UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K/A

(Amendment No. 1)

(Mark One)

|

þ

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2012

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to

Commission file number 000-25097

SILVER HORN MINING LTD.

(Exact name of registrant as specified in its charter)

|

Delaware

|

65-0783722

|

|

|

(State or other jurisdiction of

|

(I.R.S. Employer

|

|

|

incorporation or organization)

|

Identification No.)

|

|

|

3346 Guadalupe Road

Apache Junction, Arizona

|

85120

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (480) 288-6530

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, par value $0.0001

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes £ No R

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes £ No R

Indicate by check whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes R No £

Indicate by check whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such filed).

Yes R No £

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o

|

Accelerated filer o

|

|

Non-accelerated filer o (Do not check if a smaller reporting company)

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act).

Yes R No £

The aggregate market value of the voting and non-voting stock held by non-affiliates of the registrant as of the last business day of the registrant’s most recently completed second fiscal quarter, based on the price at which the common equity was last sold on the OTC Bulletin Board on such date was approximately $26,107,556. For purposes of this computation only, all officers, directors and 10% or greater stockholders of the registrant are deemed to be affiliates.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock as of the latest practicable date.

|

Class

|

Outstanding at April 12, 2013

|

|

|

Common Stock, $0.0001 par value

|

253,033,555

|

This Amendment No. 1 on Form 10-K/A (this “Amendment”) amends the Silver Horn Mining Ltd. (the “Company”) Annual Report on Form 10-K for the year ended December 31, 20012, previously filed with the Securities and Exchange Commission on April 16, 2013 (the “Original Filing”). This Amendment is being filed to include the predecessor auditor's opinion and consent, and to correct the periods covered by the current auditor.

Unless otherwise indicated, this report speaks only as of the date that the original report was filed. No attempt has been made in this Form 10-K/A to update other disclosures presented in the Original Filing. This Form 10-K/A does not reflect events occurring after the filing of the Original Filing or modify or update those disclosures, including the exhibits to the Original Filing affected by subsequent events; however, this Form 10-K/A includes as exhibits 31.1, 31.2 and 32.1 new certifications by the Company’s Chief Executive Officer and Chief Financial Officer as required by Rule 12b-15.

SILVER HORN MINING LTD.

ANNUAL REPORT ON FORM 10-K

Fiscal Year Ended December 31, 2012

TABLE OF CONTENTS

|

Page

|

|

|

PART I

|

|

|

Item 1. Business

|

1

|

|

Item 1A. Risk Factors

|

4

|

|

Item 1B. Unresolved Staff Comments

|

4

|

|

Item 2. Properties

|

4

|

|

Item 3. Legal Proceedings

|

8

|

|

Item 4. Mine Safety Disclosures

|

8

|

|

PART II

|

|

|

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

8

|

|

Item 6. Selected Financial Data

|

9

|

|

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

9

|

|

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

|

14

|

|

Item 8. Financial Statements and Supplementary Data

|

14

|

|

Item 9. Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

14

|

|

Item 9A. Controls and Procedures

|

14

|

|

Item 9B. Other Information

|

16

|

|

PART III

|

|

|

Item 10. Directors, Executive Officers and Corporate Governance

|

16

|

|

Item 11. Executive Compensation

|

18

|

|

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

19

|

|

Item 13. Certain Relationships and Related Transactions, and Director Independence

|

20

|

|

Item 14. Principal Accountant Fees and Services

|

22

|

|

PART IV

|

|

|

Item 15. Exhibits, Financial Statement Schedules

|

23

|

|

Signatures

|

24

|

PART I

Item 1. Business.

Corporate History

We were incorporated under the name “Swifty Carwash & Quick-Lube, Inc.” in the state of Florida on September 25, 1997. On October 22, 1999, we changed our name from “Swifty Carwash & Quick-Lube, Inc.” to “SwiftyNet.com, Inc.” On January 29, 2001, we changed our name from “SwiftyNet.com, Inc.” to “Yseek, Inc.” On June 10, 2003, we changed our name from “Yseek, Inc.” to “Advanced 3-D Ultrasound Services, Inc.” We merged with World Energy Solutions, Inc., a private Florida corporation, on August 17, 2005. Advanced 3D Ultrasound Services, Inc. remained as the surviving entity and legal acquirer, and World Energy Solutions, Inc. was the accounting acquirer. On November 7, 2005, we changed our name to “World Energy Solutions, Inc.” and merged with Professional Technical Systems, Inc. We remained as the surviving entity and legal acquirer, while Professional Technical Systems, Inc. was the accounting acquirer. On February 26, 2009, we changed our name to “EClips Energy Technologies, Inc.” For the purpose of changing our state of incorporation to Delaware, we merged with and into our newly-formed wholly-owned subsidiary, EClips Media Technologies, Inc. on April 21, 2010, with EClips Media Technologies, Inc. continuing as the surviving corporation. Effective April 25, 2011, we changed our name to “Silver Horn Mining Ltd.” The name change was effected pursuant to Section 253 of the Delaware General Corporation Law by merging a newly-formed, wholly-owned subsidiary with and into us, and we remained as the surviving corporation in the merger.

Our Current Business

Upon the appointment of Daniel Bleak as our Chief Executive Officer and Chairman on May 2, 2011, we focused our business efforts on the acquisition and exploration of properties that may contain mineral resources, principally silver. Our target properties are those that have been the subject of historical exploration or previous production. We have filed federal unpatented lode mining claims in Arizona for the purpose of exploration and potential development of silver on a total of approximately 1,000 acres. We plan to review opportunities to acquire additional mineral properties with current or historic silver mineralization with meaningful exploration potential.

Our properties do not have any reserves. We plan to conduct exploration programs on these properties with the objective of ascertaining whether any of our properties contain concentrations of silver that are prospective for mining.

The 76 Property is located in Yavapai County, Arizona, 50 miles northwest of Phoenix, Arizona. The property consists of 36 federal unpatented lode mining claims on Bureau of Land Management (“BLM”) land totaling 720 acres that we acquired pursuant to a quitclaim deed that we purchased from Can-Am Gold Corp., an entity controlled by Mr. Bleak, for $10.00 on April 26, 2011. To maintain the mining claims in good standing, we must make annual maintenance fee payments to the BLM, in lieu of annual assessment work. These claim fees are $140 per claim per year, plus a total annual fee of approximately $45 for all of the claims to record a notice of intent to hold the claims in Yavapai County. We are currently planning an exploration program consisting of sampling, mapping and assaying to determine potential targets for drilling and further development. The 76 Property does not currently have any reserves. All activities undertaken and currently proposed at the 76 Property are exploratory in nature.

1

The COD Property is located in Mohave County, Arizona, 7 miles southwest of Chloride, Arizona. The property consists of 14 federal unpatented lode mining claims on BLM land totaling approximately 280 acres. We filed the claims with the BLM on July 1, 2011. To maintain the mining claims in good standing, we must make annual maintenance fee payments to the BLM, in lieu of annual assessment work. These claim fees are $140 per claim per year, plus a total annual fee of approximately $14 for all of the claims to record a notice of intent to hold the claims in Mohave County. We are currently planning an exploration program consisting of sampling, mapping, performing a grid survey and assaying to determine potential targets for drilling and further development. The COD Property does not currently have any reserves. All activities undertaken and currently proposed at the COD Property are exploratory in nature.

On September 18, 2011 we received a notice from John C. Cost claiming that, of these 14 claims, at least nine are situated overlapping his alleged preexisting claims, and requesting that we cease and desist from sampling or removing any ores from these properties. We believe Mr. Cost’s demands are without merit. On March 16, 2012 we filed a complaint against Mr. Cost in Mohave County Superior Court for quiet title and recovery of real property regarding the disputed mining claims. The case is currently in discovery, and trial is set for August 20, 2013.

Competition

We do not compete directly with anyone for the exploration or removal of silver and other minerals from our property as we hold all interest and rights to the claims. Readily available commodities markets exist in the U.S. and around the world for the sale of minerals. Therefore, we will likely be able to sell silver and other minerals that we are able to recover. We will be subject to competition and unforeseen limited sources of supplies in the industry in the event spot shortages arise for supplies such as dynamite, and certain equipment such as bulldozers and excavators that we will need to conduct exploration. If we are unsuccessful in securing the products, equipment and services we need we may have to suspend our exploration plans until we are able to secure them.

Compliance with Government Regulation

We are required to comply with all regulations, rules and directives of governmental authorities and agencies applicable to the exploration of minerals in the United States generally. We are also subject to the regulations of the BLM.

We are required to pay annual maintenance fees to the BLM to keep our federal lode mining claims in good standing. The maintenance period begins at noon on September 1 through the following September 1 and payments are due by the first day of the maintenance period. The annual fee is $140 per claim.

Future exploration drilling on any of our properties that consist of BLM land will require us to either file a Notice of Intent or a Plan of Operations with the BLM, depending upon the amount of new surface disturbance that is planned. A Notice of Intent is for planned surface activities that anticipate less than five acres of surface disturbance, and usually can be obtained within a 30 to 60 day time period. A Plan of Operations will be required if there is greater than five acres of new surface disturbance involved with the planned exploration work. A Plan of Operations can take several months to be approved, depending on the nature of the intended work, the level of reclamation bonding required, the need for archeological surveys, and other factors as may be determined by the BLM. Permits to drill are also required from the Arizona Department of Water Resources.

Research and Development

We did not expend funds for research and development costs in fiscal 2011 and 2012.

2

Employees

As of December 31, 2012, we had no full time or part time employees. On April 3, 2011 we entered into a consulting agreement with Mr. Bleak that terminated on June 30, 2011. On June 1, 2011, we entered into a one year services and employee leasing agreement with MJI Resource Management Corp. pursuant to which it made available to us six of its employees, including Mr. Bleak, for the purpose of performing management, operations, legal, accounting and resource location services. Mr. Eckersley, one of our directors, served as the President of MJI Resource Management Corp. from May 18, 2011 through September 30, 2011. One of our former employees who we compensated through the services and employee leasing agreement served as the president of MJI Resource Management Corp. from October 1, 2011 through December 5, 2012.

Compliance with Government Regulation

Various levels of governmental controls and regulations address, among other things, the environmental impact of mineral exploration and mineral processing operations and establish requirements for decommissioning of mineral exploration properties after operations have ceased. With respect to the regulation of mineral exploration and processing, legislation and regulations in various jurisdictions establish performance standards, air and water quality emission standards and other design or operational requirements for various aspects of the operations, including health and safety standards. Legislation and regulations also establish requirements for decommissioning, reclamation and rehabilitation of mineral exploration properties following the cessation of operations and may require that some former mineral properties be managed for long periods of time after exploration activities have ceased.

Our exploration activities are subject to various levels of federal and state laws and regulations relating to protection of the environment, including requirements for closure and reclamation of mineral exploration properties. Some of the laws and regulations include the Clean Air Act, the Clean Water Act, the Comprehensive Environmental Response, Compensation and Liability Act, the Emergency Planning and Community Right-to-Know Act, the Endangered Species Act, the Federal Land Policy and Management Act, the National Environmental Policy Act, the Resource Conservation and Recovery Act, and all related state laws in Arizona. Additionally, our property is subject to the federal General Mining Law of 1872, which regulates how mineral claims on federal lands are obtained.

Convertible Debentures and Warrants

Between December 2009 and June 2010 we entered into various securities purchase agreements with accredited investors pursuant to which we agreed to issue an aggregate of $1,025,000 of our 6% convertible debentures for an aggregate purchase price of $1,025,000. The debentures had an interest rate of 6% per annum and matured two years from the dates of issuance. The debentures were convertible at the option of the holder at any time into shares of common stock, at a conversion price equal to the lesser of (i) $0.025 per share or (ii) until the 18 month anniversary of the debenture, the lowest price paid per share or the lowest conversion price per share in a subsequent sale of our equity and/or convertible debt securities paid by investors after the date of the debenture. In connection with the agreements, the investors received an aggregate of 41,000,000 warrants to purchase shares of our common stock. The warrants are exercisable for a period of five years from the dates of issuance at an exercise price of $0.025, subject to adjustment in certain circumstances. Warrant holders may exercise the warrant on a cashless basis if the fair market value (as defined in the warrant) of one share of common stock is greater than the initial exercise price.

On February 29, 2012, we entered into note purchase agreements with certain investors whereby we sold an aggregate of $105,882 of convertible promissory notes at an aggregate purchase price of $90,000. These investors include Daniel Bleak and several of the Company’s existing shareholders. The notes matured on February 28, 2013. We acknowledged and agreed that the notes were issued at an original issue discount. No regularly scheduled interest payments were paid on this note. The face value of each note may be converted at the holder’s option, in whole or in part, at any time at least three months following the date of issuance into shares of the Company’s common stock at a conversion price of $0.05 per share and shall be subject to adjustment in the case of stock splits, reclassifications, reorganizations, and mergers or consolidations upon issuances at less than the conversion price. We believe that the holders will elect to convert the notes.

3

On May 9, 2012 we entered into securities purchase agreement with an accredited investor pursuant to which we agreed to issue $37,500 of our 6% convertible debentures for an aggregate purchase price of $37,500. The debenture bears interest at 6% per annum and matures twenty-four months from the date of issuance. The debenture is convertible at the option of the holder at any time into shares of common stock, at an initial conversion price equal to the lesser of (i) $0.05 per share or (ii) until the eighteen (18) month anniversary of the debenture, the lowest price paid per share or the lowest conversion price per share in a subsequent sale of the Company’s equity and/or convertible debt securities paid by investors after the date of the debenture. In connection with the agreement, the investor received a warrant to purchase 750,000 shares of the Company’s common stock. The warrant is exercisable for a period of five years from the date of issuance at an initial exercise price of $0.05, subject to adjustment in certain circumstances. The investor may exercise the warrant on a cashless basis if the fair market value (as defined in the warrant) of one share of common stock is greater than the initial exercise price.

At December 31, 2012, we owed $137,500 under these convertible debentures and $105,882 under the promissory notes for total debt of $243,382.

Item 1A. Risk Factors

We qualify as a smaller reporting company, as defined by Rule 229.10(f)(1), and are not required to provide the information required by this Item.

Item 1B. Unresolved Staff Comments

None.

Item 2. Description of Property.

General

We moved to our current facilities, also in Apache Junction, Arizona, on October 3, 2011. Our current facilities are provided to us at no cost by MJI Resources Corp. Mr. Eckersley, one of our directors, served as the President of MJI Resources Corp. from May 18, 2011 through September 30, 2011. Our former operations manager served as the president of MJI Resources Corp. from October 1, 2011 through December 5, 2012. We believe that these facilities are adequate to meet our current needs.

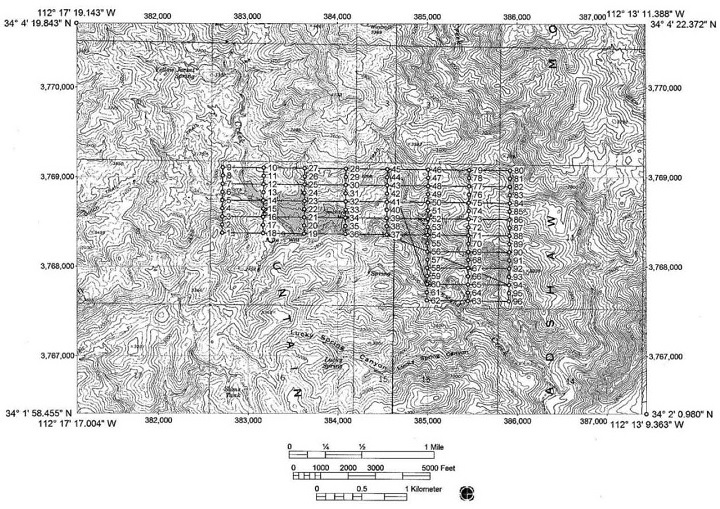

The 76 Property

The 76 Property is located in Yavapai County, Arizona, 50 miles northwest of Phoenix, Arizona. The property can be accessed from Phoenix by taking Interstate 17 north and exiting on Table Mesa Road. From there, proceed west on unimproved roads for approximately 14 miles. The property consists of 36 federal unpatented lode mining claims on BLM land totaling 720 acres that we acquired pursuant to a quitclaim deed that we purchased from Can-Am Gold Corp. for $10.00 on April 26, 2011. To maintain the mining claims in good standing, we must make annual maintenance fee payments to the BLM, in lieu of annual assessment work. These claim fees are $140 per claim per year, plus a total annual fee of approximately $45 for all of the claims to record a notice of intent to hold the claims in Yavapai County. We are currently planning an exploration program consisting of sampling, mapping and assaying to determine potential targets for drilling and further development.

With regard to the unpatented lode mining claims, future exploration drilling will require us to either file a Notice of Intent or a Plan of Operations with the BLM, depending upon the amount of new surface disturbance that is planned. A Notice of Intent is for planned surface activities that anticipate less than five acres of surface disturbance, and usually can be obtained within a 30 to 60 day time period. A Plan of Operations will be required if there is greater than five acres of new surface disturbance involved with the planned exploration work. A Plan of Operations can take several months to be approved, depending on the nature of the intended work, the level of reclamation bonding required, the need for archeological surveys, and other factors as may be determined by the BLM.

4

The 76 Property does not currently have any reserves. All activities undertaken and currently proposed at the 76 Property are exploratory in nature.

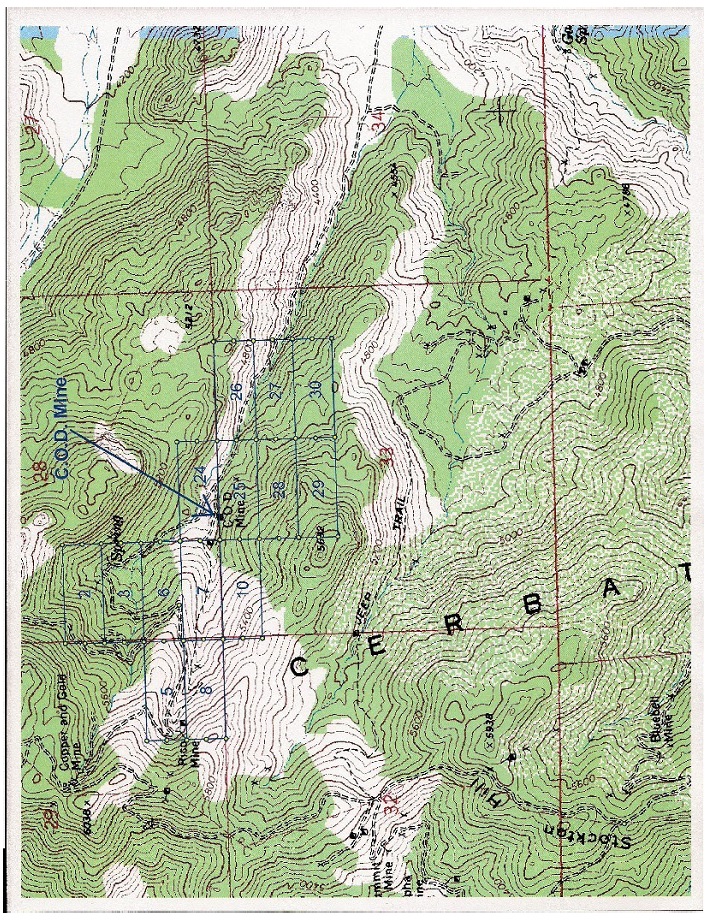

The COD Property

The COD Property is located in Mohave County, Arizona, 7 miles southwest of Chloride, Arizona. The property can be accessed from Kingman, Arizona by taking by taking Stockton Hill Road north for 11 miles, turning west onto Quail Quest Road, and then following Coyote Run Road for 0.9 miles. The property consists of 14 federal unpatented lode mining claims on BLM land totaling approximately 280 acres. We filed the claims with the BLM on July 1, 2011. To maintain the mining claims in good standing, we must make annual maintenance fee payments to the BLM, in lieu of annual assessment work. These claim fees are $140 per claim per year, plus a total annual fee of approximately $14 for all of the claims to record a notice of intent to hold the claims in Mohave County. We are currently planning an exploration program consisting of sampling, mapping, performing a grid survey and assaying to determine potential targets for drilling and further development.

On September 18, 2011 we received a notice from John C. Cost claiming that, of these 14 claims, at least nine are situated overlapping his alleged preexisting claims, and requesting that we cease and desist from sampling or removing any ores from these properties. We believe Mr. Cost’s demands are without merit. On March 16, 2012 we filed a complaint against Mr. Cost in Mohave County Superior Court for quiet title and recovery of real property regarding the disputed mining claims. The case is currently in discovery, and trial is set for August 20, 2013.

5

With regard to the unpatented lode mining claims, future exploration drilling will require us to either file a Notice of Intent or a Plan of Operations with the BLM, depending upon the amount of new surface disturbance that is planned. A Notice of Intent is for planned surface activities that anticipate less than five acres of surface disturbance, and usually can be obtained within a 30 to 60 day time period. A Plan of Operations will be required if there is greater than five acres of new surface disturbance involved with the planned exploration work. A Plan of Operations can take several months to be approved, depending on the nature of the intended work, the level of reclamation bonding required, the need for archeological surveys, and other factors as may be determined by the BLM.

The COD Property does not currently have any reserves. All activities undertaken and currently proposed at the COD Property are exploratory in nature.

6

7

Item 3. Legal Proceedings.

On January 20, 2012, a default judgment was entered against us in the Circuit Court of the Sixth Judicial Circuit in and for Pinellas County, Florida, for the amount of $47,362.29 stemming from a complaint filed against us on November 7, 2011 by Brimmer, Burke & Keelan, L.L.P., alleging non -payment for accounting services provided to our predecessor World Energy Solutions, Inc. in 2008.

On September 18, 2011 we received a notice from John C. Cost claiming that, of these 14 claims, at least nine are situated overlapping his alleged preexisting claims, and requesting that we cease and desist from sampling or removing any ores from these properties. We believe Mr. Cost’s demands are without merit. On March 16, 2012 we filed a complaint against Mr. Cost in Mohave County Superior Court for quiet title and recovery of real property regarding the disputed mining claims. The case is currently in discovery, and trial is set for August 20, 2013.

Item 4. Mine Safety Disclosures.

The Company does not have active mining operations at this time.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

In 2009 and through May 16, 2010, our common stock traded on the OTC Bulletin Board under the symbol EEGT.OB. On May 17, 2010, our trading symbol on the OTC Bulletin Board was changed to EEMT.OB as a result of our merger into our wholly owned subsidiary EClips Energy Technologies, Inc. On April 27, 2011, our trading symbol on the OTC Bulletin Board was changed to SILV.OB as a result of our name change effected pursuant to Section 235 of the Delaware General Corporation Law. The following table sets forth the high and low bid prices for the periods indicated as reported on the OTC Bulletin Board. The quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission, and may not necessarily represent actual transactions.

|

Common Stock

|

||||||||

|

High

|

Low

|

|||||||

|

1st quarter 2011

|

$

|

0.29

|

0.10

|

|||||

|

2nd quarter 2011

|

0.45

|

0.13

|

||||||

|

3rd quarter 2011

|

0.20

|

0.09

|

||||||

|

4th quarter 2011

|

0.20

|

0.09

|

||||||

|

1st quarter 2012

|

$

|

0.18

|

0.07

|

|||||

|

2nd quarter 2012

|

0.13

|

0.06

|

||||||

|

3rd quarter 2012

|

0.12

|

0.07

|

||||||

|

4th quarter 2012

|

0.10

|

0.04

|

||||||

The last reported sales price of our common stock on the OTC Bulletin Board on April 11, 2013, was $0.03 per share. As of April 12, 2013, there were 635 holders of record of our common stock.

In the past, we have not declared or paid cash dividends on our common stock, and we do not intend to pay any cash dividends on our common stock. Rather, we intend to retain future earnings (if any) to fund the operation and expansion of our business and for general corporate purposes. Subject to legal and contractual limits, our board of directors will make any decision as to whether to pay dividends in the future.

8

Item 6. Selected Financial Data.

We qualify as a smaller reporting company, as defined by Rule 229.10(f)(1), and are not required to provide the information required by this Item.

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

Cautionary Notice Regarding Forward Looking Statements

This report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 including those relating to our liquidity, our belief that we will not have sufficient cash and borrowing capacity to meet our working capital needs for the next 12 months without further financing, our expectations regarding acquisitions and new lines of business, gross profit, gross margins and capital expenditures, Additionally, words such as “expects,” “anticipates,” “intends,” “believes,” “will” and similar words are used to identify forward-looking statements.

Some or all of the results anticipated by these forward-looking statements may not occur. Important factors, uncertainties and risks that may cause actual results to differ materially from these forward-looking statements include, but are not limited to, the Risk Factors which appear in our filings and reports made with the Securities and Exchange Commission, our lack of working capital, the value of our securities, the impact of competition, the continuation or worsening of current economic conditions, technology and technological changes, a potential decrease in consumer spending and the condition of the domestic and global credit and capital markets. Additionally, these forward-looking statements are presented as of the date this Form 10-K is filed with the Securities and Exchange Commission. We do not intend to update any of these forward-looking statements.

Overview

We were incorporated under the name “Swifty Carwash & Quick-Lube, Inc.” in the state of Florida on September 25, 1997. On October 22, 1999, we changed our name from “Swifty Carwash & Quick-Lube, Inc.” to “SwiftyNet.com, Inc.” On January 29, 2001, we changed our name from “SwiftyNet.com, Inc.” to “Yseek, Inc.” On June 10, 2003, we changed our name from “Yseek, Inc.” to “Advanced 3-D Ultrasound Services, Inc.” We merged with World Energy Solutions, Inc., a private Florida corporation, on August 17, 2005. Advanced 3D Ultrasound Services, Inc. remained as the surviving entity and legal acquirer, and World Energy Solutions, Inc. was the accounting acquirer. On November 7, 2005, we changed our name to “World Energy Solutions, Inc.” and merged with Professional Technical Systems, Inc. We remained as the surviving entity and legal acquirer, while Professional Technical Systems, Inc. was the accounting acquirer. On February 26, 2009, we changed our name to “EClips Energy Technologies, Inc.” For the purpose of changing our state of incorporation to Delaware, we had merged with and into our then newly-formed wholly-owned subsidiary, EClips Media Technologies, Inc. on April 21, 2010, with EClips Media Technologies, Inc. continuing as the surviving corporation. Effective April 25, 2011, we changed our name to “Silver Horn Mining Ltd.” from “EClips Media Technologies, Inc.” pursuant to Section 253 of the Delaware General Corporation Law by merging a newly-formed, wholly-owned subsidiary of ours with and into the Company, with the Company as the surviving corporation in the merger.

Upon the appointment of Daniel Bleak as our Chief Executive Officer and Chairman on May 2, 2011, we focused our business efforts on the acquisition and exploration of properties that may contain mineral resources, principally silver. Our target properties are those that have been the subject of historical exploration or previous production. We have filed federal unpatented lode mining claims in Arizona for the purpose of exploration and potential development of silver on a total of approximately 1,000 acres. We plan to review opportunities to acquire additional mineral properties with current or historic silver mineralization with meaningful exploration potential. As a result of our focus on mineral exploration, we are considered an exploration stage company.

Our properties do not have any reserves. We plan to conduct exploration programs on these properties with the objective of ascertaining whether any of our properties contain concentrations of silver that are prospective for mining.

9

Recent Events

Effective April 25, 2011, we changed our name to “Silver Horn Mining Ltd.” from “EClips Media Technologies, Inc.” Effective April 27, 2011, our common stock began trading under a new symbol, “SILV”, on the OTC Bulletin Board. Until such date, our common stock traded under the symbol “EEMT”. On May 2, 2011, our Board of Directors appointed Daniel Bleak, Can-Am Gold Corp.’s President and sole director, as Chairman and Chief Executive Officer. Upon the effectiveness of Mr. Bleak’s appointment, we commenced focusing our business efforts on mining and resources, principally silver exploration and production.

For the year ended December 31, 2012, we had a net loss of approximately $4.8 million, and net cash used in operations of $142,000 during the year ended December 31, 2012. At December 31, 2012, we had a working capital deficiency of approximately $1.7 million. Additionally, at December 31, 2012, we had an accumulated deficit of approximately $49.6 million and stockholder’s deficit of $1.7 million. These matters and our expected needs for capital investments required to support operational growth raise substantial doubt about our ability to continue as a going concern. Our consolidated financial statements do not include any adjustments to reflect the possible effects on recoverability and classification of assets or the amounts and classification of liabilities that may result from our inability to continue as a going concern.

Critical Accounting Policies and Estimates

Our financial statements and accompanying notes are prepared in accordance with generally accepted accounting principles in the United States. Preparing financial statements requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue and expenses. These estimates and assumptions are affected by management’s applications of accounting policies. Critical accounting policies for our company include accounting for derivative liabilities and stock based compensation.

Stock Based Compensation

Stock-based compensation is accounted for based on the requirements of the Share-Based Payment Topic of ASC 718 which requires recognition in the consolidated condensed financial statements of the cost of employee and director services received in exchange for an award of equity instruments over the period the employee or director is required to perform the services in exchange for the award (presumptively, the vesting period). The ASC also requires measurement of the cost of employee and director services received in exchange for an award based on the grant-date fair value of the award.

Pursuant to ASC Topic 505-50, for share-based payments to consultants and other third-parties, compensation expense is determined at the “measurement date.” The expense is recognized over the vesting period of the award. Until the measurement date is reached, the total amount of compensation expense remains uncertain. The Company initially records compensation expense based on the fair value of the award at the reporting date.

Use of Estimates

In preparing the consolidated financial statements, management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities as of the date of the statements of financial condition, and revenues and expenses for the years then ended. Actual results may differ significantly from those estimates. Significant estimates made by management include, but are not limited to, the assumptions used to calculate stock-based compensation, derivative liabilities, debt discount and common stock issued for services.

10

Exploration Stage Company

The Company has been in the exploration stage since April 25, 2011 and has not yet realized any revenues from its planned operations. The Company intends to focus on acquiring and exploring natural resource properties. Accordingly, the Company is an exploration stage company as defined in ASC 915 “Development Stage Entities”.

Mineral Property Acquisition and Exploration Costs

Costs of lease, exploration, carrying and retaining unproven mineral lease properties are expensed as incurred. The Company has chosen to expense all mineral exploration costs as incurred given that it is still in the exploration stage. Once the Company has identified proven and probable reserves in its investigation of its properties and upon development of a plan for operating a mine, it would enter the development stage and capitalize future costs until production is established. When a property reaches the production stage, the related capitalized costs will be amortized, using the units-of-production method over the estimated life of the probable-proven reserves. When the Company has capitalized mineral properties, these properties will be periodically assessed for impairment of value and any diminution in value. To date, the Company has not established the commercial feasibility of any exploration prospects; therefore, all costs are being expensed.

Results of Operations

Net Revenues. We have not generated revenues during the year ended December 31, 2012 and 2011.

Operating Expenses. Total operating expenses for the year ended December 31, 2012 were $4,670,201, an increase of $2,726,489, or approximately 140%, from total operating expenses for the year ended December 31, 2011 of $1,943,712. This increase is primarily attributable to:

Payroll and stock based compensation expenses were $3,875,049 and $527,370 for the years ended December 31, 2012 and 2011, respectively, an increase of $3,347,679 or 637%. The increase during the year ended September 31, 2012 was primarily attributable to the 25 million shares of our common stock issued to Mr. Bleak as compensation for his continued services valued at $3,500,000. We did not have a comparable expense during the year ended December 31, 2011.

Exploration costs were $115,832 and $156,363 for the years ended December 31, 2012 and 2011, respectively, a decrease of $40,531. Exploration cost includes costs of lease, exploration, carrying and retaining unproven mineral lease properties. The Company has chosen to expense all mineral acquisition and exploration costs as incurred given that it is still in the exploration stage. The decrease is primarily attributable to the decrease in geologist, consulting and research exploration expenses as a result of limited working capital.

Impairment of mineral rights was $0 and $500,000 for the years ended December 31, 2012 and 2011, respectively, a decrease of $500,000. We did not have a comparable expense during the year ended December 31, 2012.

Professional and consulting expenses were $280,770 and $263,746 for the years ended December 31, 2012 and 2011, respectively, an increase of $17,024 or 6%. Professional expenses were incurred for our audits and public filing requirements.

General and administrative expenses, which consist of office expenses, insurance, rent and general operating expenses totaled $98,551 for the year ended December 31, 2012, as compared to $341,233 for the year ended December 31, 2011, an increase of $57,318 or 17%. The overall increase in general and administrative expenses during the year ended December 31, 2012 is primarily attributable to management fees which were incurred pursuant to the Services and Employee Leasing Agreement with MJI Resource Management Corp. during the year ended December 31, 2012.

11

Total Other Expense. Our total other expenses during the year ended December 31, 2012 primarily included expenses associated with derivative liabilities and interest expense.

Change in Fair Value of Derivative Liabilities and Derivative Liabilities Expense

We recorded derivative liability in connection with the issuance of convertible debentures and warrants. Change in fair value of derivative liabilities expense consisted of income or expense associated with the change in the fair value of derivative liabilities as a result of the application of ASC 815-40 to our financial statements. The Company recognized a derivative liability expense of $174,128 during the year ended December 31, 2012 upon issuance of the convertible debentures and warrants. The variation in fair value of the derivative liabilities between measurement dates amounted to an increase (decrease) of $(160,740) and $6,148,651 during the years ended December 31, 2012 and 2011, respectively. The increase/decrease in fair value of the derivative liabilities had been recognized as other expense/income. The Company recorded derivative liabilities as a result of the issuance of the convertible debenture in May 2012 and will continue to recognize derivative liabilities until 18 months after such issuance pursuant to the terms of the convertible debentures.

Interest Expense, Net

Interest expense consists primarily of interest recognized in connection with the amortization of debt discount, amortization of debt issuance cost and interest on our convertible debentures. The decrease in interest expense when compared to the same period in 2011 is primarily attributable to the amortization of the debt discount amounting to approximately $ 119,151 and $623,667 during the year ended December 31, 2012 and 2011, respectively, associated with the 6% convertible debenture.

Loss from Operations

We recorded loss from operations of $4,670,201 for the year ended December 31, 2012 as compared to $1,943,712 for the year ended December 31, 2011.

Net Loss

We recorded net loss of $4,811,072 for the year ended December 31, 2012 as compared to $8,722,274 for the year ended December 31, 2011. As a result of the factors described above, our loss from continuing operations per share (basic and diluted) for the year ended December 31, 2012 and 2011 were $0.02 and $0.04 per share, respectively.

Liquidity and Capital Resources

Liquidity is the ability of a company to generate funds to support its current and future operations, satisfy its obligations, and otherwise operate on an ongoing basis. At December 31, 2012, we had a cash balance of $20, and a bank overdraft of $2,982. Our working capital deficit is $1,707,811 at December 31, 2012. We reported a net loss of $4,811,072 during the year ended December 31, 2012. We do not anticipate we will be profitable in fiscal 2013.

We reported a net decrease in cash for the year ended December 31, 2012 of $15,027. At December 31, 2012 we owed $243,382 (before debt discount) under various convertible debentures and notes payable. During the year ended December 31, 2012, we have raised net proceeds of $127,500 from the issuance of convertible debenture and notes payable and $50,000 from the sale of Series D preferred stock. We do not presently have any external sources of working capital.

12

We do not have revenues to fund our operating expenses. We presently do not have any available credit, bank financing or other external sources of liquidity. We will need to obtain additional capital in order to expand operations and become profitable. In order to obtain capital, we may need to sell additional shares of our common stock or borrow funds from private lenders. There can be no assurance that we will be successful in obtaining additional funding. Additional capital is being sought, but we cannot guarantee that we will be able to obtain such investments. Financing transactions may include the issuance of equity or debt securities, obtaining credit facilities, or other financing mechanisms. However, the trading price of our common stock could make it more difficult to obtain financing through the issuance of equity or debt securities. Even if we are able to raise the funds required, it is possible that we could incur unexpected costs and expenses or experience unexpected cash requirements that would force us to seek alternative financing. Furthermore, if we issue additional equity or debt securities, stockholders may experience additional dilution or the new equity securities may have rights, preferences or privileges senior to those of existing holders of our common stock. If additional financing is not available or is not available on acceptable terms, we will have to curtail our operations and possibly cease operations.

Operating Activities

Net cash flows used in operating activities for the year ended December 31, 2012 amounted to $192,527 and were primarily attributable to our net losses of $4,811,072, offset by amortization of debt discount and debt issuance costs of $119,151, stock based compensation of $3,541,516, derivative liability expense of $174,128, total changes in assets and liabilities of $943,974 offset by change in fair value of derivative liabilities of $160,740. These changes in assets and liabilities are primarily attributable to a decrease in prepaid expenses of $32,446, and increase in accounts payable and accrued expenses of $911,528.

Net cash flows used in operating activities for the year ended December 31, 2011 amounted to $754,006 and were primarily attributable to our net losses of $8,722,274, offset by amortization of debt discount and debt issuance costs of $629,919, change in fair value of derivative liabilities of $6,148,651, amortization of prepaid expenses of $140,601, stock based compensation of $462,132, impairment of mineral rights of $500,000, total changes in assets and liabilities of $115,209 and add back gain from settlement of debt of $28,244.

Financing Activities

Net cash flows provided by financing activities were $177,500 for the year ended December 31, 2012. We received net proceeds from issuance of notes payable of $127,500 and $50,000 from the issuance of preferred stock. Net cash flows provided by financing activities were $675,000 for the year ended December 31, 2011. We received net proceeds from exercise of stock warrants of $125,000 and sale of our stocks of $550,000.

Convertible Debentures and Warrants

Between December 2009 and June 2010 we entered into various securities purchase agreements with accredited investors pursuant to which we agreed to issue an aggregate of $1,025,000 of our 6% convertible debentures for an aggregate purchase price of $1,025,000. The debentures had an interest rate of 6% per annum and matured two years from the dates of issuance. The debentures were convertible at the option of the holder at any time into shares of common stock, at a conversion price equal to the lesser of (i) $0.025 per share or (ii) until the 18 month anniversary of the debenture, the lowest price paid per share or the lowest conversion price per share in a subsequent sale of our equity and/or convertible debt securities paid by investors after the date of the debenture. In connection with the agreements, the investors received an aggregate of 41,000,000 warrants to purchase shares of our common stock. The warrants are exercisable for a period of five years from the dates of issuance at an exercise price of $0.025, subject to adjustment in certain circumstances. Warrant holders may exercise the warrant on a cashless basis if the fair market value (as defined in the warrant) of one share of common stock is greater than the initial exercise price.

On February 29, 2012, we entered into note purchase agreements with certain investors whereby we sold an aggregate of $105,882 of convertible promissory notes at an aggregate purchase price of $90,000. These investors include Daniel Bleak and several of the Company’s existing shareholders. The notes matured on February 28, 2013. We acknowledged and agreed that the notes were issued at an original issue discount. No regularly scheduled interest payments were paid on this note. The face value of each note may be converted at the holder’s option, in whole or in part, at any time at least three months following the date of issuance into shares of the Company’s common stock at a conversion price of $0.05 per share and shall be subject to adjustment in the case of stock splits, reclassifications, reorganizations, and mergers or consolidations upon issuances at less than the conversion price. We believe that the holders will elect to convert the notes.

13

On May 9, 2012 we entered into securities purchase agreement with an accredited investor pursuant to which we agreed to issue $37,500 of our 6% convertible debentures for an aggregate purchase price of $37,500. The debenture bears interest at 6% per annum and matures twenty-four months from the date of issuance. The debenture is convertible at the option of the holder at any time into shares of common stock, at an initial conversion price equal to the lesser of (i) $0.05 per share or (ii) until the eighteen (18) month anniversary of the debenture, the lowest price paid per share or the lowest conversion price per share in a subsequent sale of the Company’s equity and/or convertible debt securities paid by investors after the date of the debenture. In connection with the agreement, the investor received a warrant to purchase 750,000 shares of the Company’s common stock. The warrant is exercisable for a period of five years from the date of issuance at an initial exercise price of $0.05, subject to adjustment in certain circumstances. The investor may exercise the warrant on a cashless basis if the fair market value (as defined in the warrant) of one share of common stock is greater than the initial exercise price.

At December 31, 2012, we owed $137,500 under these convertible debentures and $105,882 under the promissory notes for a total debt of $243,382.

Off-balance Sheet Arrangements

We have not entered into any other financial guarantees or other commitments to guarantee the payment obligations of any third parties. We have not entered into any derivative contracts that are indexed to our shares and classified as stockholder’s equity or that are not reflected in our consolidated financial statements. Furthermore, we do not have any retained or contingent interest in assets transferred to an unconsolidated entity that serves as credit, liquidity or market risk support to such entity.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

We qualify as a smaller reporting company, as defined by Rule 229.10(f)(1), and are not required to provide the information required by this Item.

Item 8. Financial Statements and Supplementary Data.

See pages F-1 through F-26.

Item 9. Changes In and Disagreements with Accountants on Accounting and Financial Disclosure.

None.

Item 9A. Controls and Procedures.

Management’s Conclusions Regarding Effectiveness of Disclosure Controls and Procedures

As required by Rule 13a-15 under the Securities Exchange Act of 1934, as of December 31, 2012, the end of the year covered by this report, our management concluded its evaluation of the effectiveness of the design and operation of our disclosure controls and procedures.

Disclosure controls and procedures refer to controls and other procedures designed to ensure that information required to be disclosed in the reports we file or submit under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported within the time periods specified in the rules and forms of the SEC and that such information is accumulated and communicated to our management, including our chief executive officer and chief financial officer, as appropriate, to allow timely decisions regarding required disclosure. In designing and evaluating our disclosure controls and procedures, management recognizes that any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving the desired control objectives, and management is required to apply its judgment in evaluating and implementing possible controls and procedures.

14

Our management does not expect that our disclosure controls and procedures will prevent all error and all fraud. A control system, no matter how well designed and operated, can provide only reasonable, not absolute, assurance that the control system’s objectives will be met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, have been detected. These inherent limitations include the realities that judgments in decision-making can be faulty, and that breakdowns can occur because of simple error or mistake. The design of any system of controls is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions.

With respect to the fiscal year ending December 31, 2012, under the supervision and with the participation of our management, we conducted an evaluation of the effectiveness of the design and operations of our disclosure controls and procedures, as defined in Rules 13a-15(e) and 15d-15(e) promulgated under the Securities Exchange Act of 1934. Based upon our evaluation regarding the fiscal year ending December 31, 2012, our management, including Mr. Bleak, our principal executive officer and principal financial officer, has concluded that our disclosure controls and procedures were not effective due to our limited internal audit functions and lack of ability to have multiple levels of transaction review.

Management’s Report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting as defined in Rules 13a-15(f) and 15d-15(f) under the Securities Exchange Act. Our management is also required to assess and report on the effectiveness of our internal control over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act of 2002 (“Section 404”). Management assessed the effectiveness of our internal control over financial reporting as of December 31, 2011. In making this assessment, we used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) in Internal Control - Integrated Framework. During our assessment of the effectiveness of internal control over financial reporting as of December 31, 2012, management identified significant deficiency related to (i) our internal audit functions and (ii) a lack of segregation of duties within accounting functions. Therefore, our internal controls over financial reporting were not effective as of December 31, 2012.

Management has determined that our internal audit function is significantly deficient due to insufficient qualified resources to perform internal audit functions.

Due to our size and nature, segregation of all conflicting duties may not always be possible and may not be economically feasible. However, to the extent possible, we will implement procedures to assure that the initiation of transactions, the custody of assets and the recording of transactions will be performed by separate individuals.

We believe that the foregoing steps will remediate the significant deficiency identified above, and we will continue to monitor the effectiveness of these steps and make any changes that our management deems appropriate. Due to the nature of this significant deficiency in our internal control over financial reporting, there is more than a remote likelihood that misstatements which could be material to our annual or interim financial statements could occur that would not be prevented or detected.

A material weakness (within the meaning of PCAOB Auditing Standard No. 5) is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis. A significant deficiency is a deficiency, or a combination of deficiencies, in internal control over financial reporting that is less severe than a material weakness, yet important enough to merit attention by those responsible for oversight of the company’s financial reporting.

15

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies and procedures may deteriorate.

This annual report does not include an attestation report of our registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by our registered public accounting firm pursuant to temporary rules of the Securities and Exchange Commission that permit us to provide only management’s report in this annual report.

Changes in Internal Controls

There have been no changes in our internal control over financial reporting during the quarter ended December 31, 2012 that have materially affected, or are reasonably likely to materially affect, our internal controls over financial reporting.

Item 9B. Other Information.

None.

PART III.

Item 10. Directors, Executive Officers and Corporate Governance.

The following table sets forth information regarding the members of our board of directors and our sole executive officer. All directors hold office for one-year terms until the election and qualification of their successors. Officers are elected by the board of directors and serve at the discretion of the board.

|

Name

|

Age

|

Position

|

|

Daniel Bleak

|

56

|

Chief Executive Officer, Chairman of the Board of Directors and Chief Financial Officer

|

|

John Eckersley

|

53

|

Director

|

|

Joseph Wilkins, Jr.

|

74

|

Director

|

Daniel Bleak, Chief Executive Officer, Chairman of the Board of Directors and Chief Financial Officer. Mr. Bleak has served as our Chief Executive Officer and Chairman of the Board of Directors since May 2, 2011 and as our Chief Financial Officer since May 11, 2011. Mr. Bleak has over 30 years of experience in mineral exploration and development and has managed a broad range of exploration projects throughout North America, has discovered several producing mineral deposits, and developed decorative rock and industrial materials businesses in the southwestern U.S. Mr. Bleak has served on the board of directors and as an officer of a number of mining, mineral exploration, and real estate companies. He has served as a director of Continental Resources Group, Inc. (formerly American Energy Fields, Inc.) (AEFI.OB) since November 2010, as a director of Southwest Exploration, Inc. since 2009, as President and director of Pinal Realty Investments, Inc. since 2006, as President and a director of NPX Metals, Inc., a resource acquisition company, since 2006, as President and sole director of Can-Am Gold Corp. since 2009, as President and director of Black Mountain Mining Company since 2000 and as a leased employee of MJI Resource Management Corp. since 2011. Mr. Beak was appointed to his positions based on his corporate experience and knowledge of the resources industry.

16

John Eckersley, Director. Mr. Eckersley has served as a director since July 12, 2011. Mr. Eckersley has practiced law as a solo practitioner since 1999. His practice focuses on securities compliance, corporate governance and estate planning. He has also served as the Vice President, Legal and Corporate Affairs, of Passport Potash, Inc. (PPRTF.OTCQX) (PPI.TSXV), a resource company engaged in the exploration and development of advanced potash properties, since December 2010. At Passport Potash, Inc., Mr. Eckersley’s responsibilities include corporate counsel, corporate governance, securities compliance, land and mineral resource acquisition and permitting with local, State and federal agencies. Mr. Eckersley served as the President of MJI Resource Management Corp. from May 18, 2011 through October 1, 2011. Mr. Eckersley served as the Executive Vice President, Secretary and Treasurer of Digital Business Resource, Inc., a telecommunications company, from 1996 to 1999, where he was a founder, and was responsible for developing systems for office management, accounting, client services, vendor coordination and marketing. Prior to this position, Mr. Eckersley served as the General Counsel of TIMI, a public finance advisory company, where he advised the company on corporate strategy and was responsible for the company’s compliance filings. Mr. Eckersley was appointed as a director based on his corporate experience and knowledge of the resources industry.

Joseph Wilkins, Jr., Director. Mr. Wilkins has served as a director since July 12, 2011. Mr. Wilkins has over 45 years of experience in mineral exploration and development and has served as a consulting geologist on a broad range of exploration projects throughout North America and Australia. Mr. Wilkins has provided consulting geologist services to OZ Minerals Ltd. (OZL.A), an Australian copper and gold producer, since October 2010; to Continental Resources Group, Inc. (formerly American Energy Fields, Inc.) (AEFI.OTCBB), a uranium exploration company, from August 2010 to September 2010; to Aurum National Holdings, Ltd., a gold exploration company, from February 2010 to July 2010; to West Timmins Mining Inc. (WTM.TSXV), a gold exploration company, from April 2009 to November 2009; to Grand Central Silver Mining, a precious metals exploration company, in August 2009; to NPX Metals, a metal exploration company, from February 2008 to October 2009; to Newcrest Resources, Inc., an Australian copper and gold producer, from June 2007 to July 2007 and to Kennecott Exploration Co., a mineral exploration company, from May 2005 to November 2007. Mr. Wilkins has a BS in Geophysics and Geochemistry and a MS in Geosciences from the University of Arizona. Mr. Wilkins was appointed as a director based on his knowledge of the resources industry and substantial relevant business experience.

There are no family relationships among any of our directors and executive officers.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors and executive officers, and persons who own more than 10% of a registered class of our securities, to file with the SEC initial reports of ownership and reports of changes in ownership of our common stock. A copy of each report is furnished to us.

SEC rules require us to identify anyone who failed to file a required report, or filed a required report late, during the most recent fiscal year. Based solely on a review of copies of such reports, we believe that during the year ended December 31, 2012, all Section 16(a) filing requirements were complied with on a timely basis.

Code of Ethics

We intend to adopt a code of ethics that applies to our officers, directors and employees, including our chief executive officer and chief financial officer, but have not done so to date due to our relatively small size.

Board Committees

Audit Committee. We intend to establish an audit committee of the board of directors once we have satisfied the other initial listing standards for listing our common stock on the Nasdaq Stock Market or another national exchange. The audit committee will consist of independent directors, of which at least one director will qualify as a qualified financial expert as defined in Item 407(d)(5)(ii) of Regulation S-K. The audit committee’s duties will be to recommend to our board of directors the engagement of independent auditors to audit our financial statements and to review our accounting and auditing principles. The audit committee will review the scope, timing and fees for the annual audit and the results of audit examinations performed by the internal auditors and independent public accountants, including their recommendations to improve the system of accounting and internal controls. The audit committee will at all times be composed exclusively of directors who are, in the opinion of our board of directors, free from any relationship that would interfere with the exercise of independent judgment as a committee member and who possess an understanding of financial statements and generally accepted accounting principles.

17

Compensation Committee. We intend to establish a compensation committee of the board of directors once we have satisfied the other initial listing standards for listing our common stock on the Nasdaq Stock Market or another national exchange. The compensation committee will review and approve our salary and benefits policies, including compensation of executive officers. The compensation committee will also administer our stock option plans and recommend and approve grants of stock options under such plans.

Item 11. Executive Compensation.

The following table summarizes the overall compensation earned over each of the past two fiscal years ending December 31, 2012 by each person who served as our principal executive officer during fiscal 2012.

Summary Compensation Table

|

Name and

Principal Position

|

Year

|

Salary

($)

|

Stock

Awards

($) (1)

|

All Other

Compensation

($)

|

Total ($)

|

|||||||||||||

|

Daniel Bleak (2)

|

2011

|

90,828

|

500,000

|

(3)

|

—

|

590,828

|

||||||||||||

|

(Current Chief Executive Officer, Chief Financial Officer and Chairman)

|

2012

|

12,775

|

3,500,000

|

(4)

|

—

|

3,512,775

|

||||||||||||

(1) Reflects the grant date fair values of stock awards calculated in accordance with FASB Accounting Standards Codification Topic 718. All stock awards have been adjusted for our 1:150 reverse stock split effective August 25, 2009, our 2:1 forward exchange effective April 21, 2010 and our 2:1 stock dividend issued to certain stockholders on December 31, 2010.

(2) Mr. Bleak was appointed as our Chairman and Chief Executive Officer on May 2, 2011 and as our Chief Financial Officer on May 11, 2011.

(3) In connection with his appointment on May 2, 2011, Mr. Bleak was awarded 10,000,000 shares of common stock and a five year option to purchase 30,000,000 shares of our common stock. The option was exercisable for cash or shares of common stock at an exercise price of $0.05 per share as to one third of the number of shares granted on each of the first, second and third anniversaries of the date of grant. The option was cancelled on February 21, 2012.

(4) Mr. Bleak was issued 25,000,000 shares on February 21, 2012 as compensation for his services. Amount equals grant date fair value determined for financial reporting purposes in accordance with generally accepted accounting principles.

Agreements and Option Grant

Effective April 3, 2011 we entered into a consulting agreement with Mr. Bleak that terminated on June 30, 2011, pursuant to which we paid Mr. Bleak $5,000 a month for three months as compensation for his professional services.

On June 1, 2011, we entered into a one year services and employee leasing agreement with MJI Resource Management Corp. pursuant to which it made available to us six of its employees, including Mr. Bleak, for the purpose of performing management, operations, legal, accounting and resource location services. The agreement stipulated that we pay MJI Resource Management Corp. $15,000 a month and the six employees an aggregate of $11,000 a month under this agreement in each of June and July 2011, provided however, that such payments may be adjusted for additional services. The agreement was amended on August 1, 2011 such that, commencing in August 2011, we were to pay MJI Resource Management Corp. $25,000 a month and the six employees an aggregate of $11,000 a month, as such payments may be adjusted for additional services. The agreement was further amended on October 1, 2011 to extend its term to five years. Pursuant to this agreement, from the period from June 1, 2011 through December 31, 2011, we paid MJI Resource Management Corp. a total of $155,000, we directly paid the six employees $169,471 and we paid certain subcontractors $17,255. We paid Mr. Bleak a total of $75,828 pursuant to this agreement. For the fiscal year December 31, 2012, we directly paid the six employees $14,565 and we paid certain subcontractors $3,083. We paid Mr. Bleak a total of $12,775 pursuant to this agreement.

18

In connection with his appointment on May 2, 2011, we awarded Mr. Bleak 10,000,000 shares of common stock and a five year option to purchase 30,000,000 shares of our common stock. The option was exercisable for cash or shares of common stock at an exercise price of $0.05 per share as to one third of the number of shares granted on each of the first, second and third anniversaries of the date of grant. The option was cancelled on February 21, 2012. Also on February 21, 2012 we issued Mr. Bleak 25,000,000 shares as compensation for his services.

Director Compensation

The compensation paid to Mr. Bleak for the years ending December 31, 2011 and 2012 is fully set forth above. Mr. Eckersley and Mr. Wilkins did not receive any compensation for their services as our directors for the years ending December 31, 2011 and 2012.

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

The following table sets forth information with respect to the beneficial ownership of our common stock and Series A Convertible Preferred Stock (the “Series A Preferred Stock”) as of April 12, 2013 by:

|

·

|

each person known by us to beneficially own more than 5.0% of our common stock or Series A Preferred Stock;

|

|

·

|

each of our directors;

|

|

·

|

each of our named executive officers; and

|

|

·

|

all of our directors and executive officers as a group.

|

The percentages of common stock or Series A Preferred Stock beneficially owned are reported on the basis of regulations of the Securities and Exchange Commission governing the determination of beneficial ownership of securities. Under the rules of the Securities and Exchange Commission, a person is deemed to be a beneficial owner of a security if that person has or shares voting power, which includes the power to vote or to direct the voting of the security, or investment power, which includes the power to dispose of or to direct the disposition of the security. Except as indicated in the footnotes to this table, each beneficial owner named in the table below has sole voting and sole investment power with respect to all shares beneficially owned and each person’s address is c/o Silver Horn Mining Ltd., 3346 Guadalupe Road, Apache Junction, Arizona 85120. As of April 12, 2013, we had 253,033,555 shares of common stock and 3,000,000 shares of Series A Preferred Stock, respectively, issued and outstanding.

|

Common Stock (1)

|

Series A Preferred Stock (2)

|

|||

|

Name and Address of Beneficial Owner

|

Shares Beneficially Owned

|

Percent of Class

|

Shares Beneficially Owned

|

Percent of Class

|

|

5% Owners

|

||||

|

Auracana, LLC (3)

|

219,863

|

*

|

3,000,000

|

100%

|

|

Michael Baybak (4)

|

13,541,667

|

5.35%

|

--

|

--

|

|

Michael Brauser (5)

|

13,050,000 (6)

|

5.71%

|

--

|

--

|

|

Frost Gamma Investments Trust (7)

|

19,000,000 (8)

|

7.51%

|

--

|

--

|

|

Sandor Master Capital Fund L.P. (9)

|

15,000,000

|

5.93%

|

--

|

--

|

|

Officers and Directors

|

||||

|

Daniel Bleak

|

35,470,588 (12)

|

13.99%

|

--

|

--

|

|

Officers and Directors as a Group (1 person)

|

||||

19

|

(1)

|

Shares of common stock beneficially owned and the respective percentages of beneficial ownership of common stock assumes the exercise of all debentures, warrants and other securities convertible into common stock beneficially owned by such person or entity currently exercisable or exercisable within 60 days of April 12, 2013. In computing the number of shares beneficially owned and the percentage ownership, shares of common stock that may be acquired within 60 days of April 12, 2013 pursuant to the conversion of debentures or the exercise of warrants are deemed to be outstanding for that person. Such shares, however, are not deemed outstanding for the purpose of computing the percentage ownership of any other person.

|

|

(2)

|

Each share of the Series A Preferred Stock is entitled to 500 votes per share voting as a class with common stock.

|

|

(3)

|

Mr. Kesner is the president and a control person of Auracana, LLC and, as such, has sole voting and dispositive power over the securities held by Auracana, LLC.

|

|

(4)

|

The principal address and office of Mr. Baybak is 2110 Drew Street, Suite 200, Clearwater, Florida 33765.

|

|

(5)

|

The principal address and office of Mr. Brauser is 4400 Biscayne Boulevard, Suite 850, Miami, Florida 33137.

|

|

(6)

|

Represents (i) 12,950,000 shares of common stock, (ii) 750,000 shares of common stock issuable upon conversion of a convertible debenture and (iii) 750,000 shares of common stock issuable upon exercise of a warrant.

|

|

(7)

|

Dr. Philip Frost is the trustee and a control person of Frost Gamma Investments Trust and, as such, has sole voting and dispositive power over the securities held by Frost Gamma Investments Trust.

|

|

(8)

|

Includes 16,000,000 shares of common stock held by Frost Gamma Investments Trust and 3,000,000 shares of common stock held by Dr. Frost.

|

|

(9)

|

The principal address and office of Sandor Master Capital Fund L.P. is 2828 Routh Street, Suite 500, Dallas, Texas 75201. John Lemak is the manager and a control person of Sandor Master Capital Fund L.P., and, as such, has sole voting and dispositive power over the 15,000,000 shares of common stock held by Sandor Master Capital Fund L.P.

|

|

(10)

|

Includes 35,000,000 shares of common stock and 470,588 shares of common stock issuable upon conversion of a promissory note at a conversion price of $0.05 per share.

|

Item 13. Certain Relationships and Related Transactions, and Director Independence.

On June 21, 2010, through our wholly-owned subsidiary SD Acquisition Corp, we acquired all of the business and assets of Brand Interaction Group, LLC. In connection with the acquisition, Mr. Simon, the control person of Brand Interaction Group, LLC, was appointed as our Chief Executive Officer and was issued 10,000,000 shares of our common stock. We also issued Brand Interaction Group, LLC 20,000,000 shares of our common stock and assumed certain debt that Brand Interaction Group, LLC had previously issued to several of its creditors.

In the fall of 2010, we decided to discontinue the operations of SD Acquisition Corp. Mr. Simon resigned as our Chief Executive Officer on November 15, 2010 and on December 7, 2010, we entered into a spinoff agreement with Brand Interaction Group, LLC, Mr. Simon, SD Acquisition Corp. and certain holders of our outstanding convertible debentures pursuant to which we agreed to spinoff SD Acquisition Corp. to Brand Interaction Group, LLC and Mr. Simon and cancel the 30,000,000 shares of common stock previously issued to Brand Interaction Group, LLC and Mr. Simon. Upon the execution of the spinoff, we were released from any obligations and agreements incurred by Mr. Simon on behalf of SD Acquisition Corp.

20