Exhibit 10.1

NOTE: THIS DOCUMENT IS THE SUBJECT OF A CONFIDENTIAL TREATMENT REQUEST PURSUANT TO RULE 24B-2 UNDER THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED. PORTIONS OF THIS DOCUMENT FOR WHICH CONFIDENTIAL TREATMENT HAS BEEN REQUESTED HAVE BEEN REDACTED AND ARE MARKED HEREIN BY “[***]”. SUCH REDACTED INFORMATION HAS BEEN FILED SEPARATELY WITH THE COMMISSION PURSUANT TO THE CONFIDENTIAL TREATMENT REQUEST.

AMENDED AND RESTATED LICENSE AGREEMENT

This Amended and Restated License Agreement (this “Agreement”), by and between Immersion Software Ireland Limited (“Immersion Ireland”), an Irish company and a wholly owned subsidiary of Immersion Corporation, Immersion Corporation, a Delaware corporation (“Immersion Corporation,” and collectively with Immersion Ireland, “Immersion”), and Samsung Electronics Co., Ltd., a South Korean corporation with principal offices located at 416 Maetan-3dong, Yeongtong-gu, Suwon-si, Gyeonggi-do, 443-742 Korea for itself and on behalf of its Affiliates (collectively “Samsung”), is entered into as of January 1, 2013 (the “Effective Date”).

WHEREAS, Immersion Corporation and Samsung entered into that certain Amended and Restated License Agreement [***] as amended [***] (the “[***]”); and

WHEREAS, Immersion Ireland and Samsung desire to amend and restate the [***] to include additional software licenses and patent licenses, in each case, subject to, the terms and conditions of this Agreement.

NOW THEREFORE, in consideration of the promises, mutual covenants and agreements contained herein, the parties agree as set forth in the attached terms and conditions and exhibits, which are hereby incorporated by reference and made part of this Agreement.

Accepted by:

| IMMERSION IRELAND | SAMSUNG | |||||||||

| By: |

/s/ Liam Grainger |

By: |

/s/ Hyungmoon No |

|||||||

| Name: |

Liam Grainger |

Name: |

Hyungmoon No |

|||||||

| Title: |

Director |

Title: |

Vice President |

|||||||

| Date: |

3-6-2013 |

Date: |

7th Mar. 2013 |

|||||||

IMMERSION CORPORATION

| By: |

/s/ Victor Viegas | |

| Name: |

Victor Viegas | |

| Title: |

President and CEO | |

| Date: |

3-6-2013 | |

| Address for Notice: |

Address for Notice: | |

| Immersion Ireland c/o Immersion Corp. |

Samsung Electronics Co., Ltd. | |

| 30 Rio Robles |

416 Maetan-3dong | |

| San Jose, California 95134 |

Yeongtong-gu, Suwon-si | |

| ATTN: Legal Department |

Gyeonggi-do, 443-742 Korea | |

| ATTN: Legal Department | ||

[***] Confidential Treatment Requested

1

TERMS AND CONDITIONS

| 1. | DEFINITIONS. For purposes of this Agreement, the following terms shall have the following meanings: |

1.1 “[***]” shall have the meaning set forth in the recitals of this Agreement.

1.2 “[***] Sold Units” shall mean the units of Licensed Devices sold by Samsung during [***].

1.3 “[***]” shall have the meaning set forth in Section 13.4(a).

1.4 “[***]” shall have the meaning set forth in Section 13.4(b).

1.5 “Affiliate” means, with respect to a party, any corporation or other entity that is directly or indirectly controlling, controlled by or under common control with such party. For purposes of this definition, “control” shall mean the direct or indirect beneficial ownership of more than fifty percent (50%) of the stock or equity of such entity entitled to vote in the election of directors (or, in the case of an entity that is not a corporation, for the election of the corresponding managing authority). An Affiliate shall be deemed an Affiliate only so long as the above ownership or control exists.

1.6 “Agreement” shall have the meaning set forth in the introductory paragraph of this Agreement.

1.7 “Application” shall have the meaning set forth in Section 11.3.

1.8 “[***]” means any field of use relating to [***] products or services, including, without limitation, [***] and [***] simulators, unless agreed otherwise between the parties via an amendment to this Agreement.

1.9 “Basic Haptic Functionality” means haptic or vibrotactile functionality implemented or otherwise incorporated in a Mobile Device that satisfies all of the following: (a) incorporates no actuator (or similar device), except a [***] in each case, that is capable of being activated only in an [***] manner (i.e., such actuator can be activated [***]; (b) does not include any electrical circuit that may be used to control or condition the [***] to the actuator contained in such Mobile Device, or that may otherwise [***] are applied to such actuator; and (c) does not incorporate or otherwise utilize any Licensed Software. Notwithstanding the foregoing, for the purpose of this Agreement, the haptic or vibrotactile functionality related to the [***] and the [***] during the Term shall be included as Basic Haptic Functionality.

1.10 “Change of Control” shall have the meaning set forth in Section 14.1.

1.11 “Current Haptic Application” shall mean a software application (or function) (other than, for the avoidance of doubt, any Licensed Software or other Immersion software product) currently incorporated and utilized in a Samsung Branded Mobile Device that is commercially available to end users as of the Effective Date where such software application utilizes haptic or vibrotactile functionality. For the purpose of clarity, any derivative or enhancement of a Current Haptic Application shall be deemed a Current Haptic Application. In no event shall [***] constitute a Current Haptic Application. Notwithstanding the foregoing, for the purposes of this Agreement, [***] shall be included as Current Haptic Applications.

1.12 “Effective Date” shall have the meaning set forth in the introductory paragraph of this Agreement.

1.13 “[***]” means, unless agreed otherwise in writing between the parties via an amendment to this Agreement, any [***] relating to products, services or content designed, sold or marketed for use: (a) in the [***]; (b) in the [***]; (c) in the [***]; and/or (d) in the [***].

1.14 “Existing Claims” shall have the meaning set forth in Section 2.2.

[***] Confidential Treatment Requested

2

1.15 “Field of Use” means Mobile Devices. The “Field of Use” [***] products or services that are designed, sold, or marketed for use [***].

1.16 “[***] Payment” shall mean the [***] of [***] due to Immersion Ireland pursuant to Section 5.1.

1.17 [***]

1.18 “Foundry Products” means Mobile Devices which are: (a) designed by or for a third party without substantial input from Samsung or its Affiliates, and manufactured, reproduced, sold, leased, licensed, distributed or otherwise transferred from Samsung or its Affiliates to that third party (or to customers of, or as directed by, that third party); or (b) designed, manufactured, reproduced, sold, leased, licensed, distributed or otherwise transferred through or by Samsung or its Affiliates for or on behalf of a third party for the primary purpose of attempting to make such products licensed or immune from suit with respect to any Licensed Software or any Immersion Patent; provided, however, that Mobile Devices designed and manufactured pursuant to the request by carriers shall not constitute Foundry Products so long as such Mobile Devices are branded (or co-branded) with Samsung’s brand.

1.19 “[***]” means the market principally for [***] or [***] for use in conjunction with [***] or similar [***] purposes.

1.20 “[***]” means a software application capable of providing haptic or vibrotactile feedback to an end user of a device in connection with [***].

1.21 “[***]” means a software [***] application capable of adding haptic or vibrotactile feedback to [***].

1.22 “Haptic SDK” means Immersion Corporation’s Haptic SDK tool designed to create haptic software applications for use in Mobile Devices.

1.23 “[***]” means a software application that provides haptic or vibrotactile feedback to an end user in connection with such end user’s use of [***] a Mobile Device.

1.24 “HD Integrator” shall have the meaning set forth in Exhibit A.

1.25 “Immersion” shall have the meaning set forth in the introductory paragraph of this Agreement.

1.26 “Immersion Corporation” shall have the meaning set forth in the introductory paragraph of this Agreement.

1.27 “Immersion Integrator Software” shall mean, collectively, the following: (a) Integrator; (b) HD Integrator; and (c) all Upgrades, Updates, error corrections or replacement versions of any of the foregoing.

1.28 “Immersion Ireland” shall have the meaning set forth in the introductory paragraph of this Agreement.

1.29 “Immersion Patents” means the patents owned or controlled by Immersion or its Affiliates during the Term, along with any continuations, continuations-in-part, divisions, international counterparts, reissues and reexaminations thereof. For the sake of clarity, Immersion Patents does not include: (a) patents owned by entities that may acquire Immersion or its Affiliates, and (b) patents controlled by Immersion or its Affiliates that require the payment of a fee in connection with any sublicense of such patents to any third party other than Immersion’s employees or subcontractors who are obligated to assign such patents to Immersion or its Affiliates in consideration of such fee.

1.30 “Immersion Preexisting Technology” means Intellectual Property Rights developed, acquired or otherwise owned by Immersion or its Affiliates prior to the Effective Date.

1.31 “Immersion Solely Developed Technology” means Intellectual Property Rights developed, acquired or otherwise obtained by Immersion independently of Samsung on and after the Effective Date.

[***] Confidential Treatment Requested

3

1.32 “Immersion TouchSense Player Software” shall mean, collectively, the following: (a) TS3000; (b) TS4000; (c) TS5000; and (d) all Upgrades, Updates, error corrections or replacement versions of any of the foregoing.

1.33 “Immersion TouchSense/Integrator Solutions” shall mean, collectively, the Immersion TouchSense Player Software and the Immersion Integrator Software.

1.34 “Immersion Trademarks” shall have the meaning set forth in Section 3.3.

1.35 “Imposed Tax” shall have the meaning set forth in Section 11.2.

1.36 “Intellectual Property Rights” shall mean any intellectual property rights (or similar rights) including, but not limited to, copyrights, patent rights, trade secret rights, trademark rights, trade name rights and any other intellectual property rights (or similar rights).

1.37 “Integration and Porting Services Fee” shall have the meaning set forth in Section 5.2.

1.38 “Integrator” shall have the meaning set forth in Exhibit A.

1.39 “IP Claim” shall have the meaning set forth in Section 11.

1.40 “Licensed Basic Haptic Device” means a Samsung Branded Mobile Device that constitutes a Mobile Device With Basic Haptic Functionality.

1.41 “Licensed Device” shall mean, collectively, Licensed Basic Haptic Devices and Licensed TouchSense Devices. Licensed Device shall in no event include any products or services: (a) [***]; or (b) any Foundry Products.

1.42 “Licensed Software” shall mean, collectively, the Immersion TouchSense/Integrator Solutions and the Haptic SDK.

1.43 “Licensed TouchSense Device” shall mean a Samsung Branded Mobile Device that incorporates Licensed Software in compliance with the terms and conditions of this Agreement.

1.44 “Linux Modules” shall mean software that enables Licensed Software to operate on a Linux-based operating system.

1.45 “Mobile Device” means any electronic mobile devices having telecommunication or computing functionality including without limitation a mobile phone, laptop, notebook, netbook, MP3, camera, or tablet computer (including a convertible notebook).

1.46 “Mobile Device With Basic Haptic Functionality” means any Mobile Device that contains no haptic or vibrotactile functionality except for Basic Haptic Functionality.

1.47 “Open Source Software” shall mean any software which is subject to or meeting the criteria of the license terms and conditions listed as at any time during the term of this Agreement, as and to the extent applicable, at http://www.opensource.org/docs/definition.php (or successor URL) and including, without limitation, licenses currently listed at http://opensource.org/licenses/ (or successor URL), or which is subject to any similar license terms.

1.48 “Piezoactuator” shall mean an actuator containing materials that have the ability to generate potential mechanical strain in response to an applied electric potential.

1.49 “Prior Basic Haptic Units” shall have the meaning set forth in Section 2.2.

1.50 “[***]” shall have the meaning set forth in Section 13.4(c).

1.51 “[***]” means any field of use relating to products or services designed for use in: (a) [***]; (b) simulation of or for [***]; and/or (c) simulation for development and testing of [***].

[***] Confidential Treatment Requested

4

1.52 “[***]” means any field of use relating to: (a) the treatment of, or delivery of [***], including any field of use relating to [***]; and/or (b) [***] of physical or other characteristics of [***].

1.53 “Releasing Entities” shall have the meaning set forth in Section 2.2.

1.54 “Samsung” shall have the meaning set forth in the introductory paragraph of this Agreement.

1.55 “Samsung Branded Mobile Device” means a Mobile Device within the Field of Use that is marketed and sold under Samsung’s brand to end users of such products.

1.56 “Samsung Competitor” means any of the following: [***] and their respective affiliates and such other entities as may be agreed upon by the Parties from time to time.

1.57 “Samsung Preexisting Technology” means Intellectual Property Rights developed, acquired or otherwise owned by Samsung prior to the Effective Date.

1.58 “Samsung Solely Developed Technology” means Intellectual Property Rights developed, acquired or otherwise obtained by Samsung independently of Immersion on and after the Effective Date.

1.59 “[***]” means a software application [***] of haptic or vibrotactile feedback.

1.60 “Source Code” shall have the meaning set forth in Section 2.1(b).

1.61 “Term” shall have the meaning set forth in Section 13.1.

1.62 “TS3000” shall have the meaning set forth in Exhibit A.

1.63 “TS4000” shall have the meaning set forth in Exhibit A.

1.64 “TS5000” shall have the meaning set forth in Exhibit A.

1.65 “Update” means a future version of an Immersion TouchSense/Integrator Solution that satisfies all of the following: (i) Immersion Corporation makes such future version generally available to its customers on a when and if available basis; (ii) does not include new major feature or functionality additions to the then-currently shipping Immersion TouchSense/Integrator Solution being updated; and (iii) such future version is marketed and licensed by Immersion under the same Immersion TouchSense/Integrator Solution product name as the version of the Immersion TouchSense/Integrator Solution product being updated.

1.66 “Upgrade” means a future version of an Immersion TouchSense/Integrator Solution that satisfies all of the following: (i) Immersion Corporation makes such future version generally available to its customers on a when and if available basis; (ii) includes new major feature or functionality additions to the then-currently shipping Immersion TouchSense/Integrator Solution being upgraded; and (iii) such future version is marketed and licensed by Immersion under the same Immersion TouchSense/Integrator Solution product name as the version of the Immersion TouchSense/Integrator Solution product being upgraded.

1.67 “[***]” shall mean the applicable rights (pursuant to either 13.4(a), Section 13.4(b), or Section 13.4(c)) exercised by Samsung, if any, pursuant to Section 13.4.

1.68 “Withholding Claim” shall have the meaning set forth in Section 11.2.

| 2. | GRANT OF LICENSES. |

2.1 Basic Haptics Patent License. Subject to Samsung’s compliance with the terms and conditions of this Agreement, Immersion Ireland hereby grants to Samsung a [***], worldwide, non-transferable,

[***] Confidential Treatment Requested

5

non-exclusive, non-sublicenseable, and non-assignable license during the Term, under the Immersion Patents [***], to make, use, sell, offer for sale, export and/or import Licensed Basic Haptic Devices in the Field of Use.

2.2 Release of Claims. Contingent upon Immersion’s receipt of the [***] Payment and effective upon the Effective Date, Immersion, on behalf of itself, its Affiliates, and their successors and assigns (“Releasing Entities”), hereby fully, finally, irrevocably, and forever releases and discharges Samsung and its Affiliates (with its agents, attorneys, and employees), its respective directors, officers, managers, vendors, suppliers, manufacturers, developers, distributors, contractors, customers and end-users from any and all claims, demands, losses, costs, damages, debts, liabilities, obligations and causes of action, whether now known or unknown, suspected or unsuspected, which the Releasing Entities may now hold or own, or has at any time heretofore held or owned, that are based on the Immersion Patents (collectively “Existing Claims”), which Existing Claims have been made or which might be made at any time based on the distribution, sale or manufacture of the Prior Basic Haptic Units. For the purpose of this Agreement, “Prior Basic Haptic Units” mean Mobile Devices With Basic Haptic Functionality sold or distributed under the Samsung brand by Samsung prior to the Effective Date.

2.3 Licensed Software.

(a) Object Code License. Subject to Samsung’s compliance with the terms and conditions of this Agreement, Immersion Ireland grants to Samsung a royalty-bearing, worldwide, non-exclusive, non-sublicenseable (except for subsection (iii) below), non-transferable, and non-assignable license during the Term: (i) to copy and use and access the Immersion TouchSense/Integrator Solutions (in object code form) and incorporate and install such copy into Licensed TouchSense Devices; (ii) distribute, sell, offer to sell, import, and export such copy of the Immersion TouchSense/Integrator Solutions, directly or indirectly through distributors, resellers and/or agents, solely as incorporated in a Licensed TouchSense Device, to an end user customer for use by such end user customer; and (iii) to sublicense the rights granted in (i) to third parties solely for the purpose of exercising Samsung’s rights under (i) above. With respect to Intellectual Property Rights, the foregoing license includes the right, only under Immersion Intellectual Property Rights covering inventions embodied in the unmodified Immersion TouchSense/Integrator Solutions, for Samsung to undertake the acts set forth in (i) and (ii) above solely with respect to the Immersion TouchSense/Integrator Solutions as incorporated in a Licensed TouchSense Device.

(b) Source Code License. Subject to Samsung’s compliance with the terms and conditions of this Agreement, Immersion Ireland hereby grants to Samsung the royalty-bearing, worldwide, non-exclusive, non-sublicenseable (except as expressly permitted herein), non-transferable, and non-assignable license during the Term, to internally store, view and modify the elements/modules of the Immersion TouchSense/Integrator Solutions provided by Immersion to Samsung in source code form (the “Source Code”) solely as necessary to incorporate the Immersion TouchSense/Integrator Solutions into Licensed TouchSense Devices in accordance with this Agreement. For the avoidance of doubt, the foregoing license does not include any right or license for Samsung to transmit, display, perform or distribute to any third party, any of the Source Code. With respect to patents, the foregoing license includes the right, only under Immersion Patents covering inventions embodied in the unmodified Source Code, for Samsung to undertake the acts set forth in this Section 2.3 solely as necessary to incorporate the Immersion TouchSense/Integrator Solutions into Licensed TouchSense Devices in accordance with this Agreement.

(c) Haptic SDK License. Subject to Samsung’s compliance with the terms and conditions of this Agreement, Immersion Ireland grants to Samsung a royalty-bearing, worldwide, non-transferable, non-exclusive, non-sublicenseable (except as expressly permitted herein), and non-assignable license during the Term: (a) to use the Haptic SDK to internally develop Current Haptic Applications; and (b) to copy and incorporate such Current Haptic Applications into Licensed TouchSense Devices.

2.4 Restrictions, Conditions and Obligations.

(a) Notwithstanding anything to the contrary herein, the licenses granted in Section 2.1 with respect to Licensed Devices cannot be used by or on behalf of Samsung to sell, or offer for sale, Licensed Devices that incorporate software programs or applications that

[***] Confidential Treatment Requested

6

utilize haptic or vibrotactile functionality (other than, to the extent applicable, (i) Current Haptic Applications in the case of Licensed Basic Haptic Devices. In addition, Samsung may only use Licensed Software for use with Current Haptic Applications in compliance with the terms of this Agreement.

(b) Notwithstanding anything to the contrary herein, a party shall not have the right to enter into any legally binding obligations on behalf of the other parties.

(c) Samsung shall not distribute the Licensed Software: (a) on a stand-alone basis or with any products other than as part of a Licensed TouchSense Device distributed in accordance with this Agreement; or (b) to any entity whom Samsung knows or should reasonably conclude will use the Licensed Software primarily for purposes of benchmarking or similar testing, or for reverse engineering or disassembling.

(d) Except as provided in this Agreement, no right to sublicense the rights granted to Samsung in this Agreement is granted by Immersion to Samsung.

(e) Samsung shall store the Source Code on secure servers controlled by Samsung and located at its principal address identified in the preamble above. Samsung acknowledges that the Source Code constitutes the trade secrets of Immersion. Further, Samsung agrees to control and safeguard all Source Code using similar security measures and safeguards as Samsung uses for its own similar source code but in any event shall observe procedures and controls including at a minimum the following (for the avoidance of doubt, the obligations contained in this Section 2.4(e), and all other obligations of Samsung relating to the Source Code, shall apply with respect to all enhancements, improvements, derivative works and other modifications made to any Source Code):

(1) The Source Code shall be accessible only by those Samsung employees with a manifest “need to know” directly related to the purpose of this Agreement.

(2) Samsung agrees to notify Immersion promptly if a breach of security occurs that compromises the confidentiality of the Source Code and to take actions appropriate in the circumstances to rectify such breach.

(f) Immersion reserves all rights not expressly granted to Samsung in this Agreement. No implied licenses are granted to Samsung under or in connection with this Agreement.

2.5 Affiliates of Samsung; Use of Third Parties; Distributors/Resellers. Notwithstanding anything to the contrary in this Agreement, if any of Samsung’s Affiliates wish to exercise any rights granted to Samsung’s Affiliates pursuant to this Agreement, each such Affiliate must first agree to be bound by the same obligations, limitations and restrictions imposed on Samsung under this Agreement. Samsung shall cause each of such Affiliates to comply with the terms and conditions of this Agreement and shall be responsible for the acts or omissions of its Affiliates as if such acts and omissions had been the acts and omissions of Samsung hereunder. Samsung shall be responsible for ensuring that all third parties exercising Samsung’s rights hereunder under Section 2.3(a)(iii) shall fully comply with this Agreement. Samsung shall notify Immersion promptly if Samsung becomes aware of the unauthorized use of Licensed Software by a distributor, reseller or agent of any Licensed Device.

3. MARKETING; ATTRIBUTION.

3.1 Press Release. The parties may issue joint press releases from time to time if mutually agreed upon by the parties. Neither party shall issue any other press release regarding its relationship with the other party pursuant to this Agreement without the consent of the other party, which shall not be unreasonably withheld or delayed.

3.2 Label Requirements. In accordance with Exhibit B, Samsung agrees to use commercially reasonable efforts to provide a reference to Immersion’s patents covering the Licensed Software and Immersion Patents by including the information set forth in Exhibit B on an Internet website or manuals designed to be accessed by end users (located in the United States) of Licensed Devices.

3.3 Trademark License. Immersion Ireland hereby grants to Samsung a non-exclusive, limited license to use, and Samsung may use, the Immersion trademarks set forth in Exhibit B (“Immersion Trademarks”) in connection with the Licensed Devices solely as provided in Exhibit B. Samsung agrees not to affix any Immersion Trademarks to products other than the Licensed Devices.

[***] Confidential Treatment Requested

7

3.4 Quality. Samsung acknowledges that all use of the Immersion Trademarks will inure to the benefit of Immersion. Samsung shall not register Immersion Trademarks or a confusingly similar trademark in any jurisdiction and will not adopt any trademark which is confusingly similar to any trademark of Immersion or which includes a prominent portion of any trademark of Immersion. All use by Samsung of the Immersion Trademarks will be subject to Immersion’s then-current quality control requirements and trademark guidelines.

3.5 Acknowledgment. Samsung acknowledges that Immersion is the sole and exclusive owner of the Immersion Trademarks. Samsung agrees that Samsung will do nothing inconsistent with such ownership either during the Term or afterwards. Samsung agrees that use of the Immersion Trademarks by Samsung shall inure to the benefit of and be on behalf of Immersion. Samsung acknowledges its utilization of the Immersion Trademarks will not create any right, title, or interest in the Immersion Trademarks in Samsung.

4. DELIVERY AND IMPLEMENTATION OF LICENSED SOFTWARE.

4.1 Porting of Licensed Software. Immersion shall cooperate with Samsung to port the Licensed Software to Licensed TouchSense Devices selected by Samsung, and to otherwise integrate the Licensed Software into such Licensed TouchSense Devices. Subject to the restrictions set forth in this Agreement, all work performed under this Section 4.1 and under Section 4.2 shall be subject to the cooperation rules set forth in Section 1 of Exhibit C.

4.2 Application Support. Immersion shall cooperate with Samsung to define Current Haptic Applications for bundling with Licensed TouchSense Devices, which applications may include but may not be limited to alerts, menu or user interface effects, calling cues, power on/off effects, games and incoming call effects, in each case, to the extent such applications are Current Haptic Applications. Subject to the restrictions set forth in this Agreement, all work performed under this Section 4.2 shall be subject to the cooperation rules set forth in Section 2 of Exhibit C.

4.3 Upgrades, Updates and Error Corrections.

(a) Updates/Upgrades. Immersion shall provide Samsung with Updates and/or replacement versions that Immersion develops to any part of the Licensed Software performed under Section 4.1, at no additional charge to Samsung. Samsung and Immersion may agree to cooperate to port Upgrades to Licensed TouchSense Device models selected by Samsung.

(b) Error Corrections. In the event that Samsung notifies Immersion, in accordance with Immersion’s then-current standard bug notification process, about a material noncompliance of the Licensed Software with Immersion’s then-current specifications for the Licensed Software, Immersion will use commercially reasonable efforts to understand and correct such noncompliance. Immersion will acknowledge Samsung’s notification of noncompliance promptly after Immersion’s receipt of such notification. Within three (3) business days following its acknowledgement of proper notification, Immersion will provide a status report confirming Immersion’s ability or inability to reproduce the reported noncompliance. Should Immersion be able to reproduce the noncompliance, within five (5) business days following its acknowledgement of proper notification, Immersion will provide Samsung with a plan and timetable for resolution of the noncompliance. Should Immersion not be able to reproduce the noncompliance, the parties will schedule a teleconference to discuss how to proceed with resolution of the noncompliance. At Immersion’s request, Samsung shall provide an Immersion engineering team with access to Samsung’s software and/or hardware development tools and development environment (including applicable user interface, operating system and other source code involving calls to, or use of, the Licensed Software), at Samsung’s facilities, and shall cooperate with Immersion to reproduce, understand and correct such noncompliance. In the event that Immersion is unable to correct any such noncompliance that is preventing commercial shipment of a Licensed TouchSense Device, at Samsung’s request, Immersion shall provide a Samsung engineering team with access to Immersion’s software and/or hardware development tools and development environment (including applicable Licensed Software source code), at Immersion’s facilities, and shall cooperate with Samsung to reproduce, understand and correct such

[***] Confidential Treatment Requested

8

noncompliance. Immersion shall be obligated to provide the services set forth in Section 4 during the Term. The parties shall repeat the above process until the Licensed Software complies with the then-current specifications agreed between the parties or until Samsung has reasonably rejected the delivered Licensed Software five (5) times. In such a case, the parties shall make good faith efforts to amicably resolve the noncompliance. If the parties are unable to reach a resolution after ninety (90) days of good faith negotiations, the matter shall be resolved in accordance with the arbitration procedures set forth in Section 14.3 (provided that any award requiring Immersion to provide any refund shall be limited to a refund of [***] that is attributable to [***] following the Samsung’s initial notification of noncompliance.

5. FINANCIAL TERMS.

5.1 [***]. In partial consideration of the licenses granted herein for the Term, Samsung shall pay to Immersion Ireland [***]:

[***]

5.2 Porting and Other Implementation Fees. In consideration of the integration and porting services provided by Immersion pursuant to Section 4, Samsung shall pay to Immersion Ireland [***]

[***]

5.3 Reports. On or before the forty-fifth (45th) day following the end of each calendar quarter [***], Samsung will provide Immersion with a report, in a form reasonably specified by the parties, detailing the number of individual units of Licensed Devices (broken down by model number and stock-keeping unit number or SKU).

5.4 Payments.

(a) [***] Samsung shall pay Immersion Ireland [***] in accordance with the payment schedule set forth in Section 5.1. All [***] payments are non-refundable and non-creditable, in each case, except to the extent expressly provided in this Agreement (without limiting Samsung’s rights to seek damages pursuant to a material breach of this Agreement).

(b) Integration and Porting Services Fee. Samsung shall pay Immersion Ireland the Integration and Porting Services Fee in accordance with the payment schedule set forth in Section 5.2. The Integration and Porting Services Fee [***] payments are non-refundable and non-creditable, in each case, except to the extent expressly provided in this Agreement (without limiting Samsung’s rights to seek damages pursuant to a material breach of this Agreement). The Integration and Porting Services Fee does not include materials and travel expenses, which shall be agreed upon by the parties in writing, and which will be separately invoiced to Samsung. Any such travel expenses shall be calculated using the actual cost for airline tickets (based on economy airfare) and a per diem allowance of $[***] per day for meals, ground transportation and accommodations. Immersion shall provide Samsung with a copy of the original invoices and Samsung’s prior written approval of such expense.

(c) Payment Method. All monies to be paid by Samsung to Immersion shall be paid to Immersion Ireland in U.S. dollars, by wire transfer of funds to a bank and account number designated by Immersion Ireland. Any payments that remain unpaid after such payments are due shall thereafter bear interest at a monthly rate of 1%.

5.5 Taxes and Duties. Subject to Section 11.2, each party shall be responsible for payment of any taxes imposed on such party. If Samsung is required by a governmental authority, including a Korean tax authority, to withhold any taxes on payments to be made by Samsung to Immersion Ireland hereunder, Samsung shall have right to withhold and deduct such taxes from payments to be made by Samsung. Samsung shall provide Immersion Ireland with any certificate or other documentation that Samsung receives from a government authority as proof of payment of such withheld taxes.

6. Audits. If the parties mutually agree to renew this Agreement as contemplated in Section 13.5, Immersion Ireland shall have the right to have an independent auditor

[***] Confidential Treatment Requested

9

audit from time to time the relevant books and records of Samsung in order to confirm that the [***] Sold Units reported by Samsung pursuant to Section 5.3 are complete and accurate. Immersion Ireland will pay the costs of any audit of Samsung; provided that if such audit reveals an understatement of [***] Sold Units such that the amount of [***] Sold Units reported by Samsung pursuant to Section 5.3 is [***] units, but where such audit reveals that the amount of [***] Sold Units is [***] units, then Samsung shall pay Immersion Ireland the amounts that would have been due had Samsung reported complete and accurate amounts for [***] Sold Units, and Samsung shall also pay the reasonable costs of each such audit. Any audit shall be preceded by at least forty-five (45) days’ advance written notice and shall be performed during normal business hours by the auditor.

7. RESERVATION OF RIGHTS.

7.1 Ownership of Preexisting Intellectual Property, Solely Developed Technology, and the Licensed Software. Immersion shall retain sole ownership and control of all Immersion Preexisting Technology, the Licensed Software (including without limitation all Upgrades, Updates, error corrections, replacement versions, and ports delivered to Samsung pursuant to this Agreement [***]) and all Immersion Solely Developed Technology. Samsung shall retain sole ownership and control of all Samsung Preexisting Technology and all Samsung Solely Developed Technology. Except to the extent otherwise required by any applicable laws, no implied rights or licenses are granted pursuant to this Agreement.

7.2 Jointly-Created Intellectual Property. The parties acknowledge that, in the future, the parties may enter into agreements pursuant to which joint development projects may be undertaken. While neither party shall have any obligations unless and until such an agreement has been duly executed by the parties, the parties currently acknowledge that (a) such agreement will contain, among other things, appropriate ownership, licensing (under each party’s background and foreground intellectual property rights) and financial terms in connection with any joint development projects and other matters, and (b) to the extent that the parties collaborate on and jointly develop any Intellectual Property Rights in the course of performance under the terms of such agreements, such Intellectual Property Rights will be jointly owned by the parties, and each party shall be free to exploit such jointly-owned Intellectual Property Rights in such ways as described in such an agreement without the need to pay any royalties or other amounts to the other party (all without limiting the rights and obligations of the parties with respect to any Intellectual Property Rights separately owned or controlled by the other party), and (c) the parties will address any other rights or licenses applicable thereto. The parties acknowledge that if such an agreement is pursued, such agreement will be separately negotiated and terms mutually agreed upon by both parties.

8. PROTECTION. Samsung acknowledges that the Licensed Software (and any specifications, schematics, drawings, or other documentation related thereto) contains trade secrets of Immersion and agrees that it shall not, and shall cause its employees, agents, and/or contractors not to: (a) reverse engineer or disassemble the Licensed Software or otherwise attempt to discover the internal workings or design of the Licensed Software; or (b) develop methods to enable unauthorized parties to use the Licensed Software (or any specifications, schematics, drawings, or other documentation related thereto), except to the extent that the foregoing prohibitions violate applicable local law and provided that Samsung notifies Immersion in writing ninety (90) days prior to any proposed action in contravention of such prohibitions. Further, Samsung shall not modify, create any derivative works of, duplicate, disclose, or otherwise use the Licensed Software except as expressly permitted hereunder and shall protect the Licensed Software with at least the same degree of care with which it protects its own similar confidential information (but in no event less than reasonable care). Samsung acknowledges and agrees that unauthorized modification, derivative work, duplication, disclosure, or other use of the Licensed Software may cause Immersion serious financial loss. Accordingly, in the event of any unauthorized modification, derivative work, duplication, disclosure, or other use of the Licensed Software, Samsung agrees that Immersion shall have the right to seek injunctive or other equitable relief.

9. NO WARRANTIES. EXCEPT AS EXPRESSLY SET FORTH IN SECTION 10, TO THE MAXIMUM EXTENT PERMITTED UNDER APPLICABLE LAW, NEITHER PARTY MAKES ANY PROMISES, REPRESENTATIONS, OR WARRANTIES, EITHER EXPRESS, IMPLIED, STATUTORY, OR OTHERWISE, WITH RESPECT TO THE LICENSED

[***] Confidential Treatment Requested

10

SOFTWARE OR THE LICENSED DEVICES HEREUNDER, INCLUDING THEIR CONDITION, THEIR CONFORMITY TO ANY REPRESENTATION OR DESCRIPTION, OR THE EXISTENCE OF ANY LATENT OR PATENT DEFECTS, AND IMMERSION SPECIFICALLY EXCLUDES ALL IMPLIED WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, AND NON-INFRINGEMENT, AND ANY IMPLIED WARRANTIES ARISING FROM USAGE OF TRADE, COURSE OF DEALING, OR COURSE OF PERFORMANCE.

| 10. | REPRESENTATIONS AND WARRANTIES. |

| 10.1 | Mutual. |

(a) As of the date of execution of this Agreement, Immersion Ireland and Samsung represents and warrants that it is duly organized and validly existing under the laws of the jurisdiction of its organization or incorporation and, if relevant under such laws, in good standing.

(b) During the Term (and, in the case of Samsung, during the period of time during which Samsung has [***]), Immersion Ireland and Samsung warrants that it shall comply, in all material respects, with all applicable laws, regulations, orders or judgments of any court order or other agency of government.

(c) As of the date of execution of this Agreement, Immersion Ireland and Samsung represents and warrants that it has the power to execute this Agreement and any other documentation relating to this Agreement to which it is a party.

(d) As of the date of execution of this Agreement, Immersion Ireland and Samsung represents and warrants that: (i) it has the power to deliver this Agreement and any other documentation relating to this Agreement that it is required by this Agreement to deliver; (ii) it has the power to perform its obligations under this Agreement and has taken all necessary action to authorize such execution, delivery and performance; (iii) no consent of any third party is required for it to enter into or perform this Agreement; (iv) such execution, delivery and performance do not violate or conflict, in each case, in any material manner, with any law applicable to it, any provision of its constitutional documents, any order or judgment of any court or other agency of government applicable to it or any of its assets or any contractual restriction binding on or affecting it or any of its assets.

| 10.2 | Immersion Ireland. Immersion Ireland warrants as follows: |

(a) At the time of delivery of any Licensed Software, Immersion Ireland warrants that such Licensed Software will comply in all material respects with Immersion’s published specifications therefor. Samsung’s sole remedy with respect to breach of this warrant is set forth in Section 4.3(b).

(b) The Licensed Software, as delivered by Immersion Ireland, does not contain any known virus or any other contaminant, including but not limited to, codes, commands or instructions that, in each case, may alter, delete, erase, damage, disable, disrupt or otherwise interfere, in each case, in a manner not intended by Samsung or set forth in the applicable Immersion specifications of the Licensed Software, with the use of the Licensed Software, or any other software, data or information.

(c) Immersion Ireland warrants that, except for the Linux Modules and except as otherwise disclosed by Immersion to Samsung prior to delivery to Samsung, Immersion Ireland shall not incorporate any Open Source Software into the Licensed Software without Samsung’s prior consent.

| 11. | INDEMNITY. |

11.1 IP Claims. Immersion Ireland agrees to (1) indemnify, hold harmless and defend Samsung against any claim, legal action, or administrative procedure filed against Samsung by a third party alleging that the Licensed Software, as used within the scope of this Agreement, infringes any patent, copyright, trademark, trade secret, or other intellectual property right of any third party (an “IP Claim”), and (2) pay all damages, costs, including reasonable attorneys’ fees, finally awarded by a court of competent jurisdiction with respect to such IP Claim awarded against Samsung in a final judgment or settlement approved in advance and in writing by Immersion Ireland; provided that Samsung: (a) notifies Immersion Ireland in writing within thirty (30) days of commencement of such IP Claim, (b) grants Immersion Ireland sole control of the defense and settlement of the IP Claim, and (c) provides Immersion Ireland with all

[***] Confidential Treatment Requested

11

timely assistance, information and authority required for the defense and settlement of the IP Claim. To avoid or settle any IP Claim, Immersion Ireland, at its sole option and expense, may: (i) obtain for Samsung the right to continue to use the Licensed Software as contemplated herein, (ii) modify the Licensed Software so that it becomes non-infringing, but without materially altering its functionality, (iii) replace the Licensed Software with functionally equivalent non infringing technology, or, if options (i), (ii) and (iii) above cannot be accomplished despite Immersion Ireland’s commercially reasonable efforts, then Immersion Ireland may terminate this Agreement and, to the extent that any [***] at the time of such termination, shall [***] occurring after such termination. Notwithstanding the foregoing, Immersion Ireland assumes no liability for IP Claims to the extent arising from or based on (i) the combination of the Licensed Software with other products not provided by Immersion Ireland where such claim would not have arisen from the use of the Licensed Software standing alone; except where such combination is necessary for or the intended use of the Licensed Software, (ii) any modification of the Licensed Software not made by or under the authority of Immersion Ireland, where such infringement would not have occurred but for such modifications, or (iii) use of any version of the Licensed Software other than the current version of the Licensed Software, if the infringement would not have occurred but for use of such non-current version. Samsung’s sole and exclusive remedy with respect to any IP Claim shall be for Immersion Ireland to perform its obligations under this Section 11.

11.2 Immersion Ireland. In the event that the Korean tax authorities indicate that such Korean tax authorities intend to review the payments made by Samsung to Immersion Ireland hereunder to determine whether any withholding tax on such payments is required under applicable Korean law or international treaty to be withheld by Samsung, Samsung shall immediately inform Immersion Ireland and Immersion Corporation in writing regarding such inquiries. Immersion Ireland and Immersion Corporation shall cooperate with Samsung on behalf of Immersion Ireland or Immersion Corporation in connection with such inquiry, and Samsung shall respond to such Korean tax authorities. However, in the event that the Korean tax authorities assert that withholding tax should have been withheld on such payments and impose such withholding tax thereafter (a “Withholding Claim”), Immersion Ireland or Immersion Corporation shall either (a) pay such withholding tax (including taxes due, penalty, interest, etc. imposed by such Korean tax authority) (collectively, the “Imposed Tax”) by the due date imposed by such Korean tax authority directly to such Korean tax authority or, if necessary, Immersion Ireland or Immersion Corporation may pay Samsung the amount equal to the Imposed Tax to comply with such Withholding Claim by Samsung as an obligatory tax payer on behalf of Immersion Ireland or Immersion Corporation, or (b) appeal such Withholding Claim through all applicable administrative and judicial sources of appeal (provided that Immersion shall pay the Imposed Tax and all related expenses to appeal such Withholding Claim according to 11.2(a) above), and Samsung shall cooperate with Immersion Ireland and Immersion Corporation in connection with such appeal. For the avoidance of doubt, Samsung may not settle any Withholding Claim without the consent of Immersion Ireland and Immersion Corporation. For the purpose of clarity, Immersion shall indemnify, hold harmless, and defend Samsung against any claim, legal action, or administrative procedure in connection with any withholding tax issues. In a reasonable opinion of an independent tax attorney agreed between the parties, if it is reasonably likely that the Korean tax authorities challenge the issue of beneficial ownership with respect to Immersion Ireland, then Samsung is entitled to withhold applicable withholding taxes. Samsung shall provide all necessary assistance to Immersion to enable Immersion to obtain a credit for any Imposed Taxes paid by Immersion (or any amounts withheld by Samsung, including any Imposed Taxes withheld by Samsung) if permitted/available under applicable law.

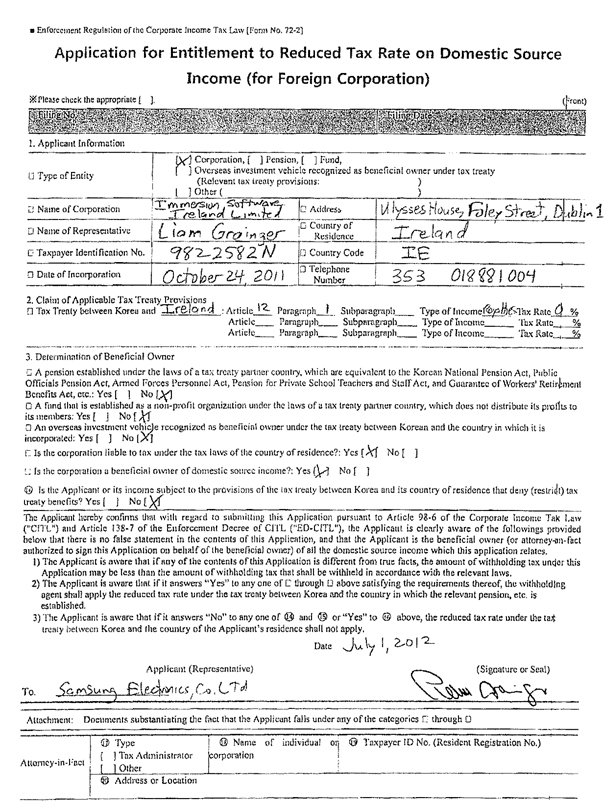

11.3 Immersion Ireland has executed an Application for Entitlement to Reduced Tax Rate on Domestic Source Income (for Foreign Corporation) (“Application”) attached as Exhibit D hereto, and has delivered such Application on or prior to the execution of this Agreement.

12. LIMITATION OF LIABILITY. IN NO EVENT WILL IMMERSION BE LIABLE FOR ANY LOSS OF USE, LOSS OF PROFIT, INTERRUPTION OF BUSINESS, OR ANY INDIRECT, SPECIAL, INCIDENTAL, PUNITIVE, OR CONSEQUENTIAL DAMAGES OF ANY KIND (INCLUDING LOST PROFITS), REGARDLESS OF THE FORM OF ACTION, WHETHER IN CONTRACT, TORT (INCLUDING NEGLIGENCE), STRICT PRODUCT LIABILITY, OR OTHERWISE, EVEN IF IMMERSION HAS BEEN ADVISED, OR SHOULD HAVE BEEN AWARE, OF THE POSSIBILITY OF SUCH DAMAGES. EXCEPT FOR INDEMNIFICATION OBLIGATIONS AND A BREACH OF

[***] Confidential Treatment Requested

12

THE CONFIDENTIALITY PROVISIONS SET FORTH HEREIN, IN NO EVENT WILL IMMERSION’S LIABILITY UNDER THIS AGREEMENT, WHETHER IN CONTRACT, TORT, OR ANY OTHER THEORY OF LIABILITY, EXCEED THE TOTAL AMOUNT RECEIVED BY IMMERSION FROM SAMSUNG PURSUANT TO THIS AGREEMENT. The parties acknowledge that the limitations of liability in this Section 12 and in the other provisions of this Agreement and the allocation of risk herein are an essential element of the bargain between the parties, without which Immersion Ireland would not have entered into this Agreement. Immersion Ireland’s pricing reflects this allocation of risk and the limitation of liability specified herein.

| 13. | TERM AND TERMINATION. |

13.1 Term. This Agreement shall commence as of the Effective Date and continue until [***] (the “Term”). Thereafter, this Agreement may be renewed for additional periods of time only upon the mutual written agreement between the parties hereto via a written amendment to this Agreement.

13.2 Termination For Cause. Either party may terminate this Agreement by written notice if the other party materially breaches the terms of this Agreement and fails to cure such breach within sixty (60) days of receipt of written notice thereof by such other party.

13.3 Effect of Termination. Notwithstanding anything to the contrary in this Agreement, upon the expiration or termination of this Agreement for any reason: (a) Samsung shall immediately cease distributing all Licensed Devices, using all Immersion Trademarks, and holding itself out as a reseller or distributor of the Licensed Software and shall promptly return or destroy, as directed by Immersion, all copies of the Licensed Software (and confidential information) and provide Immersion Ireland with a written certification of such destruction signed by an officer of Samsung; and (b) all rights and licenses granted by Immersion hereunder shall immediately cease, and Samsung shall immediately pay to Immersion all amounts then due and outstanding under this Agreement (if any). The defined terms in this Agreement and the rights and obligations contained in the following sections shall survive any expiration or termination of this Agreement: Section 1, Section 2.2, Section 2.4, Section 2.5, Section 3.1 through Section 3.3 (in each case, during the period of time that Samsung has [***]), Section 3.4, Section 3.5, Section 5.1 (with respect to amounts due at the end of the Term), Section 5.2 (with respect to amounts due at the end of the Term), Section 5.3 through Section 6, Section 7, Section 8, Section 9, Section 11, Section 12, Section 13, and Section 14.

13.4 [***]. Subject to the terms and conditions of this Section 13.4 (including, but not limited to, payment of the applicable fees to Immersion Ireland), Samsung may exercise one of the following:

(a) [***]. Notwithstanding Section 13.3, if on or prior to [***], Samsung provides written notice to Immersion Ireland that Samsung would like to exercise its rights pursuant to this Section 13.4(a) (and pays to Immersion Ireland an amount equal to U.S.$[***]), then Samsung may continue to sell Licensed Device models after the expiration of the Term that, as of the expiration of the Term, Samsung had commenced commercially producing, distributing and selling, for a period not to exceed [***] (the “[***]”);

(b) [***]. Notwithstanding Section 13.3, if on or prior to [***], Samsung provides written notice to Immersion Ireland that Samsung would like to exercise its rights pursuant to this Section 13.4(b) (and pays to Immersion Ireland an amount equal to U.S.$[***]), then Samsung may continue to sell Licensed Device models after the expiration of the Term that, as of the expiration of the Term, Samsung had commenced commercially producing, distributing and selling, for a period not to exceed [***] (the “[***]”); or

[***] Confidential Treatment Requested

13

(c) [***]. Notwithstanding Section 13.3, if on or prior to [***], Samsung provides written notice to Immersion Ireland that Samsung would like to exercise its rights pursuant to this Section 13.4(c) (and pays to Immersion Ireland an amount equal to U.S.$ [***]), then Samsung may continue to sell a Licensed Device model after the expiration of the Term that, as of the expiration of the Term, Samsung had commenced commercially producing, distributing and selling, [***] such Licensed Device model (the “[***]”).

| 13.5 | Price Protection. |

(a) [***] Sold Units [***]. If the [***] Sold Units reported by Samsung pursuant to Section 5.3 (or determined in an audit pursuant to Section 6) is [***], then if Immersion and Samsung mutually agree to renew this Agreement, then [***] consideration for the licenses set forth in this Agreement (as renewed) shall not [***] (unless otherwise agreed in writing by the parties), with respect to the [***] the Term, so long as, in connection with such amendment to renew this Agreement, Samsung agrees that all other terms and conditions set forth in this Agreement apply to this Agreement (as renewed). Notwithstanding the foregoing, no party shall be required to enter into any agreement (including, but not limited to, an amendment to extend the Term), and no party shall be entitled to unilaterally renew this Agreement or amend this Agreement in any way to extend the Term [***], in each case, without the other party’s written consent via an amendment to this Agreement.

(b) [***] Sold Units [***]. If the [***] Sold Units reported by Samsung pursuant to Section 5.3 (or determined in an audit pursuant to Section 6) is [***], then if Immersion and Samsung mutually agree to renew this Agreement, then [***] consideration for the licenses set forth in this Agreement (as renewed) shall not [***] (unless otherwise agreed in writing by the parties), with respect to the [***] the Term, so long as, in connection with such amendment to renew this Agreement, Samsung agrees that all other terms and conditions set forth in this Agreement apply to this Agreement (as renewed). Notwithstanding the foregoing, no party shall be required to enter into any agreement (including, but not limited to, an amendment to extend the Term), and no party shall be entitled to unilaterally renew this Agreement or amend this Agreement in any way to extend the Term [***], in each case, without the other party’s written consent via an amendment to this Agreement.

| 14. | MISCELLANEOUS. |

14.1 Succession and Assignment. Either party may not assign this Agreement without the prior written consent of the other party, provided however that this Agreement may be assigned either to an Affiliate of the assigning party, or to a corporate successor in interest in the case of a merger or acquisition or in connection with a sale of substantially all of a party’s assets, in each case, without the prior approval of the other party. Any attempt to assign this Agreement, or any license granted herein, in violation of the provisions of this Section 14.1 shall be void. Immersion Ireland shall ensure that any third party to whom Immersion Ireland assigns this Agreement (or sells the Intellectual Property Rights related to this Agreement) shall fully assume all the obligations and responsibilities under this Agreement of Immersion Ireland, including, but not limited to, continuing to grant the licenses to Samsung under this Agreement. Upon consummation of a Change of Control of Immersion Ireland to a Samsung Competitor, or if Immersion Ireland delegates its obligations hereunder or assigns this Agreement to a Samsung Competitor, in whole or in part, either voluntarily or by operation of law, without the prior written consent of Samsung, Samsung may (i) obtain a refund for [***] and/or (ii) may cease to pay Integration and Porting Services Fees for the remaining portion of the Term; provided that, if Samsung exercises its rights with respect to either (i) and/or (ii), then no party (including, but not limited to, Immersion Ireland, Immersion Corporation or an entity that acquires Immersion Ireland or Immersion Corporation) shall be obligated to perform any services (including, but not limited to, Section 4) for Samsung. Further, in case of a Change of Control of Immersion Ireland to a Samsung Competitor, Immersion Ireland shall ensure that Samsung may continue to use the Source Code to enable Samsung to exercise its license granted under this Agreement and Immersion shall

[***] Confidential Treatment Requested

14

provide all reasonable assistance and reasonable support to enable Samsung to exercise such license. “Change of Control” shall be deemed to have occurred in the event that (i) a Samsung Competitor acquires ownership, directly or indirectly, of more than fifty percent (50%) of the voting shares of Immersion Ireland, or otherwise the possession, directly or indirectly, of the power to direct or cause the directions of the management and policies of Immersion Ireland (whether by reason of acquisition, merger, reorganization, operation of law or otherwise); or (ii) all, or substantially all, of Immersion Ireland’s assets are acquired (whether by reason of acquisition, merger, reorganization, operation of law or otherwise) by, or combined by merger with, any other third party.

14.2 Third Party Beneficiary. Notwithstanding anything to the contrary in this Agreement, Immersion Corporation shall fulfill any of Immersion Ireland’s obligations pursuant to this Agreement should Immersion Ireland fail to meet any of its assumed obligations. Immersion Ireland and Immersion Corporation shall be jointly and severally liable for any breach of this Agreement by Immersion Ireland or Immersion Corporation or failure to perform any obligations of Immersion Ireland or Immersion Corporation under or in relation to this Agreement. Further, Immersion Corporation reserves the right to fully enforce in its own name, at law and in equity, any and all rights of Immersion Ireland under this Agreement should Immersion Ireland fail to assert such rights.

14.3 Governing Law. The validity of this Agreement, the construction and enforcement of its terms, and the interpretation of the rights and duties of the parties shall be governed by the laws of the state of New York, U.S.A., excluding its choice of law principles. The parties shall in good faith attempt to resolve any dispute arising out of or related to this Agreement promptly by negotiations between executives who have authority to settle such controversy. If such dispute has not been resolved by negotiation within ninety (90) days, the parties shall endeavor to settle such dispute by binding arbitration in Maui, Hawaii, conducted expeditiously in accordance with the Rules of Arbitration of the International Chamber of Commerce, or equivalent thereof if agreed between the parties; provided, however, that if one party has requested the other to participate in negotiation and the other has failed to participate, the requesting party may initiate arbitration before the expiration of the above period. The award of the arbitration shall be made pursuant to a written opinion stating the legal basis and factual findings underlying the opinion and shall be final and binding upon the parties.

| 14.4 Confidential | Information. |

(a) Immersion Disclosures. Samsung agrees to treat as confidential, and not to use for any other purpose other than permitted by Immersion, any information designated as confidential information by Immersion, and provided to Samsung by Immersion during the course of this Agreement which is either marked as confidential or proprietary or summarized and identified in writing as confidential or proprietary within thirty (30) days after disclosure, and further agrees not to disclose such confidential information to third parties.

(b) Samsung Disclosures. Immersion agrees to treat as confidential, and not to use for any other purpose other than permitted by Samsung, any information designated as confidential information by Samsung, and provided to Immersion by Samsung during the course of this Agreement which is either marked as confidential or proprietary or summarized and identified in writing as confidential or proprietary within thirty (30) days after disclosure, and further agrees not to disclose such confidential information to third parties.

(c) Exceptions. The foregoing obligations of confidentiality do not apply to information which (i) was previously known to the recipient without a duty of confidentiality, (ii) is rightfully received from a third party by the recipient without a duty of confidentiality, or (iii) becomes publicly known or publicly available without breach of this Agreement, (iv) was communicated by such disclosing party to an unaffiliated third party on an unrestricted basis; or (v) is independently developed without use of disclosing party’s Confidential Information. In the event either party receives a subpoena or other legal process requiring the disclosure of confidential information previously disclosed by the other, the party receiving such subpoena or legal process shall promptly notify the other party in order to permit such party to seek to prevent or limit disclosure of its confidential information. Provided such notice is timely given, required disclosure of confidential information pursuant to subpoena or other legal process shall not constitute a breach of this Agreement. Each party may, in the course of conducting such party’s business, disclose confidential information received from the other party to the recipient party’s professional business advisors such as accountants and attorneys or as otherwise required to comply with the law.

[***] Confidential Treatment Requested

15

14.5 Confidentiality of Agreement. Notwithstanding anything in this Agreement to the contrary, neither party shall disclose the information within the body of this Agreement, as well as the exhibits, to any third parties other than: (a) to the extent approved in writing in advance by the other party; (b) to the extent legally compelled, provided, however, that prior to any such compelled disclosure, such party shall give the other party reasonable advance notice and shall cooperate with such other party in protecting against any such disclosure and/or obtaining a protective order narrowing the scope of such disclosure; (c) as required by the applicable securities laws, including, without limitation, requirements to file a copy of this Agreement (redacted to the extent reasonably permitted by applicable law) or to disclose information regarding the provisions hereof or performance hereunder to applicable regulatory authorities, provided that such party shall give the other party reasonable advance notice of such disclosure; (d) in confidence, to legal counsel and accountants; (e) in confidence, in connection with a bona-fide proposed merger, acquisition or similar transaction; (f) in confidence, to banks and financing sources and their advisors for a reasonable business purpose; or (g) as reasonably necessary in connection with the enforcement of this Agreement.

14.6 No Agency. Neither party is the agent, partner, or joint venturer with respect to the other party. Neither party is authorized to act as the agent, partner, or joint venturer of the other party hereunder in any respect.

14.7 No Waiver. No delay or omission by either party hereto to exercise any right or power occurring upon any noncompliance or default by the other party with respect to any of the terms of this Agreement shall impair any such right or power or be construed to be a waiver thereof. A waiver by either of the parties hereto of any of the covenants, conditions, or agreements to be performed by the other shall not be construed to be a waiver of any succeeding breach thereof or of any covenant, condition, or agreement herein contained. Unless stated otherwise, all remedies provided for in this Agreement shall be cumulative and in addition to and not in lieu of any other remedies available to either party at law, in equity, or otherwise.

14.8 Notices. All notices sent under this Agreement shall be deemed effective when received and made in writing by either (a) registered mail, (b) certified mail, return receipt requested, or (c) DHL, Federal Express, UPS, or other reliable overnight courier service, and, except as otherwise revised by written notice provided in conformance with this Section 14.8, shall be sent to the address and attention set forth on the cover page hereof.

14.9 General. The paragraph headings appearing in this Agreement are inserted only as a matter of convenience and in no way define, limit, construe, or describe the scope or extent of such section or in any way affect this Agreement. Where the singular is used in this Agreement, the same shall be construed as meaning the plural where the context so admits or requires and the converse shall hold as applicable. Whenever used in this Agreement, unless otherwise specified, the terms “includes,” “including,” “e.g.,” “for example,” “such as” and other similar terms are deemed to include the term “without limitation” immediately thereafter. Each party acknowledges that it has had the opportunity to review this Agreement with legal counsel of its choice, and there will be no presumption that ambiguities will be construed or interpreted against the drafter, and no presumptions made or inferences drawn because of the inclusion of a term not contained in a prior draft or the deletion of a term contained in a prior draft. If any one or more of the provisions of this Agreement shall be held to be invalid, illegal, or unenforceable, the validity, legality, or enforceability of the remaining provisions of this Agreement shall not in any way be affected or impaired thereby and the invalid, illegal, or unenforceable provision shall be changed and interpreted so as to best accomplish the objectives of the provision within the limits of applicable law. This Agreement constitutes the entire agreement between Immersion and Samsung with respect to the matters contained herein and supersedes all prior oral or written representations, proposals, quotations, understandings, and agreements (including, but not limited to, [***]). Unless otherwise separately agreed to in writing by Immersion, any additional or different terms, whether contained in Samsung’s purchase order, acknowledgement form, or any other communication of Samsung, are unacceptable to Immersion, are expressly rejected, and shall not become part of this Agreement. Any

[***] Confidential Treatment Requested

16

amendment to this Agreement must be in writing and signed by authorized representatives of both parties hereto. This Agreement may be executed simultaneously in two or more counterparts (including via PDF or facsimile), each of which will be considered an original, but all of which together will constitute one and the same instrument. This Agreement is in the English language only, which language shall be controlling in all respects, and all versions of this Agreement in any other language shall be for accommodation only and shall not be binding on the parties. All communications and notices made or given pursuant to this Agreement shall be in English.

[Remainder of Page Intentionally Left Blank]

[***] Confidential Treatment Requested

17

EXHIBIT A

IMMERSION TOUCHSENSE SOLUTIONS

|

Name

|

Description

| |

| TouchSense 3000 (“TS3000”)

|

Immersion’s TouchSense Player 3000 (and any related haptic effect libraries), executable only in object code format, providing single-actuator support, solely in the form delivered by Immersion Ireland to Samsung pursuant to this Agreement.

| |

| TouchSense 4000 (“TS4000”)

|

Immersion’s TouchSense Player 4000 (and any related haptic effect libraries), executable only in object code format, providing multiple-actuator support, solely in the form delivered by Immersion Ireland to Samsung pursuant to this Agreement.

| |

| TouchSense 5000 (“TS5000”)

|

Immersion’s TouchSense Player 5000 (and any related haptic effect libraries), executable only in object code format, providing Piezoactuator support, solely in the form delivered by Immersion Ireland to Samsung pursuant to this Agreement.

| |

| Integrator (formerly MOTIV) (“Integrator”) | The modules of Immersion Corporation’s Integrator that are commercially-available as of the Effective Date – which includes, and is limited to, the following modules:

• User Interface Module, solely in the form delivered by Immersion Ireland to Samsung pursuant to this Agreement. Generally, this module provides a mechanism to integrate haptics into applications of the Android operating system that are developed using standard Android operating system “widgets.”

• Theme Manager Module, solely in the form delivered by Immersion Ireland to Samsung pursuant to this Agreement. Generally, this module provides default haptic themes that can be applied to the Android operating system.

• Reverb Module, solely in the form delivered by Immersion Ireland to Samsung pursuant to this Agreement. Generally, this module translates audio data into haptic effects.

• Ringtones Module, solely in the form delivered by Immersion Ireland to Samsung pursuant to this Agreement. Generally, this module couples pre-designed haptic effects with ringtones.

• WebKit Module, solely in the form delivered by Immersion Ireland to Samsung pursuant to this Agreement. Generally, this module provides a mechanism to integrate haptics into standard elements of webpages when viewed with the browser software known as “WebKit”.

| |

| HD Integrator (“HD Integrator”) |

The modules of Immersion Corporation’s HD Integrator that are commercially-available as of the Effective Date – which includes, and is limited to, the following modules:

• User Interface Module, solely in the form delivered by Immersion Ireland to Samsung pursuant to this Agreement. Generally, this module provides a mechanism to integrate haptics into applications of the Android operating system that are developed using standard Android operating system “widgets.” |

[***] Confidential Treatment Requested

18

| • Theme Manager Module, solely in the form delivered by Immersion Ireland to Samsung pursuant to this Agreement. Generally, this module provides default haptic themes that can be applied to the Android operating system.

• Reverb Module, solely in the form delivered by Immersion Ireland to Samsung pursuant to this Agreement. Generally, this module translates audio data into haptic effects.

• Ringtones Module, solely in the form delivered by Immersion Ireland to Samsung pursuant to this Agreement. Generally, this module couples pre-designed haptic effects with ringtones.

• WebKit Module, solely in the form delivered by Immersion Ireland to Samsung pursuant to this Agreement. Generally, this module provides a mechanism to integrate haptics into standard elements of webpages when viewed with the browser software known as “WebKit”.

|

[***] Confidential Treatment Requested

19

EXHIBIT B

ATTRIBUTION

|

Weblink or manuals

|

Required Logo and/or Legend

| |

| (1) Samsung will use best efforts to place the language in the column to the immediate right on an Internet website or manuals designed to be accessed by end users (located in the United States) of Licensed Devices.

(2) Samsung must also use best efforts to place the following Immersion logo (or future derivative or version of the mark created by Immersion), prominently in the appropriate portion of such Internet website or manuals:

(3) |

TouchSense® Technology and TouchSense ®System 3000 Series and TouchSense ®System 5000 Series Licensed from Immersion Corporation. TouchSense ®System 3000 Series, TouchSense ®System 5000 Series, and other Immersion software contained herein are protected under one or more of the U.S. Patents found at the following address www.immersion.com/patent-marking.html and other patents pending

|

[***] Confidential Treatment Requested

20

EXHIBIT C

COOPERATIVE IMPLEMENTATION

[***]

[***] Confidential Treatment Requested

21

EXHIBIT D

Application for Entitlement to Reduced Tax Rate on Domestic Source Income (for Foreign Corporation)

[See Attached]

[***] Confidential Treatment Requested

22

[***] Confidential Treatment Requested

Enforcement Regulation of the Corporate Income Tax Law [Form No, 72-2]

Application for Entitlement to Reduced Tax Rate on Domestic Source Income (for Foreign Corporation)

Please check the appropriate ¨

1. Applicant Information

¨ Type of Entity

x Corporation, ¨ Pension, ¨ Fund,

¨ Overseas investment vehicle recognized as beneficial owner under tax treaty

(Relevant tax treaty provisions: ) ¨ Other ¨

¨ Name of corporation, Immersion Software Ireland Limited

¨ Address Ulysses House, Foley Street, Dublin 1

¨ Name of Representative Liam Grainger ¨ Country of Residence Ireland

¨ Taxpayer Identification No. 9822582N

¨Country Code IE

Date of Incorporation October 24, 2011

¨ Telephone Number 353 018881004

2. Claim of Applicable Tax Treaty Provisions

¨ Tax Treaty between Korea and Ireland :

Article 12 Paragraph 1 Subparagraph Type of Income Roythes Tax Rate 0 %

Article Paragraph Subparagraph Type of Income Tax Rate%

Article Paragraph Subparagraph Type of Income Tax Rate%

3. Determination of Beneficial Owner

¨A pension established under the laws of a tax treaty partner country, which are equivalent to the Korean National Pension Act, Public Officials Pension Act, Armed Forces Personnel Act, Pension for Private School Teachers and Staff Act, and Guarantee of Workers’ Retirement, Benefits Act, etc.: Yes ¨ No x

¨ A find that is established as a non-profit organization under the laws of a tax treaty partner country, which does not distribute its profits to its members: Yes ¨ No x

¨ An overseas investment vehicle recognized as beneficial owner under the tax treaty between Korean and the country in which it is incorporated: Yes ¨ No x

¨ Is the corporation liable to tax under the tax laws of the country of residence?: Yes x No ¨

¨ Is the corporation a beneficial owner of domestic source income?: Yes x No ¨

¨ Is the Applicant or its income subject to the provisions of the tax treaty between Korea and its country of residence that deny (restrict) tax treaty benefits? Yes¨ No x

The Applicant hereby confirms that with regard to submitting this Application pursuant to Article 98-6 of the Corporate Income Tax Law (“CITL”) and Article 138-7 of the Enforcement Decree of CITL (“ED-CITL”), the Applicant is clearly aware of the followings provided below that there is no false statement in the contents of this Application, and that the Applicant is the beneficial owner (or attorney-in-fact authorized to sign this Application on behalf of the beneficial owner) of all the domestic source income which this application relates.

1) The Applicant is aware that if any of the contents of this Application is different from true facts, the amount of withholding tax under this Application may be less than the amount of withholding tax that shall be withheld in accordance with the relevant laws.

2) The Applicant is aware that if it answers “Yes” to any one of ¨ through ¨ above satisfying the requirements thereof, the withhold agent shall apply the reduced tax rate under the tax treaty between Korea and the country in which the relevant pension, etc. is established,

3) The Applicant is aware that if it answers “No” to any one of 14 and 15 or “Yes” to 16 above, the reduced tax rate under the tax treaty between Korea and the country of the Applicant’s residence shall not apply,

Date

July 1, 2012

Applicant (Representative)( Signature or Seal)

To Samsung Electronic, Co. Ltd

Attachment: Documents substantiating the fact that the Applicant falls under any of the categories ¨ through ¨

Attorney-in-Fact

17 Type 18 Name of individual on corporation 19 Taxpayer ID No. (Resident Registration No.) ¨ Tax Administrator ¨ Other

20 Address or Location

[***] Confidential Treatment Requested

Filling Instruction

The Filing date is the date on which the withholding agent files this Application as received from the beneficial owner and the filing number is the serial number assigned to such filing.

1. This Application shall be submitted by a foreign corporation which wishes to apply a reduced tax rate under the relevant tax treaty applicable to its Korean source income, and this form shall not be submitted by a foreign corporation which is exempt from Korean withholding tax pursuant to the relevant tax treaty. In the case where the Applicant receives additional Korean source income after the submission of this Application whereby a reduced tax rate under the relevant tax treaty was applied to the previous Korean source income, the Applicant is required to prepare and file a new application if there is any change in its corporate name, representative, taxpayer ID No., address, country of residence and telephone number, etc., or if three years have elapsed since the submission of this Application.

2. Item 1 Check the appropriate type of entity that applies. If the Applicant is a pension, fund of overseas investment vehicle falling under any one of the items under Article 138-7(5) of the ED-CITL, check the appropriate [space]. Also, enter the relevant tax treaty provisions in the parentheses in the case of an overseas investment vehicle. For other types of Applicants such as a government , local government or central bank, etc., select “Other” and specify the type in parentheses.

3. Item 2 Enter the Applicant’s full name in English.

4. Item 3 If the representative is a foreigner: enter his/her full English name as shown in his/her passport.