UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

Or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number:

(Exact Name of Registrant as Specified in Its Charter)

|

||

(State or Other Jurisdiction of |

|

(I.R.S. Employer Identification No.) |

Incorporation or Organization) |

|

|

(Address of Principal Executive Offices, Including Zip Code)

(

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

☒ |

Accelerated Filer |

☐ |

|

Non-accelerated Filer |

☐ |

Smaller Reporting Company |

|

|

|

Emerging Growth Company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date.

Class |

Outstanding at November 1, 2023 |

||

Common Stock, $0.001 par value per share |

|

Shares |

|

SP PLUS CORPORATION

TABLE OF CONTENTS

2 |

|

2 |

|

2 |

|

3 |

|

4 |

|

5 |

|

7 |

|

8 |

|

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations |

22 |

Item 3. Quantitative and Qualitative Disclosures about Market Risk |

32 |

33 |

|

|

|

34 |

|

34 |

|

34 |

|

35 |

|

35 |

|

35 |

|

35 |

|

36 |

|

|

|

37 |

1

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

SP Plus Corporation

Condensed Consolidated Balance Sheets

(millions, except for share and per share data) |

|

September 30, 2023 |

|

|

December 31, 2022 |

|

||

|

|

(unaudited) |

|

|

|

|

||

Assets |

|

|

|

|

|

|

||

Cash and cash equivalents |

|

$ |

|

|

$ |

|

||

Accounts receivable, net |

|

|

|

|

|

|

||

Prepaid expenses and other current assets |

|

|

|

|

|

|

||

Total current assets |

|

|

|

|

|

|

||

Property and equipment, net |

|

|

|

|

|

|

||

Right-of-use assets |

|

|

|

|

|

|

||

Goodwill |

|

|

|

|

|

|

||

Other intangible assets, net |

|

|

|

|

|

|

||

Deferred income taxes |

|

|

|

|

|

|

||

Other noncurrent assets |

|

|

|

|

|

|

||

Total noncurrent assets |

|

|

|

|

|

|

||

Total assets |

|

$ |

|

|

$ |

|

||

Liabilities and stockholders’ equity |

|

|

|

|

|

|

||

Liabilities |

|

|

|

|

|

|

||

Accounts payable |

|

$ |

|

|

$ |

|

||

Accrued and other current liabilities |

|

|

|

|

|

|

||

Short-term lease liabilities |

|

|

|

|

|

|

||

Current portion of long-term borrowings |

|

|

|

|

|

|

||

Total current liabilities |

|

|

|

|

|

|

||

Long-term borrowings, excluding current portion |

|

|

|

|

|

|

||

Long-term lease liabilities |

|

|

|

|

|

|

||

Other noncurrent liabilities |

|

|

|

|

|

|

||

Total noncurrent liabilities |

|

|

|

|

|

|

||

Total liabilities |

|

$ |

|

|

$ |

|

||

Stockholders’ equity |

|

|

|

|

|

|

||

Preferred stock, par value $ |

|

$ |

|

|

$ |

|

||

Common stock, par value $ |

|

|

|

|

|

|

||

Treasury stock, at cost; |

|

|

( |

) |

|

|

( |

) |

Additional paid-in capital |

|

|

|

|

|

|

||

Accumulated other comprehensive loss |

|

|

( |

) |

|

|

( |

) |

Retained earnings |

|

|

|

|

|

|

||

Total SP Plus Corporation stockholders’ equity |

|

|

|

|

|

|

||

Noncontrolling interests |

|

|

— |

|

|

|

( |

) |

Total stockholders’ equity |

|

|

|

|

|

|

||

Total liabilities and stockholders’ equity |

|

$ |

|

|

$ |

|

||

See Notes to Condensed Consolidated Financial Statements.

2

SP Plus Corporation

Condensed Consolidated Statements of Income

|

|

Three Months Ended |

|

Nine Months Ended |

|

||||||||||

(millions, except for share and per share data) (unaudited) |

|

September 30, 2023 |

|

|

September 30, 2022 |

|

September 30, 2023 |

|

|

September 30, 2022 |

|

||||

Services revenue |

|

|

|

|

|

|

|

|

|

|

|

||||

Management type contracts |

|

$ |

|

|

$ |

|

$ |

|

|

$ |

|

||||

Lease type contracts |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

Reimbursed management type contract revenue |

|

|

|

|

|

|

|

|

|

|

|

||||

Total services revenue |

|

|

|

|

|

|

|

|

|

|

|

||||

Cost of services (exclusive of depreciation and amortization) |

|

|

|

|

|

|

|

|

|

|

|

||||

Management type contracts |

|

|

|

|

|

|

|

|

|

|

|

||||

Lease type contracts |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

Reimbursed management type contract expense |

|

|

|

|

|

|

|

|

|

|

|

||||

Total cost of services (exclusive of depreciation and amortization) |

|

|

|

|

|

|

|

|

|

|

|

||||

General and administrative expenses |

|

|

|

|

|

|

|

|

|

|

|

||||

Depreciation and amortization |

|

|

|

|

|

|

|

|

|

|

|

||||

Operating income |

|

|

|

|

|

|

|

|

|

|

|

||||

Other expense (income) |

|

|

|

|

|

|

|

|

|

|

|

||||

Interest expense |

|

|

|

|

|

|

|

|

|

|

|

||||

Interest income |

|

|

— |

|

|

|

( |

) |

|

( |

) |

|

|

( |

) |

Total other expenses |

|

|

|

|

|

|

|

|

|

|

|

||||

Earnings before income taxes |

|

|

|

|

|

|

|

|

|

|

|

||||

Income tax expense |

|

|

|

|

|

|

|

|

|

|

|

||||

Net income |

|

|

|

|

|

|

|

|

|

|

|

||||

Less: Net income attributable to noncontrolling interests |

|

|

|

|

|

|

|

|

|

|

|

||||

Net income attributable to SP Plus Corporation |

|

$ |

|

|

$ |

|

$ |

|

|

$ |

|

||||

Common stock data |

|

|

|

|

|

|

|

|

|

|

|

||||

Net income per common share |

|

|

|

|

|

|

|

|

|

|

|

||||

Basic |

|

$ |

|

|

$ |

|

$ |

|

|

$ |

|

||||

Diluted |

|

$ |

|

|

$ |

|

$ |

|

|

$ |

|

||||

Weighted average shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

||||

Basic |

|

|

|

|

|

|

|

|

|

|

|

||||

Diluted |

|

|

|

|

|

|

|

|

|

|

|

||||

See Notes to Condensed Consolidated Financial Statements.

3

SP Plus Corporation

Condensed Consolidated Statements of Comprehensive Income

|

|

Three Months Ended |

|

Nine Months Ended |

|

||||||||||

(millions) (unaudited) |

|

September 30, 2023 |

|

|

September 30, 2022 |

|

September 30, 2023 |

|

|

September 30, 2022 |

|

||||

Net income |

|

$ |

|

|

$ |

|

$ |

|

|

$ |

|

||||

Reclassification of de-designated interest rate collars |

|

|

— |

|

|

|

— |

|

|

— |

|

|

|

|

|

Foreign currency translation loss |

|

|

( |

) |

|

|

( |

) |

|

( |

) |

|

|

( |

) |

Comprehensive income |

|

|

|

|

|

|

|

|

|

|

|

||||

Less: Comprehensive income attributable to noncontrolling interests |

|

|

|

|

|

|

|

|

|

|

|

||||

Comprehensive income attributable to SP Plus Corporation |

|

$ |

|

|

$ |

|

$ |

|

|

$ |

|

||||

See Notes to Condensed Consolidated Financial Statements.

4

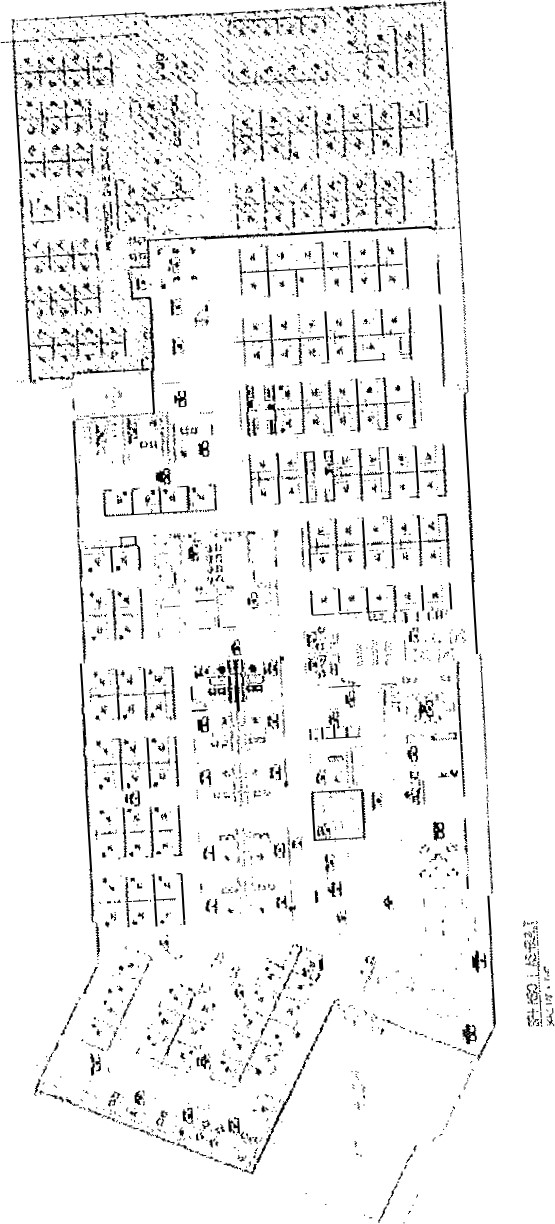

SP Plus Corporation

Condensed Consolidated Statements of Stockholders' Equity

|

|

Common Stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

(millions, except share data) (unaudited) |

|

Number |

|

|

Par |

|

|

Additional |

|

|

Accumulated |

|

|

Retained Earnings |

|

|

|

Treasury |

|

|

Noncontrolling |

|

|

Total |

|

|||||||||

Balance at January 1, 2023 |

|

|

|

|

$ |

— |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

|||||

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

||||

Foreign currency translation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|||

Issuance of restricted stock units |

|

|

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

||

Non-cash stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|||

Noncontrolling interests buyout |

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

|

|

— |

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

Repurchases of common stock |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

|

Distributions to noncontrolling interests |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

Balance at March 31, 2023 |

|

|

|

|

$ |

— |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|

|

$ |

( |

) |

|

$ |

|

|

$ |

|

||||||

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

||||

Foreign currency translation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|||

Issuance of restricted stock units |

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

||

Issuance of stock grants |

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||||

Non-cash stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|||

Distributions to noncontrolling interests |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

Balance at June 30, 2023 |

|

|

|

|

$ |

— |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|

|

$ |

( |

) |

|

$ |

|

|

$ |

|

||||||

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

||||

Foreign currency translation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

Non-cash stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|||

Noncontrolling interests buyout |

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

Distributions to noncontrolling interests |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

Balance at September 30, 2023 |

|

|

|

|

$ |

— |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|

|

$ |

( |

) |

|

$ |

— |

|

|

$ |

|

|||||

See Notes to Condensed Consolidated Financial Statements.

5

|

|

Common Stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

(millions, except share data) (unaudited) |

|

Number |

|

|

Par |

|

|

Additional |

|

|

Accumulated |

|

|

Retained Earnings |

|

|

Treasury |

|

|

Noncontrolling |

|

|

Total |

|

||||||||

Balance at January 1, 2022 |

|

|

|

|

$ |

— |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

||||

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|||

Foreign currency translation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Reclassification of de-designated interest rate collars |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Issuance of restricted stock units |

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Non-cash stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Distributions to noncontrolling interests |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Balance at March 31, 2022 |

|

|

|

|

$ |

— |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

||||

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|||

Foreign currency translation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

Reclassification of de-designated interest rate collars |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Issuance of stock grants |

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|||

Non-cash stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Repurchases of common stock |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

Distributions to noncontrolling interests |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Balance at June 30, 2022 |

|

|

|

|

$ |

— |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

||||

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|||

Foreign currency translation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

Non-cash stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Repurchases of common stock |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

Distributions to noncontrolling interests |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Balance at September 30, 2022 |

|

|

|

|

$ |

— |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

||||

See Notes to Condensed Consolidated Financial Statements.

6

SP Plus Corporation

Condensed Consolidated Statements of Cash Flows

|

|

Nine Months Ended |

|

|||||

(millions) (unaudited) |

|

September 30, 2023 |

|

|

September 30, 2022 |

|

||

Operating activities |

|

|

|

|

|

|

||

Net income |

|

$ |

|

|

$ |

|

||

Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

||

Depreciation and amortization |

|

|

|

|

|

|

||

Non-cash stock-based compensation |

|

|

|

|

|

|

||

Provisions for credit losses on accounts receivable |

|

|

|

|

|

|

||

Deferred income taxes |

|

|

|

|

|

|

||

Other |

|

|

( |

) |

|

|

|

|

Changes in operating assets and liabilities |

|

|

|

|

|

|

||

Accounts receivable |

|

|

( |

) |

|

|

( |

) |

Prepaid expenses and other current assets |

|

|

|

|

|

|

||

Accounts payable |

|

|

|

|

|

|

||

Accrued liabilities and other |

|

|

( |

) |

|

|

( |

) |

Net cash provided by operating activities |

|

|

|

|

|

|

||

Investing activities |

|

|

|

|

|

|

||

Purchases of property and equipment |

|

|

( |

) |

|

|

( |

) |

Acquisition of business |

|

|

( |

) |

|

|

— |

|

Acquisition of other intangible assets |

|

|

— |

|

|

|

( |

) |

Proceeds from sale of equipment |

|

|

— |

|

|

|

|

|

Noncontrolling interest buyout |

|

|

( |

) |

|

|

|

|

Net cash used in investing activities |

|

|

( |

) |

|

|

( |

) |

Financing activities |

|

|

|

|

|

|

||

Proceeds from credit facility revolver |

|

|

|

|

|

|

||

Payments on credit facility revolver |

|

|

( |

) |

|

|

( |

) |

Proceeds from credit facility term loan |

|

|

— |

|

|

|

|

|

Payments on credit facility term loan |

|

|

( |

) |

|

|

( |

) |

Payments of debt issuance costs |

|

|

— |

|

|

|

( |

) |

Payments on other long-term borrowings |

|

|

( |

) |

|

|

( |

) |

Payments of withholding taxes on share-based compensation |

|

|

( |

) |

|

|

|

|

Distributions to noncontrolling interests |

|

|

( |

) |

|

|

( |

) |

Repurchases of common stock |

|

|

( |

) |

|

|

( |

) |

Net cash used in financing activities |

|

|

( |

) |

|

|

( |

) |

Effect of exchange rate changes on cash and cash equivalents |

|

|

( |

) |

|

|

( |

) |

Increase in cash and cash equivalents |

|

|

|

|

|

|

||

Cash and cash equivalents at beginning of year |

|

|

|

|

|

|

||

Cash and cash equivalents at end of period |

|

$ |

|

|

$ |

|

||

Supplemental disclosures |

|

|

|

|

|

|

||

Cash paid (received) during the period for |

|

|

|

|

|

|

||

Interest |

|

$ |

|

|

$ |

|

||

Income taxes, net |

|

$ |

|

|

$ |

( |

) |

|

See Notes to Condensed Consolidated Financial Statements.

7

SP Plus Corporation

Notes to Condensed Consolidated Financial Statements (Unaudited)

1. Significant Accounting Policies and Practices

The Company

SP Plus Corporation (the "Company") develops and integrates technology with operations management and support to deliver mobility solutions that enable the efficient and time-sensitive movement of people, vehicles and personal travel belongings. The Company is committed to providing solutions that make every moment matter for a world on the go while meeting the objectives of the Company's diverse client base in North America and Europe, which includes aviation, commercial, hospitality and institutional clients. The Company typically enters into contractual agreements with property owners or managers as opposed to owning facilities.

Basis of Presentation

The accompanying unaudited Condensed Consolidated Financial Statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, certain information and disclosures normally included in the financial statements have been condensed or omitted as permitted by such rules and regulations.

All adjustments (consisting only of adjustments of a normal and recurring nature) considered necessary for a fair presentation have been included. Operating results during the three and nine months ended September 30, 2023 are not necessarily indicative of the results to be expected for any other interim period or the fiscal year ending December 31, 2023. The financial statements presented in this report should be read in conjunction with the Company’s annual Consolidated Financial Statements and notes thereto included in the Annual Report on Form 10-K for the year ended December 31, 2022 filed on February 24, 2023 with the Securities and Exchange Commission.

Principles of Consolidation

The unaudited Condensed Consolidated Financial Statements include the accounts of the Company, its wholly owned subsidiaries, and Variable Interest Entities ("VIEs") in which the Company is the primary beneficiary. The Company is the primary beneficiary of a VIE when the Company has the power to direct activities that most significantly affect the economic performance of the VIE. If the Company is not the primary beneficiary in a VIE and has significant influence, the Company accounts for the investment in the VIE as an equity method investment. As of September 30, 2023 and December 31, 2022, assets related to consolidated VIEs were $

Cash and Cash Equivalents

Cash equivalents represent funds temporarily invested in money market instruments with maturities of three months or less. Cash equivalents are stated at cost, which approximates fair value. Cash and cash equivalents that are restricted as to withdrawal or use under the terms of certain contractual agreements were $

Allowance for Doubtful Accounts

Accounts receivable, net of the allowance for doubtful accounts, represents the Company’s estimate of the amount that ultimately will be realized in cash. The Company reviews the adequacy of its allowance for doubtful accounts on an ongoing basis, primarily using a review of specific accounts, as well as historical collection trends and aging of receivables, and records adjustments to the allowance as necessary. The Company’s allowance for doubtful accounts, which was included in Accounts receivable, net, within the Condensed Consolidated Balance Sheets, was $

Property and Equipment, Net

Property and equipment includes the Company's equipment, internal-use software, vehicles, leasehold improvements and construction/development in process. Property and equipment are stated at cost, less accumulated depreciation and amortization, whenever applicable.

Certain costs incurred in the planning and evaluation stage of internal-use software projects are recorded to expense as incurred. Costs associated with directly obtaining, developing or upgrading internal-use software are capitalized and included as Software in Property and equipment, net, within the Condensed Consolidated Balance Sheets. When the internal-use software is ready for

8

its intended use, it is amortized on a straight-line basis over the estimated useful life of the internal-use software, which is typically

Equipment and vehicles are depreciated on a straight-line basis over estimated useful lives ranging from

Equity Investments in Unconsolidated Entities

The Company has ownership interests in

Other Noncurrent Assets

Other noncurrent assets consisted of equity investments of unconsolidated entities, advances, deposits and cost of contracts, net, as of September 30, 2023 and December 31, 2022.

Accrued and Other Current Liabilities

Accrued and other current liabilities consisted of insurance, accrued rent, compensation, contingent consideration, payroll withholdings, property, payroll and other taxes and other accrued expenses as of September 30, 2023 and December 31, 2022.

Noncontrolling Interests

Noncontrolling interests represent the noncontrolling holders’ percentage share of income (losses) from the subsidiaries in which the Company holds a controlling, but less than 100 percent, ownership interest. The results of these subsidiaries are consolidated and included within the Condensed Consolidated Financial Statements.

During the nine months ended September 30, 2023, the Company recorded a $

Additionally, during the nine months ended September 30, 2023, the Company paid a former minority partner $

Goodwill

Goodwill represents the excess of the purchase price paid over the fair value of net assets acquired. In accordance with the Financial Accounting Standards Board's ("FASB") authoritative accounting guidance on goodwill, the Company evaluates goodwill for impairment on an annual basis, or more often if events or circumstances change that could cause goodwill to become impaired. The Company has elected to assess the impairment of goodwill annually on October 1 or at an interim date if there is an event or change in circumstances indicating the carrying value may not be recoverable. The goodwill impairment test is performed at the reporting unit level; the Company's reporting units represent its operating segments, consisting of Commercial and Aviation. Factors that could trigger an impairment review include significant under-performance relative to expected historical or projected future operating results, significant changes in the use of acquired assets or the Company’s business strategy, and significant negative industry or economic trends.

9

The Company may perform a qualitative, rather than quantitative, assessment to determine whether it is more likely than not the fair value of a reporting unit is less than its carrying amount. If the Company determines it is more likely than not that the fair value is less than its carrying amount, the Company would need to perform a quantitative assessment. The determination of fair value of a reporting unit utilizes cash flow projections that assume certain future revenue and cost levels, comparable marketplace data, comparable company market valuations, assumed discount rates based upon current market conditions and other valuation factors, all of which involve the use of significant judgment and estimates. The Company also assesses critical areas that may impact its business, including economic conditions, market related exposures, competition, changes in service offerings and changes in key personnel.

Other Intangible Assets, net

Other intangible assets represent assets with finite lives that are amortized on a straight-line basis over their estimated useful lives. The Company evaluates other intangible assets on a periodic basis to determine whether events or circumstances warrant a revision to their remaining useful lives. In addition, other intangible assets are reviewed for impairment when circumstances change that would indicate the carrying value may not be recoverable. Assumptions and estimates about future values and remaining useful lives of intangible assets are complex and subjective, and can be affected by a variety of factors, including external factors such as industry and economic trends, and internal factors, such as changes in the Company's business strategy and forecasts. Although the Company believes its historical assumptions and estimates are reasonable and appropriate, different assumptions and estimates could materially impact reported financial results.

Long-Lived Assets

The Company evaluates long-lived assets, including ROU assets, leasehold improvements, equipment and construction/development in progress, for impairment whenever events or circumstances indicate that the carrying value of an asset or asset group may not be recoverable. The Company groups assets at the lowest level for which cash flows are separately identified in order to measure an impairment. Events or circumstances that would result in an impairment review include a significant change in the use of an asset, the planned sale or disposal of an asset, or a projection that demonstrates continuing losses associated with the use of a long-lived asset or asset group. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of the asset or asset group to future undiscounted cash flows expected to be generated by the asset or asset group. If the asset or asset group is determined to be impaired, the impairment recognized is measured by the amount by which the carrying value of the asset or asset group exceeds its fair value.

Assumptions and estimates used to determine cash flows in the evaluation of impairment and the fair values used to determine the impairment are subject to a degree of judgment and complexity. Any future changes to the assumptions and estimates resulting from changes in actual results or market conditions from those anticipated may affect the carrying value of long-lived assets or asset groups and could result in impairment charges. Future events that may result in impairment charges include economic volatility or other factors that could decrease revenues and profitability of existing locations and changes in the cost structure of existing facilities, such as increasing labor and benefit costs.

Foreign Operations

The Company has foreign operations in Canada, Puerto Rico, the United Kingdom and India. Assets and liabilities of the Company’s foreign operations are translated into U.S. dollars at the rate in effect on the respective balance sheet date, while income and expenses are translated at the average rates during the respective periods. Translation adjustments resulting from the fluctuations in exchange rates are recorded as a separate component of Accumulated other comprehensive loss in Stockholders’ equity within the Condensed Consolidated Balance Sheets, while transaction gains and losses are recorded within the Condensed Consolidated Statements of Income. Deferred income taxes are not recorded on cumulative foreign currency translation adjustments when the Company expects the foreign earnings to be permanently reinvested.

2. Acquisitions

2023 Acquisition

On

The acquisition enhances the Company's position as a global provider of frictionless technology solutions that is independent of the Company's legacy parking management related operations. The acquisition of Roker has been accounted for as a business combination, and the assets acquired and liabilities assumed were recorded at their estimated fair values as of the acquisition date. Goodwill was measured as the excess of the consideration over the assets acquired, including other intangible assets, less liabilities assumed. Tax deductible goodwill related to the acquisition was $

During the three and nine months ended September 30, 2023, the acquisition of Roker contributed $

10

The Company believes the information gathered to date provides a reasonable basis for estimating the fair values of the assets acquired and liabilities assumed, however, the provisional measurements of fair value for the other intangible assets and goodwill of Roker are subject to change. As a result, during the measurement period, which may be up to one year from the acquisition date, adjustments to the assets acquired and liabilities assumed may be recorded with corresponding adjustments to goodwill. The Company expects to complete the purchase price allocations for the Roker acquisition as soon as practicable but no later than one year from the acquisition date.

The estimated fair values of the assets acquired and liabilities assumed based on the information that was available as of the acquisition date were as follows:

(millions) |

|

|

|

Other intangible assets |

|

|

|

Goodwill |

|

|

|

Accounts payable |

|

( |

) |

Net cash paid |

$ |

|

|

As discussed above, during the nine months ended September 30, 2023, the Company recorded additions to other intangible assets of $

(millions) |

|

Estimated Life |

|

Estimated Fair Value |

|

|

Proprietary know how |

|

|

$ |

|

||

Customer relationships |

|

|

|

|

||

Estimated fair value of identified intangible assets |

|

|

|

$ |

|

|

The fair values of other intangible assets acquired were determined to be Level 3 under the fair value hierarchy. The fair value estimate for all identifiable intangible assets is based on assumptions that market participants would use in pricing an asset, based on the most advantageous market for the asset.

The estimated fair value of the Proprietary know how was determined using the multi-period excess earnings method under the income approach utilizing projected financial information for the technology that was acquired. The estimated fair value of the customer relationships was determined using the distributor method under the income approach.

2022 Acquisitions

On

On

During the three and nine months ended September 30, 2023, the acquisitions contributed $

The Company finalized its purchase price allocations for the KMP and DIVRT acquisitions during the nine months ended September 30, 2023.

11

(millions) |

|

|

|

Cash and cash equivalents |

$ |

|

|

Accounts receivable |

|

|

|

Prepaid expenses and other current assets |

|

|

|

Other intangible assets |

|

|

|

Goodwill |

|

|

|

ROU asset |

|

|

|

Accounts payable |

|

( |

) |

Accrued and other current liabilities |

|

( |

) |

Deferred income tax liability |

|

( |

) |

Other long-term borrowings |

|

( |

) |

Net assets acquired and liabilities assumed |

|

|

|

Less: cash and cash equivalents acquired |

|

|

|

Less: contingent consideration payable |

|

|

|

Net cash paid |

$ |

|

|

In addition to the acquisitions discussed above, on April 18, 2022, the Company acquired certain other intangible assets for a purchase price of $

As discussed above, during the year ended December 31, 2022, the Company recorded additions to other intangible assets of $

(millions) |

|

Estimated Life |

|

Fair Value |

|

|

Proprietary know how |

|

|

$ |

|

||

Customer relationships |

|

|

|

|

||

Trade names |

|

|

|

|

||

Covenant not to compete |

|

|

|

|

||

Fair value of identified intangible assets |

|

|

|

$ |

|

|

The fair values of other intangible assets acquired were determined to be Level 3 under the fair value hierarchy. The fair value for all identifiable intangible assets is based on assumptions that market participants would use in pricing an asset, based on the most advantageous market for the asset.

The fair values of the Proprietary know how were determined using the multi-period excess earnings method under the income approach utilizing projected financial information for each technology that was acquired. The fair value of the customer relationships was determined using the distributor method under the income approach. The fair values of the trade names were determined using the relief from royalty savings method under the income approach. The Company considered the return on assets and market comparable methods when estimating an appropriate royalty rate for the trade names.

3. Leases

The Company leases parking facilities, office space, warehouses, vehicles and equipment and determines if an arrangement is a lease at inception. The Company subleases certain real estate to third parties. The Company's sublease portfolio consists of operating leases for space within leased parking facilities.

As discussed in Note 1. Significant Accounting Policies and Practices, the Company tests ROU assets for impairment when impairment indicators are present.

The components of ROU assets and lease liabilities and the classification within the Condensed Consolidated Balance Sheets as of September 30, 2023 (unaudited) and December 31, 2022 were as follows:

(millions) |

|

Classification |

|

September 30, 2023 |

|

|

December 31, 2022 |

|

||

Assets |

|

|

|

|

|

|

|

|

||

Operating |

|

Right-of-use assets |

|

$ |

|

|

$ |

|

||

Finance |

|

|

|

|

|

|

|

|||

Total leased assets |

|

|

|

$ |

|

|

$ |

|

||

Liabilities |

|

|

|

|

|

|

|

|

||

Current |

|

|

|

|

|

|

|

|

||

Operating |

|

Short-term lease liabilities |

|

$ |

|

|

$ |

|

||

Finance |

|

|

|

|

|

|

|

|||

Noncurrent |

|

|

|

|

|

|

|

|

||

Operating |

|

Long-term lease liabilities |

|

|

|

|

|

|

||

Finance |

|

|

|

|

|

|

|

|||

Total lease liabilities |

|

|

|

$ |

|

|

$ |

|

||

12

The components of lease cost and classification within the Condensed Consolidated Statements of Income during the three and nine months ended September 30, 2023 and 2022 (unaudited) were as follows:

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

||||||||||

(millions) |

|

Classification |

|

September 30, 2023 |

|

|

September 30, 2022 |

|

|

September 30, 2023 |

|

|

September 30, 2022 |

|

||||

Operating lease cost (a)(b) |

|

Cost of services - lease type contracts |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Short-term lease (a) |

|

Cost of services - lease type contracts |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Variable lease |

|

Cost of services - lease type contracts |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Operating lease cost |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Finance lease cost |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Amortization of leased assets |

|

Depreciation and amortization |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Interest on lease liabilities |

|

Interest expense |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Net lease cost |

|

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Sublease income was $

Maturities, lease term and discount rate information of lease liabilities as of September 30, 2023 (unaudited) were as follows:

(millions) |

|

Operating |

|

|

Finance |

|

|

Total |

|

|||

2023 |

|

$ |

|

|

$ |

|

|

$ |

|

|||

2024 |

|

|

|

|

|

|

|

|

|

|||

2025 |

|

|

|

|

|

|

|

|

|

|||

2026 |

|

|

|

|

|

|

|

|

|

|||

2027 |

|

|

|

|

|

|

|

|

|

|||

After 2027 |

|

|

|

|

|

|

|

|

|

|||

Total lease payments |

|

|

|

|

|

|

|

|

|

|||

Less: Imputed interest |

|

|

|

|

|

|

|

|

|

|||

Present value of lease liabilities |

|

$ |

|

|

$ |

|

|

$ |

|

|||

Weighted-average remaining lease term (years) |

|

|

|

|

|

|

|

|

|

|||

Weighted-average discount rate |

|

|

% |

|

|

% |

|

|

|

|||

Future sublease income for the above periods shown was excluded, as the amounts are not material.

Supplemental cash flow information related to leases during the nine months ended September 30, 2023 and 2022 (unaudited) was as follows:

|

|

Nine Months Ended |

|

|||||

(millions) |

|

September 30, 2023 |

|

|

September 30, 2022 |

|

||

Cash paid for amounts included in the measurement of lease liabilities |

|

|

|

|

|

|

||

Operating cash outflows related to operating leases |

|

$ |

|

|

$ |

|

||

Operating cash outflows related to interest on finance leases |

|

|

|

|

|

|

||

Financing cash outflows related to finance leases |

|

|

|

|

|

|

||

Leased assets obtained in exchange for new operating liabilities |

|

|

|

|

|

|

||

Leased assets obtained in exchange for new finance lease liabilities |

|

|

|

|

|

|

||

4. Revenue

The Company recognizes revenue when control of the promised goods or services is transferred to customers at an amount that reflects the consideration to which the entity expects to be entitled to in exchange for those goods or services.

13

Contracts with customers and clients

The Company accounts for a contract when it has the approval and commitment from both parties, the rights of the parties are identified, the payment terms are identified, the contract has commercial substance and collectability of consideration is probable. Once a contract is identified, the Company evaluates whether the contract should be accounted for as more than one performance obligation. Substantially all of the Company’s revenues come from the following two types of arrangements: Lease type and Management type contracts.

Management type contracts

Management type contract revenue consists of management fees, including both fixed and performance-based fees, and in some cases e-commerce technology fees, customer convenience fees and monthly subscription fees related to the use of the Company's technology solutions. In exchange for this consideration, the Company may have a bundle of integrated services that comprise one performance obligation and include services such as managing the facility, as well as ancillary services such as accounting, equipment leasing, consulting, insurance and other value-added services. Management type contract revenues do not include gross customer collections at the managed facilities as these revenues belong to the property owners rather than the Company. Management type contracts generally provide the Company with management fees regardless of the operating performance of the underlying facilities. Revenue is recognized over time as the Company provides services.

Lease type contracts

Lease type contract revenue includes gross receipts (net of local taxes), consulting fees, e-commerce technology fees, customer convenience fees, gains on sales of contracts and payments for exercising termination rights. Performance obligations related to lease type contracts include parking for transient and monthly parkers. Revenue is recognized over time as the Company provides services. Under lease type arrangements, the Company pays the property owner a fixed base rent, percentage rent that is tied to the facility’s financial performance, or a combination of both. The Company operates the parking facility and is responsible for most operating expenses, but typically is not responsible for major maintenance, capital expenditures or real estate taxes. Certain expenses, primarily rental expense for the contractual arrangements that meet the definition of service concession arrangements, are recorded as a reduction of Service revenue – lease type contracts.

Service concession arrangements

Certain expenses (primarily rental expense), as well as depreciation and amortization, related to service concessions arrangements for lease type contracts, are recorded as a reduction of Service revenue – lease type contracts.

The Company recorded cost concessions related to service concession arrangements (recognized as an increase to revenue) of $

Disaggregation of revenue

The Company disaggregates its revenue from contracts with customers by type of arrangement for each of the reportable segments. The Company has concluded that such disaggregation of revenue best depicts the overall economic nature, timing and uncertainty of the Company's revenue and cash flows affected by the economic factors of the respective contractual arrangement. See Note 13. Segment Information for further information on disaggregation of the Company's revenue by segment.

Performance obligations

As of September 30, 2023, the Company had $

14

The Company expects to recognize the remaining performance obligations as revenue in future periods as follows:

(millions) (unaudited) |

|

Remaining |

|

|

|

$ |

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

Total |

|

$ |

|

|

Contract balances

Contract assets and liabilities are reported on a contract-by-contract basis and are included in Accounts receivable, net, and Accrued and other current liabilities, respectively, within the Condensed Consolidated Balance Sheets.

The following table provides information about accounts receivable, contract assets and contract liabilities with customers and clients as of September 30, 2023 (unaudited) and December 31, 2022:

(millions) |

|

September 30, 2023 |

|

|

December 31, 2022 |

|

||

Accounts receivable |

|

$ |

|

|

$ |

|

||

Contract asset |

|

|

|

|

|

|

||

Contract liabilities |

|

|

( |

) |

|

|

( |

) |

Changes in contract assets, which include the recognition of additional consideration due from the client, are offset by reclassifications of contract asset balances to accounts receivable when the Company obtains an unconditional right to consideration, thereby establishing an accounts receivable. The following table provides information about changes to contract assets during the nine months ended September 30, 2023 and 2022 (unaudited):

|

|

Nine Months Ended |

|

|||||

(millions) |

|

September 30, 2023 |

|

|

September 30, 2022 |

|

||

Balance, beginning of period |

|

$ |

|

|

$ |

|

||

Additional contract assets |

|

|

|

|

|

|

||

Reclassification to accounts receivable |

|

|

( |

) |

|

|

( |

) |

Balance, end of period |

|

$ |

|

|

$ |

|

||

Changes in contract liabilities primarily include additional contract liabilities and reductions of contract liabilities when revenue is recognized. The following table provides information about changes to contract liabilities during the nine months ended September 30, 2023 and 2022 (unaudited):

|

|

Nine Months Ended |

|

|||||

(millions) |

|

September 30, 2023 |

|

|

September 30, 2022 |

|

||

Balance, beginning of period |

|

$ |

( |

) |

|

$ |

( |

) |

Additional contract liabilities |

|

|

( |

) |

|

|

( |

) |

Recognition of revenue from contract liabilities |

|

|

|

|

|

|

||

Balance, end of period |

|

$ |

( |

) |

|

$ |

( |

) |

Cost of contracts, net

Cost of contracts expense related to service concession arrangements and certain management type contracts are recorded as a reduction of revenue. Cost of contracts expense during the three and nine months ended September 30, 2023 and 2022 (unaudited), which was included as a reduction to Services revenue – management type contracts within the Condensed Consolidated Statements of Income, was as follows:

|

|

Three Months Ended |

|

Nine Months Ended |

|

||||||||||

(millions) |

|

September 30, 2023 |

|

|

September 30, 2022 |

|

September 30, 2023 |

|

|

September 30, 2022 |

|

||||

Cost of contracts expense |

|

$ |

|

|

$ |

|

$ |

|

|

$ |

|

||||

15

As of September 30, 2023 (unaudited) and December 31, 2022, cost of contracts, net of accumulated amortization, included in Other noncurrent assets within the Condensed Consolidated Balance Sheets was $

5. Legal and Other Commitments and Contingencies

The Company is subject to claims and litigation in the normal course of its business, including those related to labor and employment, contracts, personal injury and other related matters, some of which allege substantial monetary damages and claims. Some of these actions may be brought as class actions on behalf of a class or purported class of employees. While the outcomes of claims and legal proceedings brought against the Company are subject to uncertainty, the Company believes the final outcome will not have a material adverse effect on its financial position, results of operations or cash flows.

6. Other Intangible Assets, net

The components of other intangible assets, net, as of September 30, 2023 (unaudited) and December 31, 2022, were as follows:

|

|

|

|

|

September 30, 2023 |

|

|

December 31, 2022 |

|

|||||||||||||||||||

(millions) |

|

Weighted |

|

|

Intangible |

|

|

Accumulated |

|

|

Intangible |

|

|

Intangible |

|

|

Accumulated |

|

|

Intangible |

|

|||||||

Management contract rights |

|

|

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|||||

Proprietary know how |

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|||||

Customer relationships |

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|||||

Trade names and trademarks |

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|||||

Covenant not to compete |

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|||||

Other intangible assets, net |

|

|

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|||||

Amortization expense related to other intangible assets during the three and nine months ended September 30, 2023 and 2022, (unaudited), respectively, which was included in Depreciation and amortization within the Condensed Consolidated Statements of Income, was as follows:

|

|

Three Months Ended |

|

Nine Months Ended |

|

||||||||||

(millions) |

|

September 30, 2023 |

|

|

September 30, 2022 |

|

September 30, 2023 |

|

|

September 30, 2022 |

|

||||

Amortization expense |

|

$ |

|

|

$ |

|

$ |

|

|

$ |

|

||||

7. Goodwill

The changes in the carrying amount of goodwill during the nine months ended September 30, 2023 (unaudited) were as follows:

(millions) |

|

Commercial |

|

|

Aviation |

|

|

Total |

|

|||

Net book value as of December 31, 2022 |

|

|

|

|

|

|

|

|

|

|||

Goodwill |

|

$ |

|

|

$ |

|

|

$ |

|

|||

Accumulated impairment losses |

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Total |

|

$ |

|

|

$ |

|

|

$ |

|

|||

Acquisition |

|

|

|

|

|

— |

|

|

|

|

||

Foreign currency translation |

|

|

— |

|

|

|

|

|

|

|

||

Net book value as of September 30, 2023 |

|

|

|

|

|

|

|

|

|

|||

Goodwill |

|

$ |

|

|

$ |

|

|

$ |

|

|||

Accumulated impairment losses |

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Total |

|

$ |

|

|

$ |

|

|

$ |

|

|||

8. Borrowing Arrangements

Long-term borrowings, as of September 30, 2023 (unaudited) and December 31, 2022, in order of preference, were as follows:

|

|

Amount Outstanding |

|

|||||

(millions) |

|

September 30, |

|

|

December 31, |

|

||

Senior Credit Facility, net of original discount on borrowings(1) |

|

$ |

|

|

$ |

|

||

Other borrowings(2) |

|

|

|

|

|

|

||

Deferred financing costs |

|

|

( |

) |

|

|

( |

) |

Total obligations |

|

|

|

|

|

|

||

Less: Current portion of long-term borrowings |

|

|

|

|

|

|

||

Total long-term borrowings, excluding current portion |

|

$ |

|

|

$ |

|

||

16

Senior Credit Facility

On April 21, 2022 (the “Fifth Amendment Effective Date”), the Company entered into a fifth amendment (the “Fifth Amendment”) to the Company’s credit agreement (as amended prior to the Fifth Amendment Effective Date, the “Credit Agreement”; the Credit Agreement, as amended by the Fifth Amendment, the “Amended Credit Agreement”) with Bank of America, N.A. (“Bank of America”), as Administrative Agent, swing-line lender and a letter of credit issuer; certain subsidiaries of the Company, as guarantors; and the lenders party thereto (the “Lenders”), pursuant to which the Lenders have made available to the Company a senior secured credit facility (the “Senior Credit Facility”). The Senior Credit Facility permits aggregate borrowings of $

As of September 30, 2023, the Company had $

The weighted average interest rate on the Senior Credit Facility was

Subordinated Convertible Debentures

The Company acquired Subordinated Convertible Debentures ("Convertible Debentures") as a result of the October 2, 2012 acquisition of Central Parking Corporation. As of October 2, 2012, the Convertible Debentures were no longer redeemable for shares. The Convertible Debentures mature on April 1, 2028 at $

9. Stock Repurchase Program

On February 14, 2023, the Company's Board of Directors (the "Board") authorized the Company to repurchase, on the open market, shares of the Company's outstanding common stock in an amount not to exceed $

In May 2022, the Board authorized the Company to repurchase, on the open market, shares of the Company’s outstanding common stock in an amount not to exceed $

As a condition of the Merger Agreement (As defined in Note 14. Subsequent Events), beginning on October 4, 2023, the Company is restricted from repurchasing its common stock.

Stock repurchase activity under the May 2022 stock repurchase program during the three and nine months ended September 30, 2023 and 2022 (unaudited) was as follows:

|

|

Three Months Ended |

|

Nine Months Ended |

|

||||||||||

(millions, except for share and per share data) |

|

September 30, 2023 |

|

|

September 30, 2022 |

|

September 30, 2023 |

|

|

September 30, 2022 |

|

||||

Total number of shares repurchased |

|

|

— |

|

|

|

|

|

|

|

|

|

|||

Average price paid per share |

|

$ |

— |

|

|

$ |

|

$ |

|

|

$ |

|

|||

Total value of common stock repurchased |

|

$ |

— |

|

|

$ |

|

$ |

|

|

$ |

|

|||

The Company recorded $

The remaining authorized repurchase amount under the May 2022 and February 2023 stock repurchase programs as of September 30, 2023 (unaudited), was as follows:

17

(millions) |

|

September 30, 2023 |

|

|

Total authorized repurchase amount |

|

$ |

|

|

Total value of shares repurchased |

|

|

|

|

Total remaining authorized repurchase amount |

|

$ |

|

|

10. Stock-Based Compensation

Stock Grants

The Company granted

Restricted Stock Units

During the nine months ended September 30, 2023, the Company granted

Nonvested restricted stock units as of September 30, 2023, and changes during the nine months ended September 30, 2023 (unaudited) were as follows:

|

|

Shares |

|

|

Weighted Average Grant-Date Fair Value |

|

||

Nonvested as of December 31, 2022 |

|

|

|

|

$ |

|

||

Granted |

|

|

|

|

|

|

||

Vested |

|

|

( |

) |

|

|

|

|

Nonvested as of September 30, 2023 |

|

|

|

|

$ |

|

||

The Company's stock-based compensation expense related to the restricted stock units during the three and nine months ended September 30, 2023 and 2022 (unaudited), which was included in General and administrative expenses within the Condensed Consolidated Statements of Income, was as follows:

|

|

Three Months Ended |

|

Nine Months Ended |

|

||||||||||

(millions) |

|

September 30, 2023 |

|

|

September 30, 2022 |

|

September 30, 2023 |

|

|

September 30, 2022 |

|

||||

Stock-based compensation expense |

|

$ |

|

|

$ |

|

$ |

|

|

$ |

|

||||

As of September 30, 2023, there was $

Performance Share Units (“PSUs”)

During the nine months ended September 30, 2023 and 2022, the Company granted

Nonvested PSUs as of September 30, 2023, and changes during the nine months ended September 30, 2023 (unaudited), were as follows:

|

|

Shares |

|

|

Weighted Average Grant-Date Fair Value |

|

||

Nonvested as of December 31, 2022 |

|

|

|

|

$ |

|

||

Granted |

|

|

|

|

|

|

||

Nonvested as of September 30, 2023 |

|

|

|

|

$ |

|

||

18