formdef14a.htm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

| o |

Preliminary Proxy Statement

|

| |

|

| o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

| |

|

| x |

Definitive Proxy Statement

|

| |

|

| o |

Definitive Additional Materials

|

| |

|

| o |

Soliciting Material Pursuant to § 240.14a-12

|

Hersha Hospitality Trust

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x |

No fee required.

|

| |

|

| o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

| |

|

| |

(1)

|

Title of each class of securities to which transaction applies:

|

| |

|

|

| |

(2)

|

Aggregate number of securities to which transaction applies:

|

| |

|

|

| |

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| |

|

|

| |

(4)

|

Proposed maximum aggregate value of transaction:

|

| |

|

|

| |

(5)

|

Total Fee Paid:

|

| |

|

|

| o |

Fee paid previously with preliminary materials.

|

| |

|

| o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

| |

|

| |

(1)

|

Amount Previously Paid:

|

| |

|

|

| |

(2)

|

Form, Schedule or Registration Statement No.:

|

| |

|

|

| |

(3)

|

Filing Party:

|

| |

|

|

| |

(4)

|

Date Filed:

|

HERSHA HOSPITALITY TRUST

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 24, 2012

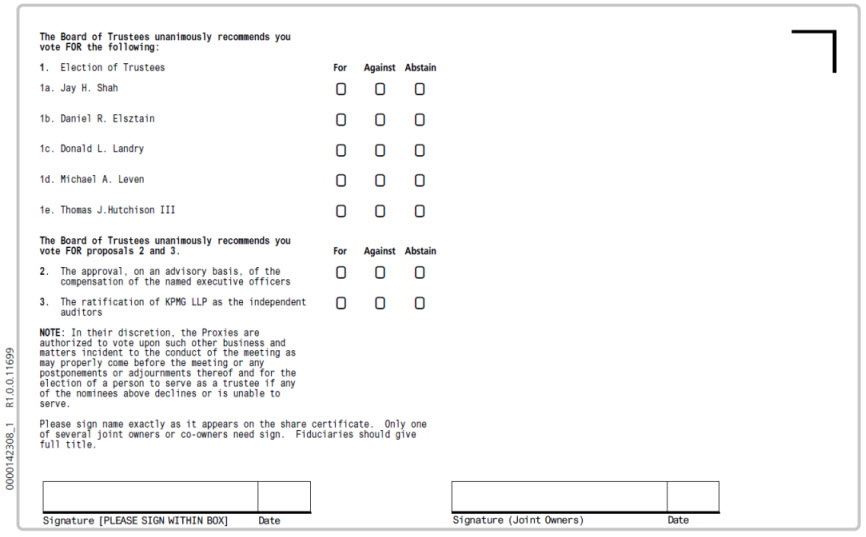

The 2012 annual meeting of shareholders of Hersha Hospitality Trust (the “Company”) will be held at the Sheraton Wilmington South Hotel, 365 Airport Road, New Castle, Delaware 19720 on May 24, 2012, at 12:00 p.m., Eastern Time, for the following purposes:

|

|

1.

|

To elect five Class I Trustees to the Board of Trustees.

|

|

|

2.

|

To approve on an advisory basis the compensation of the Company’s named executive officers.

|

|

|

3.

|

To ratify the appointment of KPMG LLP as the Company’s independent auditors.

|

|

|

4.

|

To transact such other business as may properly come before the annual meeting and any adjournment or postponement thereof.

|

Only holders of record of the Company’s common shares as of the close of business on the record date, March 30, 2012, and their legal proxy holders, are entitled to notice of, and to vote at, the annual meeting.

The 2012 proxy statement is attached to this notice. The 2012 proxy statement and other materials for the annual meeting, including the 2011 annual report to shareholders, are available on the Company’s website, www.hersha.com, and at www.proxyvote.com.

Whether or not you plan to attend the annual meeting, it is important that your common shares are represented and voted at the annual meeting. You may authorize your proxy over the Internet or by telephone as described on the proxy card accompanying this notice and the attached proxy statement. Alternatively, you may authorize your proxy by signing and returning the proxy card in the enclosed envelope. You may revoke your proxy and vote in person at the annual meeting by (1) executing and submitting a later dated proxy card that is received prior to May 24, 2012, (2) subsequently authorizing a proxy over the Internet or by telephone, (3) sending a written revocation of your proxy to the Company’s Corporate Secretary at its principal executive offices or (4) attending the annual meeting and voting in person.

| |

By Order of the Board of Trustees,

|

| |

|

| |

|

| |

/s/ David L. Desfor

|

| |

|

| |

David L. Desfor

|

| |

Corporate Secretary

|

44 Hersha Drive

Harrisburg, Pennsylvania 17102

April 20, 2012

HERSHA HOSPITALITY TRUST

44 Hersha Drive

Harrisburg, Pennsylvania 17102

2012 PROXY STATEMENT

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE 2012 ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 24, 2012:

This proxy statement and the 2011 annual report to shareholders are available on Hersha Hospitality Trust’s website, www.hersha.com, and at www.proxyvote.com. Information on or connected to these websites is not deemed to be a part of this proxy statement.

THE PROXY SOLICITATION

This proxy statement is provided in connection with the solicitation of proxies by the Board of Trustees of Hersha Hospitality Trust (the “Company”) for use at the 2012 annual meeting of shareholders to be held at the Sheraton Wilmington South Hotel, 365 Airport Road, New Castle, Delaware 19720 on May 24, 2012 and at any adjournment or postponement thereof. The mailing address of the Company’s principal executive office is 44 Hersha Drive, Harrisburg, Pennsylvania 17102. The Company’s proxy materials, including the notice of the annual meeting, this proxy statement, the proxy card and the 2011 annual report to shareholders, are first being mailed to the Company’s shareholders on or about April 20, 2012.

The solicitation of proxies is being made primarily by the use of standard mail. The cost of preparing and mailing this proxy statement and accompanying proxy materials, and the cost of any supplementary proxy solicitations, which may be made by mail, telephone or personally by the Company’s trustees, executive officers and employees, will be borne by the Company. No person is authorized to give any information or to make any representation not contained in this proxy statement and, if given or made, such information or representation should not be relied upon as having been authorized by the Company. This proxy statement does not constitute the solicitation of a proxy, in any jurisdiction, from any person to whom it is unlawful to make such solicitation in such jurisdiction. The delivery of this proxy statement shall not, under any circumstances, imply that there has not been any change in the information set forth herein since the date of the proxy statement.

How To Vote; Revocability of Proxy

You may authorize your proxy over the Internet (at www.proxyvote.com), by telephone (at 1-800-690-6903) or by executing and returning the proxy card accompanying this proxy statement. Once you authorize a proxy, you may revoke that proxy by (1) executing and submitting a later-dated proxy card prior to May 24, 2012, (2) subsequently authorizing a proxy over the Internet or by telephone, (3) sending a written revocation of your proxy to the Company’s Corporate Secretary at its principal executive offices, or (4) attending the annual meeting and voting in person.

Attending the annual meeting without submitting a new proxy or voting in person will not automatically revoke the prior authorization of your proxy. Only the last vote of a shareholder will be counted.

If you hold the Company’s common shares in “street” name (i.e., through a bank, broker or other nominee), you will receive instructions from your bank, broker or nominee that you must follow in order to give them your voting instructions, or you may contact your nominee directly to request these instructions.

Shareholders Entitled To Vote

Only holders of record of the Company’s common shares at the close of business on the record date, March 30, 2012, and their legal proxy holders, are entitled to notice of, and to vote at, the annual meeting. On the record date, there were 173,299,736 common shares outstanding. Each shareholder of record is entitled to one vote per common share. Cumulative voting is not permitted in the election of Class I Trustees.

Attending the Annual Meeting In Person

If you would like to attend the annual meeting in person, you will need to bring an account statement or other evidence acceptable to the Company of ownership of your common shares as of the close of business on the record date. If you hold common shares in “street” name and wish to vote in person at the annual meeting, you will need to contact your broker, bank or nominee and obtain a written proxy from them and bring it to the annual meeting.

The Company’s Bylaws provide that the holders of a majority of the outstanding common shares as of the close of business on the record date present in person or by proxy constitutes a quorum for the transaction of business at the annual meeting. As of March 30, 2012, there were 173,299,736 common shares outstanding.

In February 2012, the Board of Trustees amended the Company’s Bylaws to change the voting standard for the election of trustees in uncontested elections from a plurality of the votes cast to a majority of the votes cast. Under this standard, a majority of the votes cast means the number of votes cast “for” a trustee’s election exceeds the number of votes cast “against” that trustee’s election. The Bylaws continue to provide for the election of trustees by a plurality of the votes cast if the number of nominees exceeds the number of trustees to be elected (a contested election). The election of Class I Trustees at the annual meeting is uncontested. Therefore, in accordance with the Bylaws, Class I Trustee nominees will be elected at the annual meeting by a majority of the votes cast.

The affirmative vote of a majority of all of the votes cast at the annual meeting, if a quorum is present, is required for the proposal to approve on an advisory basis the compensation of the Company’s “named executive officers”(as defined under the heading “Compensation Discussion & Analysis” below).

The affirmative vote of a majority of all of the votes cast at the annual meeting, if a quorum is present, is required to ratify the appointment of KPMG LLP (“KPMG”) as the Company’s independent auditors for the fiscal year ending December 31, 2012.

How Votes Will Be Counted

In the election of Class I Trustees, you may vote “for,” “against” or “abstain” with respect to each Class I Trustee nominee. For the proposal to approve on an advisory basis the compensation of the Company’s named executive officers and for the proposal to ratify the appointment of KPMG LLP as the Company’s independent auditors for the fiscal year ending December 31, 2012, you may vote “for,” “against” or “abstain.” Abstentions with respect to any proposal at the annual meeting will be counted as present and entitled to vote for purposes of determining the presence of quorum, but will not be counted as a vote cast on the proposal and therefore will not be counted in determining the outcome of the proposal.

If you hold your common shares in street name through a brokerage firm and you do not submit voting instructions to your broker, your broker may generally vote your common shares in its discretion on routine matters. However, a broker cannot vote common shares held in street name on non-routine matters unless the broker receives voting instructions from the street name holder. The proposal to ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2012 is considered routine under applicable rules, while each of the other items to be submitted for a vote of shareholders at the annual meeting is considered non-routine. Accordingly, if you hold your common shares in street name through a brokerage account and you do not submit voting instructions to your broker, your broker may exercise its discretion to vote your common shares on the proposal to ratify the appointment of KPMG, but will not be permitted to vote your common shares on any of the other items at the annual meeting. If your broker exercises this discretion, your common shares will be counted as present for the purpose of determining the presence of a quorum at the annual meeting and will be voted on the proposal to ratify the appointment of KPMG in the manner directed by your broker, but your common shares will constitute “broker non-votes” on each of the other items at the annual meeting, including the election of Class I Trustees. Broker non-votes will not be counted as a vote cast with respect to these other items and therefore will not be counted in determining the outcome of the items.

OWNERSHIP OF THE COMPANY’S COMMON SHARES OF BENEFICIAL INTEREST

Security Ownership of Certain Beneficial Owners

The following table sets forth certain information as of March 31, 2012, with respect to each person (including any “group” as that term is used in Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) who is known to the Company to be the beneficial owner of more than five percent of the Company’s common shares.

| |

|

Common shares

|

|

|

Name and Address of Beneficial Owner

|

|

Number of

Common shares

Beneficially Owned

|

|

|

Percent

of

Class(1)

|

|

| |

|

|

|

|

|

|

|

BlackRock Inc.(2)

|

|

|

9,260,344 |

|

|

|

5.3 |

% |

|

40 East 52nd Street

|

|

|

|

|

|

|

|

|

|

New York, New York 10022

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Cohen & Steers, Inc.(3)

|

|

|

25,905,081 |

|

|

|

14.9 |

% |

|

280 Park Avenue, 10th Floor

|

|

|

|

|

|

|

|

|

|

New York, New York 10017

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Eduardo S. Elsztain(4)

|

|

|

18,121,030 |

|

|

|

10.5 |

% |

|

Bolívar 108, 1st floor

|

|

|

|

|

|

|

|

|

|

Buenos Aires, Argentina

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Jennison Associates LLC(5)

|

|

|

8,549,008 |

|

|

|

4.9 |

% |

|

466 Lexington Avenue

|

|

|

|

|

|

|

|

|

|

New York, New York 10017

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Invesco Ltd.(6)

|

|

|

10,010,335 |

|

|

|

5.8 |

% |

|

1555 Peachtree Street NE

|

|

|

|

|

|

|

|

|

|

Atlanta, Georgia 30309

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Prudential Financial, Inc.(7)

|

|

|

8,590,568 |

|

|

|

5.0 |

% |

|

751 Broad Street

|

|

|

|

|

|

|

|

|

|

Newark, New Jersey 07102

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Vanguard Group(8)

|

|

|

15,786,440 |

|

|

|

9.1 |

% |

|

100 Vanguard Blvd.

|

|

|

|

|

|

|

|

|

|

Malvern, Pennsylvania 19355

|

|

|

|

|

|

|

|

|

|

(1)

|

Percentages are based on 173,299,736 common shares outstanding as of March 31, 2012

|

|

(2)

|

Information based solely on Amendment No. 2 to a Schedule 13G filed with the SEC on February 13, 2012 by Blackrock, Inc.

|

|

(3)

|

Information based solely on Amendment No. 2 to a Schedule 13G filed with the SEC on February 14, 2012 by Cohen & Steers, Inc., Cohen & Steers Capital Management, Inc. and Cohen & Steers Europe S.A. Cohen & Steers, Inc. has reported sole voting power over 18,011,427 common shares and sole dispositive power over 25,905,081 common shares. Cohen & Steers Capital Management, Inc. has reported sole voting power over 17,773,101 common shares and sole dispositive power over 22,966,537 common shares. Cohen & Steers, Inc. reported that it holds a 100% interest in Cohen & Steers Capital Management, Inc., and that it, together with Cohen & Steers Capital Management, Inc., holds a 100% interest in Cohen & Steers Europe S.A.

|

|

(4)

|

Information based solely on Amendment No. 4 to a Schedule 13D filed with the SEC on April 11, 2012 by Eduardo Elsztain, reporting the direct and indirect ownership by Eduardo Elsztain of the Company’s common shares. Eduardo Elsztain directly owns 15,400 common shares. Eduardo Elsztain, through certain affiliates, indirectly owns 18,105,630 common shares. Eduardo Elsztain is the Chairman of the Board of IRSA Inversiones y Representaciones Sociedad Anomina (“IRSA”), Tyrus S.A. (“Tyrus”), which is wholly owned by IRSA, and Jiwin S.A. (“Jiwin”), which is wholly owned by Tyrus. Jiwin is the sole general partner of Real Estate Investment Group L.P. (“REIG”), Real Estate Investment Group II L.P. (“REIG II”), Real Estate Investment Group III L.P. and Real Estate Investment Group IV L.P. (“REIG IV”). Of the 18,105,630 common shares indirectly owned by Eduardo Elsztain through his affiliates: (i) 819,906 common shares are owned directly by IRSA; (ii) 8,126,500 common shares are owned directly by REIG; (iii) 3,894,323 common shares are owned directly by REIG II; (iv) 3,864,000 common shares are owned directly by REIG III; and (iv) 1,400,901 common shares are owned directly by REIG IV.

|

| |

The amendment to the Schedule 13D and the number of shares in the table does not include 12,947 common shares known by the Company to be owned directly by Daniel Elsztain. Daniel Elsztain, the brother of Eduardo Elsztain and the Chief Real Estate Officer and an Assistant Director of IRSA, has served on the Company’s Board of Trustees since September 2011 and has been nominated for election as a Class I Trustee at the annual meeting. To the extent Daniel Elsztain exercises voting or dispositive power over any of the common shares shown in the table above, he is deemed to be the beneficial owner of those common shares pursuant to Section 13(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules promulgated by the SEC under the Exchange Act.

|

|

(5)

|

Information based solely on a Schedule 13G filed with the SEC on February 14, 2012 by Jennison Associates LLC (“Jennison’s 13G”). Jennison Associates LLC has reported sole voting power over 8,238,933 common shares and shared dispositive power over 8,549,008 common shares. Jennison Associates LLC (“Jennison”) reported that Prudential Financial, Inc. (“Prudential”) indirectly owns 100% of equity interests of Jennison. Jennison does not file jointly with Prudential, and as such, common shares reported on Jennison’s 13G may be included on a Schedule 13G filed by Prudential.

|

|

(6)

|

Information based solely on a Schedule 13G filed with the SEC on February 13, 2012 by Invesco Ltd. According to the Schedule 13G, (i) Invesco Advisers, Inc. has sole voting power over 5,252,451 common shares, shared voting power over 55,547 common shares, sole dispositive power over 9,901,394 common shares and shared dispositive power over 39,031 common shares; (ii) Invesco PowerCommon shares Capital Management has sole voting power and sole dispositive power over 59,370; and (iii) Invesco National Trust Company has sole dispositive power over 10,540.

|

|

(7)

|

Information based solely on a Schedule 13G filed with the SEC on February 13, 2012 by Prudential Financial, Inc. Prudential Financial, Inc. has reported that it is a parent holding company and the indirect company of the following registered investment advisers: (i) The Prudential Insurance Company of America, (ii) Jennison Associates LLC, (iii) Prudential Investment Management, Inc. and (iv) Quantitative Management Associates LLC.

|

|

(8)

|

Information based solely on Amendment No. 3 to a Schedule 13G filed with the SEC on February 8, 2012 by The Vanguard Group, Inc. The Vanguard Group Inc. has disclosed that is has sole voting power over 211,706 common shares, sole dispositive power over 15,574,734 common shares and shared dispositive power over 211,706 common shares. The Vanguard Group, Inc. has reported that Vanguard Fiduciary Trust Company, a wholly-owned subsidiary of The Vanguard Group, Inc., is the beneficial owner of 211,706 common shares.

|

Security Ownership of Management

The following table sets forth certain information, known by the Company as of March 31, 2012, regarding the beneficial ownership of the Company’s common shares and the Company’s Series A preferred shares by (i) each of the Company’s trustees and trustee nominees, (ii) each of the Company’s named executive officers and (iii) the Company’s trustees and executive officers as a group. None of these individuals beneficially own any of the Company’s Series B preferred shares. At March 31, 2012, there were 173,299,736 common shares outstanding and 2,400,000 Series A preferred shares outstanding. Except as set forth in the footnotes to the table below, each of the individuals identified in the table has sole voting and investment power over the common shares and Series A preferred shares beneficially owned by that person. The address for each of the Company’s trustees, trustee nominees and named executive officers is c/o Hersha Hospitality Trust, 44 Hersha Drive, Harrisburg, Pennsylvania 17102.

| |

|

Class A Common Shares

|

|

|

Series A Preferred Shares

|

|

|

Name of Beneficial Owner

|

|

Number of

Shares Beneficially

Owned(1)

|

|

|

Percentage of Class

Beneficially

Owned(2)

|

|

|

Number of

Beneficially Owned

|

|

|

Percentage of Class

Beneficially Owned

|

|

|

Hasu P. Shah

|

|

|

806,823 |

(3) |

|

|

* |

|

|

|

- |

|

|

|

- |

|

|

Jay H. Shah

|

|

|

2,680,360 |

(4) |

|

|

1.5 |

% |

|

|

- |

|

|

|

- |

|

|

Neil H. Shah

|

|

|

2,658,138 |

(5) |

|

|

1.5 |

% |

|

|

- |

|

|

|

- |

|

|

Ashish R. Parikh

|

|

|

391,019 |

(6) |

|

|

* |

|

|

|

- |

|

|

|

- |

|

|

Michael R. Gillespie

|

|

|

112,249 |

|

|

|

* |

|

|

|

947 |

(7) |

|

|

* |

|

|

David L. Desfor

|

|

|

218,700 |

(8) |

|

|

* |

|

|

|

- |

|

|

|

- |

|

|

Thomas S. Capello

|

|

|

38,319 |

|

|

|

* |

|

|

|

- |

|

|

|

- |

|

|

Daniel R. Elsztain

|

|

|

18,118,577 |

(9) |

|

|

10.5 |

% |

|

|

- |

|

|

|

- |

|

|

Thomas J. Hutchison

|

|

|

560,861 |

(10) |

|

|

* |

|

|

|

- |

|

|

|

- |

|

|

Donald J. Landry

|

|

|

101,070 |

|

|

|

* |

|

|

|

1,000 |

|

|

|

* |

|

|

Michael A. Leven

|

|

|

61,019 |

|

|

|

* |

|

|

|

- |

|

|

|

- |

|

|

Dianna F. Morgan

|

|

|

21,380 |

|

|

|

* |

|

|

|

- |

|

|

|

- |

|

|

Kiran P. Patel

|

|

|

600,073 |

(11) |

|

|

* |

|

|

|

3,000 |

|

|

|

* |

|

|

John M. Sabin

|

|

|

53,024 |

(12) |

|

|

* |

|

|

|

- |

|

|

|

- |

|

|

All executives officers, trustees, and trustee nominees as a group (14 persons)

|

|

|

26,421,612 |

|

|

|

14.9 |

% |

|

|

4,947 |

|

|

|

* |

|

|

*

|

Represents less than one percent of the outstanding shares of the class of securities indicated in the table above.

|

|

(1)

|

Includes the total number of common shares issuable upon redemption of partnership units in Hersha Hospitality Limited Partnership, the Company’s operating partnership subsidiary (the “Operating Partnership” or “HHLP”). Partnership units are redeemable by the holder for cash, or at the Company’s option, an equivalent number of common shares.

|

|

(2)

|

The total number of common shares outstanding used in calculating the percentage ownership of each person assumes that the partnership units held by such person, directly or indirectly, are redeemed for common shares and none of the partnership units held by other persons are redeemed for common shares.

|

|

(3)

|

Includes: (i) 455,496 common shares issuable upon redemption of partnership units that are currently redeemable; and (ii) 99,130 common shares, all of which are held by Shree Associates, a family limited partnership that is controlled by Mr. Hasu Shah. Excludes: (i) 474,834 common shares issuable upon the redemption of partnership units that are currently redeemable and held by the Jay and Susie Shah 2008 Family Trust, in which Mr. Hasu Shah is the trustee; and (ii) 407,362 common shares issuable upon the redemption of partnership units that are currently redeemable and held by the Neil and Juhi Shah 2008 Family Trust, in which Mr. Hasu Shah is the trustee. Mr. Hasu Shah disclaims beneficial ownership of the common shares issuable upon the redemption of partnership units and the partnership units held by the two family trusts for which he is the trustee, and this report shall not be deemed an admission that Mr. Hasu Shah is the beneficial owner of these common shares or partnership units for purposes of Section 16 or for any other purpose.

|

|

(4)

|

Includes 416,389 common shares issuable upon redemption of partnership units that are currently redeemable, all of which are held in grantor retained annuity trusts for the benefit of Mr. Jay Shah and in which Mr. Jay Shah is the trustee. Also includes: (i) 474,834 common shares issuable upon redemption of partnership units that are currently redeemable and held by the Jay and Susie Shah 2008 Family Trust, in which Mr. Hasu Shah is the trustee; and (ii) 730,294 common shares issuable upon redemption of partnership units that are currently redeemable and held by the Hasu and Hersha Shah 2004 Trust FBO Jay H. Shah, in which the trustee is an unaffiliated third party. The partnership units held by the Hasu and Hersha Shah 2004 Trust FBO Jay H. Shah have been pledged as security to a third party.

|

|

(5)

|

Includes 364,918 common shares issuable upon redemption of partnership units that are currently redeemable, all of which are held in grantor retained annuity trusts for the benefit of Mr. Neil Shah and in which Mr. Neil Shah is the trustee. Also includes: (i) 407,362 common shares issuable upon redemption of partnership units that are currently redeemable and held by the Neil and Juhi Shah 2008 Family Trust, in which Mr. Hasu Shah is the trustee; and (ii) 832,215 common shares issuable upon redemption of partnership units that are currently redeemable and held by the Hasu and Hersha Shah 2004 Trust FBO Neil H. Shah, in which the trustee is an unaffiliated third party. The partnership units held by the Hasu and Hersha Shah 2004 Trust FBO Neil H. Shah have been pledged as security to a third party.

|

|

(6)

|

Includes 103,000 common shares that Mr. Parikh has pledged as security to a third party.

|

|

(7)

|

All 943 Series A preferred common shares are held indirectly by Mr. Gillespie’s wife.

|

|

(8)

|

Includes 211,900 common shares issuable upon redemption of partnership units held by Mr. Desfor.

|

|

(9)

|

Mr. Elsztain directly owns 12,947 common shares. In addition, Mr. Elsztain may be deemed to beneficially own a total of 18,105,630 common shares, which are owned directly by IRSA, REIG, REIG II, REIG III and REIG IV. Mr. Elsztain is the Chief Real Estate Officer and an Assistant Director of IRSA. IRSA, through its wholly owned subsidiaries, controls REIG, REIG II, REIG III and REIG IV. Mr. Elsztain has been designated to serve on the Company’s Board of Trustees by IRSA.

|

|

(10)

|

Includes 40,000 common shares that are held by Mr. Hutchison’s wife and with respect to which he shares voting and investment power.

|

|

(11)

|

Includes 512,263 common shares issuable upon redemption of partnership units that are currently redeemable, which units Mr. Patel has pledged as security to a third party.

|

|

(12)

|

Includes 1,150 common shares that are held indirectly by Mr. Sabin’s wife and with respect to which he shares voting and investment power.

|

BOARD OF TRUSTEES AND EXECUTIVE OFFICERS

Certain information regarding the Company’s trustees and executive officers, as of March 31, 2012, is set forth below.

|

Name

|

|

Age

|

|

Position

|

| |

|

|

|

|

|

Hasu P. Shah

|

|

67

|

|

Class II Trustee; Chairman of the Board

|

|

Jay H. Shah

|

|

43

|

|

Class I Trustee Nominee; Chief Executive Officer

|

|

Thomas S. Capello

|

|

68

|

|

Class I Trustee*

|

|

Thomas J. Hutchison III

|

|

70

|

|

Class I Trustee Nominee*

|

|

Donald J. Landry

|

|

63

|

|

Class I Trustee Nominee*; Lead Independent Trustee

|

|

Michael A. Leven

|

|

74

|

|

Trustee Emeritus and Class I Trustee Nominee

|

|

Daniel R. Elsztain

|

|

39

|

|

Class I Trustee Nominee*

|

|

Dianna F. Morgan

|

|

60

|

|

Class II Trustee*

|

|

Kiran P. Patel

|

|

62

|

|

Class II Trustee

|

|

John M. Sabin

|

|

57

|

|

Class II Trustee*

|

|

Neil H. Shah

|

|

38

|

|

President and Chief Operating Officer

|

|

Ashish R. Parikh

|

|

42

|

|

Chief Financial Officer and Assistant Secretary

|

|

Michael R. Gillespie

|

|

39

|

|

Chief Accounting Officer, Controller, and Assistant Secretary

|

|

David L. Desfor

|

|

51

|

|

Treasurer and Corporate Secretary

|

|

*

|

“Independent” pursuant to the corporate governance standards of the NYSE as determined by a vote of the Board of Trustees.

|

Hasu P. Shah, Class II Trustee since May 1998; Chairman of the Board of Trustees

Mr. Shah has been the Chairman of the Board and a Class II Trustee since the Company’s inception in May 1998 and was the Company’s Chief Executive Officer until his retirement in 2005. Mr. Shah is also the founder and Chief Executive Officer of the Hersha Group. Mr. Shah founded the Hersha Group with the purchase of a single hotel in Harrisburg, Pennsylvania in 1984. In the last 25 years, Mr. Shah has developed, owned, or managed over 50 hotels across the Eastern United States and started affiliated businesses in general construction, purchasing, and hotel management. He has earned numerous awards, including the Entrepreneur of the Year award given by Ernst & Young LLP. Mr. Shah has been recognized for his philanthropic work through numerous awards. He received the Creating a Voice award, instituted by Project IMPACT, which honors South Asian-American community leaders who have made a positive and tremendous impact on the United States. He also received an honorary Doctorate of Public Service (DPS) Degree from Harrisburg Area Community College. In 2010, Mr. Shah was honorably bestowed with the National United Way Tocqueville Society award, the highest honor given to volunteers across the country. Most recently, he was presented with the Hall of Fame award by Central Penn Business Journal for lifetime achievements in both business and philanthropy. Mr. Shah and his wife, Hersha, are active members of the local community and remain involved with charitable initiatives in India. Mr. Shah has been an active Rotarian for nearly 25 years and continues to serve as a trustee of several community service and spiritual organizations including Vraj Hindu Temple and the India Heritage Research Foundation. Mr. Shah received a bachelors of science degree in chemical engineering from Tennessee Technical University and obtained a masters degree in administration from Pennsylvania State University, which named him as a Fellow. Mr. Shah is also an alumnus of the Owner and President’s Management program at Harvard Business School. Mr. Shah is the father of Jay H. Shah, the Company’s Chief Executive Officer and Class I Trustee, and Neil H. Shah, the Company’s President and Chief Operating Officer.

The Board of Trustees has determined that Mr. Hasu Shah’s qualifications to serve on the Board of Trustees include his extensive experience in the lodging industry, including his role as our former Chief Executive Officer and as the founder of The Hersha Group, a privately-held company that over the past 25 years has developed, owned or managed over 50 hotels across the Eastern United States. With over 25 years of lodging industry experience, Mr. Hasu Shah has developed a broad network of hotel industry contacts and relationships, including relationships with hotel owners, operators, project managers, contractors and other key industry participants.

Thomas S. Capello, Class I Trustee since January 1999

Mr. Capello has served as President and a principal of Bank Realty LP, a partnership engaged in sale/leaseback transactions of bank properties, since 2000. He is also currently President of 1st Capital Group, Inc. which provides debt and equity placement for small businesses. From 1988 to 1999, Mr. Capello was the President, Chief Executive Officer and Director of First Capitol Bank in York, Pennsylvania. From 1983 to 1988, Mr. Capello served as Vice President and Manager of the Loan Production Office of The First National Bank of Maryland. Prior to his service at The First National Bank of Maryland, Mr. Capello served as Vice President and Senior Regional Lending Officer at Commonwealth National Bank and worked at the Pennsylvania Development Credit Corporation. Mr. Capello is a Director and Treasurer for the Ben Franklin Venture Investment Forum. Mr. Capello is a graduate of the Stonier Graduate School of Banking at Rutgers University and holds an undergraduate degree with a major in economics from the Pennsylvania State University.

Mr. Capello has advised the Board of Trustees that he will not stand for re-election as a Class I Trustee at the annual meeting.

Daniel R. Elsztain, Class I Trustee since September 2011

Mr. Elsztain was appointed to the Board of Trustees pursuant to a trustee designation agreement that the Company entered into with REIG and IRSA in August 2009 in connection with REIG’s initial investment in the Company’s common shares. Mr. Elsztain currently serves as the Chief Real Estate Officer and as a director of IRSA, a position he has held since 2007. IRSA is an Argentine real estate company that is listed on the Buenos Aires Stock Exchange and the New York Stock Exchange. Currently, Mr. Elsztain serves as a director of Alto Palermo S.A. and as an alternate director of IRSA. He received a degree in economic sciences from the Torcuato Di Tella University and a master of business administration degree from Austral IAE University. In February 2012, Mr. Elsztain was appointed to the Board of Directors of Supertel Hospitality, Inc., where he serves as a member of the Investment Committee.

The Board of Trustees has determined that Mr. Elsztain’s qualification to serve as one of our trustees include his experience in the real estate industry, including as the Chief Real Estate Officer of IRSA.

Thomas J. Hutchison III, Class I Trustee since September 2008

From May 2003 to April 2007, Mr. Hutchison was the Chief Executive Officer of CNL Hotels & Resorts, Inc. (“CNL Hotels”), a real estate investment trust that owned hotels and resort properties. During that same time period, Mr. Hutchison held various other executive officer positions with companies affiliated with CNL Hotels, including but not limited to President and Chief Executive Officer of CNL Hotel Investors, Inc. and Chief Executive Officer of CNL Income Properties, Inc. Since April 2007, Mr. Hutchison has served as a consultant with Hutchison Advisors, Inc., a real estate services company, and, since October 2008, he has served as Chairman of Legacy Healthcare Advisors, LLC, a specialized real estate services group. In October 2011, Mr. Hutchison was appointed to the Board of Directors of Marriott Vacations Worldwide Corporation (“Marriott Vacations”), where he serves as member of that board’s Audit, Nominating and Corporate Governance and Compensation Committees, including as the Chair of its Compensation Committee. Mr. Hutchison is currently a director for, KSL Capital Partners LLC, ClubCorp, Inc., U.S. Chamber of Commerce, Vision360, and The Trinity Forum and was formerly a director for ING DIRECT USA. He is also a member of The Real Estate Roundtable, Leadership Council for Communities in Schools, Advisory Council of the Erickson School of Aging Studies and serves on the Advisory Editorial Board of GlobalHotelNetwork.com. Additionally, he serves as a senior advisor to various service industry public companies. Mr. Hutchison attended Purdue University and the University of Maryland Business School.

The Board of Trustees has determined that Mr. Hutchison’s qualifications to serve on the Board of Trustees include his substantial experience in the real estate and lodging industries combined with his extensive leadership experience as a Chief Executive Officer of several SEC reporting REITs, including as the Chief Executive Officer of CNL Hotels.

Donald J. Landry, Class I Trustee since April 2001

Mr. Landry is president and owner of Top Ten, an independent hospitality industry consulting company, a position he has held since 2002. Mr. Landry has over 40 years of lodging and hospitality experience in a variety of leadership positions. Most recently, from 1998 to 2001, Mr. Landry was the Chief Executive Officer, President and Vice Chairman of Sunburst Hospitality Inc. Mr. Landry has also served as President of Choice Hotels International, Inc. (from 1996 to 1998), Manor Care Hotel Division (from 1992 to 1996) and Richfield Hotel Management (from 1989 to 1991). In February 2012, Mr. Landry was appointed to the Board of Directors of Supertel Hospitality, Inc., where he serves as the Chairman of the Investment Committee. Mr. Landry currently serves on the corporate advisory boards of Unifocus, Campo Architects, Revenue Performance Interactive, Windsor Capital Group and numerous nonprofit boards. Mr. Landry is a frequent guest lecturer at Johnson and Wales University and the University of New Orleans. Mr. Landry holds a bachelor of science from the University of New Orleans, which awarded him Alumnus of the Year in 1999. Mr. Landry is a Certified Hotel Administrator.

The Board of Trustees has determined that Mr. Landry’s qualifications to serve on the Board of Trustees include his 40 years of experience in the lodging and real estate industries, including his roles as Chief Executive Officer, President and Vice Chairman of Sunburst Hospitality Inc. and President of Choice Hotels International, Inc., Manor Care Hotel Division and Richfield Hotel Management.

Michael A. Leven, Trustee Emeritus since March 2010 and Class I Trustee Nominee

Mr. Leven currently serves as the Company’s trustee emeritus, a position he has held since March 2010. Prior to March 2010, Mr. Leven served as a Class II Trustee from May 2001 through March 2010. Mr. Leven has been the President and Chief Operating Officer of the Las Vegas Sands Corp. since March 2009, Secretary since June 2010 and a director of the Las Vegas Sands Corp. since August 2004. Mr. Leven also serves as a member of the Board of Directors of Sands China Ltd., a subsidiary of Las Vegas Sands Corp., and as an officer and/or director of several other subsidiaries of Las Vegas Sands Corp. Mr. Leven served as the Chief Executive Officer of the Georgia Aquarium from September 2008 until he joined Las Vegas Sands Corp. in March 2009. From January 2006 through September 2008, Mr. Leven was the Vice Chairman of the Marcus Foundation, Inc., a non-profit foundation. Until July 2006, Mr. Leven was the Chairman, Chief Executive Officer and President of U.S. Franchise Systems, Inc., the company he founded in 1995 that developed and franchised the Microtel Inns & Suites and Hawthorn Suites hotel brands. He was previously the president and chief operating officer of Holiday Inn Worldwide, president of Days Inn of America, and president of Americana Hotels. Mr. Leven serves on many other non-profit boards.

Mr. Leven’s extensive experience in the hospitality industry, including as an executive officer and director of the Las Vegas Sands Corp. and his past employment in leadership positions with various other hospitality companies, led the Board of Trustees to conclude that he should serve as a trustee emeritus and should be nominated for election as a Class I Trustee at this year’s annual meeting.

Dianna F. Morgan, Class II Trustee since April 2010

Ms. Morgan retired in 2001 from a long career with the Walt Disney World Company, where she served as Senior Vice President of Public Affairs and Human Resources. She also oversaw the Disney Institute — a recognized leader in experiential training, leadership development, benchmarking and cultural change for business professionals around the world. In addition, Ms. Morgan is the immediate past Chair and is a past member of the Board of Trustees for the University of Florida. She was originally appointed to the University of Florida Board of Trustees in 2001. Ms. Morgan currently serves on the Board of Directors of Chesapeake Utilities Corp., where she is a member of the Compensation Committee, and the Board of Directors of CNL Bancshares, Inc. Ms. Morgan previously served on the Board of Directors of CNL Hotels & Resorts, Inc. Ms. Morgan is a member of the Board of Directors of Orlando Health (formerly Orlando Regional Healthcare System) and serves as Chair of the national board for the Children’s Miracle Network. Ms. Morgan received her Bachelor of Arts degree in organizational communications from Rollins College.

The Board of Trustees has determined that Ms. Morgan’s experience serving as a board member of both private and public companies, her previous experience overseeing the Disney Institute and her prior service as a senior manager at Walt Disney World Company provide her with extensive knowledge of innovation and customer service, a solid foundation in media relations, risk management, and government relations and “best practice” expertise in human capital and the customer experience.

Kiran P. Patel, Class II Trustee since May 2007

Mr. Patel served as the Company’s Corporate Secretary from 1998 to April 2007 and has been a principal of the Hersha Group since 1993. Prior to 1993, Mr. Patel was employed by AMP Incorporated, an electrical component manufacturer in Harrisburg, Pennsylvania. Mr. Patel serves on various boards of directors for community service organizations. Mr. Patel received a bachelor of science degree in mechanical engineering from M.S. University of India and obtained a masters of science degree in industrial engineering from the University of Texas in Arlington.

The Board of Trustees has determined that Mr. Patel’s qualifications to serve on the Board of Trustees include his extensive experience in the lodging industry, including his role as a partner and Chief Investment Officer of The Hersha Group. Mr. Patel has developed a broad network of lodging industry contacts and has extensive experience in acquiring, selling, repositioning, developing and redeveloping hotels.

John M. Sabin, Class II Trustee since June 2003

Since May 2011 Mr. Sabin has been the Executive Vice President and Chief Financial Officer of Revolution LLC as well as the Chief Financial Officer of The Stephen Case Foundation and the Case Family Office. Previously he was the Chief Financial Officer and General Counsel of Phoenix Health Systems, Inc. a private healthcare information technology outsourcing and consulting firm, from October 2004 to May 2011. Mr. Sabin was the Chief Financial Officer, General Counsel and Secretary of NovaScreen Biosciences Corporation, a private bioinformatics and contract research biotech company (acquired by Caliper Life Sciences) from January 2000 to October 2004. Prior to joining NovaScreen, Mr. Sabin served as a finance executive with Hudson Hotels Corporation, Vistana, Inc., Choice Hotels International, Inc., Manor Care, Inc. and Marriott International, Inc. all of which were public companies at the time of his service. In his professional life Mr. Sabin has had commercial lease experience with a national law firm, transactional real estate experience with national hospitality and health care firms, commercial real estate financing experience, IPO experience, as well as experience as an audit committee and board member of five other public companies (including Competitive Technologies Corporation from 1996 to 2007, North American Scientific, Inc. from 2005 to 2010, Prime Group Realty Trust from 2005 to current and Supertel Hospitality, Inc. from 2012 to current). Mr. Sabin has received Bachelor of Science degrees in Accounting and in University Studies; a Masters of Accountancy and a Masters in Business Administration from Brigham Young University, and he also received a Juris Doctor from the J. Reuben Clark Law School at Brigham Young University. Mr. Sabin is a licensed CPA and is admitted to the bar in several states.

The Board of Trustees has determined that Mr. Sabin’s qualifications to serve on the Board of Trustees include his substantial hospitality industry experience, as well as his substantial legal, finance and accounting experience. His current and prior service as both General Counsel and Chief Financial Officer of various companies provides the Board of Trustees with valuable insights with respect to finance, accounting, legal and corporate governance matters. He also has prior public company experience as a Chief Financial Officer and finance executive, as well as a director or trustee.

Jay H. Shah, Class I Trustee since January 2006 and Chief Executive Officer

Mr. Shah was named Chief Executive Officer and a trustee as of January 1, 2006. Prior thereto, Mr. Shah had served as the Company’s President and Chief Operating Officer since September 3, 2003. Until September 2003, Mr. Shah was a principal in the law firm of Shah & Byler, LLP, which he founded in 1997, and managing director of the Hersha Group. Mr. Shah previously was a consultant with Coopers & Lybrand LLP, served the late Senator John Heinz on Capitol Hill, and was employed by the Philadelphia District Attorney’s office and two Philadelphia-based law firms. Mr. Shah received a bachelor of science degree from the Cornell University School of Hotel Administration, a masters degree from the Temple University School of Business Management and a law degree from Temple University School of Law. Mr. Shah is the son of Hasu P. Shah, the Company’s Chairman of the Board, and the brother of Neil H. Shah, the Company’s President and Chief Operating Officer.

The Board of Trustees has determined that Mr. Jay Shah’s qualifications to serve on the Board of Trustees include his extensive experience in the lodging and real estate industry and his experience negotiating and structuring real estate transactions and real estate-related joint ventures, including in his role as a former practicing real estate attorney. Mr. Jay Shah has developed a broad network of hotel industry contacts and his experience includes serving as the Company’s President and Chief Operating Officer.

Executive Officers

Biographical information for Hasu P. Shah, the Company’s Chairman of the Board, and Jay H. Shah, the Company’s Chief Executive Officer, is set forth above under “—Board of Trustees.”

Neil H. Shah, President and Chief Operating Officer

Mr. Neil H. Shah has served as the Company’s President and Chief Operating Officer of Hersha Hospitality Trust since 2006. Mr. Shah has lead the Company’s hotel acquisitions, development, and asset management platforms since 2000. Prior to Hersha, Mr. Shah served as a Director and Consultant with The Advisory Board Company and the Corporate Executive Board, strategy research firms based in Washington D.C. Mr. Shah has also worked with the Phipps Foundation in New York City contributing to urban renewal projects in New York City. Mr. Shah earned a Bachelor of Arts in Political Science and a Bachelor of Science in Management both with honors from the University of Pennsylvania and the Wharton School. He earned his MBA from the Harvard Business School. He serves on the Corporate Council for the National Constitution Center, the Barnes Foundation, and is a research sponsor at the Wharton Real Estate Center in Philadelphia. He is also a member of the Board of Directors of the Educational Foundation Institute and the Institutional Real Estate Finance Advisory Council (IREFAC) of the American Hotel & Lodging Association. Mr. Shah is an active supporter of the United Way Worldwide and a Director of its Leadership Council for India. Mr. Shah is the son of Hasu P. Shah, the Company’s Chairman of the Board and brother of Jay H. Shah, the Company’s Chief Executive Officer.

Ashish R. Parikh, Chief Financial Officer

Mr. Parikh has been the Company’s Chief Financial Officer since 1999. Prior to joining the Company, Mr. Parikh was an Assistant Vice President in the Mergers and Acquisition Group for Fleet Financial Group where he developed valuable expertise in numerous forms of capital raising activities including leveraged buyouts, bank syndications and venture financing. Mr. Parikh has also been employed by Tyco International, Ltd. and practiced as a Certified Public Accountant with Ernst & Young LLP. Mr. Parikh received his M.B.A. from The Stern School of Business at New York University and a B.B.A. from the University of Massachusetts at Amherst. Mr. Parikh is currently a board member of the Philadelphia Real Estate Council and a member of the Real Estate Capital Policy Advisory Committee of the Real Estate Roundtable.

Michael R. Gillespie, Chief Accounting Officer

Mr. Gillespie has served as the Company’s Chief Accounting Officer since 2005. Prior to joining Hersha Hospitality Trust, Mr. Gillespie was Manager of Financial Policy & Controls for Tyco Electronics Corporation, a global manufacturer of electronic components where he played a key role in developing the company’s Sarbanes-Oxley compliance program. He has also been a Senior Manager in the Audit and Assurance Practice at KPMG, LLP and Experienced Manager in the Audit and Business Advisory Practice at Arthur Andersen LLP. Mr. Gillespie received his business administration bachelors degree in accounting from Bloomsburg University of Pennsylvania. Mr. Gillespie is a licensed Certified Public Accountant. Mr. Gillespie is currently a member of the Tax Policy Advisory Committee of the Real Estate Roundtable.

David L. Desfor, Treasurer and Corporate Secretary

Mr. Desfor has served as the Company’s Treasurer since December 2002 and as Corporate Secretary since April 2007. Previously, Mr. Desfor had been a principal and comptroller of the Hersha Group since 1992. Mr. Desfor previously co-founded and served as President of a hotel management company focused on conference centers and full service hotels. Mr. Desfor earned his undergraduate degree from East Stroudsburg University in Hotel Administration.

PROPOSAL ONE

ELECTION OF CLASS I TRUSTEES

The Board of Trustees currently has nine members. The Company’s Declaration of Trust divides the Board of Trustees into two classes, as nearly equal in number as possible. At the annual meeting, shareholders are voting to elect five persons as Class I Trustees. Each Class I Trustee currently is serving a two-year term expiring at the annual meeting. Each Class II trustee is serving a two-year term expiring at the 2013 annual meeting of shareholders. Generally, one full class of trustees is elected by the shareholders of the Company at each annual meeting.

The Board of Trustees, upon the recommendation of the Nominating and Corporate Governance Committee, nominated Jay H. Shah, Daniel R. Elsztain, Donald L. Landry and Thomas J. Hutchinson III for election at the annual meeting as Class I Trustees. Each of these nominees currently is serving as a Class I Trustee. In addition, the Board of Trustees, upon the recommendation of the Nominating and Corporate Governance Committee, nominated Michael A. Leven for election at the annual meeting as a Class I Trustee. Mr. Leven, who currently is serving as a trustee emeritus and formerly served as a Class II Trustee from May 2001 until March 2010, has been nominated in the place of Mr. Capello. Mr. Capello, who has served on the Board of Trustees since the Company’s initial public offering in January 1999, has informed the Board of Trustees that he will not stand for re-election at the annual meeting. If elected, these individuals will serve as Class I Trustees until the 2014 annual meeting of shareholders and until their successors are duly elected and qualified.

Mr. Elsztain, who was appointed to the Board of Trustees in September 2011, has been nominated by the Board of Trustees for election as a Class I Trustee pursuant to the terms of a trustee designation agreement that the Company entered into with IRSA and REIG in August 2009.

Unless you direct otherwise in the proxy card accompanying this proxy statement, the persons named as proxies will vote your proxy for all of the nominees named above. If any nominee becomes unavailable or unwilling to serve as a Class I Trustee, the persons named as proxies in the accompanying proxy card will vote your proxy for an alternate nominee that has been nominated by the Board of Trustees. Alternatively, the Board of Trustees may reduce the size of the Board of Trustees and the number of nominees standing for election as Class I Trustees at the annual meeting. Proxies will only be voted for the nominees named above or their alternates. Each nominee for election to the Board of Trustees as a Class I Trustee has indicated that he is willing to serve if elected. The Board of Trustees has no reason to doubt that any nominee for election will be unable or unwilling to serve if elected.

The Board of Trustees unanimously recommends a vote “FOR” each of the nominees for election as a Class I Trustee.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires the Company’s trustees, executive officers and persons who own more than 10% of any registered class of the Company’s equity securities (“10% Holders”) to report their ownership of common shares and any changes in ownership to the SEC. These persons are also required by SEC regulations to furnish the Company with copies of these reports. Based solely on a review of the copies of such reports received by the Company and on written representations from certain reporting persons that no reports were required, or if required, such reports were filed on a timely basis for those persons, the Company believes that the only filing deficiencies under Section 16(a) by the Company’s trustees and executive officers in the year ended December 31, 2011 are as follows: Mr. Daniel Elsztain failed to timely file a Form 3 in September 2011 upon his appointment to the Board of Trustees and he failed to timely file a Form 4 in connection with a grant of common shares on December 31, 2011. His late Form 3 and late Form 4 were subsequently filed with the SEC.

CORPORATE GOVERNANCE

The Company is subject to the corporate governance standards of the NYSE. Under these standards, a majority of the members of the Board of Trustee must be independent. The Board of Trustees has determined that the following trustees and trustee nominees are independent in accordance with the corporate governance standards of the NYSE: Ms. Morgan and Messrs. Capello, Elsztain, Hutchison, Landry, Leven and Sabin. As a result, a majority of the Board of Trustees is independent.

In making a determination that Mr. Elsztain is independent in accordance with the corporate governance standards of the NYSE, the Board of Trustees considered the fact that Mr. Elsztain is an executive officer of IRSA and the brother of Eduardo Elsztain, the Chairman of the Board and Chief Executive Officer of IRSA and a former Class II Trustee. The Board of Trustees noted the share holdings of IRSA and its affiliates and that various agreements and other arrangements exist between the Company and IRSA and its affiliates which could give rise to conflicts of interest for Mr. Elsztain. Notwithstanding the significant ownership of the Company’s common shares and the existence of these agreements and arrangements and the potential for conflicts of interest, the Board of Trustees concluded that Mr. Elsztain satisfied the independence requirements set forth in the NYSE’s corporate governance standards.

Majority Voting For Trustees in Uncontested Elections

In February 2012, the Board of Trustees amended the Company’s Bylaws to change the voting standard for the election of trustees in uncontested elections from a plurality of the votes cast to a majority of the votes cast. Under this standard, a majority of the votes cast means the number of votes cast “for” a trustee’s election exceeds the number of votes cast “against” that trustee’s election. The Bylaws continue to provide for the election of trustees by a plurality of the votes cast if the number of nominees exceeds the number of trustees to be elected (a contested election).

In connection with the amendment to the Bylaws establishing a majority vote standard for the election of trustees in uncontested elections, the Board of Trustees included a trustee resignation policy in the Bylaws to establish procedures under which any incumbent trustee who fails to receive a majority of the votes cast in an uncontested election will be required to tender his or her resignation to the Board of Trustees for consideration. As provided in the Bylaws, the Board of Trustees will act on any such resignation, taking into account the Nominating and Corporate Governance Committee’s recommendation, and publicly disclose (by a press release, a filing with the SEC or other broadly disseminated means of communication) its decision regarding the tendered resignation and the rationale behind the decision within 90 days from the date of the certification of the uncontested election results.

Meetings of the Board of Trustees; Executive Sessions

The Company’s business is managed under the general direction of the Board of Trustees as provided by the Company’s Bylaws and Maryland law. The Board of Trustees holds regular quarterly meetings during the Company’s fiscal year and holds additional meetings as needed in the ordinary course of business. The Board of Trustees held a total of eight meetings during 2011. Each of the trustees attended at least 75% of the aggregate of (i) the total number of the meetings of the Board of Trustees and (ii) the total number of meetings of all committees of the Board on which the trustee then served.

The Company believes that it is important to promote open discussion among the independent trustees, and it schedules regular executive sessions in which those trustees meet without management and non-independent trustee participation. In 2011, the independent trustees met in executive session four times. Mr. Landry, who has been designated by the Board of Trustees as Lead Independent Trustee, chairs these executive sessions of the independent trustees.

Board Leadership Structure

The Board of Trustees believes that it is in the best interests of the Company that the roles of Chief Executive Officer and Chairman of the Board of Trustees be separated in order for the individuals to focus on their primary roles. The Company’s Chief Executive Officer is responsible for setting the strategic direction for the Company and the day to day leadership and performance of the Company, while the Company’s Chairman of the Board of Trustees provides guidance to the Company’s Chief Executive Officer, presides over meetings of the full Board of Trustees and, together with the Lead Independent Trustee, sets the agenda for Board of Trustees meetings. In the future, the Board of Trustees may determine that it would be in the best interests of the Company to combine the roles of Chief Executive Officer and Chairman of the Board of Trustees.

To promote the independence of the Board of Trustees and appropriate oversight of management and to demonstrate the Company’s commitment to strong corporate governance, the Board of Trustees designates an independent, non-employee trustee serve as the Lead Independent Trustee. As noted above, the Board of Trustees has currently designated Mr. Landry as the Lead Independent Trustee. Mr. Landry is expected to continue serving in this capacity following the annual meeting. In addition to chairing all executive sessions of the independent trustees, the Lead Independent Trustee presides at all meetings of the Board of Trustees at which the Chairman of the Board, the Chief Executive Officer and the President and Chief Operating Officer are not present, has the authority to call meetings of the independent trustees and has such other duties as the Board of Trustees may determine from time to time. All interested parties may communicate with the Lead Independent Trustee by following the procedure described below under “—Communications with the Board of Trustees.”

As noted above, Mr. Leven, a nominee for election as a Class I Trustee, currently serves as a trustee emeritus, a position he has held since March 2010. Mr. Leven’s role as a trustee emeritus is governed by the Company’s Bylaws. The Board of Trustees can invite, disinvite and/or remove Mr. Leven at any time from any of its meetings and may terminate his status as trustee emeritus at any time. In his capacity as trustee emeritus, Mr. Leven does not have any fiduciary duties to the Company or its shareholders, is not entitled to vote at and is not counted for purposes of determining whether a quorum exists at any meeting of the Board of Trustees. Mr. Leven has not received any compensation for his services as a trustee emeritus. The Company does not have any other trustee emeriti.

The Board of Trustees and its committees play an important role in the risk oversight of the Company. The Board of Trustees and its committees are involved in risk oversight through its direct decision-making authority with respect to significant matters and the oversight of management. The Board of Trustees (or the appropriate committee in the case of risks that are under the purview of a particular committee) administers its risk oversight function by receiving regular reports from members of senior management on areas of material risk to the Company, including operational, financial, legal, regulatory, strategic and reputational risks, and from the chairs of the Audit Committee and the Compensation Committee. In addition, the Company’s Board of Trustees administers its risk oversight function through the required approval by the Board of Trustees (or a committee thereof) of significant transactions and other decisions, including, among others, acquisitions and dispositions of properties, new borrowings, significant capital expenditures, refinancing of existing indebtedness and the appointment and retention of the Company’s senior management.

While the Board of Trustees believes it is the job of the Company’s senior management, including its Chief Executive Officer, to assess and manage the Company’s exposure to risk, the Board of Trustees relies heavily on the Audit Committee and its Risk Sub-Committee to develop guidelines and policies to govern the process by which risk assessment and management is handled by the Company’s senior management. The Audit Committee has a Risk Sub-Committee to assist the Audit Committee and the Board of Trustees in developing guidelines and policies related to risk assessment and management. The Risk Sub-Committee, which is chaired by Ms. Morgan, met four times in 2011. Senior management attended each meeting. Messrs. Landry and Sabin, both of whom serve on the Audit Committee, also serve on the Risk Sub-Committee. At each meeting of the Audit Committee, Ms. Morgan reports to the full Audit Committee on the discussions and findings of the Risk Sub-Committee and makes recommendations to the Audit Committee regarding steps the Company’s senior management has taken to monitor and control major financial and other risk exposures. In addition, as discussed under “Compensation Discussion and Analysis—Compensation-Related Risk” below, the Compensation Committee meets with senior management to discuss compensation-related risks.

Committees of the Board of Trustees

The Board of Trustees presently has an Audit Committee, Compensation Committee, Acquisition Committee and a Nominating and Corporate Governance (NCG) Committee. The Board of Trustees may, from time to time, form other committees as circumstances warrant. These committees have authority and responsibility as delegated by the Board of Trustees.

Audit Committee

The Board of Trustees has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. The current members of the Audit Committee are Mr. Capello (Chair), Mr. Sabin (Vice-Chair), Mr. Hutchison, Mr. Landry and Ms. Morgan, all of whom meet the NYSE’s and the SEC’s standards of independence. Mr. Sabin is expected to become the Chair of the Audit Committee following the annual meeting.

The Audit Committee is responsible for engaging the Company’s independent auditors, reviewing with the independent auditors the plans and results of the audit engagement, approving professional services provided by the independent auditors, reviewing the independence and qualifications of the independent auditors, considering the range of audit and non-audit fees and reviewing the adequacy of the Company’s internal accounting controls. The Audit Committee held eight meetings during 2011 and discussed relevant topics regarding financial reporting, auditing procedures and assessment and management of the Company’s major financial and other risk exposures. The Board of Trustees has adopted a written charter for the Audit Committee, a current copy of which is available on the Company’s website, www.hersha.com.

The Board of Trustees has determined that each of Mr. Capello and Mr. Sabin is an “audit committee financial expert” as that term is defined in the rules promulgated by the SEC pursuant to the Sarbanes-Oxley Act of 2002. See “Board of Trustees,” for a list of the qualifications of each of Messrs. Capello and Sabin. The Board of Trustees has also determined that each of the members of the Audit Committee is financially literate and at least one member of the Audit Committee has accounting or related financial management expertise, as such terms are interpreted by the Board of Trustees. For more information, please see “The Audit Committee Report” below.

Compensation Committee

The current members of the Compensation Committee are Mr. Hutchison (Chair), Mr. Capello, Mr. Sabin and Ms. Morgan all of whom are independent trustees. All of the members of the Compensation Committee are “non-employee” trustees within the meaning of Section 162(m) of the Code of 1986, as amended (the “Code”), and the applicable rules of the SEC and are “non-employee” trustees for the purposes of Rule 16b-3 under the Exchange Act. The Compensation Committee makes recommendations to the Board of Trustees with regard to compensation for the Company’s executive officers and administers the Company’s equity incentive plan. Subject to applicable law, the Compensation Committee may form and delegate its authority to subcommittees or executive officers when appropriate. The Compensation Committee held four meetings during 2011 and discussed relevant topics regarding executive compensation and established a formal compensation plan for all officers and trustees. The Board of Trustees has adopted a written charter for the Compensation Committee, a current copy of which is available on the Company’s website, www.hersha.com. For more information about the Compensation Committee, please see the “Compensation Discussion and Analysis” below.

Nominating and Corporate Governance (NCG) Committee

The current members of the NCG Committee are Mr. Sabin (Chair), Mr. Capello, Mr. Landry and Ms. Morgan, all of whom are independent trustees. The NCG Committee recommends candidates for election as trustees and in some cases the election of officers. The NCG Committee also develops and recommends to the Board of Trustees a set of corporate governance guidelines and annually reviews these guidelines, considers questions of possible conflicts of interest of trustees and executive officers and remains informed about existing and new corporate governance standards mandated by the SEC and the NYSE. The NCG Committee held seven meetings during 2011. The Board of Trustees has adopted a written charter for the NCG Committee, a current copy of which is available on the Company’s website, www.hersha.com.

Acquisition Committee

The current members of the Acquisition Committee are Mr. Landry (Chair), Mr. Elsztain, Mr. Hutchison and Mr. Sabin, all of whom are independent trustees. The Acquisition Committee establishes guidelines for acquisitions and dispositions to be presented to the Board of Trustees and leads the Board in its review of potential acquisitions and dispositions presented by management. The Acquisition Committee makes recommendations to the Board and senior management regarding acquisitions and reviews the due diligence conducted on all properties. The Acquisition Committee held six meetings during 2011. The Board of Trustees has adopted a written charter for the Acquisition Committee, a current copy of which is available on the Company’s website, www.hersha.com.

Availability of Corporate Governance Documents

The Company makes available on its website, www.hersha.com, current copies of its corporate governance documents, including charters of the Audit, Compensation, NCG and Acquisition Committees, its Corporate Governance Guidelines and its Code of Ethics. The Company will post any future changes to these corporate governance documents on its website and may not otherwise publicly file such changes. The Company’s regular filings with the SEC and its trustees’ and executive officers’ filings under Section 16(a) of the Exchange Act are also available on the Company’s website.

Trustee Nominating Process

The NCG Committee performs the functions of a nominating committee and will actively seek, screen and recommend trustee candidates for nomination by the Board of Trustees, consistent with criteria approved by the Board of Trustees, including, without limitation, strength of character, maturity of judgment, independence, expertise in the hospitality industry, experience as a senior executive or with corporate strategy initiatives generally, diversity and the extent to which the candidate would fill a present need on the Board of Trustees. The NCG Committee Charter describes the Committee’s responsibilities, including seeking, screening and recommending trustee candidates for nomination by the Board of Trustees.

The charter of the NCG Committee provides that the NCG Committee will consider shareholder recommendations for trustee candidates. Shareholders should submit any such recommendations for consideration by the NCG Committee through the method described under “—Communications with the Board of Trustees” below. In addition, in accordance with the Company’s Bylaws, any shareholder of record entitled to vote for the election of trustees at the applicable meeting of shareholders may nominate persons for election to the Board of Trustees if such shareholder complies with the notice procedures set forth in the Bylaws and summarized in “—Shareholder Proposals and Nominations for the 2013 Annual Meeting” below.

The NCG Committee does not have a formal policy with respect to diversity; however, the Board of Trustees and the NCG Committee believe that it is important that the trustee candidates represent key and diverse skill sets. The NCG Committee evaluates each candidate’s qualifications to serve as a member of the Board of Trustees based on his or her skills and characteristics, as well as the composition of the board as a whole. In addition, the NCG Committee will evaluate a candidate’s independence and diversity, age, skills and experience in the context of the board’s needs. In addition to considering incumbent trustees, the NCG Committee identifies trustee candidates based on recommendations from the trustees, shareholders, management and others. The NCG Committee may in the future engage the services of third-party search firms to assist in identifying or evaluating trustee candidates. No such firm was engaged in 2011.

Communications with the Board of Trustees

Shareholders and other interested parties who wish to communicate with the Board of Trustees or any of its committees, may do so by writing to the Lead Independent Trustee, Board of Trustees of Hersha Hospitality Trust, c/o Corporate Secretary, 44 Hersha Drive, Harrisburg, Pennsylvania 17102. The Corporate Secretary will review all communications received. All communications that relate to matters that are within the scope of the responsibilities of the Board of Trustees and its committees are to be forwarded to the Lead Independent Trustee. Communications that relate to matters that are within the scope of responsibility of one of the Board committees are also to be forwarded to the Chairperson of the appropriate committee. Solicitations, junk mail and obviously frivolous or inappropriate communications are not to be forwarded, but will be made available to any non-management trustee who wishes to review them.

Trustee Attendance at the Annual Meeting

The Board of Trustees has adopted a policy regarding trustee attendance at the annual meeting which specifies that all trustees should attend the annual meeting. All of the trustees currently serving on the Board of Trustees attended the 2011 annual meeting of shareholders.

The Board of Trustees has adopted a Code of Ethics that applies to all of the Company’s trustees, executive officers and employees. The Code of Ethics is posted on the Company’s website, www.hersha.com. The Company intends to satisfy the disclosure requirement under Item 5.05 of Form 8-K relating to amendments to or waivers from the Code of Ethics granted to the Company’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, and other executive officers by posting such information on the Company’s website.

Compensation Committee Interlocks and Insider Participation