d1390381_f-4.htm

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

——————————————

FORM F-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

——————————————

ULTRAPETROL (BAHAMAS) LIMITED

(Exact name of Registrant as specified in its charter)

|

Commonwealth of the Bahamas

(State or other jurisdiction of

incorporation or organization)

|

4412

(Primary Standard Industrial Classification Code Number)

|

N/A

(I.R.S. Employer

Identification No.)

|

|

H&J Corporate Services Ltd.

Ocean Centre, Montagu Foreshore

East Bay St.

Nassau, Bahamas

P.O. Box SS-19084

(242) 364-4755

(Address, including zip code, and telephone

number, including area code, of registrant's

principal executive offices)

|

CT Corporation System

111 Eighth Avenue

New York, New York 10011

(800) 624-0909

(Name, address, including zip code, and telephone number, including area code, of agent for service)

|

——————————————

Copies of communications to:

|

Ultrapetrol (Bahamas) Limited

Attention: Felipe Menendez R.

Ocean Centre, Montagu Foreshore

East Bay St.

Nassau, Bahamas

P.O. Box SS-19084

(242) 364-4755

|

Lawrence Rutkowski, Esq.

Seward & Kissel LLP

One Battery Park Plaza

New York, New York 10004

(212) 574-1200

|

———————————————————————

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

———————————————————————

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

CALCULATION OF REGISTRATION FEE

|

Title of each class of securities to be registered

|

Amount to be registered

|

Proposed maximum offering price per unit

|

Proposed maximum aggregate offering price

|

Amount of registration fee (1)

|

|

87/8% First Preferred Ship Mortgage Notes due 2021

|

$200,000,000

|

100%

|

$200,000,000

|

$27,280

|

|

Guarantees relating to the 87/8% First Preferred Ship Mortgage Notes due 2021

|

----(2)

|

----(2)

|

----(2)

|

----(2)

|

|

(1)

|

Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(f) under the Securities Act of 1933.

|

|

(2)

|

No separate consideration will be received for the guarantees relating to the 87/8% First Preferred Ship Mortgage Notes due 2021.

|

The registrant hereby amends the registration statement on such date or dates as may be necessary to delay the effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

TABLE OF ADDITIONAL REGISTRANTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Primary Standard

|

| |

|

Jurisdiction of

|

|

IRS Employee

|

|

Industrial

|

|

Name

|

|

Incorporation

|

|

Identification No.

|

|

Classification Code

|

|

|

|

|

|

|

|

|

|

Arlene Investments, Inc.

|

|

|

Panama

|

|

|

|

N/A

|

|

|

|

4412

|

|

|

Brinkley Shipping Inc.

|

|

|

Panama

|

|

|

|

N/A

|

|

|

|

4412

|

|

|

Dampierre Holdings Spain S.L.

|

|

|

Spain

|

|

|

|

N/A

|

|

|

|

4412

|

|

|

Danube Maritime Inc.

|

|

|

Panama

|

|

|

|

N/A

|

|

|

|

4412

|

|

|

Dingle Barges Inc.

|

|

|

Liberia

|

|

|

|

N/A

|

|

|

|

4412

|

|

|

General Ventures Inc.

|

|

|

Liberia

|

|

|

|

N/A

|

|

|

|

4412

|

|

|

Hallandale Commercial Corp.

|

|

|

Panama

|

|

|

|

N/A

|

|

|

|

4412

|

|

|

Longmoor Holdings Inc.

|

|

|

Panama

|

|

|

|

N/A

|

|

|

|

4412

|

|

|

Oceanpar S.A.

|

|

|

Paraguay

|

|

|

|

N/A

|

|

|

|

4412

|

|

|

Palmdeal Shipping Inc.

|

|

|

Panama

|

|

|

|

N/A

|

|

|

|

4412

|

|

|

Parabal S.A.

|

|

|

Paraguay

|

|

|

|

N/A

|

|

|

|

4412

|

|

|

Parfina S.A.

|

|

|

Paraguay

|

|

|

|

N/A

|

|

|

|

4412

|

|

|

Princely International Finance Corp.

|

|

|

Panama

|

|

|

|

N/A

|

|

|

|

4412

|

|

|

Riverview Commercial Corp.

|

|

|

Panama

|

|

|

|

N/A

|

|

|

|

4412

|

|

|

UABL S.A.

|

|

|

Argentina

|

|

|

|

N/A

|

|

|

|

4412

|

|

|

UABL Paraguay S.A.

|

|

|

Paraguay

|

|

|

|

N/A

|

|

|

|

4412

|

|

|

Ultrapetrol S.A.

|

|

|

Argentina

|

|

|

|

N/A

|

|

|

|

4412

|

|

|

The information in this prospectus is not complete and may be changed. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

|

Subject to Completion, dated July 31, 2013.

ULTRAPETROL (BAHAMAS) LIMITED

OFFER TO EXCHANGE ITS OUTSTANDING 87/8% FIRST PREFERRED SHIP

MORTGAGE NOTES DUE 2021 FOR 87/8% FIRST PREFERRED SHIP MORTGAGE NOTES

DUE 2021, WHICH HAVE BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission (the "SEC") is effective. This prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

TERMS OF THE EXCHANGE OFFER

| |

|

|

|

|

●

|

We will exchange all of our outstanding 87/8% First Preferred Ship Mortgage Notes due 2021 that were issued on June 10, 2013, which we refer to as the "outstanding notes" and which have not been registered under the Securities Act of 1933, as amended (the "Securities Act") that are validly tendered and not properly withdrawn for an equal principal amount of 87/8First Preferred Ship Mortgage Notes due 2021, which we refer to as the "exchange notes" and which are registered under the Securities Act and are freely tradable. References we make in this prospectus to "notes" shall mean both outstanding notes and exchange notes.

|

|

|

|

|

|

|

●

|

Any holder of outstanding notes electing to exchange its outstanding notes for exchange notes must surrender its exchange notes, together with the appropriate letter of transmittal, to Manufacturers and Traders Trust Company, as the Exchange Agent, or the Exchange Agent must receive an agent's message if exchange of the outstanding notes is being made by book-entry delivery through the Depository Trust Company's automated tender offer program.

|

|

|

|

|

|

|

●

|

You are entitled to withdraw your election to tender the outstanding notes at any time prior to the expiration of the exchange offer.

|

|

|

|

|

|

|

●

|

This exchange offer expires at 5:00 p.m., New York City time, on , 2013, unless we extend the expiration date.

|

|

|

|

|

|

|

●

|

The exchange of the outstanding notes for the exchange notes in the exchange offer will not be a taxable event for U.S. Federal income tax purposes.

|

|

|

|

|

|

|

●

|

We will not receive any proceeds from the exchange offer.

|

TERMS OF THE EXCHANGE NOTES

| |

|

|

|

|

●

|

The exchange notes are being offered in order to satisfy some of our obligations under the registration rights agreement entered into in connection with the private placement of the outstanding notes.

|

|

|

|

|

|

|

●

|

The terms of the exchange notes are identical to the terms of the outstanding notes except that the exchange notes are registered under the Securities Act and will not be subject to restrictions on transfer or to any increase in annual interest rate for failure to file this registration statement as required by the registration rights agreement.

|

|

|

|

|

|

|

●

|

Outstanding notes not tendered in the exchange offer will remain outstanding and continue to accrue interest but will not retain any rights under the registration rights agreement.

|

RESALES OF EXCHANGE NOTES

| |

|

|

|

|

●

|

The exchange notes may be sold in the over-the-counter market, in negotiated transactions or through a combination of these methods.

|

BROKER-DEALERS

| |

|

|

|

|

●

|

Each broker-dealer that receives exchange notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such exchange notes. The letter of transmittal states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit it is an "underwriter" within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of exchange notes received in exchange for outstanding notes where such outstanding notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that, for a period of 180 days after the expiration date, we will make this prospectus available to any broker-dealer for use in connection with any such resale. See "Plan of Distribution."

|

SEE "RISK FACTORS" BEGINNING ON PAGE 18 FOR A DISCUSSION OF SOME OF THE RISKS THAT YOU SHOULD CONSIDER IN CONNECTION WITH PARTICIPATION IN THE EXCHANGE OFFER.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2013.

TABLE OF CONTENTS

|

|

|

|

|

|

|

GLOSSARY OF SHIPPING TERMS

|

|

|

vi

|

|

|

SUMMARY

|

|

|

1

|

|

|

RISK FACTORS

|

|

|

18

|

|

|

USE OF PROCEEDS

|

|

|

44

|

|

|

CAPITALIZATION

|

|

|

45

|

|

|

RATIO OF EARNINGS TO FIXED CHARGES

|

|

|

46

|

|

|

SELECTED HISTORICAL CONSOLIDATED FINANCIAL DATA

|

|

|

47

|

|

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

|

|

48

|

|

|

BUSINESS

|

|

|

65

|

|

|

MANAGEMENT

|

|

|

89

|

|

|

OWNERSHIP

|

|

|

91

|

|

|

CERTAIN RELATED PARTY TRANSACTIONS

|

|

|

92

|

|

|

THE EXCHANGE OFFER

|

|

|

95

|

|

|

DESCRIPTION OF THE EXCHANGE NOTES

|

|

|

104

|

|

|

DESCRIPTION OF CREDIT FACILITIES AND OTHER INDEBTEDNESS

|

|

|

148 |

|

|

THE MORTGAGES ON THE VESSELS

|

|

|

155

|

|

|

TAX CONSIDERATIONS

|

|

|

158

|

|

|

PLAN OF DISTRIBUTION

|

|

|

162

|

|

|

LEGAL MATTERS

|

|

|

163

|

|

|

EXPERTS

|

|

|

163

|

|

|

WHERE YOU CAN FIND ADDITIONAL INFORMATION

|

|

|

163

|

|

|

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

|

|

|

F-1

|

|

Ultrapetrol (Bahamas) Limited is a company incorporated under the laws of the Bahamas. Our registered office is located at H&J Corporate Services Ltd., Ocean Center, Montagu Foreshore, East Bay Street,, Nassau, Bahamas, and our telephone number at that address is 1-242-364-4755. Our website is http://www.ultrapetrol.net.

In this prospectus, "Ultrapetrol (Bahamas) Limited," the "Company," "we," "us" and "our" refers only to Ultrapetrol (Bahamas) Limited and its subsidiaries.

This prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any jurisdiction or in any circumstances where the offer or sale is not permitted. Please refer to the letter of transmittal and the other documents relating to this prospectus for instructions as to your eligibility to tender outstanding notes in this exchange offer. You must not:

| |

|

|

|

|

●

|

use this prospectus for any other purpose;

|

|

|

|

|

|

|

●

|

make copies of any part of this prospectus or give a copy of it to any other person; or

|

|

|

|

|

|

|

●

|

disclose any information in this prospectus to any other person.

|

We have prepared this prospectus and we are solely responsible for its contents. You are responsible for making your own examination of us and your own assessment of the merits and risks of investing in the notes. You may contact us if you need any additional information.

We are not providing you with any legal, business, tax or other advice in this prospectus. You should consult with your own advisors as needed to assist you in making your investment decision and to advise you whether you are legally permitted to tender your outstanding notes for exchange notes.

You must comply with all laws that apply to you in any place in which you buy, offer or sell any notes or possess this prospectus. You must also obtain any consents or approvals that you need in order to tender outstanding notes. We are not responsible for your compliance with these legal requirements.

INDUSTRY AND MARKET DATA

We obtained the industry, market and competitive position data used throughout this prospectus from research, surveys or studies conducted by us and by third parties and industry or general publications. Industry and general publications generally state that they have obtained information from sources believed to be reliable, but do not guarantee the accuracy and completeness of such information. While we believe that these sources are reliable, neither we nor our affiliates have independently verified such data and neither we nor our affiliates make any representations as to the accuracy of such information. Similarly, we believe our internal research is reliable, but it has not been verified by any independent sources and neither we nor our affiliates make any representations as to the accuracy of such research. Forecasted and other forward-looking information contained in such reports is necessarily based on assumptions regarding future occurrences, events, conditions and circumstances and subjective judgments relating to various matters. Actual results may differ materially. Accordingly, you should not place undue reliance upon the third-party information contained in this prospectus, particularly where such information is forecasted or otherwise forward-looking.

ENFORCEABILITY OF CIVIL LIABILITIES

We are a Bahamas corporation. Certain of the existing and future subsidiaries of the Company (the "Subsidiary Guarantors") and the owners of mortgaged vessels used as collateral or certain subsidiaries of the Company (the "Pledgors") are incorporated in one of the following jurisdictions: Argentina, Liberia, Panama, Paraguay or Spain. Each of the vessels and barges that secure the notes and Subsidiary Guarantees is flagged in Liberia, Panama, Argentina or Paraguay. All of our and the Subsidiary Guarantors' and Pledgors' offices, administrative activities and other assets, as well as those of certain experts named herein, are located outside the United States. As a result, it may be difficult for you to effect service of process within the United States upon us, any of the Subsidiary Guarantors or such persons. In addition, most or all of our directors and officers and the directors and officers of the Subsidiary Guarantors are residents of jurisdictions other than the United States, and all or a substantial portion of the assets of such persons is or may be located outside the United States. As a result, it may be difficult for you to effect service of process within the United States upon such persons.

The following special legal counsel have advised us, the Subsidiary Guarantors and the Pledgors: (i) Perez Alati, Grondona, Benites, Arntsen & Martinez de Hoz, Jr. regarding the laws of Argentina; (ii) Higgs & Johnson, regarding the laws of The Bahamas; (iii) Seward & Kissel LLP, regarding the laws of Liberia; (iv) Palacios, Prono & Talavera, regarding the laws of Paraguay; (v) Tapia, Linares y Alfaro, regarding the laws of Panama; and (vi) Cuatrecasas, Gonçalves Pereira, regarding the laws of Spain. Each such special counsel has advised us that there is uncertainty as to whether the courts of their respective jurisdictions would (i) enforce judgments of United States courts obtained against us, the Subsidiary Guarantors, our directors and officers, the directors and officers of the Subsidiary Guarantors and the experts named herein, as applicable, predicated upon the civil liability provisions of the Federal securities laws of the United States or (ii) entertain original actions brought against such parties, predicated upon the Federal securities laws of the United States. As a result, it may be difficult for you to enforce judgments obtained in United States courts against us, the Subsidiary Guarantors, the Pledgors, our directors and officers, the directors and officers of the Subsidiary Guarantors and the Pledgors or the experts named herein, or the assets of any such parties located outside the United States. Further, it may be difficult for you to entertain actions, including those predicated upon the civil liability provision of the Federal securities laws of the United States, against such parties in courts outside of the United States.

We and each Subsidiary Guarantor and Pledgor have appointed CT Corporation System, 111 Eighth Avenue, New York, New York 10011, as agent for service of process in any action brought against us or any of them under the securities laws of the United States arising out of this offering, the guarantees of the notes issued by the Subsidiary Guarantors or the indenture relating to the notes, in any Federal or state court having subject matter jurisdiction in the Borough of Manhattan, the City of New York,

New York. In connection therewith, we have irrevocably submitted to the jurisdiction of such courts in any such action or proceeding in the United States with respect to the indenture or the notes.

FINANCIAL STATEMENTS

Our consolidated financial statements as of December 31, 2012 and for the year then ended included in this prospectus were audited by Pistrelli, Henry Martin y Asociados S.R.L., independent registered public accounting firm and a member of Ernst & Young Global. See "Experts."

FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and the applicable jurisdictions that are subject to risks and uncertainties. We may also from time to time make forward-looking statements in our periodic filings with the Securities and Exchange Commission, or SEC, in other information sent to our security holders and in other written materials. All statements other than statements of historical fact included in this prospectus are forward-looking statements. Forward-looking statements give our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as "anticipate," "estimate," "expect," "project," "plan," "intend," "believe" and other words and terms of similar meaning including future or conditional verbs such as "will," "may," "might," "should," "would," and "could," used in connection with any discussion of the expectations, plans, timing or nature of future operating or financial performance or other events.

These forward-looking statements are based on assumptions that we have made in light of our experience in the industry in which we operate, as well as our perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate under the circumstances. As you read and consider this prospectus, you should understand that these statements are not guarantees of performance or results. They involve risks, uncertainties (some of which are beyond our control) and assumptions. Although we believe that these forward-looking statements are based on reasonable assumptions, you should be aware that many factors could affect our actual financial results and cause them to differ materially from those anticipated in the forward-looking statements. These factors include, among others:

|

|

●

|

our future operating or financial results;

|

|

|

●

|

statements about future, pending or recent acquisitions, business strategy, areas of possible expansion, and expected capital spending or operating expenses, including bunker prices, drydocking and insurance costs;

|

|

|

●

|

our ability to obtain additional financing or amend existing facilities or refinance existing facilities;

|

|

|

●

|

our financial condition and liquidity, including our ability to obtain financing in the future to fund capital expenditures, acquisitions and other general corporate activities;

|

|

|

●

|

our expectations about the availability of vessels to purchase or sell, the time which it may take to construct new vessels, or vessels' useful lives;

|

|

|

●

|

our dependence on the abilities and efforts of our management team;

|

|

|

●

|

statements about general market conditions and trends, including charter rates, vessel values and factors affecting vessel supply and demand;

|

|

|

●

|

adverse weather conditions that can affect production of some of the goods we transport and navigability of the river system on which we transport them;

|

|

|

●

|

the highly competitive nature of the ocean-going transportation industry;

|

|

|

●

|

the loss of one or more key customers;

|

|

|

●

|

potential liability from pending or future litigation;

|

|

|

●

|

the strength of world economies and currencies and general domestic and international political conditions;

|

|

|

●

|

fluctuations in foreign exchange rates and inflation in the economies of the countries in which we operate, including wage inflation as a result of trade union negotiations;

|

|

|

●

|

adverse movements in commodity prices or demand for commodities may cause our customers to scale back their contract needs;

|

|

|

●

|

changes in various governmental rules and regulations or actions taken by regulatory authorities; and

|

|

|

●

|

the other factors discussed under the heading "Risk Factors."

|

Because of these factors, we caution that you should not place undue reliance on any of our forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made. New risks and uncertainties arise from time to time, and it is impossible for us to predict these events or how they may affect us. Except as required by law, we have no duty to, and do not intend to, update or revise the forward-looking statements in this prospectus after the date of this prospectus.

GLOSSARY OF SHIPPING TERMS

The following are definitions of certain terms that are commonly used in the shipping industry and in this prospectus:

Annual survey. The inspection of a vessel pursuant to international conventions, by a classification society surveyor or on behalf of the flag state that takes place every year.

Bareboat charter. Charter of a vessel under which the ship owner is usually paid a fixed amount of charterhire for a certain period of time during which the charterer is responsible for the vessel's operating expenses, and voyage expenses, as well as the management of the vessel, including crewing. A bareboat charter is also known as a "demise charter" or a "time charter by demise."

Bulk carrier. Ship designed for the carriage of dry bulk cargoes.

Bunker. The fuel oil used to operate a vessel's engines and generators.

Capesize. Bulk carrier that is over 100,000 dwt in size.

Charter. The hire of a vessel for a specified period of time or to carry a cargo from a loading port to a discharging port.

Charterer. The company that hires a vessel.

Charterhire . A sum of money paid to the ship owner by a charterer under a charter for the use of a vessel.

Classification society. An independent society that certifies that a vessel has been built and maintained according to the society's rules for that type of vessel and complies with the applicable rules and regulations of the country of the vessel and the international conventions of which that country is a member. A vessel that receives its certification is referred to as being "in-class."

Clean petroleum products. Liquid products refined from crude oil whose color is less than or equal to 2.5 on the National Petroleum Association scale. Clean petroleum products include naphtha, jet fuel, gasoline, and diesel/gasoil.

Contract of affreightment or COA. A contract for the carriage of a specific type and quantity of cargo, with payment based on metric tons of cargo carried, which will be carried in one or more shipments. For a COA, the vessel owner or operator generally pays all voyage expenses and vessel operating expenses and has the right to substitute one vessel for another. The rate is generally expressed in dollars per metric ton of cargo. Revenues earned under COAs are referred to as "freight." When used herein, COA also refers to a voyage charter.

Dirty petroleum products. Liquid products refined from crude oil whose color is greater than 2.5 on the National Petroleum Association scale. Dirty products will usually require heating during the voyage as their viscosity or waxiness makes discharge difficult at ambient temperatures. Dirty petroleum products include fuel oil, Low Sulfur Waxy Residue, or "LSWR" and Carbon Black Feedstock, or "CBFS."

Double hull. Hull construction design in which a vessel has an inner and an outer side and bottom separated by void space.

Drydocking . The removal of a vessel from the water for inspection and/or repair of those parts of a vessel which are below the water line. During drydockings, which are required to be carried out periodically, certain mandatory classification society inspections are carried out and relevant certifications issued.

dwt. Deadweight ton. A unit of a vessel's capacity for cargo, fuel oil, stores and crew measured in metric ton units which is equal to 1,000 kilograms.

Feeder Service. Feeder service refers to small ships that collect and transport shipping containers from smaller ports to container terminals or onto larger vessels.

Gross ton. A unit of measurement for the total enclosed space within a vessel equal to 100 cubic feet or 2.831 cubic meters.

Hidrovia Region. A region of navigable waters in South America on the Parana, Paraguay and Uruguay Rivers and part of the River Plate, which flow through Brazil, Bolivia, Uruguay, Paraguay and Argentina. The region covers the entire length of the Parana River south of the Itaipu Dam, the entire length of the Paraguay River south of Corumbá, the Uruguay River and the River Plate west of Buenos Aires. Our definition of the Hidrovia Region is wider than the common usage of such term.

Hull. Shell or body of a ship.

IMO. International Maritime Organization, a United Nations agency that issues international standards for shipping.

Lightering . To discharge the cargo of a larger vessel located offshore into a smaller vessel used to transport the cargo to the shore.

Newbuilding . A new vessel under construction or just completed.

Off hire. The period a vessel is unable to perform the services for which it is immediately required under a time charter. Off hire periods include days spent on repairs, drydocking and surveys, whether or not scheduled.

OPA. The United States Oil Pollution Act of 1990.

Petroleum products. Refined crude oil products, such as fuel oils, gasoline and jet fuel.

Product tanker. A tanker designed to carry a variety of liquid products varying from crude oil to clean and dirty petroleum products, acids and other chemicals. The tanks are coated to prevent product contamination and hull corrosion. The ship may have equipment designed for the loading and unloading of cargoes with a high viscosity.

Protection and indemnity (or "P&I") insurance. Insurance obtained through a mutual association formed by ship owners to provide liability insurance protection against large financial loss to one member by contribution to offset that loss by all members.

PSV or platform supply vessel. A vessel ranging in size from approximately 150 feet to 275 feet in length that serves oil drilling and production facilities by transporting supplies and equipment to offshore locations, utilizing a large clear deck and under deck tanks.

Scrapping . The disposal of old vessel tonnage by way of sale as scrap metal.

Special survey. The inspection of a vessel while in drydock by a classification society surveyor that takes place every four to five years.

Spot market. The market for immediate chartering of a vessel, usually for single voyages.

Tanker. A ship designed for the carriage of liquid cargoes in bulk with cargo space consisting of many tanks. Tankers carry a variety of products including crude oil, refined products, liquid chemicals and liquefied gas.

Time charter. Charter under which the ship owner is paid charterhire on a per day basis for a certain period of time. The ship owner is responsible for providing the crew and paying vessel operating expenses while the charterer is responsible for paying the voyage expenses. Any delays at port or during the voyages are the responsibility of the charterer, save for certain specific exceptions such as off hire.

Vessel operating expenses or running costs. The costs of operating a vessel that are incurred during a charter, primarily consisting of crew wages and associated costs, insurance premiums, lubricants and spare parts, and repair and maintenance costs. Vessel operating expenses or running costs exclude fuel costs and port fees, which are known as "voyage expenses." For a time charter, the ship owner pays vessel operating expenses. For a bareboat charter, the charterer pays vessel operating expenses.

Voyage charter. Contract for hire of a ship under which a ship owner is paid freight on the basis of moving cargo from a loading port to a discharge port. The ship owner is responsible for paying both vessel operating expenses and voyage expenses. The charterer is typically responsible for any delay at the loading or discharging port. A voyage charter is also known as a contract of affreightment or COA.

Voyage expenses. Expenses incurred due to a vessel traveling to a destination, such as fuel cost and port fees.

SUMMARY

This summary highlights key information contained elsewhere in this prospectus. As an investor or prospective investor, you should review carefully the risk factors and the more detailed information and financial statements contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that may be important to you. Before making any investment decision, for a more complete understanding of our business and this offering, you should read this entire prospectus, including the sections entitled "Risk Factors," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and the related notes thereto, each of which is included elsewhere in this prospectus. Unless the context specifically indicates otherwise, the terms "we," "us" and "our" (and similar terms) refer to Ultrapetrol (Bahamas) Limited and our subsidiaries. All references to the number of vessels and the transportation capacity in our three segments are as of March 31, 2013, unless otherwise indicated.

Our Company

We are an industrial shipping company serving the marine transportation needs of our clients primarily in South America. We serve the shipping markets for soybean, grain, forest products, minerals, crude oil, petroleum, refined petroleum products and general cargo, as well as the offshore oil platform supply market. We operate through three segments of the marine transportation industry:

|

|

●

|

River Business. We are the largest owner and operator of river barges and pushboats in the Hidrovia Region of South America, one of the largest navigable river systems in the world, which facilitates trade in a fertile and resource-rich region and provides access to the global export market. We believe our river barges provide the most efficient means of transportation in the region. In many of the areas that we serve, access to rail is limited or non-existent and the distances make trucking uneconomical for large volumes of cargo. Our river business fleet, which consists of 679 barges and 33 pushboats, which we believe is the largest in the Hidrovia and approximately as large in capacity as the fleets of our next three competitors combined. We control the largest independent network of infrastructure along the river system, consisting of two loading and storage terminals and five logistic hubs, which serve as fleeting areas at key locations, to provide integral transportation services to our customers from origin to destination. We also own a vertically integrated barge manufacturing facility at Punta Alvear, which is one of the most modern of its kind in the world and provides us with the ability to increase our fleet capacity at a very efficient cost. We believe the size and quality of our fleet and infrastructure allow us to operate through an efficient hub system across the Hidrovia, which provides us with a distinct competitive advantage.

|

|

|

●

|

Offshore Supply Business. We own and operate a fleet of technologically advanced Platform Supply Vessels ("PSVs") that provide critical logistical and transportation services for offshore petroleum exploration and production companies, in the coastal waters of Brazil and in the UK's North Sea. Our Offshore Supply Business fleet consists of ten PSVs already in operation and two under construction, scheduled to commence operation in the third quarter of 2013 and early 2014, respectively. Our large, modern PSVs have advanced dynamic positioning systems which enable us to better serve customers operating in challenging deepwater offshore environments. We believe that we are currently the second largest owner of 4,500 dwt class platform supply vessels in the Brazilian market, which have large cargo capacity and deck space, making them the most efficient vessels to serve the distant deepwater operations underway in Brazil. Brazilian law provides a preference for the utilization of Brazilian-flagged vessels in its offshore supply business. Four of our PSVs were built in Brazil and operate under the Brazilian flag, which provides them with a preference for employment over foreign vessels in the Brazilian market, while extending such preference to another two foreign-flagged PSVs in our fleet.

|

|

|

●

|

Ocean Business. We operate a fleet of product and chemical tankers and feeder containerships on cabotage trades along part of the eastern coast of South America, where we have preferential rights and strong customer relationships. Our fleet includes four product and chemical tankers that serve the principal oil refineries in the region transporting petroleum products from refineries and crude oil to various coastal destinations, as well as two container feeder vessels which transport mostly foreign containers from the transshipment ports of Buenos Aires and Montevideo to the southern region of Patagonia for the largest long-distance container lines in the world. The local cabotage markets are generally restricted by law to established local operators with local-flagged vessels or vessels with equivalent flag privileges.

|

We have a diverse customer base that includes large and well-known agricultural, petroleum and mining companies as well as major shipping lines. Some of our customers in the last three years include affiliates of Archer Daniels Midland Company ("ADM"), Bunge Limited ("Bunge"), Cargill Incorporated ("Cargill"), Continental Grain Corporation ("Continental Grain"), ESSO (a subsidiary of Exxon Mobil Corporation), MMX Mineraçao e Metalicos S.A. ("MMX"), Petroleo Brasilero S.A. ("Petrobras", the national oil company of Brazil), Petropar S.A. ("Petropar", the national oil company of Paraguay), Ternium S.A. ("Ternium Siderar") or ("Siderar"), Trafigura Beheer BV ("Trafigura"), Vale S.A. ("Vale"), Vicentin S.A.I.C. ("Vicentin"), Nexen Inc. ("Nexen"), A.P. Moller-Maersk A/S ("A.P. Moller-Maersk") and Hamburg Süd. We have a long history of operating in the Hidrovia Region, being founded in 1992 by one of our predecessor companies which had operated in the region for over a century, and have been able to generate and maintain longstanding relationships with our customers. We have been serving our key customers for more than 10 years on average.

Our Fleet Summary

| |

|

|

|

|

|

|

|

River Fleet

|

|

Number of

Vessels

|

|

Capacity

|

|

Description

|

|

Alianza G2

|

|

1

|

|

35,000 tons

|

|

Storage

|

| |

|

|

|

|

|

|

|

Parana Petrol

|

|

1

|

|

43,164 tons

|

|

Under Conversion into an Iron Ore Floating Transshipment Station

|

|

Pushboat Fleet(1)

|

|

32

|

|

120,559 BHP

|

|

Various Sizes and Horse Power Carry

|

| |

|

|

|

|

|

|

|

Tank Barges

|

|

81

|

|

197,522 m3

|

|

Liquid Cargo (Petroleum Products, Vegetable Oil)

|

| |

|

|

|

|

|

|

|

Dry Barges

|

|

598

|

|

1,063,270 tons

|

|

Dry Cargo (Soy, Iron Ore, Other Products)

|

|

|

|

|

|

|

|

|

|

Total

|

|

713

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Offshore Supply Fleet

|

|

Year Built/

Delivery

Date

|

|

|

Capacity

(dwt)

|

|

Deck Area

(sq. meters)

|

|

In Operation

|

|

|

|

|

|

|

|

|

UP Esmeralda

|

|

2005

|

|

|

4,200

|

|

840

|

|

UP Safira

|

|

2005

|

|

|

4,200

|

|

840

|

|

UP Agua-Marinha

|

|

2006

|

|

|

4,200

|

|

840

|

|

UP Topazio

|

|

2006

|

|

|

4,200

|

|

840

|

|

UP Diamante

|

|

2007

|

|

|

4,200

|

|

840

|

|

UP Rubi

|

|

2009

|

|

|

4,200

|

|

840

|

|

UP Turquoise

|

|

2010

|

|

|

4,900

|

|

1,020

|

|

UP Jasper

|

|

2011

|

|

|

4,900

|

|

1,020

|

|

UP Jade

|

|

2012

|

|

|

4,200

|

|

840

|

|

UP Amber

|

|

2013

|

|

|

4,200

|

|

840

|

|

Total

|

|

|

|

|

43,400

|

|

8,760

|

| |

|

|

|

|

|

|

|

|

Under Construction

|

|

|

|

|

|

|

|

|

UP Pearl

|

|

2013

|

|

|

4,200

|

|

840

|

|

UP Onyx

|

|

2013

|

|

|

4,200

|

|

840

|

|

Total

|

|

|

|

|

8,400

|

|

1,680

|

| |

|

|

|

|

|

|

|

|

Ocean Fleet

|

|

Year Built

|

|

Capacity

(dwt/TEUs)

|

|

|

Description

|

|

Miranda I(4)

|

|

1995

|

|

6,575

|

|

|

Product / Chemical Tanker

|

|

Amadeo(4)

|

|

1996

|

|

39,530

|

|

|

Oil / Product Tanker

|

|

Alejandrina

|

|

2006

|

|

9,219

|

|

|

Product Tanker

|

|

Austral(5)

|

|

2006

|

|

11,299

|

|

|

Product / Chemical Tanker

|

|

Asturiano

|

|

2003

|

|

1,118

|

|

|

Container Feeder Vessel

|

|

Argentino

|

|

2002

|

|

1,050

|

|

|

Container Feeder Vessel

|

|

Total

|

|

|

|

66,623

|

|

|

|

|

(1)

|

Does not include Alianza Rosario, an ocean-going pushboat which we employ in our River Business for salvage operations.

|

|

(2)

|

UP Pearl is expected to be delivered by August 2013 and to commence operations in the fourth quarter of 2013.

|

|

(3)

|

UP Onyx is expected to be delivered by the end of 2013 and to commence operations in early 2014.

|

|

(4)

|

Our Miranda I and Amadeo were both rebuilt to double hull in 2007.

|

|

(5)

|

The Austral is operated by us under a Bareboat charter.

|

|

(6)

|

Twenty Foot-Equivalent Units, or TEUs.

|

|

(7)

|

Represents sum of dwt capacity, not including the capacity of the Asturiano and Argentino which is measured in TEUs.

|

We are offering to exchange up to $200.0 million aggregate principal amount of our 87/8% First Preferred Ship Mortgage Notes due 2021 that have been registered under the Securities Act, in exchange for any or all of our outstanding 87/8% First Preferred Ship Mortgage Notes due 2021. The notes offered hereby will be secured by first preferred mortgages on 353 vessels, consisting of four ocean vessels, 335 barges and 14 pushboats having an aggregate appraised value of approximately $253 million, as of May 2013. The vessel values are based on the average of two appraisals prepared by independent appraisers included in the definition of "Appraiser" in the "Description of the Notes." While the indenture governing the notes permits us to substitute other vessels for vessels that constitute collateral in certain circumstances, the appraised value of such other vessels must be at least equal to the appraised value of the vessels for which they are substituted. See "Description of the Notes—Tender of Qualified Substitute Vessels."

Strong Market Fundamentals

We believe that the following factors allow us to successfully capitalize on the growth in our principal markets:

|

|

●

|

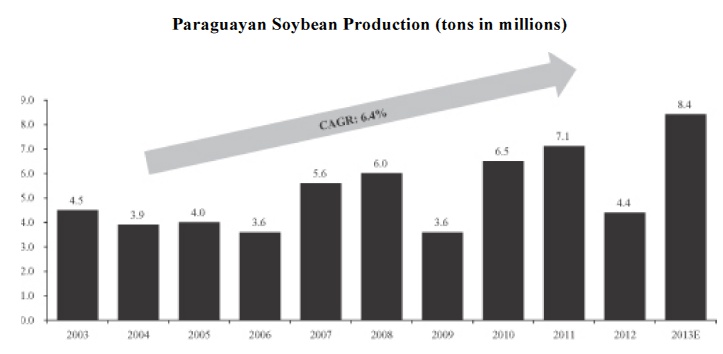

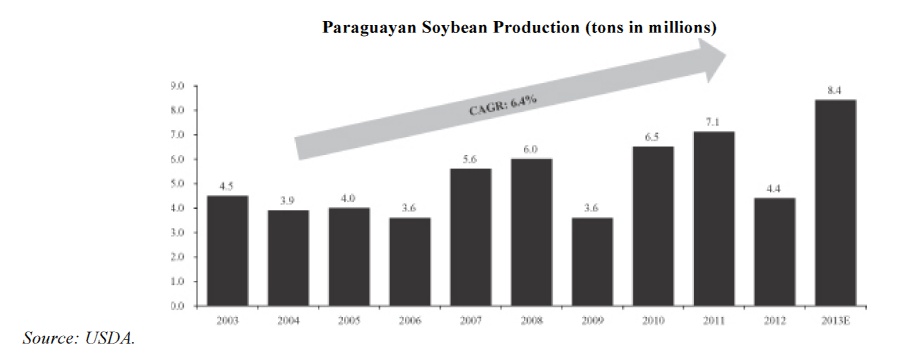

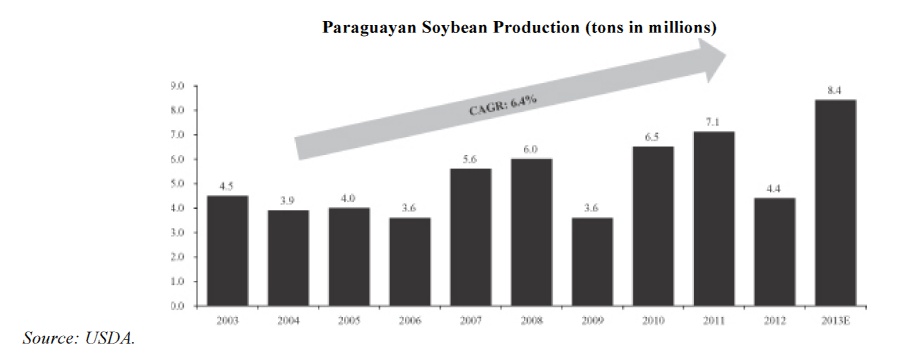

Increased Reliance on River Transportation of Agricultural and Mineral Commodities in the Hidrovia Region. The Hidrovia Region produces and exports a significant and growing amount of agricultural products and mineral commodities. Argentina, Bolivia, Brazil, Paraguay and Uruguay accounted for an estimated 55% of world soybean production in 2013, as compared to only 30% in 1995. Soybean production in these countries increased from about 41.5 million tons, or mt, in aggregate in 1995 to an estimated 115.0mt in 2012, representing a 17-year compound annual growth rate, or CAGR, of 6.2% during the period. Global growth in wealth and in industrialized agricultural products has resulted in greater consumption of meat and convenience foods, raising demand for soybeans as animal feed and as soybean oil (the second most widely used vegetable oil after palm oil). Soybeans are vital to the production of livestock feed, industrial oils, infant formula, soaps, solvents, clothing and other household materials, as well as a primary source for the production of biodiesel which, by government regulation, represents an increasing percentage of diesel consumed in Europe and other areas of the world. Production of corn (maize) and wheat in the Hidrovia Region have also grown significantly, with corn production increasing from 50.3mt in 1995 to 98.3mt in 2012, and wheat production increasing from 14.4mt in 1995 to 24.4mt in 2012. We believe that increases in crop yields through improvements in farming techniques, including the distribution of genetically modified seed technology to local farmers, as well as the large amounts of unused arable land available in the region, will allow for continued expansion of the production of soybeans and other crops.

|

Source: USDA.

Source: Paraguayan Chamber of Grains and Oilseed Exporters.

In the Corumbá area of Brazil reached by the High Paraguay River, there are three large iron ore mines, two of which are owned by Vale while the third one is owned by MMX. Volumes of iron ore shipped down the river system have grown from approximately 2 million tons to approximately 8 million tons per year over the past decade.

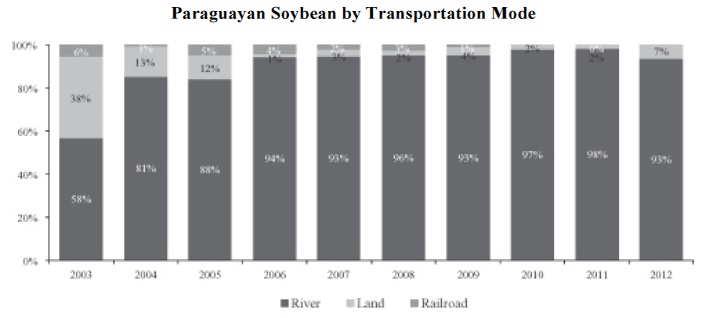

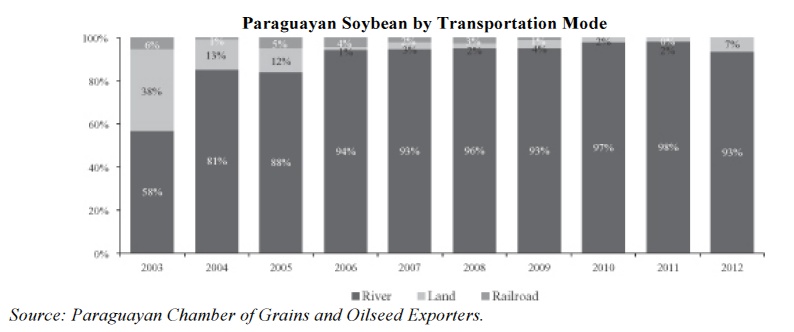

The Hidrovia river system is a vital transportation link for large volume production of bulk commodities in South America, given the long distances and the limited highway and rail transportation alternatives. It is critical to providing access to the Atlantic Ocean and the global export market, where most of these cargos are destined. River barges are the most efficient and cost-effective mode of transportation compared to other modes of transportation such as railroads and trucks. According to data collected by the Paraguayan Chamber of Grains and Oilseed Exporters, ("Capeco") approximately 97%, 98% and 93% of Paraguayan soybean production was transported along the river in 2010, 2011 and 2012, respectively. Although not all grain commodities produced in the Hidrovia Region are shipped for export through the Hidrovia waterway, the increased grain production in the region is expected to proportionally increase the amount of grains transported via the river system over time.

We believe the Hidrovia Region, and demand for barge transportation along the river system, will benefit from these continuing trends going forward. The Hidrovia river system, at over 2,200 miles in length, is one of the largest navigable river systems in the world, comparable in length to the Mississippi River system in the United States. A comparison of the two river systems illustrates the significant potential for future development of the Hidrovia, which serves economies that are expected to grow faster than the U.S. economy. We estimate that there are only approximately 1,900 barges operating in the Hidrovia, compared to over 22,000 barges in the Mississippi River system. Moreover, we believe a substantial number of barges will need to be replaced over the next four years as they approach the end of their economic useful lives, further reducing the available barge capacity.

We own the most modern barge building facility in the river system. Our facility, in Punta Alvear, which commenced production in 2010, is currently capable of producing up to two 2,500 dwt barges per week, allowing us to replenish and increase our barge capacity in the river system. In addition, we have been able to sell over half of the barge production from our facility to third parties, generating significant revenues and operating profits.

|

|

●

|

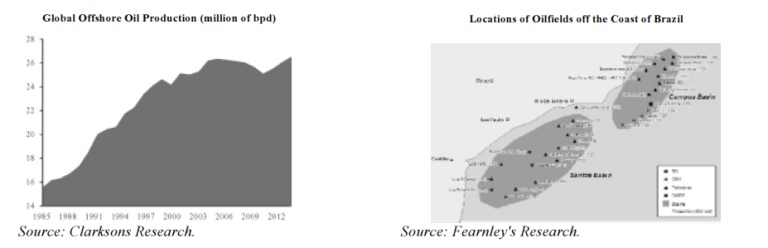

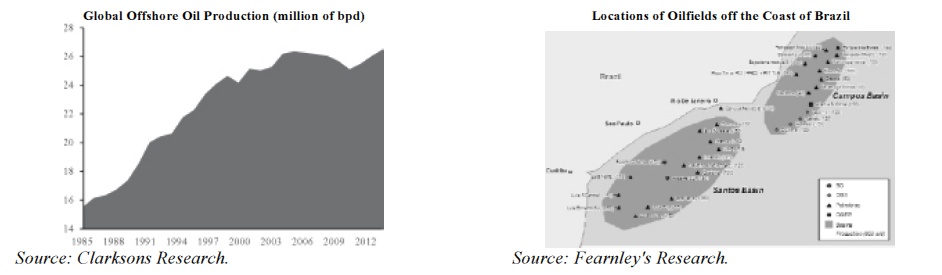

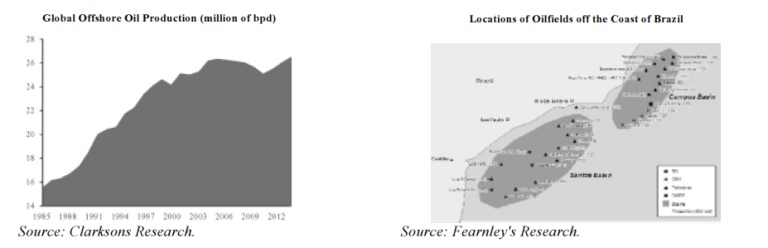

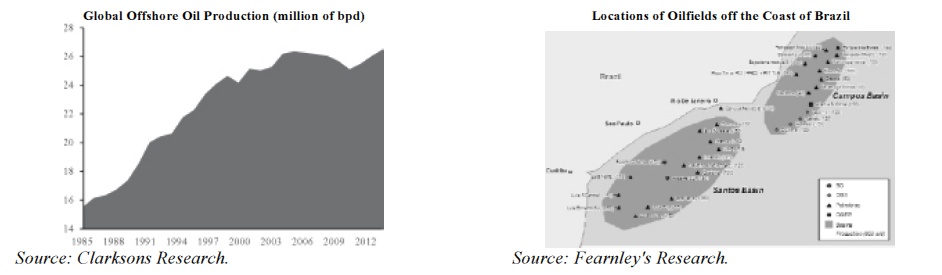

Significant Demand for Offshore Supply Vessels to Support the Growth in Offshore Oil Production. Offshore exploration and production activities are expanding globally, with total offshore oil production accounting for approximately 26.8 million bpd in 2012, according to Clarksons Research Services Ltd. Deepwater oil production is one of the fastest growing areas of the global oil industry and is replacing shallow water as the main focus of offshore oil field development. According to the IEA—World Energy Outlook 2012, deepwater production will expand from 4.8 million bpd in 2011 to 8.7 million bpd in 2035. Offshore oil production principally occurs off the coasts of Brazil and West Africa, and in the North Sea and the Gulf of Mexico. The North Sea is one of the largest offshore oil producing regions in the world and includes oil fields on the United Kingdom and Norwegian continental shelves, while Brazil is one of the fastest growing regions of deepwater and ultra-deepwater offshore production. Our offshore vessels currently operate in both Brazil and the North Sea.

|

Driven by Brazil's policy of becoming energy self-sufficient as well as by oil price and cost considerations, offshore exploration, development and production activities within Brazil have grown significantly and Brazil is increasingly becoming a major exporter of oil. The deepwater Campos Basin, an area located about 80 miles offshore, has been the leading area for offshore activity. Activities have been extended to the deepwater Santos and Espirito Santo Basins located far off the coast while additionally requiring resources to develop pre salt areas of water depths of over 9,000 feet. During 2008, 2009 and 2010, several significant discoveries have been made, which could possibly more than double Brazilian oil reserves when confirmed. This increase in activity is driven primarily by Petrobras and other producers, including British Petroleum ("BP"), Chevron Corporation ("Chevron"), Exxon Mobil Corporation ("Exxon Mobil"), OGX Petroleo e Gas Participaçoes ("OGX") and Royal Dutch Shell plc ("Shell").

Platform supply vessels generally support oil exploration, production, construction and maintenance activities and have a high degree of cargo flexibility. They utilize space above and below deck to transport dry and liquid cargo, including heavy equipment, pipe, drilling fluids, provisions, fuel, dry bulk cement and drilling mud. The market for offshore platform supply vessels, or PSVs, both on a worldwide basis and within Brazil, is driven by a variety of factors. On the demand side, the driver is the growth in offshore oil development / production activity, which in the long term is driven by the price of oil and the cost of developing the particular offshore reserves. Demand for PSVs is further driven by the location of the reserves, with fields located further offshore and in deeper waters generally requiring more vessels per field and larger, more technologically advanced vessels. Petrobras has announced that it expects to increase the use of supply and special vessels from 287 vessels at the end of 2010 to 423 vessels by 2013, 479 vessels by 2015 and 568 vessels by 2020. The Brazilian market has seen an increasing demand for larger PSVs since 2005 (prior to 2005 large PSVs in excess of 4,000 dwt were unusual in Brazilian waters), and we believe the demand for this type of vessel will grow significantly in the next three years.

The trend for offshore petroleum exploration, particularly in Brazil, has been to move toward deeper, larger and more complex projects, such as the Tupi and Jupiter fields in Brazil, which we believe will result in increased demand for more sophisticated and technologically advanced PSVs to handle the more challenging environments and greater distances. Each offshore drilling or production unit working on deepwater projects typically requires more than one offshore supply vessel to service it. Deepwater service favors large, modern vessels that can provide a full range of flexible services, including dynamic positioning systems, while providing economies of scale to installations distant from shore. Large PSVs typically service several platforms in a single voyage, which can last between three to five days.

Our Three Lines of Business

River Business

We are the leading integrated river transportation company in the Hidrovia Region. Our River Business, which we operate through our subsidiary UABL, owns and operates 679 barges with approximately 1.2 million dwt capacity and 33 pushboats. Of those, 598 are dry barges that can transport agricultural and forestry products, iron ore and other cargoes and the other 81 are tank barges that can carry petroleum products, vegetable oils and other liquids. We believe that our fleet size is roughly as large as the next three competitors in the Hidrovia river system combined. Our advanced infrastructure along the banks of the Hidrovia river system, including our modern automated shipyard, distinguishes us from all other operators in the Hidrovia.

We operate our pushboats and barges on the navigable waters of the Parana, Paraguay and Uruguay Rivers and part of the River Plate in South America, also known as the Hidrovia Region. At over 2,200 miles in length, the Hidrovia Region is comparable in length to the Mississippi River in the United States and connects Bolivia, Brazil, Paraguay, Argentina and Uruguay.

Our River Business operations includes transportation of dry cargo (including soy pellets, grains, iron ore) and liquid cargo (vegetable oil) downriver where it typically transfers to ocean-going vessels for export, and transportation of petroleum products and general cargos northward to upstream destinations in Argentina, Paraguay, Bolivia and Brazil.

Our River Business infrastructure allows us to operate an efficient hub system where our pushboats use hubs or fleeting areas to drop their barge tows, utilizing our pushboats more effectively in comparison to the use of dedicated tows. Our networks of River Terminals, which includes the Tres Fronteras Terminal at kilometer 1,928 and the Dos Fronteras Terminal at kilometer 1,800, together with multiple fleeting areas in Chaco-I, San Gotardo, Confluencia, San Lorenzo and Corumbá, provide the necessary network required for us to efficiently operate in the river system.

Our shipyard at Punta Alvear, which commenced production in January 2010, enables us to build new barges and other vessels and has given us the ability to efficiently increase our capacity in both dry and tank barges. We are also able to sell barges we produce to third parties, which has continued to contribute to the revenues and operating profits of our River Business. Our facility produces barges with a capacity of 2,500 dwt each, or approximately 66% larger than the standard Mississippi-size barge with a capacity of 1,500 dwt, which is designed to accommodate the size of the locks on the Mississippi river system. We believe our facility is one of the most modern of its kind in the world and has proven to be capable of producing barges at high rates of productivity at a cost significantly lower than any alternative source available to the region.

For the fiscal year ended December 31, 2011, revenues from barge sales to third parties from our Punta Alvear yard were $19.1 million, and manufacturing expenses for the same period were $12.7 million, resulting in an operating profit from sales of barges to third parties of $6.4 million. These results corresponded to the sale of twenty dry jumbo barges.

For the fiscal year ended December 31, 2012, revenues from barge sales to third parties from our Punta Alvear yard were $30.3 million, and manufacturing expenses for the same period were $18.5 million, resulting in an operating profit from sales of barges to third parties of $11.8 million. These results corresponded to the sale of 23 jumbo barges. The operating profit for the fiscal year ended December 31, 2012, does not include $2.1 million from the sales of 14 dry barges to a non-related third party which are on lease back to us and which operating profit is deferred over the life of the operating lease.

We have received contracts for 51 barges to be built and delivered in 2013, and on May 15, 2013, one of our customers exercised its option to purchase from us seven additional newbuild jumbo tank barges to be produced in our Punta Alvear barge building facility on terms and conditions similar to its previous order. Delivery for these barges is expected by the end of December 2013. Including this transaction, we expect to have sold and delivered 58 barges to third parties in 2013.

We are in the process of converting our Parana Petrol barge into an iron ore transshipment station in our River Business, capable of transshipping 800,000 tons per year from barges transporting iron ore down the river into ocean-going vessels for export to international markets. We expect that conversion to be finalized in the third quarter of 2013. We have entered into a take-or-pay contract for a period of three years with a major iron ore producer in the region. As part of our engine replacement program, we have re-engined six out of eleven of our biggest main line pushboats with new engines from MAN which consume heavier grades of fuels instead of diesel oil and expect to complete re-engining of a seventh pushboat by the end of 2013. Heavier fuels have been, from 2001 to 2011, 25% cheaper on average than diesel fuel and we anticipate will deliver cost savings. The engines for the remaining five pushboats have already been purchased and delivered to us, and we expect to have completed the re-engining program by 2015.

Offshore Supply Business

Our Offshore Supply Business, which we operate through our subsidiary UP Offshore, is focused on serving companies that are involved in the complex and logistically demanding activities of deepwater oil exploration and production. Our PSVs are designed to transport supplies, equipment, drill casings and pipes on deck, along with fuel, water, drilling fluids and bulk cement in under-deck tanks and a variety of other supplies to drilling rigs and offshore platforms.

Our offshore supply fleet, as of March 31, 2013, consists of ten PSVs in operation. We also have two additional PSVs under construction in India, which are expected to commence operation in the third quarter of 2013 and early 2014, respectively. Ten of the twelve vessels currently in our offshore supply fleet, including the vessel we expect to take delivery of in the second quarter of 2013, are contracted for employment in the Brazilian market, under term time charters with Petrobras. Through one of our Brazilian subsidiaries, we have the competitive advantage of being able to operate a number of our PSVs in the Brazilian market with cabotage trading privileges, enabling those PSVs to obtain employment in preference to other non-Brazilian-flagged vessels.

The trend for offshore petroleum exploration, particularly in Brazil, has been to operate a fleet capable of servicing deeper, larger, more complex projects, such as the Tupi and Jupiter fields in Brazil, which we believe will result in increased demand for more sophisticated and technologically advanced PSVs to handle the increasingly challenging environments and greater distances. Our PSVs are of a larger deadweight and are equipped with dynamic positioning capabilities, greater cargo capacity and deck space than other PSVs serving shallow water offshore rigs. These attributes provide us with a competitive advantage in efficiently serving our customers' needs.

Only one of our PSVs, the UP Jasper, is currently operating in the UK's North Sea. Our ability to operate in the UK's North Sea, where we have had a presence since 2005, allows us the flexibility to deploy our vessels in either the UK's North Sea or off the coast of Brazil in accordance with prevailing market conditions and we believe enhances our negotiating power within the Brazilian market.

Ocean Business

In our Ocean Business, we operate six ocean-going vessels. Our four Product Tankers, one of which is on bareboat charter to us from a non-related third party, are currently employed in the South American cabotage trade of petroleum and petroleum products. Waterborne transportation via the coastwise tanker trades forms a key part of the region's oil supply system. Argentina's refining capacity is largely located in the River Plate estuary near Buenos Aires. Crude oil from oil fields in southern Argentina is shipped to refineries near Buenos Aires by tankers. Coastal cities in Southern Argentina receive petroleum products by tankers from these refineries. Cabotage tankers are also used for lightering of international tankers (discharge of cargo to reduce draft) and for short voyages within the Plate Estuary and Parana River. Transportation demand is based on distribution requirements and tends to be stable, following the underlying petroleum product demand trends. Due to the remoteness of the region from active spot market tanker routes, time charters are often viewed as necessary by refineries and oil companies to ensure availability of quality vessels meeting their operating, safety and environmental requirements. Our four Tankers, Miranda I, Alejandrina, Amadeo and Austral are currently employed under time charters with principal oil refineries serving regional trades in Argentina and Brazil.

We have pursued the expansion of our ocean fleet by participating in a cabotage, flag-protected container feeder service along a portion of the eastern coast of South America, through the acquisition of two container vessels the Asturiano and Argentino during May 2010 and February 2011, respectively. Coastal container feeder shipping provides important north-south links between Buenos Aires, Montevideo and coastal ports in southern Patagonia. Economic development programs have encouraged the development of the manufacturing industry in the southern region of Tierra del Fuego in Patagonia. Components required by the manufacturing facilities in that region are imported on containerships from the Far East and other foreign ports of origin by the major international container lines, to Buenos Aires or Montevideo, with transshipment to Ushuaia under feeder agreements. Finished goods from the manufacturing facilities in the south are in turn transported north with feeder containerships from the port of Ushuaia to Buenos Aires for distribution. Cargo is also carried to and from other southern Patagonia ports, such as Puerto Madryn, to meet local demand. We have seen demand for containerized cargo increase steadily since we initiated our feeder service in 2010.

Generally throughout South America, voyages between two ports within the same country are considered "cabotage" and require the use of vessels flying the domestic flag or enjoying the equivalent privileges. Our ocean vessels enjoy such privileges in the markets they operate in.

Our Competitive Strengths

We believe that the following strengths allow us to maintain a competitive advantage within the markets we serve:

|

|

●

|

Largest Fleet and Transportation Network in the Hidrovia River System. We are the largest provider of transportation services in the Hidrovia river system with a fleet capacity approximately as large as our next three competitors combined. We have also developed the largest independently held network of loading and storage terminals, fleeting areas and transfer facilities strategically located along the river system. The size and quality of our river fleet and infrastructure allows us to operate an efficient hub system which improves our fleet utilization and provides us with a significant competitive advantage. The significant investments that have been made in our technology, on 66 new jumbo-sized barges (with a capacity of 2,500 dwt vs. 1,500 dwt for a standard Mississippi-size barge) and a significant investment in modern, highly-powered heavy fuel consuming engines, further enable our River Business to use its assets more efficiently than its competitors while providing a unique service to our customers. Our vertically integrated barge manufacturing facility, which is one of the most modern of its kind in the world, provides us with the distinct ability to increase our fleet capacity at a cost significantly lower than any alternative source available to the region and at the same time produce and sell barges to third parties both for use in the Hidrovia Region and other areas of the world.

|

|

|

●

|

Modern Fleet of Large PSVs Serving the Offshore Platform Supply Market. Our large, modern PSVs have substantial cargo capacity and deck space, as well as advanced dynamic positioning systems which enable us to better serve customers operating in challenging and distant deepwater offshore environments. We have doubled the size of our PSV fleet over the past five years, and we believe we are the second largest owner of 4,500 dwt class platform supply vessels in the Brazilian market, where we have an established presence with local flag privileges for part of our fleet and have secured employment for our vessels under term contracts. We believe that our operation of large, modern and technologically advanced PSVs and our track record provide us a competitive advantage in securing attractive long-term employment for our vessels.

|

|

|

●

|

Diverse Revenue Base Across Multiple End Markets. We believe that our diversification across multiple segments of the marine transportation industry allows us to limit our exposure to the business cycles in any particular segment, helping provide stability in our revenues and profitability. Our River Business is driven by the growing worldwide consumption of agricultural products and the demand for iron ore to manufacture steel. Our Offshore Supply Business benefits from the increasing global consumption of energy and the continued development of offshore drilling and production. Our Ocean Business meets the logistical needs to supply and distribute petroleum products and general container cargo in niche flag-protected markets. We believe this diversity in the sources of our revenues reduces the risk of exposure to any single end market.

|

|

|

●

|

Preferential Treatment in Certain Markets. Most countries provide preferential treatment, referred to as "cabotage privileges," for vessels that are flagged in their jurisdiction or chartered in for operation by local ship operators. For example, Brazilian law provides a preference for the utilization of Brazilian-flagged vessels in its cabotage trade. Through one of our Brazilian subsidiaries, we have the competitive advantage of being able to trade many of our PSVs currently in operation in the Brazilian cabotage market, enabling them to obtain employment in preference to vessels without those cabotage privileges. Similarly, all of our ocean-going vessels enjoy cabotage privileges in Argentina.

|

|

|

●

|

Long-Term Relationships with High Quality Customers. We have longstanding relationships with large, stable customers, including affiliates of major international agricultural and oil companies, such as Cargill, Petrobras, ADM, Trafigura and Continental Grain. We pride ourselves on our operational excellence, our ability to provide high quality service and our commitments to safety, quality and the environment. The quality of our vessels as well as the expertise of our vessel crews and engineering resources helps us maintain highly reliable and consistent performance for our customers. Our two largest customers, Petrobras and Trafigura, accounted for 29% and 16% of revenues for the fiscal year ended December 31, 2012, respectively, and our five largest customers accounted for 63% of revenues for the fiscal year ended December 31, 2012.

|

Our Business Strategy

Our business strategy is to continue to grow by leveraging our expertise and customer relationships through our investments in different sectors of the transportation industry. Our River Business is the leading barge transportation company in the Hidrovia Region and is well positioned to deliver strong operational results. We plan on expanding our presence in the Brazilian offshore oil platform supply services industry in order to capitalize on attractive trends in that market. We plan to implement our business strategy by doing the following:

|

|

●

|

Leverage Our Market Position to Capitalize on Strong Underlying River Fundamentals. We plan to leverage our leading market position in the Hidrovia to capitalize on the attractive supply and demand fundamentals for marine transportation in the region and to further expand our lines of business and the capacity and range of marine transportation services provided by us. The Hidrovia river system is one of the largest navigable river systems in the world, comparable in length to the Mississippi River system in the United States, and represents the most efficient means of transportation in a fertile and commodity-rich region with a shortage of transportation infrastructure alternatives. Our ability to enlarge our fleet with barges produced at our vertically integrated facility at a competitive cost, and to continue to take advantage of the economies of scale afforded to us by our large fleet, increasingly fuel-efficient pushboats and network of infrastructure should allow us to extend our dominant position in the river system.

|

|

|

●

|

Continue Expanding our Offshore Operations. We intend to continue to leverage our expertise, local presence and success in the Brazilian offshore market by deploying additional vessels in the region. We currently have nine vessels operating in the Brazilian offshore supply market and intend to deploy one of the two additional PSVs, which is now in the final stages of construction in India, in the Brazilian market upon delivery in third quarter of 2013. The demand for long-term employment at attractive and improving charter rates, particularly for our large, modern PSVs, reflects the attractive fundamentals of the Brazilian offshore market. We believe that the opening of the Brazilian oil exploration and production market to private and foreign participation will allow for further growth opportunities and customer diversification.

|

|

|

●

|

Maintain and Optimize our Asset Diversification and Employment. We continually monitor developments in the shipping industry and make charter-related decisions based on an individual vessel and segment basis, as well as on our view of overall market conditions in order to implement our overall business strategy. In our River Business, we have contracted a substantial portion of our fleet's barge capacity on a one- to five-year basis to our major customers. These contracts typically provide for fixed pricing, minimum volume requirements and fuel price adjustment formulas, and we intend to develop new customers and cargoes as we grow our fleet capacity. In our Offshore Supply Business, we plan to continue chartering our PSV fleet primarily in Brazil under long-term time charter employment. We have historically operated our cabotage Ocean Business tanker vessels under period time charters with oil refineries and major oil companies and will aim to continue to do so. Our two container feeder vessels operate on a voyage by voyage basis.

|

|

|

●

|

Focusing on Generating Operational Efficiencies. We have identified opportunities and are implementing our plans to improve overall efficiency and profitability. In our River Business our re-engining program is underway, and we have invested in new, bigger engines for our main line pushboats, which will burn less expensive fuels. We also continue to focus on optimizing our barge and tug scheduling, maximizing loads and tow size and reducing empty back-hauls through our strategically located fleeting areas. We believe that the increased traffic density from the continued growth in overall demand for waterborne transportation of commodities and the expansion of our footprint in the river system will reduce non-revenue producing days and increase our overall transportation volumes and strengthen our margins. At our barge manufacturing facility, we are focused on establishing an infrastructure that optimizes our production capabilities and efficiencies, to maximize profitability and return on capital. Our facility has increased its output and its third party sales from 19 barges in 2011 to 37 barges in 2012 with over 50 barges already contracted for sales to third parties in 2013.

|

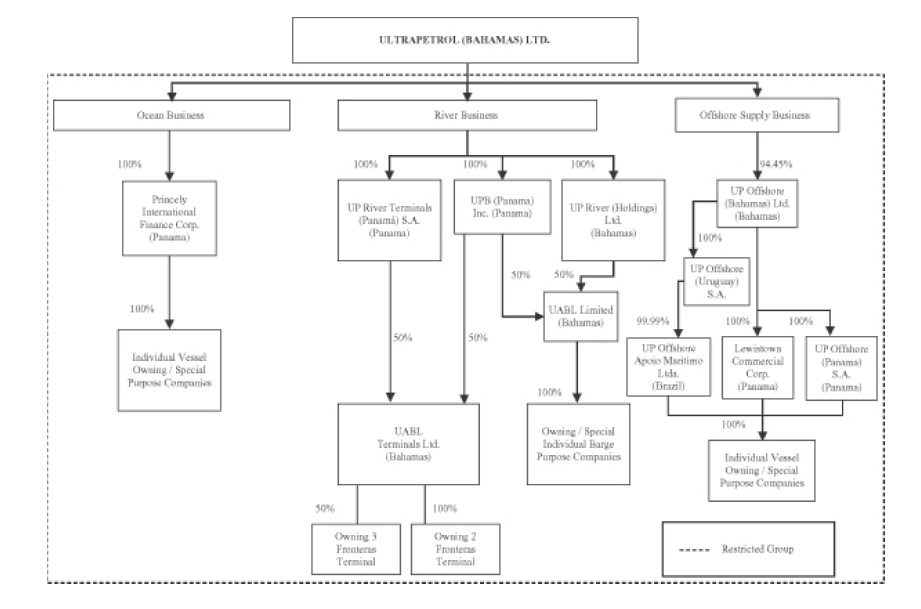

Ownership and Corporate Structure

Our management team is led by members of the Menendez family. The family collectively has been involved in the shipping industry for over 130 years. Our senior executive officers have on average 39 years of experience in the shipping industry. Our management team has significant expertise in various lines of business and has been instrumental in developing and maintaining our certified safety and quality management systems and our operational plans.