0001059556Q1false--12-312021us-gaap:AccountingStandardsUpdate201613Member412.51000010595562021-01-012021-03-310001059556us-gaap:CommonStockMember2021-01-012021-03-310001059556mco:TwoThousandAndFifteenSeniorNotesDueTwoThousandAndTwentySevenMember2021-01-012021-03-310001059556mco:A950SeniorNotesDueTwoThousandAndThirtyMember2021-01-012021-03-31xbrli:shares00010595562021-03-31iso4217:USD00010595562020-01-012020-03-31iso4217:USDxbrli:shares00010595562020-12-310001059556mco:SeriesCommonStockMember2020-12-310001059556mco:SeriesCommonStockMember2021-03-3100010595562019-12-3100010595562020-03-310001059556us-gaap:CommonStockMember2019-12-310001059556us-gaap:AdditionalPaidInCapitalMember2019-12-310001059556us-gaap:RetainedEarningsMember2019-12-310001059556us-gaap:TreasuryStockMember2019-12-310001059556us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001059556us-gaap:ParentMember2019-12-310001059556us-gaap:NoncontrollingInterestMember2019-12-310001059556us-gaap:RetainedEarningsMember2020-01-012020-03-310001059556us-gaap:ParentMember2020-01-012020-03-310001059556us-gaap:NoncontrollingInterestMember2020-01-012020-03-3100010595562019-01-012019-12-310001059556us-gaap:RetainedEarningsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-12-310001059556srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:ParentMember2019-12-310001059556srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-12-310001059556us-gaap:AdditionalPaidInCapitalMember2020-01-012020-03-310001059556us-gaap:TreasuryStockMember2020-01-012020-03-310001059556us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-03-310001059556us-gaap:CommonStockMember2020-03-310001059556us-gaap:AdditionalPaidInCapitalMember2020-03-310001059556us-gaap:RetainedEarningsMember2020-03-310001059556us-gaap:TreasuryStockMember2020-03-310001059556us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-03-310001059556us-gaap:ParentMember2020-03-310001059556us-gaap:NoncontrollingInterestMember2020-03-310001059556us-gaap:CommonStockMember2020-12-310001059556us-gaap:AdditionalPaidInCapitalMember2020-12-310001059556us-gaap:RetainedEarningsMember2020-12-310001059556us-gaap:TreasuryStockMember2020-12-310001059556us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001059556us-gaap:ParentMember2020-12-310001059556us-gaap:NoncontrollingInterestMember2020-12-310001059556us-gaap:RetainedEarningsMember2021-01-012021-03-310001059556us-gaap:ParentMember2021-01-012021-03-310001059556us-gaap:NoncontrollingInterestMember2021-01-012021-03-310001059556us-gaap:AdditionalPaidInCapitalMember2021-01-012021-03-310001059556us-gaap:TreasuryStockMember2021-01-012021-03-310001059556us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-03-310001059556us-gaap:CommonStockMember2021-03-310001059556us-gaap:AdditionalPaidInCapitalMember2021-03-310001059556us-gaap:RetainedEarningsMember2021-03-310001059556us-gaap:TreasuryStockMember2021-03-310001059556us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-03-310001059556us-gaap:ParentMember2021-03-310001059556us-gaap:NoncontrollingInterestMember2021-03-31mco:segment0001059556mco:MoodysInvestorsServiceMembermco:InvestmentGradeMembermco:CorporateFinanceMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembermco:InvestmentGradeMembermco:CorporateFinanceMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembermco:CorporateFinanceMembermco:HighYieldMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembermco:CorporateFinanceMembermco:HighYieldMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembermco:CorporateFinanceMembermco:BankLoansMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembermco:CorporateFinanceMembermco:BankLoansMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembermco:CorporateFinanceMembermco:OtherProductLinesMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembermco:CorporateFinanceMembermco:OtherProductLinesMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembermco:CorporateFinanceMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembermco:CorporateFinanceMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembermco:FinancialInstitutionsMemberus-gaap:BankingMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembermco:FinancialInstitutionsMemberus-gaap:BankingMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembermco:FinancialInstitutionsMembermco:InsuranceMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembermco:FinancialInstitutionsMembermco:InsuranceMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembermco:ManagedInvestmentsMembermco:FinancialInstitutionsMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembermco:ManagedInvestmentsMembermco:FinancialInstitutionsMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembermco:FinancialInstitutionsMembermco:OtherProductLinesMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembermco:FinancialInstitutionsMembermco:OtherProductLinesMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembermco:FinancialInstitutionsMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembermco:FinancialInstitutionsMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembermco:PublicFinanceSovereignMembermco:PublicProjectAndInfrastructureFinanceMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembermco:PublicFinanceSovereignMembermco:PublicProjectAndInfrastructureFinanceMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembermco:PublicProjectAndInfrastructureFinanceMembermco:ProjectAndInfrastructureMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembermco:PublicProjectAndInfrastructureFinanceMembermco:ProjectAndInfrastructureMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembermco:PublicProjectAndInfrastructureFinanceMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembermco:PublicProjectAndInfrastructureFinanceMember2020-01-012020-03-310001059556mco:AssetsBackedSecuritiesMembermco:MoodysInvestorsServiceMembermco:StructuredFinanceLineOfBusinessMember2021-01-012021-03-310001059556mco:AssetsBackedSecuritiesMembermco:MoodysInvestorsServiceMembermco:StructuredFinanceLineOfBusinessMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembermco:StructuredFinanceLineOfBusinessMembermco:ResidentialMortgageBackedSecuritiesProductMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembermco:StructuredFinanceLineOfBusinessMembermco:ResidentialMortgageBackedSecuritiesProductMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembermco:CommercialMortgageBackedSecuritiesProductMembermco:StructuredFinanceLineOfBusinessMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembermco:CommercialMortgageBackedSecuritiesProductMembermco:StructuredFinanceLineOfBusinessMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembermco:StructuredFinanceLineOfBusinessMembermco:StructuredCreditMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembermco:StructuredFinanceLineOfBusinessMembermco:StructuredCreditMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembermco:StructuredFinanceLineOfBusinessMembermco:OtherProductLinesMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembermco:StructuredFinanceLineOfBusinessMembermco:OtherProductLinesMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembermco:StructuredFinanceLineOfBusinessMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembermco:StructuredFinanceLineOfBusinessMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembermco:RatingRevenueMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembermco:RatingRevenueMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembermco:MISOtherMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembermco:MISOtherMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMemberus-gaap:IntersegmentEliminationMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMemberus-gaap:IntersegmentEliminationMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMemberus-gaap:OperatingSegmentsMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMemberus-gaap:OperatingSegmentsMember2020-01-012020-03-310001059556mco:MoodysAnalyticsMembermco:ResearchDataAndAnalyticsMember2021-01-012021-03-310001059556mco:MoodysAnalyticsMembermco:ResearchDataAndAnalyticsMember2020-01-012020-03-310001059556mco:MoodysAnalyticsMembermco:EnterpriseRiskSolutionsMember2021-01-012021-03-310001059556mco:MoodysAnalyticsMembermco:EnterpriseRiskSolutionsMember2020-01-012020-03-310001059556mco:MoodysAnalyticsMember2021-01-012021-03-310001059556mco:MoodysAnalyticsMember2020-01-012020-03-310001059556mco:MoodysAnalyticsMemberus-gaap:IntersegmentEliminationMember2021-01-012021-03-310001059556mco:MoodysAnalyticsMemberus-gaap:IntersegmentEliminationMember2020-01-012020-03-310001059556mco:MoodysAnalyticsMemberus-gaap:OperatingSegmentsMember2021-01-012021-03-310001059556mco:MoodysAnalyticsMemberus-gaap:OperatingSegmentsMember2020-01-012020-03-310001059556us-gaap:IntersegmentEliminationMember2021-01-012021-03-310001059556us-gaap:IntersegmentEliminationMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembercountry:USmco:CorporateFinanceMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembermco:CorporateFinanceMemberus-gaap:NonUsMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembercountry:USmco:CorporateFinanceMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembermco:CorporateFinanceMemberus-gaap:NonUsMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembercountry:USmco:FinancialInstitutionsMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembermco:FinancialInstitutionsMemberus-gaap:NonUsMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembercountry:USmco:FinancialInstitutionsMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembermco:FinancialInstitutionsMemberus-gaap:NonUsMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembercountry:USmco:PublicProjectAndInfrastructureFinanceMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembermco:PublicProjectAndInfrastructureFinanceMemberus-gaap:NonUsMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembercountry:USmco:PublicProjectAndInfrastructureFinanceMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembermco:PublicProjectAndInfrastructureFinanceMemberus-gaap:NonUsMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembercountry:USmco:StructuredFinanceLineOfBusinessMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembermco:StructuredFinanceLineOfBusinessMemberus-gaap:NonUsMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembercountry:USmco:StructuredFinanceLineOfBusinessMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembermco:StructuredFinanceLineOfBusinessMemberus-gaap:NonUsMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembercountry:USmco:RatingRevenueMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembermco:RatingRevenueMemberus-gaap:NonUsMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembercountry:USmco:RatingRevenueMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembermco:RatingRevenueMemberus-gaap:NonUsMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembermco:MISOtherMembercountry:US2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembermco:MISOtherMemberus-gaap:NonUsMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembermco:MISOtherMembercountry:US2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembermco:MISOtherMemberus-gaap:NonUsMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembercountry:US2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMemberus-gaap:NonUsMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembercountry:US2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMemberus-gaap:NonUsMember2020-01-012020-03-310001059556mco:MoodysAnalyticsMembermco:ResearchDataAndAnalyticsMembercountry:US2021-01-012021-03-310001059556mco:MoodysAnalyticsMembermco:ResearchDataAndAnalyticsMemberus-gaap:NonUsMember2021-01-012021-03-310001059556mco:MoodysAnalyticsMembermco:ResearchDataAndAnalyticsMembercountry:US2020-01-012020-03-310001059556mco:MoodysAnalyticsMembermco:ResearchDataAndAnalyticsMemberus-gaap:NonUsMember2020-01-012020-03-310001059556mco:MoodysAnalyticsMembercountry:USmco:EnterpriseRiskSolutionsMember2021-01-012021-03-310001059556mco:MoodysAnalyticsMembermco:EnterpriseRiskSolutionsMemberus-gaap:NonUsMember2021-01-012021-03-310001059556mco:MoodysAnalyticsMembercountry:USmco:EnterpriseRiskSolutionsMember2020-01-012020-03-310001059556mco:MoodysAnalyticsMembermco:EnterpriseRiskSolutionsMemberus-gaap:NonUsMember2020-01-012020-03-310001059556mco:MoodysAnalyticsMembercountry:US2021-01-012021-03-310001059556mco:MoodysAnalyticsMemberus-gaap:NonUsMember2021-01-012021-03-310001059556mco:MoodysAnalyticsMembercountry:US2020-01-012020-03-310001059556mco:MoodysAnalyticsMemberus-gaap:NonUsMember2020-01-012020-03-310001059556country:US2021-01-012021-03-310001059556us-gaap:NonUsMember2021-01-012021-03-310001059556country:US2020-01-012020-03-310001059556us-gaap:NonUsMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMemberus-gaap:EMEAMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMemberus-gaap:EMEAMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembersrt:AsiaPacificMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembersrt:AsiaPacificMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembersrt:AmericasMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembersrt:AmericasMember2020-01-012020-03-310001059556us-gaap:EMEAMembermco:MoodysAnalyticsMember2021-01-012021-03-310001059556us-gaap:EMEAMembermco:MoodysAnalyticsMember2020-01-012020-03-310001059556mco:MoodysAnalyticsMembersrt:AsiaPacificMember2021-01-012021-03-310001059556mco:MoodysAnalyticsMembersrt:AsiaPacificMember2020-01-012020-03-310001059556mco:MoodysAnalyticsMembersrt:AmericasMember2021-01-012021-03-310001059556mco:MoodysAnalyticsMembersrt:AmericasMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembermco:CorporateFinanceMembermco:TransactionRevenueMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembermco:RelationshipRevenueMembermco:CorporateFinanceMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembermco:CorporateFinanceMembermco:TransactionRevenueMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembermco:RelationshipRevenueMembermco:CorporateFinanceMember2020-01-012020-03-31xbrli:pure0001059556mco:MoodysInvestorsServiceMembermco:FinancialInstitutionsMembermco:TransactionRevenueMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembermco:RelationshipRevenueMembermco:FinancialInstitutionsMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembermco:FinancialInstitutionsMembermco:TransactionRevenueMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembermco:RelationshipRevenueMembermco:FinancialInstitutionsMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembermco:PublicProjectAndInfrastructureFinanceMembermco:TransactionRevenueMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembermco:RelationshipRevenueMembermco:PublicProjectAndInfrastructureFinanceMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembermco:PublicProjectAndInfrastructureFinanceMembermco:TransactionRevenueMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembermco:RelationshipRevenueMembermco:PublicProjectAndInfrastructureFinanceMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembermco:StructuredFinanceLineOfBusinessMembermco:TransactionRevenueMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembermco:RelationshipRevenueMembermco:StructuredFinanceLineOfBusinessMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembermco:StructuredFinanceLineOfBusinessMembermco:TransactionRevenueMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembermco:RelationshipRevenueMembermco:StructuredFinanceLineOfBusinessMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembermco:MISOtherMembermco:TransactionRevenueMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembermco:MISOtherMembermco:RelationshipRevenueMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembermco:MISOtherMembermco:TransactionRevenueMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembermco:MISOtherMembermco:RelationshipRevenueMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembermco:TransactionRevenueMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembermco:RelationshipRevenueMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMembermco:TransactionRevenueMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMembermco:RelationshipRevenueMember2020-01-012020-03-310001059556mco:MoodysAnalyticsMembermco:ResearchDataAndAnalyticsMembermco:TransactionRevenueMember2021-01-012021-03-310001059556mco:MoodysAnalyticsMembermco:ResearchDataAndAnalyticsMembermco:RelationshipRevenueMember2021-01-012021-03-310001059556mco:MoodysAnalyticsMembermco:ResearchDataAndAnalyticsMembermco:TransactionRevenueMember2020-01-012020-03-310001059556mco:MoodysAnalyticsMembermco:ResearchDataAndAnalyticsMembermco:RelationshipRevenueMember2020-01-012020-03-310001059556mco:MoodysAnalyticsMembermco:EnterpriseRiskSolutionsMembermco:TransactionRevenueMember2021-01-012021-03-310001059556mco:MoodysAnalyticsMembermco:RelationshipRevenueMembermco:EnterpriseRiskSolutionsMember2021-01-012021-03-310001059556mco:MoodysAnalyticsMembermco:EnterpriseRiskSolutionsMembermco:TransactionRevenueMember2020-01-012020-03-310001059556mco:MoodysAnalyticsMembermco:RelationshipRevenueMembermco:EnterpriseRiskSolutionsMember2020-01-012020-03-310001059556mco:MoodysAnalyticsMembermco:TransactionRevenueMember2021-01-012021-03-310001059556mco:MoodysAnalyticsMembermco:RelationshipRevenueMember2021-01-012021-03-310001059556mco:MoodysAnalyticsMembermco:TransactionRevenueMember2020-01-012020-03-310001059556mco:MoodysAnalyticsMembermco:RelationshipRevenueMember2020-01-012020-03-310001059556mco:TransactionRevenueMember2021-01-012021-03-310001059556mco:RelationshipRevenueMember2021-01-012021-03-310001059556mco:TransactionRevenueMember2020-01-012020-03-310001059556mco:RelationshipRevenueMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMemberus-gaap:TransferredAtPointInTimeMember2021-01-012021-03-310001059556mco:MoodysAnalyticsMemberus-gaap:TransferredAtPointInTimeMember2021-01-012021-03-310001059556us-gaap:TransferredAtPointInTimeMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMemberus-gaap:TransferredAtPointInTimeMember2020-01-012020-03-310001059556mco:MoodysAnalyticsMemberus-gaap:TransferredAtPointInTimeMember2020-01-012020-03-310001059556us-gaap:TransferredAtPointInTimeMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMemberus-gaap:TransferredOverTimeMember2021-01-012021-03-310001059556mco:MoodysAnalyticsMemberus-gaap:TransferredOverTimeMember2021-01-012021-03-310001059556us-gaap:TransferredOverTimeMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMemberus-gaap:TransferredOverTimeMember2020-01-012020-03-310001059556mco:MoodysAnalyticsMemberus-gaap:TransferredOverTimeMember2020-01-012020-03-310001059556us-gaap:TransferredOverTimeMember2020-01-012020-03-310001059556mco:MoodysInvestorsServiceMember2021-03-310001059556mco:MoodysInvestorsServiceMember2020-12-310001059556mco:MoodysAnalyticsMember2021-03-310001059556mco:MoodysAnalyticsMember2020-12-310001059556mco:MoodysInvestorsServiceMember2019-12-310001059556mco:MoodysAnalyticsMember2019-12-310001059556mco:MoodysInvestorsServiceMember2020-03-310001059556mco:MoodysAnalyticsMember2020-03-310001059556mco:MoodysInvestorsServiceMember2021-04-012021-03-310001059556mco:MoodysInvestorsServiceMember2022-04-012021-03-310001059556mco:MoodysAnalyticsMember2021-04-012021-03-310001059556mco:MoodysAnalyticsMember2022-04-012021-03-310001059556us-gaap:RestrictedStockMember2021-01-012021-03-310001059556us-gaap:EmployeeStockOptionMember2021-01-012021-03-310001059556mco:PerformanceBasedRestrictedStockMember2021-01-012021-03-310001059556us-gaap:EmployeeStockOptionMember2021-03-310001059556us-gaap:RestrictedStockMember2021-03-310001059556mco:PerformanceBasedRestrictedStockMember2021-03-310001059556us-gaap:RestrictedStockMember2020-01-012020-03-310001059556mco:PerformanceBasedRestrictedStockMember2020-01-012020-03-310001059556mco:NetOfFederalTaxMember2021-01-012021-03-310001059556us-gaap:CertificatesOfDepositMember2021-03-310001059556us-gaap:CertificatesOfDepositMember2021-01-012021-03-310001059556us-gaap:MutualFundMember2021-03-310001059556us-gaap:MutualFundMember2021-01-012021-03-310001059556us-gaap:CertificatesOfDepositMember2020-12-310001059556us-gaap:CertificatesOfDepositMember2020-01-012020-12-310001059556us-gaap:MutualFundMember2020-12-310001059556us-gaap:MutualFundMember2020-01-012020-12-310001059556us-gaap:ShortTermInvestmentsMembersrt:MinimumMemberus-gaap:CertificatesOfDepositMember2021-01-012021-03-310001059556us-gaap:ShortTermInvestmentsMembersrt:MinimumMemberus-gaap:CertificatesOfDepositMember2020-01-012020-12-310001059556srt:MaximumMemberus-gaap:ShortTermInvestmentsMemberus-gaap:CertificatesOfDepositMember2020-01-012020-12-310001059556srt:MaximumMemberus-gaap:ShortTermInvestmentsMemberus-gaap:CertificatesOfDepositMember2021-01-012021-03-310001059556us-gaap:OtherAssetsMembersrt:MinimumMemberus-gaap:CertificatesOfDepositMember2021-01-012021-03-310001059556srt:MaximumMemberus-gaap:OtherAssetsMemberus-gaap:CertificatesOfDepositMember2021-01-012021-03-310001059556srt:MaximumMemberus-gaap:CashAndCashEquivalentsMemberus-gaap:CertificatesOfDepositMember2021-01-012021-03-310001059556mco:CorteraMember2021-03-190001059556mco:CorteraMember2021-03-192021-03-190001059556us-gaap:DatabasesMembermco:CorteraMember2021-03-192021-03-190001059556us-gaap:DatabasesMembermco:CorteraMember2021-03-190001059556us-gaap:CustomerRelationshipsMembermco:CorteraMember2021-03-192021-03-190001059556us-gaap:CustomerRelationshipsMembermco:CorteraMember2021-03-190001059556us-gaap:ComputerSoftwareIntangibleAssetMembermco:CorteraMember2021-03-192021-03-190001059556us-gaap:ComputerSoftwareIntangibleAssetMembermco:CorteraMember2021-03-190001059556us-gaap:TradeNamesMembermco:CorteraMember2021-03-192021-03-190001059556us-gaap:TradeNamesMembermco:CorteraMember2021-03-190001059556mco:RegulatoryDataCorporationMember2020-02-130001059556mco:RegulatoryDataCorporationMember2020-02-132020-02-130001059556mco:RegulatoryDataCorporationMemberus-gaap:CustomerRelationshipsMember2020-02-132020-02-130001059556mco:RegulatoryDataCorporationMemberus-gaap:CustomerRelationshipsMember2020-02-130001059556mco:RegulatoryDataCorporationMemberus-gaap:DatabasesMember2020-02-132020-02-130001059556mco:RegulatoryDataCorporationMemberus-gaap:DatabasesMember2020-02-130001059556mco:RegulatoryDataCorporationMemberus-gaap:ComputerSoftwareIntangibleAssetMember2020-02-132020-02-130001059556mco:RegulatoryDataCorporationMemberus-gaap:ComputerSoftwareIntangibleAssetMember2020-02-130001059556mco:RegulatoryDataCorporationMemberus-gaap:TradeNamesMember2020-02-132020-02-130001059556mco:RegulatoryDataCorporationMemberus-gaap:TradeNamesMember2020-02-130001059556mco:TwoThousandTwelveSeniorNotesDueTwoThousandTwentyTwoMemberus-gaap:InterestRateSwapMemberus-gaap:FairValueHedgingMember2021-01-012021-03-310001059556mco:TwoThousandTwelveSeniorNotesDueTwoThousandTwentyTwoMemberus-gaap:InterestRateSwapMemberus-gaap:FairValueHedgingMember2021-03-310001059556mco:TwoThousandTwelveSeniorNotesDueTwoThousandTwentyTwoMemberus-gaap:InterestRateSwapMemberus-gaap:FairValueHedgingMember2020-12-310001059556us-gaap:InterestRateSwapMembermco:TwoThousandSeventeenFiveYearPrivatePlacementDueTwoThosandTwentyThreeMemberus-gaap:FairValueHedgingMember2021-01-012021-03-310001059556us-gaap:InterestRateSwapMembermco:TwoThousandSeventeenFiveYearPrivatePlacementDueTwoThosandTwentyThreeMemberus-gaap:FairValueHedgingMember2021-03-310001059556us-gaap:InterestRateSwapMembermco:TwoThousandSeventeenFiveYearPrivatePlacementDueTwoThosandTwentyThreeMemberus-gaap:FairValueHedgingMember2020-12-310001059556us-gaap:InterestRateSwapMembermco:TwoThousandSeventeenSeniorNotesDueTwoThousandTwentyEightMemberus-gaap:FairValueHedgingMember2021-01-012021-03-310001059556us-gaap:InterestRateSwapMembermco:TwoThousandSeventeenSeniorNotesDueTwoThousandTwentyEightMemberus-gaap:FairValueHedgingMember2021-03-310001059556us-gaap:InterestRateSwapMembermco:TwoThousandSeventeenSeniorNotesDueTwoThousandTwentyEightMemberus-gaap:FairValueHedgingMember2020-12-310001059556us-gaap:InterestRateSwapMembermco:TwoThousandAndTwentySeniorNotesDueTwoThousandAndTwentyFiveMemberus-gaap:FairValueHedgingMember2021-01-012021-03-310001059556us-gaap:InterestRateSwapMembermco:TwoThousandAndTwentySeniorNotesDueTwoThousandAndTwentyFiveMemberus-gaap:FairValueHedgingMember2021-03-310001059556us-gaap:InterestRateSwapMembermco:TwoThousandAndTwentySeniorNotesDueTwoThousandAndTwentyFiveMemberus-gaap:FairValueHedgingMember2020-12-310001059556us-gaap:InterestRateSwapMemberus-gaap:FairValueHedgingMember2021-03-310001059556us-gaap:InterestRateSwapMemberus-gaap:FairValueHedgingMember2020-12-310001059556us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMembermco:FairValueHedgeNetInterestSettlementsAndAccrualsMember2021-01-012021-03-310001059556us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMembermco:FairValueHedgeNetInterestSettlementsAndAccrualsMember2020-01-012020-03-310001059556us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMember2021-01-012021-03-310001059556us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMember2020-01-012020-03-31iso4217:EUR0001059556us-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMembermco:TwoThousandAndFifteenSeniorNotesDueTwoThousandAndTwentySevenMemberus-gaap:NetInvestmentHedgingMember2021-03-310001059556us-gaap:CurrencySwapMembermco:TwoThousandNineteenSeniorNoteDueTwoThousandThirtyMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:NetInvestmentHedgingMember2021-03-310001059556us-gaap:CurrencySwapMembermco:FixedReceivedWeightedAverageInterestRateMemberus-gaap:NetInvestmentHedgingMember2021-01-012021-03-310001059556mco:FixedPayWeightedAverageInterestRateMemberus-gaap:CurrencySwapMembermco:CurrencyPaidMemberus-gaap:NetInvestmentHedgingMember2021-03-310001059556mco:CurrencyReceivedMemberus-gaap:CurrencySwapMembermco:FixedReceivedWeightedAverageInterestRateMemberus-gaap:NetInvestmentHedgingMember2021-03-310001059556us-gaap:CurrencySwapMembermco:ThreeMonthsUsLiborMemberus-gaap:NetInvestmentHedgingMember2021-01-012021-03-310001059556us-gaap:CurrencySwapMembermco:CurrencyPaidMembermco:ThreeMonthsEuriborMemberus-gaap:NetInvestmentHedgingMember2021-03-310001059556us-gaap:CurrencySwapMembermco:CurrencyPaidMembermco:ThreeMonthsEuriborMemberus-gaap:NetInvestmentHedgingMember2021-01-012021-03-310001059556mco:CurrencyReceivedMemberus-gaap:CurrencySwapMembermco:ThreeMonthsUsLiborMemberus-gaap:NetInvestmentHedgingMember2021-03-310001059556mco:CurrencyReceivedMemberus-gaap:CurrencySwapMembermco:ThreeMonthsUsLiborMemberus-gaap:NetInvestmentHedgingMember2021-01-012021-03-310001059556us-gaap:CurrencySwapMembermco:CurrencyPaidMemberus-gaap:NetInvestmentHedgingMember2021-03-310001059556mco:CurrencyReceivedMemberus-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMember2021-03-310001059556us-gaap:CurrencySwapMembermco:FixedReceivedWeightedAverageInterestRateMemberus-gaap:NetInvestmentHedgingMember2020-01-012020-12-310001059556mco:FixedPayWeightedAverageInterestRateMemberus-gaap:CurrencySwapMembermco:CurrencyPaidMemberus-gaap:NetInvestmentHedgingMember2020-12-310001059556mco:CurrencyReceivedMemberus-gaap:CurrencySwapMembermco:FixedReceivedWeightedAverageInterestRateMemberus-gaap:NetInvestmentHedgingMember2020-12-310001059556us-gaap:CurrencySwapMembermco:ThreeMonthsUsLiborMemberus-gaap:NetInvestmentHedgingMember2020-01-012020-12-310001059556us-gaap:CurrencySwapMembermco:CurrencyPaidMembermco:ThreeMonthsEuriborMemberus-gaap:NetInvestmentHedgingMember2020-12-310001059556us-gaap:CurrencySwapMembermco:CurrencyPaidMembermco:ThreeMonthsEuriborMemberus-gaap:NetInvestmentHedgingMember2020-01-012020-12-310001059556mco:CurrencyReceivedMemberus-gaap:CurrencySwapMembermco:ThreeMonthsUsLiborMemberus-gaap:NetInvestmentHedgingMember2020-12-310001059556mco:CurrencyReceivedMemberus-gaap:CurrencySwapMembermco:ThreeMonthsUsLiborMemberus-gaap:NetInvestmentHedgingMember2020-01-012020-12-310001059556us-gaap:CurrencySwapMembermco:CurrencyPaidMemberus-gaap:NetInvestmentHedgingMember2020-12-310001059556mco:CurrencyReceivedMemberus-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMember2020-12-310001059556us-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMembermco:NetInvestmentHedgingSettlementYear2021Member2021-03-310001059556us-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMembermco:NetInvestmentHedgingSettlementYear2022Member2021-03-310001059556us-gaap:CurrencySwapMembermco:NetInvestmentHedgingSettlementYear2023Memberus-gaap:DesignatedAsHedgingInstrumentMember2021-03-310001059556us-gaap:CurrencySwapMembermco:NetInvestmentHedgingSettlementYear2024Memberus-gaap:DesignatedAsHedgingInstrumentMember2021-03-310001059556us-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMembermco:NetInvestmentHedgingSettlementYear2026Member2021-03-310001059556us-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:NetInvestmentHedgingMember2021-03-310001059556mco:ForeignCurrencyForwardContractsToSellEurosForUSDMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:NetInvestmentHedgingMember2021-03-310001059556mco:ForeignCurrencyForwardContractsToSellEurosForUSDMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:NetInvestmentHedgingMember2020-12-31iso4217:GBP0001059556us-gaap:DesignatedAsHedgingInstrumentMembermco:ForeignCurrencyForwardContractsToSellGBPForEURMemberus-gaap:NetInvestmentHedgingMember2021-03-310001059556us-gaap:DesignatedAsHedgingInstrumentMembermco:ForeignCurrencyForwardContractsToSellGBPForEURMemberus-gaap:NetInvestmentHedgingMember2020-12-310001059556us-gaap:ForwardContractsMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMember2020-01-310001059556us-gaap:ForwardContractsMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMember2020-01-012020-01-310001059556us-gaap:ForwardContractsMemberus-gaap:CashFlowHedgingMember2020-04-300001059556mco:TwoThousandAndTwentySeniorNoteDueTwoThousandAndFiftyMember2021-03-310001059556us-gaap:ForeignExchangeForwardMemberus-gaap:NetInvestmentHedgingMember2021-01-012021-03-310001059556us-gaap:ForeignExchangeForwardMemberus-gaap:NetInvestmentHedgingMember2020-01-012020-03-310001059556us-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMember2021-01-012021-03-310001059556us-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMember2020-01-012020-03-310001059556us-gaap:LongTermDebtMemberus-gaap:NetInvestmentHedgingMember2021-01-012021-03-310001059556us-gaap:LongTermDebtMemberus-gaap:NetInvestmentHedgingMember2020-01-012020-03-310001059556us-gaap:NetInvestmentHedgingMember2021-01-012021-03-310001059556us-gaap:NetInvestmentHedgingMember2020-01-012020-03-310001059556us-gaap:InterestRateContractMemberus-gaap:CashFlowHedgingMember2021-01-012021-03-310001059556us-gaap:InterestRateContractMemberus-gaap:CashFlowHedgingMember2020-01-012020-03-310001059556us-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMember2021-03-310001059556us-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMember2020-12-310001059556us-gaap:ForeignExchangeForwardMemberus-gaap:NetInvestmentHedgingMember2021-03-310001059556us-gaap:ForeignExchangeForwardMemberus-gaap:NetInvestmentHedgingMember2020-12-310001059556us-gaap:LongTermDebtMemberus-gaap:NetInvestmentHedgingMember2021-03-310001059556us-gaap:LongTermDebtMemberus-gaap:NetInvestmentHedgingMember2020-12-310001059556us-gaap:NetInvestmentHedgingMember2021-03-310001059556us-gaap:NetInvestmentHedgingMember2020-12-310001059556us-gaap:InterestRateContractMemberus-gaap:CashFlowHedgingMember2021-03-310001059556us-gaap:InterestRateContractMemberus-gaap:CashFlowHedgingMember2020-12-310001059556us-gaap:CurrencySwapMemberus-gaap:CashFlowHedgingMember2021-03-310001059556us-gaap:CurrencySwapMemberus-gaap:CashFlowHedgingMember2020-12-310001059556us-gaap:CashFlowHedgingMember2021-03-310001059556us-gaap:CashFlowHedgingMember2020-12-310001059556us-gaap:DesignatedAsHedgingInstrumentMember2021-03-310001059556us-gaap:DesignatedAsHedgingInstrumentMember2020-12-310001059556mco:ForeignCurrencyForwardContractsToSellUsDollarsForGbpMemberus-gaap:NondesignatedMember2021-03-310001059556mco:ForeignCurrencyForwardContractsToSellUsDollarsForGbpMemberus-gaap:NondesignatedMember2020-12-310001059556mco:ForeignCurrencyForwardContractsToSellUsdForJapaneseYenMemberus-gaap:NondesignatedMember2021-03-31iso4217:JPY0001059556mco:ForeignCurrencyForwardContractsToSellUsdForJapaneseYenMemberus-gaap:NondesignatedMember2020-12-310001059556mco:ForeignCurrencyForwardContractsToSellUsDollarsForCanadianDollarsMemberus-gaap:NondesignatedMember2021-03-31iso4217:CAD0001059556mco:ForeignCurrencyForwardContractsToSellUsDollarsForCanadianDollarsMemberus-gaap:NondesignatedMember2020-12-310001059556mco:ForeignCurrencyForwardContractsToSellUSDollarsForSingaporeDollarsMemberus-gaap:NondesignatedMember2021-03-31iso4217:SGD0001059556mco:ForeignCurrencyForwardContractsToSellUSDollarsForSingaporeDollarsMemberus-gaap:NondesignatedMember2020-12-310001059556mco:ForeignCurrencyForwardContractsToSellUsDollarsForEurosMemberus-gaap:NondesignatedMember2021-03-310001059556mco:ForeignCurrencyForwardContractsToSellUsDollarsForEurosMemberus-gaap:NondesignatedMember2020-12-310001059556mco:ForeignCurrencyForwardContractsToSellEurosforGBPMemberus-gaap:NondesignatedMember2021-03-310001059556mco:ForeignCurrencyForwardContractsToSellEurosforGBPMemberus-gaap:NondesignatedMember2020-12-310001059556mco:ForeignCurrencyForwardContractsToSellUSDollarsForRussianRublesMemberus-gaap:NondesignatedMember2021-03-31iso4217:RUB0001059556mco:ForeignCurrencyForwardContractsToSellUSDollarsForRussianRublesMemberus-gaap:NondesignatedMember2020-12-310001059556us-gaap:NondesignatedMembermco:ForeignCurrencyForwardContractsToSellUSDollarsForIndianRupeesMember2021-03-31iso4217:INR0001059556us-gaap:NondesignatedMembermco:ForeignCurrencyForwardContractsToSellUSDollarsForIndianRupeesMember2020-12-310001059556us-gaap:OtherNonoperatingIncomeExpenseMember2021-01-012021-03-310001059556us-gaap:OtherNonoperatingIncomeExpenseMember2020-01-012020-03-310001059556us-gaap:OtherAssetsMemberus-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:NetInvestmentHedgingMember2021-03-310001059556us-gaap:OtherAssetsMemberus-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:NetInvestmentHedgingMember2020-12-310001059556us-gaap:OtherAssetsMemberus-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueHedgingMember2021-03-310001059556us-gaap:OtherAssetsMemberus-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueHedgingMember2020-12-310001059556us-gaap:ForeignExchangeForwardMemberus-gaap:OtherCurrentAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:NetInvestmentHedgingMember2021-03-310001059556us-gaap:ForeignExchangeForwardMemberus-gaap:OtherCurrentAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:NetInvestmentHedgingMember2020-12-310001059556us-gaap:ForeignExchangeForwardMemberus-gaap:OtherCurrentAssetsMemberus-gaap:NondesignatedMember2021-03-310001059556us-gaap:ForeignExchangeForwardMemberus-gaap:OtherCurrentAssetsMemberus-gaap:NondesignatedMember2020-12-310001059556us-gaap:AccountsPayableAndAccruedLiabilitiesMemberus-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:NetInvestmentHedgingMember2021-03-310001059556us-gaap:AccountsPayableAndAccruedLiabilitiesMemberus-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:NetInvestmentHedgingMember2020-12-310001059556us-gaap:AccountsPayableAndAccruedLiabilitiesMemberus-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:NetInvestmentHedgingMember2021-03-310001059556us-gaap:AccountsPayableAndAccruedLiabilitiesMemberus-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:NetInvestmentHedgingMember2020-12-310001059556us-gaap:CurrencySwapMemberus-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:NetInvestmentHedgingMember2021-03-310001059556us-gaap:CurrencySwapMemberus-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:NetInvestmentHedgingMember2020-12-310001059556us-gaap:InterestRateSwapMemberus-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueHedgingMember2021-03-310001059556us-gaap:InterestRateSwapMemberus-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueHedgingMember2020-12-310001059556us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:LongTermDebtMemberus-gaap:NetInvestmentHedgingMember2021-03-310001059556us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:LongTermDebtMemberus-gaap:NetInvestmentHedgingMember2020-12-310001059556us-gaap:AccountsPayableAndAccruedLiabilitiesMemberus-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMember2021-03-310001059556us-gaap:AccountsPayableAndAccruedLiabilitiesMemberus-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMember2020-12-310001059556mco:MoodysInvestorsServiceMember2020-01-012020-12-310001059556mco:MoodysAnalyticsMember2020-01-012020-12-3100010595562020-01-012020-12-310001059556us-gaap:CustomerRelationshipsMember2021-03-310001059556us-gaap:CustomerRelationshipsMember2020-12-310001059556us-gaap:ComputerSoftwareIntangibleAssetMember2021-03-310001059556us-gaap:ComputerSoftwareIntangibleAssetMember2020-12-310001059556us-gaap:DatabasesMember2021-03-310001059556us-gaap:DatabasesMember2020-12-310001059556us-gaap:TradeNamesMember2021-03-310001059556us-gaap:TradeNamesMember2020-12-310001059556us-gaap:OtherIntangibleAssetsMember2021-03-310001059556us-gaap:OtherIntangibleAssetsMember2020-12-310001059556mco:IndianCreditRatingsAgencyMember2019-12-262019-12-260001059556mco:IndianCreditRatingsAgencyMember2020-09-222020-09-220001059556mco:EstimatedAnnualSavingsMembermco:A2020MAStrategicReorganizationRestructuringProgramMembersrt:MinimumMember2020-12-222020-12-220001059556srt:MaximumMembermco:EstimatedAnnualSavingsMembermco:A2020MAStrategicReorganizationRestructuringProgramMember2020-12-222020-12-220001059556mco:A2020MAStrategicReorganizationRestructuringProgramMembersrt:MinimumMemberus-gaap:EmployeeSeveranceMember2020-12-220001059556srt:MaximumMembermco:A2020MAStrategicReorganizationRestructuringProgramMemberus-gaap:EmployeeSeveranceMember2020-12-220001059556mco:A2020MAStrategicReorganizationRestructuringProgramMembersrt:MinimumMembersrt:ScenarioForecastMember2020-12-222022-12-310001059556srt:MaximumMembermco:A2020MAStrategicReorganizationRestructuringProgramMembersrt:ScenarioForecastMember2020-12-222022-12-310001059556mco:A2020MAStrategicReorganizationRestructuringProgramMember2021-01-012021-03-310001059556mco:A2020MAStrategicReorganizationRestructuringProgramMember2020-01-012020-03-310001059556us-gaap:EmployeeSeveranceMember2020-12-310001059556mco:A2020MAStrategicReorganizationRestructuringProgramMemberus-gaap:EmployeeSeveranceMember2021-01-012021-03-310001059556us-gaap:EmployeeSeveranceMember2021-03-310001059556mco:A2020MAStrategicReorganizationRestructuringProgramMemberus-gaap:EmployeeSeveranceMember2021-03-310001059556mco:A2020MAStrategicReorganizationRestructuringProgramMember2021-03-310001059556us-gaap:FairValueInputsLevel1Member2021-03-310001059556us-gaap:FairValueInputsLevel2Member2021-03-310001059556us-gaap:FairValueInputsLevel1Member2020-12-310001059556us-gaap:FairValueInputsLevel2Member2020-12-310001059556us-gaap:InterestRateContractMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-01-012021-03-310001059556us-gaap:InterestRateContractMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-01-012020-03-310001059556us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-01-012021-03-310001059556us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-01-012020-03-310001059556us-gaap:ForeignExchangeForwardMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMembermco:AccumulatedNetInvestmentHedgesGainLossAttributabletoParentMember2021-01-012021-03-310001059556us-gaap:ForeignExchangeForwardMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMembermco:AccumulatedNetInvestmentHedgesGainLossAttributabletoParentMember2020-01-012020-03-310001059556us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMembermco:AccumulatedNetInvestmentHedgesGainLossAttributabletoParentMember2021-01-012021-03-310001059556us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMembermco:AccumulatedNetInvestmentHedgesGainLossAttributabletoParentMember2020-01-012020-03-310001059556mco:AccumulatedDefinedBenefitPlansAdjustmentNetGainLossAndPriorServiceCostsPortionAttributableToParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2021-01-012021-03-310001059556mco:AccumulatedDefinedBenefitPlansAdjustmentNetGainLossAndPriorServiceCostsPortionAttributableToParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-01-012020-03-310001059556us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-01-012021-03-310001059556us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-01-012020-03-310001059556us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2021-01-012021-03-310001059556us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-01-012020-03-310001059556us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-12-310001059556us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-12-310001059556us-gaap:AccumulatedTranslationAdjustmentMember2020-12-310001059556mco:AccumulatedNetInvestmentHedgesGainLossAttributabletoParentMember2020-12-310001059556us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-01-012021-03-310001059556us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-01-012021-03-310001059556us-gaap:AccumulatedTranslationAdjustmentMember2021-01-012021-03-310001059556mco:AccumulatedNetInvestmentHedgesGainLossAttributabletoParentMember2021-01-012021-03-310001059556us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-03-310001059556us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-03-310001059556us-gaap:AccumulatedTranslationAdjustmentMember2021-03-310001059556mco:AccumulatedNetInvestmentHedgesGainLossAttributabletoParentMember2021-03-310001059556us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-12-310001059556us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-12-310001059556us-gaap:AccumulatedTranslationAdjustmentMember2019-12-310001059556mco:AccumulatedNetInvestmentHedgesGainLossAttributabletoParentMember2019-12-310001059556us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-01-012020-03-310001059556us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-01-012020-03-310001059556us-gaap:AccumulatedTranslationAdjustmentMember2020-01-012020-03-310001059556mco:AccumulatedNetInvestmentHedgesGainLossAttributabletoParentMember2020-01-012020-03-310001059556us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-03-310001059556us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-03-310001059556us-gaap:AccumulatedTranslationAdjustmentMember2020-03-310001059556mco:AccumulatedNetInvestmentHedgesGainLossAttributabletoParentMember2020-03-310001059556us-gaap:PensionPlansDefinedBenefitMember2021-01-012021-03-310001059556us-gaap:PensionPlansDefinedBenefitMember2020-01-012020-03-310001059556us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-01-012021-03-310001059556us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-01-012020-03-310001059556us-gaap:PensionPlansDefinedBenefitMembercountry:USus-gaap:UnfundedPlanMember2021-01-012021-03-310001059556us-gaap:PensionPlansDefinedBenefitMembercountry:USus-gaap:UnfundedPlanMember2021-03-310001059556us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembercountry:USus-gaap:UnfundedPlanMember2021-03-310001059556mco:TwoThousandTwelveSeniorNotesDueTwoThousandTwentyTwoMember2021-03-310001059556mco:TwentyThirteenSeniorNotesMember2021-03-310001059556mco:TwoThousandFourteenSeniorNotesThirtyYearMember2021-03-310001059556mco:TwoThousandAndFifteenSeniorNotesDueTwoThousandAndTwentySevenMember2021-03-310001059556mco:TwoThousandSeventeenFiveYearPrivatePlacementDueTwoThosandTwentyThreeMember2021-03-310001059556mco:TwoThousandSeventeenSeniorNotesDueTwoThousandTwentyEightMember2021-03-310001059556mco:TwoThousandEighteenSeniorNoteDueTwoThousandTwentyNineMember2021-03-310001059556mco:TwoThousandEighteenSeniorNoteDueTwoThousandFourtyEightMember2021-03-310001059556mco:A950SeniorNotesDueTwoThousandAndThirtyMember2021-03-310001059556mco:TwoThousandAndTwentySeniorNoteDueTwoThousandAndTwentyFiveMember2021-03-310001059556mco:TwoThousandAndTwentySeniorNoteDueTwoThousandAndSixtyMember2021-03-310001059556mco:TwoThousandTwelveSeniorNotesDueTwoThousandTwentyTwoMember2020-12-310001059556mco:TwentyThirteenSeniorNotesMember2020-12-310001059556mco:TwoThousandFourteenSeniorNotesThirtyYearMember2020-12-310001059556mco:TwoThousandAndFifteenSeniorNotesDueTwoThousandAndTwentySevenMember2020-12-310001059556mco:TwoThousandSeventeenFiveYearPrivatePlacementDueTwoThosandTwentyThreeMember2020-12-310001059556mco:TwoThousandSeventeenSeniorNotesDueTwoThousandTwentyEightMember2020-12-310001059556mco:TwoThousandEighteenSeniorNoteDueTwoThousandTwentyNineMember2020-12-310001059556mco:TwoThousandEighteenSeniorNoteDueTwoThousandFourtyEightMember2020-12-310001059556mco:A950SeniorNotesDueTwoThousandAndThirtyMember2020-12-310001059556mco:TwoThousandAndTwentySeniorNoteDueTwoThousandAndTwentyFiveMember2020-12-310001059556mco:TwoThousandAndTwentySeniorNoteDueTwoThousandAndFiftyMember2020-12-310001059556mco:TwoThousandAndTwentySeniorNoteDueTwoThousandAndSixtyMember2020-12-310001059556srt:MinimumMember2021-03-310001059556srt:MaximumMember2021-03-31mco:lineOfBusiness0001059556mco:MoodysInvestorsServiceMemberus-gaap:OperatingSegmentsMember2021-01-012021-03-310001059556mco:MoodysAnalyticsMemberus-gaap:OperatingSegmentsMember2021-01-012021-03-310001059556us-gaap:IntersegmentEliminationMember2021-01-012021-03-310001059556mco:MoodysInvestorsServiceMemberus-gaap:OperatingSegmentsMember2020-01-012020-03-310001059556mco:MoodysAnalyticsMemberus-gaap:OperatingSegmentsMember2020-01-012020-03-310001059556us-gaap:IntersegmentEliminationMember2020-01-012020-03-310001059556us-gaap:OperatingSegmentsMember2021-01-012021-03-310001059556us-gaap:EMEAMember2021-01-012021-03-310001059556us-gaap:EMEAMember2020-01-012020-03-310001059556srt:AsiaPacificMember2021-01-012021-03-310001059556srt:AsiaPacificMember2020-01-012020-03-310001059556srt:AmericasMember2021-01-012021-03-310001059556srt:AmericasMember2020-01-012020-03-310001059556us-gaap:SubsequentEventMember2021-04-272021-04-270001059556us-gaap:SubsequentEventMember2021-04-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Mark one)

| | | | | |

| ☑ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2021

Or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-14037

____________________

Moody’s Corporation

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

Delaware | | 13-3998945 |

| (State of Incorporation) | | (I.R.S. Employer Identification No.) |

7 World Trade Center at 250 Greenwich Street, New York, New York 10007

(Address of Principal Executive Offices)

(Zip Code)

Registrant’s telephone number, including area code:

(212) 553-0300

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | MCO | | New York Stock Exchange |

| 1.75% Senior Notes Due 2027 | | MCO 27 | | New York Stock Exchange |

| 0.950% Senior Notes Due 2030 | | MCO 30 | | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months, or for such shorter period that the registrant was required to submit such files. Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | | | | |

| Large Accelerated Filer | ☑ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

Emerging growth company | ☐ | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date:

| | |

| Shares Outstanding at March 31, 2021 |

| 187.2 million |

| | | | | | | | |

| MOODY’S CORPORATION

INDEX TO FORM 10-Q | |

| Page(s) |

| 3-6 |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

|

| | |

| | |

| | |

| | |

| | |

| | |

| |

GLOSSARY OF TERMS AND ABBREVIATIONS

The following terms, abbreviations and acronyms are used to identify frequently used terms in this report:

| | | | | |

TERM | DEFINITION |

| |

Acquire Media (AM) | Business acquired by the Company in October 2020; an aggregator and distributor of curated real-time news, multimedia, data, and alerts. |

Acquisition-Related Intangible Amortization Expense | Amortization of definite-lived intangible assets acquired by the Company from all business combination transactions |

| |

Adjusted Diluted EPS | Diluted EPS excluding the impact of certain items as detailed in the section entitled “Non-GAAP Financial Measures” |

Adjusted Net Income | Net Income excluding the impact of certain items as detailed in the section entitled “Non-GAAP Financial Measures” |

Adjusted Operating Income | Operating income excluding the impact of certain items as detailed in the section entitled “Non-GAAP Financial Measures” |

Adjusted Operating Margin | Adjusted Operating Income divided by revenue |

Americas | Represents countries within North and South America, excluding the U.S. |

AOCL | Accumulated other comprehensive loss; a separate component of shareholders’ equity |

ASC | The FASB Accounting Standards Codification; the sole source of authoritative GAAP as of July 1, 2009 except for rules and interpretive releases of the SEC, which are also sources of authoritative GAAP for SEC registrants |

Asia-Pacific | Represents Australia and countries in Asia including but not limited to: China, India, Indonesia, Japan, Korea, Malaysia, Singapore, Sri Lanka and Thailand |

| |

ASU | The FASB Accounting Standards Update to the ASC. It also provides background information for accounting guidance and the bases for conclusions on the changes in the ASC. ASUs are not considered authoritative until codified into the ASC |

Board | The board of directors of the Company |

BPS | Basis points |

Bureau van Dijk | Bureau van Dijk Electronic Publishing, B.V., a global provider of business intelligence and company information; acquired by the Company on August 10, 2017 via the acquisition of Yellow Maple I B.V., an indirect parent of Bureau van Dijk |

| Catylist | A provider of commercial real estate (CRE) solutions for brokers; acquired by the Company on December 30, 2020 |

CFG | Corporate finance group; an LOB of MIS |

CLO | Collateralized loan obligation |

CMBS | Commercial mortgage-backed securities; an asset class within SFG |

| COLI | Corporate-Owned Life Insurance |

Common Stock | The Company’s common stock |

Company | Moody’s Corporation and its subsidiaries; MCO; Moody’s |

| |

| Cortera | A provider of North American credit data and workflow solutions; the Company acquired Cortera in March 2021. |

| COVID-19 | An outbreak of a novel strain of coronavirus resulting in an international public health crisis and a global pandemic |

CP | Commercial Paper |

CP Program | A program entered into on August 3, 2016 allowing the Company to privately place CP up to a maximum of $1 billion for which the maturity may not exceed 397 days from the date of issue and which is backstopped by the 2018 Facility |

CRAs | Credit rating agencies |

DBPPs | Defined benefit pension plans |

Dodd-Frank Act | Dodd-Frank Wall Street Reform and Consumer Protection Act |

EMEA | Represents countries within Europe, the Middle East and Africa |

EPS | Earnings per share |

| | | | | |

TERM | DEFINITION |

ERS | The Enterprise Risk Solutions LOB within MA, which offers risk management software solutions as well as related risk management advisory engagements services |

ESG | Environmental, Social, and Governance |

ESMA | European Securities and Markets Authority |

ETR | Effective tax rate |

EU | European Union |

EUR | Euros |

EURIBOR | The Euro Interbank Offered Rate |

Excess Tax Benefits | The difference between the tax benefit realized at exercise of an option or delivery of a restricted share and the tax benefit recorded at the time the option or restricted share is expensed under GAAP |

Exchange Act | The Securities Exchange Act of 1934, as amended |

External Revenue | Revenue excluding any intersegment amounts |

FASB | Financial Accounting Standards Board |

FIG | Financial institutions group; an LOB of MIS |

| |

Free Cash Flow | Net cash provided by operating activities less cash paid for capital additions |

| |

FX | Foreign exchange |

GAAP | U.S. Generally Accepted Accounting Principles |

GBP | British pounds |

ICRA | ICRA Limited; a provider of credit ratings and research in India. ICRA is a public company with its shares listed on the Bombay Stock Exchange and the National Stock Exchange of India. The Company previously held 28.5% equity ownership and in June 2014, increased that ownership stake to over 50% through the acquisition of additional shares |

| |

| |

| |

KIS | Korea Investors Service, Inc; a Korean rating agency and consolidated subsidiary of the Company |

KIS Pricing | Korea Investors Service Pricing, Inc; a Korean provider of fixed income securities pricing and consolidated subsidiary of the Company |

KIS Research | Korea Investors Service Research; a Korean provider of financial research and consolidated subsidiary of the Company |

Korea | Republic of South Korea |

LIBOR | London Interbank Offered Rate |

LOB | Line of business |

MA | Moody’s Analytics - a reportable segment of MCO which provides a wide range of products and services that support financial analysis and risk management activities of institutional participants in global financial markets; consists of two LOBs - RD&A and ERS |

| |

MAKS | Moody’s Analytics Knowledge Services; formerly known as Copal Amba; provided offshore research and analytic services to the global financial and corporate sectors; business was divested in the fourth quarter of 2019 and was formerly part of the PS LOB and a reporting unit within the MA reportable segment |

| |

MCO | Moody’s Corporation and its subsidiaries; the Company; Moody’s |

MD&A | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

MIS | Moody’s Investors Service - a reportable segment of MCO; consists of five LOBs - SFG, CFG, FIG, PPIF and MIS Other |

MIS Other | Consists of non-ratings revenue from ICRA, KIS Pricing, KIS Research and revenue from providing ESG research, data and assessments. These businesses are components of MIS; MIS Other is an LOB of MIS |

Moody’s | Moody’s Corporation and its subsidiaries; MCO; the Company |

| MSS | Moody's Shared Services; primarily consists of information technology and support staff such as finance, human resources and legal that support both MIS and MA. |

| |

| |

| | | | | |

TERM | DEFINITION |

Net Income | Net income attributable to Moody’s Corporation, which excludes net income from consolidated noncontrolling interests belonging to the minority interest holder |

| New Credit Losses Accounting Standard | Updates to the ASC pursuant to ASU No. 2016-13, “Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments”. This new accounting guidance requires the use of an “expected credit loss” impairment model for most financial assets reported at amortized cost, which will require entities to estimate expected credit losses over the lifetime of the instrument. |

| |

| |

NM | Percentage change is not meaningful |

Non-GAAP | A financial measure not in accordance with GAAP; these measures, when read in conjunction with the Company’s reported results, can provide useful supplemental information for investors analyzing period-to-period comparisons of the Company’s performance, facilitate comparisons to competitors’ operating results and to provide greater transparency to investors of supplemental information used by management in its financial and operational decision making |

NRSRO | Nationally Recognized Statistical Rating Organization, which is a credit rating agency registered with the SEC. |

OCI | Other comprehensive income (loss); includes gains and losses on cash flow and net investment hedges, certain gains and losses relating to pension and other retirement benefit obligations and foreign currency translation adjustments |

| |

Operating segment | Term defined in the ASC relating to segment reporting; the ASC defines an operating segment as a component of a business entity that has each of the three following characteristics: i) the component engages in business activities from which it may recognize revenue and incur expenses; ii) the operating results of the component are regularly reviewed by the entity’s chief operating decision maker; and iii) discrete financial information about the component is available |

Other Retirement Plan | The U.S. retirement healthcare and U.S. retirement life insurance plans |

| |

PPIF | Public, project and infrastructure finance; an LOB of MIS |

Profit Participation Plan | Defined contribution profit participation plan that covers substantially all U.S. employees of the Company |

| |

| |

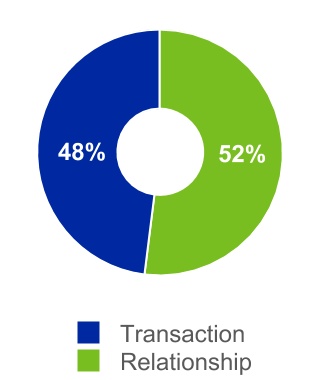

RD&A | An LOB within MA that offers subscription-based research, data and analytical products, including: credit ratings produced by MIS; credit research; quantitative credit scores and other analytical tools; economic research and forecasts; business intelligence and company information products; commercial real estate data and analytical tools; learning solutions |

| |

Reform Act | Credit Rating Agency Reform Act of 2006 |

| Regulatory DataCorp Inc. (RDC) | A global leader in risk and compliance intelligence; the Company acquired RDC in February 2020 |

| |

| |

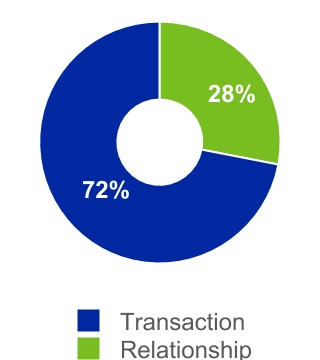

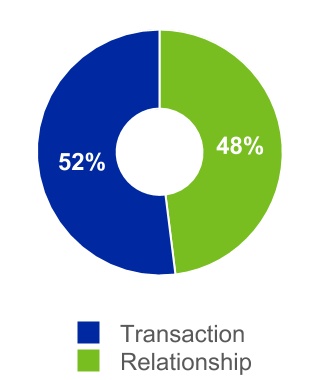

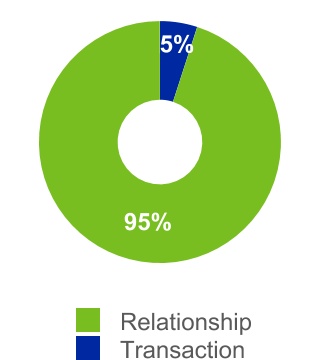

Relationship Revenue | For MIS, represents recurring monitoring fees of a rated debt obligation and/or entities that issue such obligations, as well as revenue from programs such as commercial paper, medium-term notes and shelf registrations. For MIS Other, represents subscription-based revenue. For MA, represents subscription-based revenue and software maintenance revenue |

Reporting unit | The level at which Moody’s evaluates its goodwill for impairment under U.S. GAAP; defined as an operating segment or one level below an operating segment |

Retirement Plans | Moody’s funded and unfunded pension plans, the healthcare plans and life insurance plans |

Revenue Accounting Standard | Updates to the ASC pursuant to ASU No. 2014-09, “Revenue from Contracts with Customers (ASC Topic 606)”. This accounting guidance significantly changes the accounting framework under U.S. GAAP relating to revenue recognition and to the accounting for the deferral of incremental costs of obtaining or fulfilling a contract with a customer |

| |

RMBS | Residential mortgage-backed securities; an asset class within SFG |

| |

SEC | U.S. Securities and Exchange Commission |

Securities Act | Securities Act of 1933, as amended |

SFG | Structured finance group; an LOB of MIS |

SG&A | Selling, general and administrative expenses |

| | | | | |

TERM | DEFINITION |

Tax Act | The “Tax Cuts and Jobs Act” enacted into U.S. law on December 22, 2017 which significantly amends the tax code in the U.S. |

| |

Transaction Revenue | For MIS, represents the initial rating of a new debt issuance as well as other one-time fees. For MIS Other, represents revenue from professional services as well as data services, research and analytical engagements. For MA, represents perpetual software license fees and revenue from software implementation services, risk management advisory projects, training and certification services, and research and analytical engagements |

U.K. | United Kingdom |

U.S. | United States |

USD | U.S. dollar |

UTPs | Uncertain tax positions |

| |

| ZM Financial Systems (ZMFS) | A provider of risk and financial management software for the U.S. banking sector; acquired by the Company in December 2020. |

| |

2020 MA Strategic Reorganization Restructuring Program | Restructuring program approved by the chief executive officer of Moody’s on December 22, 2020, relating to a strategic reorganization in the MA reportable segment. |

| |

2012 Senior Notes due 2022 | Principal amount of $500 million, 4.50% senior unsecured notes due in September 2022 |

2013 Senior Notes due 2024 | Principal amount of the $500 million, 4.875% senior unsecured notes due in February 2024 |

2014 Senior Notes due 2044 | Principal amount of $600 million, 5.25% senior unsecured notes due in July 2044 |

2015 Senior Notes due 2027 | Principal amount of €500 million, 1.75% senior unsecured notes due in March 2027 |

2017 Senior Notes due 2023 | Principal amount of $500 million, 2.625% senior unsecured notes due January 15, 2023 |

2017 Senior Notes due 2028 | Principal amount of $500 million, 3.250% senior unsecured notes due January 15, 2028 |

| |

2018 Facility | Five-year unsecured revolving credit facility, with capacity to borrow up to $1 billion; backstops CP issued under the CP Program |

| |

2018 Senior Notes due 2029 | Principal amount of $400 million, 4.25% senior unsecured notes due February 1, 2029 |

2018 Senior Notes due 2048 | Principal amount of $400 million, 4.875% senior unsecured notes due December 17, 2048 |

| 2019 Senior Notes due 2030 | Principal amount of €750 million, 0.950% senior unsecured notes due February 25, 2030 |

| 2020 Senior Notes due 2025 | Principal amount of $700 million, 3.75% senior unsecured notes due March 24, 2025 |

| 2020 Senior Notes due 2050 | Principal amount of $300 million, 3.25% senior unsecured notes due May 20, 2050 |

| 2020 Senior Notes due 2060 | Principal amount of $500 million, 2.55% senior unsecured notes due August 18, 2060 |

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

MOODY’S CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

(Amounts in millions, except per share data)

| | | | | | | | | | | | | | | |

| | | Three Months Ended

March 31, |

| | | | | 2021 | | 2020 |

| Revenue | | | | | $ | 1,600 | | | $ | 1,290 | |

| Expenses | | | | | | | |

| Operating | | | | | 393 | | | 340 | |

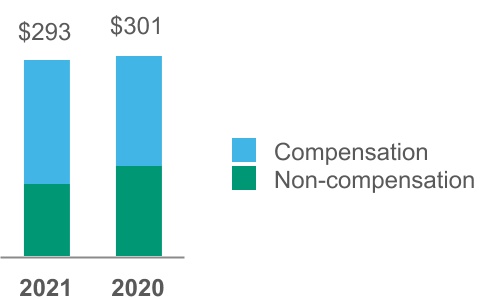

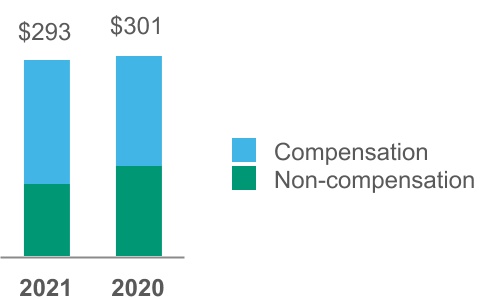

| Selling, general and administrative | | | | | 293 | | | 301 | |

| Depreciation and amortization | | | | | 59 | | | 49 | |

| Restructuring | | | | | 2 | | | (1) | |

| | | | | | | |

| Loss pursuant to the divestiture of MAKS | | | | | — | | | 9 | |

| Total expenses | | | | | 747 | | | 698 | |

| Operating income | | | | | 853 | | | 592 | |

| Non-operating (expense) income, net | | | | | | | |

| Interest expense, net | | | | | (7) | | | (40) | |

| Other non-operating income, net | | | | | 16 | | | 12 | |

| Total non-operating (expense) income, net | | | | | 9 | | | (28) | |

| Income before provisions for income taxes | | | | | 862 | | | 564 | |

| Provision for income taxes | | | | | 126 | | | 77 | |

| Net income | | | | | 736 | | | 487 | |

| Less: Net income (loss) attributable to noncontrolling interests | | | | | — | | | (1) | |

| Net income attributable to Moody's | | | | | $ | 736 | | | $ | 488 | |

| Earnings per share attributable to Moody's common shareholders | | | | | | | |

| Basic | | | | | $ | 3.93 | | | $ | 2.60 | |

| Diluted | | | | | $ | 3.90 | | | $ | 2.57 | |

| Weighted average number of shares outstanding | | | | | | | |

| Basic | | | | | 187.2 | | | 187.5 | |

| Diluted | | | | | 188.6 | | | 189.6 | |

The accompanying notes are an integral part of the condensed consolidated financial statements.

MOODY’S CORPORATION

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (UNAUDITED)

(Amounts in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

March 31, 2021 | | Three Months Ended

March 31, 2020 |

| |

| Pre-tax

amounts | | Tax

amounts | | After-tax

amounts | | Pre-tax

amounts | | Tax

amounts | | After-tax

amounts |

| Net Income | | | | | $ | 736 | | | | | | | $ | 487 | |

| Other Comprehensive Income (loss): | | | | | | | | | | | |

| Foreign Currency Adjustments: | | | | | | | | | | | |

| Foreign currency translation adjustments, net | $ | (147) | | | $ | 6 | | | (141) | | | $ | (175) | | | $ | 5 | | | (170) | |

| Net gains on net investment hedges | 175 | | | (42) | | | 133 | | | 119 | | | (30) | | | 89 | |

| Net investment hedges - reclassification of gains included in net income | (1) | | | — | | | (1) | | | — | | | — | | | — | |

| | | | | | | | | | | |

| Cash Flow Hedges: | | | | | | | | | | | |

| Net losses on cash flow hedges | — | | | — | | | — | | | (48) | | | 12 | | | (36) | |

| Reclassification of losses included in net income | 1 | | | — | | | 1 | | | 1 | | | — | | | 1 | |

| Pension and Other Retirement Benefits: | | | | | | | | | | | |

| Amortization of actuarial losses and prior service costs included in net income | 3 | | | (1) | | | 2 | | | 2 | | | (1) | | | 1 | |

| Net actuarial losses and prior service costs | — | | | — | | | — | | | (1) | | | — | | | (1) | |

| Total other comprehensive (loss) income | $ | 31 | | | $ | (37) | | | (6) | | | $ | (102) | | | $ | (14) | | | (116) | |

| Comprehensive income | | | | | 730 | | | | | | | 371 | |

| Less: comprehensive income (loss) attributable to noncontrolling interests | | | | | 2 | | | | | | | (2) | |

| Comprehensive Income Attributable to Moody's | | | | | $ | 728 | | | | | | | $ | 373 | |

The accompanying notes are an integral part of the condensed consolidated financial statements.

MOODY’S CORPORATION

CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(Amounts in millions, except per share data)

| | | | | | | | | | | |

| March 31, 2021 | | December 31, 2020 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 2,769 | | | $ | 2,597 | |

| Short-term investments | 96 | | | 99 | |

Accounts receivable, net of allowance for credit losses of $31 in 2021 and $34 in 2020 | 1,497 | | | 1,430 | |

| Other current assets | 333 | | | 383 | |

| | | |

| Total current assets | 4,695 | | | 4,509 | |

Property and equipment, net of accumulated depreciation of $946 in 2021 and $928 in 2020 | 269 | | | 278 | |

| Operating lease right-of-use assets | 375 | | | 393 | |

| Goodwill | 4,566 | | | 4,556 | |

| Intangible assets, net | 1,810 | | | 1,824 | |

| Deferred tax assets, net | 240 | | | 334 | |

| Other assets | 545 | | | 515 | |

| Total assets | $ | 12,500 | | | $ | 12,409 | |

| LIABILITIES AND SHAREHOLDERS' EQUITY |

| Current liabilities: | | | |

| Accounts payable and accrued liabilities | $ | 828 | | | $ | 1,039 | |

| Current portion of operating lease liabilities | 94 | | | 94 | |

| | | |

| | | |

| Deferred revenue | 1,232 | | | 1,089 | |

| | | |

| Total current liabilities | 2,154 | | | 2,222 | |

| Non-current portion of deferred revenue | 96 | | | 98 | |

| Long-term debt | 6,340 | | | 6,422 | |

| Deferred tax liabilities, net | 404 | | | 404 | |

| Uncertain tax positions | 402 | | | 483 | |

| Operating lease liabilities | 406 | | | 427 | |

| Other liabilities | 473 | | | 590 | |

| Total liabilities | 10,275 | | | 10,646 | |

| Contingencies (Note 17) | | | |

| Shareholders' equity: |

Preferred stock, par value $0.01 per share; 10,000,000 shares authorized; no shares issued and outstanding | — | | | — | |

Series Common Stock, par value $0.01 per share; 10,000,000 shares authorized; no shares issued and outstanding | — | | | — | |

Common stock, par value $0.01 per share; 1,000,000,000 shares authorized; 342,902,272 shares issued at March 31, 2021 and December 31, 2020, respectively. | 3 | | | 3 | |

| Capital surplus | 739 | | | 735 | |

| Retained earnings | 11,632 | | | 11,011 | |

Treasury stock, at cost; 155,737,071 and 155,808,563 shares of common stock at March 31, 2021 and December 31, 2020 | (9,904) | | | (9,748) | |

| Accumulated other comprehensive loss | (440) | | | (432) | |

| Total Moody's shareholders' equity | 2,030 | | | 1,569 | |

| Noncontrolling interests | 195 | | | 194 | |

| Total shareholders' equity | 2,225 | | | 1,763 | |

| Total liabilities, noncontrolling interests and shareholders' equity | $ | 12,500 | | | $ | 12,409 | |

The accompanying notes are an integral part of the condensed consolidated financial statements.

MOODY’S CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

(Amounts in millions)

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2021 | | 2020 |

| Cash flows from operating activities | |

| Net income | $ | 736 | | | $ | 487 | |

| Reconciliation of net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 59 | | | 49 | |

| Stock-based compensation | 45 | | | 37 | |

| Deferred income taxes | 44 | | | 57 | |

| | | |

| Loss pursuant to the divestiture of MAKS | — | | | 9 | |

| | | |

| | | |

| Changes in assets and liabilities: | | | |

| Accounts receivable | (71) | | | (7) | |

| Other current assets | 67 | | | (38) | |

| | | |

| Other assets | (30) | | | 2 | |

| | | |

| | | |

| Accounts payable and accrued liabilities | (206) | | | (198) | |

| Deferred revenue | 146 | | | 64 | |

| Unrecognized tax benefits and other non-current tax liabilities | (78) | | | (18) | |

| Other liabilities | (36) | | | (99) | |

| Net cash provided by operating activities | 676 | | | 345 | |

| Cash flows from investing activities |

| Capital additions | (14) | | | (21) | |

| Purchases of investments | (65) | | | (78) | |

| Sales and maturities of investments | 45 | | | 23 | |

| | | |

| Cash paid for acquisitions, net of cash acquired | (138) | | | (696) | |

| Receipts from settlements of net investment hedges | 1 | | | — | |

| Payments for settlements of net investment hedges | (23) | | | — | |

| Net cash used in investing activities | (194) | | | (772) | |

| Cash flows from financing activities | | | |

| Issuance of notes | — | | | 700 | |

| | | |

| Issuance of commercial paper | — | | | 789 | |

| Repayment of commercial paper | — | | | (305) | |

| Proceeds from stock-based compensation plans | 9 | | | 16 | |

| Repurchase of shares related to stock-based compensation | (51) | | | (71) | |

| Treasury shares | (132) | | | (253) | |

| Dividends | (116) | | | (105) | |

| Debt issuance costs, extinguishment costs and related fees | — | | | (6) | |

| | | |

| | | |

| | | |

| Net cash (used in) provided by financing activities | (290) | | | 765 | |

| | | |

| Effect of exchange rate changes on cash and cash equivalents | (20) | | | (29) | |

| Increase in cash and cash equivalents | 172 | | | 309 | |

| Cash and cash equivalents, beginning of period | 2,597 | | | 1,832 | |

| Cash and cash equivalents, end of period | $ | 2,769 | | | $ | 2,141 | |

The accompanying notes are an integral part of the condensed consolidated financial statements.

MOODY’S CORPORATION

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY (UNAUDITED)

(Amounts in millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Shareholders of Moody's Corporation | | | |

| Common Stock | | Capital Surplus | | Retained Earnings | | Treasury Stock | | Accumulated

Other

Comprehensive

Loss | | Total Moody's

Shareholders'

Equity | | Non- Controlling

Interests | | Total

Shareholders'

Equity |

| Shares | | Amount | | | Shares | | Amount | |

| Balance at December 31, 2019 | 342.9 | | | $ | 3 | | | $ | 642 | | | $ | 9,656 | | | (155.2) | | | $ | (9,250) | | | $ | (439) | | | $ | 612 | | | $ | 219 | | | $ | 831 | |

| Net income/ (loss) | | | | | | | 488 | | | | | | | | | 488 | | | (1) | | | 487 | |

Dividends ($0.56 per share) | | | | | | | (101) | | | | | | | | | (101) | | | — | | | (101) | |

Adoption of

New Credit

Losses

Accounting

Standard | | | | | | | (2) | | | | | | | | | (2) | | | | | (2) | |

| Stock-based compensation | | | | | 37 | | | | | | | | | | | 37 | | | | | 37 | |

| Shares issued for stock-based compensation plans at average cost, net | | | | | (63) | | | | | 0.9 | | | (21) | | | | | (84) | | | | | (84) | |

| | | | | | | | | | | | | | | | | | | |

| Treasury shares repurchased | | | | | | | | | (1.1) | | | (253) | | | | | (253) | | | | | (253) | |

Currency translation adjustment, net of net investment hedge activity (net of tax of $25 million) | | | | | | | | | | | | | (80) | | | (80) | | | (1) | | | (81) | |

| Net actuarial gains and prior service cost | | | | | | | | | | | | | (1) | | | (1) | | | | | (1) | |

Amortization of prior service costs and actuarial losses (net of tax of $1 million) | | | | | | | | | | | | | 1 | | | 1 | | | | | 1 | |

Net realized and unrealized gain on cash flow hedges (net of tax of $12 million) | | | | | | | | | | | | | (35) | | | (35) | | | | | (35) | |

| Balance at March 31, 2020 | 342.9 | | | $ | 3 | | | $ | 616 | | | $ | 10,041 | | | (155.4) | | | $ | (9,524) | | | $ | (554) | | | $ | 582 | | | $ | 217 | | | $ | 799 | |

The accompanying notes are an integral part of the condensed consolidated financial statements.

MOODY'S CORPORATION

CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (UNAUDITED)

(Amounts in millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Shareholders of Moody's Corporation | | | |

| Common Stock | | Capital

Surplus | | Retained

Earnings | | Treasury Stock | | Accumulated

Other

Comprehensive

Loss | | Total Moody's

Shareholders'

Equity | | Non- Controlling

Interests | | Total

Shareholders'

Equity |

| Shares | | Amount | | | Shares | | Amount | |

| Balance at December 31, 2020 | 342.9 | | | $ | 3 | | | $ | 735 | | | $ | 11,011 | | | (155.8) | | | $ | (9,748) | | | $ | (432) | | | $ | 1,569 | | | $ | 194 | | | $ | 1,763 | |

| Net income | | | | | | | 736 | | | | | | | | | 736 | | | — | | | 736 | |

Dividends ($0.62 per share) | | | | | | | (115) | | | | | | | | | (115) | | | (1) | | | (116) | |