UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Year Ended December 31, 2014

OR

|

¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 000-51531

SUNESIS PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

94-3295878 |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification Number) |

395 Oyster Point Boulevard, Suite 400

South San Francisco, California 94080

(Address of principal executive offices, including zip code)

(650) 266-3500

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class: |

|

Name of Each Exchange on Which Registered: |

|

Common Stock, par value $0.0001 per share |

|

The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer |

|

¨ |

|

Accelerated filer |

|

x |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

¨ (Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2.) Yes ¨ No x

The aggregate market value of common stock held by non-affiliates of the registrant, based on the closing sales price for such stock on June 30, 2014, as reported by The Nasdaq Stock Market, was $263,889,528. The calculation of the aggregate market value of voting and non-voting stock excludes 19,847,977 shares of the registrant’s common stock held by current executive officers, directors and stockholders that the registrant has concluded are affiliates of the registrant. Exclusion of such shares should not be construed to indicate that any such person possesses the power, direct or indirect, to direct or cause the direction of the management or policies of the registrant or that such person is controlled by or under common control with the registrant.

The total number of shares outstanding of the registrant’s common stock, $0.0001 par value per share, as of February 27, 2015, was 67,739,771.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Definitive Proxy Statement, to be filed with the Securities and Exchange Commission pursuant to Regulation 14A in connection with the 2015 Annual Meeting of Stockholders of Sunesis Pharmaceuticals, Inc. (hereinafter referred to as “Proxy Statement”) are incorporated by reference in Part III of this report. Such Proxy Statement will be filed with the Securities and Exchange Commission not later than 120 days after the conclusion of the registrant’s year ended December 31, 2014.

SUNESIS PHARMACEUTICALS, INC.

TABLE OF CONTENTS

|

|

|

|

|

Page No. |

|

|

|

|

|

|

|

ITEM 1. |

|

|

3 |

|

|

ITEM 1A. |

|

|

21 |

|

|

ITEM 1B. |

|

|

34 |

|

|

ITEM 2. |

|

|

34 |

|

|

ITEM 3. |

|

|

34 |

|

|

ITEM 4. |

|

|

34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ITEM 5. |

|

|

35 |

|

|

ITEM 6. |

|

|

37 |

|

|

ITEM 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

38 |

|

ITEM 7A. |

|

|

46 |

|

|

ITEM 8. |

|

|

48 |

|

|

ITEM 9. |

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

|

69 |

|

ITEM 9A. |

|

|

69 |

|

|

ITEM 9B. |

|

|

71 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ITEM 10. |

|

|

72 |

|

|

ITEM 11. |

|

|

72 |

|

|

ITEM 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

72 |

|

ITEM 13. |

|

Certain Relationships and Related Transactions, and Director Independence |

|

73 |

|

ITEM 14. |

|

|

73 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ITEM 15. |

|

|

74 |

|

|

|

|

|

75 |

|

|

|

|

|

76 |

2

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report, including the information we incorporate by reference, contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and the Private Securities Litigation Reform Act of 1995, which involve risks, uncertainties and assumptions. All statements, other than statements of historical facts, are “forward-looking statements” for purposes of these provisions, including without limitation any statements relating to our strategy, including regulatory plans to file a marketing authorization application with the European Medicines Agency, our preliminary analysis, assessment and conclusions of the results of the VALOR trail, and the commercial potential of vosaroxin, presenting clinical data and initiating clinical trials, our future research and development activities, including clinical testing and the costs and timing thereof, sufficiency of our cash resources, our ability to raise additional funding when needed, any statements concerning anticipated regulatory activities or licensing or collaborative arrangements, our research and development and other expenses, our operations and legal risks, and any statement of assumptions underlying any of the foregoing. In some cases, forward-looking statements can be identified by the use of terminology such as “anticipates,” “believe,” “continue,” “could,” “estimates,” “expects,” “intend,” “look forward,” “may,” “seeks,” “plans,” “potential,” or “will” or the negative thereof or other comparable terminology. Although we believe that the expectations reflected in the forward-looking statements contained herein are reasonable, there can be no assurance that such expectations or any of the forward-looking statements will prove to be correct, and actual results could differ materially from those projected or assumed in the forward-looking statements. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of many factors, including but not limited to those set forth under “Risk Factors,” and elsewhere in this report. We urge you not to place undue reliance on these forward-looking statements, which speak only as of the date of this report. All forward-looking statements included in this report are based on information available to us on the date of this report, and we assume no obligation to update any forward-looking statements contained in this report.

In this report, “Sunesis,” the “Company,” “we,” “us,” and “our” refer to Sunesis Pharmaceuticals, Inc. and its wholly-owned subsidiaries, except where it is made clear that the term refers only to the parent company.

General

We are a biopharmaceutical company focused on the development and commercialization of our pipeline of new oncology therapeutics for the potential treatment of solid and hematologic cancers. Our most advanced program is QINPREZOTM (vosaroxin), our product candidate for the potential treatment of acute myeloid leukemia, or AML. Vosaroxin is an anticancer quinolone derivative, or AQD—a class of compounds that has not been used previously for the treatment of cancer. We have built a highly experienced cancer drug development organization committed to advancing vosaroxin in multiple indications to improve the lives of people with cancer.

In October 2014, we announced the results of a Phase 3, multi-national, randomized, double-blind, placebo-controlled trial of vosaroxin in combination with cytarabine in patients with relapsed or refractory AML, or the VALOR trial. The VALOR trial, which enrolled 711 adult patients, was designed to evaluate the effect of vosaroxin in combination with cytarabine, a widely used chemotherapy in AML, on overall survival as compared to placebo in combination with cytarabine, and was conducted at 124 study sites in the U.S., Canada, Europe, South Korea, Australia and New Zealand. Patients treated with vosaroxin achieved increased overall survival compared to those treated with placebo (7.5 months vs 6.1 months, HR=0.87), the primary endpoint, but this difference did not achieve statistical significance (p=0.06). The complete remission (CR) rate, the sole secondary efficacy endpoint in the trial, did demonstrate a significant difference for the vosaroxin combination arm (30.1% vs 16.3%, p < 0.0001). Detailed results of the VALOR trial were presented in the "Late Breaking Abstracts" session of the American Society of Hematology (ASH) Annual Meeting in December 2014 and are summarized in the “Vosaroxin Clinical Trials in AML” section below.

Based on the results of the VALOR trial, we have submitted a letter of intent to the European Medicines Agency, or EMA, describing our intention to file a marketing authorization application, or MAA, for marketing authorization of vosaroxin plus cytarabine for the treatment of relapsed or refractory AML. We plan to meet with European regulatory authorities in preparation for an MAA filing in the second half of 2015.We are also currently engaged in discussions with the U.S. Food and Drug Administration, or FDA, to determine a potential regulatory path forward in the United States.

In the second half of 2013, we announced the initiation of three Phase 1/2 investigator-sponsored trials of vosaroxin, either as a standalone therapy or in combination with approved compounds, in various indications of AML and high-risk myelodysplastic syndrome, or MDS. The trials are being conducted at the University of Texas MD Anderson Cancer Center, or MDACC, Weill Cornell Medical College and New York-Presbyterian Hospital, and the Washington University School of Medicine.

3

In December 2014, updated results from the ongoing Phase 1b/2 MDACC-sponsored trial of vosaroxin in combination with decitabine in older patients with previously untreated AML and high-risk MDS were presented at the ASH Annual Meeting. This trial is expected to enroll up to a combined total of approximately 70 patients.

We own worldwide development and commercialization rights to vosaroxin. In 2009, vosaroxin received orphan drug designation for the treatment of AML from the FDA and in 2012, the European Commission granted orphan drug designation to vosaroxin for the treatment of AML, which may provide for 10 years of marketing exclusivity in all member countries of the European Union following a product approval for this indication in Europe. In 2011, the FDA granted fast track designation to vosaroxin for the potential treatment of relapsed or refractory AML in combination with cytarabine. We have been granted, or notified of allowance of, a number of key patents for vosaroxin, details of which are provided in the “Intellectual Property” section below.

In January 2014, we announced the expansion of our oncology franchise through separate global licensing agreements for two preclinical kinase inhibitor programs. The first agreement, with Biogen Idec MA, Inc., or Biogen Idec, is for global commercial rights to SNS-062, a selective non-covalently binding oral inhibitor of Bruton’s tyrosine kinase, or BTK. BTK is a mediator of B-cell receptor signaling that is integral to the pathogenesis of B-cell malignancies. With preclinical characteristics and activity distinct from compounds in the same class, SNS-062 may hold potential as a differentiated treatment for B-cell malignancies and other blood cancers. We are currently conducting IND-enabling studies for SNS-062, with a view to filing an IND application with the FDA.

The second agreement, with Millennium Pharmaceuticals, Inc., a wholly-owned subsidiary of Takeda Pharmaceutical Company Limited, or Millennium, is for global commercial rights to several potential first-in-class, pre-clinical inhibitors of the novel target phosphoinositide-dependent kinase-1, or PDK1. PDK1 is a key kinase and mediator of PI3K/AKT signaling, a pathway involved in cell growth, differentiation, motility and survival. PDK1 inhibitors are expected to have unique effects on survival and invasion signaling and to be broadly active in both hematologic and solid tumor malignancies. In 2014, we selected two PDK1 inhibitors, SNS-229 and SNS-510, of which we plan to take at least one into IND-enabling absorption, distribution, metabolism and excretion, or ADME, and safety studies in 2015.

Both BTK and PDK1 programs were originally developed under a research collaboration agreement between Biogen Idec and Sunesis. In 2011, the PDK1 program was purchased by and exclusively licensed to Millennium along with the more advanced program, MLN2480, a pan-RAF inhibitor currently in the maximum tolerated dose cohort expansion stage of a Millennium Phase 1, multicenter dose escalation study. We currently expect SNS-062 and the PDK1 inhibitors will be developed exclusively by Sunesis.

Our Strategy

We plan to continue to build Sunesis into a leading biopharmaceutical company focused on the development and commercialization of new oncology therapeutics for the treatment of solid and hematologic cancers by:

|

· |

pursuing regulatory approval for vosaroxin as a potential treatment for relapsed or refractory AML in Europe, the United States, and other major markets; |

|

· |

building a commercial infrastructure in order to promote and market vosaroxin in the United States as a treatment for AML; |

|

· |

leveraging potential partners and distributors to commercialize vosaroxin in selective international markets; |

|

· |

establishing vosaroxin as the new standard of care for patients with relapsed or refractory AML; |

|

· |

exploring the broader potential of vosaroxin, beyond our pivotal indication, in different patient segments within AML and MDS through investigator sponsored trials; |

|

· |

investing in additional clinical testing to evaluate vosaroxin for additional AML indications, MDS, other hematologic malignancies and solid tumors; |

|

· |

leveraging our strong intellectual property protection over vosaroxin to capitalize on its full potential; |

|

· |

supporting our multi-kinase inhibitor programs with Millennium in oncology and Biogen Idec for immunology indications; |

|

· |

conducting IND-enabling studies for our BTK inhibitor, SNS-062, with a view to filing an IND application with the FDA; |

|

· |

taking at least one of the two selected development candidates from our PDK1 inhibitor program, SNS-229 and SNS-510, into IND-enabling ADME and safety studies in 2015; and |

|

· |

continuing to expand and develop our oncology-focused pipeline through further licensing or collaboration arrangements and research and development. |

4

Development Pipeline

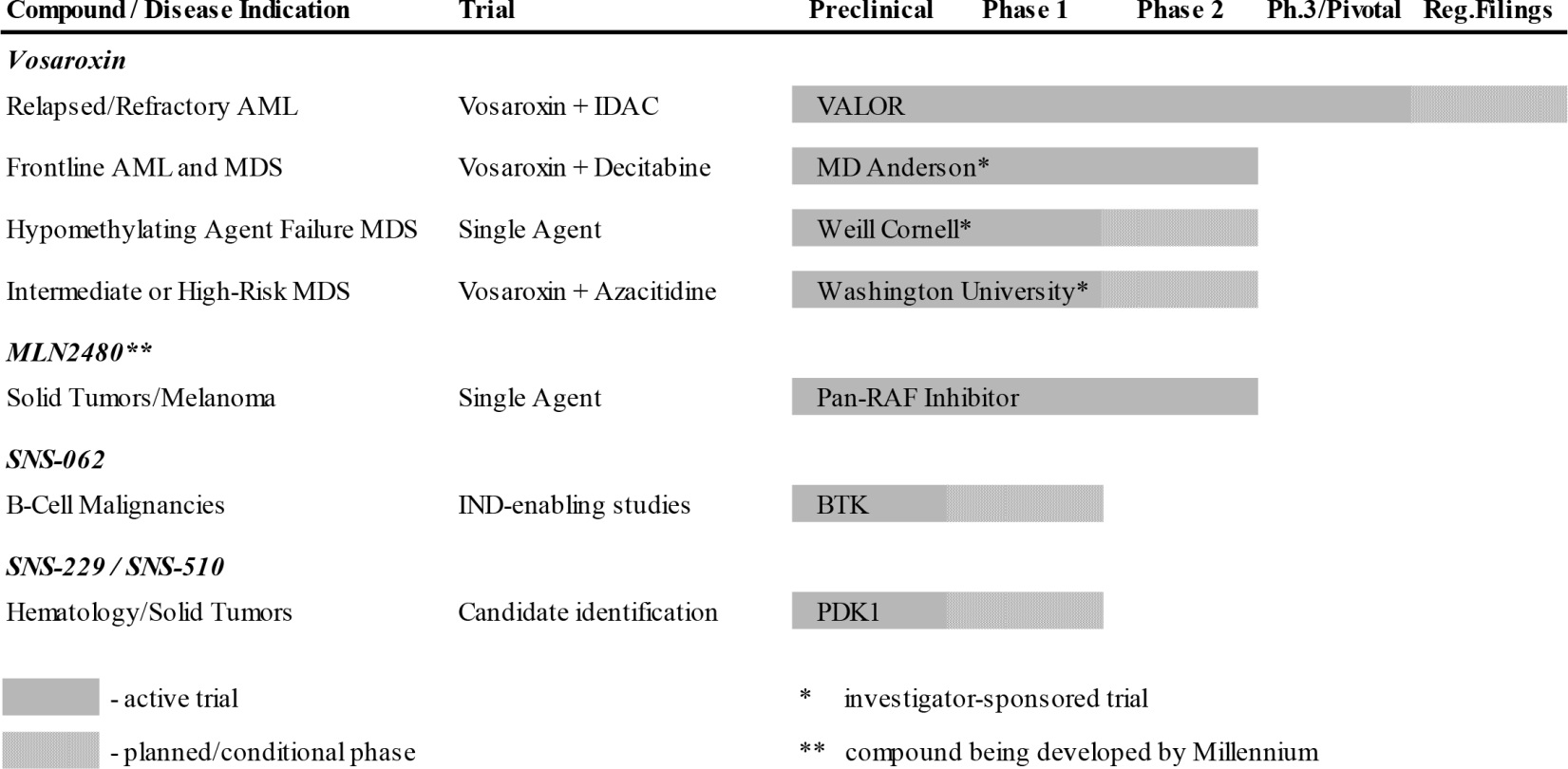

The following chart summarizes our development pipeline:

Vosaroxin

Background. Vosaroxin is an AQD—a class of compounds that has not been used previously for the treatment of cancer. Preclinical data demonstrate that vosaroxin both intercalates DNA and inhibits topoisomerase II, an enzyme critical for cell replication, resulting in replication-dependent, site-selective DNA damage, G2 arrest and apoptosis. We licensed worldwide development and commercialization rights to vosaroxin from Sumitomo Dainippon Pharma Co., Ltd., or Sumitomo, in 2003.

Mechanism of Action. The molecular core of vosaroxin is structurally similar to quinolones and distinct from anthracyclines and anthracenediones. Vosaroxin's anticancer activity results from apoptosis caused exclusively by DNA intercalation, inhibition of topoisomerase II, and cell cycle inhibition in replicating cells.

Vosaroxin’s cytotoxic activity is established in diverse human tumors and clinical activity is observed in both solid and hematologic malignancies. In preclinical studies, vosaroxin demonstrated broad antitumor activity and exhibited additive or synergistic activity when combined with several therapeutic agents currently used in the treatment of cancer, including cytarabine. Vosaroxin maintains activity in drug resistant tumor cell lines and human tumor models. Vosaroxin evades P-gp transporter-mediated resistance, and its activity is p53 independent, reducing resistance to therapy. Vosaroxin has demonstrated anticancer activity in patients who have failed other topoisomerase II inhibitor treatment.

Development Opportunity. Our goal is to establish vosaroxin in combination with cytarabine as the standard of care for patients with relapsed or refractory AML. Additionally, we are exploring the broader potential of vosaroxin in different patient segments within AML and MDS through investigator-sponsored trials. Based on the outcome of regulatory interactions related to our VALOR trial, the results of investigator-sponsored trials, competitive concerns, our financial resources and various other factors, we may further invest in the development and clinical testing of vosaroxin for related disease areas and indications such as other AML populations, MDS, other hematologic malignancies and solid tumors.

5

Vosaroxin Company-Sponsored Clinical Trials in AML

VALOR. In December 2010, we commenced enrollment of the VALOR trial, a Phase 3, randomized, double-blind, placebo-controlled, pivotal clinical trial of vosaroxin in combination with cytarabine to evaluate overall survival in patients with relapsed or refractory AML. The trial, which enrolled 711 adult patients, was conducted at 124 study sites in the U.S., Canada, Europe, South Korea, Australia and New Zealand. Patients were stratified for age, geographic region and disease status and randomized one to one to receive either vosaroxin and cytarabine or placebo and cytarabine. In October 2014, we announced the results from the VALOR trial, and further detail was presented in the "Late Breaking Abstracts" session of the American Society of Hematology (ASH) Annual Meeting in December 2014.

Patients treated with vosaroxin achieved increased overall survival compared to those treated with placebo (7.5 months vs 6.1 months, HR=0.87), the primary endpoint, but this difference did not achieve statistical significance (p=0.06). The complete remission (CR) rate, the sole secondary efficacy endpoint in the trial, did demonstrate a significant difference for the vosaroxin combination arm (30.1% vs 16.3%, p < 0.0001).

In a pre-planned analysis accounting for the stratification factors at randomization, a significant improvement in overall survival was demonstrated (HR=0.83, p=0.02). The pre-planned analysis of all treatment strata included the following poor-prognosis patient categories: over 60 years old (7.1 months vs 5.0 months, HR=0.75, p=0.003, n=451), refractory disease (6.7 months vs 5.0 months, HR=0.87, p=0.23, n=301), and early relapsed disease (6.7 months vs 5.2 months, HR=0.77, p=0.04, n=256). Outcomes in patients under 60 years old or with late relapsed disease were comparable between treatment arms, with no improvement in overall survival. Across all strata, the CR and Composite CR (CR+CRp+CRi) rates were higher in the vosaroxin combination arm.

Given the complexity of interpreting the impact of transplantation therapy, a predefined analysis of overall survival censoring for hematopoietic stem cell transplantation was planned. In this analysis, patients receiving the vosaroxin combination had a median overall survival of 6.7 months versus 5.3 months for patients receiving placebo and cytarabine (HR=0.81, p=0.02).

Regarding drug safety, Grade 3 or higher non-hematologic adverse events that were more common in the vosaroxin combination arm were gastrointestinal and infection-related toxicities, consistent with those observed in our previous clinical trials. The rate of serious adverse events was 55.5% in the vosaroxin combination arm compared to 35.7% in the placebo and cytarabine arm. 30-day and 60-day all-cause mortality were comparable between the trial arms (7.9% versus 6.6% and 19.7% versus 19.4%, for the vosaroxin combination versus placebo and cytarabine, respectively).

Phase 2 Combination. The results from our completed Phase 1b/2 clinical trial of vosaroxin in combination with cytarabine in patients with relapsed or refractory AML were published in the November 7, 2014 Ahead of Print issue of Haematologica. The article, titled “A Phase 1b/2 study of combination vosaroxin and cytarabine in patients with relapsed or refractory acute myeloid leukemia,” is available online at: http://www.haematologica.org/content/early/recent.

The Phase 1b/2 study assessed the safety and tolerability of vosaroxin in combination with cytarabine in patients with relapsed or refractory AML. Escalating vosaroxin doses (10-minute infusion; 10-90 mg/m2 on days 1, 4) were given in combination with cytarabine on one of two schedules: schedule A (24-hour continuous intravenous infusion, 400 mg/m2 per day on days 1-5) or schedule B (2-hour intravenous infusion, 1 g/m2 per day on days 1-5). Following dose escalation, enrollment was expanded at the maximum tolerated dose. The maximum tolerated dose for schedule A was vosaroxin 80 mg/m2 (dose-limiting toxicities: grade 3 bowel obstruction and stomatitis); the maximum tolerated dose was not reached for schedule B (recommended phase 2 dose: 90 mg/m2).

The median age in the study was 60 years, and patients had received as many as six prior cycles of therapy. Furthermore, most patients (89%) had intermediate or unfavorable cytogenetic risk status. The most common treatment-emergent non-hematologic adverse events of any grade were diarrhea, hypokalemia, nausea, and stomatitis. In the efficacy population, (all first relapsed or primary refractory patients treated with vosaroxin 80-90 mg/m2; n=69), the CR and combined CR rates (CR or CR with incomplete blood count recovery) were 25% and 28%, respectively. Thirty-day all-cause mortality was 2.5% among all patients treated at 80-90 mg/m2.

Phase 2 Single-Agent. The results from our completed Response Evaluation of Vosaroxin in Elderly AmL (REVEAL-1) trial, a Phase 2 trial of single agent vosaroxin in previously untreated, poor-risk elderly AML patients who are unlikely to benefit from standard induction chemotherapy, were published in the November 17, 2014 Online Version of Record of the British Journal of Haematology. The article, titled "REVEAL-1, a phase 2 dose regimen optimization study of vosaroxin in older poor-risk patients with previously untreated acute myeloid leukemia," is available online at: http://onlinelibrary.wiley.com/doi/10.1111/bjh.13214/abstract.

6

The REVEAL-1 trial evaluated single-agent vosaroxin in patients ≥60 years of age (n=113) with previously untreated unfavorable prognosis AML. Dose regimen optimization was explored in sequential cohorts (A: 72 mg/m2 on days 1, 8, 15; B: 72 mg/m2 on days 1, 8; C: 72 mg/m2 or 90 mg/m2 on days 1, 4). The primary efficacy endpoint was combined complete remission rate (CR plus CR with incomplete platelet recovery, or CRp). The median age in the study was 75 years and most patients (82%) had 2 or more risk factors (age ≥ 70, antecedent hematologic disease, ECOG PS=2, or intermediate/unfavorable cytogenetics).

Common (>20%) grade ≥3 adverse events were thrombocytopenia, febrile neutropenia, anemia, neutropenia, sepsis, pneumonia, stomatitis, and hypokalemia. Overall CR and CR/CRp rates were 29% and 32%; median overall survival, or OS, was 7.0 months; 1-year OS was 34%. Schedule C (72 mg/m2) had the most favorable balance of safety and efficacy, with faster hematologic recovery (median 27 days) and lowest incidence of aggregate sepsis (24%) and 30-day (7%) and 60-day (17%) all-cause mortality. At this dose and schedule, CR and CR/CRp rates were 31% and 35%, median OS was 7.7 months, and 1-year OS was 38%.

Phase 1 Single-Agent. Prior to 2009, we conducted a Phase 1 clinical trial to evaluate safety, pharmacokinetics, and preliminary clinical activity of two dose schedules of vosaroxin in patients with relapsed or refractory acute leukemia. Anti-leukemic activity was observed in both schedules, and the most common dose-limiting toxicity was stomatitis. The maximum tolerated dose was 72 mg/m2 for a once weekly for three weeks schedule and 40 mg/m2 for a twice weekly for two weeks schedule.

Vosaroxin Company-Sponsored Clinical Trials in Ovarian Cancer and Other Solid Tumors

In 2010, we completed a Phase 2 single-agent trial of vosaroxin in platinum-resistant ovarian cancer. Three dosing levels in two treatment schedules were studied, and encouraging, durable anti-tumor activity was observed across all doses. For patients on dosing levels of 48, 60 and 75 mg/m2, the overall response rate, or ORR, was 11%, 11% and 9%, respectively; disease control, defined as stable disease for 12 weeks or more, was 46%, 46% and 51%, respectively; and the median progression-free survival, or PFS, was 83, 61 and 103 days, respectively. Based on clinical activity and tolerability, the 60 mg/m2 dose and schedule was selected for future consideration. Overall, vosaroxin was generally well tolerated, with more than 10% of patients experiencing severe neutropenia, febrile neutropenia, fatigue, and anemia.

Prior to 2009, we conducted two Phase 1 clinical trials to evaluate different dosing schedules of vosaroxin in patients with advanced solid tumors. We also conducted two Phase 2 trials in non-small cell lung cancer and small cell lung cancer. Although objective responses were observed in both lung cancer trials, it was determined that vosaroxin could be administered with greater dose intensity given the low incidence of severe neutropenia and the trials were halted.

Vosaroxin Investigator Sponsored Clinical Trials

MD Anderson. In July 2013, we announced the initiation of an investigator-sponsored trial of vosaroxin in combination with decitabine in older patients with previously untreated AML and high-risk MDS. The Phase 1/2 trial is being conducted at the University of Texas MD Anderson Cancer Center under the direction of Naval Daver, M.D., Assistant Professor, and Farhad Ravandi, M.D., Professor of Medicine and a principal investigator in the VALOR trial. The primary endpoints of the Phase 1 cohort of the study are to determine the safety, maximum tolerated dose, or MTD, and dose limiting toxicity, or DLT, of vosaroxin in combination with decitabine in patients with high-risk MDS or AML who are elderly and/or unable or unwilling to receive standard cytarabine plus anthracycline based chemotherapy. The primary endpoint of the Phase 2 cohort of the study is to determine the efficacy of the combination based on achievement of CR, and CR with incomplete blood count recovery, or CRi. Secondary endpoints include safety, CR duration, leukemia-free survival, and overall survival. In October 2013, we announced the commencement of the Phase 2 portion of the study. In December 2014, updated results from this study were presented at the ASH Annual Meeting. This trial is expected to enroll up to a combined total of approximately 70 patients.

Weill Cornell. In October 2013, we announced the initiation of a second investigator-sponsored trial of vosaroxin in adult patients with previously treated intermediate-2 or high-risk MDS. The trial is being conducted at Weill Cornell Medical College and New York-Presbyterian Hospital under the direction of Gail J. Roboz, M.D., Associate Professor of Medicine and Director of the Leukemia Program. The Phase 1/2, open-label, dose escalating trial is expected to enroll up to 40 patients with MDS who have previously failed treatment with hypomethylating agent-based therapy. Patient cohorts will initially receive escalating doses of vosaroxin over each 28 day treatment cycle. Once the MTD is determined, an expanded evaluation of safety and hematologic response or improvement rate at this dose level will be conducted in additional subjects, so that the total number of subjects exposed to this dose level increases to up to 15 subjects. In addition to MTD and DLT, study endpoints include the rate of complete remission, partial remission, hematologic improvement and blood transfusion requirements.

7

Washington University. In December 2013, we announced the initiation of a third investigator-sponsored trial of vosaroxin in combination with azacitidine in patients with MDS. The trial is being conducted at the Washington University School of Medicine under the direction of Meagan A. Jacoby, M.D., Ph.D., Instructor of Medicine, Division of Oncology. The Phase 1/2, open label, dose-escalation trial will enroll up to approximately 40 patients with MDS who may have received up to three prior cycles of hypomethylating agent-based therapy. Patients will receive vosaroxin (days one and four) and azacitidine (days one through seven) for a maximum of six cycles. This dose escalation study is designed to enroll six patients per cohort in order to determine the MTD and DLT of the combination. Other endpoints include best response, safety, tolerability, and event-free, progression-free, disease-free and overall survival. Once the MTD is determined, up to an additional 20 patients will be enrolled, treated and evaluated at that dose level.

Cardiff University School of Medicine. In December 2011, we announced our participation in the randomized Phase 2/3 Less Intensive 1 (LI-1) Study being conducted by the United Kingdom's National Cancer Research Institute (NCRI) Haematological Oncology Study Group under the direction of Professor Alan K. Burnett, Head of Haematology, Department of Medical Genetics, Haematology & Pathology at Cardiff University School of Medicine. The trial enrolled patients over the age of 60 with AML or high-risk MDS and randomized them to one of a number of treatment regimens: Low Dose Ara-C (control); single-agent vosaroxin; vosaroxin combined with Low Dose Ara-C; or to other experimental therapies considered for inclusion in the comparison. In 2013, at the first interim analyses, the Data Monitoring and Ethics Committee recommended closure of the vosaroxin-containing trial arms as a clinically relevant benefit was unlikely.

MLN 2480

Background. A pan-Raf inhibitor program was originally developed through a collaboration agreement between Sunesis and Biogen Idec. In March 2011, Biogen Idec’s rights to this program were purchased by and exclusively licensed to Millennium. In September 2011, Millennium initiated a Phase 1 clinical study of MLN2480, an oral, investigative drug selective for pan-Raf kinase inhibition, in patients with relapsed or refractory solid tumors. The Phase 1, multicenter, open-label, dose escalation study was designed to evaluate the safety, tolerability and MTD of MLN2480, and to be conducted in two stages: dose escalation and cohort expansion. The dose escalation stage is complete and MTD was established, and MLN2480 is now in the cohort expansion stage of this multicenter study. Four abstracts of preclinical and clinical data of MLN2480 were presented at the AACR-NCI-EORTC International Conference on Molecular Targets and Cancer Therapeutics in November 2014.

Under the license agreement, we may in the future receive up to $57.5 million in pre-commercialization, event-based payments related to the development by Millennium of the first two indications for each of the licensed products directed against the Raf target, and royalty payments depending on related product sales, as further described below.

Mechanism of Action. The Raf kinases (A-Raf, B-Raf and C-Raf) are key regulators of cell proliferation and survival within the mitogen-activated protein kinase (MAPK) pathway.

Development Opportunity. MLN2480 is a pan-Raf kinase inhibitor with a distinct molecular signature which has exhibited a promising profile.

SNS-062

Background. SNS-062 is a non-covalently binding inhibitor of BTK. BTK mediates signaling through the B-cell receptor, or BCR, which is critical for adhesion, migration, proliferation and survival of normal and malignant B-lineage lymphoid cells. BTK has been well validated as a target for treatment of B-cell malignancies, with a BTK inhibitor approved for relapsed/refractory mantle cell lymphoma, relapsed/refractory chronic lymphocytic leukemia, or CLL, CLL with 17p depletion and Waldenström’s macroglobulinemia. We are currently conducting IND-enabling studies for SNS-062, with a view to filing an IND application with the FDA. The rights to develop SNS-062 for oncology indications were in-licensed from Biogen Idec in December 2013, as described below.

Mechanism of Action. SNS-062 has activity in BTK kinase assays and has shown efficacy in B-cell signaling assays and in vivo models of B-cell function. The mechanism by which SNS-062 inhibits BTK is distinct from the mechanism of in-class BTK compounds, as SNS-062 binds BTK non-covalently, which does not require interaction with Cysteine 481 in the kinase active domain. In addition, SNS-062 has a distinct kinase inhibitory profile and a favorable pharmacokinetic profile compared to covalently binding BTK inhibitors and this may translate into a distinct clinical benefit for patients.

Development Opportunity. SNS-062 has demonstrated a distinct binding site and favorable pharmacokinetic profile in preclinical studies, and may provide differentiated opportunities for treatment of B-cell malignancies and other blood cancers.

8

SNS-229 and SNS-510

Background. In January 2014, we in-licensed a series of selective PDK1 inhibitors from Millennium that were discovered under a research collaboration agreement between Biogen Idec and Sunesis, as described below. PDK1 is a key kinase and mediator of PI3K/AKT signaling, a pathway involved in cell growth, differentiation, survival and migration. PDK1 inhibitors are expected to have unique effects on survival and invasion signaling and to be broadly active in both hematologic and solid tumor malignancies. We have taken a series of PDK1 inhibitors with confirmed antitumor activity in vitro and in vivo into preclinical development, and in 2014, we selected two PDK1 inhibitors, SNS-229 and SNS-510, of which we plan to take at least one into IND-enabling ADME and safety studies in 2015.

Mechanism of Action. There are multiple PI3K pathway inhibitors in late stage development for use in CLL and solid tumor indications, including breast cancer and pancreatic cancer. Because PDK1-dependent activation of AKT is critical for PI3K pathway activation, we believe that PDK1 represents a key oncology target within the PI3K pathway. We believe Sunesis’ PDK1 inhibitors are potential first-in-class compounds with demonstrated inhibition of AKT activity and a compelling in vitro and in vivo profile, that have potential for single agent and broad-spectrum combination activity, thus providing a novel therapeutic opportunity for targeting the PI3K signaling pathway in both solid and hematologic malignancies.

Development Opportunity. Inhibitors of PDK1 are expected to be able to provide similar clinical benefits to those observed with PI3K inhibitors and have the potential to provide additional benefits through inhibition of PI3K independent cancer signaling pathways, especially in cancer types in which PDK1 is overexpressed such as breast cancer and AML. We believe that Sunesis’ PDK1 inhibitors can be differentiated from PI3K and PDK1 inhibitors currently in research and development and that may provide novel opportunities for treatment of solid and hematological malignancies.

License, Collaboration and Royalty Agreements

Inlicense Agreement with Sumitomo

In October 2003, we entered into an agreement with Sumitomo to acquire exclusive worldwide development and marketing rights for vosaroxin. In January 2011, we made a $0.5 million milestone payment to Sumitomo as a result of the initiation of our VALOR trial in December 2010. In the future we may be required to make additional milestone payments of up to $7.0 million in aggregate to Sumitomo for (a) filing NDAs, in the U.S., Europe and Japan, and (b) for receiving regulatory approvals in these regions, for cancer-related indications. If vosaroxin is approved for a non-cancer indication, an additional milestone payment will become payable to Sumitomo.

The agreement also provides for royalty payments to Sumitomo at rates based on total annual net sales. Under the agreement, we may reduce our royalty payments to Sumitomo if a third party markets a competitive product and we must pay royalties for third-party intellectual property rights necessary to commercialize vosaroxin. Royalty obligations under the agreement continue on a country-by-country and product-by-product basis until the later of the date on which no valid patent claims relating to a product exist or 10 years from the date of the first sale of the product.

If we discontinue seeking regulatory approval and/or the sale of the product in a region, we are required to return its rights to the product in that region to Sumitomo. The agreement may be terminated by either party for the other party’s uncured breach or bankruptcy.

Licensing and Collaboration Agreements with Biogen Idec and Millennium

Overview

In August 2004, we entered into the original collaboration agreement with Biogen Idec to discover, develop and commercialize small molecule inhibitors of the human protein Raf kinase, including family members Raf-1, A-Raf, B-Raf and C-Raf, collectively Raf, and up to five additional targets that play a role in oncology and immunology indications such as BTK and PDK1, or the Biogen Idec OCA.

In June 2008, the parties agreed to terminate the research term and related funding as of June 30, 2008. A total of $20.0 million of research funding was received through that date. We received a total of $3.0 million in milestone payments for meeting certain preclinical milestones through the Biogen Idec 1st ARCA date, as described below, including a $1.5 million event-based payment received in cash in July 2009 for Biogen Idec’s selection of a Raf kinase inhibitor development candidate for the treatment of cancer.

9

In March 2011, as part of a series of agreements among Sunesis, Biogen Idec and Millennium, we entered into: (a) an amended and restated collaboration agreement with Biogen Idec, or the Biogen Idec 1st ARCA; (b) a license agreement with Millennium, or the Millennium Agreement; and (c) a termination and transition agreement among the Sunesis, Biogen Idec and Millennium, or the Termination and Transition Agreement.

The Termination and Transition Agreement provided for (a) the termination of Biogen Idec’s exclusive rights under the Biogen Idec OCA to all discovery programs under such agreement other than for small molecule inhibitors of the human protein BTK; (b) the permitted assignment to Millennium of all related Sunesis collaboration assets and rights to Raf kinase and the human protein PDK1; and (c) the payment of $4.0 million to us from Millennium, which was recorded as revenue in March 2011.

Biogen Idec

The Biogen Idec 1st ARCA amended and restated the Biogen Idec OCA, to provide for the discovery, development and commercialization of small molecule BTK inhibitors. Under this agreement, we no longer have research obligations, but licenses granted to Biogen Idec with respect to the research collaboration under the Biogen Idec OCA (other than the licenses transferred to Millennium under the Millennium Agreement) remain in effect.

In June 2012, we received an event-based payment of $1.5 million from Biogen Idec for its advancement of pre-clinical work in connection with the Biogen Idec 1st ARCA. Under this agreement, we are eligible to receive up to an additional $58.5 million in pre-commercialization, event-based payments related to the development by Biogen Idec of the first two indications for licensed products against the BTK target. We are also eligible to receive royalty payments depending on related product sales, which may be increased if we exercise our option to co-fund product candidates worldwide.

In December 2013, we entered into a second amended and restated collaboration agreement with Biogen Idec, or the Biogen Idec 2nd ARCA, which amended and restated the Biogen Idec 1st ARCA, to provide us with an exclusive worldwide license to develop, manufacture and commercialize SNS-062, a BTK inhibitor synthesized under the Biogen Idec 1st ARCA, solely for oncology indications. Under the Biogen Idec 2nd ARCA, we may be required to make a $2.5 million milestone payment depending on our development of SNS-062 and royalty payments depending on related product sales of SNS-062. Additionally, potential future royalty payments to Sunesis were reduced to equal those amounts due to Biogen Idec for potential future sales of SNS-062. All other of Sunesis’ rights contained in the Biogen Idec 1st ARCA remain unchanged.

Millennium

Under the Millennium Agreement, we granted exclusive licenses to products against two oncology targets originally developed under the Biogen Idec OCA, Raf and PDK1, under substantially the same terms as under the Biogen Idec OCA.

In January 2014, we entered into an amended and restated license agreement with Millennium, or the Amended Millennium Agreement, to provide us with an exclusive worldwide license to develop and commercialize preclinical inhibitors of PDK1. In connection with execution of the Amended Millennium Agreement, we paid an upfront fee and may in the future be required to make up to $9.2 million in pre-commercialization milestone payments depending on our development of PDK1 inhibitors and royalty payments depending on related product sales.

With respect to the Raf target product rights that were originally licensed to Millennium under the Millennium Agreement, we may in the future receive up to $57.5 million in pre-commercialization, event-based payments related to the development by Millennium of the first two indications for each of the licensed products directed against the Raf target and royalty payments depending on related product sales. The agreement also provides us with future co-development and co-promotion rights. Millennium is currently conducting a Phase 1 clinical study of an oral investigative drug, MLN2480, which is licensed to them under the Amended Millennium Agreement.

Royalty Agreement with RPI

In March 2012, we entered into a Revenue Participation Agreement, or the Royalty Agreement, with RPI Finance Trust, or RPI, an entity related to Royalty Pharma. In September 2012, as a result of the recommendation by the DSMB to increase the sample size for the VALOR trial, RPI made a $25.0 million cash payment to us in exchange for a 6.75% royalty on any future net sales of vosaroxin. In conjunction with the Royalty Agreement, we issued two five-year warrants to RPI, each to purchase 1,000,000 shares of our common stock, at exercise prices of $3.48 and $4.64 per share, respectively. Of the $25.0 million, $21.9 million was recorded as deferred revenue and is being amortized to revenue over the related performance period of the Royalty Agreement. The remaining $3.1 million represents the fair value of the warrants. Both warrants were exercised in full in 2014.

10

Revenues

Over the past three years, we have generated revenue through the Royalty Agreement with RPI and the Biogen Idec 1st ARCA. In 2014 and 2013, we recognized $5.7 million and $8.0 million of revenue, respectively, related to the Royalty Agreement with RPI. In 2012, we recognized $2.3 million of revenue related to the Royalty Agreement with RPI and $1.5 million related to the Biogen Idec 1st ARCA, which represented 60% and 40% of 2012 revenues, respectively.

Manufacturing

We do not have internal manufacturing capabilities for the production of clinical or commercial quantities of vosaroxin. To date, we have relied on, and we expect to continue to rely on, a limited number of third-party contract manufacturers for the production of clinical and commercial quantities of the vosaroxin active pharmaceutical ingredient, or API, and the finished drug product incorporating the API, or FDP. We do not have commercial supply agreements with any of these third parties, and our agreements with these parties may include provisions that allow for termination at will by either party following a relatively short notice period.

We currently rely on two contract manufacturers for the vosaroxin API. We also currently rely on a single contract manufacturer to formulate the vosaroxin API and fill and finish vials of the vosaroxin FDP. Because the vosaroxin API is classified as a cytotoxic substance, the number of available manufacturers for the API and FDP is limited. We believe at least five contract manufacturers in North America have suitable facilities to manufacture the vosaroxin API, and at least four have suitable facilities to manufacture the vosaroxin FDP. A number of manufacturers outside of North America have suitable facilities, including one that currently manufactures our vosaroxin API. If we are unable to obtain sufficient quantities of the vosaroxin API and FDP from our current manufacturers, it may take time to engage alternative manufacturers, which could delay the development of and impair our ability to commercialize vosaroxin.

To date, vosaroxin has been manufactured in quantities appropriate for preclinical studies and clinical trials, including the manufacture of registration batches of API and FDP. Prior to commercial sale, we will need to perform process validation studies on API and FDP batches. If the results of these process validation studies do not meet preset criteria, the regulatory approval or commercial launch of vosaroxin may be delayed.

Competition

The life sciences industry is highly competitive, and we face significant competition from many pharmaceutical, biopharmaceutical and biotechnology companies that are researching, developing and marketing products designed to address the treatment of cancer, including AML, MDS and B-cell malignancies. Many of our competitors have significantly greater financial, manufacturing, marketing and drug development resources than we do. Large pharmaceutical companies in particular have extensive experience in the clinical testing of, obtaining regulatory approvals for, and marketing drugs.

We believe that our ability to successfully compete in the marketplace with vosaroxin and any future product candidates will depend on, among other things:

|

· |

our ability to develop novel compounds with attractive pharmaceutical properties and to secure, protect and maintain intellectual property rights based on our innovations; |

|

· |

the efficacy, safety and reliability of our product candidates; |

|

· |

the speed at which we develop our product candidates; |

|

· |

our ability to design and successfully execute appropriate clinical trials; |

|

· |

our ability to maintain a good relationship with regulatory authorities; |

|

· |

our ability to obtain, and the timing and scope of, regulatory approvals; |

|

· |

our ability to manufacture and sell commercial quantities of future products to the market; |

|

· |

the availability of reimbursement from government agencies and private insurance companies; and |

|

· |

acceptance of future products by physicians and other healthcare providers. |

Vosaroxin is a small molecule therapeutic that, if approved, will compete with other drugs and therapies currently used for AML, such as nucleoside analogs, anthracyclines, hypomethylating agents, other inhibitors of topoisomerase II, and other novel agents. Additionally, other compounds currently in development could become potential competitors of vosaroxin, if approved for marketing. We expect competition with vosaroxin for the treatment of AML and other potential future indications to increase as additional products are developed and approved for use in various patient populations.

11

Intellectual Property

We believe that patent protection is very important to our business and that our future success depends in part on our ability to obtain patents protecting vosaroxin or future drug candidates, if any. Historically, we have patented a wide range of technology, inventions and improvements related to our business, some of which we are no longer actively developing.

The vosaroxin composition-of-matter is covered by U.S. Patent No. 5,817,669 and its counterpart patents in 43 foreign jurisdictions. This U.S. patent is due to expire in October 2015, and most of its foreign counterparts are due to expire in June 2015. While it is possible that patent term restoration and/or supplemental patent certificates would be available for some of these or other patents we own or control through licenses, we cannot guarantee that such additional protection will be obtained, and the expiration dates described here do not include such term restoration.

We have been granted additional patents relating to vosaroxin compositions, and uses and manufacture of vosaroxin, in the U.S.:

|

· |

U.S. Patent No. 7,989,468 claims methods of use of vosaroxin at clinically relevant dose ranges and schedules for the treatment of leukemia, with expiry in 2026; |

|

· |

U.S. Patent Nos. 7,829,577 and 8,669,270 claim certain pharmaceutical compositions of vosaroxin, including the formulation used in our VALOR trial, with expiry in 2025; |

|

· |

U.S. Patent No. 8,580,814 claims certain methods of use of vosaroxin at clinically relevant dose ranges to treat acute myelogenous leukemia, with expiry in 2026; |

|

· |

U.S. Patent No. 8,822,493 claims certain methods of use of vosaroxin at clinically relevant dose ranges together with therapeutically effective amounts of cytarabine to treat cancer, with expiry in 2024; |

|

· |

U.S. 8,124,773 B2 claims a hydrate of vosaroxin with expiry in 2028 and U.S. Patent No. 8,765,954 claims certain compositions containing this hydrate of vosaroxin, with expiry in 2027; |

|

· |

U.S. Patent No. 8,497,282 claims a method of making vosaroxin, with expiry in 2031 and U.S. Patent No. 8,802,719 claims certain intermediates useful in the making of vosaroxin, with expiry in 2029; |

|

· |

U.S. Patent Nos. 8,586,601 and 8,138,202 claim certain compositions containing vosaroxin, with expiry in 2030; and |

|

· |

U.S. Patent No. 7,968,565 claims a combination of vosaroxin and cytarabine, with expiry in 2026. |

We have been granted additional patents relating to vosaroxin compositions, and uses and manufacture of vosaroxin, in Europe:

|

· |

EPO Patent No. 1725233 B1, which has been validated in multiple European Patent Office, or EPO, member states, claims certain pharmaceutical compositions of vosaroxin, including the formulation used in our VALOR trial, with expiry in 2025; and |

|

· |

EP Patent No. 1729770 B1, which has been validated in multiple EPO member states, claims combinations of vosaroxin and certain anticancer agents, including cytarabine, with expiry in 2025. |

In addition to the listed US and European patents, we have been granted similar and related patents in certain other countries, and patent applications are pending in these and other countries, including major markets, throughout the world. Other patents have also been granted in the US and other countries claiming certain technology related to vosaroxin and other methods of use of vosaroxin.

As of December 31, 2014, we own, co-own or have rights to approximately 171 granted U.S. and foreign patents, and approximately 136 pending U.S. and foreign applications, pertaining to vosaroxin and compositions and uses thereof. When appropriate, we intend to seek patent term restoration, orphan drug status and/or data exclusivity in the United States and their equivalents in other relevant jurisdictions, to the maximum extent that the respective laws will permit at such time. In April 2012, the European Commission granted orphan drug designation to vosaroxin for the treatment of AML, which may provide for 10 years of marketing exclusivity in all member countries of the European Union following product approval for this indication in Europe. In 2009, the FDA granted orphan drug designation to vosaroxin for the treatment of AML.

12

Our ability to build and maintain our proprietary position for vosaroxin and any future drug candidates, if any, will depend on our success in obtaining effective claims and enforcing granted claims. The patent positions of biopharmaceutical companies like ours are generally uncertain and involve complex legal and factual questions for which some important legal principles remain unresolved. No consistent policy regarding the breadth of patent claims has emerged to date in the United States. The patent situation outside the United States is even more uncertain. We do not know whether any of our patent applications or those patent applications that we license will result in the issuance of any patents. Even if patents are issued, they may not be sufficient to protect vosaroxin or future drug candidates, if any. The patents we own or license and those that may be issued in the future may be opposed, challenged, invalidated or circumvented, and the rights granted under any issued patents may not provide us with proprietary protection or competitive advantages.

Patent applications filed before November 29, 2000 in the United States are maintained in secrecy until patents issue. Later-filed U.S. applications and patent applications in most foreign countries generally are not published until at least 18 months after their earliest filing date. Scientific and patent publication often occurs long after the date of the scientific discoveries disclosed in those publications. Accordingly, we cannot be certain that we were the first to invent the subject matter covered by any patent application or that we were the first to file a patent application for any inventions.

Our commercial success depends on our ability to operate without infringing patents and proprietary rights of third parties. We cannot determine with certainty whether patents or patent applications of other parties may materially affect our ability to conduct our business. The existence of third party patent applications and patents could significantly reduce the coverage of patents owned by or licensed to us and limit our ability to obtain meaningful patent protection. If patents containing competitive or conflicting claims are issued to third parties and these claims are ultimately determined to be valid, we may be enjoined from pursuing research, development or commercialization of vosaroxin or future drug candidates, if any, or be required to obtain licenses to such patents or to develop or obtain alternative technology.

We may need to commence or defend litigation to enforce or to determine the scope and validity of any patents issued to us or to determine the scope and validity of third party proprietary rights. Litigation would result in substantial costs, even if the eventual outcome is favorable to us. An adverse outcome in litigation affecting proprietary rights we own or have licensed could present significant risk of competition for vosaroxin or future drug candidates, if any, that we market or seek to develop. Any adverse outcome in litigation affecting third party proprietary rights could subject us to significant liabilities to third parties and could require us to seek licenses of the disputed rights from third parties or to cease using the technology if such licenses are unavailable.

We also rely on trade secrets to protect our technology, especially in situations or jurisdictions in which we believe patent protection may not be appropriate or obtainable. However, trade secrets are difficult to maintain and do not protect technology against independent developments made by third parties.

We seek to protect our proprietary information by requiring our employees, consultants, contractors and other advisers to execute nondisclosure and assignment of invention agreements upon commencement of their employment or engagement. Agreements with our employees also prevent them from bringing the proprietary rights of third parties to us. We also require confidentiality or material transfer agreements from third parties that receive our confidential data or materials. There can be no assurance that these agreements will provide meaningful protection, that these agreements will not be breached, that we will have an adequate remedy for any such breach, or that our trade secrets will not otherwise become known or independently developed by a third party.

We seek to protect our company name and the names of our products and technologies by obtaining trademark registrations, as well as common law rights in trademarks and service marks, in the United States and in other countries. There can be no assurance that the trademarks or service marks we use or register will protect our company name or any products or technologies that we develop and commercialize, that our trademarks, service marks, or trademark registrations will be enforceable against third parties, or that our trademarks and service marks will not interfere with or infringe trademark rights of third parties. We may need to commence litigation to enforce our trademarks and service marks or to determine the scope and validity of our or a third party’s trademark rights. Litigation would result in substantial costs, even if the eventual outcome is favorable to us. An adverse outcome in litigation could subject us to significant liabilities to third parties and require us to seek licenses of the disputed rights from third parties or to cease using the trademarks or service marks if such licenses are unavailable.

Government Regulation

The FDA and comparable regulatory agencies in state and local jurisdictions and in foreign countries impose substantial requirements upon the clinical development, manufacture, marketing and distribution of drugs. These agencies and other federal, state and local entities regulate research and development activities and the testing, manufacture, quality control, safety, efficacy, labeling, storage, recordkeeping, approval, advertising and promotion of vosaroxin and any future drug candidates we may develop, if any. The application of these regulatory frameworks to the development, approval and commercialization of vosaroxin or our future drug candidates, if any, will take a number of years to accomplish, if at all, and involve the expenditure of substantial resources.

13

In the United States, the FDA regulates drugs under the Federal Food, Drug, and Cosmetic Act, as amended, and implementing regulations. The process required by the FDA before vosaroxin and any future drug candidates may be marketed in the United States generally involves the following:

|

· |

completion of extensive preclinical laboratory tests, in vivo preclinical studies and formulation studies; |

|

· |

submission to the FDA of an IND application, which must become effective before clinical trials begin; |

|

· |

performance of adequate and well-controlled clinical trials to establish the safety and efficacy of the product candidate for each proposed indication; |

|

· |

submission of an NDA to the FDA; |

|

· |

satisfactory completion of an FDA pre-approval inspection of the manufacturing facilities at which the product candidate is produced to assess compliance with current Good Manufacturing Practice, or cGMP, regulations; and |

|

· |

FDA review and approval of the NDA, including proposed labeling (package insert information) and promotional materials, prior to any commercial marketing, sale or shipment of the drug. |

The testing and approval process requires substantial time, effort and financial resources, and we cannot be certain that any approvals for vosaroxin or our future drug candidates, if any, will be granted on a timely basis, if at all.

Preclinical Testing and INDs

Preclinical tests include laboratory evaluation of product chemistry, formulation and stability, as well as studies to evaluate toxicity in animals. Laboratories that comply with the FDA Good Laboratory Practice regulations must conduct preclinical safety tests. The results of preclinical tests, together with manufacturing information and analytical data, are submitted as part of an IND application to the FDA. The IND automatically becomes effective 30 days after receipt by the FDA, unless the FDA, within the 30-day time period, raises concerns or questions about the conduct of the clinical trial, including concerns that human research subjects will be exposed to unreasonable health risks. In such a case, the IND sponsor and the FDA must resolve any outstanding concerns before the clinical trial can begin. Our submission of an IND, or those submitted by Biogen Idec, Millennium, or our potential future licensees or collaboration partners, if any, may not result in FDA authorization to commence a clinical trial.

Clinical Trials

Clinical trials involve the administration of an investigational drug to healthy volunteers or to patients under the supervision of a qualified principal investigator. Clinical trials are conducted in accordance with the FDA’s Protection of Human Subjects regulations and Good Clinical Practices, or GCP, under protocols that detail the objectives of the study, the parameters to be used to monitor safety, and the efficacy criteria to be evaluated. Each protocol must be submitted to the FDA as part of the IND application.

In addition, each clinical study must be conducted under the auspices of an independent institutional review board, or IRB, at each institution where the study will be conducted. Each IRB will consider, among other things, ethical factors, the safety of human subjects and the possible liability of the institution. The FDA, an IRB or the sponsor may suspend a clinical trial at any time on various grounds, including a finding that the subjects or patients are being exposed to an unacceptable health risk. Clinical testing also must satisfy extensive GCP requirements and regulations for informed consent.

Clinical trials are typically conducted in three sequential phases, which may overlap, sometimes followed by a fourth phase:

|

· |

Phase 1 clinical trials are initially conducted in a limited population to test the drug candidate for safety (adverse effects), dose tolerance, absorption, metabolism, distribution and excretion in healthy humans or, on occasion, in patients, such as cancer patients. In some cases, particularly in cancer trials, a sponsor may decide to conduct what is referred to as a “Phase 1b” evaluation, which is a second safety-focused Phase 1 clinical trial typically designed to evaluate the impact of the drug candidate in combination with currently approved drugs. |

|

· |

Phase 2 clinical trials are generally conducted in a limited patient population to identify possible adverse effects and safety risks, to determine the efficacy of the drug candidate for specific targeted indications and to determine dose tolerance and optimal dosage. Multiple Phase 2 clinical trials may be conducted by the sponsor to obtain information prior to beginning larger and more expensive Phase 3 clinical trials. In some cases, a sponsor may decide to conduct what is referred to as a “Phase 2b” evaluation, which is a second, confirmatory Phase 2 clinical trial that could, if positive and accepted by the FDA, serve as a pivotal clinical trial in the approval of a drug candidate. |

14

|

· |

Phase 3 clinical trials are commonly referred to as pivotal trials. When Phase 2 clinical trials demonstrate that a drug candidate has potential activity in a disease or condition and has an acceptable safety profile, Phase 3 clinical trials are undertaken to further evaluate clinical efficacy and to further test for safety in an expanded patient population at multiple, geographically dispersed clinical trial sites. |

|

· |

Phase 4 (post-marketing) clinical trials may be required by the FDA in some cases. The FDA may conditionally approve an NDA for a drug candidate on a sponsor’s agreement to conduct additional clinical trials to further assess the drug’s safety and/or efficacy after NDA approval. Such post-approval trials are typically referred to as Phase 4 clinical trials. |

New Drug Applications

Assuming successful completion of the required clinical testing, the results of the preclinical studies and clinical trials, together with detailed information relating to the product’s chemistry, manufacture, controls and proposed labeling, among other things, are submitted to the FDA as part of an NDA requesting approval to market the product for one or more indications. Under federal law, the submission of most NDAs is additionally subject to a substantial application user fee under the Prescription Drug User Fee Act, or PDUFA, and the sponsor of an approved NDA is also subject to annual product and establishment user fees, which fees are typically increased annually.

The FDA conducts a preliminary review of all NDAs within the first 60 days after submission before accepting them for filing to determine whether they are sufficiently complete to permit substantive review. The FDA may request additional information rather than accept an NDA for filing. In this event, the application must be resubmitted with the additional information. The resubmitted application is also subject to review before the FDA accepts it for filing. Once the submission is accepted for filing, the FDA begins an in-depth substantive review. The FDA has agreed to specified performance goals in the review of NDAs. Under these goals, the FDA has committed to review most such applications for non-priority products within 10 months of filing, and most applications for priority review products, that is, drugs that the FDA determines represent a significant improvement over existing therapy, within six months of filing. The review process may be extended by the FDA for three additional months to consider certain information or clarification regarding information already provided in the submission. The FDA may also refer applications for novel drugs or products that present difficult questions of safety or efficacy to an advisory committee, typically a panel that includes clinicians and other experts, for review, evaluation and a recommendation as to whether the application should be approved. The FDA is not bound by the recommendations of an advisory committee, but it considers such recommendations carefully when making decisions.

Before approving an NDA, the FDA typically will inspect the facility or facilities where the product is manufactured. The FDA will not approve an application unless it determines that the manufacturing processes and facilities are in compliance with cGMP requirements and adequate to assure consistent production of the product within required specifications. In addition, before approving an NDA, the FDA will typically inspect one or more clinical sites to assure compliance with GCP and integrity of the clinical data submitted.

The testing and approval process requires substantial time, effort and financial resources, and each may take many years to complete. Data obtained from clinical activities are not always conclusive and may be susceptible to varying interpretations, which could delay, limit or prevent regulatory approval. The FDA may not grant approval on a timely basis, or at all. We may encounter difficulties or unanticipated costs in our efforts to develop our product candidates and secure necessary governmental approvals, which could delay or preclude us from marketing our products.

After the FDA’s evaluation of the NDA and inspection of the manufacturing facilities, the FDA may issue an approval letter or a complete response letter. An approval letter authorizes commercial marketing of the drug with specific prescribing information for specific indications. A complete response letter generally outlines the deficiencies in the submission and may require substantial additional testing or information in order for the FDA to reconsider the application. If and when those deficiencies have been addressed to the FDA’s satisfaction in a resubmission of the NDA, the FDA will issue an approval letter. The FDA has committed to reviewing such resubmissions in two or six months depending on the type of information included. Even with submission of this additional information, the FDA ultimately may decide that the application does not satisfy the regulatory criteria for approval and refuse to approve the NDA. Even if the FDA approves a product, it may limit the approved indications for use for the product, require that contraindications, warnings or precautions be included in the product labeling, require that post-approval studies, including Phase 4 clinical trials, be conducted to further assess a drug’s safety after approval, require testing and surveillance programs to monitor the product after commercialization, or impose other conditions, including distribution restrictions or other risk management mechanisms, including Risk Evaluation and Mitigation Strategies, or REMs, which can materially affect the potential market and profitability of the product. The FDA may prevent or limit further marketing of a product based on the results of post-market studies or surveillance programs. After approval, some types of changes to the approved product, such as adding new indications, manufacturing changes and additional labeling claims, are subject to further testing requirements and FDA review and approval.

15

Orphan Drug Designation

The United States Orphan Drug Act promotes the development of products that demonstrate promise for the diagnosis and treatment of diseases or conditions that affect fewer than 200,000 people in the United States. Upon receipt of orphan drug designation from the FDA, the sponsor is eligible for tax credits of up to 50% for qualified clinical trial expenses, the ability to apply for annual grant funding, waiver of PDUFA application fee, and upon approval, the potential for seven years of market exclusivity for the orphan-designated product for the orphan-designated indication. In October 2009, the FDA granted orphan drug designation to vosaroxin for treatment of AML.

In the European Union, orphan status is available for therapies addressing conditions that affect five or fewer out of 10,000 people, and provides for the potential for 10 years of marketing exclusivity in Europe for the orphan-designated product for the orphan-designated indication. The marketing exclusivity period can be reduced to six years if, at the end of the fifth year, available evidence establishes that the product is sufficiently profitable not to justify maintenance of market exclusivity. In April 2012, the European Commission granted orphan drug designation to vosaroxin for the treatment of AML.

Fast Track Designation

The FDA’s fast track program is intended to facilitate the development, and to expedite the review, of drugs that are intended for the treatment of a serious or life-threatening condition for which there is no effective treatment and demonstrate the potential to address unmet medical needs for the condition.

With fast track designation, the FDA may initiate review of sections of an NDA before the application is complete. This rolling review is available if the applicant provides and the FDA approves a schedule for the submission of the remaining information and the applicant pays applicable user fees. However, the time period specified in the PDUFA, which governs the time period goals the FDA has committed to reviewing an application, does not begin until the complete application is submitted. Additionally, the fast track designation may be withdrawn by the FDA if the FDA believes that the designation is no longer supported by data emerging in the clinical trial process.

In some cases, a fast track designated drug candidate may also qualify for priority review. Under FDA policies, a drug candidate is eligible for priority review, or, under Prescription Drug User Fee Act V, review within eight months from the time a complete NDA is submitted (a six-month review period begins at the conclusion of the 60-day filing review period that begins on the date of FDA receipt of the submission), if the drug candidate provides a significant improvement compared to marketed drugs in the treatment, diagnosis or prevention of a disease. A fast track designated drug candidate would ordinarily meet the FDA’s criteria for priority review.

In February 2011, the FDA granted fast track designation to vosaroxin for the potential treatment of relapsed or refractory AML in combination with cytarabine. We do not know whether vosaroxin or our future drug candidates, if any, will receive a priority review designation or, if a priority designation is received, whether that review or approval will be faster than conventional FDA procedures, or the ultimate impact, if any, of the fast track designation on the timing or likelihood of FDA approval of vosaroxin or our future drug candidates, if any.

Satisfaction of FDA regulations and approval requirements or similar requirements of foreign regulatory agencies typically takes several years, and the actual time required may vary substantially based upon the type, complexity and novelty of the product or disease. Typically, if a drug candidate is intended to treat a chronic disease, as is the case with vosaroxin, safety and efficacy data must be gathered over an extended period of time. Government regulation may delay or prevent marketing of drug candidates for a considerable period of time and impose costly procedures upon our activities. The FDA or any other regulatory agency may not grant approvals for new indications for our drug candidates on a timely basis, or at all. Even if a drug candidate receives regulatory approval, the approval may be significantly limited to specific disease states, patient populations and dosages. Further, even after regulatory approval is obtained, later discovery of previously unknown problems with a drug may result in restrictions on the drug or even complete withdrawal of the drug from the market. Delays in obtaining, or failures to obtain, regulatory approvals for any of our drug candidates would harm our business. In addition, we cannot predict what adverse governmental regulations may arise from future U.S. or foreign governmental action.

16

Other Regulatory Requirements

Any drugs manufactured or distributed by us, Biogen Idec, Millennium, or our potential future licensees or collaboration partners, if any, pursuant to FDA approvals are subject to continuing regulation by the FDA, including recordkeeping requirements and reporting of adverse experiences associated with the drug. Drug manufacturers and their subcontractors are required to register with the FDA and certain state agencies, and are subject to periodic unannounced inspections by the FDA and certain state agencies for compliance with ongoing regulatory requirements, including cGMPs, which impose certain procedural and documentation requirements upon us and our third-party manufacturers. Failure to comply with the statutory and regulatory requirements can subject a manufacturer to possible legal or regulatory action, such as warning letters, suspension of manufacturing, seizure of product, injunctive action or possible civil penalties.