Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| x | Definitive Proxy Statement | |||

| ¨ | Definitive Additional Materials | |||

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |||

| Collective Brands, Inc. | ||||

| (Name of Registrant as Specified In Its Charter) | ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1) | Title of each class of securities to which transaction applies:

| |||

|

| ||||

| 2) | Aggregate number of securities to which transaction applies:

| |||

|

| ||||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

|

| ||||

| 4) | Proposed maximum aggregate value of transaction:

| |||

|

| ||||

| 5) | Total fee paid: | |||

|

| ||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1) | Amount Previously Paid:

| |||

|

| ||||

| 2) | Form, Schedule or Registration Statement No.:

| |||

|

| ||||

| 3) | Filing Party:

| |||

|

| ||||

| 4) | Date Filed:

| |||

|

| ||||

| SEC 1913 (02-02) | Persons who potentially are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. | |||

Table of Contents

3231 Southeast Sixth Avenue

Topeka, KS 66607

April 13, 2012

Dear Fellow Stockholder,

On behalf of the Board of Directors and Management of Collective Brands, Inc., I cordially invite you to attend the Annual Meeting of Stockholders to be held at the Collective Brands, Inc. Worldwide Headquarters, at 3231 Southeast Sixth Avenue, Topeka, Kansas on Thursday, May 24, 2012, at 10:00 a.m., Central Daylight Saving Time. At the meeting, you will hear a report on the Company’s progress during fiscal 2011, our strategies for the future, and have the chance to meet the Company’s directors and executives. In addition, we will conduct the following business:

| I. | Elect three directors, each for a three-year term; |

| II. | Conduct an advisory vote on executive compensation; |

| III. | Ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accountants for the 2012 fiscal year; |

| IV. | Approve the Amended and Restated Collective Brands, Inc. Incentive Compensation Plan; |

| V. | Approve the 2012 Collective Brands, Inc. Stock Incentive Plan; and |

| VI. | Conduct other business, if properly raised. |

In the following pages you will find the formal notice of the meeting and the proxy statement. The proxy statement provides more details about the agenda and procedures for the meeting and includes biographical information about the director candidates. The Company’s Annual Report for the fiscal year ended January 28, 2012 is also enclosed.

Even if you only own a few shares, we want your shares to be represented at the meeting. I encourage you to vote via telephone or the Internet. Voting by telephone or the Internet is fast and convenient. More importantly, voting by telephone or the Internet is better for our environment and saves the Company money. If you prefer, you can sign, date and return your proxy card promptly in the enclosed envelope. To attend the meeting in person, please follow the instructions on page 1.

Thank you for your investment in Collective Brands, Inc.

Sincerely,

Michael J. Massey

Chief Executive Officer and President

Table of Contents

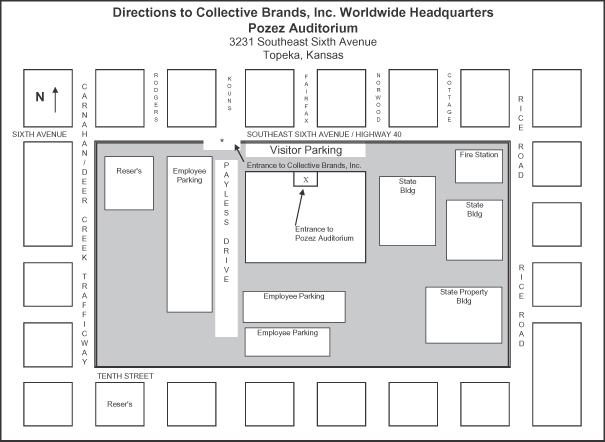

DIRECTION TO COLLECTIVE BRANDS, INC. WORLDWIDE HEADQUARTERS

The Pozez Auditorium is located at the Collective Brands, Inc. Worldwide Headquarters located at 3231 Southeast Sixth Avenue, Topeka, Kansas.

Parking is available for you in the visitor’s parking lot. From the parking lot, you may enter the Collective Brands Inc. Worldwide Headquarters from the visitor’s entrance.

Collective Brands via I-70 Eastbound Carnahan / Deer Creek Trafficway Exit 364B.

Exit 364B Carnahan / Deer Creek Trafficway and turn left (north) towards Southeast Sixth Avenue, approximately .7 miles.

Collective Brands via I-70 Westbound Carnahan / Deer Creek Trafficway Exit 364B.

Exit 364B Carnahan / Deer Creek Trafficway and turn right (north) towards Southeast Sixth Avenue, approximately .6 miles.

Table of Contents

NOTICE OF COLLECTIVE BRANDS, INC. ANNUAL MEETING OF STOCKHOLDERS

Date:

May 24, 2012

Time:

10:00 a.m., Central Daylight Saving Time

Place:

Collective Brands, Inc. Worldwide Headquarters

Pozez Auditorium

3231 Southeast Sixth Avenue

Topeka, Kansas 66607

Purposes:

| I. | Elect three directors, each for a three-year term; |

| II. | Conduct an advisory vote on executive compensation; |

| III. | Ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accountants for the 2012 fiscal year; |

| IV. | Approve the amended and restated Collective Brands, Inc. Incentive Compensation Plan; |

| V. | Approve the 2012 Collective Brands, Inc. Stock Incentive Plan; and |

| VI. | Conduct other business, if properly raised. |

Who may vote?

Only stockholders of record on April 2, 2012, may vote.

Your vote is very important. I encourage you to vote via telephone or the Internet. Voting by telephone or the Internet is fast and convenient. More importantly, voting by telephone or the Internet is better for the environment and saves the Company money. If you prefer, you can sign, date and return your proxy card promptly in the enclosed envelope. If you attend the meeting, you may revoke your proxy and vote in person, if you wish to do so.

Michael J. Massey

Secretary

April 13, 2012

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 24, 2012

The Proxy Statement related to our 2012 Annual Meeting of Stockholders and our Annual Report on Form 10-K for the fiscal year ended January 28, 2012 are available on our website at http://www.collectivebrands.com by selecting Investor Relations.

Table of Contents

| 1 | ||||

| 3 | ||||

| 6 | ||||

| 10 | ||||

| 11 | ||||

| 13 | ||||

| Compensation Committee Ineterlocks and Insider Participation |

15 | |||

| 15 | ||||

| 16 | ||||

| 33 | ||||

| 35 | ||||

| 37 | ||||

| 39 | ||||

| 40 | ||||

| 41 | ||||

| 42 | ||||

| 45 | ||||

| 46 | ||||

| 47 | ||||

| 49 | ||||

| 49 | ||||

| Proposal IV: Approve the Amended and Restated Collective Brands, Inc. Incentive Compensation Plan |

50 | |||

| Proposal V: Approve the 2012 Collective Brands, Inc. Stock Incentive Plan |

53 | |||

| 60 | ||||

| 61 | ||||

| A-1 | ||||

| Amended and Restated Collective Brands, Inc. Incentive Compensation Plan |

B-1 | |||

| C-1 |

Table of Contents

What are the purposes of this meeting?

The purposes of this meeting are to (i) elect three directors, each for a three-year term; (ii) conduct an advisory vote on executive compensation; (iii) ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accountants for the 2012 fiscal year; (iv) approve the Amended and Restated Collective Brands, Inc. Incentive Compensation Plan; (v) approve the 2012 Collective Brands, Inc. Stock Incentive Plan; and (vi) conduct other business, if properly raised.

Who may vote?

Stockholders of Collective Brands, Inc., a Delaware corporation (“Collective Brands,” the “Company,” or “CBI”), as recorded in our stock register on April 2, 2012, may vote at the meeting.

How to vote?

Proxies may be submitted via telephone by calling toll free 1-800-652-VOTE (8683), or the Internet at www.investorvote.com/PSS or United States mail. Also, you may vote in person at the meeting. We recommend that you vote by proxy even if you plan to attend the meeting. If you attend the meeting, you may revoke your proxy and vote in person, if you wish to do so.

How do proxies work?

The Board of Directors is asking for your proxy. Giving us your proxy means you authorize us to vote your shares at the meeting in the manner you direct. You may vote for or withhold voting authority with respect to each director candidate. You also may vote for, against or abstain from voting on proposals II, III, IV, and V. If you sign and return the enclosed proxy card, but do not specify how to vote, we will vote your shares in favor of our director candidates and in favor of Management’s proposals.

What is the difference between holding shares directly as a stockholder of record and holding shares in “street name” at a bank or broker?

Most of our stockholders hold their shares in “street name” through a broker, bank or other nominee rather than directly in their own name. There are differences between shares held of record and those held in “street name.”

Stockholder of Record. If your shares are registered directly in your name with our transfer agent, you are considered the stockholder of record with respect to those shares. As the stockholder of record, you have the right to vote, grant your voting directly to the Company or to a third party, or to vote in person at the meeting.

“Street Name” Stockholder. If your shares are held by a bank, broker, trustee or nominee, you are considered the beneficial owner of shares held in “street name,” and your bank or broker is considered the stockholder of record with respect to those shares. Your bank, broker, trustee or nominee will send you, as the beneficial owner, a package describing the procedure for voting your shares. You should follow the instructions provided by them to vote your shares. You are invited to attend the annual meeting; however, you may not vote these shares in person at the meeting unless you obtain a “legal proxy” from your bank, broker, trustee or nominee that holds your shares, giving you the right to vote the shares at the meeting.

This Proxy Statement and the enclosed form of proxy are being mailed to stockholders

On or about April 13, 2012.

Table of Contents

Why did I receive multiple proxy cards?

You may receive more than one proxy or voting instruction card depending on how you hold your shares. You will receive a combined proxy voting instruction card for shares registered in your name and for shares allocated to you under the Company’s profit sharing plans. If you hold shares in “street name,” you may also get material from them asking how you want to vote. Please vote each proxy or voting instruction card.

How do I revoke my proxy?

You may revoke your proxy before it is voted by submitting a new proxy card with a later date or subsequently voting via telephone or the Internet. Record holders may also revoke their proxy by voting in person at the meeting or by notifying the Company’s Secretary in writing at the address listed under “Questions” on page 65.

What is a quorum?

In order to carry on the business of the meeting, we must have a quorum. This means at least a majority of the outstanding shares eligible to vote must be represented at the meeting, either in person or by proxy. Shares owned by Collective Brands affiliated companies do not count for this purpose.

How many votes are needed?

The director candidates receiving the most votes will be elected to fill the seats on the Board. Proposals II through V of Management will each pass if a majority of the votes are in favor of them. Abstentions will have the same effect as a vote against the proposal. We count abstention and broker non-votes to determine if a quorum is present. When a broker returns a proxy, but does not have authority to vote on a particular proposal, we call it a “broker non-vote.”

As provided by law, the vote of Proposal II is advisory and non-binding. The Board will review the results of the vote and, consistent with our record of stockholder engagement, will take them into account in making determinations concerning executive compensation.

Who may attend the meeting?

Only stockholders, their proxy holders and the Company’s guests may attend the meeting. The top half of your proxy or voting instruction card is your admission ticket. Please bring the admission ticket with you to the meeting.

If you hold your shares through someone else, such as a stockbroker, send proof of your ownership to the Secretary at the address listed under “Questions” on page 65, and we will send you an admission ticket. Alternatively, you may bring proof of ownership with you to the meeting. Acceptable proof could include an account statement showing that you owned Collective Brands shares on April 2, 2012.

2

Table of Contents

PROPOSAL I: ELECTION OF DIRECTORS

Proposal I on the accompanying proxy card

Directors and Nominees for Director

The Company’s Board of Directors (the “Board”) currently consists of nine Directors, divided into three classes, serving staggered terms. Six of the Company’s current Directors are serving in two classes with terms that continue beyond the Annual Meeting, and they are not subject to election at the Annual Meeting. Three of the Company’s Directors who served in the preceding year, Messrs. John F. McGovern and D. Scott Olivet and Ms. Mylle H. Mangum serve in a class with a term that expires at the 2012 Annual Meeting of Stockholders. Messrs. John F. McGovern and D. Scott Olivet and Ms. Mylle H. Mangum are the nominees of the Board for re-election at the Annual Meeting of Stockholders, and if elected, they will each serve a term of three years that will expire at the Annual Meeting of Stockholders to be held in the year 2015, or until a successor is elected and qualified.

Messrs. Daniel Boggan Jr., Michael A. Weiss, and Robert C. Wheeler have terms expiring at the 2013 Annual Meeting of Stockholders. Messrs. Richard L. Markee, Robert F. Moran, and Matthew A. Ouimet have terms expiring at the 2014 Annual Meeting of Stockholders.

Each nominee has consented to being named as a nominee and to serve as a Director, if elected. If any nominee should subsequently become unavailable for election, the holders of proxies may, in their discretion, vote for a substitute or the Board may reduce the number of Directors to be elected.

Directors Subject to Election:

MYLLE H. MANGUM, 63, has served as a Director since November 1997. She has served as Chief Executive Officer of IBT Enterprises, LLC (formerly International Banking Technologies) since October 2003 and has also served as Chairman and Chief Executive Officer of IBT Holdings since July 2007. Prior to this, Ms. Mangum served as Chief Executive Officer of True Marketing Services, LLC since July 2002. She served as Chief Executive Officer of MMS Incentives, Inc. from 1999 to 2002. From 1997 to 1999 she served as President-Global Payment Systems and Senior Vice President-Expense Management and Strategic Planning for Carlson Wagonlit Travel, Inc. From 1992 to 1997 she served as Executive Vice President-Strategic Management for Holiday Inn Worldwide. Ms. Mangum was previously employed with BellSouth Corporation as Director-Corporate Planning and Development from 1986 to 1992, and President of BellSouth International from 1985 to 1986. Prior to that she was with General Electric. Ms. Mangum served as a Director of Emageon, Inc. from June 2004 to April 2009, Scientific-Atlanta, Inc. from November 1993 to February 2006, Respironics, Inc. from May 2004 to March 2008, and Decatur First Bank, a privately held company from May 2007 to August 2011. She has served as a Director of Barnes Group Inc. since December 2002, Haverty Furniture Companies, Inc. since May 1999, and Express, Inc. since August 2010. As a result of these and other professional experiences, Ms. Mangum possesses particular knowledge and experience in retail, merchandising, marketing, strategy, technology, supply chain, logistics, international business, and multi-division general management experience that strengthen the Board’s collective qualifications, skills, and experience.

JOHN F. MCGOVERN, 65, has served as a Director since June 2003. Mr. McGovern is the founder, and since 1999 a partner, of Aurora Capital LLC, a private investment and consulting firm based in Atlanta, GA. Prior to founding Aurora Capital, Mr. McGovern served in a number of positions of increasing responsibility at Georgia-Pacific Corporation from 1981 to 1999, including Executive Vice President/Chief Financial Officer from 1994 to 1999. Previously, Mr. McGovern had been Vice President and Division Executive, Forest Products Division from 1978 to 1981. Mr. McGovern served as a Director of GenTek, Inc. from 2003 to 2009, Golden Bear Golf, Inc. from 1996 to 2000, Seabulk International, Inc. from 2000 to 2002, Chart Industries, Inc. from 2004 to 2005, Maxim Crane Works Holdings, Inc. (a privately-held company) from

3

Table of Contents

2005 to 2008, Xerium Technologies Inc. from 2010 to present, The Newark Group from 2010 to present, and General Chemical Corp. from 2010 to present. He also served as a Director and officer of ChannelLinx, Inc. from 2000 to 2002, which filed bankruptcy subsequent to his resignation. He is currently a Director of Neenah Paper, Inc. since 2006. As a result of these and other professional experiences, Mr. McGovern possesses particular knowledge and experience in finance, strategy, and international finance that strengthen the Board’s collective qualifications, skills, and experience.

D. SCOTT OLIVET, 49, has served as a Director since September 2006 and non-executive Chairman of the Board since June 2011. Mr. Olivet has served as Executive Chairman of RED Digital Cinema, Chairman of Oakley, Inc. (“Oakley”) and Chief Executive Officer of Renegade Brands, LLC since July 2009. From 2005 to July 2009, Mr. Olivet served as Chief Executive Officer of Oakley. Prior to joining Oakley, Mr. Olivet served as Vice President, Nike Subsidiaries and New Business Development from August 2001 to September 2005. From 1998 to 2001, Mr. Olivet served as Senior Vice President of Real Estate, Store Design and Construction, for the Gap, Inc. From 1984 to 1998, Mr. Olivet was a partner with Bain & Company. He currently serves as a Director of Oakley since 2005 (a public company until 2007), and RED Digital Cinema, a privately held company, since 2006, and is a Trustee and Member of the Audit Committee of Pomona College. As a result of these and other professional experiences, Mr. Olivet possesses particular knowledge and experience in retail, merchandising, marketing, finance, strategy, technology, international business, and multi-division general management experience that strengthen the Board’s collective qualifications, skills, and experience.

THE BOARD UNANIMOUSLY RECOMMENDS THAT HOLDERS OF COLLECTIVE BRANDS COMMON STOCK VOTE IN FAVOR OF THE ABOVE NOMINEES, AND YOUR PROXY WILL BE SO VOTED UNLESS YOU SPECIFY OTHERWISE.

Continuing Directors:

DANIEL BOGGAN JR., 66, has served as a Director since September 1997. Mr. Boggan is retired. He served as Chief of Staff for Oakland, California Mayor Ron Dellums from January 2007 to July 2007. He served as Director of Business Development of Siebert Branford Shank & Co., LLC from September 2003 until his retirement in March 2006. Mr. Boggan served as Senior Vice President of the National Collegiate Athletic Association (“NCAA”) from 1998 to his retirement in August 2003. He joined the NCAA in 1994 as Group Executive Director for Education Services and served as Chief Operating Officer from January 1996 to August 1998. Prior to his tenure with the NCAA, Mr. Boggan was Vice Chancellor of the University of California from 1986 to 1994, and City Manager of Berkeley, California from 1982 to 1986. Mr. Boggan has served as a member of the Board of Directors of Viad Corporation since 2005 and The Clorox Company since 1990. As a result of these and other professional experiences, Mr. Boggan possesses particular knowledge and experience in finance, strategy, technology, government, and academia that strengthen the Board’s collective qualifications, skills, and experience.

RICHARD L. MARKEE, 58, has served as a Director since July 2011. Mr. Markee has served as Executive Chairman of Vitamin Shoppe, Inc. since April 2011, served as a Director since September 2006, and was non-executive Chairman of the Board from April 2007 to September 2009. From September 2009 to April 2011, he served as the Company’s Chief Executive Officer and as Chairman of the Board. He previously served as the President of Babies ‘R’ Us from August 2004 to November 2007 and Vice Chairman of Toys ‘R’ Us, Inc. from May 2003 to November 2007. Mr. Markee also served as Interim Chief Executive Officer of Toys ‘R’ Us, Inc. and its subsidiaries from July 2005 to February 2006. He served as President of Toys ‘R’ Us U.S. from May 2003 to August 2004. From January 2002 to May 2003, he was Executive Vice President, President- Specialty Businesses and International Operations of Toys ‘R’ Us. He was an Operating Partner of Irving Place Capital Management, L.P., a private equity firm focused on making equity investments in middle-market companies from November 2008 to September 2009. From 2006 to 2008, Mr. Markee was an Operating Partner of Bear Stearns Merchant Banking, the predecessor to Irving Place Capital Management, L.P. He has also been a

4

Table of Contents

Director of Dorel Industries since November 2008. From June 2005 through July 2006, he served on the Board of Directors of The Sports Authority, Inc. From October 1999 to January 2002, he served as Executive Vice President — President of Babies ‘R’ Us and the Chairman of Kids ‘R’ Us. He is currently a member of the Board of Directors of Vitamin Shoppe, Inc., and Dorel Industries. As a result of these and other professional experiences, Mr. Markee possesses particular knowledge and experience in branded consumer products, marketing, strategic planning and leadership of complex organizations that strengthen the Board’s collective qualifications, skills and experience.

ROBERT F. MORAN, 61, has served as a Director since March 2007. Mr. Moran has served as the Chairman of the Board and Chief Executive Officer of PetSmart since February 2012. He served as President and Chief Executive Officer and a Director of PetSmart, Inc. since June 2009 and as President and Chief Operating Officer of the company since December 2001. He joined PetSmart in July 1999 as President of North American stores. Mr. Moran served as President of Toys ‘R’ Us, Ltd., Canada from 1998 to June 1999. Prior to that, he spent 20 years with Sears, Roebuck and Company in a variety of financial and merchandising positions, including President and Chief Executive Officer of Sears de Mexico. He was also Chief Financial Officer and Executive Vice President of Galerias Preciados of Madrid, Spain from 1991 to 1993. Mr. Moran served on the Board of Medial Management International, Inc., a privately held company from 2003 to 2008. As a result of these and other professional experiences, Mr. Moran possesses particular knowledge and experience in retail, merchandising, marketing, strategy, technology, finance, supply chain, logistics, international finance, international business, and multi-division general management experience that strengthen the Board’s collective qualifications, skills, and experience.

MATTHEW A. OUIMET, 53, has served as a Director since June 2008. Mr. Ouimet has served as President of Cedar Fair, L.P. since June 2011 and as Chief Executive Officer since January 2012. He previously served as President and Chief Operating Officer for Corinthian Colleges from July 2009 to October 2010 and Executive Vice President — Operations from January 2009 to June 2009. Prior to Corinthian Colleges, he served as President, Hotel Group for Starwood Hotels and Resorts Worldwide from August 2006 to September 2008. Prior to joining Starwood, Mr. Ouimet spent 17 years at The Walt Disney Company, where he last served as President Disneyland Resort. Mr. Ouimet served in a variety of other business development and financial positions, including President of Disney Cruise Line during his employment with Disney. Prior to his work with Disney, Mr. Ouimet was Controller and Senior Vice President, Finance for Lincoln Property Company from 1983 to 1989 and served as a Certified Public Accountant with Price Waterhouse from 1980 to 1983. As a result of these and other professional experiences, Mr. Ouimet possesses particular knowledge and experience in merchandising, marketing, finance, strategy, technology, government, academia, international business, and multi-division general management experience that strengthen the Board’s collective qualifications, skills, and experience.

MICHAEL A. WEISS, 70, has served as a Director since January 2005. Mr. Weiss has served as President and Chief Executive Officer and a member of the Board of Express, Inc. since July 2007 and Chairman of the Board since November 2011. From 2004 to July 2007, Mr. Weiss was retired. He also served President and Chief Executive Officer of Express from 1997 to 2004. Mr. Weiss joined Limited in 1981 and served in a number of positions of increasing responsibility including Vice Chairman from 1993 to 1997 and President of Express from 1982 to 1993. Previously, he had been General Manager for Trousers Up, a subsidiary of Apparel Industries, Inc., and Merchandise Manager for Casual Corner Group, Inc. Mr. Weiss began his career at Abraham & Straus, a subsidiary of Federated Department Stores. Mr. Weiss served as a Director of Chicos FAS, Inc. (also served as non-executive Chairman) from 2005 to 2007, Pacific Sunwear of California, Inc. from 2005 to 2008, and Borders Group, Inc. from 2005 to 2009. As a result of these and other professional experiences, Mr. Weiss possesses particular knowledge and experience in retail, merchandising, marketing, finance, strategy, technology, supply chain and logistics that strengthen the Board’s collective qualifications, skills, and experience.

ROBERT C. WHEELER, 70, has served as a Director since September 2001. Mr. Wheeler is retired. He served as President of Hill’s Pet Nutrition, Inc. from 1981 to April 2009. He assumed the title of Chairman and

5

Table of Contents

Chief Executive Officer in June 1996. From 1987 to 1992, he served as Vice President of Colgate-Palmolive Company and had been a Corporate Officer since 1992. Mr. Wheeler served as a Director of Security Benefit Group from 1998 to July 2010 and as Director of Stormont-Vail HealthCare, Inc. from 1990 to 2012. As a result of these and other professional experiences, Mr. Wheeler possesses particular knowledge and experience in merchandising, marketing, strategy, technology, supply chain, logistics, international business, integrated technologies for global organization and multi-division general management experience that strengthen the Board’s collective qualifications, skills, and experience.

Former Director:

MATTHEW E. RUBEL, 54, served as a Director from July 2005 and as Chairman of the Board from May 2008 to June 2011. Mr. Rubel served as Chief Executive Officer and President of Collective Brands, Inc. from July 2005 to June 2011. Prior to joining Collective Brands, Mr. Rubel was Chairman and Chief Executive Officer for Cole Haan from 1999 to July 2005. He served as Executive Vice President, J. Crew Group and Chief Executive Officer of Popular Club Plan from 1994 to 1999. While at J. Crew Group, Mr. Rubel was responsible for all licensing and international activities, as well as brand marketing and served on its Group Executive Committee. Mr. Rubel has also served as President and Chief Executive Officer of Pepe Jeans USA, and President of the Specialty Division of Revlon. Mr. Rubel served as a Director of Furniture Brands, Inc. from 2006 to 2008 and a Director of SUPERVALU, INC. since June, 2010. As a result of these and other professional experiences, Mr. Rubel possesses particular knowledge and experience in retail, merchandising, marketing, finance, strategy, technology, supply chain, logistics, digital commerce, international business, and multi-division general management experience that strengthened the Board’s collective qualifications, skills, and experience.

Charters and Corporate Governance Principles

At its February 2012 meeting, the Board reviewed its charter and governance guidelines for the Company and the Board. The full text of the Company’s governance guidelines, and the charters for the Board, Audit and Finance Committee and the Compensation, Nominating and Governance Committee (the “CN&G Committee”) are each posted on the Company’s investor relations website at www.collectivebrands.com and will also be provided free of charge to any stockholder requesting a copy by writing to: Collective Brands, Inc., Attn: Investor Relations Department, 3231 Southeast Sixth Avenue, Topeka, Kansas 66607.

Purpose of the Board of Directors

The business of Collective Brands is managed under the direction of the Board. The purpose of the Board is to oversee Management’s conduct of the Company’s business.

Board Responsibilities

The Board’s responsibilities (acting as a whole and through its standing committees) include:

| • | Reviewing Management’s determination of objectives, strategies, policies and plans for the Company. |

| • | Electing, monitoring, evaluating, compensating and, if necessary, replacing the Chief Executive Officer and other senior executives. |

| • | Reviewing Management’s plans for guarding and preserving the Company’s assets including intangible assets such as the Company’s reputation and maintaining a reservoir of successor management talent. |

| • | Reviewing and approving equity and incentive compensation plans, and plans for major changes in the senior corporate organizational structure. |

6

Table of Contents

| • | Reviewing and approving Management’s strategic and business plans and conducting continuing appraisals of Management’s performance against established plans and objectives. |

| • | Through the Audit and Finance Committee, recommending outside auditors for approval by stockholders. |

| • | Reviewing and approving strategic business plans, major transactions, changes in corporate financial structure affecting balance sheet items, financial plans, objectives and actions, including significant capital allocations and expenditures. |

| • | Designating and appointing members of committees of the Board, establishing appropriate limits of authority, and receiving reports from such committees and reviewing and approving such committee’s recommendations where necessary. |

| • | Reviewing management’s recommendations for maintenance and revision of the Company’s Certificate of Incorporation and By-Laws. |

| • | Reviewing the CN&G Committee’s recommendations for perpetuation of a sound Board through planned and orderly recruitment activities, regular election and the filling of interim vacancies. |

Board Organization

The Board currently consists entirely of independent directors who the Board has determined meet the New York Stock Exchange’s (the “NYSE”) definition of independence. Mr. Olivet currently serves as the non-executive Chairman of the Board. The Chairman of the Board is elected annually and if the Chairman of the Board is not an independent director, the Board will elect an independent director to serve as Lead Director at the Board meeting immediately following the Annual Meeting of Stockholders.

The Board currently maintains three standing committees: (i) the Executive Committee, (ii) the Audit and Finance Committee, and (iii) the CN&G Committee. The Audit and Finance and the CN&G Committees are each comprised entirely of independent directors. Assignments to, and chairs of, the committees are recommended by the CN&G Committee and selected by the Board. All committees regularly report to the Board on their activities. The Board may, from time to time, establish certain other committees to act on behalf of the Board of Directors.

Board Leadership Structure

The Board is currently comprised of nine directors, all of whom are independent. Since June 2011, coincident with Mr. Rubel’s resignation, Mr. Olivet has served as the non-executive Chairman of the Board. Prior to his resignation in June, 2011, Mr. Rubel served as Chairman of the Board, Chief Executive Officer and President and Mr. Wheeler served as Lead Director. The Board’s guidelines require that if the Chairman and Chief Executive Officer positions are held by the same individual, the Board must elect a Lead Director.

The Board believes that the current governance structure providing for an independent non-executive Chairman of the Board combined with an independent Board of experienced directors benefits the Company and its stockholders. The Chairman of the Board is elected annually after the Annual Meeting of Stockholders. The Chairman of the Board is responsible for: (1) chairing the meetings of the Board of Directors, other than executive sessions of the Board; (2) planning and organizing, in consultation with the Committee Chairs, the activities of the meetings of the Board of Directors, including setting the agenda for such meetings; (3) determining, together with the Committee Chairs, the quality, quantity and timeliness of the information that is to be provided to the Board on a regular basis; (4) facilitating on-going formal and informal communications between and among directors; (5) chairing the annual and special meetings of the stockholders; and (6) arranging for executive sessions of the Board of Directors.

7

Table of Contents

We recognize that different board leadership structures may be appropriate for companies in different situations and believe that no one structure is suitable for all companies at all times. We believe our current Board leadership structure, given the current composition of the Board and with Mr. Massey serving as Chief Executive Officer and President on an interim basis, is optimal.

Our Board conducts an annual evaluation in order to determine whether it and its committees are functioning effectively. As part of this annual self-evaluation, the Board evaluates whether the current leadership structure continues to be optimal for Collective Brands and its stockholders. Our Corporate Governance Guidelines provide the flexibility for our Board to modify or continue our leadership structure in the future, as it deems appropriate.

Risk Oversight

The Board, acting directly or through its committees, is responsible for overseeing the Company’s risk management process. In discharging its responsibilities, the Board directly or through its committees focuses on the Company’s general risk management strategy, the most significant risks facing the Company, and regularly reviews risk management and specific risk mitigation strategies that are implemented by Management. The Board is also apprised of particular risk management matters in connection with its general oversight and approval of corporate matters.

The Board has delegated to the Audit and Finance Committee oversight of the Company’s risk management process. The Audit and Finance Committee reviews with management (a) the Company’s policies with respect to risk assessment and management of risks that may be material to the Company, (b) the Company’s system of disclosure controls and system of internal controls over financial reporting, and (c) the Company’s compliance with legal and regulatory requirements. The CN&G Committee is responsible for reviewing the Company’s compensation programs to evaluate whether they are likely to pose any risks that are likely to have a material adverse effect on the Company. All committees report to the full Board at each regularly scheduled Board Meeting. When a matter rises to the level of a likely material enterprise risk, it generally will be discussed with the entire Board.

The Company’s management is responsible for day-to-day risk management. The Company’s Internal Audit and Risk Insurance Departments serve as the primary monitoring and testing functions for company-wide policies and procedures. They are responsible for identifying and coordinating risk management with key business leaders and regularly reporting to the Audit and Finance Committee. These departments administratively report to the Company’s Chief Financial Officer with the Internal Audit Department reporting directly to the Audit and Finance Committee. The Audit and Finance Committee also regularly receives reports from key business functions which discuss potential risks that may exist at the enterprise, strategic, financial, operational, and compliance and reporting levels.

This approach to risk management appropriately focuses the Board’s attention and allows management to run the Company with the oversight of the Board.

Board Operation

The Board has six regularly scheduled meetings per year. Audit and Finance and Compensation, Nominating and Governance Committee meetings are normally held in conjunction with board meetings. The Board and committee chairs are responsible for conducting meetings and informal consultations in a fashion that encourages informed, meaningful and probing deliberations. Directors generally receive their agenda and materials in advance of meetings and may ask for additional information from, or meet with, senior executives at any time.

8

Table of Contents

Board Advisors

The Board and its committees (consistent with their respective charters) may retain their own advisors, as they determine necessary, to carry out their responsibilities.

Board Evaluation

The CN&G Committee coordinates an annual evaluation process of the Board and each of the Board’s standing committees. The Audit and Finance Committee and the CN&G Committee each annually perform a self evaluation and a review of the adequacy of its charter. The CN&G Committee also periodically performs a Board skill assessment which includes an evaluation of Board diversity.

Selection of Directors

The Board is responsible for selecting nominees for Board membership, and establishing criteria for identifying potential nominees. In recommending candidates for election to the Board, the CN&G Committee considers the following criteria:

| • | Personal qualities and characteristics, accomplishments and reputation in the business community; |

| • | Current knowledge and contacts in the communities in which the Company does business and in the Company’s industry or other industries relevant to the Company’s business; |

| • | Ability and willingness to commit adequate time to Board and committee matters; |

| • | The fit of the individual’s skills and personality with those of other Directors and potential directors in building a Board that is effective, collegial and responsive to the needs of the Company; |

| • | Diversity of viewpoints, background, experience and other demographics; and |

| • | A commitment to represent the Company’s stockholders as a whole. |

The CN&G Committee considers nominees for Directors from any source, including individuals nominated by stockholders or outside consultants engaged by the CN&G Committee to recommend Director nominees. Director nominee suggestions must be submitted in writing to the Company’s Corporate Secretary at 3231 Southeast Sixth Avenue, Topeka, Kansas, 66607, and otherwise comply with the terms of the Company’s By-Laws. See also “About Stockholder Proposals and Nominations for Our 2013 Annual Meeting.”

Independence of Directors and Nominees for Director

The Board annually reviews and determines the independence of Directors. The Board also reviews and determines the independence of nominees for Director. No Director nominee or Director is considered independent unless the Board determines that he or she has no material relationship with the Company either directly, as a partner, stockholder or affiliate of an organization that has a material relationship with the Company, or indirectly. The Board has adopted categorical independence standards consistent with the New York Stock Exchange listing guidelines to evaluate the materiality of any such relationship. The Board has determined that each of the nominees for Director standing for election at the 2012 Annual Meeting is independent of the Company, because none of the nominees for Director has a material relationship with the Company either directly or indirectly. The Board has made this determination based on the following factors:

| • | No nominee for Director is or has been an officer or employee of the Company or its subsidiaries or affiliates since the Company’s spin-off from The May Department Stores Company; |

| • | No nominee for Director has an immediate family member who is an officer of the Company or its subsidiaries or has any current or past material relationship with the Company; |

9

Table of Contents

| • | No nominee for Director has worked for, consulted with, been retained by, or received anything of substantial value from the Company aside from his or her compensation as a Director; |

| • | No nominee for Director is, or was within the past five years, employed by the independent auditors for the Company; |

| • | No executive officer of the Company serves on the compensation committee of any corporation that employs a nominee for Director or a member of the immediate family member of any nominee for Director; |

| • | No nominee for Director is an executive officer of any entity which the Company’s annual sales to or purchases from exceeded one percent of either entity’s annual revenues for the last fiscal year; and |

| • | No nominee for Director serves as a director, trustee, executive officer or similar position of a charitable or non-profit organization to which the Company or its subsidiaries made charitable contributions or payments in fiscal year 2011 in excess of $5,000.00. |

As part of the independence review process, in March 2012, the Board reviewed a summary of each Director’s response to a questionnaire asking about their (and their immediate family members’) relationships with the Company and other potential conflicts of interest, as well as material provided by management regarding transactions, relationships or arrangements between the Company and the Directors or parties related to the Directors. Utilizing the above criteria, the Board determined that all Directors are independent, and that the members of the Audit and Finance Committee and the CN&G Committee are also independent.

Communications with the Board of Directors

The Board believes that Management speaks for the Company. The Board and individual members of the Board may, from time to time, meet or otherwise communicate with various constituencies. It is expected, however, that Board members will speak for the Company only with the knowledge of Management and, in most instances, at the request of Management. Stockholders and other interested parties may contact non-management members of the Board by sending written correspondence to the Director at the following address:

, Director

Collective Brands, Inc.

c/o Secretary

3231 Southeast Sixth Avenue

Topeka, KS 66607

The Secretary will review and forward such correspondence to the Board members. The Secretary will also direct inquiries most properly addressed by other departments, such as customer service or accounts payable, to those departments to ensure that the inquiries are responded to in a timely manner. Any inquiry that presents a matter relevant to accounting, audit, internal controls, or similar issues that is not addressed to a specific Director, will be forwarded to the Chairman of the Audit and Finance Committee.

The Board of Directors of the Company held a total of 14 meetings during fiscal 2011. No Director attended less than 75% of the aggregate of (i) the total number of Board meetings held during the period for which such Director held such office, and (ii) the total number of meetings held by all Board committees on which such Director served during the periods that such Director served on such committee.

While the Board of Directors understands that there may be situations that prevent a Director from attending an Annual Meeting of Stockholders, the Board strongly encourages all Directors to make attendance at all Annual Meetings of Stockholders a priority. All of the Company’s nine Directors attended the Company’s Annual Meeting of Stockholders held on May 26, 2011.

10

Table of Contents

Director Compensation. Management Directors, if any, are not entitled to additional compensation for their service as a Director or for attendance at Board, committee or annual stockholder meetings.

Concurrent with the transition to a non-executive Chairman of the Board in June 2011 and the elimination of the Lead Director role, the CN&G Committee engaged Hay Group to provide compensation recommendations for the non-executive Chairman role. Hay Group provided its own benchmarking of non-executive Chairman compensation within the retail industry and data from the National Association of Corporate Directors board pay report and other sources.

Considering Hay Group’s analysis, the CN&G Committee in June 2011 established an annual non-executive Chairman retainer consisting of $75,000 in cash and $75,000 in stock; the stock retainer for 2011 was paid to Mr. Olivet on June 17, 2011, in 5,226 shares that will vest on May 1, 2012. In addition, to appropriately compensate Mr. Olivet for the increased level of involvement required until a permanent Chief Executive Officer is hired and on-boarded, the Committee authorized a special cash transition payment of $50,000 per quarter. The final transition payment will be prorated for the quarter in which a permanent Chief Executive Officer is hired and on-boarded.

Other than the non-executive Chairman compensation arrangements and the elimination of the Lead Director retainer, no changes were made to the non-management Director compensation program in the past year.

The following table explains the key components of non-management Director compensation, which is based on a Board year basis that runs from one Annual Meeting of Stockholders until the next such meeting.

ELEMENTS OF TOTAL COMPENSATION

| 2011 Board Year | ||||

| Annual Cash Retainer |

$ | 50,000 | ||

| Annual Stock Retainer |

$ | 100,000 | ||

| Meeting Fees (per meeting attended): |

||||

| Board Meeting(1) |

$ | 1,500 | ||

| Committee Meeting |

$ | 1,000 | ||

| Annual Non-Executive Chairman Retainer: Cash Stock |

$ $ |

75,000 75,000 |

| |

| Committee Chairperson Retainer: Audit and Finance Compensation, Nominating and Governance |

$ $ |

25,000 20,000 |

| |

| Lead Director Retainer (eliminated June 2011) |

$ | 20,000 | ||

| Reimbursement for expenses attendant to Board membership |

Yes | |||

| (1) | The Board meeting fee will be increased by $1,000 if a Board meeting in the continental U.S. extends beyond 1 1/2 days. An international Board meeting fee of $3,000 to $6,000 (depending on duration and distance) will be paid for Board meetings outside the continental U.S. |

The annual cash retainer, non-executive Chairman retainer, and Committee Chairperson retainer are each earned (or vest, if deferred) in one-fifth increments on the date of each regular meeting of the Board following the Annual Meeting of Stockholders. The annual retainers for any Director elected subsequent to the Annual Meeting of Stockholders are prorated.

11

Table of Contents

The 2011 Board year stock portion of each non-management Director’s annual retainer was paid in 6,548 restricted shares of Collective Brands common stock granted on May 26, 2011. The number of shares granted to each Director was determined based upon the closing share price on the date of the Annual Meeting of Stockholders. The restricted stock portion of the annual retainer vests on May 1 following the grant date. All shares of Collective Brands common stock granted to non-management Directors are subject to restrictions on transferability. Under these restrictions, Directors cannot transfer the shares granted to them until they cease membership on the Board or, if earlier, until the later of six months after they are awarded the grant and the date they have satisfied the stock ownership guidelines of the Company.

Annual stock retainers paid to the non-management Directors are granted under the Company’s Restricted Stock Plan for Non-Management Directors. This plan currently provides for the issuance of not more than 350,000 shares of Collective Brands common stock, subject to adjustment for changes in the Company’s capital structure.

The Board of Directors believes that the interests of Directors and stockholders are most closely aligned when the Directors themselves are stockholders and, accordingly, maintains Stock Ownership Guidelines for non-management Directors. The guidelines stipulate that Directors should hold (either directly or in their deferred compensation accounts discussed below) Collective Brands common stock shares equivalent in value to four times the annual cash retainer in effect at the time the guideline is established for each Director. The Board reviews Director ownership levels annually to evaluate progress toward these guidelines. Under the guidelines, Directors may not sell or otherwise transfer any of the shares of Collective Brands stock awarded to them by the Company until the target ownership level under the guideline is achieved. Currently, all Directors have met their ownership guidelines with the exception of Mr. Markee, who was elected to the Board in 2011.

The Collective Brands, Inc. Deferred Compensation Plan for Non-Management Directors allows each Director to defer receipt of retainers (but not meeting fees) received for services as a Director, whether payable in stock or cash, until after the calendar year in which the Director’s service on the Board ceases. Under this Plan, Directors may elect to use either Company stock or the thirty-year Treasury Bill rate on May 1 of each year as the measurement fund for the return on cash payments that are deferred. Directors must use Company stock as the measurement fund for any Company stock which is deferred.

The following table reflects the Compensation paid to the Company’s non-management Directors in fiscal 2011.

2011 NON-MANAGEMENT DIRECTOR COMPENSATION

| Name of Director (a) |

Fees Earned or Paid in Cash(1) ($) (b) |

Stock Awards

(1,2,3) ($) (c) |

All

Other Compensation(4) ($) (g) |

Total ($) (h) |

||||||||||||

| Daniel Boggan Jr. |

83,000 | 100,000 | – | 183,000 | ||||||||||||

| Mylle H. Mangum |

107,000 | 100,000 | – | 207,000 | ||||||||||||

| Richard L. Markee |

42,000 | 91,667 | – | 133,667 | ||||||||||||

| John F. McGovern |

108,000 | 100,000 | – | 208,000 | ||||||||||||

| Robert F. Moran |

83,000 | 100,000 | – | 183,000 | ||||||||||||

| D. Scott Olivet |

228,000 | 175,000 | – | 403,000 | ||||||||||||

| Matthew A. Ouimet |

83,000 | 100,000 | – | 183,000 | ||||||||||||

| Michael A. Weiss |

86,000 | 100,000 | – | 186,000 | ||||||||||||

| Robert C. Wheeler |

94,000 | 100,000 | – | 194,000 | ||||||||||||

| (1) | Includes fees earned that were deferred under the Collective Brands, Inc. Deferred Compensation Plan for Non-Management Directors. |

| (2) | For all Directors except Messrs. Markee and Olivet, values reflect the grant date fair value on May 26, 2011 (6,548 shares). For Mr. Markee, value reflects the grant date fair value on July 5, 2011 (6,030 shares). For Mr. Olivet, value reflects the grant date fair values on May 26, 2011 (6,548 shares) and June 17, 2011 (5,226 shares). |

12

Table of Contents

| (3) | Total shares not vested as of January 28, 2012, for each Director, including those shares that have been deferred, were: |

| Director |

Shares Not Vested as of 1/28/12 | |||

| Boggan |

6,548 | |||

| Mangum |

6,548 | |||

| Markee |

6,030 | |||

| McGovern |

6,548 | |||

| Moran |

6,548 | |||

| Olivet |

11,774 | |||

| Ouimet |

6,548 | |||

| Weiss |

6,548 | |||

| Wheeler |

6,548 | |||

| (4) | On occasion, non-management Directors receive footwear and other items of nominal value (which may include Company-paid spouse travel in conjunction with Board meetings) that may be considered perquisites. In 2011, the value of all such items did not exceed $5,000 for any individual Director. |

Executive Committee

Members, Authority and Meetings. The Executive Committee is composed of the non-executive Chairman of the Board, the chairperson of the Audit and Finance Committee and the chairperson of the Compensation, Nominating and Governance Committee. The non-executive Chairman of the Board serves as the Executive Committee’s chairperson. The Executive Committee may exercise all the powers of the Board but does not have the power to (i) approve or adopt, or recommend to the Company’s stockholders, any matter expressly required by Delaware law to be submitted to stockholders for approval; (ii) adopt, amend or repeal any By-Law of the Company; (iii) elect Directors of the Company; (iv) declare any dividend or make any other distribution to the Company’s stockholders; or (v) take actions with respect to matters delegated to other committees of the Board. The Executive Committee did not meet during fiscal 2011.

Audit and Finance Committee

Members, Authority and Meetings. Pursuant to its charter, the Audit and Finance Committee is solely responsible for selecting the Company’s independent registered public accountants, reviewing their independence, approving all engagements, and evaluating their performance. The Audit and Finance Committee reviews results of the audit for each fiscal year, all material accounting policies of the Company, the coordination between the independent registered public accountants and the Company’s internal auditing group, the scope and procedures of the Company’s internal audit work, the quality and composition of the Company’s internal audit staff, and maintains procedures for the confidential and anonymous receipt of employee concerns regarding questionable accounting or auditing matters. The Audit and Finance Committee is responsible for reviewing and making recommendations to the Board with respect to matters such as the following: the financial policies of the Company; debt ratings; short-term versus long-term debt positions; debt-to-capitalization ratios; fixed charge coverage; working capital and bank lines; dividend policy; the long-range financial plans of the Company; the Company’s capital expenditure program, including rate of return standards and evaluation methods; specific debt and/or equity placement activities; external financial relationships with investment bankers; commercial bankers, insurance companies, etc.; financial public relations and communication programs; financial aspects of proposed acquisitions and/or divestitures; and the Company’s insurance and risk management programs. See also “Risk Oversight” and “Audit and Finance Committee Report.”

The Audit and Finance Committee regularly provides the Company’s internal auditor, Chief Financial Officer, General Counsel, Chief Administrative Officer and the Company’s independent registered public accountants with opportunities to privately meet with the Committee. The Audit and Finance Committee is also authorized to retain legal, accounting or other advisors as it determines appropriate. The members of the Audit

13

Table of Contents

and Finance Committee during 2011, were Messrs. McGovern (Chairman), Boggan, Moran, Olivet, and Ouimet. The Board determined that each of the members of the Audit and Finance Committee is an independent director as required by the rules of the NYSE and an audit committee financial expert as defined by Item 407(d) of Regulation S-K. During the 2011 fiscal year, the Audit and Finance Committee met nine times.

Compensation, Nominating and Governance Committee

Members, Authority and Meetings. During 2011, the members of the CN&G Committee included Ms. Mangum (Chairman), and Messrs. Markee (since July 2011), Weiss and Wheeler. Each of these Directors satisfied the NYSE’s independence requirements, was a “non-employee director” within the meaning of Rule 16b-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and was an “outside director” within the meaning of Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”). During fiscal 2011, the CN&G Committee met 12 times. The agenda for each CN&G Committee meeting is determined by discussions among the CN&G Committee Chairman, the Company Secretary, Management and the CN&G Committee’s advisors, as appropriate. A copy of the CN&G Committee’s charter was last reviewed at its February 2012 meeting, and can be found on the company’s Investor Relations website at www.collectivebrands.com.

The CN&G Committee is primarily responsible for establishing the Company’s compensation philosophy and various compensation programs and for monitoring the Company’s executive development efforts so that there is an adequate pool of personnel for orderly Management succession. In performing these functions, the CN&G Committee reviews and approves compensation arrangements for the Executive Compensation Group (the “ECG”) which consists of the Chief Executive Officer, other Section 16 officers, the principal executives of each of the Company’s operating units (if not Section 16 officers), and any other employee whose base annual compensation is in excess of $500,000. The CN&G Committee reviewed the Company’s compensation policies and practices for fiscal 2011 for all employees, including executive officers, and determined that the Company’s compensation programs are not reasonably likely to have a material adverse effect on the Company. Nonetheless, as part of its regular review of the Company’s compensation policies, management and the CN&G Committee regularly recommend improvements based upon market and environmental conditions and best practices. The CN&G Committee also reviewed the Company’s Compensation Discussion and Analysis and recommended to the Board that it be included in this proxy statement. In addition, the CN&G Committee serves as the “Committee” under the various Company incentive compensation and retirement plans (e.g., the stock-based incentive plans, executive incentive plans, supplementary retirement plan and deferred compensation plan).

As part of its corporate duties, the CN&G Committee establishes stock ownership guidelines for Company executives, reviews “related party transactions” and ethical issues involving the Company or management, and oversees the implementation of the Company’s Code of Ethics. The CN&G Committee is also responsible for reviewing the Board of Directors’ performance and annually coordinates self evaluations for the Board and each of its Committees, reviewing the mandatory retirement policy for Directors, and evaluating conflicts of interest involving a Director. In addition, the CN&G Committee identifies and recommends candidates to serve as Directors of the Board, the Chairman of the Board and/or Lead Director, members and chairpersons of Board committees and the Chief Executive Officer. The CN&G Committee considers nominees for Directors from any source, including individuals nominated by stockholders or outside consultants engaged by the CN&G Committee to recommend Director nominees. Director nominee suggestions must be submitted in writing to the Company’s Secretary at 3231 Southeast Sixth Avenue, Topeka, Kansas, 66607, and otherwise comply with the terms of the Company’s By-Laws.

The CN&G Committee may delegate some of its duties or responsibilities to one or more individual members, but only to the extent permitted by law, the New York Stock Exchange’s listing standards and the Company’s governing documents. The CN&G Committee also engages outside consultants to advise on various issues, including Chief Executive Officer compensation, executive officer compensation and certain benefit programs. Such consulting arrangements with Hay Group are discussed in the Compensation Discussion and

14

Table of Contents

Analysis under “Role of Consultants in Compensation Decisions.” The CN&G Committee also engages other consultants from time to time to assist with specific projects. The consultants engaged by the CN&G Committee report directly to the CN&G Committee and the Chief Executive Officer generally does not participate in recommendations prepared by these consultants regarding Chief Executive Officer compensation. The role of other executive officers in setting compensation is discussed in the Compensation Discussion and Analysis.

Compensation Committee Interlocks and Insider Participation

No member of the CN&G Committee (Ms. Mangum, Messrs. Markee, Weiss and Wheeler) has served as one of the Company’s officers or employees or has any relationship requiring disclosure under Item 404 of Regulation S-K promulgated under the Securities Act of 1933, as amended (see “Related Party Transactions”). None of the Company’s executive officers named in the Summary Compensation Table serves as a member of the board of directors or as a member of compensation committee of any other company that has an executive officer serving as a member of the Company’s Board or the CN&G Committee.

Compensation, Nominating and Governance Committee Report

The following Report of the CN&G Committee does not constitute soliciting material and should not be deemed filed or incorporated by reference into any other Company filing under the Securities Act of 1933 or the Exchange Act, except to the extent the Company specifically incorporates this Report by reference therein.

The CN&G Committee has reviewed and discussed the Compensation Discussion and Analysis required under Item 402(b) of Regulation S-K set forth below with Management. Based on that review and discussion, the CN&G Committee recommended to the Company’s Board of Directors that the Compensation Discussion and Analysis be included in this proxy statement.

Compensation, Nominating and Governance Committee:

Mylle H. Mangum — Chairman

Richard L. Markee

Michael A. Weiss

Robert C. Wheeler

15

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

| 1. Executive | Summary |

Fiscal 2011 was a year of transition and strategic re-focus for the Company; nevertheless, the alignment between executive pay and performance remained strong:

| • | Named Executive Officers of Collective Brands and Payless ShoeSource received no annual incentive payments, consistent with the year-over-year declines in earnings before interest and taxes (“EBIT”) for their respective business units in fiscal 2011. |

| • | While Collective Brands Performance + Lifestyle Group (“PLG”) delivered a 10% improvement in EBIT over the prior year, actual EBIT for the PLG business unit in total still fell short of the 2011 goal and thus resulted in a below-target annual incentive payout. |

| • | All Named Executive Officers forfeited the performance-based equity grants they received in March 2011 because the Company’s fiscal 2011 earnings before interest, taxes, depreciation and amortization (“EBITDA”) results fell short of the 2011 goal. |

| • | Named Executive Officers of Collective Brands and Payless ShoeSource received below-target and zero payouts, respectively, under their fiscal 2009-2011 long-term cash incentive plans, which are based on 3-year EBITDA and return on invested capital (“ROIC”). In accordance with plan provisions, the payout was adjusted downward by 20% based on the Company’s 3-year total stockholder return. |

| • | Named Executive Officers of Collective Brands and Payless ShoeSource did not earn a performance credit in the Supplementary Retirement Account Balance Plan, because Collective Brands EBIT fell short of target. |

While the Company’s overall profitability fell short of targets set at the beginning of the year, progress was achieved on several fronts in 2011:

| • | Positive sales momentum continued at PLG, which broke the $1 billion mark in sales for the year and delivered its eighth consecutive quarter of double-digit sales growth. PLG’s comparable retail store sales grew 10% in the fourth quarter. |

| • | As a result of a strategic re-focus at Payless ShoeSource in the second half of 2011, with a particular emphasis on reconnecting with the budget-conscious consumer, that unit’s business results improved in the fourth quarter in several respects: |

| — | Traffic was better than at any time in the past six years; |

| — | U.S. comparable store sales were the strongest in nine quarters; |

| — | Footwear units sold had the strongest increase in 19 quarters. |

A leadership transition occurred in June 2011 with the departure of Mr. Matthew E. Rubel, former Chairman, Chief Executive Officer and President. Mr. Michael J. Massey, Senior Vice President and General Counsel, was appointed Chief Executive Officer and President on an interim basis, and Mr. Scott Olivet, a non-management Director, was named non-executive Chairman of the Board of Directors. Mr. Rubel’s termination compensation, which was paid in accordance with his employment agreement, and the compensation arrangements for Messrs. Massey and Olivet are discussed elsewhere in this proxy statement.

To encourage the continued retention and engagement of key executive talent and to reward significant individual contributions, the CN&G Committee made discretionary equity awards to two Named Executive Officers and modest discretionary cash awards to two Named Executive Officers during the year, as detailed later in this Compensation Discussion and Analysis.

16

Table of Contents

The Company’s 2011 advisory vote on executive compensation (say-on-pay) passed with 82% of votes cast in favor. Regarding the frequency of future say-on-pay votes, 82% of all votes were cast in support of annual frequency, which the Company had recommended. In advance of the 2011 Annual Meeting of Stockholders, the Company engaged in conversations with major stockholders regarding these proposals and the future approach to the use of time- and performance-vested equity awards; based on stockholder feedback, the CN&G Committee publicly disclosed a commitment to make at least 50% of future equity grants to Named Executive Officers in the form of performance-vested awards.

With the assistance of Hay Group, an independent compensation consultant, the CN&G Committee conducted several reviews to ensure that the Company’s executive compensation programs remain consistent with its compensation philosophy and deliver rewards that are closely aligned with the Company’s performance, talent management objectives, and stockholder interests. These reviews resulted in the following actions:

| • | In March 2011, the Company committed to granting future annual equity incentive awards to Named Executive Officers that are no less than 50% performance-based in the aggregate, and we increased the vesting period for time-based equity awards to 3-year cliff vesting. |

| • | In September 2011, the Company updated our Compensation Comparison Group to ensure the continued appropriateness of our external benchmarking. |

| • | For fiscal 2011, Named Executive Officers were awarded merit increases that directly correlate to the results each Named Executive Officer achieved on objectives established and evaluated through the Company’s performance management program. These increases ranged from 0% to 3.1%, similar to the increases awarded throughout the Company for comparable levels of performance. |

| • | The Company added a second performance measure, net revenue, to the annual incentive plan for all participants, including Named Executive Officers, beginning in fiscal 2012. The plan will be based 75% on EBIT and 25% on net revenue, to drive continued focus on profitable top-line growth. |

| • | The Company increased the weighting of the relative total stockholder return modifier in the long-term cash incentive plan from ±20% to ±50%, beginning with the 2012-2014 performance period, to further strengthen participants’ alignment with stockholder interests. |

| • | Beginning in March 2012, new equity awards will include a double-trigger provision for vesting upon a Change of Control. In the event of a Change of Control, the vesting of outstanding equity awards will occur only if the award recipient is involuntarily terminated without cause following the Change of Control. Vesting will also occur if an award recipient terminates for good reason following the Change of Control, if an employment agreement between the award recipient and the Company provides for good reason termination. |

| • | The Company have added a claw back provision to the Company’s Incentive Compensation Plan and 2012 Stock Incentive Plan, as discussed under Proposals IV and V in this proxy statement. This provision gives the CN&G Committee discretionary authority to claw back awards granted under these plans if the Company restates its financial statements and, as a result, participants’ awards should have been lower. The discretionary authority will allow the CN&G Committee to adopt a stand-alone claw back policy, which can then be applied under these plans, once the regulations required under the Dodd-Frank Act are finalized by the Securities and Exchange Commission. |

In addition, our overall compensation program is consistent with recognized best practices in corporate governance, such as:

| • | Long-standing stock ownership guidelines for executives and non-management Directors; |

| • | Limited executive benefits and perquisites; |

| • | No gross-ups on taxable benefits, other than relocation-related gross-ups applicable to all employees; |

17

Table of Contents

| • | Insider trading policy, applicable to all employees and non-management Directors, which prohibits: |

| — | Speculative transactions involving Company stock, such as short sales, opposite-way transactions within a six-month period, and the purchase or sale of puts, calls, options or other derivative securities based on Company stock; |

| — | Hedging or monetization transactions by employees and non-management Directors involving Company stock, such as zero cost collars and forward sale contracts; |

| — | The purchase of Company stock on margin or the use of Company stock as collateral for borrowing. |

The compensation-related reviews and actions undertaken in fiscal 2011 are described in detail in this Compensation Discussion and Analysis. We invite you to read the entire report and the tables that follow to obtain a complete understanding of our executive compensation program.

Throughout the Compensation Discussion and Analysis, the following definitions will apply:

| • | “CEO” refers to the Chief Executive Officer and President of Collective Brands, Inc. |

| • | “Named Executive Officer” refers to the CEO and other executive officers named in the Summary Compensation Table. These include Mr. Massey; Ms. LuAnn Via, President and Chief Executive Officer of Payless ShoeSource; Mr. Gregg Ribatt, President and Chief Executive Officer of Collective Brands Performance + Lifestyle Group; Mr. Darrel Pavelka, Executive Vice President, Global Supply Chain, Merchandise Distribution & Planning and IT; Mr. Douglas Boessen, Division Senior Vice President and Chief Financial Officer; and Mr. Rubel, formerly Chairman, Chief Executive Officer and President of Collective Brands, whose employment with the Company ended on June 15, 2011. |

| • | “EBIT” refers to earnings before interest and taxes, which is defined for purposes of this discussion as operating profit from continuing operations |

| • | “CBI” and “Company” refer to Collective Brands, Inc. |

| • | “Payless” refers to the Payless ShoeSource business unit of CBI |

| • | “PLG” refers to the Collective Brands Performance + Lifestyle Group business unit of CBI |

| • | “ICP” refers to the Collective Brands Incentive Compensation Plan |

| • | “Fiscal 2009,” “fiscal 2010,” “fiscal 2011” and “fiscal 2012” refer to the fiscal years ended(ing) January 30, 2010; January 29, 2011; January 28, 2012; and February 2, 2013, respectively |

| 2. | Compensation Framework: Philosophy and Process |

Compensation Philosophy. The philosophy underlying the Company’s executive compensation program is to provide a compelling, market-based total compensation program tied to performance and aligned with stockholder interests. Key to our executive compensation philosophy are the following objectives:

| • | Pay for performance. To foster a strong connection between executive compensation and business performance that enhances stockholder value, Named Executive Officers continue to receive a majority of their compensation through performance-based incentives and equity-based awards. |

| • | Attract, motivate and retain highly qualified executives. The Company is committed to providing a total compensation program designed to attract superior leaders to the Company and retain performers of the highest caliber. An annual talent and organization planning process helps link compensation to the sustained performance and potential of each executive. |

| • | Be competitive with the compensation programs of other comparable employers. To achieve this goal, the CN&G Committee annually compares the Company’s pay practices and overall pay levels with other leading retail and wholesale organizations. |

18

Table of Contents

Target total direct compensation (base salary and annual and annual and long-term target incentive opportunities) for Named Executive Officers is benchmarked to the market median (50th percentile) in the aggregate, although some components of compensation may vary from the median based on an executive’s experience, performance, potential and retention risk. In addition, these variations reflect the reality that the Company competes with many larger companies for top-level executive talent. When Company and individual performance exceed targets, delivered compensation should rise above median, and when performance falls short of targets, delivered compensation should fall below median.

Compensation Risk Assessment. The CN&G Committee is responsible for regularly reviewing the Company’s compensation programs to evaluate whether they pose any risks that are reasonably likely to have a material adverse effect on the Company and for reporting to the full Board as appropriate. Additionally, as part of its regular review of the Company’s compensation policies, the CN&G Committee regularly implements improvements based upon market and environmental conditions, best practices, and the advice of its independent consultant.

In March 2011, the CN&G Committee conducted an update to the 2010 risk assessment completed by its independent consultant and concluded that the Company’s compensation programs do not pose risks that are reasonably likely to have a material adverse effect on the Company. In reaching this conclusion, the CN&G Committee took into consideration the fact that our incentive plans and compensation arrangements contained similar risk mitigation features as in prior years. The design changes made for 2012 (see “Executive Summary” above) further strengthen the connections between executive pay, company performance and stockholder interests, including the mitigation of risk.

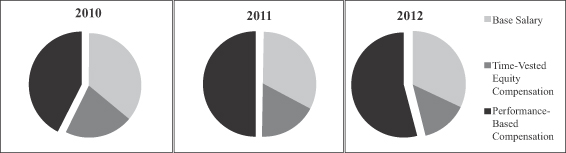

Compensation Mix. As illustrated in the charts below, over the past three years, the CN&G Committee has adjusted the mix of fixed and variable pay, and increased the proportion of equity compensation tied to specific financial measures, to ensure a solid link between Named Executive Officers’ pay, Company performance, and stockholder value creation:

| • | One-half to two-thirds of each Named Executive Officer’s target compensation is variable in nature and tied to specified financial metrics or stock price appreciation. |

| • | The “performance-based compensation” component of the charts below has increased primarily because the use of performance-vested restricted equity awards has grown in each of the last three years: |

| — | 2010: 25% of the base annual equity grant value was linked to a financial performance measure. |

| — | 2011: 37.5% of the base annual equity grant value was linked to a financial performance measure; also, for discretionary equity awards made to three Named Executive Officers later in the year, at least 50% of the grant value was linked to a financial performance measure. |

| — | 2012: 50% of the base annual equity grant was tied to a financial performance measure, consistent with the CN&G Committee’s March 2011 commitment that future annual grants to Named Executive Officers will be at least 50% performance-vested in the aggregate. |