Exhibit 10.1

[**] Certain information has been omitted from this exhibit because it is both (i) not material and (ii) would be competitively harmful if publicly disclosed.

SIXTH AMENDMENT TO LOAN AND SECURITY AGREEMENT

This Sixth Amendment to Loan and Security Agreement (this “Amendment”) is entered into as of June 28, 2024, by and among OXFORD FINANCE LLC, a Delaware limited liability company with an office located at 115 South Union Street, Suite 300, Alexandria, VA 22314 (“Oxford”), as collateral agent (in such capacity, “Collateral Agent”), the Lenders party hereto from time to time including OXFORD FINANCE CREDIT FUND II, LP, by its manager Oxford Finance Advisors, LLC (“Credit Fund II”), OXFORD FINANCE CREDIT FUND III, LP, by its manager Oxford Finance Advisors, LLC (“Credit Fund III”), OXFORD FINANCE FUNDING IX, LLC (“Funding IX”), OXFORD FINANCE FUNDING XIII, LLC (“Funding XIII”), and OXFORD FINANCE FUNDING 2023-1, LLC (“Funding 2023-1”; together with Credit Fund II, Credit Fund III, Funding IX, and Funding XIII, each a “Lender” and collectively, the “Lenders”), LEXICON PHARMACEUTICALS, INC. (“Parent”) and LEXICON PHARMACEUTICALS (NEW JERSEY), INC. (“Lex-NJ”), each a Delaware corporation with offices located at 2445 Technology Forest Blvd., 11th Floor, The Woodlands, TX 77381 (Parent and Lex-NJ, individually and collectively, jointly and severally, “Borrower”).

RECITALS

WHEREAS, Collateral Agent, Borrower and the Lenders listed on Schedule 1.1 to the Loan Agreement (as defined below) or otherwise a party thereto from time to time including Oxford in its capacity as a Lender have entered into that certain Loan and Security Agreement, dated as of March 17, 2022 (as amended, supplemented or otherwise modified from time to time, collectively, the “Loan Agreement”) pursuant to which Lenders have provided to Borrower certain loans in accordance with the terms and conditions thereof; and

WHEREAS, Borrower, Lenders and Collateral Agent desire to amend certain provisions of the Loan Agreement as provided herein and subject to the terms and conditions set forth herein.

NOW, THEREFORE, in consideration of the promises, covenants and agreements contained herein, and other good and valuable consideration, the receipt and adequacy of which are hereby acknowledged, Borrower, Lenders and Collateral Agent hereby agree as follows:

1.Capitalized terms used herein but not otherwise defined shall have the respective meanings given to them in the Loan Agreement.

2.The following defined terms in Section 13.1 of the Loan Agreement hereby are amended and restated in their entireties to read as follows:

“Amortization Date” is May 1, 2027.

“Final Payment Percentage” is seven percent (7.00%).

“Maturity Date” is March 1, 2029.

3.Section 13.1 of the Loan Agreement hereby is amended to insert the following defined terms in appropriate alphabetical order:

“Minimum Cash Period” is defined in Section 6.10(b).

“NPR” is defined in Section 6.10(b).

“Sixth Amendment Effective Date” means June 28, 2024.

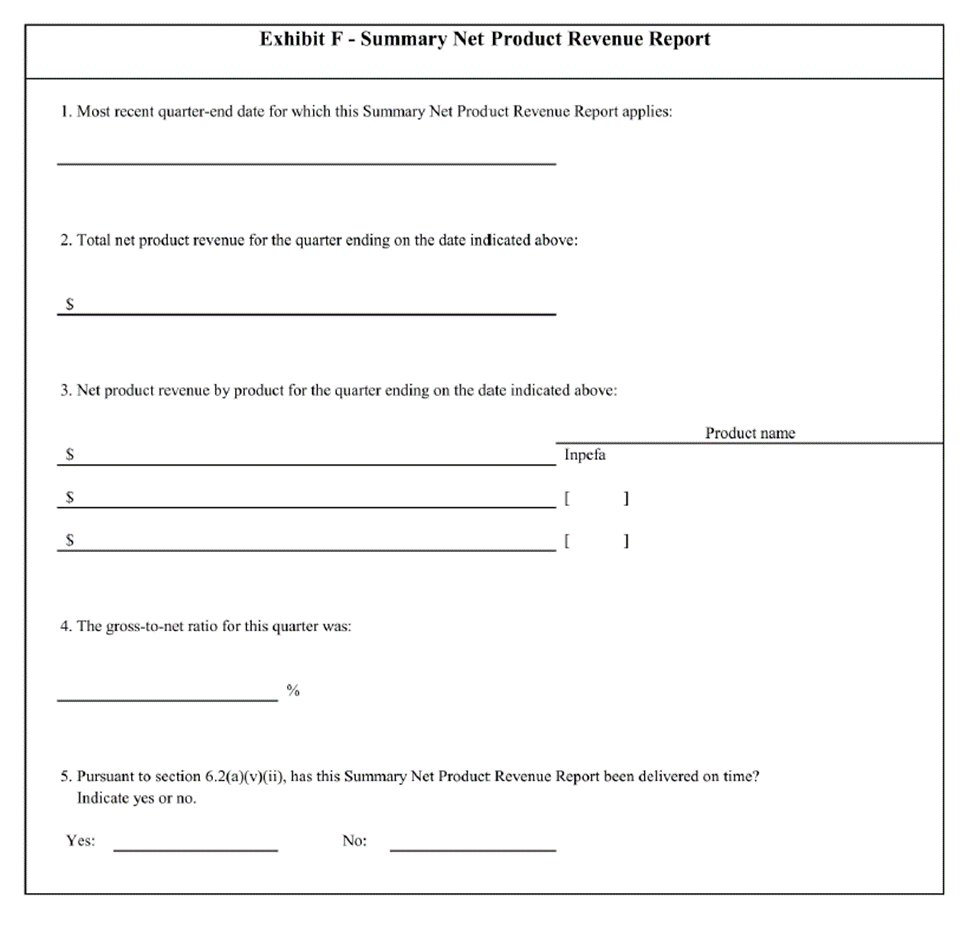

“Summary Cash and Market Capitalization Report” is defined in Section 6.2(a)(v).

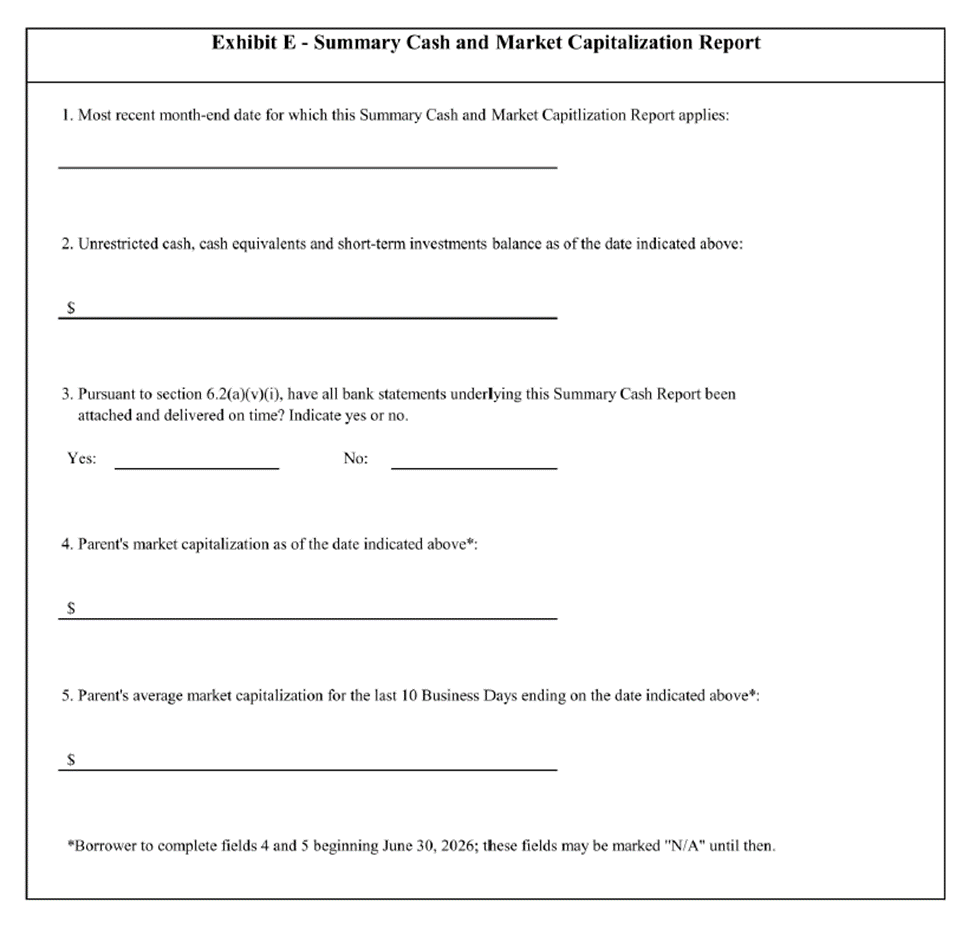

“Summary Net Product Revenue Report” is defined in Section 6.2(a)(v).

4.Section 6.2(a)(ii) of the Loan Agreement hereby is amended and restated in its entirety to read as follows:

“(ii) no later than ninety (90) days after the last day of Borrower’s fiscal year or within five (5) days of filing with the SEC, audited consolidated financial statements prepared under GAAP, consistently applied, together with an unqualified opinion on the financial statements (other than a going-concern qualification typical for companies similar to Borrower) from an independent certified public accounting firm acceptable to Collateral Agent in its reasonable discretion.”

5.Section 6.2(a)(v) of the Loan Agreement hereby is amended and restated in its entirety to read as follows:

“(v) (i) within ten (10) Business Days following the end of each calendar month, a Summary Cash and Market Capitalization Report substantially in the form attached hereto as Exhibit E (the “Summary Cash and Market Capitalization Report”), certified by a Responsible Officer and attaching bank statements for each Collateral Account subject to a Control Agreement in favor of Collateral Agent for the most recently ended calendar month and (ii) within ten (10) Business Days following the end of each fiscal quarter, a Summary Net Product Revenue Report substantially in the form attached hereto as Exhibit F (the “Summary Net Product Revenue Report”), certified by a Responsible Officer.”

6.Section 6.10 of the Loan Agreement hereby is amended and restated in its entirety to read as follows:

“6.10 Financial Covenants.

(a) Minimum Cash. From and after the Sixth Amendment Effective Date, tested monthly as of the last day of each month through and including June 30, 2026 and determined by reference to the most recent Summary Cash and Market Capitalization Report and related bank statements delivered to Collateral Agent, Borrower shall maintain minimum unrestricted cash, cash equivalents and short-term investments in Collateral Accounts subject to Control Agreements in favor of Collateral Agent in an amount equal to at least fifty percent (50.00%) of the outstanding principal amount of all Term Loans advanced to Borrower.

(b) Minimum T6M Net Product Revenue. As of the last day of each fiscal quarter beginning with the fiscal quarter ending June 30, 2026, Borrower shall achieve actual trailing six (6) month net product revenue (“NPR”), of at least:

(X) if, by March 31, 2025, Borrower has received sNDA approval from the FDA for the use of sotagliflozin in type 1 diabetes patients with chronic kidney disease (subject to verification and supporting documentation acceptable to Collateral Agent), sixty percent (60.00%) of the amount set forth in the NPR projections attached hereto as Annex X(a) to Exhibit C for such quarter, as determined by the Summary Net Product Revenue Report delivered to Collateral Agent for such quarter; provided that once Borrower achieves trailing twelve (12) month NPR of [**] or greater as of the last day of a fiscal quarter ending after the Sixth Amendment Effective Date, Borrower shall, as of the last day of each fiscal quarter thereafter, and in lieu of the requirements otherwise set forth in this Section 6.10(b), achieve trailing twelve (12) month NPR of at least [**]; or

(Y) if, by March 31, 2025, Borrower has not received sNDA approval from the FDA for the use of sotagliflozin in type 1 diabetes patients with chronic kidney disease, eighty percent (80.00%) of the amount set forth in the Inpefa NPR projections attached hereto as Annex X(b) to Exhibit C for such quarter, as determined by the Summary Net Product Revenue Report delivered to Collateral Agent for such quarter; provided that once Borrower achieves trailing twelve (12) month Inpefa NPR of [**] or greater as of the last day of a fiscal quarter ending after the Sixth Amendment Effective Date, Borrower shall, as of the last day of each fiscal quarter thereafter, and in lieu of the requirements otherwise set forth in this Section 6.10(b), achieve trailing twelve (12) month Inpefa NPR of at least [**]; and provided, further, that until Borrower achieves trailing six (6) month Inpefa NPR of at least [**], Borrower shall maintain, at all times, minimum unrestricted cash, cash equivalents and short-term investments in Collateral Accounts subject to Control Agreements in favor of Collateral Agent of at least the greater of (i) the amount required by Section 6.10(a) hereof and (ii) Fifty Million Dollars ($50,000,000.00).

In addition, at all times until Borrower achieves trailing twelve (12) month Inpefa NPR of at least [**] (such period, the “Minimum Cash Period”), Borrower shall maintain minimum unrestricted cash, cash equivalents and short-term investments of at least Ten Million Dollars ($10,000,000.00) in Collateral Accounts subject to Control Agreements in favor of Collateral Agent and determined by reference to the most recent Summary Cash and Market Capitalization Report delivered to Collateral Agent; provided, however, if any Term D Loan is funded, such amount shall be at least Twenty Five Million Dollars ($25,000,000.00), in either case measured as of the last day of each fiscal quarter and continuing as of the last day of each fiscal quarter during the Minimum Cash Period. Collateral Agent acknowledges that the minimum unrestricted cash required during the Minimum Cash Period may from time to time be satisfied de facto by Borrower’s satisfaction of the covenant described in Section 6.10(a) or clause (b)(Y) above. For the avoidance of doubt, Borrower shall always comply with the most restrictive unrestricted cash covenant as is required by any term of this Agreement.

Notwithstanding the foregoing, the Minimum T6M Net Product Revenue covenant described in this clause (b) shall not be tested if Borrower achieves, and for so long as Borrower maintains, any of the following: (a) as of the last day of each month during the applicable fiscal quarter, unrestricted cash, cash equivalents and short-term investments in Collateral Accounts subject to Control Agreements in favor of Collateral Agent of at least One Hundred Million Dollars ($100,000,000.00); (b) (i) as of the last day of each month during the applicable fiscal quarter, unrestricted cash, cash equivalents and short-term investments in Collateral Accounts subject to Control Agreements in favor of Collateral Agent of at least Fifty Million Dollars ($50,000,000.00) and (ii) a market capitalization of greater than [**] (x) as of the last day of each month during the applicable fiscal quarter and (y) as of the average closing price of Borrower’s common stock during the last ten (10) Business Days of each month during the applicable fiscal quarter (subject in each case to verification and supporting documentation acceptable to Collateral Agent); or (c) a market capitalization of greater than [**] (x) as of last day of each month during the applicable fiscal quarter and (y) as of the average closing price of Borrower’s common stock during the last ten (10) Business Days of each month during the applicable fiscal quarter (subject in each case to verification and supporting documentation acceptable to Collateral Agent).”

7.Exhibit C to the Loan Agreement hereby is replaced in its entirety with Exhibit C attached hereto.

8.Annex X to Exhibit C to the Loan Agreement hereby is replaced in its entirety with Annex X(a) and Annex X(b) attached hereto.

9.Exhibit E hereby is added to the Loan Agreement in the form of Exhibit E attached hereto.

10.Exhibit F hereby is added to the Loan Agreement in the form of Exhibit F attached hereto.

11.Limitation of Amendment.

(a) The amendments set forth above are effective for the purposes set forth herein and shall be limited precisely as written and shall not be deemed to (a) be a consent to any amendment, waiver or modification of any other term or condition of any Loan Document, or (b) otherwise prejudice any right, remedy or obligation which Lenders or Borrower may now have or may have in the future under or in connection with any Loan Document, as amended hereby.

(b) This Amendment shall be construed in connection with and as part of the Loan Documents and all terms, conditions, representations, warranties, covenants and agreements set forth in the Loan Documents, are hereby ratified and confirmed and shall remain in full force and effect.

12.To induce Collateral Agent and Lenders to enter into this Amendment, Borrower hereby represents and warrants to Collateral Agent and Lenders as follows:

a.Immediately after giving effect to this Amendment (a) the representations and warranties contained in the Loan Documents are true, accurate and complete in all material respects as of the date hereof (except to the extent such representations and warranties relate to an earlier date, in which case they are true and correct as of such date), and (b) no Event of Default has occurred and is continuing;

b. Borrower has the power and due authority to execute and deliver this Amendment and to perform its obligations under the Loan Agreement, as amended by this Amendment;

c. The organizational documents of Borrower delivered to Collateral Agent on the Effective Date, and updated pursuant to subsequent deliveries by or on behalf of the Borrower to the Collateral Agent, remain true, accurate and complete and have not been amended, supplemented or restated and are and continue to be in full force and effect;

d. The execution and delivery by Borrower of this Amendment and the performance by Borrower of its obligations under the Loan Agreement, as amended by this Amendment, do not contravene (i) any material law or regulation binding on or affecting Borrower, (ii) any material contractual restriction with a Person binding on Borrower, (iii) any material order, judgment or decree of any court or other governmental or public body or authority, or subdivision thereof, binding on Borrower, or (iv) the organizational documents of Borrower;

e. The execution and delivery by Borrower of this Amendment and the performance by Borrower of its obligations under the Loan Agreement, as amended by this Amendment, do not require any order, consent, approval, license, authorization or validation of, or filing, recording or registration with, or exemption by any governmental or public body or authority, or subdivision thereof, binding on Borrower, except as already has been obtained or made and filings required to perfect the security interest of the Collateral Agent in the Collateral; and

f. This Amendment has been duly executed and delivered by Borrower and is the binding obligation of Borrower, enforceable against Borrower in accordance with its terms, except as such enforceability may be limited by bankruptcy, insolvency, reorganization, liquidation, moratorium or other similar laws of general application and equitable principles relating to or affecting creditors’ rights.

13.Except as expressly set forth herein, the Loan Agreement shall continue in full force and effect without alteration or amendment.

14.As a condition to the effectiveness of this Amendment, Collateral Agent shall have received, in form and substance satisfactory to Collateral Agent, the following:

(a) this Amendment, duly executed by Borrower;

(b) resolutions, duly adopted by Borrower’s board of directors authorizing the entry in to and performance of this Amendment;

(c) an amendment fee equal to [**], which may be debited (or ACH’d) from the Designated Deposit Account in accordance with the Loan Agreement;

(d) all reasonable Lenders’ Expenses incurred through the date of this Amendment, which may be debited (or ACH’d) from the Designated Deposit Account in accordance with the Loan Agreement; and

(e) such other documents, and completion of such other matters, as Collateral Agent may reasonably deem necessary or appropriate.

15.This Amendment may be executed in any number of counterparts, each of which shall be deemed an original, and all of which, taken together, shall constitute one and the same instrument.

16.Section 11 of the Loan Agreement (Choice of Law, Venue and Jury Trial Waiver) is incorporated herein by this reference as though set forth in full.

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to the Loan Agreement to be executed as of the date first set forth above.

BORROWER: LEXICON PHARMACEUTICALS, INC. | |||||

| LEXICON PHARMACEUTICALS, INC. | |||||

| By: ___________________________________________ | |||||

| Name: Jeffrey L. Wade | |||||

| Title: President and Chief Financial Officer | |||||

LEXICON PHARMACEUTICALS (NEW JERSEY), INC. By: __________________________________________ Name: Jeffrey L. Wade Title: President and Chief Financial Officer | |||||

| LEXICON PHARMACEUTICALS (NEW JERSEY), INC. | |||||

| By: __________________________________________ | |||||

| Name: Jeffrey L. Wade | |||||

| Title: President and Chief Financial Officer | |||||

[Signatures continued, next page]

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to the Loan Agreement to be executed as of the date first set forth above.

| COLLATERAL AGENT | |||||

| OXFORD FINANCE LLC | |||||

| By: __________________________________________ | |||||

| Name: Colette H. Featherly | |||||

| Title: Senior Vice President | |||||

| LENDERS: | |||||

| OXFORD FINANCE FUNDING I, LLC | |||||

| OXFORD FINANCE FUNDING IX, LLC | |||||

| OXFORD FINANCE FUNDING XIII, LLC | |||||

| OXFORD FINANCE FUNDING TRUST 2023-1 LLC | |||||

| By: Oxford Finance LLC | |||||

| Its: Servicer | |||||

| By: __________________________________________ | |||||

| Name: Colette H. Featherly | |||||

| Title: Secretary | |||||

| OXFORD FINANCE CREDIT FUND II LP | |||||

| By: Oxford Finance, Advisors, LLC | |||||

| Its: Manager | |||||

| By: __________________________________________ | |||||

| Name: Colette H. Featherly | |||||

| Title: Senior Vice President | |||||

| OXFORD FINANCE CREDIT FUND III LP | |||||

| By: Oxford Finance, Advisors, LLC | |||||

| Its: Manager | |||||

| By: | |||||

| Name: Colette H. Featherly | |||||

| Title: Senior Vice President | |||||

Exhibit C

Compliance Certificate

| TO: | OXFORD FINANCE LLC, as Collateral Agent and Lender OXFORD FINANCE CREDIT FUND III, LP, as Lender | ||||

| FROM: | LEXICON PHARMACEUTICALS, INC., for itself and on behalf of each Borrower | ||||

The undersigned authorized officer (“Officer”) of LEXICON PHARMACEUTICALS, INC. (for itself and on behalf of each Borrower party to the Loan Agreement (as defined below), “Borrower”), hereby certifies that in accordance with the terms and conditions of the Loan and Security Agreement by and among Borrower, Collateral Agent, and the Lenders from time to time party thereto (the “Loan Agreement;” capitalized terms used but not otherwise defined herein shall have the meanings given them in the Loan Agreement),

(a) Borrower is in complete compliance for the period ending _______________ with all required covenants except as noted below;

(b) There are no Events of Default, except as noted below;

(c) Except as noted below, all representations and warranties of Borrower stated in the Loan Documents are true and correct in all material respects on this date and for the period described in (a), above; provided, however, that such materiality qualifier shall not be applicable to any representations and warranties that already are qualified or modified by materiality in the text thereof; and provided, further that those representations and warranties expressly referring to a specific date shall be true, accurate and complete in all material respects as of such date.

(d) Borrower, and each of Borrower’s Subsidiaries, has timely filed all required tax returns and reports, Borrower, and each of Borrower’s Subsidiaries, has timely paid all foreign, federal, state, and local taxes, assessments, deposits and contributions owed by Borrower, or Subsidiary, except as otherwise permitted pursuant to the terms of Section 5.8 of the Loan Agreement;

(e) No Liens have been levied or claims made against Borrower or any of its Subsidiaries relating to unpaid employee payroll or benefits of which Borrower has not previously provided written notification to Collateral Agent and the Lenders.

Attached are the required documents, if any, supporting our certification(s). The Officer, on behalf of Borrower, further certifies that the attached financial statements are prepared in accordance with Generally Accepted Accounting Principles (GAAP) and are consistently applied from one period to the next except as explained in an accompanying letter or footnotes and except, in the case of unaudited financial statements, for the absence of footnotes and subject to year‑end audit adjustments as to the interim financial statements.

Please indicate compliance status since the last Compliance Certificate by circling Yes, No, or N/A under “Complies” column.

| Reporting Covenant | Requirement | Actual | Complies | |||||||||||||||||

| 1) | Financial statements | Quarterly within 45 days | Yes | No | N/A | |||||||||||||||

| 2) | Annual (CPA Audited) statements | Within 90 days after FYE | Yes | No | N/A | |||||||||||||||

| 3) | Annual Financial Projections/Budget (prepared on a monthly basis) | Annually (within 45 days of FYE), and when revised | Yes | No | N/A | |||||||||||||||

| 4) | A/R & A/P agings | If applicable | Yes | No | N/A | |||||||||||||||

| 5) | 8‑K, 10‑K and 10‑Q Filings | If applicable, within 5 days of filing | Yes | No | N/A | |||||||||||||||

| 6) | Compliance Certificate | Quarterly within 45 days | Yes | No | N/A | |||||||||||||||

| 7) | Summary Cash and Market Capitalization Report | Monthly within 10 business days | Yes | No | N/A | |||||||||||||||

| 8) | Summary Net Product Revenue Report | Quarterly within 10 business days | Yes | No | N/A | |||||||||||||||

| 9) | IP Report | When required | Yes | No | N/A | |||||||||||||||

| 10) | Total amount of Borrower’s cash and cash equivalents at the last day of the measurement period | $________ | Yes | No | N/A | |||||||||||||||

| 11) | Total amount of Borrower’s Subsidiaries’ cash and cash equivalents at the last day of the measurement period | $________ | Yes | No | N/A | |||||||||||||||

| 12) | Total amount of cash and other assets maintained at Lion as of the last day of the measurement period | Total amount not to exceed $10,000 at any time per Section 7.12 of the Loan Agreement | $________ | Yes | No | N/A | ||||||||||||||

| 13) | Total amount of Investments made by Borrower in Lion during the current fiscal year as of the last day of the measurement period | Total amount not to exceed $10,000 in any fiscal year per Permitted Investments (k)(ii) of the Loan Agreement | $________ | Yes | No | N/A | ||||||||||||||

Deposit and Securities Accounts

(Please list all accounts; attach separate sheet if additional space needed)

| Institution Name | Account Number | New Account? | Account Control Agreement in place? | |||||||||||||||||

| 1) | Yes | No | Yes | No | ||||||||||||||||

| 2) | Yes | No | Yes | No | ||||||||||||||||

| 3) | Yes | No | Yes | No | ||||||||||||||||

| 4) | Yes | No | Yes | No | ||||||||||||||||

Financial Covenants

| Covenant | Requirement | Actual | Compliance | ||||||||||||||

| 1) | Minimum Cash | See Section 6.10(a) | ____________ | Yes | No | ||||||||||||

| 2) | Minimum T6M Net Product Revenue | See Section 6.10(b)/Annex X; | ____________ | Yes | No | ||||||||||||

| Minimum Cash (during Minimum Cash Period) | $10MM/$25MM | ____________ | Yes | No | |||||||||||||

*Borrower shall always comply with the most restrictive unrestricted cash covenant as is required by any term of this Agreement.

Other Matters

| 1) | Have there been any changes in management since the last Compliance Certificate? | Yes | No | ||||||||

| 2) | Have there been any transfers/sales/disposals/retirement of Collateral or IP prohibited by the Loan Agreement? | Yes | No | ||||||||

| 3) | Have there been any new or pending claims or causes of action against Borrower that involve more than Five Hundred Thousand Dollars ($500,000.00)? | Yes | No | ||||||||

| 4) | Have there been any material amendments of or other material changes to the capitalization table of Borrower and to the Operating Documents of Borrower or any of its Subsidiaries? If yes, provide copies of any such amendments or changes with this Compliance Certificate. | Yes | No | ||||||||

Exceptions

Please explain any exceptions with respect to the certification above: (If no exceptions exist, state “No exceptions.” Attach separate sheet if additional space needed.)

LEXICON PHARMACEUTICALS, INC.,

for itself and on behalf of each Borrower

By

Name:

Title:

Date:

LENDER USE ONLY

Received by: ______________ Date: ______

Verified by: _______________ Date: ______

Compliance Status: Yes No

ANNEX X

(Projected Net Product Revenue)

[**]

ANNEX X(b)

(Projected Net Product Revenue)

[**]

EXHIBIT E

(Summary Cash and Market Capitalization Report)

EXHIBIT F

(Summary Net Product Revenue Report)