Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE QUARTERLY PERIOD ENDED SEPTEMBER 30, 2016

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

Commission File Number: 001-14788

Blackstone Mortgage Trust, Inc.

(Exact name of Registrant as specified in its charter)

| Maryland | 94-6181186 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

345 Park Avenue, 42nd Floor

New York, New York 10154

(Address of principal executive offices)(Zip Code)

(212) 655-0220

(Registrant’s telephone number, including area code)

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

x |

Accelerated filer |

¨ | |||

| Non-accelerated filer |

¨ (Do not check if a smaller reporting company) |

Smaller reporting company |

¨ | |||

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The number of the Registrant’s outstanding shares of class A common stock, par value $0.01 per share, as of October 18, 2016 was 93,913,194.

Table of Contents

| PART I. | ||||||

| ITEM 1. | 2 | |||||

| Consolidated Financial Statements (Unaudited): |

||||||

| Consolidated Balance Sheets as of September 30, 2016 and December 31, 2015 |

2 | |||||

| 3 | ||||||

| 4 | ||||||

| Consolidated Statements of Changes in Equity for the Nine Months Ended September 30, 2016 and 2015 |

5 | |||||

| Consolidated Statements of Cash Flows for the Nine Months Ended September 30, 2016 and 2015 |

6 | |||||

| 7 | ||||||

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

38 | ||||

| ITEM 3. | 58 | |||||

| ITEM 4. | 60 | |||||

| PART II. | ||||||

| ITEM 1. | 61 | |||||

| ITEM 1A. | 61 | |||||

| ITEM 2. |

61 |

|||||

| ITEM 3. |

61 | |||||

| ITEM 4. |

61 | |||||

| ITEM 5. |

61 | |||||

| ITEM 6. |

62 | |||||

| SIGNATURES | 63 | |||||

Table of Contents

Blackstone Mortgage Trust, Inc.

Consolidated Balance Sheets (Unaudited)

(in thousands, except share data)

| September 30, | December 31, | |||||||

| 2016 | 2015 | |||||||

| Assets |

||||||||

| Cash and cash equivalents |

$ | 94,061 | $ | 96,450 | ||||

| Restricted cash |

877 | 9,556 | ||||||

| Loans receivable, net |

8,347,712 | 9,077,007 | ||||||

| Equity investments in unconsolidated subsidiaries |

1,678 | 9,441 | ||||||

| Other assets |

66,613 | 184,119 | ||||||

|

|

|

|

|

|||||

| Total Assets |

$ | 8,510,941 | $ | 9,376,573 | ||||

|

|

|

|

|

|||||

| Liabilities and Equity |

||||||||

| Secured debt agreements |

$ | 5,320,358 | $ | 6,116,105 | ||||

| Loan participations sold |

409,654 | 497,032 | ||||||

| Convertible notes, net |

166,064 | 164,026 | ||||||

| Other liabilities |

110,067 | 93,679 | ||||||

|

|

|

|

|

|||||

| Total Liabilities |

6,006,143 | 6,870,842 | ||||||

|

|

|

|

|

|||||

| Commitments and contingencies |

— | — | ||||||

| Equity |

||||||||

| Class A common stock, $0.01 par value, 200,000,000 shares authorized, 93,912,936 and 93,702,326 shares issued and outstanding as of September 30, 2016 and December 31, 2015, respectively |

939 | 937 | ||||||

| Additional paid-in capital |

3,084,948 | 3,070,200 | ||||||

| Accumulated other comprehensive loss |

(46,389 | ) | (32,758 | ) | ||||

| Accumulated deficit |

(535,804 | ) | (545,791 | ) | ||||

|

|

|

|

|

|||||

| Total Blackstone Mortgage Trust, Inc. stockholders’ equity |

2,503,694 | 2,492,588 | ||||||

| Non-controlling interests |

1,104 | 13,143 | ||||||

|

|

|

|

|

|||||

| Total Equity |

2,504,798 | 2,505,731 | ||||||

|

|

|

|

|

|||||

| Total Liabilities and Equity |

$ | 8,510,941 | $ | 9,376,573 | ||||

|

|

|

|

|

|||||

See accompanying notes to consolidated financial statements.

2

Table of Contents

Blackstone Mortgage Trust, Inc.

Consolidated Statements of Operations (Unaudited)

(in thousands, except share and per share data)

| Three Months Ended | Nine Months Ended | |||||||||||||||

| September 30, | September 30, | |||||||||||||||

| 2016 | 2015 | 2016 | 2015 | |||||||||||||

| Income from loans and other investments |

||||||||||||||||

| Interest and related income |

$ | 128,190 | $ | 138,361 | $ | 381,686 | $ | 282,249 | ||||||||

| Less: Interest and related expenses |

45,373 | 51,329 | 139,819 | 106,125 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income from loans and other investments, net |

82,817 | 87,032 | 241,867 | 176,124 | ||||||||||||

| Other expenses |

||||||||||||||||

| Management and incentive fees |

13,701 | 13,813 | 43,161 | 28,535 | ||||||||||||

| General and administrative expenses |

7,414 | 5,295 | 20,990 | 28,655 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total other expenses |

21,115 | 19,108 | 64,151 | 57,190 | ||||||||||||

| Gain (loss) on investments at fair value |

2,824 | (82 | ) | 13,413 | 22,108 | |||||||||||

| Income from equity investments in unconsolidated subsidiaries |

2,060 | 17 | 2,192 | 5,677 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income before income taxes |

66,586 | 67,859 | 193,321 | 146,719 | ||||||||||||

| Income tax provision |

194 | 81 | 281 | 431 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income |

66,392 | 67,778 | 193,040 | 146,288 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income attributable to non-controlling interests |

(1,598 | ) | (890 | ) | (8,119 | ) | (14,724 | ) | ||||||||

| Net income attributable to Blackstone Mortgage Trust, Inc. |

$ | 64,794 | $ | 66,888 | $ | 184,921 | $ | 131,564 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income per share of common stock basic and diluted |

$ | 0.69 | $ | 0.72 | $ | 1.97 | $ | 1.69 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted-average shares of common stock outstanding basic and diluted |

94,071,537 | 93,357,960 | 94,067,923 | 77,752,247 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Dividends declared per share of common stock |

$ | 0.62 | $ | 0.62 | $ | 1.86 | $ | 1.66 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

See accompanying notes to consolidated financial statements.

3

Table of Contents

Blackstone Mortgage Trust, Inc.

Consolidated Statements of Comprehensive Income (Unaudited)

(in thousands)

| Three Months Ended | Nine Months Ended | |||||||||||||||

| September 30, | September 30, | |||||||||||||||

| 2016 | 2015 | 2016 | 2015 | |||||||||||||

| Net income |

$ | 66,392 | $ | 67,778 | $ | 193,040 | $ | 146,288 | ||||||||

| Other comprehensive loss |

||||||||||||||||

| Unrealized loss on foreign currency remeasurement |

(10,128 | ) | (23,148 | ) | (25,472 | ) | (27,484 | ) | ||||||||

| Unrealized gain on derivative financial instruments |

5,882 | 14,891 | 11,841 | 14,920 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Comprehensive income |

62,146 | 59,521 | 179,409 | 133,724 | ||||||||||||

| Comprehensive income attributable to non-controlling interests |

(1,598 | ) | (890 | ) | (8,119 | ) | (14,724 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Comprehensive income attributable to Blackstone Mortgage Trust, Inc. |

$ | 60,548 | $ | 58,631 | $ | 171,290 | $ | 119,000 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

See accompanying notes to consolidated financial statements.

4

Table of Contents

Blackstone Mortgage Trust, Inc.

Consolidated Statements of Changes in Equity (Unaudited)

(in thousands)

| Blackstone Mortgage Trust, Inc. | ||||||||||||||||||||||||||||

| Class A | Additional | Accumulated Other | ||||||||||||||||||||||||||

| Common | Paid-In | Comprehensive | Accumulated | Stockholders’ | Non-controlling | Total | ||||||||||||||||||||||

| Stock | Capital | Loss | Deficit | Equity | Interests | Equity | ||||||||||||||||||||||

| Balance at December 31, 2014 |

$ | 583 | $ | 2,027,404 | $ | (15,024 | ) | $ | (547,592 | ) | $ | 1,465,371 | $ | 35,515 | $ | 1,500,886 | ||||||||||||

| Shares of class A common stock issued, net |

349 | 1,029,186 | — | — | 1,029,535 | — | 1,029,535 | |||||||||||||||||||||

| Restricted class A common stock earned |

— | 9,599 | — | — | 9,599 | — | 9,599 | |||||||||||||||||||||

| Dividends reinvested |

— | 192 | — | (179 | ) | 13 | — | 13 | ||||||||||||||||||||

| Deferred directors’ compensation |

— | 281 | — | — | 281 | — | 281 | |||||||||||||||||||||

| Other comprehensive loss |

— | — | (12,564 | ) | — | (12,564 | ) | — | (12,564 | ) | ||||||||||||||||||

| Net income |

— | — | — | 131,564 | 131,564 | 14,724 | 146,288 | |||||||||||||||||||||

| Dividends declared on common stock |

— | — | — | (136,674 | ) | (136,674 | ) | — | (136,674 | ) | ||||||||||||||||||

| Distributions to non-controlling interests |

— | — | — | — | — | (37,202 | ) | (37,202 | ) | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Balance at September 30, 2015 |

$ | 932 | $ | 3,066,662 | $ | (27,588 | ) | $ | (552,881 | ) | $ | 2,487,125 | $ | 13,037 | $ | 2,500,162 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Balance at December 31, 2015 |

$ | 937 | $ | 3,070,200 | $ | (32,758 | ) | $ | (545,791 | ) | $ | 2,492,588 | $ | 13,143 | $ | 2,505,731 | ||||||||||||

| Shares of class A common stock issued, net |

2 | — | — | — | 2 | — | 2 | |||||||||||||||||||||

| Restricted class A common stock earned |

— | 14,190 | — | — | 14,190 | — | 14,190 | |||||||||||||||||||||

| Dividends reinvested |

— | 276 | — | (256 | ) | 20 | — | 20 | ||||||||||||||||||||

| Deferred directors’ compensation |

— | 282 | — | — | 282 | — | 282 | |||||||||||||||||||||

| Other comprehensive loss |

— | — | (13,631 | ) | — | (13,631 | ) | — | (13,631 | ) | ||||||||||||||||||

| Net income |

— | — | — | 184,921 | 184,921 | 8,119 | 193,040 | |||||||||||||||||||||

| Dividends declared on common stock |

— | — | — | (174,678 | ) | (174,678 | ) | — | (174,678 | ) | ||||||||||||||||||

| Distributions to non-controlling interests |

— | — | — | — | — | (20,158 | ) | (20,158 | ) | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Balance at September 30, 2016 |

$ | 939 | $ | 3,084,948 | $ | (46,389) | $ | (535,804) | $ | 2,503,694 | $ | 1,104 | $ | 2,504,798 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

See accompanying notes to consolidated financial statements.

5

Table of Contents

Blackstone Mortgage Trust, Inc.

Consolidated Statements of Cash Flows (Unaudited)

(in thousands)

| Nine Months Ended September 30, |

||||||||

| 2016 | 2015 | |||||||

| Cash flows from operating activities |

||||||||

| Net income |

$ | 193,040 | $ | 146,288 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities |

||||||||

| Gain on investments at fair value |

(13,413 | ) | (22,108 | ) | ||||

| Income from equity investments in unconsolidated subsidiaries |

(2,192 | ) | (5,677 | ) | ||||

| Non-cash compensation expense |

16,517 | 14,470 | ||||||

| Distributions of income from unconsolidated subsidiaries |

8,167 | 5,007 | ||||||

| Amortization of deferred interest on loans |

(31,594 | ) | (25,489 | ) | ||||

| Amortization of deferred financing costs and premiums/discount on debt obligations |

15,129 | 14,684 | ||||||

| Changes in assets and liabilities, net |

||||||||

| Other assets |

8,315 | (28,679 | ) | |||||

| Other liabilities |

(6,405 | ) | 6,114 | |||||

|

|

|

|

|

|||||

| Net cash provided by operating activities |

187,564 | 104,610 | ||||||

|

|

|

|

|

|||||

| Cash flows from investing activities |

||||||||

| Originations and fundings of loans receivable |

(2,300,636 | ) | (6,807,347 | ) | ||||

| Principal collections and sale proceeds from loans receivable and other assets |

3,054,821 | 1,584,189 | ||||||

| Origination and exit fees received on loans receivable |

35,388 | 26,799 | ||||||

| Change in restricted cash |

8,678 | 2,528 | ||||||

|

|

|

|

|

|||||

| Net cash provided by (used in) investing activities |

798,251 | (5,193,831 | ) | |||||

|

|

|

|

|

|||||

| Cash flows from financing activities |

||||||||

| Borrowings under secured debt agreements |

2,225,895 | 6,560,426 | ||||||

| Repayments under secured debt agreements |

(2,988,217 | ) | (2,279,837 | ) | ||||

| Proceeds from sales of loan participations |

54,441 | 256,000 | ||||||

| Repayment of loan participations |

(92,000 | ) | (238,164 | ) | ||||

| Payment of deferred financing costs |

(12,564 | ) | (19,932 | ) | ||||

| Receipts under derivative financial instruments |

31,668 | 15,653 | ||||||

| Payments under derivative financial instruments |

(14,266 | ) | (3,742 | ) | ||||

| Distributions to non-controlling interests |

(20,158 | ) | (37,202 | ) | ||||

| Net proceeds from issuance of class A common stock |

20 | 1,029,535 | ||||||

| Dividends paid on class A common stock |

(174,549 | ) | (109,178 | ) | ||||

|

|

|

|

|

|||||

| Net cash (used in) provided by financing activities |

(989,730 | ) | 5,173,559 | |||||

|

|

|

|

|

|||||

| Net (decrease) increase in cash and cash equivalents |

(3,915 | ) | 84,338 | |||||

| Cash and cash equivalents at beginning of period |

96,450 | 51,810 | ||||||

| Effects of currency translation on cash and cash equivalents |

1,526 | 2,452 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents at end of period |

$ | 94,061 | $ | 138,600 | ||||

|

|

|

|

|

|||||

| Supplemental disclosure of cash flows information |

||||||||

| Payments of interest |

$ | (123,564 | ) | $ | (85,494 | ) | ||

|

|

|

|

|

|||||

| Payments of income taxes |

$ | (131 | ) | $ | (125 | ) | ||

|

|

|

|

|

|||||

| Supplemental disclosure of non-cash investing and financing activities |

||||||||

| Dividends declared, not paid |

$ | (58,388 | ) | $ | (57,800 | ) | ||

|

|

|

|

|

|||||

| Participations sold, net |

$ | 37,559 | $ | 17,836 | ||||

|

|

|

|

|

|||||

| Loan principal payments held by servicer, net |

$ | 9,515 | $ | 232,818 | ||||

|

|

|

|

|

|||||

See accompanying notes to consolidated financial statements.

6

Table of Contents

Blackstone Mortgage Trust, Inc.

Notes to Consolidated Financial Statements

(Unaudited)

1. ORGANIZATION

References herein to “Blackstone Mortgage Trust,” “Company,” “we,” “us” or “our” refer to Blackstone Mortgage Trust, Inc. and its subsidiaries unless the context specifically requires otherwise.

Blackstone Mortgage Trust is a real estate finance company that originates and purchases senior loans collateralized by properties in North America and Europe. We are externally managed by BXMT Advisors L.L.C., or our Manager, a subsidiary of The Blackstone Group L.P., or Blackstone, and are a real estate investment trust, or REIT, traded on the New York Stock Exchange, or NYSE, under the symbol “BXMT.” We are headquartered in New York City.

We conduct our operations as a REIT for U.S. federal income tax purposes. We generally will not be subject to U.S. federal income taxes on our taxable income to the extent that we annually distribute all of our net taxable income to stockholders and maintain our qualification as a REIT. We also operate our business in a manner that permits us to maintain an exclusion from registration under the Investment Company Act of 1940, as amended. We are organized as a holding company and conduct our business primarily through our various subsidiaries.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The accompanying unaudited consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America, or GAAP, for interim financial information and the instructions to Form 10-Q and Rule 10-01 of Regulation S-X. The consolidated financial statements, including the notes thereto, are unaudited and exclude some of the disclosures required in audited financial statements. Management believes it has made all necessary adjustments, consisting of only normal recurring items, so that the consolidated financial statements are presented fairly and that estimates made in preparing its consolidated financial statements are reasonable and prudent. The operating results presented for interim periods are not necessarily indicative of the results that may be expected for any other interim period or for the entire year. The accompanying unaudited consolidated interim financial statements should be read in conjunction with the audited consolidated financial statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2015 filed with the Securities and Exchange Commission.

Basis of Presentation

The accompanying consolidated financial statements include, on a consolidated basis, our accounts, the accounts of our wholly-owned subsidiaries, majority-owned subsidiaries, and variable interest entities, or VIEs, of which we are the primary beneficiary. All intercompany balances and transactions have been eliminated in consolidation. Certain of the assets and credit of our consolidated subsidiaries are not available to satisfy the debt or other obligations of us, our affiliates, or other entities.

One of our subsidiaries, CT Legacy Partners, LLC, or CT Legacy Partners, accounts for its operations in accordance with industry-specific GAAP accounting guidance for investment companies, pursuant to which it reports its investments at fair value. We have retained this accounting treatment in consolidation and, accordingly, report the loans and other investments of CT Legacy Partners at fair value on our consolidated balance sheets.

Certain reclassifications have been made in the presentation of the prior period consolidated statement of cash flows to conform to the current period presentation.

Principles of Consolidation

We consolidate all entities that we control through either majority ownership or voting rights. In addition, we consolidate all VIEs of which we are considered the primary beneficiary. VIEs are defined as entities in which equity investors (i) do not have the characteristics of a controlling financial interest and/or (ii) do not have sufficient equity at risk for the entity to finance its activities without additional subordinated financial support from other parties. The entity that consolidates a VIE is known as its primary beneficiary and is generally the entity with (i) the power to direct the activities that most significantly affect the VIE’s economic performance and (ii) the right to receive benefits from the VIE or the obligation to absorb losses of the VIE that could be significant to the VIE.

As of both September 30, 2016 and December 31, 2015, we did not consolidate any VIEs.

7

Table of Contents

Blackstone Mortgage Trust, Inc.

Notes to Consolidated Financial Statements (continued)

(Unaudited)

Use of Estimates

The preparation of consolidated financial statements in conformity with GAAP requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results may ultimately differ from those estimates.

Revenue Recognition

Interest income from our loans receivable portfolio is recognized over the life of each investment using the effective interest method and is recorded on the accrual basis. Recognition of fees, premiums, and discounts associated with these investments is deferred until the loan is advanced and is then recorded over the term of the loan as an adjustment to yield. Income accrual is generally suspended for loans at the earlier of the date at which payments become 90 days past due or when, in the opinion of our Manager, recovery of income and principal becomes doubtful. Income is then recorded on the basis of cash received until accrual is resumed when the loan becomes contractually current and performance is demonstrated to be resumed. In addition, for loans we originate, the related origination expenses are deferred and recognized as a component of interest income, however expenses related to loans we acquire are included in general and administrative expenses as incurred.

Cash and Cash Equivalents

Cash and cash equivalents represent cash held in banks, cash on hand, and liquid investments with original maturities of three months or less. We may have bank balances in excess of federally insured amounts; however, we deposit our cash and cash equivalents with high credit-quality institutions to minimize credit risk exposure. We have not experienced, and do not expect, any losses on our cash or cash equivalents.

Restricted Cash

We classify the cash balances held by CT Legacy Partners as restricted because, while these cash balances are available for use by CT Legacy Partners for its operations, they cannot be used by us until our allocable share is distributed from CT Legacy Partners and cannot be commingled with any of our unrestricted cash balances.

Loans Receivable and Provision for Loan Losses

We originate and purchase commercial real estate debt and related instruments generally to be held as long-term investments at amortized cost. We are required to periodically evaluate each of these loans for possible impairment. Impairment is indicated when it is deemed probable that we will not be able to collect all amounts due to us pursuant to the contractual terms of the loan. If a loan is determined to be impaired, we write down the loan through a charge to the provision for loan losses. Impairment of these loans, which are collateral dependent, is measured by comparing the estimated fair value of the underlying collateral, less costs to sell, to the book value of the respective loan. These valuations require significant judgments, which include assumptions regarding capitalization rates, leasing, creditworthiness of major tenants, occupancy rates, availability of financing, exit plan, loan sponsorship, actions of other lenders, and other factors deemed necessary by our Manager. Actual losses, if any, could ultimately differ from these estimates.

Our Manager performs a quarterly review of our portfolio of loans. In conjunction with this review, our Manager assesses the risk factors of each loan, and assigns a risk rating based on a variety of factors, including, without limitation, loan-to-value ratio, or LTV, debt yield, property type, geographic and local market dynamics, physical condition, cash flow volatility, leasing and tenant profile, loan structure and exit plan, and project sponsorship. Based on a 5-point scale, our loans are rated “1” through “5,” from less risk to greater risk, which ratings are defined as follows:

| 1 - | Very Low Risk | |||

| 2 - | Low Risk | |||

| 3 - | Medium Risk | |||

| 4 - | High Risk/Potential for Loss: A loan that has a risk of realizing a principal loss. | |||

| 5 - | Impaired/Loss Likely: A loan that has a very high risk of realizing a principal loss or has otherwise incurred a principal loss. | |||

8

Table of Contents

Blackstone Mortgage Trust, Inc.

Notes to Consolidated Financial Statements (continued)

(Unaudited)

During the second quarter of 2015, we acquired a portfolio of loans from General Electric Capital Corporation and certain of its affiliates, or the GE portfolio, for a total purchase price of $4.7 billion. We allocated the aggregate purchase price between each loan based on its fair value relative to the overall portfolio, which allocation resulted in purchase discounts or premiums determined on an asset-by-asset basis. Each loan will accrete from its allocated purchase price to its expected collection value over the life of the loan, consistent with the other loans in our portfolio.

Equity Investments in Unconsolidated Subsidiaries

Our carried interest in CT Opportunity Partners I, LP, or CTOPI, is accounted for using the equity method. CTOPI’s assets and liabilities are not consolidated into our financial statements due to our determination that (i) it is not a VIE and (ii) the other investors in CTOPI have sufficient rights to preclude consolidation by us. As such, we report our allocable percentage of the net assets of CTOPI on our consolidated balance sheets. The recognition of income from CTOPI is generally deferred until cash is collected or appropriate contingencies have been eliminated.

Derivative Financial Instruments

We classify all derivative financial instruments as either other assets or other liabilities on our consolidated balance sheets at fair value.

On the date we enter into a derivative contract, we designate each contract as (i) a hedge of a net investment in a foreign operation, or net investment hedge, (ii) a hedge of a forecasted transaction or of the variability of cash flows to be received or paid related to a recognized asset or liability, or cash flow hedge, (iii) a hedge of a recognized asset or liability, or fair value hedge, or (iv) a derivative instrument not to be designated as a hedging derivative, or non-designated hedge. For all derivatives other than those designated as non-designated hedges, we formally document our hedge relationships and designation at the contract’s inception. This documentation includes the identification of the hedging instruments and the hedged items, its risk management objectives, strategy for undertaking the hedge transaction and our evaluation of the effectiveness of its hedged transaction.

On a quarterly basis, we also formally assess whether the derivative we designated in each hedging relationship is expected to be, and has been, highly effective in offsetting changes in the value or cash flows of the hedged items. If it is determined that a derivative is not highly effective at hedging the designated exposure, hedge accounting is discontinued. Changes in the fair value of the effective portion of our hedges are reflected in accumulated other comprehensive income (loss) on our consolidated financial statements. Changes in the fair value of the ineffective portion of our hedges are included in net income. Amounts are reclassified out of accumulated other comprehensive income (loss) and into net income when the hedged item is sold, substantially liquidated, or de-designated. To the extent a derivative does not qualify for hedge accounting and is deemed a non-designated hedge, the changes in its value are included in net income.

Repurchase Agreements

We record investments financed with repurchase agreements as separate assets and the related borrowings under any repurchase agreements are recorded as separate liabilities on our consolidated balance sheets. Interest income earned on the investments and interest expense incurred on the repurchase agreements are reported separately on our consolidated statements of operations.

Senior Loan Participations

In certain instances, we finance our loans through the non-recourse syndication of a senior loan interest to a third-party. Depending on the particular structure of the syndication, the senior loan interest may remain on our GAAP balance sheet or, in other cases, the sale will be recognized and the senior loan interest will no longer be included in our consolidated financial statements. When these sales are not recognized under GAAP we reflect the transaction by recording a loan participations sold liability on our consolidated balance sheet, however this gross presentation does not impact stockholders’ equity or net income. When the sales are recognized, our balance sheet only includes our remaining subordinate loan and not the non-consolidated senior interest we sold.

9

Table of Contents

Blackstone Mortgage Trust, Inc.

Notes to Consolidated Financial Statements (continued)

(Unaudited)

Convertible Notes

The “Debt with Conversion and Other Options” Topic of the Financial Accounting Standards Board, or FASB, Accounting Standards Codification, or ASC, requires the liability and equity components of convertible debt instruments that may be settled in cash upon conversion, including partial cash settlement, to be separately accounted for in a manner that reflects the issuer’s nonconvertible debt borrowing rate. The initial proceeds from the sale of convertible notes are allocated between a liability component and an equity component in a manner that reflects interest expense at the rate of similar nonconvertible debt that could have been issued at such time. The equity component represents the excess initial proceeds received over the fair value of the liability component of the notes as of the date of issuance. We measured the estimated fair value of the debt component of our convertible notes as of the issuance date based on our nonconvertible debt borrowing rate. The equity component of the convertible notes is reflected within additional paid-in capital on our consolidated balance sheet, and the resulting debt discount is amortized over the period during which the convertible notes are expected to be outstanding (through the maturity date) as additional non-cash interest expense. The additional non-cash interest expense attributable to the convertible notes will increase in subsequent periods through the maturity date as the notes accrete to their par value over the same period.

Deferred Financing Costs

The deferred financing costs that are included as a reduction in the net book value of the related liability on our consolidated balance sheets include issuance and other costs related to our debt obligations. These costs are amortized as interest expense using the effective interest method over the life of the related obligations.

Fair Value of Financial Instruments

The “Fair Value Measurements and Disclosures” Topic, or ASC 820, defines fair value, establishes a framework for measuring fair value, and requires certain disclosures about fair value measurements under GAAP. Specifically, this guidance defines fair value based on exit price, or the price that would be received upon the sale of an asset or the transfer of a liability in an orderly transaction between market participants at the measurement date.

ASC 820 also establishes a fair value hierarchy that prioritizes and ranks the level of market price observability used in measuring financial instruments. Market price observability is affected by a number of factors, including the type of financial instrument, the characteristics specific to the financial instrument, and the state of the marketplace, including the existence and transparency of transactions between market participants. Financial instruments with readily available quoted prices in active markets generally will have a higher degree of market price observability and a lesser degree of judgment used in measuring fair value.

Financial instruments measured and reported at fair value are classified and disclosed based on the observability of inputs used in the determination, as follows:

| • | Level 1: Generally includes only unadjusted quoted prices that are available in active markets for identical financial instruments as of the reporting date. |

| • | Level 2: Pricing inputs include quoted prices in active markets for similar instruments, quoted prices in less active or inactive markets for identical or similar instruments where multiple price quotes can be obtained, and other observable inputs, such as interest rates, yield curves, credit risks, and default rates. |

| • | Level 3: Pricing inputs are unobservable for the financial instruments and include situations where there is little, if any, market activity for the financial instrument. These inputs require significant judgment or estimation by management of third-parties when determining fair value and generally represent anything that does not meet the criteria of Levels 1 and 2. |

The estimated value of each asset reported at fair value using Level 3 inputs is determined by an internal committee composed of members of senior management of our Manager, including our Chief Executive Officer, Chief Financial Officer, and other senior officers.

10

Table of Contents

Blackstone Mortgage Trust, Inc.

Notes to Consolidated Financial Statements (continued)

(Unaudited)

Certain of our other assets are reported at fair value either (i) on a recurring basis, as of each quarter-end, or (ii) on a nonrecurring basis, as a result of impairment or other events. Our assets that are recorded at fair value are discussed further in Note 14. We generally value our assets recorded at fair value by either (i) discounting expected cash flows based on assumptions regarding the collection of principal and interest and estimated market rates, or (ii) obtaining assessments from third-party dealers. For collateral-dependent loans that are identified as impaired, we measure impairment by comparing our Manager’s estimation of the fair value of the underlying collateral, less costs to sell, to the book value of the respective loan. These valuations may require significant judgments, which include assumptions regarding capitalization rates, leasing, creditworthiness of major tenants, occupancy rates, availability of financing, exit plan, loan sponsorship, actions of other lenders, and other factors deemed necessary by our Manager.

We are also required by GAAP to disclose fair value information about financial instruments, that are not otherwise reported at fair value in our consolidated balance sheet, to the extent it is practicable to estimate a fair value for those instruments. These disclosure requirements exclude certain financial instruments and all non-financial instruments.

The following methods and assumptions are used to estimate the fair value of each class of financial instruments, for which it is practicable to estimate that value:

| • | Cash and cash equivalents: The carrying amount of cash and cash equivalents approximates fair value. |

| • | Restricted cash: The carrying amount of restricted cash approximates fair value. |

| • | Loans receivable, net: The fair values for these loans were estimated by our Manager based on discounted cash flow methodology taking into consideration factors, including capitalization rates, discount rates, leasing, occupancy rates, availability and cost of financing, exit plan, sponsorship, actions of other lenders, and indications of market value from other market participants. |

| • | Derivative financial instruments: The fair value of our foreign currency contracts and interest rates caps was valued using advice from a third-party derivative specialist, based on contractual cash flows and observable inputs comprising foreign currency rates and credit spreads. |

| • | Secured debt agreements: The fair values for these instruments were estimated based on the rate at which a similar credit facility would have currently priced. |

| • | Loan participations sold: The fair value of these instruments were estimated based on the value of the related loan receivable asset. |

| • | Convertible notes, net: The convertible notes are actively traded and their fair values were obtained using quoted market prices for these instruments. |

Income Taxes

Our financial results generally do not reflect provisions for current or deferred income taxes on our REIT taxable income. We believe that we operate in a manner that will continue to allow us to be taxed as a REIT and, as a result, we generally do not expect to pay substantial corporate level taxes other than those payable by our taxable REIT subsidiaries. If we were to fail to meet these requirements, we may be subject to federal, state, and local income tax on current and past income, and penalties. Refer to Note 12 for additional information.

Stock-Based Compensation

Our stock-based compensation consists of awards issued to our Manager and certain of its employees that vest over the life of the awards as well as deferred stock units issued to certain members of our Board of Directors. Stock-based compensation expense is recognized for these awards in net income on a variable basis over the applicable vesting period of the awards, based on the value of our class A common stock. Refer to Note 13 for additional information.

11

Table of Contents

Blackstone Mortgage Trust, Inc.

Notes to Consolidated Financial Statements (continued)

(Unaudited)

Earnings per Share

Basic earnings per share, or Basic EPS, is computed in accordance with the two-class method and is based on the net earnings allocable to our class A common stock, including restricted class A common stock and deferred stock units, divided by the weighted-average number of shares of our class A common stock, including restricted class A common stock and deferred stock units outstanding during the period. Our restricted class A common stock is considered a participating security, as defined by GAAP, and has been included in our Basic EPS under the two-class method as these restricted shares have the same rights as our other shares of class A common stock, including participating in any gains or losses.

Diluted earnings per share, or Diluted EPS, is determined using the treasury stock method, and is based on the net earnings allocable to our class A common stock, including restricted class A common stock and deferred stock units, divided by the weighted-average number of shares of our class A common stock, including restricted class A common stock and deferred stock units. Refer to Note 10 for additional discussion of earnings per share.

Foreign Currency

In the normal course of business, we enter into transactions not denominated in United States, or U.S., dollars. Foreign exchange gains and losses arising on such transactions are recorded as a gain or loss in our consolidated statements of operations. In addition, we consolidate entities that have a non-U.S. dollar functional currency. Non-U.S. dollar denominated assets and liabilities are translated to U.S. dollars at the exchange rate prevailing at the reporting date and income, expenses, gains, and losses are translated at the average exchange rate over the applicable period. Cumulative translation adjustments arising from the translation of non-U.S. dollar denominated subsidiaries are recorded in other comprehensive income.

Underwriting Commissions and Offering Costs

Underwriting commissions and offering costs incurred in connection with common stock offerings are reflected as a reduction of additional paid-in capital. Costs incurred that are not directly associated with the completion of a common stock offering are expensed when incurred.

Recent Accounting Pronouncements

In August 2016, the FASB issued ASU 2016-15 “Statement of Cash Flows (Topic 230),” or ASU 2016-15. ASU 2016-15 is intended to reduce diversity in practice in how certain transactions are classified in the statement of cash flows. The new guidance addresses the classification of various transactions including debt prepayment or debt extinguishment costs, settlement of zero-coupon debt instruments, contingent consideration payments made after a business combination, distributions received from equity method investments, beneficial interests in securitization transactions, and others. We adopted ASU 2016-15 in the third quarter of 2016 and its adoption did not have a material impact on our consolidated financial statements.

In June 2016, the FASB issued ASU 2016-13 “Financial Instruments – Credit Losses – Measurement of Credit Losses on Financial Instruments (Topic 326),” or ASU 2016-13. ASU 2016-13 significantly changes how entities will measure credit losses for most financial assets and certain other instruments that are not measured at fair value through net income. ASU 2016-13 will replace the “incurred loss” model under existing guidance with an “expected loss” model for instruments measured at amortized cost, and require entities to record allowances for available-for-sale debt securities rather than reduce the carrying amount, as they do today under the other-than-temporary impairment model. It also simplifies the accounting model for purchased credit-impaired debt securities and loans. ASU 2016-13 is effective for fiscal years beginning after December 15, 2019 and is to be adopted through a cumulative-effect adjustment to retained earnings as of the beginning of the first reporting period in which the guidance is effective. We are currently evaluating the impact ASU 2016-13 will have on our consolidated financial statements.

12

Table of Contents

Blackstone Mortgage Trust, Inc.

Notes to Consolidated Financial Statements (continued)

(Unaudited)

In March 2016, the FASB issued ASU 2016-09, “Improvements to Employee Share-Based Payment Accounting (Topic 718),” or ASU 2016-09. ASU 2016-09 requires all income tax effects of share-based payment awards to be recognized in the income statement relating to the period in which the awards vest or are settled. ASU 2016-09 also allows an employer to repurchase more of an employee’s shares for tax withholding purposes than is permitted under current guidance without triggering liability accounting. Finally, ASU 2016-09 allows a policy election to account for employee forfeitures as they occur. We adopted ASU 2016-09 in the second quarter of 2016 and its adoption did not have a material impact on our consolidated financial statements.

In March 2016, the FASB issued ASU 2016-05, “Derivatives and Hedging (Topic 815): Effect of Derivative Contract Novations on Existing Hedge Accounting Relationships,” or ASU 2016-05. ASU 2016-05 clarifies that the novation of a derivative contract in a hedge accounting relationship does not, in and of itself, require de-designation of that hedge accounting relationship. Hedge accounting relationships can continue as long as all of the other hedge accounting criteria are met, including the expectation that the hedge will be highly effective when the creditworthiness of the new counterparty to the derivative contract is considered. We adopted ASU 2016-05 in the third quarter of 2016 and its adoption did not have a material impact on our consolidated financial statements, however ASU 2016-05 may allow us to novate derivative contracts in the future without having to de-designate the hedge accounting relationship.

In August 2014, the FASB issued ASU 2014-15, “Presentation of Financial Statements – Going Concern (Subtopic 205-40): Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern,” or ASU 2014-15. ASU 2014-15 introduces an explicit requirement for management to assess and provide certain disclosures if there is substantial doubt about an entity’s ability to continue as a going concern. ASU 2014-15 is effective for the annual period ending after December 15, 2016. We do not anticipate that the adoption of ASU 2014-15 will have a material impact on our consolidated financial statements.

In May 2014, the FASB issued ASU 2014-09, “Revenue from Contracts with Customers (Topic 606),” or ASU 2014-09. ASU 2014-09 broadly amends the accounting guidance for revenue recognition. ASU 2014-09 is effective for the first interim or annual period beginning after December 15, 2017, and is to be applied retrospectively. We do not anticipate that the adoption of ASU 2014-09 will have a material impact on our consolidated financial statements.

13

Table of Contents

Blackstone Mortgage Trust, Inc.

Notes to Consolidated Financial Statements (continued)

(Unaudited)

3. LOANS RECEIVABLE

The following table details overall statistics for our loans receivable portfolio ($ in thousands):

| September 30, 2016 | December 31, 2015 | |||||||

| Number of loans |

106 | 125 | ||||||

| Principal balance |

$ | 8,381,679 | $ | 9,108,361 | ||||

| Net book value |

$ | 8,347,712 | $ | 9,077,007 | ||||

| Unfunded loan commitments(1) |

$ | 929,030 | $ | 700,658 | ||||

| Weighted-average cash coupon(2) |

4.85 | % | 4.84 | % | ||||

| Weighted-average all-in yield(2) |

5.22 | % | 5.18 | % | ||||

| Weighted-average maximum maturity (years)(3) |

3.2 | 3.1 | ||||||

| (1) | Unfunded commitments will primarily be funded to finance property improvements or lease-related expenditures by the borrowers. These future commitments will be funded over the term of each loan, subject in certain cases to an expiration date. |

| (2) | As of September 30, 2016, our floating rate loans were indexed to various benchmark rates, with 85% of floating rate loans indexed to USD LIBOR. In addition, $277.3 million of our floating rate loans earned interest based on floors that are above the applicable index, with an average floor of 1.13%, as of September 30, 2016. As of December 31, 2015, our floating rate loans were indexed to various benchmark rates, with 84% of floating rate loans indexed to USD LIBOR. In addition, $147.9 million of our floating rate loans earned interest based on floors that are above the applicable index, with an average floor of 1.80%, as of December 31, 2015. In addition to cash coupon, all-in yield includes the amortization of deferred origination fees, loan origination costs, purchase discounts, and accrual of both extension and exit fees. Cash coupon and all-in yield assume applicable floating benchmark rate for weighted-average calculation. |

| (3) | Maximum maturity assumes all extension options are exercised by the borrower, however our loans may be repaid prior to such date. As of September 30, 2016, 66% of our loans were subject to yield maintenance or other prepayment restrictions and 34% were open to repayment by the borrower without penalty. As of December 31, 2015, 64% of our loans were subject to yield maintenance or other prepayment restrictions and 36% were open to repayment by the borrower without penalty. |

Activity relating to our loans receivable portfolio was as follows ($ in thousands):

| Principal Balance |

Deferred Fees / Other Items(1) |

Net Book Value |

||||||||||

| December 31, 2015 |

$ | 9,108,361 | $ | (31,354) | $ | 9,077,007 | ||||||

| Loan fundings |

2,300,636 | — | 2,300,636 | |||||||||

| Loan repayments and sales |

(2,942,705 | ) | — | (2,942,705 | ) | |||||||

| Unrealized (loss) gain on foreign currency translation |

(84,613 | ) | 1,181 | (83,432 | ) | |||||||

| Deferred fees and other items(1) |

— | (35,388 | ) | (35,388 | ) | |||||||

| Amortization of fees and other items(1) |

— | 31,594 | 31,594 | |||||||||

|

|

|

|

|

|

|

|||||||

| September 30, 2016 |

$ | 8,381,679 | $ | (33,967 | ) | $ | 8,347,712 | |||||

|

|

|

|

|

|

|

|||||||

| (1) | Other items primarily consist of purchase discounts or premiums, exit fees, and deferred origination expenses. |

14

Table of Contents

Blackstone Mortgage Trust, Inc.

Notes to Consolidated Financial Statements (continued)

(Unaudited)

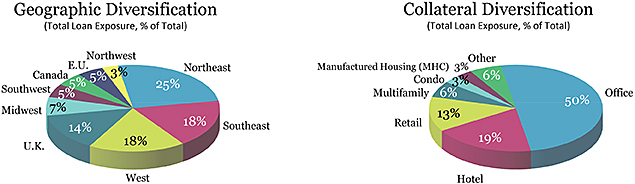

The tables below detail the property type and geographic distribution of the properties securing the loans in our portfolio ($ in thousands):

| September 30, 2016 |

||||||||||||||||

| Property Type |

Number of Loans |

Net Book Value |

Total Loan Exposure(1) |

Percentage of Portfolio |

||||||||||||

| Office |

55 | $ | 4,540,394 | $ | 4,610,800 | 50 | % | |||||||||

| Hotel |

17 | 1,761,751 | 1,832,501 | 19 | ||||||||||||

| Retail |

10 | 823,184 | 1,215,822 | 13 | ||||||||||||

| Multifamily |

8 | 586,910 | 588,809 | 6 | ||||||||||||

| Condominium |

2 | 85,436 | 315,816 | 3 | ||||||||||||

| Manufactured housing |

9 | 297,726 | 297,847 | 3 | ||||||||||||

| Other |

5 | 252,311 | 575,948 | 6 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 106 | $ | 8,347,712 | $ | 9,437,543 | 100 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Geographic Location |

Number of Loans |

Net Book Value |

Total Loan Exposure(1) |

Percentage of Portfolio |

||||||||||||

| United States |

||||||||||||||||

| Northeast |

25 | $ | 2,449,223 | $ | 2,461,548 | 25 | % | |||||||||

| Southeast |

20 | 1,343,942 | 1,739,465 | 18 | ||||||||||||

| West |

21 | 1,496,295 | 1,733,491 | 18 | ||||||||||||

| Midwest |

6 | 618,939 | 621,012 | 7 | ||||||||||||

| Southwest |

9 | 444,381 | 443,653 | 5 | ||||||||||||

| Northwest |

4 | 245,934 | 293,039 | 3 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Subtotal |

85 | 6,598,714 | 7,292,208 | 76 | ||||||||||||

| International |

||||||||||||||||

| United Kingdom |

9 | 930,677 | 1,276,234 | 14 | ||||||||||||

| Canada |

8 | 477,466 | 474,182 | 5 | ||||||||||||

| Germany |

1 | 218,855 | 271,922 | 3 | ||||||||||||

| Spain |

1 | 68,572 | 69,198 | 1 | ||||||||||||

| Netherlands |

2 | 53,428 | 53,799 | 1 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Subtotal |

21 | 1,748,998 | 2,145,335 | 24 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

106 | $ | 8,347,712 | $ | 9,437,543 | 100 | % | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1) | In certain instances, we finance our loans through the non-recourse sale of a senior loan interest that is not included in our consolidated financial statements. See Note 2 for further discussion. Total loan exposure encompasses the entire loan we originated and financed, including $1.1 billion of such non-consolidated senior interests as of September 30, 2016. |

15

Table of Contents

Blackstone Mortgage Trust, Inc.

Notes to Consolidated Financial Statements (continued)

(Unaudited)

| December 31, 2015 |

||||||||||||||||

| Property Type |

Number of Loans |

Net Book Value |

Total Loan Exposure(1) |

Percentage of Portfolio |

||||||||||||

| Office |

55 | $ | 4,039,521 | $ | 4,085,007 | 41 | % | |||||||||

| Hotel |

20 | 1,903,544 | 1,986,113 | 20 | ||||||||||||

| Manufactured housing |

18 | 1,361,572 | 1,359,132 | 13 | ||||||||||||

| Retail |

9 | 684,944 | 1,031,405 | 10 | ||||||||||||

| Multifamily |

11 | 580,112 | 582,545 | 6 | ||||||||||||

| Condominium |

3 | 127,434 | 353,144 | 3 | ||||||||||||

| Other |

9 | 379,880 | 750,780 | 7 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 125 | $ | 9,077,007 | $ | 10,148,126 | 100 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Geographic Location |

Number of Loans |

Net Book Value |

Total Loan Exposure(1) |

Percentage of Portfolio |

||||||||||||

| United States |

||||||||||||||||

| Northeast |

25 | $ | 2,260,392 | $ | 2,272,163 | 22 | % | |||||||||

| Southeast |

27 | 1,836,766 | 2,185,609 | 21 | ||||||||||||

| West |

22 | 1,125,238 | 1,356,301 | 13 | ||||||||||||

| Southwest |

15 | 1,035,839 | 1,034,732 | 10 | ||||||||||||

| Midwest |

5 | 616,964 | 617,774 | 6 | ||||||||||||

| Northwest |

5 | 390,307 | 415,207 | 4 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Subtotal |

99 | 7,265,506 | 7,881,786 | 76 | ||||||||||||

| International |

||||||||||||||||

| United Kingdom |

10 | 888,998 | 1,283,644 | 13 | ||||||||||||

| Canada |

11 | 561,023 | 558,724 | 6 | ||||||||||||

| Germany |

2 | 235,294 | 296,424 | 3 | ||||||||||||

| Spain |

1 | 66,661 | 67,416 | 1 | ||||||||||||

| Netherlands |

2 | 59,525 | 60,132 | 1 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Subtotal |

26 | 1,811,501 | 2,266,340 | 24 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

125 | $ | 9,077,007 | $ | 10,148,126 | 100 | % | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1) | In certain instances, we finance our loans through the non-recourse sale of a senior loan interest that is not included in our consolidated financial statements. See Note 2 for further discussion. Total loan exposure encompasses the entire loan we originated and financed, including $1.0 billion of such non-consolidated senior interests as of December 31, 2015. |

Loan Risk Ratings

As further described in Note 2, our Manager evaluates our loan portfolio on a quarterly basis. In conjunction with our quarterly loan portfolio review, our Manager assesses the risk factors of each loan, and assigns a risk rating based on several factors. Factors considered in the assessment include, but are not limited to, risk of loss, current LTV, debt yield, collateral performance, structure, exit plan, and sponsorship. Loans are rated “1” (less risk) through “5” (greater risk), which ratings are defined in Note 2.

16

Table of Contents

Blackstone Mortgage Trust, Inc.

Notes to Consolidated Financial Statements (continued)

(Unaudited)

The following table allocates the principal balance and net book value of our loans receivable based on our internal risk ratings ($ in thousands):

| September 30, 2016 |

December 31, 2015 | |||||||||||||||||||||||

| Risk Rating |

Number of Loans | Net Book Value | Total Loan Exposure(1) | Risk Rating | Number of Loans | Net Book Value | Total Loan Exposure(1) | |||||||||||||||||

| 1 | 10 | $ | 456,047 | $ | 456,905 | 1 | 12 | $ | 919,991 | $ | 925,443 | |||||||||||||

| 2 | 53 | 3,882,247 | 3,935,513 | 2 | 77 | 5,929,447 | 6,316,890 | |||||||||||||||||

| 3 | 43 | 4,009,418 | 5,045,125 | 3 | 35 | 2,114,531 | 2,792,510 | |||||||||||||||||

| 4 | — | — | — | 4 | 1 | 113,038 | 113,283 | |||||||||||||||||

| 5 | — | — | — | 5 | — | — | — | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| 106 | $ | 8,347,712 | $ | 9,437,543 | 125 | $ | 9,077,007 | $ | 10,148,126 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| (1) | In certain instances, we finance our loans through the non-recourse sale of a senior loan interest that is not included in our consolidated financial statements. See Note 2 for further discussion. Total loan exposure encompasses the entire loan we originated and financed, including $1.1 billion and $1.0 billion of such non-consolidated senior interests as of September 30, 2016 and December 31, 2015, respectively. |

The weighted-average risk rating of our total loan exposure was 2.5 and 2.2 as of September 30, 2016 and December 31, 2015, respectively. The increase in weighted-average portfolio risk rating was primarily driven by repayments of loans with lower risk ratings and origination of loans with a “3” risk rating, and not rating downgrades in the existing portfolio.

We did not have any impaired loans, nonaccrual loans, or loans in maturity default as of September 30, 2016 or December 31, 2015. During the third quarter of 2015, one of the loans in our portfolio experienced a maturity default as a result of not meeting certain loan covenants. The loan was subsequently modified to include, among other changes: a redetermination of asset release pricing; an additional contribution of capital by the borrower; and an extension of the maturity date to February 28, 2017. During the nine months ended September 30, 2016, three of the assets collateralizing the $113.3 million loan were sold and the loan was partially repaid by $102.6 million, resulting in a net book value of $10.2 million as of September 30, 2016. The loan’s risk rating was upgraded from “4” as of December 31, 2015 to a “2” as of September 30, 2016 as a result of the collateral asset sales and resulting loan repayments, and positive leasing activity at the remaining collateral assets. As of September 30, 2016 and December 31, 2015, the borrower was current with all terms of the loan and we expect to collect all contractual amounts due thereunder.

4. EQUITY INVESTMENTS IN UNCONSOLIDATED SUBSIDIARIES

As of September 30, 2016, our equity investments in unconsolidated subsidiaries consisted solely of our carried interest in CTOPI, a fund sponsored and managed by an affiliate of our Manager. Activity relating to our equity investments in unconsolidated subsidiaries was as follows ($ in thousands):

| CTOPI Carried Interest |

||||

| Total as of December 31, 2015 |

$ | 9,441 | ||

| Distributions |

(8,167 | ) | ||

| Income allocation(1) |

404 | |||

|

|

|

|||

| Total as of September 30, 2016 |

$ | 1,678 | ||

|

|

|

|||

| (1) | In instances where we have not received cash or all appropriate contingencies have not been eliminated, we have deferred the recognition of promote revenue allocated to us from CTOPI in respect of our carried interest in CTOPI, and recorded an offsetting liability as a component of other liabilities on our consolidated balance sheets. |

17

Table of Contents

Blackstone Mortgage Trust, Inc.

Notes to Consolidated Financial Statements (continued)

(Unaudited)

Our carried interest in CTOPI entitles us to earn promote revenue in an amount equal to 17.7% of the fund’s profits, after a 9% preferred return and 100% return of capital to the CTOPI partners. As of September 30, 2016, we had been allocated $1.7 million of promote revenue from CTOPI based on a hypothetical liquidation of the fund at its net asset value. Accordingly, we have recognized this allocation as an equity investment in CTOPI on our consolidated balance sheets. Generally, we defer recognition of income from CTOPI until cash is received or earned, pending distribution, and appropriate contingencies have been eliminated. We recognized $2.2 million of promote income from CTOPI in respect of our carried interest and recorded such amounts as income in our consolidated statement of operations during the nine months ended September 30, 2016, compared to $5.7 million during the same period in 2015. This carried interest was either received in cash, or was earned and available in cash at CTOPI pending future distribution as of each respective balance sheet date.

CTOPI Incentive Management Fee Grants

In January 2011, we created a management compensation pool for employees equal to 45% of the CTOPI promote distributions received by us. Approximately 68% of the pool is two-thirds vested as of September 30, 2016, with the remainder contingent on continued employment with an affiliate of our Manager and upon our receipt of promote distributions from CTOPI. The remaining 32% of the pool is fully vested as a result of an acceleration event. During the nine months ended September 30, 2016, we recognized $1.1 million under the CTOPI incentive plan, compared to $2.6 million for the same period in 2015. Such amounts were recognized as a component of general and administrative expenses in our consolidated statement of operations.

5. OTHER ASSETS AND LIABILITIES

The following table details the components of our other assets ($ in thousands):

| September 30, | December 31, | |||||||

| 2016 | 2015 | |||||||

| Loan portfolio payments held by servicer(1) |

$ | 33,050 | $ | 122,666 | ||||

| Accrued interest receivable |

31,323 | 37,161 | ||||||

| Real estate debt and equity investments, at fair value(2) |

1,441 | 14,220 | ||||||

| Prepaid expenses |

325 | 890 | ||||||

| Derivative assets |

268 | 8,657 | ||||||

| Prepaid taxes |

206 | 525 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 66,613 | $ | 184,119 | ||||

|

|

|

|

|

|||||

| (1) | Represents loan principal and interest payments held by our third-party loan servicer as of the balance sheet date which were remitted to us during the subsequent remittance cycle. |

| (2) | Real estate debt and equity investments consists of assets held by CT Legacy Partners and are measured at fair value. |

As of September 30, 2016, our other liabilities primarily included $58.2 million of accrued dividends payable, $22.8 million of secured debt repayments pending servicer remittance as of the balance sheet date, and $13.7 million of accrued management and incentive fees payable to our Manager. As of December 31, 2015, our other liabilities primarily included $58.1 million of accrued dividends payable and $14.4 million of accrued management and incentive fees payable to our Manager.

18

Table of Contents

Blackstone Mortgage Trust, Inc.

Notes to Consolidated Financial Statements (continued)

(Unaudited)

6. SECURED DEBT AGREEMENTS

Our secured debt agreements include revolving repurchase facilities, the GE portfolio acquisition facility, asset-specific financings, and a revolving credit agreement. The following table details our secured debt agreements ($ in thousands):

| Secured Debt Agreements | ||||||||

| Borrowings Outstanding | ||||||||

| September 30, 2016 | December 31, 2015 | |||||||

| Revolving repurchase facilities |

$ | 3,044,434 | $ | 2,495,805 | ||||

| GE portfolio acquisition facility |

1,587,822 | 3,161,291 | ||||||

| Asset-specific financings |

653,652 | 474,655 | ||||||

| Revolving credit agreement |

50,000 | — | ||||||

|

|

|

|

|

|||||

| Total secured debt agreements |

$ | 5,335,908 | $ | 6,131,751 | ||||

|

|

|

|

|

|||||

| Deferred financing costs(1) |

(15,550 | ) | (15,646 | ) | ||||

|

|

|

|

|

|||||

| Net book value of secured debt |

$ | 5,320,358 | $ | 6,116,105 | ||||

|

|

|

|

|

|||||

| (1) | Costs incurred in connection with our secured debt agreements are recorded on our consolidated balance sheet when incurred and recognized as a component of interest expense over the life of each related agreement. |

19

Table of Contents

Blackstone Mortgage Trust, Inc.

Notes to Consolidated Financial Statements (continued)

(Unaudited)

Revolving Repurchase Facilities

The following table details our revolving repurchase facilities ($ in thousands):

| September 30, 2016 | ||||||||||||||||||||

| Maximum | Collateral | Repurchase Borrowings | ||||||||||||||||||

| Lender |

Facility Size(1) | Assets(2) | Potential(3) | Outstanding | Available(3) | |||||||||||||||

| Wells Fargo |

$ | 2,000,000 | $ | 1,390,190 | $ | 1,085,153 | $ | 801,271 | $ | 283,882 | ||||||||||

| MetLife |

1,000,000 | 967,359 | 756,054 | 756,054 | — | |||||||||||||||

| Bank of America |

750,000 | 742,081 | 577,694 | 577,694 | — | |||||||||||||||

| JP Morgan(4) |

500,000 | 524,516 | 403,483 | 353,630 | 49,853 | |||||||||||||||

| Citibank |

500,000 | 623,857 | 481,572 | 252,175 | 229,397 | |||||||||||||||

| Morgan Stanley(5) |

324,200 | 254,803 | 200,665 | 200,665 | — | |||||||||||||||

| Société Générale(6) |

448,880 | 166,369 | 131,000 | 102,945 | 28,055 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| $ | 5,523,080 | $ | 4,669,175 | $ | 3,635,621 | $ | 3,044,434 | $ | 591,187 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| December 31, 2015 | ||||||||||||||||||||

| Maximum | Collateral | Repurchase Borrowings | ||||||||||||||||||

| Lender |

Facility Size(1) | Assets(2) | Potential(3) | Outstanding | Available(3) | |||||||||||||||

| Bank of America |

$ | 750,000 | $ | 840,884 | $ | 665,861 | $ | 618,944 | $ | 46,917 | ||||||||||

| Wells Fargo |

1,000,000 | 879,155 | 687,200 | 562,382 | 124,818 | |||||||||||||||

| JP Morgan(4) |

524,547 | 589,752 | 464,723 | 382,042 | 82,681 | |||||||||||||||

| Citibank |

500,000 | 568,032 | 436,217 | 344,879 | 91,338 | |||||||||||||||

| MetLife |

750,000 | 593,273 | 462,849 | 324,587 | 138,262 | |||||||||||||||

| Morgan Stanley(5) |

370,400 | 273,280 | 212,050 | 209,038 | 3,012 | |||||||||||||||

| Société Générale(6) |

437,320 | 67,416 | 53,933 | 53,933 | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| $ | 4,332,267 | $ | 3,811,792 | $ | 2,982,833 | $ | 2,495,805 | $ | 487,028 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | Maximum facility size represents the largest amount of borrowings available under a given facility once sufficient collateral assets have been approved by the lender and pledged by us. |

| (2) | Represents the principal balance of the collateral assets. |

| (3) | Potential borrowings represents the total amount we could draw under each facility based on collateral already approved and pledged. When undrawn, these amounts are immediately available to us at our sole discretion under the terms of each revolving credit facility. |

| (4) | As of September 30, 2016, the JP Morgan maximum facility size was composed of a general $500.0 million facility size, under which U.S. Dollars and British Pound Sterling borrowings are contemplated. As of December 31, 2015, the JP Morgan maximum facility was composed of general $250.0 million facility size plus a general £153.0 million ($226.7 million) facility size provided under a related agreement that contemplated U.S. Dollars and British Pound Sterling borrowings, and additional capacity of ₤32.3 million ($47.8 million) on the ₤153.0 million facility. |

| (5) | The Morgan Stanley maximum facility size represents a £250.0 million facility size that was translated to $324.2 million as of September 30, 2016, and $370.4 million as of December 31, 2015. |

| (6) | The Société Générale maximum facility size represents a €400.0 million facility size that was translated to $448.9 million as of September 30, 2016, and $437.3 million as of December 31, 2015. |

The weighted-average outstanding balance of our revolving repurchase facilities was $2.9 billion for the nine months ended September 30, 2016. As of September 30, 2016, we had aggregate borrowings of $3.0 billion outstanding under our revolving repurchase facilities, with a weighted-average cash coupon of LIBOR plus 1.82% per annum, a weighted-average all-in cost of credit, including associated fees and expenses, of LIBOR plus 2.01% per annum, and a weighted-average advance rate of 79.1%. As of September 30, 2016, outstanding borrowings under these facilities had a weighted-average maturity, excluding extension options and term-out provisions, of 1.4 years.

20

Table of Contents

Blackstone Mortgage Trust, Inc.

Notes to Consolidated Financial Statements (continued)

(Unaudited)

The weighted-average outstanding balance of our revolving repurchase facilities was $2.5 billion for the nine months ended December 31, 2015. As of December 31, 2015, we had aggregated borrowings of $2.5 billion outstanding under our revolving repurchase facilities, with a weighted-average cash coupon of LIBOR plus 1.83% per annum, a weighted-average all-in cost of credit, including associated fees and expenses, of LIBOR plus 2.05% per annum, and a weighted-average advance rate of 78.8%. As of December 31, 2015, outstanding borrowings under these facilities had a weighted-average maturity, excluding extension options and term-out provisions, of 1.3 years.

Borrowings under each facility are subject to the initial approval of eligible collateral loans by the lender and the maximum advance rate and pricing rate of individual advances are determined with reference to the attributes of the respective collateral loan.

The following table outlines the key terms of our revolving repurchase facilities as of September 30, 2016:

| Lender |

Currency |

Rate(1) |

Guarantee(2) | Advance Rate(3) | Margin Call(4) |

Term/Maturity | ||||||

| Wells Fargo |

$ | L+1.77% | 25% | 79.6% | Collateral marks only |

Term matched(5) | ||||||

| MetLife |

$ | L+1.84% | 50% | 78.8% | Collateral marks only |

April 22, 2022(6) | ||||||

| Bank of America |

$ | L+1.67% | 50% | 79.3% | Collateral marks only |

May 21, 2021(7) | ||||||

| JP Morgan |

$ / £ | L+1.84% | 50% | 78.8% | Collateral marks only |

January 7, 2019 | ||||||

| Citibank |

$ | L+1.85% | 25% | 78.3% | Collateral marks only |

Term matched(5) | ||||||

| Morgan Stanley |

£ / € | L+2.35% | 25% | 78.8% | Collateral marks only |

March 1, 2019 | ||||||

| Société Générale |

£ / € | L+1.71% | 25% | 80.0% | Collateral marks only |

Term matched(5) |

| (1) | Represents weighted-average cash coupon based on borrowings outstanding. In instances where our borrowings are denominated in currencies other than the U.S. Dollar, interest accrues at a rate equivalent to a margin plus a base rate other than 1-month USD LIBOR, such as 3-month GBP LIBOR, 3-month EURIBOR, or 3-month CDOR. |

| (2) | Other than amounts guaranteed based on specific collateral asset types, borrowings under our revolving repurchase facilities are non-recourse to us. |

| (3) | Represents weighted-average advance rate based on the outstanding principal balance of the collateral assets pledged. |

| (4) | Margin call provisions under our revolving repurchase facilities do not permit valuation adjustments based on capital markets events, and are limited to collateral-specific credit marks. |

| (5) | These revolving repurchase facilities have various availability periods during which new advances can be made and which are generally subject to each lender’s discretion. Maturity dates for advances outstanding are tied to the term of each respective collateral asset. |

| (6) | Includes five one-year extension options which may be exercised at our sole discretion. |

| (7) | Includes two one-year extension options which may be exercised at our sole discretion. |

GE Portfolio Acquisition Facility

During the second quarter of 2015, concurrently with our acquisition of the GE portfolio, we entered into an agreement with Wells Fargo to provide us with secured financing for the acquired portfolio. During the second quarter of 2016, we increased the facility size by $125.0 million. As of September 30, 2016, this facility provided for $1.8 billion of financing, of which $1.6 billion was outstanding and an additional $200.5 million was available to finance future loan fundings in the GE portfolio. The GE portfolio acquisition facility is non-revolving and consists of a single master repurchase agreement providing for both (i) asset-specific borrowings for each collateral asset as well as (ii) a sequential pay advance feature.

21

Table of Contents

Blackstone Mortgage Trust, Inc.

Notes to Consolidated Financial Statements (continued)

(Unaudited)

Asset-Specific Borrowings

The asset-specific borrowings under the GE portfolio acquisition facility were advanced at a weighted-average rate of 80% of our purchase price of the collateral assets and will be repaid pro rata from collateral asset repayment proceeds. The asset-specific borrowings are currency matched to the collateral assets and accrue interest at a rate equal to the sum of (i) the applicable base rate plus (ii) a margin of 1.75%, which will increase to 1.80% and 1.85% in year four and year five, respectively. As of September 30, 2016, those borrowings were denominated in U.S. Dollars, Canadian Dollars, British Pounds Sterling, and Euros. The asset-specific borrowings are term matched to the underlying collateral assets with an outside maturity date of May 20, 2020, which may be extended pursuant to two one-year extension options. We guarantee obligations under the GE portfolio acquisition facility in an amount equal to the greater of (i) 25% of outstanding asset-specific borrowings, and (ii) $250.0 million. We had outstanding asset-specific borrowings of $1.6 billion and $3.1 billion under the GE portfolio acquisition facility as of September 30, 2016 and December 31, 2015, respectively.

Sequential Pay Advance