Table of Contents

As filed with the Securities and Exchange Commission on December 21, 2012

Registration No. 333-185285

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

Form F-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Reynolds Group Holdings Limited

| New Zealand | 2673 | Not applicable | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

Reynolds Group Issuer Inc.

|

Delaware |

2673 | 27-1086981 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

Reynolds Group Issuer LLC

|

Delaware |

2673 | 27-1087026 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

Reynolds Group Issuer (Luxembourg) S.A.

| Luxembourg | 2673 | Not applicable | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

(See table of additional registrants on following page.)

Reynolds Group Holdings Limited

Level Nine

148 Quay Street

Auckland 1010 New Zealand

Attention: Joseph Doyle

+1 (847) 482-2409

(Address, including zip code, and telephone number, including area code, of registrants’ principal executive offices)

Reynolds Group Issuer Inc.

c/o National Registered Agents, Inc.

160 Greentree Drive, Suite 101,

Dover, Delaware 19904

(804) 281-2630

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a copy to:

Steven J. Slutzky, Esq.

Debevoise & Plimpton LLP

919 Third Avenue

New York, New York 10022

(212) 909-6000

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, as amended, or the “Securities Act,” check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ¨

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer ¨

Table of Contents

CALCULATION OF REGISTRATION FEE

|

| ||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered |

ProposedAggregate Offering Price Per Note(1) |

Amount of Registration Fee | |||

| 5.750% Senior Secured Notes due 2020 |

$3,250,000,000 | $3,250,000,000 | $443,300(2) | |||

| Guarantees of 5.750% Senior Secured Notes due 2020(3) |

$3,250,000,000 | — | None(4) | |||

|

| ||||||

|

| ||||||

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(f) promulgated under the Securities Act. |

| (2) | Previously paid. |

| (3) | See the following page for a table of guarantor registrants. |

| (4) | Pursuant to Rule 457(n) promulgated under the Securities Act, no separate filing fee is required for the guarantors. |

The Registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

TABLE OF ADDITIONAL REGISTRANTS

| Exact Name of Additional Registrant as Specified in its Charter* |

State or Other Jurisdiction of Incorporation or Organization |

I.R.S. Employer Identification Number | ||

| Whakatane Mill Australia Pty Limited |

Australia | Not Applicable | ||

| SIG Austria Holding GmbH |

Austria | Not Applicable | ||

| SIG Combibloc GmbH |

Austria | Not Applicable | ||

| SIG Combibloc GmbH & Co KG |

Austria | Not Applicable | ||

| Closure Systems International (Brazil) Sistemas de Vedação Ltda. |

Brazil | Not Applicable | ||

| SIG Beverages Brasil Ltda. |

Brazil | Not Applicable | ||

| SIG Combibloc do Brasil Ltda. |

Brazil | Not Applicable | ||

| CSI Latin American Holdings Corporation |

The British Virgin Islands |

Not Applicable | ||

| Graham Packaging PX Company |

California | 95-3571918 | ||

| Graham Packaging PX, LLC |

California | 95-3585385 | ||

| Evergreen Packaging Canada Limited |

Canada | Not Applicable | ||

| Pactiv Canada Inc. |

Canada | Not Applicable | ||

| CSI Closure Systems Manufacturing de Centro America, Sociedad de Responsabilidad Limitada |

Costa Rica | Not Applicable | ||

| Bakers Choice Products, Inc. |

Delaware | 54-1440852 | ||

| BCP/Graham Holdings L.L.C. |

Delaware | 52-2076130 | ||

| Blue Ridge Holding Corp. |

Delaware | 13-4058526 | ||

| Blue Ridge Paper Products Inc. |

Delaware | 56-2136509 | ||

| Closure Systems International Americas, Inc. |

Delaware | 13-4307216 | ||

| Closure Systems International Holdings Inc. |

Delaware | 77-0710458 | ||

| Closure Systems International Inc. |

Delaware | 25-1564055 | ||

| Closure Systems International Packaging Machinery Inc. |

Delaware | 25-1533420 | ||

| Closure Systems Mexico Holdings LLC |

Delaware | 74-3242904 | ||

| CSI Mexico LLC |

Delaware | 74-3242901 | ||

| CSI Sales & Technical Services Inc. |

Delaware | 77-0710454 | ||

| Evergreen Packaging Inc. |

Delaware | 20-8042663 | ||

| Evergreen Packaging USA Inc. |

Delaware | 76-0240781 | ||

| Evergreen Packaging International (US) Inc. |

Delaware | 33-0429774 | ||

| GPACSUB LLC |

Delaware | 26-1127569 | ||

| GPC Capital Corp. I |

Delaware | 23-2952403 | ||

| GPC Capital Corp. II |

Delaware | 23-2952404 | ||

| GPC Opco GP LLC |

Delaware | 23-2952405 | ||

| GPC Sub GP LLC |

Delaware | 23-2952400 | ||

| Graham Packaging Acquisition Corp. |

Delaware | 75-3168236 | ||

| Graham Packaging Company Inc. |

Delaware | 52-2076126 | ||

| Graham Packaging Company, L.P. |

Delaware | 23-2786688 | ||

| Graham Packaging LC, L.P. |

Delaware | 36-3735725 | ||

| Graham Packaging LP Acquisition LLC |

Delaware | 27-3420362 | ||

| Graham Packaging PET Technologies Inc. |

Delaware | 06-1088896 |

Table of Contents

| Exact Name of Additional Registrant as Specified in its Charter* |

State or Other Jurisdiction of Incorporation or Organization |

I.R.S. Employer Identification Number | ||

| Graham Packaging Plastic Products Inc. |

Delaware | 95-2097550 | ||

| Graham Packaging PX Holding Corporation |

Delaware | 59-1748223 | ||

| Graham Packaging Regioplast STS Inc. |

Delaware | 34-1743397 | ||

| Graham Packaging GP Acquisition LLC |

Delaware | 27-3420526 | ||

| GPC Holdings LLC |

Delaware | 45-2814255 | ||

| Pactiv Germany Holdings, Inc. |

Delaware | 36-4423878 | ||

| Pactiv International Holdings Inc. |

Delaware | 76-0531623 | ||

| Pactiv LLC |

Delaware | 36-2552989 | ||

| Pactiv Management Company LLC |

Delaware | 36-2552989 | ||

| Pactiv Packaging Inc. |

Delaware | 74-3183917 | ||

| PCA West Inc. |

Delaware | 76-0254972 | ||

| RenPac Holdings Inc. |

Delaware | 45-3464426 | ||

| Reynolds Consumer Products Holdings LLC |

Delaware | 77-0710450 | ||

| Reynolds Consumer Products Inc. |

Delaware | 77-0710443 | ||

| Reynolds Group Holdings Inc. |

Delaware | 27-1086869 | ||

| Reynolds Manufacturing, Inc. |

Delaware | 45-3412370 | ||

| Reynolds Presto Products Inc. |

Delaware | 76-0170620 | ||

| Reynolds Services Inc. |

Delaware | 27-0147082 | ||

| SIG Combibloc Inc. |

Delaware | 56-1374534 | ||

| SIG Holding USA, LLC |

Delaware | 22-2398517 | ||

| Closure Systems International Deutschland GmbH |

Germany | Not Applicable | ||

| Closure Systems International Holdings (Germany) GmbH |

Germany | Not Applicable | ||

| Omni-Pac Ekco GmbH Verpackungsmittel |

Germany | Not Applicable | ||

| Omni-Pac GmbH Verpackungsmittel |

Germany | Not Applicable | ||

| Pactiv Deutschland Holdinggesellschaft mbH |

Germany | Not Applicable | ||

| SIG Beteiligungs GmbH |

Germany | Not Applicable | ||

| SIG Beverages Germany GmbH |

Germany | Not Applicable | ||

| SIG Combibloc GmbH |

Germany | Not Applicable | ||

| SIG Combibloc Holding GmbH |

Germany | Not Applicable | ||

| SIG Combibloc Systems GmbH |

Germany | Not Applicable | ||

| SIG Combibloc Zerspanungstechnik GmbH |

Germany | Not Applicable | ||

| SIG Euro Holding AG & Co. KGaA |

Germany | Not Applicable | ||

| SIG Information Technology GmbH |

Germany | Not Applicable | ||

| SIG International Services GmbH |

Germany | Not Applicable | ||

| SIG Asset Holdings Limited |

Guernsey | Not Applicable | ||

| Closure Systems International (Hong Kong) Limited |

Hong Kong | Not Applicable | ||

| SIG Combibloc Limited |

Hong Kong | Not Applicable | ||

| CSI Hungary Manufacturing and Trading Limited Liability Company |

Hungary | Not Applicable | ||

| Closure Systems International Holdings (Japan) KK |

Japan | Not Applicable | ||

| Closure Systems International Japan, Limited |

Japan | Not Applicable |

Table of Contents

| Exact Name of Additional Registrant as Specified in its Charter* |

State or Other Jurisdiction of Incorporation or Organization |

I.R.S. Employer Identification Number |

||||

| Southern Plastics Inc. |

Louisiana | 72-0631453 | ||||

| Beverage Packaging Holdings (Luxembourg) I S.A. |

Luxembourg | Not Applicable | ||||

| Beverage Packaging Holdings (Luxembourg) III S.à r.l. |

Luxembourg | Not Applicable | ||||

| Beverage Packaging Holdings (Luxembourg) IV S.à r.l. |

Luxembourg | 98-1033229 | ||||

| Beverage Packaging Holdings (Luxembourg) V S.A. |

Luxembourg | Not Applicable | ||||

| Evergreen Packaging (Luxembourg) S.à r.l. |

Luxembourg | Not Applicable | ||||

| Bienes Industriales del Norte, S.A. de C.V. |

Mexico | Not Applicable | ||||

| CSI en Ensenada, S. de R.L. de C.V. |

Mexico | Not Applicable | ||||

| CSI en Saltillo, S. de R.L. de C.V. |

Mexico | Not Applicable | ||||

| CSI Tecniservicio, S. de R.L. de C.V. |

Mexico | Not Applicable | ||||

| Evergreen Packaging Mexico, S. de R.L. de C.V. |

Mexico | Not Applicable | ||||

| Grupo Corporativo Jaguar, S.A. de C.V. |

Mexico | Not Applicable | ||||

| Grupo CSI de Mexico, S. de R.L. de C.V. |

Mexico | Not Applicable | ||||

| Pactiv Foodservice Mexico, S. de R.L. de C.V. |

Mexico | Not Applicable | ||||

| Pactiv Mexico, S. de R.L. de C.V. |

Mexico | Not Applicable | ||||

| Reynolds Metals Company de Mexico, S. de R.L. de C.V. |

Mexico | Not Applicable | ||||

| Técnicos de Tapas Innovativas, S.A. de C.V. |

Mexico | Not Applicable | ||||

| Servicios Industriales Jaguar, S.A. de C.V. |

Mexico | Not Applicable | ||||

| Servicio Terrestre Jaguar, S.A. de C.V. |

Mexico | Not Applicable | ||||

| Closure Systems International B.V. |

The Netherlands | Not Applicable | ||||

| Evergreen Packaging International B.V. |

The Netherlands | Not Applicable | ||||

| Reynolds Consumer Products International B.V. |

The Netherlands | Not Applicable | ||||

| Reynolds Packaging International B.V. |

The Netherlands | Not Applicable | ||||

| Whakatane Mill Limited |

New Zealand | Not Applicable | ||||

| BRPP, LLC |

North Carolina | 56-2206100 | ||||

| International Tray Pads & Packaging, Inc. |

North Carolina | 56-1783093 | ||||

| Graham Packaging Minster LLC |

Ohio | 56-2595198 | ||||

| Graham Packaging Holdings Company |

Pennsylvania | 23-2553000 | ||||

| Graham Recycling Company, L.P. |

Pennsylvania | 23-2636186 | ||||

| SIG allCap AG |

Switzerland | Not Applicable | ||||

| SIG Combibloc Group AG |

Switzerland | Not Applicable | ||||

| SIG Combibloc Procurement AG |

Switzerland | Not Applicable | ||||

| SIG Combibloc (Schweiz) AG |

Switzerland | Not Applicable | ||||

| SIG Schweizerische Industrie-Gesellschaft AG |

Switzerland | Not Applicable | ||||

| SIG Technology AG |

Switzerland | Not Applicable | ||||

| SIG Combibloc Ltd. |

Thailand | Not Applicable | ||||

| Closure Systems International (UK) Limited |

United Kingdom | Not Applicable | ||||

| IVEX Holdings, Ltd. |

United Kingdom | Not Applicable | ||||

| J. & W. Baldwin (Holdings) Limited |

United Kingdom | Not Applicable | ||||

| Kama Europe Limited |

United Kingdom | Not Applicable | ||||

| Omni-Pac U.K. Limited |

United Kingdom | Not Applicable | ||||

| Reynolds Consumer Products (UK) Limited |

United Kingdom | Not Applicable | ||||

Table of Contents

| Exact Name of Additional Registrant as Specified in its Charter* |

State or Other Jurisdiction of Incorporation or Organization |

I.R.S. Employer Identification Number | ||

| Reynolds Subco (UK) Limited |

United Kingdom | Not Applicable | ||

| SIG Combibloc Limited |

United Kingdom | Not Applicable | ||

| The Baldwin Group Limited |

United Kingdom | Not Applicable | ||

| Graham Packaging West Jordan, LLC |

Utah | 04-3642518 |

| * | The address and telephone number for each of the additional registrants is c/o Reynolds Group Holdings Limited, Level Nine, 148 Quay Street, Auckland 1010 New Zealand, Attention: Joseph Doyle, telephone: +1 (847) 482-2409. The name and address, including zip code, of the agent for service for each additional registrant is Reynolds Group Issuer Inc. c/o National Registered Agents, Inc., 160 Greentree Drive, Suite 101, Dover, Delaware 19904, telephone: (804) 281-2630. |

Table of Contents

The information contained in this prospectus is not complete and may be changed. We may not complete this exchange offer or issue these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities nor a solicitation of an offer to buy these securities in any jurisdiction where such offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED DECEMBER 21, 2012

PROSPECTUS

Reynolds Group Issuer Inc.

Reynolds Group Issuer LLC

Reynolds Group Issuer (Luxembourg) S.A.

Offer to Exchange

$3,250,000,000 Outstanding 5.750% Senior Secured Notes due 2020

(the “old notes”) and Related Guarantees for

$3,250,000,000 Registered 5.750% Senior Secured Notes due 2020

(the “new notes”) and Related Guarantees

Reynolds Group Issuer Inc., or the “US Issuer,” Reynolds Group Issuer LLC, or the “US Co-Issuer,” and Reynolds Group Issuer (Luxembourg) S.A., or the “Lux Issuer,” which collectively we refer to as the “Issuers,” are offering to exchange the old notes, as defined in this prospectus, for a like principal amount of new notes, as defined in this prospectus.

The terms of the new notes are identical in all material respects to the terms of the old notes, except that, among other differences, the new notes are registered under the Securities Act of 1933, as amended, which we refer to as the “Securities Act,” and the transfer restrictions and registration rights relating to the old notes will not apply to the new notes. The old notes and the new notes are joint and several obligations of the Issuers. The new notes will be issued under the same indenture governing the old notes. See “Description of the Senior Secured Notes — General.”

The exchange offer will expire at 5:00 p.m., New York City time, on , 2013, which date and time we refer to as the “expiration date,” unless the Issuers extend the expiration date, in which case “expiration date” means the latest date and time to which the exchange offer is extended. You should read the section called “The Exchange Offer” for further information on how to exchange your old notes for new notes.

The old notes are, and the new notes will be, guaranteed (subject to certain customary guarantee release provisions set forth in the indenture governing the notes), on a joint and several basis, by Reynolds Group Holdings Limited, or “RGHL,” Beverage Packaging Holdings (Luxembourg) I S.A., or “BP I,” and certain of BP I’s subsidiaries that, subject to certain exceptions, are borrowers under or guarantee the Senior Secured Credit Facilities (as defined herein) of RGHL, BP I and certain subsidiaries of BP I, which collectively we refer to as the “guarantors.” Each guarantor is 100% owned by RGHL. The registration statement, of which this prospectus forms a part, registers the guarantees as well as the notes. The notes and the related guarantees are senior obligations of the Issuers and the guarantors and are secured on a first lien priority basis by existing and future assets of certain of the guarantors, including RGHL and certain of its subsidiaries, as described in this prospectus. In the event of enforcement of the liens securing the notes, the proceeds thereof will be applied (subject to repaying certain agent and transfer fees and costs of enforcement) first to repay on a ratable basis the notes and other indebtedness secured on a first lien priority basis by those liens, including under BP I’s and its subsidiaries’ senior secured credit facilities. The priority of all liens securing the notes and the related guarantees is subject to certain exceptions and prior permitted liens.

See “Risk Factors” beginning on page 44 for a discussion of risk factors that you should consider prior to tendering your old notes in the exchange offer.

Each broker-dealer that receives new notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such new notes. The letter of transmittal states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of new notes received in exchange for the old notes where such old notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. The Issuers have agreed that, for a period of 180 days after the expiration date, they will make this prospectus available to any exchanging dealer or initial purchaser and for a period of 90 days after the expiration day to any broker-dealer for use in connection with any such resale. See “Plan of Distribution.”

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2012

Table of Contents

In relation to each Member State of the European Economic Area which has implemented the Prospectus Directive (each, a “Relevant Member State”), with effect from and including the date on which the Prospectus Directive is implemented in that Relevant Member State (the “Relevant Implementation Date”) there shall be no offer of notes to the public in that Relevant Member State prior to the publication of a prospectus in relation to the notes which has been approved by the competent authority in that Relevant Member State or, where appropriate, approved in another Relevant Member State and notified to the competent authority in that Relevant Member State, all in accordance with the Prospectus Directive, except that, with effect from and including the Relevant Implementation Date, an offer of notes may be made to the public in that Relevant Member State at any time:

| • | to any legal entity which is a qualified investor as defined in the Prospectus Directive; |

| • | to fewer than 100 or, if the Relevant Member State has implemented the relevant provision of the 2010 PD Amending Directive, 150, natural or legal persons (other than qualified investors as defined in the Prospectus Directive), as permitted under the Prospectus Directive subject to obtaining the prior consent of the representatives for any such offer; or |

| • | in any other circumstances which do not require the publication by the Issuers or any guarantor of a prospectus pursuant to Article 3(2) of the Prospectus Directive. |

For the purposes of this provision, (a) the expression an “offer of notes to the public” in relation to any of the notes in any Relevant Member State means the communication in any form and by any means of sufficient information on the terms of the offer and the notes to be offered so as to enable an investor to decide to purchase or subscribe for the notes, as the same may be varied in that Relevant Member State by any measure implementing the Prospectus Directive in that Relevant Member State, (b) the expression “Prospectus Directive” means Directive 2003/71/EC (and amendments thereto, including the 2010 PD Amending Directive, to the extent implemented in the Relevant Member State), and includes any relevant implementing measure in each Relevant Member State and (c) the expression “2010 PD Amending Directive” means Directive 2010/73/EU.

NOTICE TO CERTAIN NON-U.S. INVESTORS

Austria. The notes may be offered and sold in the Republic of Austria only in accordance with the provisions of Capital Markets Act (Kapitalmarktgesetz), the Banking Act (Bankwesengesetz), the Securities Supervision Act 2007 (Wertpapieraufsichtsgesetz 2007) of Austria and any other applicable Austrian law governing the offer and sale of the notes in the Republic of Austria. The notes have not been admitted for a public offer in Austria either under the provisions of the Capital Markets Act (Kapitalmarktgesetz), or the Investment Funds Act (Investmentfondsgesetz) or the Stock Exchange Act (Börsegesetz). Neither this document nor any other document in connection with the notes is a prospectus according to the Capital Markets Act (Kapitalmarktgesetz), the Stock Exchange Act (Börsegesetz) or the Investment Funds Act (Investmentfondsgesetz) and has therefore not been drawn up, audited, approved, pass-ported and/or published in accordance with the aforesaid acts. Consequently, the notes may not be, and are not being, offered, re-sold or otherwise transferred directly or indirectly by way of a public offering in the Republic of Austria. No steps may be taken that would constitute a public offer of the notes in Austria and the offer of the notes may not be advertised publicly in the Republic of Austria.

Brazil. The notes have not been, and will not be, registered with the Brazilian Securities Commission (Comissão de Valores Mobiliários), or the CVM. The notes may not be offered or sold in Brazil, except in circumstances that do not constitute a public offering or unauthorized distribution under Brazilian laws and regulations. The notes are not being offered into Brazil. Documents relating to the offering of the notes, as well as information contained therein, may not be supplied to the public in Brazil, nor be used in connection with any offer for subscription or sale of the notes to the public in Brazil.

Denmark. This prospectus does not constitute a prospectus under Danish law or regulations and has not been and will not be filed with or approved by the Danish Financial Supervisory Authority or any other regulatory

i

Table of Contents

authority in Denmark, and the notes have not been and are not intended to be listed on a Danish stock exchange or a Danish authorized market place. Furthermore, the notes have not been and will not be offered to the public in Denmark. Consequently, this prospectus may not be made available nor may the notes otherwise be marketed or offered for sale directly or indirectly in Denmark, except to qualified investors within the meaning of, or otherwise in compliance with an exemption set forth in, Executive Order No. 306 of April 28, 2005.

France. The notes have not been and will not be offered or sold, directly or indirectly, to the public in France (offre au public de titres financiers), and no offering or marketing materials relating to the notes must be made available or distributed in any way that would constitute, directly or indirectly, an offer to the public in France.

The notes may only be offered or sold in France to qualified investors (investisseurs qualifiés) and/or to a limited group of investors (cercle restreint d’investisseurs) as defined in and in accordance with articles L.411-1, L.411-2 and D.411-1 to D.411-3 of the French Code monétaire et financier and article 211-2 of the Règlement Général of the French financial market authority (Autorité des Marchés Financiers).

Prospective investors are informed that:

| • | this prospectus has not been submitted for clearance to the Autorité des Marchés Financiers; |

| • | in compliance with article D.411-1 of the French Code monétaire et financier, any investors subscribing for the notes should be acting for their own account; and |

| • | the direct and indirect distribution or sale to the public of the notes acquired by them may only be made in compliance with articles L.411-1, L.411-2, L.412-1 and L.621-8 of the French Code monétaire et financier. |

Germany. The notes may be offered and sold in the Federal Republic of Germany only in accordance with the provisions of the Securities Prospectus Act of the Federal Republic of Germany (Wertpapierprospektgesetz, WpPG) and any other applicable German law. This prospectus has not been and will not be filed with or approved by the German Financial Services Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht, BaFin) or any other regulatory authority in Germany, and the notes have not been and will not be admitted for public offering in Germany. Consequently, in Germany the notes will only be available to, and this prospectus and any other offering material in relation to the notes is directed only at, persons who are qualified investors (qualifizierte Anleger) within the meaning of Section 2 No. 6 of the Securities Prospectus Act. Any resale of the notes in Germany may only be made in accordance with the Securities Prospectus Act and other applicable German laws.

Hungary. The offering of the notes is not a public offering in Hungary. Therefore, no license has been or will be issued by the Hungarian Financial Supervisory Authority or any other authority for the public offering of the notes in Hungary. Any marketing, subsequent transfer or on-sale of the notes must be carried out in accordance with the private placement exemptions of the Capital Markets Act (Act CXX of 2001) and any other applicable Hungarian law.

Ireland. This document does not comprise a prospectus for the purposes of the Investment Funds, Companies and Miscellaneous Provisions Act 2005 of Ireland, the Prospectus (Directive 2003\71\EC) Regulations 2005 of Ireland or the Prospectus Rules issued by the Central Bank of Ireland in March 2006. No person may: (i) underwrite the issue of, or place, the notes, otherwise than in conformity with the provisions of the Irish Investment Intermediaries Act 1995 (as amended), including, without limitation, Sections 9 and 23 thereof and any codes of conduct rules made under Section 37 thereof, and the provisions of the Investor Compensation Act 1998; (ii) underwrite the issue of, or place, the notes, otherwise than in conformity with the provisions of the Irish Central Bank Acts 1942-2003 (as amended) and any codes of conduct rules made under Section 117(1) thereof; and (iii) underwrite the issue of, or place, or otherwise act in Ireland in respect of, the notes, otherwise than in conformity with the provisions of the Irish Market Abuse (Directive 2003/6/EC) Regulations 2005 and any rules issued by The Central Bank of Ireland pursuant thereto.

ii

Table of Contents

Italy. The offering of the notes has not been cleared by the Commissione Nazionale per la Società e la Borsa (“CONSOB”) (the Italian Securities Exchange Commission), pursuant to Italian securities legislation and, accordingly, in the Republic of Italy the notes may not be offered, sold or delivered, nor may copies of the prospectus or of any other document relating to the notes be distributed in the Republic of Italy, except:

| • | to professional investors (operatori qualificati), as defined in Article 31, second paragraph, of CONSOB Regulation No. 11522 of July 1, 1998 (“Regulation 11522”), as amended; or |

| • | in circumstances which are exempted from the rules on solicitation of investments pursuant to Article 100 of Legislative Decree No. 58 of February 24, 1998 (the “Financial Services Act”) and Article 33, first paragraph, of CONSOB Regulation No. 11971 of May 14, 1999, as amended; and |

provided, however, that any such offer, sale or delivery of notes or distribution of copies of this prospectus or any other document relating to the notes in the Republic of Italy is:

| • | made by an investment firm, bank or financial intermediary permitted to conduct such activities in the Republic of Italy in accordance with Legislative Decree No. 385 of September 1, 1993, the Financial Services Act, Regulation 11522 and any other applicable laws and regulations; and |

| • | in compliance with any and all other applicable laws and regulations. |

Grand Duchy of Luxembourg. The notes may not be offered or sold within the territory of the Grand Duchy of Luxembourg unless:

| • | a prospectus has been duly approved by the Commission de Surveillance du Secteur Financier in accordance with the Law of July 10, 2005 on prospectuses for securities as amended from time to time (the “Prospectus Law”) and implementing the Prospectus Directive, as amended by the Law of July 3, 2012 which has implemented in Luxembourg law the 2010 PD Amending Directive; or |

| • | if Luxembourg is not the home member State, the Commission de Surveillance du Secteur Financier has been notified by the competent authority in the home member state that the prospectus has been duly approved in accordance with the Prospectus Directive and the 2010 PD Amending Directive; or |

| • | the offer is made to “qualified investors” as described in points (1) to (4) of Section I of Annex II to Directive 2004/39/EC of the European Parliament and of the Council of April 21, 2004 on markets in financial instruments, and persons or entities who are, on request, treated as professional clients in accordance with Annex II to Directive 2004/39/EC, or recognized as eligible counterparties in accordance with Article 24 of Directive 2004/39/EC unless they have requested that they be treated as non-professional clients; or |

| • | the offer benefits from any other exemption to, or constitutes a transaction otherwise not subject to, the requirement to publish a prospectus. |

Spain. The notes may not be offered or sold in Spain except in accordance with the requirements of the Spanish Securities Market Law (Ley 24/1988, de 28 de julio, del Mercado de Valores), as amended and restated, and Royal Decree 1310/2005 (Real Decreto 1310/2005, de 4 de noviembre de 2005, en materia de admisión a negociación de valores en mercados secundarios oficiales, de ofertas públicas de venta o suscripción y del folleto exigible a tales efectos), as amended and restated, and the decrees and regulations made thereunder. The notes may not be sold, offered or distributed to persons in Spain except in circumstances which do not constitute an offer of securities in Spain within the meaning of the Spanish Securities Market Law and further relevant legislation. This prospectus has not been registered with the Spanish Securities Market Commission (Comisión Nacional del Mercado de Valores) and therefore it is not intended for the offering or sale of the notes in Spain.

Switzerland. The notes may be offered in Switzerland on the basis of a private placement and not as a public offering. The notes will neither be listed on the SIX Swiss Exchange or any other stock exchange or regulated trading facility in Switzerland, nor are they subject to Swiss Law. This prospectus does not constitute a prospectus within the meaning of Art. 1156 of the Swiss Federal Code of Obligations, Art. 27, et seq. of the Listing Rules of the SIX Swiss Exchange or the listing rules of any other stock exchange or regulated trading

iii

Table of Contents

facility in Switzerland, and does not comply with the Directive for notes of Foreign Borrowers of the Swiss Bankers Association. Neither this document nor any other offering or marketing material relating to the notes or this offering may be publicly distributed or otherwise made publicly available in Switzerland.

Neither this document nor any other offering or marketing material relating to the offering of the notes, the Issuers or the notes have been or will be registered with the Swiss Financial Market Supervisory Authority (FINMA) or any other Swiss authority for any purpose whatsoever.

United Kingdom. The notes may not be offered or sold and will not be offered or sold to any persons in the United Kingdom other than persons whose ordinary activities involve them in acquiring, holding, managing or disposing of investments (as principal or as agent) for the purposes of their businesses and in compliance with all applicable provisions of the Financial Services and Markets Act 2000 (“FSMA”) with respect to anything done in relation to the notes in, from or otherwise involving the United Kingdom.

In addition, no person may communicate or cause to be communicated an invitation or inducement to engage in investment activity (within the meaning of section 21 of FSMA) to persons who do not have professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act of 2000 (Financial Promotion) Order 2005 or in circumstances in which section 21 of FSMA does not apply to the Issuers or any guarantor. The offering of the notes has complied with and will comply with all applicable provisions of FSMA with respect to anything done in, from or otherwise involving the United Kingdom.

We operate in markets for which it is difficult to obtain precise and current industry and market information. All statements made in this prospectus regarding our position in the markets in which we operate, including market data, certain economics data and forecasts, were estimated or derived based upon assumptions we deem reasonable and from our own research, surveys or studies conducted by third parties, and other industry or general publications. There is no single third party source for any of our market shares or total market size. Industry publications and surveys generally state that they have obtained information from sources believed to be reliable. While we believe that each of these studies and publications is reliable, we have not independently verified data from third-party sources, nor have we ascertained the underlying economic assumptions relied upon therein. Similarly, we believe our internal research with respect to our markets is reliable, but it has not been verified by any independent sources. Historical data on the food and beverage packaging manufacturing market do not have a universally recognized authoritative source.

In addition, in many cases we have made statements in this prospectus regarding our markets and our position in such markets based on our experience and investigation of market conditions. None of our internal surveys or information has been verified by any independent sources.

As used in this prospectus, Combibloc®, CombifitTM, Combishape®, Diamond®, Evergreen Packaging®, Kordite®, Presto®, Reynolds®, Reynolds Wrap®, Hefty®, Hefty® Baggies®, Hefty® Cinch Sak®, Hefty® EZ Foil®, Hefty® Odor Block®, Hefty® OneZip®, Hefty® The Gripper®, Hefty® Zoo Pals®, Monosorb®, SurShot®, Escape®, G-Lite® and SlingShotTM are trademarks of our different businesses. This prospectus also refers to brand names, trademarks or service marks of other companies. All brand names and other trademarks or service marks cited in this prospectus are the property of their respective holders.

We have not authorized anyone to give you any information or to make any representations about the transactions we discuss in this prospectus other than those contained in this prospectus. If you are given any information or representation about these matters that is not discussed in this prospectus, you must not rely on that information. This prospectus is not an offer to sell or a solicitation of an offer to buy

iv

Table of Contents

securities anywhere or to anyone where or to whom we are not permitted to offer to sell securities under applicable law.

In making an investment decision, investors must rely on their own examination of our business and the terms of the offering, including the merits and risks involved. These securities have not been recommended by any federal or state securities commission or regulatory authority. Furthermore, the foregoing authorities have not confirmed the accuracy or determined the adequacy of this document. Any representation to the contrary is a criminal offense.

In connection with the exchange offer, we have filed with the Securities and Exchange Commission, or the “SEC,” a registration statement on Form F-4, under the Securities Act, relating to the new notes to be issued in the exchange offer. As permitted by SEC rules, this prospectus does not contain all the information included in the registration statement. For a more complete understanding of the exchange offer, you should refer to the registration statement, including its exhibits.

The public may read and copy any reports or other information that we file with the SEC. Such filings are available to the public over the Internet at the SEC’s website at http://www.sec.gov. The SEC’s Internet address is included in this prospectus as an inactive textual reference only. You may also read and copy any document that we file with the SEC at its public reference room at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the public reference room by calling the SEC at 1-800-SEC-0330. You may also obtain a copy of the registration statement relating to the exchange offer and other information that we file with the SEC at no cost by calling us or writing to us at the following address:

Reynolds Group Holdings Limited

Level Nine

148 Quay Street

Auckland 1010 New Zealand

Attention: Joseph Doyle

+1 (847) 482 2409

In order to obtain timely delivery of such materials, you must request documents from us no later than five business days before you must make your investment decision or at the latest by , 2013.

v

Table of Contents

vi

Table of Contents

This summary highlights selected information contained elsewhere in this prospectus. You should read this entire prospectus carefully, including “Summary — Presentation of Financial Information,” “Risk Factors,” “Special Note of Caution Regarding Forward-Looking Statements,” and “Operating and Financial Review and Prospects.”

In this prospectus, unless otherwise indicated or the context otherwise requires (a) references to “we,” “us” or “our” are to RGHL and its consolidated subsidiaries, (b) references to “Graham Packaging” are to Graham Packaging Company Inc. and, unless the context otherwise requires, its consolidated subsidiaries and (c) references to the “RGHL Group” are to RGHL and its consolidated subsidiaries. We describe the six segments that comprise the RGHL Group following the consummation of the Graham Packaging Acquisition ((i) our aseptic carton packaging segment, or “SIG,” (ii) our fresh carton packaging, liquid packaging board, carton board and freesheet segment, or “Evergreen,” (iii) our caps and closures segment, or “Closures,” (iv) our consumer products segment, or “Reynolds Consumer Products,” (v) our foodservice packaging segment, or “Pactiv Foodservice,” and (vi) our custom blow molded plastic container segment, or “Graham Packaging”) as if they were the RGHL Group’s segments for all historical periods described in this prospectus, unless otherwise indicated.

For a discussion of the terms used to describe our transactions (e.g. “November 2012 Refinancing Transactions,” “September 2012 Refinancing Transactions,” “February 2012 Refinancing Transactions,” “Graham Packaging Change of Control Offer,” “Graham Packaging Acquisition,” “Dopaco Acquisition,” “2011 Refinancing Transactions,” “Pactiv Acquisition,” “Reynolds Foodservice Acquisition,” “Evergreen Acquisition,” “RGHL Acquisition,” “SIG Acquisition” and “Initial Evergreen Acquisition”), refer to “The Transactions.”

For ease of reference, you may also refer to the “Glossary of Selected Terms” for many of the defined terms used in this prospectus. Certain other terms used herein have the meanings indicated within this prospectus.

Our Company

We are a leading global manufacturer and supplier of consumer, beverage and foodservice packaging products. We sell our products to customers globally, including to a diversified mix of leading multinational companies, large national and regional companies and small local businesses. We primarily serve the consumer food, beverage and foodservice market segments.

Our Segments

We operate through six segments: SIG, Evergreen, Closures, Reynolds Consumer Products, Pactiv Foodservice and Graham Packaging.

SIG Overview

SIG is a leading manufacturer of aseptic carton packaging systems for both beverage and liquid food products, ranging from juices and milk to soups and sauces. Aseptic carton packaging, most prevalent in Europe and Asia, is designed to allow beverages or liquid food to be stored for extended periods of time without refrigeration. SIG supplies complete aseptic carton packaging systems, which include aseptic filling machines, aseptic cartons, spouts, caps and closures and related services. SIG has a large global customer base with its largest presence in Europe.

Evergreen Overview

Evergreen is a vertically integrated, leading manufacturer of fresh carton packaging for beverage products, primarily serving the juice and milk end-markets. Fresh carton packaging, most predominant in North America, is designed for beverages that require a cold-chain distribution system, and therefore have a more limited shelf life

1

Table of Contents

than beverages in aseptic carton packaging. Evergreen supplies integrated fresh carton packaging systems, which can include fresh cartons, spouts and filling machines. Evergreen produces liquid packaging board for its internal requirements and to sell to other manufacturers. Evergreen also produces coated groundwood primarily for catalogs, inserts, magazine and commercial printing, as well as uncoated freesheet primarily for envelope, specialty and offset printing paper. Evergreen has a large customer base and operates primarily in North America.

Closures Overview

Closures is a leading manufacturer of plastic beverage caps and closures, primarily serving the carbonated soft drink, non-carbonated soft drink and bottled water segments of the global beverage market. Closures’ products also serve the liquid dairy, food, beer and liquor and automotive fluid markets. In addition to supplying plastic caps and closures, Closures also offers high speed rotary capping equipment, which secure caps on a variety of packaging, and related services. Closures has a large global customer base with its largest presence in North America.

Reynolds Consumer Products Overview

Reynolds Consumer Products is a leading manufacturer in the U.S. of branded and store branded consumer products such as aluminum foil, wraps, waste bags, food storage bags, and disposable tableware and cookware. These products are typically used by consumers in their homes and are sold through a variety of retailers, including grocery stores, mass-merchandisers, warehouse clubs, drug stores, discount chains and military channels. Reynolds Consumer Products has a large customer base and operates primarily in North America.

Pactiv Foodservice Overview

Pactiv Foodservice is a leading manufacturer of foodservice and food packaging products. Pactiv Foodservice offers a comprehensive range of products including tableware items, takeout service containers, clear rigid-display packaging, microwaveable containers, foam trays, dual-ovenable paperboard containers, cups, molded fiber egg cartons, meat and poultry trays, plastic film and aluminum containers. Pactiv Foodservice distributes its foodservice and food packaging products through foodservice distributors, food processors, supermarket distributors, supermarkets and restaurants. Pactiv Foodservice has a large customer base and operates primarily in North America.

Graham Packaging Overview

Graham Packaging, including the operations and activities of Graham Packaging Holdings Company, or “Graham Holdings,” is a worldwide leader in the design, manufacture and sale of value-added, custom blow molded plastic containers for branded consumer products. Based on our analysis of industry data, we believe that Graham Packaging has the number one market share positions in North America for hot-fill juices, sports drinks/isotonics, yogurt drinks, liquid fabric care, dish detergents, motor oil and certain other products measured by volume. Graham Packaging operates in product categories where customers and end-users value the technology and innovation that Graham Packaging’s custom plastic containers offer as an alternative to traditional packaging materials such as glass, metal and paperboard. Graham Packaging has a large global customer base with its largest presence in North America.

Risk Factors

Our ability to successfully operate our business is subject to certain risks, including those that are generally associated with operating in the packaging industry. These risks include, but are not limited to, the following:

| • | risks related to acquisitions, including completed and future acquisitions, such as the risks that we may be unable to complete an acquisition in the timeframe anticipated, on its original terms, or at all, or that we may not be able to achieve some or all of the benefits that we expect to achieve from such acquisitions, including risks related to integration of our acquired businesses; |

2

Table of Contents

| • | risks related to the future costs of energy, raw materials and freight; |

| • | risks related to our substantial indebtedness and our ability to service our current and future indebtedness; |

| • | risks related to our hedging activities, which may result in significant losses and in period-to-period earnings volatility; |

| • | risks related to our suppliers of raw materials and any interruption in our supply of raw materials; |

| • | risks related to downturns in our target markets; |

| • | risks related to increases in interest rates, which would increase the cost of servicing our debt; |

| • | risks related to dependence on the protection of our intellectual property and the development of new products; |

| • | risks related to exchange rate fluctuations; |

| • | risks related to the consolidation of our customer bases, competition and pricing pressure; |

| • | risks related to the impact of a loss of one of our key manufacturing facilities; |

| • | risks related to our exposure to environmental liabilities and potential changes in legislation or regulation; |

| • | risks related to complying with environmental, health and safety laws or as a result of satisfying any liability or obligation imposed under such laws; |

| • | risks related to changes in consumer lifestyle, eating habits, nutritional preferences and health-related and environmental concerns that may harm our business and financial performance; |

| • | risks related to restrictive covenants in the notes and our other indebtedness, which could adversely affect our business by limiting our operating and strategic flexibility; |

| • | risks related to our dependence on key management and other highly skilled personnel; |

| • | risks related to our pension plans; and |

| • | risks related to other factors discussed or referred to in this prospectus, including in the section titled “Risk Factors.” |

We operate in a very competitive and rapidly changing environment. Investing in the notes involves substantial risk. You should consider carefully all of the information in this prospectus and, in particular, you should evaluate the specific risk factors set forth in the “Risk Factors” section of this prospectus in evaluating the exchange offer and making a decision whether to invest in the new notes.

Our Strategic Owner

We are part of a group of private companies based in New Zealand that are wholly-owned by Mr. Graeme Hart, our strategic owner.

Between January 31, 2007 and August 1, 2007, entities beneficially owned by Mr. Graeme Hart acquired the businesses that now constitute our Evergreen segment in a series of transactions for $618 million. On May 4, 2010, we acquired the equity of the businesses that now constitute our Evergreen segment from these entities for a total purchase price of $1,612 million. The purchase price was paid to entities controlled by Mr. Graeme Hart.

Through a series of acquisitions that occurred from February 29, 2008 to July 31, 2008, certain entities beneficially owned by Mr. Graeme Hart acquired from Alcoa Inc. the businesses that now constitute our Closures segment, our Reynolds consumer products business and our Reynolds foodservice packaging business for a total purchase price of $2.7 billion.

3

Table of Contents

On November 5, 2009, we acquired the equity of the businesses that now constitute our Closures segment for a total purchase price of $708 million and our Reynolds consumer products business for a total purchase price of $984 million from these entities. The purchase price was paid to entities controlled by Mr. Graeme Hart.

On September 1, 2010, we acquired the equity of the businesses that now constitute our Reynolds foodservice packaging business from these entities for a total purchase price of $342 million. The purchase price was paid to entities controlled by Mr. Graeme Hart.

In each case, the difference between the consideration paid to initially acquire a business from a third-party and the consideration paid by the RGHL Group to acquire the same business from entities that are beneficially owned by Mr. Graeme Hart reflects changes in fair value. The changes in fair value of the net assets acquired plus debt issued from the original purchase price relate to indebtedness assumed as well as changes in the underlying value of the equity of the business. The change in the underlying value of the business relates to the realization of the cost savings initiatives and operational synergies combined with improvements in industry and general market conditions. Cash payments made by us to acquire these businesses either reduced our available cash or were funded by increases in the principal amount of our outstanding indebtedness.

RGHL

Reynolds Group Holdings Limited was incorporated under the Companies Act 1993 of New Zealand on May 30, 2006. Its registered office is located at Level Nine, 148 Quay Street, Auckland 1010 New Zealand, and its telephone number is +1 (847) 482 2409.

The Issuers

US Issuer is a corporation, incorporated under the laws of the State of Delaware, United States, on September 29, 2009 as an indirect special purpose finance subsidiary of RGHL to facilitate the offering of the notes and the Existing Notes. Other than its financing activities as a co-issuer of the notes and the Existing Notes, and guaranteeing the Senior Secured Credit Facilities and the 2007 Notes, US Issuer has no material assets, operations or revenue. Accordingly, we have not included any financial statements or other information about the US Issuer. Its registered office is located at 160 Greentree Drive, Suite 101, Dover, Delaware 19904, and its telephone number is (804) 281-2630.

US Co-Issuer is a limited liability company formed under the laws of the State of Delaware, United States, on September 17, 2009 as an indirect special purpose finance subsidiary of RGHL to facilitate the offering of the notes and the Existing Notes. Other than its financing activities as a co-issuer of the notes and the Existing Notes, and guaranteeing the Senior Secured Credit Facilities and the 2007 Notes, US Co-Issuer has no material assets (other than certain intercompany loans), operations or revenue. Accordingly, we have not included any financial statements or other information about the US Co-Issuer. Its registered office is located at 160 Greentree Drive, Suite 101, Dover, Delaware 19904, and its telephone number is (804) 281-2630.

Lux Issuer is a public limited liability company (société anonyme), formed under the laws of Luxembourg on September 24, 2009 as an indirect special purpose finance subsidiary of RGHL to facilitate the offering of the notes and the Existing Notes. Other than its financing activities as a co-issuer of the notes and the Existing Notes, and guaranteeing the Senior Secured Credit Facilities and the 2007 Notes, Lux Issuer has no material assets (other than certain intercompany loans), operations or revenue. Accordingly, we have not included any financial statements or other information about the Lux Issuer. Its registered office is located at 6C Rue Gabriel Lippmann, L-5365 Munsbach, Grand Duchy of Luxembourg, and its telephone number is +352-26-258-8883.

4

Table of Contents

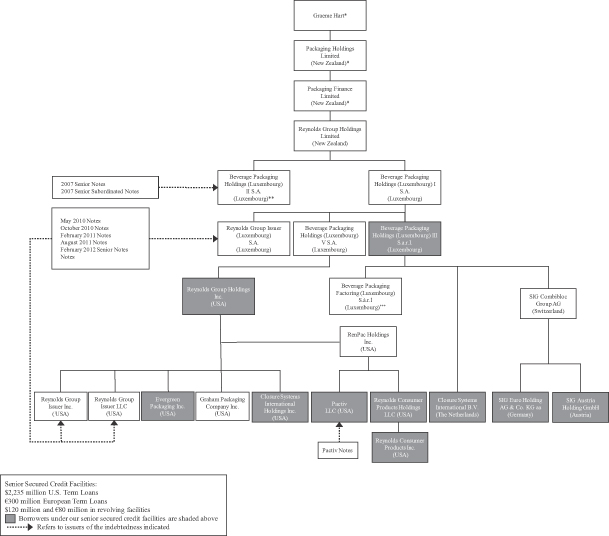

Corporate Structure

RGHL is a holding company that conducts its business operations through its controlled entities. The following diagram provides a simplified overview of our corporate structure. For a detailed list of RGHL’s controlled entities (including the guarantors of the notes), their country of incorporation and the proportion of ownership and voting interest held, directly or indirectly, in them by RGHL, refer to Annex A to this prospectus. Unless indicated below, all depicted entities are issuers or guarantors of the notes.

The following diagram sets forth a summary of our corporate structure and certain financing arrangements.

The (i) 8.0% senior notes due 2016 issued by Beverage Packaging Holdings (Luxembourg) II S.A., or “BP II,” or the “2007 Senior Notes,” the 9.5% senior subordinated notes due 2017 issued by BP II, or the “2007 Senior Subordinated Notes,” which together with the 2007 Senior Notes, we refer to as the “2007 Notes,” (ii) the 8.135% Debentures due 2017, the 6.400% Notes due 2018, the 7.950% Debentures due 2025 and the 8.375% Debentures due 2027, each issued by Pactiv, which collectively we refer to as the “Pactiv Notes,” and (iii) (a) the 8.500% senior notes due 2018, or the “May 2010 Notes,” (b) the 7.125% senior secured notes due 2019, or the “October 2010 Senior Secured Notes” and the 9.000% senior notes due 2019, or the “October 2010 Senior Notes,” which together with the October 2010 Senior Secured Notes, we refer to as the “October 2010 Notes,” (c) the 6.875% senior secured notes due 2021, or the “February 2011 Senior Secured Notes,” and the 8.250% senior notes due 2021, or the “February 2011 Senior Notes,” which together with the February 2011 Senior Secured Notes, we refer to as the “February 2011 Notes,” (d) the 7.875% senior secured notes due 2019, or the “August 2011 Senior Secured Notes” and the 9.875% senior notes due 2019 (originally issued on August 9, 2011), or the “August 2011 Senior Notes,” which together with the August 2011 Senior Secured Notes, we refer to as the “August 2011 Notes,” and (e) the 9.875% senior notes due 2019 (originally issued on February 15, 2012), or the “February 2012 Senior Notes” each issued by the Issuers are not part of and are not being registered in connection with this offering. We refer to the October 2010 Senior Secured Notes, the February 2011 Senior Secured Notes and the August 2011 Senior Secured Notes collectively as the “Existing Senior Secured Notes.” We refer to the May 2010 Notes, the October 2010 Senior Notes, the February 2011 Senior Notes, the August 2011 Senior Notes and the February 2012 Senior Notes collectively as the “Existing Senior Notes.” We refer to the Existing Senior Secured Notes and the Existing Senior Notes collectively as the “Existing Notes.”

5

Table of Contents

For a summary of the debt obligations referenced in this diagram, see “Description of Certain Other Indebtedness and Intercreditor Agreements” and “Description of the Senior Secured Notes.”

| * | Does not guarantee the notes, the Existing Notes, the 2007 Notes or the Senior Secured Credit Facilities. |

| ** | Does not guarantee the notes, the Existing Notes or the Senior Secured Credit Facilities. |

| *** | Does not guarantee the notes, the Existing Notes, the 2007 Notes or the Senior Secured Credit Facilities. Borrower under the Securitization Facility. The assets of this entity secure the Securitization Facility. |

6

Table of Contents

Summary of the Terms of the Exchange Offer

The old notes were issued in private placement offerings made only to qualified institutional buyers pursuant to Rule 144A under the Securities Act, or “Rule 144A,” and to persons outside the United States pursuant to Regulation S under the Securities Act, or “Regulation S,” and accordingly were exempt from registration under the Securities Act. See “The Exchange Offer.”

| Notes Offered |

$3,250,000,000 aggregate principal amount of new 5.750% Senior Secured Notes due 2020, which have been registered under the Securities Act. |

| We refer to (i) the outstanding 5.750% Senior Secured Notes due 2020 as the “old notes”, (ii) the notes registered pursuant to this exchange offer as the “new notes” and (iii) the old notes and the new notes as the “notes.” |

| The terms of the new notes are identical in all material respects to the terms of the old notes, except that the new notes are registered under the Securities Act and will not be subject to restrictions on transfer or provisions relating to additional interest, will bear a different CUSIP and ISIN number than the old notes, will not entitle their holders to registration rights and will be subject to terms relating to book-entry procedures and administrative terms relating to transfers that differ from those of the old notes. |

| The Exchange Offer |

You may exchange old notes and the related guarantees for a like principal amount of new notes and the related guarantees. |

| Resale of New Notes |

Based on interpretations by the staff of the SEC as set forth in no-action letters issued to third parties (including Exxon Capital Holdings Corporation (available May 13, 1988), Morgan Stanley & Co. Incorporated (available June 5, 1991), K-111 Communications Corporation (available May 14, 1993) and Shearman & Sterling (available July 2, 1993)), we believe that the new notes issued pursuant to the exchange offer may be offered for resale, resold and otherwise transferred by any holder of such new notes, other than any such holder that is a broker-dealer or an “affiliate” of us within the meaning of Rule 405 under the Securities Act, without compliance with the registration and prospectus delivery requirements of the Securities Act, provided that: |

| • | such new notes are acquired in the ordinary course of business; |

| • | at the time of the commencement of the exchange offer such holder has no arrangement or understanding with any person to participate in a distribution of such new notes; and |

| • | such holder is not engaged in and does not intend to engage in a distribution of such new notes. |

| By tendering old notes as described in “The Exchange Offer — Procedures for Tendering,” you will be making representations to this effect. If you fail to satisfy any of these conditions, you cannot rely on the position of the SEC set forth in the interpretive letters referred to above and you must comply with the registration and prospectus |

7

Table of Contents

| delivery requirements of the Securities Act in connection with a resale of the new notes. You should read the discussion under the heading “The Exchange Offer” for further information regarding the exchange offer and resale of the new notes. |

| Registration Rights Agreement |

We have undertaken the exchange offer pursuant to the terms of the registration rights agreement that the Issuers entered into with the initial purchasers of the old notes. See “The Exchange Offer — Purpose of the Exchange Offer.” |

| Consequences of Failure to Exchange the Old Notes |

You will continue to hold old notes that remain subject to their existing transfer restrictions if: |

| • | you do not tender your old notes; or |

| • | you tender your old notes and they are not accepted for exchange. |

| With some limited exceptions, we will have no obligation to register the old notes after we consummate the exchange offer. See “The Exchange Offer — Terms of the Exchange Offer” and “The Exchange Offer — Consequences of Failure to Exchange.” |

| Expiration Date |

The exchange offer will expire at 5:00 p.m., New York City time, on , 2013, unless we extend it, in which case “expiration date” means the latest date and time to which the exchange offer is extended. |

| Interest on the New Notes |

The new notes will accrue interest from the last interest payment date on which interest was paid on the old notes or, if no interest has been paid on the old notes, from the date of original issue of the old notes. |

| Conditions to the Exchange Offer |

The exchange offer is subject to several customary conditions. We will not be required to accept for exchange, or to issue new notes in exchange for, any old notes, and we may terminate or amend the exchange offer, if we determine at any time before the expiration date that the exchange offer would violate applicable law, any applicable interpretation of the SEC or its staff or any order of any governmental agency or court of competent jurisdiction. The foregoing conditions are for our sole benefit and, except those conditions related to the receipt of government regulatory approvals necessary to consummate the exchange offer, will be satisfied or waived by us at or before the expiration of the exchange offer. In addition, we will not accept for exchange any old notes tendered, and no new notes will be issued in exchange for any such old notes, if at any time any stop order is threatened or in effect with respect to: |

| • | the registration statement of which this prospectus constitutes a part; or |

| • | the qualification of the indenture governing the notes under the Trust Indenture Act of 1939, as amended, which we refer to as the “Trust Indenture Act.” |

| See “The Exchange Offer — Conditions.” We reserve the right to terminate or amend the exchange offer at any time prior to the expiration date upon the occurrence of any of the foregoing events. |

8

Table of Contents

| If we amend the exchange offer in a manner that we determine to constitute a material change, including the waiver of a material condition, we will promptly disclose the amendment in a manner reasonably calculated to inform the holders of outstanding notes of that amendment and we will extend the exchange offer if necessary so that at least five business days remain in the offer following notice of the material change. |

| Procedures for Tendering Old Notes |

If you wish to participate in the exchange offer, you must submit required documentation and effect a tender of old notes pursuant to the procedures for book-entry transfer (or other applicable procedures), all in accordance with the instructions described in this prospectus and in the relevant letter of transmittal or electronic acceptance instruction. See “The Exchange Offer — Procedures for Tendering.” |

| Guaranteed Delivery Procedures |

None. |

| Withdrawal Rights |

Tenders of old notes may be withdrawn at any time prior to 5:00 p.m., New York City time, on the expiration date. To withdraw a tender of old notes, a notice of withdrawal must be received by the exchange agent at its address set forth in “The Exchange Offer — Exchange Agent” prior to the expiration date. See “The Exchange Offer — Withdrawal of Tenders.” |

| Acceptance of Old Notes and Delivery of New Notes |

Except in some circumstances, any and all old notes that are validly tendered in the exchange offer prior to 5:00 p.m., New York City time, on the expiration date will be accepted for exchange. The new notes issued pursuant to the exchange offer will be delivered promptly after such acceptance. We reserve the absolute right to reject any and all old notes not properly tendered or any old notes which, if accepted, would, in the opinion of counsel for us, be unlawful. See “The Exchange Offer — Terms of the Exchange Offer” and “The Exchange Offer — Acceptance of Old Notes for Exchange; Delivery of New Notes.” |

| Certain U.S. Federal Tax Considerations |

We believe that the exchange of the old notes for the new notes will not constitute a taxable exchange for U.S. federal income tax purposes. See “Tax Considerations — United States Federal Income Tax Considerations.” |

| Exchange Agent |

The Bank of New York Mellon is serving as the exchange agent for the notes. |

9

Table of Contents

Summary of the Terms of the New Notes

The terms of the new notes are identical in all material respects to the terms of the old notes, except that the new notes:

| • | are registered under the Securities Act and therefore will not be subject to restrictions on transfer; |

| • | will not be subject to provisions relating to additional interest; |

| • | will bear a different CUSIP and ISIN number than the old notes; |

| • | will not entitle their holders to registration rights; and |

| • | will be subject to terms relating to book-entry procedures and administrative terms relating to transfers that differ from those of the old notes. |

| Issuers |

The new notes will be the joint and several obligations of Reynolds Group Issuer Inc., Reynolds Group Issuer LLC and Reynolds Group Issuer (Luxembourg) S.A. |

| Maturity Date |

The new notes will mature on the same date as the old notes. |

| Interest Rates and Payment Dates |

The new notes will bear interest accruing at the same coupon rate and payable at the same times as the old notes. |

| Guarantees |

The old notes are and the new notes will be guaranteed (subject to certain customary guarantee release provisions set forth in the indenture governing the notes) on a senior and joint and several basis by RGHL, BP I and, subject to certain conditions and exceptions, by certain subsidiaries of BP I that are or will be borrowers under or guarantee or will guarantee the Senior Secured Credit Facilities. Non-U.S. subsidiaries of our U.S. subsidiaries do not and will not guarantee the notes. Each guarantor is 100% owned by RGHL. See “Description of the Senior Secured Notes — Senior Secured Note Guarantees,” and “Description of the Senior Secured Notes — Certain Covenants — Future Senior Secured Note Guarantors.” The laws of certain jurisdictions may limit the enforceability of certain guarantees and security with respect to the new notes. See “Risk Factors — Risks Related to Our Structure, the Guarantees, the Collateral and the Notes” and “Certain Insolvency and Other Local Law Considerations.” |

| We refer to our senior secured credit facilities, which, as of September 30, 2012, consist of $2,235 million in senior secured term loans, €300 million in senior secured term loans, and a $120 million and €80 million senior secured revolving credit facility, as the “Senior Secured Credit Facilities.” |

| Ranking |

The notes are senior secured obligations of the Issuers and: |

| • | are effectively senior to all existing and future unsecured indebtedness of the Issuers to the extent of the value of the collateral securing the notes; |

| • | rank pari passu in right of payment with all existing and future senior indebtedness of the Issuers, including indebtedness under, or in respect to their guarantees of, the Existing Notes and the Senior Secured Credit Facilities; |

10

Table of Contents

| • | are effectively subordinated to First Lien Obligations of the Issuers (as defined in “Description of the Senior Secured Notes — Certain Definitions”), including amounts outstanding under the Senior Secured Credit Facilities, to the extent such First Lien Obligations are secured by property that does not also secure the notes to the extent of the value of all such property; |

| • | are senior in right of payment to all existing and future subordinated indebtedness of the Issuers, including the Issuers’ respective guarantees of the 2007 Senior Notes and the 2007 Senior Subordinated Notes; and |

| • | are effectively subordinated to all claims of creditors, including trade creditors, and claims of preferred stockholders (if any) of each of the subsidiaries of RGHL (including BP II) that is not a guarantor. |

| The guarantees related to the notes are senior obligations of each guarantor and: |

| • | are effectively senior to all existing and future unsecured indebtedness of the guarantors that have provided security interests in respect of their assets to the extent of the value of the collateral securing the notes; |

| • | rank pari passu in right of payment with all existing and future senior indebtedness of such guarantor, including indebtedness under, or in respect of its guarantee of, the Existing Notes and the Senior Secured Credit Facilities; |

| • | are effectively subordinated to the other First Lien Obligations (as defined in “Description of the Senior Secured Notes — Certain Definitions”) of such guarantor, including indebtedness of such guarantor under, or with respect to its guarantee of, the Senior Secured Credit Facilities, to the extent such First Lien Obligations are secured by property that does not also secure the notes to the extent of the value of all such property; and |

| • | are senior in right of payment to all existing or future subordinated indebtedness of such guarantor, including such guarantor’s guarantee of the 2007 Senior Notes and the 2007 Senior Subordinated Notes. |

| As of September 30, 2012, the RGHL Group had: |

| • | $12,006 million aggregate principal amount of outstanding indebtedness secured by any lien; |

| • | $10,842 million aggregate principal amount of outstanding indebtedness that share a pari passu lien in the collateral with the notes (excluding letters of credit which have been issued, but not drawn upon). The RGHL Group has €65 million and $42 million of availability under the revolving credit facility under the Senior Secured Credit Facilities and the ability to incur up to €77 million of secured indebtedness under certain local facilities; and |

| • | $18,006 million of unsubordinated indebtedness, whether secured or unsecured, consisting of amounts outstanding under the Senior Secured Credit Facilities, the notes (including the guarantees with |

11

Table of Contents

| respect thereto), the Existing Notes, the 2007 Senior Notes (but not including the guarantees with respect thereto), the outstanding Pactiv Notes and debentures, certain local working capital facilities, certain other local overdrafts, derivative liabilities and finance leases. |

| The notes and the related guarantees constitute “Senior Indebtedness” (as defined in “Description of the Senior Secured Notes — Certain Definitions”) for purposes of the indenture governing the 2007 Senior Subordinated Notes and, as such, in a liquidation, dissolution or bankruptcy of the Issuers or the note guarantors, holders of the notes and related guarantees will be entitled to receive payment in full of such notes and related guarantees before holders of the guarantees of the 2007 Senior Subordinated Notes are entitled to receive any payment, other than certain permitted junior securities, in respect of such guarantees. |

| As of September 30, 2012, on a pro forma basis after giving effect to the finalization of the September 2012 Refinancing Transactions and the November 2012 Refinancing Transactions, the RGHL Combined Group would have had: |

| • | $2,235 million and €300 million of indebtedness outstanding under the Senior Secured Credit Facilities; |

| • | an assumed $600 million of indebtedness under the Securitization Facility (as defined in “The Transactions”); |

| • | utilized $5 million of indebtedness under Local Facilities (as defined in “Description of the Senior Secured Notes”); |

| • | $4,000 million of indebtedness outstanding under the Existing Senior Secured Notes; |

| • | $5,750 million of indebtedness outstanding under the Existing Senior Notes; |

| • | $3,250 million of indebtedness outstanding under the notes; |

| • | €480 million of indebtedness outstanding under the 2007 Senior Notes; |

| • | €420 million of indebtedness outstanding under the 2007 Senior Subordinated Notes; and |

| • | $792 million of indebtedness outstanding under Pactiv’s notes and debentures. |

| Security |

Subject to the terms of the security documents, the notes and the related guarantees are secured by a security interest granted on a first priority basis (subject to certain exceptions and to permitted liens) in certain assets of RGHL, BP I and certain of BP I’s subsidiaries. These security interests are, subject to certain exceptions, of equal priority with the liens on such assets securing the Senior Secured Credit Facilities, the Existing Senior Secured Notes and other future first lien obligations. BP II has also granted a second and third priority security interest in respect of the proceeds loans in relation to the 2007 Notes. |

12

Table of Contents

| The collateral consists of substantially all of the assets of the Issuers and the guarantors, including their capital stock and the capital stock of their direct subsidiaries, real property, bank accounts, investments, receivables, equipment and inventory, intellectual property and insurance policies, but excluding, among others (i) real property with a value equal to or less than €5 million or in which such entity only has a leasehold interest, (ii) a number of Pactiv’s real properties, which are estimated to have a book value as of September 30, 2012 of approximately $68 million, (iii) intellectual property with a value of less than €1 million (unless subject to all-asset security documents), (iv) insurance policies that are not material to the RGHL Group as a whole, (v) equity of inactive subsidiaries with a book value of less than $100,000 and (vi) equity of subsidiaries that are not guarantors, are organized in jurisdictions in which no guarantor is organized and have (a) gross assets below 1.0% of the consolidated total assets of the RGHL Group and (b) EBITDA below 1.0% of the consolidated EBITDA of the RGHL Group. |

| The pledge of the securities of any first tier non-U.S. subsidiaries of our U.S. subsidiaries is also limited to 100% of their non-voting capital stock and 65% of their voting capital stock. “First-tier non-U.S. subsidiaries” refers to the subsidiaries of RGHL that are domiciled outside the United States that are directly owned by subsidiaries of RGHL that are domiciled in the United States. The notes and the Existing Senior Secured Notes are not secured by a pledge of (i) any of the assets of the non-U.S. subsidiaries of our U.S. subsidiaries or (ii) the capital stock of non-U.S. subsidiaries of our U.S. subsidiaries (other than first tier non-U.S. subsidiaries). In addition, the notes and the Existing Senior Secured Notes are not secured by any “principal manufacturing properties” (as defined in the Pactiv indentures). |

| Liens on assets are also limited to the extent deemed necessary to comply with legal limitations, avoid significant tax disadvantages, comply with certain third-party arrangements, satisfy fiduciary duties of directors and minimize fees, taxes and duties. Liens over assets are also not granted to the extent the granting of such lien would have a material adverse effect on the ability of the relevant Issuer or guarantor to conduct business in the ordinary course. |