CEO Letter |

Dear Shareholders:

West continues to fulfill its mission of improving patient lives through the containment and delivery of injectable therapies—a mission that has guided our work for the past century and one that continues to be critical to the customers who rely upon our partnership and expertise to bring their innovative, new therapies to the patients that need them.

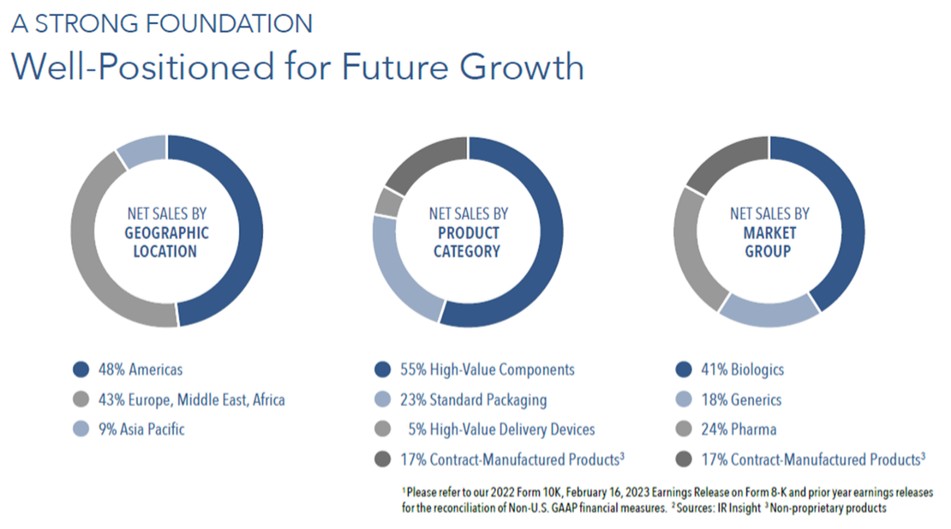

Our performance in 2022 was solid with an overall organic net sales growth of approximately 8% following the dynamic and accelerated growth of 2020 and 2021 generated by the COVID-19 pandemic. Now that the pandemic is under better control, we are seeing a return to our core baseline growth. We have continued with approximately $285 million in capital investments across our manufacturing network to meet the increased customer demand. I thank our team of more than 10,000 people across the globe that has delivered this sustained success during such a challenging period.

A highlight of 2022 was the initiation of our landmark collaboration with Corning to build the next generation of leading elastomer-glass containment system solutions. Together with the launch of the Daikyo CZ 2.25 mL insert needle syringe and the FDA approval of three drugs using our SmartDose® technology, these milestones demonstrate that West is continuing to invest and innovate to support our customers and the future needs of patients, setting the Company up for long-term growth.

I am proud to report that West has once again been recognized for our Environmental, Social and Governance (“ESG”) business practices with a MSCI AA rating; a listing in Newsweek’s Americas Most Responsible Companies for 2022; and a top 50 listing in Barron’s Most Sustainable Companies. We have made tremendous strides across the six priority areas of our ESG strategy and newly defined performance indicators, which we will outline in detail in our annual ESG Report this spring.

As our Company grows, so does our team. We welcomed 600 new team members over the course of the year and added new senior leaders including a Chief Quality Officer and a New Global Head of Corporate Development. In addition, we elected an 11th member to the Board of Directors—Stephen H. Lockhart, M.D., Ph.D., a board-certified anesthesiologist and former Chief Medical Officer of Sutter Health, whose contributions have already proven indispensable.

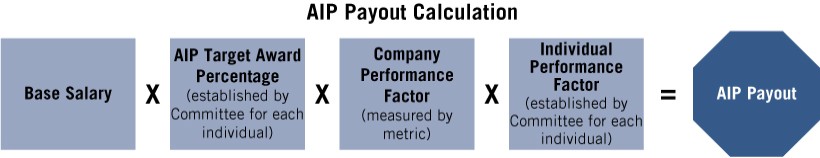

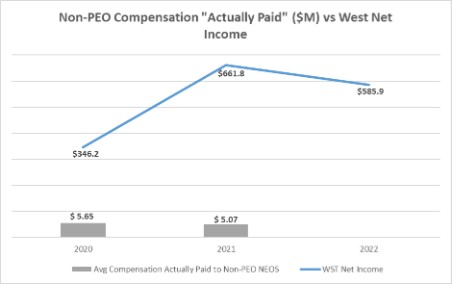

As in years past, the Management team has worked together with the Board of Directors to ensure the performance of our team is reflected in their compensation and awards framework and is aligned with the business results we have delivered. The detailed pay-for-performance plans of our executives, which in the past have received more than 93 percent support from you, our shareholders, are detailed in this Proxy Statement.

As we celebrate 100 years in business, we know that the West name has come to mean so much to so many people. We realize that our products and pursuit of scientific innovations are critical to healthcare across the globe, which is why we are so committed to support patient health today and well into the future. I am grateful to all our shareholders who have been a part of West’s journey so far and I thank you for your continued support of our Company.

Eric M. Green

President, Chief Executive Officer and Chair of the Board