0001059556Q1false--12-312024P1YP1YP2Yhttp://fasb.org/us-gaap/2023#RestructuringCharges00010595562024-01-012024-03-310001059556us-gaap:CommonStockMember2024-01-012024-03-310001059556mco:TwoThousandAndFifteenSeniorNotesDueTwoThousandAndTwentySevenMember2024-01-012024-03-310001059556mco:A950SeniorNotesDueTwoThousandAndThirtyMember2024-01-012024-03-3100010595562024-03-31xbrli:sharesiso4217:USD00010595562023-01-012023-03-31iso4217:USDxbrli:shares00010595562023-12-310001059556mco:SeriesCommonStockMember2024-03-310001059556mco:SeriesCommonStockMember2023-12-310001059556mco:NonSeriesCommonStockMember2024-03-310001059556mco:NonSeriesCommonStockMember2023-12-3100010595562022-12-3100010595562023-03-310001059556us-gaap:CommonStockMember2022-12-310001059556us-gaap:AdditionalPaidInCapitalMember2022-12-310001059556us-gaap:RetainedEarningsMember2022-12-310001059556us-gaap:TreasuryStockCommonMember2022-12-310001059556us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001059556us-gaap:ParentMember2022-12-310001059556us-gaap:NoncontrollingInterestMember2022-12-310001059556us-gaap:RetainedEarningsMember2023-01-012023-03-310001059556us-gaap:ParentMember2023-01-012023-03-310001059556us-gaap:NoncontrollingInterestMember2023-01-012023-03-310001059556us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001059556us-gaap:TreasuryStockCommonMember2023-01-012023-03-310001059556us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001059556us-gaap:CommonStockMember2023-03-310001059556us-gaap:AdditionalPaidInCapitalMember2023-03-310001059556us-gaap:RetainedEarningsMember2023-03-310001059556us-gaap:TreasuryStockCommonMember2023-03-310001059556us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001059556us-gaap:ParentMember2023-03-310001059556us-gaap:NoncontrollingInterestMember2023-03-310001059556us-gaap:CommonStockMember2023-12-310001059556us-gaap:AdditionalPaidInCapitalMember2023-12-310001059556us-gaap:RetainedEarningsMember2023-12-310001059556us-gaap:TreasuryStockCommonMember2023-12-310001059556us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001059556us-gaap:ParentMember2023-12-310001059556us-gaap:NoncontrollingInterestMember2023-12-310001059556us-gaap:RetainedEarningsMember2024-01-012024-03-310001059556us-gaap:ParentMember2024-01-012024-03-310001059556us-gaap:NoncontrollingInterestMember2024-01-012024-03-310001059556us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001059556us-gaap:TreasuryStockCommonMember2024-01-012024-03-310001059556us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001059556us-gaap:CommonStockMember2024-03-310001059556us-gaap:AdditionalPaidInCapitalMember2024-03-310001059556us-gaap:RetainedEarningsMember2024-03-310001059556us-gaap:TreasuryStockCommonMember2024-03-310001059556us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001059556us-gaap:ParentMember2024-03-310001059556us-gaap:NoncontrollingInterestMember2024-03-31mco:segment0001059556mco:DSBankingProductAndServiceMembermco:MoodysAnalyticsMembermco:DecisionSolutionsMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:DSBankingProductAndServiceMembermco:MoodysAnalyticsMembermco:DecisionSolutionsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:InsuranceMembermco:MoodysAnalyticsMembermco:DecisionSolutionsMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:InsuranceMembermco:MoodysAnalyticsMembermco:DecisionSolutionsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:MoodysAnalyticsMembermco:KYCMembermco:DecisionSolutionsMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:MoodysAnalyticsMembermco:KYCMembermco:DecisionSolutionsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:MoodysAnalyticsMembermco:DecisionSolutionsMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:MoodysAnalyticsMembermco:DecisionSolutionsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:ResearchAndInsightsMembermco:MoodysAnalyticsMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:ResearchAndInsightsMembermco:MoodysAnalyticsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:MoodysAnalyticsMembermco:DataAndInformationMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:MoodysAnalyticsMembermco:DataAndInformationMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:MoodysAnalyticsMember2024-01-012024-03-310001059556mco:MoodysAnalyticsMember2023-01-012023-03-310001059556us-gaap:IntersegmentEliminationMembermco:MoodysAnalyticsMember2024-01-012024-03-310001059556us-gaap:IntersegmentEliminationMembermco:MoodysAnalyticsMember2023-01-012023-03-310001059556mco:MoodysAnalyticsMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:MoodysAnalyticsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:CorporateFinanceMembermco:MoodysInvestorsServiceMembermco:InvestmentGradeMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:CorporateFinanceMembermco:MoodysInvestorsServiceMembermco:InvestmentGradeMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:HighYieldMembermco:CorporateFinanceMembermco:MoodysInvestorsServiceMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:HighYieldMembermco:CorporateFinanceMembermco:MoodysInvestorsServiceMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:CorporateFinanceMembermco:MoodysInvestorsServiceMembermco:BankLoansMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:CorporateFinanceMembermco:MoodysInvestorsServiceMembermco:BankLoansMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:CorporateFinanceMembermco:MoodysInvestorsServiceMembermco:OtherProductLinesMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:CorporateFinanceMembermco:MoodysInvestorsServiceMembermco:OtherProductLinesMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:CorporateFinanceMembermco:MoodysInvestorsServiceMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:CorporateFinanceMembermco:MoodysInvestorsServiceMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMembermco:AssetsBackedSecuritiesMembermco:StructuredFinanceLineOfBusinessMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMembermco:AssetsBackedSecuritiesMembermco:StructuredFinanceLineOfBusinessMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMembermco:StructuredFinanceLineOfBusinessMembermco:ResidentialMortgageBackedSecuritiesProductMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMembermco:StructuredFinanceLineOfBusinessMembermco:ResidentialMortgageBackedSecuritiesProductMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMembermco:StructuredFinanceLineOfBusinessMembermco:CommercialMortgageBackedSecuritiesProductMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMembermco:StructuredFinanceLineOfBusinessMembermco:CommercialMortgageBackedSecuritiesProductMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMembermco:StructuredFinanceLineOfBusinessMembermco:StructuredCreditMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMembermco:StructuredFinanceLineOfBusinessMembermco:StructuredCreditMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMembermco:StructuredFinanceLineOfBusinessMembermco:OtherProductLinesMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMembermco:StructuredFinanceLineOfBusinessMembermco:OtherProductLinesMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMembermco:StructuredFinanceLineOfBusinessMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMembermco:StructuredFinanceLineOfBusinessMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:FinancialInstitutionsMembermco:MoodysInvestorsServiceMemberus-gaap:BankingMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:FinancialInstitutionsMembermco:MoodysInvestorsServiceMemberus-gaap:BankingMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:FinancialInstitutionsMembermco:MoodysInvestorsServiceMembermco:InsuranceMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:FinancialInstitutionsMembermco:MoodysInvestorsServiceMembermco:InsuranceMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:ManagedInvestmentsMembermco:FinancialInstitutionsMembermco:MoodysInvestorsServiceMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:ManagedInvestmentsMembermco:FinancialInstitutionsMembermco:MoodysInvestorsServiceMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:FinancialInstitutionsMembermco:MoodysInvestorsServiceMembermco:OtherProductLinesMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:FinancialInstitutionsMembermco:MoodysInvestorsServiceMembermco:OtherProductLinesMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:FinancialInstitutionsMembermco:MoodysInvestorsServiceMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:FinancialInstitutionsMembermco:MoodysInvestorsServiceMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:PublicFinanceSovereignMembermco:MoodysInvestorsServiceMembermco:PublicProjectAndInfrastructureFinanceMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:PublicFinanceSovereignMembermco:MoodysInvestorsServiceMembermco:PublicProjectAndInfrastructureFinanceMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMembermco:PublicProjectAndInfrastructureFinanceMemberus-gaap:OperatingSegmentsMembermco:ProjectAndInfrastructureMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMembermco:PublicProjectAndInfrastructureFinanceMemberus-gaap:OperatingSegmentsMembermco:ProjectAndInfrastructureMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMembermco:PublicProjectAndInfrastructureFinanceMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMembermco:PublicProjectAndInfrastructureFinanceMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMembermco:RatingRevenueMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMembermco:RatingRevenueMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMembermco:MISOtherMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMembermco:MISOtherMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMemberus-gaap:IntersegmentEliminationMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMemberus-gaap:IntersegmentEliminationMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556us-gaap:IntersegmentEliminationMember2024-01-012024-03-310001059556us-gaap:IntersegmentEliminationMember2023-01-012023-03-310001059556country:USmco:MoodysAnalyticsMembermco:DecisionSolutionsMember2024-01-012024-03-310001059556us-gaap:NonUsMembermco:MoodysAnalyticsMembermco:DecisionSolutionsMember2024-01-012024-03-310001059556mco:MoodysAnalyticsMembermco:DecisionSolutionsMember2024-01-012024-03-310001059556country:USmco:MoodysAnalyticsMembermco:DecisionSolutionsMember2023-01-012023-03-310001059556us-gaap:NonUsMembermco:MoodysAnalyticsMembermco:DecisionSolutionsMember2023-01-012023-03-310001059556mco:MoodysAnalyticsMembermco:DecisionSolutionsMember2023-01-012023-03-310001059556mco:ResearchAndInsightsMembercountry:USmco:MoodysAnalyticsMember2024-01-012024-03-310001059556mco:ResearchAndInsightsMemberus-gaap:NonUsMembermco:MoodysAnalyticsMember2024-01-012024-03-310001059556mco:ResearchAndInsightsMembermco:MoodysAnalyticsMember2024-01-012024-03-310001059556mco:ResearchAndInsightsMembercountry:USmco:MoodysAnalyticsMember2023-01-012023-03-310001059556mco:ResearchAndInsightsMemberus-gaap:NonUsMembermco:MoodysAnalyticsMember2023-01-012023-03-310001059556mco:ResearchAndInsightsMembermco:MoodysAnalyticsMember2023-01-012023-03-310001059556country:USmco:MoodysAnalyticsMembermco:DataAndInformationMember2024-01-012024-03-310001059556us-gaap:NonUsMembermco:MoodysAnalyticsMembermco:DataAndInformationMember2024-01-012024-03-310001059556mco:MoodysAnalyticsMembermco:DataAndInformationMember2024-01-012024-03-310001059556country:USmco:MoodysAnalyticsMembermco:DataAndInformationMember2023-01-012023-03-310001059556us-gaap:NonUsMembermco:MoodysAnalyticsMembermco:DataAndInformationMember2023-01-012023-03-310001059556mco:MoodysAnalyticsMembermco:DataAndInformationMember2023-01-012023-03-310001059556country:USmco:MoodysAnalyticsMember2024-01-012024-03-310001059556us-gaap:NonUsMembermco:MoodysAnalyticsMember2024-01-012024-03-310001059556country:USmco:MoodysAnalyticsMember2023-01-012023-03-310001059556us-gaap:NonUsMembermco:MoodysAnalyticsMember2023-01-012023-03-310001059556mco:CorporateFinanceMembermco:MoodysInvestorsServiceMembercountry:US2024-01-012024-03-310001059556mco:CorporateFinanceMembermco:MoodysInvestorsServiceMemberus-gaap:NonUsMember2024-01-012024-03-310001059556mco:CorporateFinanceMembermco:MoodysInvestorsServiceMember2024-01-012024-03-310001059556mco:CorporateFinanceMembermco:MoodysInvestorsServiceMembercountry:US2023-01-012023-03-310001059556mco:CorporateFinanceMembermco:MoodysInvestorsServiceMemberus-gaap:NonUsMember2023-01-012023-03-310001059556mco:CorporateFinanceMembermco:MoodysInvestorsServiceMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMembermco:StructuredFinanceLineOfBusinessMembercountry:US2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMemberus-gaap:NonUsMembermco:StructuredFinanceLineOfBusinessMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMembermco:StructuredFinanceLineOfBusinessMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMembermco:StructuredFinanceLineOfBusinessMembercountry:US2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMemberus-gaap:NonUsMembermco:StructuredFinanceLineOfBusinessMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMembermco:StructuredFinanceLineOfBusinessMember2023-01-012023-03-310001059556mco:FinancialInstitutionsMembermco:MoodysInvestorsServiceMembercountry:US2024-01-012024-03-310001059556mco:FinancialInstitutionsMembermco:MoodysInvestorsServiceMemberus-gaap:NonUsMember2024-01-012024-03-310001059556mco:FinancialInstitutionsMembermco:MoodysInvestorsServiceMember2024-01-012024-03-310001059556mco:FinancialInstitutionsMembermco:MoodysInvestorsServiceMembercountry:US2023-01-012023-03-310001059556mco:FinancialInstitutionsMembermco:MoodysInvestorsServiceMemberus-gaap:NonUsMember2023-01-012023-03-310001059556mco:FinancialInstitutionsMembermco:MoodysInvestorsServiceMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMembercountry:USmco:PublicProjectAndInfrastructureFinanceMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMemberus-gaap:NonUsMembermco:PublicProjectAndInfrastructureFinanceMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMembermco:PublicProjectAndInfrastructureFinanceMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMembercountry:USmco:PublicProjectAndInfrastructureFinanceMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMemberus-gaap:NonUsMembermco:PublicProjectAndInfrastructureFinanceMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMembermco:PublicProjectAndInfrastructureFinanceMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMembercountry:USmco:RatingRevenueMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMemberus-gaap:NonUsMembermco:RatingRevenueMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMembermco:RatingRevenueMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMembercountry:USmco:RatingRevenueMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMemberus-gaap:NonUsMembermco:RatingRevenueMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMembermco:RatingRevenueMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMembercountry:USmco:MISOtherMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMemberus-gaap:NonUsMembermco:MISOtherMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMembermco:MISOtherMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMembercountry:USmco:MISOtherMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMemberus-gaap:NonUsMembermco:MISOtherMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMembermco:MISOtherMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMembercountry:US2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMemberus-gaap:NonUsMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMembercountry:US2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMemberus-gaap:NonUsMember2023-01-012023-03-310001059556country:US2024-01-012024-03-310001059556us-gaap:NonUsMember2024-01-012024-03-310001059556country:US2023-01-012023-03-310001059556us-gaap:NonUsMember2023-01-012023-03-310001059556country:USmco:MoodysAnalyticsMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556country:USmco:MoodysAnalyticsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556us-gaap:EMEAMembermco:MoodysAnalyticsMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556us-gaap:EMEAMembermco:MoodysAnalyticsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556srt:AsiaPacificMembermco:MoodysAnalyticsMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556srt:AsiaPacificMembermco:MoodysAnalyticsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556srt:AmericasMembermco:MoodysAnalyticsMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556srt:AmericasMembermco:MoodysAnalyticsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556us-gaap:NonUsMembermco:MoodysAnalyticsMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556us-gaap:NonUsMembermco:MoodysAnalyticsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMembercountry:USus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMembercountry:USus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMemberus-gaap:EMEAMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMemberus-gaap:EMEAMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMembersrt:AsiaPacificMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMembersrt:AsiaPacificMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMembersrt:AmericasMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMembersrt:AmericasMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMemberus-gaap:NonUsMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMemberus-gaap:NonUsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:TransactionRevenueMembermco:MoodysAnalyticsMembermco:DecisionSolutionsMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:RecurringRevenueMembermco:MoodysAnalyticsMembermco:DecisionSolutionsMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:TransactionRevenueMembermco:MoodysAnalyticsMembermco:DecisionSolutionsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:RecurringRevenueMembermco:MoodysAnalyticsMembermco:DecisionSolutionsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-31xbrli:pure0001059556mco:ResearchAndInsightsMembermco:TransactionRevenueMembermco:MoodysAnalyticsMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:ResearchAndInsightsMembermco:RecurringRevenueMembermco:MoodysAnalyticsMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:ResearchAndInsightsMembermco:TransactionRevenueMembermco:MoodysAnalyticsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:ResearchAndInsightsMembermco:RecurringRevenueMembermco:MoodysAnalyticsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:TransactionRevenueMembermco:MoodysAnalyticsMembermco:DataAndInformationMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:RecurringRevenueMembermco:MoodysAnalyticsMembermco:DataAndInformationMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:TransactionRevenueMembermco:MoodysAnalyticsMembermco:DataAndInformationMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:RecurringRevenueMembermco:MoodysAnalyticsMembermco:DataAndInformationMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:TransactionRevenueMembermco:MoodysAnalyticsMember2024-01-012024-03-310001059556mco:RecurringRevenueMembermco:MoodysAnalyticsMember2024-01-012024-03-310001059556mco:TransactionRevenueMembermco:MoodysAnalyticsMember2023-01-012023-03-310001059556mco:RecurringRevenueMembermco:MoodysAnalyticsMember2023-01-012023-03-310001059556mco:TransactionRevenueMembermco:MoodysAnalyticsMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:RecurringRevenueMembermco:MoodysAnalyticsMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:TransactionRevenueMembermco:MoodysAnalyticsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:RecurringRevenueMembermco:MoodysAnalyticsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:CorporateFinanceMembermco:MoodysInvestorsServiceMembermco:TransactionRevenueMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:CorporateFinanceMembermco:MoodysInvestorsServiceMembermco:RecurringRevenueMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:CorporateFinanceMembermco:MoodysInvestorsServiceMembermco:TransactionRevenueMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:CorporateFinanceMembermco:MoodysInvestorsServiceMembermco:RecurringRevenueMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMembermco:TransactionRevenueMembermco:StructuredFinanceLineOfBusinessMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMembermco:RecurringRevenueMembermco:StructuredFinanceLineOfBusinessMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMembermco:TransactionRevenueMembermco:StructuredFinanceLineOfBusinessMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMembermco:RecurringRevenueMembermco:StructuredFinanceLineOfBusinessMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:FinancialInstitutionsMembermco:MoodysInvestorsServiceMembermco:TransactionRevenueMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:FinancialInstitutionsMembermco:MoodysInvestorsServiceMembermco:RecurringRevenueMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:FinancialInstitutionsMembermco:MoodysInvestorsServiceMembermco:TransactionRevenueMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:FinancialInstitutionsMembermco:MoodysInvestorsServiceMembermco:RecurringRevenueMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMembermco:TransactionRevenueMembermco:PublicProjectAndInfrastructureFinanceMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMembermco:RecurringRevenueMembermco:PublicProjectAndInfrastructureFinanceMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMembermco:TransactionRevenueMembermco:PublicProjectAndInfrastructureFinanceMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMembermco:RecurringRevenueMembermco:PublicProjectAndInfrastructureFinanceMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMembermco:TransactionRevenueMembermco:MISOtherMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMembermco:RecurringRevenueMembermco:MISOtherMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMembermco:TransactionRevenueMembermco:MISOtherMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMembermco:RecurringRevenueMembermco:MISOtherMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMembermco:TransactionRevenueMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMembermco:RecurringRevenueMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMembermco:TransactionRevenueMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMembermco:RecurringRevenueMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMembermco:TransactionRevenueMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMembermco:RecurringRevenueMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMembermco:TransactionRevenueMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMembermco:RecurringRevenueMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:TransactionRevenueMember2024-01-012024-03-310001059556mco:RecurringRevenueMember2024-01-012024-03-310001059556mco:TransactionRevenueMember2023-01-012023-03-310001059556mco:RecurringRevenueMember2023-01-012023-03-310001059556us-gaap:TransferredAtPointInTimeMembermco:MoodysAnalyticsMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMemberus-gaap:TransferredAtPointInTimeMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556us-gaap:TransferredAtPointInTimeMember2024-01-012024-03-310001059556us-gaap:TransferredAtPointInTimeMembermco:MoodysAnalyticsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMemberus-gaap:TransferredAtPointInTimeMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556us-gaap:TransferredAtPointInTimeMember2023-01-012023-03-310001059556us-gaap:TransferredOverTimeMembermco:MoodysAnalyticsMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556mco:MoodysInvestorsServiceMemberus-gaap:TransferredOverTimeMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001059556us-gaap:TransferredOverTimeMember2024-01-012024-03-310001059556us-gaap:TransferredOverTimeMembermco:MoodysAnalyticsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556mco:MoodysInvestorsServiceMemberus-gaap:TransferredOverTimeMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001059556us-gaap:TransferredOverTimeMember2023-01-012023-03-310001059556us-gaap:AccountsReceivableMembermco:MoodysAnalyticsMember2024-03-310001059556us-gaap:AccountsReceivableMembermco:MoodysInvestorsServiceMember2024-03-310001059556us-gaap:AccountsReceivableMembermco:MoodysAnalyticsMember2023-12-310001059556us-gaap:AccountsReceivableMembermco:MoodysInvestorsServiceMember2023-12-310001059556mco:MoodysAnalyticsMember2023-12-310001059556mco:MoodysInvestorsServiceMember2023-12-310001059556mco:MoodysAnalyticsMember2022-12-310001059556mco:MoodysInvestorsServiceMember2022-12-310001059556mco:MoodysAnalyticsMember2024-03-310001059556mco:MoodysInvestorsServiceMember2024-03-310001059556mco:MoodysAnalyticsMember2023-03-310001059556mco:MoodysInvestorsServiceMember2023-03-310001059556mco:MoodysAnalyticsMember2023-10-012024-03-3100010595562024-01-01srt:MinimumMembermco:MoodysAnalyticsMember2024-03-3100010595562024-01-01mco:MoodysAnalyticsMember2024-03-3100010595562024-01-01srt:MaximumMembermco:MoodysAnalyticsMember2024-03-310001059556mco:MoodysInvestorsServiceMember2023-10-012024-03-3100010595562024-01-01mco:MoodysInvestorsServiceMember2024-03-3100010595562024-01-01mco:MoodysInvestorsServiceMembersrt:MinimumMember2024-03-3100010595562024-01-01mco:MoodysInvestorsServiceMembersrt:MaximumMember2024-03-310001059556us-gaap:RestrictedStockMember2024-01-012024-03-310001059556us-gaap:EmployeeStockOptionMember2024-01-012024-03-310001059556mco:PerformanceBasedRestrictedStockMember2024-01-012024-03-310001059556mco:PerformanceBasedRestrictedStockMembersrt:MinimumMember2024-01-012024-03-310001059556mco:PerformanceBasedRestrictedStockMembersrt:MaximumMember2024-01-012024-03-310001059556us-gaap:StockCompensationPlanMember2024-01-012024-03-310001059556us-gaap:EmployeeStockOptionMember2024-03-310001059556us-gaap:RestrictedStockMember2024-03-310001059556mco:PerformanceBasedRestrictedStockMember2024-03-310001059556us-gaap:RestrictedStockMember2023-01-012023-03-310001059556mco:PerformanceBasedRestrictedStockMember2023-01-012023-03-310001059556us-gaap:CertificatesOfDepositMember2024-03-310001059556us-gaap:CertificatesOfDepositMember2024-01-012024-03-310001059556us-gaap:MutualFundMember2024-03-310001059556us-gaap:MutualFundMember2024-01-012024-03-310001059556us-gaap:CertificatesOfDepositMember2023-12-310001059556us-gaap:CertificatesOfDepositMember2023-01-012023-12-310001059556us-gaap:MutualFundMember2023-12-310001059556us-gaap:MutualFundMember2023-01-012023-12-310001059556us-gaap:ShortTermInvestmentsMembersrt:MinimumMemberus-gaap:CertificatesOfDepositMember2023-12-310001059556us-gaap:ShortTermInvestmentsMembersrt:MinimumMemberus-gaap:CertificatesOfDepositMember2024-03-310001059556us-gaap:ShortTermInvestmentsMembersrt:MaximumMemberus-gaap:CertificatesOfDepositMember2024-03-310001059556us-gaap:ShortTermInvestmentsMembersrt:MaximumMemberus-gaap:CertificatesOfDepositMember2023-12-310001059556us-gaap:OtherAssetsMembersrt:MinimumMemberus-gaap:CertificatesOfDepositMember2024-03-310001059556srt:MaximumMemberus-gaap:OtherAssetsMemberus-gaap:CertificatesOfDepositMember2024-03-310001059556us-gaap:OtherAssetsMemberus-gaap:CertificatesOfDepositMember2023-12-310001059556us-gaap:CashAndCashEquivalentsMembersrt:MaximumMemberus-gaap:CertificatesOfDepositMember2024-03-310001059556us-gaap:FairValueHedgingMemberus-gaap:InterestRateSwapMembermco:TwoThousandSeventeenSeniorNoteDueTwoThousandTwentyEightMember2024-03-310001059556us-gaap:FairValueHedgingMemberus-gaap:InterestRateSwapMembermco:TwoThousandSeventeenSeniorNoteDueTwoThousandTwentyEightMember2023-12-310001059556us-gaap:FairValueHedgingMemberus-gaap:InterestRateSwapMembermco:TwoThousandSeventeenSeniorNoteDueTwoThousandTwentyEightMember2024-01-012024-03-310001059556us-gaap:FairValueHedgingMemberus-gaap:InterestRateSwapMembermco:TwoThousandSeventeenSeniorNoteDueTwoThousandTwentyEightMember2023-01-012023-12-310001059556us-gaap:FairValueHedgingMembermco:TwoThousandAndTwentySeniorNoteDueTwoThousandAndTwentyFiveMemberus-gaap:InterestRateSwapMember2024-03-310001059556us-gaap:FairValueHedgingMembermco:TwoThousandAndTwentySeniorNoteDueTwoThousandAndTwentyFiveMemberus-gaap:InterestRateSwapMember2023-12-310001059556us-gaap:FairValueHedgingMembermco:TwoThousandAndTwentySeniorNoteDueTwoThousandAndTwentyFiveMemberus-gaap:InterestRateSwapMember2023-01-012023-12-310001059556us-gaap:FairValueHedgingMembermco:TwoThousandAndTwentySeniorNoteDueTwoThousandAndTwentyFiveMemberus-gaap:InterestRateSwapMember2024-01-012024-03-310001059556mco:TwoThousandAndFourteenSeniorNotesDueTwoThousandAndFortyFourMemberus-gaap:FairValueHedgingMemberus-gaap:InterestRateSwapMember2024-03-310001059556mco:TwoThousandAndFourteenSeniorNotesDueTwoThousandAndFortyFourMemberus-gaap:FairValueHedgingMemberus-gaap:InterestRateSwapMember2023-12-310001059556mco:TwoThousandAndFourteenSeniorNotesDueTwoThousandAndFortyFourMemberus-gaap:FairValueHedgingMemberus-gaap:InterestRateSwapMember2023-01-012023-12-310001059556mco:TwoThousandAndFourteenSeniorNotesDueTwoThousandAndFortyFourMemberus-gaap:FairValueHedgingMemberus-gaap:InterestRateSwapMember2024-01-012024-03-310001059556mco:TwoThousandAndEighteenSeniorNotesDueTwoThousandAndFortyEightMemberus-gaap:FairValueHedgingMemberus-gaap:InterestRateSwapMember2024-03-310001059556mco:TwoThousandAndEighteenSeniorNotesDueTwoThousandAndFortyEightMemberus-gaap:FairValueHedgingMemberus-gaap:InterestRateSwapMember2023-12-310001059556mco:TwoThousandAndEighteenSeniorNotesDueTwoThousandAndFortyEightMemberus-gaap:FairValueHedgingMemberus-gaap:InterestRateSwapMember2023-01-012023-12-310001059556mco:TwoThousandAndEighteenSeniorNotesDueTwoThousandAndFortyEightMemberus-gaap:FairValueHedgingMemberus-gaap:InterestRateSwapMember2024-01-012024-03-310001059556us-gaap:FairValueHedgingMembermco:TwoThousandAndEighteenSeniorNotesDueTwoThousandAndTwentyNineMemberus-gaap:InterestRateSwapMember2024-03-310001059556us-gaap:FairValueHedgingMembermco:TwoThousandAndEighteenSeniorNotesDueTwoThousandAndTwentyNineMemberus-gaap:InterestRateSwapMember2023-12-310001059556us-gaap:FairValueHedgingMembermco:TwoThousandAndEighteenSeniorNotesDueTwoThousandAndTwentyNineMemberus-gaap:InterestRateSwapMember2023-01-012023-12-310001059556us-gaap:FairValueHedgingMembermco:TwoThousandAndEighteenSeniorNotesDueTwoThousandAndTwentyNineMemberus-gaap:InterestRateSwapMember2024-01-012024-03-310001059556us-gaap:FairValueHedgingMemberus-gaap:InterestRateSwapMembermco:TwoThousandAndTwentyTwoSeniorNotesDueTwoThousandAndFiftyTwoMember2024-03-310001059556us-gaap:FairValueHedgingMemberus-gaap:InterestRateSwapMembermco:TwoThousandAndTwentyTwoSeniorNotesDueTwoThousandAndFiftyTwoMember2023-12-310001059556us-gaap:FairValueHedgingMemberus-gaap:InterestRateSwapMembermco:TwoThousandAndTwentyTwoSeniorNotesDueTwoThousandAndFiftyTwoMember2024-01-012024-03-310001059556us-gaap:FairValueHedgingMemberus-gaap:InterestRateSwapMembermco:TwoThousandAndTwentyTwoSeniorNotesDueTwoThousandAndFiftyTwoMember2023-01-012023-12-310001059556mco:TwoThousandAndTwentyTwoDueTwoThousandAndThirtyTwoMemberus-gaap:FairValueHedgingMemberus-gaap:InterestRateSwapMember2024-03-310001059556mco:TwoThousandAndTwentyTwoDueTwoThousandAndThirtyTwoMemberus-gaap:FairValueHedgingMemberus-gaap:InterestRateSwapMember2023-12-310001059556mco:TwoThousandAndTwentyTwoDueTwoThousandAndThirtyTwoMemberus-gaap:FairValueHedgingMemberus-gaap:InterestRateSwapMember2023-01-012023-12-310001059556mco:TwoThousandAndTwentyTwoDueTwoThousandAndThirtyTwoMemberus-gaap:FairValueHedgingMemberus-gaap:InterestRateSwapMember2024-01-012024-03-310001059556us-gaap:FairValueHedgingMemberus-gaap:InterestRateSwapMember2024-03-310001059556us-gaap:FairValueHedgingMemberus-gaap:InterestRateSwapMember2023-12-310001059556us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMembermco:FairValueHedgeNetInterestSettlementsAndAccrualsMember2024-01-012024-03-310001059556us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMembermco:FairValueHedgeNetInterestSettlementsAndAccrualsMember2023-01-012023-03-310001059556us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMemberus-gaap:InterestExpenseMember2024-01-012024-03-310001059556us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMemberus-gaap:InterestExpenseMember2023-01-012023-03-310001059556us-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMembermco:TwoThousandAndFifteenSeniorNotesDueTwoThousandAndTwentySevenMemberus-gaap:CurrencySwapMember2024-03-31iso4217:EUR0001059556mco:TwoThousandNineteenSeniorNoteDueTwoThousandThirtyMemberus-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CurrencySwapMember2024-03-310001059556us-gaap:NetInvestmentHedgingMembermco:CurrencyPaidMembermco:FixedPayWeightedAverageInterestRateMemberus-gaap:CurrencySwapMember2024-03-310001059556us-gaap:NetInvestmentHedgingMembermco:CurrencyReceivedMembermco:FixedReceivedWeightedAverageInterestRateMemberus-gaap:CurrencySwapMember2024-03-310001059556us-gaap:NetInvestmentHedgingMembermco:EuroShortTermRateMembermco:CurrencyPaidMemberus-gaap:CurrencySwapMember2024-03-310001059556us-gaap:NetInvestmentHedgingMembermco:EuroShortTermRateMembermco:CurrencyPaidMemberus-gaap:CurrencySwapMember2024-01-012024-03-310001059556us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:NetInvestmentHedgingMembermco:CurrencyReceivedMemberus-gaap:CurrencySwapMember2024-03-310001059556us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:NetInvestmentHedgingMembermco:CurrencyReceivedMemberus-gaap:CurrencySwapMember2024-01-012024-03-310001059556us-gaap:NetInvestmentHedgingMembermco:CurrencyPaidMemberus-gaap:CurrencySwapMember2024-03-310001059556us-gaap:NetInvestmentHedgingMembermco:CurrencyReceivedMemberus-gaap:CurrencySwapMember2024-03-310001059556us-gaap:NetInvestmentHedgingMembermco:CurrencyPaidMembermco:FixedPayWeightedAverageInterestRateMemberus-gaap:CurrencySwapMember2023-12-310001059556us-gaap:NetInvestmentHedgingMembermco:CurrencyReceivedMembermco:FixedReceivedWeightedAverageInterestRateMemberus-gaap:CurrencySwapMember2023-12-310001059556us-gaap:NetInvestmentHedgingMembermco:EuroShortTermRateMembermco:CurrencyPaidMemberus-gaap:CurrencySwapMember2023-12-310001059556us-gaap:NetInvestmentHedgingMembermco:EuroShortTermRateMembermco:CurrencyPaidMemberus-gaap:CurrencySwapMember2023-01-012023-12-310001059556us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:NetInvestmentHedgingMembermco:CurrencyReceivedMemberus-gaap:CurrencySwapMember2023-12-310001059556us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:NetInvestmentHedgingMembermco:CurrencyReceivedMemberus-gaap:CurrencySwapMember2023-01-012023-12-310001059556us-gaap:NetInvestmentHedgingMembermco:CurrencyPaidMemberus-gaap:CurrencySwapMember2023-12-310001059556us-gaap:NetInvestmentHedgingMembermco:CurrencyReceivedMemberus-gaap:CurrencySwapMember2023-12-310001059556mco:NetInvestmentHedgingSettlementYear2026Membermco:CurrencyPaidMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CurrencySwapMember2024-03-310001059556mco:NetInvestmentHedgingSettlementYear2026Memberus-gaap:DesignatedAsHedgingInstrumentMembermco:CurrencyReceivedMemberus-gaap:CurrencySwapMember2024-03-310001059556mco:CurrencyPaidMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CurrencySwapMembermco:NetInvestmentHedgingSettlementYear2027Member2024-03-310001059556us-gaap:DesignatedAsHedgingInstrumentMembermco:CurrencyReceivedMemberus-gaap:CurrencySwapMembermco:NetInvestmentHedgingSettlementYear2027Member2024-03-310001059556mco:NetInvestmentHedgingSettlementYear2028Membermco:CurrencyPaidMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CurrencySwapMember2024-03-310001059556mco:NetInvestmentHedgingSettlementYear2028Memberus-gaap:DesignatedAsHedgingInstrumentMembermco:CurrencyReceivedMemberus-gaap:CurrencySwapMember2024-03-310001059556mco:CurrencyPaidMemberus-gaap:DesignatedAsHedgingInstrumentMembermco:NetInvestmentHedgingSettlementYear2029Memberus-gaap:CurrencySwapMember2024-03-310001059556us-gaap:DesignatedAsHedgingInstrumentMembermco:CurrencyReceivedMembermco:NetInvestmentHedgingSettlementYear2029Memberus-gaap:CurrencySwapMember2024-03-310001059556mco:NetInvestmentHedgingSettlementYear2031Membermco:CurrencyPaidMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CurrencySwapMember2024-03-310001059556mco:NetInvestmentHedgingSettlementYear2031Memberus-gaap:DesignatedAsHedgingInstrumentMembermco:CurrencyReceivedMemberus-gaap:CurrencySwapMember2024-03-310001059556mco:CurrencyPaidMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CurrencySwapMembermco:NetInvestmentHedgingSettlementYear2032Member2024-03-310001059556us-gaap:DesignatedAsHedgingInstrumentMembermco:CurrencyReceivedMemberus-gaap:CurrencySwapMembermco:NetInvestmentHedgingSettlementYear2032Member2024-03-310001059556us-gaap:NetInvestmentHedgingMembermco:CurrencyPaidMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CurrencySwapMember2024-03-310001059556us-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMembermco:CurrencyReceivedMemberus-gaap:CurrencySwapMember2024-03-310001059556us-gaap:NetInvestmentHedgingMemberus-gaap:CurrencySwapMember2024-01-012024-03-310001059556us-gaap:NetInvestmentHedgingMemberus-gaap:CurrencySwapMember2023-01-012023-03-310001059556us-gaap:NetInvestmentHedgingMemberus-gaap:LongTermDebtMember2024-01-012024-03-310001059556us-gaap:NetInvestmentHedgingMemberus-gaap:LongTermDebtMember2023-01-012023-03-310001059556us-gaap:NetInvestmentHedgingMember2024-01-012024-03-310001059556us-gaap:NetInvestmentHedgingMember2023-01-012023-03-310001059556us-gaap:InterestRateContractMemberus-gaap:CashFlowHedgingMember2024-01-012024-03-310001059556us-gaap:InterestRateContractMemberus-gaap:CashFlowHedgingMember2023-01-012023-03-310001059556us-gaap:CashFlowHedgingMember2024-01-012024-03-310001059556us-gaap:CashFlowHedgingMember2023-01-012023-03-310001059556us-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CurrencySwapMember2024-03-310001059556us-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CurrencySwapMember2023-12-310001059556us-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForeignExchangeForwardMember2024-03-310001059556us-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForeignExchangeForwardMember2023-12-310001059556us-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:LongTermDebtMember2024-03-310001059556us-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:LongTermDebtMember2023-12-310001059556us-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-03-310001059556us-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-12-310001059556us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateContractMemberus-gaap:CashFlowHedgingMember2024-03-310001059556us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateContractMemberus-gaap:CashFlowHedgingMember2023-12-310001059556us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMemberus-gaap:CurrencySwapMember2024-03-310001059556us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMemberus-gaap:CurrencySwapMember2023-12-310001059556us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMember2024-03-310001059556us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMember2023-12-310001059556us-gaap:DesignatedAsHedgingInstrumentMember2024-03-310001059556us-gaap:DesignatedAsHedgingInstrumentMember2023-12-310001059556us-gaap:NondesignatedMembermco:ForeignCurrencyForwardContractsToSellUsDollarsForGbpMember2024-03-31iso4217:GBP0001059556us-gaap:NondesignatedMembermco:ForeignCurrencyForwardContractsToSellUsDollarsForGbpMember2023-12-310001059556mco:ForeignCurrencyForwardContractsToSellUsdForJapaneseYenMemberus-gaap:NondesignatedMember2024-03-31iso4217:JPY0001059556mco:ForeignCurrencyForwardContractsToSellUsdForJapaneseYenMemberus-gaap:NondesignatedMember2023-12-310001059556us-gaap:NondesignatedMembermco:ForeignCurrencyForwardContractsToSellUsDollarsForCanadianDollarsMember2024-03-31iso4217:CAD0001059556us-gaap:NondesignatedMembermco:ForeignCurrencyForwardContractsToSellUsDollarsForCanadianDollarsMember2023-12-310001059556us-gaap:NondesignatedMembermco:ForeignCurrencyForwardContractsToSellUSDollarsForSingaporeDollarsMember2024-03-31iso4217:SGD0001059556us-gaap:NondesignatedMembermco:ForeignCurrencyForwardContractsToSellUSDollarsForSingaporeDollarsMember2023-12-310001059556mco:ForeignCurrencyForwardContractsToSellUsDollarsForEurosMemberus-gaap:NondesignatedMember2024-03-310001059556mco:ForeignCurrencyForwardContractsToSellUsDollarsForEurosMemberus-gaap:NondesignatedMember2023-12-310001059556us-gaap:NondesignatedMembermco:ForeignCurrencyForwardContractsToSellUSDollarsForIndianRupeesMember2024-03-31iso4217:INR0001059556us-gaap:NondesignatedMembermco:ForeignCurrencyForwardContractsToSellUSDollarsForIndianRupeesMember2023-12-310001059556mco:ForeignCurrencyForwardContractsToSellAustralianDollarsForUSDollarsMemberus-gaap:NondesignatedMember2024-03-31iso4217:AUD0001059556mco:ForeignCurrencyForwardContractsToSellAustralianDollarsForUSDollarsMemberus-gaap:NondesignatedMember2023-12-310001059556mco:ForeignCurrencyForwardContractsToSellCanadianDollarsForUSDollarsMemberus-gaap:NondesignatedMember2024-03-310001059556mco:ForeignCurrencyForwardContractsToSellCanadianDollarsForUSDollarsMemberus-gaap:NondesignatedMember2023-12-310001059556us-gaap:NondesignatedMemberus-gaap:TotalReturnSwapMember2024-03-310001059556us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMember2024-01-012024-03-310001059556us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMember2023-01-012023-03-310001059556us-gaap:OperatingExpenseMemberus-gaap:NondesignatedMemberus-gaap:TotalReturnSwapMember2024-01-012024-03-310001059556us-gaap:OperatingExpenseMemberus-gaap:NondesignatedMemberus-gaap:TotalReturnSwapMember2023-01-012023-03-310001059556us-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:NondesignatedMemberus-gaap:TotalReturnSwapMember2024-01-012024-03-310001059556us-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:NondesignatedMemberus-gaap:TotalReturnSwapMember2023-01-012023-03-310001059556us-gaap:NetInvestmentHedgingMemberus-gaap:OtherNoncurrentAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CurrencySwapMember2024-03-310001059556us-gaap:NetInvestmentHedgingMemberus-gaap:OtherNoncurrentAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CurrencySwapMember2023-12-310001059556us-gaap:NondesignatedMemberus-gaap:OtherCurrentAssetsMemberus-gaap:ForeignExchangeForwardMember2024-03-310001059556us-gaap:NondesignatedMemberus-gaap:OtherCurrentAssetsMemberus-gaap:ForeignExchangeForwardMember2023-12-310001059556us-gaap:NetInvestmentHedgingMemberus-gaap:AccountsPayableAndAccruedLiabilitiesMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CurrencySwapMember2024-03-310001059556us-gaap:NetInvestmentHedgingMemberus-gaap:AccountsPayableAndAccruedLiabilitiesMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CurrencySwapMember2023-12-310001059556us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CurrencySwapMember2024-03-310001059556us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CurrencySwapMember2023-12-310001059556us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:FairValueHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMember2024-03-310001059556us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:FairValueHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMember2023-12-310001059556us-gaap:NetInvestmentHedgingMemberus-gaap:LongTermDebtMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-03-310001059556us-gaap:NetInvestmentHedgingMemberus-gaap:LongTermDebtMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-12-310001059556us-gaap:AccountsPayableAndAccruedLiabilitiesMemberus-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMember2024-03-310001059556us-gaap:AccountsPayableAndAccruedLiabilitiesMemberus-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMember2023-12-310001059556mco:MoodysAnalyticsMember2023-01-012023-12-310001059556mco:MoodysInvestorsServiceMember2023-01-012023-12-3100010595562023-01-012023-12-310001059556us-gaap:CustomerRelationshipsMember2024-03-310001059556us-gaap:CustomerRelationshipsMember2023-12-310001059556us-gaap:ComputerSoftwareIntangibleAssetMember2024-03-310001059556us-gaap:ComputerSoftwareIntangibleAssetMember2023-12-310001059556us-gaap:DatabasesMember2024-03-310001059556us-gaap:DatabasesMember2023-12-310001059556us-gaap:TradeNamesMember2024-03-310001059556us-gaap:TradeNamesMember2023-12-310001059556us-gaap:OtherIntangibleAssetsMember2024-03-310001059556us-gaap:OtherIntangibleAssetsMember2023-12-310001059556mco:EstimatedAnnualSavingsMembersrt:MinimumMembermco:A20222023GeolocationRestructuringProgramMember2024-01-012024-03-310001059556mco:EstimatedAnnualSavingsMembersrt:MaximumMembermco:A20222023GeolocationRestructuringProgramMember2024-01-012024-03-310001059556srt:MinimumMembersrt:ScenarioForecastMembermco:A20222023GeolocationRestructuringProgramMember2022-10-012024-12-310001059556srt:MaximumMembersrt:ScenarioForecastMembermco:A20222023GeolocationRestructuringProgramMember2022-10-012024-12-310001059556us-gaap:EmployeeSeveranceMembermco:A20222023GeolocationRestructuringProgramMember2024-01-012024-03-310001059556us-gaap:EmployeeSeveranceMembermco:A20222023GeolocationRestructuringProgramMember2023-01-012023-03-310001059556us-gaap:EmployeeSeveranceMembermco:A20222023GeolocationRestructuringProgramMember2024-03-310001059556us-gaap:RealEstateMembermco:A20222023GeolocationRestructuringProgramMember2024-01-012024-03-310001059556us-gaap:RealEstateMembermco:A20222023GeolocationRestructuringProgramMember2023-01-012023-03-310001059556us-gaap:RealEstateMembermco:A20222023GeolocationRestructuringProgramMember2024-03-310001059556us-gaap:OtherRestructuringMembermco:A20222023GeolocationRestructuringProgramMember2024-01-012024-03-310001059556us-gaap:OtherRestructuringMembermco:A20222023GeolocationRestructuringProgramMember2023-01-012023-03-310001059556us-gaap:OtherRestructuringMembermco:A20222023GeolocationRestructuringProgramMember2024-03-310001059556mco:A20222023GeolocationRestructuringProgramMember2024-01-012024-03-310001059556mco:A20222023GeolocationRestructuringProgramMember2023-01-012023-03-310001059556mco:A20222023GeolocationRestructuringProgramMember2024-03-310001059556us-gaap:DerivativeMember2024-03-310001059556us-gaap:DerivativeMemberus-gaap:FairValueInputsLevel1Member2024-03-310001059556us-gaap:DerivativeMemberus-gaap:FairValueInputsLevel2Member2024-03-310001059556mco:MutualFundsAndMoneyMarketFundsMember2024-03-310001059556mco:MutualFundsAndMoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2024-03-310001059556us-gaap:FairValueInputsLevel2Membermco:MutualFundsAndMoneyMarketFundsMember2024-03-310001059556us-gaap:FairValueInputsLevel1Member2024-03-310001059556us-gaap:FairValueInputsLevel2Member2024-03-310001059556us-gaap:DerivativeMember2023-12-310001059556us-gaap:DerivativeMemberus-gaap:FairValueInputsLevel1Member2023-12-310001059556us-gaap:DerivativeMemberus-gaap:FairValueInputsLevel2Member2023-12-310001059556mco:MutualFundsAndMoneyMarketFundsMember2023-12-310001059556mco:MutualFundsAndMoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2023-12-310001059556us-gaap:FairValueInputsLevel2Membermco:MutualFundsAndMoneyMarketFundsMember2023-12-310001059556us-gaap:FairValueInputsLevel1Member2023-12-310001059556us-gaap:FairValueInputsLevel2Member2023-12-310001059556us-gaap:DebtMember2024-03-310001059556us-gaap:DebtMember2023-12-310001059556us-gaap:SwapMember2024-03-310001059556us-gaap:SwapMember2023-12-310001059556us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-12-310001059556us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-12-310001059556us-gaap:AccumulatedTranslationAdjustmentMember2023-12-310001059556mco:AccumulatedNetInvestmentHedgesGainLossAttributabletoParentMember2023-12-310001059556us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-12-310001059556us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-12-310001059556us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310001059556mco:AccumulatedNetInvestmentHedgesGainLossAttributabletoParentMember2022-12-310001059556us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-01-012024-03-310001059556us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-01-012024-03-310001059556us-gaap:AccumulatedTranslationAdjustmentMember2024-01-012024-03-310001059556mco:AccumulatedNetInvestmentHedgesGainLossAttributabletoParentMember2024-01-012024-03-310001059556us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-01-012023-03-310001059556us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-01-012023-03-310001059556us-gaap:AccumulatedTranslationAdjustmentMember2023-01-012023-03-310001059556mco:AccumulatedNetInvestmentHedgesGainLossAttributabletoParentMember2023-01-012023-03-310001059556us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-03-310001059556us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-03-310001059556us-gaap:AccumulatedTranslationAdjustmentMember2024-03-310001059556mco:AccumulatedNetInvestmentHedgesGainLossAttributabletoParentMember2024-03-310001059556us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-03-310001059556us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-03-310001059556us-gaap:AccumulatedTranslationAdjustmentMember2023-03-310001059556mco:AccumulatedNetInvestmentHedgesGainLossAttributabletoParentMember2023-03-310001059556mco:TwoThousandFourteenSeniorNotesThirtyYearMember2024-03-310001059556mco:TwoThousandAndFifteenSeniorNotesDueTwoThousandAndTwentySevenMember2024-03-310001059556mco:TwoThousandSeventeenSeniorNoteDueTwoThousandTwentyEightMember2024-03-310001059556mco:TwoThousandEighteenSeniorNoteDueTwoThousandTwentyNineMember2024-03-310001059556mco:TwoThousandEighteenSeniorNoteDueTwoThousandFourtyEightMember2024-03-310001059556mco:A950SeniorNotesDueTwoThousandAndThirtyMember2024-03-310001059556mco:TwoThousandAndTwentySeniorNoteDueTwoThousandAndTwentyFiveMember2024-03-310001059556mco:TwoThousandAndTwentySeniorNoteDueTwoThousandAndFiftyMember2024-03-310001059556mco:TwoThousandAndTwentySeniorNoteDueTwoThousandAndSixtyMember2024-03-310001059556mco:TwoThousandAndTwentyOneSeniorNoteDueTwoThousandAndThirtyOneMember2024-03-310001059556mco:TwoThousandAndTwentyOneSeniorNoteDueTwoThousandAndFortyOneMember2024-03-310001059556mco:TwoThousandAndTwentyOneSeniorNoteDueTwoThousandAndSixtyOneMember2024-03-310001059556mco:TwoThousandAndTwentyTwoSeniorNoteDueTwoThousandAndFiftyTwoMember2024-03-310001059556mco:TwoThousandAndTwentyTwoSeniorNoteDueTwoThousandAndThirtyTwoMember2024-03-310001059556mco:TwoThousandFourteenSeniorNotesThirtyYearMember2023-12-310001059556mco:TwoThousandAndFifteenSeniorNotesDueTwoThousandAndTwentySevenMember2023-12-310001059556mco:TwoThousandSeventeenSeniorNoteDueTwoThousandTwentyEightMember2023-12-310001059556mco:TwoThousandEighteenSeniorNoteDueTwoThousandTwentyNineMember2023-12-310001059556mco:TwoThousandEighteenSeniorNoteDueTwoThousandFourtyEightMember2023-12-310001059556mco:A950SeniorNotesDueTwoThousandAndThirtyMember2023-12-310001059556mco:TwoThousandAndTwentySeniorNoteDueTwoThousandAndTwentyFiveMember2023-12-310001059556mco:TwoThousandAndTwentySeniorNoteDueTwoThousandAndFiftyMember2023-12-310001059556mco:TwoThousandAndTwentySeniorNoteDueTwoThousandAndSixtyMember2023-12-310001059556mco:TwoThousandAndTwentyOneSeniorNoteDueTwoThousandAndThirtyOneMember2023-12-310001059556mco:TwoThousandAndTwentyOneSeniorNoteDueTwoThousandAndFortyOneMember2023-12-310001059556mco:TwoThousandAndTwentyOneSeniorNoteDueTwoThousandAndSixtyOneMember2023-12-310001059556mco:TwoThousandAndTwentyTwoSeniorNoteDueTwoThousandAndFiftyTwoMember2023-12-310001059556mco:TwoThousandAndTwentyTwoSeniorNoteDueTwoThousandAndThirtyTwoMember2023-12-310001059556srt:MinimumMember2024-03-310001059556srt:MaximumMember2024-03-310001059556us-gaap:IntersegmentEliminationMember2024-01-012024-03-310001059556us-gaap:IntersegmentEliminationMember2023-01-012023-03-310001059556mco:A20222023GeolocationRestructuringProgramMembermco:MoodysAnalyticsMember2024-03-310001059556mco:A20222023GeolocationRestructuringProgramMembermco:MoodysInvestorsServiceMember2024-03-310001059556mco:A20222023GeolocationRestructuringProgramMember2024-03-310001059556us-gaap:EMEAMember2024-01-012024-03-310001059556us-gaap:EMEAMember2023-01-012023-03-310001059556srt:AsiaPacificMember2024-01-012024-03-310001059556srt:AsiaPacificMember2023-01-012023-03-310001059556srt:AmericasMember2024-01-012024-03-310001059556srt:AmericasMember2023-01-012023-03-310001059556us-gaap:SubsequentEventMember2024-04-262024-04-260001059556us-gaap:SubsequentEventMember2024-04-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Mark one) | | | | | |

| ☑ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2024

Or | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-14037

____________________

Moody’s Corporation

(Exact name of registrant as specified in its charter) | | | | | | | | | | | |

Delaware | | 13-3998945 |

| (State of Incorporation) | | (I.R.S. Employer Identification No.) |

7 World Trade Center at 250 Greenwich Street, New York, New York 10007

(Address of Principal Executive Offices)

(Zip Code)

Registrant’s telephone number, including area code:

(212) 553-0300

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | MCO | | New York Stock Exchange |

| 1.75% Senior Notes Due 2027 | | MCO 27 | | New York Stock Exchange |

| 0.950% Senior Notes Due 2030 | | MCO 30 | | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one): | | | | | | | | | | | | | | |

| Large Accelerated Filer | ☑ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

Emerging growth company | ☐ | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date:

| | |

| Shares Outstanding at March 31, 2024 |

| 182.6 million |

| | | | | | | | |

| MOODY’S CORPORATION

INDEX TO FORM 10-Q | |

| Page(s) |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

|

| | |

| | |

| | |

| | |

| | |

| | |

| |

GLOSSARY OF TERMS AND ABBREVIATIONS

The following terms, abbreviations and acronyms are used to identify frequently used terms in this report: | | | | | |

TERM | DEFINITION |

| |

| |

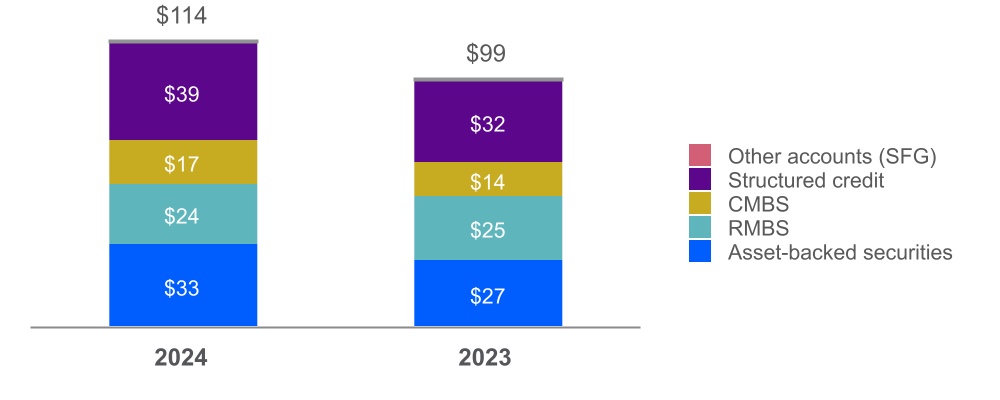

ABS | Asset backed securities; a component of SFG |

Acquisition-Related Intangible Amortization Expense | Amortization of definite-lived intangible assets acquired by the Company from all business combination transactions |

| |

Adjusted Diluted EPS | Diluted EPS excluding the impact of certain items as detailed in the section entitled “Non-GAAP Financial Measures” |

Adjusted Net Income | Net Income excluding the impact of certain items as detailed in the section entitled “Non-GAAP Financial Measures” |

Adjusted Operating Income | Operating income excluding the impact of certain items as detailed in the section entitled “Non-GAAP Financial Measures” |

Adjusted Operating Margin | Adjusted Operating Income divided by revenue |

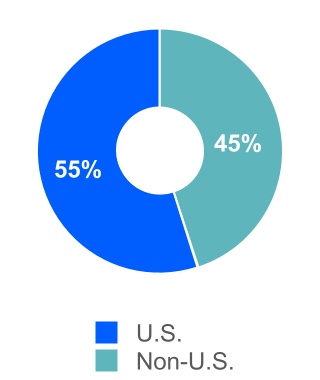

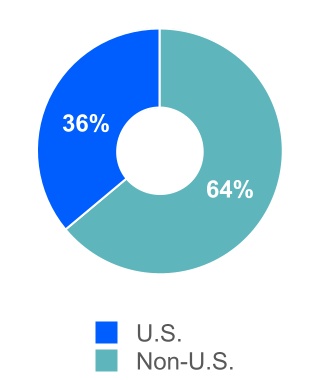

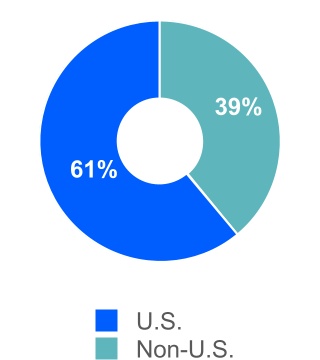

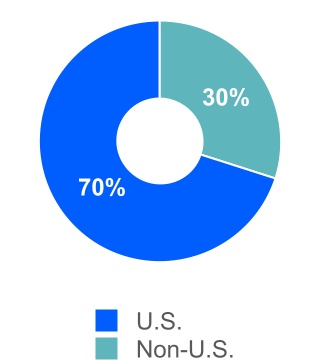

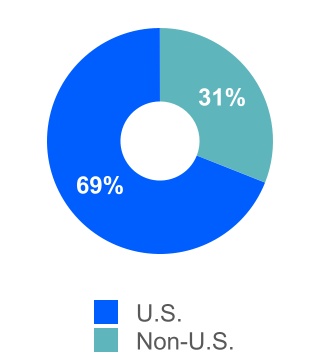

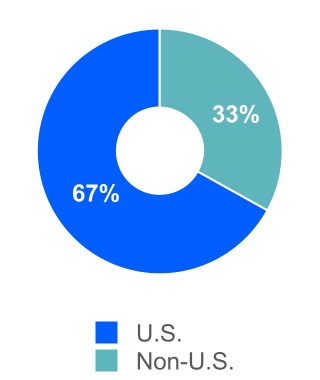

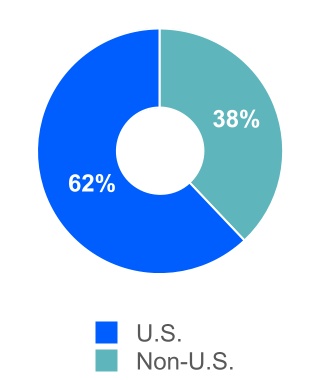

Americas | Represents countries within North and South America, excluding the U.S. |

| |

| |

ARR | Annualized Recurring Revenue; a supplemental performance metric to provide additional insight on the estimated value of MA's recurring revenue contracts at a given point in time, excluding the impact of FX and contracts related to acquisitions |

ASC | The FASB Accounting Standards Codification; the sole source of authoritative GAAP as of July 1, 2009 except for rules and interpretive releases of the SEC, which are also sources of authoritative GAAP for SEC registrants |

Asia-Pacific | Represents Australia and countries in Asia including but not limited to: China, India, Indonesia, Japan, Republic of South Korea, Malaysia, Singapore, Sri Lanka and Thailand |

ASU | The FASB Accounting Standards Update to the ASC. Provides background information for accounting guidance and the bases for conclusions on the changes in the ASC. ASUs are not considered authoritative until codified into the ASC |

AUD | Australian dollar |

| BitSight | A provider that helps global market participants understand cyber risk through ratings, analytics, and performance management tools |

Board | The board of directors of the Company |

BPS | Basis points |

| |

| |

| |

CAD | Canadian dollar |

| CCXI | China Cheng Xin International Credit Rating Co. Ltd.; China’s first and largest domestic credit rating agency approved by the People’s Bank of China; currently Moody’s owns 30% of CCXI |

| CDP | Carbon Disclosure Project; an international nonprofit organization that helps companies, cities, states and regions manage their environmental impact through a global disclosure system |

CFG | Corporate finance group; an LOB of MIS |

| |

CMBS | Commercial mortgage-backed securities; an asset class within SFG |

| COLI | Corporate-Owned Life Insurance |

| |

Common Stock | The Company’s common stock |

Company | Moody’s Corporation and its subsidiaries; MCO; Moody’s |

CODM | Chief Operating Decision Maker |

| |

| |

| COVID-19 | An outbreak of a novel strain of coronavirus resulting in an international public health crisis and a global pandemic |

CP | Commercial Paper |

CP Program | A program entered into on August 3, 2016 allowing the Company to privately place CP up to a maximum of $1 billion for which the maturity may not exceed 397 days from the date of issue, and which is backstopped by the 2021 Facility |

| |

| |

CRAs | Credit rating agencies |

| |

CreditView | A product offering from MA that incorporates credit ratings, research and data from MIS plus research, data and content from MA |

| Data and Information (D&I) | LOB within MA which provides vast data sets on companies and securities via data feeds and data applications products |

| |

| | | | | |

TERM | DEFINITION |

| Decision Solutions (DS) | LOB within MA that provides SaaS solutions supporting banking, insurance, and KYC workflows. This LOB utilizes components from the Data & Information and Research & Insights LOBs to provide risk assessment solutions |

| |

EMEA | Represents countries within Europe, the Middle East and Africa |

EPS | Earnings per share |

| |

ESG | Environmental, Social and Governance |

| |

| |

| ESTR | Euro Short-Term Rate |

ETR | Effective tax rate |

EU | European Union |

EUR | euros |

| |

Excess Tax Benefits | The difference between the tax benefit realized at exercise of an option or delivery of a restricted share and the tax benefit recorded at the time the option or restricted share is expensed under GAAP |

Exchange Act | The Securities Exchange Act of 1934, as amended |

External Revenue | Revenue excluding any intersegment amounts |

FASB | Financial Accounting Standards Board |

FIG | Financial institutions group; an LOB of MIS |

| |

Free Cash Flow | Net cash provided by operating activities less cash paid for capital additions |

| |

FX | Foreign exchange |

GAAP | U.S. Generally Accepted Accounting Principles |

GBP | British pounds |

| |

| GDP | Gross domestic product |

GLoBE | Global Anti-Base Erosion, also known as "Pillar Two"; tax model issued by the OECD in 2023 |

| |

ICRA | ICRA Limited; a provider of credit ratings and research in India |

| |

| INR | Indian rupee |

| |

| |

| |

| |

| |

| |

| |

JPY | Japanese yen |

| KYC | Know-your-customer |

| |

LOB | Line of business |

MA | Moody’s Analytics - a reportable segment of MCO; a global provider of: i) data and information; ii) research and insights; and iii) decision solutions, which help companies make better and faster decisions. MA leverages its industry expertise across multiple risks such as credit, market, financial crime, supply chain, catastrophe and climate to deliver integrated risk assessment solutions that enable business leaders to identify, measure and manage the implications of interrelated risks and opportunities |

| |

MAKS | Moody’s Analytics Knowledge Services; formerly known as Copal Amba; provided offshore research and analytic services to the global financial and corporate sectors; business was divested in the fourth quarter of 2019 and was formerly a reporting unit within the MA reportable segment |

| |

MCO | Moody’s Corporation and its subsidiaries; the Company; Moody’s |

MD&A | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

M&A | Mergers and acquisitions |

MIS | Moody’s Investors Service - a reportable segment of MCO; MIS publishes credit ratings and provides assessment services on a wide range of debt obligations, programs and facilities, and the entities that issue such obligations in markets worldwide, including various corporate, financial institution and governmental obligations, and structured finance securities; consists of five LOBs - SFG; CFG; FIG; PPIF; and MIS Other |

MIS Other | Consists of financial instruments pricing services in the Asia-Pacific region, ICRA non-ratings revenue, and revenue from professional services. These businesses are components of MIS; MIS Other is an LOB of MIS |

Moody’s | Moody’s Corporation and its subsidiaries; MCO; the Company |

| MSS | Moody's Shared Services; primarily consists of information technology and support staff such as finance, human resources and legal that support both MA and MIS |

| |

| |

| | | | | |

TERM | DEFINITION |

Net Income | Net income attributable to Moody’s Corporation, which excludes net income from consolidated noncontrolling interests belonging to the minority interest holder |

| |

| |

NM | Percentage change is not meaningful |

Non-GAAP | A financial measure not in accordance with GAAP; these measures, when read in conjunction with the Company’s reported results, can provide useful supplemental information for investors analyzing period-to-period comparisons of the Company’s performance, facilitate comparisons to competitors’ operating results and to provide greater transparency to investors of supplemental information used by management in its financial and operational decision making |

NRSRO | Nationally Recognized Statistical Rating Organization, which is a credit rating agency registered with the SEC |

| |

| |

| |

OECD | Organization for Economic Co-operation and Development; an international organization that promotes policies that improve economic and social well-being around the world |

Operating segment | Term defined in the ASC relating to segment reporting; the ASC defines an operating segment as a component of a business entity that has each of the three following characteristics: i) the component engages in business activities from which it may recognize revenue and incur expenses; ii) the operating results of the component are regularly reviewed by the entity’s CODM; and iii) discrete financial information about the component is available |

| |

| |

Pillar Two | Tax model issued by the OECD in 2023; also referred to as the "Global Anti-Base Erosion" or "GLoBE" rules |

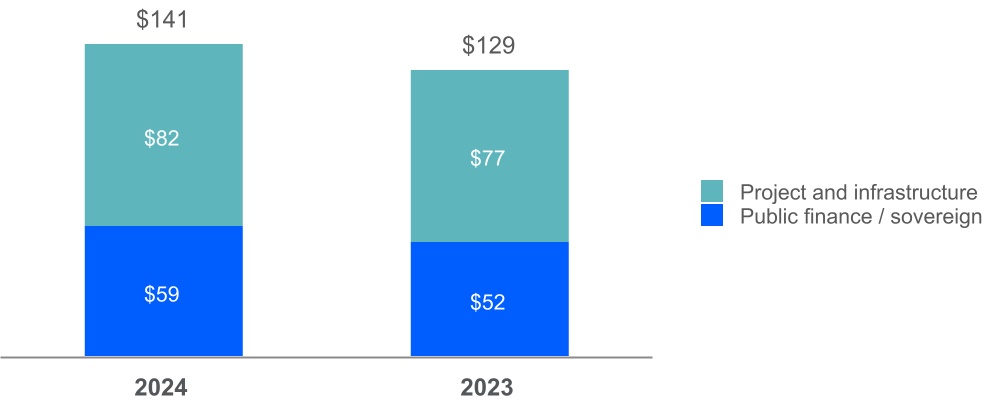

PPIF | Public, project and infrastructure finance; an LOB of MIS |

| |

| |

| |

| |

| |

| |

| |

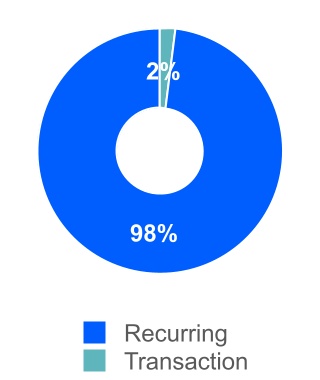

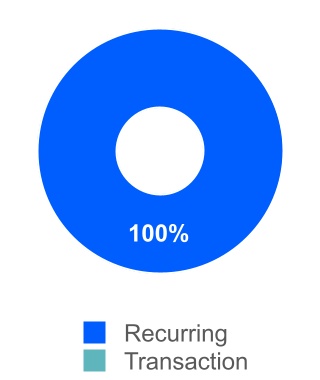

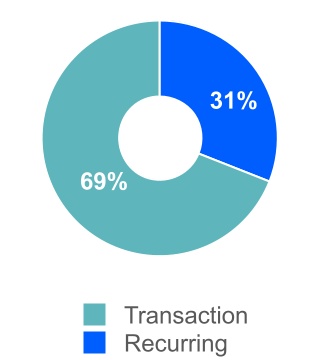

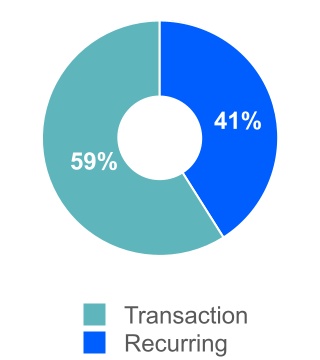

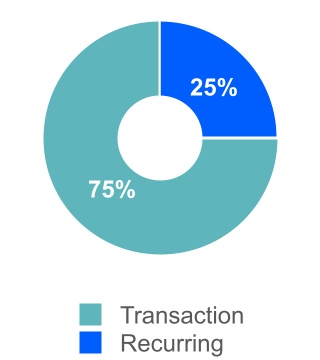

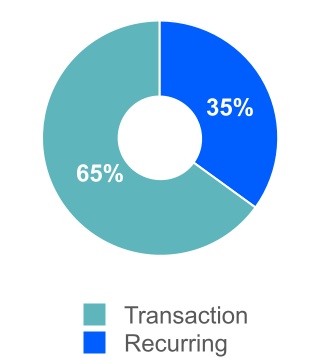

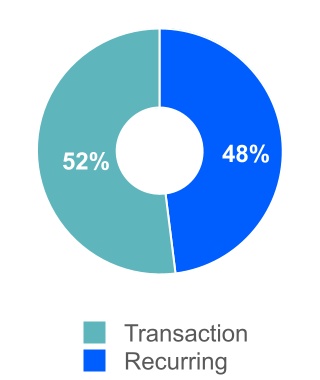

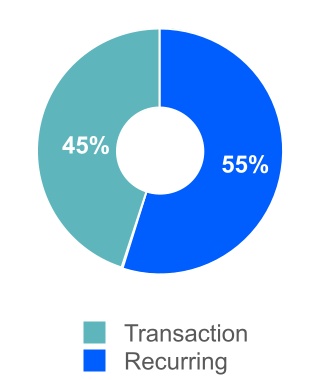

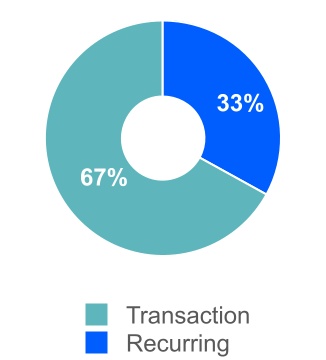

Recurring Revenue | For MA, represents subscription-based revenue and software maintenance revenue. For MIS, represents recurring monitoring fees of a rated debt obligation and/or entities that issue such obligations, as well as revenue from programs such as commercial paper, medium-term notes and shelf registrations. For MIS Other, represents subscription-based revenue |

| |

| |

| |

| |

Reporting unit | The level at which Moody’s evaluates its goodwill for impairment under GAAP; defined as an operating segment or one level below an operating segment |

| Research and Insights (R&I) | LOB within MA that provides models, scores, expert insights and commentary. This LOB includes credit research; credit models and analytics; economics data and models; and structured finance solutions |

| |

| |

RMBS | Residential mortgage-backed securities; an asset class within SFG |

| |

| RMS | Risk Management Solutions, Inc., a global provider of climate and natural disaster risk modeling and analytics; acquired by the Company in September 2021 |

| SaaS | Software-as-a-Service |

| |

| |

SEC | U.S. Securities and Exchange Commission |

| |

SFG | Structured finance group; an LOB of MIS |

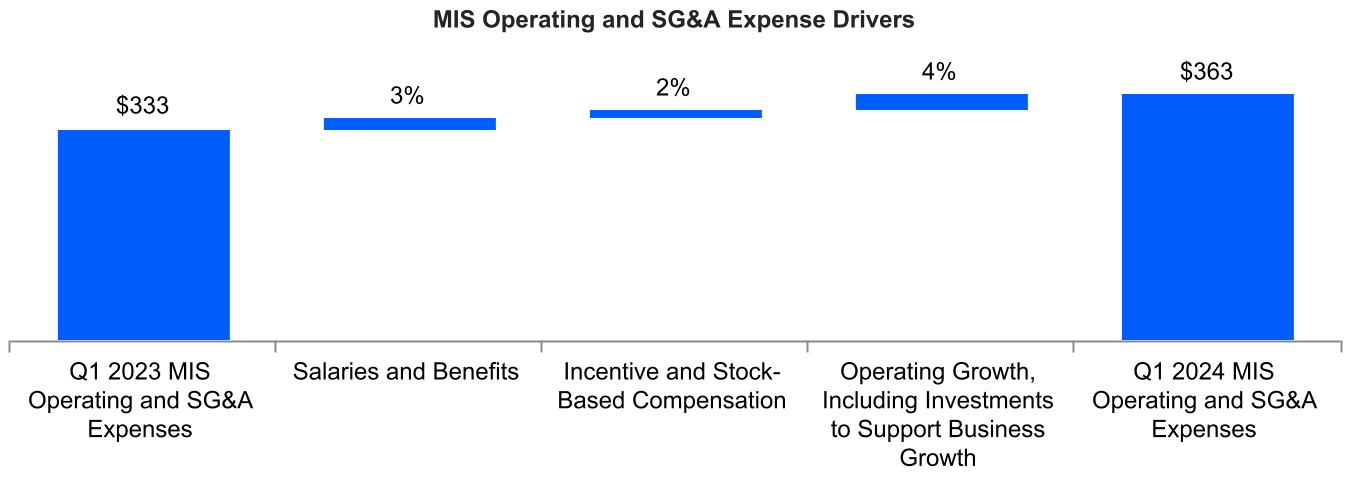

SG&A | Selling, general and administrative expenses |

SGD | Singapore dollar |

| SOFR | Secured Overnight Financing Rate |

Tax Act | The “Tax Cuts and Jobs Act” enacted into U.S. law on December 22, 2017 which significantly amends the tax code in the U.S. |

| |

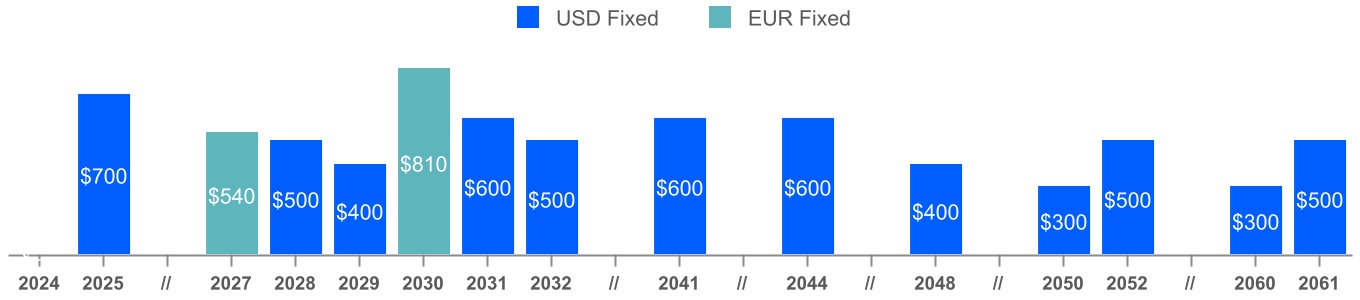

Total Debt | All indebtedness of the Company as reflected on the consolidated balance sheets |

Transaction Revenue | For MA, represents perpetual software license fees and revenue from software implementation services, risk management advisory projects, and training and certification services. For MIS (excluding MIS Other), represents the initial rating of a new debt issuance as well as other one-time fees. For MIS Other, represents revenue from professional services. |

U.K. | United Kingdom |

U.S. | United States |

USD | U.S. dollar |

UTPs | Uncertain tax positions |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| 2022 - 2023 Geolocation Restructuring Program | Restructuring program approved by the chief executive officer of Moody’s on June 30, 2022 relating to the Company's post-COVID-19 geolocation strategy |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

MOODY’S CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

(Amounts in millions, except per share data)

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2024 | | 2023 | | | | |

| Revenue | $ | 1,786 | | | $ | 1,470 | | | | | |

| Expenses | | | | | | | |

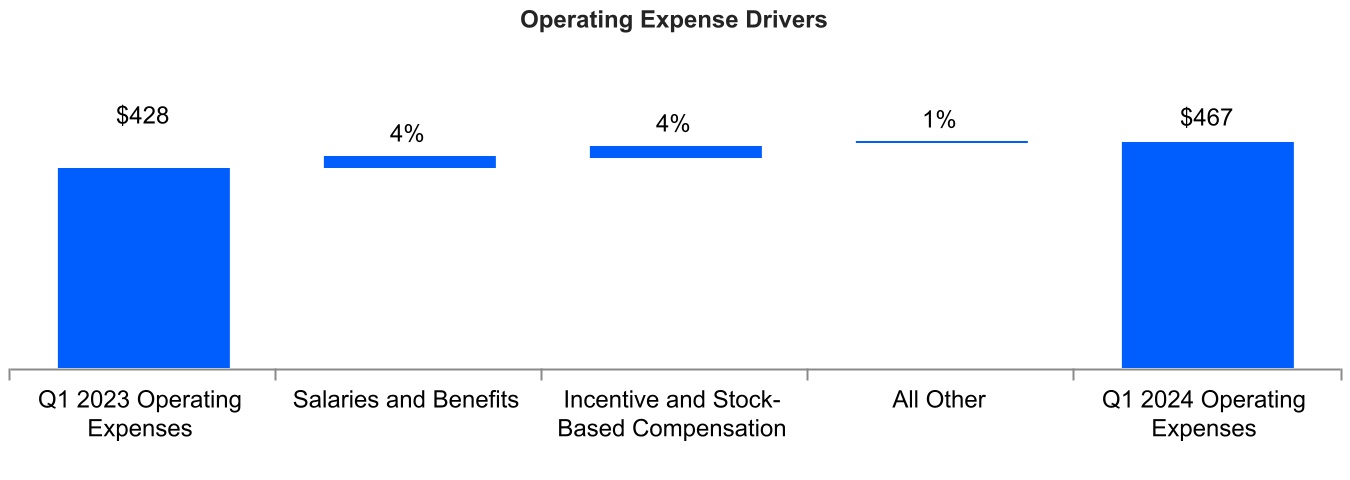

| Operating | 467 | | | 428 | | | | | |

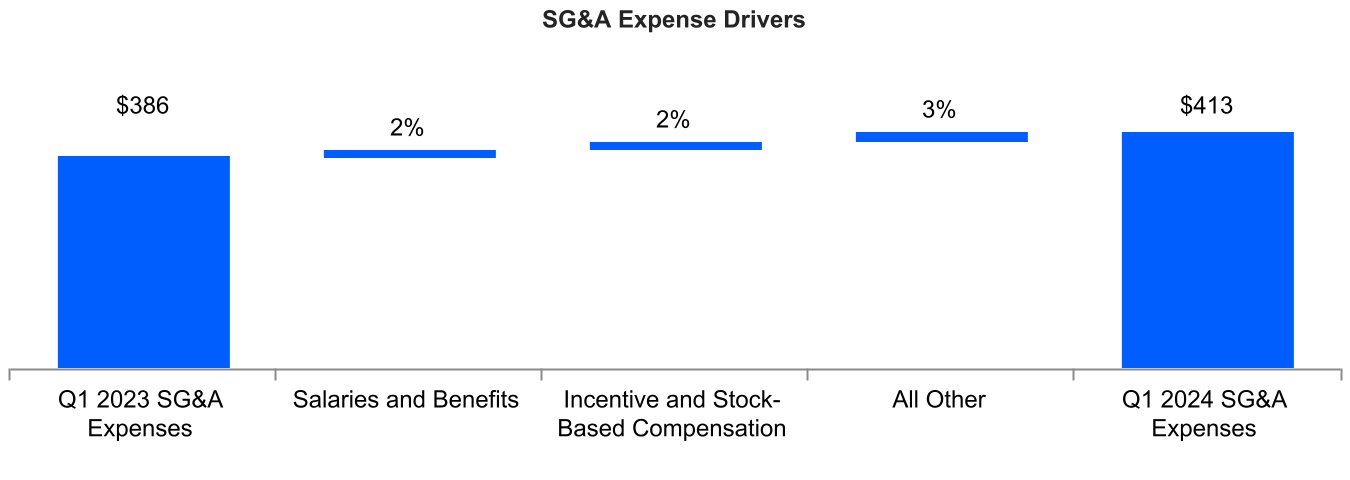

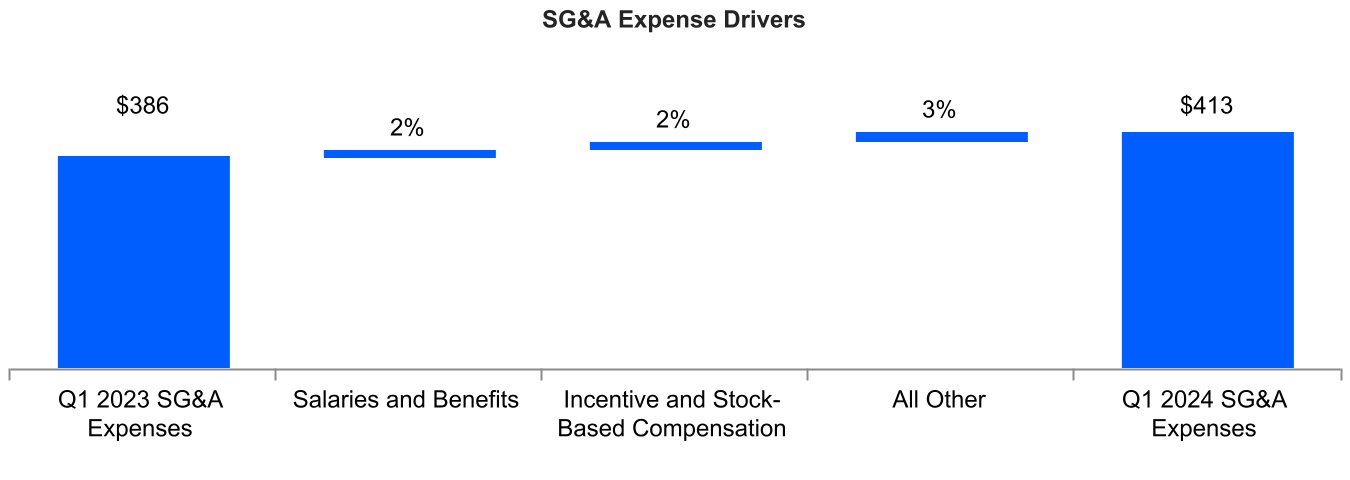

| Selling, general, and administrative | 413 | | | 386 | | | | | |

| Depreciation and amortization | 100 | | | 88 | | | | | |

| Restructuring | 5 | | | 14 | | | | | |

| | | | | | | |

| | | | | | | |

| Total expenses | 985 | | | 916 | | | | | |

| Operating income | 801 | | | 554 | | | | | |

| Non-operating (expense) income, net | | | | | | | |

| Interest expense, net | (62) | | | (48) | | | | | |

| Other non-operating income, net | 13 | | | — | | | | | |

| Total non-operating (expense) income, net | (49) | | | (48) | | | | | |

| Income before provision for income taxes | 752 | | | 506 | | | | | |

| Provision for income taxes | 175 | | | 5 | | | | | |

| | | | | | | |

| | | | | | | |

| Net income attributable to Moody's | $ | 577 | | | $ | 501 | | | | | |

| Earnings per share attributable to Moody's common shareholders | | | | | | | |

| Basic | $ | 3.16 | | | $ | 2.73 | | | | | |

| Diluted | $ | 3.15 | | | $ | 2.72 | | | | | |

| Weighted average number of shares outstanding | | | | | | | |

| Basic | 182.6 | | | 183.3 | | | | | |

| Diluted | 183.4 | | | 184.1 | | | | | |

The accompanying notes are an integral part of the consolidated financial statements.

MOODY’S CORPORATION

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (UNAUDITED)

(Amounts in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

March 31, 2024 | | Three Months Ended

March 31, 2023 |

| |

| Pre-tax

amounts | | Tax

amounts | | After-tax

amounts | | Pre-tax

amounts | | Tax

amounts | | After-tax

amounts |

| Net Income | | | | | $ | 577 | | | | | | | $ | 501 | |

| Other Comprehensive Income (Loss): | | | | | | | | | | | |

| Foreign Currency Adjustments: | | | | | | | | | | | |

| Foreign currency translation adjustments, net | $ | (115) | | | $ | — | | | (115) | | | $ | 109 | | | $ | (2) | | | 107 | |

| | | | | | | | | | | |

Net gains (losses) on net investment hedges | 101 | | | (27) | | | 74 | | | (76) | | | 19 | | | (57) | |

| | | | | | | | | | | |

| Cash Flow Hedges: | | | | | | | | | | | |

| | | | | | | | | | | |

| Reclassification of losses included in net income | 1 | | | — | | | 1 | | | 1 | | | — | | | 1 | |

| Pension and Other Retirement Benefits: | | | | | | | | | | | |

| | | | | | | | | | | |

Net actuarial losses | (1) | | | — | | | (1) | | | — | | | — | | | — | |

Total other comprehensive (loss) income | $ | (14) | | | $ | (27) | | | $ | (41) | | | $ | 34 | | | $ | 17 | | | $ | 51 | |

| Comprehensive income | | | | | 536 | | | | | | | 552 | |

| Less: comprehensive loss attributable to noncontrolling interests | | | | | — | | | | | | | (3) | |

| Comprehensive Income Attributable to Moody's | | | | | $ | 536 | | | | | | | $ | 555 | |

The accompanying notes are an integral part of the consolidated financial statements.

MOODY’S CORPORATION

CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(Amounts in millions, except share and per share data) | | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 2,476 | | | $ | 2,130 | |

| Short-term investments | 58 | | | 63 | |

Accounts receivable, net of allowance for credit losses of $35 in 2024 and $35 in 2023 | 1,835 | | | 1,659 | |

| Other current assets | 437 | | | 489 | |

| | | |

| Total current assets | 4,806 | | | 4,341 | |

Property and equipment, net of accumulated depreciation of $1,320 in 2024 and $1,272 in 2023 | 613 | | | 603 | |

| Operating lease right-of-use assets | 260 | | | 277 | |

| Goodwill | 5,909 | | | 5,956 | |

| Intangible assets, net | 1,983 | | | 2,049 | |

| Deferred tax assets, net | 270 | | | 258 | |

| Other assets | 1,170 | | | 1,138 | |

| Total assets | $ | 15,011 | | | $ | 14,622 | |

| LIABILITIES AND SHAREHOLDERS' EQUITY |

| Current liabilities: | | | |

| Accounts payable and accrued liabilities | $ | 976 | | | $ | 1,076 | |

| Current portion of operating lease liabilities | 109 | | | 108 | |

| | | |

| Current portion of long-term debt | 685 | | | — | |

| Deferred revenue | 1,612 | | | 1,316 | |

| | | |

| Total current liabilities | 3,382 | | | 2,500 | |

| Non-current portion of deferred revenue | 61 | | | 65 | |

| Long-term debt | 6,259 | | | 7,001 | |

| Deferred tax liabilities, net | 458 | | | 402 | |

| Uncertain tax positions | 201 | | | 196 | |

| Operating lease liabilities | 280 | | | 306 | |

| Other liabilities | 635 | | | 676 | |

| Total liabilities | 11,276 | | | 11,146 | |

Contingencies (Note 15) | | | |

| Shareholders' equity: | | | |

Preferred stock, par value $0.01 per share; 10,000,000 shares authorized; no shares issued and outstanding | — | | | — | |

Series common stock, par value $0.01 per share; 10,000,000 shares authorized; no shares issued and outstanding | — | | | — | |

Common stock, par value $0.01 per share; 1,000,000,000 shares authorized; 342,902,272 shares issued at March 31, 2024 and December 31, 2023, respectively | 3 | | | 3 | |

| Capital surplus | 1,252 | | | 1,228 | |

| Retained earnings | 15,081 | | | 14,659 | |

Treasury stock, at cost; 160,292,910 and 160,430,754 shares of common stock at March 31, 2024 and December 31, 2023, respectively | (12,153) | | | (12,005) | |

| Accumulated other comprehensive loss | (608) | | | (567) | |

| Total Moody's shareholders' equity | 3,575 | | | 3,318 | |

| Noncontrolling interests | 160 | | | 158 | |

| Total shareholders' equity | 3,735 | | | 3,476 | |

| Total liabilities, noncontrolling interests, and shareholders' equity | $ | 15,011 | | | $ | 14,622 | |

The accompanying notes are an integral part of the consolidated financial statements.

MOODY’S CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

(Amounts in millions) | | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| Cash flows from operating activities | |