UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

FOR THE FISCAL YEAR ENDED DECEMBER 31 , 2022

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

FOR THE TRANSITION PERIOD FROM TO

COMMISSION FILE NO. 001-14888

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

| (Address of principal executive offices) | (Zip Code) | |||||||

REGISTRANT’S TELEPHONE NUMBER, INCLUDING AREA CODE: (267 ) 440-4200

SECURITIES REGISTERED PURSUANT TO SECTION 12(B) OF THE ACT:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||||||

SECURITIES REGISTERED PURSUANT TO SECTION 12(G) OF THE ACT: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||||||||||

| x | Smaller reporting company | |||||||||||||

| Emerging growth company | ||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No x

The aggregate market value of the voting and non-voting common equity (which consists solely of shares of Common Stock) held by non-affiliates of the Registrant as of June 30, 2022 was approximately $425.5 million based on $1.73 per share, the closing price on that date of the Registrant’s Common Stock on the Nasdaq Global Select Market.

The number of shares outstanding of the Registrant’s Common Stock, $0.001 par value, was 260,131,986 as of February 24, 2023.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement to be filed with the Commission pursuant to Regulation 14A in connection with the registrant’s 2023 Annual Meeting of Stockholders (the “Proxy Statement’) are incorporated by reference into Part III of this Report. Such Proxy Statement will be filed with the Commission not later than 120 days after the conclusion of the registrant’s fiscal year ended December 31, 2022.

TABLE OF CONTENTS

1

PART I

ITEM 1. BUSINESS

This Annual Report on Form 10-K (including the following section regarding Management’s Discussion and Analysis of Financial Condition and Results of Operations), or this Annual Report, contains forward-looking statements regarding our business, financial condition, results of operations and prospects. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” and similar expressions or variations of such words are intended to identify forward-looking statements, but are not the exclusive means of identifying forward-looking statements in this Annual Report. Additionally, statements concerning future matters, including statements regarding our business, our financial position, the research and development of our products and other statements regarding matters that are not historical are forward-looking statements.

Although forward-looking statements in this Annual Report reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include without limitation those discussed under the heading “Risk Factors” below, as well as those discussed elsewhere in this Annual Report. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report. We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this Annual Report. Readers are urged to carefully review and consider the various disclosures made in this Annual Report, which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

This Annual Report includes trademarks and registered trademarks of INOVIO Pharmaceuticals, Inc. Products or service names of other companies mentioned in this Annual Report may be trademarks or registered trademarks of their respective owners. References herein to “we,” “our,” “us,” “INOVIO” or the “Company” refer to INOVIO Pharmaceuticals, Inc. and its subsidiaries. References herein to “DNA medicines” refers to our product candidates in development for diseases associated with human papillomavirus (HPV), cancer, and infectious diseases.

Summary Risk Factors

Our business is subject to a number of risks, including risks that may prevent us from achieving our business objectives or may adversely affect our business, financial condition, results of operations, cash flows and prospects. These risks are discussed more fully in Part I, Item 1A., Risk Factors herein. These risk factors include, but are not limited to, the following:

•We have incurred significant losses in recent years, expect to incur significant net losses in the foreseeable future and may never become profitable.

•We have limited sources of revenue and our success is dependent on our ability to develop our DNA medicines and proprietary smart device technology.

•We will need substantial additional capital to develop our DNA medicines and proprietary smart device technology, which may prove difficult and costly to obtain.

•None of our DNA medicine candidates have been approved for sale, and we may never develop commercially successful DNA medicine products.

•We previously expended significant resources on the development of a COVID-19 vaccine candidate. We are currently pursuing third-party sponsored and funded development of this candidate, but there can be no assurance that it will ever receive regulatory approval as a vaccine booster in any country, whether by Emergency Use Authorization or otherwise.

•DNA medicines are a novel approach to treating and preventing disease, and negative perception of the efficacy, safety, or tolerability of any investigational medicines we develop could adversely affect our ability to conduct our business, advance our investigational medicines, or obtain regulatory approvals.

•If we and the contract manufacturers upon whom we rely fail to produce our proprietary smart devices and DNA medicine candidates in the volumes that we require on a timely basis, or at all, or if these contractors fail to comply with their obligations to us or with stringent regulations, we may face delays in the development and commercialization of our proprietary smart devices and DNA medicine candidates.

•If we lose or are unable to secure collaborators or partners, or if our collaborators or partners do not apply adequate resources to their relationships with us, our product development and potential for profitability will suffer.

•We have agreements with government agencies, which are subject to termination and uncertain future funding, which could have a negative impact on our ability to develop certain of our pipeline candidates and/or require us to seek alternative funding sources to advance product candidates.

2

•Our operating results may be harmed if our restructuring plans do not achieve the anticipated results or cause undesirable consequences.

•We are currently subject to litigation and may become subject to additional litigation, which could harm our business, financial condition and reputation.

•We face intense and increasing competition and steps taken by our competitors, such as the introduction of a new, disruptive technology may impede our ability to successfully commercialize our DNA medicines, if approved.

•We have entered into collaborations with Chinese companies and conduct certain research and development activities in China. Uncertainties regarding the interpretation and enforcement of Chinese laws, rules and regulations, a trade war, political unrest or unstable economic conditions in China could materially adversely affect our business, financial condition and results of operations.

•It is difficult and costly to generate and protect our intellectual property and our proprietary technologies, and we may not be able to ensure their protection.

•If we are sued for infringing intellectual property rights of third parties, it will be costly and time-consuming, and an unfavorable outcome in that litigation would have a material adverse effect on our business.

Company Overview

We are a biotechnology company focused on developing and commercializing DNA medicines to help treat and protect people from diseases associated with HPV, cancer, and infectious diseases. Our goal is to advance our diverse pipeline of product candidates and deliver on the promise of DNA medicines technology in treating and preventing a wide array of diseases.

In clinical trials, our DNA medicine candidates have shown the ability to generate immune responses, especially CD4+, CD8+, and memory T-cell responses against targeted pathogens and cancers, via our precisely designed plasmids. These plasmids are delivered into cells using our investigational proprietary smart device, CELLECTRA.

Many of our lead candidates are focused on diseases associated with HPV. In 2022, we announced data from a Phase 1/2 clinical trial with INO-3107 for the treatment of HPV-6 and HPV-11 associated Recurrent Respiratory Papillomatosis (RRP). In this trial, treatment with INO-3107 resulted in a statistically significant reduction of the median number of surgeries, a result that reinforces our belief that DNA medicines may play a key role in the treatment of HPV-related diseases.

Characteristics of DNA Medicines

DNA medicines are optimized DNA plasmids containing a gene encoding for a target protein which is expressed once DNA medicines are delivered into cells. Characteristics of our DNA medicines include:

a.T Cell Responses: DNA medicines have demonstrated the ability to generate high levels of T cell (CD4+, CD8+, and memory) response along with antibody response. CD8+ T cell responses are thought to play an important role in clearing tumors or infected cells.

b.Tolerability: DNA medicines appear to be well-tolerated when evaluated against multiple disease targets. Our DNA medicines have been administered over 15,000 times across more than 5,000 participants to date.

c.Ability to Readminister: DNA medicines have been used in clinical trials to boost immune response via repeat administration, offering the possibility for boosting without any concerns of generating an anti-vector response.

d.Versatility: Our gene encoding technology can target any disease or condition that is strongly associated with an antigen or protein.

e.Stability of Product: DNA medicines have been shown to be stable at room temperature for extended periods and do not require frozen storage or shipping. Certain of our DNA plasmids under development have been room temperature stable for over 6 months.

f.Design and Manufacture: DNA medicines can be rapidly designed and scaled. Ease of manufacture may provide a cost advantage.

g.Delivery Mechanism: Cell membranes can hinder the entry of large molecules such as DNA plasmids. To overcome this barrier, delivery mechanisms such as electroporation are used to increase cellular uptake.

3

Overview of Our DNA Medicines Platform

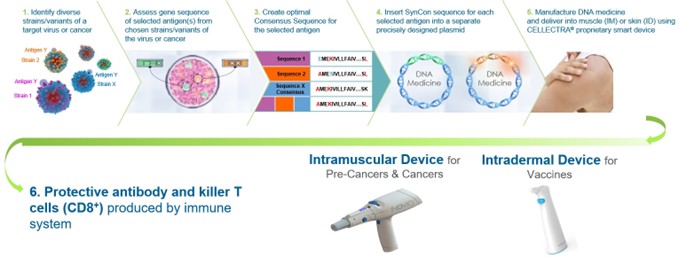

Our DNA medicines platform consists of DNA plasmids and our investigational proprietary smart device, CELLECTRA, which is used to deliver the DNA plasmids into the cell. These two components combine to create a versatile platform that has the potential to target any disease or condition that is associated with a specific antigen or protein.

SynCon® - DNA Plasmid Design Technology

Our precisely designed DNA plasmids are circular double-stranded DNA that have been optimized using our proprietary SynCon technology to express the target antigen or protein. In the areas of HPV-related diseases, cancer, and infectious diseases, the expressed proteins are the antigens that are strongly associated with the target disease. The expressed antigens, in turn, elicit antigen-specific antibody and T cell responses. We first identify one or more antigens that we believe are the best targets for directing the immune system toward a particular tumor or infectious disease. We then apply our SynCon design process, which analyzes the genetic make-up of the selected antigens from multiple variants of a tumor or strains of a virus.

For each antigen, SynCon technology creates a new genetic sequence that represents a nucleotide consensus sequence of the targeted antigen. In doing so, we believe we can create a differentiated SynCon sequence to help the immune system better recognize the target antigen and potentially variations of the target antigen. We have generated immune responses, including CD4+, CD8+, and memory T cells, with SynCon-designed DNA medicines against various tumor-associated antigens, as well as against different strains of certain infectious diseases in human clinical trials. Because the engineered SynCon sequences are substantially similar to the original sequences, without matching them exactly, we believe they are patentable.

Once a SynCon sequence is engineered, it is then inserted into a circular DNA plasmid with its own promoter. Promoters serve a vital role in “promoting” the expression of the target antigen once the DNA medicine has entered the cell. Through our SynCon technology, our DNA plasmids have been optimized to enable high expression in human cells. We believe these design capabilities allow us to better target appropriate immune system mechanisms and produce a higher level of antigen expression compared to traditional approaches, potentially enhancing the overall ability to induce the desired immune response.

The plasmids are then manufactured in a bacterial fermentation process using scalable manufacturing technology. We have recently developed a high-yield manufacturing process which we anticipate using to manufacture our DNA medicines. The manufactured DNA medicines are designed to be stable under normal environmental conditions for extended periods of time.

CELLECTRA® Delivery Technology

Large molecules, like DNA plasmids, tend to be hindered by the cell membrane from entering the cell. To overcome this hurdle and allow for an efficient cellular uptake of our DNA plasmids, we have developed the CELLECTRA delivery technology, which delivers the DNA medicines directly into cells either intramuscularly (IM) or intradermally (ID). CELLECTRA devices use brief electrical pulses to reversibly open small pores in the cell membrane, allowing DNA plasmids to enter. Through this process, the cellular uptake of the DNA plasmids can be substantially increased compared to the injection of DNA plasmids alone. This improved cellular uptake has enabled the immune responses and efficacy results observed in our clinical trials to date.

Our CELLECTRA device portfolio currently consists of three models. CELLECTRA 2000 can perform both IM and ID injections and has been used in numerous clinical trials to date. CELLECTRA 5PSP is our new IM device utilizing a prefilled drug cartridge. CELLECTRA 5PSP has been used in our Phase 3 trials (REVEAL1/REVEAL2) for cervical high-grade squamous intraepithelial lesions (HSIL). We are also planning to use CELLECTRA 5PSP for the planned Phase 3 trial for INO-3107, our DNA medicines candidate for RRP. Finally, CELLECTRA 3PSP is our next-generation ID delivery device developed with support from the U.S. Department of Defense, which is ready for large volume production and application submission to regulatory agencies for review and approval.

CELLECTRA devices are validated and manufactured under Current Good Manufacturing Practices (cGMP). We have filed device master files with the U.S. Food and Drug Administration (FDA) covering the use of CELLECTRA smart devices in human clinical trials. CELLECTRA 2000 and 5PSP models have received CE mark certification in the EU.

The process for administration of our DNA medicines is illustrated in the following graphic.

4

DNA Medicines and HPV-related Diseases

Human papillomavirus (HPV) is a sexually-transmitted, persistent viral infection with one or more high-risk genotypes that can lead to warts, precancerous lesions and cancers, such as RRP, cervical, head and neck, anal and vulvar dysplasias, which are abnormal precancerous cells, and cancers. Approximately 90% of all HPV infections clear naturally and do not result in disease. However, for those not able to clear the virus naturally, persistent infection can lead to cancer and other debilitating, life-threatening diseases affecting quality of life.

HPV types fall into two groups. Low-risk HPV (e.g., HPV 6 and HPV 11) may lead to benign growths (warts or papillomas) that can develop into conditions such as RRP. High-risk (HR) HPV (e.g., HPV 16 and HPV 18) may lead to cell changes and lesions (i.e., precancerous dysplasia) that can become malignant and lead to cervical cancer. HPV causes nearly all cervical cancers and many cancers of the vagina, vulva, penis, anus, rectum, and oropharynx.

While there are currently vaccines available to prevent HPV infection, challenges with acceptance, accessibility, and patient compliance have resulted in many vaccine-eligible people remaining unvaccinated and at risk. It is estimated that even in the United States, only 50-60% of the eligible population has been vaccinated against HPV. In addition, current preventive HPV vaccines cannot treat or protect those already infected with the same HPV genotypes. As a result, there is still an urgent need for the development of HPV therapies that can treat existing infections and prevent the development of HPV-related diseases. The current standard of care for many HPV-related diseases, including cervical dysplasia, cancer, and RRP, is surgery. These surgeries can be invasive and may be needed repeatedly because the underlying HPV infection is not eliminated. This is especially true for chronic diseases such as RRP and anal dysplasia. In addition to surgery, other options are being explored to treat HPV-related diseases, including the usage of checkpoint inhibitors and other immunotherapies.

A summary of the key characteristics of DNA medicines that we believe are important for the treatment of HPV-related diseases are listed in the following graphic:

5

Our DNA Medicines in Development

The chart below provides an overview of our DNA medicines pipeline. Each of the programs identified are described in more detail below.

INO-3107 for HPV-related Recurrent Respiratory Papillomatosis (RRP)

RRP is a life-long, rare disease characterized by the growth of tumors in the respiratory tract primarily caused by HPV-6 and/or HPV-11 genotypes. Although mostly benign, such papillomas can cause severe, sometimes life-threatening airway obstruction and respiratory complications. A distinguishing aspect of RRP is the tendency for the papilloma to recur after surgical procedures to remove them. If RRP develops in the lungs, affected individuals can potentially experience recurrent pneumonia, chronic lung disease (bronchiectasis) and, ultimately, progressive pulmonary failure. In extremely rare cases, RRP can develop into squamous cell carcinoma. Additional symptoms of RRP can include a hoarse voice, difficulty in sleeping and swallowing, and chronic coughing. RRP symptoms are usually more severe in children than in adults.

Incidence and prevalence of RRP is variable and depends on several factors that vary based on geographic location. There are estimated to be approximately 14,000 active cases and approximately 1.8 new cases per 100,000 adults in the United States each year. Global data for RRP is even more scarce, but available studies show a burden of disease in almost every country studied, ranging from an incidence of 0.18 cases per 100,000 adults in Lesotho to 0.54 per 100,000 adults in Norway and 0.02 cases per 100,000 children in Australia to 2.8 per 100,000 children in Thailand. The average yearly cost of treatment for RRP is estimated to be approximately $72,000.

In October 2022, we announced preliminary results from an open-label, multicenter Phase 1/2 trial evaluating the efficacy, safety, tolerability and immunogenicity of INO-3107, a DNA medicine candidate targeting HPV-6 and HPV-11 associated RRP. For this trial, adult patients first underwent surgical removal of their papilloma(s) and then received up to four doses of INO-3107, once every three weeks. The study protocol also included the administration of INO-9112, which encodes for human interleukin-12 (IL-12) to help enhance the immune response. The primary endpoint of this trial was safety and tolerability. Interim results from the trial showed INO-3107 to be well-tolerated with all patients completing the trial follow-up. Treatment-emergent adverse events (TEAEs) observed in the trial were generally low-grade, with 86% of patients experiencing at least one TEAE, most of which were Grade 1. Three patients (14%) experienced a Grade 3 TEAE, but none were deemed related to treatment with INO-3107. The most commonly reported TEAEs were injection site pain (38%) and fatigue (19%). While two serious adverse events were reported, these were also deemed unrelated to INO-3107.

The trial also assessed the efficacy of INO-3107. Preliminary results from the initial cohort of 21 patients showed a statistically significant reduction in the number of RRP surgical interventions in the year following the administration of INO-3107 compared with the year prior to treatment, which was the clinical endpoint of the trial. Of the 21 patients, 16 (76%) had a decrease in surgical interventions in the year following the administration of INO-3107 relative to the number of surgeries in the year prior to the trial. Of those 16 patients, six required no surgical intervention during the trial period. There was a median decrease of three surgical interventions (95% CI 1, 3) across the initial cohort.

6

In the trial, INO-3107 generated cellular responses against both HPV 6 and HPV 11, spanning both CD4 and CD8 T cells, including killer T cells. T-cell activity against HPV 6 and HPV 11 was present at the study end, which was 43 weeks after completion of treatment, and is indicative of a persistent cellular memory response.

INO-3107 was granted Orphan Drug Designation (ODD) by the FDA in July 2020.

In February 2023, we announced positive preliminary results from the second cohort of our Phase 1/2 clinical trial evaluating INO-3107 for the treatment of HPV 6 and HPV 11-associated RRP in adults. In the second cohort of 11 patients who were administered INO-3107 via the exploratory side port needle, 10 of the 11 patients (91%) had a reduction in surgical interventions in the year following initial treatment, with measurement beginning at Day 0, the start of trial therapy. Of these 10 patients, four did not require surgery. There was a statistically significant median decrease of three surgical interventions when comparing the year following treatment to the year prior. In the year prior to treatment, the number of surgical interventions for these 11 patients ranged between 2 and 8, and the median was 5.

Treatment with INO-3107 induced cellular responses against both HPV 6 and HPV 11, inducing both activated CD4 and activated lytic CD8 T cells. T cell responses were also observed at Week 52, which was 43 weeks after final treatment with INO-3107, indicating a persistent cellular memory response.

INO-3107 was well-tolerated in the trial, with all 11 patients completing the trial follow-up. Treatment-emergent adverse events (TEAE) observed in the trial were generally low-grade, with five patients (46%) experiencing at least one TEAE; four patients (36%) reported at least one related TEAE, all of which were Grade 1 or 2. The only adverse events reported by more than one patient were injection site pain (two patients) and headache (two patients). The safety and efficacy results for the second cohort were consistent with results announced for the first cohort in October 2022.

VGX-3100 for the Treatment of HPV-related Cervical HSIL

Cervical HSIL is a pre-cancerous condition caused by HPV infection. While most genital HPV infections are cleared naturally by the body's own immune system, persistent cervical infection with one or more HR-HPV genotypes can eventually lead to cervical high-grade dysplasia (HSIL) and eventually to cervical cancer.

Current management options for cervical HSIL are limited and are associated with potential unwanted side effects. The “watch-and-wait” process associated with low-grade squamous intraepithelial lesions (LSIL, formerly called low-grade dysplasia or CIN 1), and in some young women with CIN2, can be a stressful approach. The current standard of care for cervical HSIL is surgery, which involves ablating or cutting into a women’s cervix to remove the pre-cancerous lesions. These treatments may lead to short-term adverse effects including excess bleeding, and infection, or to longer-term reproductive risks such as pre-term birth, miscarriage, and perhaps infertility. Recurrence of high-grade precancerous lesions can occur after surgery because surgery does not clear the underlying HPV infection.

Currently, there is no approved immunotherapy or drug available to treat persistent HPV infection or cervical HSIL.

VGX-3100 is designed to generate T cell immune responses against the E6 and E7 oncogenic proteins of high-risk HPV types 16 and 18 that can be present in both precancerous and cancerous cells transformed by these HPV types. E6 and E7 are oncogenes that play an integral role in transforming HPV-infected cells into precancerous and cancerous cells, thus making them appealing targets for T cell-directed immunotherapy. The goal of VGX-3100 is to stimulate the body's immune system to generate a T cell response to kill the cells producing the E6/E7 protein. The potential of such immunotherapy would be to treat HSIL caused by these HPV types.

We have completed randomized, blinded, placebo-controlled Phase 2b and Phase 3 clinical trials of VGX-3100 compared to placebo, in women with HPV-16 and HPV-18 cervical HSIL. In the Phase 2b trial, women treated with VGX-3100 were more likely to demonstrate resolution of cervical HSIL and HPV clearance from cervical lesions than those women receiving placebo. In addition, antigen-specific T cell levels in women treated with VGX-3100 were greater than those treated with placebo. All women were monitored for an additional 52 weeks following the primary endpoint to assess for safety; VGX-3100 was well-tolerated and there were no safety concerns observed. Immune endpoints were also assessed and women whose lesions regressed also had higher frequencies of HPV-specific CD8+ T cells which co-expressed key molecules important in the T cell killing cascade and directly correlated with clinical efficacy. To our knowledge, this Phase 2b trial was the first study from which data was published indicating a direct correlation between antigen-specific CD8+ T cells generated in vivo and clinical efficacy.

VGX-3100 Immune Correlates and Biomarker Signatures

We are pursuing a biomarker signature for our VGX-3100 program. In May 2019, we entered into a collaboration with QIAGEN N.V. to co-develop a liquid biopsy-based diagnostic for this biomarker signature to identify women with HPV-16/18 cervical HSIL most likely to respond to VGX-3100. In February 2021, we announced an extension of our partnership with QIAGEN with a new master collaboration agreement to develop liquid biopsy-based companion diagnostic products based on

7

next-generation sequencing technology to complement our therapies. QIAGEN is utilizing the Illumina NextSeq™ 550Dx platform for this biomarker, the first development based on a partnership QIAGEN and Illumina entered into in October 2019.

In December 2021, we announced that we and QIAGEN had identified candidate biomarker signatures for VGX-3100 with the intent of selecting a final signature of a pre-treatment in vitro diagnostic to meet the specific characteristics desired to identify women with HPV-16/18 cervical HSIL most likely to respond to VGX-3100. This biomarker, if validated, may have the potential to identify those women who are more likely to have a favorable treatment outcome, specifically the regression of cervical HSIL and viral clearance.

Phase 3 Trials (REVEAL1 and REVEAL2)

Our Phase 3 program, named REVEAL, consists of a primary trial (REVEAL1; HPV-301) and confirmatory trial (REVEAL2; HPV-303). The REVEAL trials are prospective, randomized (2:1), double-blind, placebo-controlled trials evaluating adult women with HPV 16/18 positive biopsy-proven cervical HSIL (CIN 2/3). The primary endpoint is regression of cervical HSIL and virologic clearance of HPV-16 and/or HPV-18 in the cervix, which was a secondary endpoint that was achieved in our Phase 2b trial. Overall, the Phase 3 trials are evaluating cervical tissue changes at approximately 9 months after beginning a three-dose regimen of VGX-3100 administered at months 0, 1 and 3.

In March 2021, we announced the results of the REVEAL1 trial of VGX-3100. The trial protocol-defined intention to treat (ITT) population (N=201) included all randomized participants regardless of availability of endpoint data and defines those without endpoint data as non-responders. There were eight such participants (seven in the treatment group, one in the placebo group) in the ITT population. Including participants with missing endpoint data, the percentage of participants meeting the primary endpoint was 22.5% (31/138) in the treatment group, versus 11.1% (7/63) in the placebo group (p=0.029; 95%CI: -0.4,21.2), which was not statistically significant. All secondary endpoints were achieved except for regression of cervical HSIL alone (95%CI: -0.6,24.5).

For the protocol-defined mITT population (N=193), which included all participants with endpoint data, VGX-3100 achieved the primary and secondary endpoints among all evaluable participants. For the primary endpoint of histopathological regression of HSIL and virologic clearance of HPV-16 and/or HPV-18 at week 36, the percentage of responders was 23.7% (31/131) in the treatment group, versus 11.3% (7/62) in the placebo group (p=0.022; 95%CI: 0.4,22.5), which was statistically significant. All secondary efficacy endpoints were achieved in this population. These endpoints were: a) regression of cervical HSIL to normal tissue combined with HPV16/18 viral clearance, b) regression of cervical HSIL alone, c) regression of cervical HSIL to normal tissue, and d) HPV 16/18 viral clearance alone. There were no treatment-related serious adverse events (SAEs) and most adverse events (AEs) were self-resolving and were considered to be mild to moderate, consistent with earlier clinical trials. The data from REVEAL1 was presented at the 2021 American Society for Colposcopy and Cervical (ASCCP) annual scientific meeting, and at the 34th International Papillomavirus Conference (IPVC) in November 2021.

We completed the 52-week safety follow-up of participants in REVEAL1 and showed that VGX-3100 remained well-tolerated through Week 88. In addition, participants treated with VGX-3100 who met the primary endpoint at Week 36 remained clear of HPV-16 and/or HPV-18 at Week 88.

REVEAL2 is our second Phase 3 trial with VGX-3100. In April 2022, the trial protocol was amended to utilize a biomarker-selected population as the primary population, based on prior analysis of REVEAL1 results suggesting that this investigational biomarker had the potential to identify women more likely to respond to treatment with VGX-3100. We announced that this trial would no longer be considered to be a pivotal trial and would not lead to a BLA filing for a biomarker-selected population, as the FDA advised us that the biomarker-positive population would not be sufficient to support approval of a potential marketing application for VGX-3100. The FDA recommended using REVEAL2 as an exploratory trial and that conducting one or two additional well-controlled trials in the biomarker-selected population would be more likely to provide evidence to support approval of a marketing application.

Trial participants in REVEAL2 included 203 women, 18 years of age or older, who had histologically-confirmed cervical HSIL associated with HPV-16 and/or HPV-18, but who were otherwise healthy. Participants received either VGX-3100 or placebo at 0, 4 and 12 weeks (randomized 2:1). The primary endpoint, as amended, was the percentage of biomarker-selected participants with regression of cervical HSIL and virologic clearance of HPV-16 and/or HPV-18 in the cervix. A secondary endpoint was the percentage of all participants with regression and virologic clearance.

In March 2023, we announced data from our REVEAL2 trial. Statistical significance was not achieved in the investigational biomarker-selected population for the endpoint of lesion regression and viral clearance. However, statistical significance was achieved in the all-participants population for the endpoint of lesion regression and viral clearance.

The percentage of participants in the investigational biomarker-selected population meeting the endpoint was 28.6% (6/21) in the treatment group, versus 0% (0/4) in the placebo group (p=0.115; difference in percentage 28.6, 95%CI: -24.6, 50.4), which was not statistically significant.

8

The result of the all-participants population of 203 participants (134 participants in the treatment group, 69 in the placebo group) was statistically significant, with 27.6% (37/134) of the participants meeting the endpoint in the treatment group, versus 8.7% (6/69) in the placebo group (p=0.001; difference in percentage 18.9, 95%CI: 7.8, 28.6).

In particular, in the all-participants population of REVEAL2, viral clearance was observed in 37.3% (50/134) in the treatment group versus 8.7% (6/69) in the placebo group. Given the importance of viral clearance in removing the underlying cause of the HPV-related diseases, this data may have positive implications in our other HPV-related programs.

An ad hoc integrated efficacy analysis of the results for both REVEAL1 and REVEAL2 shows statistical significance in the biomarker-selected and all-participants populations for lesion regression and viral clearance. For the combined biomarker-selected population of 92 participants (68 participants in the treatment group, 24 in the placebo group), the percentage of participants meeting the primary endpoint was 54.4% (37/68 in the treatment group, versus 12.5% (3/24) in the placebo group (p=<0.001; difference in percentage 41.9, 95%CI: 20.4, 57.0). For the combined all-participants population of 404 participants (272 participants in the treatment group, 132 in the placebo group), the percentage of participants meeting the primary endpoint was 25.0% (68/272 in the treatment group, versus 9.8% (13/132) in the placebo group (p=<0.001; difference in percentage 15.2, 95%CI: 7.4, 22.1).

In both REVEAL1 and REVEAL2, VGX-3100 was well-tolerated. There were no treatment-related serious adverse events and most adverse events were considered to be mild to moderate.

This combined data set will be used as supportive data in any future regulatory interactions involving VGX-3100. We will continue to evaluate the results to determine next steps for VGX-3100 in our HPV programs. We plan to submit the data for publication in a peer-reviewed journal later this year.

VGX-3100 for the Treatment of Anal or Perianal HSIL

HPV-16 and HPV-18 can also cause precancerous lesions of the anus (anal HSIL). Left untreated, anal HSIL may progress to cancer. Spontaneous regression of anal HSIL is observed in approximately 20% of patients. Persistent infection with one or more high-risk HPV genotypes is responsible for a large portion of anal cancer. In the United States, about 55% to 80% of anal HSIL cases are associated with HPV-16/18, and worldwide about 80% of anal HSIL cases are associated with HPV-16/18. In the United States, over 90% of anal cancer is attributable to HPV, and about 87% of those HPV anal cancers are attributable to HPV-16/18 specifically.

There are no validated screening tests or a general consensus for screening recommendations for anal HSIL. Treatment usually consists of repeated ablation, most commonly radiofrequency ablation (RFA), resections or laser therapy. However, recurrence rates are high, up to 49% one year after treatment, as ablation does not clear the underlying HPV infection, resulting in an unmet medical need.

We have completed a Phase 2 clinical trial (HPV-203) to evaluate VGX-3100 in participants who are HIV-negative with histologically confirmed anal or perianal HSIL, or anal intraepithelial neoplasia (AIN), associated with HPV-16 and/or HPV-18. This open-label trial enrolled 24 participants who received three doses of VGX-3100 delivered by our CELLECTRA-5PSP device. The primary endpoint of the trial was histologic clearance of the high-grade lesions and virologic clearance of the HPV-16/18 virus in anal/perianal tissue samples. In December 2020, we announced Phase 2 efficacy results from this trial. One-half of participants treated with VGX-3100 (11/22) showed resolution of HPV-16/18-associated anal HSIL at six months following the start of treatment. VGX-3100 was well-tolerated in the trial.

In addition to the Phase 2 anal HSIL trial described above, a separate ongoing Phase 2 trial sponsored by the AIDS Malignancy Consortium (AMC-103) is evaluating VGX-3100 in participants with histologically confirmed anal or perianal HSIL associated with HPV-16 and/or HPV-18 who are HIV-positive. This open-label single-arm trial plans to enroll approximately 90 participants who will receive up to four doses of VGX-3100 delivered by CELLECTRA-5PSP smart device. The primary endpoint of the trial is histological regression of high-grade anal lesions to low-grade SIL or normal histology.

VGX-3100 for the Treatment of Vulvar HSIL

HPV-16 and HPV-18 can also cause precancerous and cancerous lesions of the vulva. These precancerous lesions, or vulvar HSIL, have less than a 5% rate of spontaneous or natural regression and there are no FDA-approved treatments. Surgery, the most common treatment, is associated with high rates of disease recurrence and can cause disfigurement, long-term pain, and psychological distress for women who undergo the procedure. Non-surgical options such as the off-label use of topical imiquimod are also available.

We have completed a Phase 2 trial (HPV-201) to evaluate the efficacy of VGX-3100 in participants with vulvar HSIL. This randomized, open-label Phase 2 clinical trial assessed the efficacy of VGX-3100 in 33 women with vulvar HSIL. VGX-3100 was administered with our CELLECTRA -5PSP smart device. The primary endpoint of the trial was histologic clearance of high-grade lesions and virologic clearance of the HPV virus in vulvar tissue samples. The trial also evaluated the safety and tolerability of VGX-3100. In January 2021, we announced efficacy results from this trial. A 25% or more reduction in HPV-16/18-associated vulvar HSIL was observed for 63% of trial participants (12 of 19) treated with VGX-3100 at six

9

months post-treatment. Three of the 20 participants with histology data (15%) resolved their vulvar HSIL and had no HPV-16/18 virus detectable in the healed area. VGX-3100 was well-tolerated in the Phase 2 trial.

INO-5401 for the Treatment of Glioblastoma Multiforme (GBM)

Glioblastoma multiforme (GBM) is the most common aggressive type of brain cancer. In the United States, the median age at diagnosis is 65 years, and the incidence rate increases thereafter. Prognosis is extremely poor, and a limited number of new therapies have been approved over the last 10 years; median overall survival for U.S. patients receiving standard of care therapy is approximately 10 months and the five-year survival is 6.8% for all ages combined. The annual incidence of GBM is estimated to be approximately 12,000 cases per year and increasing.

Our product candidate INO-5401 is an immunotherapy consisting of three DNA plasmids encoding for three tumor-associated antigens: human Telomerase Reverse Transcriptase (hTERT), Wilms Tumor gene-1 (WT1) and Prostate-Specific Membrane Antigen (PSMA).

We have completed a Phase 1/2 immuno-oncology trial of INO-5401 and INO-9012 (IL-12 plasmid) in participants with newly diagnosed GBM, in combination with cemiplimab (Libtayo®), a PD-1 inhibitor developed by Regeneron Pharmaceuticals. This open-label trial began in 2018 and enrolled 52 newly diagnosed GBM participants. The primary endpoint was safety and tolerability, and the trial also evaluated immunogenicity and efficacy (Overall Survival, or OS).

In May 2022, we presented OS data at the 2022 American Society of Clinical Oncology (ASCO) from GBM-001 Phase 2 trial. Median OS duration in patients with an unmethylated MGMT promoter (Cohort A) was 17.9 months, which compares favorably to historical comparisons (14.6-16 months). Median OS data in patients with a MGMT methylated promoter (Cohort B), was 32.5 months, which compares favorably to historical comparisons (23.2-25 months). Overall, INO-5401 + INO-9012 demonstrated tolerability and immunogenicity when administered with Libtayo and RT/TMZ (radiation and temozolomide) to newly diagnosed GBM patients. Notably, INO-5401 elicited antigen-specific T cells that may infiltrate GBM tumors.

INO-5151 (INO-5150 + INO-9012) for the Treatment of Prostate Cancer

INO-5151 consists of DNA plasmids targeting Prostate Specific Antigen (PSA) and Prostate Specific Membrane Antigen (PSMA), combined with INO-9112, the IL-12 plasmid, for the treatment of prostate cancer.

In 2019, we announced a clinical collaboration with Parker Institute for Cancer Immunotherapy (PICI) and the Cancer Research Institute (CRI) as part of which INO-5151 is being combined with an immune modulator (CDX-301, FLT3 ligand, a dendritic cell mobilizer) and a PD-1 immune checkpoint inhibitor (nivolumab) in participants with metastatic castration-resistant prostate cancer (mCRPC), in a PICI-sponsored platform trial (PORTER). This combination trial is an open-label, non-randomized, exploratory platform trial designed to assess the safety and antitumor activity of multiple immunotherapy-based combinations in participants with mCRPC who have received prior secondary androgen inhibition. The trial evaluated biomarkers of immune activity and clinical outcomes using a multi-omic, multi-parameter approach. Under the agreement, PICI designed and conducted the clinical trial, working in collaboration with its established network of clinical academic and industry cancer centers, with funding support from CRI.

In November 2022, at the Society for Immunotherapy of Cancer (SITC) 2022 annual meeting, PICI announced that while the treatment with INO-5151 induced antigen-specific T cell responses, the combination therapy of INO-5151 + nivolumab + CDX-301 was not deemed to have sufficient clinical activity by the study sponsors and will not be expanded for further study.

Infectious Disease Product Candidates

INO-4800 for COVID-19

Phase 2/3 Clinical Trial – INNOVATE

In 2022, we announced the discontinuance of all internally funded COVID-19 vaccine programs for INO-4800. The decision followed a comprehensive review of market conditions and global demand for COVID-19 vaccines. In May 2022, we announced the discontinuance of our INNOVATE program, which was focused on developing INO-4800 as a primary vaccine candidate against COVID-19. At that time, our intention was to continue our efforts to develop INO-4800 as a heterologous booster vaccine. However, in October 2022, we announced the discontinuance of these heterologous booster vaccine efforts for INO-4800 as market conditions continued to shift. While we believe that INO-4800 has attributes that could be beneficial as a potential vaccine and/or booster vaccine against COVID-19, such as its ability to elicit immune responses at the humoral and cellular level, including driving cross-reactive T cell responses against multiple variants of concern, our decision was driven by external factors. These included epidemiological trends, including reduced number of severe COVID-19 cases, difficulty in conducting heterologous booster trials in highly vaccinated populations, market conditions such as vaccine oversupply, lower

10

forecast projections for vaccine doses in the future, and vaccine fatigue, and changes in regulatory timelines and requirements, as well as diminishing government financial support.

Phase 2/3 Clinical Trial – SOLIDARITY TRIAL VACCINES (STV)

INO-4800 is one of two initial COVID-19 vaccine candidates included in the World Health Organization (WHO) sponsored Solidarity Trial Vaccines, which is designed to evaluate the efficacy and safety of promising new candidate vaccines selected by an independent vaccine prioritization advisory group composed of leading scientists and experts. Our decision to discontinue our internally funded efforts to develop INO-4800 as a COVID-19 heterologous booster vaccine does not affect the evaluation of INO-4800 in this trial.

INO-4800 in China

Our collaborator Advaccine has completed enrollment of its 200-participant homologous and 267-participant heterologous booster vaccine trials in China. The trials are designed to evaluate safety, tolerability and immunogenicity of INO-4800 as a homologous booster where INO-4800 was administered as the primary vaccine and as a heterologous booster where an inactivated vaccine was administered as the primary vaccine.

COVID-19 dMAb®

Using our SynCon technology, we are able to create a precisely designed DNA plasmid that encodes for a specific monoclonal antibody (mAb). We refer to these DNA plasmids as our dMAb product candidates. We deliver the plasmid directly into cells of the body using our CELLECTRA smart delivery system, enabling the electroporated cells to manufacture those mAbs in vivo (i.e. by the body itself), unlike conventional mAb technology that requires manufacture outside of the body. We believe this approach provides potentially significant advantages in terms of design simplicity, rapidity of execution and lower production costs. We expect to design dMAb product candidates not only for new disease targets that are not currently addressable with conventional recombinant mAbs, but also targets of existing, commercially available mAb products.

In December 2020, we, along with a team of scientists from The Wistar Institute, AstraZeneca, the University of Pennsylvania, and Indiana University, received a $37.6 million grant from the U.S. Defense Advanced Research Projects Agency (DARPA), a research and development agency of the DoD and the JPEO-CBRND, to use our dMAb technology to develop anti-SARS-CoV-2-specific dMAbs that function as both a therapeutic and preventive treatment for COVID-19.

As part of DARPA's two-year grant, the consortium constructed COVID-19 dMAb candidates mirroring AstraZeneca's traditional recombinant monoclonal antibody candidates currently being tested in clinical trials to treat COVID-19.

In July 2022, Wistar announced the dosing of the first participant in a Phase 1, open-label, single-center, 24-person dose escalation trial to evaluate the safety, tolerability and pharmacokinetic profile of two of our mAb product candidates , administered IM followed immediately by electroporation using our CELLECTRA 2000 device in a 1- and 2-dose regimen (Days 0 and 3) in healthy adults (NCT05293249).

INO-4201 for Ebola Virus Disease

The Ebola virus causes one of the most virulent viral diseases, with case fatality rates averaging approximately 50% but approaching up to 90% in past outbreaks in areas with no or under-developed health care. Ebola can spread through human-to-human transmission by direct contact with the blood, secretions, organs or bodily fluids of an infected individual and with surfaces or materials that contain the contaminated fluids of an infected person, such as bedding and clothing. It is capable of causing death within 2 to 21 days of exposure. In November 2019, the first conditional approval was issued for a preventive vaccine against Ebola virus. This approval was from the European Medicines Agency (EMA) for the vaccine ERVEBO®. That same month, the WHO pre-qualified that vaccine for use in high-risk countries. In the next month, the FDA approved that vaccine. However, there are no proven effective therapeutic treatments for Ebola. In addition, various experimental approaches have already been associated with undesirable side effects and limited ability to scale manufacturing.

In December 2021, we announced complete enrollment of a 46-participant Phase 1b trial in which our DNA medicine candidate INO-4201 was assessed as a heterologous booster in healthy volunteers previously vaccinated with rVSV-ZEBOV (ERVEBO®), an FDA- and EMA- approved viral vector-based Ebola vaccine (NCT04906629). To date, INO-4201 has been well-tolerated and has not demonstrated systemic SAEs, such as fever, joint pain, and low white blood cell counts, that have been reported in association with some viral vector-based Ebola vaccines currently in development.

In February 2022, we announced results from the Phase 1b trial. INO-4201 was well-tolerated and boosted humoral responses in 100% (36 of 36) of treated participants. We and our collaborators plan to publish the data in a peer-reviewed journal and provide updates on the next steps for INO-4201.

INO-4700 for Middle East Respiratory Syndrome (MERS)

11

The Middle East Respiratory Syndrome (MERS) is a viral respiratory illness first reported in Saudi Arabia in 2012. MERS appears to have been transmitted from an animal reservoir to humans, but human to human transmission has been confirmed. In 2018, we announced a collaboration with CEPI under which CEPI would fund up to $56 million of costs to support our pre-clinical and clinical advancement through Phase 2 of our vaccine candidate INO-4700.

We dosed and completed enrollment for the first part (dose finding stage) of the Phase 2 trial (192 participants) of INO-4700. The multi-center Phase 2 trial was a randomized, double-blinded, placebo-controlled trial designed to evaluate the safety, tolerability, and immunogenicity of INO-4700 administered with CELLECTRA 2000 in approximately 500 healthy adult participants (NCT04588428). The trial was conducted at sites in Jordan, Lebanon, and Kenya.

Based on initial analysis of data from the studies, we and CEPI agreed to discontinue development of INO-4700 for MERS in November 2022. Although INO-4700 was well-tolerated by participants in our clinical trials and generated immune responses, the two-dose regimen did not meet CEPI's selection criteria for further development.

INO-4500 for Lassa Fever

Lassa fever, also known as Lassa hemorrhagic fever, is an acute viral disease which occurs mostly in West Africa.

In October 2021, we completed enrollment of a 220 participant Phase 1b trial for our vaccine candidate INO-4500 in Accra, Ghana, which was the first vaccine clinical trial for Lassa Fever conducted in West Africa, where the viral illness is endemic. The trial was funded by CEPI. The dosing regimen involved two intradermal vaccinations at 0 and 28 days with either 1.0 mg or 2.0 mg doses.

In November 2022, we announced that we and CEPI agreed to discontinue development of INO-4500 for Lassa Fever, following initial analyses of data from studies. Although INO-4500 was well tolerated by participants in our clinical trials and generated immune responses, the two-dose regimen did not meet CEPI's selection criteria for further development.

Collaboration and Alliances

Our partners and collaborators include Advaccine Biopharmaceuticals Suzhou Co, ApolloBio Corporation, AstraZeneca, The Bill & Melinda Gates Foundation (Gates), Coalition for Epidemic Preparedness Innovations (CEPI), Defense Advanced Research Projects Agency (DARPA), The U.S. Department of Defense (DoD), HIV Vaccines Trial Network, International Vaccine Institute (IVI), Kaneka Eurogentec, National Cancer Institute (NCI), National Institutes of Health (NIH), National Institute of Allergy and Infectious Diseases (NIAID), the Parker Institute for Cancer Immunotherapy, Plumbline Life Sciences, Regeneron Pharmaceuticals, Richter-Helm BioLogics, Thermo Fisher Scientific, the University of Pennsylvania, the Walter Reed Army Institute of Research, and The Wistar Institute.

Our most material collaboration arrangements are summarized below.

Advaccine

On December 31, 2020, we entered into a Collaboration and License Agreement with Advaccine Biopharmaceuticals Suzhou Co., Ltd. (“Advaccine”), which was amended and restated on June 7, 2021 (as amended and restated, the “Advaccine Agreement”). Under the terms of the Advaccine Agreement, we granted to Advaccine the exclusive right to develop, manufacture and commercialize our vaccine candidate INO-4800 within the territories of China, Taiwan, Hong Kong and Macau (referred to collectively as “Greater China”) and 33 additional countries in Asia. Advaccine does not have the right to grant sublicenses, other than to affiliated entities, without our express prior written consent. As part of the collaboration, Advaccine also granted to us a non-exclusive license to certain DNA vaccine manufacturing processes.

In certain instances, we will have the right to convert the exclusive license to a non-exclusive license in the licensed territories, other than Greater China, unless Advaccine agrees to pay us its full share of development costs in excess of a specified maximum. Notwithstanding the foregoing, Advaccine will be fully responsible for conducting the trial in Greater China, including its costs and expenses incurred in conducting the trial in Greater China.

Under the Agreement, Advaccine made an upfront payment to us of $3.0 million in January 2021. In addition to the upfront payment, we are entitled to receive up to an aggregate of $200.0 million, payable upon the achievement of specified milestones related to the development, regulatory approval and commercialization of INO-4800, including the achievement of specified net sales thresholds for INO-4800 in Greater China and the additional covered territories, if approved. In December 2020 we earned a $2.0 million milestone payment based on the enrollment of the first participant in the Phase 2 clinical trial for the product in the Advaccine territory. We are also entitled to receive a royalty equal to a high single-digit percentage of annual net sales in each region within the licensed territory, subject to reduction in the event of competition from biosimilar products in a particular region and in other specified circumstances. Advaccine’s obligation to pay royalties will continue, on a licensed product-by-licensed product basis and region-by-region basis, for ten years after the first commercial sale in a particular region

12

within Greater China or, if later, until the expiration of the last-to-expire patent covering a given licensed product in a given region.

Beginning in the first calendar year following the first commercial sale of INO-4800 in the licensed territory outside of Greater China, Advaccine will pay us an annual maintenance fee of $1.5 million for a period of five years, which fee will be creditable against any royalties payable by Advaccine with respect to sales outside of Greater China.

Under the Advaccine Agreement, we will supply Advaccine’s clinical requirements of INO-4800 and devices, although Advaccine may manufacture INO-4800 for its clinical use and may procure alternate suppliers. Advaccine is responsible for the manufacture and supply of INO-4800 itself or through a contract manufacturer for commercial use. Upon Advaccine’s reasonable request, the parties may negotiate a separate clinical and/or commercial supply agreement.

The Advaccine Agreement will continue in force on a region-by-region basis until Advaccine has no remaining royalty obligations in such region. Either party may terminate the Advaccine Agreement (i) in the event the other party shall have materially breached its obligations thereunder and such default shall have continued for a specified period after written notice thereof or (ii) upon the bankruptcy or insolvency of the other party. In addition, we may terminate the agreement, upon prior written notice, if Advaccine (i) ceases all development or commercialization activities for at least nine months, subject to certain exceptions, or (ii) challenges the validity, enforceability or scope of any of the patents licensed by us to Advaccine under the Advaccine Agreement, subject to certain conditions. Advaccine may terminate the Advaccine Agreement at any time for convenience upon nine months’ written notice to us, if such notice is provided before the first commercial sale of INO-4800 in the licensed territory, or 18 months’ written notice thereafter; provided that we may accelerate the effectiveness of such termination to the extent permitted by law.

ApolloBio

In December 2017, we entered into an Amended and Restated License and Collaboration Agreement with Beijing Apollo Saturn Biological Technology Limited, a corporation organized under the laws of China, or ApolloBio. Under the terms of this License and Collaboration Agreement, which became effective in March 2018, we granted to ApolloBio the exclusive right to develop and commercialize VGX-3100, our DNA immunotherapy product candidate designed to treat pre-cancers caused by HPV, within the agreed upon territories - Greater China (defined as China, Hong Kong, Macao and Taiwan). As part of the collaboration, ApolloBio will fund all clinical development costs within the licensed territory.

In addition to the upfront payment that we received in 2018, we are entitled to receive up to an aggregate of $20.0 million, less required income, withholding or other taxes, upon the achievement of specified milestones related to the regulatory approval of VGX-3100 in accordance with the Amended and Restated License and Collaboration Agreement. In the event that VGX-3100 is approved for marketing in these territories, we will be entitled to receive royalty payments based on a tiered percentage of annual net sales, with such percentage being in the low- to mid-teens, subject to reduction in the event of generic competition in a particular territory. ApolloBio’s obligation to pay royalties will continue for 10 years after the first commercial sale in a particular territory or, if later, until the expiration of the last-to-expire patent covering the licensed products in the specified territory. The License and Collaboration Agreement, once effective, will continue in force until ApolloBio has no remaining royalty obligations. In December 2021, ApolloBio dosed its first participant in a separate Phase 3 trial in China (HPV-303CHN).

Competition

As we develop and seek to ultimately commercialize our product candidates, we face and will continue to encounter competition with an array of existing or development-stage drug and immunotherapy approaches targeting diseases we are pursuing. We are aware of various established enterprises, including major pharmaceutical companies, broadly engaged in vaccine/immunotherapy research and development. These include AbbVie, AstraZeneca, BioNTech, Bristol-Myers Squibb, GlaxoSmithKline plc, Janssen Pharmaceuticals (part of J&J), Merck, Moderna, Novartis, Pfizer, Roche, and Sanofi-Aventis. There are also various development-stage biotechnology companies involved in different vaccine and immunotherapy technologies, including but not limited to CureVac, Dynavax, GeneOne, Genexine, Hookipa, Imunon, Iovance, Nektar, Nykode, Precigen, Translate Bio, Vir Biotechnology, and Zydus. If these companies are successful in developing their technologies, it could materially and adversely affect our business and our future growth prospects.

Merck and GlaxoSmithKline have commercialized preventive vaccines against HPV to protect against cervical cancer. Some companies are seeking to treat early HPV infections or low-grade cervical dysplasia. Loop Electrosurgical Excision Procedure, commonly known as LEEP, is a surgical procedure and is the current standard of care for treating high-grade cervical dysplasia. In RRP caused by HPV subtypes 6 and 11, Precigen is working to develop a treatment based on a Gorilla adenovirus vector. Genexine and Gilead Sciences have therapeutic cervical cancer product candidates under development. Many companies are pursuing different approaches to pre-cancers and cancers we are targeting.

We also compete more specifically with companies seeking to utilize antigen-encoding DNA delivered with electroporation or other delivery technologies such as viral vectors or lipid vectors to induce in vivo generated antigen

13

production and immune responses to prevent or treat various diseases. These competitive technologies have shown promise, but they each also have their unique obstacles to overcome.

Viral Vaccine Delivery

This technology utilizes a virus as a carrier, or vector, to deliver genetic material into target cells. The method is efficient for delivering immunotherapy antigens and has the advantage of mimicking real viral infection so that the recipient will mount a broad immune response against the immunotherapy. The potential limitation of the technology stems from problems with unwanted immune responses against the viral vector, limiting its use to patients who have not been previously exposed to the viral vector and making repeated administration difficult. In addition, complexity and safety concerns increase their cost and complicate regulatory approval.

Lipid DNA/RNA Delivery

A number of lipid formulations have been developed that increase the effect of DNA/RNA immunotherapies. These work by either increasing uptake of the DNA/RNA into cells or by acting as an adjuvant, alerting the immune system. While there has been significant progress in this field, including emergency use authorization of COVID-19 mRNA vaccines in 2020, lipid nanoparticle delivery of mRNA may have thermal stability issues as well as the potential of adverse events from the lipid nanoparticle formulations.

DNA Immunotherapy Delivery with Electroporation

There are other companies with electroporation intellectual property and devices. We believe we have competitive advantages over other companies focused on electroporation for multiple reasons:

•We have an extensive history and experience in developing the methods and devices that optimize the use of electroporation in conjunction with DNA-based agents. This experience has been validated with multiple sets of interim data from clinical trials assessing DNA-based immunotherapies and vaccines against cancers and infectious disease.

•We have a broad product line of electroporation instruments designed to enable DNA delivery, including our intradermal and intramuscular devices.

•We have been proactive in filing for patents, as well as acquiring and licensing additional patents, to expand our global patent estate.

If any of our competitors develop products with efficacy or safety profiles significantly better than our product candidates, we may not be able to commercialize our products, and sales of any of our commercialized products could be harmed. Some of our competitors and potential competitors have substantially greater product development capabilities and financial, scientific, marketing and human resources than we do. Competitors may develop products earlier, obtain FDA approvals for products more rapidly, or develop products that are more effective than those under development by us. We will seek to expand our technological capabilities to remain competitive; however, research and development by others may render our technologies or products obsolete or noncompetitive or result in treatments or cures superior to ours.

Our competitive position will be affected by the disease indications addressed by our product candidates and those of our competitors, the timing of market introduction for these products and the stage of development of other technologies to address these disease indications. For us and our competitors, proprietary technologies, the ability to complete clinical trials on a timely basis and with the desired results, and the ability to obtain timely regulatory approvals to market these product candidates are likely to be significant competitive factors. Other important competitive factors will include efficacy, safety, ease of use, reliability, availability and price of products and the ability to fund operations during the period between technological conception and commercial sales.

The FDA and other regulatory agencies may expand current requirements for public disclosure of DNA-based product development data, which may harm our competitive position with foreign and United States companies developing DNA-based products for similar indications.

Commercialization and Manufacturing

Because of the broad potential applications of our technologies, we intend to develop and commercialize products both on our own and through our collaborators and licensees. We intend to develop and commercialize products in well-defined specialty markets, such as HPV-related diseases, infectious diseases, and cancer. Where appropriate, we intend to rely on strategic marketing and distribution alliances.

We believe our plasmids can be produced in commercial quantities through uniform methods of fermentation and processing that are applicable to all plasmids. We believe we will be able to obtain sufficient supplies of plasmids for all foreseeable clinical investigations.

Intellectual Property

14

Patents and other proprietary rights are essential to our business. We file patent applications to protect our technologies, inventions and improvements to our inventions that we consider important to the development of our business. We file for patent registration extensively in the United States and in key foreign markets. Although our patent filings include claims covering various features of our products and product candidates, including composition, methods of manufacture and use, our patents do not provide us with complete protection, or guarantee, against the development of competing products. In addition, some of our know-how and technology are not patentable. We thus also rely upon trade secrets, know-how, continuing technological innovations and licensing opportunities to develop and maintain our competitive position. We also require employees, consultants, advisors and collaborators to enter into confidentiality agreements, but such agreements may provide limited protection for our trade secrets, know-how or other proprietary information.

As of December 31, 2022, our patent portfolio included approximately 100 issued U.S. patents and approximately 80 U.S. patent applications as well as approximately 800 issued foreign counterpart patents and approximately 700 counterpart foreign patent applications. These are comprised, in part, of:

•two U.S. patent applications and approximately 40 counterpart foreign patent applications, directed to treatment of RRP;

•seven issued U.S. patents and five U.S. patent applications, as well as approximately 80 issued foreign counterpart patents and approximately 50 counterpart foreign patent applications, directed to treatment of GBM;

•approximately 70 issued U.S. patents and approximately 50 U.S. patent applications, as well as approximately 400 issued foreign counterpart patents and approximately 500 counterpart foreign patent applications, directed to our other earlier-stage product candidates; and

•approximately 30 issued U.S. patents and approximately 20 U.S. patent applications, as well as approximately 30 issued foreign counterpart patents and approximately 125 counterpart foreign patent applications, directed to our device delivery systems.

Our pending patent applications directed to treatment of RRP, if issued, would expire between about 2040 and 2043. Our issued patents directed to treatment of GBM expire between about 2027 and 2037 and our pending patent applications, if issued, would expire between about 2027 and 2040. Our issued patents directed to our other product candidates expire between about 2023 and 2036 and our pending patent applications, if issued, would expire between about 2027 and 2042. Our issued patents directed to our device delivery systems expire between about 2023 and 2036 and our pending patent applications, if issued, would expire between about 2023 and 2042.

Individual patent terms extend for varying periods of time, depending upon the date of filing of the patent application, the date of patent issuance, and the legal term of patents in the countries in which they are obtained. In most countries in which we file patent applications, including the United States, the patent term is 20 years from the date of filing of the first non-provisional patent application to which priority is claimed. In some instances, a patent term can be extended under certain circumstances, such as patent term extension or patent term adjustment; alternatively, a patent term may be shortened, for example in the United States, if a patent is terminally disclaimed over an earlier-filed patent. Protection afforded by a patent varies on a product-by-product basis, from country-to-country, and depends upon many factors, including the type of patent, the scope of its coverage, the availability of regulatory-related extensions, the availability of legal remedies in a particular country, and the validity and enforceability of the patent.

If we fail to protect our intellectual property rights adequately our competitors might gain access to our technology and our business would thus be harmed. In addition, defending our intellectual property rights might entail significant expense. Any of our intellectual property rights may be challenged by others or invalidated through administrative processes or litigation through the courts. In addition, our patents, or any other patents that may be issued to us in the future, may not provide us with any competitive advantages, or may be challenged by third parties. Furthermore, legal standards relating to the validity, enforceability and scope of protection of intellectual property rights are uncertain. Effective patent, trademark, copyright and trade secret protection may not be available to us in each country where we operate. The laws of some foreign countries may not be as protective of intellectual property rights as those in the United States, and domestic and international mechanisms for enforcement of intellectual property rights in those countries may be inadequate. Accordingly, despite our efforts, we may be unable to prevent third parties from infringing upon or misappropriating our intellectual property or otherwise gaining access to our technology. We may be required to expend significant resources to monitor and protect our intellectual property rights. We may initiate claims or litigation against third parties for infringement of our proprietary rights or to establish the validity of our proprietary rights. Any such litigation, whether or not it is ultimately resolved in our favor, would result in significant expense to us and divert the efforts of our technical and management personnel.

There may be rights we are not aware of, including applications that have been filed but not published that, when issued, could be asserted against us. These third parties could bring claims against us, and that would cause us to incur substantial expenses and, if successful against us, could cause us to pay substantial damages. Further, if a patent infringement suit were brought against us, we could be forced to stop or delay research, development, manufacturing or sales of the product or biologic

15

drug candidate that is the subject of the suit. As a result of patent infringement claims, or in order to avoid potential claims, we may choose or be required to seek a license from the third party. These licenses may not be available on acceptable terms, or at all. Even if we are able to obtain a license, the license would likely obligate us to pay license fees or royalties or both, and the rights granted to us might be non-exclusive, which could result in our competitors gaining access to the same intellectual property. Ultimately, we could be prevented from commercializing a product, or be forced to cease some aspect of our business operations, if, as a result of actual or threatened patent infringement claims, we are unable to enter into licenses on acceptable terms. All of the issues described above could also impact our collaborators, which would also impact the success of the collaboration and therefore us.

Important legal issues remain to be resolved as to the extent and scope of available patent protection for biologic products, including vaccines, and processes in the United States and other important markets outside the United States, such as Europe and Japan. Foreign markets may not provide the same level of patent protection as provided under the United States patent system. We recognize that litigation or administrative proceedings may be necessary to determine the validity and scope of certain of our and others’ proprietary rights. Any such litigation or proceeding may result in a significant commitment of resources in the future and could force us to interrupt our operations, redesign our products or processes, or negotiate a license agreement, all of which would adversely affect our revenue. Furthermore, changes in, or different interpretations of, patent laws in the United States and other countries may result in patent laws that allow others to use our discoveries or develop and commercialize our products.

We cannot guarantee that the patents we obtain or the unpatented technology we hold will afford us significant commercial protection.

Government Regulation

Government authorities in the United States at the federal, state and local level and in other countries extensively regulate, among other things, the research, development, testing, manufacture, quality control, approval, labeling, packaging, storage, record-keeping, promotion, advertising, distribution, post-approval monitoring and reporting, marketing and export and import of biological products, or biologics, and medical devices, such as our product candidates. Generally, before a new biologic or medical device can be marketed, considerable data demonstrating its quality, safety and efficacy must be obtained, organized into a format specific to each regulatory authority, submitted for review and approved by the regulatory authority.

Review and Approval of Combination Products in the United States

Certain products may be comprised of components that would normally be regulated under different types of regulatory authorities, and frequently by different centers at the FDA. These products are known as combination products. Specifically, under regulations issued by the FDA, a combination product may be:

•a product comprised of two or more regulated components that are physically, chemically, or otherwise combined or mixed and produced as a single entity;

•two or more separate products packaged together in a single package or as a unit and comprised of drug and device products;