As filed with the Securities and Exchange Commission on June 23, 2010

1933 Act Registration No.

333-52965

1940 Act Registration No. 811-08767

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-1A

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 [ X ]

Pre-Effective Amendment No.

[ ]

Post-Effective Amendment No. 28 [ X ]

REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 [ X ]

Amendment No. 29 [ X ]

UBS MONEY SERIES

(Exact

Name of Registrant as Specified in Charter)

1285 Avenue of the Americas

New

York, New York 10019-6028

(Address of Principal Executive Offices)

Registrant’s telephone number, including area code: (212) 821-3000

MARK F. KEMPER, ESQ.

UBS GLOBAL ASSET MANAGEMENT (AMERICAS) INC.

1285 Avenue of the Americas

New

York, New York 10019-6028

(Name and address of agent for service)

Copies to:

JACK W. MURPHY,

ESQ.

Dechert LLP

1775 I Street, N.W.

Washington, D.C. 20006

Telephone:

(202) 261-3300

Approximate Date of Proposed Public Offering: Effective Date of this Post-Effective Amendment.

It is proposed that this filing will become

effective:

[ ] Immediately upon filing pursuant to Rule 485(b)

[ ] On ____,

pursuant to Rule 485(b)

[ ] 60 days after filing pursuant to Rule 485(a)(1)

[X] On August 28, 2010 pursuant to Rule 485(a)(1)

[ ] 75 days after filing

pursuant to Rule 485(a)(2)

[ ] On ____, pursuant to Rule 485(a)(2)

Title

of Securities Being Registered: UBS Select Prime Capital Fund, UBS Select Treasury Capital Fund and UBS Select Tax-Free Capital Fund.

|

UBS Select Prime Capital Fund

|

Prospectus |

|

As with all mutual funds, the Securities and Exchange Commission has not approved or disapproved the funds’ shares or determined whether this prospectus is complete or accurate. To state otherwise is a crime. |

| Not FDIC Insured. May lose value. No bank guarantee. |

| Contents | ||

| The funds | ||

| What every investor should know about the funds | ||

| Fund summaries | ||

| UBS Select Prime Capital Fund | 1 | |

| UBS Select Treasury Capital Fund | 8 | |

| UBS Select Tax-Free Capital Fund | 15 | |

| More information about the funds | 22 | |

| Your investment | ||

| Information for managing your fund account | ||

| Managing your fund account | 26 | |

| —Buying shares | ||

| —Selling shares | ||

| —Exchanging shares | ||

| —Transfer of account limitations | ||

| —Additional information about your account | ||

| —Market timing | ||

| —Pricing and valuation | ||

| Additional information | ||

| Additional important information about the funds | ||

| Management | 33 | |

| Dividends and taxes | 35 | |

| Disclosure of portfolio holdings | 37 | |

| Financial highlights | 39 | |

| Appendix A: Additional information regarding purchases and redemptions | A-1 | |

| Where to learn more about the funds | Back cover |

| The funds are not a complete or balanced investment program. |

UBS Select Prime Capital Fund

Fund summary

| Investment objective | ||||||

| Maximum current income consistent with liquidity and the preservation of capital. | ||||||

| Fees and expenses of the fund | ||||||

| These tables describe the fees and expenses that you may pay if you buy and hold shares of the fund. | ||||||

| Shareholder fees (fees paid directly from your investment) | ||||||

| Maximum front-end sales charge (load) imposed on purchases (as a % of the offering price) | None | |||||

| Maximum deferred sales charge (load) (as a % of the lesser of the offering price or the redemption price) | None | |||||

| Annual fund operating expenses (expenses that you pay each year as a percentage of the value of your investment)* | ||||||

| Management fees | 0.20 | % | ||||

| Distribution (12b-1) fees | 0.25 | % | ||||

| Other expenses** | 0.15 | % | ||||

Shareholder servicing fee |

0.10 | % | ||||

Miscellaneous expenses |

0.05 | % | ||||

| Total annual fund operating expenses† | 0.60 | % | ||||

| * | The fund invests in securities through an underlying master fund, Prime Master Fund. This table reflects the direct expenses of the fund and its share of expenses of Prime Master Fund, including management fees allocated from Prime Master Fund. Management fees are comprised of investment advisory and administration fees. |

| ** | Expenses are based on estimated amounts. |

| † | UBS Global AM or the fund’s principal underwriter may voluntarily waive fees and/or reimburse fund expenses from time to time. |

UBS Global Asset Management |

1 |

Example

This example is intended to help you compare the cost of investing in the fund with the cost of investing

in other mutual funds.

The example assumes that you invest $10,000 in the fund for the time periods indicated and then

redeem all of your shares at the end of those periods. The example also assumes that your investment

has a 5% return each year and that the fund’s operating expenses remain the same.

Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 year | 3 years | 5 years | 10 years | |||

| $61 | $192 | $335 | $750 |

| 2 | UBS Global Asset Management |

| Principal strategies | |

| The fund is a money market fund and seeks to maintain a stable price of $1.00 per share. The fund seeks to achieve its objective by investing in a diversified portfolio of high quality money market instruments of governmental and private issuers. These may include: | |

| • | short-term obligations of the US government and its agencies and instrumentalities; |

| • | repurchase agreements; |

| • | obligations of US and non-US banks; and |

| • | commercial paper, other corporate obligations and asset-backed securities. |

| Money market instruments generally are short-term debt obligations and similar securities. They also may include longer-term bonds that have variable interest rates or other special features that give them the financial characteristics of short-term debt. The fund invests in foreign money market instruments only if they are denominated in US dollars. | |

| The fund invests in securities through an underlying master fund. The fund and its corresponding master fund have the same objective. Unless otherwise indicated, references to the fund include the master fund. | |

| UBS Global Asset Management (Americas) Inc. (“UBS Global AM”) acts as the investment advisor and administrator for the fund. As investment advisor, UBS Global AM makes the fund’s investment decisions. UBS Global AM selects money market instruments for the fund based on its assessment of relative values and changes in market and economic conditions. UBS Global AM considers safety of principal and liquidity in selecting securities for the fund and thus may not buy securities that pay the highest yield. | |

| Principal risks | |

| An investment in the fund is not a bank deposit and is neither insured nor guaranteed by the Federal Deposit Insurance Corporation or any other government agency. While the fund seeks to maintain the value of your investment at $1.00 per share, you may lose money by investing in the fund. Money market instruments generally have a low risk of loss, but they are not risk-free. The principal risks presented by an investment in the fund are: | |

| • | Credit risk—Issuers of money market instruments may fail to make payments when due, or they may become less willing or less able to do so. |

| • | Foreign investing risk—The value of the fund’s investments in foreign securities may fall due to adverse political, social and economic developments abroad. However, because the fund’s foreign investments must be denominated in US dollars, it generally is not subject to the risk of changes in currency valuations. |

| • | US Government securities risk—There are different types of US government securities with different levels of credit risk. US government securities may be supported by (i) the full faith and credit of the United States; (ii) the ability of the issuer to borrow from the US Treasury; (iii) the credit of the issuing agency, instrumentality or |

UBS Global Asset Management |

3 |

| government-sponsored corporation; (iv) pools of assets (e.g., mortgage-backed securities); or (v) the United States in some other way. The relative level of risk depends on the nature of the particular government support for that security. A US government-sponsored entity, although chartered or sponsored by an Act of Congress, may issue securities that are neither insured nor guaranteed by the US Treasury and are riskier than those that are. | |

| • | Interest rate risk—The value of the fund’s investments generally will fall when short-term interest rates rise, and its yield will tend to lag behind prevailing rates. |

| • | Liquidity risk—Although the fund invests in a diversified portfolio of high quality instruments, the fund’s investments may become less liquid as a result of market developments or adverse investor perception. |

| • | Management risk—The investment advisor’s judgments about the securities acquired by the fund may prove to be incorrect. |

| 4 | UBS Global Asset Management |

| Performance |

| There is no performance information quoted for the fund as the fund had not yet commenced operations as of the date of this prospectus. |

| Risk/return bar chart and table |

| The following bar chart and table give some indication of the risks of an investment in the fund. The bar chart shows the performance of UBS Select Prime Institutional Fund (formerly UBS Select Money Market Fund) as an independent fund for the periods through August 27, 2007 and as a feeder fund in Prime Master Fund beginning on August 28, 2007. (Prime Master Fund is the master fund in which the fund and UBS Select Prime Institutional Fund both invest). The fund would have similar performance; however, the past performance of UBS Select Prime Institutional Fund does not necessarily indicate how the fund will perform in the future. |

| The bar chart shows how the performance of UBS Select Prime Institutional Fund has varied from year to year, and has been adjusted to reflect the higher expenses of the fund because of its distribution, shareholder servicing and other different fee and expense arrangements. |

| The table that follows the bar chart shows the average annual returns over various time periods for UBS Select Prime Institutional Fund adjusted to reflect the higher fees and estimated expenses of the fund. |

Total return

Best quarter during years shown: 3rd quarter, 2000: 1.56%

Worst quarter during years shown: 4th quarter, 2009: 0.00%

UBS Global Asset Management |

5 |

| Average annual total returns* | |

| (for the periods ended December 31, 2009) | |

| One year | 0.02% |

| Five years | 2.88% |

| Ten years | 2.70% |

| * | The table reflects the performance of UBS Select Prime Institutional Fund, as explained above, and has been adjusted to reflect the higher expenses of the fund because of its distribution, shareholder servicing and other different fee and expense arrangements. |

| 6 | UBS Global Asset Management |

| Investment advisor |

| UBS Global Asset Management (Americas) Inc. (“UBS Global AM”) serves as the investment advisor to the fund. |

| Purchase and sale of fund shares |

| If you are buying fund shares directly, you may do so by calling the fund’s transfer agent at 1-888-547 FUND. You may also buy fund shares through financial intermediaries who are authorized to accept purchase orders on behalf of the fund. The minimum investment level for initial purchases generally is $100,000. Subsequent purchases, and purchases through exchanges, may be subject to a minimum investment level of $100,000. Shares of the fund may be redeemed in the same manner as they were purchased (i.e., directly or through a financial intermediary). Shares can be purchased and redeemed on any business day on which the Federal Reserve Bank of New York, the New York Stock Exchange and the principal bond markets (as recommended by the Securities Industry and Financial Markets Association) are open. |

| Tax information |

| The dividends and distributions you receive from the fund are taxable and will generally be taxed as ordinary income, capital gains or some combination of both. If you hold shares through a tax-exempt account or plan, such as an individual retirement account or 401(k) plan, dividends and distributions on your shares generally will not be subject to tax before distributions are made to you from the account or plan. |

| Payments to broker-dealers and other financial intermediaries |

| If you purchase the fund through a broker-dealer or other financial intermediary (such as a bank), UBS Global AM and its related companies may pay the intermediary for the sale of fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your financial advisor to recommend the fund over another investment. Ask your financial advisor or visit your financial intermediary’s Web site for more information. |

UBS Global Asset Management |

7 |

UBS Select Treasury Capital

Fund summary

| Investment objective | ||||||

| Maximum current income consistent with liquidity and the preservation of capital. | ||||||

| Fees and expenses of the fund | ||||||

| These tables describe the fees and expenses that you may pay if you buy and hold shares of the fund. | ||||||

| Shareholder fees (fees paid directly from your investment) | ||||||

| Maximum front-end sales charge (load) imposed on purchases (as a % of the offering price) | None | |||||

| Maximum deferred sales charge (load) (as a % of the lesser of the offering price or the redemption price) | None | |||||

| Annual fund operating expenses (expenses that you pay each year as a percentage of the value of your investment)* | ||||||

| Management fees | 0.20 | % | ||||

| Distribution (12b-1) fees | 0.25 | % | ||||

| Other expenses** | 0.15 | % | ||||

Shareholder servicing fee |

0.10 | % | ||||

Miscellaneous expenses |

0.05 | % | ||||

| Total annual fund operating expenses† | 0.60 | % | ||||

| * | The fund invests in securities through an underlying master fund, Treasury Master Fund. This table reflects the direct expenses of the fund and its share of expenses of Treasury Master Fund, including management fees allocated from Treasury Master Fund. Management fees are comprised of investment advisory and administration fees. |

| ** | Expenses are based on estimated amounts. |

| † | UBS Global AM or the fund’s principal underwriter may voluntarily waive fees and/or reimburse fund expenses from time to time. |

| 8 | UBS Global Asset Management |

Example

This example is intended to help you compare the cost of investing in the fund with the cost of investing

in other mutual funds.

The example assumes that you invest $10,000 in the fund for the time periods indicated and then

redeem all of your shares at the end of those periods. The example also assumes that your investment

has a 5% return each year and that the fund’s operating expenses remain the same.

Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 year | 3 years | 5 years | 10 years | |||

| $61 | $192 | $335 | $750 |

UBS Global Asset Management |

9 |

| Principal strategies | |

| The fund is a money market fund and seeks to maintain a stable price of $1.00 per share. Under normal circumstances, the fund seeks to achieve its objective by investing at least 80% of its net assets (plus the amount of any borrowing for investment purposes) in securities issued by the US Treasury and in related repurchase agreements. However, under normal circumstances the fund expects to invest substantially all of its assets in securities issued by the US Treasury and in related repurchase agreements. The fund may invest a significant percentage of its assets in repurchase agreements. Repurchase agreements involve transactions in which the fund purchases securities issued by the US Treasury and simultaneously commits to resell them to the same counterparty at a future time and at a price reflecting a market rate of interest. While income earned by the fund’s direct investments in securities issued by the US Treasury may qualify for favorable state and local income taxation, income related to repurchase agreements may not be so advantaged. Investing in repurchase agreements may permit the fund quickly to take advantage of increases in short-term rates. | |

| Money market instruments generally are short-term debt obligations and similar securities. They also may include longer-term bonds that have variable interest rates or other special features that give them the financial characteristics of short-term debt. | |

| The fund invests in securities through an underlying master fund. The fund and its corresponding master fund have the same objective. Unless otherwise indicated, references to the fund include the master fund. | |

| UBS Global Asset Management (Americas) Inc.

(“UBS Global AM”) acts as the investment advisor

and administrator for the fund. As investment

advisor, UBS Global AM makes the fund’s investment

decisions. UBS Global AM selects money market

instruments for the fund based on its assessment

of relative values and changes in market and

economic conditions. UBS Global AM considers safety of principal and liquidity in selecting securities for the fund and thus may not buy securities that pay the highest yield. |

|

| Principal risks | |

| An investment in the fund is not a bank deposit and is neither insured nor guaranteed by the Federal Deposit Insurance Corporation or any other government agency. While the fund seeks to maintain the value of your investment at $1.00 per share, you may lose money by investing in the fund. Money market instruments generally have a low risk of loss, but they are not risk-free. The principal risks presented by an investment in the fund are: | |

| • | Credit risk—Issuers of money market instruments may fail to make payments when due, or they may become less willing or less able to do so. |

| • | US Government securities risk—There are different types of US government securities with different levels of credit risk. US government securities may be supported by (i) the full faith and credit of the United States; (ii) the ability of the issuer to borrow from the US Treasury; (iii) the credit of the issuing agency, instrumentality or |

| 10 | UBS Global Asset Management |

| government-sponsored corporation; (iv) pools of assets (e.g., mortgage-backed securities); or (v) the United States in some other way. The relative level of risk depends on the nature of the particular government support for that security. A US government-sponsored entity, although chartered or sponsored by an Act of Congress, may issue securities that are neither insured nor guaranteed by the US Treasury and are riskier than those that are. | |

| • | Interest rate risk—The value of the fund’s investments generally will fall when short-term interest rates rise, and its yield will tend to lag behind prevailing rates. |

| • | Liquidity risk—Although the fund invests in securities issued by the US Treasury and in related repurchase agreements, the fund’s investments may become less liquid as a result of market developments or adverse investor perception. |

| • | Management risk—The investment advisor’s judgments about the securities acquired by the fund may prove to be incorrect. |

UBS Global Asset Management |

11 |

| Performance |

| There is no performance information quoted for the fund as the fund had not yet commenced operations as of the date of this prospectus. |

| Risk/return bar chart and table |

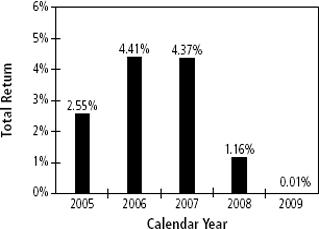

| The following bar chart and table give some indication of the risks of an investment in the fund. The bar chart shows the performance of UBS Select Treasury Institutional Fund (formerly UBS Select Treasury Fund) as an independent fund for the periods through August 27, 2007 and as a feeder fund in Treasury Master Fund beginning on August 28, 2007. (Treasury Master Fund is the master fund in which the fund and UBS Select Treasury Institutional Fund both invest). The fund would have similar performance; however, the past performance of UBS Select Treasury Institutional Fund does not necessarily indicate how the fund will perform in the future. |

| The bar chart shows how the performance of UBS Select Treasury Institutional Fund has varied from year to year, and has been adjusted to reflect the higher expenses of the fund because of its distribution, shareholder servicing and other different fee and expense arrangements. |

| The table that follows the bar chart shows the average annual returns over various time periods for UBS Select Treasury Institutional Fund adjusted to reflect the higher fees and estimated expenses of the fund. |

Total return

Best quarter during years shown: 4th quarter, 2006: 1.19%

Worst quarter during years shown: 4th quarter, 2009: 0.00%

| 12 | UBS Global Asset Management |

| Average annual total returns* | ||

| (for the periods ended December 31, 2009) | ||

| One year | 0.01 | % |

| Five years | 2.42 | % |

| Life of fund** | 2.20 | % |

| * | The table reflects the performance of UBS Select Treasury Institutional Fund, as explained above, and has been adjusted to reflect the higher expenses of the fund because of its distribution, shareholder servicing and other different fee and expense arrangements. |

| ** | The inception date for UBS Select Treasury Institutional Fund is March 23, 2004. |

UBS Global Asset Management |

13 |

| Investment advisor |

| UBS Global Asset Management (Americas) Inc. (“UBS Global AM”) serves as the investment advisor to the fund. |

| Purchase and sale of fund shares |

| If you are buying fund shares directly, you may do so by calling the fund’s transfer agent at 1-888-547 FUND. You may also buy fund shares through financial intermediaries who are authorized to accept purchase orders on behalf of the fund. The minimum investment level for initial purchases generally is $100,000. Subsequent purchases, and purchases through exchanges, may be subject to a minimum investment level of $100,000. Shares of the fund may be redeemed in the same manner as they were purchased (i.e., directly or through a financial intermediary). Shares can be purchased and redeemed on any business day on which the Federal Reserve Bank of New York, the New York Stock Exchange and the principal bond markets (as recommended by the Securities Industry and Financial Markets Association) are open. |

| Tax information |

| The dividends and distributions you receive from the fund are taxable and will generally be taxed as ordinary income, capital gains or some combination of both. If you hold shares through a tax-exempt account or plan, such as an individual retirement account or 401(k) plan, dividends and distributions on your shares generally will not be subject to tax before distributions are made to you from the account or plan. |

| Payments to broker-dealers and other financial intermediaries |

| If you purchase the fund through a broker-dealer or other financial intermediary (such as a bank), UBS Global AM and its related companies may pay the intermediary for the sale of fund shares and related services. These payments may create a conflict of interest by influencing the brokerdealer or other intermediary and your financial advisor to recommend the fund over another investment. Ask your financial advisor or visit your financial intermediary’s Web site for more information. |

| 14 | UBS Global Asset Management |

UBS Select Tax-Free Capital Fund

Fund summary

| Investment objective | ||||||

| Maximum current income exempt from federal income tax consistent with liquidity and the preservation of capital. | ||||||

| Fees and expenses of the fund | ||||||

| These tables describe the fees and expenses that you may pay if you buy and hold shares of the fund. | ||||||

| Shareholder fees (fees paid directly from your investment) | ||||||

| Maximum front-end sales charge (load) imposed on purchases (as a % of the offering price) | None | |||||

| Maximum deferred sales charge (load) (as a % of the lesser of the offering price or the redemption price) | None | |||||

| Annual fund operating expenses (expenses that you pay each year as a percentage of the value of your investment)* | ||||||

| Management fees | 0.20 | % | ||||

| Distribution (12b-1) fees | 0.25 | % | ||||

| Other expenses** | 0.15 | % | ||||

Shareholder servicing fee |

0.10 | % | ||||

Miscellaneous expenses |

0.05 | % | ||||

| Total annual fund operating expenses† | 0.60 | % | ||||

| * | The fund invests in securities through an underlying master fund, Tax-Free Master Fund. This table reflects the direct expenses of the fund and its share of expenses of Tax-Free Master Fund, including management fees allocated from Tax-Free Master Fund. Management fees are comprised of investment advisory and administration fees. |

| ** | Expenses are based on estimated amounts. |

| † | UBS Global AM or the fund’s principal underwriter may voluntarily waive fees and/or reimburse fund expenses from time to time. |

UBS Global Asset Management |

15 |

Example

This example is intended to help you compare the cost of investing in the fund with the cost of investing

in other mutual funds.

The example assumes that you invest $10,000 in the fund for the time periods indicated and then

redeem all of your shares at the end of those periods. The example also assumes that your investment

has a 5% return each year and that the fund’s operating expenses remain the same.

Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 year | 3 years | 5 years | 10 years | |||

| $61 | $192 | $335 | $750 |

| 16 | UBS Global Asset Management |

| Principal strategies | |

| The fund is a money market fund and seeks to maintain a stable price of $1.00 per share. The fund seeks to achieve its objective by investing in a diversified portfolio of high quality, municipal money market instruments. | |

| Under normal circumstances, the fund will invest

at least 80% of its net assets (plus the amount

of any borrowing for investment purposes) in

investments, the income from which is exempt

from federal income tax. Investments that are

subject to the alternative minimum tax are not

counted towards satisfying the 80% test in the

foregoing sentence. Under normal circumstances,

the fund may invest only up to 20% of its net

assets in municipal securities that pay interest that

is an item of tax preference for purposes of the

alternative minimum tax. Money market instruments generally are short-term debt obligations and similar securities. They also may include longer-term bonds that have variable interest rates or other special features that give them the financial characteristics of short-term debt. |

|

| The fund invests in securities through an underlying master fund. The fund and its corresponding master fund have the same objective. Unless otherwise indicated, references to the fund include the master fund. | |

| UBS Global Asset Management (Americas) Inc. (“UBS Global AM”) acts as the investment advisor and administrator for the master fund and administrator for the fund. As investment advisor, UBS Global AM makes the master fund’s investment decisions. UBS Global AM selects money market instruments for the master fund based on its assessment of relative values and changes in market and economic conditions. | |

| Principal risks | |

| An investment in the fund is not a bank deposit and is neither insured nor guaranteed by the Federal Deposit Insurance Corporation or any other government agency. While the fund seeks to maintain the value of your investment at $1.00 per share, you may lose money by investing in the fund. Money market instruments generally have a low risk of loss, but they are not risk-free. The principal risks presented by an investment in the fund are: | |

| • | Credit risk—Issuers of money market instruments may fail to make payments when due, or they may become less willing or less able to do so. |

| • | Interest rate risk—The value of the fund’s investments generally will fall when short-term interest rates rise, and its yield will tend to lag behind prevailing rates. |

| • | Liquidity risk—Although the fund invests in a diversified portfolio of high quality instruments, the fund’s investments may become less liquid as a result of market developments or adverse investor perception. |

| • | Management risk—The investment advisor’s judgments about the securities acquired by the fund may prove to be incorrect. |

UBS Global Asset Management |

17 |

| • | Municipal securities risk—Municipal securities are subject to interest rate and credit risks. The ability of a municipal issuer to make payments and the value of municipal securities can be affected by uncertainties in the municipal securities market. Such uncertainties could cause increased volatility in the municipal securities market and could negatively impact the fund’s net asset value and/or the distributions paid by the fund. Municipalities continue to experience difficulties in the current economic environment. |

| 18 | UBS Global Asset Management |

| Performance |

| There is no performance information quoted for the fund as the fund had not yet commenced operations as of the date of this prospectus. |

| Risk/return bar chart and table |

| The following bar chart and table give some indication of the risks of an investment in the fund. The bar chart shows the performance of UBS Select Tax-Free Institutional Fund, a feeder fund in Tax-Free Master Fund. (Tax-Free Master Fund is the master fund in which the fund and UBS Select Tax-Free Institutional Fund both invest.) The fund would have similar performance; however, the past performance of UBS Select Tax-Free Institutional Fund does not necessarily indicate how the fund will perform in the future. |

| The bar chart shows how the performance of UBS Select Tax-Free Institutional Fund has varied from year to year, and has been adjusted to reflect the higher expenses of the fund because of its distribution, shareholder servicing and other different fee and expense arrangements. |

| The table that follows the bar chart shows the average annual returns over the various time periods for UBS Select Tax-Free Institutional Fund adjusted to reflect the higher fees and estimated expenses of the fund. |

Total return

Best quarter during years shown: 1st quarter, 2008: 0.50%

Worst quarter during years shown: 3rd quarter, 2009: 0.00%

UBS Global Asset Management |

19 |

| Average annual total returns* | ||

| (for the periods ended December 31, 2009) | ||

| One year | 0.01 | % |

| Life of fund** | 1.00 | % |

| * | The table reflects the performance of UBS Select Tax-Free Institutional Fund, as explained above, and has been adjusted to reflect the higher expenses of the fund because of its distribution, shareholder servicing and other different fee and expense arrangements. |

| ** | The inception date for UBS Select Tax-Free Institutional Fund is August 28, 2007. |

| 20 | UBS Global Asset Management |

| Investment advisor |

| UBS Global Asset Management (Americas) Inc. (“UBS Global AM”) serves as the investment advisor to the fund. |

| Purchase and sale of fund shares |

| If you are buying fund shares directly, you may do so by calling the fund’s transfer agent at 1-888-547 FUND. You may also buy fund shares through financial intermediaries who are authorized to accept purchase orders on behalf of the fund. The minimum investment level for initial purchases generally is $100,000. Subsequent purchases, and purchases through exchanges, may be subject to a minimum investment level of $100,000. Shares of the fund may be redeemed in the same manner as they were purchased (i.e., directly or through a financial intermediary). Shares can be purchased and redeemed on any business day on which the Federal Reserve Bank of New York, the New York Stock Exchange and the principal bond markets (as recommended by the Securities Industry and Financial Markets Association) are open. |

| Tax information |

| The dividends and distributions you receive from the fund generally are not subject to federal income tax. If you are subject to alternative minimum tax, a portion of the dividends paid by the fund may be included in computing such taxes. |

| Payments to broker-dealers and other financial intermediaries |

| If you purchase the fund through a broker-dealer or other financial intermediary (such as a bank), UBS Global AM and its related companies may pay the intermediary for the sale of fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your financial advisor to recommend the fund over another investment. Ask your financial advisor or visit your financial intermediary’s Web site for more information. |

UBS Global Asset Management |

21 |

More information about the funds

Additional information about the investment

objectives

Each fund’s investment objective may not be

changed without shareholder approval.

Additional information about investment

strategies

Like all money market funds, the funds are subject

to maturity, quality, diversification and liquidity

requirements designed to help them maintain a

stable price of $1.00 per share. The funds’

investment strategies are designed to comply with

these requirements. The funds may invest in high

quality, short-term, US dollar-denominated money

market instruments paying a fixed, variable or

floating interest rate.

UBS Global AM may use a number of professional money management techniques to respond to changing economic and money market conditions and to shifts in fiscal and monetary policy. These techniques include varying each fund’s composition and weighted average maturity based upon UBS Global AM’s assessment of the relative values of various money market instruments and future interest rate patterns. UBS Global AM also may buy or sell money market instruments to take advantage of yield differences.

Each fund may invest to a limited extent in shares of similar money market funds.

The funds may maintain a rating from one or more rating agencies that provide ratings on money market funds. There can be no assurance that a fund will maintain any particular rating or maintain it with a particular rating agency. To maintain a rating, UBS Global AM may manage a fund more conservatively than if it were not rated.

As noted above, under normal circumstances, UBS Select Treasury Capital Fund invests at least 80% of its net assets (plus the amount of any borrowing for investment purposes) in securities issued by the US Treasury and repurchase agreements relating to those instruments. UBS Select Treasury Capital Fund’s 80% policy is a “non-fundamental” policy. This means that this investment policy may be changed by the fund’s board without shareholder approval. However, UBS Select Treasury Capital Fund has also adopted a policy to provide its shareholders with at least 60 days’ prior written notice of any change to the 80% investment policy.

As noted above, under normal circumstances, UBS Select Tax-Free Capital Fund invests at least 80% of its net assets (plus the amount of any borrowing for investment purposes) in investments the income from which is exempt from federal income tax. UBS Select Tax-Free Capital Fund’s 80% policy is a “fundamental policy.” This means that the fund may not deviate from its 80% policy without the approval of its shareholders.

More information about principal risks

The main risks of investing in the funds are

described below. Not all of these risks apply to each

fund. You can find a list of the main risks that apply

to each fund under the “Fund summary” heading

for that fund.

| 22 | UBS Global Asset Management |

Other risks of investing in a fund, along with further details about some of the risks described below, are discussed in the funds’ Statement of Additional Information (“SAI”). Information on how you can obtain the SAI can be found on the back cover of this prospectus.

Credit risk. Credit risk is the risk that the issuer of a money market instrument will not make principal or interest payments when they are due. Even if an issuer does not default on a payment, a money market instrument’s value may decline if the market believes that the issuer has become less able, or less willing, to make payments on time. Even the highest quality money market instruments are subject to some credit risk. The credit quality of an issuer can change rapidly due to market developments and may affect the fund’s ability to maintain a $1.00 share price.

Foreign investing risk. UBS Select Prime Capital Fund may invest in foreign money market instruments that are denominated in US dollars. Foreign investing may involve risks relating to political, social and economic developments abroad to a greater extent than investing in the securities of US issuers. In addition, there are differences between US and foreign regulatory requirements and market practices.

US Government securities risk. Government agency obligations have different levels of credit support, and therefore, different degrees of credit risk. Securities issued by agencies and instrumentalities of the US government that are supported by the full faith and credit of the United States, such as the Federal Housing Administration and Ginnie Mae (formally known as Government National Mortgage Association or GNMA), present little credit risk. Other securities issued by agencies and instrumentalities sponsored by the US government that are supported only by the issuer’s right to borrow from the US Treasury, subject to certain limitations, such as securities issued by Federal Home Loan Banks, and securities issued by agencies and instrumentalities sponsored by the US government that are supported only by the credit of the issuing agencies are subject to a greater degree of credit risk. Freddie Mac (formally known as Federal Home Loan Mortgage Corporation or FHLMC) and Fannie Mae (formally known as Federal National Mortgage Association or FNMA) historically were agencies sponsored by the US government that were supported only by the credit of the issuing agencies and not backed by the full faith and credit of the United States. However, on September 7, 2008, due to the value of Freddie Mac’s and Fannie Mae’s securities falling sharply and concerns that the firms did not have sufficient capital to offset losses resulting from the mortgage crisis, the Federal Housing Finance Agency (“FHFA”) placed Freddie Mac and Fannie Mae into conservatorship. The effect that this conservatorship will have on the entities and their guarantees is uncertain. Although the US government or its agencies provided financial support to such entities, no assurance can be given that they will always do so. The US government and its agencies and instrumentalities do not guarantee the market value of their securities; consequently, the value of such securities will fluctuate.

Interest rate risk. The value of money market instruments generally can be expected to fall when short-term interest rates rise and to rise

| UBS Global Asset Management | 23 |

| when short-term interest rates fall. Interest rate risk is the risk that interest rates will rise, so that the value of a fund’s investments will fall. Also, a fund’s yield will tend to lag behind changes in prevailing short-term interest rates. This means that a fund’s income will tend to rise more slowly than increases in short-term interest rates. Similarly, when short-term interest rates are falling, a fund’s income generally will tend to fall more slowly. |

| Liquidity risk. The funds’ investments may become less liquid due to market developments or adverse investor perception. When there is no willing buyer and investments cannot be readily sold at the desired time or price, the funds may have to accept a lower price or may not be able to sell an instrument at all. The inability to sell an instrument could adversely affect a fund’s ability to maintain a $1.00 share price or prevent the fund from being able to take advantage of other investment opportunities. This risk may increase during an unusually high volume of redemption requests by even a few large investors or unusual market conditions. |

| Management risk. There is the risk that the investment strategies, techniques and risk analyses employed by the investment advisor may not produce the desired results. The investment advisor may be incorrect in its assessment of a particular security or assessment of market, interest rate or other trends, which can result in losses to a fund. |

| Municipal securities risk. Municipal securities are subject to interest rate, credit, illiquidity and market risks. The ability of a municipal issuer to make payments and the value of municipal securities can be affected by uncertainties in the municipal securities market, including litigation, the strength of the local or national economy, the issuer’s ability to raise revenues through tax or other means, and the bankruptcy of the issuer affecting the rights of municipal securities holders. In particular, the municipal securities market can be significantly affected by political changes, including legislation or proposals at either the state or the federal level to eliminate or limit the tax-exempt status of municipal bond interest or the tax-exempt status of a fund’s dividends. Similarly, reductions in tax rates may make municipal bonds less attractive in comparison to taxable bonds. Legislatures also may fail to appropriate funds needed to pay municipal bond obligations. These events can cause the value of the municipal bonds held by a fund to fall and might adversely affect the tax-exempt status of a fund’s investments or of the dividends that a fund pays. In addition, third-party credit quality or liquidity enhancements are frequently characteristic of the structure of municipal securities purchased by money market funds. Problems encountered by such third-parties (such as issues negatively impacting a municipal bond insurer or bank issuing a liquidity enhancement facility) may negatively impact a municipal security even though the related municipal issuer is not experiencing problems. |

Additional risks

Political risk. With respect to UBS Select Tax-Free

Capital Fund, political or regulatory developments

could adversely affect the tax-exempt status of

interest paid on municipal securities or the taxexempt

status of a municipal money market fund’s

| 24 | UBS Global Asset Management |

dividends. These developments could also cause the value of a fund’s municipal money market instruments to fall.

Regulatory risk. The US Securities and Exchange Commission (“SEC”) continues to review the regulation of money market funds and may propose further changes to the rules that govern each fund’s operations. Legislative developments may also affect the funds. These changes and developments may affect the investment strategies, performance, yield and operating expenses of each fund.

Securities lending risk. Securities lending involves the lending of portfolio securities owned by a fund to qualified broker-dealers and financial institutions. When lending portfolio securities, a fund initially will require the borrower to provide the fund with collateral, most commonly cash, which the fund will invest. Although a fund invests this collateral in a conservative manner, it is possible that it could lose money from such an investment or fail to earn sufficient income from its investment to cover the fee or rebate that it has agreed to pay the borrower. Loans of securities also involve a risk that the borrower may fail to return the securities or deliver the proper amount of collateral, which may result in a loss to a fund. In addition, in the event of bankruptcy of the borrower, a fund could experience losses or delays in recovering the loaned securities. In some cases, these risks may be mitigated by an indemnification provided by the funds’ lending agent.

Structured security risk. UBS Select Prime Capital Fund and UBS Select Tax-Free Capital Fund may purchase securities representing interests in underlying assets, but structured to provide certain advantages not inherent in those assets (e.g., enhanced liquidity and yields linked to short-term interest rates). If those securities behaved in a way that UBS Global AM did not anticipate, or if the security structures encountered unexpected difficulties, either fund could suffer a loss. Structured securities represent a significant portion of the short-term securities markets.

Defensive positions for UBS Select Tax-Free Capital Fund. During adverse market conditions or when UBS Global AM believes there is an insufficient supply of the municipal securities in which Tax-Free Master Fund primarily invests, the fund may temporarily invest in other types of municipal securities or may invest in money market instruments that pay taxable interest. These instruments may not be consistent with achieving the fund’s investment objective during the periods that they are held.

| UBS Global Asset Management | 25 |

Managing your fund account

The following pages tell you how to buy, sell and exchange shares of each fund.

Buying shares

The funds accept the settlement of purchase

orders only in available federal funds deposited by

a commercial bank in an account at a Federal

Reserve Bank, which can be transferred to a similar

account of another bank in one day and may be

made immediately available to a fund through its

custodian.

You may buy fund shares through financial intermediaries who are authorized to accept purchase orders on behalf of the funds. If you buy fund shares through a financial intermediary who holds them in its own name on your behalf (in “street name”), the financial intermediary is responsible for sending the order to the transfer agent. You may not call the funds’ transfer agent directly if your shares are held in “street name,” but should direct all your requests to buy, sell or exchange shares directly to your financial intermediary.

You may also buy fund shares directly by calling the funds’ transfer agent, PNC Global Investment Servicing (“PNC”), at 1-888-547 FUND and speaking to a representative. If you buy fund shares directly, you will need to complete an account application in connection with your initial purchase. You can get a copy of the application from UBS Global Asset Management (US) Inc. (“UBS Global AM (US)”) or a financial intermediary or by calling the transfer agent toll-free 1-888-547 FUND.

You buy shares at the net asset value next determined after receipt of your purchase order in good form by the transfer agent. A fund must receive payment on the same day. Your purchase order will be effective only if (1) you or your financial intermediary wires payment in federal funds on the same business day that you place your order, and (2) the wire is actually credited to the fund’s bank account by a Federal Reserve Bank on that day. Otherwise, the order will be rejected. A business day is any day on which the Federal Reserve Bank of New York, the New York Stock Exchange (“NYSE”), and the principal bond markets (as recommended by the Securities Industry and Financial Markets Association (“SIFMA”)) are open. (Holidays are listed on Appendix A to this prospectus.)

Orders to buy shares received by the fund’s transfer agent before 9:00 a.m. (Eastern time) will normally be executed as of 9:00 a.m. (Eastern time). Orders received after 9:00 a.m. (Eastern time) but before noon (Eastern time) will normally be executed as of noon (Eastern time). Orders for UBS Select Tax-Free Capital Fund received after noon (Eastern time) but before 2:00 p.m. (Eastern time) will normally be executed before 2:00 p.m. (Eastern time). UBS Select Tax-Free Capital Fund does not accept purchase orders received after 2:00 p.m. (Eastern time). For UBS Select Prime Capital Fund and UBS Select Treasury Capital Fund, orders received after noon (Eastern time) but before 2:30 p.m. (Eastern time) will normally be executed as of 2:30 p.m. (Eastern time). For UBS Select Prime Capital Fund and UBS Select Treasury Capital Fund, orders received

| 26 | UBS Global Asset Management |

after 2:30 p.m. (Eastern time) but before 5:00 p.m. (Eastern time) will normally be executed as of 5:00 p.m. (Eastern time). Financial intermediaries may impose additional guidelines for when orders must be placed.

A fund may advance the time by which orders to buy or sell its shares must be received by the transfer agent on any day that the NYSE closes early because trading has been halted for the day. UBS Select Prime Capital Fund and UBS Select Treasury Capital Fund will advance the final time by which orders to buy or sell shares must be received by the transfer agent to 3:00 p.m. (Eastern time) on those days that SIFMA has recommended that the bond markets close early. Similarly, UBS Select Tax-Free Capital Fund will advance the final time by which orders to buy shares must be received by the transfer agent to noon (Eastern time) on those days that SIFMA has recommended that the bond markets close early. (The normal deadline for redemptions for the Tax-Free Fund is noon (Eastern time).) Appendix A to this prospectus lists the SIFMA US holiday recommendations schedule for the remainder of 2010 and for 2011. These days most often occur on the afternoon of a business day prior to a national holiday.

The funds, UBS Global AM and UBS Global AM (US) have the right to reject a purchase order and to suspend the offering of fund shares for a period of time or permanently. UBS Global AM (US) may return without notice money wired to a fund if the investor fails to place a corresponding share purchase order.

Wire instructions. You may instruct your bank to transfer federal funds by wire to:

PNC Bank

Philadelphia, PA

ABA #0310-0005-3

BNF: Mutual Fund Services A/C 8614973575

RE: Purchase shares of (insert name of fund)

FFC: (Name of Account and Account Number)

You should not wire money directly to the fund’s transfer agent if your shares are held in “street name,” as described above in “Buying shares.” A financial intermediary or your bank may impose a service charge for wire transfers.

Minimum investment. The minimum investment level for initial purchases generally is $100,000. Financial intermediaries may satisfy this minimum requirement if the “street name” accounts established with the funds on behalf of each of their clients meet this threshold. Direct purchasers may invest in the funds only if they have a relationship with a financial intermediary who has entered into a shareholder servicing agreement with UBS Global AM (US). Subsequent purchases, and purchases through exchanges, may be subject to a minimum investment level of $100,000. That is, if a fund account balance has fallen below the minimum initial investment amount, UBS Global AM (US) reserves the right to reject your purchase order to add to the account unless the account balance will be at least such amount after the purchase.

| UBS Global Asset Management | 27 |

Electronic trade entry. The funds may offer an electronic trade order entry capability to eligible institutional investors who meet certain conditions. This option is not available if your shares are held in “street name,” as described above in “Buying shares.” For more information about this option and its availability, contact your investment professional at your financial intermediary, or contact the transfer agent at 1-888-547 FUND.

Selling shares

You may sell your shares through financial

intermediaries that are authorized to accept

redemption requests. If you sell your shares

through a financial intermediary who holds

them in its own name on your behalf (in “street

name”), the financial intermediary is then

responsible for sending the order to the transfer

agent. You may not call the funds’ transfer

agent directly if your shares are held in “street

name,” but should direct all your requests to

buy, sell or exchange shares directly to your

financial intermediary.

Orders to sell shares received by the funds’ transfer agent before 9:00 a.m. (Eastern time) will normally be executed as of 9:00 a.m. (Eastern time). Orders received after 9:00 a.m. (Eastern time) but before noon (Eastern time) will normally be executed as of noon (Eastern time). UBS Select Tax-Free Capital Fund does not accept redemption orders received after noon (Eastern time). For UBS Select Prime Capital Fund and UBS Select Treasury Capital Fund, orders received after noon (Eastern time) but before 2:30 p.m. (Eastern time) will normally be executed as of 2:30 p.m. (Eastern time). For UBS Select Prime Capital Fund and UBS Select Treasury Capital Fund, orders received after 2:30 p.m. (Eastern time) but before 5:00 p.m. (Eastern time) will normally be executed as of 5:00 p.m. (Eastern time).

As noted above under “Buying shares,” a fund may advance the time for the transfer agent’s receipt of orders to sell shares (e.g., days on which securities markets close early prior to a national holiday).

Your sales proceeds will be paid in cash. Proceeds

from the sale will be wired to one or more accounts

you have designated. If a redemption order is

received by 5:00 p.m. (Eastern time) (noon (Eastern

time) in the case of UBS Select Tax-Free Capital

Fund), the proceeds ordinarily will be transmitted in

federal funds on the same day. If you sell all the

shares you own, dividends accrued for the month

to date will be paid in federal funds and wired on

the same day to the accounts noted above.

If the transfer agent receives your order to sell

shares late in the day, it will process your order

and initiate a wire. However, your bank account

or your account at your financial intermediary

may not receive the proceeds in a timely manner

if a Federal Reserve Bank is experiencing delay in

transfer of funds. Neither the funds, UBS Global

AM, UBS Global AM (US), a financial intermediary

nor the transfer agent is responsible for the

performance of a bank or any of its intermediaries.

The transfer agent will process orders to sell shares only if you have on file with it a properly completed account application with a signature guarantee (if you have previously completed one in connection with a direct purchase of fund shares), or other authentication acceptable to the transfer agent.

| 28 | UBS Global Asset Management |

The account application requires you to designate the account(s) for wiring sales proceeds. You must submit any change in the designated account(s) for sale proceeds in a form acceptable to the transfer agent. The transfer agent will not place the sales order if the information you provide does not correspond to the information on your application or account records.

A signature guarantee may be obtained from a financial institution, broker, dealer or clearing agency that is a participant in one of the medallion programs recognized by the Securities Transfer Agents Association. These are: Securities Transfer Agents Medallion Program (STAMP), Stock Exchanges Medallion Program (SEMP) and the New York Stock Exchange Medallion Signature Program (MSP). The transfer agent will not accept signature guarantees that are not part of these programs.

If you have additional questions on selling shares, you should contact your investment professional at your financial intermediary or call the transfer agent at 1-888-547 FUND.

Exchanging shares

You may exchange shares of a fund for shares of

the other funds.

Exchange orders for each fund are normally

accepted up until noon (Eastern time) for UBS

Select Tax-Free Capital Fund and 5:00 p.m.

(Eastern time) for UBS Select Prime Capital Fund

and UBS Select Treasury Capital Fund. Exchange

orders received after those times will not be

effected, and you or your financial intermediary

will have to place an exchange order before those times on the following business day if you still

wish to effect an exchange. If you exchange all

your fund shares, the dividends accrued on those

shares for the month to date will also be invested

in the shares of the other fund into which the

exchange is made.

You can place an exchange order through a

financial intermediary. The financial intermediary

is then responsible for sending the order to the

transfer agent. You may not call the funds’

transfer agent directly if your shares are held in

“street name,” but should direct all your requests

to buy, sell or exchange shares directly to your

financial intermediary.

Shareholders making their initial purchase of

another fund through an exchange should allow

more time. These exchange orders should be

received by the transfer agent at least one half

hour before the exchange order deadline to allow

the transfer agent sufficient time to establish an

account in the new fund. The transfer agent may

not be able to effect the exchange if this extra

time is not allotted.

The funds may modify or terminate the exchange

privilege at any time.

Transfer of account limitations

If you hold your shares with a broker or other

financial intermediary, please note that if you

change firms, you may not be able to transfer

your fund shares to an account at the new firm.

Fund shares may only be transferred to an

account held with a broker or other financial

intermediary that has entered into an agreement

| UBS Global Asset Management | 29 |

with the fund’s principal underwriter. If you cannot transfer your shares to another firm, you may choose to hold the shares directly in your own name with the fund’s transfer agent, PNC. Please contact your broker or other financial intermediary for information on how to transfer your shares to the fund’s transfer agent. If you transfer your shares to the fund’s transfer agent, the fund’s principal underwriter may be named as the dealer of record, and you will receive ongoing account statements from PNC. Should you have any questions regarding the portability of your fund shares, please contact your broker, Financial Advisor or other financial intermediary.

Additional information about your account

You will receive a confirmation of your initial

purchase of fund shares, and subsequent

transactions may be reported on periodic account

statements. These periodic statements may be

sent monthly except that, if your only fund activity

in a quarter was reinvestment of dividends, the

activity may be reported on a quarterly rather than

a monthly statement.

To help the government fight the funding of

terrorism and money laundering activities, federal

law requires all financial institutions to obtain,

verify and record information that identifies each

person who opens an account. If you do not

provide the information requested, a fund may

not be able to maintain your account. If a fund is

unable to verify your identity or that of another

person(s) authorized to act on your behalf, the

fund and UBS Global AM (US) reserve the right to

close your account and/or take such other action

they deem reasonable or required by law. Fund shares will be redeemed and valued in accordance

with the net asset value next calculated after the

determination has been made to close the account.

Each fund may suspend redemption privileges or

postpone the date of payment beyond the same

or next business day (1) for any period (a) during

which the NYSE is closed other than customary

weekend and holiday closings or (b) during which

trading on the NYSE is restricted; (2) for any period

during which an emergency exists as a result of

which (a) disposal by the fund of securities owned

by it is not reasonably practicable or (b) it is not

reasonably practicable for the fund fairly to

determine the value of its net assets; (3) for such

other periods as the SEC may by order permit for

the protection of security holders of the fund; or

(4) to the extent otherwise permitted by

applicable laws and regulations.

A financial intermediary buying or selling shares

for its customers is responsible for transmitting

orders to the transfer agent in accordance with its

customer agreements and the procedures noted

above.

UBS Global AM (US) (not the funds) also may pay

fees to entities that make shares of the funds

available to others. The amount of these fees will

be negotiated between UBS Global AM (US) and

the entity.

It costs a fund money to maintain shareholder accounts. Therefore, each fund reserves the right to repurchase all shares in any account that has a net asset value of less than $500. If a fund elects to do this with your account, it will notify you that

| 30 | UBS Global Asset Management |

you can increase the amount invested to $500 or more within 60 days. A fund will not repurchase shares in accounts that fall below $500 solely because of a decrease in the fund’s net asset value.

Market timing

Frequent purchases and redemptions of fund

shares could increase each fund’s transaction

costs, such as market spreads and custodial fees,

and may interfere with the efficient management

of each fund’s portfolio, which could impact each

fund’s performance. However, money market

funds are generally used by investors for shortterm

investments, often in place of bank checking

or savings accounts or for cash management

purposes. Investors value the ability to add and

withdraw their funds quickly, without restriction.

UBS Global AM (US) anticipates that shareholders

will purchase and sell fund shares frequently

because each fund is designed to offer investors

a liquid cash option. UBS Global AM (US) also

believes that money market funds, such as the

funds offered in this Prospectus, are not targets

of abusive trading practices because money

market funds seek to maintain a $1.00 per share

price and typically do not fluctuate in value based

on market prices. For these reasons, the Board

has not adopted policies and procedures, or

imposed redemption fees or other restrictions

such as minimum holding periods, to discourage

excessive or short-term trading of fund shares.

Other UBS Global AM funds that are not money market funds have approved policies and procedures designed to discourage and prevent abusive trading practices. For more information about market timing policies and procedures for another UBS Global AM fund, please see that fund’s Prospectus.

Pricing and valuation

The price of fund shares is based on net asset value.

The net asset value is the total value of a fund

divided by the total number of shares outstanding.

In determining net asset value, each master fund

values its securities at their amortized cost, and

each feeder fund buys the corresponding master

fund’s interests at the master fund’s net asset

value. The amortized cost method uses a constant

amortization to maturity of the difference between

the cost of the instrument to a fund and the

amount due at maturity. Each fund’s net asset

value per share is expected to be $1.00, although

this value is not guaranteed.

The net asset value per share for UBS Select Prime Capital Fund and UBS Select Treasury Capital Fund is normally determined four times each business day as of the following:

• 9:00 a.m. (Eastern time);

• noon (Eastern time);

• 2:30 p.m. (Eastern time);

• 5:00 p.m. (Eastern time).

The net asset value per share for UBS Select Tax-Free Capital Fund is normally

| UBS Global Asset Management | 31 |

determined three times each business day as of the following:

• 9:00 a.m. (Eastern time);

• noon (Eastern time);

• 2:00 p.m. (Eastern time).

Your price for buying or selling shares will be based upon the net asset value that is next calculated after the fund receives your order.

On any day that a fund determines to advance

the time by which orders to buy or sell its shares

must be received by the transfer agent as

described above under “Buying shares,” the time

for determination of the fund’s net asset value

per share will be as of the same time the fund has

determined to cease accepting orders to buy or sell its shares. The fund will not price its shares

again on that business day even though it

normally prices its shares more frequently.

Distribution and shareholder service fees

Each feeder fund has adopted a plan under rule

12b-1 that allows the fund to pay distribution

fees for the sale and distribution of its shares at

the annual rate of 0.25% of its average net assets.

Because these fees are paid out of each feeder

fund’s assets on an on-going basis, over time

these fees will increase the cost of your investment

and may cost you more than paying other types

of sales charges. In addition, each feeder fund

has adopted a separate plan under which the

fund pays for shareholder service activities at the

annual rate of 0.10% of its average net assets.

The aggregate fees paid by each feeder fund

under both plans are 0.35% of its average net

assets.

| 32 | UBS Global Asset Management |

Management

Investment advisor

UBS Global Asset Management (Americas) Inc.

(“UBS Global AM”) acts as the investment advisor

and administrator for Prime Master Fund,

Treasury Master Fund and Tax-Free Master Fund

(the “Master Funds”), which are the master

funds in which the funds invest their assets.

UBS Global AM also acts as the administrator

for the funds. As investment advisor, UBS Global

AM makes the master funds’ investment

decisions. It buys and sells securities for the

master funds and conducts the research that

leads to the purchase and sale decisions.

UBS Global AM is a Delaware corporation with offices at One North Wacker Drive, Chicago, IL 60606 and at 1285 Avenue of the Americas, New York, New York, 10019-6028. UBS Global AM is an investment advisor registered with the SEC. UBS Global AM is an indirect wholly owned subsidiary of UBS AG (“UBS”). As of March 31, 2010, UBS Global AM had approximately $143 billion in assets under management. UBS Global AM is a member of the UBS Global Asset Management Division, which had approximately $560 billion in assets under management worldwide as of March 31, 2010. UBS is an internationally diversified organization with headquarters in Zurich and Basel, Switzerland and operations in many areas of the financial services industry.

Advisory and administration fees

UBS Global AM’s contract fee for the advisory and

administrative services it provides to each master

fund is based on the following fee schedule:

| $0 – $30 billion | 0.1000 | % | |

| Above $30 billion up to $40 billion | 0.0975 | % | |

| Above $40 billion up to $50 billion | 0.0950 | % | |

| Above $50 billion up to $60 billion | 0.0925 | % | |

| Above $60 billion | 0.0900 | % |

UBS Global AM’s contract fee for the administrative services it provides to each feeder fund is 0.10% of each feeder fund’s average daily net assets.

Each fund and UBS Global AM have entered into a written fee waiver/expense reimbursement agreement pursuant to which UBS Global AM is contractually obligated to waive its management fees and/or reimburse a fund so that the fund’s ordinary net expenses through August 31, 2010 (excluding interest expense, if any, and extraordinary expenses) would not exceed 0.50%. Each fund has agreed to repay UBS Global AM for any waived fees/reimbursed expenses to the extent it can do so over the following three fiscal years without causing the fund’s expenses in any of those three years to exceed this expense cap.

UBS Global AM may further voluntarily waive fees and/or reimburse expenses from time to time. For example, UBS Global AM may voluntarily undertake to waive fees and/or reimburse expenses in the event that fund yields drop below a certain level. Once started, there is no guarantee that UBS Global AM would continue to voluntarily waive a portion of its fees and/or reimburse expenses. Waivers/reimbursements may impact a fund’s performance. In addition, in connection with voluntary agreements with the financial intermediaries that are selling fund shares, the funds’ principal underwriter has agreed to voluntarily waive fees or reimburse fund expenses so that total fund expenses do not exceed 0.45%.

| UBS Global Asset Management | 33 |

A discussion of the basis for the board’s approval of the Management Agreement between UBS Global AM and Master Trust with respect to the Master Funds is available in the funds’ semiannual report to shareholders for the fiscal period ended October 31, 2009.

Master-feeder structure. UBS Select Prime Capital Fund, UBS Select Treasury Capital Fund and UBS Select Tax-Free Capital Fund are “feeder funds” that invest all of their assets in “master funds” — Prime Master Fund, Treasury Master Fund and Tax-Free Master Fund, respectively. The feeder funds and their respective master funds have the same investment objectives.

The master funds may accept investments from other feeder funds. Each feeder fund bears the master fund’s expenses in proportion to their investment in the master fund. Each feeder fund can set its own transaction minimums, feeder fund-specific expenses and other conditions. This arrangement allows each feeder fund’s Trustees to withdraw the feeder fund’s assets from the master fund if they believe doing so is in the shareholders’ best interests. If the Trustees withdraw the feeder fund’s assets, they would then consider whether the feeder fund should hire its own investment advisor, invest in a different master fund or take other action.

Other information. To the extent authorized by law, each fund reserves the right to discontinue offering shares at any time merge, reorganize itself or cease operations and liquidate.

| 34 | UBS Global Asset Management |

Dividends and taxes

Dividends

Each fund declares dividends daily and pays them

monthly. Dividends accrued during a given month

are paid on the first business day of the next

month or upon the sale of all the fund shares in

a shareholder’s account.

Each fund may distribute all or a portion of its capital gains (if any) to the extent required to ensure that the fund maintains its federal tax law status as a regulated investment company. Each fund will also distribute all or a portion of its capital gains to the extent necessary to maintain its share price at $1.00.

Shares of each fund earn dividends on the day they are purchased but do not earn dividends on the day they are sold.

You will receive dividends in additional shares unless you elect to receive them in cash. If you prefer to receive dividends in cash, contact your firm’s representative or Financial Advisor (if you purchased your shares through a financial intermediary) or the transfer agent (if you purchased your shares directly).

While each fund declares dividends daily and pays them monthly, the amounts are rounded to the nearest $0.01 on a daily basis with respect to each investor’s fund account. As a result, investors whose fund account balances earn daily dividends that total less than one half a cent on any given day will not accrue any dividends on that day.

Taxes

The dividends that you receive from UBS Select

Prime Capital Fund and UBS Select Treasury

Capital Fund generally are subject to federal

income tax regardless of whether you receive

them in additional fund shares or in cash, and are

expected to be taxed as ordinary income. Such

dividends are not eligible for the reduced rate of

tax that may apply to certain qualifying dividends

on corporate stock.

Although dividends are generally treated as taxable to you in the year they are paid, dividends declared in October, November or December but paid in January are taxable as if they were paid in December.

Shareholders not subject to tax on their income will not be required to pay tax on amounts distributed to them. If you hold fund shares through a tax-exempt account or plan such as an IRA or 401(k) plan, dividends on your shares generally will not be subject to tax until proceeds are withdrawn from the plan.

Some states and localities do not tax dividends that are attributable to interest on certain government securities under certain circumstances. However, these dividends may be subject to corporate franchise tax in some states.

Each fund will tell you annually the character of dividends for tax reporting purposes. You will not

| UBS Global Asset Management | 35 |

recognize any gain or loss on the sale or exchange of your fund shares as long as the fund maintains a share price of $1.00.

The dividends that you receive from UBS Select Tax-Free Capital Fund generally are not subject to federal income tax. If you are subject to alternative minimum tax, a portion of the dividends paid by UBS Select Tax-Free Capital Fund may be included in computing such taxes. The dividends received from UBS Select Tax-Free Capital Fund are generally subject to any applicable state taxes.

The general exemption from federal taxes for dividends paid by UBS Select Tax-Free Capital Fund will not benefit investors in tax-sheltered retirement plans or other entities or individuals not subject to federal taxes. Further, distributions by tax-sheltered retirement plans are generally taxable even if earnings are derived from taxexempt dividends. As a result, UBS Select Tax-Free Capital Fund is generally not an appropriate investment for tax-sheltered retirement plans.

Each fund may be required to withhold a 28% (currently scheduled to increase to 31% after 2010) federal tax on all dividends payable to you

• if you fail to provide the fund with your correct taxpayer identification number on Form W-9 (for US citizens and resident aliens) or to make required certifications, or

• if you have been notified by the IRS that you are subject to backup withholding.

Taxable distributions to non-residents may be subject to a 30% withholding tax (or lower applicable treaty rate).

The above is a general and abbreviated discussion of certain tax considerations, and each investor is advised to consult with his or her own tax advisor. There is additional information on taxes in the funds’ SAI.

| 36 | UBS Global Asset Management |

Disclosure of portfolio holdings

Each fund is a “feeder fund” that invests in securities through an underlying master fund. Each fund and the corresponding master fund have the same investment objective.

As of the date of this prospectus, the complete portfolio holdings of each master fund are posted on UBS Global AM’s Web site at http://www.ubs.com/1/e/globalam/america/institutional_clients/money_market_fund.html on a monthly basis. Under normal circumstances, detailed portfolio holdings information for each master fund as of the most recent month-end is expected to be posted approximately 15 days after the end of a month.

Additionally, an abbreviated portfolio holdings report for the master fund in which UBS Select Prime Capital Fund invests is available on a weekly basis. (The abbreviated weekly portfolio holdings report contains less information about each holding.) Under normal circumstances, the abbreviated report will be as of the last business day in a week and is expected to be posted by the Thursday or Friday of the following week. Both monthly and weekly information will be posted to the Web site at least one day prior to other public dissemination.

Monthly and weekly portfolio holdings information postings will continue to remain available on the Web site, along with any more current holdings information, at least until the date on which a fund files its portfolio holdings information with the SEC on Forms N-Q or N-CSR for the period that included the date as of which the Web site information is current. (For example, a fund files its annual report for its most recent fiscal year ended April 30th with the SEC on Form N-CSR around the beginning of July. Monthly and weekly portfolio holdings information for periods ended April 30th could be removed from the Web site once the annual report is filed, but not until then.)