Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 001-14625 (Host Hotels & Resorts, Inc.)

0-25087 (Host Hotels & Resorts, L.P.)

HOST HOTELS & RESORTS, INC.

HOST HOTELS & RESORTS, L.P.

(Exact Name of Registrant as Specified in Its Charter)

| Maryland (Host Hotels & Resorts, Inc.) Delaware (Host Hotels & Resorts, L.P.) |

53-0085950 (Host Hotels & Resorts, Inc.) 52-2095412 (Host Hotels & Resorts, L.P.) | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) | |

| 6903 Rockledge Drive, Suite 1500 Bethesda, Maryland |

20817 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

(240) 744-1000

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |||

| Host Hotels & Resorts, Inc. | Common Stock, $.01 par value (726,697,966 shares outstanding as of February 21, 2013) | New York Stock Exchange | ||

| Host Hotels & Resorts, L.P. | None | None |

Securities registered pursuant to Section 12(g) of the Act:

| Host Hotels & Resorts, Inc. |

None | |

| Host Hotels & Resorts, L.P. |

Units of limited partnership interest (721,213,932 units outstanding as of February 21, 2013) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

| Host Hotels & Resorts, Inc. |

Yes | x | No | ¨ | ||||

| Host Hotels & Resorts, L.P. |

Yes | ¨ | No | x |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

| Host Hotels & Resorts, Inc. |

Yes | ¨ | No | x | ||||

| Host Hotels & Resorts, L.P. |

Yes | ¨ | No | x |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

| Host Hotels & Resorts, Inc. |

Yes | x | No | ¨ | ||||

| Host Hotels & Resorts, L.P. |

Yes | x | No | ¨ |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

| Host Hotels & Resorts, Inc. |

Yes | x | No | ¨ | ||||

| Host Hotels & Resorts, L.P. |

Yes | x | No | ¨ |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Host Hotels & Resorts, Inc.

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | (Do not check if a smaller reporting company) ¨ | Smaller reporting company | ¨ | |||

Host Hotels & Resorts, L.P.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | (Do not check if a smaller reporting company) x | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

| Host Hotels & Resorts, Inc. |

Yes | ¨ | No | x | ||||

| Host Hotels & Resorts, L.P. |

Yes | ¨ | No | x |

The aggregate market value of common shares held by non-affiliates of Host Hotels & Resorts, Inc. (based on the closing sale price on the New York Stock Exchange) on June 15, 2012 was $10,911,508,776.

Documents Incorporated by Reference

Portions of Host Hotels & Resorts, Inc.’s definitive proxy statement to be filed with the Securities and Exchange Commission and delivered to stockholders in connection with its annual meeting of stockholders to be held on May 16, 2013 are incorporated by reference into Part III of this Form 10-K.

Table of Contents

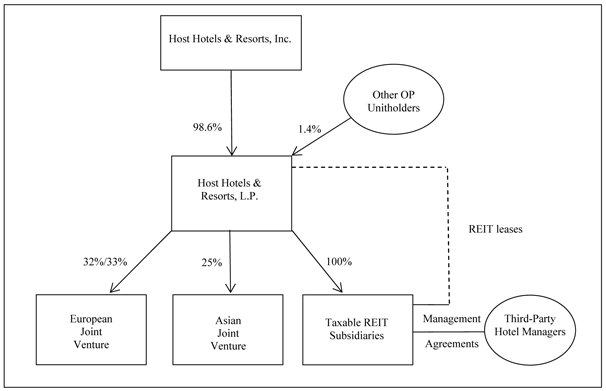

EXPLANATORY NOTE

This report combines the annual reports on Form 10-K for the fiscal year ended December 31, 2012 of Host Hotels & Resorts, Inc. and Host Hotels & Resorts, L.P. Unless stated otherwise or the context otherwise requires, references to “Host Inc.” mean Host Hotels & Resorts, Inc., a Maryland corporation, and references to “Host L.P.” mean Host Hotels & Resorts, L.P., a Delaware limited partnership, and its consolidated subsidiaries. We use the terms “we” or “our” or “the company” to refer to Host Inc. and Host L.P. together, unless the context indicates otherwise. We use the term Host Inc. to specifically refer to Host Hotels & Resorts, Inc. and the term Host L.P. to specifically refer to Host Hotels & Resorts, L.P. (and its consolidated subsidiaries) in cases where it is important to distinguish between Host Inc. and Host L.P. Host Inc. owns properties and conducts operations through Host L.P., of which Host Inc. is the sole general partner and of which it holds approximately 98.6% of the partnership interests (“OP units”) as of December 31, 2012. The remaining approximate 1.4% partnership interests are owned by various unaffiliated limited partners. As the sole general partner of Host L.P., Host Inc. has the exclusive and complete responsibility for Host L.P.’s day-to-day management and control.

We believe combining the annual reports on Form 10-K of Host Inc. and Host L.P. into this single report results in the following benefits:

| • | enhances investors’ understanding of Host Inc. and Host L.P. by enabling investors to view the business as a whole in the same manner as management views and operates the business; |

| • | eliminates duplicative disclosure and provides a more streamlined presentation, since a substantial portion of our disclosure applies to both Host Inc. and Host L.P.; and |

| • | creates time and cost efficiencies through the preparation of one combined report instead of two separate reports. |

Management operates Host Inc. and Host L.P. as one enterprise. The management of Host Inc. consists of the same members who direct the management of Host L.P. The executive officers of Host Inc. are appointed by Host Inc.’s board of directors, but are employed by Host L.P. Host L.P. employs everyone who works for Host Inc. or Host L.P. As general partner with control of Host L.P., Host Inc. consolidates Host L.P. for financial reporting purposes, and Host Inc. does not have significant assets other than its investment in Host L.P. Therefore, the assets and liabilities of Host Inc. and Host L.P. are the same on their respective financial statements.

There are a few differences between Host Inc. and Host L.P., which are reflected in the disclosure in this report. We believe it is important to understand the differences between Host Inc. and Host L.P. in the context of how Host Inc. and Host L.P. operate as an interrelated consolidated company. Host Inc. is a real estate investment trust, or REIT, and its only material asset is its ownership of partnership interests of Host L.P. As a result, Host Inc. does not conduct business itself, other than acting as the sole general partner of Host L.P., and issuing public equity from time to time, the proceeds from which are contributed to Host L.P. in exchange for OP units. Host Inc. itself does not issue any indebtedness and does not guarantee the debt or obligations of Host L.P. Host L.P. holds substantially all of our assets and holds the ownership interests in our joint ventures. Host L.P. conducts the operations of the business and is structured as a limited partnership with no publicly traded equity. Except for net proceeds from public equity issuances by Host Inc., Host L.P. generates the capital required by our business through Host L.P.’s operations, by Host L.P.’s direct or indirect incurrence of indebtedness, or through the issuance of OP units.

The substantive difference between the filings of Host Inc. and Host L.P. is that Host Inc. is a REIT with public stock, while Host L.P. is a partnership with no publicly traded equity. In the financial statements, this difference primarily is reflected in the equity (or partners’ capital for Host L.P.) section of the consolidated balance sheets and in the consolidated statements of equity (or partners’ capital) and in the consolidated statements of operations and comprehensive income (loss) with respect to the manner in which income is allocated to non-controlling interests. Income allocable to the holders of approximately 1.4% of the OP units is reflected as income allocable to non-controlling interests at Host Inc. and within net income at Host L.P. Also, earnings per share generally will be slightly less than the earnings per OP unit, as each Host Inc. common share is the equivalent of .97895 OP units (instead of 1 OP unit). Apart from these differences, the financial statements of Host Inc. and Host L.P. are nearly identical.

i

Table of Contents

To help investors understand the differences between Host Inc. and Host L.P., this report presents the following separate sections or portions of sections for each of Host Inc. and Host L.P.:

| • | Part II Item 5 – Market for Registrant’s Common Stock, Related Stockholder Matters and Issuer Purchases of Equity Securities for Host Inc. / Market for Registrant’s Common Units, Related Unitholder Matters and Issuer Purchases of Equity Securities for Host L.P.; |

| • | Part II Item 6 – Selected Financial Data; |

| • | Part II Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations is combined, except for a separate discussion of material differences, if any, in the liquidity and capital resources between Host Inc. and Host L.P.; |

| • | Part II Item 7A – Quantitative and Qualitative Disclosures about Market Risk is combined, except for separate discussions of material differences, if any, between Host Inc. and Host L.P.; and |

| • | Part II Item 8 – Consolidated Financial Statements and Supplementary Data. While the financial statements themselves are presented separately, the notes to the financial statements generally are combined, except for separate discussions of differences between equity of Host Inc. and capital of Host L.P. |

This report also includes separate Item 9A. Controls and Procedures sections and separate Exhibit 31 and 32 certifications for each of Host Inc. and Host L.P. in order to establish that the Chief Executive Officer and the Chief Financial Officer of Host Inc. and the Chief Executive Officer and the Chief Financial Officer of Host Inc. as the general partner of Host L.P. have made the requisite certifications and that Host Inc. and Host L.P. are compliant with Rule 13a-15 or Rule 15d-15 of the Securities Exchange Act of 1934 and 18 U.S.C. §1350.

ii

Table of Contents

HOST HOTELS & RESORTS, INC. AND HOST HOTELS & RESORTS, L.P.

| Page | ||||||

| Part I | ||||||

| Item 1. | 1 | |||||

| Item 1A. | 16 | |||||

| Item 1B. | 33 | |||||

| Item 2. | 33 | |||||

| Item 3. | 34 | |||||

| Item 4. | 34 | |||||

| Part II | ||||||

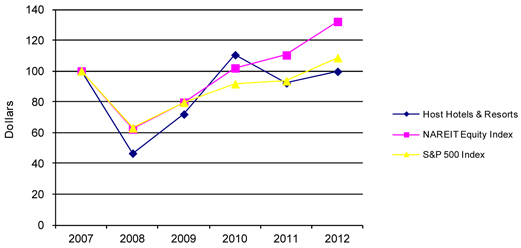

| Item 5. | 37 | |||||

| 39 | ||||||

| Item 6. | 40 | |||||

| 41 | ||||||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

42 | ||||

| Item 7A. | 91 | |||||

| Item 8. | 94 | |||||

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

150 | ||||

| Item 9A. | 150 | |||||

| Item 9B. | 151 | |||||

| Part III | ||||||

| Item 10. | 152 | |||||

| Item 11. | 152 | |||||

| Item 12. | 152 | |||||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence |

152 | ||||

| Item 14. | 152 | |||||

| Part IV | ||||||

| Item 15. | 153 | |||||

iii

Table of Contents

Forward Looking Statements

Our disclosure and analysis in this 2012 Form 10-K and in Host Inc.’s 2012 Annual Report to stockholders contain some forward-looking statements that set forth anticipated results based on management’s plans and assumptions. From time to time, we also provide forward-looking statements in other materials we release to the public. Such statements give our current expectations or forecasts of future events; they do not relate strictly to historical or current facts. We have tried, wherever possible, to identify each such statement by using words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “will,” “target,” “forecast” and similar expressions in connection with any discussion of future operating or financial performance. In particular, these forward-looking statements include those relating to future actions, future acquisitions or dispositions, future capital expenditure plans, future performance or results of current and anticipated expenses, interest rates, foreign exchange rates or the outcome of contingencies, such as legal proceedings.

We cannot guarantee that any future results discussed in any forward-looking statements will be realized, although we believe that we have been prudent in our plans and assumptions. Achievement of future results is subject to risks, uncertainties and potentially inaccurate assumptions, including those discussed in Item 1A “Risk Factors.” Should known or unknown risks or uncertainties materialize, or should underlying assumptions prove inaccurate, actual results could differ materially from past results and those results anticipated, estimated or projected. You should bear this in mind as you consider forward-looking statements.

We undertake no obligation to publicly update forward-looking statements, whether as a result of new information, future events or otherwise. You are advised, however, to consult any further disclosures we make or related subjects in our reports on Form 10-Q and Form 8-K that we file with the Securities and Exchange Commission (“SEC”). Also note that, in our risk factors, we provide a cautionary discussion of risks, uncertainties and possibly inaccurate assumptions relevant to our business. These are factors that, individually or in the aggregate, we believe could cause our actual results to differ materially from past results and those results anticipated, estimated or projected. We note these factors for investors as permitted by the Private Securities Litigation Reform Act of 1995. It is not possible to predict or identify all such risk factors. Consequently, you should not consider the discussion of risk factors to be a complete discussion of all of the potential risks or uncertainties that could affect our business.

| Item 1. | Business |

Host Inc. was incorporated as a Maryland corporation in 1998 and operates as a self-managed and self-administered REIT. Host Inc. owns properties and conducts operations through Host L.P., of which Host Inc. is the sole general partner and in which it holds approximately 98.6% of the partnership interests (“OP units”) as of December 31, 2012. The remaining approximate 1.4% partnership interests are owned by various unaffiliated limited partners. Host Inc. has the exclusive and complete responsibility for Host L.P.’s day-to-day management and control.

As of February 25, 2013, our consolidated lodging portfolio consists of 118 primarily luxury and upper-upscale hotels containing approximately 62,600 rooms, with the majority located in the United States, and 15 properties located outside of the U.S. in Canada, New Zealand, Chile, Australia, Mexico and Brazil. We also are developing two hotels in Rio de Janeiro, Brazil. In addition, we own non-controlling interests in two international joint ventures: a joint venture in Europe, which owns 19 luxury and upper upscale hotels with approximately 6,100 rooms in France, Italy, Spain, The Netherlands, the United Kingdom, Belgium, Poland and Germany; and a joint venture in Asia/Pacific, which owns one hotel in Australia and minority interests in two operating hotels in India and five additional hotels in India currently under development. Our other real estate joint ventures include the development of a 225-room Hyatt Place in Nashville, Tennessee, and the development of a 131–unit vacation ownership project in Maui, Hawaii adjacent to our Hyatt Regency Maui Resort & Spa.

1

Table of Contents

The Lodging Industry

The lodging industry in the United States consists of private and public entities that operate in an extremely diversified market under a variety of brand names. The lodging industry has several key participants:

| • | Owners – own the hotel and typically enter into an agreement for an independent third party to manage the hotel. These properties may be branded and operated under the manager’s brand or branded under a franchise agreement and operated by the franchisee or by an independent hotel manager. The properties also may be operated as an independent hotel by an independent hotel manager. |

| • | Owner/Managers – own the hotel and operate the property with their own management team. These properties may be branded under a franchise agreement, operated as an independent hotel or operated under the owner’s brand. We are prohibited from operating and managing hotels under applicable REIT rules. |

| • | Franchisors – own a brand or brands and strive to grow their revenues by expanding the number of hotels in their franchise system. Franchisors provide their hotels with brand recognition, marketing support and centralized reservation systems for the franchised hotels. |

| • | Franchisor/Managers – own a brand or brands and also operate hotels on behalf of the hotel owner or franchisee. |

| • | Managers – operate hotels on behalf of the hotel owner, but do not, themselves, own a brand. The hotels may be operated under a franchise agreement or as an independent hotel. |

The hotel manager is responsible for the day-to-day operation of the hotel, including the employment of hotel staff, the determination of room rates, the development of sales and marketing plans, the preparation of operating and capital expenditure budgets and the preparation of financial reports for the owner. They typically receive fees based on the revenues and profitability of the hotel.

Revenue per available room (“RevPAR”) is an operational measure commonly used in the hotel industry to evaluate hotel performance. RevPAR represents the product of the average daily room rate (“ADR”) charged and the average daily occupancy achieved, but excludes other revenue generated by a hotel property, such as food and beverage, parking and other revenues. ADR reflects the average rate charged by hotels. Average rates can be influenced by, among other things, demand, previously negotiated contracts, the overall mix of business and new supply in a given market.

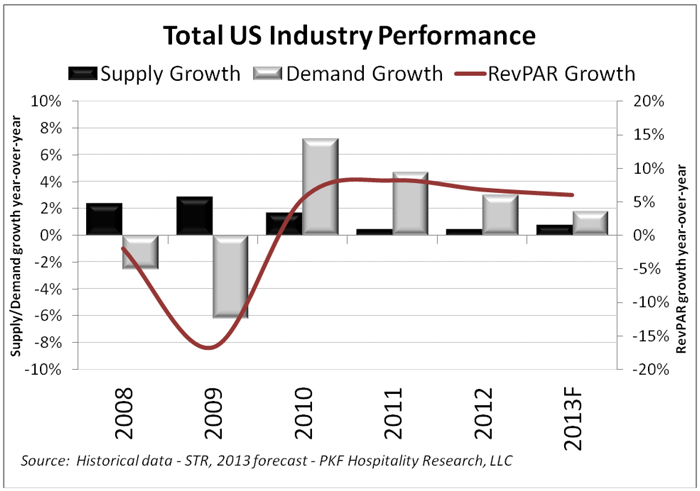

Our industry is influenced by the cyclical relationship between the supply of and demand for hotel rooms. Lodging demand growth typically is related to the vitality of the overall economy, in addition to local market factors that stimulate travel to specific destinations. In particular, economic indicators such as GDP growth, business investment and employment growth are some of the primary drivers of lodging demand. Between 2003 and 2007, broad growth in the economy led to increases in demand. However, the global recession of 2008 through 2009 resulted in a considerable decline in both consumer and business spending and a severe decline in demand within the lodging industry. While lodging demand has not recovered fully from the steep declines in those years, the gradual recovery that began in 2010 has continued through 2012, led by transient demand from business and leisure travelers. We expect demand to continue to improve in 2013, though the rate of growth may be affected by uncertainty in the direction of both the domestic and global economy.

Lodging supply growth generally is driven by overall lodging demand, as extended periods of strong demand growth tend to encourage new development. However, the rate of supply growth also is influenced by a number of additional factors, including the availability of capital, interest rates, construction costs and unique market considerations. The relatively long lead-time required to complete the development of hotels makes supply growth easier to forecast than demand growth, but increases the volatility of the cyclical behavior of the lodging industry. As illustrated in the charts below, at different points in the cycle, demand may increase when there is no new supply or supply may grow when demand is declining. The decline in lodging demand during the recession of 2008 through

2

Table of Contents

2009 and the lack of available financing for new hotel construction caused a significant reduction in hotel development. As a result, supply growth was relatively low in 2010 through 2012, and we expect growth through 2013 to continue to be below the historical growth rate of 2% (based on data from Smith Travel Research over the past 25 years).

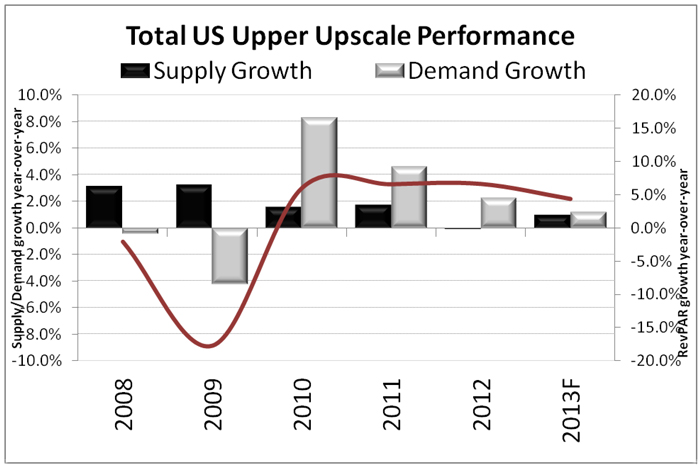

We anticipate that demand growth will exceed supply growth in the near term, resulting in continued RevPAR growth, which is consistent with analysis prepared by PKF Hospitality Research. Occupancy levels in the upper-upscale market are currently close to their 15-year average. Therefore, while there is still potential for occupancy growth, we believe RevPAR growth will primarily be driven by increases in average room rate. However, the pace of economic recovery and general market uncertainty will continue to impact negatively the pace of improvement in the industry. Therefore, there can be no assurance that any increases in hotel revenues or earnings at our properties or improvement in margins will continue for any number of reasons, including those listed above.

The charts below detail the historical supply, demand and RevPAR growth for the U.S. lodging industry and for the upper upscale segment for 2008 to 2012 and forecast data for 2013. Our portfolio primarily consists of upper upscale hotels and, accordingly, its performance is best understood in comparison to the upper upscale segment rather than the entire industry.

U.S. Lodging Industry Supply, Demand and RevPAR Growth

3

Table of Contents

U.S. Upper Upscale Supply, Demand and RevPAR Growth

Business Strategy

Our primary long-term business objective is to provide superior total returns to our equity holders through a combination of appreciation in asset values, growth in earnings and dividend distributions. To achieve this objective, we seek to:

| • | drive operating results at our properties through aggressive asset management; |

| • | acquire properties in urban and resort/conference destinations that are operated by leading management companies. We will continue to focus on target markets and gateway cities (such as New York, Washington, D.C., Boston, Miami, Chicago, Los Angeles, San Francisco, San Diego and Seattle), which we believe have strong demand generators that appeal to multiple customer segments and have high barriers to entry that limit new supply. While our focus will remain primarily on luxury and upper upscale properties, we will remain opportunistic and may acquire or develop hotels in other lodging segments or markets; |

| • | strategically invest in major redevelopment and return on investment (“ROI”) projects in order to maximize the inherent value in our portfolio; |

| • | maintain a strong balance sheet with a low leverage level and balanced debt maturities in order to minimize our cost of capital and to maximize our financial flexibility in order to take advantage of opportunities throughout the lodging cycle; |

| • | expand our global portfolio holdings and revenue sources through joint ventures or direct acquisitions that diversify our investments; and |

| • | recycle capital through the disposition of assets to better align our portfolio within our target gateway markets. We also may opportunistically dispose of hotels to take advantage of market conditions or in situations where the hotels are at a competitive risk. |

4

Table of Contents

Acquisitions and New Development. Our acquisition strategy focuses on acquiring hotels at attractive yields that exceed our cost of capital in our target markets. These markets consist of gateway cities in the U.S. and in key international cities that are positioned to attract premium corporate, leisure and international travelers, while, at the same time, have significant barriers to entry. Based on historical trends, we believe these markets will have favorable long-term supply and demand dynamics and consequently better potential for revenue growth. In the U.S., we will focus primarily on acquiring upper upscale and luxury hotels and secondarily, developing midscale and upscale hotels with strategic partners in these target markets. Our efforts in Europe will be to acquire upper upscale and luxury hotels in our target markets, such as London, Paris and Munich. In the Asia-Pacific and Latin America regions, we will concentrate on both the acquisition of upper upscale and luxury hotels and the development of midscale and upscale hotels in our target markets, such as Australia and Brazil.

Redevelopment and Return on Investment Projects. We pursue opportunities to enhance asset value by completing select capital improvements outside the scope of recurring renewal and replacement capital expenditures. These projects are designed to take advantage of changing market conditions and the favorable location of our properties to enhance customer satisfaction and increase profitability. We evaluate our capital expenditure projects based on their economic and environmental impact. In collaboration with our hotel managers, we evaluate new products and systems designed to yield predictable and targeted results, while improving overall energy efficiency and reducing water consumption. Examples include in-room and central energy management systems, lighting retrofits, low flow plumbing fixtures and intelligent landscape irrigation systems.

Redevelopment projects. These projects are designed to optimally position our hotels within their markets and competitive set. Redevelopment projects include extensive renovations of guest rooms, including bathrooms, lobbies, food and beverage outlets, expanding ballroom and meeting rooms, and major mechanical system upgrades.

Targeted Return on Investment Projects. These ROI projects often are smaller and focused on specific areas, such as converting unprofitable or underutilized space into meeting space or adding guestrooms. We also target projects that improve utility efficiency through the implementation and adoption of proven sustainable technologies.

Value enhancement capital projects. These projects identify and execute strategies that seek to maximize the highest and best use of all aspects of our hotels. These projects include the development of timeshare or condominium units on excess land, or the acquisition of air rights or development entitlements that add value to our portfolio currently or in the event that we sell the hotel.

Acquisition projects. In conjunction with the acquisition of a property, we prepare capital and operational improvement plans designed to improve profitability and enhance the guest experience. These projects may include required renewal and replacement projects, significant redevelopment and even re-branding of the property and represent a key component of our decision to invest in a hotel that are typically completed within two to three years.

Asset Management. As Host Inc. is the nation’s largest lodging REIT with a diverse portfolio of properties, we are in a unique position to work with our managers to maximize revenues, while minimizing operating costs. The size and composition of our portfolio and our affiliation with most of the leading operators and brands in the industry allow us to benchmark similar hotels and identify best practices and efficiencies that can be implemented at our properties, all of which improve the long-term profitability of the hotel.

A key component of our asset management strategy is maintaining the high standards of product quality of our properties. We work closely with our managers to ensure that renewal and replacement expenditures are spent efficiently in order to maximize the profitability of the hotel. Typically, room refurbishments occur at intervals of approximately seven years, but the timing may vary based on the type of property and equipment being replaced. These refurbishments generally are divided into the following types: soft goods, case goods, bathroom and

5

Table of Contents

infrastructure. Soft goods include items such as carpeting, bed spreads, curtains and wall vinyl and may require more frequent updates in order to maintain brand quality standards. Case goods include items such as dressers, desks, couches, restaurant and meeting room chairs and tables and generally are not replaced as frequently. Bathroom renovations range from refresh of vinyl and paint to full renovation and replacement of tile, vanity, lighting and plumbing fixtures. Infrastructure includes the physical plant of the hotel, including the roof, elevators, façade and fire systems, which are subject to regular maintenance and then replaced at the end of their useful lives.

Capital structure and liquidity profile. In order to maintain its qualification as a REIT, Host Inc. is required to distribute 90% of its taxable income (other than net capital gain) to its stockholders and, as a result, generally relies on external sources of capital to finance growth. We use a variety of debt and equity instruments to fund our external growth, including senior notes and mortgage debt, exchangeable debentures, common and preferred stock offerings, issuances of Host L.P. partnership units and joint ventures/limited partnerships to take advantage of the prevailing market conditions. While we may issue debt at any time, management believes it is prudent, over time, to target a leverage ratio of approximately 3.0x debt-to-EBITDA. Consistent with this strategy, we have significantly improved our credit statistics over the past several years. We believe that lower leverage reduces our overall cost of capital and our earnings volatility and increases our access to capital, thereby providing us with the necessary flexibility to take advantage of opportunities throughout the lodging cycle, which we consider a key competitive advantage.

We also seek to structure our debt profile to allow us to access different forms of financing, primarily senior notes and exchangeable debentures, as well as mortgage debt, particularly outside of the U.S. when debt is priced reasonably. Generally, this means we look to minimize the number of assets that are encumbered by mortgage debt, minimize near-term maturities and maintain a balanced maturity schedule.

Joint Ventures. We expect to continue to utilize joint ventures to finance external growth. We believe joint ventures provide a significant means to access external capital and spread the inherent risk of hotel ownership. Our primary focus for joint ventures is in international markets, which helps to diversify exposure to market risk.

Dispositions. Our disposition strategy is aligned with our overall portfolio focus to reallocate our investments to target gateway markets. Generally, our dispositions will be focused on secondary or tertiary markets, or as part of our strategy to limit our total investment within individual markets. We may dispose of assets in our primary markets through direct sales or through the creation of joint ventures when we have the opportunity to capitalize on value enhancement strategies and apply the proceeds to other business objectives. Additionally, we will dispose of properties where we believe the potential for growth is constrained or on properties with significant capital expenditure requirements where we do not believe we would generate a significant return on the investment. Proceeds from dispositions are deployed to repay debt or fund acquisitions and ROI/redevelopment projects.

Corporate Responsibility

Host’s corporate responsibility strategy integrates fiscal, environmental and social elements at both the corporate and portfolio levels. Our corporate responsibility program focuses on the following themes and objectives:

| • | Responsible Investment: further consider sustainability-related risks and opportunities during the development and acquisition processes and throughout the ownership period; |

| • | Environmental Stewardship: collaborate with and support our hotel managers to reduce overall carbon emissions, energy and water consumption and waste stream within our portfolio; and |

| • | Corporate Citizenship: strengthen the local communities where we do business through financial support, partnership, volunteerism and coordination with our hotel managers. |

Management and Governance. Our corporate responsibility program is managed by our Corporate Responsibility team and governed by our Board of Directors’ Nominating and Corporate Governance Committee.

Operating Structure

Host Inc. operates through an umbrella partnership structure in which substantially all of its assets are held by Host L.P., of which Host Inc. is the sole general partner and holds approximately 98.6% of the OP units as of

6

Table of Contents

December 31, 2012. A REIT is a corporation that has elected to be treated as a REIT under the Internal Revenue Code of 1986, as amended (the “Code”), and that meets certain ownership, organizational and operating requirements set forth under the Code. In general, through payments of dividends to stockholders, a REIT is permitted to reduce or eliminate federal income taxes at the corporate level. Each OP unit owned by holders other than Host Inc. is redeemable, at the option of the holder, for an amount of cash equal to the market value of one share of Host Inc. common stock multiplied by a factor of 1.021494 (rather than a conversion factor of 1 share/OP unit that existed prior to the December 2009 stock dividend). Host Inc. has the right to acquire any OP unit offered for redemption directly from the holder in exchange for 1.021494 shares of Host Inc. common stock, instead of Host L.P. redeeming such OP unit for cash. Additionally, for every share of common stock issued by Host Inc., Host L.P. will issue .97895 OP units to Host Inc. As of December 31, 2012, non-controlling limited partners held 9.9 million OP units, which were convertible into 10.1 million Host Inc. common shares. Assuming that all OP units held by non-controlling limited partners were converted into common shares, there would have been 734.7 million common shares of Host Inc. outstanding at December 31, 2012.

Our operating structure is as follows:

Because Host Inc. has elected to be treated as a REIT, certain tax laws limit the amount of “non-qualifying” income that Host Inc. and Host L.P. can earn, including income derived directly from the operation of hotels. As a result, we lease substantially all of our consolidated properties to certain of our subsidiaries designated as taxable REIT subsidiaries (“TRS”) for federal income tax purposes or to third party lessees. Our TRS are subject to income tax and are not limited as to the amount of non-qualifying income they can generate. The lessees and our TRS enter into agreements with third parties to manage the operations of the hotels. Our TRS also may own assets engaging in other activities that produce non-qualifying income, such as the development of timeshare or condominium units, subject to certain restrictions. The difference between the hotels’ net operating cash flow and the aggregate rents paid to Host L.P. is retained by our TRS as taxable income. Accordingly, the net effect of the TRS leases is that, while, as a REIT, Host Inc. generally is exempt from federal income tax to the extent that it meets specific distribution requirements, among other REIT requirements, a portion of the net operating cash flow from our properties is subject to federal, state and, if applicable, foreign income tax.

7

Table of Contents

Our Hotel Properties

Overview. We have 118 hotels in our portfolio, primarily consisting of luxury and upper upscale properties. These hotels generally are located in the central business districts of major cities, near airports and resort/conference destinations that, because of their locations, typically benefit from barriers to entry for new supply. These properties typically include meeting and banquet facilities, a variety of restaurants and lounges, swimming pools, exercise facilities and/or spas, gift shops and parking facilities, the combination of which enable them to serve business, leisure and group travelers. Forty-two of our hotels, representing approximately 59% of our revenues, have in excess of 500 rooms. The average age of our properties is 28 years, although substantially all of the properties have benefited from significant renovations or major additions, as well as regularly scheduled renewal and replacement and other capital improvements.

The following table details our consolidated hotel portfolio by brand as of February 25, 2013:

| Number | Percentage of | |||||||||||

| Brand |

of Hotels | Rooms | Revenues (1) | |||||||||

| Marriott |

62 | 34,733 | 52 | % | ||||||||

| Ritz-Carlton |

8 | 3,020 | 8 | |||||||||

| Starwood: |

||||||||||||

| Westin |

13 | 6,900 | 10 | |||||||||

| Sheraton |

7 | 5,444 | 9 | |||||||||

| W |

3 | 1,387 | 3 | |||||||||

| St. Regis |

1 | 232 | 1 | |||||||||

| The Luxury Collection |

1 | 139 | — | |||||||||

| Hyatt |

8 | 6,372 | 11 | |||||||||

| Hilton/Embassy Suites |

3 | 1,041 | 2 | |||||||||

| Swissôtel |

1 | 661 | 1 | |||||||||

| Four Seasons |

2 | 608 | 1 | |||||||||

| Fairmont |

1 | 450 | 2 | |||||||||

| Delta |

1 | 374 | — | |||||||||

| Accor: |

||||||||||||

| ibis |

3 | 455 | — | |||||||||

| Novotel |

4 | 752 | — | |||||||||

|

|

|

|

|

|

|

|||||||

| 118 | 62,568 | 100 | ||||||||||

|

|

|

|

|

|

|

|||||||

| (1) | Percentage of revenues is based on 2012 revenues. No individual property contributed more than 6% of total revenues in 2012. |

8

Table of Contents

Hotel Properties. The following table sets forth the location and number of rooms at our hotels as of February 25, 2013:

9

Table of Contents

| (1) | The land on which this hotel is built is leased from a third party under one or more lease agreements. |

| (2) | The land, building and improvements are leased from a third party under a long-term lease agreement. |

| (3) | This property is not wholly owned. |

| (4) | This property is subject to a ground lease under which we have the option to purchase the land for an incremental payment of $19.9 million through 2017. |

10

Table of Contents

Competition

The lodging industry is highly competitive. Competition often is specific to individual markets and is based on a number of factors, including location, brand, guest facilities and amenities, level of service, room rates and the quality of accommodations. The lodging industry generally is viewed as consisting of six different segments, each of which caters to a discrete set of customer tastes and needs: luxury, upper upscale, upscale, midscale (with and without food and beverage service) and economy. The classification of a property is based on lodging industry standards, which take into consideration many factors such as guest facilities and amenities, level of service and quality of accommodations. Most of our hotels operate in urban and resort markets either as luxury properties under such brand names as Fairmont®, Four Seasons®, Grand Hyatt®, JW Marriott®, Ritz-Carlton®, St. Regis®, The Luxury Collection® and W®, or as upper upscale properties under such brand names as Embassy Suites®, Hilton®, Hyatt®, Le Méridien®, Marriott Executive Apartments®, Marriott Marquis®, Marriott Suites®, Pullman®, Renaissance®, Sheraton®, Swissôtel® and Westin®. We also may selectively invest in upscale and midscale properties such as Courtyard by Marriott®, Crowne Plaza®, Four Points by Sheraton®, Hyatt Place®, ibis®, Novotel® or Residence Inn by Marriott®, particularly in international markets.1 While our hotels primarily compete with other hotels in the luxury and upper upscale segments, they also may compete with hotels in other lower-tier segments.

We believe our properties enjoy competitive advantages associated with the hotel brands under which they operate. The international marketing programs and reservation systems of these brands, combined with the strong management systems and expertise they provide, should enable our properties to perform favorably in terms of both occupancy and room rates. In addition, repeat guest business is enhanced by guest reward or guest recognition programs offered by most of these brands. Nevertheless, many management contracts for our hotels do not prohibit our managers from converting, franchising or developing other hotel properties in our markets. As a result, our hotels compete with other hotels that our managers may own, invest in, manage or franchise.

We also compete with other REITs and other public and private investors for the acquisition of new properties and investment opportunities, in both domestic and international markets, as we attempt to position our portfolio to take best advantage of changes in markets and travel patterns of our customers.

Seasonality

Our hotel sales traditionally have experienced moderate seasonality, which varies based on the individual property and the region. Historically, our reporting cycle for hotel revenues for our domestic Marriott-managed hotels reflects 16 or 17 weeks of results in the fourth quarter compared to 12 weeks for each of the first three quarters of the year. For our non-Marriott managed hotels, the first quarter includes two months of operations, the second and third quarters include three months of operations and the fourth quarter includes four months of operations. Hotel sales have averaged approximately 20%, 26%, 22% and 32% for the first, second, third and fourth quarters, respectively, under our historic reporting calendar. However, Marriott announced that beginning January 1, 2013 it will convert from a 52-53 week fiscal year to a 12-month calendar year. As a result, we will report our hotel results based on a 3-month quarterly reporting cycle beginning with the first quarter of 2013. Based on this new reporting cycle, we estimate that hotel sales will be 24% in the first quarter, 27% in the second quarter, 24% in the third quarter and 25% in the fourth quarter. See Part II Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Reporting Periods.”

| 1 | This annual report contains registered trademarks that are the exclusive property of their respective owners, which are companies other than us. None of the owners of these trademarks, their affiliates or any of their respective officers, directors, agents or employees, has or will have any responsibility or liability for any information contained in this annual report. |

11

Table of Contents

Other Real Estate Investments

European Joint Venture. We own a general and limited partnership interest in a joint venture in Europe (“Euro JV”) with APG Strategic Real Estate Pool NV, an affiliate of a Dutch Pension Fund, and Jasmine Hotels Pte Ltd, an affiliate of the real estate investment company of the Government of Singapore Investment Corporation Pte Ltd (“GIC RE”). The Euro JV consists of two funds, which we refer to as Euro JV Fund I and Euro JV Fund II. We hold a 32.0% limited partner interest and a 0.1% general partner interest in Euro JV Fund I and a 33.3% limited partner interest and a 0.1% general partner interest in Euro JV Fund II. The Euro JV also acts as the asset manager for the hotels owned by the Euro JV, as well as one hotel in Paris, France, in exchange for a fee. As of February 25, 2013, the Euro JV owns the following hotels:

| Hotel |

City |

Country |

Rooms/Units | |||||

| Fund I: |

||||||||

| Hotel Arts Barcelona |

Barcelona | Spain | 483 | |||||

| The Westin Palace, Madrid |

Madrid | Spain | 467 | |||||

| Sheraton Roma Hotel & Conference Center |

Rome | Italy | 640 | |||||

| The Westin Palace, Milan |

Milan | Italy | 227 | |||||

| The Westin Europa & Regina |

Venice | Italy | 185 | |||||

| Renaissance Brussels Hotel |

Brussels | Belgium | 262 | |||||

| Brussels Marriott Hotel |

Brussels | Belgium | 221 | |||||

| Marriott Executive Apartments |

Brussels | Belgium | 56 | |||||

| Crowne Plaza Hotel Amsterdam City Centre |

Amsterdam | The Netherlands | 270 | |||||

| Sheraton Skyline Hotel & Conference Centre |

Hayes | United Kingdom | 350 | |||||

| Sheraton Warsaw Hotel & Towers |

Warsaw | Poland | 350 | |||||

|

|

|

|||||||

| Fund I total rooms |

3,511 | |||||||

|

|

|

|||||||

| Fund II: |

||||||||

| Paris Marriott Rive Gauche Hotel & Conference Center |

Paris | France | 757 | |||||

| Pullman Bercy Paris |

Paris | France | 396 | |||||

| Renaissance Paris La Defense Hotel |

Paris | France | 327 | |||||

| Courtyard Paris La Defense West – Colombes |

Paris | France | 150 | |||||

| Renaissance Paris Vendome Hotel |

Paris | France | 97 | |||||

| Renaissance Amsterdam Hotel |

Amsterdam | The Netherlands | 402 | |||||

| Le Méridien Piccadilly |

London | United Kingdom | 280 | |||||

| Le Méridien Grand Hotel Nuremberg |

Nuremberg | Germany | 192 | |||||

|

|

|

|||||||

| Fund II total rooms |

2,601 | |||||||

|

|

|

|||||||

| Total European joint venture rooms |

6,112 | |||||||

|

|

|

|||||||

Asian Joint Venture. We own a 25% interest in a joint venture (the “Asia/Pacific JV”) with RECO Hotels JV Private Limited, an affiliate of GIC RE. Our Asia/Pacific JV owns the 278-room Four Points by Sheraton Perth in Perth, Australia and a 36% non-controlling interest in a joint venture in India with Accor S.A. and InterGlobe Enterprises Limited that owns two hotels, with an additional five hotels under development, totaling 1,750 rooms for an estimated $325 million of construction costs. The seven Indian hotels will be operated under the Pullman, Novotel and ibis brands.

Other U.S. Real Estate Investments. Our other domestic real estate investments include the following:

| • | We have a non-controlling 50% interest in a joint venture with White Lodging Services to develop the 255-room Hyatt Place in Nashville, Tennessee. The hotel is expected to open in late 2013. |

| • | We have a non-controlling 67% interest in a joint venture with Hyatt Residential Group to develop, sell and operate a 131-unit vacation ownership project in Maui, Hawaii adjacent to our Hyatt Regency Maui Resort & Spa. Construction has begun and the project is expected to be completed in late 2014. |

12

Table of Contents

Consolidated International Operations

Excluding hotels owned by our European and Asian joint ventures, as of December 31, 2012, we own one property in Australia, one property in Brazil, three in Canada, one in Mexico, two in Chile, and seven in New Zealand, which collectively contain approximately 3,865 rooms. Approximately 5%, 5%, and 3% of our revenues were attributed to the operations of these properties in 2012, 2011 and 2010, respectively.

Environmental and Regulatory Matters

Under various federal, state and local environmental laws, ordinances and regulations, a current or previous owner or operator of real property may be liable for the costs of removal or remediation of hazardous or toxic substances. These laws may impose liability whether or not the owner or operator knew of, or was responsible for, the presence of such hazardous or toxic substances. In addition, certain environmental laws and common law principles could be used to impose liability for release of hazardous or toxic materials, and third parties may seek recovery from owners or operators of real properties for personal injury associated with exposure to released hazardous or toxic materials. Environmental laws also may impose restrictions on the manner in which property may be used or businesses may be operated, and these restrictions may require corrective or other expenditures. In connection with our current or prior ownership or operation of hotels, we potentially may be liable for various environmental costs or liabilities. Although currently we are not aware of any material environmental claims pending or threatened against us, we can offer no assurance that a material environmental claim will not be asserted against us in the future.

Operational Agreements

All of our hotels are managed by third parties pursuant to management or operating agreements, with some of those hotels also subject to separate license agreements addressing matters pertaining to operation under the designated brand. Under these agreements, the managers generally have sole responsibility and exclusive authority for all activities necessary for the day-to-day operation of the hotels, including establishing room rates, securing and processing reservations, procuring inventories, supplies and services, providing periodic inspection and consultation visits to the hotels by the managers’ technical and operational experts and promoting and publicizing the hotels. The managers provide all managerial and other employees for the hotels, review the operation and maintenance of the hotels, prepare reports, budgets and projections, and provide other administrative and accounting support services to the hotels. These support services include planning and policy services, divisional financial services, product planning and development, employee staffing and training, corporate executive management and certain in-house legal services. We have certain approval rights over budgets, capital expenditures, significant leases and contractual commitments, and various other matters.

General Terms and Provisions – Agreements governing the management and operation of our hotels typically include the terms described below:

| • | Term and fees for operational services. The initial term of our management and operating agreements generally is 15 to 25 years, with one or more renewal terms at the option of the manager. The majority of our management agreements condition the manager’s right to exercise options for specified renewal terms upon the satisfaction of specified economic performance criteria. The manager typically receives compensation in the form of a base management fee, which is calculated as a percentage (generally 2-3%) of annual gross revenues, and an incentive management fee, which typically is calculated as a percentage (generally 10-20%) of operating profit after the owner has received a priority return on its investment in the hotel. In the case of our Starwood-managed hotels, the base management fee only is 1% of annual gross revenues, but that amount is supplemented by license fees payable to Starwood under a separate license agreement (as described below). |

| • | License services. In the case of our Starwood-managed hotels, the operation of the hotels is subject to separate license agreements addressing matters pertaining to the designated brand, including rights to use trademarks, service marks and logos, matters relating to compliance with certain brand standards and policies, and the provision of certain system programs and centralized services. Although the term of these license agreements with Starwood generally is coterminous with the corresponding operating |

13

Table of Contents

| agreements, the license agreements contemplate the potential for continued brand affiliation even in the event of a termination of the operating agreement. As noted above, the Starwood licensors receive compensation in the form of license fees (generally 5% of gross revenues attributable to room sales and 2% of gross revenues attributable to food and beverage sales), which amounts supplement the lower base management fee of 1% of gross revenues received by Starwood under the operating agreements. |

| • | Chain or system programs and services. Managers are required to provide chain or system programs and services generally that are furnished on a centralized basis. Such services include the development and operation of certain computer systems and reservation services, regional or other centralized management and administrative services, marketing and sales programs and services, training and other personnel services, and other centralized or regional services as may be determined to be more efficiently performed on a centralized, regional or group basis rather than on an individual hotel basis. Costs and expenses incurred in providing these chain or system programs and services generally are allocated on a cost reimbursement basis among all hotels managed by the manager or its affiliates or that otherwise benefit from these services. |

| • | Working capital and fixed asset supplies. We are required to maintain working capital for each hotel and to fund the cost of certain fixed asset supplies (for example, linen, china, glassware, silver and uniforms). We also are responsible for providing funds to meet the cash needs for hotel operations if at any time the funds available from working capital are insufficient to meet the financial requirements of the hotels. For certain hotels, the working capital accounts which would otherwise be maintained by the managers for each of such hotels are maintained on a pooled basis, with managers being authorized to make withdrawals from such pooled account as otherwise contemplated with respect to working capital in accordance with the provisions of the management or operating agreements. |

| • | Furniture, fixtures and equipment replacements. We are required to provide the managers with all furniture, fixtures and equipment (“FF&E”) necessary for the operation of the hotels (including funding any required FF&E replacements). On an annual basis, the managers prepare budgets for FF&E to be acquired and certain routine repairs and maintenance to be performed in the next year and an estimate of the necessary funds, which budgets are subject to our review and approval. For purposes of funding such expenditures, a specified percentage (typically 5%) of the gross revenues of each hotel is deposited by the manager into an escrow or reserve account in our name, to which the manager has access. In the case of our Starwood-managed hotels, our operating agreements contemplate that this reserve account also may be used to fund the cost of certain major repairs and improvements affecting the hotel building (as described below). For certain of our Marriott-managed hotels, we have entered into an agreement with Marriott to allow for such expenditures to be funded from one pooled reserve account, rather than funds being deposited into separate reserve accounts at each hotel, with the minimum required balance maintained on an ongoing basis in that pooled reserve account being significantly below the amount that would otherwise have been maintained in such separate hotel reserve accounts. For certain of our Starwood-managed hotels, the periodic reserve fund contributions, which otherwise would be deposited into reserve accounts maintained by managers for each hotel, are distributed to us and, as to this pool of hotels, we are responsible for providing funding of expenditures which otherwise would be funded from reserve accounts for each of the subject hotels. |

| • | Building alterations, improvements and renewals. The managers are required to prepare an annual estimate of the expenditures necessary for major repairs, alterations, improvements, renewals and replacements to the structural, mechanical, electrical, heating, ventilating, air conditioning, plumbing and elevators of each hotel, along with alterations and improvements to the hotel as are required, in the manager’s reasonable judgment, to keep the hotel in a competitive, efficient and economical operating condition that is consistent with brand standards. We generally have approval rights as to such budgets and expenditures, which we review and approve based on our manager’s recommendations and on our judgment. Expenditures for these major repairs and improvements affecting the hotel building typically are funded directly by owners, although (as noted above) our agreements with Starwood contemplate that certain such expenditures may be funded from the reserve account. |

14

Table of Contents

| • | Treatment of additional owner funding. As additional owner funding becomes necessary either for expenditures generally funded from the FF&E replacement funds, or for any major repairs or improvements to the hotel building which may be required to be funded directly by owners, most of our agreements provide for an economic benefit to us through an impact on the calculation of incentive management fees payable to our managers. One approach frequently utilized at our Marriott-managed hotels is to provide such owner funding through loans which are repaid, with interest, from operational revenues, with the repayment amounts reducing operating profit available for payment of incentive management fees. Another approach typically that is used at our Starwood-managed hotels, as well as with certain expenditures projects at our Marriott-managed hotels, is to treat such owner funding as an increase to our investment in the hotel, resulting in an increase to owner’s priority return with a corresponding reduction to the amount of operating profit available for payment of incentive management fees. For our Starwood-managed hotels that are subject to the pooled arrangement described above, the amount of any additional reserve account funding is allocated to each of such hotels on a pro rata basis, determined with reference to the net operating income of each hotel and the total net operating income of all such pooled hotels for the most recent operating year. |

| • | Territorial protections. Certain management and operating agreements impose restrictions for a specified period which limit the manager and its affiliates from owning, operating or licensing a hotel of the same brand within a specified area. The area restrictions vary with each hotel, from city blocks in urban areas to up to a multi-mile radius from the hotel in other areas. |

| • | Sale of the hotel. Subject to specific agreements as to certain hotels (see below under ‘Special Termination Rights’), we generally are limited in our ability to sell, lease or otherwise transfer the hotels by the requirement that the transferee assume the related management agreements and meet specified other conditions, including the condition that the transferee not be a competitor of the manager. |

| • | Performance Termination Rights. In addition to any right to terminate that may arise as a result of a default by the manager, most of our management and operating agreements include reserved rights by us to terminate management or operating agreements on the basis of the manager’s failure to meet certain performance-based metrics, typically including a specified threshold return on owner’s investment in the hotel, along with a failure of the hotel to achieve a specified RevPAR performance threshold established with reference to other competitive hotels in the market. Typically, such performance-based termination rights arise in the event the operator fails to achieve specified performance thresholds over a consecutive two-year period, and are subject to the manager’s ability to ‘cure’ and avoid termination by payment to us of specified deficiency amounts (or, in some instances, waiver of the right to receive specified future management fees). We have agreed in the past, and may agree in the future, to waive certain of these termination rights in exchange for consideration from a manager or its affiliates, which consideration may include cash compensation or amendments to management agreements. |

| • | Special Termination Rights. In addition to any performance-based or other termination rights set forth in our management and operating agreements, we have negotiated with Marriott and Starwood specific termination rights as to certain management and operating agreements. While the brand affiliation of a property may increase the value of a hotel, the ability to dispose of a property unencumbered by a management agreement or even brand affiliation also can increase the value for prospective purchasers. These termination rights can take a number of different forms, including termination of agreements upon sale that leave the property unencumbered by any agreement; termination upon sale provided that the property continues to be operated under a license or franchise agreement with continued brand affiliation; as well as termination without sale or other condition, which may require payment of a fee. These termination rights also may restrict the number of agreements that may be terminated over any annual or other period; impose limitations on the number of agreements terminated as measured by EBITDA; require that a certain number of properties continue to maintain the brand affiliation; or be restricted to a specific pool of assets. |

15

Table of Contents

Employees

As of December 31, 2012, we had 233 employees, of which 208 work in the United States. We had 25 employees located in our offices in London, Rio de Janeiro, Amsterdam and Singapore. None of Host’s employees are covered by collective bargaining agreements, other than those working in our office in Rio de Janeiro. These employee numbers do not include the 522 hotel employees of our New Zealand and Australian properties, which also are Host employees, as they are under the direct supervision and control of our third-party hotel managers. Our third-party managers are responsible for hiring and maintaining the labor force at each of our hotels. Although we do not manage employees at our consolidated hotels, we still are subject to many of the costs and risks generally associated with the hotel labor force, particularly those hotels with unionized labor. We believe relations with these employees are positive. For a discussion of these relationships, see Part I Item 1A. “Risk Factors – We are subject to risks associated with the employment of hotel personnel, particularly with hotels that employ unionized labor.”

Employees at certain of our third-party managed hotels are covered by collective bargaining agreements that are subject to review and renewal on a regular basis. For a discussion of these relationships, see Part I Item 1A. “Risk Factors – We are subject to risks associated with the employment of hotel personnel, particularly with hotels that employ unionized labor.”

Where to Find Additional Information

The address of our principal executive office is 6903 Rockledge Drive, Suite 1500, Bethesda, Maryland, 20817. Our phone number is 240-744-1000. We maintain an internet website at: www.hosthotels.com. Through our website, we make available free of charge as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The public also may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov.

Our website also is a key source of important information about us. We routinely post to the Investor Relations section of our website important information about our business, our operating results and our financial condition and prospects, including, for example, information about material acquisitions and dispositions, our earnings releases and certain supplemental financial information related or complimentary thereto. The website also has a Governance page in the Investor Relations section that includes, among other things, copies of our By-laws, our Code of Business Conduct and Ethics and Conflicts of Interest Policy for our directors, our Code of Business Conduct and Ethics Policy for employees, our Corporate Governance Guidelines and the charters for each standing committee of Host Inc.’s Board of Directors, which currently are the Audit Committee, the Compensation Policy Committee and the Nominating and Corporate Governance Committee. Copies of these charters and policies, Host Inc.’s By-laws and Host L.P.’s partnership agreement also are available in print to stockholders and unitholders upon request to Host Hotels & Resorts, Inc., 6903 Rockledge Drive, Suite 1500, Bethesda, Maryland 20817, Attn: Secretary. Please note that the information contained on our website is not incorporated by reference in, or considered to be a part of, any document, unless expressly incorporated by reference therein.

| Item 1A. | Risk Factors |

The statements in this section describe the major risks to our business and should be considered carefully. In addition, these statements constitute our cautionary statements under the Private Securities Litigation Reform Act of 1995.

16

Table of Contents

Financial Risks and Risks of Operation

Our revenues and the value of our properties are subject to conditions affecting the lodging industry.

The lodging industry is subject to changes in the travel patterns of business and leisure travelers, both of which are affected by the strength of the economy, as well as other factors. Changes in travel patterns of both business and leisure travelers may create difficulties for the industry over the long-term and adversely affect our results. During the recession in 2008 and 2009, overall travel was reduced, which had a significant effect on our results of operations. While operating results have improved since then, uncertainty in the strength and direction of the recovery and continued high unemployment have slowed the pace of the overall economic recovery. Therefore, there can be no assurance that any increases in hotel revenues or earnings at our properties will continue for any number of reasons, including, but not limited to, slower than anticipated growth in the economy. Our results of operations and any forecast we make, may be affected by, and can change based on, a variety of circumstances that affect the lodging industry, including:

| • | changes in the international, national, regional and local economic climate; |

| • | changes in business and leisure travel patterns; |

| • | the effect of terrorist attacks and terror alerts in the United States and internationally, as well as other geopolitical disturbances; |

| • | supply growth in markets where we own hotels, which may adversely affect demand at our properties; |

| • | the attractiveness of our hotels to consumers relative to competing hotels; |

| • | the performance of the managers of our hotels; |

| • | outbreaks of disease and the impact on travel of natural disasters and weather; |

| • | physical damage to our hotels as a result of earthquakes, hurricanes, or other natural disasters, or the income lost as a result of the damage; |

| • | changes in room rates and increases in operating costs due to inflation and other factors; and |

| • | unionization of the labor force at our hotels. |

A reduction in our revenue or earnings as a result of the above risks may reduce our working capital, impact our long-term business strategy, and impact the value of our assets and our ability to meet certain covenants in our existing debt agreements.

In addition, the continuing debate in Congress regarding the national debt ceiling, federal budget deficit concerns, and overall weakness in the economy resulted in actual and threatened downgrades of U.S. government securities by the various major credit ratings agencies, including Standard & Poor’s and Fitch Ratings. All of these factors have created uncertainty in U.S. and global financial markets, which factors could have material adverse impacts on financial markets and economic conditions in the United States and throughout the world. This in turn could, directly or indirectly, adversely affect lodging demand and therefore our business and financial condition. Because of the unprecedented nature of these events, including the negative credit rating actions with respect to U.S. government securities, the ultimate impact on global markets and our business, financial condition and liquidity are unpredictable and may not be immediately apparent. Also, in 2012 Standard & Poor’s lowered its long term sovereign credit rating on France, Italy and seven other European countries, which has impacted negatively global markets and economic conditions. The continued uncertainty over the outcome of the governments’ and other European Union (“EU”) member states’ financial support programs and the possibility that other EU member states may experience similar financial troubles could further disrupt global markets and economic growth in these countries. We have properties in several EU member states’, held through our European joint venture, that have experienced difficulties servicing their sovereign debt, including Italy and Spain, and the results of operations at those hotels also could be affected adversely by any adverse economic conditions in these countries.

17

Table of Contents

Disruptions in the financial markets may affect adversely our business and results of operations, our ability to obtain financing on reasonable and acceptable terms, and our ability to hedge our foreign currency exchange risk.

The United States and global equity and credit markets have at times experienced significant price volatility, dislocations and liquidity disruptions since 2008, all of which caused market prices of the stock of many companies to fluctuate substantially and the spreads on prospective and outstanding debt financings to widen considerably. These circumstances impacted liquidity in the financial markets, which made terms for financings less attractive, and, in some cases, resulted in the lack of availability of certain types of financing. Continued uncertainty in the equity and credit markets may impact negatively our ability to access additional short-term and long-term financing on reasonable terms or at all, which would impact negatively our liquidity and financial condition. A prolonged downturn in the stock or credit markets may cause us to seek alternative sources of potentially less attractive financing and may impact negatively our ability to enter into derivative contracts in order to hedge risks associated with changes in interest rates and foreign currency exchange rates. Disruptions in the financial markets also may adversely affect our credit rating. While we believe we have adequate sources of liquidity with which to meet our anticipated requirements for working capital, debt service and capital expenditures for the foreseeable future, if our operating results weaken significantly and our cash flow or capital resources prove inadequate, or if interest rates increase significantly, we could face liquidity problems that could affect materially and adversely our results of operations and financial condition.

Economic conditions may affect adversely the value of our hotels which may result in impairment charges on our properties.

We analyze our assets for impairment in several situations, including when a property has current or projected losses from operations, when it becomes more likely than not that a hotel will be sold before the end of its previously estimated useful life, or when other material trends, contingencies or changes in circumstances indicate that a triggering event has occurred, such that an asset’s carrying value may not be recoverable. For impaired assets, we record an impairment charge equal to the excess of the property’s carrying value over its fair value. We may incur additional impairment charges in the future, which charges will affect negatively our results of operations. We can provide no assurance that any impairment loss recognized would not be material to our results of operations. For information on impairment charges taken in 2011 and 2012, see Part II Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Critical Accounting Policies.”

We depend on external sources of capital for future growth and we may be unable to access capital when necessary.

Unlike regular C corporations, Host Inc. must finance its growth and fund debt repayments largely with external sources of capital because it is required to distribute to its stockholders at least 90% of its taxable income (other than net capital gain) in order to qualify as a REIT, including taxable income recognized for federal income tax purposes but with regard to which it does not receive cash. Funds used by Host Inc. to make required distributions are provided through distributions from Host L.P. Our ability to access external capital could be hampered by a number of factors, many of which are outside of our control, including credit market conditions as discussed above, unfavorable market perception of our growth potential, decreases in our current and estimated future earnings, or decreases in the market price of the common stock of Host Inc. Our ability to access additional capital also may be limited by the terms of our existing indebtedness which, under certain circumstances, restrict our incurrence of debt and the payment of dividends and Host L.P. distributions. The occurrence of any of these factors, individually or in combination, could prevent us from being able to obtain the external capital we require on terms that are acceptable to us, or at all, which could have a material adverse effect on our ability to finance our future growth.

We have substantial debt and may incur additional debt.

As of December 31, 2012, we and our subsidiaries had total indebtedness of approximately $5.4 billion. Our substantial indebtedness requires us to dedicate a significant portion of our cash flow from operations to debt service payments, which reduces the availability of our cash flow to fund working capital, capital expenditures, expansion efforts, dividends and distributions and other general corporate needs. Additionally, our substantial indebtedness could:

| • | make it more difficult for us to satisfy our obligations with respect to our indebtedness; |

18

Table of Contents

| • | limit our ability in the future to undertake refinancings of our debt or to obtain financing for expenditures, acquisitions, development or other general corporate needs on terms and conditions acceptable to us, if at all; or |

| • | affect adversely our ability to compete effectively or operate successfully under adverse economic conditions. |

If our cash flow and working capital are not sufficient to fund our expenditures or service our indebtedness, we will have to raise additional funds through:

| • | sales of Host L.P.’s OP units or Host Inc.’s common stock; |

| • | the incurrence of additional permitted indebtedness by Host L.P.; or |

| • | the sale of our assets. |

We cannot make any assurances that any of these sources of funds will be available to us or, if available, will be on terms that we would find acceptable or in amounts sufficient to meet our obligations or fulfill our business plan. Under certain circumstances, we would be required to use the cash from some of the events described above to repay other indebtedness.

The terms of our debt place restrictions on us and our subsidiaries and these restrictions reduce our operational flexibility and create default risks.

The documents governing the terms of our existing senior notes and our credit facility contain covenants that place restrictions on us and our subsidiaries. These covenants restrict, among other things, our ability to:

| • | conduct acquisitions, mergers or consolidations, unless the successor entity in such transaction assumes our indebtedness; |

| • | incur additional debt in excess of certain thresholds and without satisfying certain financial metrics; |

| • | create liens securing indebtedness, unless an effective provision is made to secure our other indebtedness by such liens; |