10-K

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

| |

X | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF |

| THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| For the fiscal year ended December 31, 2015 |

OR

|

| |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF |

| THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ................... to .................................................................

|

| | |

| Exact name of registrants as specified in | |

Commission | their charters, address of principal executive | IRS Employer |

File Number | offices, zip code and telephone number | Identification Number |

1-14465 | IDACORP, Inc. | 82-0505802 |

1-3198 | Idaho Power Company | 82-0130980 |

| 1221 W. Idaho Street | |

| Boise, ID 83702-5627 | |

| (208) 388-2200 | |

|

State of incorporation: Idaho |

|

| Name of exchange on |

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT: | which registered |

IDACORP, Inc.: Common Stock, without par value | New York |

| Stock Exchange |

|

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: |

Idaho Power Company: Preferred Stock |

Indicate by check mark whether the registrants are well-known seasoned issuers, as defined in Rule 405 of the Securities Act.

|

| | | | | | | | | |

IDACORP, Inc. | Yes | (X) | No | ( ) | Idaho Power Company | Yes | ( ) | No | (X) |

Indicate by check mark if the registrants are not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

|

| | | | | | | | | |

IDACORP, Inc. | Yes | ( ) | No | (X) | Idaho Power Company | Yes | ( ) | No | (X) |

Indicate by check mark whether the registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. Yes (X) No ( )

Indicate by check mark whether the registrants have submitted electronically and posted on their corporate Web sites, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrants were required to submit and post such files).

|

| | | | | | | | | |

IDACORP, Inc. | Yes | (X) | No | ( ) | Idaho Power Company | Yes | (X) | No | ( ) |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrants’ knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. (X)

Indicate by check mark whether the registrants are large accelerated filers, accelerated filers, non-accelerated filers, or smaller reporting companies.

|

| | | | | | | | |

IDACORP, Inc.: |

| Large accelerated filer | (X) | Accelerated filer | ( ) | Non-accelerated filer | ( ) | Smaller reporting company | ( ) |

|

Idaho Power Company: |

| Large accelerated filer | ( ) | Accelerated filer | ( ) | Non-accelerated filer | (X) | Smaller reporting company | ( ) |

Indicate by check mark whether the registrants are shell companies (as defined in Rule 12b-2 of the Act).

|

| | | | | | | | | |

IDACORP, Inc. | Yes | ( ) | No | (X) | Idaho Power Company | Yes | ( ) | No | (X) |

Aggregate market value of voting and non-voting common stock held by non-affiliates (June 30, 2015):

|

| | | | | | | | |

IDACORP, Inc.: | | $ | 2,798,093,674 |

| | Idaho Power Company: | | None |

|

| |

Number of shares of common stock outstanding as of February 12, 2016: |

IDACORP, Inc.: | 50,297,581 |

Idaho Power Company: | 39,150,812, all held by IDACORP, Inc. |

|

| |

Documents Incorporated by Reference: |

|

Part III, Items 10 - 14 | Portions of IDACORP, Inc.’s definitive proxy statement to be filed pursuant to Regulation 14A for the 2016 annual meeting of shareholders. |

|

This combined Form 10-K represents separate filings by IDACORP, Inc. and Idaho Power Company. Information contained herein relating to an individual registrant is filed by that registrant on its own behalf. Idaho Power Company makes no representation as to the information relating to IDACORP, Inc.’s other operations.

Idaho Power Company meets the conditions set forth in General Instruction (I)(1)(a) and (b) of Form 10-K and is therefore filing this Form with the reduced disclosure format.

|

| | |

TABLE OF CONTENTS |

| | |

| | Page |

| | |

Commonly Used Terms | |

Cautionary Note Regarding Forward-Looking Statements | |

| | |

Part I | | |

| | |

Item 1 | Business | |

| Executive Officers of the Registrants | |

Item 1A | Risk Factors | |

Item 1B | Unresolved Staff Comments | |

Item 2 | Properties | |

Item 3 | Legal Proceedings | |

Item 4 | Mine Safety Disclosures | |

| | |

Part II | | |

| | |

Item 5 | Market for Registrant's Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities | |

Item 6 | Selected Financial Data | |

Item 7 | Management's Discussion and Analysis of Financial Condition and Results of Operations | |

Item 7A | Quantitative and Qualitative Disclosures About Market Risk | |

Item 8 | Financial Statements and Supplementary Data | |

Item 9 | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |

Item 9A | Controls and Procedures | |

Item 9B | Other Information | |

| | |

Part III | | |

| | |

Item 10 | Directors, Executive Officers and Corporate Governance* | |

Item 11 | Executive Compensation* | |

Item 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters* | |

Item 13 | Certain Relationships and Related Transactions, and Director Independence* | |

Item 14 | Principal Accountant Fees and Services* | |

| | |

Part IV | | |

| | |

Item 15 | Exhibits and Financial Statement Schedules | |

| | |

Signatures | |

| | |

* Except as indicated in Items 10, 12, and 14, IDACORP, Inc. information is incorporated by reference to IDACORP, Inc.'s definitive proxy statement for the 2016 annual meeting of shareholders. |

|

| | | | | | |

COMMONLY USED TERMS |

| | | | |

The following select abbreviations, terms, or acronyms are commonly used or found in multiple locations in this report: |

| | | | | | |

ADITC | - | Accumulated Deferred Investment Tax Credits | | IRP | - | Integrated Resource Plan |

AFUDC | - | Allowance for Funds Used During Construction | | IRS | - | U.S. Internal Revenue Service |

APCU | - | Annual Power Cost Update | | kW | - | Kilowatt |

BCC | - | Bridger Coal Company, a joint venture of IERCo | | MATS | - | Mercury and Air Toxics Standards |

BLM | - | U.S. Bureau of Land Management | | MD&A | - | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

BPA | - | Bonneville Power Administration | | MW | - | Megawatt |

CAA | - | Clean Air Act | | MWh | - | Megawatt-hour |

CO2 | - | Carbon Dioxide | | NAAQS | - | National Ambient Air Quality Standards |

CWA | - | Clean Water Act | | NMFS | - | National Marine Fisheries Service |

EGUs | - | Electric Utility Generating Units | | NOx | - | Nitrogen Oxide |

EIS | - | Environmental Impact Statement | | NSPS | - | New Source Performance Standards |

EPA | - | U.S. Environmental Protection Agency | | NSR/PSD | - | New Source Review / Prevention of Significant Deterioration |

EPS | - | Earnings Per Share | | O&M | - | Operations and Maintenance |

ESA | - | Endangered Species Act | | OATT | - | Open Access Transmission Tariff |

FCA | - | Fixed Cost Adjustment | | OPUC | - | Public Utility Commission of Oregon |

FERC | - | Federal Energy Regulatory Commission | | PCA | - | Power Cost Adjustment |

FPA | - | Federal Power Act | | PCAM | - | Oregon Power Cost Adjustment Mechanism |

GAAP | - | Generally Accepted Accounting Principles | | PURPA | - | Public Utility Regulatory Policies Act of 1978 |

GHG | - | Greenhouse Gas | | REC | - | Renewable Energy Certificate |

HCC | - | Hells Canyon Complex | | RPS | - | Renewable Portfolio Standard |

Ida-West | - | Ida-West Energy Company, a subsidiary of IDACORP, Inc. | | SEC | - | U.S. Securities and Exchange Commission |

Idaho ROE | - | Idaho-jurisdiction return on year-end equity | | SMSP | - | Security Plan for Senior Management Employees |

IERCo | - | Idaho Energy Resources Co., a subsidiary of Idaho Power Company | | SO2 | - | Sulfur Dioxide |

IESCo | - | IDACORP Energy Services Co., a subsidiary of IDACORP, Inc. | | USFWS | - | U.S. Fish and Wildlife Service |

IFS | - | IDACORP Financial Services, Inc., a subsidiary of IDACORP, Inc. | | VIEs | - | Variable Interest Entities |

IPUC | - | Idaho Public Utilities Commission | | | | |

|

| | |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS |

In addition to the historical information contained in this report, this report contains (and oral communications made by IDACORP, Inc. and Idaho Power Company may contain) statements that relate to future events and expectations, such as statements regarding projected or future financial performance, cash flows, capital expenditures, dividends, capital structure or ratios, strategic goals, challenges, objectives, and plans for future operations. Such statements constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements that express, or involve discussions as to, expectations, beliefs, plans, objectives, assumptions, or future events or performance, often, but not always, through the use of words or phrases such as "anticipates," "believes," "estimates," "expects," "intends," "potential," "plans," "predicts," "projects," "may result," "may continue," or similar expressions, are not statements of historical facts and may be forward-looking. Forward-looking statements are not guarantees of future performance and involve estimates, assumptions, risks, and uncertainties. Actual results, performance, or outcomes may differ materially from the results discussed in the statements. In addition to any assumptions and other factors and matters referred to specifically in connection with such forward-looking statements, factors that could cause actual results or outcomes to differ materially from those contained in forward-looking statements include those factors set forth in Part I, Item 1A - “Risk Factors” and Part II, Item 7 - “Management’s Discussion and Analysis of Financial Condition and Results of Operations" of this report, as well as in subsequent reports filed by IDACORP and Idaho Power with the Securities and Exchange Commission, and the following important factors:

| |

• | the effect of decisions by the Idaho and Oregon public utilities commissions, the Federal Energy Regulatory Commission, and other regulators that impact Idaho Power's ability to recover costs and earn a return; |

| |

• | changes in residential, commercial, and industrial growth and demographic patterns within Idaho Power's service area and the loss or change in the business of significant customers, and their associated impacts on loads and load growth, and the availability of regulatory mechanisms that allow for timely cost recovery in the event of those changes; |

| |

• | the impacts of economic conditions, including the potential for changes in customer demand for electricity, revenue from sales of excess power, financial soundness of counterparties and suppliers, and the collection of receivables; |

| |

• | unseasonable or severe weather conditions, wildfires, drought, and other natural phenomena and natural disasters, which affect customer demand, hydroelectric generation levels, repair costs, and the availability and cost of fuel for generation plants or purchased power to serve customers; |

| |

• | advancement of technologies that reduce loads or reduce the need for Idaho Power's generation or sale of electric power; |

| |

• | adoption of, changes in, and costs of compliance with laws, regulations, and policies relating to the environment, natural resources, and threatened and endangered species, and the ability to recover increased costs through rates; |

| |

• | variable hydrological conditions and over-appropriation of surface and groundwater in the Snake River Basin, which may impact the amount of power generated by Idaho Power's hydroelectric facilities; |

| |

• | the ability to purchase fuel, power, and transmission capacity under reasonable terms, particularly in the event of unanticipated power demands, lack of physical availability, transportation constraints, or a credit downgrade; |

| |

• | accidents, fires (either at or caused by Idaho Power facilities), explosions, and mechanical breakdowns that may occur while operating and maintaining an electric system, which can cause unplanned outages, reduce generating output, damage the companies’ assets, operations, or reputation, subject the companies to third-party claims for property damage, personal injury, or loss of life, or result in the imposition of civil, criminal, and regulatory fines and penalties; |

| |

• | the increased costs and operational challenges associated with purchasing and integrating intermittent renewable energy sources into Idaho Power's resource portfolio; |

| |

• | administration of reliability, security, and other requirements for system infrastructure required by the Federal Energy Regulatory Commission and other regulatory authorities, which could result in penalties and increase costs; |

| |

• | disruptions or outages of Idaho Power's generation or transmission systems or of any interconnected transmission system; |

| |

• | the ability to obtain debt and equity financing or refinance existing debt when necessary and on favorable terms, which can be affected by factors such as credit ratings, volatility in the financial markets, interest rate fluctuations, decisions by the Idaho or Oregon public utility commissions, and the companies' past or projected financial performance; |

| |

• | reductions in credit ratings, which could adversely impact access to capital markets and would require the posting of additional collateral to counterparties pursuant to credit and contractual arrangements; |

| |

• | the ability to enter into financial and physical commodity hedges with creditworthy counterparties to manage price and commodity risk, and the failure of any such risk management and hedging strategies to work as intended; |

| |

• | changes in actuarial assumptions, changes in interest rates, and the return on plan assets for pension and other post-retirement plans, which can affect future pension and other postretirement plan funding obligations, costs, and liabilities; |

| |

• | the ability to continue to pay dividends based on financial performance, and in light of contractual covenants and restrictions and regulatory limitations; |

| |

• | changes in tax laws or related regulations or new interpretations of applicable laws by federal, state, or local taxing jurisdictions, the availability of tax credits, and the tax rates payable by IDACORP shareholders on common stock dividends; |

| |

• | employee workforce factors, including the operational and financial costs of unionization or the attempt to unionize all or part of the companies' workforce, the impact of an aging workforce and retirements, the cost and ability to retain skilled workers, and the ability to adjust the labor cost structure when necessary; |

| |

• | failure to comply with state and federal laws, policies, and regulations, including new interpretations and enforcement initiatives by regulatory and oversight bodies, which may result in penalties and fines and increase the cost of compliance, the nature and extent of investigations and audits, and the cost of remediation; |

| |

• | the inability to obtain or cost of obtaining and complying with required governmental permits and approvals, licenses, rights-of-way, and siting for transmission and generation projects and hydroelectric facilities; |

| |

• | the cost and outcome of litigation, dispute resolution, and regulatory proceedings, and the ability to recover those costs or the costs of operational changes through insurance or rates, or from third parties; |

| |

• | the failure of information systems or the failure to secure data, failure to comply with privacy laws, security breaches, or the direct or indirect effect on the companies' business or operations resulting from cyber attacks, terrorist incidents or the threat of terrorist incidents, and acts of war; |

| |

• | unusual or unanticipated changes in normal business operations, including unusual maintenance or repairs, or the failure to successfully implement new technology solutions; and |

| |

• | adoption of or changes in accounting policies and principles, changes in accounting estimates, and new Securities and Exchange Commission or New York Stock Exchange requirements, or new interpretations of existing requirements. |

Any forward-looking statement speaks only as of the date on which such statement is made. New factors emerge from time to time and it is not possible for management to predict all such factors, nor can it assess the impact of any such factor on the business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. IDACORP and Idaho Power disclaim any obligation to update publicly any forward-looking information, whether in response to new information, future events, or otherwise, except as required by applicable law.

PART I

ITEM 1. BUSINESS

OVERVIEW

Background

IDACORP, Inc. (IDACORP) is a holding company incorporated in 1998 under the laws of the state of Idaho. Its principal operating subsidiary is Idaho Power Company (Idaho Power). IDACORP is subject to the provisions of the Public Utility Holding Company Act of 2005, which provides the Federal Energy Regulatory Commission (FERC) and state utility regulatory commissions with access to books and records and imposes record retention and reporting requirements on IDACORP.

Idaho Power was incorporated under the laws of the state of Idaho in 1989 as the successor to a Maine corporation that was organized in 1915 and began operations in 1916. Idaho Power is an electric utility engaged in the generation, transmission, distribution, sale, and purchase of electric energy and capacity and is regulated by the state regulatory commissions of Idaho and Oregon and by the FERC. Idaho Power is the parent of Idaho Energy Resources Co. (IERCo), a joint venturer in Bridger Coal Company (BCC), which mines and supplies coal to the Jim Bridger generating plant owned in part by Idaho Power. Idaho Power's utility operations constitute nearly all of IDACORP's current business operations and are IDACORP’s only reportable business segment. Segment financial information is presented in Note 17 – "Segment Information" to the consolidated financial statements included in this report. As of December 31, 2015, IDACORP had 2,002 full-time employees, 1,993 of whom were employed by Idaho Power, and 21 part-time employees, 19 of whom were employed by Idaho Power.

IDACORP’s other subsidiaries include IDACORP Financial Services, Inc. (IFS), an investor in affordable housing and other real estate investments; Ida-West Energy Company (Ida-West), an operator of small hydroelectric generation projects that satisfy the requirements of the Public Utility Regulatory Policies Act of 1978 (PURPA); and IDACORP Energy Services Co. (IESCo), the successor to IDACORP Energy L.P., a marketer of energy commodities that wound down operations in 2003.

IDACORP’s and Idaho Power’s principal executive offices are located at 1221 W. Idaho Street, Boise, Idaho 83702, and the telephone number is (208) 388-2200.

Available Information

IDACORP and Idaho Power make available free of charge on their websites their Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the U.S. Securities Exchange Act of 1934 as soon as reasonably practicable after the reports are electronically filed with or furnished to the U.S. Securities and Exchange Commission (SEC). IDACORP's website is www.idacorpinc.com and Idaho Power's website is www.idahopower.com. The contents of these websites are not part of this Annual Report on Form 10-K. Reports, proxy and information statements, and other information regarding IDACORP and Idaho Power may also be obtained directly from the SEC’s website, www.sec.gov, or from the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549.

UTILITY OPERATIONS

Background

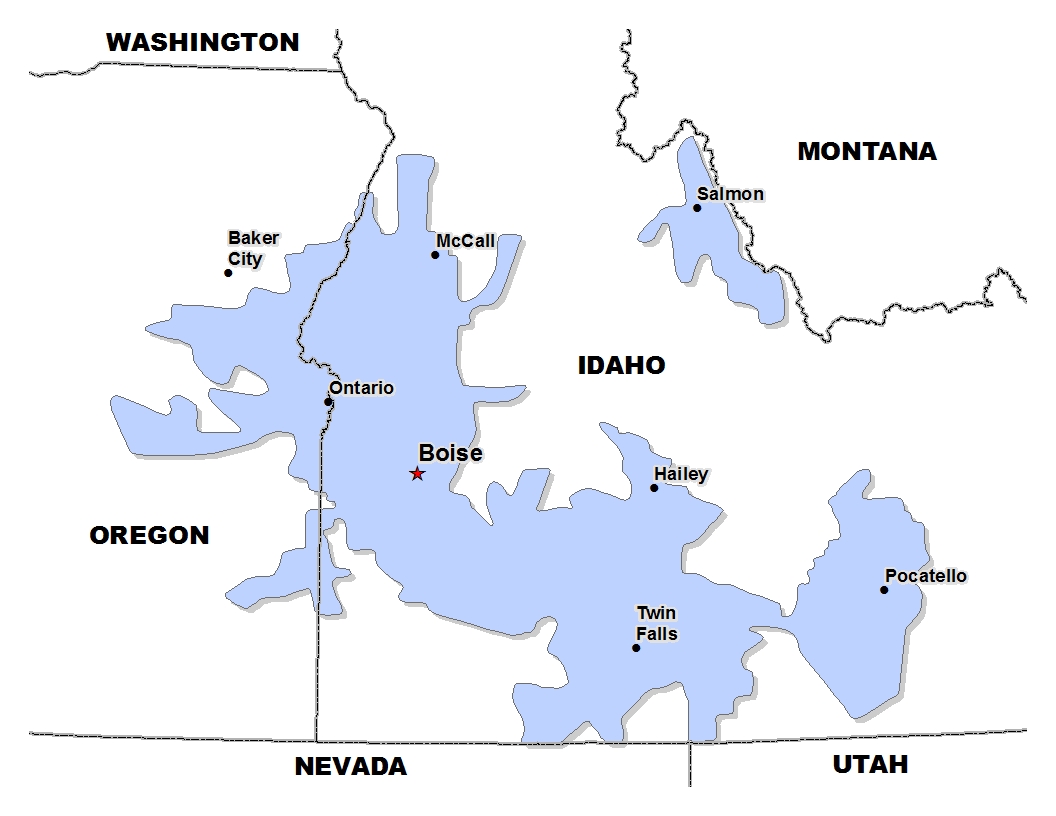

Idaho Power provided electric utility service to approximately 525,000 general business customers in southern Idaho and eastern Oregon as of December 31, 2015. Over 436,000 of these customers are residential. Idaho Power’s principal commercial and industrial customers are involved in food processing, electronics and general manufacturing, agriculture, health care, and winter recreation. Idaho Power holds franchises, typically in the form of right-of-way arrangements, in 71 cities in Idaho and 9 cities in Oregon and holds certificates from the respective public utility regulatory authorities to serve all or a portion of 25 counties in Idaho and 3 counties in Oregon. Idaho Power's service area is shaded in the illustration on the following page and covers approximately 24,000 square miles with an estimated population of one million.

Idaho Power is under the jurisdiction (as to rates, service, accounting, and other general matters of utility operation) of the Idaho Public Utilities Commission (IPUC), the Public Utility Commission of Oregon (OPUC), and the FERC. The IPUC and OPUC determine the rates that Idaho Power is authorized to charge to its general business customers. Idaho Power is also under the regulatory jurisdiction of the IPUC, the OPUC, and the Public Service Commission of Wyoming as to the issuance of debt and equity securities. As a public utility under the Federal Power Act, Idaho Power has authority to charge market-based rates for wholesale energy sales under its FERC tariff and to provide transmission services under its open access transmission tariff (OATT). Additionally, the FERC has jurisdiction over Idaho Power's sales of transmission capacity and wholesale electricity, hydroelectric project relicensing, and system reliability, among other items.

Regulatory Accounting

Idaho Power is subject to accounting principles generally accepted in the United States of America, with the impacts of rate regulation reflected in its financial statements. These principles sometimes result in Idaho Power recording expenses and revenues in a different period than when an unregulated enterprise would record such expenses and revenues. In these instances, the amounts are deferred or accrued as regulatory assets or regulatory liabilities on the balance sheet and recorded on the income statement when recovered or returned in rates. Additionally, regulators can impose regulatory liabilities upon a regulated company for amounts previously collected from customers that are expected to be refunded. Idaho Power records regulatory assets or liabilities if it is probable that they will be reflected in future prices, based on regulatory orders or other available evidence.

Business Strategy

IDACORP’s business strategy emphasizes Idaho Power as IDACORP’s core business, as Idaho Power's utility operations are the primary driver of IDACORP's operating results. Idaho Power's three-part strategy can be summarized as follows:

| |

• | Responsible Planning: Idaho Power’s planning process is intended to ensure adequate generation, transmission, and distribution resources to meet anticipated population growth and increasing electricity demand. This planning process integrates Idaho Power’s regulatory strategy and financial planning, including the consideration of regional economic development in the communities Idaho Power serves. |

| |

• | Responsible Development and Protection of Resources: Idaho Power’s business strategy includes the development and protection of generation, transmission, distribution, and associated infrastructure, and stewardship of the natural resources upon which Idaho Power and the communities it serves depend. Additionally, the strategy considers workforce planning and employee development and retention related to these strategic elements. |

| |

• | Responsible Energy Use: Idaho Power's business strategy includes energy efficiency and demand response programs and preparation for potential carbon and renewable portfolio standards legislation. The strategy also includes targeted reductions relating to carbon emission intensity and public reporting of these reductions, as well as operating Idaho Power's system in a manner that extracts additional value through changes in fuel mix and generation. |

Idaho Power’s business strategy seeks to balance the interests of owners, customers, employees, and other stakeholders while maintaining the company’s financial stability and flexibility. Idaho Power has further refined its three-part business strategy to include three core focuses for 2016—improving its core business, growing revenues, and enhancing the brand and positioning the company for the future. IDACORP continues to focus on its core business and its goal of generating returns for its shareholders and long-term shareholder value.

Rates and Revenues

Idaho Power generates revenue primarily through the sale of electricity to retail and wholesale customers and the provision of transmission service. The prices that the IPUC, the OPUC, and the FERC authorize Idaho Power to charge for the electric power and services Idaho Power sells are a critical factor in determining IDACORP's and Idaho Power's results of operations and financial condition. In addition to the discussion below, for more information on Idaho Power's regulatory framework and rate regulation, see the “Regulatory Matters” section of Part II, Item 7 – “Management’s Discussion and Analysis of Financial Condition and Results of Operations” (MD&A) and Note 3 – “Regulatory Matters” to the consolidated financial statements included in this report.

Retail Rates: Idaho Power periodically evaluates the need to request changes to its retail electricity price structure to cover its operating costs and to seek to earn a return on its investments. Idaho Power uses general rate cases, power cost adjustment (PCA) mechanisms, a fixed cost adjustment (FCA) mechanism, balancing accounts and tariff riders, and subject-specific filings to recover its costs of providing service and to earn a return on investment. Retail prices are generally determined through formal ratemaking proceedings that are conducted under established procedures and schedules before the issuance of a final order. Participants in these proceedings include Idaho Power, the staffs of the IPUC or OPUC, and other interested parties. The IPUC and OPUC are charged with ensuring that the prices and terms of service are fair, are non-discriminatory, and provide Idaho Power an opportunity to recover its prudently incurred or allowable costs and expenditures and earn a reasonable return on investment. The ability to request rate changes does not, however, ensure that Idaho Power will recover all of its costs or earn a specified rate of return, or that its costs will be recovered in advance of or at the same time as the costs are incurred.

In addition to general rate case filings, ratemaking proceedings can involve charges or credits related to specific costs, programs, or activities, as well as the recovery or refund of amounts recorded under specific authorization from the IPUC or OPUC but deferred for recovery or refund. Deferred amounts are generally collected from or refunded to retail customers through the use of base rates or supplemental tariffs. Outside of base rates, three of the most significant mechanisms for recovery of costs are the PCA mechanisms, FCA mechanism, and energy efficiency rider. The Idaho and Oregon PCA mechanisms are intended to address the volatility of power supply costs and provide for annual adjustments to the rates charged to retail customers by allowing partial recovery of the difference between net power supply costs included in base rates and actual net power supply costs incurred by Idaho Power. The FCA mechanism is designed to remove Idaho Power’s financial disincentive to invest in energy efficiency programs by separating (or decoupling) the recovery of fixed costs from the variable kilowatt-hour charge for certain Idaho customer classes and linking it instead to a set amount per customer. Separately, Idaho Power collects most of its energy efficiency program costs through an energy efficiency rider on customer bills.

Wholesale Markets: As a public utility subject to the provisions of Part II of the Federal Power Act (FPA), Idaho Power has authority to charge market-based rates for wholesale energy sales under its FERC tariff and to provide transmission services under its OATT. Idaho Power’s OATT transmission rate is revised each year based primarily on financial and operational data Idaho Power files annually with the FERC in its Form 1. The Energy Policy Act of 2005 granted the FERC increased statutory authority to implement mandatory transmission and network reliability standards, as well as enhanced oversight of power and transmission markets, including protection against market manipulation. These mandatory transmission and reliability standards were developed by the North American Electric Reliability Corporation (NERC) and the Western Electricity Coordinating Council (WECC), which have responsibility for compliance and enforcement of transmission and reliability standards.

Idaho Power participates in the wholesale energy markets by purchasing power to help meet load demands and selling power that is in excess of load demands. Idaho Power's market activities are guided by a risk management policy and frequently updated operating plans. These operating plans are impacted by factors such as customer demand for power, market prices, generating costs, transmission constraints, and availability of generating resources. Some of Idaho Power's 17 hydroelectric generation facilities are operated to optimize the water that is available by choosing when to run hydroelectric generation units and when to store water in reservoirs. Idaho Power at times operates these and its other generation facilities to take advantage of market opportunities. These decisions affect the timing and volumes of market purchases and market sales. Even in below-normal water years, there are opportunities to vary water usage to capture wholesale marketplace economic benefits, maximize generation unit efficiency and meet peak loads. Compliance factors such as allowable river stage elevation changes and flood control requirements also influence these generation dispatch decisions. Idaho Power's off-system sales revenues depend largely on the availability of generation resources above the amount necessary to serve customer loads as well as adequate market power prices at the time when those resources are available. When either factor is low, off-system sales revenue is reduced.

Energy Sales: Weather, seasonal customer demand, and economic conditions all impact the amount of electricity that Idaho Power sells as well as the costs it incurs to provide that electricity. Idaho Power's utility revenues are not earned, and associated expenses are not incurred, evenly during the year. Idaho Power’s retail energy sales typically peak during the summer irrigation and cooling season, with a lower peak in the winter. Extreme temperatures increase sales to customers who use electricity for cooling and heating, and moderate temperatures decrease sales. Increased precipitation levels during the agricultural growing season reduce electricity sales to customers who use electricity to operate irrigation pumps. The table that follows presents Idaho Power’s revenues and sales volumes for the last three years, classified by customer type. Approximately 95 percent of Idaho Power’s general business revenue originates from customers located in Idaho, with the remainder originating from customers located in Oregon. Idaho Power’s operations, including information on energy sales, are discussed further in Part II, Item 7 - MD&A - "Results of Operations - Utility Operations.”

|

| | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2015 | | 2014 | | 2013 |

General business revenues (thousands of dollars) | | |

| | |

| | |

|

Residential | | $ | 512,068 |

| | $ | 500,195 |

| | $ | 513,914 |

|

Commercial | | 306,178 |

| | 299,462 |

| | 281,009 |

|

Industrial | | 182,254 |

| | 182,675 |

| | 165,941 |

|

Irrigation | | 164,403 |

| | 158,654 |

| | 159,242 |

|

Provision for rate refund for sharing mechanism | | (3,159 | ) | | (7,999 | ) | | (7,602 | ) |

Deferred revenue related to Hells Canyon Complex relicensing AFUDC | | (10,706 | ) | | (10,706 | ) | | (10,776 | ) |

Total general business revenues | | 1,151,038 |

| | 1,122,281 |

| | 1,101,728 |

|

Off-system sales | | 30,887 |

| | 77,165 |

| | 54,473 |

|

Other | | 85,580 |

| | 79,205 |

| | 86,897 |

|

Total revenues | | $ | 1,267,505 |

| | $ | 1,278,651 |

| | $ | 1,243,098 |

|

Energy sales (thousands of MWh) | | |

| | |

| | |

|

Residential | | 4,977 |

| | 4,965 |

| | 5,365 |

|

Commercial | | 4,045 |

| | 3,944 |

| | 3,975 |

|

Industrial | | 3,196 |

| | 3,217 |

| | 3,182 |

|

Irrigation | | 2,047 |

| | 1,966 |

| | 2,097 |

|

Total general business | | 14,265 |

| | 14,092 |

| | 14,619 |

|

Off-system sales | | 1,254 |

| | 2,220 |

| | 1,683 |

|

Total | | 15,519 |

| | 16,312 |

| | 16,302 |

|

Competition: Idaho Power's electric utility business has historically been recognized as a natural monopoly. Idaho Power's rates for retail electric services are generally determined on a “cost of service” basis. Rates are designed to provide, after recovery of allowable operating expenses including depreciation on capital investments, an opportunity for Idaho Power to earn a reasonable return on investment as authorized by regulators. However, alternative methods of generation, including customer-owned solar and other forms of distributed generation, compete with Idaho Power for sales to existing customers. Also, non-utility businesses are developing new technologies and services to help energy consumers manage energy in new

ways that could alter demand for Idaho Power's electric energy. Idaho Power also competes with fuel distribution companies in serving the energy needs of customers for space heating, water heating, and appliances.

Idaho Power also participates in the wholesale energy markets and in the electric transmission markets. Generally, these wholesale markets are regulated by the FERC, which requires electric utilities to transmit power to or for wholesale purchasers and sellers and make available, on a non-discriminatory basis, transmission capacity for the purpose of providing these services.

In return for agreeing to provide service to all customers within a defined service area, electric utilities are typically provided with an exclusive right to provide service in that service area. However, certain prescribed areas within Idaho Power's service area, such as municipalities or Native American Tribal reservations, may elect not to take service from Idaho Power and instead operate as a municipal electric utility or otherwise as a separate entity. In such cases, the entity would be required to purchase or otherwise obtain rights (such as by contract) to Idaho Power's distribution infrastructure within the municipal or other designated area. Idaho Power would have no responsibility for providing electric service to the municipal or separate entity, absent Idaho Power's voluntary execution of an agreement to provide that service. Separately, the Shoshone-Bannock Tribes, located in southeastern Idaho, have recently taken steps toward the adoption of a separate utility code applicable to electric utilities operating within the Shoshone-Bannock Tribal Reservation (Reservation). The proposed tribal utility code, if adopted, could ultimately lead to Idaho Power's cessation of its historical provision of service to the Reservation and could result in either no or a limited electric service relationship with the Reservation, or could result solely in Idaho Power's sale of power to the Reservation pursuant to a power purchase agreement. Idaho Power estimates that the average load for the Reservation over the prior five years is approximately 14 MW.

Power Supply

Overview: Idaho Power primarily relies on company-owned hydroelectric, coal-fired, and gas-fired generation facilities and long-term power purchase agreements to supply the energy needed to serve customers. Market purchases and sales are used to supplement Idaho Power's generation and balance supply and demand throughout the year. Idaho Power’s generating plants and their capacities are listed in Part I, Item 2 - “Properties.”

Weather, load demand, supply constraints, economic conditions, and availability of generation resources impact power supply costs. Idaho Power’s annual hydroelectric generation varies depending on water conditions in the Snake River Basin. Drought conditions and increased peak load demand cause a greater reliance on potentially more expensive energy sources to meet load requirements. Conversely, favorable hydroelectric generation conditions increase production at Idaho Power’s hydroelectric generating facilities and reduce the need for thermal generation and wholesale market purchased power. Economic conditions and governmental regulations can affect the market price of natural gas and coal, which may impact fuel expense and market prices for purchased power. Idaho Power's PCA mechanisms mitigate in large part the potentially adverse financial statement impacts of volatile fuel and power costs.

Idaho Power’s system is dual peaking, with the larger peak demand occurring in the summer. The all-time system peak demand was 3,407 Megawatts (MW), set on July 2, 2013, at which time Idaho Power had deployed 30 MW of demand response programs to mitigate the load demand. The all-time winter peak demand was 2,527 MW, set on December 10, 2009. Idaho Power's peak demand during 2015 was 3,402 MW, the magnitude of which was diminished by the deployment of 60 MW of demand response programs during the peak load period. During these and other similarly heavy load periods Idaho Power’s system is fully committed to serve load and meet required operating reserves. The table that follows shows Idaho Power’s total power supply for the last three years.

|

| | | | | | | | | | | | | | | | | | |

| | MWh | | Percent of Total Generation |

| | 2015 | | 2014 | | 2013 | | 2015 | | 2014 | | 2013 |

| | (thousands of MWh) | | | |

Hydroelectric plants | | 5,910 |

| | 6,170 |

| | 5,656 |

| | 47 | % | | 47 | % | | 42 | % |

Coal-fired plants | | 4,676 |

| | 5,851 |

| | 6,327 |

| | 37 | % | | 44 | % | | 47 | % |

Natural gas fired plants | | 2,076 |

| | 1,175 |

| | 1,576 |

| | 16 | % | | 9 | % | | 11 | % |

Total system generation | | 12,662 |

| | 13,196 |

| | 13,559 |

| | 100 | % | | 100 | % | | 100 | % |

| | |

| | |

| | |

| | |

| | |

| | |

|

Purchased power - cogeneration and small power production | | 2,008 |

| | 2,286 |

| | 2,127 |

| | |

| | |

| | |

|

Purchased power - other | | 1,784 |

| | 1,867 |

| | 1,775 |

| | |

| | |

| | |

|

Total purchased power | | 3,792 |

| | 4,153 |

| | 3,902 |

| | |

| | |

| | |

|

Total power supply | | 16,454 |

| | 17,349 |

| | 17,461 |

| | |

| | |

| | |

|

Hydroelectric Generation: Idaho Power operates 17 hydroelectric projects located on the Snake River and its tributaries. Together, these hydroelectric facilities provide a total nameplate capacity of 1,709 MW and annual generation of approximately 8.5 million Megawatt-hours (MWh) under median water conditions. The amount of water available for hydroelectric power generation depends on several factors—the amount of snow pack in the mountains upstream of Idaho Power’s hydroelectric facilities, upstream reservoir storage, springtime precipitation and temperatures, main river and tributary base flows, the condition of the Eastern Snake Plain Aquifer and its spring flow impact, summer time irrigation withdrawals and returns, and upstream reservoir regulation. Idaho Power actively participates in collaborative work groups focused on water management issues in the Snake River Basin, with the goal of preserving the long-term availability of water for use at Idaho Power’s hydroelectric projects on the Snake River.

During low water years, when stream flows into Idaho Power’s hydroelectric projects are reduced, Idaho Power’s hydroelectric generation is reduced. The result is a greater reliance on other generation resources and power purchases. In 2014, significantly low upstream carryover water storage hindered the impact of the runoff of near-normal snow accumulation, resulting in generation of 6.2 million MWh. In 2015, below-normal snow accumulation resulted in a lower than median hydro production of 5.9 million MWh. The Northwest River Forecast Center of the National Oceanic Atmospheric Administration reported that the 2015 April through July inflow volume into Brownlee Reservoir (the uppermost reservoir of Idaho Power's Hells Canyon Complex) was only 46 percent of normal. By comparison, April through July Brownlee Reservoir inflow was 63 percent of normal in 2014. For 2016, Idaho Power estimates annual generation from its hydroelectric facilities of between 6.0 million MWh and 8.0 million MWh.

Idaho Power obtains licenses for its hydroelectric projects from the FERC, similar to other utilities that operate nonfederal hydroelectric projects on qualified waterways. The licensing process includes an extensive public review process and involves numerous natural resource and environmental agencies. The licenses last from 30 to 50 years depending on the size, complexity, and cost of the project. Idaho Power is actively pursuing the relicensing of the Hells Canyon Complex project, its largest hydroelectric generation source. Idaho Power also has three Oregon licenses under the Oregon Hydroelectric Act, which applies to Idaho Power’s Brownlee, Oxbow, and Hells Canyon facilities. For further information on relicensing activities see Part II, Item 7 – MD&A – "Regulatory Matters – Relicensing of Hydroelectric Projects.”

Idaho Power is subject to the provisions of the FPA as a “public utility” and as a “licensee” by virtue of its hydroelectric operations. As a licensee under Part I of the FPA, Idaho Power and its licensed hydroelectric projects are subject to conditions described in the FPA and related FERC regulations. These conditions and regulations include, among other items, provisions relating to condemnation of a project upon payment of just compensation, amortization of project investment from excess project earnings, and possible takeover of a project after expiration of its license upon payment of net investment and severance damages.

Coal-Fired Generation: Idaho Power co-owns the following coal-fired power plants:

| |

• | Jim Bridger located in Wyoming, in which Idaho Power has a one-third interest; |

| |

• | North Valmy located in Nevada, in which Idaho Power has a 50 percent interest; and |

| |

• | Boardman located in Oregon, in which Idaho Power has a 10 percent interest. |

Bridger Coal Company (BCC) supplies coal to the Jim Bridger power plant. Idaho Power owns a one-third interest in BCC and PacifiCorp owns a two-third interest in BCC and is the operator of the Bridger Coal Mine. The mine operates under a long-term sales agreement that provides for delivery of coal over a 51-year period ending in 2024 from surface and underground sources. Idaho Power believes that BCC has sufficient reserves to provide coal deliveries for at least the term of the sales agreement. Idaho Power also has a coal supply contract providing for annual deliveries of coal through 2017 from the Black Butte Coal Company’s Black Butte mine located near the Jim Bridger plant. This contract supplements the BCC deliveries and provides another coal supply to operate the Jim Bridger plant. The Jim Bridger plant’s rail load-in facility and unit coal train, while limited, provides the opportunity to access other fuel supplies for tonnage requirements above established contract minimums.

NV Energy is the operator of the North Valmy power plant. NV Energy and Idaho Power have contracts with a coal supplier through 2016. Idaho Power's share of these contracts, together with the existing coal inventory at the North Valmy plant, are expected to meet Idaho Power's projected coal requirements at the plant through 2017. Idaho Power expects to be able to obtain future coal requirements through similar contracts.

Portland General Electric Company is the operator of the Boardman power plant. Idaho Power believes that it has sufficient inventory and coal contracts to supply the Boardman plant with fuel through 2016 and has 25 percent of projected fuel needs for 2017. The Boardman plant receives coal through annual contracts with suppliers from the Powder River Basin in northeast Wyoming. Idaho Power expects to meet future coal needs through similar contracts. In December 2010, the Oregon Environmental Quality Commission approved a plan to cease coal-fired operations at the Boardman power plant no later than December 31, 2020.

Natural Gas-fired Generation: Idaho Power owns and operates the Langley Gulch natural gas-fired combined cycle power plant and the Danskin and Bennett Mountain natural gas-fired simple cycle combustion turbine power plants. All three plants are located in Idaho.

Idaho Power operates the Langley Gulch plant as a baseload unit and the Danskin and Bennett Mountain plants to meet peak supply needs. The plants are also used to take advantage of wholesale market opportunities. Natural gas for all facilities is purchased based on system requirements and dispatch efficiency. The natural gas is transported through the Williams-Northwest Pipeline under Idaho Power's 55,584 million British thermal units (MMBtu) per day long-term gas transportation service agreements. These transportation agreements vary in contract length but generally contain the right for Idaho Power to extend the term. In addition to the long-term gas transportation service agreements, Idaho Power has entered into a long-term storage service agreement with Northwest Pipeline for 131,453 MMBtu of total storage capacity at the Jackson Prairie Storage Project. This firm storage contract expires in 2043. Idaho Power purchases and stores natural gas with the intent of fulfilling needs as identified for seasonal peaks or to meet system requirements.

As of December 31, 2015, approximately 9.8 million MMBtu's of natural gas was financially hedged for physical delivery for the operational dispatch of the Langley Gulch plant through January 2017. Idaho Power plans to manage the procurement of additional natural gas for the peaking units on the daily spot market or from storage inventory as necessary to meet system requirements and fueling strategies.

Purchased Power: As described below, Idaho Power purchases power in the wholesale market as well as power pursuant to long-term power purchase contracts and exchange agreements.

Wholesale Market Transactions: To supplement its self-generated power and long-term purchase arrangements, Idaho Power purchases power in the wholesale market based on economics, operating reserve margins, risk management policy limitations, and unit availability. Depending on availability of excess power or generation capacity, pricing, and opportunities in the markets, Idaho Power also sells power in the wholesale markets. During 2015 and 2014, Idaho Power purchased 1.8 million MWh and 1.9 million MWh of power through wholesale market purchases at an average cost of $49.57 per MWh and $49.31 per MWh, respectively. During 2015 and 2014, Idaho Power sold 1.3 million MWh and 2.2 million MWh of power in wholesale market sales, with an average price of $24.63 per MWh and $34.76 per MWh, respectively.

Long-term Power Purchase and Exchange Arrangements: In addition to its wholesale market purchases, Idaho Power has the following notable firm long-term power purchase contracts and energy exchange agreements:

| |

• | Telocaset Wind Power Partners, LLC - for 101 MW (nameplate generation) from its Elkhorn Valley wind project located in eastern Oregon. The contract term is through 2027. |

| |

• | USG Oregon LLC - for 22 MW (estimated average annual output) from the Neal Hot Springs #1 geothermal power plant located near Vale, Oregon. The contract term is through 2037. |

| |

• | Clatskanie People's Utility - for the exchange of up to 18 MW of energy from the Arrowrock hydroelectric project in southern Idaho in exchange for energy from Idaho Power's system or power purchased at the Mid-Columbia trading hub. The initial term of the agreement was through December 31, 2015, but the term of the agreement has been extended through December 31, 2020. Idaho Power has the right to renew the agreement for one additional five-year term. |

| |

• | Raft River Energy I, LLC - for up to 13 MW (nameplate generation) from its Raft River Geothermal Power Plant Unit #1 located in southern Idaho. The contract term is through 2033. |

PURPA Power Purchase Contracts: Idaho Power purchases power from PURPA projects as mandated by federal law. As of February 5, 2016, Idaho Power had contracts with on-line PURPA-related projects with a total of 784 MW of nameplate generation capacity, with an additional 423 MW nameplate capacity of projects projected to be on-line by June 1, 2017. The power purchase contracts for these projects have original contract terms ranging from one to 35 years. The expense and volume of PURPA project power purchases during the last three years is included in the following table:

|

| | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2015 | | 2014 | | 2013 |

PURPA contract expense (in thousands) | | $ | 131,340 |

| | $ | 144,617 |

| | $ | 131,338 |

|

MWh purchased under PURPA contracts (in thousands) | | 2,008 |

| | 2,286 |

| | 2,127 |

|

Average cost per MWh from PURPA contracts | | $ | 65.41 |

| | $ | 63.26 |

| | $ | 61.75 |

|

Pursuant to the requirements of PURPA, the IPUC and OPUC have each issued orders and rules regulating Idaho Power’s purchase of power from "qualifying facilities" that meet the requirements of PURPA. A key component of the PURPA contracts is the energy price contained within the agreements. PURPA regulations specify that a utility must pay energy prices based on the utility’s avoided costs. The IPUC and OPUC have established specific rules and regulations to calculate the avoided cost that Idaho Power is required to include in PURPA contracts. For PURPA power purchase agreements:

| |

• | Idaho Power is required to purchase all of the output from the facilities located inside its service area, subject to some exceptions such as adverse impacts on system reliability. |

| |

• | Idaho Power is required to purchase the output of projects located outside its service area if it has the ability to receive power at the facility’s requested point of delivery on Idaho Power's system. |

| |

• | The IPUC jurisdictional portion of the costs associated with PURPA contracts is fully recovered through base rates and the PCA, and the OPUC jurisdictional portion is recovered through general rate case filings and an Oregon PCA mechanism. Thus, the primary impact of high power purchase costs under PURPA contracts is on customer rates. |

| |

• | The IPUC issued an order in August 2015 that revised the standard PURPA power purchase contract term for new contracts to 2 years from the previously required 20 year term. |

| |

• | OPUC jurisdictional regulations have generally provided for PURPA standard contract terms of up to 20 years. Various ongoing cases are being processed at the OPUC in which the contract term and other PURPA regulations are being reviewed. |

| |

• | The IPUC requires Idaho Power to pay "published avoided cost" rates for all wind and solar projects that are smaller than 100 kilowatts (kW) and all other types of projects that are smaller than 10 average MWs. For PURPA qualifying facilities that exceed these size limitations, Idaho Power is required to negotiate an applicable price (premised on avoided costs) based upon IPUC regulations. |

| |

• | The OPUC requires that Idaho Power pay the published avoided costs for all PURPA qualifying facilities with a nameplate rating of 10 MW or less and that Idaho Power negotiate an applicable price (premised on avoided costs) for all other qualifying facilities based upon OPUC regulations. As part of the ongoing cases at the OPUC, the OPUC has temporarily reduced this nameplate rating for solar and wind projects to 3 MW. |

Idaho Power, as well as other affected electric utilities, have engaged in proceedings at the IPUC and OPUC relating to PURPA contracts. Final rulings were issued in the IPUC proceedings in 2015, and the OPUC proceedings are ongoing. These proceedings have related to, among other things, appropriate contract term lengths and the prices paid for energy purchased from PURPA projects. Refer to Part II - Item 7 - MD&A - "Regulatory Matters - Renewable Energy Contracts and PURPA" for a summary of those proceedings.

Consideration of Participation in Energy Imbalance Market: Utilities in the western United States outside the California Independent System Operator (California ISO) have traditionally relied upon a combination of automated and manual dispatch

within the hour to balance generation and load to maintain reliable supply. These utilities have limited capability to transact within the hour outside their own borders. In contrast, energy imbalance markets use automated intra-hour economic dispatch of generation from committed resources to serve loads. The California ISO and PacifiCorp implemented a new energy imbalance market in 2014 (Western EIM) under which the parties enabled their systems to interact for dispatch purposes. The Western EIM is intended to reduce the power supply costs to serve customers through more efficient dispatch of a larger and more diverse pool of resources, to integrate intermittent power from renewable generation sources more effectively, and to enhance reliability. Participation in the Western EIM is voluntary and available to all balancing authorities in the western United States. Since 2015, Idaho Power has been evaluating the potential power supply cost savings and other advantages, system upgrade requirements, capital and ongoing operating costs, and other aspects of Idaho Power's potential participation in the Western EIM.

Transmission Services

Electric transmission systems deliver energy from electric generation facilities to distribution systems for final delivery to customers. Transmission systems are designed to move electricity over long distances because generation facilities can be located hundreds of miles away from customers. Idaho Power’s generating facilities are interconnected through its integrated transmission system and are operated on a coordinated basis to achieve maximum capability and reliability. Idaho Power’s transmission system is directly interconnected with the transmission systems of the Bonneville Power Administration, Avista Corporation, PacifiCorp, NorthWestern Energy, and NV Energy. These interconnections, coupled with transmission line capacity made available under agreements with some of those entities, permit the interchange, purchase, and sale of power among entities in the Western Interconnection. Idaho Power provides wholesale transmission service for eligible transmission customers on a non-discriminatory basis. Idaho Power is a member of the WECC, the NWPP, the Northern Tier Transmission Group, and the North American Energy Standards Board. These groups have been formed to more efficiently coordinate transmission reliability and planning throughout the Western Interconnection.

Transmission to serve Idaho Power's retail customers is subject to the jurisdiction of the IPUC and OPUC for retail rate making purposes. Idaho Power provides cost-based wholesale and retail access transmission services under the terms of a FERC approved OATT. Services under the OATT are offered on a nondiscriminatory basis such that all potential customers, including Idaho Power, have an equal opportunity to access the transmission system. As required by FERC standards of conduct, Idaho Power's transmission function is operated independently from Idaho Power's energy marketing function.

Idaho Power is jointly working on the permitting of two significant transmission projects. The Boardman-to-Hemingway line is a proposed 300-mile, 500-kV transmission project between a station near Boardman, Oregon and the Hemingway station near Boise, Idaho. The Gateway West line is a proposed 500-kV transmission project between a station located near Douglas, Wyoming and the Hemingway station. Both projects are intended to meet future anticipated resource needs and are discussed in Part II, Item 7 – MD&A - "Liquidity and Capital Resources - Capital Requirements" in this report.

Resource Planning

Integrated Resource Planning: The IPUC and OPUC require that Idaho Power prepare biennially an Integrated Resource Plan (IRP). Idaho Power filed its most recent IRP in June 2015. The IRP seeks to forecast Idaho Power's loads and resources for a 20-year period, analyzes potential supply-side and demand-side resource options, and identifies potential near-term and long-term actions. The four primary goals of the IRP are to:

| |

• | identify sufficient resources to reliably serve the growing demand for energy within Idaho Power's service area throughout the 20-year planning period; |

| |

• | ensure the selected resource portfolio balances cost, risk, and environmental concerns; |

| |

• | give equal and balanced treatment to both supply-side resources and demand-side measures; and |

| |

• | involve the public in the planning process in a meaningful way. |

During the time between IRP filings, the public and regulatory oversight of the activities identified in the IRP allows for discussion and adjustment of the IRP as warranted. Idaho Power makes periodic adjustments and corrections to the resource plan to reflect economic conditions, anticipated resource development, changes in technology, and regulatory requirements.

The load forecast Idaho Power used for purposes of the 2015 IRP predicts an average annual growth rate of 1.2 percent for average loads and 1.5 percent for summer peak loads over the 20-year planning horizon from 2015 to 2034. The rate of load growth can impact the timing and extent of development of resources, such as new generation plants or transmission infrastructure, to serve those loads. The load forecast Idaho Power used in the 2013 IRP predicted an average annual growth

rate of 1.1 percent for average loads and 1.4 percent for summer peak loads over the 20-year planning horizon from 2013 to 2032.

The 2015 IRP identified a preferred resource portfolio, which includes the completion of the Boardman-to-Hemingway 500-kV transmission line and the potential early retirement of the North Valmy power plant, both in 2025, with no other new resource needs prior to 2025. However, as noted in the 2015 IRP, there is considerable uncertainty surrounding the resource sufficiency estimates and project completion dates, including uncertainty around the timing and extent of third party development of renewable resources, implementation of the EPA's rules under Section 111(d) of the Clean Air Act, the actual completion date of the Boardman-to-Hemingway transmission project, and the economics and logistics of plant retirements. These and other uncertainties could result in changes to the desirability of the preferred portfolio and adjustments to the timing and nature of anticipated and actual actions.

The 2015 IRP includes as near-term action items the continued permitting and planning for the Boardman-to-Hemingway transmission line and further investigation of the early retirement of the North Valmy power plant in collaboration with the plant's co-owner. The near-term action plan also includes a decrease in the size of the planned Shoshone Falls expansion from 50 MW to a range of 1.7 MW to 4 MW with a scheduled on-line date in 2019, as well as commencement of an economic evaluation of environmental control retrofits for units 1 and 2 at the Jim Bridger power plant.

Energy Efficiency and Demand Response Programs: Idaho Power’s energy efficiency and demand response portfolio is comprised of 22 programs. These energy efficiency and demand response programs target energy savings across the entire year and system demand reduction in the summer. The programs are offered to all customer segments and emphasize the wise use of energy, especially during periods of high demand. This energy and demand reduction can minimize or delay the need for new generation or transmission infrastructure. Idaho Power’s programs include:

| |

• | financial incentives for irrigation customers for either improving the energy efficiency of an irrigation system or installing new energy efficient systems; |

| |

• | energy efficiency for new and existing homes including heating, ventilation and cooling equipment, energy efficient building techniques, insulation improvement, air duct sealing, and energy efficient lighting; |

| |

• | incentives to industrial and commercial customers for acquiring energy efficient equipment, and using energy efficiency techniques for operational and management processes; |

| |

• | demand response programs to reduce peak summer demand through the voluntary cycling of central air conditioners for residential customers, interruption of irrigation pumps, and reduction of commercial and industrial demand through actions taken by business owners and operators; and |

| |

• | membership in the Northwest Energy Efficiency Alliance, which supports market transformation efforts across the region. |

In 2015, Idaho Power’s energy efficiency programs reduced energy usage by approximately 140,000 MWh. For 2015, Idaho Power had a demand response available capacity of approximately 385 MW. In 2015 and 2014, Idaho Power expended approximately $39 million and $37 million, respectively, on both energy efficiency and demand response programs. Funding for these programs is provided through a combination of the Idaho and Oregon energy efficiency tariff riders, base rates, and the Idaho PCA mechanism.

Environmental Regulation and Costs

Idaho Power's activities are subject to a broad range of federal, state, regional, and local laws and regulations designed to protect, restore, and enhance the quality of the environment. Environmental regulation impacts Idaho Power’s operations due to the cost of installation and operation of equipment and facilities required for compliance with environmental regulations, the modification of system operations to accommodate environmental regulations, and the cost of acquiring and complying with permits and licenses. In addition to generally applicable regulations, Idaho Power's three coal-fired power plants, three natural gas combustion turbine power plants, and 17 hydroelectric generating plants are subject to a broad range of environmental requirements, including those related to air and water quality, waste materials, and endangered species. For a more detailed discussion of these and other environmental issues, refer to Item 7 - MD&A - "Environmental Matters" in this report.

Environmental Expenditures: Idaho Power’s environmental compliance expenditures will remain significant for the foreseeable future, especially given the additional regulations proposed and issued at the federal level. Idaho Power estimates its environmental expenditures, based upon present environmental laws and regulations, will be as follows for the periods indicated, excluding allowance for funds used during construction (AFUDC) (in millions of dollars):

|

| | | | | | | | |

| | 2016 | | 2017 - 2018 |

Capital expenditures: | | | | |

License compliance and relicensing efforts at hydroelectric facilities | | $ | 16 |

| | $ | 27 |

|

Investments in equipment and facilities at thermal plants | | 29 |

| | 11 |

|

Total capital expenditures | | $ | 45 |

| | $ | 38 |

|

Operating expenses: | | | | |

Operating costs for environmental facilities - hydroelectric | | $ | 22 |

| | $ | 44 |

|

Operating costs for environmental facilities - thermal | | 14 |

| | 27 |

|

Total operations and maintenance | | $ | 36 |

| | $ | 71 |

|

Idaho Power anticipates that finalization and implementation of a number of federal and state rulemakings and other proceedings addressing, among other things, greenhouse gases and endangered species, could result in substantially increased operating and compliance costs in addition to the amounts set forth above, but Idaho Power is unable to estimate those costs given the uncertainty associated with potential future regulations. Idaho Power would seek to recover those increased costs through the ratemaking process.

Idaho Power monitors environmental requirements and assesses whether environmental control measures are or remain economically appropriate. Continued review of the economic appropriateness of further investments in coal-fired plants was included in a February 2014 order of the IPUC, in which the IPUC requested that Idaho Power continue monitoring environmental requirements at a national level and account for their impact in resource planning and promptly apprise the IPUC of developments that could impact the company's continued reliance on the North Valmy plant as a coal-fired resource. Idaho Power has been working with the plant's co-owner to monitor environmental requirements and costs associated with the plant, and to develop alignment on potential retirement dates for the plant. In its 2015 IRP, Idaho Power included retirement scenarios ranging from 2019 to 2025 for the North Valmy plant, with a later date within that range being more likely.

Voluntary CO2 Intensity Reduction Goal: Idaho Power is engaged in voluntary greenhouse gas emissions intensity reduction efforts. In September 2009, IDACORP's and Idaho Power's boards of directors approved guidelines that established a goal to reduce Idaho Power's resource portfolio's average carbon dioxide (CO2) emissions intensity for the 2010 through 2013 time period to a level of 10 to 15 percent below Idaho Power's 2005 CO2 emissions intensity of 1,194 lbs CO2/MWh. The combination of effective utilization of hydroelectric projects, above average stream flows in some years, reduced usage of coal-fired facilities, the purchase of renewable energy, and the addition of the Langley Gulch natural gas-fired power plant positioned Idaho Power to extend its CO2 emissions intensity reduction goal period for an additional two years, targeting an average reduction of 10 to 15 percent below its 2005 levels for the entire 2010 through 2015 time period. Idaho Power achieved its initial reduction goal, as well as its extended goal through 2015. Idaho Power estimates that its average CO2 emission intensity from company-owned resources for the 2010 through 2015 period was 21 percent below the 2005 CO2 emission intensity level.

In 2015, Idaho Power further extended and expanded the goal, seeking to reduce the company-owned resource portfolio average CO2 emission intensity to 15-20 percent below 2005 levels for the 2010-2017 period.

Carbon Disclosure Project Reporting: Idaho Power's estimated historic CO2 emissions intensity from its generation facilities, as submitted to the Carbon Disclosure Project, was as follows:

|

| | | | | | | | | | |

| | 2010 | | 2011 | | 2012 | | 2013 | | 2014 |

Emission Intensity (lbs CO2/MWh) | | 1,060 | | 677 | | 871 | | 1,129 | | 1,019 |

IDACORP FINANCIAL SERVICES, INC.

IFS invests in affordable housing developments, which provide a return principally by reducing federal and state income taxes through tax credits and accelerated tax depreciation benefits. IFS has focused on a diversified approach to its investment strategy in order to limit both geographic and operational risk with most of IFS’s investments having been made through syndicated funds. IFS is no longer actively pursuing further investment opportunities, but will continue to maintain and manage its current portfolio of investments. At December 31, 2015, the gross amount of IFS’s portfolio equaled $182 million in tax credit investments. IFS generated tax credits of $3.3 million, $5.2 million, and $5.5 million in 2015, 2014, and 2013, respectively.

IDA-WEST ENERGY COMPANY

Ida-West operates and has a 50 percent ownership interest in nine hydroelectric projects that have a total generating capacity of 45 MW. Four of the projects are located in Idaho and five are in northern California. All nine projects are “qualifying facilities” under PURPA. Idaho Power purchased all of the power generated by Ida-West’s four Idaho hydroelectric projects at a cost of approximately $8 million in 2015 and $9 million in both 2014 and 2013.

EXECUTIVE OFFICERS OF THE REGISTRANTS

The names, ages, and positions of the executive officers of IDACORP and Idaho Power are listed below (in alphabetical order), along with their business experience during at least the past five years. Mr. J. LaMont Keen, a member of IDACORP's and Idaho Power's boards of directors and former President and Chief Executive Officer of IDACORP and Idaho Power, and Mr. Steven R. Keen, are brothers. There are no other family relationships among these officers, nor is there any arrangement or understanding between any officer and any other person pursuant to which the officer was appointed.

DARREL T. ANDERSON, 57

| |

• | President and Chief Executive Officer of IDACORP, Inc., May 2014 - present |

| |

• | President and Chief Executive Officer of Idaho Power Company, January 2014 - present |

| |

• | President and Chief Financial Officer of Idaho Power Company, January 2012 - December 2013 |

| |

• | Executive Vice President, Administrative Services and Chief Financial Officer of IDACORP, Inc., October 2009 - April 2014 |

| |

• | Executive Vice President, Administrative Services and Chief Financial Officer of Idaho Power Company, October 2009 - December 2011 |

| |

• | Member of the Boards of Directors of both IDACORP, Inc. and Idaho Power Company since September 2013 |

REX BLACKBURN, 60

| |

• | Senior Vice President and General Counsel, IDACORP, Inc. and Idaho Power Company, April 2009 - present |

LISA A. GROW, 50

| |

• | Senior Vice President of Operations of Idaho Power Company, January 2016 - present |

| |

• | Senior Vice President - Power Supply of Idaho Power Company, October 2009 - December 2015 |

STEVEN R. KEEN, 55

| |

• | Senior Vice President - Chief Financial Officer, and Treasurer of IDACORP, Inc., May 2014 - present |

| |

• | Senior Vice President - Chief Financial Officer, and Treasurer of Idaho Power Company, January 2014 - present |

| |

• | Vice President - Finance and Treasurer of IDACORP, Inc., June 2010 - April 2014 |

| |

• | Senior Vice President - Finance and Treasurer of Idaho Power Company, January 2012 - December 2013 |

| |

• | Vice President - Finance and Treasurer of Idaho Power Company, June 2010 - December 2011 |

| |

• | Vice President and Treasurer of IDACORP, Inc. and Idaho Power Company, June 2006 - May 2010 |

LONNIE KRAWL, 52

| |

• | Senior Vice President of Administrative Services and Chief Information Officer of Idaho Power Company, January 2016 - present |

| |

• | Vice President and Chief Information Officer of Idaho Power Company, October 2013 - December 2015 |

| |

• | Director of Human Resources of Idaho Power Company, July 2009 - September 2013 |

DANIEL B. MINOR, 58

•Executive Vice President of Idaho Power Company, January 2016 - present

| |

• | Executive Vice President and Chief Operating Officer of Idaho Power Company, January 2012 - December 2015 |

•Executive Vice President of IDACORP, Inc., May 2010 - present

•Executive Vice President - Operations of Idaho Power Company, October 2009 - December 2011

TESSIA PARK, 54

| |

• | Vice President of Power Supply of Idaho Power Company, January 2016 - present |

| |

• | Director of Load Serving Operations of Idaho Power Company, September 2012 - December 2015 |

| |

• | Operating Projects Manager of Idaho Power Company, January 2011 - September 2012 |

| |

• | Manager of Power Supply Operations of Idaho Power Company, August 2009 - January 2011 |

KEN W. PETERSEN, 52

| |

• | Vice President, Controller and Chief Accounting Officer of IDACORP, Inc. and Idaho Power Company, January 2014 - present |

| |

• | Corporate Controller and Chief Accounting Officer of IDACORP, Inc. and Idaho Power Company, May 2010 - December 2013 |

| |

• | Corporate Controller of IDACORP, Inc. and Idaho Power Company, December 2007 - May 2010 |

N. VERN PORTER, 56

| |

• | Vice President of Customer Operations of Idaho Power Company, January 2016 - present |

| |

• | Senior Vice President of Customer Operations of Idaho Power Company, April 2015 - December 2015 |

| |

• | Vice President of Idaho Power Company, January 2014 - April 2015 |

| |

• | Vice President of Delivery Engineering and Construction of Idaho Power Company, May 2012 - December 2013 |

| |

• | Vice President of Delivery Engineering and Operations of Idaho Power Company, October 2009 - May 2012 |

ITEM 1A. RISK FACTORS

IDACORP and Idaho Power operate in a highly regulated industry and business environment that involves significant risks, many of which are beyond the companies' control. The circumstances and factors set forth below may have a material impact on the business, financial condition, or results of operations of IDACORP and Idaho Power and could cause actual results or outcomes to differ materially from those discussed in any forward-looking statements. These risk factors, as well as other information in this report and in other reports the companies file with the SEC, should be considered carefully when making any investment decisions relating to IDACORP or Idaho Power.