Table of Contents

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement. |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)). |

| þ | Definitive Proxy Statement. |

| ¨ | Definitive Additional Materials. |

| ¨ | Soliciting Material Pursuant to § 240.14a-12. |

QUICKSILVER RESOURCES INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) |

Title of each class of securities to which transaction applies: | |

|

| ||

| (2) |

Aggregate number of securities to which transaction applies: | |

|

| ||

| (3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

|

| ||

| (4) |

Proposed maximum aggregate value of transaction: | |

|

| ||

| (5) |

Total fee paid: | |

|

| ||

| ¨ |

Fee paid previously with preliminary materials. | |

| ¨ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) |

Amount Previously Paid: | |

|

| ||

| (2) |

Form, Schedule or Registration Statement No.: | |

|

| ||

| (3) |

Filing Party: | |

|

| ||

| (4) |

Date Filed: | |

|

| ||

Table of Contents

QUICKSILVER RESOURCES INC.

801 Cherry Street, Suite 3700, Unit 19

Fort Worth, Texas 76102

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

| When is the annual meeting? |

• | 9:00 a.m. Central Daylight Time, May 16, 2012 | ||

| Where is the annual meeting held? |

• | Fort Worth Club 306 West Seventh Street, 12th Floor Fort Worth, Texas 76102 | ||

| What are the items of business? |

• | Elect two directors, Glenn Darden and W. Yandell Rogers, III | ||

| • | Advisory vote to approve executive compensation | |||

| • | Transact other business as may properly come before the meeting, and any adjournment or postponement thereof | |||

| Who can vote? |

• | You can vote if you were a stockholder of record on March 19, 2012. Your shares can be voted at the meeting only if you are present or represented by a valid proxy. Whether or not you plan to attend the annual meeting, Quicksilver encourages you to vote by proxy at your earliest convenience. | ||

| How can I vote? |

• | Your vote is important. Please vote in one of the following ways: | ||

| - By proxy – submit your instructions over the internet or by telephone or complete, sign, date and promptly return the enclosed proxy card (or if you are a participant in the Quicksilver 401(k) Plan, the enclosed voting instruction card) in the pre-addressed, postage-paid envelope. | ||||

| - In person – submit a ballot at the annual meeting on May 16, 2012. If your shares are held in “street name” (that is, in the name of a bank, broker or other holder of record), you must obtain a proxy from that entity and bring it with you to hand in with your ballot, in order to be able to vote your shares at the meeting. | ||||

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on May 16, 2012: The proxy statement and Quicksilver’s annual report to security holders are also available for your review at www.proxydocs.com/kwk.

John C. Cirone

Executive Vice President — General Counsel

April 26, 2012

Table of Contents

| Page | ||||

| 1 | ||||

| 4 | ||||

| 4 | ||||

| 5 | ||||

| 5 | ||||

| 5 | ||||

| Corporate Governance Principles, Processes and Code of Business Conduct and Ethics |

6 | |||

| 6 | ||||

| 10 | ||||

| 10 | ||||

| 10 | ||||

| 10 | ||||

| 11 | ||||

| 11 | ||||

| SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL HOLDERS |

13 | |||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| 17 | ||||

| 28 | ||||

| 29 | ||||

| 30 | ||||

| 32 | ||||

| 34 | ||||

| Potential Payments Upon Termination or in Connection with a Change in Control |

35 | |||

| 39 | ||||

| 40 | ||||

| 41 | ||||

| 41 | ||||

| 41 | ||||

| 43 | ||||

| 43 | ||||

| 44 | ||||

| 44 | ||||

Table of Contents

QUICKSILVER RESOURCES INC.

801 Cherry Street, Suite 3700, Unit 19

Fort Worth, Texas 76102

PROXY STATEMENT

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

What is the purpose of this proxy statement?

The purpose of this proxy statement is to provide information regarding matters to be voted on at the annual meeting of stockholders of Quicksilver Resources Inc. to be held on May 16, 2012. Additionally, it contains certain information that the Securities and Exchange Commission, or SEC, and the New York Stock Exchange, or NYSE, require Quicksilver to provide to its stockholders. This proxy statement is also the document used by Quicksilver’s Board of Directors to solicit proxies to be used at the annual meeting. Quicksilver pays the costs of soliciting proxies. Proxies are solicited to give all stockholders of record an opportunity to vote on the matters to be presented at the annual meeting, even if they cannot attend the meeting.

When is the proxy statement being mailed?

This proxy statement is first being mailed to Quicksilver’s stockholders on or about April 26, 2012.

Who is entitled to vote on the matters discussed in this proxy statement?

You are entitled to vote if you were a stockholder of record of Quicksilver common stock as of the close of business on March 19, 2012. Your shares can be voted at the meeting only if you are present or represented by a valid proxy. If your shares are held in street name, you must obtain a proxy, executed in your favor, from your bank, broker or other holder of record to be able to vote at the annual meeting.

How many votes do I have?

Each share of Quicksilver common stock that you held on March 19, 2012 entitles you to one vote at the annual meeting. At the close of business on March 19, 2012, there were a total of 173,272,103 shares of Quicksilver common stock outstanding that are entitled to vote at the annual meeting.

How can I vote?

You can vote in person by completing a ballot at the annual meeting, or you can vote prior to the meeting by proxy. Whether or not you plan to attend the annual meeting, Quicksilver encourages you to vote by proxy at your earliest convenience. You may vote by proxy over the internet, by telephone or by mail as discussed below.

How do I vote by proxy?

If you choose to vote your shares by proxy, you have the following options:

| • | Over the internet – you can vote over the internet at the web address shown on your proxy card. Internet voting is available 24 hours a day, seven days a week. If you vote over the internet, you should not return your proxy card. |

| • | By telephone – you can vote by telephone by calling the toll-free number on your proxy card. Telephone voting is available 24 hours a day, seven days a week. Easy-to-follow voice prompts allow you to vote your shares and confirm that your instructions have been properly recorded. If you vote by telephone, you should not return your proxy card. |

| • | By mail – you can vote by mail by completing, signing, dating and mailing your proxy card to the Secretary of Quicksilver in the pre-addressed, postage-paid envelope provided. If you sign your proxy card but do not specify how you want your shares to be voted, your shares will be voted as recommended by the Board. If you mail the proxy card, but fail to sign it your vote cannot be counted. |

Table of Contents

How can I vote my shares held in the Quicksilver 401(k) Plan?

If you participate in the Quicksilver 401(k) Plan, you will receive a voting instruction card that lists shares of Quicksilver common stock credited to your 401(k) Plan account as of the close of business on March 19, 2012. To cast your vote with respect to these shares, you must instruct The Charles Schwab Trust Company, the trustee for the 401(k) Plan, as to how to vote your shares held in the 401(k) Plan through one of the following options:

| • | Over the internet – you can instruct the trustee how to vote over the internet at the web address shown on your voting instruction card. Internet voting instructions may be submitted 24 hours a day, seven days a week. If you instruct the trustee how to vote over the internet, you should not return your voting instruction card. |

| • | By telephone – you can instruct the trustee how to vote by telephone by calling the toll-free number on your voting instruction card. Telephone voting instructions may be submitted 24 hours a day, seven days a week. Easy-to-follow voice prompts allow you to instruct the trustee how to vote your shares and confirm that your instructions have been properly recorded. If you instruct the trustee how to vote by telephone, you should not return your voting instruction card. |

| • | By mail – you can instruct the trustee how to vote by mail by completing, signing, dating and mailing your voting instruction card to the trustee in the pre-addressed, postage-paid envelope provided. |

To allow the trustee sufficient time to vote shares held in the 401(k) Plan, you must submit your voting instructions by 11:59 p.m. Eastern Daylight Time on May 8, 2012. If you do not instruct the trustee how to vote your shares held in the 401(k) Plan, those shares will be voted in the same proportion as the shares held in the 401(k) Plan for which voting instructions are received.

Can I change my mind after I vote?

If you vote by proxy, you can revoke that proxy at any time before it is voted at the annual meeting. You can do this by:

| • | giving written notice to the Secretary of Quicksilver at 801 Cherry Street, Suite 3700, Unit 19, Fort Worth, Texas 76102; |

| • | voting again over the internet or by telephone; |

| • | signing another proxy card with a later date and returning it prior to the annual meeting; or |

| • | attending the annual meeting in person and casting a ballot. |

What constitutes a quorum for the annual meeting?

A majority of Quicksilver common stock entitled to vote must be present, either in person or by proxy, in order to constitute a quorum necessary to conduct the annual meeting. Abstentions and broker non-votes will be counted for purposes of determining whether a quorum is present at the meeting. Broker non-votes are shares held by a broker or nominee that are represented at the meeting, but with respect to which the beneficial owner of the shares has not instructed the broker or nominee on how to vote the shares on a particular matter and with respect to which the broker or nominee does not have discretionary authority to vote on the matter.

How many votes are required to elect the director nominees?

Directors are elected by a plurality of the votes present in person or by proxy entitled to vote, which means that the two nominees who receive the highest number of votes will be elected as directors. Abstentions and broker non-votes will not have any effect on the outcome of the election of directors.

How many votes are required to approve the other matters to be voted on?

The affirmative vote of a majority of the shares voted, either in person or by proxy, at the annual meeting is needed to approve the advisory vote on executive compensation. Abstentions and broker non-votes will not have any effect on the outcome of this vote.

2

Table of Contents

Where else are proxy materials available?

The proxy statement and Quicksilver’s annual report to security holders are also available for your review at www.proxydocs.com/kwk.

Where can I find directions to the annual meeting location?

Directions to the Fort Worth Club are available at www.fortworthclub.com.

3

Table of Contents

At the date of this proxy statement, the Board consists of seven members, four of whom are non-employee directors. Quicksilver’s Certificate of Incorporation provides that the Board will have not less than three nor more than nine members as fixed from time-to-time by vote of a majority of the entire Board. A majority of the entire Board previously fixed the number of directors at seven.

The Board is currently divided into three classes with three-year terms. The terms are staggered so that the term of one class expires at each annual meeting of Quicksilver’s stockholders. Two director nominees, Messrs. Glenn Darden and W. Yandell Rogers, III, have been nominated for election at the annual meeting. Messrs. Darden and Rogers are standing for re-election to the Board by the stockholders of Quicksilver.

The age, principal occupation and certain other information for each director nominee and other directors serving unexpired terms are set forth below. Also presented below is information regarding each director’s experience, qualifications, attributes and skills that led the Nominating and Corporate Governance Committee and the Board to the conclusion that he or she should serve as a director of Quicksilver.

Nominees for election at this meeting to a term expiring in 2015:

| • | Glenn Darden, age 56, has served on the Board since December 1997 and became our Chief Executive Officer in December 1999. He served as Quicksilver’s Vice President until he was elected President and Chief Operating Officer in March 1999. Prior to that time, he served with Mercury Exploration Company for 18 years, the last five as Executive Vice President. Mr. Darden previously worked as a geologist for Mitchell Energy Company LP (subsequently merged with Devon Energy). He served as a director of Crestwood Gas Services GP LLC, the general partner of Crestwood Gas Services LP (formerly known as Quicksilver Gas Services LP), from March 2007 to October 2010. We believe Mr. Darden’s qualifications to serve on the Board include his depth of knowledge of Quicksilver’s business, including its strategies, operations and markets, his 32 years of experience in the oil and gas industry and his previous position with Quicksilver Gas Services GP LLC. |

| • | W. Yandell Rogers, III, age 49, has served on the Board since March 1999. Since 2008, Mr. Rogers has served as Chief Executive Officer of Lewiston Atlas Ltd., a privately-owned holding company with investments in service, manufacturing and oil and gas interests since 2008. He served as Chief Executive Officer of Priest River Ltd., a privately-owned holding company, from 2002 to 2008. He served as Chief Executive Officer of Ridgway’s, Inc., a provider of reprographics to the engineering and construction industries, from 1997 to 2002. Mr. Rogers also served as a director of BreitBurn GP, LLC from April 2010 to December 2011. We believe Mr. Roger’s qualifications to serve on the Board include his executive leadership and management experience, his depth of knowledge of Quicksilver’s business and 12 years of experience as a director of Quicksilver. |

Directors whose terms expire in 2013:

| • | Anne Darden Self, age 54, has served on the Board since August 1999 and became Quicksilver’s Vice President – Human Resources in July 2000. Ms. Self has also served as President of Mercury Exploration Company since 2000. She served as Vice President – Human Resources of Mercury Exploration from 1992 to 2000. We believe Ms. Self’s qualifications to serve on the Board include her executive leadership and management experience, her depth of knowledge of Quicksilver’s business and 12 years of experience as a director of Quicksilver. |

| • | Steven M. Morris, age 60, has served on the Board since March 1999. Mr. Morris is a Certified Public Accountant and has served as President of Morris & Company, a private investment firm, since 1992. We believe Mr. Morris’ qualifications to serve on the Board include his experience in public accounting and his 25 years of experience in the oil and gas industry, including 12 years as director of Quicksilver. |

4

Table of Contents

Directors whose terms expire in 2014:

| • | Thomas F. Darden, age 58, has served on the Board since December 1997 and became Chairman of the Board in March 1999. Prior to joining Quicksilver, Mr. Darden was employed by Mercury Exploration Company for 22 years in various executive level positions. He served as a director of Crestwood Gas Services GP LLC, the general partner of Crestwood Gas Services LP (formerly known as Quicksilver Gas Services LP), from July 2007 to September 2011. We believe Mr. Darden’s qualifications to serve on the Board include his strategic, operating and marketing expertise from 36 years of experience in the oil and gas industry, his depth of knowledge of Quicksilver’s business and his previous positions with Crestwood Gas Services GP LLC. |

| • | W. Byron Dunn, age 58, has served on the Board since October 2007. Mr. Dunn has been a Principal of Tubular Synergy Group L.P., a wholesale marketer of steel tubular products, since February 2008. Prior to that, Mr. Dunn served with Lone Star Steel Company, a subsidiary of Lone Star Technologies, Inc., for 32 years, including as President and Chief Executive Officer from August 1997 until retiring in June 2007. He has served as a director of Enerflex Ltd., a Canadian oil and gas services company, since June 2011. We believe Mr. Dunn’s qualifications to serve on the Board include his extensive executive leadership and management experience in the oil and gas service industry, including as Chief Executive Officer of a subsidiary of a publicly-traded company. |

| • | Mark J. Warner, age 48, has served on the Board since March 1999. Mr. Warner serves as Managing Director of Natural Resource Investments for The University of Texas Investment Management Company and has served in other capacities since November 2007. Mr. Warner served as the Director of Corporate Development of PointOne, a telecommunications company, from April 2004 to November 2007. Mr. Warner served as Senior Vice President of Growth Capital Partners, L.P., an investment banking firm, from 2000 to 2004 and as Director of Domestic Finance of Enron Corporation, an energy company, from 1995 to 2000. Mr. Warner previously served as a director for Hornbeck Offshore Services, a marine transport provider, from 1998 to 2001. We believe Mr. Warner’s qualifications to serve on the Board include his 27 years of experience in the oil and gas industry, his investing and transactional experience, particularly in the energy industry, and his 12 years of experience as a director of Quicksilver. |

Family Relationship Among Directors

Thomas F. Darden, Glenn Darden and Anne Darden Self are siblings.

An important component of a strong company is an independent Board that is accountable to Quicksilver and its stockholders. Quicksilver’s Board has been composed of a majority of independent directors since going public in 1999. The categorical independence standards for directors adopted by the Board appear in the Corporate Governance section of Quicksilver’s website (www.qrinc.com/corporate_governance).

The Board determined that each of Messrs. Dunn, Morris, Rogers and Warner satisfies Quicksilver’s categorical independence standards and further determined that each of them is independent of Quicksilver and its management within the meaning of the NYSE’s listing standards.

Presiding Non-Management Director and Executive Sessions

Quicksilver’s non-management directors meet in executive session without management either before or after all regularly scheduled Board meetings. In May 2011, the Board elected W. Yandell Rogers, III as Presiding Non-Management Director, in accordance with the NYSE rules. In his capacity as Presiding Non-Management Director, Mr. Rogers’s primary responsibility is to preside over executive sessions of Quicksilver’s non-management directors.

5

Table of Contents

Corporate Governance Principles, Processes and Code of Business Conduct and Ethics

You may find the full texts of Quicksilver’s Corporate Governance Guidelines and the Code of Business Conduct and Ethics, as well as the charters for the Audit Committee, Nominating and Corporate Governance Committee and Compensation Committee, in the Corporate Governance section of Quicksilver’s website (www.qrinc.com/corporate_governance). Quicksilver intends to post any amendments to or waivers of its Code of Business Conduct and Ethics with respect to its directors or executive officers in the Corporate Governance section of its website.

The Board has standing Audit, Nominating and Corporate Governance, and Compensation Committees, each of which is composed solely of independent directors. Messrs. Dunn, Morris, Rogers and Warner serve on each of these Committees.

Audit Committee. The Audit Committee was established in accordance with applicable requirements of the Securities Exchange Act of 1934 and its purposes are to:

| • | oversee management’s conduct of Quicksilver’s financial reporting process and systems of internal accounting and financial controls to assist in the Board’s oversight of: (i) the integrity of Quicksilver’s financial statements; (ii) Quicksilver’s compliance with legal and regulatory requirements; (iii) the independent registered public accounting firm’s qualification and independence; and (iv) the performance of Quicksilver’s internal audit function and independent registered public accounting firm; |

| • | select, determine the compensation of, and monitor the independence and performance of Quicksilver’s independent registered public accounting firm; |

| • | select, determine the compensation of, and monitor the performance of Quicksilver’s Director of Internal Audit; |

| • | provide an avenue of communication among the independent registered public accounting firm, management and the Board; and |

| • | prepare the report that the SEC rules require be included in Quicksilver’s annual proxy statement. |

The Audit Committee met nine times during 2011. The Board has determined that (i) each of Messrs. Dunn, Morris, Rogers and Warner meets the additional audit committee independence criteria specified in SEC rules and the NYSE’s listing standards; (ii) each of Messrs. Dunn, Morris, Rogers and Warner has a basic understanding of finance and accounting and is able to read and understand fundamental financial statements; (iii) each of Messrs. Dunn, Morris, Rogers and Warner has accounting or related financial management expertise; and (iv) Mr. Morris, the Chair of the Audit Committee, is an “audit committee financial expert” within the meaning of Item 407(d)(5) of Regulation S-K.

Nominating and Corporate Governance Committee. The purposes of the Nominating and Corporate Governance Committee, also referred to as the NCG Committee, are to:

| • | identify individuals qualified to become members of the Board, consistent with criteria approved by the Board; |

| • | recommend director nominees for each annual meeting of Quicksilver’s stockholders; |

| • | develop and recommend to the Board a set of corporate governance guidelines applicable to Quicksilver; and |

| • | oversee the evaluation of the Board and management. |

6

Table of Contents

The NCG Committee met five times during 2011. The NCG Committee recommended to the Board that Messrs. Glenn Darden and W. Yandell Rogers, III be nominated to serve as directors for a term ending on the date of the 2015 annual meeting.

The NCG Committee also has oversight over Quicksilver’s compliance program. The NCG Committee has implemented a board education program designed to familiarize members of the Board with their responsibilities.

Criteria and Procedures for Selection of Director Nominees. In considering candidates for nomination, the NCG Committee will first determine the incumbent directors whose terms expire at the upcoming meeting and who wish to continue their service on the Board. As to each such incumbent director, the NCG Committee considers the director’s qualifications for Board membership using the criteria set forth below, the performance of the director during his or her current term, whether any special, countervailing considerations exist against re-nominating the director and such other factors as it deems appropriate. If the NCG Committee determines that an incumbent director consenting to re-nomination continues to be qualified and has satisfactorily performed his or her duties as a director during the preceding term, and there exist no reasons, including considerations relating to the composition and functional needs of the Board as a whole, why the incumbent should not be re-nominated, the NCG Committee will, absent special circumstances, propose the incumbent director for re-election. In the event of the resignation, retirement, removal, death or disability of an incumbent director or a decision of the directors to expand the size of the Board or not to re-nominate an incumbent director, the NCG Committee will identify and evaluate potential candidates for recommendation to the Board for nomination. The NCG Committee will solicit recommendations for candidates for nomination from the NCG Committee members, the Board, management and other persons that the NCG Committee believes are likely to be familiar with qualified candidates. The Committee may also determine to engage a professional search firm to assist in identifying qualified candidates; where such a search firm is engaged, the Committee shall determine such firm’s scope of engagement and compensation. As to each candidate that the Committee believes merits consideration, the Committee will cause to be assembled information concerning the background and qualifications of the candidate, including information concerning the candidate required to be disclosed in Quicksilver’s proxy statement or other filings with the SEC and any relationship between the candidate and the person or persons recommending the candidate.

In considering nominees for election as directors, the NCG Committee takes into consideration the following criteria:

| • | personal and professional qualities, characteristics, attributes, accomplishments and reputation in the business community; |

| • | current knowledge and contacts in the communities in which Quicksilver does business and in its industry or other industries relevant to its business; |

| • | ability and willingness to commit adequate time to Board and committee matters, including service on boards of other publicly-traded companies; |

| • | skills and personality and how they fit with those of other directors and potential directors in building a Board that is effective, collegial and responsive to the needs of Quicksilver; and |

| • | diversity of viewpoints, background, experience and other demographics versus those of other directors and potential directors. |

The NCG Committee also considers such other relevant factors as it deems appropriate, including the current composition of the Board, the balance of management directors and independent directors, the need for Audit Committee expertise and its evaluations of other candidates.

Stockholder Recommendations for Nomination of Directors. The NCG Committee will consider nominees for directors recommended by stockholders of Quicksilver and will evaluate such nominees using the same criteria used to evaluate director candidates otherwise identified by the NCG Committee. Stockholders wishing to make such recommendations should write to the Nominating and Corporate Governance Committee c/o Elizabeth K. Giddens, Secretary, Quicksilver Resources Inc., 801 Cherry Street, Suite 3700, Unit 19, Fort Worth, Texas 76102.

7

Table of Contents

Stockholder Nomination of Directors. Any stockholder entitled to vote in the election of directors at an annual meeting of stockholders may nominate persons for election as directors of Quicksilver at such meeting. Any stockholder who intends to make a nomination at the annual meeting of stockholders must deliver notice addressed to Elizabeth K. Giddens, Secretary, Quicksilver Resources Inc., 801 Cherry Street, Suite 3700, Unit 19, Fort Worth, Texas 76102. The notice should be delivered for receipt not more than 90 days and not less than 60 days prior to the first anniversary of the preceding year’s annual meeting of stockholders; provided that, in the event that the date of the meeting of stockholders is more than 30 days before or after such anniversary date, stockholder recommendations for nominees should be delivered for receipt not later than the close of business on the 15th day following the earlier of the day the notice was mailed or public disclosure of the meeting was made. Persons making submissions must include:

| • | as to each nominee whom the stockholder proposes to nominate for election as a director: |

| – | the name, age, business address and residence address of the nominee |

| – | the principal occupation or employment of the nominee |

| – | the class and number of shares of capital stock of Quicksilver which are beneficially owned by the nominee |

| – | any other information concerning the nominee that would be required, under the rules of the SEC, in a proxy statement soliciting proxies for the election of such nominee |

| • | as to the stockholder giving the notice: |

| – | the name and record address of the stockholder and of each beneficial owner on behalf of which the stockholder is acting |

| – | the class and number of shares of capital stock of Quicksilver which are beneficially owned by the stockholder and by any such beneficial owner |

| – | a representation that the stockholder is a holder of record of capital stock of Quicksilver entitled to vote at such annual meeting and intends to appear in person or by proxy at the annual meeting to nominate the nominee for election as a director |

| – | a description of all arrangements or understandings between or among any of such stockholder, the beneficial owner on whose behalf the notice is given, each nominee, and any other person or persons (naming such person or persons) pursuant to which the nominations are to be made by such stockholder |

| – | whether the proponent intends or is part of a group which intends to solicit proxies from other stockholders in support of the nomination |

This notice must also include a signed consent of each nominee to serve as a director, if elected.

Compensation of Non-Management Directors. The NCG Committee is also responsible for conducting an annual review of the compensation of the non-management directors and, when it deems appropriate, recommending changes in their compensation to the Board. Meridian Compensation Partners, LLC (“Meridian”), an independent compensation consulting firm directly engaged by the Compensation Committee, assisted the NCG Committee in reviewing the 2011 compensation of the non-management directors by providing the NCG Committee with competitive market data of non-management director compensation of comparably sized publicly-traded oil and gas companies and an analysis of the types and amounts of non-management director compensation shown in this analysis. Based on the information provided by Meridian, the NCG Committee makes its recommendations to the Board, generally targeting between the 50th and 75th percentiles of comparable non-management director compensation. Based on the recommendations of the NCG Committee, the Board approves the amount of compensation that the non-management directors receive for service on the Board and its committees.

8

Table of Contents

Compensation Committee. The purpose of the Compensation Committee is to assist the Board in discharging its responsibilities relating to compensation of Quicksilver’s executives. The Committee has the authority to engage compensation consultants to assist in the evaluation of compensation matters, and sole authority to retain and terminate any such consultants, including sole authority to approve the consultant’s fees and other retention terms.

The Compensation Committee is responsible for:

| • | reviewing and approving corporate goals and objectives relevant to the compensation of the Chief Executive Officer, evaluating the Chief Executive Officer’s performance in light of those goals and objectives, and determining and approving the Chief Executive Officer’s compensation level based on this evaluation; |

| • | reviewing and approving non-CEO executive officer compensation; |

| • | making recommendations to the Board with respect to incentive compensation plans and equity-based plans that are subject to Board approval; |

| • | granting awards under the 2006 Equity Plan, other than awards to non-employee directors under such plan; |

| • | establishing, in the Committee’s discretion, any equity-based award pool (other than an option pool) to be allocated among Quicksilver’s non-executive officer employees by another committee of the Board; |

| • | establishing, in the Committee’s discretion, salary increase, bonus, other non-equity-based award and option pools to be allocated among Quicksilver’s non-executive officer employees by another committee of the Board or one or more members of management; |

| • | reviewing the potential effect on Quicksilver of any risks arising from Quicksilver’s employee compensation policies and practices; |

| • | reviewing and discussing with management the Compensation Discussion and Analysis disclosure required to be included in Quicksilver’s annual proxy statement or annual report on Form 10-K filed with the SEC and, based on this review and discussion, determining whether to recommend to the Board that the Compensation Discussion and Analysis disclosure be included in Quicksilver’s annual proxy statement or annual report on Form 10-K; and |

| • | publishing an annual Compensation Committee Report required by the SEC to be included in Quicksilver’s annual proxy statement or annual report on Form 10-K filed with the SEC. |

Additional information regarding the Compensation Committee’s processes and procedures for consideration of executive compensation is set forth under “Executive Compensation — Compensation Discussion and Analysis.”

The 2006 Equity Plan permits the Compensation Committee to delegate its authority to grant awards, except for certain awards to executive officers and directors, to one or more executive officers of Quicksilver. Pursuant to this authority, the Compensation Committee has delegated to the Equity Awards Committee, which consists of Glenn Darden, the authority to make certain awards to individuals other than executive officers and directors of Quicksilver. Glenn Darden is a director and the Chief Executive Officer of Quicksilver.

The Compensation Committee met nine times during 2011.

Role of the Compensation Consultant. The Compensation Committee has engaged Meridian, an independent compensation consultant, to provide research data and advice to the Compensation Committee in connection with its determination of the types and amounts of compensation to be provided to Quicksilver’s executives. Meridian provides its services at the request, and under the direction, of the Compensation Committee. As discussed in further detail under “Executive Compensation — Compensation Discussion and

9

Table of Contents

Analysis,” Meridian provides the Compensation Committee with competitive market data from a peer group and a survey, as well as assists the Compensation Committee in evaluating and structuring its executive compensation programs. In addition to the services provided to the Compensation Committee, as discussed above, Meridian provides services to the NCG Committee in connection with its determination of the types and amounts of compensation to be provided to Quicksilver’s non-employee directors. Meridian reports directly to the Compensation Committee and provides no other human resource services or advice to Quicksilver other than the services provided to the Compensation Committee and the NCG Committee.

Compensation Committee Interlocks and Insider Participation

Messrs. Dunn, Morris, Rogers and Warner serve on Quicksilver’s Compensation Committee. Byron Dunn, the son of Quicksilver’s director W. Byron Dunn, was employed by Quicksilver as a landman until March 2012. For more information regarding the compensation received by Byron Dunn for his services, see “Certain Relationships and Related Transactions.”

Messrs. Glenn Darden and Thomas Darden are executive officers and directors of Quicksilver. During 2011, each of Glenn and Thomas Darden served as an executive officer and a director of Quicksilver Resources GP LLC. Quicksilver Resources GP LLC did not have a compensation committee. The board of directors of Quicksilver Resources GP LLC did not hold any deliberations regarding compensation in 2011. For information regarding certain related-party transactions among Quicksilver and the Darden family, see “Certain Relationships and Related Transactions.”

Quicksilver separates the roles of Chief Executive Officer and Chairman of the Board in recognition of the distinct contributions of these positions. The Chief Executive Officer is responsible for the day-to-day leadership, management direction and performance of the company, while the Chairman of the Board is responsible for determining growth opportunities, and together with the Chief Executive Officer, is responsible for the strategic direction of Quicksilver and presides over meetings of the full Board.

Board’s Role in Risk Oversight

The Board utilizes an Enterprise Risk Management (ERM) process to assist in fulfilling its oversight of Quicksilver’s risks. Management, which is responsible for day-to-day risk management, conducts a risk assessment of Quicksilver’s business semiannually. The risk assessment process is global in nature and has been developed to identify and assess Quicksilver’s risks and to identify steps to mitigate and manage the risks, which may be financial, operational or strategic in nature. All Quicksilver’s key business leaders, functional heads and other managers are surveyed or interviewed to develop this information.

While risk oversight is a full Board responsibility, the responsibility for monitoring the ERM process has been delegated to the Audit Committee. The results of each risk assessment are reviewed with the Audit Committee and the full Board. The centerpiece of the assessment is a discussion of Quicksilver’s key risks, which includes a review of the potential magnitude and likelihood of each risk, the senior managers responsible for managing each risk and management’s initiatives to manage each risk. Because overseeing risk is an ongoing process and inherent in Quicksilver’s strategic decisions, the Board also discusses risk throughout the year at other meetings in relation to specific proposed actions.

Director Compensation for 2011

Directors who are also employees of Quicksilver are not separately compensated for their services as directors. For 2011, each non-employee director is entitled to an annual fee of $205,000, with $49,500 of the fee payable in restricted stock, $49,500 payable in stock options and $106,000 of the fee payable in cash (subject to elections by the directors to receive restricted stock or stock options in lieu of some or all of the cash portion of the fee). The Quicksilver restricted stock and stock options were granted in accordance with the terms of the 2006 Equity Plan on January 3, 2011.

10

Table of Contents

The following table sets forth certain information regarding the compensation earned in 2011 by Quicksilver’s non-employee directors.

| Name (1) |

Fees Earned or Paid in Cash ($)(2) |

Stock Awards ($)(3) |

Option Awards ($)(4) |

Total ($) | ||||

| W. Byron Dunn |

— (5) | 155,500 | 49,500 | 205,000 | ||||

| Steven M. Morris |

— (5) | 155,500 | 49,500 | 205,000 | ||||

| W. Yandell Rogers, III |

106,000 | 49,500 | 49,500 | 205,000 | ||||

| Mark J. Warner |

106,000 | 49,500 | 49,500 | 205,000 |

| (1) | Messrs. Glenn Darden and Thomas Darden and Ms. Self serve as directors and executive officers of Quicksilver and are not separately compensated for their services as directors. For information regarding the compensation that Messrs. Glenn Darden and Thomas Darden received for their services as Quicksilver’s President and Chief Executive Officer, and Quicksilver’s Chairman of the Board, respectively, see “Executive Compensation.” For information regarding the compensation that Ms. Self received for her services as Quicksilver’s Vice President – Human Resources, see “Certain Relationships and Related Transactions.” |

| (2) | This column reports the amount of compensation earned in 2011 and paid in cash for Board and committee service. |

| (3) | The grant date fair value calculated in accordance with FASB ASC Topic 718 of the 3,327 shares of restricted stock granted to each of the non-employee directors on January 3, 2011 was $49,500. Additional information regarding the calculation of this amount is included in Note 2 and Note 17 to Quicksilver’s audited financial statements included in Quicksilver’s 2011 Annual Report on Form 10-K. The grant date fair value calculated in accordance with FASB ASC Topic 718 of the 7,124 shares of restricted stock granted to each of Messrs. Dunn and Morris on January 3, 2011 in lieu of annual cash fees was $106,000. As of December 31, 2011, the non-employee directors held the following numbers of shares of restricted stock: Mr. Dunn – 15,186; Mr. Morris – 15,186; Mr. Rogers – 8,062; and Mr. Warner – 8,062. |

| (4) | This column reports the aggregate grant date fair value of stock option awards computed in accordance with FASB ASC Topic 718. Additional information regarding the calculation of these amounts is included in Note 2 and Note 17 to Quicksilver’s audited financial statements included in Quicksilver’s 2011 Annual Report on Form 10-K. The grant date fair value calculated in accordance with FASB ASC Topic 718 of the option to purchase 5,405 shares of common stock granted to each of the non-employee directors on January 3, 2011 was $49,500. As of December 31, 2011, the non-employee directors held options to purchase the following numbers of shares of common stock: Mr. Dunn – 67,858; Mr. Morris – 75,106; Mr. Rogers – 48,325; and Mr. Warner – 86,218. |

| (5) | Messrs. Dunn and Morris elected to receive all of the annual $106,000 cash fee in the form of 7,124 shares of restricted stock in accordance with the terms of the 2006 Equity Plan. |

Any stockholder or other interested party who wishes to communicate directly with the Board or any of its members may do so by writing to: Board of Directors (or one or more named individuals) c/o John C. Cirone, Executive Vice President – General Counsel, Quicksilver Resources Inc., 801 Cherry Street, Suite 3700, Unit 19, Fort Worth, Texas 76102. Additionally, a stockholder or other interested party can contact the non-employee directors at (800) 826-6762.

Board, Committee and Annual Meetings

The Board held 18 meetings during 2011. Each director attended at least 75% of the total number of meetings of the Board and committees held during the periods that he or she served. All persons serving on the Board at the time of such meetings attended the 2011 annual meeting of Quicksilver’s stockholders and each regularly scheduled quarterly meeting of the Board in 2011.

11

Table of Contents

Under Quicksilver’s Corporate Governance Guidelines, each director is expected to dedicate adequate time, energy and attention to ensure the diligent performance of his or her duties, which includes attending meetings of the Board and committees of which he or she is a member. In addition, Board members are expected to expend reasonable efforts to attend annual meetings of Quicksilver’s stockholders.

12

Table of Contents

SECURITY OWNERSHIP OF MANAGEMENT

AND CERTAIN BENEFICIAL HOLDERS

Quicksilver Resources Inc.

The following table sets forth certain information regarding the beneficial ownership of Quicksilver common stock as of February 14, 2012, by:

| • | each director of Quicksilver; |

| • | each named executive officer of Quicksilver; |

| • | all directors and executive officers of Quicksilver as a group; and |

| • | each person known to Quicksilver to beneficially own more than 5% of Quicksilver common stock. |

Unless otherwise indicated by footnote, the beneficial owner exercises sole voting and investment power over the shares. The percentage of beneficial ownership is calculated on the basis of 173,360,392 shares of Quicksilver common stock outstanding as of February 14, 2012.

| Beneficial Owner |

Number of Shares |

Percent of Outstanding Shares | ||||

| Directors and Executive Officers |

||||||

| Glenn Darden (1)(2)(3)(4)(5) |

45,939,603 | 26.4% | ||||

| Thomas F. Darden (1)(2)(3)(4)(5) |

46,055,393 | 26.5% | ||||

| Anne Darden Self (1)(2)(3)(4)(5) |

44,021,021 | 25.4% | ||||

| W. Byron Dunn (3)(5)(6) |

141,264 | * | ||||

| Steven M. Morris (3)(5) |

411,232 | * | ||||

| W. Yandell Rogers, III (3)(5) |

179,197 | * | ||||

| Mark J. Warner (3)(5) |

141,785 | * | ||||

| John C. Cirone (3)(5)(7)(8) |

614,499 | * | ||||

| Jeff Cook (3)(5) |

1,014,537 | * | ||||

| Philip W. Cook (2)(3)(4)(5)(6) |

480,924 | * | ||||

| Directors and executive officers as a group (14 persons) (1)(2)(3)(4)(5)(6)(7)(8) |

56,087,566 | 31.9% | ||||

| Holders of More Than 5% Not Named Above |

||||||

| Pennsylvania Management, LLC (9) |

41,677,288 | 24.0% | ||||

| Quicksilver Energy L.P. (9) |

41,677,288 | 24.0% | ||||

| SPO Advisory Corp. (10) |

24,985,154 | 14.4% | ||||

| Southeastern Asset Management, Inc. (11) |

17,560,000 | 10.1% | ||||

| BlackRock, Inc. (12) |

17,203,450 | 9.9% | ||||

* Indicates less than 1%

| (1) | Includes as to each of Messrs. Glenn Darden and Thomas Darden and Ms. Self: 41,677,288 shares beneficially owned by Quicksilver Energy L.P., for which he or she has shared voting and investment power as a member of Pennsylvania Management, LLC, the sole general partner of Quicksilver Energy L.P. Each of Messrs. Glenn Darden and Thomas Darden and Ms. Self disclaims beneficial ownership of all shares owned by Quicksilver Energy L.P., except to the extent of his or her pecuniary interest therein. The business address of each of Messrs. Glenn Darden and Thomas Darden and Ms. Self is 801 Cherry Street, Suite 3700, Unit 19, Fort Worth, Texas 76102. |

| (2) | Includes with respect to each of the following individuals and all directors and executive officers as a group, the following approximate numbers of shares represented by units in a Unitized Stock Fund held through Quicksilver’s 401(k) Plan: Mr. Glenn Darden – 38,009; Mr. Thomas Darden – 106,369; Ms. Self – 58,091; Mr. Philip W. Cook – 15,957; and all directors and executive officers as a group – 231,775. |

13

Table of Contents

| (3) | Includes with respect to each of the following individuals and all directors and executive officers as a group, the following numbers of shares subject to options that are or could become exercisable on or before April 14, 2012: Mr. Glenn Darden – 548,728; Mr. Thomas Darden – 548,728; Ms. Self – 70,594; Mr. Dunn – 62,585; Mr. Morris – 69,833; Mr. Rogers – 43,052; Mr. Warner – 85,238; Mr. Cirone – 338,503; Mr. Jeff Cook – 259,322; Mr. Philip Cook – 168,836; and all directors and executive officers as a group – 2,319,724. |

| (4) | Includes with respect to each of the following individuals and all directors and executive officers as a group, the following numbers of shares pledged as collateral security for loans or loan commitments or in accordance with customary terms and conditions of standard margin account arrangements: Mr. Glenn Darden – 9,113,749 (including 9,113,749 shares beneficially owned by Quicksilver Energy L.P.); Mr. Thomas Darden – 12,273,442 (including 9,113,749 shares beneficially owned by Quicksilver Energy L.P.); Ms. Self – 9,113,749 (including 9,113,749 shares beneficially owned by Quicksilver Energy L.P.); Mr. Philip Cook – 134,673; and all directors and executive officers as a group – 12,426,196 (including 9,113,749 shares beneficially owned by Quicksilver Energy L.P.). |

| (5) | Includes with respect to each of the following individuals and all directors and executive officers as a group, the following numbers of shares of restricted stock for which the indicated beneficial owners have no investment power: Mr. Glenn Darden – 407,697; Mr. Thomas Darden – 407,697; Ms. Self – 40,977; Mr. Dunn – 25,599; Mr. Morris – 25,599; Mr. Rogers – 10,369; Mr. Warner – 10,369; Mr. Cirone – 6,488; Mr. Jeff Cook – 194,914; Mr. Philip Cook – 159,458; and all directors and officers as a group – 1,469,050. |

| (6) | Includes as to each of Messrs. Dunn and Philip Cook, 35,700 and 134,673 shares, respectively, held by him jointly with his spouse. |

| (7) | Includes 129,338 shares subject to restricted stock units that could vest on or before April 14, 2012 and for which Mr. Cirone has no voting or investment power. |

| (8) | Includes shares subject to options that would become exercisable, and restricted stock units that would vest, upon Mr. Cirone’s retirement. Mr. Cirone satisfied the retirement eligibility criteria under the 2006 Equity Plan on January 22, 2012 (see “—Potential Payments Upon Termination or in Connection with a Change in Control”). |

| (9) | As sole general partner of Quicksilver Energy L.P., Pennsylvania Management, LLC has sole voting and investment power with respect to 41,677,288 shares of Quicksilver common stock beneficially owned by Quicksilver Energy L.P. The address of Pennsylvania Management, LLC and Quicksilver Energy L.P. is 801 Cherry Street, Suite 3700, Unit 19, Fort Worth, Texas 76102. |

| (10) | Based on a Schedule 13D filed by SPO Advisory Corp. with the SEC on March 17, 2011, SPO Advisory Corp. had sole voting and investment power over 24,985,154 shares of Quicksilver common stock, SPO Partners II, L.P. had sole voting and investment power over 23,311,254 shares, SPO Advisory Partners, L.P. had sole voting and investment power over 23,311,254 shares, San Francisco Partners, L.P. had sole voting and investment power over 1,673,900 shares, SF Advisory Partners, L.P. had sole voting and investment power over 1,673,900 shares, John H. Scully had sole voting and investment power over 19,900 shares and shared voting and investment power over 24,985,154 shares, William E. Oberndorf had sole voting and investment power over 155,400 shares and shared voting and investment power over 24,985,154 shares, and Edward H. McDermott had sole voting and investment power over 2,300 shares and shared voting and investment power over 24,985,154 shares. The address of SPO Advisory Corp., SPO Partners II, L.P., SPO Advisory Partners, L.P., San Francisco Partners, L.P., SF Advisory Partners, L.P., John H. Scully, William E. Oberndorf, and Edward H. McDermott is 591 Redwood Highway, Suite 3215, Mill Valley, California 94941. |

| (11) | Based on a Schedule 13G filed by Southeastern Asset Management, Inc. with the SEC on February 7, 2012, Southeastern Asset Management, Inc. had shared voting and investment power over 17,343,000 shares of Quicksilver common stock and sole investment power over 217,000 shares and Longleaf Partners Small-Cap Fund had shared voting and investment power over 17,343,000 shares. The address of Southeastern Asset Management, Inc. and Longleaf Partners Small-Cap Fund is 6410 Poplar Avenue, Suite 900, Memphis, Tennessee 38119. |

| (12) | Based on a Schedule 13G filed by BlackRock, Inc. with the SEC on February 9, 2012, BlackRock, Inc. had sole voting and investment power over 17,203,450 shares of Quicksilver common stock. The address of BlackRock, Inc. is 40 East 52nd Street, New York, New York 10022. |

14

Table of Contents

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires Quicksilver’s executive officers and directors, and persons who own more than 10% of a registered class of its equity securities, to file reports of ownership and changes in ownership with the SEC. Executive officers, directors and greater than 10% stockholders are required by SEC rules to furnish Quicksilver with copies of all Section 16(a) forms they file.

To Quicksilver’s knowledge, based solely on a review of the copies of such forms furnished to Quicksilver with respect to 2011 and written representations from Quicksilver’s directors, executive officers and greater than 10% stockholders, Quicksilver believes that during 2011 all of its executive officers and directors and all owners of more than 10% of Quicksilver common stock were in compliance with all applicable Section 16(a) filing requirements.

15

Table of Contents

EQUITY COMPENSATION PLAN INFORMATION

The following table sets forth information as of December 31, 2011, with respect to shares of common stock that may be issued under Quicksilver’s existing equity compensation plans.

| Plan Category |

Number of shares of common stock to be issued upon exercise of outstanding options, warrants and rights |

Weighted-average exercise price of outstanding options, warrants and rights |

Number of shares of common stock remaining available for future issuance under equity compensation plans (excluding shares of common stock reflected in column (a)) |

|||||||||

| (a) | (b) | (c) | ||||||||||

| Equity compensation plans approved by stockholders (1) |

3,932,136 | (2) | $ | 12.01 | (3) | 12,627,890 | (4) | |||||

| Equity compensation plans not approved by stockholders |

— | — | — | |||||||||

| Total |

3,932,136 | $ | 12.01 | 12,627,890 | ||||||||

| (1) | Consists of the 2006 Equity Plan and the 2004 Non-Employee Director Equity Plan. |

| (2) | Consists of 3,760,696 options and 171,440 stock-settled restricted stock units. Each restricted stock unit entitles the holder to receive, upon vesting and without payment of any cash, one share of common stock with respect to each restricted stock unit. |

| (3) | Reflects the weighted-average exercise price for the 3,760,696 options outstanding under equity compensation plans approved by stockholders. |

| (4) | Upon stockholder approval of the 2006 Equity Plan, Quicksilver ceased to grant awards under the 2004 Non-Employee Director Equity Plan. Accordingly, this number reflects only shares of common stock remaining available for future issuance under the 2006 Equity Plan. |

16

Table of Contents

Compensation Discussion and Analysis

Overview of 2011 Compensation

Below is an overview of the more detailed disclosure in this Compensation Discussion and Analysis regarding Quicksilver’s 2011 compensation program for Quicksilver’s named executive officers.

| • | There were no changes to the compensation philosophy, objectives or components from 2010 to 2011. |

| • | The main objectives of the compensation program are to improve company performance by creating a direct relationship between compensation and company performance and to attract, retain and motivate high-quality executive officers. |

| • | Quicksilver provides the following elements of compensation for the named executive officers: base salary, annual cash and equity bonuses, long-term incentive equity awards, retirement benefits and limited perquisites. |

| • | Quicksilver generally targets at or above the 50th percentile of the competitive market when considering cash compensation and between the 50th and 75th percentiles when considering long-term incentives. |

| • | The annual bonus program provides awards based on achievement of financial and operational goals. The 2011 performance goals consisted of cash flow from operations, earnings per share, finding and development cost, production and reserves. During 2011 Quicksilver’s operating and financial performance resulted in an annual bonus payout of 65.5% percent of target. |

| • | Quicksilver encourages the named executive officers to think and act like owners and enhance their commitment to Quicksilver’s success through the award of equity-based long-term incentive grants. In 2011, the grants to the named executive officers included stock options to purchase Quicksilver common stock and shares of restricted stock or restricted stock units. |

| • | The Compensation Committee makes all compensation decisions regarding the named executive officers but may seek input and guidance from the Chief Executive Officer, executive management and the Compensation Committee’s independent compensation consultant. |

Objectives

Quicksilver’s philosophy with respect to compensation of its named executive officers is to improve company performance by creating a direct relationship between compensation and company performance and by providing competitive compensation in order to attract, retain and motivate high-quality executive officers. To accomplish the objectives of this philosophy, the Compensation Committee believes that compensation should:

| • | take into account both personal performance and Quicksilver’s performance; |

| • | be structured to advance both the short- and long-term interests of Quicksilver and its stockholders; and |

| • | tie a significant portion of the named executive officers’ compensation to the value of Quicksilver stock to align them with owners and enhance their commitment to Quicksilver’s success. |

Compensation Strategies

To achieve these objectives, the Compensation Committee employs the following general compensation strategies with respect to compensation of the named executive officers:

17

Table of Contents

| • | target base salary and cash bonus each at or above the 50th percentile of competitive market data for a peer group of 13 companies in the oil and natural gas exploration and production industry and competitive market data for a survey of companies in the industry, as described below; |

| • | target long-term incentive compensation, in the form of equity-based awards, between the 50th and 75th percentiles of the competitive market data (or higher if base salary or target cash bonus is set below the 50th percentile); and |

| • | target total compensation between the 50th and 75th percentiles of the competitive market data. |

In considering the 2011 compensation packages for the named executive officers, the Compensation Committee discussed potential changes from 2010 compensation packages to the level and form of compensation in light of Quicksilver’s compensation philosophy, the overall economy and Quicksilver’s performance. In addition, the Compensation Committee reviewed factors such as each named executive officer’s contribution to Quicksilver’s overall performance, experience, skills, scope of responsibility and tenure. The Compensation Committee also examined the objectives behind each component of compensation for each of the named executive officers and considered the potential economic consequences of making changes from both an operational standpoint and a stockholder perspective.

As part of this process, the Compensation Committee worked with Meridian, the Chief Financial Officer at the time and the Vice President – Human Resources to evaluate whether risks arising from Quicksilver’s compensation policies and practices are reasonably likely to have a material adverse effect on Quicksilver. Following this review, the Compensation Committee concluded that Quicksilver’s current compensation policies and practices do not create risks that are reasonably likely to have a material adverse effect on Quicksilver.

Role of the Compensation Committee

The Compensation Committee is responsible for reviewing and recommending Quicksilver’s executive compensation program, including reviewing and approving all compensation decisions for Quicksilver’s named executive officers. The Compensation Committee completes a performance assessment of the Chief Executive Officer each year, which is discussed with him. In executive session, the Compensation Committee develops its own recommendation for, and approves, the compensation of the Chief Executive Officer.

The Compensation Committee strives to maintain sound basic practices for the development and administration of Quicksilver’s compensation program. The Compensation Committee has set forth certain practices to effectively carry out its responsibilities, such as:

| • | maintaining membership of only independent directors in accordance with NYSE requirements; |

| • | holding executive sessions without executive management present; |

| • | annually reviewing detailed compensation tally sheets for each of the named executive officers; |

| • | engaging an independent compensation consultant to advise the Compensation Committee; |

| • | meeting with the independent compensation consultant without executive management present at least once during the year to discuss Quicksilver’s compensation program and actions on a confidential basis; |

| • | assessing the independent compensation consultant’s performance and providing feedback as appropriate; and |

| • | evaluating the performance of the Compensation Committee each year. |

18

Table of Contents

Role of Executive Management

Each year executive management presents Quicksilver’s financial and operating budget to the Board for the next fiscal year for approval. The performance measures and targets for the annual bonus awards are recommended by executive management to the Compensation Committee based on the Board–approved budget. After year end, executive management reviews the actual performance with the Compensation Committee and recommends annual bonus awards for each named executive officer.

All compensation decisions include an assessment of individual performance, including each named executive officer’s contribution to Quicksilver’s overall performance for the applicable performance period, experience, skills, scope of responsibility and tenure. The Chief Executive Officer each year evaluates all named executive officers and makes compensation recommendations to the Compensation Committee for all named executive officers except himself. In making individual compensation decisions, the Compensation Committee reviews and discusses these recommendations.

Certain members of executive management have key roles in supporting the Compensation Committee as described above including the Chief Executive Officer, the Chief Financial Officer and the Vice President – Human Resources.

Role of the Compensation Consultant

The Compensation Committee has the authority under its charter to engage the services of outside advisors, experts and others to assist the Compensation Committee in the performance of its duties. For 2011, the Compensation Committee engaged Meridian to serve as its independent compensation consultant on matters related to executive compensation. The consultant reports directly to the Compensation Committee and provides no other human resource services or advice to Quicksilver other than the services provided to the Compensation Committee and the NCG Committee. The Compensation Committee annually reviews and establishes the scope of the engagement of the consultant, which is reflected in an annual engagement letter between the consultant and the Compensation Committee.

The consultant provides advice to the Compensation Committee on matters related to the fulfillment of its responsibilities under its charter, including the overall design of Quicksilver’s executive compensation program, competitive compensation market data, review of the disclosures in Quicksilver’s proxy statement, annual review of the Compensation Committee’s charter, legislative and regulatory developments and all other matters related to the compensation of Quicksilver’s named executive officers.

The Compensation Committee meets with its consultant in executive session without members of management present. The consultant also communicates with the Compensation Committee Chairman outside of the meetings. The consultant reviews materials prepared by executive management, including recommendations and proposals being submitted to the Compensation Committee and provides advice and guidance to the Compensation Committee regarding these recommendations. The consultant also gathers and provides competitive market data and other background information for consideration by the Compensation Committee.

Executive management works with the consultant as necessary to support the work of the consultant on behalf of the Compensation Committee. The interactions of the consultant with executive management are limited to those that are on the Compensation Committee’s behalf or related to proposals that will be presented to the Compensation Committee for review and approval.

Summary of 2011 Compensation

The named executive officers are Quicksilver’s Chief Executive Officer, Chief Financial Officer who served during 2011 and the three most highly-compensated executive officers other than the Chief Executive Officer and Chief Financial Officer who served as executive officers as of December 31, 2011. For 2011, the named executive officers were Messrs. Glenn Darden, Philip W. Cook, Thomas F. Darden, Jeff Cook and John C. Cirone.

19

Table of Contents

General

Each element of Quicksilver’s compensation program is intended to advance Quicksilver’s objectives of attracting, retaining and motivating talented executives, and to enhance Quicksilver’s competitive position in the market for executive-level talent and to improve company performance. Quicksilver’s compensation program for the named executive officers in 2011 consisted of base salary, annual cash and equity bonuses, long-term incentive equity awards, retirement benefits and limited perquisites. In addition, Quicksilver provides change-in-control benefits for each of the named executive officers.

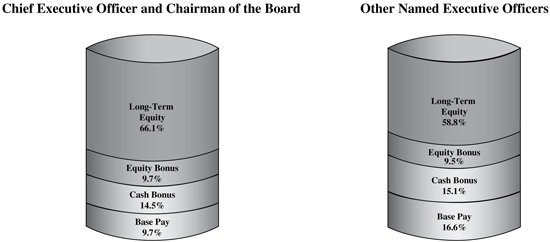

The charts below reflect the average percentage of total target compensation represented by each element of the compensation package for (1) the Chief Executive Officer and the Chairman of the Board and (2) the other named executive officers. For purposes of computing these percentages, target opportunity (rather than actual payments) of both the annual cash and equity award bonus components of 2011 compensation were used.

The Compensation Committee believes that this mix of compensation elements provides sufficient fixed cash compensation in the form of base salary to attract and retain qualified executives. The Compensation Committee also believes the mix places an adequate amount of potential cash compensation at risk to motivate the executives to achieve annual company goals, and provides the executives with sufficient equity incentives to motivate them to achieve long-term company goals. In addition, because the equity component vests over time, it encourages executives to continue their employment relationship with Quicksilver.

The Compensation Committee reviews tally sheets presenting the individual components and total compensation for each named executive officer to provide an overall current and historical perspective of each individual’s compensation and an annual growth and compensation analysis presenting changes in Quicksilver’s performance relative to changes in compensation of the named executive officers. While not directly considered when making compensation decisions, the Compensation Committee periodically reviews the equity holdings and wealth accumulation analyses of the named executive officers, which include unvested stock awards and unexercised stock options. In arriving at the compensation packages for the named executive officers for 2011, the Compensation Committee also received input from Meridian and executive management.

As part of its process, the Compensation Committee considered publicly available compensation information filed with the SEC by the companies in Quicksilver’s 2011 peer group, as compiled by Meridian, and other competitive market data from a North American oil and gas exploration and production industry survey provided by Meridian. Quicksilver’s peer group for 2011 consisted of the following 13 small to midsize publicly-traded companies engaged in oil and natural gas production and exploration: Berry Petroleum Company, Bill Barrett Corporation, Cabot Oil & Gas Corporation, Forest Oil Corporation, Newfield Exploration Company, Petrohawk Energy Corporation, QEP Resources, Inc., Range Resources Corporation, Southwestern Energy Company, SM Energy Company (formerly known as St. Mary Land & Exploration Company), Swift Energy Company, Ultra Petroleum Corp. and Whiting Petroleum Corporation. Factors considered in selecting the 2011 peer

20

Table of Contents

group included type of business, revenue, assets, market capitalization, enterprise value and total stockholder return. The North American oil and gas exploration and production industry survey used this same 2011 peer group of companies.

Base Salaries

Base salaries are intended to attract executive talent and compensate executives for their experiences, skills, scope of responsibility and tenure. In evaluating the 2011 base salaries of the named executive officers, the Compensation Committee considered Quicksilver’s performance and each executive’s skills and experience, the Compensation Committee’s evaluation of the performance of the Chief Executive Officer and, with respect to the other named executive officers, the Chief Executive Officer’s evaluation of the performance of each named executive officer.

In November 2010, after considerable discussion of Quicksilver’s compensation philosophy, the overall economy and Quicksilver’s and individual performance, and in consultation with Meridian and executive management, upon the recommendation of the Chief Executive Officer, the Compensation Committee increased (after keeping salary levels flat for 2010) the named executive officers’ salaries, effective as of January 1, 2011, as follows:

| Name |

Salary Increase ($) |

Salary Increase (%) | ||

| Glenn Darden |

15,000 | 3.4 | ||

| Philip W. Cook |

15,000 | 4.5 | ||

| Thomas F. Darden |

15,000 | 3.4 | ||

| Jeff Cook |

15,000 | 3.9 | ||

| John C. Cirone |

15,000 | 5.0 |

The Compensation Committee determined that the above adjustments would be made for 2011 in light of each named executive officer’s individual performance and the Compensation Committee’s desire to retain these individuals. Following the adjustment, the base salaries of the Chairman of the Board and the Chief Executive Officer remained below the 25th percentile of the competitive market data and those of the other named executives were between the 25th and 50th percentiles. The base salaries are set forth in the “Salary” column in the “Summary Compensation Table for 2011.”

Bonuses

Annual bonus targets are set to reflect a range of award levels that are intended to be competitive with awards offered by other peer companies to reward similarly situated executives. The Compensation Committee includes annual bonuses in the named executive officers’ pay mix to ensure their focus on the annual performance goals that have been developed to align with Quicksilver’s long-term strategy and objectives that it believes will ultimately increase stockholder value. Because bonus payouts for each year are linked to the achievement of overall corporate goals for that year (with the relevant goals and objectives established and communicated near the beginning of each year), these bonuses are designed to incentivize the named executive officers to achieve Quicksilver’s near-term objectives. In addition, to encourage the named executive officers to continually focus on meeting stockholder value over the long term, Quicksilver pays a portion of the annual bonus in shares of restricted stock or restricted stock units that vest over three years, one third on each of the first three anniversaries of the date of grant.

Quicksilver’s Chief Executive Officer formulated a proposed 2011 Executive Bonus Plan, which he presented to the Compensation Committee for consideration in November 2010. The Chief Executive Officer’s proposal recommended annual cash bonuses providing target opportunities sufficient to bring the named executive officers’ total cash compensation to (i) below the 25th percentile of total cash compensation for similar positions in the competitive market data for the Chairman and the Chief Executive Officer; (ii) between the 25th and 50th percentiles for the then Chief Financial Officer; and (iii) between the 50th and 75th percentiles for the Executive Vice President – Operations and for the Executive Vice President – General Counsel. The Compensation Committee also explored with executive management the likelihood of Quicksilver achieving the targeted performance measures. The Compensation Committee considered Meridian’s review regarding the proposed 2011 Executive Bonus Plan.

21

Table of Contents

On February 22, 2011, the Compensation Committee adopted the 2011 Executive Bonus Plan which established target and maximum levels with respect to the cash bonuses to be paid under the Plan to the named executive officers expressed as a percentage (which remained unchanged from 2010) of each participant’s base salary for 2011, as follows:

| Cash Bonus | ||||||||||

| Target | Maximum | |||||||||

| Name |

Percentage of Base Pay |

Dollar Amount ($) |

Percentage of Base Pay |

Dollar Amount ($) |

||||||

| Glenn Darden |

150% | 682,500 | 300% | 1,365,000 | ||||||

| Philip W. Cook |

85% | 293,250 | 170% | 586,500 | ||||||

| Thomas F. Darden |

150% | 682,500 | 300% | 1,365,000 | ||||||

| Jeff Cook |

100% | 400,000 | 200% | 800,000 | ||||||

| John C. Cirone |

85% | 267,750 | 170% | 535,500 | ||||||

The Compensation Committee also established target and maximum levels with respect to the restricted stock or restricted stock unit bonus to be paid to the named executive officers, expressed as a percentage (which remained unchanged from 2010) of each participant’s base salary for 2011, as follows:

| Restricted Stock or Restricted Stock Unit Bonus | ||||||||

| Target | Maximum | |||||||

| Name |

Percentage of Base Pay |

Dollar Value ($) |

Percentage of Base Pay |

Dollar Value ($) | ||||

| Glenn Darden |

100% | 455,000 | 200% | 910,000 | ||||

| Philip W. Cook |

55% | 189,750 | 110% | 379,500 | ||||

| Thomas F. Darden |

100% | 455,000 | 200% | 910,000 | ||||

| Jeff Cook |

60% | 240,000 | 120% | 480,000 | ||||

| John C. Cirone |

55% | 173,250 | 110% | 346,500 | ||||

The 2011 Executive Bonus Plan provides that the number of shares of restricted stock or restricted stock units to be received as a bonus would be determined by dividing the applicable dollar amount of the bonus by the closing market price of Quicksilver’s common stock on the date of grant (i.e., the payment date). The Compensation Committee believes these grants of restricted stock or restricted stock units encourage the named executive officers to think and act like owners and to enhance their commitment to Quicksilver. The awards are intended to reward the long-term performance of Quicksilver and how that performance is viewed by its stockholders.

The Compensation Committee established the performance measures, the relative weight to be assigned to each performance measure and the percentage of target bonus to be awarded for achievement of various performance levels with respect to each performance measure under the 2011 Executive Bonus Plan. The Compensation Committee kept these relative weights unchanged for 2011 from those of 2010. Bonus payouts under the 2011 Executive Bonus Plan are structured to be based on actual performance relative to the established performance targets and weightings.

The 2011 Executive Bonus Plan provides for payment of the target payout if 100% of budget is achieved for all performance measures. A threshold payment of 50% of target is earned for a performance measure if achievement for such performance measure is more than 50% but less than 80% of budget. A payment of 60% of target is earned for a performance measure if achievement for such performance measure is 80% of budget. A maximum payment of 200% of target is earned for a performance measure if achievement for such performance measure is 120% of budget. Payments earned increase in 10% increments from 60% to 100% of target for a performance measure as achievement for such performance measure against budget increases in 5% increments

22

Table of Contents