UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

þ | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material Pursuant to §240.14a-12 | |

Westmoreland Coal Company

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

þ | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

(1) | Title of each class of securities to which transaction applies: | |||

(2) | Aggregate number of securities to which transaction applies: | |||

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

(4) | Proposed maximum aggregate value of transaction: | |||

(5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

(2) | Form, Schedule or Registration Statement No.: | |||

(3) | Filing Party: | |||

(4) | Date Filed: | |||

Westmoreland Values

Our Vision, Mission, and Values reflect who we are

and what we stand for as a company.

Our Vision To deliver the premium value in the coal industry. |

Our Mission Westmoreland Coal Company is dedicated to diligently applying our mining expertise to attain economic advantages. • Leverage unique operations • Maximize transportation advantages • Identify and develop niche reserves • Cultivate unique partnerships • Sustain efficiency and standardization | ||

Our Values Our decisions and practices are guided by the values below. They are the core to who we are and how we behave as a company. To excel at the pillars of coal mining by: • Uncompromised safety • Environmental stewardship • State-of-the-art mining techniques To exceed partner expectations by: • Fair and collaborative approach • Community and tribal partnerships • Delivery of shareholder value • Agile and responsive interactions • Commitment focused - we do what we say To maintain a foundation of integrity by: • Honest, transparent, and respectful communication • Highest legal and ethical standards • Pride in our work and our company • Dedication to diversity - respect and honor all | ||

| ||

2013: A Transformational Year at Westmoreland Coal Company

The past year was transformational for Westmoreland Coal Company. On the heels of a record year in 2012, we increased revenue and operating free cash flow while achieving record adjusted EBITDA in 2013. We also decreased our shareholder’s deficit by over $98 million during 2013. Our years of cost control efforts resulted in favorable spend experience, which along with interest rate increases, drove down our long-term heritage medical and pension liabilities. The year culminated with our entering into an agreement to acquire Sherritt International's coal mining business. In addition to significantly increasing our coal production, this acquisition will provide geographic and regulatory diversification into Canada, a favorable mining jurisdiction, and access to the seaborne export market through strategic port facilities in western Canada.

WESTMORELAND COAL COMPANY

9540 S. Maroon Circle, Suite 200

Englewood, Colorado 80112

March 26, 2014

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Westmoreland Stockholders:

We invite you to join us for the 2014 Annual Meeting of Stockholders of Westmoreland Coal Company, which will once again be held as a virtual meeting. You will be able to attend the 2014 Annual Meeting, vote, and submit your questions during the meeting via live webcast by visiting www.virtualshareholdermeeting.com/WLB2014. Be sure to have your 12-Digit Control Number to enter the meeting. The Annual Meeting of Stockholders of Westmoreland Coal Company will be held via the Internet on Tuesday, May 20, 2014 at 8:30 a.m. Mountain Daylight Time, for the following purposes:

1. | The election of eight directors to the Board of Directors to serve for a one-year term; |

2. | To approve the 2014 Equity Incentive Plan for Employees and Non-Employee Directors; |

3. | Advisory approval of Westmoreland Coal Company's executive compensation; |

4. | The ratification of the appointment of Ernst & Young LLP as principal independent auditor for fiscal year 2014; and |

5. | To transact such other business as may properly come before the meeting or any postponement or adjournment thereof. |

Only stockholders of record at the close of business on March 24, 2014 will be entitled to notice of and to vote at the meeting and any postponement or adjournment thereof.

YOUR VOTE IS IMPORTANT. Whether or not you plan to attend the annual meeting, we hope you will vote as soon as possible. You may vote by proxy over the Internet or by telephone, or, if you received paper copies of the proxy materials, you can also vote by mail by following the instructions on the proxy card or voting instruction card. Voting over the Internet, by telephone or by written proxy or voting instruction card will ensure your representation at the annual meeting regardless of whether you attend.

This proxy statement, the annual report to stockholders and the proxy voter card are being mailed on or about April 4, 2014.

By Order of the Board of Directors, | ||

| ||

By Order of the Board of Directors, Jennifer S. Grafton General Counsel and Secretary | ||

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON MAY 20, 2014. This notice, the accompanying proxy statement and Westmoreland Coal Company's annual report to stockholders for the fiscal year ended December 31, 2013 are available at www.proxyvote.com. |

PROXY SUMMARY

We provide below highlights of certain information in this proxy statement. As it is only a summary, please review the complete proxy statement and 2013 annual report before you vote.

2013 Performance Highlights

On the heels of a record year in 2012, we increased revenue and operating cash flow while achieving record adjusted EBITDA. The year ended with the announcement of our entering into an agreement to acquire Sherritt International's coal mining business. The following are key highlights from fiscal year 2013:

• | Adjusted EBITDA grew 10.3% in 2013 to a record $116.3 million, which included a $2.9 million charge for costs associated with the previously announced Sherritt acquisition; |

• | We decreased our shareholder’s deficit by over $98 million during 2013. Our years of cost control efforts resulted in favorable spend experience, which along with interest rate increases, drove down our long-term heritage medical and pension liabilities; |

• | Our total revenues increased 12.4%, up to $674.7 million in 2013 from $600.4 million in 2012; |

• | We lowered our net debt through the amortization of $28.1 million in debt; |

• | We increased operating cash flows $20.0 million, which caused the net leverage ratio to decline to 2.3, almost a full turn from the 3.0 net leverage in 2012; |

• | We successfully reached an agreement with Dominion Virginia to restructure our ROVA power purchase agreement effective January 1, 2014; |

• | The Jewett mine received the Texas Environmental Excellence Award and the Texas Parks and Wildlife Land Stewardship Award. This is the first time either of these awards was given to a mining company; |

• | The Absaloka mine completed the Western Wye railroad connection that allows us to connect with new customers who serve high-density areas in the northwest United States. Our first customer served by the Western Wye is TransAlta’s Centralia Plant in Centralia, Washington, which signed a long-term contract through 2025; |

• | We positioned Westmoreland for long-term viability by executing coal leases at our Colstrip mine for land containing 170 million tons of coal resources and completing the tract 1 coal lease at our Absaloka mine for land containing 145 million coal reserves and resources; and |

• | We continued our strong track record of safety by achieving a reportable incident rate 21.9% below the national average and a lost time incident rate 43.6% below the national average. |

See page 42 for information about reconciliation of non-GAAP financial measures.

Executive Compensation Program

Our executive compensation program is designed to reward our leadership team for delivering results and building long-term value. We believe our program's performance measures align the interests of our stockholders and senior executives by tying pay outcomes to our short- and long-term performance. Several important features of our executive compensation program are:

ü | No employment agreements or individual change-in-control agreements for executive officers, all executive officers are at-will employees; |

ü | No gross-ups; |

ü | No company aircraft or company-provided vehicles, other than vehicles used at mine operation sites; |

ü | No SERPS, defined benefit plans or other executive-only retirement plans; |

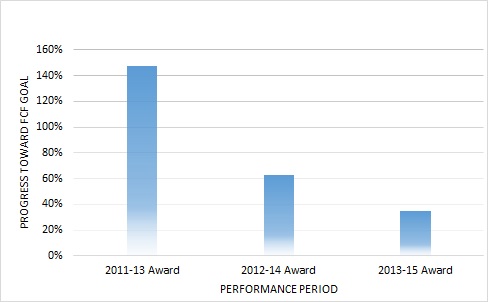

ü | Our long-term incentive awards included performance-vested restricted stock units whose value is based on achievement of three-year free cash flow targets; and |

ü | We require our executive officers to have significant ownership of company stock. |

For more information on our compensation programs, total compensation in 2013 and our compensation philosophy, see our Compensation Discussion and Analysis that starts on page 17.

Corporate Governance Highlights

At Westmoreland Coal Company, good governance remains a critical component of our corporate culture. Several of our key governance strengths and actions are noted in the table below.

BOARD AND OTHER GOVERNANCE INFORMATION | 2014* |

Size of Board | 8 |

Number of Independent Directors | 6 |

Diverse Board (as to Gender, Experience and Skills) | Yes |

Annual Election of All Directors | Yes |

Majority Voting for Directors | Yes |

Separate Chairman & CEO | Yes |

Independent Directors Meet Without Management Present | Yes |

Annual Board Self-Evaluation Conducted by Independent Third-Party | Yes |

Annual Equity Grant to Non-Employee Directors | Yes |

Board Orientation Program | Yes |

Code of Business Conduct and Ethics for Directors | Yes |

Corporate Governance Guidelines for Directors | Yes |

Annual Advisory Approval of Executive Compensation | Yes |

Policy Prohibiting Use of Corporate Funds for Political Expenditures | Yes |

_____________________

* As of March 26, 2014

Meeting Agenda Items

Item 1-Election of Directors - Our board recommends a vote FOR the election of the director candidates nominated by the board.

You are being asked to elect eight directors. Each of our current directors is standing for reelection to hold office until the next annual meeting of stockholders and until his or her successor is duly elected and qualified. All directors attended greater than 90% of the meetings of the board and board committees on which they served in 2013.

SUMMARY INFORMATION ABOUT OUR DIRECTOR NOMINEES

AGE | DIRECTOR SINCE | OCCUPATION AS OF 3/24/14 | INDEPENDENT | |||||

Keith E. Alessi | 59 | 2007 | Chief Executive Officer, Westmoreland Coal Company | |||||

Gail E. Hamilton | 64 | 2011 | Retired IT Executive | X | ||||

Michael G. Hutchinson | 58 | 2012 | Retired Audit Partner, Deloitte & Touche | X | ||||

Robert P. King | 61 | 2012 | President - U.S. Operations, Westmoreland Coal Company | |||||

Richard M. Klingaman | 78 | 2006 | Retired Energy Industry Consultant | X | ||||

Craig R. Mackus | 62 | 2013 | Retired Equipment Manufacturer CFO | X | ||||

Jan B. Packwood | 70 | 2011 | Retired Public Utility CEO | X | ||||

Robert C. Scharp | 67 | 2011 | Retired Coal Industry Executive | X | ||||

Item 2-Approval of the 2014 Equity Incentive Plan for Employees and Non-Employee Directors - Our board recommends a vote FOR this proposal.

We are asking stockholders to approve the 2014 Equity Incentive Plan for Employees and Non-Employee Directors, which is discussed in more detail in our equity plan section on page 36.

Item 3-Advisory Approval of Our Executive Compensation - Our board recommends a vote FOR this proposal.

We are asking stockholders to approve on an advisory basis the compensation of our named executive officers, who are discussed in more detail in the Compensation Discussion and Analysis, which starts on page 17. We hold this advisory vote on an annual basis.

Item 4-Ratification of Appointment of Ernst & Young LLP for 2014 - Our board recommends a vote FOR this proposal.

Ernst & Young LLP has been our independent registered public accounting firm since 2009. The fees paid to Ernst & Young LLP are detailed on page 41. One or more representatives of Ernst & Young LLP will be present at the meeting, will be given the opportunity to make a statement if they desire to do so, and will be available to respond to appropriate questions.

PROXY STATEMENT

Table of Contents

Page | |

A-1 | |

WESTMORELAND COAL COMPANY

9540 S. Maroon Circle, Suite 200

Englewood, Colorado 80112

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

To be held May 20, 2014

GENERAL INFORMATION ABOUT THE 2014 ANNUAL MEETING OF STOCKHOLDERS

This proxy statement is being furnished by the Board of Directors (the “Board”) of Westmoreland Coal Company (the “Company”) to holders of our common stock and depositary shares in connection with the solicitation by the Board of proxies to be voted at the Annual Meeting of Stockholders of Westmoreland Coal Company (the “Annual Meeting”). The Annual Meeting will be held via the Internet on Tuesday, May 20, 2014 at 8:30 a.m. Mountain Daylight Time, for the purposes set forth in the accompanying Notice of Annual Meeting and this proxy statement.

This proxy statement and the enclosed proxy voter card relating to the Annual Meeting are first being mailed to stockholders on or about April 4, 2014. As of March 1, 2014, the Company's officers and directors are the record and beneficial owners of a total of 485,417 shares (approximately 3.23%) of the Company's outstanding common stock and have no ownership in the Company's outstanding depositary shares. It is management's intention to vote all of its shares in the manner recommended by the Board for each matter to be considered by the stockholders.

QUESTIONS AND ANSWERS ABOUT THE 2014 ANNUAL MEETING OF STOCKHOLDERS

What is a Virtual Annual Meeting?

A virtual annual meeting of stockholders is an official annual meeting held over the Internet that offers the ability to verify attendance and provides an interactive element that allows for real-time voting in a secure environment. The virtual meeting also enables two-way engagement, allowing stockholders to ask questions of corporate officers and directors. The virtual meeting provides Westmoreland a low-cost way for stockholders to attend and interact with management, and has the potential to increase participation and reduce costs associated with meeting facilities and travel.

Westmoreland will be hosting the 2014 Annual Meeting live via the Internet. A summary of the information you need to attend the meeting online is provided below:

• | Any stockholder can attend the 2014 Annual Meeting live via the Internet at www.virtualshareholdermeeting.com/WLB2014; |

• | Webcast starts at 8:30 a.m. Mountain Time; |

• | Stockholders may vote and submit questions while attending the Annual Meeting on the Internet; |

• | Please have your 12-Digit Control Number to enter the Annual Meeting; |

• | Instructions on how to attend and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at www.virtualshareholdermeeting.com/WLB2014; and |

• | Webcast replay of the Annual Meeting will be available until May 20, 2015. |

Who can vote at the meeting?

Only stockholders who owned our common stock or depositary shares, each of which represents one quarter of a share of Series A Convertible Exchangeable Preferred Stock, $1.00 par value (“depositary shares”), of record at the close of business on March 24, 2014 are entitled to vote. Each holder of common stock is entitled to one vote per share. Each holder of depositary shares is entitled to one vote per share. There were 14,850,503 shares of common stock and 490,542 depositary shares outstanding on March 24, 2014.

What constitutes a quorum for the meeting?

The holders of a majority of the aggregate voting power of the common stock and depositary shares outstanding on the record date, present in person or by proxy at the Annual Meeting, shall constitute a quorum to conduct business at the Annual

Meeting. Abstentions and “broker non-votes” (shares held by a broker or nominee that does not have discretionary authority to vote on a particular matter and has not received voting instructions from its client) are counted for purposes of determining the presence or absence of a quorum for the transaction of business at the Annual Meeting.

How do I vote?

• | Via the Internet at www.proxyvote.com; |

• | By phone for registered owners at 1-800-690-6903, or for beneficial owners at 1-800-454-8683; or |

• | By completing and mailing in a paper proxy card. |

If your shares are registered directly in your name with our transfer agent, you are considered a stockholder of record with respect to those shares and the proxy card and voting instructions have been sent directly to you. If, like most stockholders, you hold your shares in “street name” through a stockbroker, bank or other nominee rather than directly in your own name, you may not vote your shares in person at the Annual Meeting without obtaining authorization from your stockbroker, bank or other nominee. You need to submit voting instructions to your stockbroker, bank or other nominee in order to cast your vote.

We encourage you to register your vote via the Internet. If you attend the virtual Annual Meeting, you may also submit your vote in person over the Internet and any votes that you previously submitted - whether via the Internet, by phone or by mail - will be superseded by the vote that you cast at the Annual Meeting. Whether your proxy is submitted by the Internet, by phone or by mail, if it is properly completed and submitted and if you do not revoke it prior to the Annual Meeting, your shares will be voted at the Annual Meeting as specified by you or, if you do not specify a choice as to a particular matter, in the manner set forth in this proxy statement.

Can I change my vote after I return my proxy card?

Yes. Even after you have submitted your proxy card, you may change your vote at any time before the proxy is exercised by either filing with our Secretary a written notice of revocation or a duly executed proxy card bearing a later date or by voting in person at the Annual Meeting. The powers of the proxy holders will be suspended if you attend the Annual Meeting in person and so request. However, attendance at the virtual Annual Meeting will not, by itself, revoke a previously granted proxy. If you want to change or revoke your proxy and you hold your shares in “street name,” contact your broker or the nominee that holds your shares. Any written notice of revocation sent to us must include the stockholder's name and must be received prior to the Annual Meeting to be effective.

What vote is required to approve each item?

Under our bylaws, which were amended and restated in January 2013, we now have a majority vote standard for election of directors. In an uncontested election, each director will be elected by a vote of the majority of the votes cast, meaning the number of shares cast “for” a director exceeds the number of votes cast “against” that director. In a contested election, the directors will be elected by a plurality of the votes cast, meaning the directors receiving the largest number of “for” votes will be elected to the open positions. With respect to Proposal 1, regardless of whether the majority of votes cast or plurality standard applies, broker non-votes, abstentions and withheld votes will have no effect because such votes are not treated as being cast.

In an uncontested election, a nominee who does not receive a majority vote will not be elected. An incumbent director who is not elected because he or she does not receive a majority vote will continue to serve as a holdover director until the earliest of: (a) 90 days after the date on which the election inspector determines the voting results as to that director, (b) the date on which the Board appoints an individual to fill the office held by that director, or (c) the date of that director's resignation.

Approval of Proposals 2, 3 and 4, requires the affirmative vote of a majority of the shares present or represented by proxy and entitled to vote at the Annual Meeting. With respect to Proposals 2, 3 and 4, broker non-votes will have no effect, but abstentions will have the same effect as a vote against such proposals.

Which ballot measures are considered “routine” or “non-routine”?

The ratification of the appointment of Ernst & Young LLP as the Company's independent registered public accounting firm for 2014 (Proposal 4) is a matter considered routine under applicable rules. A broker or other nominee may generally vote on routine matters, and therefore broker non-votes are not expected in connection with Proposal 4.

The election of directors (Proposal 1), the approval of the 2014 Equity Incentive Plan for Employees and Non-Employee Directors (Proposal 2) and the advisory approval of the Company's executive compensation (Proposal 3), are matters

1

considered non-routine under applicable rules. A broker or other nominee cannot vote without instructions on non-routine matters, and therefore there may be broker non-votes on Proposals 1, 2 and 3.

How are you handling solicitation of votes?

The accompanying proxy is solicited on behalf of our Board and the cost of solicitation is borne by us. In addition to solicitations by mail, our directors, officers, and employees may solicit proxies by telephone, e-mail and personal interview, but will receive no additional compensation for doing so. We will also request brokerage houses, custodians, nominees, and fiduciaries to forward copies of the proxy material to those persons for whom they hold shares and request instructions for voting the proxies. We will reimburse those brokerage houses and other persons for their reasonable expenses for such services.

Do I have any rights of appraisal?

Under Delaware law, stockholders are not entitled to dissenters' rights on any proposal referred to herein.

Where can I find the voting results of the Annual Meeting?

We will announce preliminary general voting results at the Annual Meeting and publish final detailed voting results on a Form 8-K that we will file with the SEC within four business days after the Annual Meeting.

How do I submit a stockholder proposal for the 2015 Annual Meeting?

Any proposal that a stockholder wishes to be considered for inclusion in our proxy statement and proxy card for the 2015 Annual Meeting of Stockholders (the “2015 Annual Meeting”) must be submitted to the Company's Secretary at our offices, 9540 S. Maroon Circle, Suite 200, Englewood, Colorado 80112, no later than November 25, 2014. In addition, such proposals must comply with the requirements of Rule 14a-8 under the Securities Exchange Act of 1934.

If a stockholder wishes to present a proposal before the 2015 Annual Meeting, without having the proposal included in our proxy statement and proxy card, such stockholder must give written notice to the Secretary at the address noted above. The Secretary must receive such notice no earlier than January 20, 2015 and no later than February 19, 2015, and the stockholder must comply with the provisions of Sections 2.5 or 2.6, as applicable, of our bylaws. Only proposals included in the proxy statement or that comply with our advance notice bylaw requirements will be considered properly brought before the Annual Meeting.

Does the Company offer an opportunity to receive future proxy materials electronically?

Yes. If you are a stockholder of record or a member of the 401(k) plan, you may, if you wish, receive future proxy statements and annual reports online rather than receiving proxy materials in paper form. If you elect this feature, you will receive an e-mail message notifying you when the materials are available, along with a web address for viewing the materials and instructions for voting by telephone or on the Internet. You may sign up for electronic delivery at any time by visiting http://enroll.icsdelivery.com/wlb. If you received this proxy statement electronically, you do not need to do anything to continue receiving proxy materials electronically in the future. If you hold your shares in a brokerage account, you may also have the opportunity to receive proxy materials electronically. Please follow the instructions of your broker.

How can I get electronic access to the proxy materials and the annual report?

This proxy statement and our 2013 annual report are available at www.proxyvote.com; see your ballot for information.

Will I receive a separate proxy statement if I share the same address and last name as another stockholder?

No. If you are the beneficial owner, but not the record holder, of shares of our stock, your broker, bank or other nominee may only deliver one copy of this proxy statement and our annual report to multiple stockholders who share an address, unless that nominee has received contrary instructions from one or more of the stockholders. We will deliver promptly, upon written or oral request, a separate copy of this proxy statement and our annual report to a stockholder at a shared address to which a single copy of the documents was delivered. Beneficial owners sharing an address who are receiving multiple copies of proxy materials and annual reports and who wish to receive a single copy of such materials in the future will need to contact their broker, bank or other nominee to request that only a single copy of each document be mailed to all stockholders at the shared address in the future.

2

DIRECTORS AND EXECUTIVE OFFICERS

Name | Age | Director/ Executive Officer Since | Position |

Keith E. Alessi | 59 | 2007 | Director; Chief Executive Officer |

Gail E. Hamilton | 64 | 2011 | Director - Independent |

Michael G. Hutchinson | 58 | 2012 | Director - Independent |

Robert P. King | 61 | 2012 | Director; President - U.S. Operations |

Richard M. Klingaman | 78 | 2006 | Director - Independent; Chairman of the Board |

Craig R. Mackus | 62 | 2013 | Director - Independent |

Jan B. Packwood | 70 | 2011 | Director - Independent |

Robert C. Scharp | 67 | 2011 | Director - Independent |

Kevin A. Paprzycki | 43 | 2008 | Chief Financial Officer and Treasurer |

Douglas P. Kathol | 61 | 2010 | Executive Vice President |

Joseph E. Micheletti | 48 | 2011 | Senior Vice President - Coal Operations |

Jennifer S. Grafton | 38 | 2011 | General Counsel and Secretary |

Director Information

The Board has fixed the number of directors at eight. All our directors bring to our Board a wealth of leadership experience derived from their service as executives and respected professionals. Certain individual qualifications and skills of our directors that contribute to the Board's effectiveness as a whole are described in the following paragraphs.

Keith E. Alessi has served in various capacities at Westmoreland since 2007 and currently serves as our Chief Executive Officer. Prior to Westmoreland, Mr. Alessi was an adjunct lecturer at the University of Michigan Ross School of Business from 2001 to 2010 and was an Adjunct Professor at The Washington and Lee University Law School from 1999 to 2007. He previously served as Chief Executive Officer, Chief Operating Officer or Chief Financial Officer of a number of public and private companies from 1982 to 2000. Mr. Alessi currently serves as a member of the board of directors of MWI Veterinary Supply, Inc.

Mr. Alessi has over 30 years of turnaround management experience gained in a senior executive capacity. This has given him unique insights into the hurdles, challenges and opportunities facing Westmoreland and provides him the necessary leadership experience to lead the integration of the globally-diversified mining assets as its Chief Executive Officer.

Gail E. Hamilton most recently served as Executive Vice President of Symantec Corporation, an infrastructure software and services provider, retiring in 2005. Previously, she served as the General Manager of the Communications Division of Compaq Computer Corporation and as the General Manager of the Telecom Platform Division for Hewlett-Packard Company. She is currently a director of Arrow Electronics Inc., OpenText Corp., and Ixia.

Ms. Hamilton is a former senior executive with business and operational experience at a public technology company, whose strategic planning and business development experience are invaluable in guiding the development and progression of our information technology infrastructure and programs. In addition, Ms. Hamilton's extensive public and private board experience will bring further professionalism and insight to the board room.

Michael G. Hutchinson recently retired from Deloitte & Touche. His Deloitte career spanned nearly 35 years, leading their Denver Energy and Natural Resources Practice for the last fifteen years while at the same time managing the Audit and Enterprise Risk Management practice of the Denver office. Mr. Hutchinson currently serves as a member of the board of directors of One Gas, Inc.

As the former lead audit partner at a top four auditing firm, Mr. Hutchinson brings to the Board his substantial expertise in accounting and finance matters, which he gained during his 35 years of experience in public accounting. Mr. Hutchinson is well qualified to serve as a director based on his experience with accounting principles, financial controls and evaluating financial statements of public companies in the energy sector, particularly from an auditor's perspective.

Robert P. King joined Westmoreland in March 2012 as President and Chief Operating Officer. He served as President and Chief Executive Officer from April 2013 until March 2014. In anticipation of the closing of the Sherritt transaction, Mr. King was appointed President of U.S. Operations in March 2014 as part of a corporate realignment. From 2006 through 2012, Mr. King held various executive leadership roles at Consol Energy, Inc., including Executive Vice President - Business Advancement and Support Services. Mr. King has over 30 years of experience in the coal industry, both underground and surface mines.

3

Mr. King brings a breadth of coal mining experience to Westmoreland, both as a top executive of a Fortune 500 energy company, as well as his hands-on operational experience running coal mining operations.

Richard M. Klingaman has been a consultant to the natural resources and energy industries since May 1992. Prior to consulting, Mr. Klingaman was a senior executive with Penn Virginia Corporation, a natural resources company specializing in coal, oil, natural gas, timber, lime and limestone.

Mr. Klingaman's extensive experience in the mining and energy industries, including as Senior Vice President of a large natural resources company, provides him with an intimate knowledge of our operations and our industry.

Craig R. Mackus became Chief Financial Officer of Bucyrus International, Inc. in June 2004 after serving as Vice President-Finance from October 2002 through June 2004 and as Controller from February 1988 through May 2006. Mr. Mackus retired from Bucyrus International, Inc. in 2011 upon its merger with Caterpillar. He also served as Bucyrus's secretary from May 1996 through his retirement in 2011.

As a senior manager of an international manufacturing company provided equipment to the mining industry, Mr. Mackus brings significant financial, governance and operational mining experience to the Board. As the CFO during a major merger transaction between Bucyrus International Inc. and Caterpillar, Mr. Mackus provides the Board with his first-hand experience in significant M&A activity.

Jan B. Packwood was the President and Chief Executive Officer of IDACORP, Inc. (NYSE: IDA), a holding company whose main subsidiary, Idaho Power Company, is an electric utility engaged in the generation, transmission, distribution, sale and purchase of electric energy, from 1999 to 2006. Prior to such time, Mr. Packwood served in various executive-level capacities of Idaho Power Company beginning in the 1980s. He currently serves as a director of IDACORP, Inc. and of various IDACORP, Inc. subsidiaries, including Idaho Power Company, IDACORP Financial Services, Inc. and Ida-West Energy Company.

As the former President and Chief Executive Officer of an electric utility involved in the mining and use of coal in the Pacific Northwest, Mr. Packwood brings to the Board a vast knowledge of our and our main customers' business, including an understanding of the risks faced by our own power plant and the power plants we supply. This expertise will be invaluable in directing the future of our power plant operations, as well as providing insight into potential growth and expansion activities in our mining segment.

Robert C. Scharp was previously the Chief Executive Officer of Shell Coal Pty Ltd from 1997 to 2000 and then Chief Executive Officer of Anglo Coal Australia from 2000 to 2001. He served as the Chairman of the Shell Canada Energy Mining Advisory Council from 2005 to 2010. He had a 22 year career with Kerr McGee Corporation including serving as President - Kerr McGee Coal Corporation and Senior Vice President - Oil and Gas Production. Mr. Scharp was a director of Bucyrus International from 2005 to 2011 and was a director of Foundation Coal Holdings from 2005 to 2009. Mr. Scharp is also a retired Army National Guard colonel.

Mr. Scharp brings a wealth of coal mining industry experience to the Board, including invaluable chief executive operational oversight of coal mine operations. Mr. Scharp's vast industry experience will assist the Board in driving future operational mining excellence and evaluating potential growth and expansion opportunities.

Executive Officer Information

Keith E. Alessi, who joined Westmoreland in 2007 and serves as Chief Executive Officer, is discussed above under “Director Information.”

Robert P. King, who joined Westmoreland in 2012 and serves as President of U.S. Operations, is discussed above under “Director Information.”

Kevin A. Paprzycki joined Westmoreland as Controller and Principal Accounting Officer in June 2006 and was named Chief Financial Officer in April 2008. In June 2010, he was also named Treasurer. Prior to Westmoreland, Mr. Paprzycki was Corporate Controller at Applied Films Corporation from 2005 to 2006. Mr. Paprzycki became a certified public accountant in 1994 and a certified financial manager and certified management accountant in 2004.

Douglas P. Kathol joined Westmoreland in 2003 as Vice President - Development, adding additional responsibility as Treasurer in 2008. In 2010, Mr. Kathol was named Executive Vice President. Prior to Westmoreland, Mr. Kathol spent almost

4

twenty years in various positions, including Senior Vice President of Norwest Corporation, a consulting firm providing expertise to the energy, mining, and natural resources industries.

Joseph E. Micheletti joined Westmoreland in 2001 and has held a series of positions with Westmoreland since such time, including President and General Manager of our Jewett Mine. In June 2011, Mr. Micheletti was named Senior Vice President - Coal Operations. Mr. Micheletti has worked in the production, maintenance, processing, and engineering disciplines of the mining industry for 24 years and sits as a Director of the Rocky Mountain Coal Mining Institute.

Jennifer S. Grafton joined Westmoreland as Associate General Counsel in December 2008 and was named General Counsel and Secretary in February 2011. Prior to Westmoreland, Ms. Grafton worked in the corporate group of various Denver-based and national law firms focusing her practice on securities and corporate governance. She is a member of the Colorado bar.

CORPORATE GOVERNANCE

We are committed to maintaining the highest standards of business conduct and corporate governance, which we believe are essential to running our business efficiently, serving our stockholders and maintaining our integrity in the marketplace. The Code of Conduct Handbook for directors, officers and employees, in conjunction with the Certificate of Incorporation, Bylaws, Board committee charters and Corporate Governance Guidelines, form the framework for the governance of Westmoreland. All of these documents are available on our website at www.westmoreland.com. On an annual basis, all directors, officers and employees sign an acknowledgment that they have received and reviewed the guidelines provided in the Code of Conduct Handbook. We will post on our website any amendments to the Code of Conduct Handbook or waivers of the Code of Conduct Handbook for directors and executive officers. You can request a copy of any of these documents by writing to the Corporate Secretary, Westmoreland Coal Company, 9540 S. Maroon Circle, Suite 200, Englewood, Colorado 80112.

Board Structure

The Board of Directors does not have a policy regarding the separation of the roles of Chief Executive Officer and Chairman of the Board as the Board believes it is in the best interests of Westmoreland to make that determination based on the position and direction of Westmoreland, and the membership of the Board. Currently, the roles of Chairman of the Board and CEO are split, allowing our CEO to focus on our day-to-day business, while allowing the Chairman of the Board to lead the Board in its fundamental role of providing advice to and independent oversight of management. On April 8, 2013, Keith Alessi transitioned from CEO to Executive Chairman of the Board. Simultaneously, Robert King transitioned from President and Chief Operating Officer to President and CEO. As Executive Chairman, Mr. Alessi continued to play an important role in the Company's strategic direction, chaired all regular sessions of the Board and, in consultation with the Lead Independent Director and with input from the CEO, set the agenda for Board meetings. In light of the recent announcement relating to the Sherritt acquisition, Mr. Alessi was asked to resume his service in an employee capacity as CEO to facilitate an efficient transition of the Sherritt business into Westmoreland. Accordingly, Mr. Klingaman, formerly our Lead Independent Director, was elevated to the Chairman of the Board position. We believe this structure promotes a unified approach to corporate strategy development and allows for a bridge between management and the Board, helping each to pursue its common purpose more efficiently.

Risk Oversight by the Board of Directors

Risk is inherent with every business, and how well a business manages risk can ultimately influence its success. We face a number of risks, including economic risks, operational risks, environmental and regulatory risks, and others, such as the impact of competition, weather conditions and pressures from competing fuel sources. Management is responsible for the day-to-day supervision of risks that we face, while the Board, as a whole and through its committees, has responsibility for the oversight of risk management. In its risk oversight role, the Board has the responsibility to satisfy itself that the risk management processes designed and implemented by management are adequate and functioning as designed.

The Board believes that establishing the right “tone at the top” and full and open communication between management and the Board are essential for effective risk management and oversight. Our Chairman has regular communications with our CEO to discuss strategy and the risks we face. The executive management team attends the quarterly board meetings and is available to address any questions or concerns raised by the Board on risk management related matters. Each quarter, the Board receives presentations from senior management on strategic matters involving our operations and is provided extensive materials that highlight the various factors that could lead to risk in our organization. The Board holds a strategic planning session with the management team on an annual basis to discuss strategies, key challenges, and risks and opportunities for us. Further, the Board is empowered to hire its own advisors without management approval to assist it in fulfilling its duties.

5

While the Board is ultimately responsible for our risk oversight, our committees assist the Board in fulfilling its oversight responsibilities in certain areas of risk. The Audit Committee assists the Board in fulfilling its oversight responsibilities with respect to risk management in the areas of financial reporting, internal controls and compliance with legal and regulatory requirements. The Compensation and Benefits Committee assists the Board in fulfilling its oversight responsibilities with respect to the management of risks arising from our compensation policies and programs. The Nominating and Corporate Governance Committee is tasked with the oversight of succession planning for our directors and executive officers. On an annual basis, pursuant to such committee's charters, the committees assess risk and have specific conversations with senior management regarding the risks faced.

Director Independence

NASDAQ Marketplace Rules require that a majority of the Board be independent. No director qualifies as independent unless the Board determines that the director has no direct or indirect relationship with the Company that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In assessing the independence of its members, the Board examined the commercial, industrial, banking, consulting, legal, accounting, charitable and familial relationships of each member. The Board's inquiry extended to both direct and indirect relationships with the Company. Based upon both detailed written submissions by nominees and discussions regarding the facts and circumstances pertaining to each nominee, considered in the context of applicable NASDAQ Marketplace Rules, the Board has determined that all of the nominees for election, other than Messrs. Alessi and King, are independent. The independent directors meet during most Board meetings in separate executive session led by our Chairman and without management present.

Each member of the Audit Committee must, in addition to the independence requirements of the NASDAQ Marketplace Rules, meet the heightened independence standards required for audit committee members under the NASDAQ Marketplace Rules listing standards, Section 10A of the Securities Exchange Act of 1934, and Rule 10A-3 thereunder. The Board determined that Messrs. Klingaman, Mackus, Packwood and Hutchinson, the 2013 Audit Committee members, each met such heightened independence standards. Beginning in July 2013, each member of the Compensation and Benefits Committee was required to also meet heightened independence standards under the NASDAQ Marketplace Rules listing standards. In 2013, the members of the Compensation and Benefits Committee met such heightened independence standards.

Communicating with the Board

Stockholders who wish to write directly to the Board on any topic should address communications to the Board of Directors in care of the Chairman of the Board, Westmoreland Coal Company Board of Directors, 9540 S. Maroon Circle, Suite 200 Englewood, Colorado 80112. Our Chairman of the Board will report on stockholder communications to the Board and provide copies or specific summaries to directors on matters deemed to be of appropriate importance. In general, communications from stockholders relating to corporate governance will be forwarded to the Board unless they are frivolous, obscene, repeat the same information contained in earlier communications, or fail to identify the author.

6

COMMITTEES OF THE BOARD OF DIRECTORS

As of the date of this proxy statement, our Board consists of eight directors and the following four committees: (1) Audit; (2) Compensation and Benefits; (3) Nominating and Corporate Governance; and (4) Executive. Each of the committees operates under a written charter adopted by the Board. All of the committee charters are available on our website at www.westmoreland.com. During 2013, the Board held thirteen meetings. Each of our current directors attended at least 90% of the aggregate of all Board and applicable committee meetings held during the period that he or she served as a director. All directors attended the last Annual Meeting of Stockholders and all are expected to attend this year's Annual Meeting of Stockholders. The 2013 committee membership, number of meetings held during 2013 and function of each of the committees are described in the table below.

Name of Director | Audit | Compensation and Benefits | Nominating and Corporate Governance | Executive | ||||

Non-Employee Directors: | ||||||||

Keith E. Alessi | Chair | |||||||

Gail E. Hamilton | Member | Member | ||||||

Michael G. Hutchinson | Chair | Member | ||||||

Richard M. Klingaman | Member | Member | ||||||

Craig R. Mackus | Member | Member | ||||||

Jan B. Packwood | Member | Chair | Member | |||||

Robert C. Scharp | Chair | Member | ||||||

Employee Director: | ||||||||

Robert P. King | Member | |||||||

Number of Meetings in 2013 | 5 | 2 | 3 | 2 | ||||

Audit Committee

The Audit Committee provides oversight of the quality and integrity of our accounting, auditing and financial reporting practices and is responsible for retaining and terminating our independent accounts. The committee exercises its oversight obligations through regular meetings with management, the Director of Internal Audit and our independent registered public accounting firm, Ernst & Young LLP. The Audit Committee is also responsible for oversight of risks relating to accounting matters, financial reporting and regulatory compliance. To satisfy these oversight responsibilities, the committee separately meets with our Chief Financial Officer, the Director of Internal Audit, Ernst & Young LLP and management. The committee also receives periodic reports regarding issues such as the status and findings of audits being conducted by the internal and independent auditors, the status of material litigation, accounting changes that could affect our financial statements and proposed audit adjustments. The Board has determined that Michael G. Hutchinson qualifies as an “audit committee financial expert” as defined in Item 407(d)(5) of Regulation S-K.

Audit Committee Report

Under its charter, the Audit Committee assists the Board of Directors in fulfilling the Board's responsibility for oversight of Westmoreland's financial reporting process and practices, and its internal control over financial reporting. Management is primarily responsible for our financial statements, the reporting process and assurance for the adequacy of the internal control over financial reporting. Our independent registered public accounting firm, Ernst & Young LLP, is responsible for performing an independent audit of Westmoreland's financial statements and internal control over financial reporting, and for expressing an opinion on the conformity of our audited financial statements to generally accepted accounting principles used in the United States and the adequacy of our internal control over financial reporting.

The Audit Committee has reviewed and discussed with Ernst & Young LLP Westmoreland's audited consolidated financial statements and internal control over financial reporting. The Audit Committee has discussed with Ernst & Young LLP, during the 2013 fiscal year, the matters required to be discussed by Statement on Auditing Standards No. 16, as amended (Communication with Audit Committees) as adopted by the Public Company Accounting Oversight Board. The Audit Committee has received and reviewed the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the Public Company Accounting Oversight Board regarding such firm's communications with the Audit Committee concerning independence, and has discussed with the independent accountants their independence.

7

The Audit Committee discussed with our internal and independent auditors the overall scope and plans for their respective audits. The Audit Committee meets with the independent auditors, with and without management present, to discuss the results of its examinations, the evaluations of our internal controls and the overall quality of our financial reporting. The Audit Committee also has reviewed and discussed the audited financial statements with management.

Based on the reviews and discussions described above, the Audit Committee recommended to the Board that the audited financial statements and assessment of internal controls over financial reporting be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2013. The Audit Committee has selected Ernst & Young LLP as our independent registered public accounting firm for fiscal year 2014.

Michael G. Hutchinson, Chairman

Jan B. Packwood

Richard M. Klingaman

Craig R. Mackus

Compensation and Benefits Committee

The Compensation and Benefits Committee is responsible for assuring that the Board, our Chief Executive Officer, other executive officers, and our key management are compensated appropriately and in a manner consistent with our approved compensation strategy, internal equity considerations, competitive practice, and any relevant laws or regulations. In addition, the committee reviews our compensation programs to ensure that our programs are not promoting imprudent risk-taking. In accordance with its charter, the committee may retain and terminate outside counsel, compensation consultants, or other experts or consultants, as it deems appropriate, form and delegate authority to subcommittees and delegate authority to one or more designated members of the committee. To assist it in satisfying its oversight responsibilities, the committee approved the continued engagement of Pay Governance to serve as its compensation consultant for fiscal year 2014.

Compensation and Benefits Committee Risk Assessment

On an annual basis, the committee reviews the structure of our compensation program to assess whether any aspect of the program could provide an incentive to our executive officers or other employees to take any unnecessary or inappropriate risks that could threaten our operating results, financial condition or impact long-term stockholder value. To assist the committee in its annual review it engaged Pay Governance in January 2014 to conduct a risk assessment of our incentive-based compensation plans (including the annual and long-term incentive programs) and our compensation practices.

Based on the findings of Pay Governance, our internal controls, policies and risk-mitigating components in our incentive arrangements, as well as the committee's formal review and discussion, the committee believes our compensation programs represent an appropriate balance of short-term and long-term compensation and do not encourage executive officers or other employees to take on unnecessary or excessive risks that are reasonably likely to have a material adverse effect on us.

Our incentive compensation is designed to reward bonus-eligible employees for committing to and achieving goals that are intended to be challenging yet provide them a reasonable opportunity to reach the threshold amount, while requiring meaningful growth to reach the target level and substantial growth to reach the maximum level. The amount of growth required to reach the maximum level of compensation is developed within the context of the normal business planning cycle and, while difficult to achieve, is not viewed to be at such an aggressive level that it would induce bonus-eligible employees to take inappropriate risks that could threaten our financial or operating stability. The annual bonus program contains a cap on the maximum financial payout to employees as a whole.

Our executive compensation program includes the following features to help minimize risk.

Compensation Mix. We allocate compensation between fixed and contingent components, and between annual cash incentives and long-term time-based incentives, based in part on an employee's position and level of responsibility within the organization. We believe our mix of compensation elements helps to ensure that executives and other employees who are eligible for incentive compensation do not focus on achieving short-term results at the expense of the long-term growth and sustainability of the Company. None of our employees receive commissions.

Base salary is the only assured portion of compensation that we provide to our executives and other employees. Consequently, our incentive compensation arrangements are intended to reward performance.

8

The annual incentive plan establishes cash-based award opportunities that are payable if, and only to the extent that, pre-established corporate financial, operational safety and individual performance objectives are achieved. The committee has discretion to exclude certain events outside our direct control and to reward exemplary performance.

The long-term component of the executive compensation program consists of grants of time-vested and performance-based restricted stock units or cash awards. The use of both time-based and performance-based awards for fiscal 2014 balances our desire to drive long-term growth with the retention pressures we face from our direct peers, as well as from emerging and evolving competitors.

Stock Ownership Guidelines. We have established stock ownership guidelines to ensure that our executives' interests are aligned with those of stockholders. These guidelines also help ensure that the decisions our executives implement to achieve our financial and strategic objectives are focused on our long-term growth and health. We believe that this policy effectively mitigates the possibility that our executives would make business decisions to influence stock price increases in the short-term that cannot be sustained over the long-term or would liquidate their equity holdings to capture short-term fluctuations in our stock price.

Board Approval of Transactions. Management must obtain approval from the Board for significant transactions (i.e., mergers, acquisitions, dividends, etc.) that could impact the achievement of previously approved financial performance targets used in the executive compensation program, and the Compensation and Benefit Committee retains the discretion to ignore the impact of certain factors over which management has no control (such as accounting changes or force majeure events) for purposes of determining whether pre-established performance targets have been met.

Compensation and Benefits Committee Interlocks and Insider Participation

During 2013, each of Messrs. Hutchinson, Mackus and Scharp, and Ms. Hamilton served on our Compensation and Benefits Committee. None of these directors was a current or former officer or employee of the Company, and none had any related party transaction involving the Company that is disclosable under Item 404 of Regulation S-K. During 2013, none of our executive officers served on the board of directors of any entity that had one or more executive officers serving on our Board.

Compensation and Benefits Committee Report

The Compensation and Benefits Committee has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K with management. Based on this review and discussion, the Compensation and Benefits Committee recommended to the Board that the Compensation Discussion and Analysis, provided herein, be included in this proxy statement and incorporated by reference into Westmoreland's Annual Report on Form 10-K for the fiscal year ended December 31, 2013.

Robert C. Scharp, Chairman

Gail E. Hamilton

Michael G. Hutchinson

Craig R. Mackus

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee identifies and recommends individuals qualified to be nominated as members of the Board and considers director candidates brought to the Board by stockholders. The committee oversees succession planning. It also provides oversight on corporate governance matters and conducts the evaluation of the Board, committees, and individual director performance.

The committee regularly assesses the mix of skills and industry experience currently represented on the Board, whether any vacancies on the Board are expected due to retirement or otherwise, the skills represented by retiring directors, and additional skills highlighted during the Board self-assessment process that could improve the overall quality and ability of the Board to carry out its functions. In the event vacancies are anticipated or arise, the Nominating and Corporate Governance Committee considers various potential candidates for director and employs the same process for evaluating all candidates, including those submitted by stockholders. The committee is responsible for ensuring all director nominees undergo a thorough background check prior to nomination or appointment as a director and to review any adverse findings prior to such nomination or appointment. Candidates may come to the attention of the committee through current Board members, professional search firms, stockholders or other persons.

9

The committee initially evaluates a candidate based on publicly available information and any additional information supplied by the party recommending the candidate. If the candidate appears to satisfy the selection criteria and the committee's initial evaluation is favorable, the candidate is contacted by the chairman of the committee for an interview to determine the mutual levels of interest in pursuing the candidacy. The committee is tasked with considering whether the candidate is (i) independent pursuant to the requirements of The NASDAQ Stock Market, (ii) accomplished in his or her field and has a reputation, both personal and professional, that is consistent with our ideals and integrity, (iii) able to read and understand basic financial statements, (iv) knowledgeable as to us and the issues affecting our business, (v) committed to enhancing stockholder value, (vi) able to understand fully the legal responsibilities of a director and the governance processes of a public company, (vii) able to develop a good working relationship with other Board members and senior management and (viii) able to suggest business opportunities to us. If these discussions and considerations are favorable, the committee makes a final recommendation to the Board to nominate the candidate for election.

In considering whether to recommend any particular candidate, including incumbent directors, for inclusion in the Board's slate of recommended director nominees, the Nominating and Corporate Governance Committee takes into consideration a number of criteria, including: professional work experience; skills; expertise; diversity; personal and professional integrity; character; temperament; business judgment; time availability in light of other commitments; dedication; conflicts of interest; and public company experience. The committee does not assign specific weights to particular criteria and no particular criterion is a prerequisite for each prospective nominee. The committee focuses on issues of diversity, such as diversity of education, professional experience and differences in viewpoints and skills. The committee does not have a formal policy with respect to diversity; however, the Board and the committee believe that it is essential that the Board members represent diverse viewpoints and strives to ensure that the slate of nominees represents a wide breadth of diverse backgrounds and skill sets to adequately represent the needs of the stockholders. With respect to the nomination of continuing directors for re-election, the individual's contributions to the Board are also considered. We believe that the backgrounds and qualifications of our directors, considered as a group, provide a composite mix of skills, experience, and knowledge that will assure that the Board can continue to fulfill its responsibilities.

The Board's retirement policy mandates that directors elected to the Board at our annual meeting retire from the Board at the first annual meeting of stockholders following the director's 75th birthday. The Board grandfathered all directors then serving as a director at the time the policy was adopted in November 2010, making the new retirement policy only applicable to current and future directors who will turn 75 after May 2010.

Stockholders may recommend individuals to the Nominating and Corporate Governance Committee for consideration as potential director candidates by submitting their names, together with appropriate biographical information and background materials and a statement as to whether the stockholder or group of stockholders making the recommendation has beneficially owned more than 5% of our common stock for at least a year as of the date such recommendation is made, to the Nominating and Corporate Governance Committee, c/o Corporate Secretary, Westmoreland Coal Company, 9540 South Maroon Circle, Suite 200, Englewood, Colorado 80112. Assuming that appropriate biographical and background material has been provided on a timely basis, the committee will evaluate stockholder-recommended candidates by following the same process, and applying the same criteria, as it follows for candidates submitted by others. If the Board determines to nominate a stockholder-recommended candidate and recommends his or her election, then his or her name will be included in our proxy statement for the next annual meeting.

Stockholders also have the right to nominate director candidates directly, without any action or recommendation on the part of the committee or the Board, by following the procedures set forth in Section 2.6, “Advance Notice of Nominees,” in our bylaws. Among other things, a stockholder wishing to nominate a director candidate must give notice to us within the specified time period that includes the information about the stockholder and the proposed nominee required by the bylaws. Any stockholder wishing to nominate a candidate for election to the Board pursuant to the bylaw provision must strictly comply with the procedures specified in Section 2.6 of the bylaws.

Jan B. Packwood, Chairman

Gail E. Hamilton

Robert C. Scharp

Executive Committee

During 2013, the Board had an Executive Committee. Pursuant to its charter reviewed and adopted on an annual basis, the Executive Committee is authorized to act on behalf of the Board during periods between Board meetings. During 2013, the Executive Committee held two meetings.

10

DIRECTOR COMPENSATION

The Board's goal in designing director compensation is to provide a competitive package that will enable it to attract and retain highly skilled individuals with relevant experience and that reflects the time and talent required to serve on the Board. Compensation for our non-employee directors is reviewed by the Compensation and Benefits Committee with the assistance of Pay Governance. The table below reflects the total director compensation for 2013.

2013 Non-Employee Director Compensation

Name(1) | Fees Earned Or Paid In Cash($) | Grant Date Fair Value of Stock Awards($)(2) | Total Compensation ($) |

Keith E. Alessi | 175,385 | 84,140 | 259,525 |

Gail E. Hamilton | 68,000 | 84,140 | 152,140 |

Michael G. Hutchinson | 76,625 | 84,140 | 160,765 |

Richard M. Klingaman | 84,375 | 84,140 | 168,515 |

Craig R. Mackus | 40,069 | 84,140 | 124,209 |

Jan B. Packwood | 82,000 | 84,140 | 166,140 |

Robert C. Scharp | 73,725 | 84,140 | 157,865 |

Former Directors | |||

Michael R. D'Appolonia | 20,369 | — | 20,369 |

____________________

(1) | Mr. King did not receive any additional compensation for his services as a director. Mr. Alessi, who transitioned from Chief Executive Officer to Executive Chairman of the Board on April 8, 2013, did not receive additional compensation for his services as a director prior to that date. As Executive Chairman, Mr. Alessi received compensation as described in the director compensation table above. |

(2) | 7,000 restricted stock units were awarded to each non-employee director elected to the Board in May 2013. The restricted stock units vest on May 21, 2014. The grant date fair value of these awards was $12.02 per share. |

Approved 2014 Non-Employee Director Compensation Structure

In February 2014, the Compensation and Benefits Committee recommended, and the Board approved, the below compensation structure for fiscal year 2014. All non-employee directors receive the “Annual Cash Retainer” in addition to any other retainers they may be entitled for service as the Chair of a committee or for serving as a member of a committee.

Type of Compensation | Amount | |

Annual Cash Retainer | $55,000 | |

Annual Stock Award Retainer (restricted stock units with one-year vest) | $90,000 stock equivalent | |

Annual Retainer for Lead Independent Director | $18,000 | |

Annual Retainer for Committee Chair: | ||

Audit Committee | $15,000 | |

Compensation and Benefits Committee | $15,000 | |

Nominating and Corporate Governance Committee | $8,000 | |

Annual Retainer for Serving on a Committee: | ||

Audit Committee | $10,000 | |

Compensation and Benefits Committee | $7,500 | |

Nominating and Corporate Governance Committee | $5,000 | |

Attendance at Board or Committee Meeting (in-person) | $1,500 per meeting | |

Attendance at Board or Committee Meeting (telephonic) | $1,000 per meeting | |

11

Non-Employee Director Stock Ownership Guidelines

In February 2014, the Board adopted new stock ownership guidelines for non-employee directors under which the directors are expected to own a threshold amount of Westmoreland equity. Each non-employee director is now required to hold Westmoreland common stock with an aggregate value of at least three times his or her annual cash retainer. The directors have a five-year window to comply with these new guidelines.

12

BENEFICIAL OWNERSHIP OF SECURITIES

The following table sets forth information, as of March 1, 2014 (the "Table Date"), concerning beneficial ownership by: holders of more than 5% of any class of our voting securities; directors; each of the named executive officers listed in the Summary Compensation Table; and all directors and executive officers as a group. The information provided in the table is based on our records, information filed with the SEC and information provided to us, except where otherwise noted. The number of shares beneficially owned by each entity or individual is determined under SEC rules, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares as to which the entity or individual has sole or shared voting power or investment power and also any shares that the entity or individual has the right to acquire within 60 days of the Table Date through the exercise of any stock options, the conversion of depositary shares at a conversion ratio of 1.708 shares of common stock for each depositary share, the vesting of restricted stock or upon the exercise or conversion of other rights. Unless otherwise indicated, each person has sole voting and investment power with respect to the shares set forth in the table. The percentage calculations set forth in the table are based on 14,847,053 shares of common stock outstanding on the Table Date.

Name of Beneficial Owner | Common Stock | % of Common |

5% or Greater Equity Holders | ||

Jeffrey L. Gendell(1) | 1,722,713 | 11.60% |

BlackRock Inc.(2) | 828,111 | 5.58% |

Wynnefield Persons(3) | 743,257 | 5.01% |

Officers and Directors | ||

Gail E. Hamilton | 11,892 | * |

Michael G. Hutchinson | 8,025 | * |

Richard M. Klingaman | 22,235 | * |

Craig R. Mackus | — | * |

Jan B. Packwood | 11,892 | * |

Robert C. Scharp | 11,892 | * |

Keith E. Alessi(4) | 247,439 | 1.65% |

Robert P. King(5) | 52,739 | * |

Kevin A. Paprzycki(6) | 34,537 | * |

Douglas P. Kathol(7) | 51,776 | * |

Joseph E. Micheletti(8) | 19,700 | * |

Jennifer S. Grafton(9) | 13,290 | * |

Directors and Executive Officers as a Group (12 persons) | 485,417 | 3.23% |

____________________

* Percentages of less than 1% are indicated by an asterisk | |

(1) | The total for Mr. Gendell includes shares of common stock, as well as shares of common stock issuable upon conversion of depositary shares. According to a Schedule 13D/A filed November 27, 2013 and a For 4 filed on January 3, 2014, Mr. Gendell owns 549,000 shares of common stock of which he has sole voting and dispositive power. In addition, Tontine Capital Partners, L.P. and other limited partnerships and limited liability companies that are affiliates of Tontine Capital Partners, L.P. own 1,067,395 shares of common stock. Mr. Gendell is either a managing member of, or a managing member of the general partner of, these limited partnerships and limited liability companies and has shared voting and dispositive power over these shares. All of the foregoing shares may be deemed to be beneficially owned by Mr. Gendell. Mr. Gendell disclaims beneficial ownership of these shares for purposes of Section 16(a) under the Exchange Act, or otherwise, except as to shares directly owned by Mr. Gendell or representing Mr. Gendell’s pro rata interest in, and interest in the profits of, these limited partnerships and limited liability companies. The address for Mr. Gendell is 1 Sound Shore Drive, Greenwich, CT 06830. |

(2) | According to a Schedule 13G filed on January 31, 2014, BlackRock Inc., a parent holding company of certain institutional investment managers registered under the Exchange Act and certain other entities, beneficially owns 828,111 shares with sole dispositive power, and has sole voting power to 808,338 of those shares. The principal business address of BlackRock Inc. is 40 East 52nd street, New York, New York 10022. |

13

(3) | Reflects beneficial ownership derived solely from information reported in a Schedule 13G filed February 14, 2014. The Schedule 13G indicates that beneficial ownership is comprised of Wynnefield Partners Small Cap Value, LP (“Wynnefield Partners”); Wynnefield Partners Small Cap Value, LP I (“Wynnefield Partners I”); Wynnefield Capital Management, LLC (“Wynnefield LLC”); Wynnefield Small Cap Value Offshore Fund, Ltd. (“Wynnefield Offshore”); Wynnefield Capital, Inc. (“Wynnefield Capital”); Wynnefield Capital, Inc. Profit Sharing Plan (the “Plan”); Nelson Obus, who serves as co-managing member of Wynnefield LLC, principal executive officer of Wynnefield Capital (the investment manager of Wynnefield Offshore), and portfolio manager of the Plan; and Joshua Landes, who serves as co-managing member of Wynnefield LLC and a principal executive officer of Wynnefield Capital (collectively, the “Wynnefield Persons”). Mr. Obus may be deemed to hold an indirect beneficial ownership interest in the shares directly owned by Wynnefield Partners, Wynnefield Partners I, Wynnefield Offshore, and the Plan, totalling 743,257 shares. Mr. Landes may be deemed to hold an indirect beneficial ownership interest in the shares directly owned by Wynnefield Partners, Wynnefield Partners I, and Wynnefield Offshore, totalling 733,257 shares. Mr. Obus and Mr. Landes each disclaim any beneficial ownership of the shares of the Company’s common stock, for purposes of Section 16(a) under the Exchange Act, or otherwise in which they do not have a pecuniary interest, covered by the Schedule 13G. |

(4) | Includes 30,556 shares of common stock that may be purchased upon the exercise of options under our 2002 Plan, 60,000 shares of common stock that may be purchase upon the exercise of options under our 2007 Plan and 34,000 shares of restricted stock issued under our 2007 Plan that will vest on April 1, 2014. |

(5) | Includes 2,307 shares of common stock held by Prudential Retirement, as trustee of Westmoreland’s 401(k) plan and 18,826 shares of restricted stock issued under our 2007 Plan that will vest on April 1, 2014. |

(6) | Includes 6,934 shares of common stock held by Prudential Retirement, as trustee of Westmoreland’s 401(k) plan, 7,000 shares of common stock that may be purchased upon exercise of options under our 2007 Plan and 6,067 shares of restricted stock issued under our 2007 Plan that will vest on April 1, 2014. |

(7) | Includes 7,640 shares of common stock held by Prudential Retirement, as trustee of Westmoreland’s 401(k) plan, 7,000 shares of common stock which may be purchased upon exercise of options under our 2007 Plan and 7,752 shares of restricted stock issued under our 2007 Plan that will vest on April 1, 2014. In addition, beneficial ownership includes 9,657 shares of common stock owned by Mr. Kathol’s wife. Mr. Kathol expressly disclaims beneficial ownership of these securities, and this disclosure shall not be an admission that the reporting person is the beneficial owner of such securities for purposes of Section 16 or for any other purpose. |

(8) | Includes 3,369 shares of common stock held by Prudential Retirement, as trustee of Westmoreland’s 401(k) plan, 5,000 shares of common stock that may be purchased upon exercise of options under our 2007 Plan and 4,356 shares of restricted stock issued under our 2007 Plan that will vest on April 1, 2014. |

(9) | Includes 5,072 shares of common stock held by Prudential Retirement, as trustee of Westmoreland’s 401(k) plan and 3,743 shares of restricted stock issued under our 2007 Plan that will vest on April 1, 2014. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires our executive officers and directors and persons who own more than ten percent of a registered class of our equity securities to file reports of ownership and changes in ownership on Forms 3, 4 and 5 with the SEC and The NASDAQ Stock Market. To the knowledge of management, based solely on its review of such reports, no person who at any time during the fiscal year ended December 31, 2013, was a director, executive officer, or beneficial owner of more than ten percent of any class of equity securities of the Company failed to file on a timely basis reports required by Section 16(a) of the Securities Exchange Act of 1934 during the most recent fiscal year.

14

EQUITY COMPENSATION PLAN INFORMATION

At December 31, 2013, we had stock options and stock appreciation rights (“SARs”) outstanding from two stockholder-approved stock plans and one plan that was not approved by stockholders. The 2000 Nonemployee Directors' Stock Incentive Plan is the only plan not approved by stockholders and provided for the grant of stock options to non-employee directors at the time they were first elected to the Board and at the time of each subsequent re-election to the Board. In October 2009, the Board terminated the 2000 Nonemployee Directors' Stock Incentive Plan and several other stock-holder approved plans. The termination of these plans does not impair the rights of any participant under any award granted pursuant to the plans. All new equity issuances, whether to directors or officers, are made out of our stockholder-approved 2007 plan. We intend to make future equity issuances out of the 2014 Equity Incentive Plan, subject to shareholder approval.

Plan Category | Number of Securities to be Issued Upon Exercise of Outstanding Options (a) | Weighted Average Exercise Price of Outstanding Options (b) | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column (a)) (c) |

Equity plans approved by security holders | 160,806(1) | $21.92 | 49,050(3) |

Equity plans not approved by security holders | 0(2) | $— | — |

Total | 160,806 | $21.92 | 49,050 |

____________________

(1) | Excludes SARs to acquire 88,967 shares of common stock with exercise prices above $19.29, the closing price of a share of our common stock as reported on The NASDAQ Stock Market on December 31, 2013. On December 31, 2013, 88,967 SARs were outstanding with base prices between $19.37 and $29.48. |

(2) | Excludes SARs to acquire 16,067 shares of common stock with exercise prices above $19.29, the closing price of a share of our common stock as reported on The NASDAQ Stock market on December 31, 2013. On December 31, 2013, 16,067 SARs were outstanding with base prices between $23.985 and $25.14. |