Exhibit 99.1

February 19, 2015

IDACORP, Inc. Announces Year-End and Fourth Quarter 2014 Results, Initiates 2015 Earnings Guidance

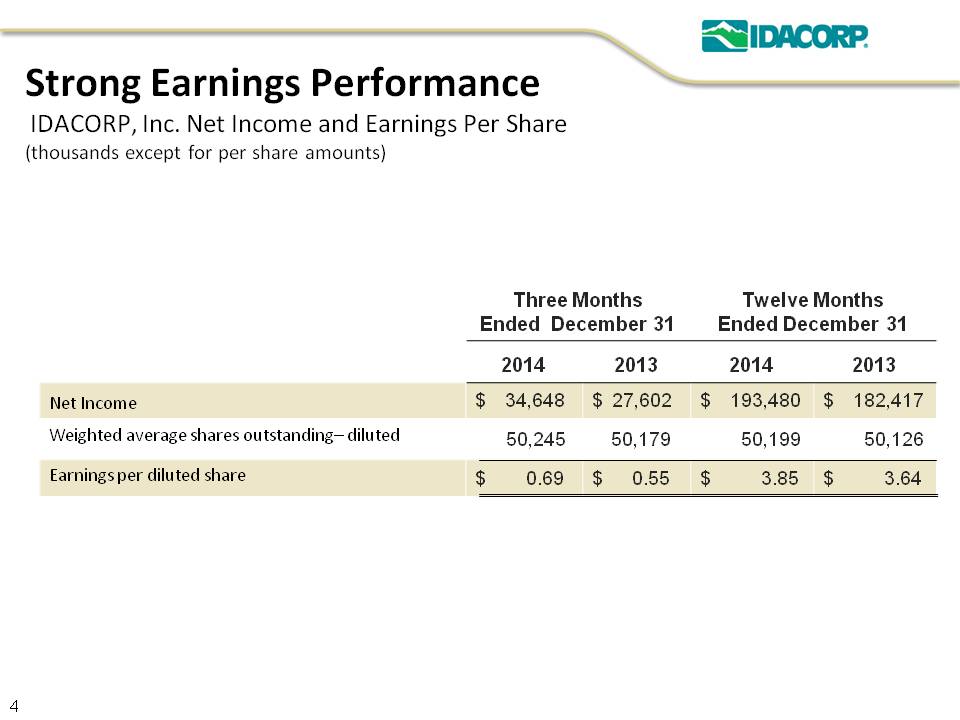

BOISE--IDACORP, Inc. (NYSE: IDA) reported 2014 net income attributable to IDACORP of $193.5 million, or $3.85 per diluted share, compared with $182.4 million, or $3.64 per diluted share, in 2013. IDACORP recorded fourth quarter net income attributable to IDACORP of $34.6 million, or $0.69 per diluted share, compared with $27.6 million, or $0.55 per diluted share, in the fourth quarter of 2013. IDACORP is initiating 2015 full year earnings guidance in the range of $3.65 to $3.80 per diluted share and is not expected to use any additional accumulated deferred investment tax credits in 2015 under the Idaho regulatory settlement.

Idaho Power Company, IDACORP's principal operating subsidiary, reported 2014 net income of $189.4 million compared with $176.7 million in 2013, and net income of $34.2 million in the fourth quarter of 2014, compared with net income of $27.4 million for the same period in 2013.

“2014 was another successful year for our company—our seventh consecutive year of earnings growth,” said IDACORP, Inc. President and CEO Darrel Anderson. “Our improved results were largely due to income tax benefits related to tax method changes combined with our continued focus on executing business optimization initiatives and actively managing costs. Operationally, weather conditions were more moderate than in 2013, which reduced sales volumes compared to last year, though continued growth in our customer base partially offset the weather-related impacts.

“Idaho Power’s 2014 return on year-end equity in the Idaho jurisdiction exceeded 10.5 percent, so Idaho Power will share earnings of approximately $25 million with Idaho customers under the Idaho regulatory settlement.

“Today IDACORP is initiating 2015 full-year earnings per share guidance in the range of $3.65 to $3.80. This estimate reflects continued benefits from tax method changes, normal weather conditions, and ongoing cost management,” added Anderson.

Performance Summary

A summary of financial highlights for the years ended December 31, 2014, 2013, and 2012 is as follows (in thousands except per share amounts):

Year Ended December 31, | ||||||||||||

2014 | 2013 | 2012 | ||||||||||

Idaho Power net income | $ | 189,387 | $ | 176,741 | $ | 168,168 | ||||||

Net income attributable to IDACORP, Inc. | $ | 193,480 | $ | 182,417 | $ | 173,014 | ||||||

Average outstanding shares – diluted (000’s) | 50,199 | 50,126 | 50,010 | |||||||||

IDACORP, Inc. earnings per diluted share | $ | 3.85 | $ | 3.64 | $ | 3.46 | ||||||

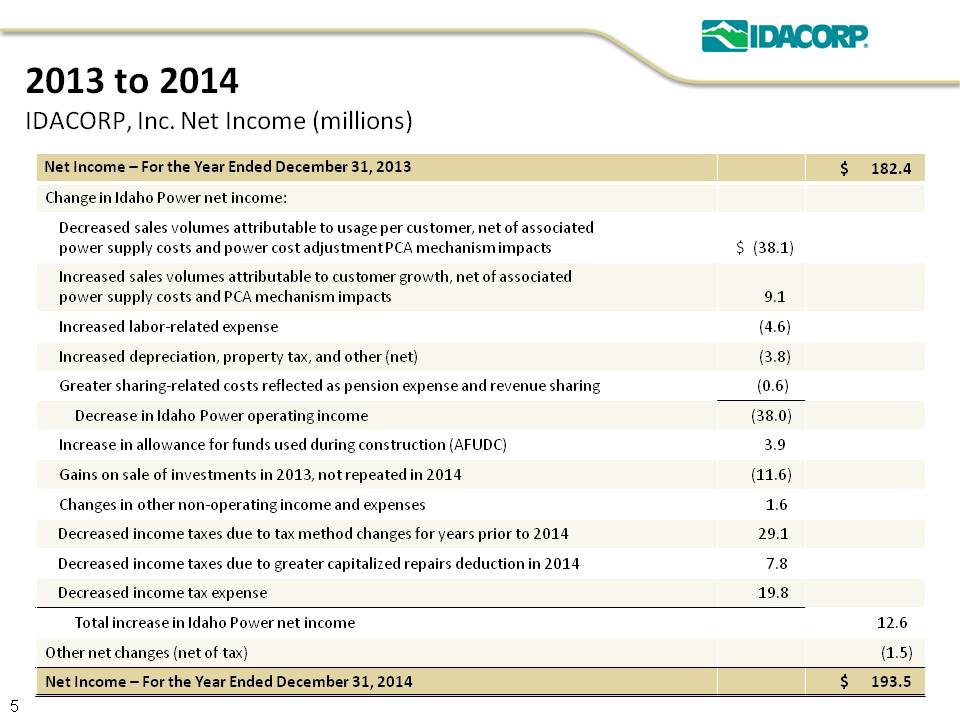

The table below provides a reconciliation of net income attributable to IDACORP for the year ended December 31, 2014 to the year ended December 31, 2013 (items are in millions and are before tax unless otherwise noted):

Net income attributable to IDACORP, Inc. - December 31, 2013 | $ | 182.4 | ||||||

Change in Idaho Power net income: | ||||||||

Decreased sales volumes attributable to usage per customer, net of associated power supply costs and power cost adjustment (PCA) mechanism impacts | $ | (38.1 | ) | |||||

Increased sales volumes attributable to customer growth, net of associated power supply costs and PCA mechanism impacts | 9.1 | |||||||

Increased labor-related expenses | (4.6 | ) | ||||||

Increased depreciation, property tax, and other (net) | (3.8 | ) | ||||||

Greater sharing-related costs reflected as pension expense and revenue sharing | (0.6 | ) | ||||||

Decrease in Idaho Power operating income | (38.0 | ) | ||||||

Increase in allowance for funds used during construction (AFUDC) | 3.9 | |||||||

Gains on sale of investments in 2013, not repeated in 2014 | (11.6 | ) | ||||||

Changes in other non-operating income and expenses | 1.6 | |||||||

Decreased income taxes due to tax method changes for years prior to 2014 | 29.1 | |||||||

Decreased income taxes due to greater capitalized repairs deduction in 2014 | 7.8 | |||||||

Decreased other income tax expense | 19.8 | |||||||

Total increase in Idaho Power net income | 12.6 | |||||||

Other net changes (net of tax) | (1.5 | ) | ||||||

Net income attributable to IDACORP, Inc. - December 31, 2014 | $ | 193.5 | ||||||

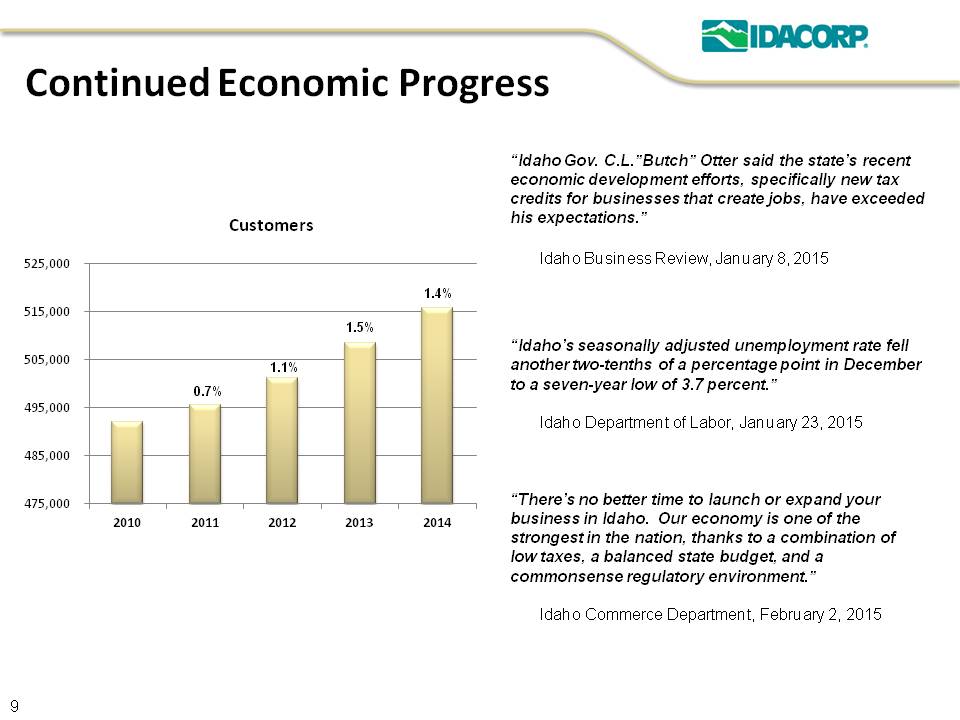

IDACORP's net income increased $11.1 million for the year ended December 31, 2014 when compared with 2013. Idaho Power's operating income decreased by $38.0 million for 2014 compared with 2013. Lower overall usage per customer, primarily due to a return to moderate weather conditions in 2014 compared with 2013, decreased operating income by $38.1 million. These weather-related decreases were partially offset by increased sales volumes associated with continued growth in the number of Idaho Power customers, which increased operating income by $9.1 million when compared with 2013. The number of Idaho Power's general business customers increased by 1.4 percent from December 31, 2013 to December 31, 2014. Increases in labor-related expenses, depreciation, property taxes, and other items combined to decrease operating income by $8.4 million in 2014 when compared with 2013.

In 2014, Idaho Power recorded a $3.9 million increase in AFUDC related to greater average construction work in progress, while in 2013 it recorded a gain of $11.6 million related to the sale of investments in securities that was not repeated in 2014. The net decrease in income tax expense of $56.7 million more than offset the lower pre-tax income in 2014.

Effect of Income Taxes and Tax Method Changes on Results

Income tax accounting method changes for years prior to 2014 increased net income by $29.1 million for 2014 when compared with 2013. In 2013, Idaho Power recorded $4.6 million of income tax expense as a result of a cumulative method change adjustment related to its capitalized repairs deduction for generation assets for years prior to 2013. By contrast, during 2014, Idaho Power recorded an income tax benefit of $24.5 million related to finalization of its method change adjustment for generation assets for years prior to 2014 as well as modifications to its overall capitalized repairs deduction tax method as agreed to with the U.S. Internal Revenue Service. The income tax benefit related to Idaho Power's 2014 capitalized repairs deduction was $7.8 million greater than 2013, due to the impact of the method changes and the amount and type of 2014 capital additions. Income tax expense at Idaho Power not related to method changes was $19.8 million lower in 2014 than in 2013, primarily due to lower pre-tax earnings in 2014.

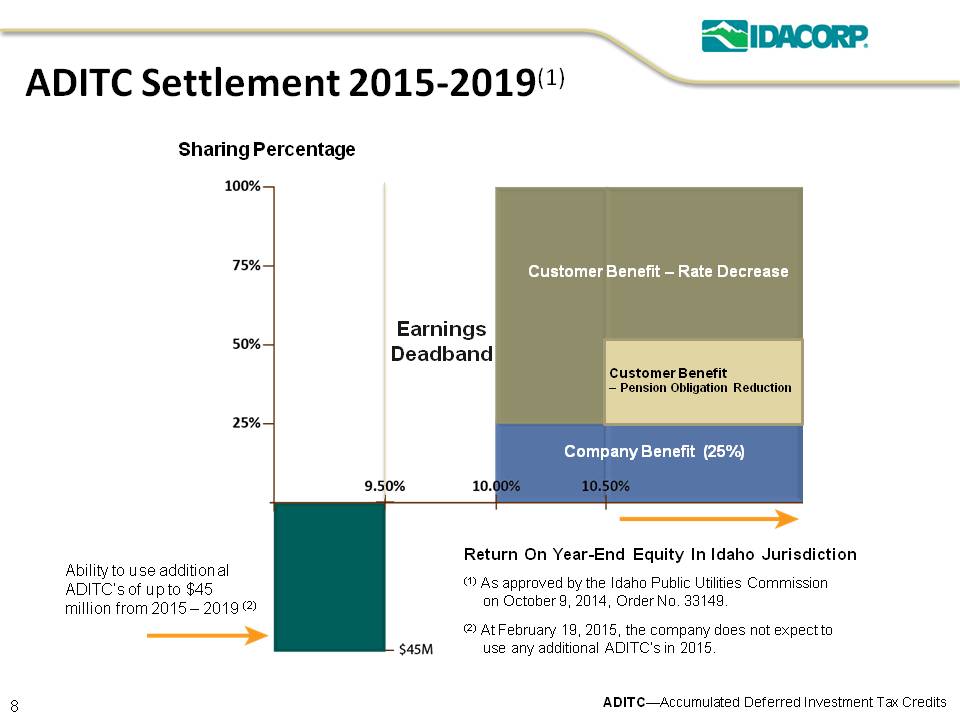

Effect of Sharing Mechanism on Results

During 2014, Idaho Power recorded a total of $24.7 million related to a December 2011 Idaho regulatory settlement agreement, which requires sharing with Idaho customers of a portion of 2014 earnings exceeding a 10.0 percent return on year-end equity in the Idaho jurisdiction. In accordance with the terms of the settlement agreement, of the $24.7 million, $16.7 million was recorded as additional pension expense and $8.0 million was recorded as a provision against current revenues to be refunded to customers through a future rate reduction. Idaho Power recorded similar amounts in 2013. A total of $118 million in earnings has been shared with Idaho customers through sharing mechanisms since 2009. The impact of sharing on 2014 and 2013 results is reflected in the following table (in millions):

2014 | 2013 | Variance | ||||||||||

Additional pension expense funded through sharing | $ | (16.7 | ) | $ | (16.5 | ) | $ | (0.2 | ) | |||

Provision against current revenue as a result of sharing | (8.0 | ) | (7.6 | ) | (0.4 | ) | ||||||

Total | $ | (24.7 | ) | $ | (24.1 | ) | $ | (0.6 | ) | |||

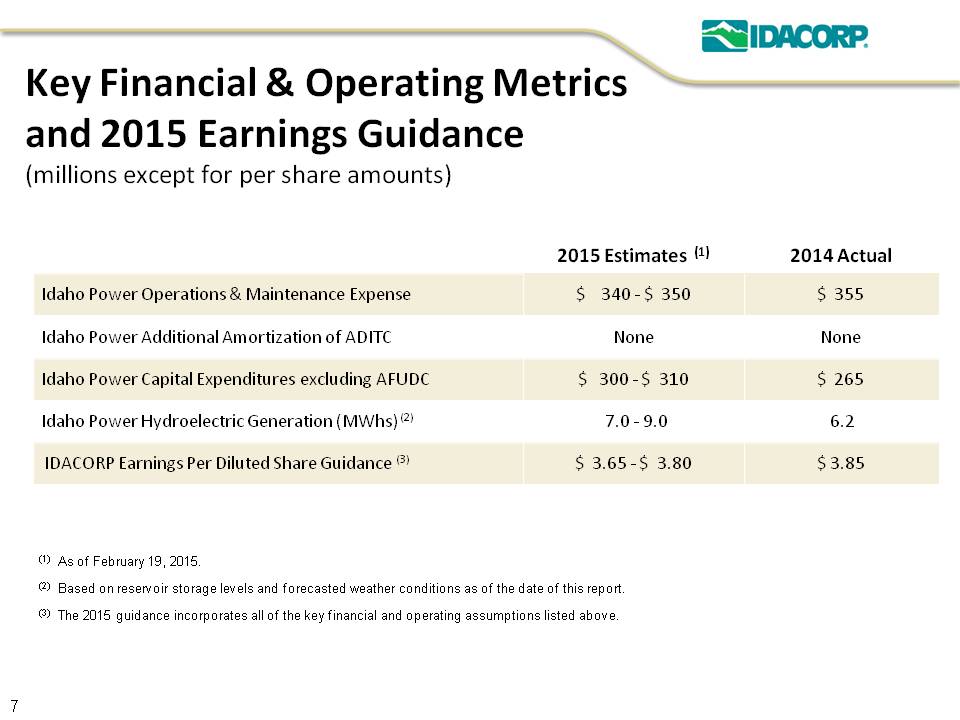

2015 Annual Earnings Guidance and Key Operating and Financial Metrics

IDACORP is initiating its earnings guidance estimate for 2015 in a range of $3.65 to $3.80 per diluted share. The 2015 guidance incorporates the key operating and financial assumptions listed below:

2015 Estimate(1) | 2014 Actual | |||

Idaho Power Operating & Maintenance Expense (millions) | $340-$350 | $355 | ||

Idaho Power Additional Amortization of Accumulated Deferred Investment Tax Credits (millions) | None | None | ||

Idaho Power Capital Expenditures, excluding allowance for funds used during construction (millions) | $300-$310 | $265 | ||

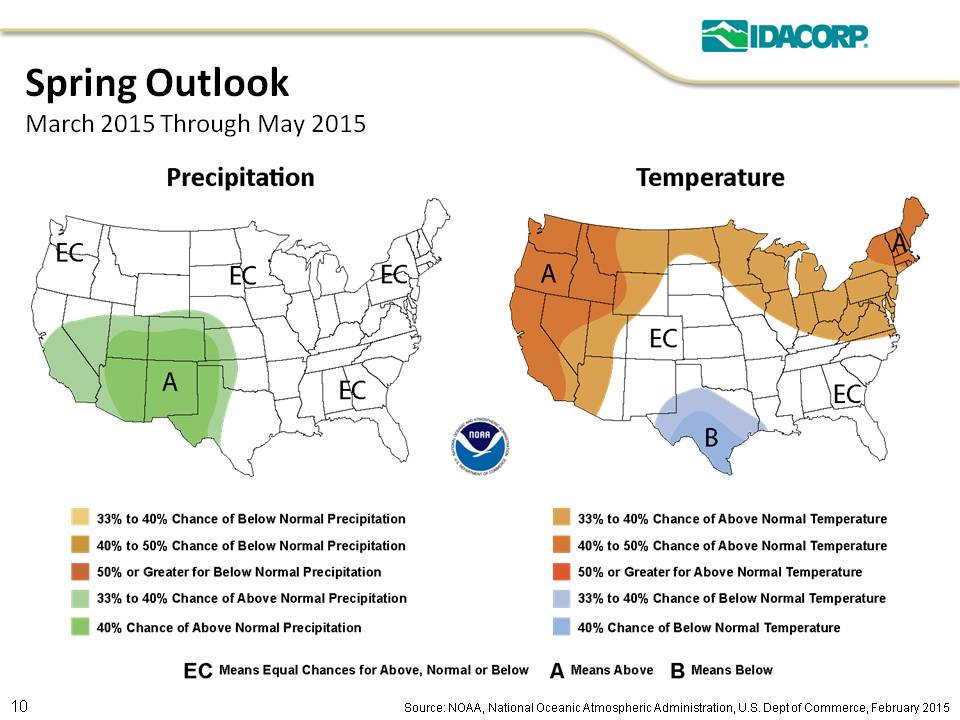

Idaho Power Hydroelectric Generation (MWh)(2) | 7.0-9.0 | 6.2 | ||

IDACORP Earnings Guidance (per share) | $3.65-$3.80 | $3.85 | ||

(1) As of February 19, 2015.

(2) Based on reservoir storage levels and forecasted weather conditions as of February 19, 2015.

More detailed financial information is provided in IDACORP's Annual Report on Form 10-K filed today with the U.S. Securities and Exchange Commission and posted to the IDACORP Web site at www.idacorpinc.com.

Web Cast / Conference Call

IDACORP will hold an analyst conference call today at 2:30 p.m. Mountain Time (4:30 p.m. Eastern Time). All parties interested in listening may do so through a live Web cast, or by calling (973) 200-3032 for listen-only mode. The passcode is 70388100. Slides will be included during the conference call. To access the slide deck, register for the event just prior to the call at www.idacorpinc.com/financials/confcalls.cfm. A replay of the conference call will be available on the IDACORP Web site for a period of 12 months.

Background Information

IDACORP, Inc. (NYSE: IDA) is based in Boise, Idaho and was formed in 1998 as a holding company. IDACORP subsidiaries include: Idaho Power, a regulated electric utility; IDACORP Financial, an investor in affordable housing projects and real estate; and Ida-West Energy, an operator of small hydroelectric projects. IDACORP's origins lie with Idaho Power and operations beginning in 1916. Today, Idaho Power employs approximately 2,000 people who serve more than 515,000 customers throughout a 24,000-square-mile area in southern Idaho and eastern Oregon. To learn more, visit www.idahopower.com or www.idacorpinc.com.

Forward-Looking Statements

In addition to the historical information contained in this press release, this press release contains (and oral communications made by IDACORP, Inc. and Idaho Power Company may contain) statements, including, without limitation, earnings guidance, that relate to future events and expectations and, as such, constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements that express, or involve discussions as to, expectations, beliefs, plans, objectives, outlook, assumptions, or future events or

performance, often, but not always, through the use of words or phrases such as "anticipates," "believes," "estimates," "expects," "intends," "plans," "predicts," "projects," "targets," "continues," or similar expressions, are not statements of historical facts and may be forward-looking. Forward-looking statements are not guarantees of future performance and involve estimates, assumptions, risks, and uncertainties. Actual results, performance, or outcomes may differ materially from the results discussed in the statements. In addition to any assumptions and other factors and matters referred to specifically in connection with such forward-looking statements, factors that could cause actual results or outcomes to differ materially from those contained in forward-looking statements include the following: (a) Idaho Power's rate design and the effect of regulatory decisions by state public utility commissions and federal regulators affecting Idaho Power's ability to recover costs and earn a return; (b) changes in customer growth rates, loss of significant customers, and related changes in loads; (c) the impacts of changes in economic conditions, including on customer demand; (d) unseasonable or severe weather conditions, wildfires, droughts, and other natural phenomena, which affect customer demand, hydroelectric generation levels, infrastructure repair costs, and fuel costs; (e) advancement of new technologies that reduce loads; (f) adoption of or changes in, and costs of compliance with, laws, regulations, and policies, including those relating to the environment, and the ability to obtain and comply with governmental authorizations; (g) variable hydrological conditions and over-appropriation of surface and groundwater and the impact on generation from hydroelectric facilities; (h) the ability to purchase fuel and power from suppliers on reasonable terms; (i) accidents, fires, explosions, and mechanical breakdowns that may occur while operating and maintaining an electric system, and disruptions and outages of generation and transmission systems or the western interconnected transmission system; (j) the ability to obtain debt and equity financing when necessary and on reasonable terms; (k) reductions in credit ratings and potential reduction in liquidity; (l) the ability to buy and sell power, transmission capacity, and fuel in the markets and the availability to enter into, and success or failure of, financial and physical commodity hedges; (m) changes in or implementation of mandatory reliability, security, and other requirements; (n) costs and operational challenges of integrating an increasing volume of mandated purchased intermittent power; (o) the magnitude of future benefit plan funding obligations; (p) the ability and willingness of the companies' boards of directors to continue to pay dividends, and contractual and regulatory restrictions on those dividends; (q) changes in tax laws and the availability of tax credits; (r) employee workforce factors, including potential unionization of all or part of the companies' workforce and the impacts of an aging workforce; (s) the failure of information systems or technology solutions or the failure to secure information system data, failure to comply with privacy laws, security breaches, or the effect on the companies from cyber attacks, terrorist incidents, or the threat of terrorist incidents, and acts of war; (t) unusual or unanticipated changes in normal business operations, including unusual maintenance or repairs, and (u) adoption of or changes in accounting policies, principles, or estimates. Any forward-looking statement speaks only as of the date on which such statement is made. New factors emerge from time to time and it is not possible for management to predict all such factors, nor can it assess the impact of any such factor on the business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. Readers should also review the risks and uncertainties listed in IDACORP, Inc.'s and Idaho Power Company's most recent Annual Report on Form 10-K and other reports the companies file with the U.S. Securities and Exchange Commission, including (but not limited to) Part I, Item 1A - “Risk Factors” in the Form 10-K and Management's Discussion and Analysis of Financial Condition and Results of Operations and the risks described therein from time to time. IDACORP and Idaho Power disclaim any obligation to update publicly any forward-looking information, whether in response to new information, future events, or otherwise, except as required by applicable law.

Investor and Analyst Contact | Media Contact |

Lawrence F. Spencer | Stephanie McCurdy |

Director of Investor Relations | Corporate Communications |

Phone: (208) 388-2664 | Phone: (208) 388-6973 |

LSpencer@idacorpinc.com | SMcCurdy@idahopower.com |

###