Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE QUARTERLY PERIOD ENDED March 31, 2015

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

Commission File Number: 001-14788

Blackstone Mortgage Trust, Inc.

(Exact name of Registrant as specified in its charter)

| Maryland | 94-6181186 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

345 Park Avenue, 42nd Floor

New York, New York 10154

(Address of principal executive offices)(Zip Code)

(212) 655-0220

(Registrant’s telephone number, including area code)

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The number of the Registrant’s outstanding shares of class A common stock, par value $0.01 per share, as of April 21, 2015 was 81,451,211.

Table of Contents

Table of Contents

Blackstone Mortgage Trust, Inc.

Consolidated Balance Sheets (Unaudited)

(in thousands, except share and per share data)

| March 31, | December 31, | |||||||

| 2015 | 2014 | |||||||

| Assets |

||||||||

| Cash and cash equivalents |

$ | 18,474 | $ | 51,810 | ||||

| Restricted cash |

26,890 | 11,591 | ||||||

| Loans receivable, net |

4,943,383 | 4,428,500 | ||||||

| Equity investments in unconsolidated subsidiaries |

11,570 | 10,604 | ||||||

| Accrued interest receivable, prepaid expenses, and other assets |

85,381 | 86,016 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 5,085,698 | $ | 4,588,521 | ||||

|

|

|

|

|

|||||

| Liabilities and Equity |

||||||||

| Accounts payable, accrued expenses, and other liabilities |

$ | 62,862 | $ | 61,013 | ||||

| Revolving repurchase facilities |

2,241,630 | 2,040,783 | ||||||

| Asset-specific repurchase agreements |

407,203 | 324,553 | ||||||

| Loan participations sold |

708,845 | 499,433 | ||||||

| Convertible notes, net |

162,460 | 161,853 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

3,583,000 | 3,087,635 | ||||||

|

|

|

|

|

|||||

| Equity |

||||||||

| Class A common stock, $0.01 par value, 100,000,000 shares authorized, 58,451,077 and 58,269,889 shares issued and outstanding as of March 31, 2015 and December 31, 2014, respectively |

585 | 583 | ||||||

| Additional paid-in capital |

2,030,760 | 2,027,404 | ||||||

| Accumulated other comprehensive loss |

(31,756 | ) | (15,024 | ) | ||||

| Accumulated deficit |

(542,654 | ) | (547,592 | ) | ||||

|

|

|

|

|

|||||

| Total Blackstone Mortgage Trust, Inc. stockholders’ equity |

1,456,935 | 1,465,371 | ||||||

| Non-controlling interests |

45,763 | 35,515 | ||||||

|

|

|

|

|

|||||

| Total equity |

1,502,698 | 1,500,886 | ||||||

|

|

|

|

|

|||||

| Total liabilities and equity |

$ | 5,085,698 | $ | 4,588,521 | ||||

|

|

|

|

|

|||||

See accompanying notes to consolidated financial statements.

2

Table of Contents

Blackstone Mortgage Trust, Inc.

Consolidated Statements of Operations (Unaudited)

(in thousands, except share and per share data)

| Three Months Ended March 31, | ||||||||

| 2015 | 2014 | |||||||

| Income from loans and other investments |

||||||||

| Interest and related income |

$ | 63,407 | $ | 33,656 | ||||

| Less: Interest and related expenses |

24,161 | 12,074 | ||||||

|

|

|

|

|

|||||

| Income from loans and other investments, net |

39,246 | 21,582 | ||||||

| Other expenses |

||||||||

| Management and incentive fees |

6,671 | 3,397 | ||||||

| General and administrative expenses |

7,663 | 3,199 | ||||||

|

|

|

|

|

|||||

| Total other expenses |

14,334 | 6,596 | ||||||

| Unrealized gain (loss) on investments at fair value |

17,476 | (1,339 | ) | |||||

| Income from equity investments in unconsolidated subsidiaries |

3,950 | — | ||||||

|

|

|

|

|

|||||

| Income before income taxes |

46,338 | 13,647 | ||||||

| Income tax provision |

245 | 531 | ||||||

|

|

|

|

|

|||||

| Net income |

46,093 | 13,116 | ||||||

|

|

|

|

|

|||||

| Net income attributable to non-controlling interests |

(10,700 | ) | (51 | ) | ||||

|

|

|

|

|

|||||

| Net income attributable to Blackstone Mortgage Trust, Inc. |

$ | 35,393 | $ | 13,065 | ||||

|

|

|

|

|

|||||

| Net income per share of common stock |

||||||||

| Basic |

$ | 0.60 | $ | 0.34 | ||||

|

|

|

|

|

|||||

| Diluted |

$ | 0.60 | $ | 0.34 | ||||

|

|

|

|

|

|||||

| Weighted-average shares of common stock outstanding |

||||||||

| Basic |

58,576,025 | 37,967,365 | ||||||

|

|

|

|

|

|||||

| Diluted |

58,576,025 | 37,967,365 | ||||||

|

|

|

|

|

|||||

| Dividends Declared per share of common stock |

$ | 0.52 | $ | 0.48 | ||||

|

|

|

|

|

|||||

See accompanying notes to consolidated financial statements.

3

Table of Contents

Blackstone Mortgage Trust, Inc.

Consolidated Statements of Comprehensive Income (Unaudited)

(in thousands)

| Three Months Ended March 31, | ||||||||

| 2015 | 2014 | |||||||

| Net income |

$ | 46,093 | $ | 13,116 | ||||

| Other comprehensive income: |

||||||||

| Unrealized (loss) gain on foreign currency remeasurement |

(16,732 | ) | 36 | |||||

|

|

|

|

|

|||||

| Comprehensive income |

29,361 | 13,152 | ||||||

| Comprehensive income attributable to non-controlling interests |

(10,700 | ) | (51 | ) | ||||

|

|

|

|

|

|||||

| Comprehensive income attributable to Blackstone Mortgage Trust, Inc. |

$ | 18,661 | $ | 13,101 | ||||

|

|

|

|

|

|||||

See accompanying notes to consolidated financial statements.

4

Table of Contents

Blackstone Mortgage Trust, Inc.

Consolidated Statements of Changes in Equity (Unaudited)

(in thousands)

| Blackstone Mortgage Trust, Inc. | ||||||||||||||||||||||||||||

| Class A Common Stock |

Additional Paid-In Capital |

Accumulated Other Comprehensive Income (loss) |

Accumulated Deficit |

Stockholders’ Equity |

Non-Controlling Interests |

Total Equity | ||||||||||||||||||||||

| Balance at December 31, 2013 |

$ | 295 | $ | 1,252,986 | $ | 798 | $ | (536,170 | ) | $ | 717,909 | $ | 38,841 | $ | 756,750 | |||||||||||||

| Shares of class A common stock issued, net |

99 | 255,994 | — | — | 256,093 | — | 256,093 | |||||||||||||||||||||

| Restricted class A common stock earned |

(1 | ) | 1,741 | — | — | 1,740 | — | 1,740 | ||||||||||||||||||||

| Deferred directors’ compensation |

— | 139 | — | — | 139 | — | 139 | |||||||||||||||||||||

| Other comprehensive income |

— | — | 36 | — | 36 | — | 36 | |||||||||||||||||||||

| Net income |

— | — | — | 13,065 | 13,065 | 51 | 13,116 | |||||||||||||||||||||

| Dividends declared on common stock |

— | — | — | (18,899 | ) | (18,899 | ) | — | (18,899 | ) | ||||||||||||||||||

| Distributions to non-controlling interests |

— | — | — | — | — | (575 | ) | (575 | ) | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Balance at March 31, 2014 |

$ | 393 | $ | 1,510,860 | $ | 834 | $ | (542,004 | ) | $ | 970,083 | $ | 38,317 | $ | 1,008,400 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Balance at December 31, 2014 |

$ | 583 | $ | 2,027,404 | $ | (15,024 | ) | $ | (547,592 | ) | $ | 1,465,371 | $ | 35,515 | $ | 1,500,886 | ||||||||||||

| Shares of class A common stock issued, net |

2 | — | — | — | 2 | — | 2 | |||||||||||||||||||||

| Restricted class A common stock earned |

— | 3,202 | — | — | 3,202 | — | 3,202 | |||||||||||||||||||||

| Dividends reinvested |

— | 60 | — | (57 | ) | 3 | — | 3 | ||||||||||||||||||||

| Deferred directors’ compensation |

— | 94 | — | — | 94 | — | 94 | |||||||||||||||||||||

| Other comprehensive loss |

— | — | (16,732 | ) | — | (16,732 | ) | — | (16,732 | ) | ||||||||||||||||||

| Net income |

— | — | — | 35,393 | 35,393 | 10,700 | 46,093 | |||||||||||||||||||||

| Dividends declared on common stock |

— | — | — | (30,398 | ) | (30,398 | ) | — | (30,398 | ) | ||||||||||||||||||

| Distributions to non-controlling interests |

— | — | — | — | — | (452 | ) | (452 | ) | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Balance at March 31, 2015 |

$ | 585 | $ | 2,030,760 | $ | (31,756 | ) | $ | (542,654 | ) | $ | 1,456,935 | $ | 45,763 | $ | 1,502,698 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

See accompanying notes to consolidated financial statements.

5

Table of Contents

Blackstone Mortgage Trust, Inc.

Consolidated Statements of Cash Flows (Unaudited)

(in thousands)

| Three Months Ended March 31, | ||||||||

| 2015 | 2014 | |||||||

| Cash flows from operating activities |

||||||||

| Net income |

$ | 46,093 | $ | 13,116 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities |

||||||||

| Unrealized (gain) loss on investments at fair value |

(17,476 | ) | 1,339 | |||||

| Income from equity investments in unconsolidated subsidiaries |

(3,950 | ) | — | |||||

| Non-cash compensation expense |

6,104 | 1,970 | ||||||

| Amortization of deferred interest on loans |

(5,717 | ) | (3,470 | ) | ||||

| Amortization of deferred financing costs and premiums/discount on debt obligations |

3,519 | 1,625 | ||||||

| Changes in assets and liabilities, net |

||||||||

| Accrued interest receivable, prepaid expenses, and other assets |

2,021 | (2,051 | ) | |||||

| Accounts payable, accrued expenses, and other liabilities |

1,819 | 2,510 | ||||||

|

|

|

|

|

|||||

| Net cash provided by operating activities |

32,413 | 15,039 | ||||||

|

|

|

|

|

|||||

| Cash flows from investing activities |

||||||||

| Originations and fundings of loans receivable |

(903,152 | ) | (740,236 | ) | ||||

| Origination and exit fees received on loans receivable |

6,078 | 7,121 | ||||||

| Principal collections and proceeds from the sale of loans receivable and other assets |

348,153 | 76,562 | ||||||

| Increase in restricted cash |

(15,299 | ) | (581 | ) | ||||

|

|

|

|

|

|||||

| Net cash used in investing activities |

(564,220 | ) | (657,134 | ) | ||||

|

|

|

|

|

|||||

| Cash flows from financing activities |

||||||||

| Borrowings under revolving repurchase facilities |

588,980 | 760,462 | ||||||

| Repayments under revolving repurchase facilities |

(379,235 | ) | (315,862 | ) | ||||

| Borrowings under asset-specific repurchase agreements |

99,162 | — | ||||||

| Repayments under asset-specific repurchase agreements |

(8,320 | ) | (23,250 | ) | ||||

| Repayment of other liabilities |

— | (787 | ) | |||||

| Proceeds from sales of loan participations |

256,000 | — | ||||||

| Repayment of loan participations |

(28,164 | ) | — | |||||

| Payment of deferred financing costs |

(3,053 | ) | (2,217 | ) | ||||

| Settlement of forward contracts |

4,141 | — | ||||||

| Distributions to non-controlling interests |

(452 | ) | (575 | ) | ||||

| Proceeds from issuance of class A common stock |

3 | 256,093 | ||||||

| Dividends paid on class A common stock |

(30,300 | ) | (13,276 | ) | ||||

|

|

|

|

|

|||||

| Net cash provided by financing activities |

498,762 | 660,588 | ||||||

|

|

|

|

|

|||||

| Net (decrease) increase in cash and cash equivalents |

(33,045 | ) | 18,493 | |||||

| Cash and cash equivalents at beginning of period |

51,810 | 52,342 | ||||||

| Effects of currency translation on cash and cash equivalents |

(291 | ) | (1 | ) | ||||

|

|

|

|

|

|||||

| Cash and cash equivalents at end of period |

$ | 18,474 | $ | 70,834 | ||||

|

|

|

|

|

|||||

| Supplemental disclosure of cash flows information |

||||||||

| Payments of interest |

$ | (18,996 | ) | $ | (7,629 | ) | ||

|

|

|

|

|

|||||

| Payments of income taxes |

$ | (129 | ) | $ | (1,160 | ) | ||

|

|

|

|

|

|||||

| Supplemental disclosure of non-cash investing and financing activities |

||||||||

| Dividends declared, not paid |

$ | (30,398 | ) | $ | (18,899 | ) | ||

|

|

|

|

|

|||||

| Participations sold, net |

$ | 227,836 | $ | — | ||||

|

|

|

|

|

|||||

See accompanying notes to consolidated financial statements.

6

Table of Contents

Blackstone Mortgage Trust, Inc.

Notes to Consolidated Financial Statements

(Unaudited)

1. ORGANIZATION

References herein to “Blackstone Mortgage Trust,” “Company,” “we,” “us” or “our” refer to Blackstone Mortgage Trust, Inc. and its subsidiaries unless the context specifically requires otherwise.

Blackstone Mortgage Trust is a real estate finance company that originates and purchases senior loans collateralized by properties in North America and Europe. We are externally managed by BXMT Advisors L.L.C., or our Manager, a subsidiary of The Blackstone Group L.P., or Blackstone, and are a real estate investment trust, or REIT, traded on the New York Stock Exchange, or NYSE, under the symbol “BXMT.” We are headquartered in New York City.

We conduct our operations as a REIT for U.S. federal income tax purposes. We generally will not be subject to U.S. federal income taxes on our taxable income to the extent that we annually distribute all of our net taxable income to stockholders and maintain our qualification as a REIT. We also operate our business in a manner that permits us to maintain our exemption from registration under the Investment Company Act of 1940, as amended, or the Investment Company Act. We are organized as a holding company and conduct our business primarily through our various subsidiaries.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The accompanying unaudited consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America, or GAAP, for interim financial information and the instructions to Form 10-Q and Rule 10-01 of Regulation S-X. The consolidated financial statements, including the notes thereto, are unaudited and exclude some of the disclosures required in audited financial statements. Management believes it has made all necessary adjustments, consisting of only normal recurring items, so that the consolidated financial statements are presented fairly and that estimates made in preparing its consolidated financial statements are reasonable and prudent. The operating results presented for interim periods are not necessarily indicative of the results that may be expected for any other interim period or for the entire year. The accompanying unaudited consolidated interim financial statements should be read in conjunction with the audited consolidated financial statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2014 filed with the Securities and Exchange Commission.

Basis of Presentation

The accompanying consolidated financial statements include, on a consolidated basis, our accounts, the accounts of our wholly-owned subsidiaries, majority-owned subsidiaries, and variable interest entities, or VIEs, of which we are the primary beneficiary. All intercompany balances and transactions have been eliminated in consolidation. Certain of the assets and credit of our consolidated subsidiaries are not available to satisfy the debt or other obligations of us, our affiliates, or other entities.

One of our subsidiaries, CT Legacy Partners, LLC, or CT Legacy Partners, accounts for its operations in accordance with industry-specific GAAP accounting guidance for investment companies, pursuant to which it reports its investments at fair value. We have retained this accounting treatment in consolidation and, accordingly, report the loans and other investments of CT Legacy Partners at fair value on our consolidated balance sheets.

Certain reclassifications have been made in the presentation of the prior period consolidated statement of cash flows to conform to the current period presentation.

Principles of Consolidation

We consolidate all entities that we control through either majority ownership or voting rights. In addition, we consolidate all VIEs of which we are considered the primarily beneficiary. VIEs are defined as entities in which equity investors (i) do not have the characteristics of a controlling financial interest and/or (ii) do not have sufficient equity at risk for the entity to finance its activities without additional subordinated financial support from other parties. The entity that consolidates a VIE is known as its primary beneficiary and is generally the entity with (i) the power to direct the activities that most significantly affect the VIE’s economic performance and (ii) the right to receive benefits from the VIE or the obligation to absorb losses of the VIE that could be significant to the VIE.

As of December 31, 2014, we no longer had any assets or liabilities on our consolidated balance sheet attributable to a consolidated VIE.

7

Table of Contents

Blackstone Mortgage Trust, Inc.

Notes to Consolidated Financial Statements (continued)

(Unaudited)

Use of Estimates

The preparation of financial statements in conformity with GAAP requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results may ultimately differ from those estimates.

Revenue Recognition

Interest income from our loans receivable is recognized over the life of each investment using the effective interest method and is recorded on the accrual basis. Recognition of fees, premiums, discounts, and direct costs associated with these investments is deferred until the loan is advanced and is then recorded over the term of the loan as an adjustment to yield. Income accrual is generally suspended for loans at the earlier of the date at which payments become 90 days past due or when, in the opinion of our Manager, recovery of income and principal becomes doubtful. Income is then recorded on the basis of cash received until accrual is resumed when the loan becomes contractually current and performance is demonstrated to be resumed.

Cash and Cash Equivalents

Cash and cash equivalents represent cash held in banks, cash on hand, and liquid investments with original maturities of three months or less. We may have bank balances in excess of federally insured amounts; however, we deposit our cash and cash equivalents with high credit-quality institutions to minimize credit risk exposure. We have not experienced, and do not expect, any losses on our cash or cash equivalents.

Restricted Cash

We classify the cash balances held by CT Legacy Partners as restricted because, while these cash balances are available for use by CT Legacy Partners for its operations, they cannot be used by us until our allocable share is distributed from CT Legacy Partners and cannot be commingled with any of our unrestricted cash balances.

Loans Receivable and Provision for Loan Losses

We originate and purchase commercial real estate debt and related instruments generally to be held as long-term investments at amortized cost. We are required to periodically evaluate each of these loans for possible impairment. Impairment is indicated when it is deemed probable that we will not be able to collect all amounts due to us pursuant to the contractual terms of the loan. If a loan is determined to be impaired, we write down the loan through a charge to the provision for loan losses. Impairment of these loans, which are collateral dependent, is measured by comparing the estimated fair value of the underlying collateral to the book value of the respective loan. These valuations require significant judgments, which include assumptions regarding capitalization rates, leasing, creditworthiness of major tenants, occupancy rates, availability of financing, exit plan, loan sponsorship, actions of other lenders, and other factors deemed necessary by our Manager. Actual losses, if any, could ultimately differ from these estimates.

Our Manager performs a quarterly review of our portfolio of loans. In conjunction with this review, our Manager assesses the risk factors of each loan, and assigns a risk rating based on a variety of factors, including, without limitation, loan-to-value ratio, debt yield, property type, geographic and local market dynamics, physical condition, cash flow volatility, leasing and tenant profile, loan structure and exit plan, and project sponsorship. Based on a 5-point scale, our loans are rated “1” through “5,” from less risk to greater risk, which ratings are defined as follows:

| 1 | - | Very Low Risk | ||

| 2 | - | Low Risk | ||

| 3 | - | Medium Risk | ||

| 4 | - | High Risk/Potential for Loss: A loan that has a risk of realizing a principal loss. | ||

| 5 | - | Impaired/Loss Likely: A loan that has a very high risk of realizing a principal loss or has otherwise incurred a principal loss. | ||

8

Table of Contents

Blackstone Mortgage Trust, Inc.

Notes to Consolidated Financial Statements (continued)

(Unaudited)

Equity Investments in Unconsolidated Subsidiaries

Our carried interest in CT Opportunity Partners I, LP, or CTOPI, is accounted for using the equity method. CTOPI’s assets and liabilities are not consolidated into our financial statements due to our determination that (i) it is not a VIE and (ii) the other investors in CTOPI have sufficient rights to preclude consolidation by us. As such, we report our allocable percentage of the net assets of CTOPI on our consolidated balance sheets. The recognition of income from CTOPI is generally deferred until cash is collected or appropriate contingencies have been eliminated.

Derivative Financial Instruments

We classify all derivative financial instruments as other assets or other liabilities on our consolidated balance sheets at fair value.

On the date we enter into a derivative contract, we designate each contract as (i) a hedge of a net investment in a foreign operation, or net investment hedge, (ii) a hedge of a forecasted transaction or of the variability of cash flows to be received or paid related to a recognized asset or liability, or cash flow hedge, (iii) a hedge of a recognized asset or liability, or fair value hedge, or (iv) a derivative instrument not to be designated as a hedging derivative, or freestanding derivative. For all derivatives other than those designated as freestanding derivatives, we formally document our hedge relationships and designation at inception. This documentation includes the identification of the hedging instruments and the hedged items, its risk management objectives, strategy for undertaking the hedge transaction and our evaluation of the effectiveness of its hedged transaction.

On a quarterly basis, we also formally assess whether the derivative we designated in each hedging relationship is expected to be, and has been, highly effective in offsetting changes in the value or cash flows of the hedged items. If it is determined that a derivative is not highly effective at hedging the designated exposure, hedge accounting is discontinued. Changes in the fair value of the effective portion of our hedges are reflected in accumulated other comprehensive income (loss) on our consolidated financial statements. Changes in the fair value of the ineffective portion of our hedges are included in net income (loss). Amounts are reclassified out of accumulated other comprehensive income (loss) and into net income (loss) when the hedged item is either sold or substantially liquidated. To the extent a derivative does not qualify for hedge accounting and is deemed a freestanding derivative, the changes in its value are included in net income (loss).

Repurchase Agreements

We record investments financed with repurchase agreements as separate assets and the related borrowings under any repurchase agreements are recorded as separate liabilities on our consolidated balance sheets. Interest income earned on the investments and interest expense incurred on the repurchase agreements are reported separately on our consolidated statements of operations.

Loan Participations Sold

Loan participations sold represent senior interests in certain loans that we sold, however, we present such loan participations sold as liabilities because these arrangements do not qualify as sales under GAAP. These participations are non-recourse and remain on our consolidated balance sheet until the loan is repaid. The gross presentation of loan participations sold does not impact stockholders’ equity or net income.

Convertible Notes

The “Debt with Conversion and Other Options” Topic of the Financial Accounting Standards Board, or FASB, Accounting Standards Codification, or Codification, requires the liability and equity components of convertible debt instruments that may be settled in cash upon conversion, including partial cash settlement, to be separately accounted for in a manner that reflects the issuer’s nonconvertible debt borrowing rate. The initial proceeds from the sale of convertible notes are allocated between a liability component and an equity component in a manner that reflects interest expense at the rate of similar nonconvertible debt that could have been issued at such time. The equity component represents the excess initial proceeds received over the fair value of the liability component of the notes as of the date of issuance. We measured the estimated fair value of the debt component of our convertible notes as of the issuance date based on our nonconvertible debt borrowing rate. The equity component of the convertible notes is reflected within additional paid-in capital on our consolidated balance sheet, and the resulting debt discount is amortized over the period during which the convertible notes are expected to be outstanding (through the maturity date) as additional non-cash interest expense. The additional non-cash interest expense attributable to the convertible notes will increase in subsequent periods through the maturity date as the notes accrete to their par value over the same period.

9

Table of Contents

Blackstone Mortgage Trust, Inc.

Notes to Consolidated Financial Statements (continued)

(Unaudited)

Deferred Financing Costs

The deferred financing costs that are included in accrued interest receivable, prepaid expenses, and other assets on our consolidated balance sheets include issuance and other costs related to our debt obligations. These costs are amortized as interest expense using the effective interest method over the life of the related obligations.

Fair Value of Financial Instruments

The Codification defines fair value, establishes a framework for measuring fair value, and requires certain disclosures about fair value measurements under GAAP. Specifically, this guidance defines fair value based on exit price, or the price that would be received upon the sale of an asset or the transfer of a liability in an orderly transaction between market participants at the measurement date.

The “Fair Value Measurement and Disclosures” Topic of the Codification also establishes a fair value hierarchy that prioritizes and ranks the level of market price observability used in measuring financial instruments. Market price observability is affected by a number of factors, including the type of financial instrument, the characteristics specific to the financial instrument, and the state of the marketplace, including the existence and transparency of transactions between market participants. Financial instruments with readily available quoted prices in active markets generally will have a higher degree of market price observability and a lesser degree of judgment used in measuring fair value.

Financial instruments measured and reported at fair value are classified and disclosed based on the observability of inputs used in the determination, as follows:

| • | Level 1: Generally includes only unadjusted quoted prices that are available in active markets for identical financial instruments as of the reporting date. |

| • | Level 2: Pricing inputs include quoted prices in active markets for similar instruments, quoted prices in less active or inactive markets for identical or similar instruments where multiple price quotes can be obtained, and other observable inputs, such as interest rates, yield curves, credit risks, and default rates. |

| • | Level 3: Pricing inputs are unobservable for the financial instruments and include situations where there is little, if any, market activity for the financial instrument. These inputs require significant judgment or estimation by management of third parties when determining fair value and generally represent anything that does not meet the criteria of Levels 1 and 2. |

The estimated value of each asset reported at fair value using Level 3 inputs is determined by an internal committee composed of members of senior management of our Manager, including our Chief Executive Officer, Chief Financial Officer, and other senior officers.

Certain of our other assets are reported at fair value either (i) on a recurring basis, as of each quarter-end, or (ii) on a nonrecurring basis, as a result of impairment or other events. Our assets that are recorded at fair value are discussed further in Note 12. We generally value our assets recorded at fair value by either (i) discounting expected cash flows based on assumptions regarding the collection of principal and interest and estimated market rates, or (ii) obtaining assessments from third-party dealers. For collateral-dependent loans that are identified as impaired, we measure impairment by comparing our Manager’s estimation of fair value of the underlying collateral, less costs to sell, to the book value of the respective loan. These valuations may require significant judgments, which include assumptions regarding capitalization rates, leasing, creditworthiness of major tenants, occupancy rates, availability of financing, exit plan, loan sponsorship, actions of other lenders, and other factors deemed necessary by our Manager.

We are also required by GAAP to disclose fair value information about financial instruments, that are not otherwise reported at fair value in our consolidated balance sheet, to the extent it is practicable to estimate a fair value for those instruments. These disclosure requirements exclude certain financial instruments and all non-financial instruments.

10

Table of Contents

Blackstone Mortgage Trust, Inc.

Notes to Consolidated Financial Statements (continued)

(Unaudited)

The following methods and assumptions are used to estimate the fair value of each class of financial instruments, for which it is practicable to estimate that value:

| • | Cash and cash equivalents: The carrying amount of cash on deposit and in money market funds approximates fair value. |

| • | Restricted cash: The carrying amount of restricted cash approximates fair value. |

| • | Loans receivable, net: The fair values for these loans were estimated by our Manager taking into consideration factors, including capitalization rates, leasing, occupancy rates, availability and cost of financing, exit plan, sponsorship, actions of other lenders, and indications of market value from other market participants. In the case of impaired loans receivable, fair value was determined based on the lower of amortized cost and the value of the underlying real estate collateral. |

| • | Derivative financial instruments: The fair value of our foreign currency contracts was valued using advice from a third party derivative specialist, based on contractual cash flows and observable inputs comprising foreign currency rates and credit spreads. |

| • | Repurchase obligations: The fair values for these instruments were estimated based on the rate at which a similar credit facility would have currently priced. |

| • | Convertible notes, net: The convertible notes are actively traded and their fair values were obtained using quoted market prices based on recent transactions. |

| • | Participations sold: The fair value of these instruments were estimated based on the value of the related loan receivable asset. |

Income Taxes

Our financial results generally do not reflect provisions for current or deferred income taxes on our REIT taxable income. We believe that we operate in a manner that will continue to allow us to be taxed as a REIT and, as a result, we generally do not expect to pay substantial corporate level taxes other than those payable by our taxable REIT subsidiaries. If we were to fail to meet these requirements, we may be subject to federal, state, and local income tax on current and past income, and penalties. Refer to Note 10 for additional information.

Stock-Based Compensation

Our stock-based compensation consists of awards issued to our Manager and certain of its employees that vest over the life of the awards as well as deferred stock units issued to certain members of our Board of Directors. Stock-based compensation expense is recognized for these awards in net income on a variable basis over the applicable vesting period of the awards, based on the value of our class A common stock. Refer to Note 11 for additional information.

Earnings per Share

Basic earnings per share, or Basic EPS, is computed in accordance with the two-class method and is based on the net earnings allocable to our class A common stock, including restricted class A common stock and deferred stock units, divided by the weighted-average number of shares of class A common stock, including restricted class A common stock and deferred stock units outstanding during the period. Our restricted class A common stock is considered a participating security, as defined by GAAP, and has been included in our Basic EPS under the two-class method as these restricted shares have the same rights as our other shares of class A common stock, including participating in any gains or losses.

Diluted earnings per share, or Diluted EPS, is determined using the treasury stock method, and is based on the net earnings allocable to our class A common stock, including restricted class A common stock and deferred stock units, divided by the weighted-average number of shares of class A common stock, including restricted class A common stock and deferred stock units. Refer to Note 8 for additional discussion of earnings per share.

Foreign Currency

In the normal course of business, we enter into transactions not denominated in United States, or U.S., dollars. Foreign exchange gains and losses arising on such transactions are recorded as a gain or loss in our consolidated

11

Table of Contents

Blackstone Mortgage Trust, Inc.

Notes to Consolidated Financial Statements (continued)

(Unaudited)

statements of operations. In addition, we consolidate entities that have a non-U.S. dollar functional currency. Non-U.S. dollar denominated assets and liabilities are translated to U.S. dollars at the exchange rate prevailing at the reporting date and income, expenses, gains, and losses are translated at the prevailing exchange rate on the dates that they were recorded. Cumulative translation adjustments arising from the translation of non-U.S. dollar denominated subsidiaries are recorded in other comprehensive income.

Underwriting Commissions and Offering Costs

Underwriting commissions and offering costs incurred in connection with common stock offerings are reflected as a reduction of additional paid-in capital. Costs incurred that are not directly associated with the completion of a common stock offering are expensed when incurred.

Segment Reporting

We previously operated our business through two segments, the Loan Origination segment and the CT Legacy Portfolio segment. In the first quarter of 2015, as a result of asset resolutions in our CT Legacy Portfolio, our Manager determined that the CT Legacy Portfolio segment was no longer a distinct and separately managed business. Accordingly, we no longer present segment reporting.

Recent Accounting Pronouncements

In April 2015, the FASB issued ASU 2015-03, “Interest – Imputation of Interest (Subtopic 835-30): Simplifying the Presentation of Debt Issuance Costs,” or ASU 2015-03. ASU 2015-03 simplifies the presentation of debt issuance costs by amending the accounting guidance to require that debt issuance costs related to a recognized debt liability be presented in the balance sheet as a direct deduction from the carrying amount of the related debt liability. The amendments presented in ASU 2015-03 are consistent with the accounting guidance related to debt discounts. ASU 2015-03 is effective for the first interim or annual period beginning after December 15, 2015. Early adoption is permitted, and we are currently assessing the impact of ASU 2015-03 on our consolidated financial statements.

In February 2015, the FASB issued ASU 2015-02, “Consolidation (Topic 810): Amendments to the Consolidation Analysis,” or ASU 2015-02. ASU 2015-02 amends the guidance related to accounting for the consolidation of certain legal entities. The modifications made in ASU 2015-02 impact limited partnerships and similar legal entities, the evaluation of (i) fees paid to a decision maker or a service provider as a variable interest, (ii) fee arrangements, and (iii) related parties on the primary beneficiary determination. ASU 2015-02 is effective for the first interim or annual period beginning after December 15, 2015. We do not anticipate that the adoption of ASU 2015-02 will have a material impact on our consolidated financial statements.

In August 2014, the FASB issued ASU 2014-15, “Presentation of Financial Statements – Going Concern (Subtopic 2015-40): Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern,” or ASU 2014-15. ASU 2014-15 introduces an explicit requirement for management to assess and provide certain disclosures if there is substantial doubt about an entity’s ability to continue as a going concern. ASU 2014-15 is effective for the annual period ending after December 15, 2016. We do not anticipate that the adoption of ASU 2014-15 will have a material impact on our consolidated financial statements.

In June 2014, the FASB issued ASU 2014-11, “Transfers and Servicing (Topic 860): Repurchase-to-Maturity Transactions, Repurchase Financings, and Disclosures,” or ASU 2014-11. ASU 2014-11 amends the accounting guidance for repurchase-to-maturity transactions and repurchase agreements executed as repurchase financings, and requires additional disclosure about certain transactions by the transferor. ASU 2014-11 is effective for certain transactions that qualify for sales treatment for the first interim or annual period beginning after December 15, 2014. The new disclosure requirements for repurchase agreements, securities lending transactions, and repurchase-to-maturity transactions that qualify for secured borrowing treatment is effective for annual periods beginning after December 15, 2014, and for interim periods beginning after March 15, 2015. We have historically recorded our repurchase arrangements as secured borrowings and, accordingly, the adoption of ASU 2014-11 did not have a material impact on our consolidated financial statements.

In May 2014, the FASB issued ASU 2014-09, “Revenue from Contracts with Customers (Topic 606),” or ASU 2014-09. ASU 2014-09 broadly amends the accounting guidance for revenue recognition. ASU 2014-09 is effective for the first interim or annual period beginning after December 15, 2016, and is to be applied prospectively. We do not anticipate that the adoption of ASU 2014-09 will have a material impact on our consolidated financial statements.

12

Table of Contents

Blackstone Mortgage Trust, Inc.

Notes to Consolidated Financial Statements (continued)

(Unaudited)

3. LOANS RECEIVABLE

The following table details overall statistics for our loans receivable portfolio ($ in thousands):

| March 31, 2015 | December 31, 2014 | |||||||

| Number of loans |

60 | 60 | ||||||

| Principal balance |

$ | 4,977,468 | $ | 4,462,897 | ||||

| Net book value |

$ | 4,943,383 | $ | 4,428,500 | ||||

| Unfunded loan commitments(1) |

$ | 550,012 | $ | 513,229 | ||||

| Weighted-average cash coupon(2) |

L+4.26 | % | L+4.36 | % | ||||

| Weighted-average all-in yield(2) |

L+4.68 | % | L+4.81 | % | ||||

| Weighted-average maximum maturity (years)(3) |

3.7 | 3.9 | ||||||

| (1) | Unfunded commitments will primarily be funded to finance property improvements or lease-related expenditures by the borrowers. These future commitments will expire over the next four years. |

| (2) | As of March 31, 2015, our floating rate loans and related liabilities were indexed to the various benchmark rates relevant in each case in terms of currency and payment frequency. Therefore the net exposure to each benchmark rate is in direct proportion to our net assets indexed to that rate. In addition, 8% of our loans earned interest based on LIBOR floors, with an average floor of 0.24%, as of March 31, 2015. In addition to cash coupon, all-in yield includes the amortization of deferred origination fees, loan origination costs, and accrual of both extension and exit fees. |

| (3) | Maximum maturity assumes all extension options are exercised by the borrower, however our loans may be repaid prior to such date. As of March 31, 2015, 83% of our loans are subject to yield maintenance, lock-out provisions, or other prepayment restrictions and 17% are open to repayment by the borrower. |

Activity relating to our loans receivable was ($ in thousands):

| Principal Balance |

Deferred Fees and Other Items |

Net Book Value |

||||||||||

| December 31, 2014 |

$ | 4,462,897 | $ | (34,397 | ) | $ | 4,428,500 | |||||

| Loan fundings |

903,152 | — | 903,152 | |||||||||

| Loan repayments and sales |

(333,113 | ) | — | (333,113 | ) | |||||||

| Unrealized loss on foreign currency translation |

(55,468 | ) | 673 | (54,795 | ) | |||||||

| Deferred origination fees and expenses |

— | (6,078 | ) | (6,078 | ) | |||||||

| Amortization of deferred fees and expenses |

— | 5,717 | 5,717 | |||||||||

|

|

|

|

|

|

|

|||||||

| March 31, 2015 |

$ | 4,977,468 | $ | (34,085 | ) | $ | 4,943,383 | |||||

|

|

|

|

|

|

|

|||||||

13

Table of Contents

Blackstone Mortgage Trust, Inc.

Notes to Consolidated Financial Statements (continued)

(Unaudited)

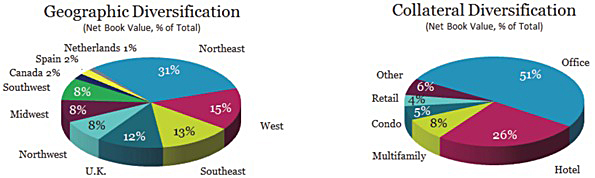

The tables below detail the types of loans in our loan portfolio, as well as the property type and geographic distribution of the properties securing these loans ($ in thousands):

| March 31, 2015 | December 31, 2014 | |||||||||||||||

| Asset Type |

Net Book Value |

Percentage | Net Book Value |

Percentage | ||||||||||||

| Senior loans(1) |

$ | 4,909,214 | 99 | % | $ | 4,340,586 | 98 | % | ||||||||

| Subordinate loans(2) |

34,169 | 1 | 87,914 | 2 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 4,943,383 | 100 | % | $ | 4,428,500 | 100 | % | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Property Type |

Net Book Value |

Percentage | Net Book Value |

Percentage | ||||||||||||

| Office |

$ | 2,516,133 | 51 | % | $ | 1,878,605 | 42 | % | ||||||||

| Hotel |

1,269,408 | 26 | 1,267,486 | 29 | ||||||||||||

| Multifamily |

414,807 | 8 | 426,094 | 10 | ||||||||||||

| Condominium |

252,065 | 5 | 315,686 | 7 | ||||||||||||

| Retail |

218,620 | 4 | 270,812 | 6 | ||||||||||||

| Other |

272,350 | 6 | 269,817 | 6 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 4,943,383 | 100 | % | $ | 4,428,500 | 100 | % | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Geographic Location |

Net Book Value |

Percentage | Net Book Value |

Percentage | ||||||||||||

| United States |

||||||||||||||||

| Northeast |

$ | 1,508,339 | 31 | % | $ | 1,383,258 | 31 | % | ||||||||

| West |

756,791 | 15 | 628,275 | 14 | ||||||||||||

| Southeast |

666,938 | 13 | 657,484 | 15 | ||||||||||||

| Northwest |

416,234 | 8 | 138,796 | 3 | ||||||||||||

| Midwest |

389,586 | 8 | 335,406 | 8 | ||||||||||||

| Southwest |

377,964 | 8 | 405,741 | 9 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Subtotal |

4,115,852 | 83 | 3,548,960 | 80 | ||||||||||||

| International |

||||||||||||||||

| United Kingdom |

603,306 | 12 | 622,692 | 14 | ||||||||||||

| Canada |

117,355 | 2 | 137,024 | 3 | ||||||||||||

| Spain |

76,954 | 2 | 86,289 | 2 | ||||||||||||

| Netherlands |

29,916 | 1 | 33,535 | 1 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Subtotal |

827,531 | 17 | 879,540 | 20 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 4,943,383 | 100 | % | $ | 4,428,500 | 100 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1) | Includes senior mortgages and similar credit quality loans, including related contiguous subordinate loans, and pari passu participations in senior mortgage loans. |

| (2) | Includes subordinate interests in mortgages and mezzanine loans. |

14

Table of Contents

Blackstone Mortgage Trust, Inc.

Notes to Consolidated Financial Statements (continued)

(Unaudited)

Loan Risk Ratings

As further described in Note 2, our Manager evaluates our loan portfolio on a quarterly basis. In conjunction with our quarterly loan portfolio review, our Manager assesses the risk factors of each loan, and assigns a risk rating based on several factors. Factors considered in the assessment include, but are not limited to, risk of loss, current LTV, collateral performance, structure, exit plan, and sponsorship. Loans are rated “1” (less risk) through “5” (greater risk), which ratings are defined in Note 2.

The following table allocates the principal balance and net book value of our loans receivable based on our internal risk ratings ($ in thousands):

| March 31, 2015 | December 31, 2014 | |||||||||||||||||||||||

| Risk Rating |

Number of Loans |

Principal Balance |

Net Book Value |

Number of Loans |

Principal Balance |

Net Book Value |

||||||||||||||||||

| 1 |

4 | $ | 405,957 | $ | 401,840 | 5 | $ | 209,961 | $ | 209,112 | ||||||||||||||

| 2 |

45 | 3,741,108 | 3,717,453 | 44 | 3,339,972 | 3,313,906 | ||||||||||||||||||

| 3 |

11 | 830,403 | 824,090 | 11 | 912,964 | 905,482 | ||||||||||||||||||

| 4 - 5 |

— | — | — | — | — | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| 60 | $ | 4,977,468 | $ | 4,943,383 | 60 | $ | 4,462,897 | $ | 4,428,500 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

We do not have any loan impairments, nonaccrual loans, or loans in maturity default as of March 31, 2015 or December 31, 2014.

4. EQUITY INVESTMENTS IN UNCONSOLIDATED SUBSIDIARIES

As of March 31, 2015, our equity investments in unconsolidated subsidiaries consisted solely of our carried interest in CTOPI, a fund sponsored and managed by an affiliate of our Manager. Activity relating to our equity investments in unconsolidated subsidiaries was ($ in thousands):

| CTOPI Carried Interest |

||||

| Total as of December 31, 2014 |

$ | 10,604 | ||

| Deferred income allocation(1) |

966 | |||

|

|

|

|||

| Total as of March 31, 2015 |

$ | 11,570 | ||

|

|

|

|||

| (1) | In instances where we have not received cash or all appropriate contingencies have not been eliminated, we have deferred the recognition of promote revenue allocated to us from CTOPI in respect of our carried interest in CTOPI, and recorded an offsetting liability as a component of accounts payable, accrued expenses, and other liabilities on our consolidated balance sheets. |

Our carried interest in CTOPI entitles us to earn promote revenue in an amount equal to 17.7% of the fund’s profits, after a 9% preferred return and 100% return of capital to the CTOPI partners. As of March 31, 2015, we had been allocated $11.6 million of promote revenue from CTOPI based on a hypothetical liquidation of the fund at its net asset value. Accordingly, we have recognized this allocation as an equity investment in CTOPI on our consolidated balance sheets. Generally, we defer recognition of income from CTOPI until cash is received or earned, pending distribution, and appropriate contingencies have been eliminated. During the three months ended March 31, 2015, we recognized $3.9 million of promote income from CTOPI in respect of our carried interest and recorded such amount as income in our consolidated statement of operations. This carried interest was earned and was available in cash at CTOPI pending distribution as of March 31, 2015.

CTOPI Incentive Management Fee Grants

In January 2011, we created a management compensation pool for employees equal to 45% of the CTOPI promote distributions received by us. As of March 31, 2015, we had granted 96% of the pool, and the remainder was unallocated. If any awards remain unallocated at the time promote distributions are received by us, any amounts otherwise payable to the unallocated awards will be distributed pro rata to the plan participants then employed by an affiliate of our Manager.

15

Table of Contents

Blackstone Mortgage Trust, Inc.

Notes to Consolidated Financial Statements (continued)

(Unaudited)

Approximately 65% of these grants have the following vesting schedule: (i) one-third on the date of grant; (ii) one-third on September 13, 2012; and (iii) the remainder is contingent on continued employment with an affiliate of our Manager and upon our receipt of promote distributions from CTOPI. Of the remaining 35% of these grants, 31% are fully vested as a result of an acceleration event, and 4% vest solely upon our receipt of promote distributions from CTOPI or the disposition of certain investments owned by CTOPI.

During the three months ended March 31, 2015, we accrued $1.8 million under the CTOPI incentive plan, which amount was recognized as a component of general and administrative expenses in our consolidated statement of operations.

5. SECURED FINANCINGS

As of March 31, 2015, our secured financings included revolving repurchase facilities, asset-specific financings, and senior loan participations sold. During the three months ended March 31, 2015, we increased the maximum facility size of three of our revolving repurchase facilities, entered into one asset-specific repurchase agreement, and sold one senior loan participation, providing an additional $1.1 billion of credit capacity.

Repurchase Agreements

Revolving Repurchase Facilities

The following table details our revolving repurchase facilities ($ in thousands):

| March 31, 2015 | Dec. 31, 2014 Borrowings Outstanding |

|||||||||||||||||||||||

| Maximum Facility Size(1) |

Collateral Assets(2) |

Repurchase Borrowings(3) | ||||||||||||||||||||||

| Lender |

Potential | Outstanding | Available | |||||||||||||||||||||

| Wells Fargo |

$ | 1,000,000 | $ | 837,372 | $ | 654,656 | $ | 515,103 | $ | 139,553 | $ | 484,365 | ||||||||||||

| JP Morgan(4) |

739,147 | 741,916 | 580,899 | 513,813 | 67,086 | 341,487 | ||||||||||||||||||

| Bank of America |

750,000 | 501,041 | 397,700 | 397,033 | 667 | 389,347 | ||||||||||||||||||

| MetLife |

750,000 | 527,611 | 409,178 | 347,943 | 61,235 | 305,889 | ||||||||||||||||||

| Citibank |

500,000 | 625,053 | 474,103 | 340,511 | 133,592 | 392,455 | ||||||||||||||||||

| Morgan Stanley(5) |

370,250 | 171,590 | 135,125 | 127,227 | 7,898 | 127,240 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| $ | 4,109,397 | $ | 3,404,583 | $ | 2,651,661 | $ | 2,241,630 | $ | 410,031 | $ | 2,040,783 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (1) | Maximum facility size represents the total amount of borrowings in each repurchase agreement, however these borrowings are only available to us once sufficient collateral assets have been pledged under each facility at the discretion of the lender. |

| (2) | Represents the principal balance of the collateral assets. |

| (3) | Potential borrowings represent the total amount we could draw under each facility based on collateral already approved and pledged. When undrawn, these amounts are immediately available to us at our sole discretion under the terms of each revolving credit facility. |

| (4) | The JP Morgan maximum facility size is composed of a $250.0 million facility and a £153.0 million ($226.6 million) facility, and $262.5 million related solely to a specific asset with a repurchase date of January 9, 2018. |

| (5) | The Morgan Stanley maximum facility size represents a £250.0 million ($370.3 million) facility. |

The weighted-average outstanding balance of our revolving repurchase facilities was $2.3 billion for the three months ended March 31, 2015. As of March 31, 2015, we had aggregate borrowings of $2.2 billion outstanding under our revolving repurchase facilities, with a weighted-average cash coupon of LIBOR plus 1.87% per annum and a weighted-average all-in cost of credit, including associated fees and expenses, of LIBOR plus 2.09% per annum. As of March 31, 2015, outstanding borrowings under these facilities had a weighted-average maturity, excluding extension options and term-out provisions, of 1.7 years. Borrowings under each facility are subject to the initial approval of eligible collateral loans by the lender and the maximum advance rate and pricing rate of individual advances are determined with reference to the attributes of the respective collateral loan.

16

Table of Contents

Blackstone Mortgage Trust, Inc.

Notes to Consolidated Financial Statements (continued)

(Unaudited)

The following table outlines the key terms of our revolving repurchase facilities:

| Lender |

Rate(1)(2) |

Guarantee(1)(3) | Advance Rate(1) | Margin Call(4) |

Term/Maturity | |||||

| Wells Fargo |

L+1.82% | 25% | 79.18% | Collateral marks only | Term matched(5) | |||||

| JP Morgan |

L+1.87% | 25% | 80.09% | Collateral marks only | Term matched(5)(6) | |||||

| Bank of America |

L+1.80% | 50% | 79.54% | Collateral marks only | May 21, 2019(7) | |||||

| MetLife |

L+1.81% | 50% | 77.82% | Collateral marks only | February 24, 2021(8) | |||||

| Citibank |

L+1.92% | 25% | 76.64% | Collateral marks only | Term matched(5) | |||||

| Morgan Stanley |

L+2.32% | 25% | 78.75% | Collateral marks only | March 3, 2017 |

| (1) | Represents a weighted-average based on collateral assets pledged and borrowings outstanding as of March 31, 2015. |

| (2) | Represents weighted-average cash coupon on borrowings outstanding as of March 31, 2015. As of March 31, 2015, our floating rate loans and related liabilities were indexed to the various benchmark rates relevant in each case in terms of currency and payment frequency. Therefore the net exposure to each benchmark rate is in direct proportion to our net assets indexed to that rate. |

| (3) | Other than amounts guaranteed based on specific collateral asset types, borrowings under our revolving repurchase facilities are not recourse to us. |

| (4) | Margin call provisions under our revolving repurchase facilities do not permit valuation adjustments based on capital markets activity, and are limited to collateral-specific credit marks. |

| (5) | These revolving repurchase facilities have various availability periods during which new advances can be made and which are generally subject to each lender’s discretion. Maturity dates for advances outstanding are tied to the term of each respective collateral asset. |

| (6) | Borrowings denominated in British pound sterling under this facility mature on January 7, 2018. |

| (7) | Includes two one-year extension options which may be exercised at our sole discretion. |

| (8) | Includes five one-year extension options which may be exercised at our sole discretion. |

Asset-Specific Repurchase Agreements

The following table details statistics for our asset-specific repurchase agreements ($ in thousands):

| March 31, 2015 | December 31, 2014 | |||||||||||||||

| Repurchase Agreements |

Collateral Assets |

Repurchase Agreements |

Collateral Assets |

|||||||||||||

| Number of loans |

4 | 5 | 3 | 4 | ||||||||||||

| Principal balance |

$ | 407,203 | $ | 539,043 | $ | 324,553 | $ | 429,197 | ||||||||

| Weighted-average cash coupon(1) |

L+2.75 | % | L+5.21 | % | L+2.68 | % | L+5.07 | % | ||||||||

| Weighted-average cost / all-in yield(1) |

L+3.20 | % | L+5.70 | % | L+3.16 | % | L+5.53 | % | ||||||||

| (1) | As of March 31, 2015, our floating rate loans and related liabilities were indexed to the various benchmark rates relevant in each case in terms of currency and payment frequency. Therefore the net exposure to each benchmark rate is in direct proportion to our net assets indexed to that rate. In addition to cash coupon, all-in yield / cost includes the amortization of deferred origination fees / financing costs. |

The weighted-average outstanding balance of our asset-specific repurchase agreements was $338.6 million for the three months ended March 31, 2015.

Debt Covenants

Each of the guarantees related to our revolving repurchase facilities and asset-specific repurchase agreements contain the following uniform financial covenants: (i) our ratio of earnings before interest, taxes, depreciation, and amortization, or EBITDA, to fixed charges shall be not less than 1.40 to 1.0; (ii) our tangible net worth, as defined in the agreements, shall not be less than $1.1 billion as of March 31, 2015 plus 75% of the net cash proceeds of future equity issuances subsequent to March 31, 2015; (iii) cash liquidity shall not be less than the greater of (x) $10.0 million or (y) 5% of our recourse indebtedness; and (iv) our indebtedness shall not exceed 83.33% of our total assets. As of March 31, 2015 and December 31, 2014, we were in compliance with these covenants.

17

Table of Contents

Blackstone Mortgage Trust, Inc.

Notes to Consolidated Financial Statements (continued)

(Unaudited)

Loan Participations Sold

The financing of a loan by the non-recourse sale of a senior interest in the loan through a participation agreement does not qualify as a sale under GAAP. Therefore, in the instance of such sales, we present the whole loan as an asset and the loan participation sold as a liability on our consolidated balance sheet until the loan is repaid. The gross presentation of loan participations sold does not impact stockholders’ equity or net income.

The following table details statistics for our loan participations sold ($ in thousands):

| March 31, 2015 | December 31, 2014 | |||||||||||||||

| Participations Sold |

Underlying Loans |

Participations Sold |

Underlying Loans |

|||||||||||||

| Number of loans |

4 | 4 | 4 | 4 | ||||||||||||

| Principal balance |

$ | 708,845 | $ | 879,043 | $ | 499,433 | $ | 635,701 | ||||||||

| Weighted-average cash coupon(1) |

L+2.40 | % | L+4.06 | % | L+2.51 | % | L+4.10 | % | ||||||||

| Weighted-average all-in cost / yield(1) |

L+2.68 | % | L+4.36 | % | L+2.71 | % | L+4.71 | % | ||||||||

| (1) | As of March 31, 2015, our floating rate loans and related liabilities were indexed to the various benchmark rates relevant in each case in terms of currency and payment frequency. Therefore the net exposure to each benchmark rate is in direct proportion to our net assets indexed to that rate. In addition to cash coupon, all-in cost / yield includes the amortization of deferred origination fees / financing costs. |

6. CONVERTIBLE NOTES, NET

In November 2013, we issued $172.5 million of 5.25% convertible senior notes due on December 1, 2018, or Convertible Notes. The Convertible Notes’ issuance costs are amortized through interest expense over the life of the Convertible Notes using the effective interest method. Including this amortization, our all-in cost of the Convertible Notes is 5.87% per annum. As of March 31, 2015, the Convertible Notes were carried on our consolidated balance sheet at $162.5 million, net of an unamortized discount of $6.9 million.

The Convertible Notes are convertible at the holders’ option into shares of our class A common stock, only under specific circumstances, prior to the close of business on August 31, 2018, at the applicable conversion rate in effect on the conversion date. Thereafter, the Convertible Notes are convertible at the option of the holder at any time until the second scheduled trading day immediately preceding the maturity date. The Convertible Notes were not convertible as of March 31, 2015. The conversion rate was initially set to equal 34.8943 shares of class A common stock per $1,000 principal amount of Convertible Notes, which is equivalent to an initial conversion price of $28.66 per share of class A common stock, subject to adjustment upon the occurrence of certain events. We may not redeem the Convertible Notes prior to maturity. As of March 31, 2015, the conversion option value was zero based on the price of our class A common stock of $28.37. In addition, we had the intent and ability to settle the Convertible Notes in cash. As a result, the Convertible Notes did not have any impact on our diluted earnings per share.

We recorded a $9.1 million discount upon issuance of the Convertible Notes based on the implied value of the conversion option and an assumed effective interest rate of 6.50%. Including the amortization of this discount and the issuance costs, our total cost of the Convertible Notes is 7.16% per annum. During the three months ended March 31, 2015, we incurred total interest on our convertible notes of $2.9 million, of which $2.3 million related to cash coupon and $630,000 related to the amortization of discount and certain issuance costs. During the three months ended March 31, 2014, we incurred total interest on our convertible notes of $2.9 million, of which $2.3 million related to cash coupon and $592,000 related to the amortization of discount and certain issuance costs. Refer to Note 2 for additional discussion of our accounting policies for the Convertible Notes.

7. DERIVATIVE FINANCIAL INSTRUMENTS

We enter into derivative financial instruments to achieve certain risk management objectives. Currently, we use derivative financial instruments to manage, or hedge, the variability in the carrying value of certain of our net investments in consolidated, foreign currency-denominated subsidiaries caused by the fluctuations in foreign currency exchange rates. For derivatives that are designated and qualify as a hedge of net investment in a foreign currency, the gain or loss is reported in other comprehensive income as part of the cumulative translation adjustment to the extent it is effective. Any ineffective portion of a net investment hedge is recognized in the consolidated statement of operations. For derivatives that are not designated as hedging instruments, the gain or loss is recognized in the consolidated statement of operations during the current period.

18

Table of Contents

Blackstone Mortgage Trust, Inc.

Notes to Consolidated Financial Statements (continued)

(Unaudited)

As of and during the three months ended March 31, 2015, we had net investment hedges related to our investment in a Canadian dollar-denominated subsidiary which consisted of two forward contracts to sell Canadian dollars for United States dollars at agreed upon rates in May 2015. These foreign currency contracts had an aggregate notional value of CAD 44.0 million, and a fair value of $351,000 which is included as a component of accrued interest receivable, prepaid expenses, and other assets on our consolidated balance sheet. In addition, we had offsetting contracts to both sell and buy Canadian dollars in an amount of CAD 4.46 million in exchange for United States dollars in May 2015. The purpose of this contract was to effectively terminate part of a pre-existing contract. Due to the fact that these contracts offset, there was no gain or loss recognized in the consolidated statement of operations related to these contracts.

The following table summarizes the fair value of our derivative financial instruments ($ in thousands):

| Fair Value of Derivatives in an Asset Position as of(1) |

Fair Value of Derivatives in a Liability Position as of(2) |

|||||||||||||||

| March 31, 2015 | December 31, 2014 | March 31, 2015 | December 31, 2014 | |||||||||||||

| Derivatives designated as hedging instruments: |

||||||||||||||||

| Foreign exchange contracts |

$ | 351 | $ | 1,138 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total derivatives designated as hedging instruments |

351 | 1,138 | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Derivatives not designated as hedging instruments: |

||||||||||||||||

| Foreign exchange contracts(3) |

36 | — | 52 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total derivatives not designated as hedging instruments |

— | — | 52 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Derivatives |

$ | 387 | $ | 1,138 | $ | 52 | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1) | Included in accrued interest receivable, prepaid expenses, and other assets in our consolidated balance sheet. |

| (2) | Included in accounts payable, accrued expenses, and other liabilities in our consolidated balance sheet. |

| (3) | Balances represent offsetting contracts with the same counterparty, both with a settlement date of May 11, 2015. |

The following table summarizes the impact of our derivative financial instruments on our consolidated statement of operations and consolidated statement of comprehensive income for the three months ended March 31, 2015 and 2014 ($ in thousands):

| Derivatives in Net Investment Hedging Relationships |

Amount of Gain (Loss) Recognized in OCI on Derivative (Effective Portion)(1) |

Location of Gain (Loss) Reclassified from Accumulated OCI into Income (Effective Portion) |

Amount of Gain (Loss) Reclassified from Accumulated OCI into Income (Effective Portion) |

|||||||||||||||

| 2015 | 2014 | 2015 | 2014 | |||||||||||||||

| Foreign Exchange contracts |

$ | 3,337 | $ | — | Gain (Loss) on Sale of Subsidiary |

$ | — | $ | — | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

$ | 3,337 | $ | — | $ | — | $ | — | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | During the three months ended March 31, 2015 we received a cash settlement of $4.1 million on our foreign currency forward contracts. |

We have entered into agreements with certain of our derivative counterparties that contain provisions where if we were to default on any of our indebtedness, including default where repayment of the indebtedness has not been accelerated by the lender, we may also be declared in default on our derivative obligations. In addition, certain of our agreements with our derivative counterparties require that we post collateral to secure net liability positions. As of March 31, 2015, we were in net asset positions with all of our derivative counterparties.

19

Table of Contents

Blackstone Mortgage Trust, Inc.

Notes to Consolidated Financial Statements (continued)

(Unaudited)

8. EQUITY

Share and Share Equivalents

Authorized Capital

As of March 31, 2015, we had the authority to issue up to 200,000,000 shares of stock, consisting of 100,000,000 shares of class A common stock and 100,000,000 shares of preferred stock. Subject to applicable NYSE listing requirements, our board of directors is authorized to cause us to issue additional shares of authorized stock without stockholder approval. In addition, to the extent not issued, currently authorized stock may be reclassified between class A common stock and preferred stock. We do not have any shares of preferred stock issued and outstanding as of March 31, 2015. Refer to Note 15 for additional discussion of our authorized capital.

Class A Common Stock and Deferred Stock Units

Holders of shares of our class A common stock are entitled to vote on all matters submitted to a vote of stockholders and are entitled to receive such dividends as may be authorized by our board of directors and declared by us, in all cases subject to the rights of the holders of shares of outstanding preferred stock, if any.

We also issue restricted class A common stock under our stock-based incentive plans. Refer to Note 11 for additional discussion of these long-term incentive plans.

In addition to our class A common stock, we also issue deferred stock units to certain members of our board of directors in lieu of cash compensation for services rendered. These deferred stock units are non-voting, but carry the right to receive dividends in the form of additional deferred stock units in an amount equivalent to the cash dividends paid to holders of shares of class A common stock.

The following table details the movement in our outstanding shares of class A common stock, including restricted class A common stock and deferred stock units:

| Three Months Ended March 31, | ||||||||

| Common Stock Outstanding(1) |

2015 | 2014 | ||||||

| Beginning balance |

58,388,808 | 29,602,884 | ||||||

| Issuance of class A common stock |

139 | 9,775,000 | ||||||

| Issuance of restricted class A common stock, net |

181,049 | — | ||||||

| Issuance of deferred stock units |

5,414 | 4,955 | ||||||

|

|

|

|

|

|||||

| Ending balance |

58,575,410 | 39,382,839 | ||||||

|

|

|

|

|

|||||

| (1) | Deferred stock units held by members of our board of directors totalled 124,333 and 106,188 as of March 31, 2015 and 2014, respectively. |

Dividend Reinvestment and Direct Stock Purchase Plan

On March 25, 2014, we adopted a dividend reinvestment and direct stock purchase plan, under which we registered and reserved for issuance, in the aggregate, 10,000,000 shares of class A common stock. Under the dividend reinvestment component of this plan, our class A common stockholders can designate all or a portion of their cash dividends to be reinvested in additional shares of class A common stock. The direct stock purchase component allows stockholders and new investors, subject to our approval, to purchase shares of class A common stock directly from us. During the three months ended March 31, 2015, we issued 139 shares of class A common stock under the dividend reinvestment component and zero shares under the direct stock purchase plan component. As of March 31, 2015, 9,999,855 shares of class A common stock, in the aggregate, remain available for issuance under the dividend reinvestment and direct stock purchase plan.

At the Market Stock Offering Program

On May 9, 2014, we entered into equity distribution agreements, or ATM Agreements, pursuant to which we may sell, from time to time, up to an aggregate sales price of $200.0 million of our class A common stock. Sales of class A common stock made pursuant to the ATM Agreements, if any, may be made in negotiated transactions or transactions that are deemed to be “at the market” offerings as defined in Rule 415 under the Securities Act of 1933, as amended. Actual sales will depend on a variety of factors including market conditions, the trading price of our

20

Table of Contents

Blackstone Mortgage Trust, Inc.

Notes to Consolidated Financial Statements (continued)

(Unaudited)

class A common stock, our capital needs, and our determination of the appropriate sources of funding to meet such needs. We did not sell any shares of our class A common stock under the ATM Agreements during the three months ended March 31, 2015. As of March 31, 2015, sales of our class A common stock with an aggregate sales price of $197.2 million remain available for issuance under the ATM Agreements.

Dividends