ANNUALREPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||

For the fiscal year ended | ||

or | ||

TRANSITIONREPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||

State or other jurisdiction of incorporation or organization |

(I.R.S. Employer Identification No.) | |

(Address of principal executive offices) |

(Zip Code) | |

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

Title of each class |

Name of each exchange on which registered | |

N/A |

N/A |

☒ |

Accelerated filer |

☐ | ||||

Non-accelerated filer |

☐ |

Smaller reporting company |

||||

Emerging growth company |

2 |

||||||

Item 1 |

2 |

|||||

Item 1A |

9 |

|||||

Item 1B |

21 |

|||||

Item 2 |

22 |

|||||

Item 3 |

23 |

|||||

Item 4 |

23 |

|||||

24 |

||||||

Item 5 |

24 |

|||||

Item 6 |

26 |

|||||

Item 7 |

28 |

|||||

Item 7A |

48 |

|||||

Item 8 |

51 |

|||||

Item 9 |

101 |

|||||

Item 9A |

101 |

|||||

Item 9B |

102 |

|||||

102 |

||||||

Item 10 |

102 |

|||||

Item 11 |

103 |

|||||

Item 12 |

103 |

|||||

Item 13 |

103 |

|||||

Item 14 |

103 |

|||||

104 |

||||||

Item 15 |

104 |

|||||

Item 16 |

108 |

|||||

109 |

||||||

Item 1 |

Business |

| • | Fuel Specialties |

| • | Performance Chemicals |

| • | Oilfield Services |

| • | Octane Additives (ceased trading June 30, 2020) |

Item 1A |

Risk Factors |

| • | any derivative action or proceeding brought on behalf of the Corporation, |

| • | any action asserting a claim of breach of a fiduciary duty owed by any director, officer, other employee or stockholder of the Corporation to the Corporation or the Corporation’s stockholders, |

| • | any action asserting a claim arising pursuant to any provision of the Delaware General Corporation Law (“DGCL”), the Certificate of Incorporation, the By-laws, or as to which the DGCL confers jurisdiction upon the Court of Chancery of the State of Delaware, |

| • | any action asserting a claim governed by the internal affairs doctrine, or |

| • | any other internal corporate claim as defined in Section 115 of the DGCL. |

Item 1B |

Unresolved Staff Comments |

Item 2 |

Properties |

Location |

Reporting Segment |

Operations | ||

| Englewood, Colorado (1) |

Fuel Specialties and Performance Chemicals | Corporate Headquarters Business Teams Sales/Administration | ||

| Newark, Delaware (1) |

Fuel Specialties | Research & Development | ||

| Herne, Germany | Fuel Specialties | Sales/Manufacturing/Administration Research & Development | ||

| Vernon, France | Fuel Specialties | Sales/Manufacturing/Administration Research & Development | ||

| Moscow, Russia (1) |

Fuel Specialties | Sales/Administration | ||

| Leuna, Germany | Fuel Specialties | Sales/Manufacturing/Administration Research & Development | ||

| Ellesmere Port, United Kingdom | Fuel Specialties, Performance Chemicals and Octane Additives | European Headquarters Business Teams Sales/Manufacturing/Administration Research & Development Fuel Technology Center | ||

| Beijing, China (1) |

Fuel Specialties and Performance Chemicals | Sales/Administration | ||

| Singapore (1) |

Fuel Specialties and Performance Chemicals | Asia-Pacific Headquarters Business Teams Sales/Administration | ||

| Milan, Italy (1) |

Fuel Specialties and Performance Chemicals | Sales/Administration | ||

| Rio de Janeiro, Brazil (1) |

Fuel Specialties, Performance Chemicals and Oilfield Services | Sales/Administration | ||

| High Point, North Carolina | Performance Chemicals | Manufacturing/Administration Research & Development | ||

| Salisbury, North Carolina | Performance Chemicals | Manufacturing/Administration Research & Development | ||

| Chatsworth, California (1) |

Performance Chemicals | Sales/Manufacturing/Administration | ||

| Saint Mihiel, France | Performance Chemicals | Manufacturing/Administration/Research & Development | ||

| Castiglione, Italy | Performance Chemicals | Manufacturing/Administration/Research & Development | ||

| Barcelona, Spain (1) |

Performance Chemicals | Manufacturing/Administration/Research & Development | ||

Location |

Reporting Segment |

Operations | ||

| Oklahoma City, Oklahoma |

Oilfield Services |

Sales/Manufacturing/Administration | ||

| Midland, Texas | Oilfield Services | Sales/Manufacturing/Administration | ||

| Pleasanton, Texas | Oilfield Services | Sales/Manufacturing/Administration | ||

| Sugar Land, Texas (1) |

Oilfield Services | Sales/Administration/Research & Development | ||

| The Woodlands, Houston, Texas (1) |

Oilfield Services | Sales/Administration/Research & Development | ||

| Williston, North Dakota | Oilfield Services | Sales/Warehouse | ||

| Casper, Wyoming (1) |

Oilfield Services | Warehouse | ||

(1) |

Leased property |

Item 3 |

Legal Proceedings |

Item 4 |

Mine Safety Disclosures |

Item 5 |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

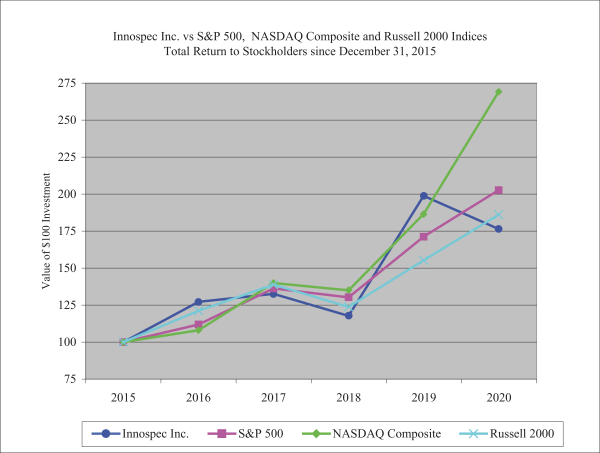

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

|||||||||||||||||||

| Innospec Inc. |

$ | 100.00 | $ | 127.36 | $ | 132.70 | $ | 117.76 | $ | 199.17 | $ | 176.70 | ||||||||||||

| S&P 500 Index |

100.00 | 111.96 | 136.40 | 130.42 | 171.49 | 203.04 | ||||||||||||||||||

| NASDAQ Composite Index |

100.00 | 108.09 | 140.12 | 135.09 | 186.79 | 269.70 | ||||||||||||||||||

| Russell 2000 Index |

$ | 100.00 | $ | 121.31 | $ | 139.08 | $ | 123.76 | $ | 155.35 | $ | 186.36 | ||||||||||||

Item 6 |

Selected Financial Data |

| (in millions, except financial ratios, share and per share data) |

2020 |

2019 |

2018 |

2017 |

2016 |

|||||||||||||||

| Summary of performance: |

||||||||||||||||||||

| Net sales |

$ | 1,193.1 | $ | 1,513.3 | $ | 1,476.9 | $ | 1,306.8 | $ | 883.4 | ||||||||||

| Operating income |

33.7 | 149.9 | 133.5 | 125.0 | 98.2 | |||||||||||||||

| Income before income taxes |

39.7 | 150.4 | 131.6 | 128.1 | 103.1 | |||||||||||||||

| Income taxes |

(11.0 | ) | (38.2 | ) | (46.6 | ) | (66.3 | ) | (21.8 | ) | ||||||||||

| Net income |

28.7 | 112.2 | 85.0 | 61.8 | 81.3 | |||||||||||||||

| Net income attributable to Innospec Inc. |

28.7 | 112.2 | 85.0 | 61.8 | 81.3 | |||||||||||||||

| Net cash provided by operating activities |

$ | 145.9 | $ | 161.6 | $ | 104.9 | $ | 82.7 | $ | 105.5 | ||||||||||

| Financial position at year end: |

||||||||||||||||||||

| Total assets |

$ | 1,397.4 | $ | 1,468.8 | $ | 1,473.4 | $ | 1,410.2 | $ | 1,181.4 | ||||||||||

| Long-term debt including finance leases (including current portion) |

0.6 | 60.1 | 210.9 | 224.3 | 273.3 | |||||||||||||||

| Cash, cash equivalents, and short-term investments |

105.3 | 75.7 | 123.1 | 90.2 | 101.9 | |||||||||||||||

| Total equity |

$ | 944.9 | $ | 918.9 | $ | 825.5 | $ | 794.3 | $ | 653.8 | ||||||||||

| Financial ratios: |

||||||||||||||||||||

| Net income attributable to Innospec Inc. as a percentage of net sales |

2.4 | 7.4 | 5.8 | 4.7 | 9.2 | |||||||||||||||

| Effective tax rate as a percentage (1) |

27.7 | 25.4 | 35.4 | 51.8 | 21.1 | |||||||||||||||

| Current ratio (2) |

2.3 | 2.1 | 2.2 | 2.1 | 2.4 | |||||||||||||||

| Share data: |

||||||||||||||||||||

| Earnings per share attributable to Innospec Inc. |

||||||||||||||||||||

| – Basic |

$ | 1.17 | $ | 4.58 | $ | 3.48 | $ | 2.56 | $ | 3.39 | ||||||||||

| – Diluted |

$ | 1.16 | $ | 4.54 | $ | 3.45 | $ | 2.52 | $ | 3.33 | ||||||||||

| Dividend paid per share |

$ | 1.04 | $ | 1.02 | $ | 0.89 | $ | 0.77 | $ | 0.67 | ||||||||||

| Shares outstanding (basic, thousands) |

||||||||||||||||||||

| – At year end |

24,596 | 24,507 | 24,434 | 24,350 | 24,071 | |||||||||||||||

| – Average during year |

24,563 | 24,482 | 24,401 | 24,148 | 23,998 | |||||||||||||||

(1) |

The effective tax rate is calculated as income taxes as a percentage of income before income taxes. Income taxes are impacted in 2017 by the provisional estimates recorded in respect of the Tax Cuts and Jobs Act of 2017 (“Tax Act”), and in 2018 by the finalization and recording of additional taxes due as a consequence of the Tax Act. Income taxes in 2019 and 2020 are calculated under the new legislation of the Tax Act. |

(2) |

Current ratio is defined as current assets divided by current liabilities. |

| (in millions, except per share data) |

First Quarter |

Second Quarter |

Third Quarter |

Fourth Quarter |

||||||||||||

| 2020 |

||||||||||||||||

| Net sales |

$ | 372.3 | $ | 244.9 | $ | 265.1 | $ | 310.8 | ||||||||

| Gross profit |

113.9 | 59.1 | 78.7 | 91.0 | ||||||||||||

| Operating income |

40.9 | (53.4 | ) | 16.8 | 29.4 | |||||||||||

| Net income |

33.1 | (39.7 | ) | 12.7 | 22.6 | |||||||||||

| Net cash provided by operating activities |

$ | 2.4 | $ | 29.8 | $ | 55.5 | $ | 58.2 | ||||||||

| Per common share: |

||||||||||||||||

| Earnings – basic |

$ | 1.35 | $ | (1.62 | ) | $ | 0.52 | $ | 0.92 | |||||||

| – diluted |

$ | 1.34 | $ | (1.62 | ) | $ | 0.51 | $ | 0.91 | |||||||

| 2019 |

||||||||||||||||

| Net sales |

$ | 388.3 | $ | 362.4 | $ | 371.9 | $ | 390.7 | ||||||||

| Gross profit |

117.8 | 111.1 | 119.1 | 118.2 | ||||||||||||

| Operating income |

36.2 | 31.7 | 38.2 | 43.8 | ||||||||||||

| Net income |

28.7 | 22.3 | 30.1 | 31.1 | ||||||||||||

| Net cash provided by operating activities |

$ | 13.2 | $ | 50.0 | $ | 40.0 | $ | 58.4 | ||||||||

| Per common share: |

||||||||||||||||

| Earnings – basic |

$ | 1.17 | $ | 0.91 | $ | 1.23 | $ | 1.27 | ||||||||

| – diluted |

$ | 1.17 | $ | 0.90 | $ | 1.22 | $ | 1.26 | ||||||||

Item 7 |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

| (in millions) |

2020 |

2019 |

2018 |

|||||||||

| Net sales: |

||||||||||||

| Fuel Specialties |

$ | 512.7 | $ | 583.7 | $ | 574.5 | ||||||

| Performance Chemicals |

425.4 | 428.7 | 468.1 | |||||||||

| Oilfield Services |

255.0 | 479.9 | 400.6 | |||||||||

| Octane Additives |

0.0 | 21.0 | 33.7 | |||||||||

| |

|

|

|

|

|

|||||||

| $ | 1.193.1 | $ | 1,513.3 | $ | 1,476.9 | |||||||

| |

|

|

|

|

|

|||||||

| Gross profit: |

||||||||||||

| Fuel Specialties |

$ | 160.3 | $ | 204.5 | $ | 195.0 | ||||||

| Performance Chemicals |

103.8 | 100.1 | 97.5 | |||||||||

| Oilfield Services |

80.8 | 159.9 | 130.4 | |||||||||

| Octane Additives |

(2.2 | ) | 1.7 | 12.1 | ||||||||

| |

|

|

|

|

|

|||||||

| $ | 342.7 | $ | 466.2 | $ | 435.0 | |||||||

| |

|

|

|

|

|

|||||||

| Operating income: |

||||||||||||

| Fuel Specialties |

$ | 84.5 | $ | 116.6 | $ | 116.3 | ||||||

| Performance Chemicals |

54.8 | 48.7 | 44.7 | |||||||||

| Oilfield Services |

(9.5 | ) | 39.7 | 22.1 | ||||||||

| Octane Additives |

(2.8 | ) | (0.7 | ) | 9.9 | |||||||

| Corporate costs |

(52.2 | ) | (54.4 | ) | (52.4 | ) | ||||||

| Restructuring charge |

(21.3 | ) | 0.0 | (7.1 | ) | |||||||

| Impairment of intangible assets |

(19.8 | ) | 0.0 | 0.0 | ||||||||

| |

|

|

|

|

|

|||||||

| Total operating income |

$ | 33.7 | $ | 149.9 | $ | 133.5 | ||||||

| |

|

|

|

|

|

|||||||

| Other income, net |

$ | 7.8 | $ | 5.3 | $ | 5.0 | ||||||

| Interest expense, net |

(1.8 | ) | (4.8 | ) | (6.9 | ) | ||||||

| |

|

|

|

|

|

|||||||

| Income before income taxes |

39.7 | 150.4 | 131.6 | |||||||||

| Income taxes |

(11.0 | ) | (38.2 | ) | (46.6 | ) | ||||||

| |

|

|

|

|

|

|||||||

| Net income |

$ | 28.7 | $ | 112.2 | $ | 85.0 | ||||||

| |

|

|

|

|

|

|||||||

| (in millions, except ratios) |

2020 |

2019 |

Change |

|||||||||||||

| Net sales: |

||||||||||||||||

| Fuel Specialties |

$ | 512.7 | $ | 583.7 | $ | (71.0 | ) | -12 | % | |||||||

| Performance Chemicals |

425.4 | 428.7 | (3.3 | ) | -1 | % | ||||||||||

| Oilfield Services |

255.0 | 479.9 | (224.9 | ) | -47 | % | ||||||||||

| Octane Additives |

0.0 | 21.0 | (21.0 | ) | -100 | % | ||||||||||

| |

|

|

|

|

|

|||||||||||

| $ | 1,193.1 | $ | 1,513.3 | $ | (320.2 | ) | -21 | % | ||||||||

| |

|

|

|

|

|

|||||||||||

| Gross profit: |

||||||||||||||||

| Fuel Specialties |

$ | 160.3 | $ | 204.5 | (44.2 | ) | -22 | % | ||||||||

| Performance Chemicals |

103.8 | 100.1 | 3.7 | +4 | % | |||||||||||

| Oilfield Services |

80.8 | 159.9 | (79.1 | ) | -49 | % | ||||||||||

| Octane Additives |

(2.2 | ) | 1.7 | (3.9 | ) | -229 | % | |||||||||

| |

|

|

|

|

|

|||||||||||

| $ | 342.7 | $ | 466.2 | (123.5 | ) | -26 | % | |||||||||

| |

|

|

|

|

|

|||||||||||

| Gross margin (%): |

||||||||||||||||

| Fuel Specialties |

31.3 |

35.0 |

-3.7 |

|||||||||||||

| Performance Chemicals |

24.4 |

23.3 |

1.1 |

|||||||||||||

| Oilfield Services |

31.7 |

33.3 |

-1.6 |

|||||||||||||

| Octane Additives |

0.0 |

8.1 |

-8.1 |

|||||||||||||

| Aggregate |

28.7 |

30.8 |

-2.1 |

|||||||||||||

| Operating expenses: |

||||||||||||||||

| Fuel Specialties |

$ | (75.8 | ) | $ | (87.9 | ) | $ | 12.1 | -14 | % | ||||||

| Performance Chemicals |

(49.0 | ) | (51.4 | ) | 2.4 | -5 | % | |||||||||

| Oilfield Services |

(90.3 | ) | (120.2 | ) | 29.9 | -25 | % | |||||||||

| Octane Additives |

(0.6 | ) | (2.4 | ) | 1.8 | -75 | % | |||||||||

| Corporate costs |

(52.2 | ) | (54.4 | ) | 2.2 | -4 | % | |||||||||

| Restructuring charge |

(21.3 | ) | 0.0 | (21.3 | ) | n/a | ||||||||||

| Impairment of intangible assets |

(19.8 | ) | 0.0 | (19.8 | ) | n/a | ||||||||||

| |

|

|

|

|

|

|||||||||||

| $ | (309.0 | ) | $ | (316.3 | ) | $ | 7.3 | -2 | % | |||||||

| |

|

|

|

|

|

|||||||||||

| Change (%) |

Americas |

EMEA |

ASPAC |

AvTel |

Total |

|||||||||||||||

| Volume |

-7 | -8 | -11 | +11 | -7 | |||||||||||||||

| Price and product mix |

-1 | -7 | -10 | -19 | -6 | |||||||||||||||

| Exchange rates |

0 | +2 | 0 | 0 | +1 | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| -8 | -13 | -21 | -8 | -12 | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Change (%) |

Americas |

EMEA |

ASPAC |

Total |

||||||||||||

| Volume |

+13 | -1 | +14 | +4 | ||||||||||||

| Price and product mix |

-12 | -4 | +3 | -6 | ||||||||||||

| Exchange rates |

0 | +2 | +1 | +1 | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| +1 | -3 | +18 | -1 | |||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

2020 |

2019 |

Change |

||||||||||

| United Kingdom pension credit |

$ | 6.2 | $ | 7.7 | $ | (1.5 | ) | |||||

| German pension charge |

(0.9 | ) | (0.5 | ) | (0.4 | ) | ||||||

| Foreign exchange gains/(losses) on translation |

4.0 | (1.3 | ) | 5.3 | ||||||||

| Foreign currency forward contracts losses |

(1.5 | ) | (0.6 | ) | (0.9 | ) | ||||||

| |

|

|

|

|

|

|||||||

| $ | 7.8 | $ | 5.3 | $ | 2.5 | |||||||

| |

|

|

|

|

|

|||||||

| (in millions, except ratios) |

2020 |

2019 |

||||||

| Income before income taxes |

$ | 39.7 | $ | 150.4 | ||||

| Adjustment for stock compensation |

5.8 | 6.6 | ||||||

| Indemnification asset regarding tax audit |

0.2 | (1.6 | ) | |||||

| Restructuring charge |

21.3 | 0.0 | ||||||

| Impairment of acquired intangible assets |

19.8 | 0.0 | ||||||

| Legacy cost of closed operations |

2.5 | 0.0 | ||||||

| Acquisition costs |

4.2 | 0.0 | ||||||

| |

|

|

|

|||||

| Adjusted income before income taxes |

$ | 93.5 | $ | 155.4 | ||||

| |

|

|

|

|||||

| Income taxes |

$ | 11.0 | $ | 38.2 | ||||

| Adjustment of income tax provisions |

0.7 | (2.5 | ) | |||||

| Tax on stock compensation |

1.7 | 0.9 | ||||||

| Tax on restructuring charge |

4.3 | 0.0 | ||||||

| Tax on impairment of acquired intangible asset |

4.6 | 0.0 | ||||||

| Tax on site closure provision |

0.0 | (0.7 | ) | |||||

| Tax loss on distribution |

0.4 | 1.2 | ||||||

| Change in UK statutory tax rate |

(2.7 | ) | 0.0 | |||||

| Tax on legacy cost of closed operations |

0.5 | 0.0 | ||||||

| Tax on acquisition costs |

0.9 | 0.0 | ||||||

| Other discrete items |

0.6 | (2.0 | ) | |||||

| |

|

|

|

|||||

| Adjusted income taxes |

$ | 22.0 | $ | 35.1 | ||||

| |

|

|

|

|||||

| GAAP effective tax rate |

27.7 | % | 25.4 | % | ||||

| |

|

|

|

|||||

| Adjusted effective tax rate |

23.5 | % | 22.6 | % | ||||

| |

|

|

|

|||||

| (in millions, except ratios) |

2019 |

2018 |

Change |

|||||||||||||

| Net sales: |

||||||||||||||||

| Fuel Specialties |

$ | 583.7 | $ | 574.5 | $ | 9.2 | +2 | % | ||||||||

| Performance Chemicals |

428.7 | 468.1 | (39.4 | ) | -8 | % | ||||||||||

| Oilfield Services |

479.9 | 400.6 | 79.3 | +20 | % | |||||||||||

| Octane Additives |

21.0 | 33.7 | (12.7 | ) | -38 | % | ||||||||||

| |

|

|

|

|

|

|||||||||||

| $ | 1,513.3 | $ | 1,476.9 | $ | 36.4 | +2 | % | |||||||||

| |

|

|

|

|

|

|||||||||||

| Gross profit: |

||||||||||||||||

| Fuel Specialties |

$ | 204.5 | $ | 195.0 | $ | 9.5 | +5 | % | ||||||||

| Performance Chemicals |

100.1 | 97.5 | 2.6 | +3 | % | |||||||||||

| Oilfield Services |

159.9 | 130.4 | 29.5 | +23 | % | |||||||||||

| Octane Additives |

1.7 | 12.1 | (10.4 | ) | -86 | % | ||||||||||

| |

|

|

|

|

|

|||||||||||

| $ | 466.2 | $ | 435.0 | $ | 31.2 | +7 | % | |||||||||

| |

|

|

|

|

|

|||||||||||

| Gross margin (%): |

||||||||||||||||

| Fuel Specialties |

35.0 |

33.9 |

+1.1 |

|||||||||||||

| Performance Chemicals |

23.3 |

20.8 |

+2.5 |

|||||||||||||

| Oilfield Services |

33.3 |

32.6 |

+0.7 |

|||||||||||||

| Octane Additives |

8.1 |

35.9 |

-27.8 |

|||||||||||||

| Aggregate |

30.8 |

29.5 |

+1.3 |

|||||||||||||

| Operating expenses: |

||||||||||||||||

| Fuel Specialties |

$ | (87.9 | ) | $ | (78.7 | ) | $ | (9.2 | ) | +12 | % | |||||

| Performance Chemicals |

(51.4 | ) | (52.8 | ) | 1.4 | -3 | % | |||||||||

| Oilfield Services |

(120.2 | ) | (108.3 | ) | (11.9 | ) | +11 | % | ||||||||

| Octane Additives |

(2.4 | ) | (2.2 | ) | (0.2 | ) | +9 | % | ||||||||

| Corporate costs |

(54.4 | ) | (52.4 | ) | (2.0 | ) | +4 | % | ||||||||

| Restructuring charge |

0.0 | (7.1 | ) | 7.1 | -100 | % | ||||||||||

| |

|

|

|

|

|

|||||||||||

| $ | (316.3 | ) | $ | (301.5 | ) | $ | (14.8 | ) | +5 | % | ||||||

| |

|

|

|

|

|

|||||||||||

| Change (%) |

Americas |

EMEA |

ASPAC |

AvTel |

Total |

|||||||||||||||

| Volume |

-8 | +4 | +3 | +52 | +3 | |||||||||||||||

| Price and product mix |

+6 | +4 | +8 | -37 | +3 | |||||||||||||||

| Exchange rates |

0 | -8 | -1 | 0 | -4 | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| -2 | 0 | +10 | +15 | +2 | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Change (%) |

Americas |

EMEA |

ASPAC |

Total |

||||||||||||

| Volume |

-3 | -4 | +16 | -3 | ||||||||||||

| Price and product mix |

+4 | -4 | -9 | -2 | ||||||||||||

| Exchange rates |

0 | -5 | -3 | -3 | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| +1 | -13 | +4 | -8 | |||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

2019 |

2018 |

Change |

||||||||||

| United Kingdom pension credit |

$ | 7.7 | $ | 6.3 | $ | 1.4 | ||||||

| German pension charge |

(0.5 | ) | (0.6 | ) | 0.1 | |||||||

| Foreign exchange losses on translation |

(1.3 | ) | (5.9 | ) | 4.6 | |||||||

| Foreign currency forward contracts (losses)/gains |

(0.6 | ) | 5.2 | (5.8 | ) | |||||||

| |

|

|

|

|

|

|||||||

| $ | 5.3 | $ | 5.0 | $ | 0.3 | |||||||

| |

|

|

|

|

|

|||||||

| (in millions, except ratios) |

2019 |

2018 |

||||||

| Income before income taxes |

$ | 150.4 | $ | 131.6 | ||||

| Adjustment for stock compensation |

6.6 | 4.8 | ||||||

| Indemnification asset regarding tax audit |

(1.6 | ) | (1.2 | ) | ||||

| Site closure provision |

0.0 | 6.8 | ||||||

| |

|

|

|

|||||

| Adjusted income before income taxes |

$ | 155.4 | $ | 142.0 | ||||

| |

|

|

|

|||||

| Income taxes |

$ | 38.2 | $ | 46.6 | ||||

| Adjustment of income tax provisions |

(2.5 | ) | (1.8 | ) | ||||

| Tax on stock compensation |

0.9 | 0.2 | ||||||

| Tax Cuts & Jobs Act 2017 impact |

0.0 | (12.3 | ) | |||||

| Tax on site closure provision |

(0.7 | ) | 1.9 | |||||

| Tax loss on distribution |

1.2 | 0.0 | ||||||

| Other discrete items |

(2.0 | ) | (0.9 | ) | ||||

| |

|

|

|

|||||

| Adjusted income taxes |

$ | 35.1 | $ | 33.7 | ||||

| |

|

|

|

|||||

| GAAP effective tax rate |

25.4 | % | 35.4 | % | ||||

| |

|

|

|

|||||

| Adjusted effective tax rate |

22.6 | % | 23.7 | % | ||||

| |

|

|

|

|||||

| (in millions) |

2020 |

2019 |

||||||

| Total current assets |

$ | 566.2 | $ | 630.3 | ||||

| Total current liabilities |

(252.4 | ) | (303.5 | ) | ||||

| |

|

|

|

|||||

| Working capital |

313.8 | 326.8 | ||||||

| Less cash and cash equivalents |

(105.3 | ) | (75.7 | ) | ||||

| Less prepaid income taxes |

(4.2 | ) | (2.5 | ) | ||||

| Less other current assets |

(0.4 | ) | (0.8 | ) | ||||

| Add back current portion of accrued income taxes |

5.5 | 10.3 | ||||||

| Add back current portion of finance leases |

0.5 | 1.0 | ||||||

| Add back current portion of plant closure provisions |

6.6 | 5.6 | ||||||

| Add back current portion of operating lease liabilities |

11.3 | 10.6 | ||||||

| |

|

|

|

|||||

| Adjusted working capital |

$ | 227.8 | $ | 275.3 | ||||

| |

|

|

|

|||||

| (in millions) |

||||

| 2021 |

$ | 0.5 | ||

| 2022 |

0.1 | |||

| 2023 |

0.0 | |||

| 2024 |

0.0 | |||

| |

|

|||

| Total debt |

0.6 | |||

| Current portion of long-term debt and finance leases |

(0.1 | ) | ||

| |

|

|||

| Long-term debt and finance leases, net of current portion |

$ | 0.5 | ||

| |

|

|||

| (in millions) |

Total |

2021 |

2022-23 |

2024-25 |

Thereafter |

|||||||||||||||

| Operating activities |

||||||||||||||||||||

| Remediation payments |

58.5 | 6.6 | 9.4 | 7.1 | 35.4 | |||||||||||||||

| Operating lease commitments |

40.2 | 11.3 | 17.3 | 8.9 | 2.7 | |||||||||||||||

| Raw material purchase obligations |

19.7 | 3.8 | 7.8 | 8.1 | 0.0 | |||||||||||||||

| Interest payments on debt |

3.4 | 0.9 | 1.8 | 0.7 | 0.0 | |||||||||||||||

| Investing activities |

||||||||||||||||||||

| Capital commitments |

14.7 | 14.7 | 0.0 | 0.0 | 0.0 | |||||||||||||||

| Financing activities |

||||||||||||||||||||

| Long-term debt obligations |

0.0 | 0.0 | 0.0 | 0.0 | 0.0 | |||||||||||||||

| Finance leases |

0.6 | 0.5 | 0.1 | 0.0 | 0.0 | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

$ | 137.1 | $ | 37.8 | $ | 36.4 | $ | 24.8 | $ | 38.1 | ||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

Item 7A |

Quantitative and Qualitative Disclosures about Market Risk |

Item 8 |

Financial Statements and Supplementary Data |

Years ended December 31 |

||||||||||||

2020 |

2019 |

2018 |

||||||||||

Net sales |

$ | $ | $ | |||||||||

Cost of goods sold |

( |

) | ( |

) | ( |

) | ||||||

Gross profit |

||||||||||||

Operating expenses: |

||||||||||||

Selling, general and administrative |

( |

) | ( |

) | ( |

) | ||||||

Research and development |

( |

) | ( |

) | ( |

) | ||||||

Restructuring charge |

( |

) | ( |

) | ||||||||

Impairment of intangible assets |

( |

) | ||||||||||

Total operating expenses |

( |

) | ( |

) | ( |

) | ||||||

Operating income |

||||||||||||

Other income, net |

||||||||||||

Interest expense, net |

( |

) | ( |

) | ( |

) | ||||||

Income before income tax expense |

||||||||||||

Income tax expense |

( |

) | ( |

) | ( |

) | ||||||

Net income |

$ | $ | $ | |||||||||

Earnings per share: |

||||||||||||

Basic |

$ | $ | $ | |||||||||

Diluted |

$ | $ | $ | |||||||||

Weighted average shares outstanding (in thousands): |

||||||||||||

Basic |

||||||||||||

Diluted |

||||||||||||

Total comprehensive income for the years ended December 31 |

2020 |

2019 |

2018 |

|||||||||||||

Net income |

$ | $ | $ | |||||||||||||

Changes in cumulative translation adjustment, net of tax of $ |

( |

) | ( |

) | ||||||||||||

Changes in derivative instruments, net of tax of $ |

( |

) | ||||||||||||||

Amortization of prior service credit, net of tax of $ |

( |

) | ( |

) | ( |

) | ||||||||||

Amortization of actuarial net losses, net of tax of $( |

||||||||||||||||

Actuarial net (losses)/gains arising during the year, net of tax of $ |

( |

) | ( |

) | ||||||||||||

Total comprehensive income |

$ | $ | $ | |||||||||||||

At December 31 |

||||||||

2020 |

2019 |

|||||||

Assets |

||||||||

Current assets: |

||||||||

Cash and cash equivalents |

$ |

$ |

||||||

Trade and other accounts receivable (less allowances of $ million and $ million, respectively) |

||||||||

Inventories (less allowances of $ million and $ million, respectively): |

||||||||

Finished goods |

||||||||

Raw materials |

||||||||

Total inventories |

||||||||

Prepaid expenses |

||||||||

Prepaid income taxes |

||||||||

Other current assets |

||||||||

Total current assets |

||||||||

Net property, plant and equipment |

||||||||

Operating leases right-of-use |

||||||||

Goodwill |

||||||||

Other intangible assets |

||||||||

Deferred tax assets |

||||||||

Pension asset |

||||||||

Other non-current assets |

||||||||

Total assets |

$ |

$ |

||||||

Liabilities and Equity |

||||||||

Current liabilities: |

||||||||

Accounts payable |

$ |

$ |

||||||

Accrued liabilities |

||||||||

Current portion of finance leases |

||||||||

Current portion of plant closure provisions |

||||||||

Current portion of accrued income taxes |

||||||||

Current portion of operating lease liabilities |

||||||||

Total current liabilities |

||||||||

Long-term debt, net of current portion |

||||||||

Finance leases, net of current portion |

||||||||

Operating lease liabilities, net of current portion |

||||||||

Plant closure provisions, net of current portion |

||||||||

Accrued income taxes, net of current portion |

||||||||

Unrecognized tax benefits, net of current portion |

||||||||

Deferred tax liabilities |

||||||||

Pension liabilities and post-employment benefits |

||||||||

Other non-current liabilities |

||||||||

Equity: |

||||||||

Common stock, $ shares |

||||||||

Additional paid-in capital |

||||||||

Treasury stock ( |

( |

) |

( |

) | ||||

Retained earnings |

||||||||

Accumulated other comprehensive loss |

( |

) |

( |

) | ||||

Total Innospec stockholders’ equity |

||||||||

Non-controlling interest |

||||||||

Total equity |

||||||||

Total liabilities and equity |

$ |

$ |

||||||

Years ended December 31 |

||||||||||||

2020 |

2019 |

2018 |

||||||||||

| Cash Flows from Operating Activities |

||||||||||||

| Net income |

$ |

$ |

$ |

|||||||||

| Adjustments to reconcile net income to net cash provided by operating activities: |

||||||||||||

| Depreciation and amortization |

||||||||||||

| Impairment of intangible assets |

||||||||||||

| Impairment of tangible assets |

||||||||||||

| Deferred tax (benefit)/expense |

( |

) |

( |

) |

||||||||

| Cash contributions to defined benefit pension plans |

( |

) |

( |

) | ||||||||

| Non-cash income of defined benefit pension plans |

( |

) |

( |

) |

( |

) | ||||||

| Stock option compensation |

||||||||||||

| Changes in assets and liabilities, net of effects of acquired and divested companies: |

||||||||||||

| Trade and other accounts receivable |

( |

) |

( |

) | ||||||||

| Inventories |

( |

) | ||||||||||

| Prepaid expenses |

( |

) |

( |

) |

||||||||

| Accounts payable and accrued liabilities |

( |

) |

||||||||||

| Accrued income taxes |

( |

) |

( |

) |

( |

) | ||||||

| Plant closure provisions |

||||||||||||

| Unrecognized tax benefits |

( |

) |

||||||||||

| Other assets and liabilities |

( |

) |

( |

) |

( |

) | ||||||

| Net cash provided by operating activities |

||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash Flows from Investing Activities |

||||||||||||

| Capital expenditures |

( |

) |

( |

) |

( |

) | ||||||

| Business combinations, net of cash acquired |

( |

) | ||||||||||

| Internally developed software |

( |

) |

( |

) | ||||||||

| Net cash used in investing activities |

( |

) |

( |

) |

( |

) | ||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash Flows from Financing Activities |

||||||||||||

| Non-controlling interest |

||||||||||||

| Proceeds from revolving credit facility |

||||||||||||

| Repayments of revolving credit facility |

( |

) |

( |

) |

( |

) | ||||||

| Repayment of term loans |

( |

) |

( |

) | ||||||||

| Repayment of finance leases |

( |

) |

( |

) |

( |

) | ||||||

| Refinancing costs |

( |

) |

( |

) |

||||||||

| Dividend paid |

( |

) |

( |

) |

( |

) | ||||||

| Issue of treasury stock |

||||||||||||

| Repurchase of common stock |

( |

) |

( |

) |

( |

) | ||||||

| Net cash used in financing activities |

( |

) |

( |

) |

( |

) | ||||||

| Effect of foreign currency exchange rate changes on cash |

( |

) |

( |

) | ||||||||

| Net change in cash and cash equivalents |

( |

) |

||||||||||

| Cash and cash equivalents at beginning of year |

||||||||||||

| Cash and cash equivalents at end of year |

$ |

$ |

$ |

|||||||||

Common Stock |

Additional Paid-In Capital |

Treasury Stock |

Retained Earnings |

Accumulated Other Comprehensive Loss |

Non- controlling Interest |

Total Equity |

||||||||||||||||||||||

| Balance at December 31, 2017 |

$ |

$ |

$ |

( |

) |

$ |

$ |

( |

) |

$ |

$ |

|||||||||||||||||

| Net income |

||||||||||||||||||||||||||||

| Dividend paid ($ per share) |

( |

) |

( |

) | ||||||||||||||||||||||||

| Changes in cumulative translation adjustment, net of tax |

( |

) |

( |

) | ||||||||||||||||||||||||

| Share of net income |

||||||||||||||||||||||||||||

| Change in derivative instruments, net of tax |

||||||||||||||||||||||||||||

| Treasury stock re-issued |

( |

) |

||||||||||||||||||||||||||

| Treasury stock repurchased |

( |

) |

( |

) | ||||||||||||||||||||||||

| Stock option compensation |

||||||||||||||||||||||||||||

| Amortization of prior service credit, net of tax |

( |

) |

( |

) | ||||||||||||||||||||||||

| Amortization of actuarial net losses, net of tax |

||||||||||||||||||||||||||||

| Actuarial net losses arising during the year, net of tax |

( |

) |

( |

) | ||||||||||||||||||||||||

| Balance at December 31, 2018 |

$ |

$ |

$ |

( |

) |

$ |

$ |

( |

) |

$ |

$ |

|||||||||||||||||

| Net income |

||||||||||||||||||||||||||||

| Dividend paid ($ per share) |

( |

) |

( |

) | ||||||||||||||||||||||||

| Changes in cumulative translation adjustment, net of tax |

( |

) |

( |

) | ||||||||||||||||||||||||

| Share of net income |

( |

) |

( |

) | ||||||||||||||||||||||||

| Changes in derivative instruments, net of tax |

( |

) |

( |

) | ||||||||||||||||||||||||

| Treasury stock re-issued |

( |

) |

||||||||||||||||||||||||||

| Treasury stock repurchased |

( |

) |

( |

) | ||||||||||||||||||||||||

| Stock option compensation |

||||||||||||||||||||||||||||

| Amortization of prior service credit, net of tax |

( |

) |

( |

) | ||||||||||||||||||||||||

| Actuarial net gains arising during the year, net of tax |

||||||||||||||||||||||||||||

| Balance at December 31, 2019 |

$ |

$ |

$ |

( |

) |

$ |

$ |

( |

) |

$ |

$ |

|||||||||||||||||

| Net income |

||||||||||||||||||||||||||||

| Dividend paid ($ per share) |

( |

) |

( |

) | ||||||||||||||||||||||||

| Changes in cumulative translation adjustment, net of tax |

||||||||||||||||||||||||||||

| Share of net income |

||||||||||||||||||||||||||||

| Treasury stock re-issued |

( |

) |

||||||||||||||||||||||||||

| Treasury stock repurchased |

( |

) |

( |

) | ||||||||||||||||||||||||

| Stock option compensation |

||||||||||||||||||||||||||||

| Amortization of prior service credit, net of tax |

( |

) |

( |

) | ||||||||||||||||||||||||

| Amortization of actuarial net losses, net of tax |

||||||||||||||||||||||||||||

| Actuarial net gains arising during the year, net of tax |

( |

) |

( |

) | ||||||||||||||||||||||||

| Balance at December 31, 2020 |

$ |

$ |

$ |

( |

) |

$ |

$ |

( |

) |

$ |

$ |

|||||||||||||||||

| Buildings |

||||

| Equipment |

| Technology |

||||

| Customer lists |

||||

| Brand names |

||||

| Product rights |

||||

| Internally developed software |

||||

| Marketing related |

| (in millions) |

2020 |

2019 |

2018 |

|||||||||

| Net Sales: |

||||||||||||

| Refinery and Performance |

$ | $ | $ | |||||||||

| Other |

||||||||||||

| |

|

|

|

|

|

|||||||

| Fuel Specialties |

||||||||||||

| |

|

|

|

|

|

|||||||

| Personal Care |

||||||||||||

| Home Care |

||||||||||||

| Other |

||||||||||||

| |

|

|

|

|

|

|||||||

| Performance Chemicals |

||||||||||||

| |

|

|

|

|

|

|||||||

| Oilfield Services |

||||||||||||

| Octane Additives |

||||||||||||

| |

|

|

|

|

|

|||||||

| $ | $ | $ | ||||||||||

| |

|

|

|

|

|

|||||||

| (in millions) |

2020 |

2019 |

2018 |

|||||||||

| Gross profit: |

||||||||||||

| Fuel Specialties |

$ | $ | $ | |||||||||

| Performance Chemicals |

||||||||||||

| Oilfield Services |

||||||||||||

| Octane Additives |

( |

) | ||||||||||

| |

|

|

|

|

|

|||||||

| $ | $ | $ | ||||||||||

| |

|

|

|

|

|

|||||||

| Operating income/(expense): |

||||||||||||

| Fuel Specialties |

$ | $ | $ | |||||||||

| Performance Chemicals |

||||||||||||

| Oilfield Services |

( |

) | ||||||||||

| Octane Additives |

( |

) | ( |

) | ||||||||

| Corporate costs |

( |

) | ( |

) | ( |

) | ||||||

| Restructuring charge |

( |

) | ( |

) | ||||||||

| Impairment of intangible assets |

( |

) | ||||||||||

| |

|

|

|

|

|

|||||||

| Total operating income |

$ | $ | $ | |||||||||

| |

|

|

|

|

|

|||||||

| Identifiable assets at year end: |

||||||||||||

| Fuel Specialties |

$ | $ | $ | |||||||||

| Performance Chemicals |

||||||||||||

| Oilfield Services |

||||||||||||

| Octane Additives |

||||||||||||

| Corporate |

||||||||||||

| |

|

|

|

|

|

|||||||

| $ | $ | $ | ||||||||||

| |

|

|

|

|

|

|||||||

| • | managing the Group as a company with securities listed on the NASDAQ and registered with the SEC; |

| • | the President/CEO’s office, group finance, group human resources, group legal and compliance counsel, and investor relations; |

| • | running the corporate offices in the U.S. and Europe; |

| • | the corporate development function since they do not relate to the current trading activities of our other reporting segments; and |

| • | the corporate share of the information technology, product technology, safety, health, environment, accounting and human resources departments. |

| (in millions) |

2020 |

2019 |

2018 |

|||||||||

| Net sales by source: |

||||||||||||

| United States & North America |

$ | $ | $ | |||||||||

| United Kingdom |

||||||||||||

| Rest of Europe |

||||||||||||

| Rest of World |

||||||||||||

| Sales between areas |

( |

) | ( |

) | ( |

) | ||||||

| |

|

|

|

|

|

|||||||

| $ | $ | $ | ||||||||||

| |

|

|

|

|

|

|||||||

| Income before income taxes: |

||||||||||||

| United States & North America |

$ | $ | $ | |||||||||

| United Kingdom |

||||||||||||

| Rest of Europe |

||||||||||||

| Rest of World |

||||||||||||

| |

|

|

|

|

|

|||||||

| $ | $ | $ | ||||||||||

| |

|

|

|

|

|

|||||||

| Long-lived assets at year end: |

||||||||||||

| United States & North America |

$ | $ | $ | |||||||||

| United Kingdom |

||||||||||||

| Rest of Europe |

||||||||||||

| Rest of World |

||||||||||||

| |

|

|

|

|

|

|||||||

| $ | $ | $ | ||||||||||

| |

|

|

|

|

|

|||||||

| (in millions) |

2020 |

2019 |

2018 |

|||||||||

| Identifiable assets at year end: |

||||||||||||

| United States & North America |

$ | $ | $ | |||||||||

| United Kingdom |

||||||||||||

| Rest of Europe |

||||||||||||

| Rest of World |

||||||||||||

| Goodwill |

||||||||||||

| $ | $ | $ | ||||||||||

2020 |

2019 |

2018 |

||||||||||

| Numerator (in millions): |

||||||||||||

| Net income available to common stockholders |

$ | $ | $ | |||||||||

| |

|

|

|

|

|

|||||||

| Denominator (in thousands): |

||||||||||||

| Weighted average common shares outstanding |

||||||||||||

| Dilutive effect of stock options and awards |

||||||||||||

| |

|

|

|

|

|

|||||||

| Denominator for diluted earnings per share |

||||||||||||

| |

|

|

|

|

|

|||||||

| Net income per share, basic: |

$ | $ | $ | |||||||||

| |

|

|

|

|

|

|||||||

| Net income per share, diluted: |

$ | $ | $ | |||||||||

| |

|

|

|

|

|

|||||||

| (in millions) |

2020 |

2019 |

||||||

| Land |

$ | $ | ||||||

| Buildings |

||||||||

| Equipment |

||||||||

| Work in progress |

||||||||

| |

|

|

|

|||||

| Less accumulated depreciation and impairment |

( |

) | ( |

) | ||||

| |

|

|

|

|||||

| $ | $ | |||||||

| |

|

|

|

|||||

| (in millions) |

Twelve Months Ended December 31 |

Twelve Months Ended December 31 |

||||||

2020 |

2019 |

|||||||

| Finance lease cost: |

||||||||

| Amortization of right-of-use |

$ | $ | ||||||

| Interest on lease liabilities |

||||||||

| |

|

|

|

|||||

| Total finance lease cost |

||||||||

| Operating lease cost |

||||||||

| Short-term lease cost |

||||||||

| Variable lease cost |

||||||||

| |

|

|

|

|||||

| Total lease cost |

$ | $ | ||||||

| |

|

|

|

|||||

| (in millions) |

Twelve Months Ended December 31 |

Twelve Months Ended December 31 |

||||||

2020 |

2019 |

|||||||

| Cash paid for amounts included in the measurement of lease liabilities: |

||||||||

| Operating cash flows from operating leases |

$ | $ | ||||||

| Operating cash flows from finance leases |

||||||||

| Finance cash flows from finance leases |

||||||||

| Right-of-use |

||||||||

| Operating leases |

$ | $ | ||||||

| Finance leases |

||||||||

| (in millions except lease term and discount rate) |

December 31 2020 |

December 31 2019 |

||||||

| Operating leases: |

||||||||

| Operating lease right-of-use |

$ | $ | ||||||

| |

|

|

|

|||||

| Current portion of operating lease liabilities |

$ | $ | ||||||

| Operating lease liabilities, net of current portion |

||||||||

| |

|

|

|

|||||

| Total operating lease liabilities |

$ | $ | ||||||

| |

|

|

|

|||||

| |

|

|

|

|

|

|

|

|

| Finance leases: |

||||||||

| Property, plant and equipment at cost |

$ | $ | ||||||

| Accumulated depreciation |

( |

) |

( |

) | ||||

| |

|

|

|

|||||

| Net property, plant and equipment |

$ | $ |

||||||

| |

|

|

|

|||||

| Current portion of finance leases |

$ |

$ |

||||||

| Finance leases, net of current portion |

||||||||

| |

|

|

|

|||||

| Total finance lease liabilities |

$ |

$ |

||||||

| |

|

|

|

|||||

| |

|

|

|

|

|

|

|

|

| Weighted average remaining lease term: |

||||||||

| Operating leases |

years |

|||||||

| Finance leases |

years |

|||||||

| Weighted average discount rate: |

||||||||

| Operating leases |

% | % | ||||||

| Finance leases |

% |

% |

| (in millions) |

Operating Leases |

Finance Leases |

||||||

| Within one year |

$ | $ |

||||||

| Year two |

||||||||

| Year three |

||||||||

| Year four |

||||||||

| Year five |

||||||||

| Thereafter |

||||||||

| |

|

|

|

|||||

| Total lease payments |

||||||||

| Less imputed interest |

( |

) | ||||||

| |

|

|

|

|||||

| Total |

$ |

$ |

||||||

| |

|

|

|

|||||

| (in millions) |

Operating Leases |

Finance Leases |

||||||

| Within one year |

$ |

$ |

||||||

| Year two |

||||||||

| Year three |

||||||||

| Year four |

||||||||

| Year five |

||||||||

| Thereafter |

||||||||

| |

|

|

|

|||||

| Total lease payments |

||||||||

| Less imputed interest |

( |

) |

( |

) | ||||

| |

|

|

|

|||||

| Total |

$ |

$ |

||||||

| |

|

|

|

|||||

| (in millions) |

Fuel Specialties |

Performance Chemicals |

Oilfield Services |

Octane Additives |

Total |

|||||||||||||||

| At December 31, 2018 |

||||||||||||||||||||

| Gross cost (1) |

$ | $ |

$ |

$ |

$ |

|||||||||||||||

| Accumulated impairment losses |

( |

) | ( |

) | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Net book amount |

$ |

$ |

$ |

$ |

$ |

|||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Exchange effect |

( |

) |

( |

) |

( |

) | ||||||||||||||

| At December 31, 2019 |

||||||||||||||||||||

| Gross cost (1) |

$ |

$ |

$ |

$ |

$ |

|||||||||||||||

| Accumulated impairment losses |

( |

) |

( |

) | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Net book amount |

$ |

$ |

$ |

$ |

$ |

|||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Exchange effect |

||||||||||||||||||||

| At December 31, 2020 |

||||||||||||||||||||

| Gross cost (1) |

$ |

$ |

$ |

$ |

$ |

|||||||||||||||

| Accumulated impairment losses |

||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Net book amount |

$ |

$ |

$ |

$ |

$ |

|||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

(1) |

Gross cost is net of $ |

| (in millions) |

2020 |

|

2019 | |||||

| Gross cost at January 1 |

$ |

|

$ |

|

||||

| Additions |

|

|

|

|

|

|

|

|

| Exchange effect |

|

|

|

( |

) | |||

| Gross cost at December 31 |

|

|

|

|

||||

| Accumulated amortization at January 1 |

|

( |

) | |

|

( |

) | |

| Amortization expense |

|

( |

) | |

|

( |

) | |

| Impairment |

|

( |

) | |

|

|

||

| Exchange effect |

|

( |

) | |

|

|

||

| Accumulated amortization at December 31 |

|

( |

) | |

|

( |

) | |

| Net book amount at December 31 |

$ |

|

$ |

|

||||

| (in millions) |

December 31 2020 |

December 31 2019 |

||||||

| Product rights |

$ | $ | ||||||

| Brand names |

||||||||

| Technology |

||||||||

| Customer relationships |

||||||||

| Internally developed software |

||||||||

| |

|

|

|

|||||

| $ | $ | |||||||

| |

|

|

|

|||||

| (in millions) |

||||

| 2021 |

$ | |||

| 2022 |

$ | |||

| 2023 |

$ | |||

| 2024 |

$ | |||

| 2025 |

$ | |||

| (in millions) |

2020 |

2019 |

2018 |

|||||||||

| Plan net pension (credit)/charge: |

||||||||||||

| Interest cost on PBO |

$ | $ | $ | |||||||||

| Expected return on plan assets |

( |

) | ( |

) | ( |

) | ||||||

| Amortization of prior service credit |

( |

) | ( |

) | ( |

) | ||||||

| Amortization of actuarial net losses |

||||||||||||

| |

|

|

|

|

|

|||||||

| $ | ( |

) | $ | ( |

) | $ | ( |

) | ||||

| |

|

|

|

|

|

|||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Plan assumptions at December 31, (%): |

||||||||||||

| Discount rate |

||||||||||||

| Inflation rate |

||||||||||||

| Rate of return on plan assets – overall on bid-value |

||||||||||||

| Plan asset allocation by category (%): |

||||||||||||

| Debt securities and insurance contracts |

||||||||||||

| Equity securities and real estate |

||||||||||||

| Cash |

||||||||||||

| |

|

|

|

|

|

|||||||

| |

|

|

|

|

|

|||||||

| (in millions) |

2020 |

2019 |

||||||

| Change in PBO: |

||||||||

| Opening balance |

$ | $ | ||||||

| Interest cost |

||||||||

| Service cost |

||||||||

| Benefits paid |

( |

) | ( |

) | ||||

| Plan amendments |

||||||||

| Actuarial losses |

||||||||

| Exchange effect |

||||||||

| |

|

|

|

|||||

| Closing balance |

$ | $ | ||||||

| |

|

|

|

|||||

| Fair value of plan assets: |

||||||||

| Opening balance |

$ | $ | ||||||

| Benefits paid |

( |

) | ( |

) | ||||

| Actual contributions by employer |

||||||||

| Actual return on assets |

||||||||

| Exchange effect |

||||||||

| |

|

|

|

|||||

| Closing balance |

$ | $ | ||||||

| |

|

|

|

|||||

| (in millions) |

Quoted Prices in Active Markets for Identical Assets (Level 1) |

Significant Other Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

Total |

||||||||||||

| At December 31, 2020 |

||||||||||||||||

| Debt securities : |

||||||||||||||||

| Debt securities issued by non-U.S. governments and government agencies |

$ | $ | $ | $ | ||||||||||||

| Corporate debt securities |

||||||||||||||||

| Equity backed securities: |

||||||||||||||||

| Other financial derivatives |

( |

) | ( |

) | ||||||||||||

| Investments measured at net asset value (1) |

||||||||||||||||

| Other asset backed securities: |

||||||||||||||||

| Insurance contracts |

||||||||||||||||

| Real estate |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total assets at fair value |

||||||||||||||||

| Cash |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total plan assets |

$ | $ | $ | $ | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| (in millions) |

Quoted Prices in Active Markets for Identical Assets (Level 1) |

Significant Other Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

Total |

||||||||||||

| At December 31, 2019 |

||||||||||||||||

| Debt securities: |

||||||||||||||||

| Debt securities issued by non-U.S. governments and government agencies |

$ | $ | $ | $ | ||||||||||||

| Corporate debt securities |

||||||||||||||||

| Equity backed securities: |

||||||||||||||||

| |

( |

) | ( |

) | ||||||||||||

| (1) |

||||||||||||||||

| Other asset backed securities: |

||||||||||||||||

| Insurance contracts |

||||||||||||||||

| Real estate |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total assets at fair value |

||||||||||||||||

| Cash |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total plan assets |

$ | $ | $ | $ | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

(1) |

Certain investments that are measured at fair value using the net asset value per share (or its equivalent) have not been categorized in the fair value table with a hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the amounts presented in the statement of financial position. |

| (in millions) |

Other Assets |

|||

| Balance at December 31, 2018 |

$ | |||

| |

|

|||

| Realized/unrealized gains/(losses): |

||||

| Relating to assets still held at the reporting date |

||||

| Purchases, issuances and settlements |

( |

) | ||

| Exchange effect |

||||

| |

|

|||

| Balance at December 31, 2019 |

$ | |||

| |

|

|||

| Realized/unrealized gains/(losses): |

||||

| Relating to assets still held at the reporting date |

||||

| Purchases, issuances and settlements |

( |

) | ||

| Exchange effect |

||||

| |

|

|||

| Balance at December 31, 2020 |

$ | |||

| |

|

|||

| (in millions) |

||||

| Interest cost on PBO |

$ | |||

| Expected return on plan assets |

( |

) | ||

| Amortization of prior service credit |

||||

| Amortization of actuarial net losses |

||||

| |

|

|||

| $ | ( |

) | ||

| |

|

|||

| (in millions) |

||||

| 2021 |

$ | |||

| 2022 |

$ | |||

| 2023 |

$ | |||

| 2024 |

$ | |||

| 2025 |

$ | |||

| 2026-2030 |

$ | |||

| (in millions) |

2020 |

2019 |

2018 |

|||||||||

| Plan net pension charge: |

||||||||||||

| Interest cost on PBO |

$ | $ | $ | |||||||||

| Amortization of actuarial net loss |

||||||||||||

| |

|

|

|

|

|

|||||||

| $ | $ | $ | ||||||||||

| Plan assumptions at December 31, (%): |

||||||||||||

| Discount rate |

||||||||||||

| Inflation rate |

||||||||||||

| Rate of increase in compensation levels |

| (in millions) |

2020 |

2019 |

||||||

| Change in PBO: |

||||||||

| Opening balance |

$ | $ | ||||||

| Service cost |

||||||||

| Interest cost |

||||||||

| Benefits paid |

( |

) | ( |

) | ||||

| Actuarial losses |

||||||||

| Exchange effect |

( |

) | ||||||

| |

|

|

|

|||||

| Closing balance |

$ | $ | ||||||

| |

|

|

|

|||||

| (in millions) |

Unrecognised Tax Benefits |

Interest and Penalties |

Total |

|||||||||

| Opening balance at January 1, 2018 |

$ | $ | $ | |||||||||

| Additions for tax positions of prior periods |

||||||||||||

| Reductions due to lapsed statute of limitations |

( |

) | ( |

) | ( |

) | ||||||

| |

|

|

|

|

|

|||||||

| Closing balance at 31 December, 2018 |

||||||||||||

| Current |

||||||||||||

| |

|

|

|

|

|

|||||||

| Non-current |

$ | $ | $ | |||||||||

| |

|

|

|

|

|

|||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Opening balance at January 1, 2019 |

$ | $ | $ | |||||||||

| Additions for tax positions of prior periods |

||||||||||||

| |

|

|

|

|

|

|||||||

| Closing balance at 31 December, 2019 |

||||||||||||

| Current |

||||||||||||

| |

|

|

|

|

|

|||||||

| Non-current |

$ | $ | $ | |||||||||

| |

|

|

|

|

|

|||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Opening balance at January 1, 2020 |

$ | $ | $ | |||||||||

| Reductions for tax positions of prior periods |

( |

) | ( |

) | ( |

) | ||||||

| Additions for tax positions of prior periods |

||||||||||||

| |

|

|

|

|

|

|||||||

| Closing balance at 31 December, 2020 |

||||||||||||

| Current |

||||||||||||

| |

|

|

|

|

|

|||||||

| Non-current |

$ | $ | $ | |||||||||

| |

|

|

|

|

|

|||||||

| (in millions) |

2020 |

2019 |

2018 |

|||||||||

| Domestic |

$ | ( |

) | $ | $ | |||||||

| Foreign |

||||||||||||

| |

|

|

|

|

|

|||||||

| $ | $ | $ | ||||||||||

| |

|

|

|

|

|

|||||||

| (in millions) |

2020 |

2019 |

2018 |

|||||||||

| Current: |

||||||||||||

| Federal |

$ | $ | $ | |||||||||

| State and local |

||||||||||||

| Foreign |

||||||||||||

| |

|

|

|

|

|

|||||||

| |

|

|

|

|

|

|||||||

| Deferred: |

||||||||||||

| Federal |

( |

) | ( |

) | ||||||||

| State and local |

( |

) | ( |

) | ||||||||

| Foreign |

||||||||||||

| |

|

|

|

|

|

|||||||

| ( |

) | ( |

) | |||||||||

| |

|

|

|

|

|

|||||||

| $ | $ | $ | ||||||||||

| |

|

|

|

|

|

|||||||

| (in percent) |

2020 |

2019 |

2018 |

|||||||||

| Statutory rate |

% | % | % | |||||||||

| Foreign income inclusions |

||||||||||||

| Foreign tax rate differential |

( |

) | ( |

) | ||||||||

| Tax charge/(credit) from previous years |

||||||||||||

| Net charge/(credit) from unrecognized tax benefits |

( |

) | ||||||||||

| Foreign currency transactions |

( |

) | ( |

) | ||||||||

| Effect of U.S. tax law change |

||||||||||||

| Tax on unremitted earnings |

( |

) | ||||||||||

| Non-deductible foreign interest |

||||||||||||

| Change in UK statutory tax rate |

||||||||||||

| State and local taxes |

||||||||||||

| US incentive for foreign derived intangible income |

( |

) | ( |

) | ( |

) | ||||||

| Innovation incentives – current year |

( |

) | ( |

) | ( |

) | ||||||

| Innovation incentives – prior years |

( |

) | ||||||||||

| Non-deductible officer compensation |

||||||||||||

| Other items and adjustments, net |

( |

) | ||||||||||

| |

|

|

|

|

|

|||||||

| % | % | % | ||||||||||

| |

|

|

|

|

|

|||||||

| (in millions) |

2020 |

2019 |

||||||

| Deferred tax assets: |

||||||||

| Stock compensation |

$ | $ | ||||||

| Net operating loss carry forwards |

||||||||

| Other intangible assets |

||||||||

| Accretion expense |

||||||||

| Restructuring provision |

||||||||

| Foreign tax credits |

||||||||

| Operating lease liabilities |

|

|

|

|

|

|

|

|

| Other |

||||||||

| |

|

|

|

|||||

| Subtotal |

||||||||

| Less valuation allowance |

( |

) | ( |

) | ||||

| |

|

|

|

|||||

| Total net deferred tax assets |

$ | $ | ||||||

| |

|

|

|

|||||

| Deferred tax liabilities: |

||||||||

| Property, plant and equipment |

$ | ( |

) | $ | ( |

) | ||

| Intangible assets including goodwill |

( |

) | ( |

) | ||||

| Pension asset |

( |

) | ( |

) | ||||

| Investment impairment recapture |

( |

) | ||||||

| Customer relationships |

( |

) | ( |

) | ||||

| Unremitted overseas earnings |

( |

) | ( |

) | ||||

| Right-of-use assets |

|

|

( |

) |

|

|

( |

) |

| Other |

( |

) | ( |

) | ||||

| |

|

|

|

|||||

| Total deferred tax liabilities |

$ | ( |

) | $ | ( |

) | ||

| |

|

|

|

|||||

| Net deferred tax liability |

$ | ( |

) | $ | ( |

) | ||

| |

|

|

|

|||||

| Deferred tax assets |

$ | $ | ||||||

| Deferred tax liabilities |

( |

) | ( |

) | ||||

| |

|

|

|

|||||

| $ | ( |

) | $ | ( |

) | |||

| |

|

|

|

|||||

| (in millions) |

2020 |

2019 |

||||||

| Revolving credit facility |

$ | $ | ||||||

| Term loan |

||||||||

| Deferred finance costs |

( |

) | ||||||

| |

|

|

|

|||||

| Less current portion |

||||||||

| |

|

|

|

|||||

| $ | $ | |||||||

| |

|

|

|

|||||

| (in millions) |

2020 |

2019 |

||||||

| Gross cost at January 1 |

$ | $ | ||||||

| Capitalized in the year |

||||||||

| Written down in the year |

( |

) | ||||||

| |

|

|

|

|||||

| |

|

|

|

|||||

| Accumulated amortization at January 1 |

$ | ( |

) | $ | ( |

) | ||

| Amortization in the year |

( |

) | ( |

) | ||||

| Amortization written down in the year |

||||||||

| |

|

|

|

|||||

| $ | ( |

) | $ | ( |

) | |||

| |

|

|

|

|||||

| Net book value at December 31 |

$ | $ | ||||||

| |

|

|

|

|||||

| (in millions) |

2020 |

2019 |

2018 |

|||||||||

| Total at January 1 |

$ | $ | $ | |||||||||

| Charge for the period excluding restructuring |

||||||||||||

| Restructuring (see Note 5) |

||||||||||||

| Utilized in the period |

( |

) | ( |

) | ( |

) | ||||||

| Exchange effect |

( |

) | ( |

) | ||||||||

| Total at December 31 |

||||||||||||

| Due within one year |

( |

) | ( |

) | ( |

) | ||||||

| |

|

|

|

|

|

|||||||

| Due after one year |

$ | $ | $ | |||||||||

| |

|

|

|

|

|

|||||||

December 31, 2020 |

December 31, 2019 |

|||||||||||||||

(in millions) |

Carrying Amount |

Fair Value |

Carrying Amount |

Fair Value |

||||||||||||

Assets |

||||||||||||||||

Non-derivatives: |

||||||||||||||||

Cash and cash equivalents |

$ | $ | $ | $ | ||||||||||||

Derivatives (Level 1 measurement): |

||||||||||||||||

Other current and non-current assets: |

||||||||||||||||

Foreign currency forward exchange contracts |

||||||||||||||||

Liabilities |

||||||||||||||||

Non-derivatives: |

||||||||||||||||

Long-term debt (including current portion) |

$ | $ | $ | $ | ||||||||||||

Finance leases (including current portion) |

||||||||||||||||

Derivatives (Level 1 measurement): |

||||||||||||||||

Other current liabilities: |

||||||||||||||||

Foreign currency forward exchange contracts |

||||||||||||||||

Non-financial liabilities (Level 3 measurement): |

||||||||||||||||

Stock equivalent units |

||||||||||||||||

Common Stock |

Treasury Stock |

|||||||||||||||||||||||

(number of shares in thousands) |

2020 |

2019 |

2018 |

2020 |

2019 |

2018 |

||||||||||||||||||

At January 1 |

||||||||||||||||||||||||

Exercise of options |

( |

) | ( |

) | ( |

) | ||||||||||||||||||

Stock purchases |

||||||||||||||||||||||||

At December 31 |

||||||||||||||||||||||||

2020 |

2019 |

2018 |

||||||||||

Dividend yield |

% | % | % | |||||||||

Expected life |

||||||||||||

Volatility |

% | % | % | |||||||||

Risk free interest rate |

% | % | % | |||||||||

Number of Options |

Weighted Average Exercise Price |

Weighted Average Grant-Date Fair Value |

||||||||||

Outstanding at December 31, 2019 |

$ | $ | ||||||||||

Granted – at discount |

$ | $ | ||||||||||

– at market value |

$ | $ | ||||||||||

Exercised |

( |

) | $ | $ | ||||||||

Forfeited |

( |

) | $ | $ | ||||||||

Outstanding at December 31, 2020 |

$ | $ | ||||||||||

2020 |

2019 |

2018 |

||||||||||

Dividend yield |

% | % | % | |||||||||

Expected life |

||||||||||||

Volatility |

% | % | % | |||||||||

Risk free interest rate |

% | % | % | |||||||||

Number of SEUs |

Weighted Average Exercise Price |

Weighted Average Grant-Date Fair Value |

||||||||||

Outstanding at December 31, 2019 |

$ | $ | ||||||||||

Granted – at discount |

$ | $ | ||||||||||

– at market value |

$ | $ | ||||||||||

Exercised |

( |

) | $ | $ | ||||||||

Forfeited |

( |

) | $ | $ | ||||||||

Outstanding at December 31, 2020 |

$ | $ | ||||||||||

(in millions) |

Amount Reclassified from AOCL |

Affected Line Item in the Statement where Net | ||||

Details about AOCL Components | ||||||

Defined benefit pension plan items: |

||||||

Amortization of prior service credit |

$ | ( |

) | See (1) below | ||

Amortization of actuarial net losses |

See (1) below | |||||

| Total before tax | ||||||

| ( |

) | Income tax expense | ||||

Total reclassifications |

$ | Net of tax | ||||

(1) These items are included in the computation of net periodic pension cost. See Note 9 of the Notes to the Consolidated Financial Statements for additional information. |

(in millions) |

Defined Benefit Pension Plan Items |

Cumulative Translation Adjustments |

Total |

|||||||||

Balance at December 31, 2019 |

$ | ( |

) | $ | ( |

) | $ | ( |

) | |||

Other comprehensive income before reclassifications |

||||||||||||

Amounts reclassified from AOCL |

||||||||||||

Actuarial net gains arising during the year |

( |

) | ( |

) | ||||||||

Net current period other comprehensive income |

( |

) | ||||||||||

Balance at December 31, 2020 |

$ | ( |

) | $ | ( |

) | $ | ( |

) | |||

Item 9 |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

Item 9A |

Controls and Procedures |

| • | pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of our assets; |

| • | provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with accounting principles generally accepted in the United States of America and that our receipts and expenditures are being made only in accordance with authorization of our management and directors; and |

| • | provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of assets that could have a material effect on the consolidated financial statements. |

Item 9B |

Other Information |

Item 10 |

Directors, Executive Officers and Corporate Governance |

Item 11 |

Executive Compensation |

Item 12 |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

Item 13 |

Certain Relationships and Related Transactions, and Director Independence |

Item 14 |

Principal Accountant Fees and Services |

Item 15 |

Exhibits and Financial Statement Schedules |

(1) |

Financial Statements |

(2) |

Financial Statement Schedules |

(3) |

Exhibits |

| 2.1 |

| 3.1 |