Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2013

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 1-14788

Blackstone Mortgage Trust, Inc.

(Exact name of registrant as specified in its charter)

| Maryland | 94-6181186 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| 345 Park Avenue, 42nd Floor, New York, NY | 10154 | |

| (Address of principal executive offices) | (Zip Code) |

(212) 655-0220

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The number of outstanding shares of the registrant’s class A common stock, par value $0.01 per share, as of October 22, 2013 was 29,272,244.

Table of Contents

Table of Contents

Forward-Looking Statements

This report may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which reflect our current views with respect to, among other things, our operations and financial performance. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. We believe these factors include but are not limited to those described under the section entitled “Risk Factors” in our annual report on Form 10-K for the year ended December 31, 2012 and in this report, as such factors may be updated from time to time in our periodic filings with the United States Securities and Exchange Commission (“SEC”), which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this report and in our other periodic filings. We undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

Website and Social Media Disclosure

We use our website (www.bxmt.com) as a channel of distribution of company information. The information we post through our website may be deemed material. Accordingly, investors should monitor our website, in addition to following our press releases, SEC filings and public conference calls and webcasts. In addition, you may automatically receive e-mail alerts and other information about us when you enroll your e-mail address by visiting the “E-mail Alerts” section of our website at www.blackstonemortgagetrust.com/investor-relations. The contents of our website are not, however, a part of this report.

- 1 -

Table of Contents

| ITEM 1. | FINANCIAL STATEMENTS |

Blackstone Mortgage Trust, Inc. and Subsidiaries

Consolidated Balance Sheets (Unaudited)

(in thousands, except share and per share data)

| September 30, | December 31, | |||||||

| 2013 | 2012 | |||||||

| Assets | ||||||||

| Cash and cash equivalents |

$ | 10,283 | $ | 15,423 | ||||

| Restricted cash |

76,396 | 14,246 | ||||||

| Loans receivable, net |

1,362,891 | 141,500 | ||||||

| Loans receivable, at fair value |

66,063 | — | ||||||

| Investment in CT Legacy Asset, at fair value |

— | 132,000 | ||||||

| Equity investments in unconsolidated subsidiaries |

25,632 | 13,306 | ||||||

| Accrued interest receivable, prepaid expenses, and other assets |

36,045 | 5,868 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 1,577,310 | $ | 322,343 | ||||

|

|

|

|

|

|||||

| Liabilities and Equity | ||||||||

| Liabilities |

||||||||

| Accounts payable, accrued expenses and other liabilities |

$ | 47,495 | $ | 21,209 | ||||

| Secured notes |

9,030 | 8,497 | ||||||

| Repurchase obligations |

643,040 | — | ||||||

| Securitized debt obligations |

74,203 | 139,184 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

773,768 | 168,890 | ||||||

|

|

|

|

|

|||||

| Equity |

||||||||

| Class A common stock, $0.01 par value, 100,000 shares authorized, 28,802 and 2,927 shares issued and outstanding as of September 30, 2013 and December 31, 2012, respectively |

288 | 293 | ||||||

| Additional paid-in capital |

1,242,986 | 609,002 | ||||||

| Accumulated deficit |

(529,947 | ) | (535,851 | ) | ||||

|

|

|

|

|

|||||

| Total Blackstone Mortgage Trust, Inc. stockholders’ equity |

713,327 | 73,444 | ||||||

| Non-controlling interests |

90,215 | 80,009 | ||||||

|

|

|

|

|

|||||

| Total equity |

803,542 | 153,453 | ||||||

|

|

|

|

|

|||||

| Total liabilities and equity |

$ | 1,577,310 | $ | 322,343 | ||||

|

|

|

|

|

|||||

See notes to consolidated financial statements.

- 2 -

Table of Contents

Blackstone Mortgage Trust, Inc. and Subsidiaries

Consolidated Balance Sheets (Unaudited)

(in thousands)

The following presents the portion of the consolidated balances presented above attributable to consolidated variable interest entities, or VIEs. The following assets may only be used to settle obligations of these consolidated VIEs and these liabilities are only the obligations of consolidated VIEs and their creditors do not have recourse to the general credit of Blackstone Mortgage Trust, Inc.

| September 30, 2013 |

December 31, 2012 |

|||||||

| Assets | ||||||||

| Loans receivable, net |

$ | 77,000 | $ | 141,500 | ||||

| Accrued interest receivable, prepaid expenses, and other assets |

6,336 | 4,021 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 83,336 | $ | 145,521 | ||||

|

|

|

|

|

|||||

| Liabilities | ||||||||

| Accounts payable, accrued expenses and other liabilities |

$ | 40 | $ | 88 | ||||

| Securitized debt obligations |

74,203 | 139,184 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

$ | 74,243 | $ | 139,272 | ||||

|

|

|

|

|

|||||

See notes to consolidated financial statements.

- 3 -

Table of Contents

Blackstone Mortgage Trust, Inc. and Subsidiaries

Consolidated Statements of Operations (Unaudited)

(in thousands, except share and per share data)

| Three Months Ended | Nine Months Ended | |||||||||||||||

| September 30, | September 30, | |||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

| Income from loans and other investments |

||||||||||||||||

| Interest and related income |

$ | 18,853 | $ | 6,944 | $ | 26,327 | $ | 28,423 | ||||||||

| Less: Interest and related expenses |

4,407 | 5,147 | 6,492 | 33,902 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income (loss) from loans and other investments, net |

14,446 | 1,797 | 19,835 | (5,479 | ) | |||||||||||

| Other expenses |

||||||||||||||||

| General and administrative |

4,048 | 3,991 | 9,512 | 6,314 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total other expenses |

4,048 | 3,991 | 9,512 | 6,314 | ||||||||||||

| Portion of other-than-temporary impairments of securities recognized in other comprehensive income |

— | — | — | (160 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net impairments recognized in earnings |

— | — | — | (160 | ) | |||||||||||

| Recovery of provision for loan losses |

— | 2,811 | — | 2,819 | ||||||||||||

| Valuation allowance on loans held-for-sale |

(600 | ) | — | 1,200 | — | |||||||||||

| Unrealized gain on investments at fair value |

464 | — | 4,464 | — | ||||||||||||

| Fair value adjustment on investment in CT Legacy Asset |

— | 11,987 | — | 19,645 | ||||||||||||

| Gain on deconsolidation of subsidiary |

— | — | — | 146,380 | ||||||||||||

| Gain on extinguishment of debt |

— | — | 38 | — | ||||||||||||

| Income from equity investments in unconsolidated subsidiaries |

— | 411 | — | 1,312 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income before income taxes |

10,262 | 13,015 | 16,025 | 158,203 | ||||||||||||

| Income tax (benefit) provision |

(264 | ) | 166 | 329 | 467 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income from continuing operations |

10,526 | 12,849 | 15,696 | 157,736 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income (loss) from discontinued operations, net of tax |

— | 51 | — | (863 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income |

10,526 | 12,900 | 15,696 | 156,873 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income attributable to non-controlling interests |

(2,206 | ) | (5,901 | ) | (7,743 | ) | (81,038 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income attributable to Blackstone Mortgage Trust, Inc. |

$ | 8,320 | $ | 6,999 | $ | 7,953 | $ | 75,835 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Per share information |

||||||||||||||||

| Income from continuing operations per share of common stock |

||||||||||||||||

| Basic |

$ | 0.29 | $ | 3.00 | $ | 0.53 | $ | 33.39 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted |

$ | 0.29 | $ | 2.82 | $ | 0.53 | $ | 31.40 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income (loss) from discontinued operations per share of common stock |

||||||||||||||||

| Basic |

$ | — | $ | 0.02 | $ | — | ($ | 0.37 | ) | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted |

$ | — | $ | 0.02 | $ | — | ($ | 0.37 | ) | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income per share of common stock |

||||||||||||||||

| Basic |

$ | 0.29 | $ | 3.02 | $ | 0.53 | $ | 33.02 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted |

$ | 0.29 | $ | 2.84 | $ | 0.53 | $ | 31.03 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted-average shares of common stock outstanding |

||||||||||||||||

| Basic |

28,894,515 | 2,317,343 | 14,865,530 | 2,296,910 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted |

28,894,515 | 2,461,603 | 14,865,530 | 2,444,206 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

See notes to consolidated financial statements.

- 4 -

Table of Contents

Blackstone Mortgage Trust, Inc. and Subsidiaries

Consolidated Statements of Comprehensive Income (Unaudited)

(in thousands)

| Three Months Ended | Nine Months Ended | |||||||||||||||

| September 30, | September 30, | |||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

| Net income |

$ | 10,526 | $ | 12,900 | $ | 15,696 | $ | 156,873 | ||||||||

| Other comprehensive income |

||||||||||||||||

| Unrealized gain on derivative financial instruments |

— | 2,103 | — | 5,852 | ||||||||||||

| Gain on interest rate swaps no longer designated as cash flow hedges |

— | — | — | 2,481 | ||||||||||||

| Amortization of unrealized gains and losses on securities |

— | (4 | ) | — | (769 | ) | ||||||||||

| Amortization of deferred gains and losses on settlement of swaps |

— | — | — | (56 | ) | |||||||||||

| Other-than-temporary impairments of securities related to fair value adjustments in excess of expected credit losses, net of amortization |

— | 206 | — | 419 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other comprehensive income |

— | 2,305 | — | 7,927 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Comprehensive income |

10,526 | 15,205 | 15,696 | 164,800 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Less: Comprehensive income attributable to non-controlling interests |

(2,206 | ) | (5,901 | ) | (7,743 | ) | (81,048 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Comprehensive income attributable to Blackstone Mortgage Trust, Inc. |

$ | 8,320 | $ | 9,304 | $ | 7,953 | $ | 83,752 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

See notes to consolidated financial statements.

- 5 -

Table of Contents

Blackstone Mortgage Trust, Inc. and Subsidiaries

Consolidated Statements of Changes in (Deficit) Equity (Unaudited)

(in thousands)

| Class A Common Stock |

Restricted Class A Common Stock |

Additional Paid-In Capital |

Accumulated Other Comprehensive (Loss) Income |

Accumulated Deficit |

Total Blackstone Mortgage Trust, Inc. Stockholders’ (Deficit) Equity |

Non-controlling Interests |

Total | |||||||||||||||||||||||||

| Balance at January 1, 2012 |

$ | 220 | $ | 2 | $ | 597,049 | ($ | 40,584 | ) | ($ | 667,111 | ) | ($ | 110,424 | ) | ($ | 18,515 | ) | ($ | 128,939 | ) | |||||||||||

| Net income |

— | — | — | — | 75,835 | 75,835 | 81,038 | 156,873 | ||||||||||||||||||||||||

| Other comprehensive income |

— | — | — | 7,917 | — | 7,917 | 10 | 7,927 | ||||||||||||||||||||||||

| Deconsolidation of CT Legacy Asset |

— | — | — | 1,293 | — | 1,293 | — | 1,293 | ||||||||||||||||||||||||

| Distributions to non-controlling interests |

— | — | — | — | — | — | (8 | ) | (8 | ) | ||||||||||||||||||||||

| Restricted class A common stock earned, net of shares deferred |

— | 3 | 648 | — | — | 651 | — | 651 | ||||||||||||||||||||||||

| Deferred directors’ compensation |

— | — | 169 | — | — | 169 | — | 169 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Balance at September 30, 2012 |

$ | 220 | $ | 5 | $ | 597,866 | ($ | 31,374 | ) | ($ | 591,276 | ) | ($ | 24,559 | ) | $ | 62,525 | $ | 37,966 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Balance at January 1, 2013 |

$ | 293 | $ | — | $ | 609,002 | $ | — | ($ | 535,851 | ) | $ | 73,444 | $ | 80,009 | $ | 153,453 | |||||||||||||||

| Net income |

— | — | — | — | 7,953 | 7,953 | 7,743 | 15,696 | ||||||||||||||||||||||||

| Consolidation of subsidiary |

— | — | — | — | 5,727 | 5,727 | 6,235 | 11,962 | ||||||||||||||||||||||||

| Contributions from non-controlling interests |

— | — | — | — | — | — | 15,000 | 15,000 | ||||||||||||||||||||||||

| Purchase of and distributions to non-controlling interests |

— | — | — | — | — | — | (18,772 | ) | (18,772 | ) | ||||||||||||||||||||||

| Proceeds from offering of common stock |

258 | — | 633,552 | — | — | 633,810 | — | 633,810 | ||||||||||||||||||||||||

| Reverse stock split |

(263 | ) | — | 263 | — | — | — | — | — | |||||||||||||||||||||||

| Dividends declared |

— | — | — | — | (7,776 | ) | (7,776 | ) | — | (7,776 | ) | |||||||||||||||||||||

| Deferred directors’ compensation |

— | — | 169 | — | — | 169 | — | 169 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Balance at September 30, 2013 |

$ | 288 | $ | — | $ | 1,242,986 | $ | — | ($ | 529,947 | ) | $ | 713,327 | $ | 90,215 | $ | 803,542 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

See notes to consolidated financial statements.

- 6 -

Table of Contents

Blackstone Mortgage Trust, Inc. and Subsidiaries

Consolidated Statements of Cash Flows (Unaudited)

(in thousands)

| Nine Months Ended | ||||||||

| September 30, | ||||||||

| 2013 | 2012 | |||||||

| Cash flows from operating activities |

||||||||

| Net income |

$ | 15,696 | $ | 156,873 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities |

||||||||

| Net impairments recognized in earnings |

— | 160 | ||||||

| Recovery of provision for loan losses |

— | (2,819 | ) | |||||

| Valuation allowance on loans held-for-sale |

(1,200 | ) | — | |||||

| Unrealized gain on investments at fair value |

(4,464 | ) | — | |||||

| Gain on extinguishment of debt |

(38 | ) | — | |||||

| Fair value adjustment on CT Legacy Asset |

— | (19,645 | ) | |||||

| Gain on deconsolidation of subsidiary |

— | (146,380 | ) | |||||

| Income from equity investments in unconsolidated subsidiaries |

— | (1,312 | ) | |||||

| Distributions of income from unconsolidated subsidiaries |

— | 1,933 | ||||||

| Distributions from CT Legacy Asset |

— | 9,221 | ||||||

| Non-cash compensation expense |

2,138 | 1,788 | ||||||

| Amortization of premiums/discounts on loans and securities and deferred interest on loans |

(3,265 | ) | (669 | ) | ||||

| Amortization of deferred gains and losses on settlement of swaps |

— | (56 | ) | |||||

| Amortization of deferred financing costs and premiums/discounts on debt obligations |

1,381 | 10,747 | ||||||

| Loss on interest rate swaps not designated as cash flow hedges |

4 | 2,772 | ||||||

| Changes in assets and liabilities, net |

||||||||

| Accrued interest receivable |

299 | (4,765 | ) | |||||

| Deferred income taxes |

— | (1,826 | ) | |||||

| Prepaid expenses and other assets |

883 | 2,764 | ||||||

| Accounts payable and accrued expenses |

3,011 | 2,812 | ||||||

|

|

|

|

|

|||||

| Net cash provided by operating activities |

14,445 | 11,598 | ||||||

|

|

|

|

|

|||||

| Cash flows from investing activities |

||||||||

| Origination/purchase of loans receivable |

(1,385,729 | ) | — | |||||

| Origination and exit fees received on loans receivable |

9,036 | — | ||||||

| Principal collections and proceeds from securities |

349 | 40,344 | ||||||

| Distributions from equity investments |

3,518 | |||||||

| Principal collections and proceeds from the sale of loans receivable |

239,282 | 91,889 | ||||||

| Contributions to unconsolidated subsidiaries |

— | (4,030 | ) | |||||

| Distributions from unconsolidated subsidiaries |

— | 1,006 | ||||||

| Increase in restricted cash |

(62,150 | ) | (3,160 | ) | ||||

|

|

|

|

|

|||||

| Net cash (used in) provided by investing activities |

(1,195,694 | ) | 126,049 | |||||

|

|

|

|

|

|||||

| Cash flows from financing activities |

||||||||

| Borrowings under repurchase obligations |

891,608 | 123,977 | ||||||

| Repayments under repurchase obligations |

(268,782 | ) | (58,464 | ) | ||||

| Repayments under mezzanine loan |

— | (63,000 | ) | |||||

| Repayment of securitized debt obligations |

(64,943 | ) | (136,078 | ) | ||||

| Payment of deferred financing costs |

(5,744 | ) | — | |||||

| Contributions from non-controlling interests |

15,000 | — | ||||||

| Purchase of and distributions to non-controlling interests |

(18,717 | ) | (8 | ) | ||||

| Settlement of interest rate swaps |

(6,123 | ) | — | |||||

| Vesting of restricted class A common stock |

— | (25 | ) | |||||

| Proceeds from issuance of common stock |

633,810 | — | ||||||

|

|

|

|

|

|||||

| Net cash provided by (used in) financing activities |

1,176,109 | (133,598 | ) | |||||

|

|

|

|

|

|||||

| Net (decrease) increase in cash and cash equivalents |

(5,140 | ) | 4,049 | |||||

| Cash and cash equivalents at beginning of period |

15,423 | 34,818 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents at end of period |

$ | 10,283 | $ | 38,867 | ||||

|

|

|

|

|

|||||

| Supplemental disclosure of cash flows information |

||||||||

| Payments of interest |

($ | 4,801 | ) | ($ | 21,922 | ) | ||

|

|

|

|

|

|||||

| Payments of income taxes |

($ | 218 | ) | ($ | 788 | ) | ||

|

|

|

|

|

|||||

| Supplemental disclosure of non-cash investing and financing activities |

||||||||

| (Consolidation) deconsolidation of subsidiaries |

($ | 38,913 | ) | $ | 122,312 | |||

|

|

|

|

|

|||||

See notes to consolidated financial statements.

- 7 -

Table of Contents

Blackstone Mortgage Trust, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

(Unaudited)

1. ORGANIZATION

References herein to “Blackstone Mortgage Trust,” “Company,” “we,” “us” or “our” refer to Blackstone Mortgage Trust, Inc. and its subsidiaries unless the context specifically requires otherwise.

We are a real estate finance company that primarily originates and purchases senior mortgage loans collateralized by properties in the United States and Europe. We are externally managed by BXMT Advisors L.L.C., which we refer to as our Manager, a subsidiary of The Blackstone Group L.P., or Blackstone, and are a real estate investment trust, or REIT, traded on the New York Stock Exchange, or NYSE, under the symbol “BXMT.” We are headquartered in New York City.

We conduct our operations as a REIT for U.S. federal income tax purposes. We generally will not be subject to U.S. federal income taxes on our taxable income to the extent that we annually distribute all of our net taxable income to stockholders and maintain our qualification as a REIT. We also operate our business in a manner that permits us to maintain our exemption from registration under the Investment Company Act of 1940, as amended, or the Investment Company Act. We are organized as a holding company and conduct our business primarily through our various subsidiaries. Our business is organized into two operating segments: the Loan Origination segment and the CT Legacy Portfolio segment.

On April 26, 2013, our board of directors approved the change of our name from Capital Trust, Inc. to Blackstone Mortgage Trust, Inc., which we effected on May 6, 2013 concurrently with a one-for-ten reverse stock split of our class A common stock. Except where the context indicates otherwise, all class A common stock numbers herein have been adjusted to give retroactive effect to the reverse stock split.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The accompanying unaudited consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America, or GAAP, for interim financial information and the instructions to Form 10-Q and Rule 10-01 of Regulation S-X. The consolidated financial statements, including the notes, are unaudited and exclude some of the disclosures required in audited financial statements. Management believes it has made all necessary adjustments (consisting of only normal recurring items) so that the consolidated financial statements are presented fairly and that estimates made in preparing its consolidated financial statements are reasonable and prudent. The operating results presented for interim periods are not necessarily indicative of the results that may be expected for any other interim period or for the entire year. The accompanying unaudited consolidated interim financial statements should be read in conjunction with the audited consolidated financial statements and the related management’s discussion and analysis of financial condition and results of operations included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2012 filed with the Securities and Exchange Commission.

Principles of Consolidation and Basis of Presentation

The accompanying financial statements include, on a consolidated basis, our accounts, the accounts of our wholly-owned subsidiaries, and variable interest entities, or VIEs, of which we are the primary beneficiary. All significant intercompany balances and transactions have been eliminated in consolidation. Certain of the assets and credit of our consolidated subsidiaries are not available to satisfy the debt or other obligations of us, our affiliates, or other entities.

VIEs are defined as entities in which equity investors (i) do not have the characteristics of a controlling financial interest, and/or (ii) do not have sufficient equity at risk for the entity to finance its activities without additional subordinated financial support from other parties. The entity that consolidates a VIE is known as its primary beneficiary, and is generally the entity with (i) the power to direct the activities that most significantly impact the VIE’s economic performance, and (ii) the right to receive benefits from the VIE or the obligation to absorb losses of the VIE that could be significant to the VIE.

We have separately presented, following our consolidated balance sheet, the assets of consolidated VIEs that can only be used to satisfy the obligations of those VIEs, and the liabilities of consolidated VIEs that are non-recourse to us. We have aggregated all of such assets and liabilities of consolidated VIEs in this presentation due to our determination that these entities are substantively similar and therefore a further disaggregated presentation would not be more meaningful.

Our subsidiary, CT Legacy Partners, LLC, or CT Legacy Partners, accounts for its operations in accordance with industry-specific GAAP accounting guidance for investment companies, pursuant to which it reports its investments at fair value. We have retained this specialized accounting in consolidation and, accordingly, report the loans and securities investments of CT Legacy Partners at fair value on our consolidated balance sheet.

- 8 -

Table of Contents

Blackstone Mortgage Trust, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (continued)

(Unaudited)

As more fully described in Note 3, we sold our investment management business to Blackstone in December 2012. As a result, the income and expense items related to our investment management business have been reclassified to income from discontinued operations on our consolidated statements of operations.

Certain reclassifications have been made in the presentation of the prior period consolidated financial statements to conform to the current presentation.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results may ultimately differ from those estimates.

Revenue Recognition

Interest income from our loans receivable is recognized over the life of the investment using the effective interest method and is recorded on the accrual basis. Fees, premiums, discounts and direct costs associated with these investments are deferred until the loan is advanced and are then recognized over the term of the loan as an adjustment to yield. Income accrual is generally suspended for loans at the earlier of the date at which payments become 90 days past due or when, in the opinion of our Manager, recovery of income and principal becomes doubtful. Income is then recorded on the basis of cash received until accrual is resumed when the loan becomes contractually current and performance is demonstrated to be resumed.

Cash and Cash Equivalents

Cash and cash equivalents represents cash on hand, cash held in banks and liquid investments with original maturities of three months or less. We deposit our cash and cash equivalents with high credit quality institutions to minimize credit risk exposure. We may have bank balances in excess of federally insured amounts. We have not experienced, and do not expect, any losses on our demand deposits, commercial paper or money market investments.

Restricted Cash

We classify the cash balances held by CT Legacy Partners as restricted because, while these cash balances are available for use by CT Legacy Partners for its operations, they cannot be used by us until our allocable share is distributed from CT Legacy Partners, and cannot be commingled with any of our other unrestricted cash balances.

Loans Receivable and Provision for Loan Losses

We purchase and originate commercial real estate debt and related instruments generally to be held as long-term investments at amortized cost. We are required to periodically evaluate each of these loans for possible impairment. Impairment is indicated when it is deemed probable that we will not be able to collect all amounts due according to the contractual terms of the loan. If a loan is determined to be impaired, we write down the loan through a charge to the provision for loan losses. Impairment on these loans is measured by comparing the estimated fair value of the underlying collateral to the book value of the respective loan. These valuations require significant judgments, which include assumptions regarding capitalization rates, leasing, creditworthiness of major tenants, occupancy rates, availability of financing, exit plan, loan sponsorship, actions of other lenders and other factors deemed necessary by our Manager. Actual losses, if any, could ultimately differ from these estimates.

Our Manager performs a quarterly review of our portfolio of loans. In conjunction with this review, our Manager assesses the performance of each loan, and assigns a risk rating based on several factors including risk of loss, loan-to-value ratio, or LTV, collateral performance, structure, exit plan, and sponsorship.

- 9 -

Table of Contents

Blackstone Mortgage Trust, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (continued)

(Unaudited)

Loans are rated “1” through “8”, from less risk to greater risk, which ratings are defined as follows:

| 1 - |

Low Risk: A loan that is expected to perform through maturity, with relatively lower LTV, higher in-place debt yield, and stable projected cash flow. | |

| 2 - |

Average Risk: A loan that is expected to perform through maturity, with medium LTV, average in-place debt yield, and stable projected cash flow. | |

| 3 - |

Acceptable Risk: A loan that is expected to perform through maturity, with relatively higher LTV, acceptable in-place debt yield, and some uncertainty (due to lease rollover or other factors) in projected cash flow. | |

| 4 - |

Higher Risk: A loan that is expected to perform through maturity, but has exhibited a material deterioration in cash flow and/or other credit factors. If negative trends continue, default could occur. | |

| 5 - |

Low Probability of Default/Loss: A loan with one or more identified weakness that we expect to have a 15% probability of default or principal loss. | |

| 6 - |

Medium Probability of Default/Loss: A loan with one or more identified weakness that we expect to have a 33% probability of default or principal loss. | |

| 7 - |

High Probability of Default/Loss: A loan with one or more identified weakness that we expect to have a 67% or higher probability of default or principal loss. | |

| 8 - |

In Default: A loan which is in contractual default and/or which has a very high likelihood of principal loss. | |

Loans Held-for-Sale and Related Allowance

In certain cases, we may classify loans as held-for-sale based upon the specific facts and circumstances of particular loans, including known or expected transactions. Loans held-for-sale are carried at the lower of their amortized cost basis or fair value less cost to sell. A reduction in the fair value of loans held-for-sale is recorded as a charge to our consolidated statement of operations as a valuation allowance on loans held-for-sale.

Equity Investments in Unconsolidated Subsidiaries

Our carried interest in CT Opportunity Partners I, LP, or CTOPI is accounted for using the equity method. CTOPI’s assets and liabilities are not consolidated into our financial statements due to our determination that (i) it is not a VIE and (ii) the investors have sufficient rights to preclude consolidation by us. As such, we report our allocable percentage of the net assets of CTOPI on our consolidated balance sheet. We have deferred the recognition of income from CTOPI until cash is collected or appropriate contingencies have been eliminated and, therefore do not recognize any income from equity investments in unconsolidated subsidiaries.

Deferred Financing Costs

The deferred financing costs that are included in prepaid expenses and other assets on our consolidated balance sheets include issuance costs related to our debt obligations, and are amortized using the effective interest method, or a method that approximates the effective interest method, over the life of the related obligations.

Repurchase Obligations

We record investments financed with repurchase obligations as separate assets and the related borrowings under any repurchase agreements recorded as separate liabilities on our consolidated balance sheets. Interest income earned on the investments and interest expense incurred on the repurchase obligations are reported separately on our consolidated statements of operations.

Fair Value of Financial Instruments

The “Fair Value Measurements and Disclosures” Topic of the Financial Accounting Standards Board, or FASB, Accounting Standards Codification, or the Codification, defines fair value, establishes a framework for measuring fair value, and requires certain disclosures about fair value measurements under GAAP. Specifically, this guidance defines fair value based on exit price, or the price that would be received upon the sale of an asset or the transfer of a liability in an orderly transaction between market participants at the measurement date.

The “Fair Value Measurement and Disclosures” Topic of the Codification also establishes a fair value hierarchy that prioritizes and ranks the level of market price observability used in measuring financial instruments. Market price observability is affected by a number of factors, including the type of financial instrument, the characteristics specific to the financial instrument, and the state of the marketplace, including the existence and transparency of transactions between market participants. Financial instruments with readily available quoted prices in active markets generally will have a higher degree of market price observability and a lesser degree of judgment used in measuring fair value.

- 10 -

Table of Contents

Blackstone Mortgage Trust, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (continued)

(Unaudited)

Financial instruments measured and reported at fair value are classified and disclosed based on the observability of inputs used in the determination, as follows:

| • | Level 1 – Generally includes only unadjusted quoted prices that are available in active markets for identical financial instruments as of the reporting date. |

| • | Level 2 – Pricing inputs include quoted prices in active markets for similar instruments, quoted prices in less active or inactive markets for identical or similar instruments where multiple price quotes can be obtained, and other observable inputs such as interest rates, yield curves, credit risks, and default rates. |

| • | Level 3 – Pricing inputs are unobservable for the financial instruments and include situations where there is little, if any, market activity for the financial instrument. These inputs require significant judgment or estimation by management of third parties when determining fair value and generally represent anything which does not meet the criteria of Levels 1 and 2. |

Each type of asset recorded at fair value using Level 3 inputs are determined by an internal committee comprised of members of senior management of our Manager, including our chief executive officer, chief financial officer, and other senior officers.

Certain of our assets and liabilities are measured at fair value either (i) on a recurring basis, as of each quarter-end, or (ii) on a nonrecurring basis, as a result of impairment or other events. Our assets and liabilities that are measured at fair value are discussed further in Note 17. Generally, loans held-for-sale and certain of our loans receivable and securities are measured at fair value on a recurring basis, while impaired loans are measured at fair value on a nonrecurring basis.

The following valuation techniques were used to estimate the fair value of each type of asset and liability which was recorded at fair value:

Loans receivable, at fair value – Loans receivable are generally valued by discounting expected cash flows using internal cash flow models and estimated market rates. Expected cash flows of each loan are based on our Manager’s assumptions regarding the collection of principal and interest from the respective borrowers.

Other assets, at fair value – Our other assets balance include certain commercial mortgage-backed securities, collateral debt obligations, and equity investments and are generally valued by a combination of (i) obtaining assessments from third-party dealers and (ii) in cases where such assessments are unavailable or deemed not to be indicative of fair value, discounting expected cash flows using internal cash flow models and estimated market discount rates. In the case of internal models, expected cash flows of each security are based on assumptions regarding the collection of principal and interest on the underlying loans and securities.

Impaired loans – Loans identified as impaired are collateral dependent loans. Impairment on these loans is measured by comparing our Manager’s estimation of fair value of the underlying collateral less costs to sell, to the book value of the respective loan. These valuations require significant judgments, which include assumptions regarding capitalization rates, leasing, creditworthiness of major tenants, occupancy rates, availability of financing, exit plan, loan sponsorship, actions of other lenders and other factors deemed necessary by our Manager.

Investment in CT Legacy Asset – We arrived at the fair value of our investment in CT Legacy Asset by discounting the net cash flows expected to be distributed to its equity holders after the repayment of the repurchase facility. To determine the net cash flows of CT Legacy Asset, our Manager estimated the timing and recovery amount for each of its assets, and then applied the proceeds to first satisfy the related repurchase facility.

We are also required by GAAP to disclose fair value information about financial instruments, which are otherwise not reported in the statement of financial position at fair value, to the extent it is practicable to estimate a fair value for those instruments. In cases where quoted market prices are not available, fair values are estimated using present value or other valuation techniques. Those techniques are significantly affected by the assumptions used, including the estimated market discount rate and the estimated future cash flows. In that regard, the derived fair value estimates cannot be substantiated by comparison to independent markets and, in many cases, could not be realized in an immediate settlement of the instrument. Rather, these fair values reflect the amounts that our Manager believes are realizable in an orderly transaction among willing parties. These disclosure requirements exclude certain financial instruments and all non-financial instruments.

- 11 -

Table of Contents

Blackstone Mortgage Trust, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (continued)

(Unaudited)

The following methods and assumptions were used to estimate the fair value of each class of financial instruments, excluding those described above that are carried at fair value, for which it is practicable to estimate that value:

Cash and cash equivalents – The carrying amount of cash on deposit and in money market funds approximates fair value.

Restricted cash – The carrying amount of restricted cash approximates fair value.

Loans receivable, net – Other than impaired loans, these assets are recorded at their amortized cost and not at fair value. The fair values for these instruments are estimated by our Manager taking into consideration factors including capitalization rates, leasing, occupancy rates, availability and cost of financing, exit plan, sponsorship, actions of other lenders and indications of market value from other market participants.

Secured notes – These notes are recorded at their aggregate principal balance and not at fair value. The fair value was estimated based on the rate at which a similar instrument would be priced today.

Repurchase obligations – These facilities are recorded at their aggregate principal balance and not at fair value. The fair value was estimated based on the rate at which a similar credit facility would be priced today.

Securitized debt obligations – These obligations are recorded at the face value of outstanding obligations to third-parties and not at fair value. The fair values for these instruments have been estimated by obtaining assessments from third party dealers.

Income Taxes

Our financial results generally do not reflect provisions for current or deferred income taxes on our REIT taxable income. We believe that we operate in a manner that will continue to allow us to be taxed as a REIT and, as a result, we generally do not expect to pay substantial corporate level taxes other than those payable by our taxable REIT subsidiaries. Many of these requirements, however, are highly technical and complex. If we were to fail to meet these requirements, we may be subject to federal, state and local income tax on current and past income, and penalties. Refer to Note 15 for additional information.

Accounting for Stock-Based Compensation

Stock-based compensation expense is recognized in net income using a fair value measurement method, which we determine with the assistance of a third-party appraisal firm. Compensation expense for the time vesting of stock-based compensation grants is recognized on the accelerated attribution method and compensation expense for performance vesting of stock-based compensation grants is recognized on a straight line basis.

The fair value of the performance vesting restricted class A common stock is measured on the grant date using a Monte Carlo simulation to estimate the probability of the market vesting conditions being satisfied. The Monte Carlo simulation is run approximately 100,000 times. For each simulation, the payoff is calculated at the settlement date, and is then discounted to the grant date at a risk-free interest rate. The average of the values over all simulations is the expected value of the restricted class A common stock on the grant date. The valuation is performed in a risk-neutral framework, so no assumption is made with respect to an equity risk premium. Significant assumptions used in the valuation included an expected term and stock price volatility, an estimated risk-free interest rate and an estimated dividend growth rate.

Earnings per Share of Common Stock

Basic earnings per share, or Basic EPS, is computed based on the net earnings allocable to common stock and stock units, divided by the weighted-average number of shares of common stock and stock units outstanding during the period. Diluted earnings per share, or Diluted EPS, is determined using the treasury stock method, and is based on the net earnings allocable to common stock and stock units, divided by the weighted-average number of shares of common stock, stock units and potentially dilutive common stock options and warrants. On April 26, 2013, our board of directors approved a one-for-ten reverse stock split of our class A common stock which we effected on May 6, 2013. Our earnings per share disclosures have been retroactively adjusted to reflect the reverse stock split.

We have separately determined Basic EPS and Diluted EPS for income (loss) from continuing operations and for net income (loss) allocable to common stockholders. Refer to Note 12 for additional discussion of earnings per share.

Recent Accounting Pronouncements

In January 2013, the FASB issued Accounting Standards Update 2013-01, “Balance Sheet (Topic 210): Clarifying the Scope of Disclosures About Offsetting Assets and Liabilities,” or ASU 2013-01. ASU 2013-01 was developed to clarify which instruments and transactions are subject to the offsetting disclosure requirements set forth by

- 12 -

Table of Contents

Blackstone Mortgage Trust, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (continued)

(Unaudited)

Accounting Standards Update 2011-11 “Balance Sheet (Topic 210): Disclosures about Offsetting Assets and Liabilities.” ASU 2013-01 was effective for the first interim or annual period beginning on or after January 1, 2013, and was applied retrospectively for all comparative periods presented. The adoption of ASU 2013-01 did not have a material impact on our consolidated financial statements.

In February 2013, the FASB issued Accounting Standards Update 2013-02, “Comprehensive Income (Topic 220): Reporting of Amounts Reclassified Out of Accumulated Other Comprehensive Income,” or ASU 2013-02. ASU 2013-02 implements the previously deferred requirement to disclose reclassification adjustments into and out of accumulated other comprehensive income in either a note or on the face of the financial statements. ASU 2013-02 was effective for the first interim or annual period beginning after December 15, 2012, and was applied prospectively. As we no longer have a balance of accumulated other comprehensive income, the adoption of ASU 2013-02 did not have a material impact on our consolidated financial statements.

In June 2013, the FASB issued Accounting Standards Update 2013-08, “Financial Services-Investment Companies (Topic 946): Amendments to the Scope, Measurement, and Disclosure Requirements,” or ASU 2013-08. ASU 2013-08 amends the criteria for qualification as an investment company under Topic 946 of the FASB Accounting Standards Codification, or Topic 946, and requires additional disclosure by investment companies. ASU 2013-08 is effective for the first interim or annual period beginning after December 15, 2013, and is to be applied prospectively. We currently consolidate CT Legacy Partners, which accounts for its operations as an investment company under Topic 946. We do not expect the adoption of ASU 2013-08 to impact CT Legacy Partners’ status as an investment company. Further, because ASU 2013-08 specifically excludes REITs from its scope, it will not otherwise impact our consolidated financial statements.

3. CORPORATE TRANSACTIONS

Blackstone Loan Warehouse Joint Venture

On May 13, 2013, we entered into a joint venture, 42-16 Partners, LLC, or 42-16 Partners, with an affiliate of our Manager to originate and warehouse loans prior to the completion of our class A common stock offering on May 29, 2013. 42-16 Partners was controlled by us and owned 16.7% by us and 83.3% by an affiliate of our Manager, and originated one senior mortgage loan on May 21, 2013. On May 30, 2013, we ended this relationship with the affiliate of our Manager and purchased 100% of the equity interests in 42-16 Partners held by the affiliate of our Manager using proceeds from the sale of our class A common stock and, as a result, 42-16 Partners became a 100% owned and consolidated subsidiary.

CT Legacy Partners Merger

To maintain its tax efficiency, on March 22, 2013, CT Legacy REIT Mezz Borrower, Inc., or CT Legacy REIT, was merged with and into CT Legacy Partners, LLC, or CT Legacy Partners, whereby CT Legacy Partners was the surviving entity. We refer to this transaction as the Merger. As a result of the Merger, all outstanding shares of class A-1 common stock, class A-2 common stock, class B common stock, and class A preferred stock of CT Legacy REIT were converted into limited liability company shares, or LLC Shares, in CT Legacy Partners. These LLC Shares have economic and voting rights equivalent to the corresponding shares of stock of CT Legacy REIT. In addition, all outstanding shares of class B preferred stock of CT Legacy REIT were redeemed on March 21, 2013 for an aggregate of $147,000 in cash, which amount was comprised of the shares’ par value, liquidation preference, and accrued dividends thereon.

As a result of the Merger, we have consolidated CT Legacy Partners as of March 20, 2013 and, therefore, the remaining legacy assets and liabilities from our comprehensive debt restructuring on March 31, 2011, which we refer to as our March 2011 Restructuring. Refer to Note 8 and Note 12 for further discussion of CT Legacy Partners.

Investment Management Business Sale

On December 19, 2012, pursuant to a purchase and sale agreement, dated as of September 27, 2012, or Purchase Agreement, by and between us and an affiliate of Blackstone, we completed the disposition of our investment management and special servicing business for a purchase price of $21.4 million. The sale included our equity interests in CT Investment Management Co., LLC, or CTIMCO, our related private investment fund co-investments, and 100% of the outstanding class A preferred stock of CT Legacy REIT. We refer to the entire transaction as our Investment Management Business Sale. Pursuant to the terms of the Purchase Agreement, on December 19, 2012, we entered into a management agreement with our Manager, which was amended and restated as of March 26, 2013, pursuant to which we are now managed by our Manager pursuant to the terms and conditions of the management

- 13 -

Table of Contents

Blackstone Mortgage Trust, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (continued)

(Unaudited)

agreement. In addition, Blackstone received the right to designate two members of our board of directors, and exercised that right by designating an employee of Blackstone and one of its senior advisors to replace two former members of our board of directors who resigned effective December 19, 2012. As a result of the Investment Management Business Sale, the income and expense items related to our investment management business have been reclassified to income from discontinued operations on our consolidated statements of operations. Refer to Note 14 for a further discussion of discontinued operations.

On December 19, 2012, we also closed our sale to Blackstone of 500,000 shares of our class A common stock for a purchase price of $10.0 million.

In connection with the consummation of the Investment Management Business Sale and the closing of our sale of 500,000 shares of class A common stock to Blackstone, we paid a $20.00 per share special cash dividend on December 20, 2012 to holders of record of our class A common stock at the close of business on November 12, 2012.

CT CDO Deconsolidation

On December 19, 2012, as a result of the Investment Management Business Sale, we are no longer the collateral manager for certain collateralized debt obligations, or CT CDOs, nor are we the special servicer on their collateral assets. Due to the externalization of these management functions, and our lack of material economic interest in the residual equity we own in CT CDOs II and IV, we ceased to be the primary beneficiary of these entities and, therefore, discontinued the consolidation of CT CDOs II and IV, which we refer to as the CT CDO Deconsolidation. We recognized a gain of $53.9 million on the deconsolidation of CT CDOs II and IV, which was due primarily to the reversal of charges to stockholders’ equity resulting from losses previously recorded in excess of our economic interests in these non-recourse securitization vehicles.

4. CASH AND CASH EQUIVALENTS, INCLUDING RESTRICTED CASH

As discussed in Note 2, we deposit our cash and cash equivalents, including restricted cash, with high credit quality institutions to minimize credit risk exposure. The following table provides details of our cash and cash equivalents, including restricted cash balances ($ in thousands):

| Asset Category |

Depository |

Credit Rating(1) |

September 30, 2013 | December 31, 2012 | ||||||||

| Cash and cash equivalents |

Bank of America | A-1 | $ | 10,283 | $ | 15,423 | ||||||

| Restricted cash |

Bank of America | A-1 | 76,396 | 14,246 | ||||||||

|

|

|

|

|

|||||||||

| $ | 86,679 | $ | 29,669 | |||||||||

|

|

|

|

|

|||||||||

| (1) | Represents the short-term credit rating for the Bank of America, N.A. legal entity as issued by Standard & Poor’s as of August 22, 2013. |

5. LOANS RECEIVABLE

As of September 30, 2013, our consolidated balance sheet included $1.3 billion of loans receivable related to our Loan Originations segment and $77.0 million of loans receivable owned by CT CDO I, a consolidated securitization vehicle included in our CT Legacy Portfolio segment. Refer to Note 19 for further discussion of our operating segments.

- 14 -

Table of Contents

Blackstone Mortgage Trust, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (continued)

(Unaudited)

Activity relating to our loans receivable was ($ in thousands):

| Gross Book | Provision for | Net Book | ||||||||||

| Value | Loan Losses | Value | ||||||||||

| December 31, 2012 |

$ | 164,180 | ($ | 22,680 | ) | $ | 141,500 | |||||

| Loan originations |

1,384,318 | — | 1,384,318 | |||||||||

| Deferred origination fees and expenses |

(9,036 | ) | — | (9,036 | ) | |||||||

| Amortization of deferred fees and expenses |

2,939 | — | 2,939 | |||||||||

| Additional fundings |

1,411 | — | 1,411 | |||||||||

| Loan satisfactions |

(120,500 | ) | — | (120,500 | ) | |||||||

| Participations sold |

(17,903 | ) | — | (17,903 | ) | |||||||

| Partial loan repayments |

(17,838 | ) | — | (17,838 | ) | |||||||

| Reclassification to loans held-for-sale |

(6,601 | ) | 4,601 | (2,000 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| September 30, 2013 |

$ | 1,380,970 | ($ | 18,079 | ) | $ | 1,362,891 | |||||

|

|

|

|

|

|

|

|||||||

As of September 30, 2013, we had unfunded commitments of $96.3 million related to nine senior mortgage loans, which amounts will only be funded to finance lease-related or capital expenditures by our borrowers. These future commitments will expire over the next five years.

The following table details overall statistics for our loans receivable portfolio ($ in thousands):

| September 30, 2013 | December 31, 2012 | |||||||

| Number of loans |

22 | 7 | ||||||

| Principal balance |

$ | 1,387,067 | $ | 164,180 | ||||

| Net book value (1) |

$ | 1,362,891 | $ | 141,500 | ||||

| Weighted-average cash coupon (2) |

L+4.28 | % | L+2.51 | % | ||||

| Weighted-average all-in yield (2) |

L+4.91 | % | L+4.53 | % | ||||

| Weighted-average maximum maturity (years) (3) |

4.0 | 0.7 | ||||||

| (1) | The difference between principal balance and net book value is due to deferred origination fees on loans in our loan origination segment, and provisions for loan losses in our CT Legacy Portfolio Segment. |

| (2) | All loans are floating rate loans indexed to LIBOR as of September 30, 2013 and December 31, 2012. LIBOR was 0.18% and 0.21% as of September 30, 2013 and December 31, 2012, respectively; however, certain of our loans receivable earn interest based on a minimum LIBOR floor ranging from 0.20% to 1.00%. Amounts exclude all non-performing loans. |

| (3) | Maximum maturity date assumes all extension options are exercised. |

- 15 -

Table of Contents

Blackstone Mortgage Trust, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (continued)

(Unaudited)

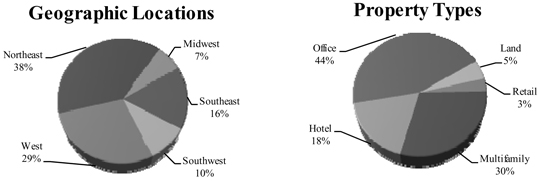

The tables below detail the types of loans in our loan portfolio, as well as the property type and geographic distribution of the properties securing these loans ($ in thousands):

| September 30, 2013 | December 31, 2012 | |||||||||||||||

| Net Book | Net Book | |||||||||||||||

| Asset Type |

Value | Percentage | Value | Percentage | ||||||||||||

| Senior mortgages (1) |

$ | 1,285,891 | 94 | % | $ | 62,500 | 44 | % | ||||||||

| Subordinate interests in mortgages |

77,000 | 6 | 79,000 | 56 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 1,362,891 | 100 | % | $ | 141,500 | 100 | % | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Book | Net Book | |||||||||||||||

| Property Type |

Value | Percentage | Value | Percentage | ||||||||||||

| Office |

$ | 614,025 | 45 | % | $ | 111,500 | 79 | % | ||||||||

| Multifamily |

383,601 | 28 | — | — | ||||||||||||

| Hotel |

257,942 | 19 | 30,000 | 21 | ||||||||||||

| Land |

64,271 | 5 | — | — | ||||||||||||

| Retail |

43,052 | 3 | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 1,362,891 | 100 | % | $ | 141,500 | 100 | % | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Book | Net Book | |||||||||||||||

| Geographic Location |

Value | Percentage | Value | Percentage | ||||||||||||

| Northeast |

$ | 523,662 | 38 | % | $ | 27,000 | 19 | % | ||||||||

| West |

402,121 | 30 | 92,500 | 65 | ||||||||||||

| Southeast |

219,093 | 16 | 12,404 | 9 | ||||||||||||

| Southwest |

132,407 | 10 | 9,596 | 7 | ||||||||||||

| Midwest |

85,608 | 6 | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 1,362,891 | 100 | % | $ | 141,500 | 100 | % | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1) | Senior mortgages include four pari passu participations in mortgages with a combined book value of $204.1 million as of September 30, 2013. |

Loan risk ratings

Quarterly, our Manager evaluates our loan portfolio as described in Note 2. In conjunction with our quarterly loan portfolio review, our Manager assesses the performance of each loan, and assigns a risk rating based on several factors including risk of loss, current LTV, collateral performance, structure, exit plan, and sponsorship. Loans are rated “1” (less risk) through “8” (greater risk), which ratings are defined in Note 2.

The following table allocates the principal balance and net book value of our loans receivable based on our internal risk ratings ($ in thousands):

| September 30, 2013 | December 31, 2012 | |||||||||||||||||||||||

| Number | Principal | Net | Number | Principal | Net | |||||||||||||||||||

| Risk Rating |

of Loans | Balance | Book Value | of Loans | Balance | Book Value | ||||||||||||||||||

| 1 - 3 |

19 | $ | 1,341,988 | $ | 1,335,891 | 2 | $ | 47,000 | $ | 47,000 | ||||||||||||||

| 4 - 5 |

1 | 27,000 | 27,000 | 2 | 92,500 | 92,500 | ||||||||||||||||||

| 6 - 8 |

2 | 18,079 | — | 3 | 24,680 | 2,000 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| 22 | $ | 1,387,067 | $ | 1,362,891 | 7 | $ | 164,180 | $ | 141,500 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

In making this risk assessment, one of the primary factors we consider is how senior or junior each loan is relative to other debt obligations of the borrower.

- 16 -

Table of Contents

Blackstone Mortgage Trust, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (continued)

(Unaudited)

The following tables further allocate our loans receivable by loan type and our internal risk ratings ($ in thousands):

| Senior Mortgage Loans (1) | ||||||||||||||||||||||||

| September 30, 2013 | December 31, 2012 | |||||||||||||||||||||||

| Number | Principal | Net | Number | Principal | Net | |||||||||||||||||||

| Risk Rating |

of Loans | Balance | Book Value | of Loans | Balance | Book Value | ||||||||||||||||||

| 1 - 3 |

17 | $ | 1,291,988 | $ | 1,285,891 | — | $ | — | $ | — | ||||||||||||||

| 4 - 5 |

— | — | — | 1 | 62,500 | 62,500 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| 17 | $ | 1,291,988 | $ | 1,285,891 | 1 | $ | 62,500 | $ | 62,500 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (1) | Senior mortgages include four pari passu participations in mortgages with a combined book value of $204.1 million as of September 30, 2013. |

| Subordinate Interests in Mortgages | ||||||||||||||||||||||||

| September 30, 2013 | December 31, 2012 | |||||||||||||||||||||||

| Number | Principal | Net | Number | Principal | Net | |||||||||||||||||||

| Risk Rating |

of Loans | Balance | Book Value | of Loans | Balance | Book Value | ||||||||||||||||||

| 1 - 3 |

2 | $ | 50,000 | $ | 50,000 | 2 | $ | 47,000 | $ | 47,000 | ||||||||||||||

| 4 - 5 |

1 | 27,000 | 27,000 | 1 | 30,000 | 30,000 | ||||||||||||||||||

| 6 - 8 |

2 | 18,079 | — | 3 | 24,680 | 2,000 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| 5 | $ | 95,079 | $ | 77,000 | 6 | $ | 101,680 | $ | 79,000 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Loan impairments

We do not have any loan impairments in our Loan Origination segment. As of September 30, 2013, CT CDO I, which is in our CT Legacy Portfolio segment, had one impaired subordinate interest in a mortgage loan with a gross book value of $7.5 million that is current in its interest payments and one impaired subordinate interest in a mortgage loan with a gross book value of $10.6 million that is delinquent on its contractual payments. We have taken a 100% loan loss reserve on each of these loans.

As of December 31, 2012, consolidated securitization vehicles in our CT Legacy Portfolio segment had one impaired subordinate interest in a mortgage loan with a gross book value of $7.5 million that was current in its interest payments and two impaired subordinate interest in a mortgage loans with a combined gross book value of $17.2 million that was delinquent on their contractual payments. We had an aggregate 92% loan loss reserve on these loans resulting in a net book value of $2.0 million.

Generally, we have recorded loan loss reserves for loans which are in maturity default, or otherwise have past-due principal payments. As of September 30, 2013, CT CDO I, which is in our CT Legacy Portfolio segment, had one loan with a net book value of $27.0 million which was in maturity default but had no reserve recorded. We expect to collect all principal and interest due under this loan. We do not have any loans in maturity default or with past-due principal payments in our Loan Origination segment.

There was no income recorded on impaired loans during the nine months ended September 30, 2013. We recorded $404,000 of income on impaired subordinate interests in mortgage loans owned by CT CDO I that had an average net book value of $5.1 million during the nine months ended September 30, 2012. In addition, we recorded $378,000 of income on loans owned by CDOs no longer consolidated that had an average net book value of $9.4 million during the nine months ended September 30, 2012. Substantially all income recorded on impaired loans during the period was received in cash.

Nonaccrual loans

We do not have any nonaccrual loans in our Loan Origination segment. CT CDO I, which is in our CT Legacy Portfolio segment, had two subordinate interests in mortgages on nonaccrual status with an aggregate principal balance of $18.1 million and an aggregate net book value of zero as of September 30, 2013. Consolidated securitization vehicles in our CT Legacy Portfolio segment had three subordinate interests in mortgages on nonaccrual status with an aggregate principal balance of $24.7 million and an aggregate net book value of $2.0 million as of December 31, 2012. In accordance with our revenue recognition policies discussed in Note 2, we do not accrue interest on loans which are 90 days past due or, in the opinion of our Manager, are otherwise uncollectable. Accordingly, we do not have any material interest receivable accrued on nonperforming loans as of September 30, 2013 or December 31, 2012.

- 17 -

Table of Contents

Blackstone Mortgage Trust, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (continued)

(Unaudited)

6. LOANS HELD-FOR-SALE

Activity relating to our loans held-for-sale was ($ in thousands):

| Gross Book | Valuation | Net Book | ||||||||||||

| Value | Allowance | Value | ||||||||||||

| December 31, 2012 |

$ | — | $ | — | $ | — | ||||||||

| Reclassification from loans receivable |

6,601 | (4,601 | ) | 2,000 | ||||||||||

| Valuation allowance on loans held-for-sale |

— | 1,200 | 1,200 | |||||||||||

| Loans sold |

(6,601 | ) | 3,401 | (3,200 | ) | |||||||||

|

|

|

|

|

|

|

|||||||||

| September 30, 2013 |

$ | — | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|||||||||

During the first quarter of 2013, we reclassified a $6.6 million subordinate mortgage loan and its related $4.6 million provision for loan losses to loans held-for-sale. We subsequently sold this loan and recorded a $1.2 million valuation adjustment to reflect the position at its fair value based on the proceeds expected to be received from the sale.

7. LOANS RECEIVABLE, AT FAIR VALUE

We record CT Legacy Partners’ loans receivable investments at fair value, which are determined using internal financial model-based estimations. The CT Legacy Partners loans receivable portfolio included nine loans with an aggregate principal balance of $176.0 million, which were reported at their aggregate fair value of $66.1 million as of September 30, 2013. As of December 31, 2012, there were no loans receivables at fair value because we accounted for CT Legacy Partners as a non-consolidated subsidiary. Refer to Note 3 and Note 8 for additional discussion of CT Legacy Partners. Refer to Note 17 for additional disclosure regarding fair value and Note 19 for an allocation of our loans receivable between our operating segments.

Activity relating to our loans receivable, at fair value was ($ in thousands):

| December 31, 2012 |

$ | — | ||

| Consolidation of CT Legacy Partners |

150,332 | |||

| Capitalized interest |

325 | |||

| Loan satisfactions |

(79,959 | ) | ||

| Partial loan repayments |

(1,721 | ) | ||

| Unrealized gain on investments at fair value |

3,899 | |||

| Reclassification to other assets |

(6,813 | ) | ||

|

|

|

|||

| September 30, 2013 |

$ | 66,063 | ||

|

|

|

|||

- 18 -

Table of Contents

Blackstone Mortgage Trust, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (continued)

(Unaudited)

The following table details overall statistics for CT Legacy Partners’ loans receivable, which is held at fair value as of September 30, 2013 ($ in thousands):

| Loans Receivable, at Fair Value | ||||||||||||

| Floating Rate | Fixed Rate | Total | ||||||||||

| Number of loans |

6 | 3 | 9 | |||||||||

| Net book value |

$ | 42,452 | $ | 23,611 | $ | 66,063 | ||||||

| Weighted-average cash coupon (1) |

L+3.78 | % | 8.14 | % | 5.13 | % | ||||||

| Weighted-average all-in yield (1) |

L+3.78 | % | 8.14 | % | 5.13 | % | ||||||

| Weighted-average maximum maturity (years) (2) |

1.1 | 1.1 | 1.1 | |||||||||

| (1) | Floating rate loans are indexed to LIBOR as of September 30, 2013. LIBOR was 0.18% as of September 30, 2013; however, certain of our loans receivable earn interest based on a minimum LIBOR floor of 2.00%. Amounts exclude all non-performing loans. |

| (2) | Maximum maturity date assumes all extension options are exercised. |

The tables below detail the types of loans in CT Legacy Partners’ loan portfolio, as well as the property type and geographic distribution of the properties securing these loans ($ in thousands):

| September 30, 2013 | ||||||||

| Asset Type |

Fair Value | Percentage | ||||||

| Senior mortgages |

$ | 25,597 | 39 | % | ||||

| Mezzanine loans |

40,466 | 61 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 66,063 | 100 | % | ||||

|

|

|

|

|

|||||

| Property Type |

Fair Value | Percentage | ||||||

| Office |

$ | 39,560 | 60 | % | ||||

| Hotel |

26,503 | 40 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 66,063 | 100 | % | ||||

|

|

|

|

|

|||||

| Geographic Location |

Fair Value | Percentage | ||||||

| Northeast |

$ | 39,560 | 60 | % | ||||

| West |

14,604 | 22 | ||||||

| Southeast |

11,899 | 18 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 66,063 | 100 | % | ||||

|

|

|

|

|

|||||

Nonaccrual loans

In accordance with our revenue recognition policies discussed in Note 2, we do not accrue interest on loans which are 90 days past due or, in the opinion of our Manager, are otherwise uncollectable. We do not have any material interest receivable accrued on nonperforming loans as of September 30, 2013.

The following table details CT Legacy Partner’s loans receivable which are on nonaccrual status ($ in thousands):

| September 30, 2013 | ||||||||

| Principal | ||||||||

| Asset Type |

Balance | Fair Value | ||||||

| Subordinate Interests in Mortgages |

$ | 43,448 | $ | — | ||||

| Mezzanine & Other Loans |

69,146 | 11,899 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 112,594 | $ | 11,899 | ||||

|

|

|

|

|

|||||

8. INVESTMENT IN CT LEGACY ASSET, AT FAIR VALUE

As a result of the merger effective on March 22, 2013, we began consolidating CT Legacy Partners and its subsidiary, CT Legacy Asset, LLC, or CT Legacy Asset. Previously, we accounted for CT Legacy Asset on a non-consolidated basis, and as of December 31, 2012, our consolidated balance sheet included a net investment in CT Legacy Asset of $132.0 million. We had elected the fair value option of accounting for CT Legacy REIT’s

- 19 -

Table of Contents

Blackstone Mortgage Trust, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (continued)

(Unaudited)

investment in CT Legacy Asset due to our determination that the fair value of the investment in CT Legacy Asset, as a net liquidating portfolio of assets, was more meaningful and indicative of our interests in CT Legacy Asset than equity method accounting. Following its consolidation, the loans receivable and repurchase obligations of CT Legacy Partners, as well as its other assets and liabilities, are included in our consolidated balance sheet. Refer to Note 3 for additional discussion of the consolidation of CT Legacy Partners and Note 7 and Note 10 for further discussion of CT Legacy Partners’ loan receivables and repurchase obligation, respectively.

CT Legacy Partners

CT Legacy Partners holds a portion of our legacy portfolio, which we had previously transferred to CT Legacy REIT (the predecessor of CT Legacy Partners) in connection with our March 2011 Restructuring. CT Legacy Partners is beneficially owned 52% by us and 48% by our former lenders. In addition, CT Legacy Partners has issued class B common shares, a subordinate class of equity which entitles its holders to receive approximately 25% of the dividends that would otherwise be payable to us on our equity interest in CT Legacy Partners, after aggregate cash distributions of $50.0 million have been paid to all other classes of common equity. Further, CT Legacy Partners has issued class A preferred shares which entitle its holder to cumulative preferred distributions in an amount generally equal to the greater of (i) 2.5% of certain of CT Legacy Partners’ assets, and (ii) $1.0 million per annum.