10-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________________________________

FORM 10-K

________________________________________________________________________

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

Commission file number 1-14379

CONVERGYS CORPORATION

|

| |

An Ohio | I.R.S. Employer |

Corporation | No. 31-1598292 |

201 East Fourth Street, Cincinnati, Ohio 45202

Telephone Number (513) 723-7000

__________________________________________________________________

Securities registered pursuant to Section 12(b) of the Act: |

| |

Title of each class | Name of each exchange on which registered |

Common Shares (no par value) | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

_____________________________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer þ Accelerated filer ¨

Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

The aggregate market value of the voting shares held by non-affiliates of the registrant was $2,505,101,708, computed by reference to the closing sale price of the stock on the New York Stock Exchange on June 30, 2015, the last business day of the registrant’s most recently completed second fiscal quarter.

At January 31, 2016, there were 96,585,169 common shares outstanding, excluding amounts held in treasury of 93,804,496.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for the Annual Meeting of Shareholders to be held on April 14, 2016 are incorporated by reference into Part III of this report.

TABLE OF CONTENTS

|

| | |

PART I | | Page |

Item 1. | | |

| | |

Item 1A. | | |

| | |

Item 1B. | | |

| | |

Item 2. | | |

| | |

Item 3. | | |

| | |

Item 4. | | |

| | |

Item 4A. | | |

PART II | | |

Item 5. | | |

| | |

Item 6. | | |

| | |

Item 7. | | |

| | |

Item 7A. | | |

| | |

Item 8. | | |

| | |

Item 9. | | |

| | |

Item 9A. | | |

| | |

Item 9B. | | |

PART III | | |

Item 10. | | |

| | |

Item 11. | | |

| | |

Item 12. | | |

| | |

Item 13. | | |

| | |

Item 14. | | |

PART IV | | |

Item 15. | | |

| | |

| | |

Convergys Corporation 2015 Annual Report 1

SAFE HARBOR STATEMENT

Private Securities

Litigation Reform Act of 1995

Safe Harbor Cautionary Statement

This report and the documents incorporated by reference herein contain forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995, that are based on the current expectations, estimates and projections of Convergys Corporation (we, the Company or Convergys). Statements that are not historical facts, including statements about our beliefs and expectations, are forward-looking statements and may be identified by words such as “believes,” “expects,” “intends,” “could,” “should,” “will,” “plans,” “anticipates” and other similar words. These statements discuss our projections and expectations and actual results may differ materially. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they were made. The Company has no current intention to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Important factors that may affect these forward-looking statements include, but are not limited to: the future financial performance of our largest clients and the major industries that we serve, including global communications, technology and financial services; contractual provisions that may limit our profitability or enable our clients to reduce or terminate services; the loss of a significant client or significant business from a client; our failure to successfully acquire and integrate businesses; our inability to protect proprietary or personally identifiable data against unauthorized access or unintended release; our inability to maintain and upgrade our technology and network equipment in a timely and cost effective manner; international business and political risks, including economic weakness and operational disruption as a result of natural events, political unrest, war, terrorist attacks or other civil disruption; the effects of foreign currency exchange rate fluctuations, including the adverse impact of a strengthening U.S. dollar relative to the Australian dollar, the British pound and the euro; the failure to meet expectations regarding our future tax liabilities or the unfavorable resolution of tax contingencies; the adverse effects of regulatory requirements, investigative and legal actions, and other commitments and contingencies; our inability to effectively manage our contact center capacity; volatility in financial markets, including fluctuations in interest or exchange rates; and other risks that are described under “Risk Factors” in Part I, Item 1A of this report. These uncertainties may cause our actual future results to be materially different than those expressed in our forward-looking statements.

PART I

ITEM 1. BUSINESS

OVERVIEW

Convergys Corporation is a global leader in customer management, focused on bringing value to our clients through every customer interaction. Convergys has 130,000 employees working in more than 150 locations in 31 countries, interacting with our clients’ customers in 58 languages. In order to help our clients serve their customers, we operate over 130 contact centers in 31 countries. As the second-largest global provider in our industry, Convergys has a history of commitment and dedication to excellence in serving many of the world’s largest brands. Our business model allows us to deliver consistent, quality service, at the scale and in the geographies and channels that meet our clients’ business needs and proactively partner to solve client business challenges through our account management model. We leverage our geographic footprint and comprehensive capabilities to help leading companies create quality customer experiences across multiple interaction channels, such as voice, chat, email and interactive voice response, while increasing revenue and reducing their cost to serve. We are a well-capitalized leader in our market and are able to invest in the services, technology, and analytics that matter to our clients and their customers.

Acquisition of Stream

On March 3, 2014, Convergys completed its acquisition of SGS Holdings, Inc. (Stream), a global leader in customer management, providing technical support, customer care and sales, for Fortune 1000 companies. This acquisition expanded the Company’s geographic footprint and capabilities and added approximately 40,000 employees in 22 countries. Stream’s complementary client portfolio further diversified Convergys’ client base through the addition of leading technology, communications and other clients. Our acquisition of Stream is more fully described in Note 3 of the Notes to Consolidated Financial Statements.

OUR BUSINESS

Convergys Corporation 2015 Annual Report 2

Our talented, highly trained and dedicated teams serve leading brands across industries including communications and media, technology, financial services, retail and healthcare. Convergys strives to deliver world-class customer experiences each and every day. We understand that our clients have individual business needs and that customer interactions in an increasingly multi-channel environment can be complicated. Our role is to solve the complexities and deliver unparalleled customer experiences on behalf of our clients.

We believe our clients benefit from our worldwide workforce located in key geographies throughout the world, including the United States, Canada, the Philippines, India, Malaysia, China, Indonesia, Australia, the U.K., France, Tunisia, Egypt, Bulgaria and other countries throughout the EMEA (Europe, the Middle East and Africa) region, Costa Rica, Colombia, Dominican Republic, El Salvador, Nicaragua and Honduras. The Stream acquisition expanded the Company’s presence in North America, Latin America, and the Philippines. Most notably, the acquisition increased Convergys’ presence in EMEA by adding Stream’s sites across Europe, as well as multiple sites in North Africa. As a result of this combination, Convergys further diversified its client base and enhanced its ability to offer a wider range of customer transactions in a more cost effective manner from multiple geographies, at scale. The geographic information included in Note 17 of the Notes to Consolidated Financial Statements is incorporated by reference in this Item 1.

Our 30+ years of experience and unique mix of agents, analytics and technology allow us to support our clients as they balance their priorities to grow revenue, improve customer satisfaction, and reduce costs. Our agents provide a full range of contact center services delivered via phone, email and chat. We provide solutions across the customer lifecycle, including:

Our innovative omni-channel contact center technology solutions include:

| |

• | Multichannel Interaction Solutions (Intelligent Self-Service, Voice, Chat, Email, and Knowledge Management) |

| |

• | Cross-Channel Integration Framework |

| |

• | Real-Time Decisioning Engine |

| |

• | Intelligent Notifications |

We have a dedicated team of professionals to deliver data-driven insights to improve the customer experience through analytics and consulting solutions, including:

| |

• | Relational Loyalty Research |

| |

• | Customer Segmentation and Profiling |

| |

• | Call Elimination Analysis |

| |

• | Analysis of Customer Effort |

| |

• | Digital Channel Optimization |

| |

• | Integrated Contact Center Analytics |

STRATEGY

Our strategy is to build on our leading position in a large global market by investing in what matters most to our clients and leveraging our strong financial position to drive sustainable growth and value creation for our shareholders.

Build on a Leading Market Position to Grow With Loyal and Expanding Client Base

The Company’s primary focus is on growth with multinational corporations and other large companies in the communications and media, financial services, technology, healthcare, retail and other vertical markets. Convergys will continue to compete for

Convergys Corporation 2015 Annual Report 3

additional market share in the global customer management market by expanding with existing clients and further penetrating under-served verticals through pursuit of new clients.

Capitalize on Industry Trends by Investing in Quality, Capability and Clients

We believe we are well-positioned to benefit from several trends in the Customer Management industry, including increasing customer contact complexity, demand for full life-cycle services, vendor consolidation and global delivery. To capitalize on these trends, the Company invests in a combination of global quality delivery, comprehensive solutions, and close client engagement.

Increasing Customer Contact Complexity

As technology becomes more pervasive, customer contact to troubleshoot this technology becomes increasingly complex and difficult to resolve. Convergys invests in its global operating model to attract and retain the right talent that is trained and supported by the right tools to handle these complex customer contacts in a quality manner, at scale, regardless of location.

Full Lifecycle Services

Client strategies for customer service change rapidly. Increasingly, clients want business partners that offer a breadth and depth of capabilities and the flexibility to make rapid adjustments to the services they provide to their customers. To meet these changing client needs, Convergys invests in services, technology and analytics solutions that support the full life-cycle of contact types, including sales, customer service, technical support, customer retention and collections.

Vendor Consolidation

Increasingly, clients seek to drive efficiencies and a consistent customer experience by concentrating outsourced operations with a smaller number of strategic partners. Convergys invests in account management to ensure close client engagement to better understand unique client needs. We have also invested in a breadth of capabilities and delivery geographies to enable us to win additional market share as clients attempt to consolidate their volume with fewer vendors.

Global Delivery

Clients demand contact center services from multiple geographies. Convergys invests in global capacity to provide the right services, including language support, to better serve customers and drive the quality delivery and value our clients demand around the world.

Leverage Financial Strength to Invest in Strategic Growth, Return Capital to Investors

Convergys historically has demonstrated an ability to generate strong operating cash flow, which allows it to both invest in strategic growth and return capital to investors. The Company has followed and expects to continue to follow a disciplined capital deployment strategy through selective pursuit of acquisitions, focusing on diversity of clients, capabilities and countries, and the return of capital to investors through share repurchases and a quarterly dividend.

Additional Company Information

Convergys was formed as an Ohio corporation in 1998. The Company maintains an internet website at www.convergys.com. Information about the Company is available on the website, free of charge, including our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission (SEC). The Company’s website and the information contained therein are not incorporated by reference into this annual report. You may read and copy any materials the Company files with the SEC at the SEC’s public reference room at 100 F Street NE, Washington, DC 20549. The public may obtain information about the operation of the public reference room by calling the SEC at 1-800-SEC-0330. The SEC’s website, www.sec.gov, contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

The Company has a Code of Business Conduct that applies to all employees as well as our Board of Directors; a Financial Code of Ethics that applies to our principal executive officer, principal financial officer, principal accounting officer and certain other senior officers; and Governance Principles for our Board of Directors.

Convergys Corporation 2015 Annual Report 4

The Code of Business Conduct, Financial Code of Ethics and Governance Principles, as well as the charters for the Audit Committee, Compensation and Benefits Committee, and Governance and Nominating Committee of our Board of Directors, are posted on the Corporate Governance page of our website at www.convergys.com. The Company will post on our website any amendments to, or waivers of, the Code of Business Conduct and Financial Code of Ethics. Copies of these documents also will be provided free of charge upon written request directed to Investor Relations, Convergys Corporation, 201 East Fourth Street, Cincinnati, Ohio 45202.

CLIENTS

We derive significant revenues from AT&T Inc. (AT&T), our largest client. Revenues from AT&T (including DIRECTV Group, Inc. in all years) were 21.3%, 23.7% and 33.4% of our consolidated revenues for 2015, 2014 and 2013, respectively. Revenues from Comcast Corporation (Comcast) accounted for less than 10% of our revenue for 2015 and 2014 and 12.4% of our revenue for 2013. No other client accounted for more than 10% of our consolidated revenues for 2015, 2014 or 2013. Volumes with individual clients are often earned under multiple contracts and are subject to variation based on, among other things, general economic conditions, client outsourcing trends and seasonal patterns in our clients’ businesses.

We focus on developing long-term, strategic relationships with large companies in customer-intensive industries. We focus on these types of clients because of the complexity of services required, the anticipated growth of their market segments and their increasing need for more cost-effective customer management services.

OPERATIONS

We operate over 130 contact centers averaging approximately 66,000 square feet per center. We have approximately 92,900 production workstations and provide service 24 hours a day, 365 days a year. Our workforce is located throughout the world, including the United States, Canada, the Philippines, Malaysia, India, China, Indonesia, Costa Rica, Colombia, Dominican Republic, El Salvador, Nicaragua, Honduras, Australia, the U.K., France, Tunisia, Egypt, Bulgaria and other countries throughout EMEA. Our global operating model seeks to deliver a consistent customer experience regardless of where the service is provided. We establish new contact centers as needed to accommodate anticipated growth in business or in response to a specific customer need.

Our contact centers can employ a broad range of technology, including digital switching, intelligent call routing and tracking, proprietary workforce management systems, case management tools, proprietary software systems, computer telephony integration, interactive voice response, advanced speech recognition, web-based tools and relational database management systems. Our use of technology enables us to improve our voice, chat, web and e-mail handling and personnel scheduling, thereby increasing our efficiency and enhancing the quality of the services we deliver to our clients and their customers. We are able to respond to changes in client call volumes and manage call volume traffic based on agent availability. Additionally, we can use this technology to collect information concerning the contacts, including number, response time, duration and results of the contact and report the information to the client on a periodic basis for purposes of monitoring quality of service and accuracy of the related billing.

We operate a distributed data processing environment that can integrate call center data servers and databases with two primary data centers in Orlando, Florida and Cincinnati, Ohio, comprising, in total, approximately 90,000 square feet of space. Our technologically advanced data centers provide 24 hours a day, 365 days a year availability (with redundant power and communication feeds and emergency power back-up) and are designed to withstand most natural disasters.

The capacity of our data center and contact center operations, coupled with the scalability of our customer management solutions, enable us to meet the changing needs of large-scale and rapidly growing companies and government entities. By employing the scale and efficiencies of common application platforms, we can provide client-specific enhancements and modifications without incurring many of the costs of a full custom application, which positions us as a value-added provider of customer support products and services.

TECHNOLOGY, RESEARCH AND DEVELOPMENT

We will continue to emphasize the design, development and deployment of scalable customer management solutions. Our success depends, in part, on the technology we use in the delivery of services to clients. As a result, we continue to invest in the enhancement and development of advanced contact center technology.

Convergys Corporation 2015 Annual Report 5

Our intellectual property consists primarily of business methods and software systems. To protect our proprietary rights, we rely primarily on a combination of U.S. and foreign copyright, trade secret and trademark laws; confidentiality agreements with employees and third parties, and contractual protections contained in licenses and other agreements with consultants, suppliers, strategic partners and clients.

We own 147 patents, which protect certain technology and business methods that we use to manage our internal systems and processes effectively and we believe give us competitive advantages in developing innovative technologies to provide customer management services to our clients. Our existing patents were issued between October 1996 and December 2015 and generally have a life of 20 years. Additional applications for U.S. patents currently are pending.

Our name and logo are protected by their historic use and by trademarks and service marks that are registered or pending in the U.S. Patent and Trademark Office and under the laws of more than 64 foreign countries.

EMPLOYEES

As of December 31, 2015, we employed approximately 130,000 employees in over 150 locations across the globe and in our work-at-home environment. Our clients benefit from our worldwide workforce located in the United States, Australia, Brazil, Bulgaria, Canada, China, Colombia, Costa Rica, Dominican Republic, Egypt, El Salvador, France, Germany, Honduras, India, Indonesia, Ireland, Italy, Malaysia, the Netherlands, Nicaragua, the Philippines, Poland, Singapore, Spain, South Africa, Sweden, Tunisia, the United Arab Emirates and the United Kingdom.

COMPETITION

The market in which we operate is competitive. We compete based on quality of service, breadth and depth of capabilities, scope of geographic reach, and timely and flexible service. Our primary competitors include other customer management companies, such as Atento (ATTO), Sykes Enterprises Inc. (SYKE), Teleperformance (RCF) and TeleTech Holdings Inc. (TTEC). In addition, niche providers or new entrants can enter the market by developing new systems or services that could impact our business.

ITEM 1A. RISK FACTORS

Economic and market conditions in our customers’ industries and changes in our customers’ demand for outsourcing services may adversely affect our business, results of operations and financial condition.

Our results of operations are affected directly by the level of business activity of our clients, which in turn is affected by the level of economic activity in the industries and markets that they serve. Economic slowdowns in some markets, particularly the United States, may cause reductions in spending by our clients, which may impede our ability to maintain existing business or develop new business and adversely impact our results of operations and financial condition. Our revenues also depend on our clients’ success. If our clients or their programs are unsuccessful, the amount of business that they outsource, the prices that they are willing to pay for outsourcing or the revenues generated by our contracts may decline. A reduction in the amount of business we receive from our clients could result in stranded capacity and costs.

Our revenues also depend, in large part, on the demand for outsourcing services. Outsourcing involves companies contracting with a third party, such as Convergys, to provide customer management services rather than performing such services in-house. There can be no assurance that the current demand for outsourcing will continue or grow, and organizations may elect to perform such services in-house. A significant reduction in the demand for outsourcing services could have a material adverse effect on our financial condition and results of operations.

The terms of our client contracts may limit our profitability or enable our clients to reduce or terminate services that we prefer to continue.

Most of our client contracts do not have minimum volume requirements, and the profitability of each client contract or work order may fluctuate, sometimes significantly, throughout various stages of the program. Certain contracts have performance-related bonus or penalty provisions that require the client to pay us a bonus, or require us to issue the client a credit, based upon our meeting, or failing to meet, agreed-upon service levels and performance metrics. Moreover, although our objective is to sign multi-year agreements, our contracts generally allow the client to terminate the contract for convenience or reduce the amount of our services. There can be no assurance that our clients will not terminate their contracts before their scheduled expiration dates, that the volume of services for these programs will not be reduced, that we will be able to avoid penalties or earn performance bonuses for our services, or that we will be able to terminate unprofitable contracts without incurring significant liabilities. For these

Convergys Corporation 2015 Annual Report 6

reasons, there can be no assurance that our client contracts will be profitable for us or that we will be able to achieve or maintain any particular level of profitability through our client contracts.

We depend on a limited number of clients for a significant portion of our revenue, and the loss of business from one or more of these clients could adversely affect our results of operations.

Our three largest clients collectively represented 35.8% of our revenue in 2015. At any given time, we typically have multiple work orders or contracts with our largest customers. While we would not expect all work orders or contracts to terminate at the same time, the loss of one or more of the larger work orders or contracts with one of our largest clients could adversely affect our business, results of operations and financial condition if the lost revenues are not replaced with profitable revenues from that client or other clients.

Our business is substantially dependent on the global communications industry.

Approximately 53% of our revenue in 2015 was received from customers operating in the global communications industry. At times, this industry has experienced significant fluctuations in growth rates and capital investment, and predicting future performance in this industry is challenging. General economic weakness or a slowdown in the communications industry could result in a loss of business and adversely affect our revenues and earnings. In addition, the communications industry has experienced significant consolidation in recent years. If this consolidation continues, we may lose business from existing clients following a merger or acquisition, as a result of a change in our client’s outsourcing strategy or a reduction in the amount of business given to any one vendor by the client. The loss of business from one or more of our clients could have an adverse effect on our business, results of operations and financial condition if the lost revenues are not replaced with profitable revenues from other clients.

The markets in which we operate include a large number of service providers and are highly competitive.

We operate in highly competitive markets. Many of our competitors are expanding the services they offer in an attempt to gain additional business. In addition, niche providers or new entrants can enter markets by developing new systems or services that could impact our business. New competitors, alliances among competitors or mergers could result in significant market share gain by our competitors, which could have an adverse effect on our revenues.

Some of our competitors may adopt more aggressive pricing policies or provide services that gain greater market acceptance than the services that we offer or develop. Large and well-capitalized competitors may be able to better respond to the need for technological changes faster, price their services more aggressively, compete for skilled professionals, finance acquisitions, fund internal growth and compete for market share. Our customers routinely negotiate for better pricing, and we may be required to lower our pricing or extend our payment terms to respond to increased competition and pricing pressures. If our competitors are able to compete more effectively or we are forced to reduce our pricing to respond to competitive pressures, our revenues and profit margin may decline.

Our pursuit of acquisitions to grow our business presents certain risks to our business and operations.

We have made, and in the future may make, acquisitions of or investments in companies, technologies or products in existing, related or new markets. Business combinations, acquisitions and investments, such as our 2014 acquisition of Stream, involve numerous risks that vary depending on the scale and nature of the transaction, including, among other things, that:

| |

• | Management’s attention may be diverted from operational matters; |

| |

• | The acquired businesses may fail to meet or exceed expected returns; |

| |

• | Our integration of operations, systems, technologies, or employees may be ineffective or cost more than expected and impede our ability to realize anticipated synergies or other benefits or result in business interruptions and deterioration in our employee and customer relationships; |

| |

• | We may have difficulty attracting, retaining and motivating employees that are necessary to successfully operate the expanded business; |

| |

• | The announcement or consummation of a proposed transaction may have an adverse impact on relationships with third parties, including existing and potential clients; |

| |

• | The Company’s credit rating could be downgraded, which could adversely impact our access to and cost of capital; |

| |

• | We may use cash on hand or incur additional debt obligations to finance activities associated with a transaction, thereby reducing our available liquidity for general corporate or other purposes; |

| |

• | The acquired businesses may be located in regions where we have not historically conducted business and subject us to new operational risks, rules, regulations, employee expectations, customs and practices; |

Convergys Corporation 2015 Annual Report 7

| |

• | The management of new, more diverse and more widespread operations, projects and people, and the provision of services to new industries may present challenges; |

| |

• | The acquired company’s internal financial controls, disclosure controls and procedures, and anti-corruption, human resource, and other policies or practices may be inadequate or ineffective; |

| |

• | The acquisition may expose our business to commitments or liabilities that were unknown or undisclosed by the seller or for which we underestimated our potential liability; |

| |

• | We may be unable or fail to appropriately scale critical resources and facilities for the business needs of the expanded enterprise; and |

| |

• | We may fail to realize anticipated growth opportunities from the acquisition or existing clients may reduce the volume of services they obtain from the expanded entity following the acquisition. |

The occurrence of any one or more of these risks could have a material adverse effect on our business, results of operations, financial condition or cash flows, particularly in the case of a larger acquisition or several concurrent acquisitions.

Cyberattacks or the improper disclosure or control of personal information could result in liability and harm our reputation, which could adversely affect our business.

Our business is heavily dependent upon information technology networks and systems. Internal or external attacks on those networks and systems could disrupt the normal operations of our call centers and impede our ability to provide critical services to our clients, subjecting us to liability under our contracts and damaging our reputation.

Moreover, our business involves the use, storage and transmission of information about our employees, our clients and customers of our clients. If any person, including any of our employees, negligently disregards or intentionally breaches our established controls with respect to such data or otherwise mismanages or misappropriates that data, we could be subject to monetary damages, fines or criminal prosecution. Unauthorized disclosure of sensitive or confidential client or customer data, whether through system failure, employee negligence, fraud or misappropriation, along with unauthorized access to or through our information systems or those we develop for clients, whether by our employees or third parties, could result in negative publicity, loss of clients, legal liability and damage to our reputation, business, results of operations and financial condition.

While we take measures to protect the security of, and prevent unauthorized access to, our systems and personal and proprietary information, the security controls for our systems, as well as other security practices we follow, may not prevent improper access to, or disclosure of, personally identifiable or proprietary information. Furthermore, data privacy is subject to frequently changing rules and regulations, which sometimes conflict among the various jurisdictions and countries in which we provide services. In particular, the European Court of Justice recently invalidated the U.S.-EU Safe Harbor Framework regarding data privacy in connection with the transfer of personal data by U.S. companies from the European Economic Area. Our failure to adhere to or successfully implement processes in response to changing regulatory requirements in this area could result in legal liability or impairment to our reputation in the marketplace, which could have a material adverse effect on our business, financial condition and results of operations.

Interruption of our data centers and contact centers could have a materially adverse effect on our business.

If we experience a temporary or permanent interruption in our operations at one or more of our data or contact centers, through natural disaster, casualty, operating malfunction, cyberattack, sabotage or other causes, we may be unable to provide the services we are contractually obligated to deliver. Failure to provide contracted services could result in contractual damages or clients’ termination or renegotiation of their contracts. Although we maintain disaster recovery and business continuity plans and precautions to protect our company and our clients from events that could interrupt our delivery of services, there is no guarantee that such plans and precautions will be effective or that any interruption will not be prolonged. Any prolonged interruption in our ability to provide services to our clients for which our plans and precautions fail to adequately protect us could have a material adverse effect on our business, results of operation and financial condition.

We may be unable to effectively and efficiently deliver our services if the technology and network equipment that we rely upon is not appropriately maintained or upgraded.

Our clients, and the services we provide to our clients, are highly dependent upon the persistent availability and uncompromised security of our information technology systems. We utilize and deploy internally-developed and third-party software solutions across various hardware environments. We operate an extensive internal voice and data network that links our global sites together in a multi-hub model that enables the rerouting of voice and data across the network, and we rely on multiple public communication channels for connectivity to our clients. Accordingly, maintenance of, and investment in, technology is critical to the success of our service delivery model.

Convergys Corporation 2015 Annual Report 8

Our systems are subject to the risk of an extended interruption or outage due to many factors, including system failures, acts of nature and cyberattacks from third parties. If the reliability of our technology or our network operations falls below required service levels, or a systemic fault affects the organization broadly, we may be unable to deliver contracted services to our clients. Non-performance could result in contractual performance penalties, damage to our reputation, and the loss of business from existing and potential clients. Any one or more of these consequences could adversely impact our revenue and cash flow.

Defects or errors within software could adversely affect our business.

The software we use to conduct our business is highly complex and may, from time to time, contain design defects, coding errors or other software errors that may be difficult to detect or correct. Design defects, coding errors or other software errors may delay software introductions or operations implementations, reduce the satisfaction level of our clients, impact our operational performance or prevent us from complying with our commercial agreements and may have a materially adverse effect on our business and results of operations.

In addition, because we may use third-party software to support our clients, design defects, coding or other software errors and other potential problems may be outside of our control. Although our commercial agreements may contain provisions designed to limit our exposure to potential claims and liabilities, these provisions may not effectively protect us against claims in all cases and in all jurisdictions. As a result, problems with the software we use may result in financial or other damages to our clients for which we are held responsible or cause damage to our reputation, adversely affecting our business, results of operations and financial condition.

Our business performance and growth plans may be adversely affected if we are unable to effectively manage changes in the application and use of technology.

The use of technology in our industry has and will continue to expand and change rapidly. Our future success depends, in part, upon our ability to develop and implement solutions that anticipate and keep pace with continuing changes in technology, industry standards and client preferences. Our efforts to gain technological expertise and develop new technologies require us to incur significant expenses. If customer preferences for technology outpace our ability to provide such technologies, we could incur additional costs and our revenue profile and growth plans may be hindered.

In addition, we may be unsuccessful at anticipating or responding to new developments on a timely and cost-effective basis, and our use of technology may differ from accepted practices in the marketplace. If we cannot offer new technologies as quickly or efficiently as our competitors, or if our competitors develop more cost-effective or client-preferred technologies, it could have a material adverse effect on our ability to obtain and complete customer engagements, which could adversely affect our business.

Client consolidations could result in a loss of clients and adversely affect our business.

Many of our clients operate in industries that have experienced a significant level of consolidation. Our clients have been, and may continue to be, participants in consolidations in which they acquire additional businesses or are acquired themselves. Such consolidations may increase our dependence on a more limited number of clients or result in the termination of existing client contracts, which could have an adverse effect on our business, results of operations and financial condition.

Natural events, war, terrorist attacks, other civil disturbances and epidemics could disrupt our operations or lead to economic weakness in the countries in which we operate, resulting in decreased revenues, earnings and cash flow.

Natural events (such as floods and earthquakes), war, terrorist attacks and epidemics of contagious illnesses could disrupt our operations in the United States and abroad and could lead to economic weakness in the countries in which they occur. We have substantial operations in countries - most notably the Philippines - that have experienced severe natural events, such as earthquakes and floods, in the recent past. Such disruptions could cause service interruptions or reduce the quality level of the services that we provide, resulting in the payment of contractual penalties to our clients or our clients’ termination of our services, which could reduce our revenues, earnings and cash flow.

Our revenue and earnings are affected by foreign currency exchange rate fluctuations.

While most of our contracts are priced in U.S. dollars, we recognize a substantial amount of revenue under contracts that are denominated in Australian dollars, British pounds, Canadian dollars and euros. A significant increase in the value of the U.S. dollar relative to these currencies may have a material adverse impact on the value of those revenues when translated to U.S. dollars.

Additionally, we serve an increasing number of our U.S.-based clients using contact center capacity outside of the United States, most notably in the Philippines, India, Latin America, Canada and locations throughout EMEA. Although our contracts with U.S.-

Convergys Corporation 2015 Annual Report 9

based clients are typically priced in U.S. dollars, a substantial portion of our costs to provide services under these contracts are denominated in Philippine pesos, Indian rupees, Canadian dollars, Colombian pesos, Egyptian pounds, Costa Rican colon, Honduran lempira, Nicaraguan cordoba and Dominican pesos. Additionally, we have certain client contracts that are priced in Australian dollars, for which a substantial portion of the costs to deliver services are in other currencies. Although we enter into hedging contracts in certain currencies to limit our potential foreign currency exposure, a significant decrease in the value of the U.S. dollar or, in certain cases, the Australian dollar, relative to these currencies could have a material adverse impact on our U.S. dollar operating expenses that are not fully offset by gains realized under our hedging contracts. The impact on our earnings will depend on the timing of our derivative instruments and the movement of the U.S. dollar relative to other currencies.

The cash we hold and our external foreign exchange contracts may be subject to counterparty credit risk.

While we monitor the creditworthiness of the institutions holding our cash, a global economic crisis or credit crisis could weaken the creditworthiness of financial institutions. If one or more of the institutions holding our cash were to experience cash flow problems or were to become subject to insolvency proceedings, we may be unable to recover some or all of our deposited or invested cash. In addition, the counterparties to our hedge transactions are financial institutions or affiliates of financial institutions and our hedging exposure is not secured by collateral. If one or more of these counterparties becomes insolvent and fails to perform their financial obligations under our hedge transactions, our hedging arrangements may not achieve our intended results and our results of operations and cash flow may be adversely affected.

We may be unable to repatriate to the United States cash held in foreign accounts without paying taxes.

As of December 31, 2015, approximately 90% of our cash and short-term investments balance of $216.9 was held in accounts outside of the United States, most of which would be subject to additional taxes if repatriated to the United States. Changes in U.S. tax laws could also subject our cash and short-term investments to tax. Additionally, regulations and laws in the related jurisdictions could further restrict our ability to repatriate these balances.

If we are unable to accurately predict our future tax liabilities or become subject to increased levels of taxation or our tax contingencies are unfavorably resolved, our results of operations and financial condition could be adversely affected.

Due to the global nature of our operations, we are subject to the complex and varying tax laws and rules of several foreign jurisdictions and have material tax-related contingent liabilities that are difficult to predict or quantify. In preparing our financial statements, we calculate our effective income tax rate based on current tax laws and regulations and our estimated taxable income within each of these jurisdictions. Officials in some of the jurisdictions in which we do business, including the United States, have proposed or announced that they are considering tax increases and other revenue raising laws and regulations. Any resulting changes in tax laws or regulations could increase our effective tax rate or impose new restrictions, costs or prohibitions on our current practices and reduce our net income and adversely affect our cash flows.

We are also subject to tax audits, including with respect to transfer pricing, in the United States and other jurisdictions and our tax positions may be challenged by local tax authorities. While we believe that our current tax provisions are reasonable and appropriate, there can be no assurance that these items will be settled for the amounts accrued, that additional tax exposures will not be identified in the future or that additional tax reserves will not be necessary for any such exposures. Any increase in the amount of taxation incurred as a result of challenges to our tax filing positions could result in a material adverse effect on our business, results of operations and financial condition.

Our results of operations could be adversely affected by litigation and other commitments and contingencies.

We face risks arising from various unasserted and asserted claims, including, but not limited to, commercial, tax and patent infringement claims. Unfavorable outcomes in pending or future litigation or the settlement of asserted claims could negatively affect us.

In the ordinary course of business, we may make certain commitments, including representations, warranties and indemnities relating to current and past operations and divested businesses, and issue guarantees of third party obligations. The amounts of such commitments can only be estimated, and the actual amounts for which we are responsible may differ materially from our estimates.

If we incur liability as a result of any current or future litigation, commitments or contingencies and such liability exceeds any amounts accrued, our business, results of operations and financial condition could be adversely affected.

Convergys Corporation 2015 Annual Report 10

We are susceptible to business and political risks from our international operations that could result in reduced revenues or earnings.

We operate a global business and have facilities located throughout North and South America, EMEA and the Asia-Pacific region, including China. Conducting business internationally exposes us to certain risks including currency fluctuations, longer payment cycles, greater difficulties in accounts receivable collection, difficulties in complying with differing laws across many jurisdictions, changing legal and regulatory requirements and the interpretation and enforcement of such requirements, difficulties in staffing and managing foreign operations, inflation, political instability, compliance with anti-bribery and anti-corruption regulations and potentially adverse tax consequences.

As North American companies require additional offshore customer management outsourcing capacity, we expect to continue international expansion through start-up operations and acquisitions. In addition to the risks described above, expansion of our existing international operations and entry into additional countries may divert management attention from our existing operations and require significant financial resources. If we are unable to manage the risks associated with our international operations and expanding such operations, our business could be adversely affected and our revenues and earnings could be reduced.

Our business is subject to many regulatory requirements, and changes in current regulations or their interpretation and enforcement, or the adoption of new regulations could significantly increase our cost of doing business.

Our business is subject to many laws and regulatory requirements in the United States and the foreign countries in which we operate, covering such matters as labor relations, health care requirements, trade restrictions, tariffs, taxation, sanctions, data privacy, consumer protection (including the method and timing of placing outbound telephone calls and the recording or monitoring of telephone calls), internal and disclosure control obligations, governmental affairs and immigration. Many of these regulations, including those related to data privacy, change frequently and sometimes conflict among the various jurisdictions and countries in which we provide services. Violations of any laws and regulations to which we are subject, including failing to adhere to or successfully implement processes in response to changing regulatory requirements, could result in liability for damages, fines, criminal prosecution, unfavorable publicity and damage to our reputation, and restrictions on our ability to operate, which could have a material adverse effect on our business, results of operations and financial condition.

In particular, because a substantial portion of our operating costs consist of labor costs, changes in governmental regulations (particularly in the foreign jurisdictions in which we operate) relating to wages, healthcare and healthcare reform and other benefits or employment taxes, or violations of such regulations, could have a material adverse effect on our business, results of operations or financial condition.

In addition, in recent years, politicians have discussed and debated worldwide competitive sourcing, labor-related legislation and information-flow restrictions, particularly from the United States to offshore locations. If Federal or state legislation is adopted that restricts or discourages U.S. companies from outsourcing services outside of the United States, it could have an adverse effect on our business, results of operations and financial condition.

If we do not effectively manage our capacity, our results of operations could be adversely affected.

Our ability to profit from the demand for outsourcing depends largely on how effectively we manage our contact center capacity. Although we periodically assess the expected long-term capacity utilization of our contact centers based, in part, on expected client demand for our services, we may be unsuccessful at achieving or maintaining optimal utilization of our contact center capacity. To create additional capacity necessary to accommodate new or expanded outsourcing projects, we may open new contact centers or expand existing contact centers that create idle capacity until we fully implement new or expanded programs for our clients. Furthermore, we may, if deemed necessary, consolidate, close or partially close underperforming contact centers to maintain or improve targeted utilization and margins.

We also may experience short- or long-term fluctuations in client demand for services performed in one or more of our contact centers. A short-term decline in demand may result in less than optimal site utilization for a period of time, while a long-term decline in demand may result in site closures. As a result, we may not achieve or maintain targeted site utilization levels or site utilization levels may decrease from time to time, and our profitability may suffer as a result.

If we are unable to hire and retain qualified personnel, our ability to execute our business plans could be impaired and our revenues could decrease.

We employ approximately 130,000 employees worldwide. From time to time, we experience difficulties in hiring personnel with the desired levels of training or experience. Additionally, quality service depends on our ability to retain employees and control

Convergys Corporation 2015 Annual Report 11

personnel turnover. Any increase in our employee turnover rate could increase recruiting and training costs and could decrease operating effectiveness and productivity. We may be unable to continue to hire, train and retain a sufficient number of qualified personnel to adequately staff new client projects.

The inability or unwillingness of clients that represent a large portion of our accounts receivable balance to timely pay such balances could adversely affect our business.

We often carry significant accounts receivable balances from a limited number of clients that generate a large portion of our revenues. A client may become unable or unwilling to timely pay its balance due to a general economic slowdown, economic weakness in its industry or the financial insolvency of its business. While we closely monitor our accounts receivable balances, a client’s financial inability or unwillingness, for any reason, to pay a large accounts receivable balance or many clients’ inability or unwillingness to pay accounts receivable balances that are large in the aggregate would adversely impact our income and cash flow.

We may incur material restructuring charges in the future.

We continually evaluate ways to reduce our operating expenses and adapt to changing industry and market conditions through new restructuring opportunities, including more effective utilization of our assets, workforce, and operating facilities. We have recorded restructuring charges in the past related to involuntary employee terminations, facility closures, and other restructuring activities, and we may incur material restructuring charges in the future. The risk that we incur material restructuring charges may be heightened during economic downturns or with expanded global operations.

We may incur non-cash goodwill impairment charges in the future.

As a result of past acquisitions, we carry a significant goodwill balance on our balance sheet. We test goodwill for impairment annually as of October 1 and at other times if events have occurred or circumstances exist that indicate the carrying value of goodwill may no longer be recoverable. There can be no assurance that we will not incur impairment charges in the future, particularly in the event of a prolonged economic slowdown. See Note 6 of the Notes to Consolidated Financial Statements.

Our controls and procedures may not prevent or detect all errors or acts of fraud.

Disclosure controls and procedures and internal controls and procedures can provide only reasonable, not absolute, assurance that the objectives of the control system are met. The design of controls must consider the benefits of controls relative to their costs, and controls cannot assure that judgments in decision-making will not be faulty or that breakdowns will not occur because of simple error or mistake. Additionally, controls can be circumvented by the unauthorized acts of one or more persons acting individually or by collusion. Furthermore, while controls are designed with the intent of providing reasonable assurance of the effectiveness of the controls, the design is based, in part, upon certain assumptions about the likelihood of future events, and such assumptions, while reasonable, may not take into account all potential future conditions. Accordingly, because of the inherent limitations of a cost-effective control system, misstatements due to error or fraud may occur and may not be prevented or detected. Such misstatements could result in a loss of investor confidence in the accuracy and completeness of our financial reports and other disclosures, which could have an adverse effect on the trading price of our common shares.

The trading price of our common shares may be volatile.

The trading price of our common shares has been and may be subject to substantial fluctuations over short and long periods of time. The trading prices of stocks in the outsourced customer contact management services industry have experienced volatility in recent years, which could affect the market price of our common shares even if we have strong financial results or performance. Various factors can impact the trading price of our common shares, including general economic conditions, changes or volatility in the financial markets, changing market conditions in the outsourced customer contact management services industry, quarterly variations in our financial results, the announcement of acquisitions or divestitures, strategic partnerships or new product offerings, and changes in financial estimates and recommendations by securities analysts. Many of these factors are outside of our control and there can be no assurance that the trading price of our common shares will not decline or fluctuate substantially in the future.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

Convergys Corporation 2015 Annual Report 12

ITEM 2. PROPERTIES

Our principal executive offices are located at 201 East Fourth Street, Cincinnati, Ohio 45202, and the telephone number at that address is (513) 723-7000. We own office facilities in Jacksonville, Florida, Pueblo, Colorado, Ogden, Utah and Orlando, Florida.

We lease space for our corporate headquarters, offices, data centers and contact centers. Domestic facilities are located in Arizona, Colorado, Florida, Georgia, Idaho, Iowa, Kansas, Kentucky, Massachusetts, Minnesota, Missouri, Nebraska, New Mexico, New York, North Carolina, Ohio, Oregon, Tennessee, Texas, Utah and Wisconsin. International facilities are located in Brazil, Bulgaria, Canada, China, Colombia, Costa Rica, Dominican Republic, Egypt, El Salvador, France, Germany, Honduras, India, Indonesia, Ireland, Italy, Malaysia, the Netherlands, Nicaragua, the Philippines, Poland, Singapore, Spain, South Africa, Sweden, Tunisia, the United Arab Emirates, and the United Kingdom. Upon the expiration or termination of any such leases, we believe we could obtain comparable office space.

We also lease some of the computer hardware, computer software and office equipment necessary to conduct our business. In addition, we own computer hardware, communications equipment, software and leasehold improvements. We depreciate these assets using the straight-line method over the estimated useful lives of the assets. Leasehold improvements are depreciated over the shorter of their estimated useful life or the term of the associated lease.

We believe that our facilities and equipment are adequate and have sufficient productive capacity to meet our current needs.

ITEM 3. LEGAL PROCEEDINGS

For a discussion of legal proceedings, see Note 11 of the Notes to Consolidated Financial Statements.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

Convergys Corporation 2015 Annual Report 13

ITEM 4A. EXECUTIVE OFFICERS OF THE REGISTRANT

As of February 23, 2016, our Executive Officers were:

|

| | |

Name | Age | Title |

Andrea J. Ayers (a) | 52 | President and Chief Executive Officer |

Andre S. Valentine | 52 | Chief Financial Officer |

Jarrod B. Pontius | 44 | General Counsel and Chief Administrative Officer |

Marjorie M. Connelly | 54 | Chief Operating Officer |

(a) Member of the Board of Directors | | |

Officers are appointed annually, but are removable at the discretion of the Board of Directors.

ANDREA J. AYERS, President and Chief Executive Officer since November 2012; President and Chief Operating Officer, Customer Management, 2010-2012; President, Customer Management, 2008-2012; President, Relationship Technology Management, 2007-2008; President, Government and New Markets, 2005-2007.

ANDRE S. VALENTINE, Chief Financial Officer since August 2012; Senior Vice President of Finance, Customer Management, 2010-2012 and 2002-2009; Senior Vice President, Controller, 2009-2010; Vice President, Controller, 1998-2002.

JARROD B. PONTIUS, General Counsel and Chief Administrative Officer since July 2015; Deputy General Counsel and Corporate Secretary, 2012-2015; Vice President, Chief Legal Officer and Secretary, Kendle International 2009-2011.

MARJORIE M. CONNELLY, Chief Operating Officer since November 2014; Interim President, Longwood College, 2012-2013; Global Chief Operating Officer, Barclaycard, 2009-2011; Chief Operating Officer, Wachovia Securities 2006-2008.

PART II

ITEM 5. MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Convergys Corporation’s common shares, no par value, are listed on the New York Stock Exchange under the symbol “CVG.” As of January 31, 2016, there were 7,115 holders of record of the 96,585,169 common shares of Convergys outstanding.

The high, low and closing prices of our common shares for each quarter in 2015 and 2014 are listed below:

|

| | | | | | | | | | | | | | | |

Quarter | 1st | | 2nd | | 3rd | | 4th |

2015 | | | | | | | |

High | $ | 23.01 |

| | $ | 26.56 |

| | $ | 26.22 |

| | $ | 26.60 |

|

Low | 18.81 |

| | 22.32 |

| | 20.57 |

| | 22.60 |

|

Close | 22.87 |

| | 25.49 |

| | 23.11 |

| | 24.89 |

|

2014 | | | | | | | |

High | $ | 24.43 |

| | $ | 24.26 |

| | $ | 21.96 |

| | $ | 21.51 |

|

Low | 18.83 |

| | 20.56 |

| | 17.69 |

| | 17.36 |

|

Close | 21.91 |

| | 21.44 |

| | 17.82 |

| | 20.37 |

|

During 2014 and 2015, the Company’s Board of Directors approved, and the Company paid, the following dividends per common share:

Convergys Corporation 2015 Annual Report 14

|

| | | |

Announcement Date | Record Date | Dividend Amount | Payment Date |

February 5, 2014 | March 21, 2014 | $0.06 | April 4, 2014 |

May 12, 2014 | June 19, 2014 | $0.07 | July 3, 2014 |

August 11, 2014 | September 19, 2014 | $0.07 | October 3, 2014 |

November 5, 2014 | December 26, 2014 | $0.07 | January 9, 2015 |

February 18, 2015 | March 20, 2015 | $0.07 | April 3, 2015 |

May 5, 2015 | June 18, 2015 | $0.08 | July 2, 2015 |

August 4, 2015 | September 18, 2015 | $0.08 | October 2, 2015 |

November 4, 2015 | December 24, 2015 | $0.08 | January 8, 2016 |

On February 23, 2016, the Company announced that its Board of Directors declared a quarterly cash dividend of $0.08 per common share to be paid on April 8, 2016 to shareholders of record as of March 24, 2016.

The Board expects that future cash dividends will be paid on a quarterly basis. However, any decision to pay future cash dividends will be subject to Board approval, and will depend on the Company’s future earnings, cash flow, financial condition, financial covenants and other relevant factors.

We repurchased 3.1 of our common shares for $72.5 during 2015, as summarized in the following table:

|

| | | | | | |

| Shares repurchased | | Average price per share |

January 2015 | 311,479 |

| | $ | 19.80 |

|

February 2015 | 250,556 |

| | 21.11 |

|

March 2015 | 293,242 |

| | 22.30 |

|

April 2015 | 249,903 |

| | 23.02 |

|

May 2015 | 205,622 |

| | 24.10 |

|

June 2015 | 155,064 |

| | 25.35 |

|

July 2015 | 168,634 |

| | 25.36 |

|

August 2015 | 331,415 |

| | 22.92 |

|

September 2015 | 361,047 |

| | 22.87 |

|

October 2015 | 267,810 |

| | 24.90 |

|

November 2015 | 247,294 |

| | 25.34 |

|

December 2015 | 268,100 |

| | 25.26 |

|

Total | 3,110,166 |

| | $ | 23.30 |

|

All share repurchases were made pursuant to publicly announced programs. At December 31, 2015, the Company had the authority to repurchase an additional $214.7 of outstanding common shares pursuant to current authorizations. The timing and terms of any future transactions will depend on a number of considerations including market conditions, our available liquidity and capital needs, and limits on share repurchases that may be applicable under the covenants in our credit agreement.

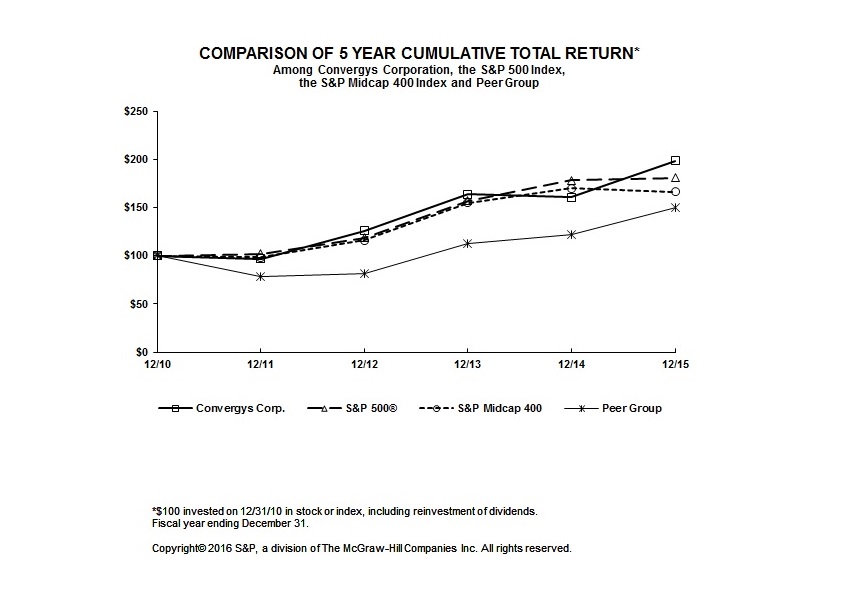

Performance Graph

The following Performance Graph compares, for the period from December 31, 2010 through December 31, 2015, the percentage change of the cumulative total shareholder return on the Company’s common shares with the cumulative total return of the S&P Midcap 400 Stock Index, the S&P 500 Stock Index and a Peer Group. The Peer Group consists of Atento SA, Sykes Enterprises Inc., Teleperformance and Teletech Holdings Inc.

Convergys elected to replace the S&P 500 Stock Index with the S&P Midcap 400 Stock Index as it is more representative of companies with market capitalizations that are comparable to Convergys’. The median market capitalization of the S&P Midcap 400 Stock Index was $3,349.1 as of December 31, 2015.

Convergys Corporation 2015 Annual Report 15

|

| | | | | | | | | | | | | | | | | | |

| Dec-10 | Dec-11 | Dec-12 | Dec-13 | Dec-14 | Dec-15 |

Convergys Corporation | $ | 100.00 |

| $ | 96.96 |

| $ | 125.80 |

| $ | 163.45 |

| $ | 160.29 |

| $ | 198.37 |

|

S&P 500 | $ | 100.00 |

| $ | 102.11 |

| $ | 118.45 |

| $ | 156.82 |

| $ | 178.29 |

| $ | 180.75 |

|

S&P Midcap 400 | $ | 100.00 |

| $ | 98.27 |

| $ | 115.84 |

| $ | 154.64 |

| $ | 169.75 |

| $ | 166.05 |

|

Peer Group | $ | 100.00 |

| $ | 78.07 |

| $ | 81.48 |

| $ | 112.51 |

| $ | 122.21 |

| $ | 149.60 |

|

Copyright© 2016 Standard & Poor’s, a division of McGraw-Hill Financial. All rights reserved. (www.researchdatagroup.com/S&P.htm)

Convergys Corporation 2015 Annual Report 16

ITEM 6. SELECTED FINANCIAL DATA

|

| | | | | | | | | | | | | | | |

(Amounts in millions except per share amounts) | 2015 |

| 2014 |

| 2013 |

| 2012 |

| 2011 |

|

RESULTS OF OPERATIONS | | | | | |

Revenues | $ | 2,950.6 |

| $ | 2,855.5 |

| $ | 2,046.1 |

| $ | 2,005.0 |

| $ | 1,933.2 |

|

Costs and expenses (1) (2) | 2,756.2 |

| 2,704.7 |

| 1,908.7 |

| 1,966.4 |

| 1,823.1 |

|

Operating Income | 194.4 |

| 150.8 |

| 137.4 |

| 38.6 |

| 110.1 |

|

Earnings and gain from Cellular Partnerships, net | — |

| — |

| — |

| — |

| 285.2 |

|

Other income (expense), net | 0.8 |

| (2.2 | ) | 5.1 |

| 4.3 |

| 9.8 |

|

Interest expense | (18.2 | ) | (19.3 | ) | (11.5 | ) | (13.6 | ) | (16.1 | ) |

Income before Income Taxes | 177.0 |

| 129.3 |

| 131.0 |

| 29.3 |

| 389.0 |

|

Income tax expense (3) | 8.6 |

| 12.8 |

| 72.5 |

| 1.1 |

| 106.5 |

|

Income from Continuing Operations, net of tax | 168.4 |

| 116.5 |

| 58.5 |

| 28.2 |

| 282.5 |

|

Income from Discontinued Operations (4) | 0.6 |

| 3.5 |

| 2.4 |

| 72.4 |

| 52.3 |

|

Net Income | $ | 169.0 |

| $ | 120.0 |

| $ | 60.9 |

| $ | 100.6 |

| $ | 334.8 |

|

Basic Earnings Per Common Share: | | | | | |

Continuing Operations | $ | 1.72 |

| $ | 1.16 |

| $ | 0.57 |

| $ | 0.25 |

| $ | 2.35 |

|

Discontinued Operations | 0.01 |

| 0.03 |

| 0.02 |

| 0.65 |

| 0.44 |

|

Basic Earnings Per Common Share | $ | 1.73 |

| $ | 1.19 |

| $ | 0.59 |

| $ | 0.90 |

| $ | 2.79 |

|

Diluted Earnings Per Common Share: | | | | | |

Continuing Operations | $ | 1.60 |

| $ | 1.10 |

| $ | 0.54 |

| $ | 0.24 |

| $ | 2.30 |

|

Discontinued Operations | 0.01 |

| 0.03 |

| 0.02 |

| 0.62 |

| 0.42 |

|

Net Diluted Earnings Per Common Share | $ | 1.61 |

| $ | 1.13 |

| $ | 0.56 |

| $ | 0.86 |

| $ | 2.72 |

|

Weighted Average Common Shares Outstanding: | | | | | |

Basic | 98.1 |

| 100.7 |

| 103.3 |

| 112.2 |

| 120.2 |

|

Diluted | 104.7 |

| 106.2 |

| 109.2 |

| 117.1 |

| 122.9 |

|

FINANCIAL POSITION | | | | | |

Total Assets | $ | 2,358.1 |

| $ | 2,416.1 |

| $ | 1,956.7 |

| $ | 2,037.9 |

| $ | 2,330.8 |

|

Total debt and capital lease obligations | 340.8 |

| 375.9 |

| 61.1 |

| 60.6 |

| 127.1 |

|

Shareholders’ Equity | 1,276.2 |

| 1,227.2 |

| 1,224.1 |

| 1,371.9 |

| 1,411.5 |

|

OTHER DATA | | | | | |

Net cash flows provided by operating activities | | | | | |

Operating activities of continuing operations | $ | 249.3 |

| $ | 261.0 |

| $ | 208.4 |

| $ | 103.9 |

| $ | 161.4 |

|

Operating activities of discontinued operations | — |

| — |

| 1.6 |

| 9.1 |

| 35.2 |

|

| $ | 249.3 |

| $ | 261.0 |

| $ | 210.0 |

| $ | 113.0 |

| $ | 196.6 |

|

Net cash flows (used in) provided by investing activities | | | | | |

Investing activities of continuing operations | $ | (108.4 | ) | $ | (850.5 | ) | $ | (36.6 | ) | $ | (162.7 | ) | $ | 235.6 |

|

Investing activities of discontinued operations | — |

| — |

| 1.0 |

| 425.3 |

| (13.5 | ) |

| $ | (108.4 | ) | $ | (850.5 | ) | $ | (35.6 | ) | $ | 262.6 |

| $ | 222.1 |

|

Net cash flows (used in) provided by financing activities | | | | | |

Financing activities of continuing operations | $ | (135.1 | ) | $ | 207.6 |

| $ | (148.3 | ) | $ | (242.6 | ) | $ | (183.0 | ) |

Financing activities of discontinued operations | — |

| — |

| — |

| (0.1 | ) | — |

|

| $ | (135.1 | ) | $ | 207.6 |

| $ | (148.3 | ) | $ | (242.7 | ) | $ | (183.0 | ) |

Adjusted EBITDA (5) | $ | 375.0 |

| $ | 356.9 |

| $ | 250.6 |

| $ | 239.5 |

| $ | 220.2 |

|

Adjusted diluted earnings per common share from continuing operations (5) | $ | 1.76 |

| $ | 1.60 |

| $ | 1.10 |

| $ | 0.95 |

| $ | 0.79 |

|

Adjusted free cash flow (5) | $ | 153.4 |

| $ | 208.1 |

| $ | 146.2 |

| $ | 8.4 |

| $ | 108.3 |

|

Convergys Corporation 2015 Annual Report 17

| |

(1) | Costs and expenses include restructuring charges of $7.2, $1.7, $5.4, $11.6 and $1.2 in 2015, 2014, 2013, 2012 and 2011, respectively; gain on sale of real estate of $1.6 in 2014; asset impairment loss of $1.5 and $88.6 in 2013 and 2012, respectively; net pension and other post-employment benefit plan charges of $4.6, $13.1 and $4.1 in 2014, 2013 and 2012, respectively; and transaction and integration expenses of $11.3 and $37.7 in 2015 and 2014, respectively. |

| |

(2) | Costs and expenses also include $8.8 and $23.6 in 2012 and 2011, respectively, of certain costs previously allocated to the Information Management segment that do not qualify as discontinued operations and are reported as costs from continuing operations. The Company took actions to reduce these costs and earned transition service revenues, resulting from services being provided to the buyers subsequent to completion of the sale of Information Management, to offset these costs. |

| |

(3) | Income tax expense in 2013 includes $46.4 of expense to record the deferred tax liability associated with a change in classification for a portion of undistributed earnings of the Company’s foreign subsidiaries. Income tax expense in 2015 and 2014 includes benefits of $1.8 and $6.0, respectively, for changes in estimates related to tax previously accrued for the repatriation of foreign earnings. Income tax expense in 2015 also includes tax benefits of $22.4 associated with statute expirations for previous uncertain tax positions and favorable resolutions of tax audits. |

| |

(4) | Discontinued operations includes the historical financial results of the Information Management business, excluding certain costs referred to in note 2, above, that did not meet the criteria for such presentation. |

| |

(5) | Management uses the following measures that are not defined under accounting principles generally accepted in the United States (U.S. GAAP or GAAP) to monitor and evaluate the underlying performance of the business and believes the presentation of these non-GAAP measures enhances investors’ ability to analyze trends in the business and evaluate the Company’s underlying performance relative to other companies in the industry. |

| |

• | EBITDA is calculated as income from continuing operations, net of tax, plus interest expense, tax expense, depreciation and amortization. Adjusted EBITDA further excludes certain acquisition-related costs and other one-time items. EBITDA and adjusted EBITDA should not be considered in isolation or as a substitute for income from continuing operations, net of tax or other income statement data prepared in accordance with U.S. GAAP, and our presentation of EBITDA and adjusted EBITDA may not be comparable to similarly-titled measures used by other companies. |

| |

• | Adjusted diluted earnings per common share from continuing operations is calculated as diluted earnings per common share from continuing operations plus or minus certain operating charges or credits, along with certain discrete tax expense or benefit adjustments. Management compensates for these limitations by using both the non-GAAP measures, adjusted diluted earnings per common share from continuing operations, and the GAAP measure, diluted earnings per common share from continuing operations, in its evaluation of performance. |

| |

• | Free cash flow is calculated as cash flows from operations less capital expenditures (net of proceeds from disposal) with adjusted free cash flow further excluding certain acquisition-related cash payments associated with investment activity. Management compensates for these limitations by using both the non-GAAP measures, free cash flow and adjusted free cash flow, and the GAAP measure, cash from operating activities, in its evaluation of performance. |

These non-GAAP measures are supplemental in nature and should not be considered in isolation or be construed as being more important than comparable GAAP measures. For more detail and a reconciliation of these non-GAAP measures to the most comparable GAAP measure, see “Results of Operations” and “Financial Condition, Liquidity and Capital Resources” in Part II, Item 7 of this report.

Convergys Corporation 2015 Annual Report 18

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

(Amounts in millions except per share amounts)

BACKGROUND

Convergys Corporation is a global leader in customer management, focused on bringing value to our clients through every customer interaction. Convergys has approximately 130,000 employees working in more than 150 locations in 31 countries, interacting with our clients’ customers in 58 languages. As a global provider in the industry, Convergys has a history of commitment and dedication to excellence in serving many of the world’s largest brands. Our business model allows us to deliver consistent, quality service, at the scale and in the geographies that meet our clients’ business needs and proactively partner to solve client business challenges through our account management model. We leverage our geographic footprint and comprehensive capabilities to help leading companies create quality customer experiences across multiple interaction channels while increasing revenue and reducing their cost to serve. We are a well-capitalized leader in our market and are able to invest in the services, technology, and analytics that matter to our clients and their customers.

Operations and Structure