|

Investment Company Act file number: 811-08747

|

|

|

|

|

SEEKING PRIMARILY HIGH CURRENT INCOME

AND SECONDARILY CAPITAL APPRECIATION

DIVIDEND

AND INCOME

FUND

DECEMBER 31, 2016

ANNUAL REPORT

|

WWW.DIVIDENDANDINCOMEFUND.COM

|

|

PORTFOLIO ANALYSIS

|

||

|

December 31, 2016

|

Top ten holdings and industries are shown for informational purposes only and are subject to change. The above portfolio information should not be considered as a recommendation to purchase or sell a particular security and is not indicative of future portfolio characteristics. There is no assurance that any securities will remain in or out of the Fund.

|

DIVIDEND AND INCOME FUND

|

Annual Report 2016

|

|

TO OUR SHAREHOLDERS

|

||

|

December 31, 2016

|

|

1 Annual Report 2016 |

DIVIDEND AND INCOME FUND

|

|

TO OUR SHAREHOLDERS

|

||

|

December 31, 2016

|

|

DIVIDEND AND INCOME FUND

|

Annual Report 2016 2

|

|

SCHEDULE OF PORTFOLIO INVESTMENTS

|

December 31, 2016

|

|

|

Financial Statements

|

|

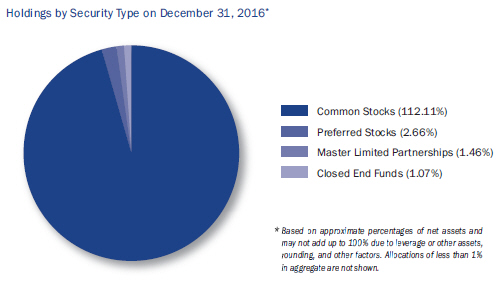

Common Stocks (112.11%)

|

Shares

|

Value

|

Shares

|

Value

|

||||||||||||||||

|

Agricultural Chemicals (2.00%) |

|

Computer & Office Equipment (0.99%) | ||||||||||||||||||

|

Monsanto Company |

15,000 | $ 1,578,150 |

International Business Machines Corporation |

9,000 | $ 1,493,910 | |||||||||||||||

|

Potash Corporation of Saskatchewan Inc. |

80,000 | 1,447,200 | ||||||||||||||||||

|

|

|

|||||||||||||||||||

| 3,025,350 |

Construction, Mining & Materials Handling Machinery & |

|

||||||||||||||||||

|

Agriculture Production - Livestock & Animal Specialties (0.67%) |

|

Dover Corp. |

13,500 | 1,011,555 | ||||||||||||||||

|

Cal-Maine Foods, Inc. (a) |

23,000 | 1,016,025 | ||||||||||||||||||

|

Deep Sea Foreign Transportation of Freight (0.87%) |

|

|||||||||||||||||||

|

Aircraft Engines & Engine Parts (0.29%) |

Costamare Inc. |

130,000 | 728,000 | |||||||||||||||||

|

United Technologies Corporation |

3,980 | 436,288 |

DHT Holdings, Inc. (a) |

140,000 | 579,600 | |||||||||||||||

|

|

|

|||||||||||||||||||

| 1,307,600 | ||||||||||||||||||||

|

Air Transportation, Scheduled (4.05%) |

||||||||||||||||||||

|

Alaska Air Group, Inc. (a) (b) |

27,000 | 2,395,710 |

Drilling Oil & Gas Wells (0.98%) |

|||||||||||||||||

|

Allegiant Travel Company (a) (b) |

13,700 | 2,279,680 |

Transocean Ltd. (c) |

100,000 | 1,474,000 | |||||||||||||||

|

Southwest Airlines Co. (a) |

29,000 | 1,445,360 | ||||||||||||||||||

|

|

|

|||||||||||||||||||

| 6,120,750 |

Electric Services (1.55%) |

|||||||||||||||||||

|

Southern Company |

47,500 | 2,336,525 | ||||||||||||||||||

|

Apparel & Other Finished Products of Fabrics & Similar Material (1.39%) |

|

|||||||||||||||||||

|

Carter’s, Inc. |

24,300 | 2,099,277 |

Electronic & Other Electrical Equipment (0.96%) |

|

||||||||||||||||

|

Emerson Electric Co. (a) (b) |

26,000 | 1,449,500 | ||||||||||||||||||

|

Biological Products (2.63%) |

||||||||||||||||||||

|

Amgen Inc. (b) |

13,500 | 1,973,835 |

Electronic Components, Not Elsewhere Classified (1.47%) |

|

||||||||||||||||

|

Gilead Sciences, Inc. (b) |

28,000 | 2,005,080 |

TE Connectivity Ltd. (a) |

32,000 | 2,216,960 | |||||||||||||||

|

|

|

|||||||||||||||||||

| 3,978,915 | ||||||||||||||||||||

|

Electronic Computers (1.57%) |

|

|||||||||||||||||||

|

Blankbooks, Looseleaf Binders & Bookbinding & Related Work (1.28%) |

|

Apple Inc. (b) |

20,500 | 2,374,310 | ||||||||||||||||

|

Deluxe Corporation (b) |

27,000 | 1,933,470 | ||||||||||||||||||

|

Electronic Connectors (0.68%) |

|

|||||||||||||||||||

|

Cable & Other Pay Television Services (3.42%) |

|

Methode Electronics, Inc. |

25,000 | 1,033,750 | ||||||||||||||||

|

Rogers Communications Inc. |

32,500 | 1,253,850 | ||||||||||||||||||

|

Scripps Networks Interactive, Inc. |

33,000 | 2,355,210 |

Engines & Turbines (0.31%) |

|

||||||||||||||||

|

The Walt Disney Company |

15,000 | 1,563,300 |

Cummins Inc. (b) |

3,400 | 464,678 | |||||||||||||||

|

|

|

|||||||||||||||||||

| 5,172,360 | ||||||||||||||||||||

|

Finance Services (1.18%) |

|

|||||||||||||||||||

|

Cigarettes (1.70%) |

American Express Company (b) |

24,000 | 1,777,920 | |||||||||||||||||

|

Philip Morris International, Inc. |

28,000 | 2,561,720 | ||||||||||||||||||

|

Food & Kindred Products (0.70%) |

|

|||||||||||||||||||

|

Commercial Banks (2.39%) |

Nestle S.A. |

14,700 | 1,054,578 | |||||||||||||||||

|

Australia and New Zealand Banking |

30,000 | 660,816 |

Grocery Stores (0.68%) |

|

||||||||||||||||

|

Lloyds Banking Group plc ADR |

243,700 | 755,470 |

The Kroger Co. (a) |

30,000 | 1,035,300 | |||||||||||||||

|

The Royal Bank of Scotland Group |

141,200 | 780,836 |

Hotels & Motels (1.52%) |

|

||||||||||||||||

|

Westpac Banking Corporation |

60,000 | 1,408,800 |

Wyndham Worldwide Corporation (a) |

30,000 | 2,291,100 | |||||||||||||||

|

|

|

|||||||||||||||||||

| 3,605,922 | ||||||||||||||||||||

|

Industrial Organic Chemicals (1.56%) |

|

|||||||||||||||||||

|

Computer and Computer Software Stores (0.67%) |

|

LyondellBasell Industries N.V. Class A |

27,500 | 2,358,950 | ||||||||||||||||

|

GameStop Corp. (b) |

40,000 | 1,010,400 | ||||||||||||||||||

|

Industrial Trucks, Tractors, Trailers, and Stackers (0.85%) |

|

|||||||||||||||||||

|

PACCAR Inc. |

20,000 | 1,278,000 | ||||||||||||||||||

See notes to financial statements.

|

3 Annual Report 2016 |

DIVIDEND AND INCOME FUND

|

|

SCHEDULE OF PORTFOLIO INVESTMENTS

|

December 31, 2016

|

|

|

Financial Statements

|

|

Common Stocks (continued)

|

Shares

|

Value

|

Shares

|

Value

|

||||||||||||||||

|

Investment Advice (6.11%) |

Ordnance & Accessories (1.50%) |

|||||||||||||||||||

|

Ameriprise Financial Inc. |

9,600 | $ 1,065,024 |

Sturm, Ruger & Company, Inc. (a) |

43,000 | $ 2,266,100 | |||||||||||||||

|

Cohen & Steers, Inc. (b) |

65,000 | 2,184,000 | ||||||||||||||||||

|

Federated Investors, Inc. (a) (b) |

81,000 | 2,290,680 |

Other Chemical Products (0.78%) |

|||||||||||||||||

|

Franklin Resources, Inc. (a) (b) |

21,700 | 858,886 |

Praxair, Inc. (a) |

10,000 | 1,171,900 | |||||||||||||||

|

Invesco Ltd. |

37,000 | 1,122,580 | ||||||||||||||||||

|

Lazard Ltd. |

41,500 | 1,705,235 |

Other Educational Services (0.68%) |

|||||||||||||||||

|

|

|

|||||||||||||||||||

| 9,226,405 |

Grand Canyon Education, Inc. (b) |

17,500 | 1,022,875 | |||||||||||||||||

|

Jewelry Stores (0.84%) |

Paperboard Containers & Boxes (1.46%) |

|||||||||||||||||||

|

Signet Jewelers Limited (a) |

13,400 | 1,263,084 |

Packaging Corporation of America (a) |

26,000 | 2,205,320 | |||||||||||||||

|

Lessors of Real Property, Not Elsewhere Classified (0.61%) |

|

Personal Credit Institutions (2.71%) |

||||||||||||||||||

|

HFF, Inc. |

30,724 | 929,401 |

Credit Acceptance Corporation (a) (b) |

11,500 | 2,501,365 | |||||||||||||||

| Discover Financial Services (a) (b) | 22,000 | 1,585,980 | ||||||||||||||||||

|

|

|

|||||||||||||||||||

|

Life Insurance (0.91%) |

4,087,345 | |||||||||||||||||||

|

Prudential Financial, Inc. |

13,200 | 1,373,592 | ||||||||||||||||||

|

Petroleum Refining (2.18%) |

||||||||||||||||||||

|

Lumber and Other Building Materials Dealers (1.51%) |

|

Phillips 66 |

20,500 | 1,771,405 | ||||||||||||||||

|

The Home Depot, Inc. (b) |

17,000 | 2,279,360 | Western Refining, Inc. | 40,000 | 1,514,000 | |||||||||||||||

|

|

|

|||||||||||||||||||

| 3,285,405 | ||||||||||||||||||||

|

Measuring & Controlling Devices (0.92%) |

||||||||||||||||||||

|

Rockwell Automation, Inc. |

10,300 | 1,384,320 |

Pharmaceutical Preparations (0.45%) |

|||||||||||||||||

|

Shire plc |

4,001 | 681,690 | ||||||||||||||||||

|

Metal Mining (0.89%) |

||||||||||||||||||||

|

Rio Tinto plc ADR (a) |

35,000 | 1,346,100 |

Plastic Materials, Synthetic Resins & Nonvulcan Elastomers (2.32%) |

|

||||||||||||||||

|

The Dow Chemical Company (b) |

40,000 | 2,288,800 | ||||||||||||||||||

|

Miscellaneous Industrial & Commercial Machinery & Equipment (0.80%) |

|

Hexcel Corporation (a) (b) |

23,500 | 1,208,840 | ||||||||||||||||

|

|

|

|||||||||||||||||||

|

Eaton Corporation plc |

18,000 | 1,207,620 | 3,497,640 | |||||||||||||||||

|

Motor Vehicle Parts & Accessories (3.75%) |

|

Potash, Soda, and Borate Minerals (0.62%) |

||||||||||||||||||

|

BorgWarner Inc. (a) (b) |

22,000 | 867,680 |

Ciner Resources LP |

32,238 | 937,481 | |||||||||||||||

|

Honeywell International Inc. |

13,500 | 1,563,975 | ||||||||||||||||||

|

Lear Corporation |

7,000 | 926,590 |

Radio & TV Broadcasting & Communications Equipment (2.28%) |

|

||||||||||||||||

|

Magna International Inc. |

53,000 | 2,300,200 |

QUALCOMM, Incorporated |

20,000 | 1,304,000 | |||||||||||||||

|

|

|

|||||||||||||||||||

| 5,658,445 |

Ubiquiti Networks, Inc. (a) (c) |

37,000 | 2,138,600 | |||||||||||||||||

|

|

|

|||||||||||||||||||

| 3,442,600 | ||||||||||||||||||||

|

Motor Vehicles & Passenger Car Bodies (2.91%) |

|

|||||||||||||||||||

|

Ford Motor Company (b) |

160,000 | 1,940,800 |

Railroads, Line-Haul Operating (1.94%) |

|||||||||||||||||

|

General Motors Company (b) |

41,500 | 1,445,860 |

Norfolk Southern Corp. |

15,000 | 1,621,050 | |||||||||||||||

|

Volkswagen AG |

35,000 | 1,003,975 |

Union Pacific Corporation |

12,650 | 1,311,552 | |||||||||||||||

|

|

|

|

|

|||||||||||||||||

| 4,390,635 | 2,932,602 | |||||||||||||||||||

|

Real Estate Agents & Managers (For Others) (1.49%) |

|

|||||||||||||||||||

|

ILG, Inc. (a) |

124,000 | 2,253,080 | ||||||||||||||||||

|

National Commercial Banks (1.79%) |

|

|||||||||||||||||||

|

Capital One Financial Corporation (a) (b) |

20,200 | 1,762,248 | ||||||||||||||||||

|

The PNC Financial Services Group, Inc. |

8,000 | 935,680 |

Retail - Building Materials, Hardware, Garden Supply (1.51%) |

|

||||||||||||||||

|

|

|

|||||||||||||||||||

| 2,697,928 |

The Sherwin-Williams Company |

8,500 | 2,284,290 | |||||||||||||||||

|

Retail - Department Stores (1.51%) |

||||||||||||||||||||

|

Dillard’s, Inc. (a) (b) |

13,800 | 865,122 | ||||||||||||||||||

|

Kohl’s Corporation (a) |

28,600 | 1,412,268 | ||||||||||||||||||

|

|

|

|||||||||||||||||||

| 2,277,390 | ||||||||||||||||||||

See notes to financial statements.

|

DIVIDEND AND INCOME FUND

|

Annual Report 2016 4

|

|

SCHEDULE OF PORTFOLIO INVESTMENTS

|

December 31, 2016

|

|

|

Financial Statements

|

|

Common Stocks (concluded)

|

Shares

|

Value

|

Shares

|

Value

|

||||||||||||||||

|

Retail - Family Clothing Stores (0.78%) |

Services - Prepackaged Software (1.15%) |

|||||||||||||||||||

|

The Buckle, Inc. (a) (b) |

12,650 | $ 288,420 |

Oracle Corporation |

45,000 | $ 1,730,250 | |||||||||||||||

|

The GAP, Inc. (a) (b) |

40,000 | 897,600 | ||||||||||||||||||

|

|

|

|||||||||||||||||||

| 1,186,020 |

Ship & Boat Building & Repairing (0.57%) |

|||||||||||||||||||

|

Huntington Ingalls Industries, Inc. (b) |

4,700 | 865,693 | ||||||||||||||||||

|

Retail - Home Furniture, Furnishings & Equipment Stores (1.31%) |

|

|||||||||||||||||||

|

Williams-Sonoma, Inc. (a) |

41,000 | 1,983,990 |

Special Industry Machinery (0.98%) |

|||||||||||||||||

|

Lam Research Corporation |

14,000 | 1,480,220 | ||||||||||||||||||

|

Security & Commodity Brokers, Dealers, Exchanges & Services (1.54%) |

|

|||||||||||||||||||

|

T. Rowe Price Group, Inc. (a) |

30,900 | 2,325,534 |

Sporting Goods Stores (0.94%) |

|||||||||||||||||

|

Dick’s Sporting Goods, Inc. (a) |

26,764 | 1,421,168 | ||||||||||||||||||

|

Security Brokers, Dealers, and Flotation Companies (1.45%) |

|

|||||||||||||||||||

|

GAMCO Investors, Inc. (b) |

71,000 | 2,193,190 |

Surety Insurance (1.25%) |

|||||||||||||||||

|

Assured Guaranty Ltd. (a) |

50,000 | 1,888,500 | ||||||||||||||||||

|

Semiconductors & Related Devices (3.79%) |

||||||||||||||||||||

|

Intel Corporation (a) |

65,000 | 2,357,550 |

Telephone Communications (1.59%) |

|||||||||||||||||

|

Skyworks Solutions, Inc. (a) |

27,000 | 2,015,820 |

Verizon Communications Inc. |

45,000 | 2,402,100 | |||||||||||||||

|

Texas Instruments Incorporated |

18,500 | 1,349,945 | ||||||||||||||||||

|

|

|

|||||||||||||||||||

| 5,723,315 |

Title Insurance (1.58%) |

|||||||||||||||||||

|

First American Financial Corporation (a) (b) |

65,000 | 2,380,950 | ||||||||||||||||||

|

Services - Advertising Agencies (0.52%) |

||||||||||||||||||||

|

Omnicom Group Inc. (a) |

9,200 | 783,012 |

Transportation Equipment (1.14%) |

|||||||||||||||||

|

Polaris Industries Inc. (a) |

20,900 | 1,721,951 | ||||||||||||||||||

|

Services - Business Services (1.19%) |

||||||||||||||||||||

|

The Western Union Company (a) |

83,000 | 1,802,760 |

Variety Stores (3.64%) |

|||||||||||||||||

|

Big Lots, Inc. (a) (b) |

30,000 | 1,506,300 | ||||||||||||||||||

|

Services - Computer Processing & Data Preparation (1.56%) |

|

Dollar General Corporation (b) |

20,600 | 1,525,842 | ||||||||||||||||

|

DST Systems, Inc. (b) |

22,000 | 2,357,300 |

Wal-Mart Stores, Inc. (a) |

35,650 | 2,464,128 | |||||||||||||||

|

|

|

|||||||||||||||||||

| 5,496,270 | ||||||||||||||||||||

|

Services - Computer Programming Services (0.18%) |

|

|||||||||||||||||||

|

Syntel, Inc. (a) (c) |

13,754 | 272,192 |

Wholesale - Drugs, Proprietaries & Druggists’ Sundries (2.18%) |

|

||||||||||||||||

|

AmerisourceBergen Corporation (a) |

13,500 | 1,055,565 | ||||||||||||||||||

|

Services - Help Supply Services (1.18%) |

|

Cardinal Health, Inc. |

31,000 | 2,231,070 | ||||||||||||||||

|

|

|

|||||||||||||||||||

|

Robert Half International Inc. (a) |

36,700 | 1,790,226 | 3,286,635 | |||||||||||||||||

|

Wholesale - Electronic Parts & Equipment (1.01%) |

|

|||||||||||||||||||

|

Services - Medical Laboratories (1.19%) |

Avnet, Inc. (a) (b) |

32,000 | 1,523,520 | |||||||||||||||||

|

Laboratory Corporation of America Holdings (a) (c) |

14,000 | 1,797,320 | ||||||||||||||||||

|

Wholesale - Industrial Machinery & Equipment (1.22%) |

|

|||||||||||||||||||

|

Services - Miscellaneous Repair Services (0.0%) |

|

MSC Industrial Direct Co., Inc. (a) |

20,000 | 1,847,800 | ||||||||||||||||

|

|

|

|||||||||||||||||||

|

Aquilex Holdings LLC Units (c) (d) |

756 | 0 | ||||||||||||||||||

|

Total common stocks (Cost $162,252,662) |

169,290,898 | |||||||||||||||||||

|

|

|

|||||||||||||||||||

|

Services - Personal Services (0.67%) |

|

|||||||||||||||||||

|

H&R Block, Inc. (a) |

43,900 | 1,009,261 | ||||||||||||||||||

See notes to financial statements.

|

5 Annual Report 2016 |

DIVIDEND AND INCOME FUND

|

|

SCHEDULE OF PORTFOLIO INVESTMENTS

|

December 31, 2016

|

|

|

Financial Statements

|

|

Principal

|

Value

|

Shares

|

Value

|

|||||||||||||||

|

Corporate Bonds and Notes (0.77%) |

Preferred Stocks (2.66%) |

|

||||||||||||||||

|

Cogeneration Services & Small Power Producers (0.30%) |

Financial (1.76%) |

|

||||||||||||||||

|

Covanta Holding Corp., 7.25%, 12/1/20 |

450,000 | $ 459,787 |

Annaly Capital Management, Inc., 7.625% |

79,469 | $ 1,915,203 | |||||||||||||

|

Electric Services (0.36%) |

Annaly Capital Management, Inc., 7.625% |

|||||||||||||||||

|

Elwood Energy LLC, 8.159%, 7/5/26 |

490,360 | 551,655 |

Series E |

30,809 | 742,497 | |||||||||||||

|

|

|

|||||||||||||||||

| 2,657,700 | ||||||||||||||||||

|

Oil & Gas Field Exploration Services (0.11%) |

||||||||||||||||||

|

CGG-Veritas, 7.75%, 5/15/17 |

169,000 | 159,705 |

Deep Sea Foreign Transportation of Freight (0.37%) |

|

||||||||||||||

|

|

|

|||||||||||||||||

|

Costamare Inc., 8 3/4% Series D |

25,000 | 555,000 | ||||||||||||||||

|

Total corporate bonds and notes (Cost $1,135,210) |

1,171,147 | |||||||||||||||||

|

|

|

|||||||||||||||||

|

Real Estate Investment Trusts (0.53%) |

|

|||||||||||||||||

|

Public Storage Depositary Shares, 4.95% |

||||||||||||||||||

|

Shares

|

7,500 | 159,000 | ||||||||||||||||

|

Closed End Funds (1.07%) |

|

Public Storage Depositary Shares, 4.90% |

26,168 | 552,145 | ||||||||||||||

|

Neuberger Berman Real Estate Securities Income Fund, Inc. |

|

Vornado Realty Trust, 5.40% Series L |

4,357 | 97,814 | ||||||||||||||

|

|

|

|||||||||||||||||

|

(Cost $1,607,429) |

300,000 | 1,611,000 | 808,959 | |||||||||||||||

|

|

|

|

|

|||||||||||||||

|

Total preferred stocks (Cost $3,804,364) |

4,021,659 | |||||||||||||||||

|

|

|

|||||||||||||||||

|

Reorganization Interests (0%) |

|

|||||||||||||||||

|

Penson Technologies LLC Units (c) (d) |

||||||||||||||||||

|

(Cost $ 0) |

813,527 | 0 |

Money Market Fund (0.37%) |

|

||||||||||||||

|

|

|

|||||||||||||||||

|

State Street Institutional U.S. Government Money Market Fund, |

|

|||||||||||||||||

|

Master Limited Partnerships (1.46%) |

Administration Class shares 7 day annualized yield 0.17% |

|

||||||||||||||||

|

Natural Gas Transmission (1.46%) |

(Cost $557,838) |

557,838 | 557,838 | |||||||||||||||

|

|

|

|||||||||||||||||

|

Enterprise Products Partners LP (b) |

40,000 | 1,081,600 | ||||||||||||||||

|

Spectra Energy Partners, LP |

24,400 | 1,118,496 |

Total investments (Cost $170,780,695) (118.44%) |

|

178,852,638 | |||||||||||||

|

|

|

|

|

|||||||||||||||

|

Total master limited partnerships (Cost $1,423,192) |

2,200,096 |

Liabilities in excess of other assets (-18.44%) |

|

(27,847,674 | ) | |||||||||||||

|

|

|

|

|

|||||||||||||||

|

Net assets (100.00%) |

|

$151,004,964 | ||||||||||||||||

|

|

|

|||||||||||||||||

|

(a) |

All or a portion of this security is on loan, and is a component of the Fund’s leverage under the Liquidity Agreement. As of December 31, 2016, the value of the securities on loan was $24,963,826. |

|

|

(b) |

All or a portion of this security has been pledged as collateral to secure the Fund’s obligations under the Liquidity Agreement. As of December 31, 2016, the value of securities pledged as collateral was $4,333,284. |

|

|

(c) |

Non-income producing. |

|

|

(d) |

Illiquid and/or restricted security that has been fair valued. |

ADR American Depositary Receipt

LLC Limited Liability Company

LP Limited Partnership

PLC Public Limited Company

See notes to financial statements.

|

DIVIDEND AND INCOME FUND

|

Annual Report 2016 6

|

|

STATEMENT OF ASSETS AND LIABILITIES

|

||

|

Financial Statements

|

|

December 31, 2016

|

||||||

| Assets | ||||||

| Investments, at value (cost: $170,780,695) | $178,852,638 | |||||

| Receivables: | ||||||

|

Dividends |

215,909 | |||||

|

Interest |

24,048 | |||||

|

Foreign withholding tax reclaims |

11,877 | |||||

| Other assets | 28,088 | |||||

|

|

||||||

| Total assets | 179,132,560 | |||||

|

|

||||||

| Liabilities | ||||||

| Liquidity agreement borrowing | 27,780,000 | |||||

| Payables: | ||||||

|

Accrued expenses |

174,876 | |||||

|

Investment management |

146,801 | |||||

|

Administrative services |

22,233 | |||||

|

Trustees |

3,686 | |||||

|

|

||||||

|

Total liabilities |

28,127,596 | |||||

|

|

||||||

| Net Assets | $151,004,964 | |||||

|

|

||||||

| Net Asset Value Per Share | ||||||

| (applicable to 10,649,171 shares issued and outstanding) | $ 14.18 | |||||

|

|

||||||

| Net Assets Consist of | ||||||

| Paid in capital | $143,871,823 | |||||

| Accumulated net realized loss on investments | (938,111) | |||||

| Net unrealized appreciation on investments | 8,071,252 | |||||

|

|

||||||

| $151,004,964 | ||||||

|

|

||||||

|

See notes to financial statements. |

||||||

|

7 Annual Report 2016 |

DIVIDEND AND INCOME FUND

|

|

STATEMENT OF OPERATIONS

|

||

|

Financial Statements

|

|

Year Ended

|

||||||

|

Investment Income |

||||||

|

Dividends (net of $54,920 foreign tax withholding) |

$ 4,752,027 | |||||

|

Interest |

144,603 | |||||

|

Securities lending income, net |

22,827 | |||||

|

|

||||||

|

Total investment income |

4,919,457 | |||||

|

|

||||||

|

Expenses |

||||||

|

Investment management |

1,410,682 | |||||

|

Interest and fees on bank borrowings |

222,431 | |||||

|

Administrative services |

213,445 | |||||

|

Bookkeeping and pricing |

74,670 | |||||

|

Legal |

69,427 | |||||

|

Shareholder communications |

63,323 | |||||

|

Trustees |

61,213 | |||||

|

Insurance |

44,250 | |||||

|

Exchange listing and registration |

43,600 | |||||

|

Auditing |

42,090 | |||||

|

Custodian |

32,567 | |||||

|

Transfer agent |

15,745 | |||||

|

Other |

7,130 | |||||

|

|

||||||

|

Total expenses |

2,300,573 | |||||

|

Expense reduction |

(307) | |||||

|

|

||||||

|

Net expenses |

2,300,266 | |||||

|

|

||||||

|

Net investment income |

2,619,191 | |||||

|

|

||||||

|

Realized and Unrealized Gain (Loss) |

||||||

|

Net realized gain (loss) on |

||||||

|

Investments |

14,588,381 | |||||

|

Foreign currencies |

(13,507) | |||||

|

Unrealized appreciation (depreciation) on |

||||||

|

Investments |

4,954,563 | |||||

|

Translation of assets and liabilities in foreign currencies |

(414) | |||||

|

|

||||||

|

Net realized and unrealized gain |

19,529,023 | |||||

|

|

||||||

|

Net increase in net assets resulting from operations |

$ 22,148,214 | |||||

|

|

||||||

|

See notes to financial statements. |

||||||

|

DIVIDEND AND INCOME FUND

|

Annual Report 2016 8

|

|

STATEMENTS OF CHANGES IN NET ASSETS

|

||

|

Financial Statements

|

|

Year Ended

|

Year Ended

|

|||||||||||

|

Operations |

||||||||||||

|

Net investment income |

$ 2,619,191 | $ 2,813,403 | ||||||||||

|

Net realized gain on investments |

14,574,874 | 4,964,667 | ||||||||||

|

Unrealized appreciation (depreciation) on investments |

4,954,149 | (20,575,304) | ||||||||||

|

|

|

|||||||||||

|

Net increase (decrease) in net assets resulting from operations |

22,148,214 | (12,797,234) | ||||||||||

|

|

|

|||||||||||

|

Distributions to Shareholders |

||||||||||||

|

Net investment income |

(2,423,544) | (2,393,241) | ||||||||||

|

Return of capital |

(8,168,833) | (12,516,950) | ||||||||||

|

|

|

|||||||||||

|

Total distributions |

(10,592,377) | (14,910,191) | ||||||||||

|

|

|

|||||||||||

|

Capital Share Transactions |

||||||||||||

|

Reinvestment of distributions to shareholders |

1,031,696 | 958,981 | ||||||||||

|

Proceeds from shares issued in rights offering |

- | 21,162,983 | ||||||||||

|

Offering costs of rights offering charged to paid in capital |

- | (276,827) | ||||||||||

|

|

|

|||||||||||

|

Increase in net assets from capital share transactions |

1,031,696 | 21,845,137 | ||||||||||

|

|

|

|||||||||||

|

Total change in net assets |

12,587,533 | (5,862,288) | ||||||||||

|

Net Assets |

||||||||||||

|

Beginning of period |

138,417,431 | 144,279,719 | ||||||||||

|

|

|

|||||||||||

|

End of period |

$151,004,964 | $ 138,417,431 | ||||||||||

|

|

|

|||||||||||

|

End of period net assets include undistributed net investment income |

$ - | $ - | ||||||||||

|

|

|

|||||||||||

|

See notes to financial statements. |

||||||||||||

|

9 Annual Report 2016 |

DIVIDEND AND INCOME FUND

|

|

STATEMENT OF CASH FLOWS

|

||

|

Financial Statements

|

|

Year Ended December 31, 2016

|

||||||||

|

Cash Flows From Operating Activities |

||||||||

|

Net increase in net assets resulting from operations |

$ 22,148,214 | |||||||

|

Adjustments to reconcile increase in net assets resulting from operations to net cash provided by (used in) operating activities: |

||||||||

|

Unrealized appreciation of investments |

(4,954,149) | |||||||

|

Net realized gain on sales of investments |

(14,574,874) | |||||||

|

Purchase of long term investments |

(113,795,256) | |||||||

|

Proceeds from sales of long term investments |

101,092,413 | |||||||

|

Net purchases of short term investments |

(553,038) | |||||||

|

Amortization of premium net of accretion of discount of investments |

1,448 | |||||||

|

Decrease in dividends receivable |

30,829 | |||||||

|

Decrease in interest receivable |

11,258 | |||||||

|

Increase in foreign withholding tax reclaims |

(21,430) | |||||||

|

Decrease in other assets |

1,593 | |||||||

|

Increase in accrued expenses |

33,367 | |||||||

|

Increase in investment management fee payable |

23,047 | |||||||

|

Increase in administrative services payable |

4,757 | |||||||

|

Decrease in trustee expenses payable |

(5,701) | |||||||

|

|

||||||||

|

Net cash used in operating activities |

(10,557,522) | |||||||

|

|

||||||||

|

Cash Flows from Financing Activities |

||||||||

|

Bank borrowings, net |

19,713,863 | |||||||

|

Cash distributions paid |

(9,232,574) | |||||||

|

|

||||||||

|

Net cash provided by financing activities |

10,481,289 | |||||||

|

|

||||||||

|

Net change in cash |

(76,233) | |||||||

|

Cash |

||||||||

|

Beginning of period |

76,233 | |||||||

|

|

||||||||

|

End of period |

$ - | |||||||

|

|

||||||||

|

Supplemental disclosure of cash flow information: |

||||||||

|

Cash paid for interest on bank borrowings |

$ 81,349 | |||||||

|

Non-cash financing activities not included herein consisted of: |

||||||||

|

Reinvestment of dividend distributions |

$ 1,031,696 | |||||||

|

See notes to financial statements. |

||||||||

|

DIVIDEND AND INCOME FUND

|

Annual Report 2016 10

|

|

NOTES TO FINANCIAL STATEMENTS

|

December 31, 2016

|

|

|

Financial Statements

|

|

11 Annual Report 2016 |

DIVIDEND AND INCOME FUND

|

|

NOTES TO FINANCIAL STATEMENTS

|

December 31, 2016 continued

|

|

|

Financial Statements

|

|

DIVIDEND AND INCOME FUND

|

Annual Report 2016 12

|

|

NOTES TO FINANCIAL STATEMENTS

|

December 31, 2016 continued

|

|

|

Financial Statements

|

shares, pursuant to the Fund’s governing documents that permit ownership of more than 4.99% of the Fund’s outstanding shares only with the prior approval of the Fund’s Board of Trustees. For the year ended December 31, 2016 and year ended December 31, 2015, Bexil Securities acquired 72,557 and 304,220 shares of the Fund, respectively, through participation in the Fund’s Dividend Reinvestment Plan and 2015 rights offering.

The Fund compensates each Trustee who is not an employee of the Investment Manager or its affiliates. These Trustees receive fees for service as a Trustee from the Fund and the other investment companies for which the Investment Manager or its affiliates serve as investment manager. In addition, Trustee out-of-pocket expenses are allocated to each Fund for which the Investment Manager or its affiliates serve as investment manager on the basis of relative net assets, except where a more appropriate allocation can be made fairly in the judgment of the Investment Manager.

3. DISTRIBUTIONS TO SHAREHOLDERS AND DISTRIBUTABLE EARNINGS The tax character of distributions paid by the Fund for the years ended December 31, 2016 and 2015 are comprised of the following:

|

Tax characteristics of distributions:

|

2016

|

2015

|

||||||||||

|

Ordinary income |

$ | 2,423,544 | $ | 2,393,241 | ||||||||

|

Return of capital |

|

8,168,833

|

|

|

12,516,950

|

|

||||||

|

|

|

|

|

|||||||||

|

Total distribution

|

$

|

10,592,377

|

|

$

|

14,910,191

|

|

||||||

|

|

||||||||||||

|

|

||||||||||||

As of December 31, 2016, the components of distributable earnings on a tax basis were as follows:

|

|

||||

|

Accumulated net realized loss on investments |

$ | (1,442,265) | ||

|

Unrealized appreciation |

|

8,575,406

|

|

|

|

|

|

|||

| $

|

7,133,141

|

|

||

|

|

||||

|

|

||||

The difference between book and tax unrealized appreciation is primarily related to partnership income.

Federal income tax regulations permit post-October net capital losses, if any, to be deferred and recognized on the tax return of the next succeeding taxable year.

Capital loss carryover is calculated and reported as of a specific date. Results of transactions and other activity after that date may affect the amount of capital loss carryover actually available for the Fund to utilize under the IRC and related regulations based on the results of future transactions.

Under the IRC, capital losses incurred in taxable years beginning after December 22, 2010, are allowed to be carried forward indefinitely and retain the character of the original loss. The Fund has a net capital loss carryover as of December 31, 2016 of $1,442,265 which expires in 2018. As a transition rule, post-enactment net capital losses are required to be utilized before pre-enactment net capital losses.

During the year ended December 31, 2016, $28,003,769 of capital loss carryovers expired.

GAAP requires certain components related to permanent differences of net assets to be classified differently for financial reporting than for tax reporting purposes. These differences have no effect on net assets or net asset value per share. These differences, which may result in distribution reclassifications, are primarily due to differences in partnership income, return of capital dividends, recharacterization of capital gain income, and timing of distributions. As of December 31, 2016, the Fund recorded the following financial reporting reclassifications to the net asset accounts to reflect those differences:

|

|

||||

|

Accumulated

|

Accumulated Net Realized

|

Paid in Capital

|

||

|

$7,973,186

|

$28,207,520

|

$(36,180,706)

|

||

|

|

||||

|

13 Annual Report 2016 |

DIVIDEND AND INCOME FUND

|

|

NOTES TO FINANCIAL STATEMENTS

|

December 31, 2016 continued

|

|

|

Financial Statements

|

The following is a summary of the inputs used as of December 31, 2016 in valuing the Fund’s assets. Refer to the Schedule of Portfolio Investments for detailed information on specific investments.

|

ASSETS

|

Level 1 | Level 2 | Level 3 | Total | ||||||||||||

|

Investments, at value |

||||||||||||||||

|

Common stocks |

$ 169,290,898 | $ - | $ 0 | $ 169,290,898 | ||||||||||||

|

Corporate bonds and notes |

- | 1,171,147 | - | 1,171,147 | ||||||||||||

|

Closed end funds |

1,611,000 | - | - | 1,611,000 | ||||||||||||

|

Reorganization interests |

- | - | 0 | 0 | ||||||||||||

|

Master limited partnerships |

2,200,096 | - | - | 2,200,096 | ||||||||||||

|

Preferred stocks |

4,021,659 | - | - | 4,021,659 | ||||||||||||

|

Money market funds |

|

557,838

|

|

|

-

|

|

|

-

|

|

|

557,838

|

|

||||

|

Total investments, at value |

|

$ 177,681,491

|

|

|

$ 1,171,147

|

|

|

$ 0

|

|

|

$ 178,852,638

|

|

||||

There were no securities transferred from level 1 on December 31, 2015 to level 2 on December 31, 2016.

|

DIVIDEND AND INCOME FUND

|

Annual Report 2016 14

|

|

NOTES TO FINANCIAL STATEMENTS

|

December 31, 2016 continued

|

|

|

Financial Statements

|

The following is a reconciliation of level 3 assets including securities valued at zero:

|

Common

|

Reorganization

|

Preferred

|

Total

|

|||||||||||||||||||

|

Balance at December 31, 2015

|

$ 37,605 | $ 0 | $ 0 | $ 37,605 | ||||||||||||||||||

|

Liquidation proceeds

|

- | - | (19,200) | (19,200) | ||||||||||||||||||

|

Realized loss

|

- | - | (549,602) | (549,602) | ||||||||||||||||||

|

Transfers into (out of) level 3

|

- | - | - | - | ||||||||||||||||||

|

Change in unrealized depreciation

|

|

(37,605)

|

|

- | 568,802 | 531,197 | ||||||||||||||||

|

Balance at December 31, 2016

|

|

$ 0

|

|

$ 0 | $ - | $ 0 | ||||||||||||||||

|

Net change in unrealized appreciation attributable to assets still held as level 3 at December 31, 2016

|

$ (37,605) | $ 0 | $ - | $ (37,605) | ||||||||||||||||||

Unrealized gains (losses) are included in the related amounts on investments in the Statement of Operations.

The Investment Manager, under the direction of the Fund’s Board of Trustees, considers various valuation approaches for valuing assets categorized within level 3 of the fair value hierarchy. The factors used in determining the value of such assets may include, but are not limited to: the discount applied due to the private nature of the asset; the type of the security; the size of the asset; the initial cost of the security; the existence of any contractual restrictions on the security’s disposition; the price and extent of public trading in similar securities of the issuer or of comparable companies; quotations or evaluated prices from broker-dealers and/or pricing services; information obtained from the issuer or analysts; an analysis of the company’s or issuer’s financial statements; or an evaluation of the forces that influence the issuer and the market in which the asset is purchased and sold. Significant changes in any of those inputs in isolation may result in a significantly lower or higher fair value measurement. The pricing of all fair value assets is regularly reported to the Fund’s Board of Trustees.

The following table presents additional information about valuation methodologies and inputs used for assets that are measured at fair value and categorized as level 3 as of December 31, 2016:

|

Fair Value

|

Valuation Technique

|

Unobservable Input

|

Range

|

|||||||||||||||||||||

|

Common Stocks

|

||||||||||||||||||||||||

|

Services - Miscellaneous Repair Services |

$ 0 |

|

Share of taxable income and comparable exchange offer

|

|

|

|

|

|

Discount rate for lack of marketability

|

|

100% | |||||||||||||

|

Reorganization Interests |

$ 0 |

|

Cost; last known market value for predecessor securities; estimated recovery on liquidation

|

|

|

Discount rate for lack of marketability

|

|

100% | ||||||||||||||||

5. INVESTMENT TRANSACTIONS Purchases and proceeds from sales or maturities of investment securities, excluding short term investments, were $113,795,256 and $101,092,413, respectively, for the year ended December 31, 2016. As of December 31, 2016, for federal income tax purposes, the aggregate cost of securities was $170,276,541 and net unrealized appreciation was $8,576,097, comprised of gross unrealized appreciation of $17,593,900 and gross unrealized depreciation of $9,017,803.

|

15 Annual Report 2016 |

DIVIDEND AND INCOME FUND

|

|

NOTES TO FINANCIAL STATEMENTS

|

December 31, 2016 continued

|

|

|

Financial Statements

|

6. ILLIQUID AND RESTRICTED SECURITIES The Fund owns securities which have a limited trading market and/or certain restrictions on trading and, therefore, may be illiquid and/or restricted. Such securities have been valued using fair value pricing. Due to the inherent uncertainty of valuation, fair value pricing values may differ from the values that would have been used had a readily available market for the securities existed. These differences in valuation could be material. Illiquid and/or restricted securities owned as of December 31, 2016 were as follows:

| Acquisition Date

|

|

|

Cost

|

|

|

|

|

|

Value

|

|

|

|

|

|||||||

|

Aquilex Holdings LLC |

3/08/12 | $ | 496,372 | $ | 0 | |||||||||||||||

|

Penson Technologies LLC |

4/09/14 |

|

0

|

|

|

0

|

|

|||||||||||||

|

Total

|

$

|

496,372

|

|

$

|

0

|

|

||||||||||||||

|

Percent of net assets

|

|

0.33%

|

|

|

0.00%

|

|

||||||||||||||

7. LIQUIDITY AGREEMENT Effective July 28, 2016, the Fund entered into a Liquidity Agreement (“LA”) with State Street Bank and Trust Company (“SSB”), the Fund’s custodian and securities lending agent. The LA allows the Fund to draw up to $35 million (maximum liquidity commitment) and includes a securities lending authorization by the Fund to SSB to engage in agency securities lending and reverse repurchase activity.

Interest is charged on the drawn amount at the rate of one-month LIBOR (London Interbank Offered Rate) plus 1.20% per annum, and is payable monthly. A non-usage fee is charged on the difference between the maximum liquidity commitment and the drawn amount at the rate of one-month LIBOR plus 0.07% per annum, and is payable monthly.

Generally, the Fund pledges its assets as collateral to secure its obligations under the LA and makes these assets available for securities lending and repurchase transactions initiated by SSB, although the Fund retains the risks and rewards of the ownership of assets pledged. Under the terms of the LA, the Fund may enter into securities lending transactions initiated by SSB, acting as the Fund’s authorized securities lending agent. All securities lent through SSB are required to be secured with cash collateral received from the securities lending counterparty in amounts at least equal to 100% of the initial market value of the securities lent. Cash collateral received by SSB, in its role as securities lending agent for the Fund, is credited against the amounts drawn under the LA. Any amounts credited against the LA are considered leverage and would be subject to various limitations in the LA and the Act, or both. Upon return of loaned securities, SSB will return collateral to the securities lending counterparty and may fund the amount of collateral returned through securities lending, repurchase, and/or other lending activities provided under the LA. Amounts paid by securities lending counterparties for loaned securities are retained by SSB.

In the event of a securities lending counterparty default, SSB indemnifies the Fund for certain losses that may arise in connection with the default. SSB uses the collateral received from the securities lending counterparty to purchase replacement securities of the same issue, type, class and series of the loaned securities. If the value of the collateral is less than the purchase cost of the replacement securities, SSB is responsible for satisfying the shortfall but only to the extent that the shortfall is not due to any decrease in the value of the collateral. Although the risk of the loss of the securities lent is mitigated by receiving collateral from the securities lending counterparty and through SSB indemnification, the Fund could experience a delay in recovering securities or could experience a lower than expected return if the securities lending counterparty fails to return the securities on a timely basis.

The Fund or SSB may terminate the LA with 179 days’ prior written notice to the other party absent a default or facility termination event. If certain asset coverage and collateral requirements, minimum net assets or other covenants are not met, the LA could be deemed in default and result in termination.

Prior to July 28, 2016, the Fund had a Committed Facility Agreement (“CFA”) with BNP Paribas Prime Brokerage, Inc. (“BNP”) that allowed it to adjust its credit facility up to $45,000,000 subject to BNP’s approval, and a Lending Agreement, as defined below. The Lending Agreement with BNP allowed BNP to may make loans to the Fund from time to time in its sole discretion and in amounts determined by BNP in its sole discretion. Borrowings under the CFA and the Lending Agreement (collectively, the “Lending Agreements”) were secured by assets of the Fund (the “pledged collateral”) that were held in a segregated account with the Fund’s custodian. Interest was charged at the 1 month LIBOR plus 0.95% on the amount borrowed and 0.50% on the undrawn balance. Because the Fund adjusted the facility amount each day

|

DIVIDEND AND INCOME FUND

|

Annual Report 2016 16

|

|

NOTES TO FINANCIAL STATEMENTS

|

December 31, 2016 continued

|

|

|

Financial Statements

|

to equal borrowing drawn that day, the annualized rate charge on undrawn facility amounts provided for by the CFA had not been incurred. The Lending Agreements provided for BNP to borrow a portion of the pledged collateral (the “Lent Securities”) in an amount not to exceed the outstanding borrowings owed by the Fund to BNP. The Lending Agreements allowed BNP to re-register the Lent Securities in its own name or in another name other than the Fund’s and pledge, re-pledge, sell, lend, or otherwise transfer or use the Lent Securities with all attendant rights of ownership. The Fund could designate any security within the pledged collateral as ineligible to be a Lent Security, provided there were eligible securities within the pledged collateral in an amount equal to the outstanding borrowing owed by the Fund. BNP remitted payment to the Fund equal to the amount of all dividends, interest, or other distributions earned or made by the Lent Securities. The Fund earned securities lending income of $22,827 for the period ended July 28, 2016, consisting of payments received from BNP for lending certain securities, less any rebates paid to borrowers and lending agent fees associated with the loan.

The outstanding loan balance and the value of assets pledged as collateral as of December 31, 2016 were $27,780,000 and $4,333,284, respectively, and the weighted average interest rate and average daily amount outstanding under the LA and CFA combined for the year ended December 31, 2016 were 1.50% and $7,943,217, respectively. The maximum amount outstanding during the year ended December 31, 2016 was $30,295,000.

8. SHARE TRANSACTIONS The Fund is authorized to issue an unlimited amount of $0.01 par value shares of beneficial interest. As of December 31, 2016, there were 10,649,171 shares outstanding. Share transactions for the following periods were:

|

Year Ended December 31, 2016 |

Year Ended December 31, 2015 |

|||||||||||||||||||

|

Shares issued in: |

Shares | Amount | Shares | Amount | ||||||||||||||||

|

Reinvestment of distributions |

91,916 | $ 1,031,696 | 77,459 | $ | 958,981 | |||||||||||||||

|

Rights offering

|

|

-

|

|

|

-

|

|

|

1,821,255

|

|

|

21,162,983

|

|

||||||||

|

|

91,916

|

|

|

$ 1,031,696

|

|

|

1,898,714

|

|

$

|

22,121,964

|

|

|||||||||

A registration statement allowing the Fund to offer, from time to time, in one or more offerings, including through rights offerings, up to $150,000,000 shares of beneficial interest (the “shelf offering”) was declared effective by the U.S. Securities and Exchange Commission (the “SEC”) on June 30, 2015. On September 28, 2015, the shareholders of the Fund received one non-transferable right for each share of the Fund held on that date rounded up to the nearest number of rights evenly divisible by three. Three rights were required to purchase one additional share of beneficial interest at the subscription price of $11.62 per share. On November 2, 2015, the Fund issued 1,821,255 shares of beneficial interest and recorded proceeds of $21,162,983, prior to the deduction of shelf and rights offering expenses of $276,827. The NAV per share of the Fund was reduced by approximately $0.53 per share as a result of the issuance of shares below NAV.

9. MARKET AND CREDIT RISKS The Fund may invest in below investment grade fixed income securities (commonly referred to as “junk” bonds), which carry ratings of BB or lower by Standard & Poor’s Ratings Group, a division of The McGraw-Hill Companies, Inc. (“S&P”) and/or Ba1 or lower by Moody’s Investors Service, Inc. (“Moody’s”). Investments in these below investment grade securities may be accompanied by a greater degree of credit risk than higher rated securities. Additionally, lower rated securities may be more susceptible to adverse economic and competitive industry conditions than investment grade securities. The relative illiquidity of some of these securities may adversely affect the ability of the Fund to dispose of such securities in a timely manner and at a fair price at times when it might be necessary or advantageous for the Fund to liquidate portfolio securities.

10. FOREIGN SECURITIES Investments in the securities of foreign issuers involve special risks which include changes in foreign exchange rates and the possibility of future adverse political and economic developments which could adversely affect the value of such securities. Moreover, securities of foreign issuers and traded in foreign markets may be less liquid and their prices more volatile than those of U.S. issuers and markets. In June 2016, the United Kingdom (UK) voted to leave the European Union (EU) following a referendum referred to as “Brexit.” It is expected that the UK will exit the EU within two years; however, the exact timeframe for the UK’s exit is unknown. There is still considerable uncertainty relating to the potential consequences of the withdrawal, including how the financial markets will react. In light of the uncertainties surrounding the impact of the Brexit on the broader global economy, the negative impact could be significant, potentially resulting in increased volatility and illiquidity and lower economic growth for companies that rely significantly on Europe for their business activities and revenues, which could have an adverse effect on the value of the Fund’s investments.

|

17 Annual Report 2016 |

DIVIDEND AND INCOME FUND

|

|

NOTES TO FINANCIAL STATEMENTS

|

December 31, 2016 concluded

|

|

|

Financial Statements

|

11. LEVERAGE RISK The Fund utilizes its LA to increase its assets available for investment. When the Fund leverages its assets, shareholders bear the fees associated with the LA and have potential to benefit or be disadvantaged from the use of leverage. The Investment Manager’s fee is also increased in dollar terms from the use of leverage. Consequently, the Fund and the Investment Manager may have differing interests in determining whether to leverage the Fund’s assets. Leverage creates risks that may adversely affect the return for shareholders including: the likelihood of greater volatility of net asset value and market price of Fund shares; fluctuations in the interest rate paid for the use of the LA; increased operating costs, which may reduce the Fund’s total return; the potential for a decline in the value of an investment acquired through leverage, while the Fund’s obligations under such leverage remains fixed; and the Fund is more likely to have to sell securities in a volatile market in order to meet asset coverage or other debt compliance requirements. There can be no assurance that the Fund’s use of leverage will be successful.

To the extent the income or capital appreciation derived from securities purchased with funds received from leverage exceeds the cost of leverage, the Fund’s return will be greater than if leverage had not been used, conversely, returns would be lower if the cost of the leverage exceeds the income or capital appreciation derived.

In addition to the risks created by the Fund’s use of leverage, the Fund is subject to the risk that it would be unable to timely, or at all, obtain replacement financing if the LA is terminated. Were this to happen, the Fund would be required to de-leverage, selling securities at a potentially inopportune time and incurring tax consequences. Further, the Fund’s ability to generate income from the use of leverage would be adversely affected.

12. CONTINGENCIES The Fund indemnifies its officers and trustees from certain liabilities that might arise from their performance of their duties for the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which may provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as it involves future claims that may be made against the Fund under circumstances that have not occurred.

13. SHARE REPURCHASE PROGRAM In accordance with Section 23(c) of the Act, the Fund may from time to time repurchase its shares in the open market at the discretion of and upon such terms as determined by the Board of Trustees. The Fund did not repurchase any of its shares during 2016 or 2015.

|

DIVIDEND AND INCOME FUND

|

Annual Report 2016 18

|

|

FINANCIAL HIGHLIGHTS

|

December 31, 2016

|

|

|

Financial Statements

|

| Year Ended December 31, | ||||||||||||||||||||||||||||||||||||||||||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||||||||||||||||||||||||||

| Per Share Operating Performance | ||||||||||||||||||||||||||||||||||||||||||||

|

Net asset value, beginning of period |

$13.11 | $16.66 | $17.20 | $15.53 | $15.48 | |||||||||||||||||||||||||||||||||||||||

|

Income from investment operations: (1) |

||||||||||||||||||||||||||||||||||||||||||||

|

Net investment income |

0.25 | 0.31 | 0.34 | 0.40 | 0.56 | |||||||||||||||||||||||||||||||||||||||

|

Net realized and unrealized gain (loss) on investments |

1.84 | (1.68 | ) | 0.76 | 4.12 | 1.13 | ||||||||||||||||||||||||||||||||||||||

|

Total income from investment operations |

2.09 | (1.37 | ) | 1.10 | 4.52 | 1.69 | ||||||||||||||||||||||||||||||||||||||

|

Less distributions: |

||||||||||||||||||||||||||||||||||||||||||||

|

Net investment income |

(0.23 | ) | (0.26 | ) | (1.63) | (1.16) | (0.56) | |||||||||||||||||||||||||||||||||||||

|

Return of capital |

(0.77 | ) | (1.37 | ) | - | (0.47) | (1.07) | |||||||||||||||||||||||||||||||||||||

|

Total distributions |

(1.00 | ) | (1.63 | ) | (1.63) | (1.63) | (1.63) | |||||||||||||||||||||||||||||||||||||

|

Fund share transactions |

||||||||||||||||||||||||||||||||||||||||||||

|

Effect of reinvestment of distributions |

(0.02 | ) | (0.02 | ) | (0.01) | (0.01) | (0.01) | |||||||||||||||||||||||||||||||||||||

|

Decrease in net asset value from rights offering |

- | (0.53 | ) | - | (1.21) | - | ||||||||||||||||||||||||||||||||||||||

|

Total Fund share transactions |

(0.02 | ) | (0.55 | ) | (0.01) | (1.22) | (0.01) | |||||||||||||||||||||||||||||||||||||

|

Net asset value, end of period |

$14.18 | $13.11 | $16.66 | $17.20 | $15.53 | |||||||||||||||||||||||||||||||||||||||

|

Market value, end of period |

$11.85 | $11.01 | $15.12 | $15.11 | $13.53 | |||||||||||||||||||||||||||||||||||||||

| Total Return (2) | ||||||||||||||||||||||||||||||||||||||||||||

|

Based on net asset value |

18.13 | % | (10.65 | )% | 7.28 | % | 23.35 | % | 12.67 | % | ||||||||||||||||||||||||||||||||||

|

Based on market price |

17.55 | % | (17.32 | )% | 10.83 | % | 24.38 | % | 10.75 | % | ||||||||||||||||||||||||||||||||||

|

Ratios/Supplemental Data (3) |

||||||||||||||||||||||||||||||||||||||||||||

|

Net assets, end of period (000s omitted) |

$151,005 | $138,417 | $144,280 | $148,081 | $93,951 | |||||||||||||||||||||||||||||||||||||||

| Ratios to average net assets of: | ||||||||||||||||||||||||||||||||||||||||||||

|

Total expenses (4) (5) |

1.62 | % | 1.65 | % | 1.55 | % | 1.87 | % | 2.57 | % | ||||||||||||||||||||||||||||||||||

|

Net expenses (6) |

1.62 | % | 1.65 | % | 1.55 | % | 1.87 | % | 2.57 | % | ||||||||||||||||||||||||||||||||||

|

Net investment income |

1.85 | % | 2.02 | % | 1.94 | % | 2.38 | % | 3.56 | % | ||||||||||||||||||||||||||||||||||

|

Portfolio turnover rate |

69 | % | 35 | % | 52 | % | 45 | % | 13 | % | ||||||||||||||||||||||||||||||||||

|

Leverage analysis (000s omitted): |

||||||||||||||||||||||||||||||||||||||||||||

|

Outstanding loan balance, end of period |

$27,780 | $8,066 | $17,284 | $21,346 | $21,348 | |||||||||||||||||||||||||||||||||||||||

|

Asset coverage per $1,000, end of period (7) |

$6,436 | $18,161 | $9,347 | $7,937 | $5,401 | |||||||||||||||||||||||||||||||||||||||

|

Average commission rate paid |

|

$0.0143

|

|

|

$0.0185

|

|

|

$0.0131

|

|

|

$0.0139

|

|

|

$0.0179

|

|

|||||||||||||||||||||||||||||

| (1) |

The per share amounts were calculated using the average number of shares outstanding during the period. |

| (2) |

Total return on a market value basis is calculated assuming a purchase of shares on the opening of the first day and a sale on the closing of the last day of each period reported. Dividends and distributions, if any, are assumed for purposes of this calculation to be reinvested at prices obtained under the Fund’s Dividend Reinvestment Plan. Generally, total return on a net asset value basis will be higher than total return on a market value basis in periods where there is an increase in the discount or a decrease in the premium of the market value to the net asset value from the beginning to the end of such periods. Conversely, total return on a net asset value basis will be lower than total return on a market value basis in periods where there is a decrease in the discount or an increase in the premium of the market value to the net asset value from the beginning to the end of such periods. Total return calculated for a period of less than one year is not annualized. The calculation does not reflect brokerage commissions, if any. |

| (3) |

Expenses and income ratios do not include expenses incurred by the Acquired Funds in which the Fund invests. |

| (4) |

“Total expenses” are the expenses of the Fund as presented in the Statement of Operations before fee waivers and expense reductions. |

| (5) |

The ratio of total expenses excluding interest expense and fees incurred from the use of leverage to average net assets was 1.46%, 1.51%, 1.47%, 1.72% and 2.30% for the years ended December 31, 2016, 2015, 2014, 2013 and 2012, respectively. |

| (6) |

“Net expenses” are the expenses of the Fund presented in the Statement of Operations after fee waivers and expense reductions. |

| (7) |

Represents the value of total assets less liabilities not represented by senior securities representing indebtedness divided by the total number of senior indebtedness units, where one unit equals $1,000 of senior indebtedness. For purposes of this calculation, the bank credit facility is considered a senior security representing indebtedness. |

See notes to financial statements.

|

19 Annual Report 2016 |

DIVIDEND AND INCOME FUND

|

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

December 31, 2016

|

|

|

Financial Statements

|

To the Board of Trustees and Shareholders of

Dividend and Income Fund

|

DIVIDEND AND INCOME FUND

|

Annual Report 2016 20

|

|

POLICIES AND UPDATES

|

(Unaudited)

|

|

|

Additional Information

|

|

21 Annual Report 2016

|

DIVIDEND AND INCOME FUND

|

|

DIVIDENDS

|

(Unaudited)

|

|

|

Additional Information

|

|

HISTORICAL DISTRIBUTION SUMMARY*

|

||||||||

|

PERIOD

|

Investment Income

|

Return of Capital

|

Capital Gains

|

Total

|

||||

|

2016 |

$ 0.23 | $ 0.77 | $ - | $ 1.00 | ||||

|

2015 |

$ 0.26 | $ 1.37 | $ - | $ 1.63 | ||||

|

2014** |

$ 1.63 | $ - | $ - | $ 1.63 | ||||

|

2013** |

$ 1.16 | $ 0.47 | $ - | $ 1.63 | ||||

|

2012 |

$ 0.56 | $ 1.07 | $ - | $ 1.63 | ||||

|

2011 |

$ 1.00 | $ 0.76 | $ - | $ 1.76 | ||||

|

2010 |

$ 1.40 | $ 0.24 | $ - | $ 1.64 | ||||

|

2009 |

$ 1.56 | $ 0.08 | $ - | $ 1.64 | ||||

|

2008 |

$ 2.36 | $ 1.08 | $ - | $ 3.44 | ||||

|

2007 |

$ 3.36 | $ 0.20 | $ - | $ 3.56 | ||||

|

2006 |

$ 3.72 | $ - | $ - | $ 3.72 | ||||

|

2005 |

$ 2.12 | $ 1.88 | $ - | $ 4.00 | ||||

|

2004 |

$ 2.16 | $ 1.84 | $ - | $ 4.00 | ||||

|

2003 |

$ 2.44 | $ 1.56 | $ - | $ 4.00 | ||||

|

2002 |

$ 2.64 | $ 1.84 | $ - | $ 4.48 | ||||

|

2001 |

$ 2.60 | $ 2.36 | $ - | $ 4.96 | ||||

|

2000 |

$ 3.20 | $ 1.76 | $ - | $ 4.96 | ||||

|

1999 |

$ 3.44 | $ 1.40 | $ 0.12 | $ 4.96 | ||||

|

From June 29, 1998 to November 30, 1998

|

$ 1.64

|

$ -

|

$ -

|

$ 1.64

|

||||

|

* The Fund implemented a 1-for-4 reverse stock split with an ex-date of December 10, 2012. Prior period distribution amounts have been restated to reflect the impact of the reverse stock split. |

||||||||

|

** Includes net capital gains recognized in the year and distributable as ordinary income in accordance with tax regulations. |

||||||||

|

DIVIDEND AND INCOME FUND

|

Annual Report 2016 22

|

|

DIVIDENDS

|

(Unaudited)

|

|

|

Additional Information

|

|

23 Annual Report 2016

|

DIVIDEND AND INCOME FUND

|

|

DIVIDENDS

|

(Unaudited)

|

|

|

Additional Information

|

|

DIVIDEND AND INCOME FUND

|

Annual Report 2016 24

|

|

TRUSTEES

|

(Unaudited)

|

|

|

Additional Information

|

The following table sets forth certain information concerning the trustees currently serving on the Board of Trustees of the Fund. The trustees of each class shall serve for terms of three years and then carryover until their successors are elected and qualify.

|

INDEPENDENT TRUSTEES

|

||||||||||||||||||

|

Name, Address (1), and Date of Birth

|

Position(s) Held with the Fund

|

Trustee Since

|

Principal Occupation(s) for the Past Five Years

|

Number of Portfolios in Fund Complex Overseen by Trustee (2)

|

Other Directorships Held by Trustee (3)

|

|||||||||||||

|

BRUCE B. HUBER, CLU, ChFC, MSFS February 7, 1930 |

Class I Trustee |

2011 |

Retired. He is a former Financial Representative with New England Financial, specializing in financial, estate, and insurance matters. He is a member of the Board, emeritus, of the Millbrook School, and a member of the Endowment Board of the Community YMCA of Red Bank, NJ.

|

4

|

|

None

|

|

|||||||||||

|

PETER K. WERNER August 16, 1959 |

Class II Trustee |

2011 |

Since 1996, he has taught, directed, and coached many programs at The Governor’s Academy of Byfield, MA. Currently, he teaches economics and history at the Governor’s Academy. Previously, he held the position of Vice President in the Fixed Income Departments of Lehman Brothers and First Boston. His responsibilities included trading sovereign debt instruments, currency arbitrage, syndication, medium term note trading, and money market trading.

|

4

|

|

None |

|

|||||||||||

|

JAMES E. HUNT December 14, 1930 |

Class III Trustee |

2011 |

Retired. He is a former Limited Partner of Hunt Howe Partners LLC (executive recruiting consultants).

|

4 |

|

None |

|

|||||||||||

|

INTERESTED TRUSTEE

|

||||||||||||||||||

|

THOMAS B. WINMILL (4) PO Box 4, Walpole, NH 03608 June 25, 1959 |

Class II Trustee |

2011 |

He is President, Chief Executive Officer, Chairman, and a Trustee or Director of the Fund, Foxby Corp., and Midas Series Trust. He is President, Chief Executive Officer, and General Counsel of the Investment Manager and Midas Management Corporation (registered investment advisers, collectively, the “Advisers”), Bexil Securities LLC and Midas Securities Group, Inc. (registered broker-dealers, collectively, the “Broker-Dealers”), Bexil Corporation (a holding company) (“Bexil”) and Winmill & Co. Incorporated (a holding company) (“Winco”). He is a Director and Vice President of Global Self Storage, Inc. (a self storage REIT) (“SELF”). He is a Director of Bexil American Mortgage Inc. He is Vice President of Tuxis Corporation (a real estate company) (“Tuxis”). He is Chairman of the Investment Policy Committee of each of the Advisers (the “IPCs”), and he is a portfolio manager of the Fund, Foxby Corp., Midas Fund, and Midas Magic. He is a member of the New York State Bar and the SEC Rules Committee of the Investment Company Institute. He is the brother of Mark C. Winmill.

|

4 |

|

Global Self |

|

|||||||||||

|

(1) Unless otherwise noted, the address of record of the trustees is 11 Hanover Square, New York, New York, 10005. (2) The “Fund Complex” is comprised of the Fund, Foxby Corp., and Midas Series Trust which are managed by the Investment Manager or its affiliates. (3) Refers to directorships and trusteeships held by a trustee in any company with a class of securities registered pursuant to Section 12 of the Securities Exchange Act of 1934 or any company registered as an investment company under the Act, excluding those within the Fund Complex. (4) He is an “interested person” of the Fund as defined in the Act due to his affiliation with the Investment Manager.

Messrs. Huber, Hunt, and Werner also serve on the Audit and Nominating Committees of the Board. Mr. Winmill also serves on the Executive Committee of the Board. Each of the trustees serves on the Continuing Trustees Committee of the Board.

|

|

|||||||||||||||||

|

25 Annual Report 2016 |

DIVIDEND AND INCOME FUND

|

|

OFFICERS

|

(Unaudited)

|

|

|

Additional Information

|

The executive officers, other than those who serve as trustees, and their relevant biographical information are set forth below.

|

EXECUTIVE OFFICERS

|

||||||||

|

Name, Address (1), and Date of Birth

|

Position(s) Held with the Fund

|

Officer Since (2)

|

Principal Occupation(s) for the Past Five Years

|

|||||

|

Russell Kamerman, Esq. July 8, 1982 |

Chief Compliance Officer, AML Officer, Associate General Counsel, Vice President, and Assistant Secretary

|

2014 |

Chief Compliance Officer, Anti-Money Laundering Officer, Associate General Counsel, Vice President and Assistant Secretary of the other investment companies in the Fund Complex, the Advisers, the Broker-Dealers, Bexil, SELF, Tuxis, and Winco. He is a member of the New York State Bar and the Chief Compliance Officer Committee and the Advertising Compliance Advisory Committee of the Investment Company Institute. Previously, he was an attorney in private practice focusing on regulatory, compliance, and other general corporate matters relating to the structure, formation, and operation of investment funds and investment advisers.

|

|||||

|

Heidi Keating March 28, 1959 |

Vice President |

2011 |

Vice President of the other investment companies in the Fund Complex, the Advisers, Bexil, SELF, Tuxis, and Winco. She is a member of the IPCs.

|

|||||

|

Thomas O’Malley July 22, 1958 |

Chief Accounting Officer, Chief Financial Officer, Treasurer, and Vice President

|

2011 |

Chief Accounting Officer, Chief Financial Officer, Vice President, and Treasurer of the other investment companies in the Fund Complex, the Advisers, the Broker-Dealers, Bexil, SELF, Tuxis, and Winco. He is a certified public accountant. |

|||||

|

John F. Ramirez, Esq. April 29, 1977 |

General Counsel, Chief Legal Officer, Vice President, and Secretary | 2011 |

General Counsel, Chief Legal Officer, Vice President, and Secretary of the other investment companies in the Fund Complex, SELF, and Tuxis. He is Vice President, Senior Associate General Counsel, and Secretary of the Advisers, the Broker-Dealers, Bexil, and Winco. He is a member of the IPCs. He also is a member of the New York State Bar and the Investment Advisers Committee, Small Funds Committee, and the Compliance Advisory Committee of the Investment Company Institute.

|

|||||

|

Mark C. Winmill November 26, 1957 |

Vice President | 2012 |

Vice President of the other investment companies in the Fund Complex and the Advisers. He is a member of the IPCs. He is President, Chief Executive Officer, Chairman, and a Director of SELF and Tuxis. He is Executive Vice President and a Director of Winco, Vice President of Bexil, and a principal of the Broker-Dealers. He is the brother of Thomas B. Winmill.

|

|||||

|

(1) Unless otherwise noted, the address of record of the officers is 11 Hanover Square, New York, New York, 10005. (2) Officers hold their positions with the Fund until a successor has been duly elected and qualifies. Officers are generally elected annually. The officers were last elected on December 14, 2016.

|

||||||||

|

DIVIDEND AND INCOME FUND

|

Annual Report 2016 26

|

|

GENERAL INFORMATION

|

(Unaudited)

|

|

|

Additional Information

|

Cautionary Note Regarding Forward Looking Statements - Certain information presented in this report may contain “forward looking statements” within the meaning of the federal securities laws, including the Private Securities Litigation Reform Act of 1995. Forward looking statements include, but are not limited to, statements concerning the Fund’s plans, objectives, goals, strategies, future events, future performance, or intentions, and other information that is not historical information. In some cases, forward looking statements can be identified by terminology such as “believes,” “expects,” “estimates,” “may,” “will,” “should,” “anticipates” or “intends,” or the negative of such terms or other comparable terminology, or by discussions of strategy. All forward looking statements by the Fund involve known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Fund, which may cause the Fund’s actual results to be materially different from those expressed or implied by such statements. The Fund may also make additional forward looking statements from time to time. All such subsequent forward looking statements, whether written or oral, by the Fund or on its behalf, are also expressly qualified by these cautionary statements. All forward looking statements, including without limitation, the Fund’s examination of historical trends and estimates, are based upon the Fund’s current expectations and various assumptions. The Fund’s expectations, beliefs, and projections are expressed in good faith and it believes there is a reasonable basis for them, but there can be no assurance that the Fund’s expectations, beliefs, and projections will result or be achieved. All forward looking statements apply only as of the date made. The Fund undertakes no obligation to publicly update or revise forward looking statements which may be made to reflect events or circumstances after the date made or to reflect the occurrence of unanticipated events. There is no assurance that the Fund’s investment objectives will be attained.

Closed end funds are traded on the secondary market. The Fund’s investment return and principal value will fluctuate so that an investor’s shares may be worth more or less than the original cost. Shares of the Fund may trade above (a premium) or below (a discount) the net asset value (NAV) of the Fund’s portfolio. The market price for a closed end fund is based on supply and demand which fluctuates daily based on many factors, such as economic conditions and global events, investor sentiment, and security-specific factors. The possibility of a market decline should be considered market risk.

Investment products, including shares of the Fund, are not federally or FDIC insured, are not deposits or obligations of, or guaranteed by, any financial institution and involve investment risk, including possible loss of principal and fluctuation in value. Consult with your tax advisor or attorney regarding specific tax issues.