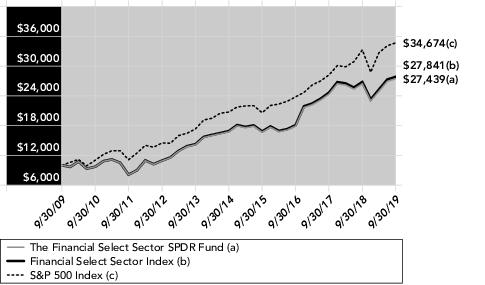

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line

graph is based on cumulative total return.

The total

expense ratio for The Financial Select Sector SPDR Fund as stated in the Fees and Expenses table of the most recent prospectus is 0.13%.

Performance quoted represents past performance, which is no

guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.spdrs.com for most recent month-end

performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. See "Notes to Performance Summaries" on page 1 for more information.

See accompanying notes to financial

statements.

15

The Financial Select Sector SPDR Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of September 30,

2019

|

|

|

|

|

| |

Description

|

Market

Value |

%

of Net Assets |

|

| |

Berkshire

Hathaway, Inc. Class B |

2,871,614,794

|

12.7%

|

|

| |

JPMorgan

Chase & Co. |

2,649,255,331

|

11.7

|

|

| |

Bank

of America Corp. |

1,720,377,934

|

7.6

|

|

| |

Wells

Fargo & Co. |

1,423,790,107

|

6.3

|

|

| |

Citigroup,

Inc. |

1,098,643,415

|

4.9

|

|

| |

TOTAL

|

9,763,681,581

|

43.2%

|

|

(The five largest holdings are subject to

change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

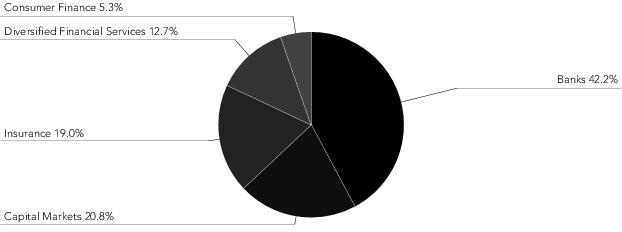

Industry Breakdown as of September 30,

2019*

* The

Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

16

The Health Care Select Sector SPDR Fund

Management's Discussion of Fund Performance (Unaudited)

The Health Care Select Sector SPDR Fund (the

“Fund”) seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Health Care Select Sector Index. The Fund’s

benchmark is the Health Care Select Sector Index (the “Index”).

For the 12-month period ended September 30, 2019 (the

“Reporting Period”), the total return for the Fund was –3.65%, and the Index was –3.57%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index

is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns.

A number of factors have contributed to this Fund’s

return over the Reporting Period. One of these has revolved around concerns regarding the government’s heightened scrutiny and increasing legislative initiatives on pharmaceutical pricing. Similarly, continued government actions regarding the

amending and potentially eliminating of the Affordable Care Act impacted a number of this Fund’s constituents. In regard to eliminating, there were also a number of legal challenges regarding the Affordable Care Act including a pending

constitutionality challenge in the Texas courts. Another factor negatively impacting a number of constituents was expiring pharmaceutical patents. Conversely, the continuing increased health care demands associated with the ongoing aging of the

American population made a positive contribution to many of this Fund’s constituents. Finally, a significantly heightened level of merger and acquisition both completed and anticipated contributed to this Fund’s return.

On an individual security level, the top positive

contributors to the Fund’s performance during the Reporting Period were Merck & Co., Inc., Danaher Corporation, and Abbott Laboratories. The top negative contributors to the Fund’s performance during the Reporting Period were Biogen

Inc., Pfizer Inc., and UnitedHealth Group Incorporated.

The views expressed above reflect those of the Fund’s

portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any

responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

17

The Health Care Select Sector SPDR Fund

Performance Summary (Unaudited)

Performance as of September 30, 2019

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Cumulative

Total Return |

|

Average

Annual Total Return |

|

|

| |

|

|

|

Net

Asset

Value |

Market

Value |

Health

Care Select Sector Index |

S&P

500 Index |

|

Net

Asset

Value |

Market

Value |

Health

Care Select Sector Index |

S&P

500 Index |

|

| |

|

ONE

YEAR |

|

–

3.65% |

–

3.64% |

–

3.57% |

4.25%

|

|

–

3.65% |

–

3.64% |

–

3.57% |

4.25%

|

|

| |

|

FIVE

YEARS |

|

52.35%

|

52.31%

|

53.33%

|

67.27%

|

|

8.78%

|

8.78%

|

8.93%

|

10.84%

|

|

| |

|

TEN

YEARS |

|

271.88%

|

272.33%

|

278.09%

|

246.74%

|

|

14.04%

|

14.05%

|

14.23%

|

13.24%

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

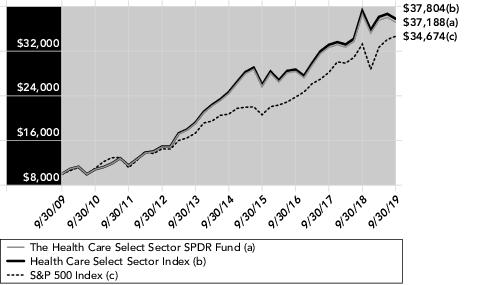

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line

graph is based on cumulative total return.

The total

expense ratio for The Health Care Select Sector SPDR Fund as stated in the Fees and Expenses table of the most recent prospectus is 0.13%.

Performance quoted represents past performance, which is no

guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.spdrs.com for most recent month-end

performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. See "Notes to Performance Summaries" on page 1 for more information.

See accompanying notes to financial

statements.

18

The Health Care Select Sector SPDR Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of September 30,

2019

|

|

|

|

|

| |

Description

|

Market

Value |

%

of Net Assets |

|

| |

Johnson

& Johnson |

1,699,771,281

|

10.1%

|

|

| |

Merck

& Co., Inc. |

1,072,929,238

|

6.4

|

|

| |

UnitedHealth

Group, Inc. |

1,025,236,004

|

6.1

|

|

| |

Pfizer,

Inc. |

989,287,242

|

5.9

|

|

| |

Abbott

Laboratories |

735,781,513

|

4.4

|

|

| |

TOTAL

|

5,523,005,278

|

32.9%

|

|

(The five largest holdings are subject to

change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

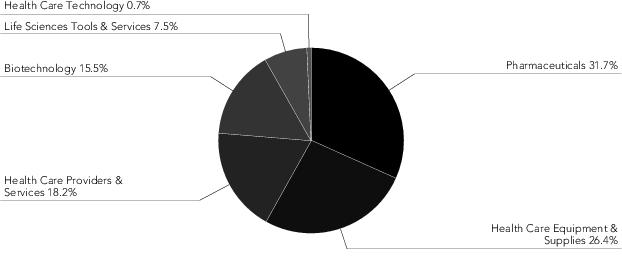

Industry Breakdown as of September 30,

2019*

* The

Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

19

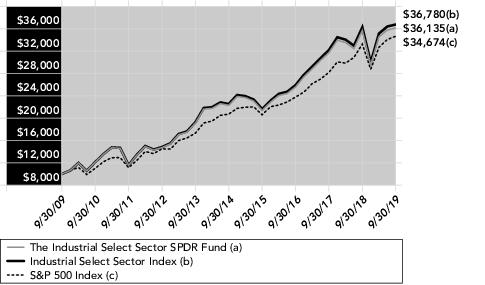

THE INDUSTRIAL SELECT SECTOR SPDR FUND

Management's Discussion of Fund Performance (Unaudited)

The Industrial Select Sector SPDR Fund (the

“Fund”) seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Industrial Select Sector Index. The Fund’s

benchmark is the Industrial Select Sector Index (the “Index”).

For the 12-month period ended September 30, 2019 (the

“Reporting Period”), the total return for the Fund was 1.25%, and the Index was 1.39%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the

Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Fees and expenses and the cumulative effect of security misweights

contributed to the difference between the Fund’s performance and that of the Index.

Fears of a global economic slowdown, uncertainty over the

timing of a US-China trade agreement, and continued geopolitical risks were primary drivers of Fund performance during the Reporting Period. Industrial shares suffered in Q4 2018 along with the broad equity markets as rising interest rates and

economic growth concerns weighed on the more cyclical sectors. Industrials did bounce back in early Q1 2019, however, as recession fears subsided and strong earnings results were reported by firms involved in capital goods and transportation. But

the sector nearly gave up all of its quarterly outperformance in March – much of which was attributed to a sharp decline in Boeing’s share price as the firm faced backlash associated with tragic accidents involving its 737 Max aircraft.

Aerospace and Defense companies overall enjoyed a solid overall Reporting Period as they are considered more defensive in nature and not as susceptible to the trade and tariff tensions in the market. Airline stocks were less fortunate as most

declined over the Reporting Period due to issues related to the 737 Max groundings and higher oil prices. Conglomerates and stocks in other industries within the Industrials sector such as Machinery and Electrical Equipment have also been suffering

due to the ongoing uncertainty with the US-China trade war and what it could mean to future demand for their products and services.

On an individual security level, the top positive

contributors to the Fund’s performance during the Reporting Period were Boeing Company, Waste Management, Inc., and Lockheed Martin Corporation. The top negative contributors to the Fund’s performance during the Reporting Period were

General Electric Company, 3M Company, and FedEx Corporation.

The views expressed above reflect those of the Fund’s

portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any

responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

20

The Industrial Select Sector SPDR Fund

Performance Summary (Unaudited)

Performance as of September 30, 2019

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Cumulative

Total Return |

|

Average

Annual Total Return |

|

|

| |

|

|

|

Net

Asset

Value |

Market

Value |

Industrial

Select Sector Index |

S&P

500 Index |

|

Net

Asset

Value |

Market

Value |

Industrial

Select Sector Index |

S&P

500 Index |

|

| |

|

ONE

YEAR |

|

1.25%

|

1.24%

|

1.39%

|

4.25%

|

|

1.25%

|

1.24%

|

1.39%

|

4.25%

|

|

| |

|

FIVE

YEARS |

|

61.98%

|

61.91%

|

63.14%

|

67.27%

|

|

10.13%

|

10.12%

|

10.29%

|

10.84%

|

|

| |

|

TEN

YEARS |

|

261.35%

|

261.87%

|

267.77%

|

246.74%

|

|

13.71%

|

13.72%

|

13.91%

|

13.24%

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line

graph is based on cumulative total return.

The total

expense ratio for The Industrial Select Sector SPDR Fund as stated in the Fees and Expenses table of the most recent prospectus is 0.13%.

Performance quoted represents past performance, which is no

guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.spdrs.com for most recent month-end

performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. See "Notes to Performance Summaries" on page 1 for more information.

See accompanying notes to financial

statements.

21

The Industrial Select Sector SPDR Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of September 30,

2019

|

|

|

|

|

| |

Description

|

Market

Value |

%

of Net Assets |

|

| |

Boeing

Co. |

862,349,713

|

8.8%

|

|

| |

Honeywell

International, Inc. |

516,223,955

|

5.2

|

|

| |

Union

Pacific Corp. |

483,906,179

|

4.9

|

|

| |

United

Technologies Corp. |

469,551,393

|

4.8

|

|

| |

Lockheed

Martin Corp. |

410,983,599

|

4.2

|

|

| |

TOTAL

|

2,743,014,839

|

27.9%

|

|

(The five largest holdings are subject to

change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

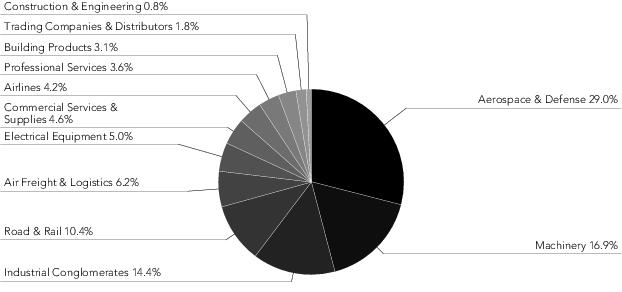

Industry Breakdown as of September 30,

2019*

* The

Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

22

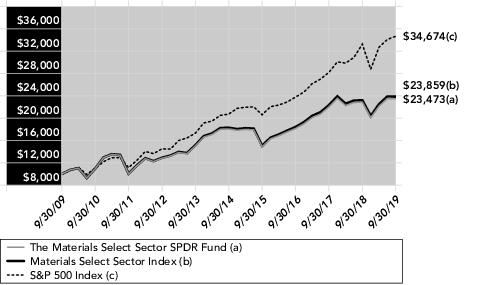

THE MATERIALS SELECT SECTOR SPDR FUND

Management's Discussion of Fund Performance (Unaudited)

The Materials Select Sector SPDR Fund (the

“Fund”) seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Materials Select Sector Index. The Fund’s benchmark

is the Materials Select Sector Index (the “Index”).

For the 12-month period ended September 30, 2019 (the

“Reporting Period”), the total return for the Fund was 2.64%, and the Index was 2.79%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the

Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Fees and expenses and the cumulative effect of security misweights

contributed to the difference between the Fund’s performance and that of the Index

Fears of a global economic slowdown, uncertainty over the

timing of a US-China trade agreement, and continued geopolitical risks were primary drivers of Fund performance during the Reporting Period. Materials shares suffered in Q4 2018 along with the broad equity markets as rising interest rates and

economic growth concerns weighed on the more cyclical sectors. Materials did bounce back in early Q1 2019, as recession fears subsided. Q2 2019, saw some M& A activity in the Materials sector which helped to drive performance for the quarter.

The two most notable M&A activities surrounded Index constituents Newmont Mining Corp and Amcor. Newmont Mining acquiried Goldcorp and formed Newmont Goldcorp. While Amcor merged with Bemis into a New Amcor Ltd. The final quarter of the

Reporting Period generated slightly negative performance despite the optimism of a trade deal between the US and China at the G20 summit in Japan and positive earnings and easing of geopolitical tensions.

On an individual security level, the top positive

contributors to the Fund’s performance during the Reporting Period were Linde plc, Air Products and Chemicals, Inc., and Ecolab Inc.. The top negative contributors to the Fund’s performance during the Reporting Period were WestRock

Company, Dow, Inc., and Freeport-McMoRan, Inc..

The

views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or

other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an

indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

23

The Materials Select Sector SPDR Fund

Performance Summary (Unaudited)

Performance as of September 30, 2019

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Cumulative

Total Return |

|

Average

Annual Total Return |

|

|

| |

|

|

|

Net

Asset

Value |

Market

Value |

Materials

Select Sector Index |

S&P

500 Index |

|

Net

Asset

Value |

Market

Value |

Materials

Select Sector Index |

S&P

500 Index |

|

| |

|

ONE

YEAR |

|

2.64%

|

2.64%

|

2.79%

|

4.25%

|

|

2.64%

|

2.64%

|

2.79%

|

4.25%

|

|

| |

|

FIVE

YEARS |

|

29.87%

|

29.84%

|

30.48%

|

67.27%

|

|

5.37%

|

5.36%

|

5.47%

|

10.84%

|

|

| |

|

TEN

YEARS |

|

134.73%

|

135.00%

|

138.40%

|

246.74%

|

|

8.91%

|

8.92%

|

9.08%

|

13.24%

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line

graph is based on cumulative total return.

The total

expense ratio for The Materials Select Sector SPDR Fund as stated in the Fees and Expenses table of the most recent prospectus is 0.13%.

Performance quoted represents past performance, which is no

guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.spdrs.com for most recent month-end

performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. See "Notes to Performance Summaries" on page 1 for more information.

See accompanying notes to financial

statements.

24

The Materials Select Sector SPDR Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of September 30,

2019

|

|

|

|

|

| |

Description

|

Market

Value |

%

of Net Assets |

|

| |

Linde

PLC |

652,233,737

|

15.5%

|

|

| |

DuPont

de Nemours, Inc. |

331,090,191

|

7.9

|

|

| |

Ecolab,

Inc. |

308,772,680

|

7.4

|

|

| |

Air

Products & Chemicals, Inc. |

304,479,333

|

7.2

|

|

| |

Sherwin-Williams

Co. |

281,209,017

|

6.7

|

|

| |

TOTAL

|

1,877,784,958

|

44.7%

|

|

(The five largest holdings are subject to

change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

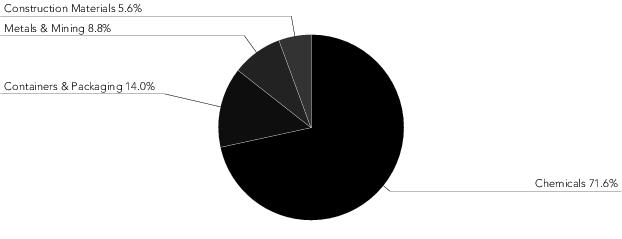

Industry Breakdown as of September 30,

2019*

* The

Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

25

THE REAL ESTATE SELECT SECTOR SPDR FUND

Management's Discussion of Fund Performance (Unaudited)

The Real Estate Select Sector SPDR Fund (the

“Fund”) seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Real Estate Select Sector Index. The Fund’s

benchmark is the Real Estate Select Sector Index (the “Index”).

For the 12-month period ended September 30, 2019 (the

“Reporting Period”), the total return for the Fund was 24.64%, and the Index was 24.74%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing

the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Fees and expenses contributed to the difference between the

Fund’s performance and that of the Index.

The

S&P Real Estate Select Sector Index advanced over 24% and was one of the top performing sectors over the Reporting Period. Healthy real estate fundamentals and the low unemployment rate helped drive earnings in general and the more patient pace

of future interest rate increases by the US Federal Reserve also helped the sector outperform the broader equity market, as measured by the S&P 500 Index, by over 20% over the Reporting Period. Real estate investment trusts (REITs) are also less

exposed to trade policy than the broader market.

Specialized REITs such as American Tower Corporation (AMT),

which leases cell towers to mobile carriers, performed well. AMT has a solid history revenue and earnings growth and may be positioned to grow with 5G coming. On the contrary, Hotel and Resort REITs such as Host Hotels and Resorts Inc, have

suffered, due to the weakening economy and late cycle concerns.

On an individual security level, the top positive

contributors to the Fund’s performance during the Reporting Period were American Tower Corporation, Crown Castle International Corp, and Welltower, Inc.. The top negative contributors to the Fund’s performance during the Reporting Period

were Host Hotels & Resorts, Inc., Simon Property Group, Inc., and Weyerhaeuser Company.

The views expressed above reflect those of the Fund’s

portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any

responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

26

The Real Estate Select Sector SPDR Fund

Performance Summary (Unaudited)

Performance as of September 30, 2019

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Cumulative

Total Return |

|

Average

Annual Total Return |

|

|

| |

|

|

|

Net

Asset

Value |

Market

Value |

Real

Estate Select Sector Index |

S&P

500 Index |

|

Net

Asset

Value |

Market

Value |

Real

Estate Select Sector Index |

S&P

500 Index |

|

| |

|

ONE

YEAR |

|

24.64%

|

24.61%

|

24.74%

|

4.25%

|

|

24.64%

|

24.61%

|

24.74%

|

4.25%

|

|

| |

|

SINCE

INCEPTION(1) |

|

51.32%

|

51.30%

|

52.03%

|

61.81%

|

|

10.95%

|

10.95%

|

11.10%

|

12.85%

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1)

|

For

the period October 7, 2015 to September 30, 2019. |

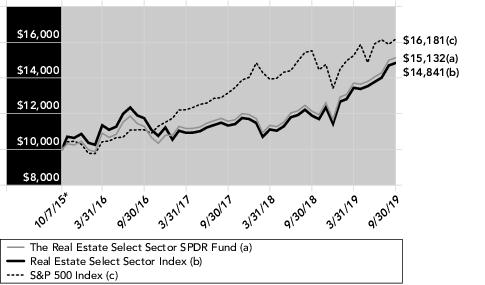

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line

graph is based on cumulative total return.

* Inception date.

The total expense ratio for The Real Estate Select Sector SPDR

Fund as stated in the Fees and Expenses table of the most recent prospectus is 0.13%.

Performance quoted represents past performance, which is no

guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.spdrs.com for most recent month-end

performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. See "Notes to Performance Summaries" on page 1 for more information.

See accompanying notes to financial

statements.

27

The Real Estate Select Sector SPDR Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of September 30,

2019

|

|

|

|

|

| |

Description

|

Market

Value |

%

of Net Assets |

|

| |

American

Tower Corp. REIT |

476,607,238

|

12.3%

|

|

| |

Crown

Castle International Corp. REIT |

281,396,275

|

7.2

|

|

| |

Prologis,

Inc. REIT |

261,873,901

|

6.7

|

|

| |

Equinix,

Inc. REIT |

238,241,472

|

6.1

|

|

| |

Simon

Property Group, Inc. REIT |

233,432,196

|

6.0

|

|

| |

TOTAL

|

1,491,551,082

|

38.3%

|

|

(The five largest holdings are subject to

change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

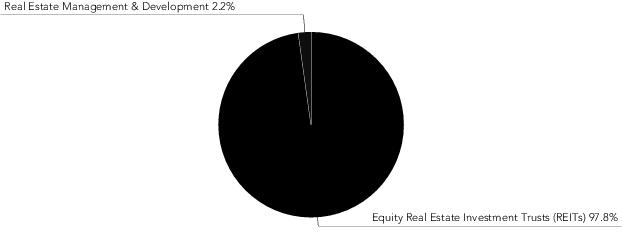

Industry Breakdown as of September 30,

2019*

* The

Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

28

THE TECHNOLOGY SELECT SECTOR SPDR FUND

Management's Discussion of Fund Performance (Unaudited)

The Technology Select Sector SPDR Fund (the

“Fund”) seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Technology Select Sector Index. The Fund’s

benchmark is the Technology Select Sector Index (the “Index”).

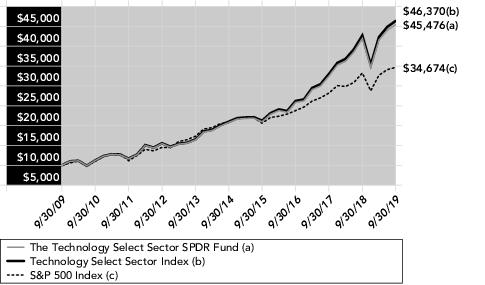

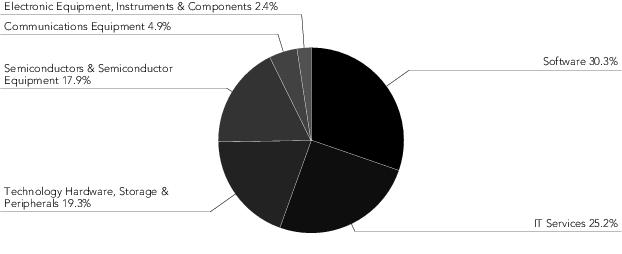

For the 12-month period ended September 30, 2019 (the

“Reporting Period”), the total return for the Fund was 8.44%, and the Index was 8.59%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the

Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Expenses of the Fund, the effects of cash holdings on the Fund

performance and the cumulative effect of small weight differences between the securities in the Fund and the Index contributed to the difference between the Fund’s performance and that of the Index.

Global reliance on technology products and services, strong

macroeconomic data and corporate earnings were primary drivers of Fund performance during the Reporting Period. The Fund had positive performance for the Reporting Period. The first quarter of the Reporting Period, however, resulted in negative

performance. The performance was driven in part by increased hostilities between the US and China over trade, a hawkish stance on monetary policy from the Fed, signs of a slowing global economy and geopolitical issues such as tensions with Saudi

Arabia over the disappearance of a journalist in Turkey, Brexit, and the Italian budget deficit. Performance turned positive after the first quarter of the Reporting Period. Global reliance on technology products such as digital payment processing,

cloud computing, smartphones and enhancements in artificial intelligence helped spur positive performance for the remainder of the Reporting Period. Performance in the second quarter of the Reporting Period was also aided by progress in the trade

talks with China, better-than-expected earnings reports and dovish tones from the Fed. The third and fourth quarters of the Reporting Period had positive performance and were aided by optimism of a trade deal between the US and China at the G20

summit in Japan, positive earnings and easing of geopolitical tensions.

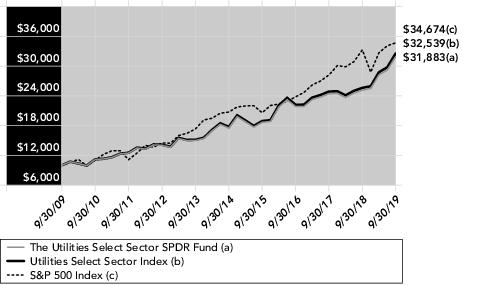

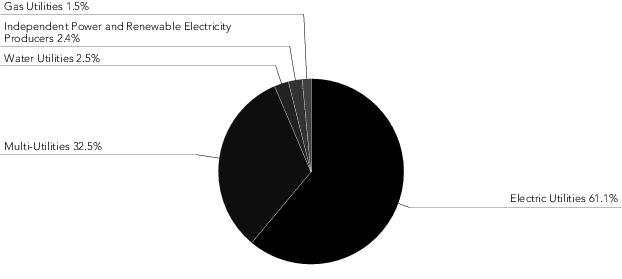

On an individual security level, the top positive