Exhibit 99.1

|

|

Cardinal Financial Corporation Raymond James Institutional Investors Conference March 4, 2014 |

|

|

FORWARD LOOKING STATEMENTS Statements contained in this presentation which are not historical facts are forward-looking statements as that item is defined in the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are subject to risks and uncertainties which could cause actual results to differ materially from estimated results. For an explanation of the risks and uncertainties associated with forward-looking statements, please refer to the Company’s Annual Report on Form 10-K for the year ended December 31, 2012 and other reports filed and furnished to the Securities and Exchange Commission. | 2 |

|

|

Aggressive on Sales, CONSERVATIVE ON RISK OUR OPERATING PHILOSOPHY | 3 |

|

|

BUSINESS LINE PROFILE | 4 Founded 1998 Retail Banking Offices 301 Headquarters Tysons Corner Fairfax, VA Mortgage Banking Offices 19 Commercial Banking Retail Banking Residential Mortgage Wealth Management 1 Includes net acquisition-related Banking Office Consolidation and new Lee-Harrison (Arlington, VA) branch scheduled to open late spring, 2014. |

|

|

MANAGEMENT TEAM Industry Experience Years in Market Bernard Clineburg Chairman & CEO 42 years 42 Chris Bergstrom EVP, CCO/CRO 31 years 24 Alice Frazier EVP, COO 25 years 22 Dennis Griffith EVP, Chief Lending Officer 40 years 40 Kevin Reynolds EVP, Director of Sales 31 years 31 Mark Wendel EVP, CFO 31 years 7 Bob Brower CEO, George Mason Mortgage 22 years 22 | 5 |

|

|

4th Consecutive Appearance PUBLIC RECOGNITION 2011 (38th), 2012 (37th) | 6 ABABANKINGJOURNAL Ranked 8th among institutions with total assets between $1 billion and $10 billion 2013 Bank Performance Scorecard Overall Financial Performance Ranked 5th of 187 Banks Nationwide $1 billion to $5 billion in assets. 2012 BANK HONOR ROLL SmallCap600® August 9, 2013 |

|

|

Strong Largest economy in the U.S.1 Housing trends year over year2 Median sales price increased 9.0% Median Days on Market decreased 14% Stable 7.4% regional economic growth since 2006; highest of all major metropolitan areas in US3 Unemployment rate consistently below national average THE GREATER WASHINGTON MSA | 7 Sources: 1Policom Corporation, 2013 Economic Strength Rankings 2GMU Center for Regional Analysis, Real Estate Business Intelligence, 1/10/14 3Inflation-adjusted, 2013 Regional Report, Washington Board of Trade |

|

|

THE GREATER WASHINGTON MSA | 8 Growing 5 major corporate headquarter relocations in recent years1 Gained more than 285,000 jobs (8.87% growth) since 2000 56 Inc. “500 Fastest-Growing Companies” Greater Washington Jobs by Sector, 20122 12013 Regional Report, Washington Board of Trade 2GMU Center for Regional Analysis |

|

|

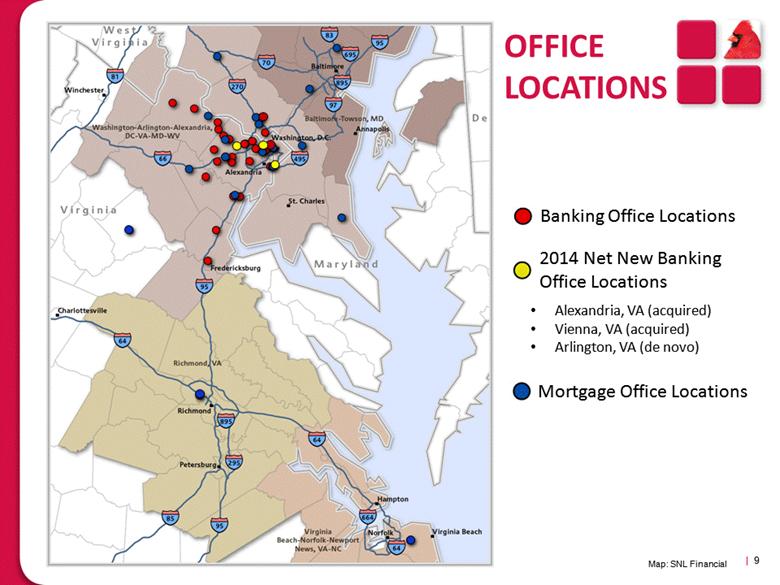

OFFICE LOCATIONS | 9 Map: SNL Financial Banking Office Locations Mortgage Office Locations Alexandria, VA (acquired) Vienna, VA (acquired) Arlington, VA (de novo) 2014 Net New Banking Office Locations |

|

|

INTEGRATED BUSINESS MODEL Regional Teams with Local Expertise Established Market Executives Commercial Retail Mortgage Wealth Management Strategic Business Units Government Contract Lending Real Estate Lending Strategic Business Initiatives Medical Practices Title Companies Nonprofits Property Management | 10 |

|

|

OUR RETAIL MARKETS Region Median Household Income 20121 Total Population 20121 Projected Population Increase 2012 – 20171 Fairfax County and City of Fairfax, VA $101,779 1,100,757 5.48% Loudoun County, VA $113,282 327,715 15.03% Prince William County, VA $89,162 415,479 11.61% Arlington County, VA $90,423 215,286 8.62% Alexandria (City), VA $80,536 143,372 8.71% Montgomery County , MD $91,837 986,965 5.23% District of Columbia $59,100 617,405 2.61% Fredericksburg (City), VA $48,767 25,368 12.44% Stafford County, VA $87,476 130,703 5.83% | 11 1Source: SNL Financial |

|

|

OUR DEPOSIT MARKET SHARE PROFORMA Region 2Q2013 CFNL Banking Offices2 CFNL Deposit Market Share Total Deposits in Market1 CFNL Deposits2 Greater Washington MSA $154.98 billion $2.43 billion 29 1.67% Fairfax County, VA $41.3 billion $1.38 billion 11 3.35% Loudoun County, VA $5.0 billion $241 million 3 4.80% Montgomery County, MD $30.8 billion $143.3 million 2 0.46% Arlington County, VA $5.6 billion $161.9 million 4 2.90% District of Columbia $36.5 billion $88.7 million 2 0.24% Prince William County, VA $3.6 billion $61.1 million 1 1.68% Manassas, VA (City) $1.0 billion $128.6 million 1 12.40% Fairfax, VA (City) $3.0 billion $101.8 million 1 3.36% Alexandria, VA (City) $5.4 billion $70.7 million 2 1.30% Fredericksburg , VA (City) $1.2 billion $32.8 million 1 2.68% Stafford County, VA $826 million $18.2 million 1 2.20% | 12 Source: SNL Financial 1Excludes E-Trade Bank which are brokered deposits 2 Includes net of acquisition-related banking office consolidations. |

|

|

THE BUSINESS BANK (TBB) ACQUISITION | 13 1Q2014 2Q2014 3Q2014 4Q2014 Acquisition Completed January 15, 2014 Systems Conversion March 7-9, 2014 Transaction Costs Range: $6.8 million - $7 million Systems Termination Fees Lease Terminations Severance Branch Consolidations 4 Branch Consolidations 1 Branch Consolidation 1 Branch Consolidation Cost Savings Exceed 50% |

|

|

ANNUAL GROWTH | 14 1From 12/31/2008 through 12/31/2013 Excludes Brokered Deposits CAGR1 Loans: 12.36% Deposits: 10.25% Total Assets: 10.66% |

|

|

COMMERCIAL LENDING PROFILE Loan Portfolio of $2.04 billion 25 Loan Officers Commercial Real Estate Government Contract Small Business Retail | 15 Net Loans Held for Investment Loan Officers Average Industry Experience Average Years In-Market 25 19 Years 17 |

|

|

LOAN PORTFOLIO MIX1 | 16 As of 12/31/2013 |

|

|

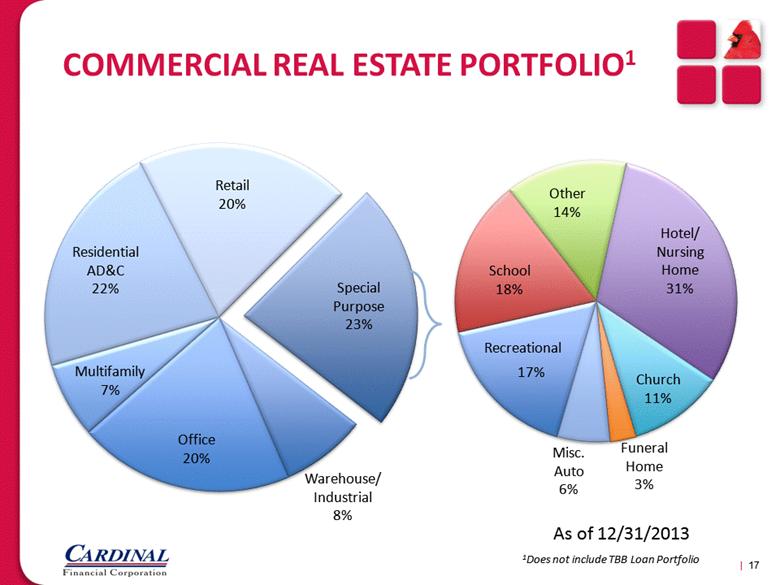

COMMERCIAL REAL ESTATE PORTFOLIO1 | 17 Recreational As of 12/31/2013 1Does not include TBB Loan Portfolio |

|

|

STRONG CONSERVATIVE CREDIT CULTURE | 18 |

|

|

DEPOSIT PROFILE Emphasis on core deposits and increasing relationships 6 Business Deposit Officers Aggressive deposit campaigns with strategic follow-up marketing | 19 Total Deposits1 Area # of Officers Average Industry Experience Average Years In-Market Retail Officers 28 22 Years 22 Business Deposit Officers 6 15 Years 10 Leadership 2 32 Years 30 1Excludes Brokered Deposits and TBB Deposits |

|

|

CORE DEPOSIT BASE & COST OF DEPOSITS | 20 Cost of Deposits1 1Excludes Brokered Deposits and TBB Deposits Money Market/ Savings $1.777 billion as of 12/31/2013 |

|

|

DEPOSIT GROWTH | 21 |

|

|

CARDINAL IS WELL CAPITALIZED | 22 Average Tang. Common Equity/Tang. Assets National Peer Group (see Appendix A)reported as of 12/31/13 Source: SNL Financial |

|

|

MORTGAGE BANKING PROFILE George Mason Mortgage operates 19 branches in 15 counties, throughout Virginia, Maryland, and the District of Columbia Marketing gains typically range between 1.90% and 2.10% | 23 GMM Loan Officers Q42011 102 Q42012 160 Q42013 201 1Excludes Managed Companies |

|

|

Full Service Brokerage Services1 Investment Management WEALTH MANAGEMENT PROFILE 1 Securities offered through Raymond James Financial Services, Inc., Member FINRA/SIPC, and are: • Not deposits • Not insured by FDIC or any other government agency • Not guaranteed by Cardinal Bank • Subject to risk, may lose value. Cardinal Bank and Cardinal Wealth Services are independent of Raymond James Financial Services. | 24 Senior Management Average Industry Experience Average Years In-Market 2 23 Years 17 |

|

|

COST-SAVING INITIATIVES Retail Two underperforming banking offices identified for 1Q2014 closure Mortgage1 21% reduction of back office staff since August 2013 One mortgage banking office consolidated, 1Q 2014 Ongoing expense control measures | 25 1 Quarterly Expense Reduction detailed in Appendix B |

|

|

STRATEGIC GROWTH: DE NOVO Expand DC/ Montgomery County Presence 2 New Banking Offices in 2013 Georgetown, Washington, DC Rockville, MD New Market Executive and two additional commercial lenders with regional expertise 2014 New Banking Offices Lee-Harrison, Arlington, VA Targeted Industry Initiatives | 26 Map: SNL Financial 2014 Lee-Harrison Office Location |

|

|

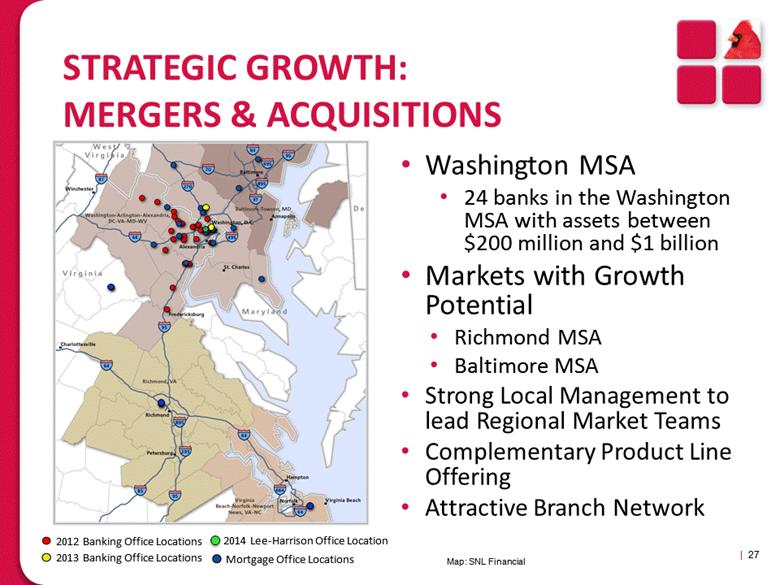

STRATEGIC GROWTH: MERGERS & ACQUISITIONS | 27 Washington MSA 24 banks in the Washington MSA with assets between $200 million and $1 billion Markets with Growth Potential Richmond MSA Baltimore MSA Strong Local Management to lead Regional Market Teams Complementary Product Line Offering Attractive Branch Network Map: SNL Financial 2014 Lee-Harrison Office Location |

|

|

FINANCIAL HIGHLIGHTS 2010 2011 2012 2013 Assets In billions $2.072 $2.063 $3.039 $2.894 Loans In billions $1.409 $1.632 $1.803 $2.040 Core Deposits In billions $1.315 $1.323 $1.627 $1.776 Net Income In thousands $18,442 $27,998 $45,297 $25,510 Return on Assets 0.92% 1.27% 1.70% 0.92% Return on Equity 8.44% 11.58% 16.02% 7.96% | 28 |

|

|

STOCK PROFILE: CFNL (NASDAQ) | 29 Share Price (2/17/14) $17.06 52 Week Range $14.40 - $19.02 Shares Outstanding 31,891,083 Market Capitalization $544.1 million Average Daily Volume 198,995 Price /Book (2/17/14) 1.61x Price/ Tangible Book (2/17/14) 1.67x |

|

|

INVESTMENT SUMMARY Well-positioned for growth Franchise value in premier market Resilient regional economy Opportunities for organic and M&A growth Strong, experienced management team Excellent asset quality and diversified loan portfolio Diversified revenue stream Shareholder-focused Attractive valuation Dividend has increased 650% since 2009 45% compound annual EPS growth rate over past 5 years | 30 |

|

|

Aggressive on Sales, CONSERVATIVE ON RISK OUR OPERATING PHILOSOPHY | 31 |

|

|

APPENDIX A Peer Comparisons |

|

|

REGIONAL PEER GROUP | 33 Company Name Ticker Total Assets Reported 2013Y ($000) American National Bankshares Inc. AMNB $1,307,512 Burke & Herbert Bank & Trust Company BHRB $2,558,967 C&F Financial Corporation CFFI $1,312,297 Cardinal Financial Corporation CFNL $2,894,230 Carter Bank & Trust CARE $4,442,296 Community Bankers Trust Corporation ESXB $1,089,532 Community Financial Corporation TCFC $1,023,824 Eagle Bancorp, Inc. EGBN $3,771,503 Eastern Virginia Bankshares, Inc. EVBS $1,075,553 First Community Bancshares, Inc. FCBC $2,602,514 First Mariner Bancorp FMARQ $1,377,529 First United Corporation FUNC $1,320,783 Franklin Financial Corporation FRNK $1,059,321 Hampton Roads Bankshares, Inc. HMPR $2,054,092 Middleburg Financial Corporation MBRG $1,228,253 Monarch Financial Holdings, Inc. MNRK $1,016,700 National Bankshares, Inc. NKSH $1,104,361 Source: SNL Financial Includes VA/MD/DC Banks with Assets between $1b and $5b |

|

|

NATIONAL PEER GROUP Company Name Ticker Total Assets Reported 2013Y ($000) BNC Bancorp BNCN $3,229,576 BofI Holding, Inc. BOFI $3,090,771 Cardinal Financial Corporation CFNL $2,894,230 CoBiz Financial Inc. COBZ $2,800,691 Enterprise Financial Services Corp EFSC $3,170,197 Financial Institutions, Inc. FISI $2,928,636 First Bancorp FBNC $3,185,070 First Financial Corporation THFF $3,018,718 First National Bank Alaska FBAK $3,103,135 Hanmi Financial Corporation HAFC $3,055,539 HomeStreet, Inc. HMST $3,066,054 Hudson Valley Holding Corp. HVB $2,999,199 Kearny Financial Corp. (MHC) KRNY $3,145,360 Lakeland Financial Corporation LKFN $3,175,764 MainSource Financial Group, Inc. MSFG $2,859,864 Mechanics Bank MCHB $3,182,474 Metro Bancorp, Inc. METR $2,781,118 Oritani Financial Corp. ORIT $2,831,922 Sun Bancorp, Inc. SNBC $3,087,350 Washington Trust Bancorp, Inc. WASH $3,188,867 | 34 Source: SNL Financial Includes Banks with Assets between $2.75b and $3.5b Excludes First Financial Corporation |

|

|

CREDIT QUALITY RANKING | 35 Source: SNL Financial National Peers Ticker NPAs/Assets (%) Y2013 Cardinal Financial Corporation CFNL 0.08 Washington Trust Bancorp, Inc. WASH 0.62 First National Bank Alaska FBAK 0.65 BofI Holding, Inc. BOFI 0.66 CoBiz Financial Inc. COBZ 0.68 Lakeland Financial Corporation LKFN 0.77 Hudson Valley Holding Corp. HVB 0.78 Hanmi Financial Corporation HAFC 0.87 Oritani Financial Corp. ORIT 0.91 MainSource Financial Group, Inc. MSFG 0.93 Kearny Financial Corp. (MHC) KRNY 1.05 Sun Bancorp, Inc. SNBC 1.31 BNC Bancorp BNCN 1.42 Metro Bancorp, Inc. METR 1.61 First Bancorp FBNC 1.70 Enterprise Financial Services Corp EFSC NA Financial Institutions, Inc. FISI NA First Financial Corporation THFF NA HomeStreet, Inc. HMST NA Mechanics Bank MCHB NA Regional Peers Ticker NPAs/Assets (%) Y2013 Cardinal Financial Corporation CFNL 0.08 Burke & Herbert Bank & Trust Company BHRB 0.53 C&F Financial Corporation CFFI 0.64 American National Bankshares Inc. AMNB 0.65 Sandy Spring Bancorp, Inc. SASR 0.78 Eagle Bancorp, Inc. EGBN 0.90 First Community Bancshares, Inc. FCBC 1.02 Old Line Bancshares, Inc. OLBK 1.13 Union First Market Bankshares Corporation UBSH 1.34 WashingtonFirst Bankshares, Inc. WFBI 1.47 Community Bankers Trust Corporation ESXB 1.68 Community Financial Corporation TCFC 1.75 Middleburg Financial Corporation MBRG 1.95 Shore Bancshares, Inc. SHBI 2.11 Franklin Financial Corporation FRNK 5.27 Carter Bank & Trust CARE NA Eastern Virginia Bankshares, Inc. EVBS NA First Mariner Bancorp FMARQ NA First United Corporation FUNC NA Hampton Roads Bankshares, Inc. HMPR NA Monarch Financial Holdings, Inc. MNRK NA National Bankshares, Inc. NKSH NA TowneBank TOWN NA |

|

|

APPENDIX B |

|

|

CARDINAL FINANCIAL: NET INCOME In Thousands 2010 2011 2012 2013 Reported Net Income $18,442 $27,998 $45,297 $25,510 Accounting Impact (SAB-109)1 ($569) ($3,917) ($10,102) $9,759 Adjusted Net Income2 $17,873 $24,081 $35,269 $35,195 | 37 1 Staff Accounting Bulletin 109 (SAB-109) requires income to be recognized at the mortgage loan commitment date when the price is “locked” with an investor, rather than at the date the loan is sold to the investor, which is when commission/incentive expenses are incurred. 2Adjusted Net Income represents results as if income and expense were concurrently recognized. |

|

|

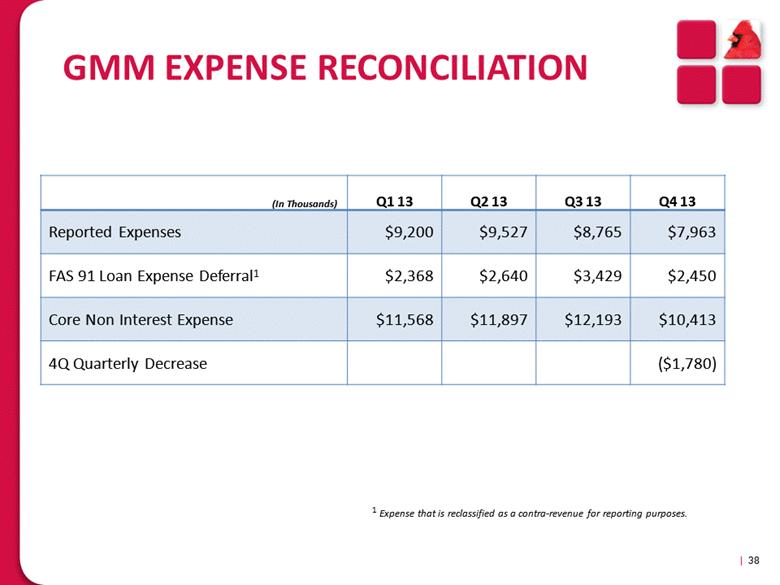

GMM EXPENSE RECONCILIATION | 38 (In Thousands) Q1 13 Q2 13 Q3 13 Q4 13 Reported Expenses $9,200 $9,527 $8,765 $7,963 FAS 91 Loan Expense Deferral1 $2,368 $2,640 $3,429 $2,450 Core Non Interest Expense $11,568 $11,897 $12,193 $10,413 4Q Quarterly Decrease ($1,780) 1 Expense that is reclassified as a contra-revenue for reporting purposes. |