DEAR SHAREHOLDERS,

Despite the uncertainties that the world faced in 2022, including one of the highest inflationary periods on record, it was a tremendous year for Chipotle that continued to demonstrate the strength of our company.

With a focus on being brilliant at the basics, our teams delivered delicious culinary and great guest experiences, which accelerated the business. With a mission to Cultivate a Better World, we remained true to our purpose and pushed the boundaries with digital innovations and more sustainable options to advance ourselves and the entire restaurant industry. Chipotle’s Food With Integrity principles guided our responsible sourcing and further enhanced our menu of real ingredients. The results highlight that Chipotle’s delicious food made fresh daily, combined with talented leaders and a thriving culture, is the recipe for growth for many years to come.

We focused on our strategic priorities to propel the business forward. These include:

| 1. | Running successful restaurants with a people accountable culture that provide delicious food with integrity while delivering exceptional in-restaurant and digital experiences; |

| 2. | Sustaining world class people leadership by developing and retaining diverse talent at every level; |

| 3. | Making the brand visible, relevant, and loved to improve overall guest engagement; |

| 4. | Amplifying technology and innovation to drive growth and productivity at our restaurants and support centers; and |

| 5. | Expanding access and convenience by accelerating new restaurant openings. |

During the pandemic, unforeseen challenges continually arose with supply, staffing and exclusions tied to COVID-19, where workarounds were needed. As COVID-19 receded, we established Project Square One to reset our operational standards and build a culture of excellence.

We also invested in technology like Chippy, an autonomous kitchen assistant designed to fry chips, and Hyphen, an automated make line, designed to ease points of friction identified by our team members, ultimately enhancing the experience for both our teams and our guests. We invested in our people with competitive wages, industry-leading benefits and career progression opportunities and, as a result, in 2022 we made approximately 22,000 internal promotions. Additionally, 90% of all restaurant management roles in 2022 were internal promotions. With a focus on being the employer of choice, we made progress on our diversity, equity and inclusion plans and continued increasing our internal pipeline of candidates for salaried corporate positions and field leadership roles.

Our increased visibility and relevance with consumers enabled us to lead culture, drive difference, and generate purchases. The Real Food for Real Athletes program highlighted premier athlete superfans competing on the world’s biggest stages. Purpose-driven marketing continued to shed light on the challenges the agricultural industry faces and the need to support the 2023 Farm Bill, calling for equitable access to up to one million acres of land for the next generation of farmers. We introduced Garlic Guajillo Steak, Pollo Asado, and Plant-Based Chorizo to our menu and continued to identify opportunities that will drive growth and sales in the year ahead. Additionally, Chipotle surpassed two million followers on TikTok and is recognized amongst the top brands in the world for its engaging content and status as a first mover on emerging platforms.

An important component of the brand’s success is the Chipotle Rewards loyalty program, which increased membership by 20% to 31.6 million members. Enhancements to the program like targeted offers, relevant content and gamified badging helped to drive frequency and transactions.

We also expanded access and convenience for our guests by opening 236 new restaurants last year, 202 of which included a Chipotlane. In Canada, we built out a strong local field leadership team to ensure best practices, and in the coming year will see our fastest development growth rate since we entered the Canadian market. Additionally, we made progress in Europe and are now focused on rolling out digital capabilities and several more locations. The commitment of our phenomenal teams to bring Food With Integrity to more communities is evident and we’re well on our way to achieving, and hopefully exceeding, our long-term goal of 7,000 restaurants.

Our focus on our strategic priorities has resulted in strong growth despite a pandemic, record inflation and an uncertain consumer environment. Since 2019, we have grown revenue 55%, EPS 159% and opened 612 restaurants with 476 Chipotlanes. At the restaurant level, since 2019, we have expanded average unit volumes (AUVs) from $2.2 million to $2.8 million and expanded restaurant level operating margin to 23.9% of sales.* We are proud to be one of the large cap consumer growth companies with a market cap of over $40 billion.

Looking forward, we believe that we are well positioned to more than double our restaurant count, grow AUVs beyond $3 million and expand margins. We believe we have the right teams and strategies in place to achieve these aggressive goals. I am optimistic about our future and confident that we’ll continue to deliver on our promise to Cultivate a Better World.

Sincerely,

Brian Niccol

Chairman and CEO, Chipotle Mexican Grill

| * | See Appendix A for a reconciliation of GAAP to non-GAAP information used in this proxy statement. |

|

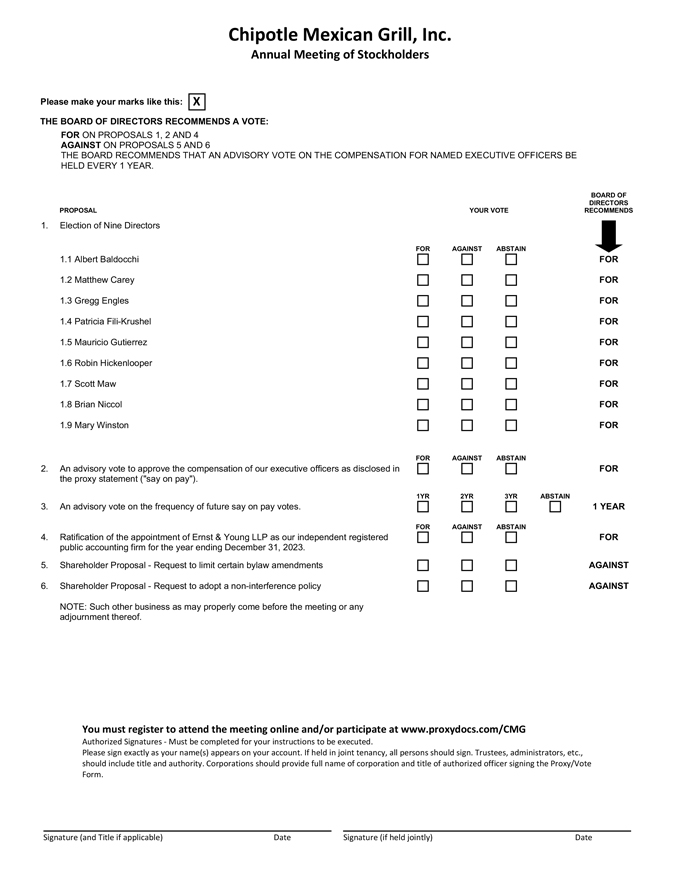

Conduct extensive shareholder engagement on executive compensation and ESG related matters. Carefully consider the annual “say on pay” vote result and solicit and respond to shareholder feedback.

Conduct extensive shareholder engagement on executive compensation and ESG related matters. Carefully consider the annual “say on pay” vote result and solicit and respond to shareholder feedback. Allow executive officers and directors to hedge or pledge shares of Chipotle stock or hold Chipotle stock in margin accounts.

Allow executive officers and directors to hedge or pledge shares of Chipotle stock or hold Chipotle stock in margin accounts.