Exhibit 99.1

Table of Contents

| CORPORATE STRUCTURE |

1 | |||

| INCORPORATION AND REGISTERED OFFICE |

1 | |||

| SUBSIDIARIES |

1 | |||

| CAPITAL STRUCTURE |

1 | |||

| Stock Splits |

2 | |||

| MARKET FOR SECURITIES, TRADING PRICE AND VOLUME |

2 | |||

| Normal Course Issuer Bid and Share Purchases for Cancellation |

2 | |||

| CORPORATE GOVERNANCE |

2 | |||

| BOARD AND STANDING COMMITTEE CHARTERS AND CODES OF ETHICS |

2 | |||

| AUDIT COMMITTEE INFORMATION |

2 | |||

| DIRECTORS AND OFFICERS |

3 | |||

| Directors |

3 | |||

| Executive Committee and Executive Officers |

3 | |||

| Ownership of Securities on the Part of Directors and Officers |

4 | |||

| DESCRIPTION OF CGI’S BUSINESS |

4 | |||

| MISSION, VISION AND STRATEGY |

4 | |||

| BUSINESS STRUCTURE |

5 | |||

| Services Offered by CGI |

5 | |||

| Markets for CGI’s Services |

6 | |||

| Intangible Properties |

7 | |||

| Human Resources |

7 | |||

| Specialized Skills and Knowledge |

7 | |||

| CGI Offices and Proximity and Global Delivery Models |

7 | |||

| Commercial Alliances |

9 | |||

| Quality Processes |

9 | |||

| THE IT SERVICES INDUSTRY |

9 | |||

| Trends and Outlook |

9 | |||

| COMPETITIVE ENVIRONMENT |

10 | |||

| SIGNIFICANT DEVELOPMENTS OF THE THREE MOST RECENT FISCAL YEARS |

10 | |||

| Key Performance Measures |

10 | |||

| Fiscal Year ended September 30, 2019 |

12 | |||

| Fiscal Year ended September 30, 2018 |

14 | |||

| Fiscal Year ended September 30, 2017 |

15 | |||

| FORWARD LOOKING INFORMATION AND RISKS AND UNCERTAINTIES |

17 | |||

| LEGAL PROCEEDINGS |

18 | |||

| TRANSFER AGENT AND REGISTRAR |

18 | |||

| AUDITOR |

18 | |||

| ADDITIONAL INFORMATION |

18 | |||

| 2019 ANNUAL INFORMATION FORM i

| 2019 ANNUAL INFORMATION FORM i | ||||

This Annual Information Form is dated December 9, 2019 and, unless specifically stated otherwise, all information disclosed in this form, is provided as at September 30, 2019, the end of CGI’s most recently completed fiscal year. All dollar amounts are in Canadian dollars, unless otherwise stated.

Corporate Structure

Incorporation and Registered Office

CGI Inc. (the “Company”, “CGI”, “we”, “us” or “our”) was incorporated on September 29, 1981 under Part IA of the Companies Act (Quebec), predecessor to the Business Corporations Act (Quebec), which came into force on February 14, 2011, and which now governs the Company. The Company continued the activities of Conseillers en gestion et informatique CGI Inc., which was originally founded in 1976. The executive and registered offices of the Company are located at 1350 René-Lévesque Blvd. West, 25th Floor, Montréal, Quebec, Canada, H3G 1T4. CGI became a public company on December 17, 1986 upon completing an initial public offering of its Class A subordinate voting shares (“Class A Shares”).

Subsidiaries

The activities of the Company are conducted either directly or through subsidiaries. The table below lists the principal subsidiaries of the Company as at September 30, 2019, each of which is directly or indirectly wholly-owned by the Company. Certain subsidiaries whose total assets did not represent more than 10% of the Company’s consolidated assets or whose revenue did not represent more than 10% of the Company’s consolidated revenue as at September 30, 2019, have been omitted1. The subsidiaries that have been omitted represent, as a group, less than 20% of the consolidated assets and revenue of the Company as at September 30, 2019. This table also omits subsidiaries whose primary role is to hold investments in other CGI subsidiary entities.

| Name of Subsidiary | Country of Incorporation | |

| Conseillers en gestion et informatique CGI Inc. |

Canada | |

| CGI Information Systems and Management Consultants Inc. |

Canada | |

| CGI Technologies and Solutions Inc. |

United States of America | |

| CGI Federal Inc. |

United States of America | |

| CGI Suomi Oy |

Finland | |

| CGI Sverige AB |

Sweden | |

| CGI Nederland B.V. |

Netherlands | |

| CGI IT UK Limited |

United Kingdom | |

| CGI France SAS |

France | |

| CGI Deutschland BV & Co. KG |

Germany | |

Capital Structure

The Company’s authorized share capital consists of an unlimited number of Class A Shares carrying one vote per share and an unlimited number of Class B shares (multiple voting) (“Class B Shares”) carrying 10 votes per share, all without par value, of which, as of December 9, 2019, 240,193,687 Class A subordinate voting shares and 28,945,706 Class B Shares, were issued and outstanding. These shares represent respectively 45.35% and 54.65% of the aggregate voting rights attached to the outstanding Class A Shares and Class B Shares. Two classes of preferred shares also form part of CGI’s authorized capital: an unlimited number of First Preferred Shares, issuable in series, and an unlimited number of Second Preferred Shares, also issuable in series. As of December 9, 2019, there were no preferred shares outstanding.

The Company incorporates by reference the disclosure contained under the headings Class A Subordinate Voting Shares and Class B Shares on pages 3 and 4, and First Preferred Shares and Second Preferred Shares on page 4 of CGI’s Management Proxy Circular (“Circular”) dated December 9, 2019, which was filed with Canadian securities regulators and which is available at www.sedar.com and on CGI’s website at www.cgi.com.

| 1 | Based on the Company’s annual audited consolidated financial statements for the fiscal year ended September 30, 2019 filed with Canadian securities regulators and which are available at www.sedar.com and on CGI’s website at www.cgi.com. |

| 2019 ANNUAL INFORMATION FORM 1

| 2019 ANNUAL INFORMATION FORM 1 | ||||

Stock Splits

As of December 9, 2019, the Company had proceeded with four subdivisions of its issued and outstanding Class A Shares as follows:

| • | August 12, 1997 on a two for one basis; |

| • | December 15, 1997 on a two for one basis; |

| • | May 21, 1998 on a two for one basis; and |

| • | January 7, 2000 on a two for one basis. |

Market for Securities, Trading Price and Volume

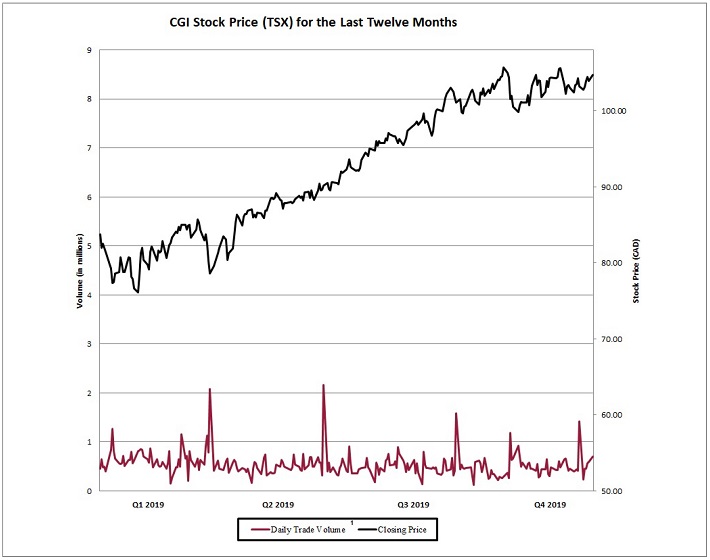

The Class A Shares are listed for trading on the Toronto Stock Exchange (the “TSX”) under the symbol GIB.A and on the New York Stock Exchange under the symbol GIB. A total of 136,393,614 Class A subordinate voting shares were traded on the TSX during the fiscal year ended September 30, 2019, as follows:

| Month | High(a) ($) |

Low(a) ($) |

Volume | |||

| October 2018 |

83.91 | 75.54 | 14,685,047 | |||

| November 2018 |

85.21 | 78.56 | 13,081,703 | |||

| December 2018 |

86.43 | 77.92 | 13,192,745 | |||

| January 2019 |

87.40 | 80.27 | 11,043,022 | |||

| February 2019 |

89.50 | 86.25 | 9,297,080 | |||

| March 2019 |

92.27 | 87.55 | 12,251,755 | |||

| April 2019 |

97.25 | 91.22 | 9,881,777 | |||

| May 2019 |

100.64 | 94.04 | 12,069,828 | |||

| June 2019 |

104.22 | 96.03 | 10,436,877 | |||

| July 2019 |

106.11 | 100.20 | 9,032,889 | |||

| August 2019 |

104.89 | 98.41 | 10,691,135 | |||

| September 2019 |

106.63 | 100.84 | 10,729,756 | |||

| (a) | The high and low prices reflect the highest and lowest prices at which a board lot trade was executed in a trading session during the month. |

Normal Course Issuer Bid and Share Purchases for Cancellation

On January 30, 2019, CGI announced that it was renewing its normal course issuer bid (“NCIB”) to purchase for cancellation up to 10% of the Company’s public float of its issued and outstanding Class A Shares during the NCIB term that commenced on February 6, 2019 and will expire on February 5, 2020 at the latest. On June 12, 2019, the Company completed a private share purchase which is considered within the annual aggregate limit that the Company is entitled to purchase under the NCIB. See Description of CGI’s Business – Significant developments of the Three Most Recent Fiscal Years – Fiscal Year ended September 30, 2019 – Normal Course Issuer Bid later in this Annual Information Form.

Corporate Governance

Board and Standing Committee Charters and Codes of Ethics

CGI’s Codes of Ethics, including its Code of Ethics and Business Conduct (which incorporates the CGI Anti-Corruption Policy) and its Executive Code of Conduct, the charter of the Board of Directors and the charters of the standing committees of the Board of Directors, including the charter of the Audit and Risk Management Committee, are annexed as Appendix A to this Annual Information Form.

Audit Committee Information

The Company incorporates by reference the disclosure contained under the heading Expertise and Financial and Operational Literacy on pages 50 and 51 and the disclosure contained under the heading Report of the Audit and Risk Management Committee, on pages 59 and following of CGI’s Circular dated December 9, 2019.

| 2019 ANNUAL INFORMATION FORM 2

| 2019 ANNUAL INFORMATION FORM 2 | ||||

Directors and Officers

Directors

The Company incorporates by reference the disclosure under the heading Nominees for Election as Directors relating to the Company’s directors contained on pages 8 to 16, and the table on the Board of Directors committee membership on page 48 of CGI’s Circular dated December 9, 2019.

Executive Committee and Executive Officers

CGI’s global strategy is overseen by a management committee (the “Executive Committee”) comprised of the Founder and Executive Chairman of the Board, the President and Chief Executive Officer and his direct operational and functional reports. The Executive Committee meets at least six times a year and is accountable for enterprise-wide strategy as well as all enterprise policies and operations oversight.

The following table states the names of CGI’s executive officers, their place of residence, their principal occupation within the Company as of December 9, 2019 and, where required, any other previously held positions in the last five years with the Company or one of its direct or indirect subsidiaries, or outside of the Company:

| Name and Residence | Principal Occupation with the Company |

Previously held position (last five years) | ||

| Jean-Michel Baticle Précy-sur-Oise, Oise, France |

President, Western and Southern Europe Operations |

• President, France, Luxembourg and Morocco Operations | ||

| François Boulanger Westmount, Quebec, Canada |

Executive Vice-President and Chief Financial Officer |

• Senior Vice-President and Corporate Controller | ||

| Mark Boyajian Toronto, Ontario, Canada |

Executive Vice-President and Global Chief Business Engineering Officer |

• President, Canada Operations • Senior Vice-President and | ||

| Benoit Dubé St-Lambert, Quebec, Canada |

Executive Vice-President, Legal and Economic Affairs, and |

– | ||

| Pär Fors Saltsjöbaden, Södermanland, Sweden |

President, Scandinavia Operations | • Senior Vice-President, Sweden | ||

| Julie Godin Verdun (Nuns’ Island), Quebec, Canada |

Vice-Chair of the Board, Executive Vice-President, and Chief Planning and Administration Officer |

• Executive Vice-President, Global Human Resources and Strategic Planning and Vice-Chair of the Board • Executive Vice-President, Human Resources and Strategic Planning | ||

| Serge Godin Westmount, Quebec, Canada |

Founder and Executive Chairman of the Board | – | ||

| David L. Henderson Vienna, Virginia, United States |

President, United States Operations, Commercial & State Government | – | ||

| Leena-Mari Lähteenmaa Helsinki, Uusimaa, Finland |

President, Finland, Poland, and Baltics Operations | • Senior Vice-President, Finland | ||

| George J. Mattackal Bengaluru, Karnataka, India |

President, Asia Pacific Operations, Global Delivery Centers of Excellence |

• Senior Vice-President and Business Unit Leader, Asia Pacific Communication and Enterprise Services Delivery Center • Vice-President, Consulting Services, India | ||

| Tara McGeehan Flintham Newark, Nottinghamshire, United Kingdom |

President, United Kingdom and Australia Operations | • Senior Vice-President, United Kingdom North and Energy, Utilities and Telecoms | ||

| George D. Schindler Fairfax, Virginia, United States |

President and Chief Executive Officer | • President and Chief Operating Officer • Chief Operating Officer • President, United States and Canada Operations | ||

| Torsten Strass Wiesbaden, Hesse, Germany |

President, Central and Eastern Europe Operations |

• Senior Vice-President, Germany Operations | ||

| Guy Vigeant Deux-Montagnes, Quebec, Canada |

President, Canada Operations | • Senior Vice-President, Mergers and Acquisitions • Senior Vice-President, Greater Montréal |

| 2019 ANNUAL INFORMATION FORM 3

| 2019 ANNUAL INFORMATION FORM 3 | ||||

Ownership of Securities on the Part of Directors and Officers

The Company incorporates by reference the disclosure under the heading Principal Holders of Class A Subordinate Voting Shares and Class B Shares on page 6 of CGI’s Circular dated December 9, 2019.

Description of CGI’s Business

Mission, Vision and Strategy

The mission of CGI is to help its clients succeed through outstanding quality, competence and objectivity, providing thought leadership and delivering the best services and solutions to fully satisfy client objectives in information technology (“IT”), business processes, and management. In all we do, we are guided by our dream and living by our values to foster trusted relationships and meet our commitments now and in the future.

CGI is unique in that our vision is based on a dream: “To create an environment in which we enjoy working together and, as owners, contribute to building a company we can be proud of.” This dream has motivated us since our founding in 1976 and drives our vision: “To be a global, world-class end-to-end IT and business consulting services leader helping our clients succeed.”

In pursuing our dream and vision, CGI has been highly disciplined throughout its history in executing a “Build and Buy” profitable growth strategy comprised of four pillars that combine profitable organic growth (Build) and accretive acquisitions (Buy):

| • | Pillar 1: Win, renew and extend contracts; |

| • | Pillar 2: New large managed IT and business process services contracts; |

These first two pillars relate to driving profitable organic growth through the pursuit of contracts with new and existing clients in our targeted industries. Successes in these pillars reflect the strength of our end-to-end portfolio of capabilities, the depth of expertise of our consultants in business and IT and the appreciation of the proximity model by our clients, both existing and potential.

| • | Pillar 3: Metro market acquisitions; and |

The third pillar focuses on growth through metro market acquisitions, complementing the proximity model, helping provide a fuller range of end-to-end services. We identify metro market acquisitions through a strategic qualification process that systematically searches for targets to strengthen our proximity model, leveraging strong local relationships with customers, and enhancing our industry expertise, services and solutions.

| • | Pillar 4: Large, transformational acquisitions. |

We also pursue large acquisitions to further expand our geographic presence and critical mass, which enables us to compete for large managed IT and business process services contracts and broaden our client relationships. CGI will continue to be a consolidator in the IT services industry by being active on both of these last pillars.

Executing Our Strategy

CGI’s strategy is executed through a unique business model that combines client proximity with an extensive global delivery network to deliver the following benefits:

| • | Local relationships and accountability: We live and work near our clients to provide a high level of responsiveness, partnership, and innovation. Our local CGI members speak our clients’ language, understand their business environment, and collaborate to meet their goals and advance their business; |

| • | Global reach: Our local presence is complemented by an expansive global delivery network that ensures our clients have 24/7 access to best-fit digital capabilities and resources to meet their end-to-end needs. In addition, clients benefit from our unique combination of industry domain and technology expertise within our global delivery model; |

| • | Committed experts: One of our key strategic goals is to be our clients’ partner and expert of choice. To achieve this, we invest in developing and recruiting professionals with extensive industry, business and in-demand technology expertise. In addition, CGI consultants and other professionals are also owners through our Share Purchase Plan, which, combined with the Profit Participation Plan, provide an added level of commitment to the success of our clients; |

| • | Comprehensive quality processes: CGI’s investment in quality frameworks and rigorous client satisfaction assessments has resulted in a consistent track record of on-time and within-budget project delivery. With regular reviews of engagements and transparency at all levels, the company ensures that client objectives and its own targets are consistently followed at all times. This thorough process enables CGI to generate continuous improvements for all stakeholders by applying corrective measures as soon as they are required; and |

| 2019 ANNUAL INFORMATION FORM 4

| 2019 ANNUAL INFORMATION FORM 4 | ||||

| • | Corporate responsibility: Social Responsibility is one of CGI’s core values. Our business model is designed to ensure that we are close to our clients and communities. At CGI, our members embrace our responsibilities to contribute to the continuous improvement of the economic, social and environmental well-being of the communities in which we live and work. |

Applied Innovation

At CGI, innovation happens across many interconnected fronts. It starts in our everyday work on client projects, where thousands of innovations are applied daily. Through benchmark in-person interviews we conduct each year, business and technology executives share their priorities with us, informing our own innovation investments and driving our client proximity teams’ focus on local client priorities. We also turn ideas into new business solutions through our “Innovate, Collaborate and Evolve” program which incubates proximity team innovations into scalable, replicable solutions for global application.

Since 1976, CGI is a trusted partner in delivering innovative, client-inspired business services and solutions. We help develop, innovate and protect the technology that enables clients to achieve their digital transformation goals faster, with reduced risk and enduring results. Through our day-to-day project engagements as well as global programs and investments, CGI partners with clients to generate practical innovations that are replicable and scalable, followed by the delivery of measurable results.

Business Structure

During the fiscal year ended September 30, 2019, the Company was managed through the following eight operating segments: Western and Southern Europe (primarily France, Portugal and Belgium); Northern Europe (including Nordics, Baltics and Poland); Canada; United States of America (“U.S.”) Commercial and State Government; U.S. Federal; United Kingdom (“U.K.”) and Australia; Central and Eastern Europe (primarily Netherlands and Germany); and Asia Pacific Global Delivery Centers of Excellence (India and Philippines) (“Asia Pacific”). The Company has retrospectively revised the segmented information for the comparative periods. For additional information on our operating and reporting segments, please refer to sections 3.4, 3.6, 5.4 and 5.5 of CGI’s Management’s Discussion and Analysis (“MD&A”) for the fiscal year ended September 30, 2019 and to note 27 of our annual audited consolidated financial statements for the fiscal years ended September 30, 2019 and 2018, which were filed with Canadian securities regulators and are available at www.sedar.com and on CGI’s website at www.cgi.com. The following table provides a summary of the year-over-year changes in our revenue, in total and by reporting segment, for the fiscal years ended September 30, 2019 and 2018:

| Reporting Segment Revenue (in thousand of dollars CAD) |

2019 | 2018 | ||

| Western and Southern Europe |

2,019,663 | 1,995,811 | ||

| Northern Europe |

1,877,252 | 1,800,460 | ||

| Canada |

1,711,927 | 1,671,060 | ||

| U.S. Commercial and State Government |

1,802,462 | 1,689,686 | ||

| U.S. Federal |

1,621,987 | 1,458,741 | ||

| U.K. and Australia |

1,351,993 | 1,342,662 | ||

| Central and Eastern Europe |

1,162,593 | 1,027,055 | ||

| Asia Pacific |

563,359 | 521,350 | ||

| Total |

12,111,236 | 11,506,825 |

Services Offered by CGI

CGI delivers an end-to-end range of services, including strategic IT and business consulting, systems integration, intellectual property and managed IT and business process services.

CGI delivers comprehensive services that cover the full spectrum of technology delivery; from digital strategy and architecture to solution design, development, integration, implementation and operations.

| 2019 ANNUAL INFORMATION FORM 5

| 2019 ANNUAL INFORMATION FORM 5 | ||||

Our portfolio encompasses:

| • | High-end IT services and business consulting and systems integration: CGI helps clients define their digital strategy and roadmap, adopting an agile, iterative approach that facilitates innovation, connection and optimization of mission-critical systems to deliver enterprise-wide change; |

| • | Managed IT and business process services: Our clients entrust us with full or partial responsibility for their IT and business functions to improve how they operate and transform their business. In return, we deliver innovation, significant efficiency gains, and cost savings. Typical services in an end-to-end engagement include: application development, integration and maintenance; technology infrastructure management; and business process services, such as in collections and payroll management. Managed IT and business process services contracts are long-term in nature, with a typical duration greater than five years, allowing our clients to reinvest savings, alongside CGI, in their digital transformations; and |

| • | Intellectual property (“IP”): Our IP portfolio includes more than 175 business solutions, some of which are crossindustry solutions. Most IP has been co-innovated with clients and act as business accelerators for the industries we serve and include the following1: |

| – | Momentum is an integrated enterprise resource planning (“ERP”) suite trusted by more than 150 organizations across the three branches of the U.S. federal government, including intelligence and defense organizations. Momentum provides comprehensive capabilities to improve federal back-office operations. Its delivery options include on-premise implementation, managed services hosted in a CGI data center or publically available cloud, or as a “software as a service” (“SaaS”) subscription-based offering. Momentum offers practical support for today’s financial, acquisitions and budgeting operations, combined with strategic solutions to position agencies and organizations for the rapidly changing environment of the future; |

| – | CGI Advantage is a leading ERP solution that helps state and local governments improve their back-office operations and better serve their citizens. Its full suite of built-for-government applications includes financial management, budgeting, payroll, human resource management, case management, collections and business intelligence. CGI Advantage has had more than 400 successful implementations spanning U.S. states, cities and counties. Clients include 22 state governments, the two largest U.S. cities by population and four of the six largest U.S. counties by population. CGI Advantage delivery options include on-premises implementation, managed services hosted in a private or publically available cloud, or as a SaaS offering; |

| – | CGI’s credit services solutions, including CGI Collections360 and CGI Gateway360, are our comprehensive managed services approach to collections and debt management. We combine software, business processes, underlying IT and planning into a single, cohesive suite. Users of our credit services solutions include large to mid-size banks, consumer finance companies, state and local governments, and telecommunications and utilities providers. Through our solutions, we assist our clients in default management, hosting/application management, multichannel integration, operations management, business intelligence, system implementation and consulting in order to enhance their collection efforts while reducing costs; |

| – | CGI Atlas360 is an end-to-end outsourcing solution with the ability to deliver individual components to support the needs of clients who require one or more specialized services, particularly those who would like to improve the customer experience using an omni channel solution. It is used in five continents, more than 70 countries and in 39 languages, and its business process services include global call center support, fee processing, cash management and complex scheduling, all supported by a cloud-based customer relationship management software; and |

| – | CGI Trade360 delivers all of the software, infrastructure and support resources necessary to power a bank’s global trade business. Delivered as a SaaS offering, CGI Trade360 enables banks to provide the full range of traditional trade, trade loans, payables, receivables, factoring, collateral management and cash management services to their customers – anywhere, anytime – on a single, integrated and global platform. The CGI Trade360 platform is built uniquely for multi-bank, multi-currency and multi-time zone processing, and is a global platform used in more than 100 countries and more than 250 locations across the world, as well as by more than 55,000 front-end corporate users. |

| 1 | CGI Advantage, Momentum, CGI Collections360, CGI Gateway360, CGI Atlas360 and CGI Trade360 are trademarks or registered trademarks of CGI or its subsidiaries. |

Markets for CGI’s Services

CGI has long standing and focused practices in all of its core industries, providing clients with a partner that is not only an expert in IT, but also an expert in their industries. This combination of business knowledge and digital technology expertise allows us to help our clients adapt with shifts in market dynamics and changing consumer and citizen expectations. In the process, we evolve the services and solutions we deliver within our targeted industries.

| 2019 ANNUAL INFORMATION FORM 6

| 2019 ANNUAL INFORMATION FORM 6 | ||||

Our targeted industries include: communications, financial services, government, health & life sciences, manufacturing, oil & gas, retail & consumer services, transportation, post & logistics and utilities. While these represent our go-to-market industry targets, we group these industries into the following for reporting purposes: government; manufacturing, retail & distribution (“MRD”); financial services; communications & utilities; and health.

As the move toward digitalization continues across industries, CGI partners with clients to help guide them in becoming customer and citizen-centric digital organizations.

Intangible Properties

We own and use various intangible assets that include, without limitation, brand names, trademarks, patents and patent applications, copyrights and copyrighted material, trade secrets, domain names, customer lists, know-how, tools, techniques, software, processes and methodologies. We derive value through the use of these assets in our business activities and they are central to our operations.

Our success depends, in part, on our ability to protect our proprietary intangible assets that we use to provide our services. We rely on a combination of contractual and licensing agreements and trademark, copyright, trade secret and patent laws to protect these assets against infringement.

Our general practice is to pursue trademark, patent, copyright or other appropriate IP protection that is timely and necessary to protect and leverage our intellectual assets for the longest possible period. We will continue to seek IP protection for our technology, software, methodologies, processes, know-how, tools, techniques and other proprietary information throughout the various countries within which CGI operates.

Human Resources

As of September 30, 2019, CGI had approximately 77,500 members. In order to encourage the high degree of commitment necessary to provide quality and continuity of client service, CGI offers its members the right to acquire Class A Shares pursuant to a Share Purchase Plan. Among the countries in which we currently offer our Share Purchase Plan, approximately 62,000 of our members own Class A Shares. The Company also has a Profit Participation Plan, a short-term incentive plan that pays an annual cash bonus based on achievement of performance objectives and designed to provide CGI’s management and members with an incentive to increase the profitability and growth of the Company.

Specialized Skills and Knowledge

The skills, expertise and competencies required by clients in the IT industry are constantly evolving. CGI strives to be one step ahead and adopts a proactive approach, not only by recruiting engaged and skilled professionals but, more importantly, by developing and retaining them to meet our clients’ needs. In addition to training and development activities and participation in professional associations, our talent management strategy includes stretch project assignments (local and abroad), job shadowing, coaching, mentoring and access to leadership and core competencies development programs through CGI’s Leadership Institute. Over the years, we have put in place multiple initiatives to meet our clients’ needs, fulfill our business plans, and maintain and develop professionals of very high calibre for the benefits of our clients, members and shareholders.

CGI Offices and Proximity and Global Delivery Models

CGI serves its clients from offices and through a network of global delivery locations across six continents: North America, South America, Europe, Africa, Asia and Australia. Through our proximity-based business model, CGI is deeply rooted in our clients’ businesses and communities. We are organized by metro markets in which clients have concentrated footprints, which empowers our local teams to build strong, trusted relationships, providing accountability for delivering client success.

CGI’s metro market teams augment their local expertise through skilled resources and experience from across our global operations to help clients spur greater innovation and achieve faster delivery times. Our delivery centers enable us to provide our clients with an optimal blend of delivery options, either locally or globally best suits their business needs.

CGI’s main offices and delivery centers are listed below:

| Canada | ||||||

| Calgary, AB |

Markham, ON |

Quebec City, QC‡ |

Stratford, PEI‡ | |||

| Drummondville, QC‡ |

Mississauga, ON‡ |

Regina, SK‡ |

Toronto, ON | |||

| Edmonton, AB |

Moncton, NB‡ |

Saguenay, QC‡ |

Victoria, BC | |||

| Fredericton, NB‡ |

Montréal, QC‡ |

Shawinigan, QC‡ |

||||

| Halifax, NS‡ |

Ottawa, ON |

Sherbrooke, QC‡ |

||||

| United States | ||||||

| Annapolis Junction, MD |

Dallas / Fort Worth, TX |

Lebanon, VA‡ |

San Antonio, TX | |||

| Arlington, VA |

Denver, CO |

Los Angeles, CA |

San Diego, CA | |||

| Atlanta, GA |

Fairfax, VA |

Manassas, VA |

Sterling, VA | |||

| Belton, TX‡ |

Fairview Heights, IL |

Mobile, AL‡ |

Tampa, FL | |||

| Birmingham, AL |

Gales Ferry, CT |

New York, NY |

Tempe, AZ | |||

| 2019 ANNUAL INFORMATION FORM 7

| 2019 ANNUAL INFORMATION FORM 7 | ||||

| Burlington, MA |

Hot Springs, AR |

North Charleston, SC |

Troy, AL‡ | |||

| Cleveland, OH |

Houston, TX |

Phoenix, AZ‡ |

Tucson, AZ | |||

| Columbia, SC |

Huntsville, AL |

Pittsburg, PA |

Washington, DC | |||

| Columbus, OH |

Lafayette, LA‡ |

Plymouth, PA |

Waterville, ME‡ | |||

| Cranford, NJ |

Lawton, OK |

Sacramento, CA |

Wausau, WI‡ | |||

| South America | ||||||

| Moggi das Cruzes, Brazil |

||||||

| São Paulo, Brazil‡ |

||||||

| Europe | ||||||

| Aarhus, Denmark |

Chelmsford, U.K. |

Leinfelden-Echterdingen, Germany |

Porto, Portugal‡ | |||

| Aix-en-Provence, France |

Clermont-Ferrand, France |

Lille, France |

Prague, Czech Republic‡ | |||

| Amiens, France‡ |

Darmstadt, Germany |

Lisbon, Portugal‡ |

Reading, U.K. | |||

| Amstelveen, Netherlands‡ |

Diegem, Belgium |

London, U.K. |

Rennes, France | |||

| Amsterdam, Netherlands |

Düsseldorf, Germany |

Lyon, France‡ |

Riga, Latvia | |||

| Arnhem, Netherlands |

Edinburgh, U.K. |

Maastricht, Netherlands |

Rotterdam, Netherlands | |||

| Ballerup, Denmark |

Eindhoven, Netherlands |

Lahti, Finland |

Sacavém, Portugal | |||

| Berlin, Germany |

Erfurt, Germany |

Madrid, Spain‡ |

Sintra, Portugal | |||

| Bertrange, Luxembourg |

Espoo, Finland |

Málaga, Spain‡ |

Solihull, U.K. | |||

| Bordeaux, France‡ |

Glasgow, U.K. |

Malmö, Sweden |

Stockholm, Sweden | |||

| Borlänge, Sweden |

Gloucester, U.K. |

Manchester, U.K. |

Strasbourg, France | |||

| Bratislava, Slovakia |

Göteborg, Sweden |

Milan, Italy |

Sulzback (Taunus), Germany | |||

| Braunschweig, Germany |

Grenoble, France |

Milton Keynes, U.K. |

Sundsvall, Sweden | |||

| Bremen, Germany‡ |

Groningen, Netherlands |

Montpellier, France‡ |

Tallinn, Estonia | |||

| Brest, France |

Hamburg, Germany |

Munich, Germany |

Tampere, Finland | |||

| Bridgend, U.K.‡ |

Helsinki, Finland‡ |

Nantes, France |

Toulouse, France‡ | |||

| Bristol, U.K. |

Ivögatan, Sweden‡ |

Oslo, Norway‡ |

Turku, Finland | |||

| Brno, Czech Republic‡ |

Karlstad, Sweden |

Östersund, Sweden‡ |

Vilnius, Lithuania‡ | |||

| Bromölla, Sweden |

Köln / Bonn, Germany |

Ostrava, Czech Republic |

Warsaw, Poland‡ | |||

| Bucarest, Romania‡ |

Krakow, Poland‡ |

Oulu, Finland |

||||

| Budapest, Hungary |

Leatherhead, U.K |

Paris, France |

||||

| Africa |

||||||

| Casablanca, Morocco‡ |

||||||

| Fes, Morocco |

||||||

| Johannesburg, South Africa |

||||||

| Rabat, Morocco‡ |

||||||

| Asia |

||||||

| Bangalore, India‡ |

Hyderabad, India‡ |

|||||

| Chennai, India‡ |

Kuala Lumpur, Malaysia‡ |

|||||

| Gurgaon, India |

Manila, Philippines‡ |

|||||

| Hong Kong, China |

Mumbai, India‡ |

|||||

| Australia |

||||||

| Melbourne, Australia |

||||||

| ‡ indicates locations where CGI operates delivery centers. | ||||||

All of CGI’s offices are located in rented premises with the exception of the following properties, which are owned by CGI: one property in Belton, Texas; one property in Lebanon, Virginia; one property in Phoenix, Arizona; one property in Montreal, Quebec; one property in Mississauga, Ontario; one office building in Mumbai, India, that is built on land that we lease; one property in Odivelas, Portugal; one property in Bromölla, Sweden; and one property in Bridgend, U.K.

| 2019 ANNUAL INFORMATION FORM 8

| 2019 ANNUAL INFORMATION FORM 8 | ||||

Commercial Alliances

CGI currently has commercial alliance agreements with various business partners. These non-exclusive commercial agreements with hardware and software providers allow the Company to provide its clients with high quality technology, often on advantageous commercial terms for our clients. CGI’s business partners include prominent hardware and software providers.

Quality Processes

CGI holds ISO quality certification for the management of its partnerships with each of its three major stakeholder groups: clients, members and shareholders.

CGI’s ISO 9001 certified operations that are reflected in its Client Partnership Management Framework, its Member Partnership Management Framework and its Shareholder Partnership Management Framework greatly contribute to clearly defining clients’ objectives, properly scoping projects and identifying and allocating necessary resources to meet objectives. Together, these frameworks allow CGI to more efficiently build clients’ requirements into its solutions: clients are constantly kept informed, their degree of satisfaction is regularly measured and assessed and members’ interests are kept aligned with those of CGI’s clients and shareholders by providing incentive compensation to managers linked to CGI’s results and creating value through share ownership.

The Company began working towards obtaining ISO 9001 certification for the portion of its operations covered by its Project Management Framework (which now forms part of its Client Partnership Management Framework) in 1993 and CGI’s Quebec City office was granted ISO 9001 certification in June 1994, which allowed CGI to become North America’s first organization in the IT consulting field to receive ISO 9001 certification for the way in which it managed projects. Beginning in 1995, CGI expanded its ISO 9001 certification throughout its Canadian, U.S. and international offices as well as its corporate headquarters. Over the past several years, in the context of CGI’s high growth rate, its ISO certified quality system has been a key ingredient in spreading its culture, in part because it helps to integrate new members successfully, and in maintaining a high degree of quality of services by applying the same processes into each business unit.

As clients grow and IT projects become increasingly complex, CGI strives to further refine its quality processes while allowing them to branch out across all its activities. CGI’s enhanced quality system is simpler and provides the Company’s business units with greater autonomy in a context of decentralized activities. Over the years, CGI has also obtained additional ISO certifications and other appraisals, including ISO 27001 certification, which supports its strong information security management system, in more than 90 locations, and CMMI Level 5 certification, which supports its application management and infrastructure management services in its India global delivery centers. Some of CGI’s strategic business units maintain additional ISO certifications in accordance with local requirements, including: ISO 20000 – Information technology – Service management; ISO 14001 – Environmental management system; ISO 22301 – Business continuity management system; and ISO 50001 – Energy management system.

The IT Services Industry

Trends and Outlook

CGI intends to continue executing on its “Build and Buy” growth strategy, expanding both through profitable organic growth (Build) and through accretive acquisitions (Buy). Today more than ever, government and commercial organizations across industries rely on technology as a core part of their business model and to drive change. Any new service, program or efficiency improvement implemented as part of these changes brings a need for additional IT services.

As part of our annual strategic planning activities during the fiscal year ended September 30, 2019, we held over 1,550 face-to-face client interviews with business and technology executives across our targeted industries in regions in which CGI operates.

Once again this year, meeting customer and citizen expectations for digital services remains the most impactful industry trend for client executives across industries. IT modernization and integration is now second in terms of impact, rising significantly from 2018. IT modernization and becoming digital are both also among the top IT and business priorities, reflecting a strong theme among executives globally.

In line with these trends and priorities is a continued focus on enterprise-wide digital strategies. While 96% of interviewed executives cited having a digital strategy in place at some level, just 39% indicated those strategies are defined for the entire enterprise, and 18% are working to extend their enterprise strategies to their supply chain or ecosystem. Only 10% of interviewed executives reported that they are producing results from a digital strategy at the enterprise level. Delivering on this demand and helping clients achieve the business results they need requires significant investments in scale, reach, and capabilities to support clients everywhere they are around the world.

| 2019 ANNUAL INFORMATION FORM 9

| 2019 ANNUAL INFORMATION FORM 9 | ||||

These trends continue to present opportunities that CGI has successfully exploited in the past. We believe that the potential for end-to-end IT and business services and solutions – including strategic IT and business consulting, systems integration, managed IT and business process services, and IP – to help organizations accelerate their performance remains strong.

As part of our annual client interviews, CGI analyzes spending on IT and business process services in Canada, the U.S., the U.K. and Europe. As the digital transformation of industries expands and as our clients develop and implement enterprise-wide digital strategies, spending patterns continue to change. Our interviews indicate that clients in each of our targeted industries again plan to increase or maintain their IT spend and are planning to re-balance their budgets to spend more on new applications and reduce legacy costs. Over a three-year period, our interviews indicate that clients plan to increase the allocation of their budgets to new projects. We believe this indicates a large untapped potential market for our end-to-end services and solutions.

Competitive Environment

In today’s digital era, there is a competitive urgency for organizations across industries to become digital in a sustainable way. The pressure is on to modernize legacy assets and connect them to digital business and operating models. Central to this massive transformation is the evolving role of technology. Traditionally viewed as an enabler, technology is now recognized as a driver of business transformation. The promise of digital creates an enormous opportunity to transform organizations end-to-end, and CGI is well-positioned to serve as a digital partner and expert of choice. We are working with clients across the globe to implement digital strategies, roadmaps and solutions that revolutionize the customer/citizen experience, drive the launch of new products and services, and deliver efficiencies and cost savings.

As the demand for digitalization increases, competition within the global IT industry is intensifying. CGI’s competition comprises a variety of players; from metro market companies providing specialized services and software, to global, end-to-end IT service providers, to large consulting firms and government pure-play firms. All of these players are competing to deliver some or all of the services we provide.

Many factors distinguish the industry leaders, including the following:

| • | Depth and breadth of industry and technology expertise; |

| • | Local presence and strength of client relationships; |

| • | Consistent, on-time, within-budget delivery everywhere the client operates; |

| • | Breadth of digital IP solutions; |

| • | Ability to deliver practical innovation for measurable results; |

| • | Total cost of services and value delivered; and |

| • | Unique global delivery network, including onshore, nearshore and offshore options. |

CGI is one of the leaders in the industry with respect to all of these factors. We are not only delivering all of the capabilities clients need to compete in a digital world, but also the immediate results and long-term value they expect. As the market dynamics and industry trends continue to increase demand for enterprise solutions from global, end-to-end IT and business consulting services firms, CGI is one of few firms with the scale, reach, and capabilities to meet clients’ enterprise needs.

Significant Developments of the Three Most Recent Fiscal Years

Key Performance Measures

The Company reports its financial results in accordance with International Financial Reporting Standards (“IFRS”). However, we use a combination of financial measures, ratios, and non-generally accepted accounting principles (“non-GAAP”) measures to assess the Company’s performance. The non-GAAP measures used to report our financial results do not have any standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other issuers. These measures should be considered as supplemental in nature and not as a substitute for the related financial information prepared in accordance with IFRS.

The table below summarizes our non-GAAP measures and most relevant key performance measures used in this Annual Information Form:

| Profitability |

Adjusted EBIT (non-GAAP) – is a measure of earnings excluding acquisition-related and integration costs, restructuring costs, net finance costs and income tax expense. Management believes this measure is useful to investors as it best reflects the performance of the Company’s activities and allows for better comparability from period to period as well as to trend analysis. A reconciliation of the adjusted EBIT to its closest IFRS measure can be found in section 3.7 of CGI’s MD&A for the fiscal year ended September 30, 2019. |

| 2019 ANNUAL INFORMATION FORM 10

| 2019 ANNUAL INFORMATION FORM 10 | ||||

| Adjusted EBIT margin (non-GAAP) – is obtained by dividing our adjusted EBIT by our revenues. Management believes this measure is useful to investors as it best reflects the performance of its activities and allows for better comparability from period to period as well as to trend analysis. A reconciliation of the adjusted EBIT to its closest IFRS measure can be found in section 3.7 of CGI’s MD&A for the fiscal year ended September 30, 2019. | ||

| Net earnings – is a measure of earnings generated for shareholders. | ||

| Diluted earnings per share (diluted EPS) – is a measure of earnings generated for shareholders on a per share basis, assuming all dilutive elements are exercised. | ||

| Net earnings excluding specific items (non-GAAP) – is a measure of net earnings excluding acquisition-related and integration costs, restructuring costs and tax adjustments. Management believes this measure is useful to investors as it best reflects the Company’s performance and allows for better comparability from period to period. A reconciliation of the net earnings excluding specific items to its closest IFRS measure can be found in section 3.8.3 of CGI’s MD&A for the fiscal year ended September 30, 2019. | ||

| Diluted earnings per share excluding specific items (non-GAAP) – is defined as the net earnings excluding specific items on a per share basis. Management believes that this measure is useful to investors as it best reflects the Company’s performance on a per share basis and allows for better comparability from period to period. The diluted earnings per share reported in accordance with IFRS can be found in section 3.8 of CGI’s MD&A for the fiscal year ended September 30, 2019, while the basic and diluted earnings per share excluding specific items can be found in section 3.8.3 of CGI’s MD&A for the fiscal year ended September 30, 2019. | ||

| Liquidity |

Cash provided by operating activities – is a measure of cash generated from managing our day-to-day business operations. Management believes strong operating cash flow is indicative of financial flexibility, allowing us to execute the Company’s strategy. | |

| Days sales outstanding (“DSO”) (non-GAAP) – is the average number of days needed to convert our trade receivables and work in progress into cash. DSO is obtained by subtracting deferred revenue from trade accounts receivable and work in progress; the result is divided by our most recent quarter’s revenue over 90 days. Management tracks this metric closely to ensure timely collection and healthy liquidity. Management believes this measure is useful to investors as it demonstrates the Company’s ability to timely convert its trade receivables and work in progress into cash. | ||

| Growth |

Constant currency growth (non-GAAP) – is a measure of revenue growth before foreign currency impacts. This growth is calculated by translating current period results in local currency using the conversion rates in the equivalent period from the prior year. Management believes that it is helpful to adjust revenue to exclude the impact of currency fluctuations to facilitate period-to-period comparisons of business performance and that this measure is useful to investors for the same reason. | |

| Backlog (non-GAAP) – includes new contract wins, extensions and renewals (bookings (non-GAAP)), adjusted for the backlog consumed during the period as a result of client work performed and adjustments related to the volume, cancellation and the impact of foreign currencies to our existing contracts. Backlog incorporates estimates from management that are subject to change. Management tracks this measure as it is a key indicator of management’s best estimate of contracted revenue to be realized in the future and believes that this measure is useful to investors for the same reason. | ||

| Book-to-bill ratio (non-GAAP) – is a measure of the proportion of the value of our bookings (non-GAAP) to our revenue in the period. This metric allows management to monitor the Company’s business development efforts to ensure we grow our backlog (non-GAAP) and our business over time and management believes that this measure is useful to investors for the same reason. Management remains committed to maintaining a target ratio greater than 100% over a trailing twelve-month period. Management believes that monitoring the Company’s bookings over a longer period is a more representative measure as the services and contract type, size and timing of bookings could cause this measurement to fluctuate significantly if taken for only a three-month period. | ||

| 2019 ANNUAL INFORMATION FORM 11

| 2019 ANNUAL INFORMATION FORM 11 | ||||

| Capital Structure |

Net debt (non-GAAP) – is obtained by subtracting from our debt our cash and cash equivalents, short-term investments, long-term investments and fair value of foreign currency derivative financial instruments related to debt. Management uses the net debt metric to monitor the Company’s financial leverage and believes that this metric is useful to investors as it provides insight into our financial strength. A reconciliation of net debt to its closest IFRS measure can be found in section 4.5 of CGI’s MD&A for the fiscal year ended September 30, 2019. | |

| Net debt to capitalization ratio (non-GAAP) – is a measure of our level of financial leverage and is obtained by dividing the net debt (non-GAAP) by the sum of shareholder’s equity and debt. Management uses the net debt to capitalization ratio to monitor the proportion of debt versus capital used to finance the Company’s operations and to assess its financial strength. Management believes that this metric is useful to investors for the same reasons. | ||

| Return on equity (“ROE”) (non-GAAP) – is a measure of the rate of return on the ownership interest of our shareholders and is calculated as the proportion of net earnings for the last 12 months over the last four quarters’ average equity. Management looks at ROE to measure its efficiency at generating net earnings for the Company’s shareholders and how well the Company uses the invested funds to generate net earnings growth and believes that this measure is useful to investors for the same reasons. | ||

| Return on invested capital (“ROIC”) (non-GAAP) – is a measure of the Company’s efficiency at allocating the capital under its control to profitable investments and is calculated as the proportion of the net earnings excluding net finance costs after-tax for the last 12 months, over the last four quarters’ average invested capital, which is defined as the sum of equity and net debt. Management examines this ratio to assess how well it is using its funds to generate returns and believes that this measure is useful to investors for the same reason. | ||

Fiscal Year ended September 30, 2019

Highlights and Key Performance Measures

Key performance figures for the year include:

| • | Revenue of $12.1 billion, up 5.3% or 5.9% in constant currency; |

| • | Adjusted EBIT of $1,825 million, up 7.2%; |

| • | Adjusted EBIT margin of 15.1%, up 30 bps; |

| • | Net earnings of $1,263.2 million, up 10.7%; |

| • | Diluted EPS of $4.55, up 15.2%; |

| • | Net earnings, excluding specific items1, of $1,305.9 million, up 7.9%; |

| • | Diluted EPS, excluding specific items1, of $4.70, up 12.2%; |

| • | Cash provided by operating activities of $1,633.9 million, up 9.4%; |

| • | Bookings of $12.6 billion, or 104.4% of revenue; and |

| • | Backlog of $22.6 billion, representing 1.9 times revenue. |

| 1 | Specific items are comprised of acquisition-related and integration costs and restructuring costs, both net of tax, and the net favourable tax adjustment, which are discussed in sections 3.7.1, 3.7.2 and 3.8.1 of CGI’s MD&A for the fiscal year ended September 30, 2019. |

Acquisitions

During the fiscal year ended September 30, 2019, the Company made the following acquisitions through its subsidiaries:

| • | On October 11, 2018, the Company acquired all of the outstanding shares of ckc AG (“ckc”), for a purchase price of $21 million (€13.9 million). ckc was a specialized provider of agile software development and management services, with a focus on the automotive sector, headquartered in Brunswick, Germany. This acquisition added approximately 300 professionals and annualized revenues of approximately €30 million to the Company. |

| • | On April 16, 2019, the Company acquired control of Acando AB (“Acando”) under a tender offer for a total offer value of approximately $647 million (SEK 4,491 million). Acando was a consulting services firm with strategic consulting, system integration and customer-centric digital innovation capabilities, headquartered in Stockholm, Sweden, with additional offices in Finland, Norway, Germany and Latvia. This acquisition added approximately 2,100 professionals and annualized revenues of approximately $400 million to the Company, before considering divestitures in the range of 5%-10%. |

| 2019 ANNUAL INFORMATION FORM 12

| 2019 ANNUAL INFORMATION FORM 12 | ||||

With significant strategic consulting, system integration and customer-centric digital innovation capabilities, these acquisitions were made to complement the Company’s proximity model and expertise across key sectors, including manufacturing, retail and government.

| • | On June 14, 2019, the Company announced a cash offer of approximately $131 million to acquire all outstanding shares of SCISYS Group Plc (“SCISYS”). The transaction is expected to be completed by the end of calendar 2019. SCISYS operates in several sectors, with deep expertise and industry leading solutions in the space and defense sectors, as well as in the media and broadcast news industries and is headquartered in Dublin, Ireland. This acquisition would add approximately 670 professionals predominantly based in the UK and Germany and annualized revenues of approximately £58.4 million to the Company. |

Long-Term Debt

On November 5, 2019, the unsecured committed revolving credit facility of $1,500 million of the Company was extended by one year to December 2024 and can be further extended. There were no material changes in the terms and conditions.

During the fiscal year ended September 30, 2019, we drew $139.6 million under the unsecured committed revolving credit facility and we entered into a five-year unsecured committed term loan credit facility of $670 million (swapped into euro currency). The proceeds of the credit facility and term loan were used to repay the scheduled repayments of the senior unsecured notes of the Company in the amount of $306.8 million, used to invest in business acquisitions and in the purchase for cancellation of Class A Shares.

Normal Course Issuer Bid

On January 30, 2019, the Company’s Board of Directors authorized and subsequently received approval from the TSX for the renewal of CGI’s NCIB which allows for the purchase for cancellation of up to 20,100,499 Class A Shares, representing 10% of the Company’s public float as of the close of business on January 23, 2019. Class A Shares may be purchased for cancellation under the current NCIB commencing on February 6, 2019 until no later than February 5, 2020, or on such earlier date when the Company has either acquired the maximum number of Class A Shares allowable under the NCIB or elects to terminate the bid.

During the fiscal year ended September 30, 2019, the Company purchased for cancellation 12,460,232 Class A Shares for $1,126.1 million at a weighted average price of $90.37 under the previous and current NCIB. The purchased shares included 5,158,362 Class A Shares purchased for cancellation from Caisse de dépôt et placement du Québec for cash consideration of $500 million. The purchase was considered within the annual aggregate limit that the Company is entitled to purchase under its current NCIB.

As at September 30, 2019, the Company could purchase up to 13,315,767 Class A Shares for cancellation under the current NCIB.

Bookings and Book-To-Bill Ratio

Bookings for the fiscal year ended September 30, 2019 were $12.6 billion representing a book-to-bill ratio of 104.4%. Of the $12.6 billion in bookings signed during this year, 33% came from new business, while 67% came from extensions, renewals and add-ons.

The Company’s largest vertical markets for bookings were government, financial services and MRD, making up approximately 31%, 27% and 20% of total bookings, respectively. From a reporting segment perspective, our U.S. Commercial and State Government operating segment accounted for 19% of total bookings, followed by our Northern Europe operating segment at 18% and Western and Southern Europe operating segment at 16%.

Information regarding our bookings is a key indicator of the volume of our business over time. However, due to the timing and transition period associated with managed IT and business process services contracts, the realization of revenue related to these bookings may fluctuate from period to period. The values initially booked may change over time due to their variable attributes, including demand-driven usage, modifications in the scope of work to be performed caused by changes in client requirements as well as termination clauses at the option of the client. As such, information regarding our bookings is not comparable to, nor should it be substituted for, an analysis of our revenue. Management however believes that it is a key indicator of potential future revenue.

Foreign currency impact

Foreign currency rate fluctuations unfavourably impacted our revenue by 0.6%. This contrasts with a favourable impact of 1.5% during the fiscal year ended September 30, 2018 and an unfavourable impact of 2.8% during the fiscal year ended September 30, 2017.

| 2019 ANNUAL INFORMATION FORM 13

| 2019 ANNUAL INFORMATION FORM 13 | ||||

Fiscal Year ended September 30, 2018

Highlights and Key Performance Measures

Key performance figures for the year include:

| • | Revenue of $11.5 billion, up 6.1%, or 4.6% in constant currency; |

| • | Adjusted EBIT of $1,701.7 million, up 7.3%; |

| • | Adjusted EBIT margin of 14.8%, up 20 bps; |

| • | Net earnings of $1,141.4 million, up 10.3%; |

| • | Diluted EPS of $3.95, up 15.8%; |

| • | Net earnings, excluding specific items1, of $1,210.7 million, up 9.4%; |

| • | Diluted EPS, excluding specific items1, of $4.19, up 14.8%; |

| • | Cash provided by operating activities of $1,493.4 million, up 9.9%; |

| • | Bookings of $13.5 billion, or 117.3% of revenue; and |

| • | Backlog of $22.6 billion, up $1.8 billion. |

| 1 | Specific items were comprised of acquisition-related and integration costs and restructuring costs, both net of tax, and the net favourable tax adjustment, which were discussed in sections 3.7.1, 3.7.2 and 3.8.1 of CGI’s MD&A for the fiscal year ended September 30, 2018. |

Acquisitions

During the fiscal year ended September 30, 2018, the Company made the following acquisitions through its subsidiaries:

| • | The Company acquired 96.7% of the outstanding shares of Affecto Plc (“Affecto”) in October 2017 and the remaining outstanding shares during the three months ended March 31, 2018 for a purchase price of $145 million (€98.5 million). Affecto was a leading provider of business intelligence and enterprise information management solutions and services, headquartered in Helsinki, Finland. This acquisition added more than 1,000 professionals and annualized revenues of approximately €110 million to the Company. |

| • | On December 7, 2017, the Company acquired all of the outstanding shares of Paragon Solutions, Inc. (“Paragon”), for a purchase price of $79.5 million (US$61.9 million). Paragon was a high-end commercial business consultancy with depth in health and life sciences and IT expertise in digital transformation and systems integration, headquartered in Cranford, New Jersey. This acquisition added more than 300 professionals and annualized revenues of approximately US$54 million to the Company. |

| • | On May 16, 2018, the Company acquired all of the outstanding shares of Facilité Informatique Canada Inc. (“Facilité Informatique”) for a purchase price of $42 million. Facilité Informatique was an IT consulting services firm in high-demand digital services across a wide range of industries with a strong local presence in Montreal and Quebec City, headquartered in Montreal, Quebec. This acquisition added more than 350 professionals and annualized revenues of approximately $60 million to the Company. |

These acquisitions were made to complement CGI’s proximity model and further strengthen the Company’s global capabilities across several in-demand digital transformation areas.

Long-Term Debt

On November 6, 2018, the unsecured committed revolving credit facility of $1,500 million of the Company was extended by one year to December 2023. There were no material changes in the terms and conditions.

During the fiscal year ended September 30, 2018, we used $101.7 million to reduce our outstanding long-term debt, mainly driven by the first yearly scheduled repayment on a tranche of the Senior U.S. unsecured notes in the amount of $65 million (US$50 million).

Normal Course Issuer Bid

On January 31, 2018, the Company’s Board of Directors authorized and subsequently received the approval from the TSX for the renewal of its NCIB which allowed for the purchase for cancellation of up to 20,595,539 Class A Shares, representing 10% of the Company’s public float as of the close of business on January 24, 2018. Class A Shares could be purchased for cancellation under the renewed NCIB commenced on February 6, 2018 until no later than February 5, 2019, or on such earlier date on which the Company had either acquired the maximum number of Class A Shares allowable under the NCIB or elected to terminate the bid.

| 2019 ANNUAL INFORMATION FORM 14

| 2019 ANNUAL INFORMATION FORM 14 | ||||

During the fiscal year ended September 30, 2018, the Company purchased for cancellation 10,375,879 Class A Shares for approximately $797.9 million, excluding fees, at a weighted average price of $76.90. The purchased shares included 3,634,729 Class A Shares purchased for cancellation from Caisse de dépôt et placement du Québec for a cash consideration of approximately $272.8 million and 3,230,450 Class A Shares purchased for cancellation from Serge Godin, Founder and Executive Chairman of the Board, for a cash consideration of approximately $231.4 million. The purchase from Serge Godin was recommended by an independent committee of the Board of Directors of the Company following the receipt of an external opinion regarding the reasonableness of the terms of the transaction. Both purchases were considered within the annual aggregate limit that the Company was entitled to purchase under the then current NCIB. The NCIB allowed for purchases outside of the facilities of the TSX by private agreements pursuant to exemption orders issued by Canadian securities regulators. Of the 10,375,879 Class A Shares purchased for cancellation, 50,000 Class A Shares purchased for approximately $4.2 million were paid after September 30, 2018.

As at September 30, 2018, the Company could still purchase up to 10,219,660 Class A Shares for cancellation, under the then current NCIB.

Bookings and Book-To-Bill Ratio

Bookings for the fiscal year ended September 30, 2018 were $13.5 billion representing a book-to-bill ratio of 117.3%. Of the $13.5 billion in bookings signed during this year, 45% came from new business, while 55% came from extensions and renewals.

The Company’s largest vertical markets for bookings were government, MRD and financial services, making up approximately 42%, 22% and 19% of total bookings, respectively. From a reporting segment perspective, our U.S. Federal operating segment accounted for 19% of total bookings, followed by our Northern Europe operating segment at 18% and U.S. Commercial and State Government operating segment at 15%.

Foreign currency impact

Foreign currency rate fluctuations favourably impacted our revenue by 1.5%. This contrasted with an unfavourable impact of 2.8% during the fiscal year ended September 30, 2017 and a favourable impact of 3.7% during the fiscal year ended September 30, 2016.

Fiscal Year ended September 30, 2017

Highlights and Key Performance Measures

Key performance figures for the year include:

| • | Revenue of $10.8 billion, up 1.5%, or 4.3% in constant currency; |

| • | Adjusted EBIT of $1,586.6 million, up $26.3 million; |

| • | Adjusted EBIT margin of 14.6%, stable; |

| • | Net earnings of $1,035.2 million, down $33.5 million; |

| • | Net earnings excluding specific items1 of $1,107 million, up $25.5 million; |

| • | Net earnings margin of 9.5%, down 50 basis points; |

| • | Net earnings margin excluding specific items1 of 10.2%, up 10 basis points; |

| • | Diluted EPS of $3.41, down 0.3%; |

| • | Diluted EPS excluding specific items1 of $3.65, up 5.5%; |

| • | Bookings of $11.3 billion, or 104% of revenue; |

| • | Backlog of $20.8 billion, down $80.5 million; and |

| • | Cash provided by operating activities of $1,358.6, or 12.5% of revenue. |

| 1 | Specific items included the acquisition-related and integration costs, restructuring costs, both net of tax, which were discussed in sections 3.7.1 and 3.7.2 of CGI’s MD&A for the year ended September 30, 2017. |

| 2019 ANNUAL INFORMATION FORM 15

| 2019 ANNUAL INFORMATION FORM 15 | ||||

Acquisitions

During the fiscal year ended September 30, 2017, the Company acquired through its subsidiaries four consulting companies in the U.S.:

| • | On November 3, 2016, the Company acquired all units of Collaborative Consulting, LLC, a high-end IT consulting company with specialized expertise in financial, life sciences and public sectors, headquartered in Boston, Massachusetts. |

| • | On April 19, 2017, the Company acquired all outstanding shares of Computer Technology Solutions, Inc., a high-end IT consulting company focused on commercial markets, specialized in cloud, analytics and digital transformation, headquartered in Birmingham, Alabama. |

| • | On May 12, 2017, the Company acquired all outstanding shares of eCommerce Systems, Inc., a high-end IT consulting company focused on commercial markets, specialized in cloud, analytics and digital transformation, headquartered in Denver, Colorado. |

| • | On August 22, 2017, the Company acquired all outstanding shares of Summa Technologies, Inc., a high-end IT consulting company with expertise in digital experience and agile software development, headquartered in Pittsburgh, Pennsylvania. |

These companies increased CGI’s workforce by approximately 1,000 professionals and, together, generated annual revenues of approximately US$182 million. These companies were acquired for a total purchase price of $307.1 million (US$230.2 million). They complemented CGI’s proximity model and further strengthened the Company’s global capabilities across several in-demand digital transformation areas.

Long-Term Debt

On November 7, 2017, the unsecured committed revolving credit facility of $1,500 million of the Company was extended by one year to December 2022. There were no material changes in the terms and conditions including interest rates and banking covenants.

During the fiscal year ended September 30, 2017, we used $180.9 million to reduce our outstanding long-term debt mainly driven by the scheduled repayment of a tranche of Senior U.S. unsecured notes in the amount of $113.6 million (US$85 million). In addition, we drew $200 million on the Company’s unsecured committed revolving credit facility to purchase shares for cancellation under the then current NCIB.

Normal Course Issuer Bid

On February 1, 2017, the Company’s Board of Directors authorized and subsequently received the approval from the TSX for the renewal of its NCIB which allowed for the purchase for cancellation of up to 21,190,564 Class A Shares, representing 10% of the Company’s public float as of the close of business on January 25, 2017. Class A Shares could be purchased for cancellation under the renewed NCIB between February 6, 2017 and the earlier of February 5, 2018 or the date on which the Company had either acquired the maximum number of Class A Shares allowable under the NCIB or elected to terminate the NCIB.

During the fiscal year ended September 30, 2017, the Company purchased for cancellation 19,929,268 Class A Shares for approximately $1,246.7 million at a weighted average price of $62.55 under the then current NCIB. The purchased shares included 4,854,368 Class A Shares purchased for cancellation from Caisse de dépôt et placement du Québec for a cash consideration of approximately $300 million. This purchase was considered in the annual aggregate limit that the Company was entitled to purchase for cancellation under the then current NCIB. The NCIB allowed for purchases outside of the facilities of the TSX by private agreements pursuant to exemption orders issued by Canadian securities regulators. As at September 30, 2017, all of the Class A Shares purchased for cancellation were cancelled and paid.

As at September 30, 2017, the Company could purchase up to 7,358,996 Class A Shares for cancellation under the then current NCIB.

Bookings and Book-To-Bill Ratio

Bookings for the fiscal year ended September 30, 2017 were $11.3 billion representing a book-to-bill ratio of 104.1%. Of the $11.3 billion in bookings signed during this year, 42% came from new business, while 58% came from extensions and renewals.

The Company’s largest vertical markets for bookings were government, MRD and financial services, making up approximately 36%, 24% and 21% of total bookings, respectively. From a reporting segment perspective, our then current U.S. operating segment (which is now split into two distinct operating segments) accounted for 34% of total bookings, followed by the then current Nordics and France operating segments, each respectively at 15%.

| 2019 ANNUAL INFORMATION FORM 16

| 2019 ANNUAL INFORMATION FORM 16 | ||||

Foreign currency impact

Foreign currency rate fluctuations unfavourably impacted our revenue by 2.8%. This contrasted with a favourable impact of 3.7% during the fiscal year ended September 30, 2016 and 2.0% during the fiscal year ended September 30, 2015.

Forward Looking Information and Risks and Uncertainties

This Annual Information Form contains “forward-looking information” within the meaning of Canadian securities laws and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and other applicable United States safe harbours. All such forward-looking information and statements are made and disclosed in reliance upon the safe harbour provisions of applicable Canadian and United States securities laws. Forward-looking information and statements include all information and statements regarding CGI’s intentions, plans, expectations, beliefs, objectives, future performance, and strategy, as well as any other information or statements that relate to future events or circumstances and which do not directly and exclusively relate to historical facts. Forward-looking information and statements often but not always use words such as “believe”, “estimate”, “expect”, “intend”, “anticipate”, “foresee”, “plan”, “predict”, “project”, “aim”, “seek”, “strive”, “potential”, “continue”, “target”, “may”, “might”, “could”, “should”, and similar expressions and variations thereof. These information and statements are based on our perception of historic trends, current conditions and expected future developments, as well as other assumptions, both general and specific, that we believe are appropriate in the circumstances. Such information and statements are, however, by their very nature, subject to inherent risks and uncertainties, of which many are beyond the control of the Company, and which give rise to the possibility that actual results could differ materially from our expectations expressed in, or implied by, such forward-looking information or forward-looking statements.

These risks and uncertainties include but are not restricted to: risks related to the market such as the level of business activity of our clients, which is affected by economic and political conditions, and our ability to negotiate new contracts; risks related to our industry such as competition and our ability to attract and retain qualified employees, to develop and expand our services, to penetrate new markets, and to protect our intellectual property rights; risks related to our business such as risks associated with our growth strategy, including the integration of new operations, financial and operational risks inherent in worldwide operations, foreign exchange risks, income tax laws, our ability to negotiate favorable contractual terms, to deliver our services and to collect receivables, and the reputational and financial risks attendant to cybersecurity breaches and other incidents; as well as other risks identified or incorporated by reference in this Annual Information Form, in CGI’s annual and quarterly Management’s Discussion and Analysis and in other documents that we make public, including our filings with Canadian Securities Administrators (on SEDAR at www.sedar.com) and the U.S. Securities and Exchange Commission (on EDGAR at www.sec.gov). Unless otherwise stated, the forward-looking information and statements contained in this Annual Information Form are made as of the date hereof and CGI disclaims any intention or obligation to publicly update or revise any forward-looking information or forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law.

While we believe that our assumptions on which these forward-looking information and forward-looking statements are based were reasonable as at the date of this Annual Information Form, readers are cautioned not to place undue reliance on these forward-looking information or statements. Furthermore, readers are reminded that forward-looking information and statements are presented for the sole purpose of assisting investors and others in understanding our objectives, strategic priorities and business outlook as well as our anticipated operating environment. Readers are cautioned that such information may not be appropriate for other purposes.