nordion_2013q2mda.htm

MANAGEMENT’S DISCUSSION AND ANALYSIS

June 5, 2013

In this Management’s Discussion and Analysis (MD&A), “we”, “Nordion”, and “the Company” refer to Nordion Inc. In this MD&A, we explain Nordion’s results of operations and cash flows for the three and six months ended April 30, 2013, and our financial position as of April 30, 2013. You should read this MD&A in conjunction with our unaudited consolidated financial statements and related note disclosures for the same period. Readers are also referred to Nordion’s 2012 audited annual consolidated financial statements, MD&A, Annual Information Form (AIF), Annual Report, and Form 40-F. These documents and additional information regarding Nordion are available on Nordion’s website at www.nordion.com or at www.sedar.com and www.sec.gov.

Our MD&A is intended to enable readers to gain an understanding of Nordion’s current results of operations, cash flows and financial position. To do so, we provide information and analysis comparing our results of operations, cash flows and financial position for the current fiscal year with those of the preceding fiscal year. We also provide analysis and commentary that we believe will help investors assess Nordion’s future prospects. In addition, we provide “forward-looking statements” relating to a proposed transaction to divest our Targeted Therapies business and other statements that are not historical facts. Accordingly, certain sections of this report contain forward-looking statements that are based on our current plans and expectations, which are subject to known and unknown important risks, uncertainties, assumptions and other factors that could cause actual results or events to differ materially from current expectations. These may include, but are not limited to, risks and uncertainties that are discussed in greater detail in the “Risk Factors” section in our 2012 AIF, and elsewhere in this MD&A. In particular, the timing and completion of the proposed sale of Targeted Therapies is subject to many conditions, risks and uncertainties, including without limitation closing conditions, and there can be no assurance that the proposed transaction will occur, or that it will occur on the terms and conditions currently contemplated by the Nordion and its management. The proposed transaction could be modified, restructured or terminated.

The forward-looking statements contained in this MD&A are made as of the date of this MD&A and, accordingly, are subject to change after such date. We caution our readers that actual events and results may vary materially from those anticipated in these forward-looking statements. We do not undertake any obligation to update or revise any forward-looking statements that may be contained herein, except as required by law. Additionally, we undertake no obligation to comment on expectations of, or statements made by, third parties in respect of the proposed transaction.

We have prepared our consolidated financial statements in accordance with accounting principles generally accepted in the United States of America. Amounts are in thousands of United States (U.S.) dollars, except per share amounts and where otherwise noted.

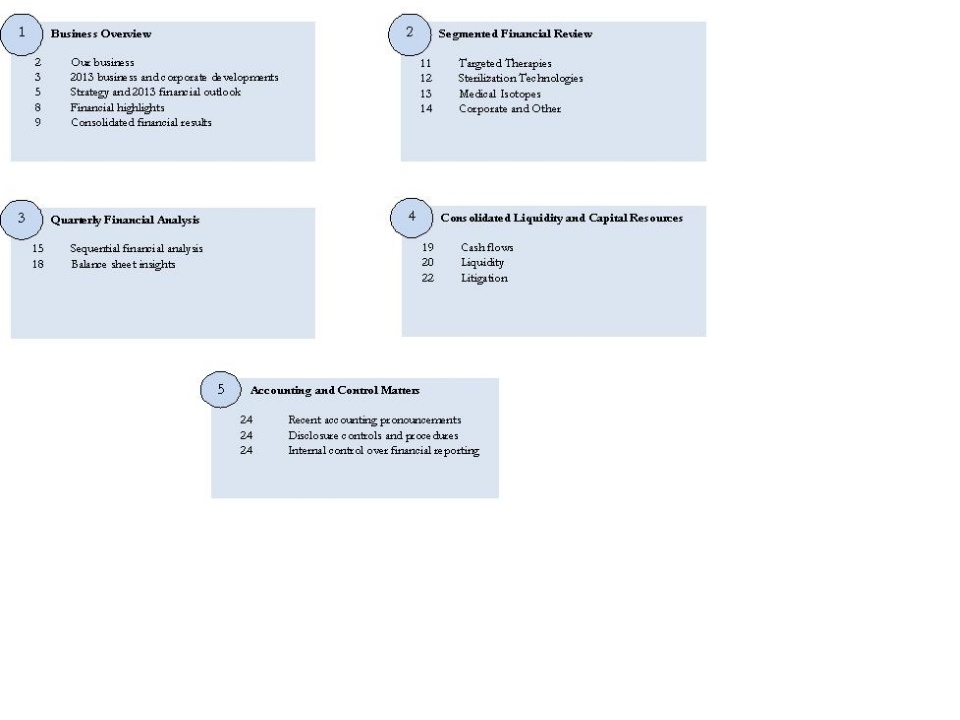

We have organized our MD&A into five sections:

1) Business Overview

Our business

Nordion is a global health science company providing market-leading products and services used for the prevention, diagnosis and treatment of disease. Our products benefit the lives of millions of people in more than 60 countries around the world and are used daily by pharmaceutical and biotechnology companies, medical-device manufacturers, hospitals, clinics and research laboratories. We have approximately 500 highly skilled employees worldwide.

We have organized our operations into a Business Unit model with two distinct Business Units: Targeted Therapies and Specialty Isotopes, each of which are supported by centralized corporate functions. The Specialty Isotopes Business Unit includes two segments: Sterilization Technologies and Medical Isotopes.

We report our operations as three business segments: Targeted Therapies, Sterilization Technologies, and Medical Isotopes, as well as certain corporate functions and activities reported as Corporate and Other.

Targeted Therapies

Our Targeted Therapies segment is focused on the targeted treatment of cancer. Our Targeted Therapies product, TheraSphere®, is used in the treatment of liver cancer by targeting the disease from within the body with concentrated radiation directed to the tumor, thereby limiting both damage to surrounding healthy tissue and side effects for the patient. TheraSphere is used in the treatment of both inoperable primary and metastatic liver cancer, and has approvals and is reimbursed in certain key markets.

Agreement to Divest Targeted Therapies Business to BTG plc

On May 23, 2013, we announced that we have entered into an agreement to divest our Targeted Therapies business to BTG plc (BTG), an international specialist healthcare company based in London, United Kingdom, for a cash purchase price of $200 million.

Sterilization Technologies

Our Sterilization Technologies segment is focused on the prevention of disease through terminal (in final packaging) sterilization of medical products and devices, as well as food and consumer products. We produce and install Cobalt-60 (Co-60) radiation sources and design, construct, install, and maintain commercial gamma sterilization systems, referred to as production irradiators.

We are one of the world's leading suppliers of Co-60, an isotope that produces gamma radiation that destroys harmful micro-organisms. Gamma sterilization technologies are used globally to sterilize approximately 40% of single use medical products including disposable medical devices and supplies such as surgeon's gloves, syringes, sutures, and catheters, as well as pharmaceuticals. Gamma sterilization is also used for the treatment of food and consumer products.

Medical Isotopes

Our Medical Isotopes segment primarily focuses on products used in the diagnosis and treatment of diseases, including cardiac and neurological conditions, and several types of cancer. According to the World Nuclear Association, over 10,000 hospitals worldwide use radioisotopes with about 90% of the procedures being for diagnostic purposes.

We sell a breadth of isotopes, which our customers incorporate into products that are used in medical procedures. Our primary product is Molybdenum-99 (Mo-99), which decays into Technetium-99 (Tc-99m), utilized in approximately 80% of nuclear medical procedures worldwide (source: World Nuclear Association).

Mo-99 is produced in a nuclear reactor along with other isotopes including Xe-133 (used in lung scans), I-131 (used to treat hyperthyroidism, thyroid cancer and non-Hodgkin’s lymphoma), and I-125 (used to treat prostate cancer). We refer to isotopes produced in nuclear reactors as Reactor isotopes.

We manufacture other isotopes at our facility in Vancouver, Canada using equipment referred to as a cyclotron; these are reported as Cyclotron isotopes. We are also a contract manufacturer of Bexxar®, a radiotherapeutic.

Corporate and Other

Nordion is a publicly traded company listed on the Toronto Stock Exchange (TSX: NDN) and on the New York Stock Exchange (NYSE: NDZ). The number of outstanding Nordion common shares at April 30, 2013 and June 5, 2013 was 61,909,101.

Certain of Nordion’s shared corporate functions and activities are reported as Corporate and Other.

For a detailed description of our Targeted Therapies, Sterilization Technologies, and Medical Isotopes businesses, see the “Description of the Business” section in our 2012 AIF.

2013 business and corporate developments

Engaging in Review of Strategic Alternatives

During Q1 2013, we initiated a review of strategic alternatives with a view to enhancing shareholder value and creating new opportunities. Jefferies LLC has been engaged to advise and assist in this review, which is ongoing. Except for the agreement to divest Targeted Therapies as described below, no decision has been made for any other specific strategic transaction or alternative at this time. We intend to continue with planned business activities throughout the strategic alternatives review process.

Agreement to Divest Targeted Therapies Business to BTG plc

On May 23, 2013, we announced that we have entered into an agreement to divest our Targeted Therapies business to BTG plc (BTG), an international specialist healthcare company based in London, United Kingdom, for a cash purchase price of $200 million. Net of cash taxes and transaction costs, we expect to realize approximately $185 million in cash on closing. We expect to retain certain liabilities relating to the Targeted Therapies business. The closing of this transaction is subject to customary closing conditions and approval by BTG’s shareholders.

Under the terms of the transaction agreements, BTG is expected to acquire rights to TheraSphere and we have agreed to continue manufacturing TheraSphere under a Manufacturing and Support Agreement (MSA) with a contract term of three years, plus up to a two-year extension at BTG’s option. Approximately 40 Nordion employees are expected to join BTG following the completion of this transaction. The transaction is anticipated to be completed by the end of June 2013.

Sterilization Technologies

Co-60 Shipments

The volume of Co-60 we shipped in Q2 2013 was 36% and 19% higher than Q2 2012 and Q1 2013, respectively. As previously disclosed, we expect that Co-60 revenue in the second half of fiscal 2013 will be significantly higher than the first half. This is primarily due to the timing of shipments to our customers, which often varies significantly from quarter-to-quarter.

Medical Isotopes

Shutdown of Competitor’s Reactor in Europe

The primary reactor in Europe used to supply certain of our competitors has been shut down since November 2012. Additional orders resulting from this shutdown have had a positive impact on Mo-99 revenue during the first half of fiscal 2013. As a result, we have updated our forecast for Medical Isotopes revenue for fiscal 2013, which is further discussed in the “2013 financial outlook – update” section of this MD&A. As of June 4, 2013, it was announced that the reactor in Europe is expected to re-start during June 2013.

National Research Universal (NRU) Supply Interruptions

On May 16, 2013, our primary supplier of medical isotopes, AECL, reported that the NRU reactor at Chalk River, Ontario, returned to service from its planned maintenance shutdown. Initiated on April 14, 2013, the one month shutdown resulted in an interruption in our supply of medical isotopes during Q2 and Q3 2013. Our production and sales have resumed as expected and planned Mo-99 shipments began the week of May 19, 2013.

MAPLE Arbitration

On September 10, 2012, we announced the decision in the confidential arbitration with Atomic Energy of Canada Limited (AECL). Nordion was unsuccessful in its claim for specific performance or monetary damages relating to AECL's cancelled construction of the MAPLE facilities.

As the decision of the tribunal favors AECL, Nordion may be responsible for a portion of AECL's costs, which could be material. In December 2012, AECL submitted total arbitration-related costs of approximately $46 million. In February 2013, Nordion filed its response to AECL’s costs submission asserting that the Company should pay approximately $22 million and AECL subsequently filed a reply to Nordion’s submissions. Nordion and AECL have agreed upon a schedule with the tribunal to determine the allocation of arbitration-related costs. The tribunal has scheduled proceedings to hear both parties in June 2013. We expect to receive a decision thereafter.

The arbitration decision leaves Nordion open to pursue its ongoing lawsuit against AECL in the Ontario courts in relation to the 1996 Isotope Production Facilities Agreement (IPFA). Nordion filed an amended statement of claim against AECL on January 18, 2013. The claim requests damages in the amount of $243.7 million (C$243.5 million) for negligence and breach of the IPFA, as well as pre- and post-judgment interest and costs. On April 15, 2013, AECL filed a statement of defense and counterclaim. In its counterclaim, AECL is seeking $80 million in damages based on a claim against Nordion for unpaid construction charges. The parties have agreed on a preliminary schedule for proceeding in the IPFA claim under which documentary productions and discoveries are anticipated to begin during 2013. Based on the current schedule, a trial would not be expected to begin before mid-2014. For further details on this claim, see the “Litigation” section of this MD&A.

Corporate and Other

Settlement of Dr. Reddy’s Claim

During fiscal 2009, Nordion was served with a Complaint from Dr. Reddy’s Laboratories Ltd. and certain affiliate companies (Dr. Reddy’s) claiming repeat study and mitigation costs of $10 million and lost profits of $70 million. This legal action was related to certain bioequivalence studies carried out by the former MDS Pharma Services business unit from January 1, 2000 to December 31, 2004.

In March 2013, we settled the claim filed by Dr. Reddy’s. The settlement resulted in a loss of $1.3 million for the Company after taking into account our litigation accruals in relation to the claim. The settlement, most of which was covered by insurance, resulted in a net cash outflow of $17 million that included $8.3 million of insurance proceeds we received previously. In May 2013, Nordion was successful in a claim of $5 million against one of its insurers in this matter. The insurer has 30 days to appeal. Nordion recognizes a gain contingency such as this only when a claimed amount is received and realized.

Internal Investigation

In 2012, we discovered potential irregularities related to potential improper payments and other related financial irregularities in connection with the supply of materials and services to the Company. As a result, we made voluntarily disclosure to relevant regulators and authorities in the U.S. and Canada and commenced an internal investigation of the possible compliance issues, focusing on compliance with the Canadian Corruption of Foreign Public Officials Act (CFPOA) and the U.S. Foreign Corrupt Practices Act (FCPA). We remain unable to determine whether there will be any potential regulatory and/or enforcement action resulting from these matters or, if any such action is taken, whether it will have a material adverse effect on our business, financial position, profitability or liquidity. If regulatory or enforcement authorities determine to take action against the Company, Nordion may be, among other things, subject to fines and/or penalties which may be material.

We are committed to the highest standards of integrity and diligence in our business dealings and to the ethical and legally compliant business conduct of our employees, representatives and suppliers. We continue to cooperate with regulatory and enforcement authorities. In parallel with the internal investigation, we developed and implemented a number of new and enhanced policies and procedures related to compliance. We also created and staffed a Director, Corporate Compliance position who reports to the Finance and Audit Committee. The intent of these changes is to strengthen our overall compliance framework.

Credit Facility

Subsequent to our Q2 2013, the Company sought consent from the Amended and Restated Credit Facility Lenders for the divestiture of the Targeted Therapies business to BTG, as described above.

Nordion Inc. Interim Report April 30, 2013

MANAGEMENT’S DISCUSSION AND ANALYSIS

Strategy and 2013 financial outlook

Summary of strategic objectives

We are committed to delivering long-term value to our shareholders by exploring strategic alternatives for the Company and executing our strategic plans with operational and financial discipline. The Company’s management continues to focus on building the business of each of our business units.

Targeted Therapies

As announced on May 23, 2013, and described in the “2013 business and corporate developments” section of this MD&A, we have agreed to sell our Targeted Therapies business to BTG. The transaction is anticipated to be completed by the end of June 2013. Under the terms of the transaction agreements, we have agreed to continue manufacturing TheraSphere under the MSA with a contract term of three years, plus up to a two-year extension at BTG’s option. Upon the close of the proposed transaction, we expect to report the results of manufacturing TheraSphere under the MSA as a Contract Manufacturing product line in Medical Isotopes segment. Should the proposed transaction not close, we intend to continue our existing strategic and business plans for Targeted Therapies.

Specialty Isotopes

Sterilization Technologies

Our strategy for Sterilization Technologies is to maintain our market leading position and strong margins in the relatively stable gamma sterilization – Co-60 market which is characterized by significant barriers to entry. For Nordion, this business is characterized by high margins and strong cash flows.

We endeavour to maintain our segment leading position and strong margins in gamma sterilization through value-based pricing, selectively investing in growth opportunities, and the recognition of the Nordion brand as a global leader in the gamma sterilization market. We plan to selectively grow gamma sterilization sales over the long-term through innovation and the development of new product offerings (e.g., GammaFIT) that we anticipate will enable us to strengthen our relationships with current customers and facilitate our entry into new and emerging markets.

We expect that our strategy will allow us to continue our market leadership in this business, with flat to low percentage revenue growth.

Medical Isotopes

In our Medical Isotopes segment, we are focused on optimizing the value of this business by working to maintain our revenues and pursue a long-term reliable supply of reactor isotopes.

The volatility of Mo-99 supply in 2009 and 2010 has resulted in a number of current and potential Mo-99 customers diversifying their supply away from single sources. Although we look to opportunistically grow our customer base for Medical Isotopes as potential new customers continue to diversify their supply, the planned and unplanned NRU reactor maintenance shutdowns combined with delays and reduced back-up supply available to date continue to make this difficult.

Nordion Inc. Interim Report April 30, 2013

MANAGEMENT’S DISCUSSION AND ANALYSIS

2013 financial outlook - update

We currently expect that upon the anticipated completion of the planned divestiture of Targeted Therapies that the historic results of Targeted Therapies will be reported in continuing operations due to our ongoing involvement in manufacturing. Taking into consideration the impact of the divestiture, we expect, overall total 2013 revenue and gross margin to decline. This gross margin decline combined with an increase in pension expense are expected to result in a significant decline in segment earnings as disclosed in our 2012 annual report.

Our 2013 financial outlook reflects current exchange rates and is subject to the uncertainties described in this MD&A and the risk factors outlined in our 2012 AIF.

Targeted Therapies

As announced on May 23, 2013, and described in the “2013 business and corporate developments” section of this MD&A, we have agreed to sell the Targeted Therapies business to BTG. Upon the close of the proposed transaction, we expect to report the results of manufacturing TheraSphere under the MSA as Contract Manufacturing product line in Medical Isotopes segment. We currently expect sales from the MSA to be approximately $12 million per year. Should the proposed transaction not close, we intend to continue our existing strategic and business plans for Targeted Therapies.

Specialty Isotopes

Sterilization Technologies

We continue to expect Sterilization Technologies revenue in fiscal 2013 to be approximately the same as in fiscal 2012. We expect Co-60 revenue to be slightly higher than 2012 with a relatively flat volume and slightly higher price. Gross margins are expected to be flat due primarily to higher product cost offset by higher price. We currently do not have orders for production irradiators in 2013.

As in previous years, the timing of quarterly revenues for Sterilization Technologies will vary due to the timing of shipments of Co-60 and production irradiators to our customers. When our customers purchase and install Co-60, they need to shut down their production irradiator operations while the Co-60 is being loaded into the irradiator. Therefore, we coordinate this process closely with our customers to limit disruption to their operations.

Consistent with our revenue profile in 2012, we expect that Co-60 revenue in the second half of 2013 will be significantly higher than the first half.

Medical Isotopes

Currently the primary reactor in Europe that is used to supply certain of our competitors is shut down. We continue to receive additional orders as a result of this shutdown; however, its duration is unknown at this time. As of June 4, 2013, it was announced that the reactor is expected to be re-started during June 2013. Based on additional orders resulting from this shutdown, we now expect our forecasted decline in Medical Isotopes revenue to be approximately 10%, excluding the potential impact of TheraSphere contract manufacturing, compared to our original annual forecast of a 20% decline for fiscal 2013 compared with fiscal 2012. This revised forecast may vary further depending on the duration of shutdown of the primary reactor in Europe as well as any potential supply interruptions we may experience with the NRU reactor other than the recently completed one month shutdown.

As previously disclosed, we resumed our sales of Strontium-82 (Sr-82) during April 2013. Our Contract Manufacturing activities in fiscal 2013 are expected to primarily relate to the Bexxar product and the manufacturing of TheraSphere under the MSA.

Internal Investigation Costs

Nordion has engaged an external legal firm, which has in turn engaged various other advisors, including an accounting firm to conduct an internal investigation of the possible compliance issues as discussed in the “2013 business and corporate developments” section of this MD&A. The internal investigation process is ongoing and we presently cannot estimate the duration or the cost of the overall internal investigation, or the work required to support regulatory and enforcement activities.

We incurred an additional $4.5 million relating to the internal investigation during Q2 2013 and $8.6 million for the six months ended April 30, 2013. Our current estimate for investigation and remediation costs for fees and other expenses relating to legal and other professional firms assisting us in this matter during fiscal 2013 has increased and is now expected to be approximately $12 million. The cost in fiscal 2013 could vary significantly based on, among other things, requests from regulatory and enforcement authorities and/or new findings.

Corporate and Other

We continue to expect that fiscal 2013 corporate selling, general and administrative (SG&A) will increase compared to the approximately $10 million in fiscal 2012, as we make additional investment in our compliance efforts to support our global operations.

SG&A for all segments

In fiscal 2013, we continue to expect our SG&A expense to increase compared with fiscal 2012 due to several factors. Our 2013 pension expense is expected to increase by approximately $7 million due to the impact of lower interest rates on the value of pension liabilities. This accounting expense does not directly change the amount of funding we are required to contribute to our pension plans. In the proposed Targeted Therapies divestiture, BTG will not be acquiring people or costs in the general and administrative (G&A) functions, however, we expect to recover certain costs through the billing of transition service to BTG.

AECL arbitration legal costs

Our legal costs associated with the MAPLE arbitration cost determination and our pursuit of the lawsuit against AECL are expected to be approximately $2 million in fiscal 2013.

Depreciation

Depreciation expense is expected to decline by approximately $3.5 million in fiscal 2013 compared with fiscal 2012. This decrease is primarily because the significant portion of our computer systems became fully depreciated during Q2 2012.

Potential non-cash fixed asset impairment

Nordion records impairment losses on long-lived assets used in operations when events and circumstances indicate that long-lived assets might be impaired and the undiscounted cash flows estimated to be generated by those assets are less than the carrying amounts of those assets.

As of April 30, 2013, our estimate of undiscounted cash flows indicated that the carrying amounts of long-lived assets were expected to be recovered. Subsequent to April 30, 2013, we announced that Nordion had agreed to divest its Targeted Therapies business. Nordion has buildings and machinery with a carrying value of approximately $40 million that support the Targeted Therapies business, in addition to other business segments. If the planned divestiture of Targeted Therapies is completed, our estimate of cash flows supporting those assets may change significantly and these assets may be considered to be impaired, which would result in the need to write down a significant portion of those assets to fair value.

Tax

As of April 30, 2013, Nordion had $51.7 million recorded deferred tax assets. If the transaction with BTG closes, we would expect to utilize approximately $15 million of the deferred tax asset to offset cash taxes on the gain. In addition the Company may have to write down an additional portion of the deferred tax assets.

Nordion Inc. Interim Report April 30, 2013

MANAGEMENT’S DISCUSSION AND ANALYSIS

Financial highlights

| |

Three months ended April 30

|

Six months ended April 30

|

|

(thousands of U.S. dollars, except per share amounts)

|

|

2013

|

|

2012

|

|

2013

|

|

2012

|

|

Revenues

|

|

|

|

|

|

|

|

|

|

Targeted Therapies

|

|

|

|

|

|

|

|

|

|

TheraSphere

|

$

|

13,150

|

$

|

12,392

|

$

|

25,188

|

$

|

23,404

|

|

Sterilization Technologies

|

|

|

|

|

|

|

|

|

|

Cobalt

|

|

20,100

|

|

13,860

|

|

35,468

|

|

29,541

|

|

Sterilization - Other

|

|

94

|

|

982

|

|

1,156

|

|

1,437

|

| |

|

20,194

|

|

14,842

|

|

36,624

|

|

30,978

|

|

Medical Isotopes

|

|

|

|

|

|

|

|

|

|

Reactor

|

|

17,150

|

|

17,179

|

|

37,556

|

|

38,121

|

|

Cyclotron

|

|

3,820

|

|

3,610

|

|

6,674

|

|

6,708

|

|

Contract Manufacturing

|

|

1,775

|

|

1,990

|

|

3,711

|

|

3,817

|

| |

|

22,745

|

|

22,779

|

|

47,941

|

|

48,646

|

|

Consolidated segment revenues from continuing operations

|

$

|

56,089

|

$

|

50,013

|

$

|

109,753

|

$

|

103,028

|

| |

|

|

|

|

|

|

|

|

|

Segment earnings (loss)

|

|

|

|

|

|

|

|

|

|

Targeted Therapies

|

$

|

1,062

|

$

|

3,820

|

$

|

2,492

|

$

|

6,933

|

|

Sterilization Technologies

|

|

6,415

|

|

3,504

|

|

9,931

|

|

7,958

|

|

Medical Isotopes

|

|

5,174

|

|

5,905

|

|

12,113

|

|

13,616

|

|

Corporate and Other

|

|

(2,210)

|

|

(2,815)

|

|

(5,027)

|

|

(4,730)

|

|

Total segment earnings

|

$

|

10,441

|

$

|

10,414

|

$

|

19,509

|

$

|

23,777

|

| |

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

3,054

|

|

5,158

|

|

6,334

|

|

10,338

|

|

Restructuring charges (recovery), net

|

|

41

|

|

(5)

|

|

52

|

|

(653)

|

|

AECL arbitration and legal costs

|

|

131

|

|

1,941

|

|

633

|

|

3,819

|

|

Litigation settlement loss

|

|

1,300

|

|

-

|

|

1,300

|

|

-

|

|

Pension settlement loss

|

|

-

|

|

-

|

|

7,003

|

|

-

|

|

Loss on Celerion note receivable

|

|

-

|

|

-

|

|

218

|

|

2,411

|

|

Recovery from previously written off investments

|

|

(814)

|

|

-

|

|

(814)

|

|

-

|

|

Internal investigation costs

|

|

4,510

|

|

-

|

|

8,634

|

|

-

|

|

Strategic review costs

|

|

616

|

|

-

|

|

616

|

|

-

|

|

Change in fair value of embedded derivatives

|

|

493

|

|

171

|

|

206

|

|

6,425

|

|

Consolidated operating income (loss) from continuing operations

|

$

|

1,110

|

$

|

3,149

|

$

|

(4,673)

|

$

|

1,437

|

| |

|

|

|

|

|

|

|

|

|

Basic earnings per share from continuing operations

|

$

|

0.01

|

$

|

0.05

|

$

|

0.01

|

$

|

0.04

|

| |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

$

|

81,534

|

$

|

77,800

|

$

|

81,534

|

$

|

77,800

|

Nordion Inc. Interim Report April 30, 2013

MANAGEMENT’S DISCUSSION AND ANALYSIS

Financial results analysis

In this section, we provide detailed information and analysis regarding our performance for the three and six months ended April 30, 2013 compared with the same period in fiscal 2012.

Consolidated financial results

| |

Three months ended April 30

|

Six months ended April 30

|

|

(thousands of U.S. dollars)

|

|

2013

|

% of

revenues

|

|

2012

|

% of

revenues

|

|

2013

|

% of

revenues

|

|

2012

|

% of

revenues

|

|

Revenues

|

$

|

56,089

|

100%

|

$

|

50,013

|

100%

|

$

|

109,753

|

100%

|

$

|

103,028

|

100%

|

|

Costs and expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Direct cost of revenues

|

|

26,157

|

47%

|

|

24,586

|

49%

|

|

52,016

|

47%

|

|

50,044

|

49%

|

|

Selling, general and

administration

|

|

23,091

|

41%

|

|

14,581

|

29%

|

|

44,324

|

40%

|

|

30,626

|

30%

|

|

Depreciation and

amortization

|

|

3,054

|

5%

|

|

5,158

|

10%

|

|

6,334

|

6%

|

|

10,338

|

10%

|

|

Restructuring charges (recovery), net

|

|

41

|

-

|

|

(5)

|

-

|

|

52

|

-

|

|

(653)

|

(1%)

|

|

Change in fair value of embedded derivatives

|

|

493

|

1%

|

|

171

|

-

|

|

206

|

1%

|

|

6,425

|

6%

|

|

Other expenses, net

|

|

2,143

|

4%

|

|

2,373

|

5%

|

|

11,494

|

10%

|

|

4,811

|

5%

|

|

Operating income (loss)

|

$

|

1,110

|

2%

|

$

|

3,149

|

6%

|

$

|

(4,673)

|

(4%)

|

$

|

1,437

|

1%

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

(893)

|

(2%)

|

|

(1,119)

|

(2%)

|

|

(2,216)

|

(2%)

|

|

(2,292)

|

(2%)

|

|

Interest income

|

|

1,003

|

2%

|

|

1,495

|

3%

|

|

2,854

|

3%

|

|

3,275

|

3%

|

|

Income tax (expense) recovery

|

|

(489)

|

(1%)

|

|

(304)

|

(1%)

|

|

4,497

|

4%

|

|

(86)

|

-

|

|

Net income

|

$

|

731

|

1%

|

$

|

3,221

|

6%

|

$

|

462

|

-

|

$

|

2,334

|

2%

|

|

Gross margin

|

|

53%

|

|

|

51%

|

|

|

53%

|

|

|

51%

|

|

|

Capital expenditures

|

$

|

855

|

|

$

|

2,345

|

|

$

|

953

|

|

$

|

4,656

|

|

|

Total assets

|

$

|

408,321

|

|

$

|

434,946

|

|

$

|

408,321

|

|

$

|

434,946

|

|

|

Long term financial

obligations

|

$

|

42,360

|

|

$

|

44,404

|

|

$

|

42,360

|

|

$

|

44,404

|

|

Revenues

Revenues of $56.1 million in the three months ended Q2 2013 increased by $6.1 million or 12% compared with the same period in fiscal 2012. Revenues of $109.8 million for the six months ended Q2 2013 increased by $6.7 million or 7% compared with the same period in fiscal 2012. Excluding the impact of foreign exchange, revenues for the three and six months ended Q2 2013 increased approximately 13% and 6% compared with the same periods in fiscal 2012, respectively.

The increase in revenue compared to the prior year was attributable to: i) continued growth in TheraSphere sales and ii) higher Co-60 revenue due to higher volume impacted by the timing of our shipments which typically vary significantly quarter-to-quarter.

See further detailed analysis on revenues in the “Targeted Therapies”, “Sterilization Technologies” and “Medical Isotopes”, sections of this MD&A.

Gross margin

Gross margins from continuing operations of 53% for the three and six months ended Q2 2013 were slightly higher by 2% compared to the same periods in fiscal 2012. Our overall gross margin was impacted by higher volume from our TheraSphere and Co-60 products covering relatively fixed production support costs as well as slightly higher pricing for Co-60.

See further detailed analysis on gross margin in the “Targeted Therapies”, “Sterilization Technologies” and “Medical Isotopes”, sections of this MD&A.

Costs and expenses

Selling, general and administration (SG&A)

SG&A expenses of $23.1 million for the three months ended Q2 2013 increased by $8.5 million compared to the same period in fiscal 2012. The increase was largely due to $4.5 million in internal investigation costs, an increase of $2.6 million in annual incentive costs, an increase of $1.8 million in pension expenses, and $0.6 million in strategic review costs.

SG&A expenses of $44.3 million for the six months ended Q2 2013 increased by $13.7 million compared to the same period in fiscal 2012. The increase was largely due to $8.6 million in internal investigation costs, an increase of $3.0 million in annual incentive costs, an increase of $3.6 million in pension expenses, and $0.6 million in strategic review costs.

These increases were partially offset by a small favourable foreign exchange impact from the weakening of the Canadian dollar relative to the U.S. dollar for the three and six months ended Q2 2013. The significant majority of our SG&A expenses are denominated in Canadian dollars.

Depreciation and amortization (D&A)

D&A expenses of $3.1 million and $6.3 million for the three and six months ended Q2 2013 decreased by $2.1 million and $4.0 million, respectively, compared to the same periods in fiscal 2012. The decrease in D&A expense is primarily because a significant portion of our computer systems became fully depreciated during Q2 2012.

Restructuring charges

For the six months ended Q2 2013, we recorded a $0.1 million net restructuring expense for certain adjustments made to the provision of Q4 2012 restructuring activity.

We expect the majority of the remaining restructuring provision for 2012 and 2011 restructuring activities to be utilized during fiscal 2013.

Change in fair value of embedded derivatives

We have Russian supply contracts for Co-60 that are denominated in U.S. dollars. This creates embedded derivatives as our Canadian operation has Canadian dollars as its functional currency. At each period end, we mark-to-market any changes in the fair value of the embedded derivatives and record these increases and decreases as gains and losses within operating income.

For the three and six months ended Q2 2013, we recorded losses of $0.5 million and $0.2 million for the change in the fair value of the embedded derivatives, respectively, compared to losses of $0.2 million and $6.4 million for the same periods in fiscal 2012. The changes in the fair value of the embedded derivatives were primarily driven by changes in the U.S. to Canadian dollar exchange rates and our estimated notional supply amount during the contract periods. These gains and losses are for accounting purposes and do not represent cash transactions in the period of reporting.

Other expenses, net

Other expenses, net, of $2.1 million and $11.5 million for the three and six months ended Q2 2013, respectively, primarily included R&D costs of $2.1 million and $4.3 million, respectively, and in Q2 2013 a litigation settlement loss of $1.3 million, a recovery from previously written off investment of $0.8 million as well as a foreign exchange gain of $0.6 million. Other expenses, net for the six months ended Q2 2013 also included a $7.0 pension settlement loss and a $0.2 million loss on the Celerion note receivable.

Other expenses, net, of $2.4 million and $4.8 million for the three and six months ended Q2 2012, respectively, primarily included R&D costs of $1.6 million and $3.0 million as well as foreign exchange loss of $0.8 million and gain of $0.5 million. Other expenses, net for the six months ended Q2 2012 also included a $2.4 million loss on the Celerion note receivable recorded in Q1 2012.

Interest income (expense), net

Net interest income for the three and six months ended Q2 2013 were $0.1 million and $0.6 million, respectively, compared to $0.4 million and $1.0 million for the same periods in fiscal 2012. The decrease was primarily due to a decrease in accreted interest income related to our note receivable from Celerion reflecting $7.3 million partial repayment for a reduction of $9 million in the principal amount which occurred during Q1 2013.

Income tax expense

For the three and six months ended Q2 2013, we recorded expenses (recovery) of $0.5 million and $(4.5) million on the pre-tax income (loss) from continuing operations of $1.2 million and $(4.0) million, respectively. The tax expense and related effective tax rate on continuing operations was determined by applying an estimated annual effective tax rate of 28.2% to pre-tax income and then adjusting for various discrete tax items. Discrete tax items primarily include adjustments to reserves for uncertain tax positions, adjustments to the valuation allowance and other adjustments.

Nordion Inc. Interim Report April 30, 2013

MANAGEMENT’S DISCUSSION AND ANALYSIS

2) Segmented Financial Review

Targeted Therapies

| |

Three months ended April 30

|

Six months ended April 30

|

|

(thousands of U.S. dollars)

|

|

2013

|

% of

revenues

|

|

2012

|

% of

revenues

|

|

2013

|

% of

revenues

|

|

2012

|

% of

revenues

|

|

Revenues

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TheraSphere

|

$

|

13,150

|

100%

|

$

|

12,392

|

100%

|

$

|

25,188

|

100%

|

$

|

23,404

|

100%

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Direct cost of revenues

|

|

4,115

|

31%

|

|

3,887

|

31%

|

|

7,549

|

30%

|

|

7,351

|

31%

|

|

Selling, general and administration

|

|

6,039

|

46%

|

|

3,652

|

29%

|

|

11,348

|

45%

|

|

7,354

|

31%

|

|

Other expenses, net

|

|

1,934

|

15%

|

|

1,033

|

8%

|

|

3,799

|

15%

|

|

1,766

|

8%

|

|

Segment earnings

|

$

|

1,062

|

8%

|

$

|

3,820

|

31%

|

$

|

2,492

|

10%

|

$

|

6,933

|

30%

|

As described in “2013 business and corporate developments” section of this MD&A, we have agreed to sell the Targeted Therapies business to BTG. Upon the close of the proposed transaction, we expect to report the results of manufacturing TheraSphere under the MSA as Contract Manufacturing product line in Medical Isotopes segment.

Revenues

Revenues of $13.2 million for the three months ended Q2 2013 increased by $0.8 million or 6% compared to the same period in fiscal 2012. For the six months ended Q2 2013, revenues of $25.2 million increased by $1.8 million or 8% compared to the same period in fiscal 2012. These increases were primarily driven by an increase in TheraSphere doses to healthcare providers with which we had an existing relationship as well as adoption by new clinics. As the majority of our Targeted Therapies revenues are denominated in U.S. dollars, the impact of foreign exchange on revenues was not significant.

Gross margin

Gross margin for our Targeted Therapies segment of 69% for the three months ended Q2 2013 was flat compared to the same period in fiscal 2012. For the six months ended Q2 2013, the gross margin was 70% compared to 69% for the same period in fiscal 2012. TheraSphere has a relatively fixed cost over certain volumes such that incremental revenue has a positive impact on gross margin. Contributing to this increase was the weakening of the Canadian dollar relative to the U.S. dollar as a majority of our direct costs are denominated in Canadian dollars whereas the majority of revenues are denominated in U.S. dollars. These positive impacts on gross margin were largely offset by higher costs for a supply agreement and new excise tax in the U.S.

Selling, general and administration (SG&A)

SG&A expenses of $6.0 million and $11.3 million for the three and six months ended Q2 2013 increased by $2.4 million and $4.0 million, respectively, compared to the same periods in fiscal 2012. The increase was primarily driven by an increased investment in TheraSphere sales and marketing, an increase in general and administrative costs required to support the growth of the product, an increase in annual incentive costs, and pension expenses. There was a small favourable foreign exchange impact due to the weakening of the Canadian dollar relative to the U.S. dollar. A majority of our SG&A expenses are denominated in Canadian dollars.

Other expenses, net

R&D expenses increased by $0.9 million and $2.0 million for the three and six months ended Q2 2013, respectively, compared to the same periods in fiscal 2012 due to increased spending in TheraSphere clinical trials.

Nordion Inc. Interim Report April 30, 2013

MANAGEMENT’S DISCUSSION AND ANALYSIS

Sterilization Technologies

| |

Three months ended April 30

|

Six months ended April 30

|

|

(thousands of U.S. dollars)

|

|

2013

|

% of

revenues

|

|

2012

|

% of

revenues

|

|

2013

|

% of

revenues

|

|

2012

|

% of

revenues

|

|

Revenues

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cobalt

|

$

|

20,100

|

100%

|

$

|

13,860

|

93%

|

$

|

35,468

|

97%

|

$

|

29,541

|

95%

|

|

Sterilization - Other

|

|

94

|

-

|

|

982

|

7%

|

|

1,156

|

3%

|

|

1,437

|

5%

|

| |

|

20,194

|

100%

|

|

14,842

|

100%

|

|

36,624

|

100%

|

|

30,978

|

100%

|

|

Costs and expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Direct cost of revenues

|

|

9,262

|

46%

|

|

7,833

|

53%

|

|

17,848

|

49%

|

|

15,834

|

51%

|

|

Selling, general and administration

|

|

4,477

|

22%

|

|

3,446

|

23%

|

|

8,747

|

24%

|

|

7,096

|

23%

|

|

Other expenses, net

|

|

40

|

-

|

|

59

|

-

|

|

98

|

-

|

|

90

|

-

|

|

Segment earnings

|

$

|

6,415

|

32%

|

$

|

3,504

|

24%

|

$

|

9,931

|

27%

|

$

|

7,958

|

26%

|

Revenues

Revenues of $20.2 million for the three months ended Q2 2013 increased by $5.4 million or 36% compared to the same period in fiscal 2012. For the six months ended Q2 2013, revenues of $36.6 million increased by $5.6 million or 18%, compared to the same period in fiscal 2012. The majority of revenue for Sterilization Technologies is denominated in Canadian dollars so the weakening Canadian dollar compared to the U.S. dollar negatively impacted revenue. Excluding the impact of foreign exchange, revenues increased by 39% and 18% for the three and six months ending April 30, 2013, respectively.

For the three and six months ended Q2 2013, Co-60 revenues increased by $6.2 million or 45% and $5.9 million or 20%, respectively, compared to the same periods in fiscal 2012. The increase in Co-60 revenue was primarily due to the quarterly variability of the timing of our shipments to customers in addition to the impact from the relative difference in mix of customers in each respective year.

For the three and six months ended Q2 2013, revenues from Sterilization – Other decreased compared to the same periods in fiscal 2012 primarily because of a decrease in production irradiator refurbishments performed.

As in prior years, the quarterly profile of revenues for Sterilization Technologies vary significantly due to the timing of our Co-60 shipments to customers and the sales of production irradiators. When our customers purchase and install Co-60, they need to shut down their production irradiator operations while the Co-60 is being loaded into the irradiator. Therefore, we coordinate this process closely with our customers in an effort to minimize disruption to their operations. The timing of Co-60 discharges from power reactor sites in Canada can also affect the variability in quarterly revenues for Sterilization Technologies.

Gross margin

Gross margin for our Sterilization Technologies segment of 54% and 51% for the three and six months ended Q2 2013, respectively, was higher compared to 47% and 49% for the same periods in fiscal 2012. The increase in gross margin was primarily driven by higher revenue, as described above, covering relatively fixed Co-60 production support costs.

Selling, general and administration (SG&A)

SG&A expenses of $4.5 million and $8.7 million for the three and six months ended Q2 2013 increased by $1.0 million and $1.7 million, respectively, compared to the same periods in fiscal 2012. The increase in SG&A expenses is due to an increase in annual incentive costs and pension expense. A significant majority of our SG&A expenses are denominated in Canadian dollars.

Other expenses, net

Other expenses, net are primarily foreign exchange revaluation gains and losses for the three and six months ended Q2 2013 and 2012.

Nordion Inc. Interim Report April 30, 2013

MANAGEMENT’S DISCUSSION AND ANALYSIS

Medical Isotopes

| |

Three months ended April 30

|

Six months ended April 30

|

|

(thousands of U.S. dollars)

|

|

2012

|

% of

revenues

|

|

2011

|

% of

revenues

|

|

2012

|

% of

revenues

|

|

2011

|

% of

revenues

|

|

|

Revenues

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reactor

|

$

|

17,150

|

75%

|

$

|

17,179

|

75%

|

$

|

37,556

|

78%

|

$

|

38,121

|

78%

|

|

|

Cyclotron

|

|

3,820

|

17%

|

|

3,610

|

16%

|

|

6,674

|

14%

|

|

6,708

|

14%

|

|

|

Contract manufacturing

|

|

1,775

|

8%

|

|

1,990

|

9%

|

|

3,711

|

8%

|

|

3,817

|

8%

|

|

| |

|

22,745

|

100%

|

|

22,779

|

100%

|

|

47,941

|

100%

|

|

48,646

|

100%

|

|

|

Costs and expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Direct cost of revenues

|

|

12,780

|

56%

|

|

12,866

|

56%

|

|

26,619

|

56%

|

|

26,859

|

55%

|

|

|

Selling, general and administration(a)

|

|

4,619

|

20%

|

|

3,460

|

15%

|

|

8,760

|

18%

|

|

7,079

|

15%

|

|

|

Other expenses (income), net

|

|

172

|

1%

|

|

548

|

2%

|

|

449

|

1%

|

|

1,092

|

2%

|

|

|

Segment earnings

|

$

|

5,174

|

23%

|

$

|

5,905

|

26%

|

$

|

12,113

|

25%

|

$

|

13,616

|

28%

|

|

(a) Excludes AECL arbitration and legal costs of $0.1 million (2012 - $1.9 million) and $0.5 million (2012 - $3.8 million) for the three and six months ended April 30, 2013, respectively, which are not included in the calculation of segment earnings.

Revenues

Revenues of $22.7 million for the three months ended April 30, 2013, remained flat compared to the same period in fiscal 2012. For the six months ended Q2 2013, revenues of $47.9 million decreased by $0.7 million or 1% compared with the same period in fiscal 2012. The majority of Medical Isotopes revenues are denominated in U.S. dollars and, therefore, foreign exchange had a nominal impact on revenue. Reactor products accounted for 75% of Q2 2013 Medical Isotopes revenue, while cyclotron-based products accounted for 17% and contract manufacturing accounted for 8%.

Reactor isotopes revenues remained relatively flat for the three months ended Q2, 2013. For the six months ended Q2 2013, reactor isotopes revenue decreased by 1%, compared to the same period in fiscal 2012. An increase in sales volume was largely offset by a decrease in price of Mo-99. As described in the “Recent business and corporate developments” section of this MD&A, the increase in sales volume was impacted by the shutdown of the primary reactor in Europe.

With the return of Sr-82 sales, Cyclotron isotopes revenues were higher by 6% for the three months ended Q2 2013 due to an increase in sales volume. For the six months ended Q2 2013, cyclotron isotopes revenues remained flat.

Contract manufacturing revenues remained relatively flat for the three and six months ended Q2 2013.

Gross margin

Gross margin for the three months ended Q2 2013, was flat compared to the same periods in fiscal 2012. For the six months ended Q2 2013, gross margin was 1% lower than the same period in fiscal 2012 primarily due to lower Mo-99 revenue, as described above, covering relatively fixed production support costs in the current periods.

Selling, general and administration (SG&A)

SG&A expenses of $4.6 million and $8.8 million for the three and six months ended Q2 2013 were increased by $1.2 million and $1.7 million, respectively, for the same periods in fiscal 2012. The increase in SG&A was primarily due to an increase in the level of general and administrative costs associated with supporting the segment, an increase in annual incentive costs and pension expense, partially offset by a favourable impact of the weakening of the Canadian dollar relative to the U.S. dollar. A significant majority of our SG&A expenses are denominated in Canadian dollars.

Other (income) expenses, net

Other expenses (income), net are primarily foreign exchange revaluation gains and losses for the three and six months ended April 30, 2013 and 2012.

Nordion Inc. Interim Report April 30, 2013

MANAGEMENT’S DISCUSSION AND ANALYSIS

Corporate and Other

| |

Three months ended April 30

|

Six months ended April 30

|

|

(thousands of U.S. dollars)

|

|

2013

|

|

2012

|

|

2013

|

|

2012

|

|

Costs and expenses

|

|

|

|

|

|

|

|

|

|

Selling, general and administration(a)

|

$

|

2,699

|

$

|

2,082

|

$

|

5,586

|

$

|

5,278

|

|

Other expenses (income), net(b)

|

|

(489)

|

|

733

|

|

(559)

|

|

(548)

|

|

Segment loss

|

$

|

(2,210)

|

$

|

(2,815)

|

$

|

(5,027)

|

$

|

(4,730)

|

(a) Excludesinternal investigation costs of $4.5 million and $8.6 million (2012 - $nil and $nil) for the three and six months ended April 30, 2013, respectively, and strategic review costs of $0.6 million for the three months ended April 30, 2013, which are not included in the calculation of segment loss.

(b) Excludes a litigation settlement loss of $1.3 million and a recovery from previously written off investment of $0.8 million for the three months ended April 30, 2013, as well as a pension settlement loss of $7.0 million and a loss on Celerion note receivable of $0.2 million (2012 - $2.4 million) for the six months ended April 30, 2013, which are not included in the calculation of segment loss.

Selling, general and administration (SG&A)

Corporate SG&A expenses of $2.7 million and $5.6 million for the three and six months ended Q2 2013 increased by $0.6 million and $0.3 million, respectively, compared to the same periods in fiscal 2012. The increase was primarily due to higher stock based compensation partially offset by the impact of the weakening of the Canadian dollar relative to the U.S. dollar.

Other (income) expenses, net

For the three and six months ended Q2 2013 and 2012, Other expenses (income), net were primarily related to foreign exchange (gains) and losses.

Nordion Inc. Interim Report April 30, 2013

MANAGEMENT’S DISCUSSION AND ANALYSIS

3) Quarterly Financial Analysis

Sequential financial analysis

In this section, we provide a summary of selected financial information for each of the eight most recently completed quarters.

|

(thousands of U.S. dollars, except per share amounts)

|

Trailing four

quarters

|

April 30

2013

|

January 31 2013

|

October 31

2012

|

July 31

2012

|

|

Revenues

|

|

|

|

|

|

|

|

|

|

|

|

TheraSphere

|

$

|

50,235

|

$

|

13,150

|

$

|

12,038

|

$

|

12,023

|

$

|

13,024

|

|

Targeted Therapies

|

|

50,235

|

|

13,150

|

|

12,038

|

|

12,023

|

|

13,024

|

|

Cobalt

|

|

98,329

|

|

20,100

|

|

15,368

|

|

31,020

|

|

31,841

|

|

Sterilization-other

|

|

2,751

|

|

94

|

|

1,062

|

|

1,291

|

|

304

|

|

Sterilization Technologies

|

|

101,080

|

|

20,194

|

|

16,430

|

|

32,311

|

|

32,145

|

|

Reactor

|

|

76,845

|

|

17,150

|

|

20,406

|

|

24,793

|

|

14,496

|

|

Cyclotron

|

|

15,444

|

|

3,820

|

|

2,854

|

|

3,567

|

|

5,203

|

|

Contract Manufacturing

|

|

7,961

|

|

1,775

|

|

1,936

|

|

1,977

|

|

2,273

|

|

Medical Isotopes

|

|

100,250

|

|

22,745

|

|

25,196

|

|

30,337

|

|

21,972

|

| |

$

|

251,565

|

$

|

56,089

|

$

|

53,664

|

$

|

74,671

|

$

|

67,141

|

|

Segment earnings (loss)

|

|

|

|

|

|

|

|

|

|

|

|

Targeted Therapies

|

|

9,637

|

|

1,062

|

|

1,430

|

|

2,809

|

|

4,336

|

|

Sterilization Technologies

|

|

41,010

|

|

6,415

|

|

3,516

|

|

16,676

|

|

14,403

|

|

Medical Isotopes

|

|

27,936

|

|

5,174

|

|

6,939

|

|

11,251

|

|

4,572

|

|

Corporate and Other

|

|

(9,003)

|

|

(2,210)

|

|

(2,817)

|

|

(1,273)

|

|

(2,703)

|

| |

$

|

69,580

|

$

|

10,441

|

$

|

9,068

|

$

|

29,463

|

$

|

20,608

|

| |

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income

|

$

|

(30,741)

|

$

|

731

|

$

|

(269)

|

$

|

(43,505)

|

$

|

12,302

|

|

Basic and diluted (loss) earnings per share

|

$

|

(0.49)

|

$

|

0.01

|

$

|

-

|

$

|

(0.70)

|

$

|

0.20

|

|

(thousands of U.S. dollars, except per share amounts)

|

Trailing four

quarters

|

April 30

2012

|

January 31

2012

|

October 31

2011

|

July 31

2011

|

|

Revenues from continuing operations

|

|

|

|

|

|

|

|

|

|

|

|

TheraSphere

|

$

|

45,817

|

$

|

12,392

|

$

|

11,012

|

$

|

10,884

|

$

|

11,529

|

|

Targeted Therapies

|

|

45,817

|

|

12,392

|

|

11,012

|

|

10,884

|

|

11,529

|

|

Cobalt

|

|

88,545

|

|

13,860

|

|

15,681

|

|

28,125

|

|

30,879

|

|

Sterilization-other

|

|

7,020

|

|

982

|

|

455

|

|

4,342

|

|

1,241

|

|

Sterilization Technologies

|

|

95,565

|

|

14,842

|

|

16,136

|

|

32,467

|

|

32,120

|

|

Reactor

|

|

75,732

|

|

17,179

|

|

20,942

|

|

21,916

|

|

15,695

|

|

Cyclotron

|

|

15,649

|

|

3,610

|

|

3,098

|

|

3,250

|

|

5,691

|

|

Contract Manufacturing

|

|

11,072

|

|

1,990

|

|

1,827

|

|

5,483

|

|

1,772

|

|

Medical Isotopes

|

|

102,453

|

|

22,779

|

|

25,867

|

|

30,649

|

|

23,158

|

| |

$

|

243,835

|

$

|

50,013

|

$

|

53,015

|

$

|

74,000

|

$

|

66,807

|

|

Segment earnings (loss)

|

|

|

|

|

|

|

|

|

|

|

|

Targeted Therapies

|

|

13,271

|

|

3,820

|

|

3,113

|

|

2,196

|

|

4,142

|

|

Sterilization Technologies

|

|

37,749

|

|

3,504

|

|

4,454

|

|

14,480

|

|

15,311

|

|

Medical Isotopes

|

|

27,802

|

|

5,905

|

|

7,711

|

|

11,411

|

|

2,775

|

|

Corporate and Other

|

|

(8,097)

|

|

(2,815)

|

|

(1,915)

|

|

(327)

|

|

(3,040)

|

| |

$

|

70,725

|

$

|

10,414

|

$

|

13,363

|

$

|

27,760

|

$

|

19,188

|

| |

|

|

|

|

|

|

|

|

|

|

|

Income from continuing operations

|

$

|

13,526

|

$

|

3,221

|

$

|

(887)

|

$

|

6,499

|

$

|

4,693

|

|

(Loss) income from discontinued operations,

net of income taxes

|

|

(8,412)

|

|

-

|

|

-

|

|

402

|

|

(8,814)

|

|

Net income (loss)

|

$

|

5,114

|

$

|

3,221

|

$

|

(887)

|

$

|

6,901

|

$

|

(4,121)

|

|

Basic and diluted (loss) earnings per share

|

|

|

|

|

|

|

|

|

|

|

|

- from continuing operations

|

$

|

0.21

|

$

|

0.05

|

$

|

(0.01)

|

$

|

0.10

|

$

|

0.07

|

|

- from discontinued operations

|

|

(0.12)

|

|

-

|

|

-

|

|

0.01

|

|

(0.13)

|

|

Basic and diluted (loss) earnings per share

|

$

|

0.09

|

$

|

0.05

|

$

|

(0.01)

|

$

|

0.11

|

$

|

(0.06)

|

Nordion Inc. Interim Report April 30, 2013

MANAGEMENT’S DISCUSSION AND ANALYSIS

Revenues from continuing operations

Targeted Therapies

Targeted Therapies revenue of $13.2 million in Q2 2013 increased by $1.1 million or 9% compared to Q1 2013, primarily due to an increase in TheraSphere doses to healthcare providers with which we had an existing relationship.

Sterilization Technologies

Sterilization Technologies revenues of $20.2 million in Q2 2013 increased by $16.4 million or 23% compared to Q1 2013.

Co-60 revenue in Q2 2013 increased 31% compared to Q1 2013. Co-60 revenues can vary significantly quarter-to-quarter due to the timing of our shipments to customers. The shipments are planned between Nordion and our customers and are forecast several months in advance.

Medical Isotopes

Medical Isotopes revenue decreased 10% in Q2 2013 compared to Q1 2013. The decrease was primarily driven by lower Reactor isotopes revenue due to decreases in Mo-99 sales volume. As described in the “Recent business and corporate development” section of this MD&A, the decrease in Mo-99 sales volume was partly driven by the planned shutdown of the NRU reactor which began April 14, 2013.

In Q2 2013, Cyclotron isotopes revenue increased by 34% compared to Q1 2013. This increase is attributable to an increase in sales of Sr-82.

Contract Manufacturing revenue was relatively flat quarter over quarter.

Segment earnings (loss)

Targeted Therapies

Targeted Therapies segment earnings of $1.1 million in Q2 2013 decreased by $0.4 million or 26% compared to Q1 2013 primarily due to an increased investment in TheraSphere sales and marketing and incentive programs costs.

Sterilization Technologies

Sterilization Technologies segment earnings of $6.4 million in Q2 2013 increased by $2.9 million or 82% compared to Q1 2013. This is primarily due to increased Co-60 volume.

Quarter-to-quarter Sterilization Technologies segment earnings are impacted by the mix of Co-60, one of our higher gross margin products, with Sterilization – Other, which includes production irradiator refurbishments.

Medical Isotopes

Medical Isotopes segment earnings of $4.9 million in Q2 2013 decreased by $2.0 million or 29% compared to Q1 2013. This is primarily due to the same reason described above for quarter-to-quarter Reactor isotopes revenue decrease. Generally, our Reactor isotopes products have higher gross margins than the Cyclotron isotopes products.

Corporate and Other

Corporate and Other segment loss of $2.2 million in Q2 2013 decreased by $0.6 million compared to Q1 2013 due mainly to a favourable impact of foreign exchange partially offset by increase in stock-based compensation expenses.

Items that impact the comparability of the operating (loss) income from operations include:

|

·

|

Results for the quarter ended October 31, 2012 included a $3.6 million embedded derivative loss driven by changes in our estimate for the notional supply amount and fluctuations in the foreign exchange rate; and a $2.5 million restructuring charge primarily due to our strategic realignment.

|

|

·

|

Results for the quarter ended January 31, 2012 included a $6.3 million embedded derivative loss driven by changes in our estimate for the notional supply amount and fluctuations in the foreign exchange rate; and a $2.4 million loss on Celerion note receivable.

|

|

·

|

Results for the quarter ended October 31, 2011 included a $13 million embedded derivative loss driven by changes in our estimate for the notional supply amount and fluctuations in the foreign exchange rate; and a $1.0 million restructuring charges.

|

|

·

|

Results for the quarter ended January 31, 2011 reflect an $18.6 million embedded derivative gain driven by changes in our estimate for the notional supply amount and fluctuations in the foreign exchange rate.

|

Balance sheet insights

To assist your understanding of our balance sheet accounts, we have briefly summarized a number of items below that are recorded in our balance sheet and described in more detail in our financial statement notes.

Embedded derivatives

Included in Other current assets and Accrued liabilities are embedded derivatives assets and liabilities of $0.1 million and $1.1 million, respectively, as of April 30, 2013. These relate to certain long-term supply contracts that are denominated in currencies that are not the functional currency of either party to the agreements. These embedded derivatives can fluctuate significantly from period to period as they are based on notional amounts exceeding $53 million at April 30, 2013, and are revalued at the end of each reporting period based on changes in currency exchange rates relative to the Canadian dollar.

Investment in Celerion, Inc. (Celerion) & note receivable from Celerion

Long-term investments include our 15% minority interest in Celerion, carried at $1.5 million and a note receivable from Celerion, carried at $7.4 million. The face value of the note as of April 30, 2013 is $8.0 million, with the carrying value reflecting discount rates of 28% and 8% for unsecured and secured cash flows, respectively. The note has a five year term bearing interest at 4% per annum which is accruing to the principal amount of the note. Our exposure to losses with respect to Celerion is limited to the carrying amount of this note receivable and our minority interest in Celerion.

Investment in LCC Legacy Holdings (LCC) (formerly Lumira Capital Corp.)

Included in Long-term investments is our investment in Lumira, a privately held investment fund management company that has long-term investments in development-stage enterprises. We record this investment using the equity method of accounting and the carrying amount of this investment is $nil as of April 30, 2013, resulting from cumulative dividends received and equity losses recorded in prior periods. We have no further exposure to losses with respect to Lumira as our exposure is limited to the carrying amount of this investment.

Financial instrument pledged as security on long-term debt & Long-term debt

Included in Notes receivable and Other long-term assets is a financial instrument with a carrying value of $42.1 million as of April 30, 2013. This financial instrument is classified as held to maturity and is not readily tradable. Included in Long-term debt includes a non-interest-bearing Canadian government loan with a carrying value of $42.1 million as of April 30, 2013. The cash inflow of the financial instrument exactly offsets the cash outflow of the long-term debt. We have pledged the financial instrument as security to offset the long-term debt, effectively resulting in net nil debt.

Deferred tax assets

We have recorded net current and non-current deferred tax assets of $51.7 million as of April 30, 2013. These assets relate to our Canadian operations and can be used to reduce future cash taxes in Canada. Our total deferred tax assets are comprised of $52.1 million of net capital loss carryforwards, $87.9 million of Canadian federal investment tax credits, and a small amount of foreign tax losses. Against these assets, we have recorded a valuation allowance of $97.1 million.

Assets and liabilities related to captive insurance