As filed with the Securities and Exchange Commission on April 24, 2018

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

ANNUAL REPORT PURSUANT TO SECTION 13

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

Commission file number 001-35934

Fomento Económico Mexicano, S.A.B. de C.V.

(Exact name of registrant as specified in its charter)

Mexican Economic Development, Inc.

(Translation of registrant’s name into English)

United Mexican States

(Jurisdiction of incorporation or organization)

General Anaya No. 601 Pte.

Colonia Bella Vista

Monterrey, NL 64410 Mexico

(Address of principal executive offices)

Juan F. Fonseca

General Anaya No. 601 Pte.

Colonia Bella Vista

Monterrey, NL 64410 Mexico

(52-818) 328-6167

investor@femsa.com.mx

(Name, telephone, e-mail and/or facsimile number and

address of company contact person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class: |

Name of each exchange on which registered: | |||

| American Depositary Shares, each representing 10 BD Units, and each BD Unit consisting of one Series B Share, two Series D-B Shares and two Series D-L Shares, without par value |

New York Stock Exchange | |||

| 2.875% Senior Notes due 2023 | New York Stock Exchange | |||

| 4.375% Senior Notes due 2043 | New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

| 2,161,177,770 |

BD Units, each consisting of one Series B Share, two Series D-B Shares and two Series D-L Shares, without par value. The BD Units represent a total of 2,161,177,770 Series B Shares, 4,322,355,540 Series D-B Shares and 4,322,355,540 Series D-L Shares. | |

| 1,417,048,500 |

B Units, each consisting of five Series B Shares without par value. The B Units represent a total of 7,085,242,500 Series B Shares. |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

| ☒ Yes |

☐ No |

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

| ☐ Yes |

☒ No |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). N/A

| ☐ Yes |

☐ No |

Indicate by check mark whether the registrant: (1) has filed all reports required to be file by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

| ☒ Yes |

☐ No |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” and emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated filer ☒ | Accelerated filer ☐ | |

| Non-accelerated filer ☐ | Emerging growth company ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ |

IFRS ☒ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

| ☐ Item 17 |

☐ Item 18 |

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

| ☐ Yes |

☒ No |

| 1 | ||||||

| 1 | ||||||

| 1 | ||||||

| 1 | ||||||

| ITEMS 1-2. |

2 | |||||

| ITEM 3. |

2 | |||||

| 2 | ||||||

| 4 | ||||||

| 6 | ||||||

| 7 | ||||||

| ITEM 4. |

21 | |||||

| 21 | ||||||

| 21 | ||||||

| 21 | ||||||

| 24 | ||||||

| 24 | ||||||

| 26 | ||||||

| 26 | ||||||

| 48 | ||||||

| 58 | ||||||

| 58 | ||||||

| 59 | ||||||

| 60 | ||||||

| 60 | ||||||

| ITEM 4A. |

69 | |||||

| ITEM 5. |

69 | |||||

| 69 | ||||||

| 70 | ||||||

| 70 | ||||||

| 70 | ||||||

| 71 | ||||||

| Future Impact of Recently Issued Accounting Standards not yet in Effect |

75 | |||||

| 79 | ||||||

| 89 | ||||||

| ITEM 6. |

97 | |||||

| 97 | ||||||

| 106 | ||||||

| 110 | ||||||

| 110 | ||||||

i

| 111 | ||||||

| 111 | ||||||

| 112 | ||||||

| 113 | ||||||

| ITEM 7. |

115 | |||||

| 115 | ||||||

| 115 | ||||||

| 115 | ||||||

| 116 | ||||||

| Business Transactions between Coca-Cola FEMSA, FEMSA and The Coca-Cola Company |

117 | |||||

| ITEM 8. |

119 | |||||

| 119 | ||||||

| 119 | ||||||

| 119 | ||||||

| 120 | ||||||

| ITEM 9. |

120 | |||||

| 120 | ||||||

| 121 | ||||||

| 121 | ||||||

| 122 | ||||||

| ITEM 10. |

123 | |||||

| 123 | ||||||

| 130 | ||||||

| 133 | ||||||

| 139 | ||||||

| ITEM 11. |

140 | |||||

| 140 | ||||||

| 144 | ||||||

| 148 | ||||||

| 148 | ||||||

| ITEM 12. |

148 | |||||

| ITEM 12A. |

148 | |||||

| ITEM 12B. |

148 | |||||

| ITEM 12C. |

148 | |||||

| ITEM 12D. |

148 | |||||

| ITEMS 13-14. |

149 | |||||

| ITEM 15. |

149 | |||||

| ITEM 16A. |

151 | |||||

| ITEM 16B. |

151 | |||||

ii

| ITEM 16C. |

151 | |||||

| ITEM 16D. |

152 | |||||

| ITEM 16E. |

PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS |

152 | ||||

| ITEM 16F. |

153 | |||||

| ITEM 16G. |

153 | |||||

| ITEM 16H. |

155 | |||||

| ITEM 17. |

155 | |||||

| ITEM 18. |

155 | |||||

| ITEM 19. |

156 | |||||

iii

This annual report contains information materially consistent with the information presented in the audited consolidated financial statements and is free of material misstatements of fact that would result in material inconsistencies with the information in the audited consolidated financial statements.

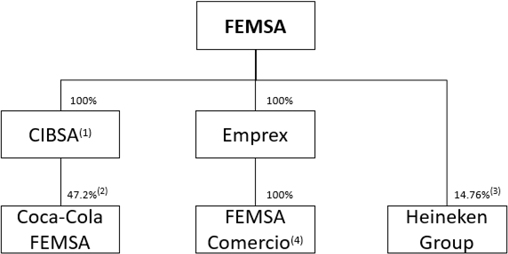

The terms “FEMSA,” “our company,” “we,” “us” and “our,” are used in this annual report to refer to Fomento Económico Mexicano, S.A.B. de C.V. and, except where the context otherwise requires, its subsidiaries on a consolidated basis. We refer to our former subsidiary Cuauhtémoc Moctezuma Holding, S.A. de C.V. (formerly FEMSA Cerveza, S.A. de C.V.) as “Cuauhtémoc Moctezuma” or “FEMSA Cerveza”, to our subsidiary Coca-Cola FEMSA, S.A.B. de C.V., as “Coca-Cola FEMSA”, to our subsidiary FEMSA Comercio, S.A. de C.V., as “FEMSA Comercio”. Our equity investment in Heineken, through subsidiaries of FEMSA, including CB Equity LLP, “CB Equity”, is referred to as the “Heineken Investment”. FEMSA Comercio comprises a Retail Division, Fuel Division and Health Division, which we refer to as the “Retail Division”, “Fuel Division” and “Health Division”, respectively.

The term “S.A.B.” stands for sociedad anónima bursátil, which is the term used in the United Mexican States, or “Mexico”, to denominate a publicly traded company under the Mexican Securities Market Law (Ley del Mercado de Valores), which we refer to as the “Mexican Securities Law”.

References to “U.S. dollars,” “US$,” “dollars” or “$” are to the lawful currency of the United States of America (which we refer to as the “United States”). References to “Mexican pesos,” “pesos” or “Ps.” are to the lawful currency of Mexico. References to “euros” or “€” are to the lawful currency of the European Economic and Monetary Union (which we refer to as the Euro Zone).

As used in this annual report, “sparkling beverages” refers to non-alcoholic carbonated beverages. “Still beverages” refers to non-alcoholic non-carbonated beverages. Non-flavored waters, whether or not carbonated, are referred to as “waters.”

Currency Translations and Estimates

This annual report contains translations of certain Mexican peso amounts into U.S. dollars at specified rates solely for the convenience of the reader. These translations should not be construed as representations that the Mexican peso amounts actually represent such U.S. dollar amounts or could be converted into U.S. dollars at the rate indicated. Unless otherwise indicated, such U.S. dollar amounts have been translated from Mexican pesos at an exchange rate of Ps. 19.6395 to US$ 1.00, the noon buying rate for Mexican pesos on December 29, 2017, as published by the U.S. Federal Reserve Board in its H.10 Weekly Release of Foreign Exchange Rates. On April 20, 2018, this exchange rate was Ps. 18.6145 to US$ 1.00. See “Item 3. Key Information—Exchange Rate Information” for information regarding exchange rates since 2013.

To the extent estimates are contained in this annual report, we believe that such estimates, which are based on internal data, are reliable. Amounts in this annual report are rounded, and the totals may therefore not precisely equal the sum of the numbers presented.

Per capita growth rates, consumer price indices and population data have been computed based upon statistics prepared by the Instituto Nacional de Estadística, Geografía e Informática of Mexico (National Institute of Statistics, Geography and Information, which we refer to as “INEGI”), the U.S. Federal Reserve Board and Banco de México (Bank of Mexico), local entities in each country and upon our estimates.

This annual report contains words such as “believe,” “expect,” “anticipate” and similar expressions that identify forward-looking statements. Use of these words reflects our views about future events and financial performance. Actual results could differ materially from those projected in these forward-looking statements as a result of various factors that may be beyond our control, including, but not limited to, effects on our company from changes in our relationship with or among our affiliated companies, movements in the prices of raw materials, competition, significant developments in Mexico and the other countries where we operate, our ability to successfully integrate mergers and acquisitions we have completed in recent years, international economic or political conditions or changes in our regulatory environment. Accordingly, we caution readers not to place undue reliance on these forward-looking statements. In any event, these statements speak only as of their respective dates, and we undertake no obligation to update or revise any of them, whether as a result of new information, future events or otherwise.

1

Selected Consolidated Financial Data

This annual report includes (under Item 18) our audited consolidated statements of financial position as of December 31, 2017 and 2016, and the related consolidated income statements, consolidated statements of comprehensive income, changes in equity and cash flows for the years ended December 31, 2017, 2016, and 2015. Our audited consolidated financial statements are prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”).

Pursuant to IFRS, the information presented in this annual report presents financial information for 2017, 2016, 2015, 2014 and 2013 in nominal terms in Mexican pesos, taking into account local inflation of any hyperinflationary economic environment and converting the inflation adjusted local currency to Mexican pesos using the exchange rate at the end of the period of each country categorized as a hyperinflationary economic environment (for this annual report, only Venezuela).

Furthermore, pursuant to IFRS, determined as a result of Venezuela’s hyperinflationary economic environment and currency exchange regime, Coca-Cola FEMSA reported the results of its Venezuelan subsidiary, Coca-Cola FEMSA de Venezuela, S.A., or KOF Venezuela, as a separate consolidated reporting segment. Since its Venezuelan subsidiary will continue doing operations in Venezuela, Coca-Cola FEMSA changed the method of accounting for its investment in Venezuela from consolidation to fair value measured using a Level 3 concept as of December 31, 2017. Prior to December 31, 2017, Coca-Cola FEMSA’s recognition of the operations of KOF Venezuela involved a three-step accounting process to (1) translate all transactions based in foreign currencies into bolivars, (2) restate all nonmonetary accounts to current bolivar by applying the general price index and (3) then translate the bolivar amounts to Mexican Pesos. We translated the Venezuela subsidiary figures at an exchange rate of 22,793 bolivars per U.S. dollar at December 31, 2017, which better represents the economic conditions in Venezuela that are not otherwise reflected in the market exchange rate (the exchange rate was not published by the local central bank). For further information, see Notes 3.3, and 3.4 to our audited consolidated financial statements. For each non-hyperinflationary economic environment, local currency is converted to Mexican pesos using the year-end exchange rate for assets and liabilities, the historical exchange rate for equity and the average exchange rate for the income statement. See Note 3.3 to our audited consolidated financial statements.

Our non-Mexican subsidiaries maintain their accounting records in the currency and in accordance with accounting principles generally accepted in the country where they are located. For presentation in our consolidated financial statements, we adjust these accounting records into IFRS and report in Mexican pesos under these standards.

Commencing on February 1, 2017 Coca-Cola FEMSA started consolidating the financial results of Coca-Cola FEMSA Philippines, Inc., or KOF Philippines, in Coca-Cola FEMSA’s financial statements.

Except when specifically indicated, information in this annual report on Form 20-F is presented as of December 31, 2017 and does not give effect to any transaction, financial or otherwise, subsequent to that date.

2

The following table presents selected financial information of our company. This information should be read in conjunction with, and is qualified in its entirety by reference to, our audited consolidated financial statements, including the notes thereto. The selected financial information contained herein is presented on a consolidated basis, and is not necessarily indicative of our financial position or results at or for any future date or period. See Note 3 to our audited consolidated financial statements for our significant accounting policies.

| December 31, | ||||||||||||||||||||||||

| 2017(1)(2) | 2017(2)(3) | 2016(2)(4) | 2015(2)(5) | 2014 | 2013(6) | |||||||||||||||||||

| (in millions of Mexican pesos or millions of U.S. dollars, except percentages and share and per share data) |

||||||||||||||||||||||||

| Income Statement Data (for the year ended): |

||||||||||||||||||||||||

| Total revenues |

$ | 23,445 | Ps. | 460,456 | Ps. | 399,507 | Ps. | 311,589 | Ps. | 263,449 | Ps. | 258,097 | ||||||||||||

| Gross Profit |

8,669 | 170,268 | 148,204 | 123,179 | 110,171 | 109,654 | ||||||||||||||||||

| Income before Income Taxes and Share of the Profit of Associates and Joint Ventures Accounted for Using the Equity Method | 2,031 | 39,866 | 28,556 | 25,163 | 23,744 | 25,080 | ||||||||||||||||||

| Income taxes |

539 | 10,583 | 7,888 | 7,932 | 6,253 | 7,756 | ||||||||||||||||||

| Consolidated net income |

1,895 | 37,206 | 27,175 | 23,276 | 22,630 | 22,155 | ||||||||||||||||||

| Controlling interest net income |

2,160 | 42,408 | 21,140 | 17,683 | 16,701 | 15,922 | ||||||||||||||||||

| Non-controlling interest net income |

(265 | ) | (5,202 | ) | 6,035 | 5,593 | 5,929 | 6,233 | ||||||||||||||||

| Basic controlling interest net income: |

||||||||||||||||||||||||

| Per Series B Share |

0.11 | 2.12 | 1.05 | 0.88 | 0.83 | 0.79 | ||||||||||||||||||

| Per Series D Share |

0.13 | 2.65 | 1.32 | 1.10 | 1.04 | 1.00 | ||||||||||||||||||

| Diluted controlling interest net income: |

||||||||||||||||||||||||

| Per Series B Share |

0.11 | 2.11 | 1.05 | 0.88 | 0.83 | 0.79 | ||||||||||||||||||

| Per Series D Share |

0.13 | 2.64 | 1.32 | 1.10 | 1.04 | 0.99 | ||||||||||||||||||

| Weighted average number of shares outstanding (in millions): |

||||||||||||||||||||||||

| Series B Shares |

9,246.4 | 9,246.4 | 9,246.4 | 9,246.4 | 9,246.4 | 9,246.4 | ||||||||||||||||||

| Series D Shares |

8,644.7 | 8,644.7 | 8,644.7 | 8,644.7 | 8,644.7 | 8,644.7 | ||||||||||||||||||

| Allocation of earnings: |

||||||||||||||||||||||||

| Series B Shares |

46.11 | % | 46.11 | % | 46.11 | % | 46.11 | % | 46.11 | % | 46.11 | % | ||||||||||||

| Series D Shares |

53.89 | % | 53.89 | % | 53.89 | % | 53.89 | % | 53.89 | % | 53.89 | % | ||||||||||||

| Financial Position Data (as of): |

||||||||||||||||||||||||

| Total assets |

$ | 29,967 | Ps. | 588,541 | Ps. | 545,623 | Ps. | 409,332 | Ps. | 376,173 | Ps. | 359,192 | ||||||||||||

| Current liabilities |

5,348 | 105,022 | 86,289 | 65,346 | 49,319 | 48,869 | ||||||||||||||||||

| Long-term debt(7) |

5,996 | 117,758 | 131,967 | 85,969 | 82,935 | 72,921 | ||||||||||||||||||

| Other long-term liabilities |

1,468 | 28,849 | 41,197 | 16,161 | 13,797 | 14,852 | ||||||||||||||||||

| Capital stock |

170 | 3,348 | 3,348 | 3,348 | 3,347 | 3,346 | ||||||||||||||||||

| Total equity |

17,155 | 336,912 | 286,170 | 241,856 | 230,122 | 222,550 | ||||||||||||||||||

| Controlling interest |

12,744 | 250,291 | 211,904 | 181,524 | 170,473 | 159,392 | ||||||||||||||||||

| Non-controlling interest |

4,411 | 86,621 | 74,266 | 60,332 | 59,649 | 63,158 | ||||||||||||||||||

| Other Information |

||||||||||||||||||||||||

| Depreciation |

$ | 795 | Ps. | 15,613 | Ps. | 12,076 | Ps. | 9,761 | Ps. | 9,029 | Ps. | 8,805 | ||||||||||||

| Capital expenditures(8) |

1,282 | 25,180 | 22,155 | 18,885 | 18,163 | 17,882 | ||||||||||||||||||

| Gross margin(9) |

37 | % | 37 | % | 37 | % | 40 | % | 42 | % | 42 | % | ||||||||||||

| (1) | Translation to U.S. dollar amounts at an exchange rate of Ps. 19.6395 to US$ 1.00 solely for the convenience of the reader. |

| (2) | The exchange rate used to translate our operations in Venezuela as of and for the year ended on December 31, 2017 was an exchange rate of 22,793 bolivars to US$ 1.00, compared to the year ended on December 31, 2016 which was the DICOM rate of 673.76 bolivars to US$ 1.00 and compared to the year ended on December 31, 2015 which was the SIMADI rate of 198.70 bolivars to US$ 1.00. See “Item 3. Key Information—Selected Consolidated Financial Data” Note 3.3 of our audited consolidated financial statements. |

| (3) | Includes results of Coca-Cola FEMSA Philippines (“CCFPI” or “KOF Philippines”) (formerly Coca-Cola Bottlers Philippines, Inc.), from February 2017 starting of consolidation accounting method. See “Item 4. Information on the Company—The Company—Corporate Background” and Note 4 to our audited consolidated financial statements. |

| (4) | Includes results of Vonpar, S.A. (“Vonpar” or “Group Vonpar”), from December 2016, and other business acquisitions. See “Item 4. Information on the Company—The Company—Corporate Background” and Note 4 to our audited consolidated financial statements. |

| (5) | Includes results of Socofar, S.A. (“Socofar” or “Group Socofar”), from October 2015, the Fuel Division from March 2015 and other business acquisitions. See “Item 4. Information on the Company—The Company—Corporate Background” and Note 4 of our audited consolidated financial statements. |

| (6) | Includes results of KOF Philippines, from February 2013 using the equity method, Grupo Yoli, S.A. de C.V. (“Group Yoli”) from June 2013, Companhia Fluminense de Refrigerantes (“Companhia Fluminense”) from September 2013, Spaipa S.A. Indústria Brasileira de Bebidas (“Spaipa”) from November 2013 and other business acquisitions. See “Item 4. Information on the Company—Coca-Cola FEMSA—Corporate History.” |

| (7) | Includes long-term debt minus the current portion of long-term debt. |

| (8) | Includes investments in property, plant and equipment, intangible and other assets, net of cost of long lived assets sold, and write-off. |

| (9) | Gross margin is calculated by dividing gross profit by total revenues. |

3

We have historically paid dividends per BD Unit (including in the form of American Depositary Shares, or “ADSs”) approximately equal to or greater than 1% of the market price on the date of declaration, subject to changes in our results and financial position, including due to extraordinary economic events and to the factors described in “Item 3. Key Information—Risk Factors” that affect our financial condition and liquidity. These factors may affect whether or not dividends are declared and the amount of such dividends. We do not expect to be subject to any contractual restrictions on our ability to pay dividends, although our subsidiaries may be subject to such restrictions. Because we are a holding company with no significant operations of our own, we will have distributable profits and cash to pay dividends only to the extent that we receive dividends from our subsidiaries. Accordingly, we cannot assure you that we will pay dividends or as to the amount of any dividends.

The following table sets forth for each year the nominal amount of dividends per share that we declared in Mexican peso and U.S. dollar amounts and their respective payment dates for the 2013 to 2017 fiscal years:

| Date Dividend Paid |

Fiscal Year with Respect to which Dividend was Declared |

Aggregate Amount of Dividend Declared |

Per Series B Share Dividend |

Per Series B Share Dividend(7) |

Per Series D Share Dividend |

Per Series D Share Dividend(7) |

||||||||||||||||

| May 7, 2013 and November 7, 2013(1) | 2012 | Ps.6,684,103,000 | Ps.0.3333 | $ | 0.0264 | Ps.0.4166 | $ | 0.0330 | ||||||||||||||

| May 7, 2013 |

Ps.0.1666 | $ | 0.0138 | Ps.0.2083 | $ | 0.0173 | ||||||||||||||||

| November 7, 2013 |

Ps.0.1666 | $ | 0.0126 | Ps.0.2083 | $ | 0.0158 | ||||||||||||||||

| December 18, 2013(2) |

2012 | Ps.6,684,103,000 | Ps.0.3333 | $ | 0.0257 | Ps.0.4166 | $ | 0.0321 | ||||||||||||||

| May 7, 2015 and November 5, 2015(3) | 2014 | Ps.7,350,000,000 | Ps.0.3665 | $ | 0.0230 | Ps.0.4581 | $ | 0.0287 | ||||||||||||||

| May 7, 2015 |

Ps.0.1833 | $ | 0.0120 | Ps.0.2291 | $ | 0.0149 | ||||||||||||||||

| November 5, 2015 |

Ps.0.1833 | $ | 0.0110 | Ps.0.2291 | $ | 0.0132 | ||||||||||||||||

| May 5, 2016 and November 3, 2016(4) | 2015 | Ps.8,355,000,000 | Ps.0.4167 | $ | 0.0225 | Ps.0.5208 | $ | 0.0282 | ||||||||||||||

| May 5, 2016 |

Ps.0.2083 | $ | 0.0117 | Ps.0.2604 | $ | 0.0146 | ||||||||||||||||

| November 3, 2016 |

Ps.0.2083 | $ | 0.0108 | Ps.0.2604 | $ | 0.0135 | ||||||||||||||||

| May 5, 2017 and November 3, 2017(5) | 2016 | Ps.8,636,000,000 | Ps.0.4307 | $ | 0.0226 | Ps.0.5383 | $ | 0.0282 | ||||||||||||||

| May 5, 2017 |

Ps.0.2153 | $ | 0.0113 | Ps.0.2692 | $ | 0.0142 | ||||||||||||||||

| November 3, 2017 |

Ps.0.2153 | $ | 0.0112 | Ps.0.2692 | $ | 0.0140 | ||||||||||||||||

| May 4, 2018 and November 6, 2018(6) | 2017 | Ps.9,220,625,674 | Ps.0.4598 | N/A | Ps.0.5748 | N/A | ||||||||||||||||

| May 4, 2018 |

Ps.0.2299 | N/A | Ps.0.2874 | N/A | ||||||||||||||||||

| November 6, 2018 |

Ps.0.2299 | N/A | Ps.0.2874 | N/A | ||||||||||||||||||

| (1) | The dividend payment for 2012 was divided into two equal payments in Mexican pesos. The first payment was payable on May 7, 2013 with a record date of May 6, 2013, and the second payment was payable on November 7, 2013 with a record date of November 6, 2013. |

| (2) | The dividend payment declared in December 2013 was payable on December 18, 2013 with a record date of December 17, 2013. |

| (3) | The dividend payment for 2014 was divided into two equal payments in Mexican pesos. The first payment was payable on May 7, 2015 with a record date of May 6, 2015, and the second payment was payable on November 5, 2015 with a record date of November 4, 2015. The dividend payment for 2014 was derived from the balance of the net tax profit account for the fiscal year ended December 31, 2013. See Note 22 to our audited consolidated financial statements. |

| (4) | The dividend payment for 2015 was divided into two equal payments. The first payment was payable on May 5, 2016 with a record date of May 4, 2016, and the second payment was payable on November 3, 2016 with a record date of November 1, 2016. The dividend payment for 2015 was derived from the balance of the net tax profit account for the fiscal year ended December 31, 2013. See Note 22 to our audited consolidated financial statements. |

| (5) | The dividend payment for 2016 was divided into two equal payments. The first payment was payable on May 5, 2017 with a record date of May 4, 2017, and the second payment was payable on November 3, 2017 with a record date of November 1, 2017. The dividend payment for 2016 was derived from the balance of the net tax profit account for the fiscal year ended December 31, 2013. See Note 22 to our audited consolidated financial statements. |

| (6) | The dividend payment for 2017 will be divided into two equal payments. The first payment will become payable on May 4, 2018 with a record date of May 3, 2018 and the second payment will become payable on November 6, 2018 with a record date of November 5, 2018. The dividend payment for 2017 was derived from the balance of the net tax profit account for the fiscal year ended December 31, 2013. See Note 22 to our audited consolidated financial statements. |

| (7) | Translations to U.S. dollars are based on the exchange rates on the dates the payments were made. |

4

At the annual ordinary general shareholders meeting, or “AGM”, the board of directors submits the audited consolidated financial statements of our company for the previous fiscal year, together with a report thereon by the board of directors. Once the holders of Series B Shares have approved the audited consolidated financial statements, they determine the allocation of our net profits for the preceding year. Mexican law requires the allocation of at least 5% of net profits to a legal reserve, which is not subsequently available for distribution, until the amount of the legal reserve equals 20% of our paid in capital stock. As of the date of this report, the legal reserve of our company is fully constituted. Thereafter, the holders of Series B Shares may determine and allocate a certain percentage of net profits to any general or special reserve, including a reserve for open-market purchases of our shares. The remainder of net profits is available for distribution in the form of dividends to our shareholders. Dividends may only be paid if net profits are sufficient to offset losses from prior fiscal years.

Our bylaws provide that dividends will be allocated among the outstanding and fully paid shares at the time a dividend is declared in such manner that each Series D-B Share and Series D-L Share receives 125% of the dividend distributed in respect of each Series B Share. Holders of Series D-B Shares and Series D-L Shares are entitled to this dividend premium in connection with all dividends paid by us other than payments in connection with the liquidation of our company.

Subject to certain exceptions contained in the deposit agreement dated May 11, 2007, among FEMSA, The Bank of New York Mellon (formerly The Bank of New York), as ADS depositary and holders and beneficial owners from time to time of our ADSs, evidenced by American Depositary Receipts, or ADRs, any dividends distributed to holders of our ADSs will be paid to the ADS depositary in Mexican pesos and will be converted by the ADS depositary into U.S. dollars. As a result, restrictions on conversion of Mexican pesos into foreign currencies may affect the ability of holders of our ADSs to receive U.S. dollars, and exchange rate fluctuations may affect the U.S. dollar amount actually received by holders of our ADSs.

5

The following table sets forth, for the periods indicated, the high, low, average and year-end noon exchange rate, expressed in Mexican pesos per US$ 1.00, as published by the Federal Reserve Bank of New York. The rates have not been restated in constant currency units and therefore represent nominal historical figures.

| Year ended December 31, |

Exchange Rate | |||||||||||||||

| High | Low | Average(1) | Year End | |||||||||||||

| 2013 |

13.43 | 11.98 | 12.86 | 13.10 | ||||||||||||

| 2014 |

14.79 | 12.85 | 13.35 | 14.75 | ||||||||||||

| 2015 |

17.36 | 14.56 | 15.97 | 17.20 | ||||||||||||

| 2016 |

20.84 | 17.19 | 18.70 | 20.62 | ||||||||||||

| 2017 |

21.89 | 17.48 | 18.89 | 19.64 | ||||||||||||

| (1) | Average month-end rates. |

| Exchange Rate | ||||||||||||

| High | Low | Period End | ||||||||||

| 2016: |

||||||||||||

| First Quarter |

Ps.19.19 | Ps.17.21 | Ps.17.21 | |||||||||

| Second Quarter |

19.15 | 17.19 | 18.49 | |||||||||

| Third Quarter |

19.86 | 17.98 | 19.34 | |||||||||

| Fourth Quarter |

20.84 | 18.44 | 20.62 | |||||||||

| 2017: |

||||||||||||

| First Quarter |

Ps.21.89 | Ps.18.67 | Ps.18.83 | |||||||||

| Second Quarter |

19.15 | 17.88 | 18.08 | |||||||||

| Third Quarter |

18.33 | 17.48 | 18.15 | |||||||||

| Fourth Quarter |

19.73 | 18.21 | 19.64 | |||||||||

| October |

19.18 | 18.21 | 19.13 | |||||||||

| November |

19.26 | 18.51 | 18.63 | |||||||||

| December |

19.73 | 18.62 | 19.64 | |||||||||

| 2018: |

||||||||||||

| January |

Ps.19.48 | Ps.18.49 | Ps.18.62 | |||||||||

| February |

18.90 | 18.36 | 18.84 | |||||||||

| March |

18.86 | 18.17 | 18.17 | |||||||||

| First Quarter |

19.48 | 18.17 | 18.17 | |||||||||

6

Risks Related to Our Company

Coca-Cola FEMSA

Coca-Cola FEMSA’s business depends on its relationship with The Coca-Cola Company, and changes in this relationship may adversely affect its business, financial condition, results of operations and prospects.

Substantially all of Coca-Cola FEMSA’s sales are derived from sales of Coca-Cola trademark beverages. Coca-Cola FEMSA produces, markets, sells and distributes Coca-Cola trademark beverages through standard bottler agreements in the territories where Coca-Cola FEMSA operates. Coca-Cola FEMSA is required to purchase concentrate for all Coca-Cola trademark beverages from companies designated by The Coca-Cola Company, which price may be unilaterally determined from time to time by The Coca-Cola Company in all such territories. Coca-Cola FEMSA is also required to purchase sweeteners and other raw materials only from companies authorized by The Coca-Cola Company. See “Item 4. Information on the Company—Coca-Cola FEMSA—Coca-Cola FEMSA’s Territories.” Pursuant to Coca-Cola FEMSA’s bottler agreements, The Coca-Cola Company has the right to participate in the process for making certain decisions related to Coca-Cola FEMSA’s business.

In addition, under Coca-Cola FEMSA’s bottler agreements, Coca-Cola FEMSA is prohibited from bottling or distributing any other beverages without The Coca-Cola Company’s authorization or consent, and Coca-Cola FEMSA may not transfer control of the bottler rights of any of its territories without prior consent from The Coca-Cola Company.

The Coca-Cola Company makes significant contributions to Coca-Cola FEMSA’s marketing expenses, although it is not required to contribute a particular amount. Accordingly, The Coca-Cola Company may discontinue or reduce such contributions at any time.

Coca-Cola FEMSA depends on The Coca-Cola Company to continue with Coca-Cola FEMSA’s bottler agreements. Coca-Cola FEMSA’s bottler agreements are automatically renewable for ten-year terms, subject to the right of either party to give prior notice that it does not wish to renew the applicable agreement. In addition, these agreements generally may be terminated in the case of material breach. See “Item 10. Additional Information—Material Contracts— Material Contracts Relating to Coca-Cola FEMSA —Bottler Agreements.” Termination of any such bottler agreement would prevent Coca-Cola FEMSA from selling Coca-Cola trademark beverages in the affected territory. The foregoing and any other adverse changes in Coca-Cola FEMSA’s relationship with The Coca-Cola Company would have an adverse effect on Coca-Cola FEMSA’s business, financial condition, results of operations and prospects.

The Coca-Cola Company has substantial influence on the conduct of Coca-Cola FEMSA’s business, which may result in Coca-Cola FEMSA taking actions contrary to the interests of its shareholders other than The Coca-Cola Company.

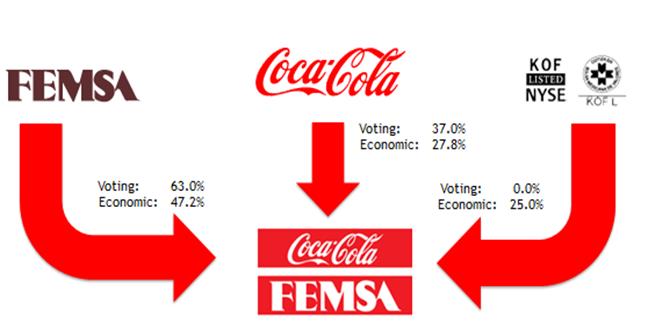

The Coca-Cola Company has substantial influence on the conduct of Coca-Cola FEMSA’s business. As of April 13, 2018, The Coca-Cola Company indirectly owned 27.8% of Coca-Cola FEMSA’s outstanding capital stock, representing 37.0% of Coca-Cola FEMSA’s capital stock with full voting rights. The Coca-Cola Company is entitled to appoint five of Coca-Cola FEMSA’s maximum of 21 directors and the vote of at least two of them is required to approve certain actions by Coca-Cola FEMSA’s board of directors. As of April 13, 2018, we indirectly owned 47.2% of Coca-Cola FEMSA’s outstanding capital stock, representing 63.0% of Coca-Cola FEMSA’s capital stock with full voting rights. We are entitled to appoint 13 of Coca-Cola FEMSA’s maximum of 21 directors and all of Coca-Cola FEMSA’s executive officers. We and The Coca-Cola Company together, or only us in certain circumstances, have the power to determine the outcome of all actions requiring approval by Coca-Cola FEMSA’s board of directors, and we and The Coca-Cola Company together, or only us in certain circumstances, have the power to determine the outcome of all actions requiring approval of Coca-Cola FEMSA’s shareholders. See “Item 10. Additional Information—Material Contracts— Material Contracts Relating to Coca-Cola FEMSA—The Shareholders Agreement.” The interests of The Coca-Cola Company may be different from the interests of Coca-Cola FEMSA’s other shareholders, which may result in Coca-Cola FEMSA taking actions contrary to the interests of such other shareholders.

7

Changes in consumer preferences and public concern about health related issues could reduce demand for some of Coca-Cola FEMSA’s products.

The non-alcoholic beverage industry is evolving mainly as a result of changes in consumer preferences and regulatory actions. There have been different plans and actions adopted in recent years by governmental authorities in some of the countries where Coca-Cola FEMSA operates. These include increases in tax rates or the imposition of new taxes on the sale of beverages containing certain sweeteners, and other regulatory measures, such as restrictions on advertising for some of Coca-Cola FEMSA’s products. Moreover, researchers, health advocates and dietary guidelines are encouraging consumers to reduce their consumption of certain types of beverages sweetened with sugar and High Fructose Corn Syrup (or “HFCS”). In addition, concerns over the environmental impact of plastic may reduce the consumption of Coca-Cola FEMSA’s products sold in plastic bottles or result in additional taxes that could adversely affect consumer demand. Increasing public concern about these issues, new or increased taxes, other regulatory measures or our failure to meet consumers’ preferences, could reduce demand for some of Coca-Cola FEMSA’s products, which would adversely affect Coca-Cola FEMSA’s business, financial condition, results of operations and prospects. See “Item 4. Information on the Company—Coca-Cola FEMSA—Business Strategy.”

The reputation of Coca-Cola trademarks and trademark infringement could adversely affect Coca-Cola FEMSA’s business.

Substantially all of Coca-Cola FEMSA’s sales are derived from sales of Coca-Cola trademark beverages owned by The Coca-Cola Company. Maintenance of the reputation and intellectual property rights of these trademarks is essential to Coca-Cola FEMSA’s ability to attract and retain retailers and consumers and is a key driver for Coca-Cola FEMSA’s success. Failure to maintain the reputation of Coca-Cola trademarks and/or to effectively protect these trademarks could have a material adverse effect on Coca-Cola FEMSA’s business, financial condition, results of operations and prospects.

If Coca-Cola FEMSA is unable to protect its information systems against service interruption, misappropriation of data or breaches of security, Coca-Cola FEMSA’s operations could be disrupted, which could have a material adverse effect on its business, financial condition, results of operations and prospects.

Coca-Cola FEMSA relies on networks and information systems and other technology, or information system, including the Internet and third-party hosted platforms and services to support a variety of business processes and activities, including procurement and supply chain, manufacturing, distribution, invoicing and collection of payments, and to store client and employee personal data. Coca-Cola FEMSA uses information systems to process financial information and results of operations for internal reporting purposes and to comply with regulatory financial reporting and legal and tax requirements. Because information systems are critical to many of Coca-Cola FEMSA’s operating activities, Coca-Cola FEMSA’s business may be impacted by system shutdowns, service disruptions or security breaches. In addition, such incidents could result in unauthorized disclosure of material confidential information. Coca-Cola FEMSA could be required to spend significant financial and other resources to remedy the damage caused by a security breach or to repair or replace networks and information systems. Any severe damage, disruption or shutdown in Coca-Cola FEMSA’s information systems could have a material adverse effect on its business, financial condition, results of operations and prospects.

Negative or inaccurate information on social media could adversely affect Coca-Cola FEMSA’s reputation.

In recent years, there has been a marked increase in the use of social media and similar platforms, including weblogs (blogs), social media websites, and other forms of Internet-based communications which allow individual access to a broad audience of consumers and other interested persons. Negative or inaccurate information concerning or affecting Coca-Cola FEMSA or the Coca-Cola trademarks may be posted on such platforms at any time. This information may harm Coca-Cola FEMSA’s reputation without affording us an opportunity for redress or correction, which could in turn have a material adverse effect on Coca-Cola FEMSA’s business, financial condition, results of operations and prospects.

8

Competition could adversely affect Coca-Cola FEMSA’s business, financial condition, results of operations and prospects.

The beverage industry in the territories where Coca-Cola FEMSA operates is highly competitive. Coca-Cola FEMSA faces competition from other bottlers of sparkling beverages, such as Pepsi trademark products and other bottlers and distributors of local beverage brands, and from producers of low-cost beverages or “B brands.” Coca-Cola FEMSA also competes in beverage categories other than sparkling beverages, such as water, juice-based beverages, coffee, teas, milk, value-added dairy products, sports drinks, energy drinks and plant-based beverages. Coca-Cola FEMSA expects that it will continue to face strong competition in Coca-Cola FEMSA’s beverage categories in all of Coca-Cola FEMSA’s territories and anticipate that existing or new competitors may broaden their product lines and extend their geographic scope.

Although competitive conditions are different in each of Coca-Cola FEMSA’s territories, we compete mainly in terms of price, packaging, effective promotional activities, access to retail outlets and sufficient shelf space, customer service, product innovation and product alternatives and the ability to identify and satisfy consumer preferences. See “Item 4. Information on the Company—Coca-Cola FEMSA—Competition.” Lower pricing and activities by Coca-Cola FEMSA’s competitors and changes in consumer preferences may have an adverse effect on Coca-Cola FEMSA’s business, financial condition, results of operations and prospects.

Water shortages or any failure to maintain existing concessions could adversely affect Coca-Cola FEMSA’s business, financial condition, results of operations and prospects.

Water is an essential component of all of Coca-Cola FEMSA’s products. Coca-Cola FEMSA obtains water from various sources in its territories, including springs, wells, rivers and municipal and state water companies pursuant to either concessions granted by governments in Coca-Cola FEMSA’s various territories (including governments at the federal, state or municipal level) or pursuant to contracts.

Coca-Cola FEMSA obtains the vast majority of the water used in its production from municipal utility companies and pursuant to concessions to use wells, which are generally granted based on studies of the existing and projected groundwater supply. Coca-Cola FEMSA’s existing water concessions or contracts to obtain water may be terminated by governmental authorities under certain circumstances and their renewal depends on several factors, including having paid all fees in full, having complied with applicable laws and obligations and receiving approval for renewal from local and/or federal water authorities. See “Item 4. Information on the Company—Regulatory Matters—Water Supply.” In some of Coca-Cola FEMSA’s other territories, Coca-Cola FEMSA’s existing water supply may not be sufficient to meet its future production needs, and the available water supply may be adversely affected by shortages or changes in governmental regulations and environmental changes.

We cannot assure you that water will be available in sufficient quantities to meet Coca-Cola FEMSA’s future production needs or will prove sufficient to meet Coca-Cola FEMSA’s water supply needs. Continued water scarcity in the regions where Coca-Cola FEMSA operates may adversely affect its business, financial condition, results of operations and prospects.

Increases in the prices of raw materials would increase Coca-Cola FEMSA’s cost of goods sold and may adversely affect its business, financial condition, results of operations and prospects.

In addition to water, Coca-Cola FEMSA’s most significant raw materials are (i) concentrate, which Coca-Cola FEMSA acquires from affiliates of The Coca-Cola Company, (ii) sweeteners and (iii) packaging materials.

Prices for Coca-Cola trademark beverages concentrate are determined by The Coca-Cola Company as a percentage of the weighted average retail price in local currency, net of applicable taxes. The Coca-Cola Company has the right to unilaterally change concentrate prices or change the manner in which such prices are calculated. In the past, The Coca-Cola Company has increased concentrate prices for Coca-Cola trademark beverages in some of the countries where Coca-Cola FEMSA operates. Coca-Cola FEMSA may not be successful in negotiating or implementing measures to mitigate the negative effect this may have in the pricing of Coca-Cola FEMSA’s products or its results.

9

The prices for Coca-Cola FEMSA’s other raw materials are driven by market prices and local availability, the imposition of import duties and restrictions and fluctuations in exchange rates. Coca-Cola FEMSA is also required to meet all of Coca-Cola FEMSA’s supply needs (including sweeteners and packaging materials) from suppliers approved by The Coca-Cola Company, which may limit the number of suppliers available to Coca-Cola FEMSA. Coca-Cola FEMSA’s sales prices are denominated in the local currency in each country where it operates, while the prices of certain materials, including those used in the bottling of Coca-Cola FEMSA’s products, mainly polyethylene terephthalate (or “PET”), resin, preforms to make plastic bottles, finished plastic bottles, aluminum cans, HFCS and certain sweeteners, are paid in, or determined with reference to, the U.S. dollar, and therefore may increase if the U.S. dollar appreciates against the applicable local currency. Coca-Cola FEMSA cannot anticipate whether the U.S. dollar will appreciate or depreciate with respect to such local currencies in the future, and we cannot assure you that Coca-Cola FEMSA will be successful in mitigating any such fluctuations through derivative instruments or otherwise. See “Item 4. Information on the Company—Coca-Cola FEMSA—Raw Materials.”

Coca-Cola FEMSA’s most significant packaging raw material costs arise from the purchase of PET resin, the price of which is related to crude oil prices and global PET resin supply. Crude oil prices have a cyclical behavior and are determined with reference to the U.S. dollar; therefore, high currency volatility may affect Coca-Cola FEMSA’s average price for PET resin in local currencies. In addition, since 2010, international sugar prices have been volatile due to various factors, including shifting demand, availability and climate issues affecting production and distribution. In all of the countries where Coca-Cola FEMSA operates, other than Brazil, sugar prices are subject to local regulations and other barriers to market entry that cause Coca-Cola FEMSA to purchase sugar above international market prices. See “Item 4. Information on the Company—Coca-Cola FEMSA—Raw Materials.” We cannot assure you that its raw material prices will not further increase in the future or that Coca-Cola FEMSA will be successful in mitigating any such increase through derivative instruments or otherwise. Increases in the prices of raw materials would increase its cost of goods sold and adversely affect its business, financial condition, results of operations and prospects.

Taxes could adversely affect Coca-Cola FEMSA’s business, financial condition, results of operations and prospects.

The countries where Coca-Cola FEMSA operates may adopt new tax laws or modify existing tax laws to increase taxes applicable to its business or products. Coca-Cola FEMSA’s products are subject to certain taxes in many of the countries where it operates. See “Item 4. Information on the Company—Regulatory Matters—Taxation of Beverages.” The imposition of new taxes, increases in existing taxes, or changes in the interpretation of tax laws and regulation by tax authorities may have a material adverse effect on Coca-Cola FEMSA’s business, financial condition, results of operations and prospects.

Tax legislation in some of the countries where Coca-Cola FEMSA operates has recently been subject to major changes. See “Item 4. Information on the Company—Regulatory Matters—Tax Reforms.” We cannot assure you that these reforms or other reforms adopted by governments in the countries where Coca-Cola FEMSA operates will not have a material adverse effect on its business, financial condition, results of operations and prospects.

Regulatory developments may adversely affect Coca-Cola FEMSA’s business, financial condition, results of operations and prospects.

Coca-Cola FEMSA is subject to several laws and regulations in each of the territories where it operates. The principal areas in which Coca-Cola FEMSA is subject to laws and regulations are water, environment, labor, taxation, health and antitrust. Laws and regulations can also affect Coca-Cola FEMSA’s ability to set prices for its products. See “Item 4. Information on the Company—Regulatory Matters.” Changes in existing laws and regulations, the adoption of new laws or regulations, or a stricter interpretation or enforcement thereof in the countries where Coca-Cola FEMSA operates may increase its operating and compliance costs or impose restrictions on Coca-Cola FEMSA’s operations which, in turn, may adversely affect its financial condition, business, results of operations and prospects. In particular, environmental standards are becoming more stringent in several of the countries where Coca-Cola FEMSA operates. There is no assurance that Coca-Cola FEMSA will be able to comply with changes in environmental laws and regulations within the timelines established by the relevant regulatory authorities. See “Item 4. Information on the Company—Regulatory Matters—Environmental Matters.”

10

Voluntary price restraints or statutory price controls have been imposed historically in several of the countries where Coca-Cola FEMSA operates. Currently, there are no price controls on Coca-Cola FEMSA’s products in any of the territories where Coca-Cola FEMSA has operations, except for those voluntary price restraints in Argentina, where authorities directly supervise certain of Coca-Cola FEMSA’s products sold through supermarkets as a measure to control inflation, and statutory price controls in the Philippines, where the government has imposed price controls on certain products considered as basic necessities, such as Coca-Cola FEMSA’s bottled water. We cannot assure you that existing or future laws and regulations in the countries where Coca-Cola FEMSA operates relating to goods and services (in particular, laws and regulations imposing statutory price controls) will not affect Coca-Cola FEMSA’s products, or that Coca-Cola FEMSA will not need to implement voluntary price restraints, which could have a negative effect on its business, financial condition, results of operations and prospects. See “Item 4. Information on the Company—Regulatory Matters—Price Controls.”

Unfavorable outcome of legal proceedings could have an adverse effect on Coca-Cola FEMSA’s business, financial condition, results of operations and prospects.

Coca-Cola FEMSA’s operations have from time to time been and may continue to be subject to investigations and proceedings by antitrust authorities relating to alleged anticompetitive practices. Coca-Cola FEMSA also has been subject to investigations and proceedings on tax, consumer protection, environmental, labor and commercial matters. We cannot assure you that these investigations and proceedings will not have an adverse effect on Coca-Cola FEMSA’s business, financial condition, results of operations and prospects. See “Item 8. Financial Information—Legal Proceedings.”

Weather conditions and natural disasters may adversely affect Coca-Cola FEMSA’s business, financial condition, results of operations and prospects.

Lower temperatures, higher rainfall and other adverse weather conditions such as typhoons and hurricanes, as well as natural disasters such as earthquakes and floods, may negatively impact consumer patterns, which may result in reduced sales of Coca-Cola FEMSA’s beverage offerings. Additionally, such adverse weather conditions and natural disasters may affect plant installed capacity, road infrastructure and points of sale in the territories where Coca-Cola FEMSA operates and limit its ability to produce, sell and distribute its products, thus affecting Coca-Cola FEMSA’s business, financial condition, results of operations and prospects.

Coca-Cola FEMSA may not be able to successfully integrate its acquisitions and achieve the expected operational efficiencies or synergies.

Coca-Cola FEMSA has and it may continue to acquire bottling operations and other businesses. Key elements to achieving the benefits and expected synergies of Coca-Cola FEMSA’s acquisitions and mergers are the integration of acquired or merged businesses’ operations into Coca-Cola FEMSA’s own in a timely and effective manner and the retention of qualified and experienced key personnel. Coca-Cola FEMSA may incur unforeseen liabilities in connection with acquiring, taking control of, or managing bottling operations and other businesses and may encounter difficulties and unforeseen or additional costs in restructuring and integrating them into Coca-Cola FEMSA’s operating structure. We cannot assure you that these efforts will be successful or completed as expected by Coca-Cola FEMSA, and Coca-Cola FEMSA’s business, financial condition, results of operations and prospects could be adversely affected if it is unable to do so.

11

FEMSA Comercio

Competition from other retailers in the markets where FEMSA Comercio operates could adversely affect its business, financial condition, results of operations and prospects.

The retail sector is highly competitive in the markets where FEMSA Comercio operates. The Retail Division participates in the retail sector primarily through its OXXO stores, which face competition from small-format stores such as 7-Eleven, Circle K, other numerous chains of grocery retailers across Mexico and other regional small-format retailers and small informal neighborhood stores. In particular, small informal neighborhood stores can sometimes avoid regulatory oversight and taxation, enabling them to sell certain products at prices below average market prices. In addition, these small informal neighborhood stores could improve their technological capabilities so as to enable credit card transactions and electronic payment of utility bills, which would diminish one of the Retail Division’s competitive advantages.

In the pharmacy sector, FEMSA Comercio participates through the Health Division in Mexico, Chile and Colombia. In Mexico, it faces competition from other drugstore chains such as Farmacias Guadalajara, Farmacias del Ahorro and Farmacias Benavides, as well as regional and independent pharmacies, supermarkets and other informal neighborhood drugstores. In Chile, relevant competitors are chain drugstores such as Farmacias Ahumada and Salcobrand, while in Colombia, the most relevant competitors are Farmatodo, Olimpica, Farmacenter, La Rebaja and Colsubsidio.

For the Fuel Division, the opening of the Mexican fuel distribution market is expected to alter the competitive dynamics of the industry. The consolidation process, expected to take place as large companies and international competitors enter the market, may occur rapidly and materially alter the market dynamics in Mexico. Currently, the Fuel Division faces competition from small independently owned and operated service stations, regional chains such as Corpogas, Hidrosina, Petro-7, Orsan and international players such as British Petroleum and Shell.

Additionally, we expect the competitive landscape to continue to evolve as new technologies are developed based on changing consumer behavior. The continuing migration and evolution of retailing to on-line and mobile-based platforms for consumers may present competition in the retail space in the future that could adversely affect the Retail Division.

FEMSA Comercio may face additional competition from new market participants. The increase in competition may limit the number of new locations available and could require FEMSA Comercio to modify its product offering or pricing scheme. As a consequence, future competition may affect the financial situation, operation results and prospects of FEMSA Comercio.

FEMSA Comercio’s points of sale performance may be adversely affected by changes in economic conditions in the markets where it operates.

The markets in which FEMSA Comercio operates are highly sensitive to economic conditions, because a decline in consumer purchasing power is often a consequence of an economic slowdown which, in turn, results in a decline in the overall consumption of main product categories. During periods of economic slowdown, FEMSA Comercio’s points of sale may experience a decline in same-store traffic and average ticket per customer, which may result in a decline in overall performance. See “Item 5. Operating and Financial Review and Prospects—Overview of Events, Trends and Uncertainties.”

FEMSA Comercio’s business expansion strategy and entry into new markets and retail formats may lead to decreased profit margins.

FEMSA Comercio has recently entered into new markets through the acquisition of other small-format retail businesses such as quick-service restaurants. In recent years, the Retail Division and the Health Division have continued with this strategy. These new businesses are currently less profitable than OXXO and might therefore marginally dilute FEMSA Comercio’s margins in the short to medium term.

Regulatory changes in the countries where we operate may adversely affect FEMSA Comercio’s business.

In the markets where it operates, FEMSA Comercio is subject to regulation in areas such as labor, zoning, operations and related local permits and health and safety regulations. Changes in existing laws and regulations, the adoption of new laws or regulations, or a stricter interpretation or enforcement thereof in the countries where FEMSA Comercio operates may increase its operating and compliance costs or impose restrictions on its operations which, in turn, may adversely affect the financial situation, operation results and prospects of FEMSA Comercio’s business. In addition, changes in current laws and regulations may negatively impact customer traffic, revenues, operational costs and commercial practices, which may have an adverse effect on the financial situation, operation results and prospects of FEMSA Comercio.

12

FEMSA Comercio’s business depends heavily on information technology and a failure, interruption or breach of its IT systems could adversely affect it.

FEMSA Comercio’s businesses rely heavily on advanced information technology (“IT”) systems to effectively manage its data, communications, connectivity and other business processes. FEMSA Comercio invests aggressively in IT to maximize its value generation potential. The development of IT systems, hardware and software needs to keep pace with the businesses’ growth due to the high speed at which the division adds new services and products to its commercial offerings. If these systems become obsolete or if the planning for future IT investments is inadequate, FEMSA Comercio businesses could be adversely affected.

Although FEMSA Comercio constantly improves and protects its IT systems with advanced security measures, they still may be subject to defects, interruptions or security breaches such as viruses or data theft. Such a defect, interruption or breach could adversely affect the financial situation, operation results and prospects of FEMSA Comercio.

FEMSA Comercio’s business may be adversely affected by an increase in the price of electricity in the markets where it operates.

The performance of FEMSA Comercio’s points of sale would be adversely affected by increases in the price of utilities on which the stores and stations depend, such as electricity. As an example, given the relevance of the Mexican market, the price of electricity in Mexico generally remained stable or decreased in recent years, with an exception for the second half of 2016 and 2017, when the price increased significantly. Electricity prices could potentially increase further as a result of inflation, shortages, interruptions in supply or other reasons, and such an increase could adversely affect the financial situation, operation results and prospects of FEMSA Comercio’s business.

Tax changes in the countries where we operate could adversely affect FEMSA Comercio’s business.

The imposition of new taxes, increases in existing taxes or changes in the interpretation of tax laws and regulations by tax authorities, may have a material adverse effect on the financial situation, operation results and prospects of FEMSA Comercio’s business.

The Retail Division may not be able to maintain its historic growth rate.

The Retail Division increased the number of OXXO stores at a compound annual growth rate of 9.0% from 2013 to 2017. The growth in the number of OXXO stores has driven growth in total revenue and results at the Retail Division over the same period. As the overall number of stores increases, percentage growth in the number of OXXO stores is likely to slow. In addition, as small-format store penetration in Mexico grows, the number of viable new store locations may decrease, and new store locations may be less favorable in terms of same-store sales, average ticket and store traffic. Thus, our future results and financial situation may not be consistent with prior periods and may be characterized by lower growth rates in terms of total revenue and results of operations. In Chile and Colombia, OXXO stores may not be able to achieve or maintain historic growth rates like those in Mexico. We cannot assure that the revenues and cash flows of the Retail Division that come from future retail stores will be comparable with those generated by existing retail stores. See “Item 4. Information on the Company—FEMSA Comercio—Retail Division—Store Locations.”

The Health Division’s sales may be affected by a material change in institutional sale trends in some of the markets where it operates.

In some of the markets where we operate, our sales are highly dependent on institutional sales, as well as traditional, open-market sales. The institutional market involves public and private health care providers, and the performance of the Health Division could be affected by its ability to maintain and grow its client base.

13

The Health Division’s performance may be affected by contractual conditions with its suppliers.

The Health Division, especially in Mexico, acquires the majority of its inventories and healthcare products from a limited number of suppliers. Its ability to maintain favorable conditions in its current price and service agreements could potentially affect the Health Division’s operating and financial performance.

Energy regulatory changes may impact fuel prices and therefore adversely affect the Fuel Division’s business.

The Fuel Division mainly sells gasoline and diesel through owned or leased retail service stations. Previously, the prices of these products were regulated in Mexico by the government agency named Comisión Reguladora de Energía (“CRE” or Energy Regulatory Commission). During 2017, fuel prices gradually began to follow the dynamics of the international fuel market, and in 2018 we expect them to continue to do so in accordance with the regulatory framework, which may also adversely affect the financial situation, operation results and prospects of the Fuel Division’s business.

The Fuel Division’s performance may be affected by changes in commercial terms with suppliers, or disruptions to the industry supply chain

The Fuel Division mainly purchases gasoline and diesel for its operations in Mexico. The fuel market in Mexico is currently undergoing structural changes that should gradually increase the number of suppliers. As the industry evolves, commercial terms for the Fuel Division could deteriorate in the future, and potential disruptions to the order of the supply chain to our gas stations could adversely impact the financial performance and prospects of the Fuel Division.

The Fuel Division’s business could be affected by new safety and environmental regulations enforced by the government, global environmental regulations and new energy technologies.

Federal, state and municipal laws and regulations for the installation and operation of service stations are becoming more stringent. Compliance with these laws and regulations is often difficult and costly. Global trends to reduce the consumption of fossil fuels through incentives and taxes could push sales of these fuels at service stations to slow or decrease in the future and automotive technologies, including efficiency gains in traditional fuel vehicles and increased popularity of alternative fuel vehicles, such as electric and liquefied petroleum gas (“LPG”) vehicles, have caused a significant reduction in fuel consumption globally. Other new technologies could further reduce the sale of traditional fuels, all of which could adversely affect operation results and financial situation of the Fuel Division. See “Item 4. Information on the Company—Regulatory Matters—Environmental Matters.”

Risks Related to Mexico and the Other Countries Where We Operate

Adverse economic conditions in Mexico may adversely affect our financial position and results.

We are a Mexican corporation and our Mexican operations are our single most important geographic territory. For the year ended December 31, 2017, 63% of our consolidated total revenues were attributable to Mexico. During 2015 and 2016 the Mexican gross domestic product, or GDP, increased by approximately 2.6% and 2.3% respectively, and in 2017 it increased by approximately 2.3% on an annualized basis compared to 2016, due to stronger performance in the services and primary sectors, which were partially offset by lower volumes and higher prices in the oil and gas industries. We cannot assure that such conditions will not slow down in the future or will not have a material adverse effect on our business, financial condition, results of operations and prospects going forward. The Mexican economy continues to be heavily influenced by the U.S. economy, and therefore, deterioration in economic conditions in, or delays in the recovery of, the U.S. economy may hinder any recovery. In the past, Mexico has experienced both prolonged periods of weak economic conditions and deteriorations in economic conditions that have had a negative impact on our results.

Our business may be significantly affected by the general condition of the Mexican economy, or by the rate of inflation in Mexico, interest rates in Mexico and exchange rates for, or exchange controls affecting, the Mexican peso. Decreases in the growth rate of the Mexican economy, periods of negative growth and/or increases in inflation or interest rates may result in lower demand for our products, lower real pricing of our products or a shift to lower margin products. Because a large percentage of our costs and expenses are fixed, we may not be able to reduce costs and expenses upon the occurrence of any of these events and our profit margins may suffer as a result.

14

In addition, an increase in interest rates in Mexico would increase the cost of our debt and would cause an adverse effect on our financial position and results. Mexican peso-denominated debt (including currency hedges) constituted 39.6% of our total debt as of December 31, 2017.

Depreciation of the Mexican peso and of our other local currencies relative to the U.S. dollar could adversely affect our financial position and results.

Depreciation of the Mexican peso and of our other local currencies relative to the U.S. dollar increases the cost of a portion of the raw materials we acquire, the price of which is paid in or determined with reference to U.S. dollars, and of our debt obligations denominated in U.S. dollars, and thereby negatively affects our financial position and results. A severe devaluation or depreciation of the Mexican peso, which is our main operating currency, may result in disruption of the international foreign exchange markets and may limit our ability to transfer or to convert Mexican pesos into U.S. dollars and other currencies for the purpose of making timely payments of interest and principal on our U.S. dollar-denominated debt or obligations in other currencies. The Mexican peso is a free-floating currency and, as such, it experiences exchange rate fluctuations relative to the U.S. dollar over time. During 2017, the Mexican peso appreciated relative to the U.S. dollar by approximately 4.8% compared to 2016. During 2016 and 2015, the Mexican peso experienced fluctuations relative to the U.S. dollar consisting of 19.9% of depreciation and 16.6% of depreciation respectively, compared to the years of 2015, 2014. Through April 20, 2018, the Mexican peso has appreciated 5.2% since December 29, 2017.

While the Mexican government does not currently restrict, and since 1982 has not restricted, the right or ability of Mexican or foreign persons or entities to convert Mexican pesos into U.S. dollars or to transfer other currencies out of Mexico, the Mexican government could impose restrictive exchange rate policies in the future, as it has done in the past. Currency fluctuations may have an adverse effect on our financial position, results and cash flows in future periods.

When the financial markets are volatile, as they have been in recent periods, our results may be substantially affected by variations in exchange rates and commodity prices and, to a lesser degree, interest rates. These effects include foreign exchange gain and loss on assets and liabilities denominated in U.S. dollars, fair value gain and loss on derivative financial instruments, commodities prices and changes in interest income and interest expense. These effects can be much more volatile than our operating performance and our operating cash flows. See “Item 11. Quantitative and Qualitative Disclosures about Market Risk—Foreign Currency Exchange Rate Risk.”

Political events in Mexico could adversely affect our operations.

Mexican political events may significantly affect our operations. The most recent presidential and congressional elections took place in July 2012 and 2015, respectively. Enrique Peña Nieto, a member of the Institutional Revolutionary Party (Partido Revolucionario Institucional or “PRI”), was elected President of Mexico and took office on December 1, 2012. Mexico’s next presidential election will be in July 2018. We cannot predict whether potential changes in Mexican governmental and economic policy could adversely affect economic conditions in Mexico or the sector in which we operate. The Mexican president strongly influences new policies and governmental actions regarding the Mexican economy, and the new administration could implement substantial changes in law, policy and regulations in Mexico, which could negatively affect our business, financial condition, results of operations and prospects. In response to these actions, opponents of the administration could react with, among other things, riots, protests and looting that could negatively affect our operations.

Furthermore, no single party has a majority in the Senate or the Cámara de Diputados (House of Representatives). Mexican congressional elections held in June 2015 in the lower house resulted in a relative majority (29.18%) for the PRI, but the PRI still lacks an absolute majority. The absence of a clear majority by a single party could result in government gridlock and political uncertainty on further reforms and secondary legislation to modernize key sectors of the Mexican economy. Mexico’s next federal legislative election will be in July 2018 for both the Senate and House of Representatives. We cannot provide any assurances that political developments in Mexico, over which we have no control, will not have an adverse effect on our business, financial condition, results of operations and prospects.

15

Economic, political and social conditions in Mexico and other countries may adversely affect our results.

Many countries worldwide, including Mexico, have suffered significant economic, political and social volatility in recent years, and this may occur again in the future. Global instability has been caused by many different factors, including substantial fluctuations in economic growth, high levels of inflation, changes in currency values, changes in governmental economic or tax policies and regulations and overall political, social and economic instability. We cannot assure you that such conditions will not return or that such conditions will not have a material adverse effect on our financial situation and results.

The Mexican economy and the market value of securities issued by Mexican issuers may be, to varying degrees, affected by economic and market conditions in other emerging market countries and in the United States. Furthermore, economic conditions in Mexico are highly correlated with economic conditions in the United States as a result of the North American Free Trade Agreement (“NAFTA”), and increased economic activity between the two countries. In November 2016, presidential elections took place in the United States that resulted in a change of the nation’s leadership. President Donald Trump has made public his intention to terminate or re-negotiate the terms of NAFTA, but the content of any potential revisions has not been specified. Furthermore, President Donald Trump has stated that if Canada and Mexico do not agree to the United States’ terms to re-negotiate the pact, the United States may withdraw from NAFTA. However, there can be no assurance as to what the U.S. administration will do, and the impact of these measures or any others adopted by the new U.S. administration cannot be predicted.

Adverse economic conditions in the United States, the termination or re-negotiation of NAFTA in North America or other related events could have an adverse effect on the Mexican economy. Although economic conditions in other emerging market countries and in the United States may differ significantly from economic conditions in Mexico, investors’ reactions to developments in other countries may have an adverse effect on the market value of securities of Mexican issuers or of Mexican assets. There can be no assurance that future developments in other emerging market countries and in the United States, over which we have no control, will not have a material adverse effect on our financial situation and results.

Natural disasters could adversely affect our business.

From time to time, different regions of Mexico and certain areas of the other countries in which we operate experience torrential rains and hurricanes, as well as earthquakes. FEMSA Comercio’s points of sales and some operating facilities have been affected by hurricanes and other weather events in the past, which have resulted in temporary closures and losses. Natural disasters may impede operations, damage facilities necessary to our operations and adversely affect the purchasing power of our clients. Also, any of these events could force us to increase our capital expenditures to put our stores back in operation. Accordingly, the occurrence of natural disasters in the locations where we have operations could adversely affect our business, results of operations and financial condition. See “Item 4. Information on the Company—Insurance.”

Technology and cyber-security risks.

We use information systems to operate our business, to process financial information and results of operations for internal reporting purposes and to comply with regulatory financial reporting and legal and tax requirements. Because information systems are critical to many of our operating activities, our business may be impacted by system shutdowns, service disruptions or security breaches, such as failures during routine operations, network or hardware failures, malicious or disruptive software, unintentional or malicious actions of employees or contractors, cyber-attacks by common hackers, criminal groups or nation-state organizations or social-activist (hacktivist) organizations, natural disasters, failures or impairments of telecommunication networks or other catastrophic events. Such incidents could result in unauthorized disclosure of material confidential information, and we could experience delays in reporting our financial results. In addition, misuse, leakage or falsification of information could result in violations of data privacy laws and regulations, damage our reputation and credibility and, therefore, could have a material adverse effect on our financial situation and results, or may require us to spend significant financial and other resources to remedy the damage caused by a security breach or to repair or replace networks and information systems.

16

Security risks in Mexico could increase, and this could adversely affect our results.